Form 6-K GALAPAGOS NV For: May 11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2021

Commission File Number: 001-37384

GALAPAGOS NV

(Translation of registrant’s name into English)

Generaal De Wittelaan L11 A3

2800 Mechelen, Belgium

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

First Quarter 2021 Results

On May 6, 2021, the Registrant announced its unaudited first quarter results for 2021, which are further described in the attached report.

| # | Confidential treatment has been requested for portions of this exhibit. These portions have been omitted from this Form 6-K. |

The information contained in this Report on Form 6-K, including the exhibits, except for the quotes of Onno van de Stolpe and the quote of Bart Filius contained in Exhibit 99.1, is hereby incorporated by reference into the Company’s Registration Statements on Forms F-3 (File No. 333-230639) and S-8 (File Nos. 333-204567, 333-208697, 333-211834, 333-215783, 333-218160, 333-225263, 333-231765 and 333-249416).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GALAPAGOS NV | ||||||

| (Registrant) | ||||||

| Date: May 11, 2021 | /s/ Xavier Maes | |||||

| Xavier Maes | ||||||

| Company Secretary | ||||||

Exhibit 99.1

Galapagos refocuses pipeline and rightsizes operations

| • | First three months 2021 financial results: |

| • | Group revenues and other income of €124.2 million |

| • | Operating loss of €50.8 million |

| • | Net profit of €9.4 million |

| • | Cash and current financial investments of €5.1 billion on 31 March 2021 |

| • | Refocused clinical pipeline by critically examining risk profile and breadth |

| • | Filgotinib launch in Europe on track |

| • | Initiated €150 million savings program |

Webcast presentation tomorrow, 07 May 2021, at 14.00 CET / 8 AM ET,

www.glpg.com, +32 2 793 38 47, code 5042688

Mechelen, Belgium; 06 May 2021, 22.01 CET; regulated information – Galapagos NV (Euronext & NASDAQ: GLPG) announces its unaudited Q1 results and operational highlights, which are further detailed in the Q1 2021 report available on the Galapagos website, www.glpg.com.

“These last months, we completed a review of our portfolio and development plans with the goal to select a more risk-balanced pipeline. We decided to retain our focus on novel targets to address unmet medical needs in inflammation, fibrosis, and kidney diseases. We also remain fully committed to the launch of Jyseleca in Europe. Moving forward with confidence, we decided to:

| • | Refocus our clinical pipeline by critically examining its risk profile and breadth; |

| • | Cut significant cost in the organization to support this re-sized pipeline development; |

| • | Task our business development team to identify and execute on a transformative opportunity. |

We believe that our strong cash position, expert teams, and solid scientific foundation position us well for future growth,” said Onno van de Stolpe, CEO of Galapagos.

Refocused pipeline

In the revision exercise, Galapagos set goals to focus and adjust the overall risk profile of its clinical pipeline. Consequently, we prioritized those assets with what we believe have enhanced chances of clinical success in our core therapeutic areas. As such, we announce:

| • | We are testing our lead Toledo program ‘3970, a SIK2/3 inhibitor, in five Proof of Concept studies in different indications, and pending the outcome of the studies, we plan to roll out our further development plans in the second half of the year; |

| • | We selected an additional molecule from our Toledo program, SIK2/3 inhibitor ‘4876, as a candidate to accelerate from preclinical phase into clinical development; |

| • | We aim to progress our TYK2 inhibitor ‘3667 into Phase 2b; |

| • | We selected chitinase inhibitor ’4617 to progress to Phase 2 in IPF and decided to stop development of our other IPF molecule ’1205; |

| • | We stopped further work on ‘4059 for metabolic disease, given that this is not a core therapeutic area; |

| • | We discontinued our early research efforts in metabolic diseases and osteoarthritis; and |

| • | We challenged and fine-tuned our stage-gating process to advance compounds. |

Commercial progress

We remain well on track in launching filgotinib in Europe. In the first quarter, we successfully completed the transitions of commercial and medical teams from Gilead in Germany, the UK, Spain, and Italy. We believe everything is in place to complete the final transitions from Gilead to us by year-end. Q1 also saw progress on access and reimbursement for filgotinib in rheumatoid arthritis (RA). Gilead submitted the new drug application in Japan for the treatment of ulcerative colitis (UC). We are encouraged by the primary endpoint outcome with the MANTA/RAy semen parameter studies as we await the Committee for Medicinal Products for Human Use (CHMP) opinion in UC.

Bart Filius, President and COO, added, “In line with our review, we decided to discontinue or cancel certain studies and consequently identified opportunities to reduce operational costs, for a total potential savings of €150M on a full-year basis. Roughly half of these savings will be realized in 2021, resulting in a 2021 cash burni guidance of between €580 million and €620 million. We are working towards a right-sized, refocused version of Galapagos, setting us on a path towards success with our first commercial product, new R&D opportunities, substantial clinical news flow, and a lengthened cash runway for validation of our early pipeline assets.”

Key figures first quarter report 2021 (unaudited)

(€ millions, except basic & diluted gain/loss (-) per share)

| 31 March 2021 group total |

31 March 2020 group total (*) |

|||||||

| Revenues and other income |

124.2 | 103.6 | ||||||

| R&D expenditure |

(130.0 | ) | (115.5 | ) | ||||

| G&Aii and S&Miii expenses |

(45.0 | ) | (34.3 | ) | ||||

| Operating loss |

(50.8 | ) | (46.2 | ) | ||||

| Fair value re-measurement of financial instruments |

2.0 | (20.5 | ) | |||||

| Net other financial result |

36.2 | 14.8 | ||||||

| Income taxes |

(0.2 | ) | (0.3 | ) | ||||

| Net loss from continuing operations |

(12.8 | ) | (52.3 | ) | ||||

| Net profit from discontinued operations |

22.2 | 1.7 | ||||||

| Net profit/loss (-) of the period |

9.4 | (50.6 | ) | |||||

| Basic gain/loss (-) per share (€) |

0.14 | (0.78 | ) | |||||

| Diluted gain/loss (-) per share (€) |

0.14 | (0.78 | ) | |||||

| Current financial investments and cash and cash equivalents |

5,114.7 | 5,722.4 | ||||||

(*) The 2020 comparatives have been restated to consider the impact of classifying the Fidelta business as discontinued operations in 2020.

Details of the financial results

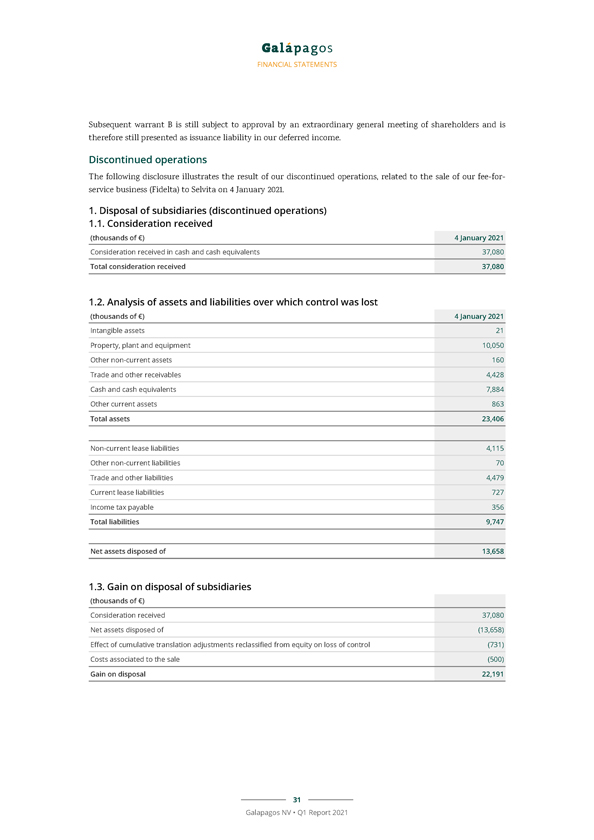

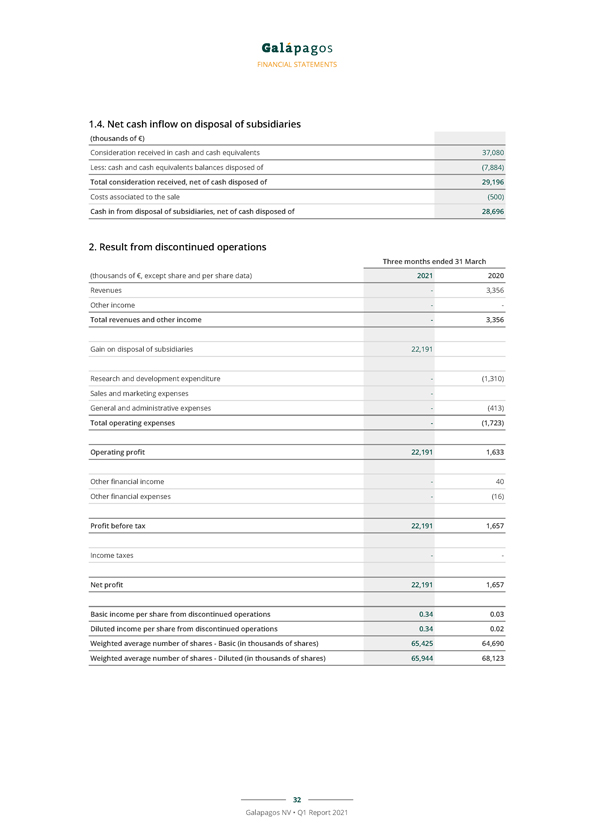

Due to the sale of our fee-for-service business (Fidelta) to Selvita on 4 January 2021 for a total consideration of €37.1 million (including customary adjustments for net cash and working capital), the results of Fidelta are presented as “Net profit from discontinued operations” in our consolidated income statements for the three months ended 31 March 2021 and 31 March 2020.

Revenues and other income from continuing operations

Our revenues and other income from continuing operations for the first three months of 2021 increased to €124.2 million compared to €103.6 million in the first three months of 2020. Our revenues from the Gilead collaboration in the first three months of 2021 (€113.7 million) related to (i) the exclusive access to our drug discovery platform (€57.8 million), (ii) the filgotinib revenue recognition (€55.3 million) and (iii) royalties (€0.7 million).

Our deferred income balance on 31 March 2021 includes €1.9 billion allocated to our drug discovery platform that is recognized linearly over 10 years, and €0.8 billion allocated for the filgotinib development (including considerations for the previous and the renegotiated collaboration combined) that is recognized over time until the end of the development period.

Results from continuing operations

We realized a net loss from continuing operations of €12.8 million for the first three months of 2021, compared to a net loss of €52.3 million for the first three months of 2020.

We reported an operating loss amounting to €50.8 million for the first three months of 2021, compared to an operating loss of €46.2 million for the same period last year.

Our R&D expenditure in the first three months of 2021 amounted to €130.0 million, compared to €115.5 million for the first three months of 2020. This increase was due to an increase in subcontracting costs primarily related to our filgotinib program, our Toledo program and other clinical programs, compensated by a decrease for ziritaxestat, the OA program with GLPG1972 and the program in atopic dermatitis (AtD) with MOR106. Furthermore, the increase in personnel costs is explained by a planned headcount increase following the growth in our activities, and increased cost of the subscription right plans. This factor, and the increased cost of the commercial launch of filgotinib in Europe, contributed to the increase in our S&M and G&A expenses, which were respectively €14.6 million and €30.4 million in the first three months of 2021, compared to respectively €9.8 million and €24.5 million in the first three months of 2020.

We reported a non-cash fair value gain from the re-measurement of initial warrant B issued to Gilead, amounting to €2.0 million, mainly due to the decreased implied volatility of the Galapagos share price and its evolution between 31 December 2020 and 31 March 2021.

Net other financial income in the first three months of 2021 amounted to €36.2 million, compared to net other financial income of €14.8 million for the first three months of 2020, which was primarily attributable to €45.5 million of currency exchange gain on our cash and cash equivalents and current financial investments in U.S. dollars, and to €6.5 million of negative changes in (fair) value of current financial investments and financial assets.

Results from discontinued operations

The net profit from discontinued operations for the three months ended 31March 2021 consisted of the gain on the sale of Fidelta, our fee-for-services business, for €22.2 million.

Group net results

We reported a group net profit for the first three months of 2021 of €9.4 million, compared to a group net loss of €50.6 million for the first three months of 2020.

Cash position

Current financial investments and cash and cash equivalents totaled €5,114.7 million on 31 March 2021, as compared to €5,169.3 million on 31 December 2020.

Total net decrease in cash and cash equivalents and current financial investments amounted to €54.6 million during the first three months of 2021, compared to a net decrease of €58.4 million during the first three months of 2020. This net decrease was composed of (i) €127.7 million of operational cash burn, (ii) offset by €2.3 million of cash proceeds from capital and share premium increase from exercise of subscription rights in the first three months of 2021, (iii) €3.6 million negative changes in (fair) value of current financial investments and €45.7 million of mainly positive exchange rate differences, (iv) €28.7 million cash in from disposal of subsidiaries, net of cash disposed.

Finally, our balance sheet on 31 March 2021 held a receivable from the French government (Crédit d’Impôt Rechercheiv) and a receivable from the Belgian Government for R&D incentives, for a total of both receivables of €142.3 million.

Outlook 2021

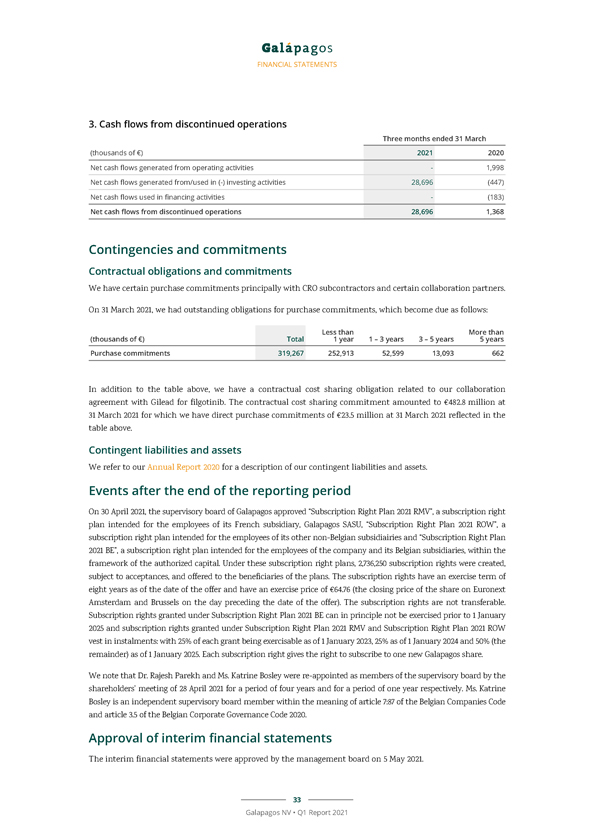

We anticipate several regulatory announcements on filgotinib as well as progress in our differentiated pipeline of novel target-based candidates.

We expect reimbursement decisions in most key European markets for filgotinib in RA this year, as we complete the transition to a full European commercial operation by year end. We anticipate a CHMP opinion and a European Commission decision for filgotinib in UC. We expect that our collaboration partner Gilead will complete recruitment for the global DIVERSITY Phase 3 trial in Crohn’s disease this year.

Within our broader inflammation portfolio, we expect to report topline results from several trials this year, including a Phase 1b trial with TYK2 inhibitor ‘3667 in psoriasis, and three Proof of Concept studies with lead Toledo candidate SIK2/3 inhibitor ‘3970 in psoriasis, UC, and RA.

Within our fibrosis portfolio, we expect to progress early clinical compounds with novel mechanisms of action, with the aim to develop novel treatments to help patients suffering from this debilitating condition.

Following the review of our plans for 2021, we give guidance for full year 2021 operational cash burn of €580 to €620 million.

First quarter report 2021

Galapagos’ financial report for the first three months ended 31 March 2021, including details of the unaudited consolidated results, is accessible via www.glpg.com/financial-reports.

Results of annual ordinary shareholders’ meeting

On 28 April 2021, Galapagos held its annual ordinary shareholders’ meeting. All agenda items were approved, including the re-appointments of Ms. Katrine Bosley and Dr. Raj Parekh as members of the supervisory board, and approval of the remuneration report. All documents relating to the shareholders’ meeting are posted on our website at https://www.glpg.com/shareholders-meetings.

Conference call and webcast presentation

Galapagos will conduct a conference call open to the public tomorrow, 07 May 2021, at 14:00 CET / 8 AM ET, which will also be webcasted. To participate in the conference call, please call one of the following numbers ten minutes prior to commencement:

CODE: 5042688

| Standard International: | +44 (0) 2071 928338 | |

| USA: | +1 646 741 3167 | |

| UK: | +44 844 481 9752 | |

| Netherlands: | +31 207 95 66 14 | |

| France: | +33 1 70 70 0781 | |

| Belgium: | +32 2 793 38 47 |

A question and answer session will follow the presentation of the results. Go to www.glpg.com to access the live audio webcast. The archived webcast will also be available for replay shortly after the close of the call.

Financial calendar

| 05 August 2021 |

Half year 2021 results |

(webcast 06 August 2021) | ||

| 04 November 2021 |

Third quarter 2021 results |

(webcast 05 November 2021) | ||

| 24 February 2022 |

Full year 2021 results |

(webcast 25 February 2022) |

About Galapagos

Galapagos NV discovers and develops small molecule medicines with novel modes of action, several of which show promising patient results and are currently in late-stage development in multiple diseases. Our pipeline comprises discovery through Phase 3 programs in inflammation, fibrosis and other indications. Our ambition is to become a leading global biopharmaceutical company focused on the discovery, development, and commercialization of innovative medicines. More information at www.glpg.com.

Except for filgotinib’s approval for the treatment of rheumatoid arthritis by the European Commission and Japanese Ministry of Health, Labour and Welfare, our drug candidates are investigational; their efficacy and safety have not been fully evaluated by any regulatory authority.

Jyseleca® is a trademark of Galapagos NV and Gilead Sciences, Inc. or its related companies.

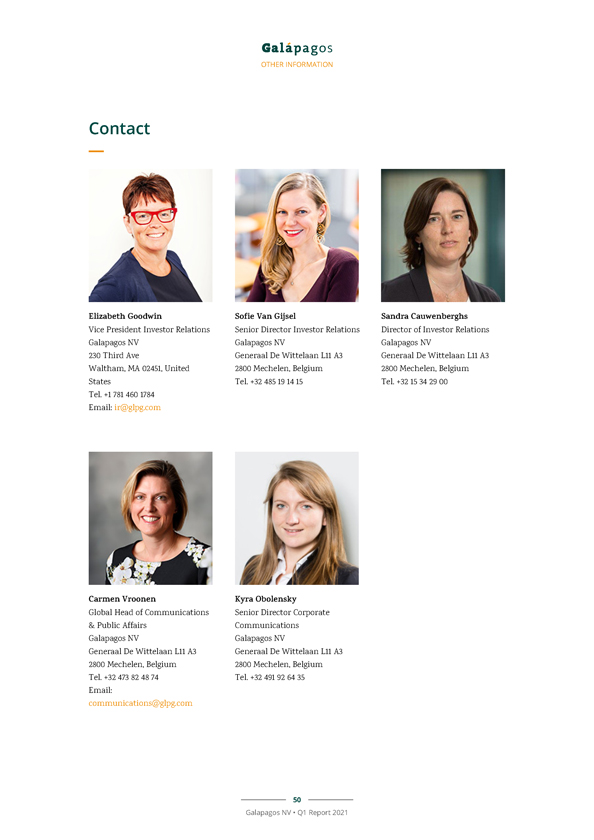

Contact

Investors:

Elizabeth Goodwin

VP Investor Relations

+1 781 460 1784

Sofie Van Gijsel

Senior Director Investor Relations

+32 485 19 14 15

Media:

Carmen Vroonen

Global Head of Communications & Public Affairs

+32 473 824 874

Kyra Obolensky

Senior Director Corporate Communications

+32 491 92 64 35

Forward-looking statements

This release may contain forward-looking statements, including, among other things, statements regarding the global R&D collaboration with Gilead, the amount and timing of potential future milestones, opt-in and/or royalty payments by Gilead, Galapagos’ strategic R&D ambitions, including progress on our fibrosis portfolio, and potential changes of such ambitions,

the guidance from management (including guidance regarding the expected operational use of cash during financial year 2021), financial results, statements regarding the expected timing, design and readouts of ongoing and planned clinical trials, including recruitment for trials and topline results for our trials and studies in our inflammation portfolio, statements regarding the strategic re-evaluation, statements relating to interactions with regulatory authorities, the timing or likelihood of additional regulatory authorities’ approval of marketing authorization for filgotinib for RA, UC or any other indication, including UC and IBD indication for filgotinib in Europe, the UK, Japan, and the U.S., such additional regulatory authorities requiring additional studies, the timing or likelihood of pricing and reimbursement interactions for filgotinib, statements relating to the build-up of our commercial organization and commercial sales for filgotinib, including in Europe, the expected impact of COVID-19, and our strategy, business plans and focus. Galapagos cautions the reader that forward-looking statements are not guarantees of future performance. Forward-looking statements involve known and unknown risks, uncertainties and other factors which might cause the actual results, financial condition and liquidity, performance or achievements of Galapagos, or industry results, to be materially different from any historic or future results, financial conditions and liquidity, performance or achievements expressed or implied by such forward-looking statements. In addition, even if Galapagos’ results, performance, financial condition and liquidity, and the development of the industry in which it operates are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are that our expectations regarding our 2021 revenues and financial results and our 2021 operating expenses may be incorrect (including because one or more of its assumptions underlying its expense expectations may not be realized), Galapagos’ expectations regarding its development programs may be incorrect, the inherent uncertainties associated with competitive developments, clinical trial and product development activities and regulatory approval requirements (including the risk that data from Galapagos’ ongoing and planned clinical research programs in rheumatoid arthritis, Crohn’s disease, ulcerative colitis, idiopathic pulmonary fibrosis, osteoarthritis, and other inflammatory indications may not support registration or further development of its product candidates due to safety, efficacy or other reasons), Galapagos’ reliance on collaborations with third parties (including our collaboration partner Gilead), the timing of and the risks related to implementing the amendment of our arrangement with Gilead for the commercialization and development of filgotinib, estimating the commercial potential of our product candidates and Galapagos’ expectations regarding the costs and revenues associated with the transfer of European commercialization rights to filgotinib may be incorrect, and the uncertainties relating to the impact of the COVID-19 pandemic. A further list and description of these risks, uncertainties and other risks can be found in Galapagos’ Securities and Exchange Commission (SEC) filings and reports, including in Galapagos’ most recent annual report on Form 20-F filed with the SEC and other filings and reports filed by Galapagos with the SEC. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. Galapagos expressly disclaims any obligation to update any such forward-looking statements in this document to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation.

| i | The operational cash burn (or operational cash flow if this performance measure is positive) is equal to the increase or decrease in our cash and cash equivalents (excluding the effect of exchange rate differences on cash and cash equivalents), minus: |

| i. | the net proceeds, if any, from share capital and share premium increases included in the net cash flows generated from/used in (-) financing activities |

| ii. | the net proceeds or cash used, if any, in acquisitions or disposals of businesses; the movement in restricted cash and movement in current financial investments, if any, included in the net cash flows generated from/used in (-) investing activities. |

This alternative performance measure is in our view an important metric for a biotech company in the development stage.

The operational cash burn for the three months ended 31 March 2021 amounted to €127.7 million and can be reconciled to our cash flow statement by considering the increase in cash and cash equivalents of €379.1 million, adjusted by (i) the cash proceeds from capital and share premium increase from the exercise of subscription rights by employees for €2.3 million, (ii) the net sale of current financial investments amounting to €475.8 million, and (iii) the cash in from sale of subsidiaries, net of cash disposed of, of €28.7 million.

| ii | General and administrative |

| iii | Sales and marketing |

| iv | Crédit d’Impôt Recherche refers to an innovation incentive system underwritten by the French government |

Exhibit 99.2

Exhibit 99.2 Forward with confidence Q1 Report 2021

Contents The Galapagos group Letter from the management 4 COVID-19 impact 9 At a glance. 11 Risk factors 13 The Galapagos share 13 Disclaimer and other information 14 Financial statements Unaudited financial statements condensed consolidated interim 17 Notes 24 Other information Glossary of terms 34 Financial calendar 49 Colophon 49 Contact 50 2 Galapagos NV • Q1 Report 2021

The Galapagos group An overview of Galapagos, its strategy and portfolio in the first three months of 2021 Forward with confidence

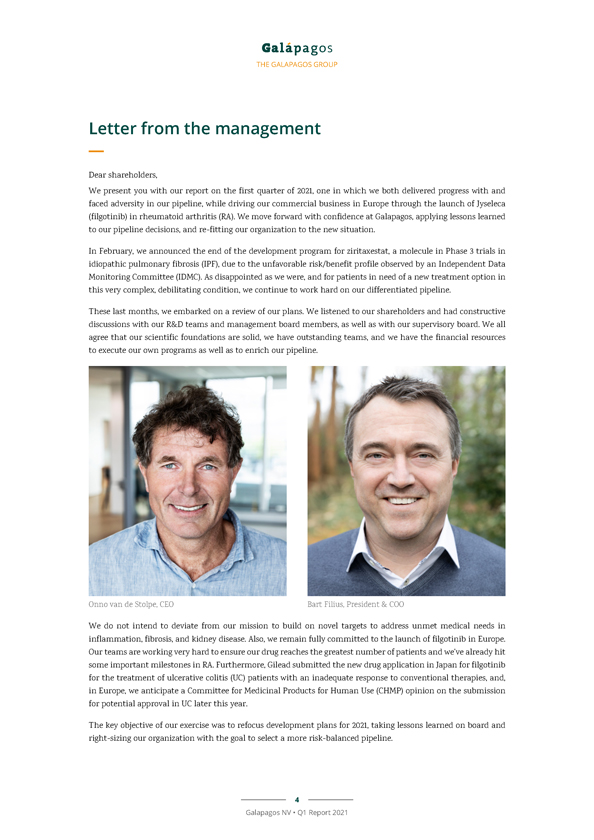

THE GALAPAGOS GROUP Letter from the management Dear shareholders, We present you with our report on the first quarter of 2021, one in which we both delivered progress with and faced adversity in our pipeline, while driving our commercial business in Europe through the launch of Jyseleca (filgotinib) in rheumatoid arthritis (RA). We move forward with confidence at Galapagos, applying lessons learned to our pipeline decisions, and re-fitting our organization to the new situation. In February, we announced the end of the development program for ziritaxestat, a molecule in Phase 3 trials in idiopathic pulmonary fibrosis (IPF), due to the unfavorable risk/benefit profile observed by an Independent Data Monitoring Committee (IDMC). As disappointed as we were, and for patients in need of a new treatment option in this very complex, debilitating condition, we continue to work hard on our differentiated pipeline. These last months, we embarked on a review of our plans. We listened to our shareholders and had constructive discussions with our R&D teams and management board members, as well as with our supervisory board. We all agree that our scientific foundations are solid, we have outstanding teams, and we have the financial resources to execute our own programs as well as to enrich our pipeline. Onno van de Stolpe, CEO Bart Filius, President & COO We do not intend to deviate from our mission to build on novel targets to address unmet medical needs in inflammation, fibrosis, and kidney disease. Also, we remain fully committed to the launch of filgotinib in Europe. Our teams are working very hard to ensure our drug reaches the greatest number of patients and we’ve already hit some important milestones in RA. Furthermore, Gilead submitted the new drug application in Japan for filgotinib for the treatment of ulcerative colitis (UC) patients with an inadequate response to conventional therapies, and, in Europe, we anticipate a Committee for Medicinal Products for Human Use (CHMP) opinion on the submission for potential approval in UC later this year. The key objective of our exercise was to refocus development plans for 2021, taking lessons learned on board and right-sizing our organization with the goal to select a more risk-balanced pipeline. 4 Galapagos NV • Q1 Report 2021

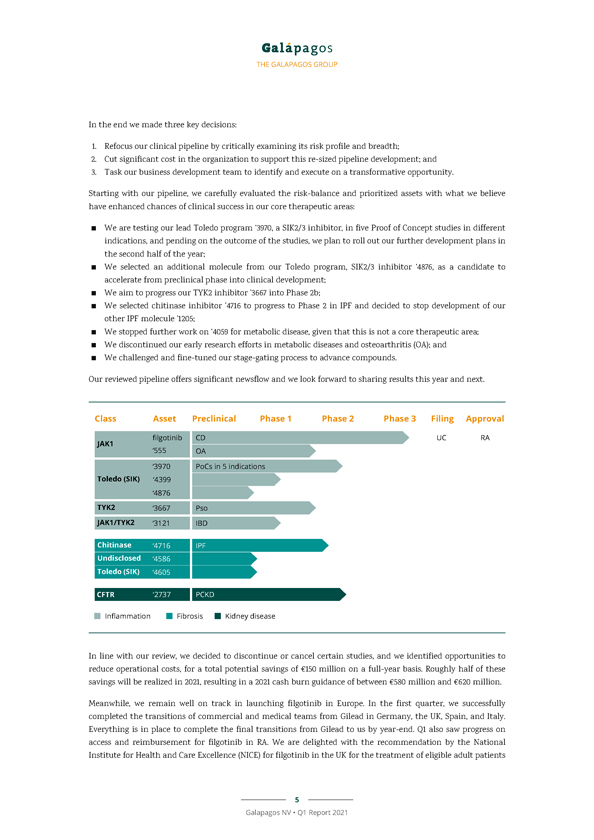

THE GALAPAGOS GROUP In the end we made three key decisions: 1. Refocus our clinical pipeline by critically examining its risk profile and breadth; 2. Cut significant cost in the organization to support this re-sized pipeline development; and 3. Task our business development team to identify and execute on a transformative opportunity. Starting with our pipeline, we carefully evaluated the risk-balance and prioritized assets with what we believe have enhanced chances of clinical success in our core therapeutic areas: â–ª We are testing our lead Toledo program ‘3970, a SIK2/3 inhibitor, in five Proof of Concept studies in different indications, and pending on the outcome of the studies, we plan to roll out our further development plans in the second half of the year; â–ª We selected an additional molecule from our Toledo program, SIK2/3 inhibitor ‘4876, as a candidate to accelerate from preclinical phase into clinical development; â–ª We aim to progress our TYK2 inhibitor ‘3667 into Phase 2b; â–ª We selected chitinase inhibitor ’4716 to progress to Phase 2 in IPF and decided to stop development of our other IPF molecule ’1205; â–ª We stopped further work on ‘4059 for metabolic disease, given that this is not a core therapeutic area; â–ª We discontinued our early research efforts in metabolic diseases and osteoarthritis (OA); and â–ª We challenged and fine-tuned our stage-gating process to advance compounds. Our reviewed pipeline offers significant newsflow and we look forward to sharing results this year and next. Class Asset Preclinical Phase 1 Phase 2 Phase 3 Filing Approval In line with our review, we decided to discontinue or cancel certain studies, and we identified opportunities to reduce operational costs, for a total potential savings of €150 million on a full-year basis. Roughly half of these savings will be realized in 2021, resulting in a 2021 cash burn guidance of between €580 million and €620 million. Meanwhile, we remain well on track in launching filgotinib in Europe. In the first quarter, we successfully completed the transitions of commercial and medical teams from Gilead in Germany, the UK, Spain, and Italy. Everything is in place to complete the final transitions from Gilead to us by year-end. Q1 also saw progress on access and reimbursement for filgotinib in RA. We are delighted with the recommendation by the National Institute for Health and Care Excellence (NICE) for filgotinib in the UK for the treatment of eligible adult patients 5 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP with moderate to severe active RA. Furthermore, we received an additional benefit in RA by the Gemeinsamer Bundesausschuss (G-BA) in Germany. We are encouraged by the primary endpoint outcome with the MANTA/RAy semen parameter studies as we await the CHMP opinion in UC. We are pleased that our partner Gilead recently announced an extension of the lockup period for their current holding in Galapagos (16,707,477 shares) until 2024, which is testament to their continued support. Altogether, these adjustments make for a right-sized, refocused version of Galapagos, on a path towards success with our first commercial product as well as with new R&D opportunities, substantial clinical news flow, and a lengthened cash runway for clinical validation of our early assets. Operational overview Q1 2021 In inflammation â–ª We and Gilead announced interim data on the MANTA/RAy studies. 8.3% of patients on placebo and 6.7% of patients on filgotinib had a 50% or more decline in sperm concentration at week 13; these results are being shared with regulatory authorities â–ª We initiated two additional Proof of Concept trials with Toledo compound ’3970, a SIK2/3 inhibitor. The first patients were dosed in both the TAPINOMA study in systemic lupus erythematosus and in the GLIDER study in Sjögren’s syndrome â–ª Gilead announced that NICE recommended filgotinib for reimbursement for moderate to severe RA patients in the UK â–ª We published the FINCH 1 Phase 3 data (Combe et al. 2021) and FINCH 3 Phase 3 data (Westhovens et al. 2021) in the Annals of the Rheumatic Diseases In fibrosis â–ª We discontinued development of ziritaxestat in the ISABELA Phase 3 program in IPF Corporate & other â–ª Bart Filius was promoted to President and Chief Operating Officer â–ª We raised €2.3 million from subscription right exercises Recent events â–ª All annual general meeting (AGM) proposals were approved by shareholders at the AGM on 28 April 2021 â–ª We received a transparency notification from the Capital Group indicating they hold 4.65% of the current outstanding Galapagos shares â–ª Gilead submitted the new drug application in Japan for filgotinib for the treatment of UC with an inadequate response to conventional therapies â–ª We and Gilead ended the DIVERGENCE 2 trial with filgotinib in fistulizing CD â–ª We completed enrollment of the SEA TURTLE Phase 2 study with ‘3970 in UC â–ª We announced an extension of the lockup period for Gilead’s current shares in Galapagos to 2024 â–ª We received the second installment of €75 million from Gilead, following payment of an earlier installment of €35 million in January 2021, included under the revised filgotinib agreement as announced in December 2020 Q1 2021 financial result Details of financial results Due to the sale of our fee-for-service business (Fidelta) to Selvita on 4 January 2021 for a total consideration of €37.1 million (including customary adjustments for net cash and working capital), the results of Fidelta are presented as “Net profit from discontinued operations” in our consolidated income statements. 6 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP Revenues and other income from continuing operations Our revenues and other income from continuing operations for the first three months of 2021 amounted to €124.2 million, compared to €103.6 million for the first three months of 2020. Revenues amounted to €113.9 million for the first three months of 2021 compared to €94.8 million for the first three months of 2020, and were higher mainly driven by the increase in revenue recognition of upfront consideration and milestone payments received in the scope of the collaboration with Gilead for filgotinib amounting to €55.3 million for the first three months of 2021 (€35.4 million for the same period last year). Other income (€10.3 million vs €8.7 million for the same period last year) increased, mainly driven by higher incentives income from the government for our R&D activities. Results from continuing operations We realized a net loss from continuing operations of €12.8 million for the first three months of 2021, compared to a net loss of €52.3 million for the first three months of 2020. We reported an operating loss amounting to €50.8 million for the first three months of 2021, compared to an operating loss of €46.2 million for the same period last year. Our R&D expenditure in the first three months of 2021 amounted to €130.0 million, compared to €115.5 million for the first three months of 2020. This increase was due to an increase in subcontracting costs primarily related to our filgotinib program, our Toledo program and other clinical programs, compensated by a decrease for ziritaxestat, the OA program with GLPG1972 and the program in atopic dermatitis (AtD) with MOR106. Furthermore, personnel costs increased explained by a planned headcount increase following the growth of our activities and increased cost of our subscription right plans. This last factor, together with increased costs of the commercial launch of filgotinib in Europe, contributed to the increase in our G&A and S&M expenses which were €45.0 million in the first three months of 2021, compared to €34.3 million in the first three months of 2020. We reported a non-cash fair value gain from the re-measurement of initial warrant B issued to Gilead, amounting to €2.0 million, mainly due to the decreased implied volatility of the Galapagos share price as well as its evolution between 31 December 2020 and 31 March 2021. Net other financial income in the first three months of 2021 amounted to €36.2 million, compared to net other financial income of €14.8 million for the first three months of 2020, which was primarily attributable to €45.5 million of currency exchange gain on our cash and cash equivalents and current financial investments in U.S. dollars and to €6.5 million of negative changes in (fair) value of current financial investments and financial assets. Results from discontinued operations The net profit from discontinued operations for the three months ended 31 March 2021 consisted of the gain on the sale of Fidelta, our fee-for-services business, for €22.2 million. Group net results The group realized a net profit for the first three months of 2021 amounting to €9.4 million, compared to a net loss of €50.6 million for the same period in 2020. Cash position Current financial investments and cash and cash equivalents totaled €5,114.7 million on 31 March 2021 (€5,169.3 million on 31 December 2020, including the cash and cash equivalents included in the assets classified as held for sale). 7 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP Total net decrease in current financial investments and cash and cash equivalents amounted to €54.6 million in the first three months of 2021, compared to a net decrease of €58.4 million during the first three months of 2020. This net decrease was composed of (i) €127.7 million of operational cash burn,1 (ii) offset by €2.3 million of cash proceeds from capital and share premium increase from exercise of subscription rights in the first three months of 2021, (iii) €3.6 million of negative changes in (fair) value of current financial investments and €45.7 million of mainly positive exchange rate differences, (iv) €28.7 million cash in from the disposal of Fidelta, net of cash disposed. Finally, our balance sheet on 31 March 2021 held a receivable from the French government (Crédit d’Impôt Recherche2) and a receivable from the Belgian Government for R&D incentives, for a total of €142.3 million. Outlook 2021 We anticipate regulatory announcements with filgotinib as well as news on progress in our differentiated pipeline of novel target-based candidates this year. We expect reimbursement decisions in most key European markets for filgotinib in RA this year, as we complete the transition to a full European commercial operation by year end. We anticipate a CHMP opinion and a European Commission decision for filgotinib in UC. We expect that our collaboration partner Gilead will complete recruitment for the global DIVERSITY Phase 3 trial in Crohn’s disease this year. Within our broader inflammation portfolio, we expect to report topline results from several trials this year, including a Phase 1b trial with TYK2 inhibitor ‘3667 in psoriasis and three Proof of Concept studies with lead Toledo candidate SIK2/3 inhibitor ‘3970 in psoriasis, UC, and RA. Within our fibrosis portfolio, we expect to progress early clinical compounds with novel mechanisms of action, with the aim to develop novel treatments to help patients suffering from this debilitating condition. Following the review of our plans for 2021, we give guidance for full year 2021 operational cash burn of €580 to €620 million, and potential savings of €150 million on a full-year basis. We thank you for your continued support, as we move forward on our strategy to develop novel mechanism of action drugs aimed at addressing unmet need in inflammation, fibrosis, and kidney disease. We are confident that we have a strong cash position, expert teams, and excellent science to achieve this. Onno van de Stolpe Bart Filius CEO President & COO 1 We refer to the note on the cash position of our condensed consolidated interim financial statements for an explanation and reconciliation of this alternative performance measure. 2 Crédit d’Impôt Recherche refers to an innovation incentive system underwritten by the French government 8 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP COVID-19 impact During the COVID-19 pandemic, we continue to innovate to accommodate for the current situation and minimize the impact to operations. We closely follow local governmental measures and apply these as appropriate within our organization, guided and supported by our dedicated COVID-19 task force teams. All local and global task force teams meet regularly and make recommendations directly to the COO. We report the following impacts: â–ª Staff We implemented strict measures to help prevent the spread of the virus and protect the health of our staff. We rolled out our global and site-specific business continuity plans and took appropriate recommended precautions, including suspending almost all business travel. We continue to believe that during the pandemic most of the international travel can be replaced by virtual meetings, resulting in improved cost efficiency, a better work-life balance, and a reduced carbon footprint. The positive impact of this forced way- of-working will therefore be retained in our future habits and updated work place strategy, called “To the Next Normal.” During lock-down periods, we arranged for essential tasks to be carried out within our facilities. Employees working on site need an authorization letter signed by the line leader and site head. Consequently, the majority of our Research staff continue working from the offices/labs, with periodic exceptions for local lockdowns during which no staff is allowed to come into the facilities. For those employees coming to the office, we have stringent cleaning and sanitation protocols in place, and we strictly respect social distancing policies at all times in order to minimize risk of exposure. Except for employees with laboratory operations and safety roles which require an on-site presence, over 95% of our staff systematically work from home. As the global pandemic continues into 2021, we anticipate that we will maintain our measures and protocols to ensure the health of our employees. â–ª Research portfolio By prioritizing the most advanced projects very early on, increasing the flexibility of our staff in the labs within projects, and maintaining our hiring efforts and outscourcing as planned, we sustain our research delivery, keep the compound management facility running at all times, and continue our early drug research and the implementation of new modalities for target or drug discovery. So far, the scorecard of the research department objectives shows a similar productivity compared to previous years, indicating that we continue to minimize the impact of the pandemic. 9 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP â–ª Development portfolio We have a business continuity plan for our clinical development programs. We closely monitor each program in the context of the current global and local situation of the pandemic and the associated specific regulatory, institutional, and government guidance and policies related to COVID-19. Within the boundaries of these guidances and policies, and in consultation with our CROs and clinical trial sites, we applied various measures to minimize the impact of the COVID-19 pandemic on our clinical development programs, with the primary aim to ensure the safety of our trial participants and to preserve the data integrity and scientific validity of the trials. These measures continue to be implemented on a case-by-case basis, tailored to the specific study and country needs at any given time, with specific attention paid to vulnerable populations and the use of investigational medicines with immunosuppressive properties. The measures include, among others, increased, transparent communication to all stakeholders and the direct supply of investigational medicines to patients. For each clinical trial, we actively monitor and document the impact of COVID-19 on the study where necessary and to facilitate the interpretation and reporting of results. Following the global increase of COVID-19 testing and vaccinations, we issued an internal guidance on the impact of testing and vaccinations on clinical trials. â–ª Filgotinib filing process UC As of publication of this Q1 report, our collaboration partner Gilead has not been informed by the regulatory agencies in Europe of approval timeline delays related to the pandemic. â–ª Manufacturing and supply chain To date, there has been no COVID-19 impact to the commercial supply of filgotinib. Gilead also confirmed that all sites involved in the manufacturing of filgotinib are established sites that currently manufacture other Gilead marketed products and are in good standing with the FDA and are GMP certified. Under the revised agreement with Gilead for filgotinib in Europe, Galapagos plans to become the marketing authorization holder of filgotinib in Europe by year-end 2021, and then become responsible for manufacturing. We intend to work with the same manufacturing sites to ensure continuity. â–ª Commercial organization The form of outreach of our commercial teams to physicians and hospitals was impacted by the COVID-19 pandemic and consequent travel restrictions, becoming virtual instead. The teams invested in virtual channels as part of the overall commercial build strategy, and these channels are being utilized during our commercial launch today. We note as of now no material impact on our commercial operations due to travel restrictions, nor has there been an impact of COVID-19 on our ability to engage in market access discussions thus far. Nevertheless, healthcare systems are under pressure across Europe, increasing the risk of future volatility in reimbursement procedures and potentially reducing the number of new therapy initiations. 10 Galapagos NV • Q1 Report 2021

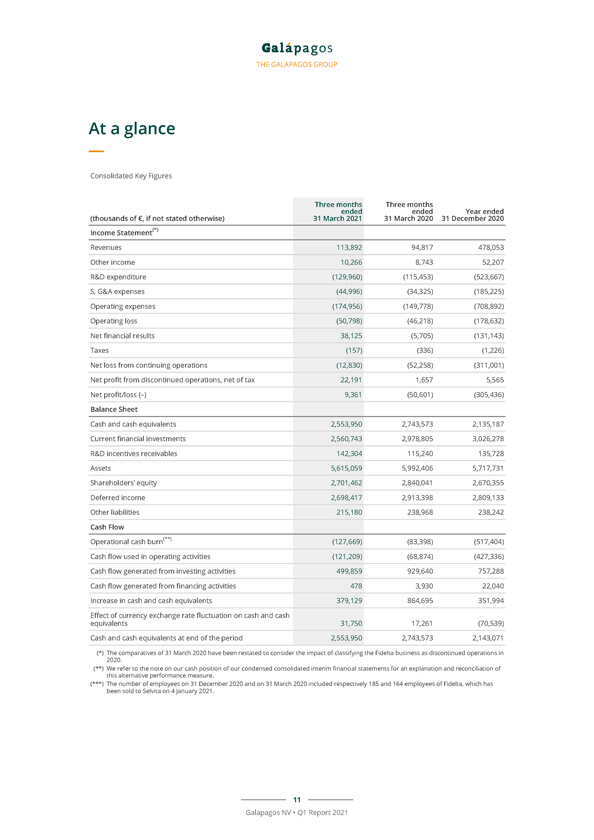

THE GALAPAGOS GROUP At a glance Consolidated Key Figures Three months Three months ended ended Year ended (thousands of €, if not stated otherwise) 31 March 2021 31 March 2020 31 December 2020 Income Statement(*) Revenues 113,892 94,817 478,053 Other income 10,266 8,743 52,207 R&D expenditure (129,960) (115,453) (523,667) S, G&A expenses (44,996) (34,325) (185,225) Operating expenses (174,956) (149,778) (708,892) Operating loss (50,798) (46,218) (178,632) Net financial results 38,125 (5,705) (131,143) Taxes (157) (336) (1,226) Net loss from continuing operations (12,830) (52,258) (311,001) Net profit from discontinued operations, net of tax 22,191 1,657 5,565 Net profit/loss (–) 9,361 (50,601) (305,436) Balance Sheet Cash and cash equivalents 2,553,950 2,743,573 2,135,187 Current financial investments 2,560,743 2,978,805 3,026,278 R&D incentives receivables 142,304 115,240 135,728 Assets 5,615,059 5,992,406 5,717,731 Shareholders’ equity 2,701,462 2,840,041 2,670,355 Deferred income 2,698,417 2,913,398 2,809,133 Other liabilities 215,180 238,968 238,242 Cash Flow Operational cash burn(**) (127,669) (83,398) (517,404) Cash flow used in operating activities (121,209) (68,874) (427,336) Cash flow generated from investing activities 499,859 929,640 757,288 Cash flow generated from financing activities 478 3,930 22,040 Increase in cash and cash equivalents 379,129 864,695 351,994 Effect of currency exchange rate fluctuation on cash and cash equivalents 31,750 17,261 (70,539) Cash and cash equivalents at end of the period 2,553,950 2,743,573 2,143,071 (*) The comparatives of 31 March 2020 have been restated to consider the impact of classifying the Fidelta business as discontinued operations in (**) We 2020 refer . to the note on our cash position of our condensed consolidated interim financial statements for an explanation and reconciliation of (***) The this alternative number of performance employees on measure 31 December . 2020 and on 31 March 2020 included respectively 185 and 164 employees of Fidelta, which has been sold to Selvita on 4 January 2021. 11 Galapagos NV • Q1 Report 2021

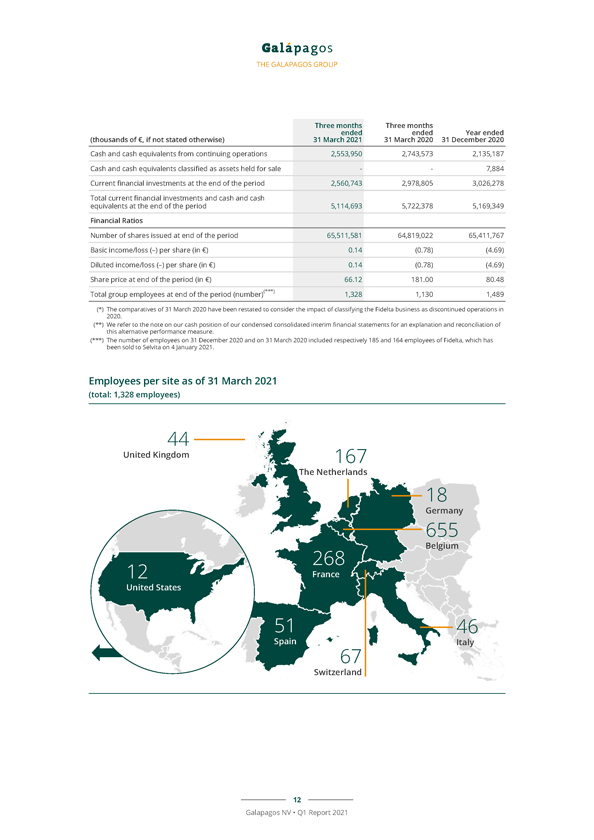

THE GALAPAGOS GROUP Three months Three months ended ended Year ended (thousands of €, if not stated otherwise) 31 March 2021 31 March 2020 31 December 2020 Cash and cash equivalents from continuing operations 2,553,950 2,743,573 2,135,187 Cash and cash equivalents classified as assets held for sale — 7,884 Current financial investments at the end of the period 2,560,743 2,978,805 3,026,278 Total current financial investments and cash and cash equivalents at the end of the period 5,114,693 5,722,378 5,169,349 Financial Ratios Number of shares issued at end of the period 65,511,581 64,819,022 65,411,767 Basic income/loss (–) per share (in €) 0.14 (0.78) (4.69) Diluted income/loss (–) per share (in €) 0.14 (0.78) (4.69) Share price at end of the period (in €) 66.12 181.00 80.48 Total group employees at end of the period (number)(***) 1,328 1,130 1,489 (*) The comparatives of 31 March 2020 have been restated to consider the impact of classifying the Fidelta business as discontinued operations in (**) 2020 We refer . to the note on our cash position of our condensed consolidated interim financial statements for an explanation and reconciliation of (***) The this alternative number of performance employees on measure 31 December . 2020 and on 31 March 2020 included respectively 185 and 164 employees of Fidelta, which has been sold to Selvita on 4 January 2021. Employees per site as of 31 March 2021 (total: 1,328 employees) 12 Galapagos NV • Q1 Report 2021

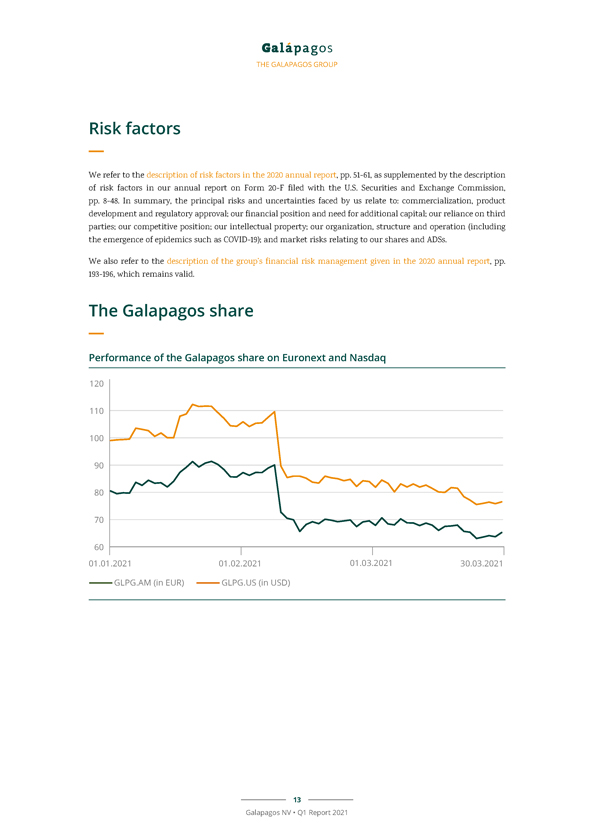

THE GALAPAGOS GROUP Risk factors We refer to the description of risk factors in the 2020 annual report, pp. 51-61, as supplemented by the description of risk factors in our annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, pp. 8-48. In summary, the principal risks and uncertainties faced by us relate to: commercialization, product development and regulatory approval; our financial position and need for additional capital; our reliance on third parties; our competitive position; our intellectual property; our organization, structure and operation (including the emergence of epidemics such as COVID-19); and market risks relating to our shares and ADSs. We also refer to the description of the group’s financial risk management given in the 2020 annual report, pp. 193-196, which remains valid. The Galapagos share Performance of the Galapagos share on Euronext and Nasdaq 13 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP Disclaimer and other information Galapagos NV is a limited liability company organized under the laws of Belgium, having its registered office at Generaal De Wittelaan L11 A3, 2800 Mechelen, Belgium. Throughout this report, the term “Galapagos NV” refers solely to the non-consolidated Belgian company and references to “we,” “our,” “the group” or “Galapagos” include Galapagos NV together with its subsidiaries. With the exception of filgotinib’s approval for the treatment of rheumatoid arthritis by the European Commission and Japanese Ministry of Health, Labour and Welfare, our drug candidates mentioned in this report are investigational; their efficacy and safety have not been fully evaluated by any regulatory authority. This report is published in Dutch and in English. In case of inconsistency between the Dutch and the English versions, the Dutch version shall prevail. Galapagos is responsible for the translation and conformity between the Dutch and English version. This report is available free of charge and upon request addressed to: Galapagos NV Investor Relations Generaal De Wittelaan L11 A3 2800 Mechelen, Belgium Tel: +32 15 34 29 00 Email: [email protected] A digital version of this report is available on our website, www.glpg.com. We will use reasonable efforts to ensure the accuracy of the digital version, but we do not assume responsibility if inaccuracies or inconsistencies with the printed document arise as a result of any electronic transmission. Therefore, we consider only the printed version of this report to be legally valid. Other information on our website or on other websites does not form a part of this report. Jyseleca® is a trademark of Galapagos NV and Gilead Sciences, Inc. or its related companies. Listings Euronext Amsterdam and Brussels: GLPG Nasdaq: GLPG Forward-looking statements This report contains forward-looking statements, all of which involve certain risks and uncertainties. These statements are often, but are not always, made through the use of words or phrases such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “seek,” “estimate,” “may,” “will,” “could,” “stand to,” “continue,” as well as similar expressions. Forward-looking statements contained in this report include, but are not limited to, statements made in the “Letter from the management”, the information provided in the section captioned “Outlook 2021”, guidance from management regarding the expected operational use of cash during financial year 2021, statements regarding the amount and timing of potential future milestones, opt-in and/or royalty payments by Gilead, Galapagos’ strategic R&D ambitions, including progress on our fibrosis portfolio, and potential changes of such ambitions, statements regarding the strategic re-evaluation, our statements and expectations regarding commercial sales of filgotinib, statements regarding the global R&D collaboration with Gilead and regarding the amendment of our arrangement with Gilead for the commercialization and development of filgotinib, 14 Galapagos NV • Q1 Report 2021

THE GALAPAGOS GROUP statements regarding the expected timing, design and readouts of ongoing and planned clinical trials (i) with filgotinib in ulcerative colitis and Crohn’s disease, (ii) with GLPG4716 in IPF, (iii) with GLPG3970 in inflammation, ulcerative colitis, rheumatoid arthritis and psoriatic arthritis, (iv) with GLPG0555, GLPG4399 and GLPG3121 in inflammation, (v) with GLPG3667 in psoriasis, (vi) with GLPG2737 in PCKD, (vii) with GLPG4876 in inflammation, and (viii) with GLPG4586 in fibrosis, statements relating to interactions with regulatory authorities, the timing or likelihood of additional regulatory authorities’ approval of marketing authorization for filgotinib for RA, UC or any other indication, including the UC and IBD indications for filgotinib in Europe, the UK, Japan, and the U.S., such additional regulatory authorities requiring additional studies, the timing or likelihood of pricing and reimbursement interactions for filgotinib, statements relating to the build-up of our commercial organization and commercial sales for filgotinib, including in Europe, the expected impact of COVID-19, and our strategy, business plans and focus. We caution the reader that forward-looking statements are not guarantees of future performance. Forward-looking statements may involve known and unknown risks, uncertainties and other factors which might cause our actual results, financial condition and liquidity, performance or achievements, or the development of the industry in which we operate, to be materially different from any historic or future results, financial conditions, performance or achievements expressed or implied by such forward-looking statements. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with such forward-looking statements, they may not be predictive of results or developments in future periods. Among the factors that may result in differences are that our expectations regarding our 2021 revenues and financial results and our 2021 operating expenses may be incorrect (including because one or more of our assumptions underlying our revenue or expense expectations may not be realized), the inherent uncertainties associated with competitive developments, clinical trial and product development activities and regulatory approval requirements (including the risk that data from our ongoing and planned clinical research programs in rheumatoid arthritis, Crohn’s disease, ulcerative colitis, idiopathic pulmonary fibrosis, osteoarthritis, and other inflammatory indications may not support registration or further development of our product candidates due to safety, efficacy, or other reasons), our reliance on collaborations with third parties (including our collaboration partner, Gilead), the timing of and the risks related to implementing the amendment of our arrangement with Gilead for the commercialization and development of filgotinib, estimating the commercial potential of our product candidates and Galapagos’ expectations regarding the costs and revenues associated with the transfer of European commercialization rights to filgotinib may be incorrect, and the uncertainties relating to the impact of the COVID-19 pandemic. A further list and description of these risks, uncertainties and other risks can be found in our Securities and Exchange Commission filing and reports, including in our most recent annual report on Form 20-F filed with the SEC and our subsequent filings and reports filed with the SEC. We also refer to the “Risk Factors” section of this report. Given these uncertainties, the reader is advised not to place any undue reliance on such forward-looking statements. These forward-looking statements speak only as of the date of publication of this document. We expressly disclaim any obligation to update any such forward-looking statements in this document to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements, unless specifically required by law or regulation. 15 Galapagos NV • Q1 Report 2021

Financial statements Unaudited condensed consolidated interim financial statements for the first three months of 2021 Forward with confidence

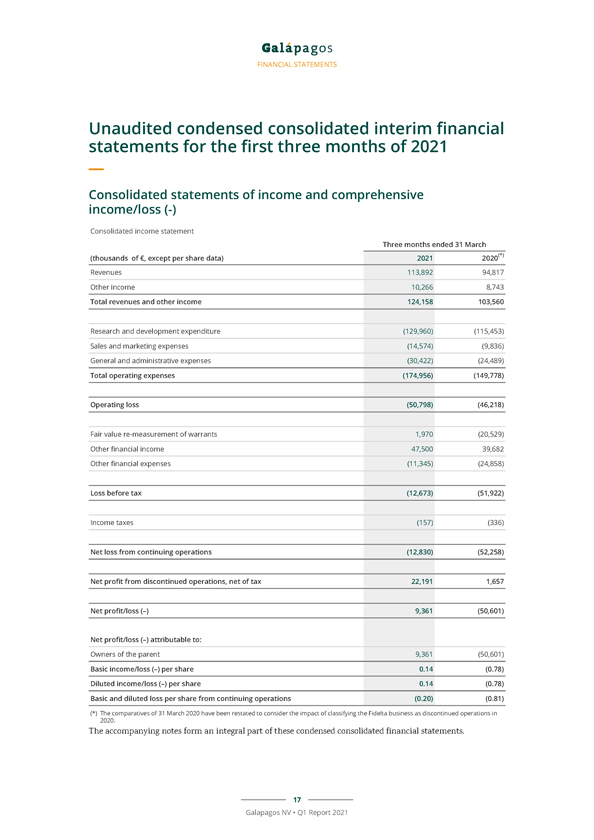

FINANCIAL STATEMENTS Unaudited condensed consolidated interim financial statements for the first three months of 2021 Consolidated statements of income and comprehensive income/loss (-) Consolidated income statement Three months ended 31 March (thousands of €, except per share data) 2021 2020(*) Revenues 113,892 94,817 Other income 10,266 8,743 Total revenues and other income 124,158 103,560 Research and development expenditure (129,960) (115,453) Sales and marketing expenses (14,574) (9,836) General and administrative expenses (30,422) (24,489) Total operating expenses (174,956) (149,778) Operating loss (50,798) (46,218) Fair value re-measurement of warrants 1,970 (20,529) Other financial income 47,500 39,682 Other financial expenses (11,345) (24,858) Loss before tax (12,673) (51,922) Income taxes (157) (336) Net loss from continuing operations (12,830) (52,258) Net profit from discontinued operations, net of tax 22,191 1,657 Net profit/loss (–) 9,361 (50,601) Net profit/loss (–) attributable to: Owners of the parent 9,361 (50,601) Basic income/loss (–) per share 0.14 (0.78) Diluted income/loss (–) per share 0.14 (0.78) Basic and diluted loss per share from continuing operations (0.20) (0.81) (*) The comparatives of 31 March 2020 have been restated to consider the impact of classifying the Fidelta business as discontinued operations in 2020. The accompanying notes form an integral part of these condensed consolidated financial statements. 17 Galapagos NV • Q1 Report 2021

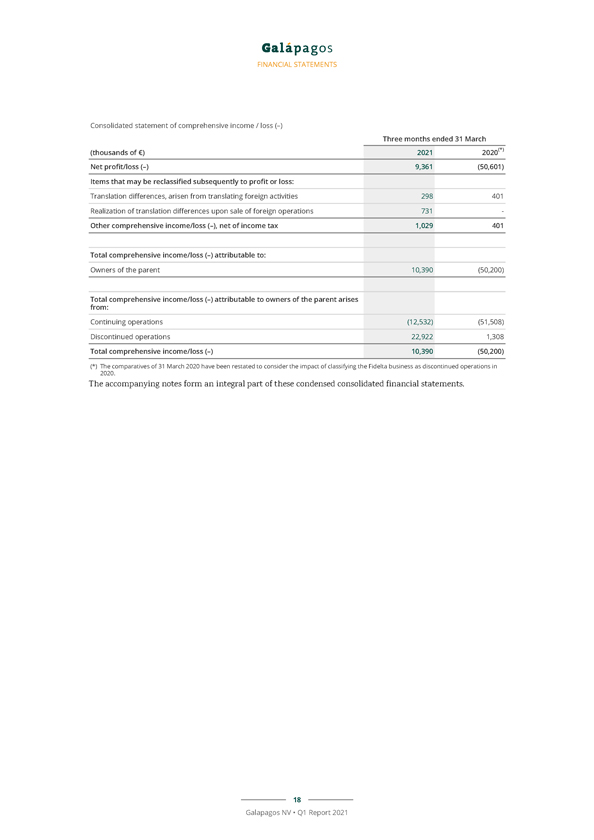

FINANCIAL STATEMENTS Consolidated statement of comprehensive income / loss (–) Three months ended 31 March (thousands of €) 2021 2020(*) Net profit/loss (–) 9,361 (50,601) Items that may be reclassified subsequently to profit or loss: Translation differences, arisen from translating foreign activities 298 401 Realization of translation differences upon sale of foreign operations 731—Other comprehensive income/loss (–), net of income tax 1,029 401 Total comprehensive income/loss (–) attributable to: Owners of the parent 10,390 (50,200) Total comprehensive income/loss (–) attributable to owners of the parent arises from: Continuing operations (12,532) (51,508) Discontinued operations 22,922 1,308 Total comprehensive income/loss (–) 10,390 (50,200) (*) The comparatives of 31 March 2020 have been restated to consider the impact of classifying the Fidelta business as discontinued operations in 2020. The accompanying notes form an integral part of these condensed consolidated financial statements. 18 Galapagos NV • Q1 Report 2021

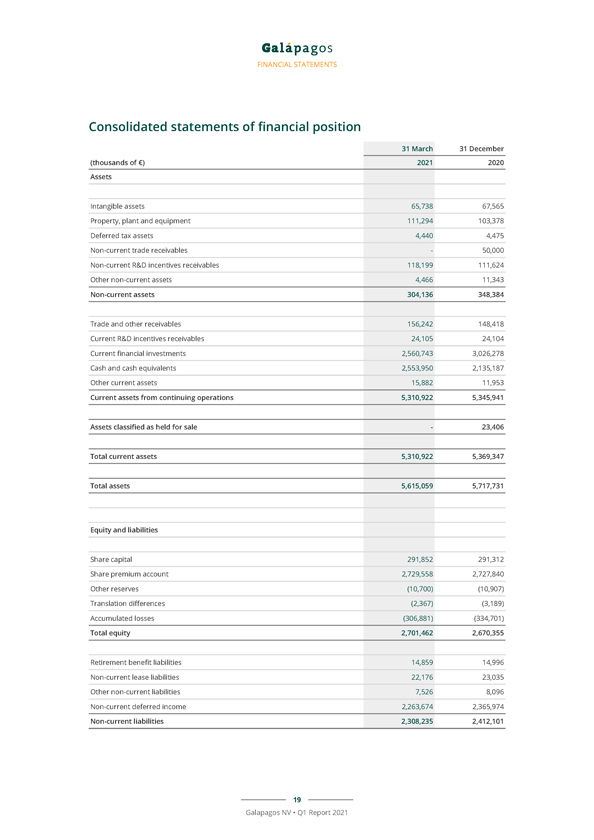

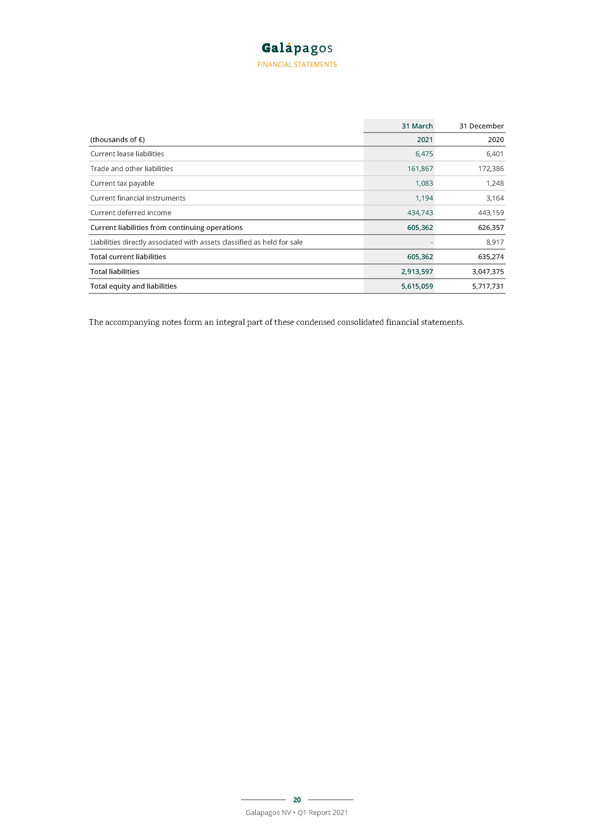

FINANCIAL STATEMENTS Consolidated statements of financial position 31 March 31 December (thousands of €) 2021 2020 Assets Intangible assets 65,738 67,565 Property, plant and equipment 111,294 103,378 Deferred tax assets 4,440 4,475 Non-current trade receivables—50,000 Non-current R&D incentives receivables 118,199 111,624 Other non-current assets 4,466 11,343 Non-current assets 304,136 348,384 Trade and other receivables 156,242 148,418 Current R&D incentives receivables 24,105 24,104 Current financial investments 2,560,743 3,026,278 Cash and cash equivalents 2,553,950 2,135,187 Other current assets 15,882 11,953 Current assets from continuing operations 5,310,922 5,345,941 Assets classified as held for sale—23,406 Total current assets 5,310,922 5,369,347 Total assets 5,615,059 5,717,731 Equity and liabilities Share capital 291,852 291,312 Share premium account 2,729,558 2,727,840 Other reserves (10,700) (10,907) Translation differences (2,367) (3,189) Accumulated losses (306,881) (334,701) Total equity 2,701,462 2,670,355 Retirement benefit liabilities 14,859 14,996 Non-current lease liabilities 22,176 23,035 Other non-current liabilities 7,526 8,096 Non-current deferred income 2,263,674 2,365,974 Non-current liabilities 2,308,235 2,412,101 19 Galapagos NV • Q1 Report 2021

FINANCIAL STATEMENTS 31 March 31 December (thousands of €) 2021 2020 Current lease liabilities 6,475 6,401 Trade and other liabilities 161,867 172,386 Current tax payable 1,083 1,248 Current financial instruments 1,194 3,164 Current deferred income 434,743 443,159 Current liabilities from continuing operations 605,362 626,357 Liabilities directly associated with assets classified as held for sale—8,917 Total current liabilities 605,362 635,274 Total liabilities 2,913,597 3,047,375 Total equity and liabilities 5,615,059 5,717,731 The accompanying notes form an integral part of these condensed consolidated financial statements. 20 Galapagos NV • Q1 Report 2021

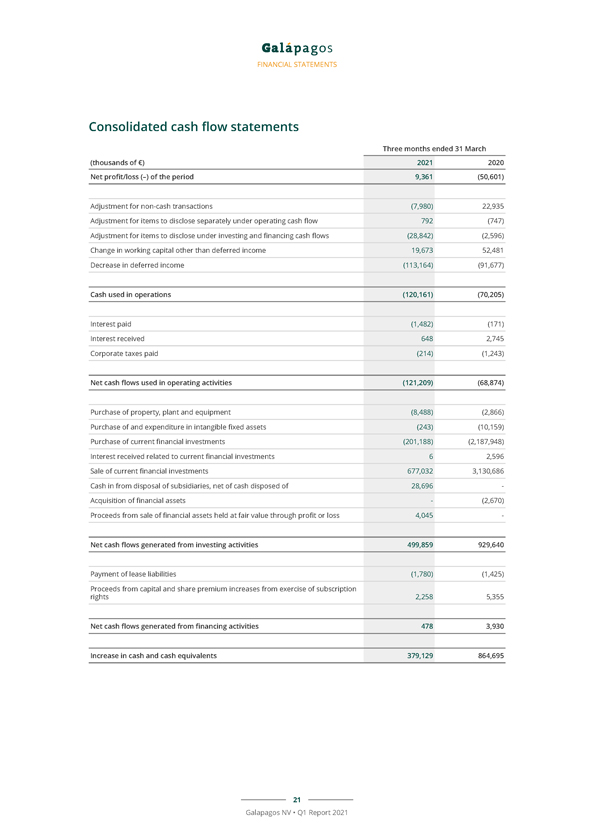

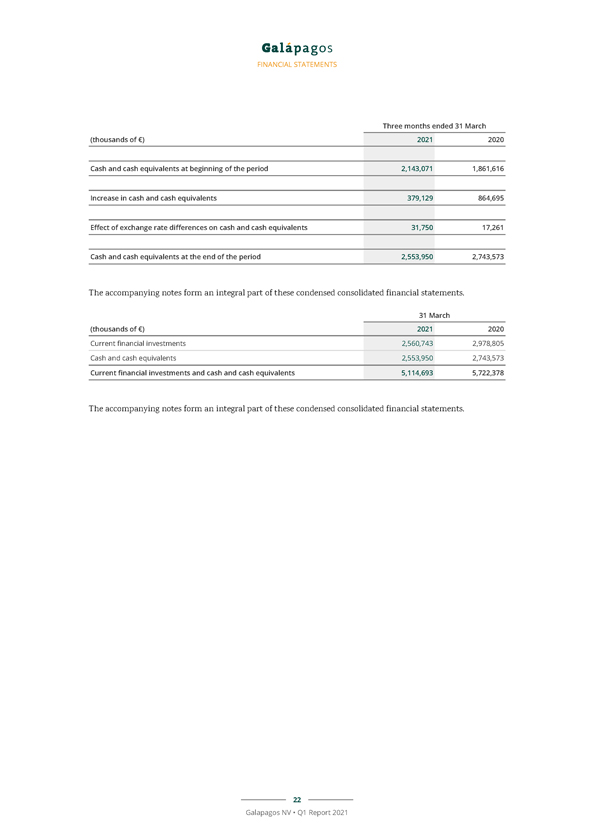

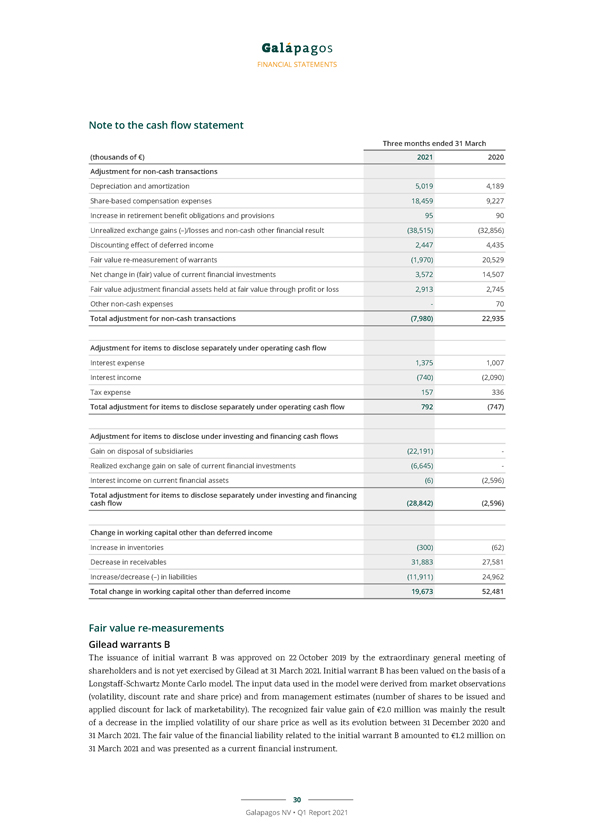

FINANCIAL STATEMENTS Consolidated cash flow statements Three months ended 31 March (thousands of €) 2021 2020 Net profit/loss (–) of the period 9,361 (50,601) Adjustment for non-cash transactions (7,980) 22,935 Adjustment for items to disclose separately under operating cash flow 792 (747) Adjustment for items to disclose under investing and financing cash flows (28,842) (2,596) Change in working capital other than deferred income 19,673 52,481 Decrease in deferred income (113,164) (91,677) Cash used in operations (120,161) (70,205) Interest paid (1,482) (171) Interest received 648 2,745 Corporate taxes paid (214) (1,243) Net cash flows used in operating activities (121,209) (68,874) Purchase of property, plant and equipment (8,488) (2,866) Purchase of and expenditure in intangible fixed assets (243) (10,159) Purchase of current financial investments (201,188) (2,187,948) Interest received related to current financial investments 6 2,596 Sale of current financial investments 677,032 3,130,686 Cash in from disposal of subsidiaries, net of cash disposed of 28,696—Acquisition of financial assets—(2,670) Proceeds from sale of financial assets held at fair value through profit or loss 4,045—Net cash flows generated from investing activities 499,859 929,640 Payment of lease liabilities (1,780) (1,425) Proceeds from capital and share premium increases from exercise of subscription rights 2,258 5,355 Net cash flows generated from financing activities 478 3,930 Increase in cash and cash equivalents 379,129 864,695 21 Galapagos NV • Q1 Report 2021

FINANCIAL STATEMENTS Three months ended 31 March (thousands of €) 2021 2020 Cash and cash equivalents at beginning of the period 2,143,071 1,861,616 Increase in cash and cash equivalents 379,129 864,695 Effect of exchange rate differences on cash and cash equivalents 31,750 17,261 Cash and cash equivalents at the end of the period 2,553,950 2,743,573 The accompanying notes form an integral part of these condensed consolidated financial statements. 31 March (thousands of €) 2021 2020 Current financial investments 2,560,743 2,978,805 Cash and cash equivalents 2,553,950 2,743,573 Current financial investments and cash and cash equivalents 5,114,693 5,722,378 The accompanying notes form an integral part of these condensed consolidated financial statements. 22 Galapagos NV • Q1 Report 2021

FINANCIAL STATEMENTS Consolidated statements of changes in equity Share premium Translation Other Accumul. (thousands of €) Share capital account differences reserves Losses Total On 1 January 2020 287,282 2,703,583 (1,142) (4,842) (109,223) 2,875,658 Net loss (50,601) (50,601) Other comprehensive income/loss (–) 478 (77) 401 Total comprehensive income/loss (–) 478 (77) (50,601) (50,200) Share-based compensation 9,227 9,227 Exercise of subscription rights 824 4,531 5,355 On 31 March 2020 288,106 2,708,114 (663) (4,919) (150,597) 2,840,041 On 1 January 2021 291,312 2,727,840 (3,189) (10,907) (334,701) 2,670,355 Net profit 9,361 9,361 Other comprehensive income 822 207 1,029 Total comprehensive income 822 207 9,361 10,390 Share-based compensation 18,459 18,459 Exercise of subscription rights 540 1,718 2,258 On 31 March 2021 291,852 2,729,558 (2,367) (10,700) (306,881) 2,701,462 The accompanying notes form an integral part of these condensed consolidated financial statements. 23 Galapagos NV • Q1 Report 2021

FINANCIAL STATEMENTS Notes to the unaudited condensed consolidated interim financial statements for the first three months of 2021 Basis of preparation These condensed consolidated interim financial statements have been prepared in accordance with IAS 34 ‘Interim Financial Reporting’ as adopted by the European Union and as issued by the IASB. The condensed consolidated interim financial statements do not contain all information required for an annual report and should therefore be read in conjunction with our Annual Report 2020. Impact of COVID-19 on the financial statements To date, we have experienced limited impact on our financial performance, financial position, cash flows and significant judgements and estimates, although we continue to face additional risks and challenges associated with the impact of the outbreak. We refer to the section Covid-19 impact in this Q1 report for a comprehensive overview of the impact of Covid-19 on the business evolution of Galapagos. Significant accounting policies There were no significant changes in accounting policies applied by us in these condensed consolidated interim financial statements compared to those used in the most recent annual consolidated financial statements of 31 December 2020. New standards and interpretations applicable for the annual period beginning on 1 January 2021 did not have any impact on our condensed consolidated interim financial statements. We have not early adopted any other standard, interpretation, or amendment that has been issued but is not yet effective. 24 Galapagos NV • Q1 Report 2021

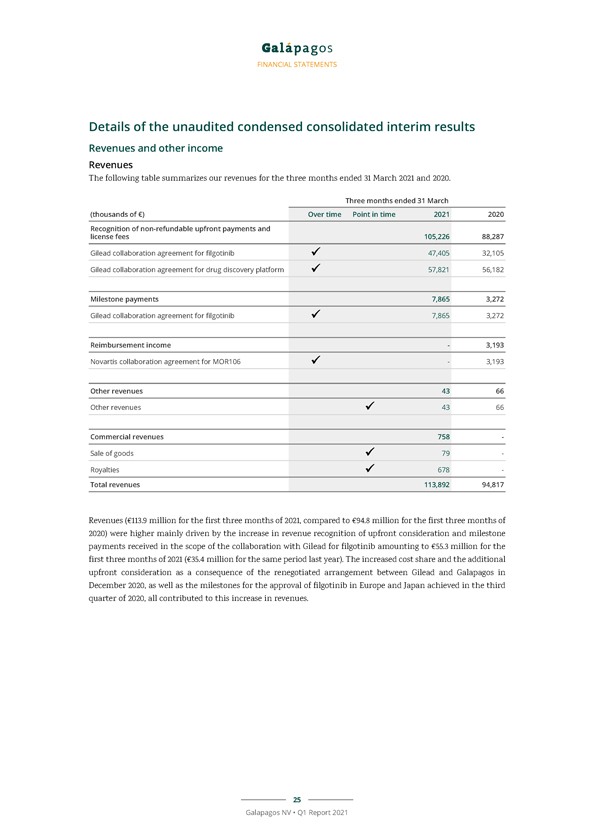

FINANCIAL STATEMENTS Details of the unaudited condensed consolidated interim results Revenues and other income Revenues The following table summarizes our revenues for the three months ended 31 March 2021 and 2020. Three months ended 31 March (thousands of €) Over time Point in time 2021 2020 Recognition of non-refundable upfront payments and license fees 105,226 88,287 Gilead collaboration agreement for filgotinib 47,405 32,105 Gilead collaboration agreement for drug discovery platform 57,821 56,182 Milestone payments 7,865 3,272 Gilead collaboration agreement for filgotinib 7,865 3,272 Reimbursement income—3,193 Novartis collaboration agreement for MOR106—3,193 Other revenues 43 66 Other revenues 43 66 Commercial revenues 758—Sale of goods 79—Royalties 678—Total revenues 113,892 94,817 Revenues (€113.9 million for the first three months of 2021, compared to €94.8 million for the first three months of 2020) were higher mainly driven by the increase in revenue recognition of upfront consideration and milestone payments received in the scope of the collaboration with Gilead for filgotinib amounting to €55.3 million for the first three months of 2021 (€35.4 million for the same period last year). The increased cost share and the additional upfront consideration as a consequence of the renegotiated arrangement between Gilead and Galapagos in December 2020, as well as the milestones for the approval of filgotinib in Europe and Japan achieved in the third quarter of 2020, all contributed to this increase in revenues. 25 Galapagos NV • Q1 Report 2021

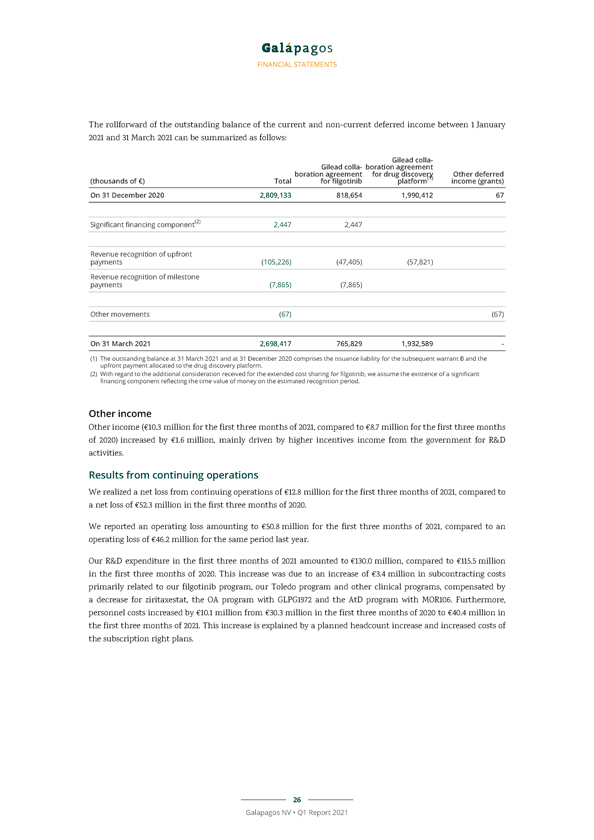

FINANCIAL STATEMENTS The rollforward of the outstanding balance of the current and non-current deferred income between 1 January 2021 and 31 March 2021 can be summarized as follows: Gilead colla- Gilead colla- boration agreement boration agreement for drug discovery (1) Other deferred (thousands of €) Total for filgotinib platform income (grants) On 31 December 2020 2,809,133 818,654 1,990,412 67 Significant financing component(2) 2,447 2,447 Revenue recognition of upfront payments (105,226) (47,405) (57,821) Revenue recognition of milestone payments (7,865) (7,865) Other movements (67) (67) On 31 March 2021 2,698,417 765,829 1,932,589—(1) The outstanding balance at 31 March 2021 and at 31 December 2020 comprises the issuance liability for the subsequent warrant B and the (2) With upfront regard payment to the allocated additional to consideration the drug discovery received platform. for the extended cost sharing for filgotinib, we assume the existence of a significant financing component reflecting the time value of money on the estimated recognition period. Other income Other income (€10.3 million for the first three months of 2021, compared to €8.7 million for the first three months of 2020) increased by €1.6 million, mainly driven by higher incentives income from the government for R&D activities. Results from continuing operations We realized a net loss from continuing operations of €12.8 million for the first three months of 2021, compared to a net loss of €52.3 million in the first three months of 2020. We reported an operating loss amounting to €50.8 million for the first three months of 2021, compared to an operating loss of €46.2 million for the same period last year. Our R&D expenditure in the first three months of 2021 amounted to €130.0 million, compared to €115.5 million in the first three months of 2020. This increase was due to an increase of €3.4 million in subcontracting costs primarily related to our filgotinib program, our Toledo program and other clinical programs, compensated by a decrease for ziritaxestat, the OA program with GLPG1972 and the AtD program with MOR106. Furthermore, personnel costs increased by €10.1 million from €30.3 million in the first three months of 2020 to €40.4 million in the first three months of 2021. This increase is explained by a planned headcount increase and increased costs of the subscription right plans. 26 Galapagos NV • Q1 Report 2021

FINANCIAL STATEMENTS The table below summarizes our R&D expenditure for the three months ended 31 March 2021 and 2020, broken down by program. Three months ended 31 March (thousands of €) 2021 2020 Filgotinib program (36,932) (29,296) Ziritaxestat program (10,513) (13,783) OA program with GLPG1972 (636) (6,427) Toledo program (27,823) (16,871) AtD program with MOR106 (152) (4,248) Other programs (53,904) (44,828) Total research and development expenditure (129,960) (115,453) Our G&A and S&M expenses were €45.0 million in the first three months of 2021, compared to €34.3 million in the first three months of 2020. This increase mainly resulted from higher personnel costs for €9.6 million (€26.5 million in the first three months of 2021 compared to €16.9 million in the same period last year). This increase was due to a planned headcount increase following the commercial launch of filgotinib in Europe as well as higher costs of the subscription right plans. In the first three months of 2021, we reported a non-cash fair value gain from the re-measurement of initial warrant B issued to Gilead, amounting to €2.0 million, mainly due to the decreased implied volatility of the Galapagos share price as well as its evolution between 31 December 2020 and 31 March 2021. Net other financial income in the first three months of 2021 amounted to €36.2 million (as compared to €14.8 million in the same period last year), which was primarily attributable to €45.5 million of currency exchange gains on our cash and cash equivalents and current financial investments in U.S. dollars (as compared to €34.3 million in the first three months of 2020) and €3.6 million negative changes in (fair) value of current financial investments (€14.5 million in the same period last year). The other financial expenses also contained the effect of discounting our long term deferred income for €2.4 million (€4.4 million in the same period last year) and the fair value loss of financial assets held at fair value through profit or loss of €2.9 million (€2.7 million in the same period last year). Cash position Cash and cash equivalents and current financial investments totaled €5,114.7 million on 31 March 2021 (€5,169.3 million on 31 December 2020, including the cash and cash equivalents included in the assets classified as held for sale). A net decrease of €54.6 million in cash and cash equivalents and current financial investments was recorded during the first three months of 2021, compared to a net decrease of €58.4 million during the first three months of 2020. This net decrease was composed of (i) €127.7 million of operational cash burn, (ii) offset by €2.3 million of cash proceeds from capital and share premium increase from exercise of subscription rights in the first three months of 2021, (iii) €3.6 million of negative changes in (fair) value of current financial investments and €45.7 million of mainly positive exchange rate differences, and (iv) €28.7 million cash in from disposal of subsidiaries, net of cash disposed of. The operational cash burn (or operational cash flow if this performance measure is positive) is a financial measure that is not calculated in accordance with IFRS. Operational cash burn/cash flow is defined as the increase or decrease in our cash and cash equivalents (excluding the effect of exchange rate differences on cash and cash equivalents), minus: 27 Galapagos NV • Q1 Report 2021

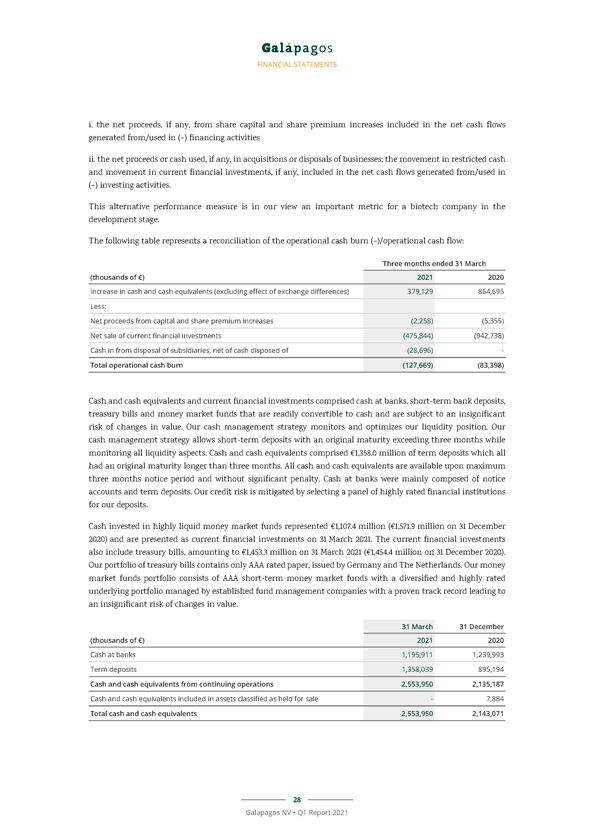

FINANCIAL STATEMENTS i. the net proceeds, if any, from share capital and share premium increases included in the net cash flows generated from/used in (–) financing activities ii. the net proceeds or cash used, if any, in acquisitions or disposals of businesses; the movement in restricted cash and movement in current financial investments, if any, included in the net cash flows generated from/used in (–) investing activities. This alternative performance measure is in our view an important metric for a biotech company in the development stage. The following table represents a reconciliation of the operational cash burn (–)/operational cash flow: Three months ended 31 March (thousands of €) 2021 2020 Increase in cash and cash equivalents (excluding effect of exchange differences) 379,129 864,695 Less: Net proceeds from capital and share premium increases (2,258) (5,355) Net sale of current financial investments (475,844) (942,738) Cash in from disposal of subsidiaries, net of cash disposed of (28,696)—Total operational cash burn (127,669) (83,398) Cash and cash equivalents and current financial investments comprised cash at banks, short-term bank deposits, treasury bills and money market funds that are readily convertible to cash and are subject to an insignificant risk of changes in value. Our cash management strategy monitors and optimizes our liquidity position. Our cash management strategy allows short-term deposits with an original maturity exceeding three months while monitoring all liquidity aspects. Cash and cash equivalents comprised €1,358.0 million of term deposits which all had an original maturity longer than three months. All cash and cash equivalents are available upon maximum three months notice period and without significant penalty. Cash at banks were mainly composed of notice accounts and term deposits. Our credit risk is mitigated by selecting a panel of highly rated financial institutions for our deposits. Cash invested in highly liquid money market funds represented €1,107.4 million (€1,571.9 million on 31 December 2020) and are presented as current financial investments on 31 March 2021. The current financial investments also include treasury bills, amounting to €1,453.3 million on 31 March 2021 (€1,454.4 million on 31 December 2020). Our portfolio of treasury bills contains only AAA rated paper, issued by Germany and The Netherlands. Our money market funds portfolio consists of AAA short-term money market funds with a diversified and highly rated underlying portfolio managed by established fund management companies with a proven track record leading to an insignificant risk of changes in value. 31 March 31 December (thousands of €) 2021 2020 Cash at banks 1,195,911 1,239,993 Term deposits 1,358,039 895,194 Cash and cash equivalents from continuing operations 2,553,950 2,135,187 Cash and cash equivalents included in assets classified as held for sale—7,884 Total cash and cash equivalents 2,553,950 2,143,071 28 Galapagos NV • Q1 Report 2021

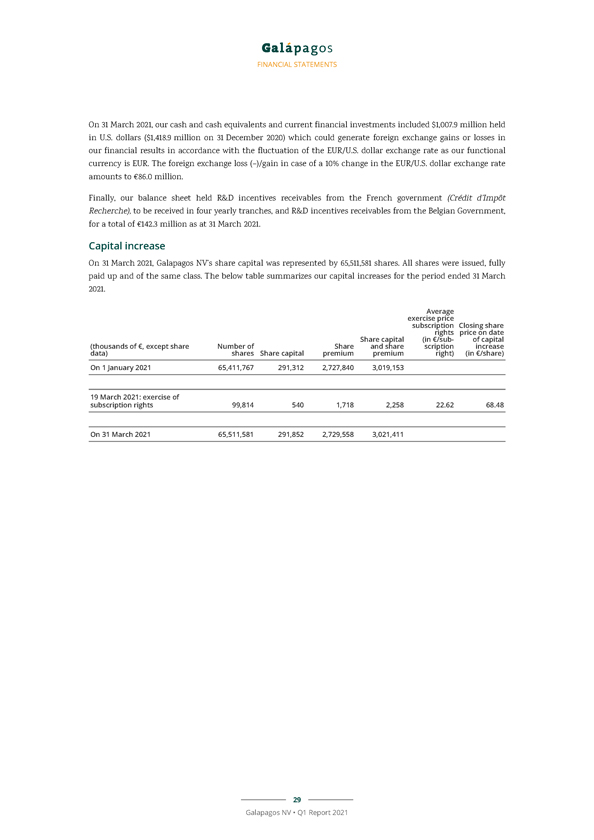

FINANCIAL STATEMENTS On 31 March 2021, our cash and cash equivalents and current financial investments included $1,007.9 million held in U.S. dollars ($1,418.9 million on 31 December 2020) which could generate foreign exchange gains or losses in our financial results in accordance with the fluctuation of the EUR/U.S. dollar exchange rate as our functional currency is EUR. The foreign exchange loss (–)/gain in case of a 10% change in the EUR/U.S. dollar exchange rate amounts to €86.0 million. Finally, our balance sheet held R&D incentives receivables from the French government (Crédit d’Impôt Recherche), to be received in four yearly tranches, and R&D incentives receivables from the Belgian Government, for a total of €142.3 million as at 31 March 2021. Capital increase On 31 March 2021, Galapagos NV’s share capital was represented by 65,511,581 shares. All shares were issued, fully paid up and of the same class. The below table summarizes our capital increases for the period ended 31 March 2021. Average exercise price subscription Closing share rights price on date Share capital (in €/sub- of capital (thousands of €, except share Number of Share and share scription increase data) shares Share capital premium premium right) (in €/share) On 1 January 2021 65,411,767 291,312 2,727,840 3,019,153 19 March 2021: exercise of subscription rights 99,814 540 1,718 2,258 22.62 68.48 On 31 March 2021 65,511,581 291,852 2,729,558 3,021,411 29 Galapagos NV • Q1 Report 2021