Form 6-K CHINA MOBILE LTD /ADR/ For: Apr 16

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the Month of April 2020

Commission File Number: 1-14696

China Mobile Limited

(Translation of registrant’s name into English)

60/F, The Center

99 Queen’s Road Central

Hong Kong, China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.:

|

Form 20-F X |

|

Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

|

Yes |

|

No X_ |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .

|

Exhibit Number |

|

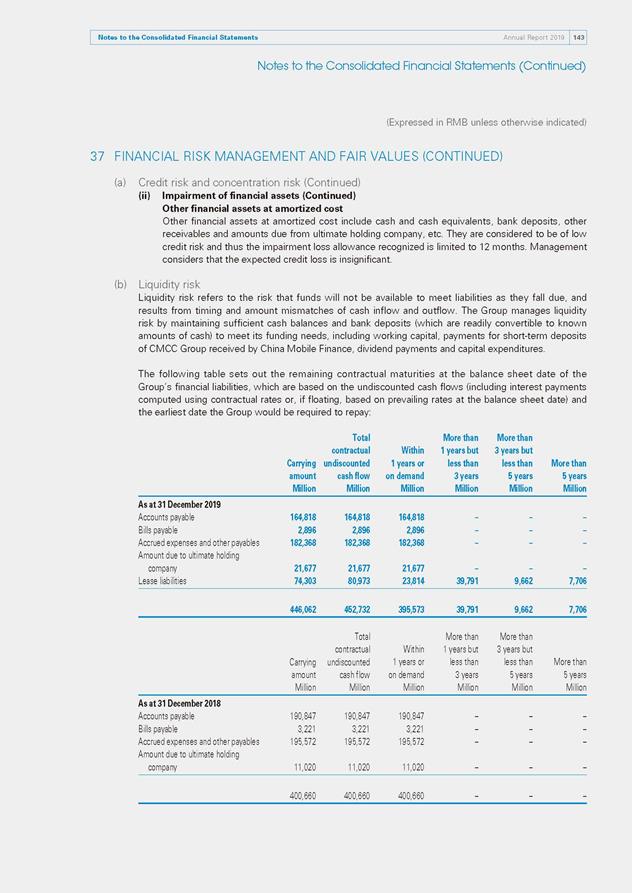

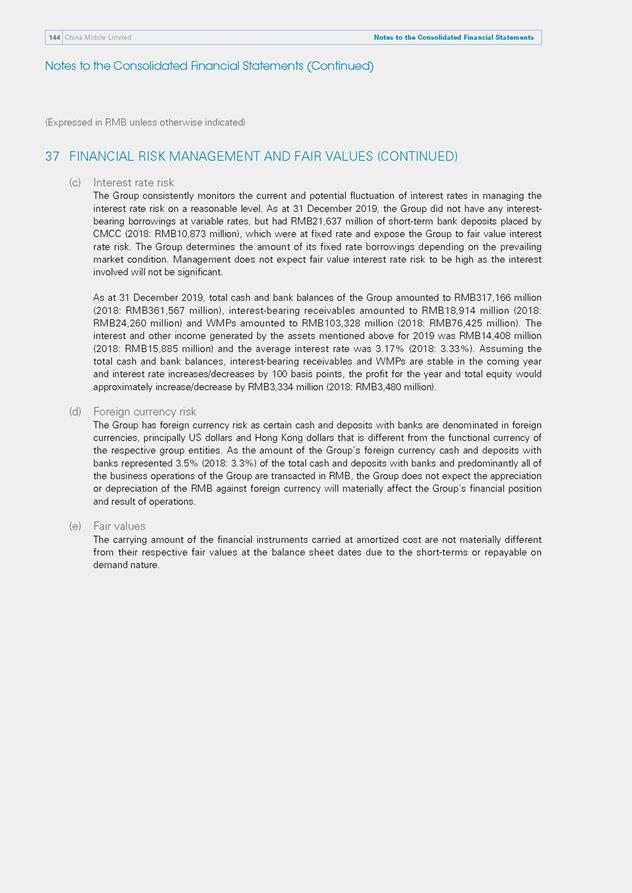

|

|

|

|

|

|

1.1 |

|

|

|

|

|

|

|

2.1 |

|

|

|

|

|

|

|

3.1 |

|

|

|

|

|

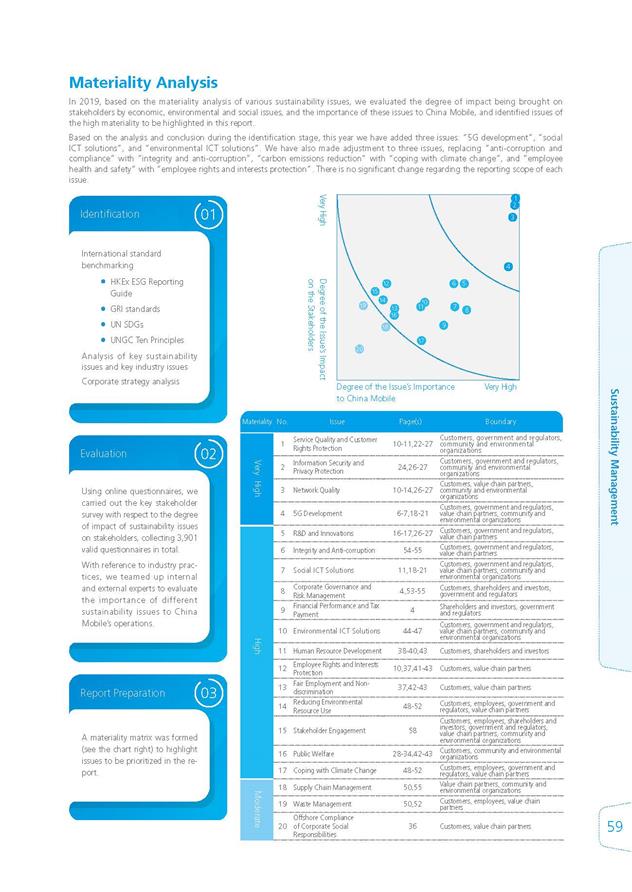

|

|

4.1 |

|

|

|

|

|

|

|

5.1 |

|

Proposed Adoption of Share Option Scheme, dated April 14, 2020 |

FORWARD-LOOKING STATEMENTS

This announcement contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are, by their nature, subject to significant risks and uncertainties. These forward-looking statements include, without limitation, statements relating to:

|

|

• |

our business objectives and strategies, including those relating to the development of our terminal procurement and distribution business; |

|

|

• |

our operations and prospects; |

|

|

• |

our network expansion and capital expenditure plans; |

|

|

• |

the expected impact of any acquisitions or other strategic transactions; |

|

|

• |

our provision of services, including fifth generation, or 5G, services, wireline broadband services and services based on technological evolution, and the ability to attract customers to these services; |

|

|

• |

the planned development of future generations of mobile technologies, including 5G technologies, and other technologies and related applications; |

|

|

• |

the anticipated evolution of the industry chain of 5G and future generations of mobile technologies, including future development in, and availability of, terminals that support our provision of services based on 5G and future generations of mobile technologies, and testing and commercialization of future generations of mobile technologies; |

|

|

• |

the expected benefit from our investment in and any arrangements with China Tower Corporation Limited; |

|

|

• |

the expected impact of the implementation in Mainland China of the policy of “speed upgrade and tariff reduction” and the cancellation of roaming tariffs on our business, financial condition and results of operations; |

|

|

• |

the expected impact of tariff changes on our business, financial condition and results of operations; |

|

|

• |

the potential impact of restrictions, sanctions or other legal or regulatory actions under relevant laws and regulations in various jurisdictions on our telecommunications equipment suppliers and other business partners; |

2

|

|

• |

the potential impact of the outcome of the State Administration for Market Regulation’s investigation on us; |

|

|

• |

the impact of the outbreak of the coronavirus disease, or COVID-19, a disease caused by a novel strain of coronavirus, on the PRC economy and our operations and financial performance; |

|

|

• |

the expected impact of new service offerings on our business, financial condition and results of operations; and |

|

|

• |

future developments in the telecommunications industry in Mainland China, including changes in the regulatory and competitive landscape. |

The words “aim”, “anticipate”, “believe”, “could”, “endeavor”, “estimate”, “expect”, “intend”, “may”, “plan”, “seek”, “should”, “strive”, “target”, “will” and similar expressions, as they relate to us, are intended to identify certain of these forward-looking statements. We do not intend to update these forward-looking statements and are under no obligation to do so.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual results may differ materially from information contained in the forward-looking statements as a result of a number of factors, including the risk factors set forth in the “Risk Factor” section of our latest Annual Report on Form 20-F, as filed with the U.S. Securities and Exchange Commission.

3

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

CHINA MOBILE LIMITED |

||||

|

|

|

|

|

|

||||

|

Date: |

|

April 16, 2020 |

|

By: |

|

/s/ Dong Xin |

||

|

|

|

|

|

|

|

Name: |

|

Dong Xin |

|

|

|

|

|

|

|

Title: |

|

Executive Director, Vice Precedent and Chief Financial Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

Exhibit 1.1

China Mobile Limited Stock Code: 941 ANNUAL REPORT 2019 EDGE AI IoT CLOUD BIG DATA ...... Inf inite Future

THEME China Mobile put in an all-out effort to drive the “5G+” plan forward in 2019, pursuing every possible avenue to promote 5G+4G coordinated development, foster 5G+AICDE integrated and joint innovations, cultivate collaborative 5G+Eco ecology and encourage the wider use of 5G+X applications. Central to the “5G+” plan is our overarching mission to inspire the world with brand-new experiences: from providing a fresh impetus to economic growth and creating new opportunities for social development, to offering an unprecedented digital lifestyle and building new business models driven by cooperation. We are confident what lay ahead of our exciting 5G journey are infinite possibilities and enchantments, plus a marvellous future. FORWARD-LOOKING STATEMENTS Certain statements contained in this annual report may be viewed as “forward-looking statements” within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual performance, financial condition or results of operations of the Company to be materially different from those implied by such forward-looking statements. In addition, we do not intend to update these forward-looking statements. Further information regarding these risks, uncertainties and other factors is included in the Company’s most recent Annual Report on Form 20-F filed and other filings with the U.S. Securities and Exchange Commission.

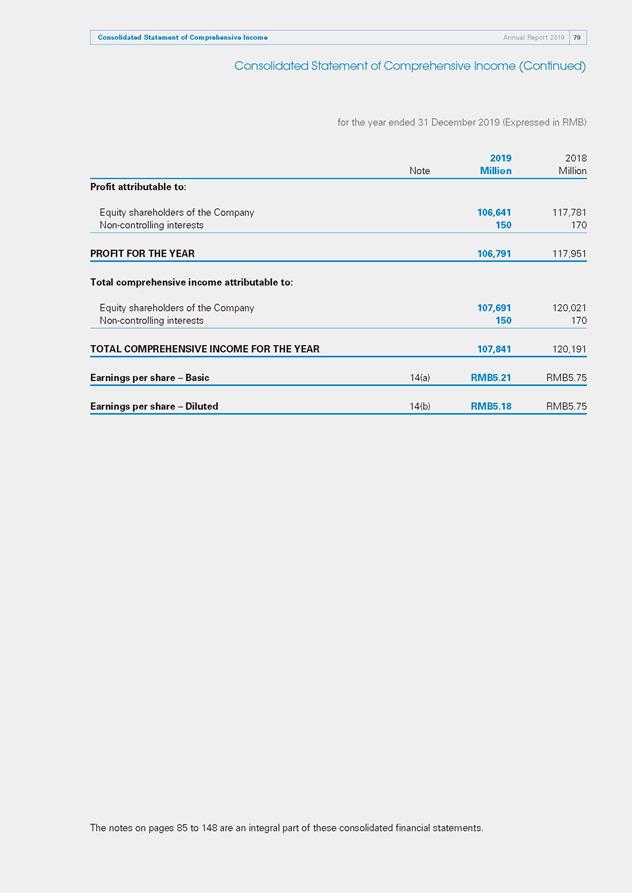

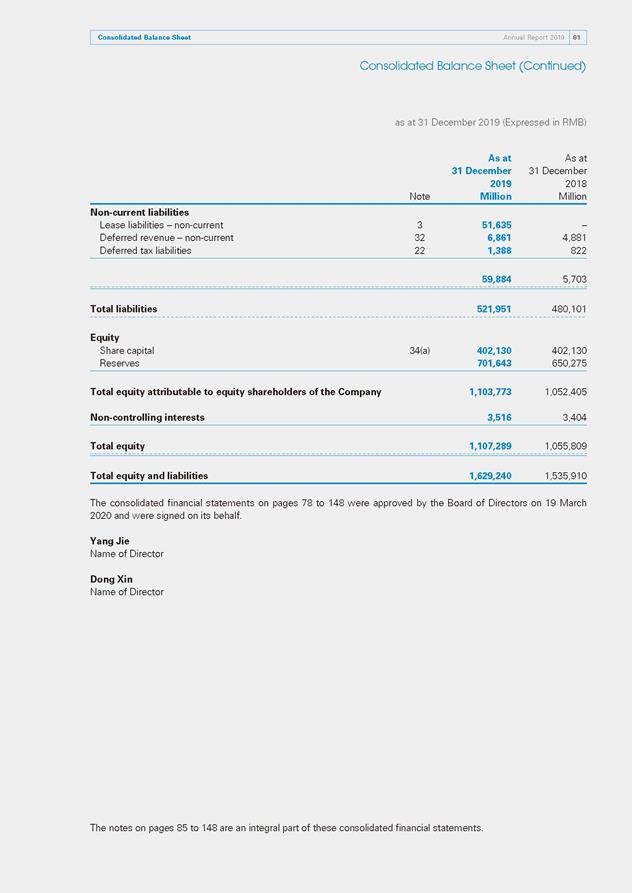

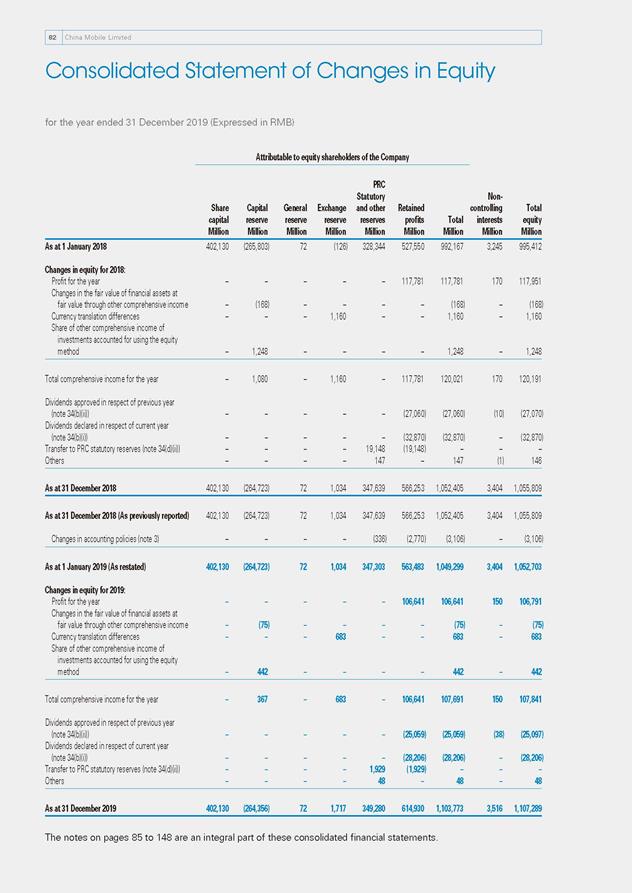

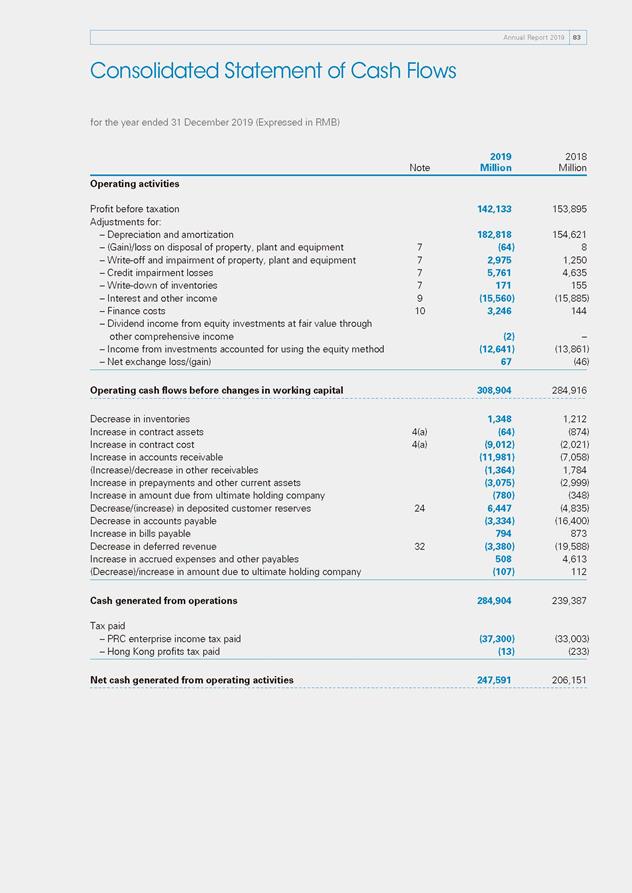

02 04 05 06 6244 70 78 80 152 61 14 Chairman’s Statement Contents Milestones Financial Highlights Biographies of Directors and Senior Management Company Profile 28 Business Review 36 Financial Review Notice of the Annual General Meeting Consolidated Balance Sheet Consolidated Statement of Comprehensive Income 24 Corporate Recognitions Corporate Governance Report 73 Independent Auditor’s Report Report of Directors Human Resources Development Corporate Information 149 Financial Summary 85 Notes to the Consolidated Financial Statements 83 Consolidated Statement of Cash Flows 82 Consolidated Statement of Changes in Equity 14 Chairman’s Statement Contents Milestones Financial Highlights Biographies of Directors and Senior Management Company Profile 28 Business Review 36 Financial Review Notice of the Annual General Meeting Consolidated Balance Sheet Consolidated Statement of Comprehensive Income 24 Corporate Recognitions Corporate Governance Report 73 Independent Auditor’s Report Report of Directors Human Resources Development Corporate Information 149 Financial Summary 85 Notes to the Consolidated Financial Statements 83 Consolidated Statement of Cash Flows 82 Consolidated Statement of Changes in Equity

China Mobile Limited02 02 Milestones MARCH 2019 • Supported a medical institution in Beijing to perform China’s first- ever 5G-based remote surgery on a human; FEBRUARY 2019 JUNE 2019 AUGUST 2019 • Joined hands with China Media • Obtained the 5G operating permit • China Mobile made a statement Group to debut the Chinese New and announced the “5G+” plan; on its overall development plan Year Gala live using “5G+4K” which aims for becoming a technologies; world-class enterprise by building a dynamic “Powerhouse”;

Annual Report 2019 03Milestones 03Milestones AUGUST 2019 • Unveiled the first self-branded 5G handset, “Pioneer X1”; OCTOBER 2019 NOVEMBER 2019 DECEMBER 2019 • Officially released 5G commercial • Fully implemented “Mobile Number • China Mobile was granted the packages and launched 5G Portability”; accolade of “Top Ten Model services in 50 cities in China; Brands of the Year” at the “2019 China Brand Power Grand Ceremony” held by China Media Group.

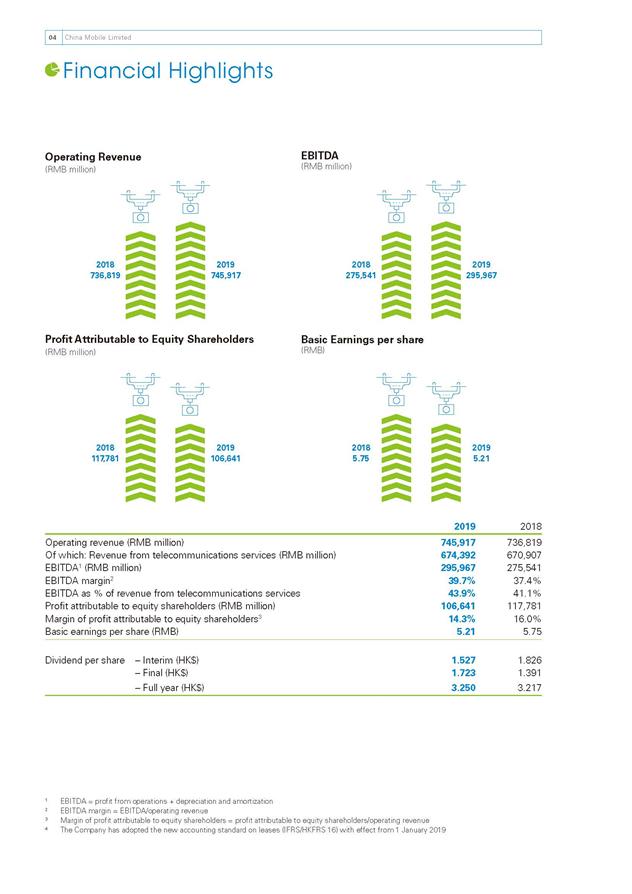

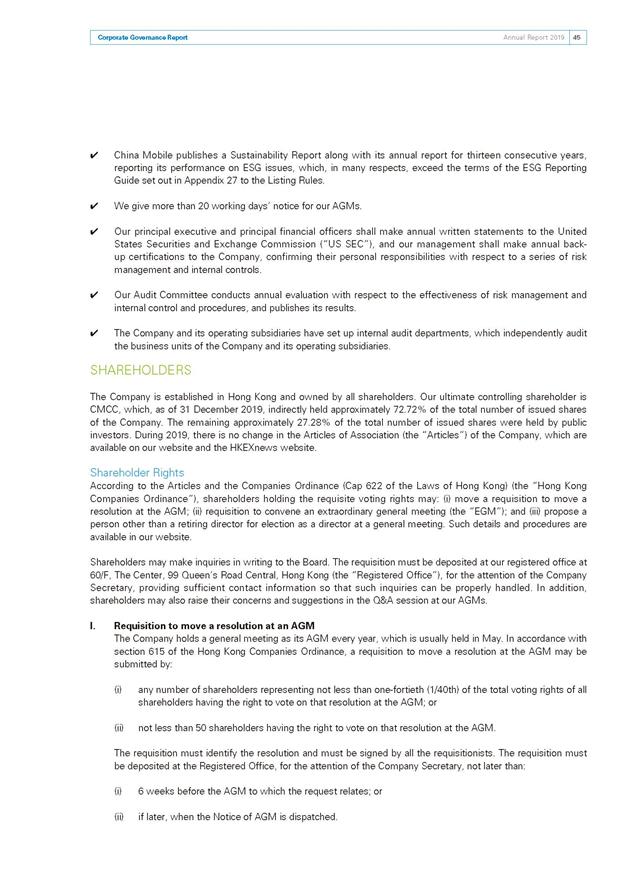

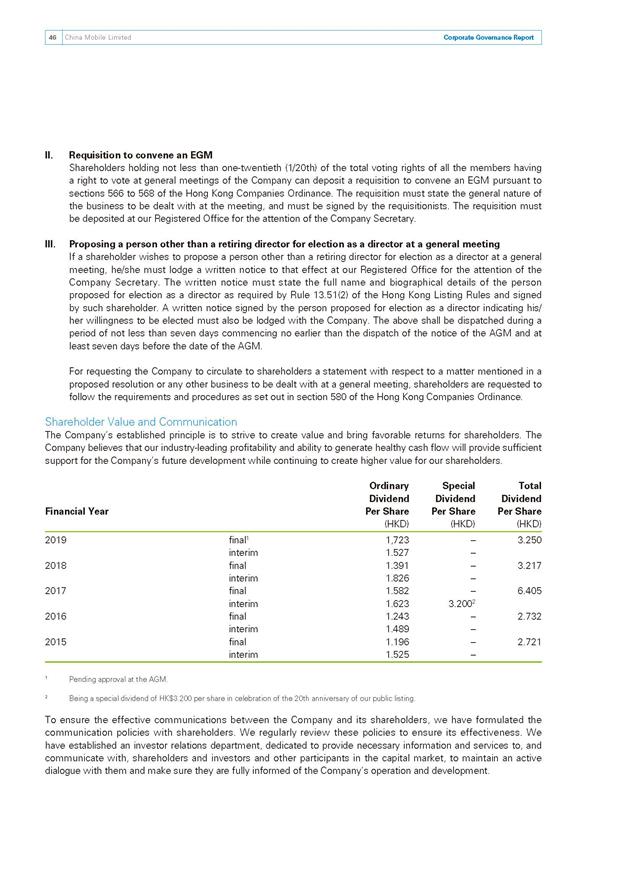

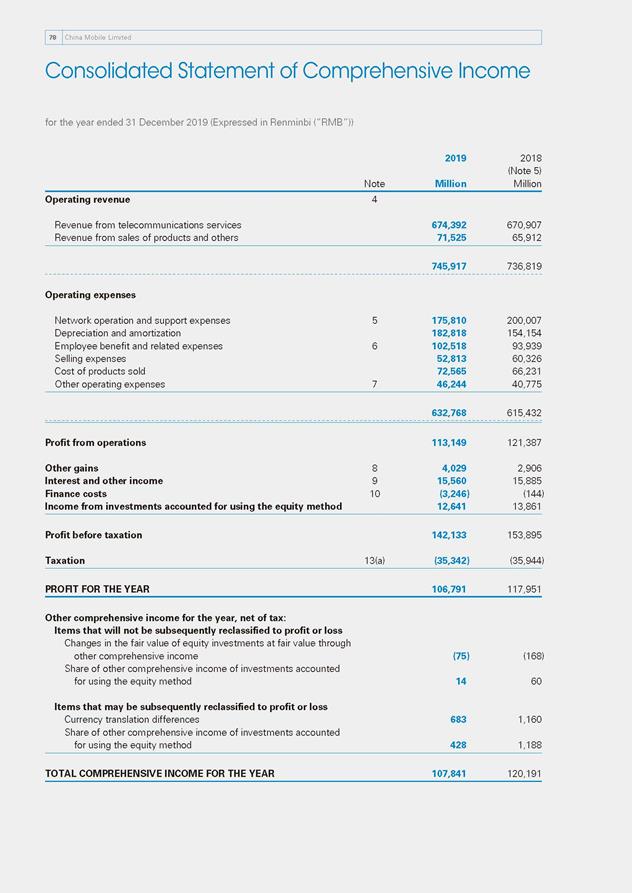

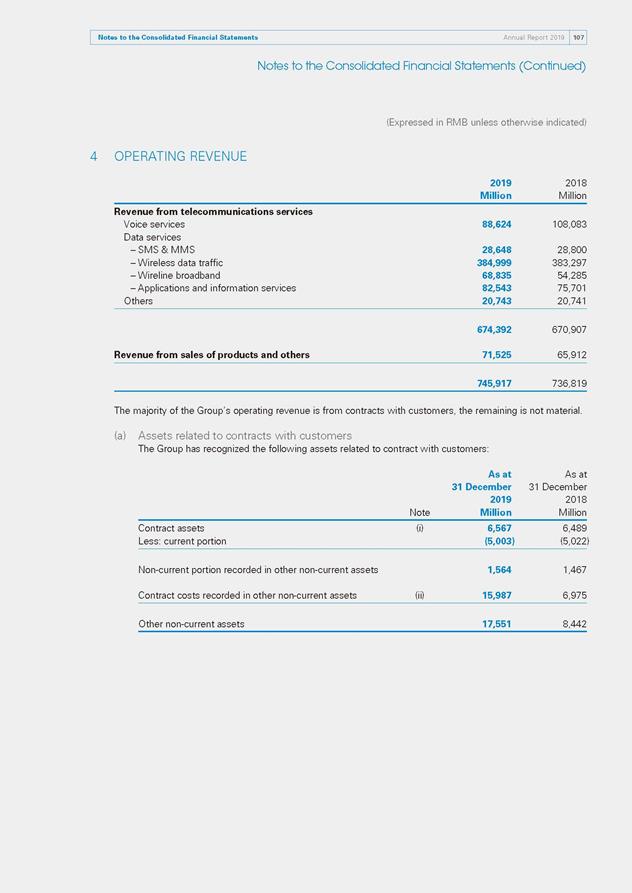

China Mobile Limited04 04 Financial Highlights Operating Revenue EBITDA (RMB million) (RMB million) 2018 2019 2018 2019 736,819 745,917 275,541 295,967 Profit Attributable to Equity Shareholders Basic Earnings per share (RMB million) (RMB) 2018 2019 2018 2019 117,781 106,641 5.75 5.21 2019 2018 Operating revenue (RMB million) 745,917 736,819 Of which: Revenue from telecommunications services (RMB million) 674,392 670,907 EBITDA1 (RMB million) 295,967 275,541 EBITDA margin2 39.7% 37.4% EBITDA as % of revenue from telecommunications services 43.9% 41.1% Profit attributable to equity shareholders (RMB million) 106,641 117,781 Margin of profit attributable to equity shareholders3 14.3% 16.0% Basic earnings per share (RMB) 5.21 5.75 Dividend per share – Interim (HK$) 1.527 1.826 – Final (HK$) 1.723 1.391 – Full year (HK$) 3.250 3.217 1 EBITDA = profit from operations + depreciation and amortization 2 EBITDA margin = EBITDA/operating revenue 3 Margin of profit attributable to equity shareholders = profit attributable to equity shareholders/operating revenue 4 The Company has adopted the new accounting standard on leases (IFRS/HKFRS 16) with effect from 1 January 2019

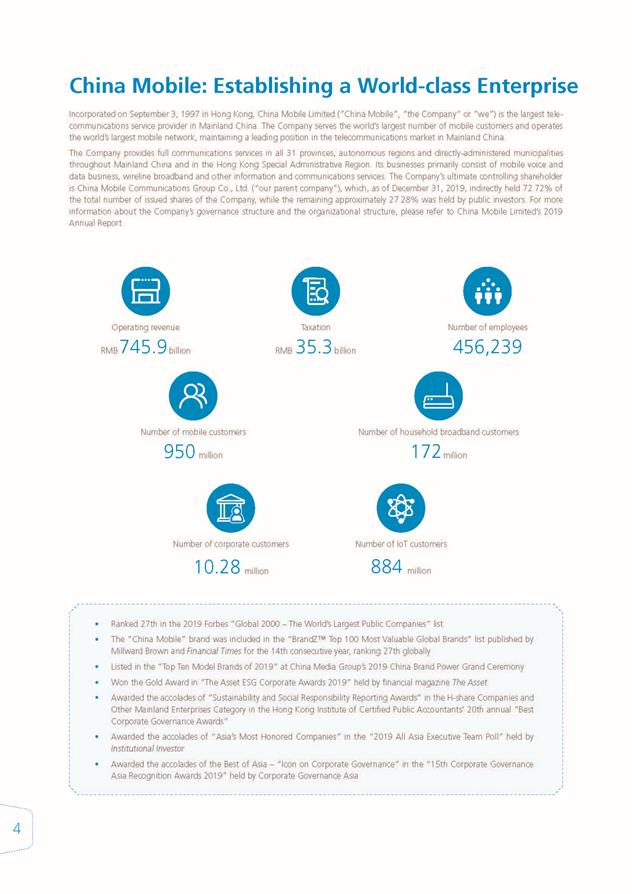

Annual Report 2019 05 05 Company Profile China Mobile Limited (the “Company”, and together with its subsidiaries, the “Group”) was incorporated in Hong Kong on 3 September 1997. The Company was listed on the New York Stock Exchange (“NYSE”) and The Stock Exchange of Hong Kong Limited (“HKEX” or the “Stock Exchange”) on 22 October 1997 and 23 October 1997, respectively. The Company was admitted as a constituent stock of the Hang Seng Index in Hong Kong on 27 January 1998. As the leading telecommunications services provider in Mainland China, the Group provides full communications services in all 31 provinces, autonomous regions and directly-administered municipalities throughout Mainland China and in Hong Kong Special Administrative Region, and boasts a world-class telecommunications operator with the world’s largest network and customer base, a leading position in profitability and market value ranking. Its businesses primarily consist of mobile voice and data business, wireline broadband and other information and communications services. As of 31 December 2019, the Group had a total of 456,239 employees, and a total of 950 million mobile customers and 187 million wireline broadband customers, with its annual revenue totalling RMB745.9 billion. The Company’s ultimate controlling shareholder is China Mobile Communications Group Co., Ltd. (formerly known as China Mobile Communications Corporation, “CMCC”), which, as of 31 December 2019, indirectly held approximately 72.72% of the total number of issued shares of the Company. The remaining approximately 27.28% was held by public investors. In 2019, the Company was once again selected as one of The Global 2,000 World’s Largest Public Companies by Forbes magazine and Fortune Global 500 by Fortune magazine. The China Mobile brand was once again listed in BrandZTM Top 100 Most Valuable Global Brands of 2019 by Millward Brown ranking 27. Currently, the Company’s corporate credit ratings are equivalent to China’s sovereign credit ratings, namely, A+/Outlook Stable from Standard & Poor’s and A1/Outlook Stable from Moody’s. China Mobile Principal Organizational Structure China Mobile Communications Group Co., Ltd. China Mobile (Hong Kong) Group Limited 72.72% 27.28% China Mobile Hong Kong (BVI) Limited China Mobile Limited Public shareholders Operating subsidiaries in 31 provinces, autonomous regions and directly–administered municipalities in Mainland China and Hong Kong Other specialized subsidiaries* China Mobile Communication Co., Ltd * Other specialized subsidiaries include: • China Mobile Group Design Institute Co., Ltd. • China Mobile Group Finance Co., Ltd. • China Mobile Group Device Co., Ltd. • China Mobile IoT Company Limited • China Mobile International Limited • China Mobile Information Technology Company Limited • China Mobile Online Services Co., Ltd. • MIGU Co., Ltd. • China Mobile (Suzhou) Software Technology • China Mobile (Hangzhou) Information Technology Co., Ltd. Company Limited • China Mobile Internet Company Limited • China Mobile TieTong Company Limited • China Mobile Investment Holdings Co., Ltd. • China Mobile Quantong System Integration Co., Ltd. • China Mobile Financial Technology Co., Ltd. • China Mobile (Chengdu) ICT Co., Ltd. • China Mobile (Shanghai) ICT Co., Ltd. • Aspire Holdings Ltd.

06 06 Biographies of Directors and Senior Management EXECUTIVE DIRECTORS Mr. YANG Jie Age 57, Executive Director and Chairman of the Company, joined the Board of Directors of the Company in March 2019, in charge of the overall management of the Company. He is currently the Chairman of CMCC and a Director and the Chairman of China Mobile Communication Co., Ltd. (“CMC”). Mr. Yang formerly served as deputy director general of Shanxi Posts and Telecommunications Administration, general manager of Shanxi Telecommunications Corporation, vice president of China Telecom Beijing Research Institute, general manager of Business Department of the Northern Telecom of China Telecommunications Corporation, vice president, president and chairman of China Telecommunications Corporation, and president and chief operating officer, chairman and chief executive officer of China Telecom Corporation Limited. Mr. Yang graduated from the Beijing University of Posts and Telecommunications majoring in radio engineering in 1984 and obtained a doctorate degree in business administration from the ESC Rennes School of Business, France in 2008. Mr. Yang is a professor-level senior engineer with extensive experience in management and telecommunications industry. Mr. WANG Yuhang Age 58, Executive Director of the Company, joined the Board of Directors of the Company in October 2019, principally in charge of human resources and inspection matters. He is also a Director of CMCC and CMC. Mr. Wang formerly served as a deputy general manager of Development Department, general manager of Supervision Department, deputy director of Supervision and Inspection Office, the chief director of Legal Center, general manager of Human Resources Department and executive vice president of China Ocean Shipping (Group) Company; a vice president of COSCO Americas Inc.; the general manager of COSCO Shipbuilding Industry Company; the general manager of COSCO Shipyard Group Co., Ltd. as well as the executive vice president of China COSCO SHIPPING Corporation Limited. Over the past three years, Mr. Wang had served as a non-executive director and vice chairman of China International Marine Containers (Group) Co., Ltd. (listed in Hong Kong and Shenzhen), a non-independent and non-executive director and the chairman of COSCO SHIPPING International (Singapore) Co., Ltd. (listed in Singapore), a non-executive director of COSCO SHIPPING Holdings Co., Ltd. (listed in Hong Kong and Shanghai), and an executive director and the chairman of COSCO SHIPPING International (Hong Kong) Co., Ltd. (listed in Hong Kong). Mr. Wang graduated from Dalian Maritime College in 1983 with a major in marine engineering management. He is a senior engineer with many years of experience in the shipping industry and in human resources and corporate management.

07Biographies of Directors and Senior Management 07Biographies of Directors and Senior Management Mr. DONG Xin Age 53, Executive Director, Vice President and Chief Financial Officer of the Company, joined the Board of Directors of the Company in March 2017, principally in charge of corporate affairs, planning and construction, finance, internal audit and investor relations of the Company. He is also a Vice President and Chief Accountant of CMCC and a Director and Vice President of CMC. In May 2018, Mr. Dong was appointed as a Non-Executive Director of China Tower Corporation Limited (“China Tower”, listed in Hong Kong). Mr. Dong formerly served as a deputy director of Corporate Finance Division of Finance Department of the former Ministry of Posts and Telecommunications, a director of Economic Adjustment Division of the Department of Economic Adjustment and Communication Clearing of the former Ministry of Information Industry of China, director general of the Finance Department of CMCC, chairman and president of Hainan Mobile, director general of the Planning and Construction Department of CMCC, chairman and president of Henan Mobile and Beijing Mobile. Mr. Dong received a Bachelor’s degree from Beijing University of Posts and Telecommunications in 1989, a Master’s degree in financial and accounting management from Australian National University, and a Doctoral degree in business administration jointly issued by Shanghai Jiao Tong University and ESC Rennes School of Business, France. Mr. Dong is a senior engineer and senior accountant with many years of experience in the telecommunications industry and financial management. INDEPENDENT NON-EXECUTIVE DIRECTOR Dr. Moses CHENG Mo Chi, GBM, GBS, OBE, JP Age 70, Independent Non-Executive Director of the Company, joined the Board of Directors of the Company in March 2003. He was appointed as the Chairman of the Remuneration Committee in May 2016. Dr. Cheng is a practising solicitor and a consultant of Messrs. P.C. Woo & Co. after serving as its Senior Partner from 1994 to 2015. Dr. Cheng was a member of the Legislative Council of Hong Kong. He is the founder chairman of the Hong Kong Institute of Directors of which he is now the Honorary President and Chairman Emeritus. He is now also serving as chairman of the Insurance Authority. Dr. Cheng currently holds directorships in Liu Chong Hing Investment Limited, China Resources Beer (Holdings) Company Limited, Towngas China Company Limited, K. Wah International Holdings Limited, Guangdong Investment Limited, Tian An China Investments Company Limited and The Hong Kong and China Gas Company Limited, all of which are public listed companies in Hong Kong. Dr. Cheng had ceased to be a non-executive director of Kader Holdings Company Limited and an independent non-executive director of ARA Asset Management Limited, a company formerly listed in Singapore.

08 Biographies of Directors and Senior Management 08 Biographies of Directors and Senior Management Mr. Paul CHOW Man Yiu, GBS, SBS, JP Age 73, Independent Non-Executive Director of the Company, joined the Board of Directors of the Company in May 2013. He was appointed as the Chairman of the Nomination Committee in May 2016. He was the Chief Executive of the Asia Pacific Region (ex-Japan) of HSBC Asset Management (Hong Kong) Limited from 1997 to 2003, an executive director and Chief Executive of Hong Kong Exchanges and Clearing Limited from April 2003 to January 2010, the Chairman of Hong Kong Cyberport Management Company Limited from June 2010 to May 2016, an independent non-executive director of Bank of China Limited from October 2010 to August 2016, a member of the Advisory Committee on Innovation and Technology of the Government of the Hong Kong Special Administrative Region from April 2015 to March 2017 and an independent non-executive director of CITIC Limited from March 2016 to June 2019. Mr. Chow currently serves as an independent non-executive director of Julius Baer Group Ltd. and Bank Julius Baer & Co. Ltd. Mr. Stephen YIU Kin Wah Age 59, Independent Non-Executive Director of the Company, joined the Board of Directors of the Company in March 2017. He was appointed as the Chairman of the Audit Committee in May 2018. Mr. Yiu is currently a Non-Executive Director of the Insurance Authority, an Independent Non-Executive Director of Hong Kong Exchanges and Clearing Limited and ANTA Sports Products Limited, a Council member of The Hong Kong University of Science and Technology, and a member of the Exchange Fund Advisory Committee of The Hong Kong Monetary Authority and ICAC Complaints Committee. Mr. Yiu joined the global accounting firm KPMG (“KPMG”) in Hong Kong in 1983 and was seconded to KPMG in London, the United Kingdom from 1987 to 1989. Mr. Yiu became a partner of KPMG in 1994, served as the Partner in Charge of Audit of KPMG from 2007 to 2010, and served as the Chairman and Chief Executive Officer of KPMG China and Hong Kong as well as a member of the Executive Committee and the Board of KPMG International and KPMG Asia Pacific from April 2011 to March 2015. Mr. Yiu formerly also served as a member of the Audit Profession Reform Advisory Committee and the Mainland Affairs Committee of the Hong Kong Institute of Certified Public Accountants. Mr. Yiu is a fellow member of the Association of Chartered Certified Accountants, a fellow member of the Hong Kong Institute of Certified Public Accountants and a member of the Institute of Chartered Accountants of England and Wales. Mr. Yiu received a professional diploma in accountancy from The Hong Kong Polytechnic (now known as The Hong Kong Polytechnic University) in 1983, and holds a master’s degree in business administration from the University of Warwick in the United Kingdom.

09Biographies of Directors and Senior Management 09Biographies of Directors and Senior Management SENIOR MANAGEMENT Dr. YANG Qiang Aged 58, Independent Non-Executive Director of the Company, joined the Board of Directors of the Company in May 2018. Dr. Yang is currently the Chief AI Officer of WeBank Co., Ltd., the Founding Director of the Big Data Institute, the Chair Professor and former New Bright Professor of Engineering and the former Head of the Department of Computer Science and Engineering of the Hong Kong University of Science and Technology (“HKUST”), as well as the Chief Scientific Consultant to Shenzhen Qianhai 4Paradigm Data Technology Co., Ltd. Dr. Yang had served as, among other posts, an Assistant Professor and a Tenured Associate Professor at the Department of Computer Science of the University of Waterloo in Canada from September 1989 to August 1995, a Tenured Associate Professor, an Industrial Research Chair and a Full Professor at the School of Computing Science of Simon Fraser University in Canada from August 1995 to August 2001, and an Associate Professor, a Full Professor and an Associate Head of the Department of Computer Science and Engineering of HKUST from August 2001 to June 2012. From 2009 to November 2014, Dr. Yang was also a Technical Consultant to the 2012 Laboratories of Huawei Technologies Co., Ltd. (“Huawei”) in charge of big data research, and served as, among other posts, the Founding Head of Huawei’s Noah’s Ark Research Lab and the Head of Huawei’s Big Data Committee. Dr. Yang received a bachelor’s degree in astrophysics from Peking University in 1982, master’s degrees in astrophysics and computer science from the University of Maryland, College Park in the United States in 1985 and 1987 respectively, and a doctor’s degree in computer science from the University of Maryland, College Park in 1989. Mr. LI Huidi Age 51, Vice President of the Company, appointed in September 2019, principally in charge of network, international information harbor, information security, procurement, terminals and others. He is also a Vice President of CMCC and a Director and Vice President of CMC. Previously he served as a research fellow in Lucent Technologies – Bell Labs Innovations, a vice president of UTStarcom Inc., a vice president and general manager of New Mobile Technology and High-end Products Division of Lenovo Group Limited, chief technology officer and chairman of Technology Innovation Committee of Lenovo Mobile Communication Technology Co., Ltd. Mr. Li graduated in 1990 with a Bachelor of Electronic Engineering from Harbin Institute of Technology, and received a master’s degree in Mobile Communications from Polytechnic Institute of New York University and a doctoral degree in management from Hong Kong Polytechnic University.

10 Biographies of Directors and Senior Management 10 Biographies of Directors and Senior Management Mr. GAO Tongqing Age 56, Vice President of the Company, appointed in February 2020, principally in charge of legal and regulatory matters, technology R&D, international business, investment and others. He is also a Vice President of CMCC, a Director and Vice President of CMC. Mr. Gao previously served as a deputy director general of Xinjiang Uygur Autonomous Region Posts and Telecommunications Administration, deputy general manager and general manager of Xinjiang Uygur Autonomous Region Telecom Company, general manager of China Telecom Jiangsu branch, vice president of China Telecommunications Corporation, and executive director and executive vice president of China Telecom Corporation Limited. He graduated from the Changchun Institute of Posts and Telecommunications with a major in telecommunications engineering and received a doctorate degree in business administration from the Hong Kong Polytechnic University. Mr. JIAN Qin Age 54, Vice President of the Company, appointed in September 2019, principally in charge of marketing, customer service, information and technology, mobile Internet, financial technology and others. He is also a Vice President of CMCC, a Director and Vice President of CMC and a Director of Phoenix Media Investment (Holdings) Limited. Previously he served as a deputy director of the Nanchang Telecom Bureau, chairman and president of Jiangxi Mobile, Sichuan Mobile and Guangdong Mobile. Mr. Jian graduated in 1989 from Beijing University of Posts and Telecommunications majoring in Computer and Communication, and received a doctoral degree in Industrial Economics from Jiangxi University of Finance and Economics.

11Biographies of Directors and Senior Management 11Biographies of Directors and Senior Management Mr. ZHAO Dachun Age 49, Vice President of the Company, appointed in September 2019, principally in charge of corporate customers, software technology R&D, IoT and other matters. He is also a Vice President of CMCC and a Director and Vice President of CMC. Previously he served as the chairman and president of Shaanxi Mobile and Sichuan Mobile. Mr. Zhao graduated in 1993 from Southeast University majoring in Radio Technology and received an EMBA from Nanjing University.

+ 4G Coordinated Development + 4G Coordinated Development

4g 100m 48mph

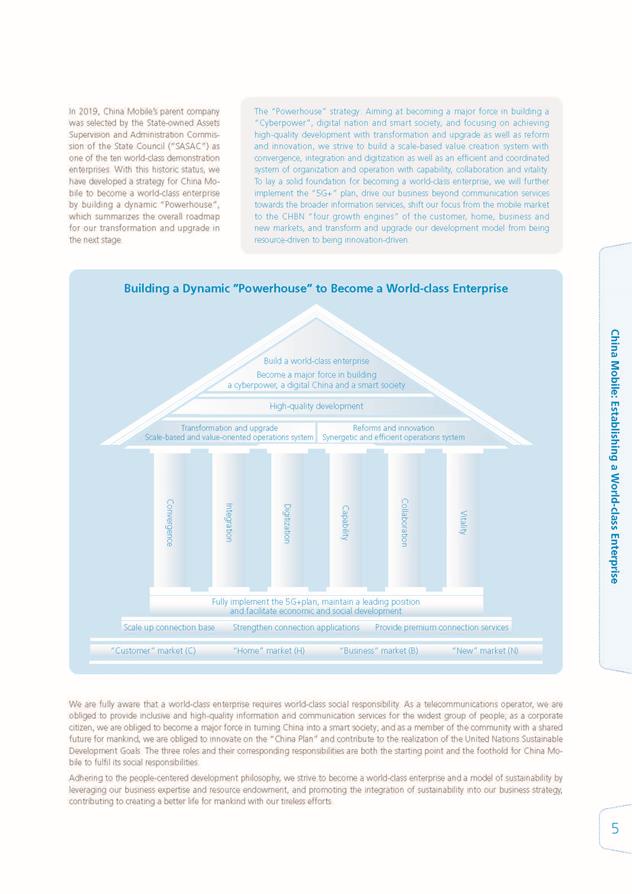

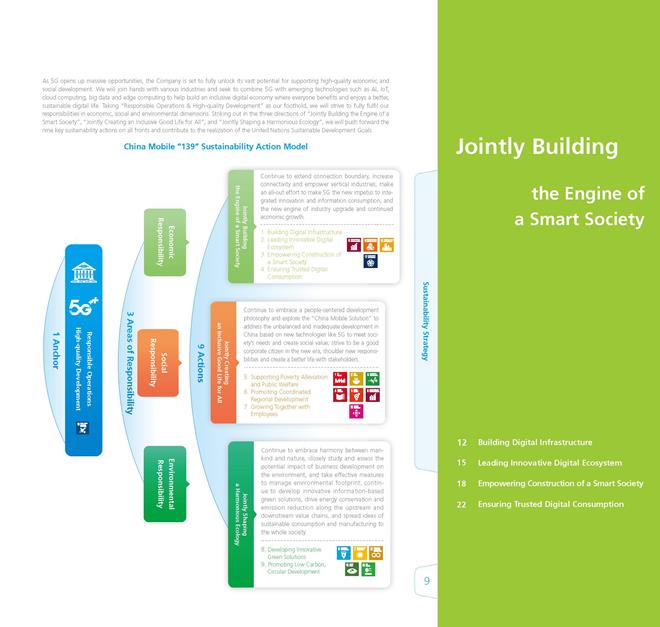

14 14 Chairman’s Statement As we speak, the development of the global digital economy has entered a new phase, driven by cross-sector integration, systematic innovation and increasing digitisation. A new generation of information technology, with the emergence of 5G at the forefront, is triggering faster and more frequent technological breakthroughs and industry revolutions that are systematic, sweeping and extensive. Riding the wave of 5G development and after thoroughly assessing external factors and trends, we have accelerated “gear-changes” in three areas. In terms of business development, we extended our solutions beyond telecommunications to information services; our market focus has shifted from the mobile market to the more encompassing CHBN “four growth engines”, comprising the “customer”, “home”, “business” and “new” markets; and finally, our development model has transformed from being resource-driven to innovation-driven, which we believe is essential for any company seeking to grow further. Good strategists win in the market; long-term strategic planning ensures sustainable prosperity. With the development of 5G, the future presents infinite possibilities. China Mobile will follow the industry development trends and serve as a major force in the development of China as a “Cyberpower”, digital nation and smart society. Working towards our goal of becoming a world–class enterprise by building a dynamic “Powerhouse”, we will further implement the “5G+” plans, connecting all industries and servicing mass demand. By doing so, we aim to create more value for our investors in the 5G era.

15Chairman’s Statement 15Chairman’s Statement

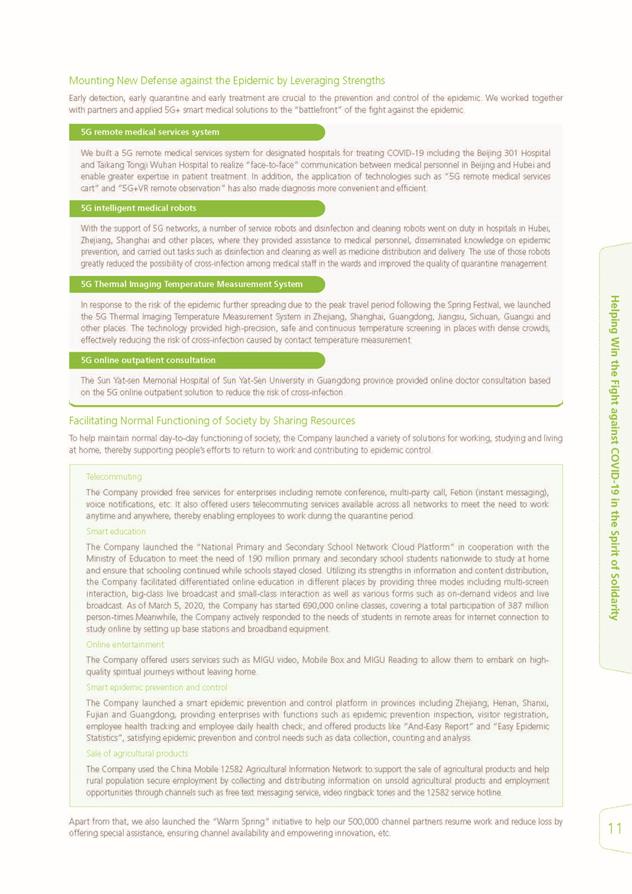

China Mobile Limited16 Chairman’s Statement 16 Chairman’s Statement Dear Shareholders, We were faced with a challenging and complicated operating environment in 2019 where the upside of data traffic was rapidly diminishing and competition within the telecommunications industry and from cross-sector players was becoming ever more intense. Coupled with this was the impact of government policies, including the continued implementation of the “speed upgrade and tariff reduction”. Against this backdrop, all of us at China Mobile joined together to overcome these hurdles and work towards our ultimate goal of becoming a world-class enterprise by building a dynamic “Powerhouse”. This was centred on the key strategy of high-quality development, supported by a value-driven operating system that leverages our advantages of scale to drive further convergence, integration and digitization across the board. We structured our organization to enable effective and synergetic capability building and collaborative growth, while nurturing internal vitality. In addition, we further implemented our “5G+” plan to spearhead the development of “four growth engines”, comprising the “customer”, “home”, “business” and “new” markets. These measures have helped us obtain positive momentum in overall operating results, which was a hard-earned achievement for us in a tough year. OPERATING RESULTS China Mobile recorded operating revenue of RMB745.9 billion for the 2019 financial year, up by 1.2% compared to last year. Of this, telecommunications services revenue amounted to RMB674.4 billion, or growth of 0.5% year-on-year. EBITDA was RMB296.0 billion, up by 7.4% from last year. EBITDA margin was 39.7%, up by 2.3 percentage points compared to the previous year. Measures to boost revenue, reduce costs and enhance the quality and efficiency of operations have helped us maintain leading profitability levels among top-tier global telecommunications operators. Profit attributable to equity shareholders reached RMB106.6 billion or RMB5.21 per share, down by 9.5% year-onyear. Our capital expenditure was RMB165.9 billion and we maintained our free cash flow at a healthy level, amounting to RMB81.7 billion. The Board recommends a final dividend payment of HK$1.723 per share for the year ended 31 December 2019. Together with the interim dividend payment of HK$1.527 per share, the total dividend payment for the 2019 financial year amounted to HK$3.250 per share. The Company attaches great importance to shareholder returns, and will maintain a stable dividend per share for the full year of 2020, after giving overall consideration to its profitability and cash flow generation. The Board believes that our industry-leading profitability and ability to generate healthy cash flow will provide sufficient support for the Company’s future development and create favourable returns for our shareholders. FORGED COORDINATED DEVELOPMENT OF CHBN “FOUR GROWTH ENGINES” In view of changes in the market landscape, we transformed and upgraded our services beyond telecommunications to the broader space of information services, and kicked off at full speed the coordinated development of our CHBN “four growth engines” – the “customer”, “home”, “business” and “new” markets. These strategic shifts have further enhanced our revenue structure, infusing new growth momentum into our business. Considering the rapid growth in data traffic demand and squeezed data value in the “customer” market, we responded by further converging data access, applications and customer benefits in our operations. As a result, we gained solid growth in customers and further strengthened our revenue base. With a net addition of 25.21 million, the total number of mobile customers reached 950 million in 2019. Handset data traffic increased by 90.3% year-on-year and DOU (the average handset data traffic per user per month) was 6.7 GB. We also managed to achieve an industry- leading mobile ARPU (average revenue per user per month) of RMB49.1. We continued to upgrade our products, including “GoTone”, and optimize our service management mechanism. Customer satisfaction was further enhanced.

Annual Report 2019 17Chairman’s Statement 17Chairman’s Statement With regard to the “home” market, we focused our efforts on scale expansion, brand building, ecology cultivation and value lifting, while delivering better one- stop marketing, installation, maintenance and customer services. We further promoted smart family operations and as a result, this business was able to deliver strong growth. The number of household broadband customers increased by 17.1% year-on-year and reached 172 million. Among them, our digital set-top box “Mobaihe” registered a total of 122 million customers, representing a penetration rate of 70.9%. Meanwhile, household broadband blended ARPU reached RMB35.3. The “business” market was our new growth engine and we strove to nurture new growth points by fully leveraging our cloud and network convergence advantages, building on our DICT (data, information and communications technology) infrastructure comprising IDC, ICT, Mobile Cloud, big data and other corporate applications and information services. Buoyed by our active promotion of our “Network + Cloud + DICT” smart services, customers and revenue recorded rapid growth. As of the end of 2019, the number of our corporate customers increased to 10.28 million, representing year-on-year growth of 43.2%. Focusing on key sectors such as industry, agriculture, education, public administration, healthcare, transportation and finance, we deepened go-to-market resources to promote DICT solutions that cater to sector-specific scenarios. This strategy has boosted DICT revenue to RMB26.1 billion, or growth of 48.3% year-on-year, contributing a larger portion of our overall revenue. In the “new” market, we continued to grow four new areas – international business, equity investment, digital content and FinTech. Our increased efforts have generated initial results. In 2019, our international business gained traction with year-on-year revenue growth of 31.4%. Centring on the principles of value contribution, ecosystem formation and investment- derived sector synergy, we have increased efforts to pursue equity investment, and income from equity investment contributed 11.9% to our net profit. Monthly active users for “MIGU Video” and the core functions of “and-Wallet” increased by 46.4% and 58.9% year-onyear respectively.

China Mobile Limited18 Chairman’s Statement 18 Chairman’s Statement PROMOTED CONVERGENCE, INTEGRATION AND DIGITIZATION, BUSINESS TRANSFORMATION AND UPGRADE SHOWED EARLY SIGNS OF SUCCESS Leveraging our advantages of scale, we began to establish a value-driven operating system focusing on the three elements of convergence, integration and digitization. We have seen positive initial results from this transformative development and upgrade. We expanded our market presence through the convergence strategy. We launched more marketing and sales initiatives under this strategy based on customer’s profiles and consumption behaviours (such as their level of loyalty, benefits and devices) to push products that are tailored to customers’ individual content and traffic demands. As a result, our full business bundling rate rose by 33 percentage points year-on-year to reach 82.7%. In the meantime, we accelerated “cloud reforms” by optimizing our cloud resources and diversifying our cloud network, cloud-based designated line and cloud database offerings to build out our network-wide “Mobile Cloud”. Full-year revenue generated from the Mobile Cloud businesses increased by 59.3% year-on-year. We created value through integration. By accelerating channel integration and unleashing synergies from online and offline, as well as business-to-business and business-to-customer integration, the share of traditional channel commission reduced by 11 percentage points while online channel contribution to overall business transactions reached 58.8%. Through the “Safeguard” campaign, we gained 23.56 million high-value customers. We also actively established a shared IT (information technology) platform for all operating functions and compatible capabilities. Across the network, 220,000 of our devices have run on the IT cloud platform and our centralized big data platform has stored effectively all data from our business, operation and management support systems, releasing higher value through further sharing. We enhanced efficiency through digitization. We continued to build up our smart mid-end platform and promote the applications of various technologies such as AI (artificial intelligence) and big data in order to strengthen the provision of smart services for various business areas, including network, markets, services, security and management. In 2019, we made significant progress in the development of NFV (Network Function Virtualization) and fully implemented the SDN (Software Defined Networking) technology, allowing one- stop subscription to our designated international and corporate transmission network with flexible bandwidth. Basic operating functions of our business in 31 provinces were centralized on one single platform, significantly enhancing efficiency in coordinating touch points, evaluation and precise marketing. We upgraded our customer service system with proprietary technology and persistently strengthened smart customer service capabilities. Our proprietary Jiutian AI Platform and AI R&D (research and development) cloud have led to the wider use of various AI applications, which have helped us reduce cost and increase efficiency. BOOSTED CAPABILITY, COLLABORATION AND VITALITY AND ACHIEVED BREAKTHROUGHS IN REFORM AND INNOVATION Capability, collaboration and organizational vitality formed a strong foundation for us to forge full-blown reforms and innovations. In this aspect, we have sped up progress in establishing a synergetic and efficient operating system across the organization. We further optimized our operating system to support market, corporate business and network operations, and proceeded with a number of reforms including cloudification of corporate services, development of smart home business, construction of smart mid-end platforms and acceleration of business internationalization. We adjusted our organizational structure and streamlined operating mechanisms to enhance efficiency and motivate our employees. Our structure fully equipped headquarters to command, the regions to compete and the specialized businesses to provide supporting services, creating strong synergetic dynamics and ensuring an organizational and operating structure that adapts to the strategic needs of the Company.

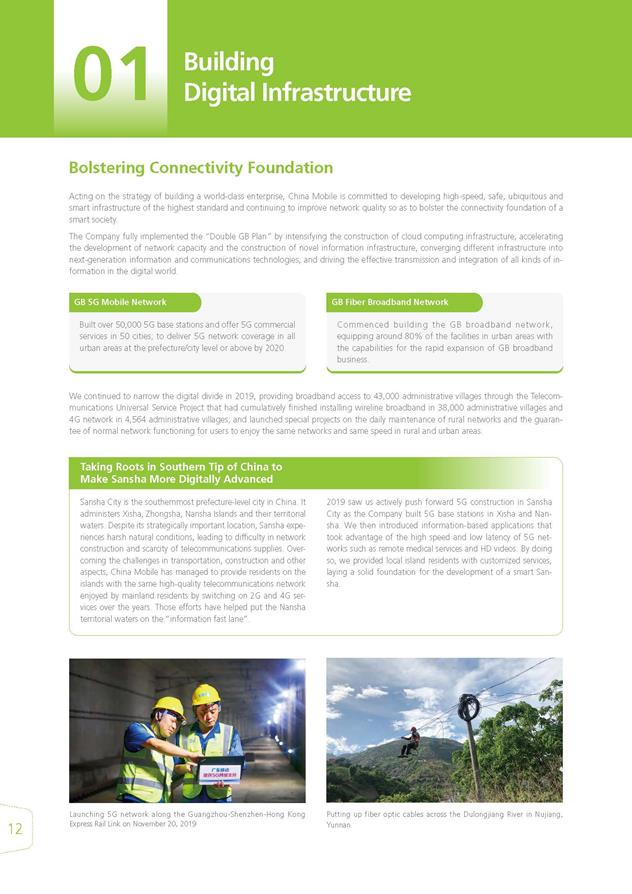

Annual Report 2019 19Chairman’s Statement 19Chairman’s Statement Elsewhere, our network capability continued to grow. Forging the well-coordinated development of 4G and 5G, our 3.09 million 4G base stations served to support traffic growth. We have commenced building the GB broadband network, and prioritized completing the OLT (Optical Line Terminal) facility upgrade for urban areas and high-value zones, equipping around 80% of the facilities in urban areas with the capabilities for the rapid expansion of GB broadband business. We proactively migrated our IT system, business platform and core network elements to the cloud while the gradual centralization of mobile could resources also helped us formulate comprehensive plans to enhance our cloud service capability. We have added the 25.9 Tbps bandwidth option for our international and corporate designated transmission network while boosting our network capabilities, supported by international submarine cables, cross-border terrestrial cables and PoPs (points of presence). We strengthened open collaboration. We established or deepened strategic partnerships with 12 local governments and 31 large enterprises and public organizations covering areas such as 5G and other digital services innovation. These complementary collaborations combined the strengths and resources of these partners to drive social and economic development. Our initiative to establish a new 5G “friendly circle” mechanism has progressed well, and we have taken measures to collaborate with up- and down-stream businesses within the sector, as well as technology and innovation companies, tertiary institutes and research institutes. In addition, we explored building a strategic and synergetic ecosystem covering areas such as 5G, cloud computing, digital content and network safety through capital investment and capital cooperation. We infused vitality into the Company. We initiated a new round of our share option scheme, which is now proceeding smoothly. In addition, we started to put in place equity and bonus schemes in our technology subsidiaries to gradually establish a mid- to long-term incentive scheme that will nurture a culture of shared interests and responsibilities. We have also furthered the implementation of the “Double-hundred Action”, an initiative for reforming state-owned enterprises that benchmarks world-leading companies. Reforms in three of our subsidiaries have made good progress. We also took solid steps to build national level innovation and entrepreneurship demo centres and joint laboratories to strengthen our R&D capability on cross-sector applications and the commercial conversion of research results, as a way to contribute to the prosperous growth of the innovation ecosystem. Elsewhere, we explored grid operations, dividing base-level operations into units and identifying people to take responsibility. With better- aligned responsibilities, authority and benefits, we aim to fully motivate our staff and infuse vitality into our base layers. “5G+” ACHIEVED A GOOD START We sped up the development of 5G and have been fully implementing our “5G+” plan since June 2019, when we were granted the 5G licence. These initiatives have shown good initial results. We actively participated in setting international standards for 5G to drive technological development. We led 61 key projects in relation to 5G international standards setting and own more than 2,000 5G patents. We also helped to continuously strengthen the Standalone International Standards (SA). Our “6 international standards on 5G system architecture” and “38 international standards including 5G NR (New Radio) terminals and base station radio frequency” scooped all the top prizes in the 2019 Science and Technology Awards presented by the China Communications Standards Association, demonstrating our leadership in 5G communications standards.

China Mobile Limited20 Chairman’s Statement 20 Chairman’s Statement At the same time, we accelerated the implementation of “5G+” by formulating well-coordinated development of 5G and 4G. We constructed and began operating more than 50,000 5G base stations and launched 5G commercial services in 50 cities. We assimilated emerging technologies such as AI, IoT (Internet of Things), cloud computing, big data and edge computing into 5G (5G+AICDE) and developed more than 200 critical capabilities, while making breakthroughs in over 100 5G joint projects. In terms of 5G+Eco, we aimed to develop the ecosystem with other industry players. Through our 5G Innovation Centre and 5G Industry Digital Alliance, we attracted more than 1,900 partners. We established the 5G Device Forerunner Initiative, guiding manufacturers to launch 32 5G devices. The level of maturity was basically the same between the 2.6 GHz and 3.5 GHz industry chains. Benefiting from forward-looking planning and effective execution, we expanded 5G+X, where “X” stands for the wider application of 5G, in applications that have been adopted by a plethora of industry sectors, as well as the mass market. For the latter, we launched exclusive plans for 5G customers and feature services such as ultra-high definition videos, cloud-based games and full-screen video connecting tones. As of the end of February 2020, our 5G plans attracted 15.40 million package customers – maintaining an industry-leading position. In terms of vertical sector, we explored the possibility of combining 5G with AICDE capabilities, extending collaboration in the industry and deep- diving into classic manufacturing scenarios to develop our leadership in 5G smart manufacturing, 5G remote medical services and 5G automated mining, among other sectors. We implemented a total of 50 group-level demo application projects. Looking ahead, 5G presents infinite possibilities. We will continue to take a systematic approach to planning and steadily implementing our “5G+” initiatives. We will speed up technology, network, application, operations and ecosystem upgrades, accelerate industry transformation by converging technologies, integrate data to strengthen information transmission in society, and introduce digitized management to build the foundation for digital society development. By doing so, we will seek more extensive 5G deployment, covering more sectors and creating greater efficiency and social value. CORPORATE GOVERNANCE The Company always upholds the principles of integrity, transparency, openness and efficiency and fully complies with all applicable listing rules to ensure sound corporate governance. We have been optimizing the composition of our Board membership, ensuring diversity and fully leveraging the experience and expertise of our independent non-executive directors, so as to introduce further improvements to our governance structure and decision-making mechanisms. We are also committed to compliance. We continued to enhance compliance management and ensure best practices in our daily operations through initiatives such as the “Safeguarding Compliance” program. We further improved our compliance management structure and reinforced legal accountability to ensure that the Company complies with the laws. We were consistent in adopting the Company’s compliance philosophy, which is “abide by the law, follow the rules, observe commitments and uphold integrity”. Operating according to the laws and regulations is a culture that we have established across the board and we continued to enhance our supervision system.

Annual Report 2019 21Chairman’s Statement 21Chairman’s Statement We are dedicated to enhancing our risk and internal control systems, increasing the level of competence in risk detection and management. We have further strengthened our supervision over key issues such as business performance and cost deployment. We also strove to mitigate business risks and close any gaps in our business management processes to ensure sustainable and high-quality operations. SOCIAL RESPONSIBILITY AND ACCOLADES The Company remained committed to leveraging our expertise to reciprocate the society and satisfy the needs of more people as they pursue a better life. We contributed to the national strategy of building a “Cyberpower” and spurred the development of the digital economy. We continued to implement the “speed upgrade and tariff reduction” requirement and fully launched the “Mobile Number Portability” policy as scheduled, and we continuously lowered the threshold for digital services and promoted inclusive technology. At the same time, we strove to build up an industry collaboration mechanism, creating a healthy and orderly competitive environment to promote high-quality development of the whole industry. In addition, the Company proactively assumed its responsibilities in the areas of contingency telecommunications, information security, targeted poverty alleviation, philanthropy, energy saving and emissions reduction. To help combat the novel coronavirus (COVID-19) outbreak, we worked to safeguard communications and services. Contributing to epidemic prevention and control measures, we enhanced the communications network in key areas and venues affected by the outbreak. We also fully leveraged competitive edges brought about by our online services, such as the China Mobile App, to provide convenient services for customers around the clock. During the epidemic, we provided our customers with multiple products free of charge, including Cloud Video Meeting and MIGU Video, to enrich our solutions on remote working and home entertainment. Regarding contingency communications and information security, the Company successfully completed 6,800 contingency communications missions in 2019, participating in coordinated disaster and emergency rescue efforts and ensuring uninterrupted communications during major incidents. We have also taken the initiative to combat evolving telecommunications frauds and cybercrime, in order to create a healthy and safe telecommunications environment. In terms of poverty alleviation and philanthropy, we proactively launched tariff concession plans as part of targeted poverty-alleviation efforts for people in need. Our proprietary TPAS (Targeted Poverty Alleviation System) has been deployed in 14 provinces and 92 cities and counties across the country, covering 8.169 million disadvantaged individuals. The “Blue Dream” education project has provided professional training for a total of 127,338 primary and secondary school headmasters in rural villages. Meanwhile, the “Heart Caring” campaign has sponsored the surgery of an accumulative total of 5,973 impoverished children with congenital heart disease.

China Mobile Limited22 Chairman’s Statement 22 Chairman’s Statement Turning to energy saving and emissions reduction, the Company continued to implement its “Green Action Plan” to reduce our carbon footprint. In 2019, the overall energy consumption per unit information flow fell by 43%, compared with the previous year. We advocated environmental protection among our suppliers and the rate of eco-friendly packaging usage on new main equipment reached 69%. Our achievements have received wide recognition. We won the “Top Ten Model Brands of the Year” award at the 2019 China Brand Power Grand Ceremony organized by the China Media Group. In addition, we were a Gold Award winner at The Asset ESG Corporate Awards 2019 and received the Asia’s Most Honoured Company award from Institutional Investor, as well as Icon on Corporate Governance and Best Investor Relations Company award from Corporate Governance Asia. At the same time, Moody’s and Standard & Poor’s maintained our corporate credit ratings at the same level as China’s sovereign ratings in 2019. FUTURE OUTLOOK At present, the social and economic landscapes are undergoing four paradigm shifts. Economically, the digital economy has become the major driving force of growth. Technologically, emerging information technology has become the core engine to spur industry transformation and upgrades. With regard to business competition, technological innovation forms the pillar of companies’ competitive advantages. And, last but not least, demand for a better digital life has pervaded the whole of society. These paradigm shifts will bring massive “Blue Ocean” opportunities to the information telecommunications industry. The accelerating development of 5G will provide better infrastructure and more scenarios to boost the scale application of AI, IoT, cloud computing, big data, edge computing and blockchain, among other technologies, promoting the digital transformation of all industries and digital life. At the same time, we will encounter disruptive changes brought forth by digitization, challenging the existing network and business models and giving rise to unforeseen competition within the industry, as well as from cross- sector players. The novel coronavirus (COVID-19) outbreak since early 2020 has posed certain impact on the overall society and economy. Our business development has been no exception. Good strategists win in the market; long-term strategic planning ensures sustainable prosperity. Facing opportunities and challenges, we will speed up “gear-changes” in three areas. In terms of business development, we will extend our offerings beyond telecommunications to information services; our market focus will shift from the mobile market to the all- encompassing “four growth engines”; and finally, our development model will transform from being resource- driven to innovation-driven. We will uphold our strategy of becoming a world-class enterprise by building a dynamic “Powerhouse”. We will serve as a major force in the development of China as a “Cyberpower”, digital nation and smart society. Centred around our objective for high-quality growth, we will focus on business transformation and upgrade while giving impetus to reform and innovation. We will place emphasis on implementing our “5G+” plans while forging convergence, integration and digitization across our operations and building capabilities, establishing collaboration and infusing vitality in the organization. By doing so, we will make great strides towards becoming a top-tier global telecommunications operator and continuously create greater value for our shareholders.

Annual Report 2019 23Chairman’s Statement 23Chairman’s Statement In 2020, we will strive to overcome the impact of the novel coronavirus (COVID-19) outbreak on business development and 5G network construction. The epidemic has bolstered the growing trend of businesses and customers going online and using more digital and cloud-based services, among other opportunities arisen. We will leverage these opportunities, as well as the 5G network to further develop the information and communications services market. With concerted efforts, we will strive to maintain growth in telecommunications services revenue and a stable level of net profit. We will also strive to maintain an industry- leading customer satisfaction. ACKNOWLEDGEMENT Mr. Li Yue resigned from his position as Executive Director and CEO in October 2019. Over the course of his long service with the Company, Mr. Li made a tremendous contribution, leading the remarkable journey of China Mobile from 2G to 5G. On behalf of the Board, I thank Mr. Li for his exceptional contribution to China Mobile. Finally, on behalf of the Board, I would like to take this opportunity to express my heartfelt gratitude for the support of our shareholders, customers and the general public, and for the dedication and contribution of our employees. Yang Jie Chairman Hong Kong, 19 March 2020

24 China Mobile Limited Corporate Recognitions INSTITUTIONAL INVESTOR ALL ASIA GOLD WINNER ARC AWARDS GOLD AWARD

Institional invester cpa BEST CORPORATE GOVERNANCE AWARDS 2019 GOLD WINNER ASIAN EXCELLENCE AWARD 2019

Corporate Recognitions Annual Report 2019 25 Big data lot

+ AICDE Integrated Innovations + AICDE AI EDGE CLOUD Integrated Innovations

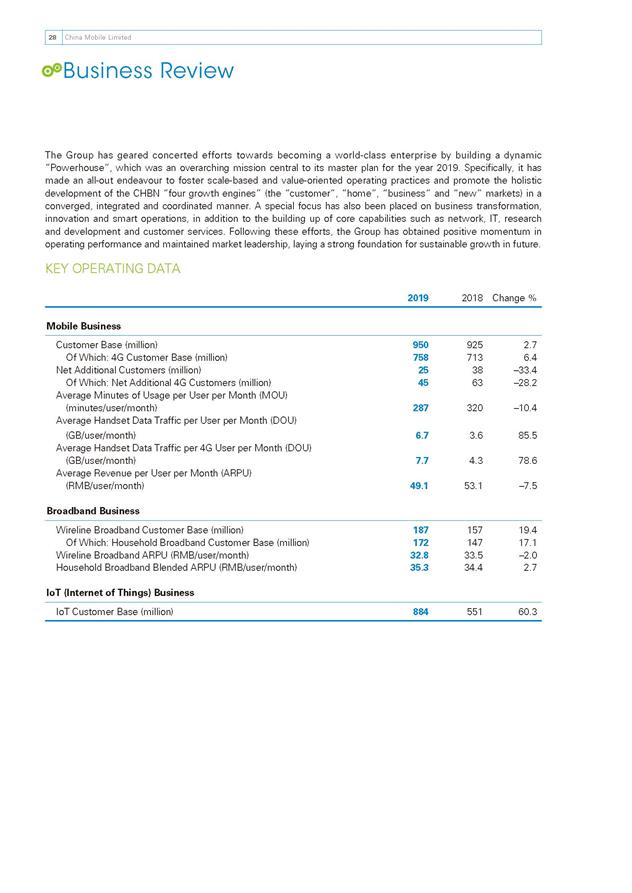

China Mobile Limited28 28 Business Review The Group has geared concerted efforts towards becoming a world-class enterprise by building a dynamic “Powerhouse”, which was an overarching mission central to its master plan for the year 2019. Specifically, it has made an all-out endeavour to foster scale-based and value-oriented operating practices and promote the holistic development of the CHBN “four growth engines” (the “customer”, “home”, “business” and “new” markets) in a converged, integrated and coordinated manner. A special focus has also been placed on business transformation, innovation and smart operations, in addition to the building up of core capabilities such as network, IT, research and development and customer services. Following these efforts, the Group has obtained positive momentum in operating performance and maintained market leadership, laying a strong foundation for sustainable growth in future. KEY OPERATING DATA 2019 2018 Change % Mobile Business Customer Base (million) 950 925 2.7 Of Which: 4G Customer Base (million) 758 713 6.4 Net Additional Customers (million) 25 38 –33.4 Of Which: Net Additional 4G Customers (million) 45 63 –28.2 Average Minutes of Usage per User per Month (MOU) (minutes/user/month) 287 320 –10.4 Average Handset Data Traffic per User per Month (DOU) (GB/user/month) 6.7 3.6 85.5 Average Handset Data Traffic per 4G User per Month (DOU) (GB/user/month) 7.7 4.3 78.6 Average Revenue per User per Month (ARPU) (RMB/user/month) 49.1 53.1 –7.5 Broadband Business Wireline Broadband Customer Base (million) 187 157 19.4 Of Which: Household Broadband Customer Base (million) 172 147 17.1 Wireline Broadband ARPU (RMB/user/month) 32.8 33.5 –2.0 Household Broadband Blended ARPU (RMB/user/month) 35.3 34.4 2.7 IoT (Internet of Things) Business IoT Customer Base (million) 884 551 60.3

Annual Report 2019 29Business Review 29Business Review OPERATING PERFORMANCE The Group continued to comfortably maintain market leadership in 2019. Telecommunications services revenue has successfully reversed its unfavourable downward trajectory recorded in the first half of 2019 and managed to deliver positive growth for full-year 2019. The Group has achieved a further enhancement to its revenue structure, where the respective proportions of revenues from “home”, “business” and “new” markets to total revenue have continuously increased. New drivers such as DICT and international business have also demonstrated sound growth momentum. 4G customer base has recorded a net addition of 45.36 million to reach 758 million. Amongst them, the number of VoLTE customers stood at 521 million. Handset DOU increased by 85.5% year-on-year to 6.7GB. The Group’s broadband business has also reported robust growth, with the number of household broadband customers increasing by 17.1% to reach 172 million. The Group’s “business” market has played a key role in fostering the Group’s overall revenue growth, with its corporate customer base reaching 10.28 million subsequent to a net addition of 3.1 million. In the meantime, the number of IoT customers has registered a net addition of 333 million to reach 884 million. CHBN “FOUR GROWTH ENGINES” SHOWING EARLY SIGNS OF SUCCESS The “Customer” Market The Group has taken a multi-pronged approach to cope with increasing competition arising from the homogeneous nature of industry operators. It has placed a special emphasis on customers and adopted the three strategies of convergence, integration and digitisation, making a concerted effort to devise a holistic operations model by combining “data access + applications + customer benefits”. It has also shifted its focus from increasing customer and data traffic market shares to nurturing loyalty of existing customers and enhancing the value of full life cycle. In 2019, full business bundling rate has increased by 33 percentage points and customer satisfaction rate has gone up from that of last year. In addition, the Group has upgraded the three popular brands of “GoTone”, “M-zone” and “Easy

China Mobile Limited30 Business Review 30 Business Review Own”, rejuvenating them by providing new customer benefits, content and services, amongst others. All these efforts have resulted in a stronger sense of gain amongst customers, and the retention rate of mid – to high-end customers has been on a rise. Since the official announcement of the commercial launch of 5G packages, the Group has recorded an industry-leading number of 15.4 million 5G package customers as of the end of February 2020. The Group has also proactively promoted the popularisation of 5G devices, taking a number of promising sales and marketing measures to attract early users. The “Home” Market The Group remained committed to achieving “scale expansion, brand building, ecology cultivation and value uplift” for the “home” market. To achieve these goals, it has redoubled efforts to promote integrated development and consistently explored ways to add value to this business line. It has also stepped up measures to strengthen customer experience and continued to enhance broadband quality, creating a brand image of premium quality. This business line continued to demonstrate robust growth momentum, with household broadband customer base recording a net addition of 25.09 million to reach 172 million. Amongst them, the proportion of customers subscribing to products with bandwidth of 100Mbps or above has increased by 21.1 percentage points year-on-year to reach 88.1%. Driving further reforms on smart home business, the Group has stepped up additional efforts on TV content development and continuously enhanced products such as “smart home network deployment”, “Mobaihe” (a set-top box that provides high-definition video-on-demand service), “and-Mu” (a family surveillance camera). These initiatives, coupled with the Group’s endeavours to promote the bundle sales of “smart home network deployment” and home hardware and the complete opening-up of the corresponding service capabilities, have resulted in a significant boost to network access value. Household broadband blended ARPU has risen by 2.7% year-on-year to reach RMB35.3. The “Business” Market As the new driver of the Group’s revenue growth and business transformation and upgrade, the “business” market has stepped up a number of measures to strengthen basic capacities and promote innovative business practices. The Group has worked further on the integrated development of “network+ cloud+ DICT” for this business line, leading to a further enhancement to market competitiveness and contribution to the Group’s total revenue. DICT revenue has registered a year-on-year increase of 48.3% to RMB26.1 billion. Of which, mobile cloud revenue has propelled a year-onyear increase of 59.3% to RMB2 billion. Revenues from IDC and ICT have also recorded respective year-on-year increases of 46.8% and 163.5%. Taking full advantage of 5G, the Group has swiftly set up demonstrative showcases of 5G application scenarios for the vertical market, aiming at a number of industry sectors. As of the end of 2019, it has implemented 50 Group-level applications. The Group will continue to join hands with industry partners, cultivating accommodative industry ecology inclusive of the vertical market and building three types of resource pools which gather resources from industry partners providing devices, applications and integrated services. The “New” Market The Group has scaled up efforts to develop the international market and to seek more investment cooperation opportunities. It has proactively promoted a number of businesses including video aggregation on the MIGU platform, ultra-high definition VR, video connecting tones, cloud-based games, satisfying the demands from 2C and 2H markets. The Group has also worked further on integrating its core businesses with financial services, building new, holistic business ecology. As for international expansion, the Group has maintained market leadership in LTE roaming coverage and established three international business brands of CMLink, iConnect and iSolutions. The “Hand-in-hand” program has registered more than 2,900 million users on a global scale. With respect to digital content and Internet finance, the number of “video connecting tone” users has recorded a year-on-year increase of 442% and that of “cloud-based game” users has exceeded 17.57 million. At the same time, the number of monthly active users of the core functions of “and-Wallet” has increased by 58.9%, and the number of merchants has increased by 49.5%.

Annual Report 2019 31Business Review 31Business Review CONTINUOUSLY STRENGTHENING CUSTOMER SERVICES Making every endeavour to promote high-quality development, the Group has taken the lead amongst its peers to achieve service and value upgrades. In 2019, the Group continued to show unwavering devotion to providing exceptional customer services and place a relentless focus on its valued customers, further increasing customer satisfaction and loyalty. The Group has persistently taken measures to enhance customer perception. Last year, by carefully looking into major customer concerns, the Group has thoroughly analysed the root causes of complaints and examined key factors that undermined customer satisfaction and network quality. It has also scaled up efforts to improve the quality of mobile networks, home broadband, corporate dedicated lines and service platforms and launched thematic campaigns to protect customer interests. As a result, overall customer satisfaction has improved. As to the mobile market, handset data tariff has dropped by 47.2% year-on-year. The Group has fully implemented “Mobile Number Portability” as scheduled and has maintained a stable customer base overall. As to the broadband business, the Group has ensured the quality of broadband installation and maintenance services by introducing a service workflow that streamlines and shortens the handling time of these services, in addition to other initiatives that foster service transparency and facilitate whole-process management and control. Thanks to these efforts, the Group has achieved an industry-leading customer satisfaction rate in terms of household broadband installation and maintenance services. As to the corporate business, the Group has redoubled efforts to enhance end-to-end service support, fostering a responsive and centralised service delivery system that pools and coordinates resources from the entire network. Handling time for service inception has significantly shortened and the number of complaints has continued to go down. The Group has stepped up efforts to persistently enhance products and services. Tariff plans presently on-shelf has been largely simplified and rules were made less complicated. The Group has put a focus on customer value and experience, and incorporated new service features into its business model by considering new elements from its new 5G network service capabilities and benefits provided by external partners. On top of these were the Group’s initiatives on launching the 5G personal packages and family packages and implementing the “GoTone Through-Train” plan. It has also comprehensively driven the upgrade of the three major brands. In an effort to achieve a brand image with “exceptional taste, quality and character”, it continued to enhance benefits for GoTone customers, formulated and implemented product communication strategies for M-zone, and launched a new suite of services for Easy Own regular customers. The Group has also scaled up efforts to promote channel transformation, where more traditional services are available from smart-based channels and the Internet. Overall, the proportion of transactions handled by online channels has gone up to 58.8% year-on-year. By introducing new forms of cooperation, the Group was able to obtain more than 1 million omni-channel retailers. The Group has also proactively explored grid operations, where each grid forms a separate base-layer business unit fulfilling general sales duties to better satisfy customer needs and make timely responses, thus injecting vigour into the company at the base level.

China Mobile Limited32 Business Review 32 Business Review STRENGTHENING BUSINESS TRANSFORMATION 5G has reached a new stage of development and set new trends. The Group has kept abreast of the times, making every correct move to firmly build up capabilities for key areas and making good preparation for sustainable growth. The Group has been constantly raising the bar for network capabilities. As of the end of 2019, it has built a total of 4.48 million base stations for its mobile networks, of which, 3.09 million were 4G base stations. The Group has also obtained an industry- leading 4G Customer Net Promoter Score and 4G network satisfaction. In respect of 5G, the Group has proactively driven 5G network development, building more than 50,000 5G base stations and providing 5G commerical services in 50 cities. In these cities, the Group has completed upgrades and transformation on NSA in areas where both 4G and 5G networks were simultaneously covered. By doing so, the Group was able to meet network capacity needs during the initial phase of 5G commericalisation. It has also promoted the maturity of SA products and industry development, and completed transformation of the 5G SA core network for pre-commercialisation in Nanjing. In addition, the Group has continued to strengthen broadband coverage and quality. It has laid down a set of principles that give priority to nurturing platform capabilities and deploy ports based on market demands. Accordingly, the Group has made suitable advance planning on building up Gigabit network capabilities and aligned its construction efforts with market development. Besides, the Group has scaled up efforts to expedite the construction of dedicated cloud-based networks and by leveraging cloud-network synergy, it has managed to enhance business competitiveness. The Group has also devised a new three-pronged strategy that puts a special focus on achieving global acessibility, global network construction and global deployment. Following this strategy, the Group has boosted its ongoing work to build up basic network resources on a global scale, including laying international submarine cables, cross-border terrestrial cables and PoPs (points of present) especially in areas covered by the “Belt and Road Initiative”. The Group continued to bolster its own abilities and build up a remarkable pool of proprietary resources. Besides its an ongoing effort to promote the maturity of the 5G standard, the Group has established a mechanism for the commercial use of end-to-end technologies and, following which, these technologies are able to speak in sync with their international counterparts and meet case implementation requirements. These initiatives helped the Group deliver a well-developed suite of 5G technologies. The Group has also scaled up research efforts on the technical aspects of 5G security, taking initiatives to complete China’s first 5G security standards for the industry and formulating 5G security standards for corporates. In addition, the Group continued to enhance core competences with a special focus on the requirements of cloud, launching the Big Cloud 5.0 Product Series. The Group has also launched the Pioneer 300 Plan and formulated strategies for edge computing technology. Amongst its peers, the Group was the first operator to launch a proprietary cloud platform using edge technology. This compact platform is easy to operate and maintain and has already entered the trial stage. Further, the Group has continously enriched value-added offerings under the IoT OneNET platform, supporting implementation of various industry projects. The Group has also centralized its AI (Artificial Intelligence) development platform, making it online and available to all units within the Group. It has also incubated a number of AI applications including smart networks, smart audits, smart editing, industry quality control and smart film diagnoses.

Annual Report 2019 33Business Review 33Business Review CONTINUOUSLY ENHANCING INVESTMENT EFFICIENCY Entering a crucial phase of business transformation and 5G network construction, the Group will focus on laying a solid foundation for the integrated development of the CHBN “four growth engines” and asserting ongoing 5G market leadership over the next course of development. It will also step up efforts to exercise strong investment discipline and achieve a refined investment structure, deploying resources to meet the demands arising from evolving market competition in the most rational manner and enhancing investment efficiency. To provide strong support for business growth, the Group has incurred an actual capital expenditure of RMB165.9 billion for 2019. Capital expenditure to service revenue ratio has fallen by 0.3 percentage points from that of last year, demonstrating enhanced investment efficiency. Capital expenditure was spent mainly on, amongst other areas, strengthening 5G first-mover advantage, supporting 4G data traffic growth, bettering the deployment of cloud resources, promoting cloud- based network transformation, building up transmission capability and boosting IT support. The Group plans to spend total capital expenditure of RMB179.8 billion for 2020. Capital expenditure will serve for a variety of purposes which primarily include the proactive build-out of the 5G network, the construction of cloud-based infrastructure, support for the all-rounded development of the “four growth engines” and enhancements to smart operations. The capital requirements under this capital expenditure plan will be primarily sourced from the cash generated from the Group’s operating activities. With a view to satisfying business transformation needs and striving to continuously lift resource utilisation efficiency, the Group will continue to make scientific and rational allocation and deployment of resources and make targeted investments and construction considering the needs arising from use cases.

+ ECOLOGY Collaborative Cultivation + ECOLOGY Collaborative Cultivation

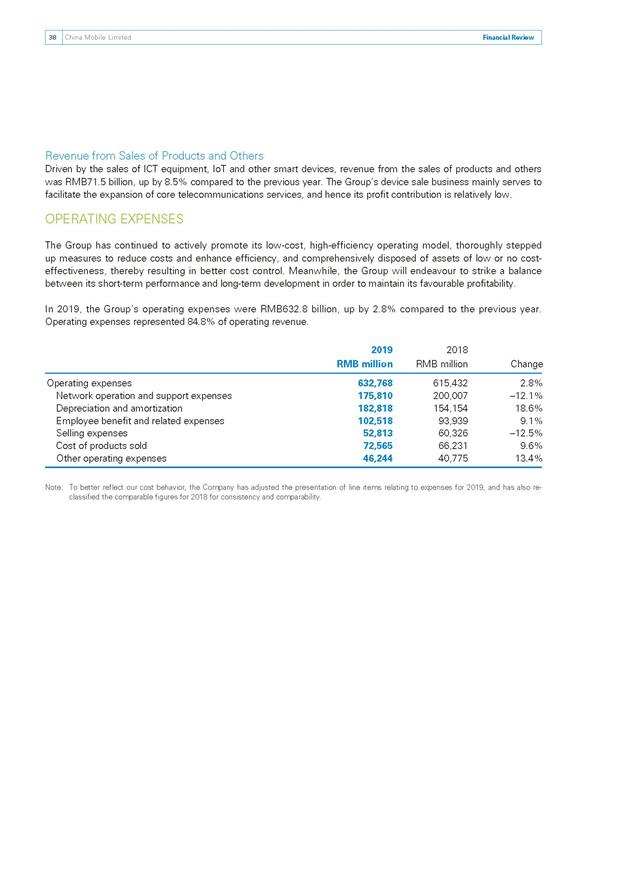

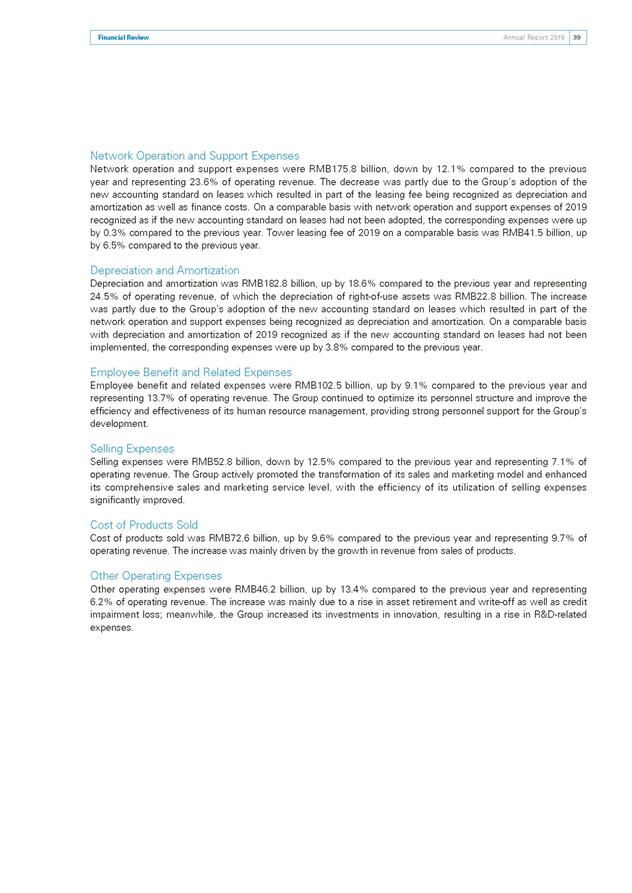

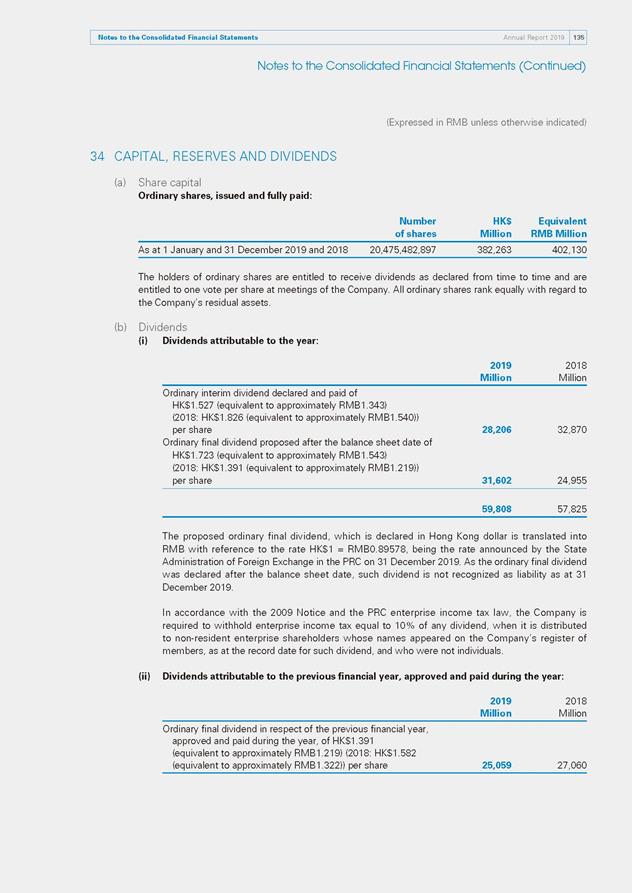

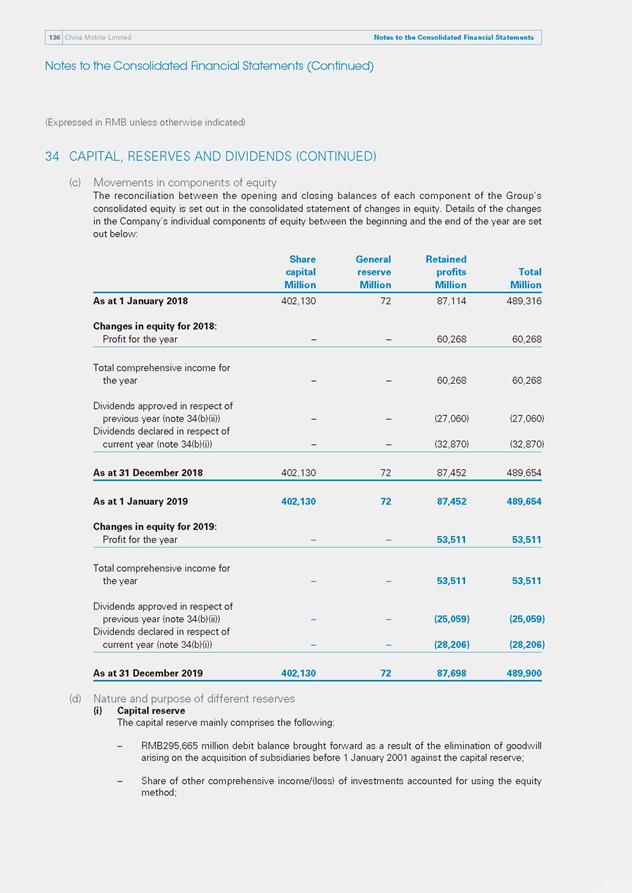

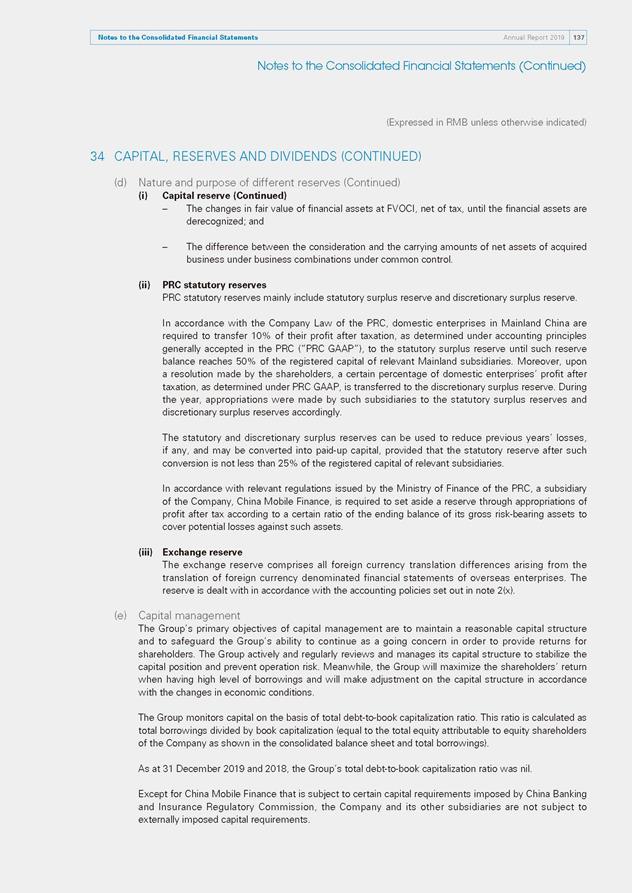

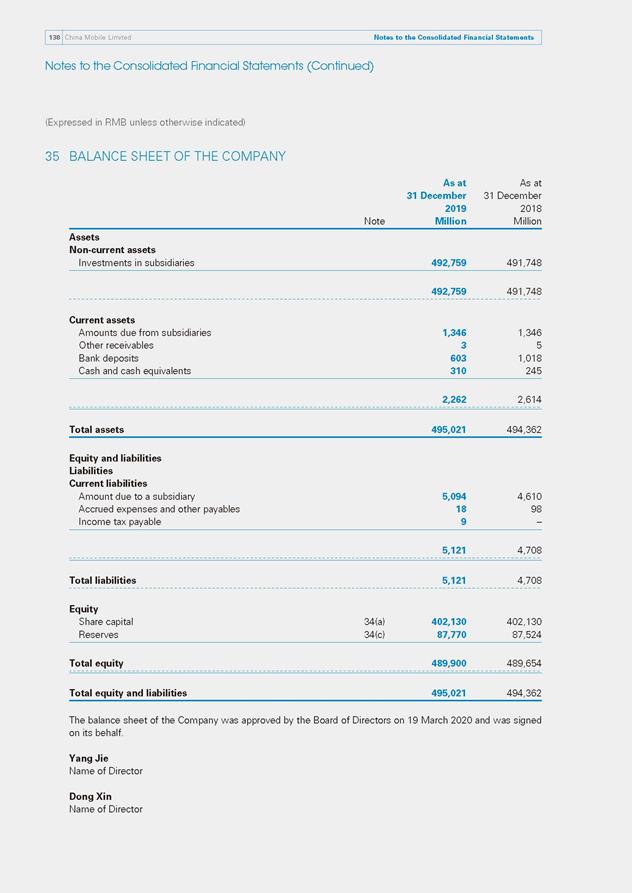

China Mobile Limited36 36 Financial Review We were faced with a challenging and complicated operating environment in 2019 where the upside of data traffic was rapidly diminishing and competition within the telecommunications industry and from cross-sector players was becoming ever more intense. Coupled with this was the impact of government policies, including the continued implementation of the “speed upgrade and tariff reduction”. Towards our ultimate goal of becoming a world-class enterprise by building a dynamic “Powerhouse”, we deepened our reforms to organizational systems, promoted our business transformation and insisted on creating value in our operations. We announced and implemented our “5G+” plan, resulting in continuous growth in revenue, persistently good profitability and positive growth momentum. 2019 2018 Change Operating revenue (RMB million) 745,917 736,819 1.2% Revenue from telecommunications services (RMB million) 674,392 670,907 0.5% Revenue from sales of products and others (RMB million) 71,525 65,912 8.5% EBITDA (RMB million) 295,967 275,541 7.4% EBITDA margin 39.7% 37.4% 2.3pp Profit attributable to equity shareholders (RMB million) 106,641 117,781 –9.5% Margin of profit attributable to equity shareholders 14.3% 16.0% –1.7pp Basic earnings per share (RMB) 5.21 5.75 –9.5%