Form 6-K CANADIAN NATIONAL RAILWA For: Apr 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2020

Commission File Number: 001-02413

Canadian National Railway Company

(Translation of registrant’s name into English)

935 de la Gauchetiere Street West

Montreal, Quebec

Canada H3B 2M9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F o Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes o No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes o No x

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

Canadian National Railway Company | ||

|

Date: |

March 24, 2020 |

|

|

|

|

|

|

|

|

By: |

/s/ Sean Finn | |

|

|

|

|

|

Name: |

Sean Finn |

|

|

|

|

|

Title: |

Executive Vice-President Corporate Services and Chief Legal Officer |

CANADIAN NATIONAL RAILWAY COMPANY

|

Items |

|

Description |

|

|

|

|

|

1 |

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

5 |

|

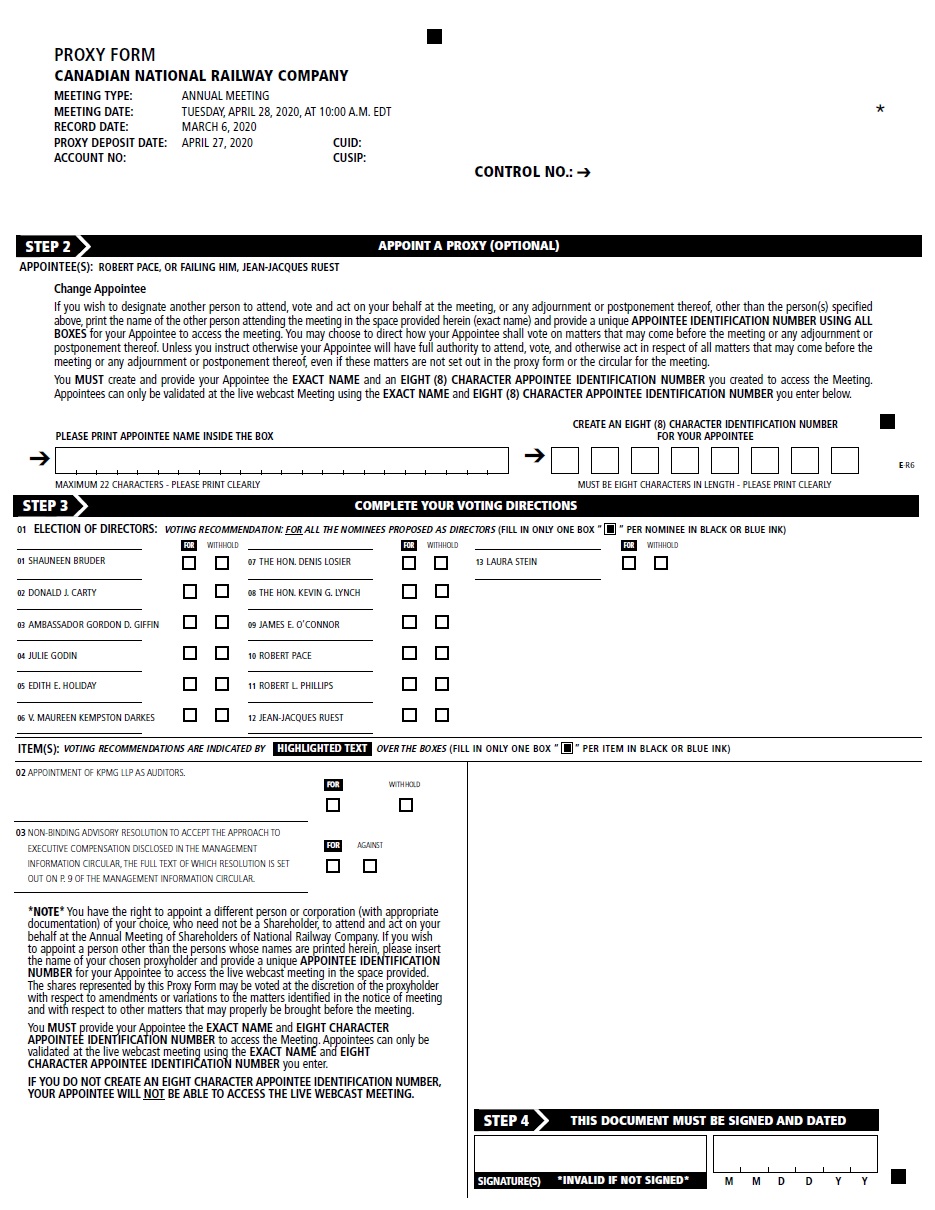

Notice of Availability of Materials for the 2020 Annual Meeting of Shareholders Canadian National Railway Company Our annual meeting of holders of common shares will be conducted solely via a live webcast meeting on Tuesday, April 28, 2020 at 10:00 a.m. (Eastern Daylight Time) at www.virtualshareholdermeeting.com/CNI2020. At this website, shareholders will be able to attend the meeting live, submit questions and vote their shares while the meeting is being held. For the purposes of: 1. receiving the consolidated financial statements for the year ended December 31, 2019, and the auditors’ reports thereon (for details, see subsection “Financial Statements” under the “Business of the Meeting” section of the management information circular dated March 10, 2020 (the “Information Circular”)); 2. electing the directors (for details, see subsection “Election of Directors” under the “Business of the Meeting” section of the Information Circular); 3. appointing the auditors (for details, see subsection “Appointment of Auditors” under the “Business of the Meeting” section of the Information Circular); 4. considering and approving, in an advisory, non-binding capacity, a resolution (the full text of which is set out on page 9 of the Information Circular) accepting Canadian National Railway Company’s (the “Company”) approach to executive compensation as disclosed in the “Statement of Executive Compensation” section of the Information Circular (for details, see subsection “Advisory Vote on Executive Compensation” under the “Business of the Meeting” section of the Information Circular); and 5. transacting such other business as may properly be brought before the meeting or any adjournment or postponement thereof (for details, see subsection “Other Business” under the “Business of the Meeting” section of the Information Circular). The Board of Directors has fixed March 6, 2020 as the record date (the “Record Date”) for the determination of the holders of common shares entitled to receive notice of the meeting and vote at the meeting.

Notice-And-Access This year, as permitted under Canadian securities rules, you are receiving this notification as the Company has opted to use the “notice-and-access” mechanism for delivery of this notice of annual meeting of shareholders, the Information Circular prepared in connection with the Meeting, the Annual Financial Statements and other proxy-related materials (collectively, the “Meeting Materials”) to its shareholders. In lieu of mailing physical copies of the Meeting Materials to shareholders, the “notice-and-access” provisions allow Canadian companies to send shareholders a notice about how to access Meeting Materials online and how to request that a paper copy be sent to them. The use of notice and access allows for faster access to the Meeting Materials, contributes to the protection of the environment, is consistent with our sustainability strategy and helps reduce printing and postage costs. The Meeting Materials are available electronically via the links mentioned below. To receive a physical copy of the Meeting Materials, please follow the instructions set out in this notice. Shareholders who have already signed up for electronic delivery of Meeting Materials will continue to receive them by email. Shareholders will continue to receive by mail a proxy form or voting instruction form enabling them to vote at the Company’s Meeting. How to Access the Meeting Materials The Meeting Materials are available on our website (www.cn.ca/en/investors/), on the website of our transfer agent, Computershare Trust Company of Canada (“Computershare”) (www.envisionreports.com/CNR2020), on SEDAR (www.sedar.com) and on the U.S. Securities and Exchange Commission (“SEC”) website (www.sec.gov) through EDGAR. How to Request a Paper Copy of the Meeting Materials Before the Meeting You may request paper copies of the Meeting Materials at no cost up to one year from the date the Information Circular was filed on SEDAR (on or about March 24, 2020). Your request should be received at least ten (10) business days prior to the Meeting date in order to receive the Meeting Materials in advance of such date and the Meeting date. You may request paper copies of the Meeting Materials by calling 1-877-907-7643 and entering the control number provided on the form of proxy or the voting instruction form and following the instructions provided. Please note that you will not receive another form of proxy or voting instruction form. Please retain your current one to vote your common shares. After the Meeting By contacting Broadridge at 1-877-907-7643 or Computershare via their website (www.investorcentre.com/service) or by phone at 1-800-564-6253, a copy of the Meeting Materials will be sent to you within ten (10) calendar days of receiving your request. Voting You may vote your common shares on the Internet, by phone or by mail. Please refer to the instructions on your separate form of proxy or voting instruction form, as applicable, on how to vote using these methods. If you wish to vote at the meeting, you do not need to complete or return your proxy form or voting instruction form, as applicable. The day of the Meeting, you may vote via the live webcast by completing a ballot online during the Meeting. You will need to visit www.virtualshareholdermeeting.com/CNI2020 and check-in using your control number included on your proxy form or voting instruction form, as applicable. The deadline for receiving duly completed forms of proxy or voting instruction forms or a vote using the telephone or over the Internet ahead of the Meeting is 5:00 p.m. (Eastern Daylight Time) on April 27, 2020. Shareholders are reminded to read the information circular and other meeting materials carefully before voting their common shares. Questions If you have any questions regarding this notice, the notice-and-access mechanism or the Meeting you can contact Broadridge at 1-855-887-2244 or Computershare via their website (www.investorcentre.com/service) or by phone at 1-800-564-6253.

Notice of Annual Meeting of Shareholders Our annual meeting of holders of common shares will be conducted solely via a live webcast meeting on Tuesday, April 28, 2020 at 10:00 a.m. (Eastern Daylight Time) at www.virtualshareholdermeeting.com/CNI2020. At this website, shareholders will be able to attend the meeting live, submit questions and vote their shares while the meeting is being held. For the purposes of: 1. receiving the consolidated financial statements for the year ended December 31, 2019, and the auditors’ reports thereon; 2. electing the directors; 3. appointing the auditors; 4. considering and approving, in an advisory, non-binding capacity, a resolution (the full text of which is set out on page 9 of the accompanying management information circular) accepting the Company’s approach to executive compensation as disclosed in the “Statement of Executive Compensation” section of the accompanying management information circular; and 5. transacting such other business as may properly be brought before the meeting or any adjournment or postponement thereof. The Board of Directors has fixed March 6, 2020 as the Record Date for the determination of the holders of common shares entitled to receive notice of the meeting and vote at the meeting. By order of the Board of Directors Sean Finn Executive Vice-President Corporate Services and Chief Legal Officer and Corporate Secretary March 10, 2020 Montreal, Quebec

ONWARD TOGETHER MANAGEMENT INFORMATION CIRCULAR AND NOTICE OF ANNUAL MEETING OF SHAREHOLDERS APRIL 28, 2020

Notice of Annual Meeting of Shareholders Our annual meeting of holders of common shares will be conducted solely via a live webcast meeting on Tuesday, April 28, 2020 at 10:00 a.m. (Eastern Daylight Time) at www.virtualshareholdermeeting.com/CNI2020. At this website, shareholders will be able to attend the meeting live, submit questions and vote their shares while the meeting is being held. For the purposes of: 1. receiving the consolidated financial statements for the year ended December 31, 2019, and the auditors’ reports thereon; 2. electing the directors; 3. appointing the auditors; 4. considering and approving, in an advisory, non-binding capacity, a resolution (the full text of which is set out on page 9 of the accompanying management information circular) accepting the Company’s approach to executive compensation as disclosed in the “Statement of Executive Compensation” section of the accompanying management information circular; and 5. transacting such other business as may properly be brought before the meeting or any adjournment or postponement thereof. The Board of Directors has fixed March 6, 2020 as the Record Date for the determination of the holders of common shares entitled to receive notice of the meeting and vote at the meeting. By order of the Board of Directors Sean Finn Executive Vice-President Corporate Services and Chief Legal Officer and Corporate Secretary March 10, 2020 Montreal, Quebec

Letter to Shareholders March 10, 2020 Dear Shareholder: On behalf of the Board of Directors (the “Board” or “Board of Directors”) and management of Canadian National Railway Company (the “Company” or “CN”), we cordially invite you to attend the annual meeting of shareholders, which will be held on Tuesday April 28, 2020 at 10:00 a.m. (Eastern Daylight Time). This management information circular (the “Information Circular”) describes the business to be conducted at the meeting and provides information on executive compensation and CN’s governance practices. In addition to these items, we will discuss highlights of our 2019 performance and our plans for the future. 2019 was a historic year for CN as we celebrated 100 years on the move. We’ve certainly come a long way in the past century thanks to the support of thousands of dedicated employees, customers, supply chain partners, shareholders and other stakeholders. Delivering responsibly is at the heart of how we are building for the future. It means moving customer goods safely and efficiently, being environmentally responsible, attracting and developing the best and diverse railroaders, helping build safer, stronger communities, while adhering to the highest ethical standards. Five principles anchor our sustainability commitment: Safety, Environment, People, Community, and Governance. We believe rail has a tremendous potential to reduce the environmental impact of transportation. As a mover of the economy, CN is committed to playing a key role in the transition to a lower carbon economy. Our sustainability performance has continued to earn us a place among the world’s best for several years running. For example, we are proud to have been consistently listed on the Dow Jones Sustainability World Index, recognized as a leader by the CDP, ranked again as one of the Best 50 Corporate Citizens in Canada by Corporate Knights, and are a proud member of the FTSE4Good Index, Global Challenges Index and the Jantzi Social Index. We have also received many accolades for our performance in corporate governance over the years, including ranking again first in the industrials group and seventh overall among Canadian publicly traded companies on the Globe and Mail’s 2019 review of corporate governance practices. We also prioritize community engagement. Over the past century, CN has been proud to be an important part of the many cities, towns and Aboriginal communities across our network. Our goal is to get involved in local efforts, bring people together and create positive, lasting change through trust and integrity. One example is how we work with communities to enhance emergency preparedness through training, risk assessments, and information sharing. The annual meeting of shareholders will be held online, through a live webcast meeting. You will be able to attend the meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/CNI2020. You will also be able to vote your shares electronically during the meeting. We are pleased to embrace the latest technology to provide easy access, improved communication, and cost savings for our shareholders and the Company. We believe hosting an online webcast meeting helps enable greater participation by our shareholders by allowing shareholders that might not otherwise be able to travel to a physical meeting to attend online and participate from any location around the world. Holding an online webcast shareholder meeting minimizes the health risk that may be associated with large gatherings and is also in line with our sustainability vision and belief. Your participation in the affairs of the Company is important to us. If you attend the meeting via webcast, you will have the opportunity to interact with members of the Board and senior executive officers of the Company. We encourage you to complete and return the enclosed proxy form or voting instruction form in the envelope provided for this purpose, so that your views can be represented. Even if you plan to attend the meeting, you may find it convenient to vote your shares in advance of the meeting over the internet or by completing and returning the enclosed proxy form or voting instruction form, as applicable. Please consult the information on page 5 of the Information Circular to find out how to attend the meeting online and vote your shares. Robert Pace, D.COMM., C.M. Chair of the Board Jean-Jacques Ruest President and Chief Executive Officer 1 CN MANAGEMENT INFORMATION CIRCULAR 2020 LETTER TO SHAREHOLDERS

What’s Inside Notice of Annual Meeting of Shareholders 3 Proxy Summary 5 Delivery of Meeting Materials and Voting Information 1 Letter to Shareholders 8 Business of the Meeting 10 Nominees for Election to the Board 17 Board of Directors Compensation 22 Statement of Corporate Governance Practices 34 Statement of Executive Compensation 38 Compensation Discussion and Analysis 67 Other Information 68 Schedule A – Mandate of the Board 69 Schedule B – Reports of the Committees 75 Schedule C – Additional Audit Committee Disclosure This Information Circular is provided in connection with the solicitation of proxies by management of Canadian National Railway Company for use at the annual meeting of its shareholders or at any adjournment or postponement thereof (the “Meeting”). In this document “you” and “your” refer to the shareholders of CN and “CN”, the “Company”, “we”, “us”, or “our” refer to Canadian National Railway Company. The Meeting will be held on Tuesday, April 28, 2020, at 10:00 a.m. (Eastern Daylight Time) for the purposes set forth in the foregoing Notice of Meeting. The information contained herein is given as at February 27, 2020, except as indicated otherwise. Shareholder Voting Matters and Recommendation V OTING M AT TER Election of 13 Directors V OTING M AT TER Appointment of KPMG LLP as Auditors V OTING M AT TER Advisory Resolution on Executive Compensation BOARD VOTE RECOMMENDATION FOR each nominee BOARD VOTE RECOMMENDATION FOR BOARD VOTE RECOMMENDATION FOR FOR MORE INFORMATION SEE PAGE 8 FOR MORE INFORMATION SEE PAGE 8 FOR MORE INFORMATION SEE PAGE 9 2 CN MANAGEMENT INFORMATION CIRCULAR 2020

The following summary highlights some of the important information you will find in this Information Circular, as well as information about our Company. We recommend that you read the entire Information Circular before voting. Proxy Summary Board of Directors Highlights 5X Director’s share ownership set at 5 times the annual director retainer within 5 years 49 100% Combined number of board and committee meetings held in 2019 Board and committee attendance in 2019 0 100% Percentage of board members, other than our CEO, who are independent 38% Board members that sit together on the Percentage of board members board of another public company who are women Our Director Nominees SHARE OTHER OWNERSHIP (2) TOP 3 COMPETENCIES (1) DIRECTOR SINCE PUBLIC BOARDS % OF VOTES FOR 2019 (MULTIPLE OF REQUIREMENT) NAME / AGE POSITION Shauneen Bruder (60) Finance, Strategy, Sales 2017 Corporate Director 1 0.9 99.62 Donald J. Carty (73) Strategy, Finance, HR 2011 Corporate Director 2 8 99.03 Gordon D. Giffin (70) Policy, Legal, HR 2001 Partner, Dentons US LLP 2 8 96.06 Julie Godin (45) HR, Strategy, Finance 2017 Co-Chair of the Board and Executive Vice-President, Strategic Planning and Corporate Development, CGI Inc. 1 0.9 99.20 Edith E. Holiday (68) Legal, Policy, Strategy 2001 Corporate Director and Trustee 4 8 88.22 V. Maureen Kempston Darkes (71) Transport, Sales, HR 1995 Corporate Director 2 15 95.21 Denis Losier (67) Finance, HR, Sales 1994 Corporate Director 1 22 93.52 Kevin G. Lynch (69) Policy, Finance, Strategy 2014 Vice-Chair, BMO Financial Group 1 2 92.07 James E. O’Connor (70) Strategy, Engineering, HR 2011 Corporate Director 2 3 99.55 Robert Pace (65) HR, Transport, Strategy 1994 Chair of the Board, CN President and CEO, The Pace Group 1 11 95.13 Robert L. Phillips (69) Transport, Strategy, Sales 2014 President, R.L. Phillips Investments Inc. 4 (3) 2 98.07 Jean-Jacques Ruest (65) Sales, Transport, Strategy 2018 President and Chief Executive Officer, CN — Note 4 99.36 Laura Stein (58) Legal, Engineering, Finance 2014 Executive Vice-President – General Counsel & Corporate Affairs, The Clorox Company 1 2 93.30 (1) Refer to description of competencies on page 27 of this Information Circular. (2) For a discussion on the shareholding requirements of the Board Chair and non-executive directors, please see section on “Share Ownership” on page 19 of this Information Circular. (3) Will be a member of three public boards other than CN starting in May 2020. (4) For a discussion on Mr. Ruest’s shareholding requirements, please see section on “Stock Ownership” on page 47 of this Information Circular. 3 CN MANAGEMENT INFORMATION CIRCULAR 2020 PROXY SUMMARY

2019 Key Business Highlights Employees at year end 25,975 Revenues $14.9 B Free cash flow (1) $2.0 B Capital investments $3.9 B Reported diluted earnings per share $5.83 Adjusted diluted earnings per share (1) $5.80 Key Environment, Social & Governance Highlights 38% Adopted a policy of having a minimum representation of 1/3 of the Board by women; 38% of our directors are women. Transparency Publicly disclosing on www.cn.ca website information on our lobbying activities, a list of our political contributions and a detailed list of our corporate memberships, including industry associations and policy organizations. Iconic Brand Recognized by Interbrand Canada as one of the 150 companies, organizations and institutions that are the most iconic in Canada. Catalyst Accord Signatory to the Catalyst Accord 2022 which promotes gender diversity on boards and executive management. Climate Change Over the past 25 years, CN has reduced its locomotive emission intensity by 39% while achieving record growth in the volume of freight it moves. In support of keeping the global temperature increase below 2 degrees Celsius compared to pre-industrial temperatures, in 2018, CN was the first railroad in North America to set a science-based target of 29% emission intensity reduction by 2030 based on 2015 levels. Sustainability Leader For eight consecutive years, CN has been listed on the DJSI World Index and for 11 consecutive years on the DJSI North America Index. In 2019, CN was the only Canadian company listed in the Transportation and Transportation Infrastructure sector. Best Corporate Citizen Ranked among the Best 50 Corporate Citizens in Canada by Corporate Knights for the 11 consecutive year in a row. First th Recognized by the Globe and Mail’s annual review of corporate governance practices in Canada, where CN ranked 1st in the industrials group and 7th overall. Executive Compensation Disciplined Approach to Compensation CN’s approach to executive compensation is driven by a commitment to deliver sustainable and solid returns to shareholders. CN exercises a disciplined approach to executive compensation by ensuring that target compensation, while reasonable, supports attraction and retention of executive talent. In addition, short-and long-term incentive plans are structured to align realized pay and shareholder returns. Compensation programs are designed to encourage appropriate behaviours and include appropriate risk mitigation mechanisms. The executive compensation policy aims to position target total direct compensation between the median and the 60th percentile of the executives’ respective comparator group. • ~ 77% of NEOs’ target total direct compensation is variable and linked to CN’s performance • Incentive payout capped and no guaranteed minimum payout • Inclusion of a relative total shareholder return condition as a performance measure for Performance Share Units Best practices adopted by CN • Safety component in the Annual Incentive Bonus Plan has been extended to all senior management employees in 2019 • Increased stock ownership requirements introduced in 2019 • President and CEO post-employment shareholding requirement • Extended executive clawback policy allowing the clawback of bonus or incentive based compensation awarded after March 7, 2017 in circumstances of gross negligence, intentional misconduct, fraud, theft or embezzlement without the need for a financial restatement • No employment contracts for NEOs • Benchmark compensation against a reasonable / size appropriate peer group • Double trigger change-of-control provisions • Provide shareholders an annual say on pay vote All NEOs 2019 Target Pay at Risk 23.4% Base Salary 76.6% At-Risk (1) See the section entitled Adjusted performance measures in CN’s Management’s Discussion and Analysis included in the Company’s 2019 Annual Report for an explanation of this measure and reconciliation to the nearest GAAP measure. 4 CN MANAGEMENT INFORMATION CIRCULAR 2020 PROXY SUMMARY 18.6% Annual Incentive Bonus Plan 33.7% Performance Share Units Awards 24.3% Stock Options Awards

Delivery of Meeting Materials and Voting Information Your Vote is Important As a shareholder, it is important that you read this Information Circular carefully and then vote your shares, either before or at the Meeting. The following section provides you with information on how to vote your shares. Notice and Access This year, as permitted under Canadian Securities Rules and pursuant to exemptions from the sending of financial statements and proxy solicitation requirements granted by the Director of Corporations Canada, we are using “Notice and Access” to deliver this Information Circular to both registered and non-registered shareholders. Instead of receiving a paper copy of the Information Circular in the mail, shareholders who hold common shares of CN on March 6, 2020, the record date for the Meeting, have access to it online. Shareholders will receive a package in the mail with a notice (the “Notice”) explaining how to access the Information Circular electronically and how to request a paper copy of it. A form of proxy for registered shareholders or a voting instruction form for non-registered shareholders or Employee Shares, will be included with the Notice with instructions on how to vote your shares. Adopting Notice and Access allows for faster access to the Information Circular, contributes to the protection of the environment, is consistent with our sustainability strategy and helps reduce printing and postage costs. How to access the Information Circular electronically T h e In format i on Ci r cul ar i s a v ai l abl e on our we bs i t e (www.cn.ca/investors) and on the website of our transfer agent, Computershare Trust Company of Canada (Computershare) (www.envisionreports.com/CNR2020), on SEDAR (www.sedar.com) and on the U.S. Securities and Exchange Commission (“SEC”) website (www.sec.gov) through EDGAR. How to request a paper copy of the Information Circular and Financial Statements You may request paper copies of the Information Circular and Financial Statements at no cost up to one year from the date the Information Circular was filed on SEDAR (on or about March 24, 2020). Your request should be received at least ten (10) business days prior to the Meeting date in order to receive the Information Circular in advance of such date and the Meeting date. You may request paper copies of either the Information Circular and Financial Statements by calling 1-877-907-7643 and entering the control number provided on the proxy form or the voting instruction form and following the instructions provided. If you request a paper copy of the Information Circular note that you will not receive a new form of proxy or voting instruction form, so you should keep the original form sent to you in order to vote. Questions? If you have questions about Notice and Access or to request a paper copy of the Information Circular after the Meeting at no charge, you can contact Broadridge at 1-877-907-7643 or Computershare via their website (www.investorcentre.com/service) or by phone at 1-800-564-6253. Important information about the Meeting The Meeting will be conducted online only, via a live webcast. Shareholders will not be able to attend the Meeting in person. You will be able to attend, participate and vote at the Meeting online via the webcast. Board members and senior executive officers will participate in the Meeting and be available for questions. Attending the Online Annual Meeting To participate in the Meeting, shareholders (registered, non-registered and holders of Employee Shares) will need to visit www.virtualshareholdermeeting.com/CNI2020 and check-in using the control number included either on your proxy form or voting instruction form, as applicable. The Meeting platform is fully supported across browsers and devices running the most updated version of applicable software plugins. You should ensure you have a strong, preferably high-speed, internet connection wherever you intend to participate in the Meeting. The Meeting will begin promptly at 10:00 a.m. (Eastern Daylight Time) on April 28, 2020. Online check-in will begin starting an hour prior, at 9:00 a.m. (Eastern Daylight Time). You should allow ample time for online check-in procedures. For any technical difficulties experienced during the check-in process or during the Meeting, please call 1-800-586-1548 (Canada and U.S.) or 1-303-562-9288 (international toll-free) for assistance. The webcast Meeting allows you to attend the Meeting live, submit questions and submit your vote while the Meeting is being held if you have not done so in advance of the Meeting. CN is also providing a toll-free conference call for shareholders that do not have internet access or that prefer that method, either to verbally ask a question at the Meeting, or to listen in as an alternative to the webcast. Using your control number included either on your proxy form or voting instruction form, as applicable, you will be able to listen to the Meeting proceedings and submit your question verbally during the Meeting; however, you will not be able to vote your shares on the phone during the Meeting and will have to use the online webcast for that purpose if you have not done so in advance of the Meeting. To join the conference call, you must call 1-877-328-2502 (Canada and U.S.) or 1-412-317-5419 (international toll-free). Guests will be able to attend the Meeting through the live webcast only, by joining the webcast as a guest www.virtualshareholdermeeting. com/CNI2020. They will not be able to submit questions or vote. They will not be allowed to dial into the conference call. Submitting Questions Following the Meeting, we will hold a live Q&A session, during which we intend to answer all written questions submitted before or during the Meeting. Only shareholders may submit questions at the Meeting, either before or during the Meeting. To ask a question before the Meeting, you need go to proxyvote.com and log in using your control number included either on your proxy form or voting instruction form, as applicable. Once 5 CN MANAGEMENT INFORMATION CIRCULAR 2020 VOTING INFORMATION

past the log-in screen, please click on “Questions for Management,” type in your question and click “Submit.” To ask a question during the Meeting you may do so in two ways: in writing through the live webcast at www.virtualshareholdermeeting.com/CNI2020 after logging-in, type your question into the “Ask a Question” field, and click “Submit”; or verbally through the conference call by dialing 1-877-328-2502 (Canada and U.S.) or 1-412-317-5419 (international toll-free) using your control number. A meeting operator will queue-in your question and open the line at the appropriate time. Guests will not be able to submit questions either before or during the Meeting. The Chair of the Meeting reserves the right to edit or reject questions he deems profane or otherwise inappropriate in accordance with the rules of conduct of the Meeting which are available at www.cn.ca/en/investors/ and following the Meeting web page. Any questions pertinent to the Meeting that cannot be answered during the Meeting due to time constraints will be posted online and answered at www.cn.ca/en/investors/. The questions and answers will be available as soon as practical after the Meeting and will remain available until one week after posting. The Chair of the Meeting has broad authority to conduct the Meeting in an orderly manner. To ensure the Meeting is conducted in a manner that is fair to all shareholders, the Chair of the Meeting may exercise broad discretion in the order in which questions are asked and the amount of time devoted to any one question. Consistent with our prior in-person annual meetings, all questions submitted in accordance with our rules of conduct for shareholders meeting generally are addressed in the order received. Who can vote Shareholders at the close of business on March 6, 2020 (the “Record Date”), are entitled to vote at the Meeting or at any adjournment or postponement thereof, either personally or by proxy. As of the close of business on the Record Date, the Company had 712,016,062 common shares without par value outstanding. Subject to the voting restrictions described in this section, each common share carries the right to one vote. How to vote If you are eligible to vote and your common shares are either registered in your name or are held in the name of a nominee (non-registered or Employee Shares), you can vote your common shares at the Meeting or by proxy in advance of the Meeting, as explained below. Voting by proxy in advance of the Meeting is the easiest way to vote your shares. The same procedures apply whether you are a registered shareholder, non-registered shareholder or holder of Employee Shares. You are a registered shareholder if your name appears on your share certificate or your Direct Registration System (DRS) confirmation. If you are a registered shareholder, you will receive a proxy form containing the relevant details concerning the business of the Meeting, including a control number that must be used to vote by proxy in advance of the Meeting or join the live webcast and phone line the day of the Meeting to attend the Meeting live, submit your questions and submit your vote while the Meeting is being held. If your common shares are not registered in your name and are held in the name of a nominee such as a trustee, financial institution or securities broker, you are a non-registered shareholder. If your common shares are listed in an account statement provided to you by your broker, those common shares will, in all likelihood, not be registered in your name. Such common shares will more likely be registered under the name of your broker or an agent of that broker. Without specific instructions, brokers and their agents or nominees are prohibited from voting shares for the broker’s client. If you are a non-registered shareholder, you will receive a voting instruction form containing the relevant details concerning the business of the Meeting, including a control number that must be used to vote by proxy in advance of the Meeting or join the live webcast and phone line the day of the Meeting to attend the Meeting live, submit your questions and submit your vote while the Meeting is being held. Common shares purchased by employees of the Company under its Canadian and U.S. Employee Share Investment Plans and its Savings Plan for U.S. Operations (the “Plans”) are known as Employee Shares. Employee Shares remain registered in the name of the Plans’ Custodian (currently Computershare Trust Company of Canada or Fidelity Institutional Retirement Services Company, as applicable), unless the employees have withdrawn their common shares from the Plans in accordance with their provisions. If you are a holder of Employee Shares you will receive a voting instruction form containing the relevant details concerning the business of the Meeting, including a control number that must be used to vote by proxy in advance of the Meeting or join the live webcast and phone line the day of the Meeting to attend the Meeting live, submit your questions and submit your vote while the Meeting is being held. Vote in advance of the Meeting - Voting by Proxy Below are the different ways in which you can give your voting instructions, details of which are found in the proxy form or voting instruction form, as applicable, accompanying this Information Circular: Go to www.proxyvote.com and follow the instructions. You will need your control number found on your proxy form or voting instruction form, as applicable. Complete and return the proxy form or voting instruction form as applicable, in the prepaid envelope provided. INTERNET MAIL Call 1-800-474-7493 (English) or 1-800-474-7501 (French). You will need your control number found on your proxy form or voting instruction form, as applicable. Complete the proxy form or voting instruction form, as applicable and return it by fax at 905-507-7793 or 514-281-8911. PHONE FAX If you are using mail, your duly completed proxy form or voting instruction form, as applicable must have been received by our proxy tabulator with sufficient time for your vote to be processed, and in all cases, no later than 5:00 p.m. on April 24, 2020 (Eastern Daylight Time). For all other methods, you must have voted before 5:00 p.m. on April 27, 2020, (Eastern Daylight Time) or if the Meeting is adjourned or postponed, by no later than 5:00 p.m. on the business day prior to the day fixed for the adjourned or postponed Meeting. Voting at the Meeting If you wish to vote at the meeting, you do not need to complete or return your proxy form or voting instruction form, as applicable. The day of the Meeting, all shareholders, whether you are a registered or non-registered shareholder or holder of Employee Shares, you will be able to vote via the live webcast by completing a ballot online during the Meeting. You will need to visit www.virtualshareholdermeeting.com/CNI2020 and check-in using your control number included on your proxy form or voting instruction form, as applicable, as further described under “Attending the Online Meeting”. If you wish to appoint someone as proxy to vote your shares for you at the Meeting during the live webcast, please follow the instructions found on either your proxy form or voting instruction form, as applicable. You will need to create a unique eight-character identification number which will allow your appointee to join the Meeting and vote your shares on your behalf. WEBCAST 6 CN MANAGEMENT INFORMATION CIRCULAR 2020 VOTING INFORMATION

How your Shares will be Voted You can choose to vote FOR, WITHHOLD or AGAINST, depending on the items to be voted on. When you vote by proxy, you may appoint either the persons named as proxies in the proxy form or voting instruction form (who are the Board Chair and the President and Chief Executive Officer of the Company, or in the case of Employee Shares, Computershare Trust Company of Canada or Fidelity Institutional Retirement Services Company) or you may appoint someone else to vote for you as your proxy holder by using the enclosed form of proxy or voting instruction form. You have the right to appoint any other person or company (who need not be a shareholder) to attend and act on your behalf at the Meeting. That right may be exercised by writing the name of such person or company in the blank space provided, and following the instructions, found in the proxy form or voting instruction form, or by completing another proper form of proxy. Make sure that the person you appoint is aware that he or she is appointed and that this person log into the online Meeting using the credentials you created for him/her as your appointee. Your common shares will be voted or withheld from voting in accordance with your instructions indicated on the proxy form or voting instruction form. If no instructions are indicated, your common shares represented by proxies in favour of the Board Chair or the President and Chief Executive Officer (or in the case of Employee Shares, Computershare Trust Company of Canada or Fidelity Institutional Retirement Services Company) will be voted as follows: Changing your Vote You may revoke your proxy at any time, by voting again on the Internet or by phone or fax before 5:00 p.m. on April 27, 2020 (Eastern Daylight Time) or by following the below instructions: • by completing an instrument in writing (which includes another form of proxy or voting instructions form, as applicable with a later date) executed by you, or by your attorney (duly authorized in writing), and: • deposited with the Corporate Secretary of the Company at the registered office of the Company (935 de La Gauchetière Street West, 16th Floor, Montreal, Quebec, Canada, H3B 2M9) at any time up to and including 5:00 p.m. on April 27, 2020 (Eastern Daylight Time) or any adjournment or postponement thereof. filed electronically with the chair of the Meeting (at [email protected]) on the day of the Meeting or any adjournment or postponement thereof, or in any other manner permitted by law. • CN’s Voting Restrictions Our articles of continuance, as amended, provide that no person, together with his or her associates, shall hold, beneficially own or control, directly or indirectly, voting shares to which are attached more than 25% in the aggregate of the votes attached to all our voting shares that may ordinarily be cast to elect directors of the Company. In addition, where the total number of voting shares held, beneficially owned or controlled, directly or indirectly, by any one person together with his or her associates exceeds such 25% maximum, no person shall, in person or by proxy, exercise the voting rights attached to the voting shares held, beneficially owned or controlled, directly or indirectly, by such person or his or her associates. To the knowledge of the directors and senior officers of the Company, based on the most recent publicly available information, the only person who beneficially owns, or directly or indirectly exercises control or direction over, shares carrying 10% or more of the voting rights attached to any class of shares of the Company is Mr. William H. Gates, III. Mr. Gates is the sole member of Cascade Investment, L.L.C. (“Cascade”). Cascade held 101,400,770 common shares of the Company on the Record Date, representing 14.24% of the outstanding common shares of the Company. In addition, Mr. Gates is a co-trustee of the Bill & Melinda Gates Foundation Trust, which held 17,126,874 common shares of the Company on the Record Date, representing 2.40% of the outstanding common shares of the Company. Hence, on the Record Date, Mr. Gates is deemed to have control or direction over 118,527,644 common shares, representing 16.64% of the outstanding common shares of the Company. i) ii) iii) FOR the election of management’s nominees as directors FOR the appointment of KPMG LLP as auditors FOR, in an advisory, non-binding capacity, the approach to executive compensation disclosed in the “Statement of Executive Compensation” section of this Information Circular and at the discretion of the proxy holder in respect of amendments to any of the foregoing matters or on such other business as may properly be brought before the Meeting. Should any nominee named herein for election as a director become unable to accept nomination for election, it is intended that the person acting under proxy in favour of management will vote for the election in his or her stead of such other person as management of the Company may recommend. Management has no reason to believe that any of the nominees for election as directors will be unable to serve if elected to office and is not aware of any amendment or other business likely to be brought before the Meeting. The Board of Directors and management are recommending that shareholders vote FOR items (i), (ii) and (iii). A simple majority of the votes cast will constitute approval of each of these matters. Additional Information Proxy Solicitation Management of the Company is soliciting your proxy. The solicitation is being made primarily by mail, but our directors, officers or employees may also solicit proxies at a nominal cost to the Company. The Company has retained and will pay for the services of D.F. King, a division of AST Investor Services Inc. (“D.F. King”), for the solicitation of proxies in Canada and the U.S., at an aggregate cost estimated to be approximately C$31,000 plus additional costs relating to out-of-pocket expenses. Questions If you have questions about the information contained in this Information Circular or require assistance in completing your form of proxy or voting instruction form, please call D.F. King, the Company’s proxy solicitation agent, toll-free in North America at 1-800-239-6813 or at 1-212-771-1133 outside of North America; or by e-mail at [email protected]. Transfer Agent You can contact the transfer agent either by mail at Computershare Trust Company of Canada, 100 University Ave., 8th Floor, Toronto (Ontario) M5J 2Y1, by telephone at 1-800-564-6253, by fax at 1-888-453-0330 or by internet at www.investorcentre.com/service, or in French at www.centredesinvestisseurs.com/service. Intermediaries Fees Non-registered shareholders are either objecting beneficial owners who object that intermediaries disclose information about their ownership in the Company, or non-objecting beneficial owners, who do not object to such disclosure. The Company pays intermediaries to send proxy-related materials to both objecting and non-objecting beneficial owners. 7 CN MANAGEMENT INFORMATION CIRCULAR 2020 VOTING INFORMATION

Business of the Meeting Financial Statements Our consolidated financial statements for the year ended December 31, 2019, together with the auditors’ reports thereon, are included in the 2019 Annual Report of the Company, available on our website at www.cn.ca, on SEDAR at www.sedar.com, in the Company’s annual report on Form 40-F available on the SEC’s website at www.sec.gov through EDGAR, and in print, free of charge, to any shareholder who requests a copy by contacting our Corporate Secretary at (514) 399-7091 or Vice-President, Investor Relations at (514) 399-0052. Election of Directors Our articles of continuance, as amended, provide that our Board of Directors shall consist of a minimum of seven and a maximum of 21 directors. Pursuant to a resolution of the Board of Directors, 13 persons are to be elected as directors for the current year, each to hold office until the next annual meeting of shareholders or until such person’s successor is elected or appointed. The term of office of each of the present directors expires at the close of the Meeting. The persons named in the section entitled “Nominees for Election to the Board — Description of Nominees” will be presented for election at the Meeting as management’s nominees. All of the nominees proposed for election as directors are currently directors of the Company. All persons nominated were recommended to the Board of Directors by the Corporate Governance and Nominating Committee. Unless authority is withheld, the persons designated in the accompanying form of proxy or voting instruction form intend to vote FOR the election of the persons named in the section entitled “Nominees for Election to the Board — Description of Nominees”. These nominees are, in the opinion of the Board of Directors and management, well qualified to act as directors of the Company for the ensuing year and have confirmed their willingness to serve as directors. The Board of Directors and management do not contemplate that any of these nominees will be unable to serve as a director, but should that occur for any reason before the Meeting, the persons designated in the accompanying form of proxy or voting instruction form reserve the right to vote for another nominee at their discretion unless the shareholder who has given such proxy or voting instruction form has directed that the common shares be withheld from voting on the election of any of the directors. Majority Voting Policy The Board of Directors has adopted a policy which is part of our Corporate Governance Manual, to the effect that a nominee for election as a director of the Company who receives a greater number of votes “withheld” than votes “for”, with respect to the election of directors by shareholders, will tender his or her resignation to the Board Chair promptly following the meeting of shareholders at which the director is elected. The Corporate Governance and Nominating Committee will consider such offer and make a recommendation to the Board of Directors whether to accept it or not. The Board of Directors will make its decision and promptly announce it in a press release within 90 days following the meeting of shareholders, a copy of which will be provided to the Toronto Stock Exchange (“TSX”). The Board of Directors shall however, accept such resignation absent exceptional circumstances. The resignation shall be effective when accepted by the Board of Directors. The director who offered to tender his or her resignation should not be part of any committee or Board of Directors deliberations pertaining to the resignation offer. This policy only applies in circumstances involving an uncontested election of directors. An “uncontested election of directors” means that the number of director nominees is the same as the number of directors to be elected to the Board and that no proxy material is circulated in support of one or more nominees who are not part of the candidates supported by the Board of Directors. Appointment of Auditors The Board of Directors and the Audit Committee recommend that KPMG LLP be appointed to serve as the Company’s auditors until the next annual meeting of shareholders. The Audit Committee is responsible for recommending the appointment of the external auditors, evaluating and monitoring their qualifications, performance and independence, as well as assessing the appropriateness of the audit fees. KPMG LLP has served as the Company’s independent auditors since 1992. The Audit Committee continuously assesses the Company’s external auditors, and on an annual basis reviews the audit and non-audit fees, audit quality, independence, and tenure of our auditors, including the benefits and risks of having a long-tenured auditor and the controls and processes that help ensure KPMG’s independence. See “Schedule C – Additional Audit Committee Disclosure” for more details on auditors’ independence. For the years ended December 31, 2019 and 2018, the fees for audit, audit-related, tax and all other services provided to the Company by KPMG LLP were the following: Pursuant to the terms of its charter, the Audit Committee approves all audit and audit-related services, audit engagement fees and terms and all non-audit engagements provided by the external auditors. The Audit Committee pre-approved all the services performed by the auditors for audit, audit-related and non-audit related services for the years ended December 31, 2019 and 2018. The nature of the services under each category is described below. Audit Fees Consists of fees incurred for professional services rendered by the auditors in relation to the audit of the Company’s consolidated annual financial statements and those of its subsidiaries and the audit relating to the Company’s internal control over financial reporting. Audit-Related Fees Audit-related fees were incurred for professional services rendered by the auditors in relation to the audit of the financial statements for the Company’s pension plans, and for attestation services in connection with reports required by statute or regulation and due diligence and other services, including comfort letters, in connection with the issuance of securities and other audit-related fees. FEE (IN THOUSANDS) 2019 (C$) 2018 (C$) Audit Audit-related Tax All other 2,718 1,234 1,288 50 2,745 1,243 1,143 417 TOTAL FEES 5,290 5,548 8 CN MANAGEMENT INFORMATION CIRCULAR 2020 BUSINESS OF THE MEETING

Tax Fees Fees consist of compliance related services associated to cross-border employee tax filings, for assistance related to the preparation of Canadian and U.S. research and development tax credit filings and other tax compliance services. All Other Fees Consists of fees related to cybersecurity services and for services related to a foreign subsidiary. Unless authority is withheld, the persons designated in the accom-panying form of proxy or voting instruction form intend to vote FOR the appointment of KPMG LLP as auditors of the Company to hold office until the next annual meeting of shareholders. Advisory Vote on Executive Compensation The Company is again providing its shareholders with an opportunity to cast at the Meeting an advisory vote on the Company’s approach to executive compensation, as disclosed in the “Statement of Executive Compensation” section of this Information Circular. Such section describes the role of the Human Resources and Compensation Committee in overseeing compensation of executives and ensuring that it is linked to the Company’s three-year business plan. The section also describes the Company’s executive compensation principles, the structure of the compensation plans for executives, and the alignment of such plans with the interests of our shareholders. The Board of Directors recommends that shareholders vote FOR the resolution set out below and, unless otherwise instructed, the persons designated in the form of proxy or voting information form intend to vote FOR the following resolution: “RESOLVED that, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, the shareholders accept the approach to executive compensation disclosed in the section entitled ‘Statement of Executive Compensation’ of the Information Circular of the Company dated March 10, 2020.” The Board of Directors has adopted a policy to the effect that, if a majority of the shares represented in person or by proxy at a meeting are voted against the above non-binding advisory resolution, the Board Chair or the Chair of the Human Resources and Compensation Committee will oversee a process to engage with shareholders with a view to giving them the opportunity to express their specific concerns. The Board of Directors and the Human Resources and Compensation Committee will consider the results of this process and, if appropriate, review the Company’s approach to executive compensation in the context of shareholders’ specific concerns. Other Business Following the conclusion of the formal business to be conducted at the Meeting, we will: • discuss highlights of our 2019 performance and plans for the future, and • invite questions and comments from shareholders. As of the date of this Circular, management is not aware of any changes to these items and does not expect any other items to be brought forward at the Meeting. If there are changes or new items, your proxyholder can vote your shares on these items as he or she sees fit. 9 CN MANAGEMENT INFORMATION CIRCULAR 2020 BUSINESS OF THE MEETING

Nominees for Election to the Board Description of Nominees The following tables set out information as at February 27, 2020, unless otherwise indicated, and include a profile of each nominated director with an explanation of his or her experience, qualifications, top three competencies, participation on the Board and its committees, ownership of securities of CN, as well as participation on the boards of other public companies during the past five years. A more detailed description of our directors’ competencies can be found under the heading “Competency Matrix” in the section entitled “Statement of Corporate Governance Practices”. Each nominee is a current director of the Company. Shauneen Bruder Corporate Director Ms. Bruder was, until her retirement on October 31, 2019, the Executive Vice-President, Operations at the Royal Bank of Canada (“RBC”) where she was responsible for overseeing operations related to all personal and business clients in Canada. Her previous senior roles at RBC include Executive Vice-President of Business and Commercial Banking, Chief Operating Officer of the Global Wealth Management division and President of RBC Centura Banks, Inc. in North Carolina. She is a member of the Institute of Corporate Directors and is Chair of the Board of Governors for the University of Guelph. Previously, she was appointed as the Chairperson of the Canadian Chamber of Commerce and the Canadian American Business Council. She serves as Honorary Consul for Luxembourg in Toronto. In 2012, she was awarded the Queen’s Diamond Jubilee Medal. Ms. Bruder was inducted in the Women’s Executive Network 100 Most Powerful Women in Canada Hall of Fame in 2016. Ms. Bruder holds a B.A. from the University of Guelph and an MBA (Gold Medalist) from Queen’s University. AGE 60 (1) Ontario, Canada DIRECTOR SINCE April 25, 2017 Independent PRINCIPAL COMPETENCIES Finance/Accounting, Strategy, Sales/ Marketing MEMBER OF (2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARD Board Donations and Sponsorships Committee (3) Environment, Safety and Security Committee(6) Finance Committee Human Resources and Compensation Committee Pension and Investment Committee(7) Strategic Planning Committee 100% 100% 100% 100% 100% 100% 100% Andrew Peller Limited (2018 - present) SECURITIES HELD Value at risk C$1,525,650(4) Common Shares Owned or Controlled (5) 13,125 9,873 February 2020 February 2019 99.62% votes in favour in 2019 Donald J. Carty, O.C., LL.D. Corporate Director Mr. Carty retired as Vice-Chairman and Chief Financial Officer of Dell, Inc. (computer manufacturer), a position he assumed from January 2007 until June 2008, and as Chairman and CEO of AMR Corporation and American Airlines in 2003 after 30 years in the airline business, where he previously served as President and Executive Vice-President of Finance & Planning of AMR Airline Group and American Airlines. He was President and CEO of CP Air from 1985 to 1987. In the voluntary sector, Mr. Carty is on the Executive Board of the SMU Cox School of Business. He is a former Chairman of Big Brothers Big Sisters of America. In 1999, Board Alert named Mr. Carty one of the year’s Outstanding Directors and in 2015, he was named to the top 100 of the National Association of Corporate Directors List. He was named an Officer of the Order of Canada in 2003. In addition to serving on the public boards mentioned in the following table, Mr. Carty serves as Chairman of the board of Porter Airlines, Inc. Mr. Carty holds a B.A. and an Honorary Doctor of Laws from Queen’s University and an MBA from Harvard Business School. AGE 73 (1) Texas, U.S.A. DIRECTOR SINCE January 1, 2011 Independent PRINCIPAL COMPETENCIES Strategy, Finance/ Accounting, Human Resources MEMBER OF (2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARDS Board Audit Committee (Chair) Environment, Safety and Security Committee Human Resources and Compensation Committee Pension and Investment Committee (3) Strategic Planning Committee 100% 100% 100% 100% 100% 100% Hawaiian Holdings, Inc. VMWare, Inc. OTHER PUBLIC BOARDS DURING PAST 5 YEARS (2016 - present) (2015 - present) EMC Corporation Virgin America Inc. Talisman Energy Inc. (2015 - 2016) (2006 - 2016) (2009 - 2015) 99.03% votes in favour in 2019 SECURITIES HELD Value at risk C$12,062,471 (4) Common Shares Owned or Controlled (5) 105,518 101,858 February 2020 February 2019 10 CN MANAGEMENT INFORMATION CIRCULAR 2020 NOMINEES FOR ELECTION TO THE BOARD

Ambassador Gordon D. Giffin Partner, Dentons US LLP Mr. Giffin is a Partner of Dentons (law firm), where he maintains offices in Washington, D.C. and Atlanta, Georgia. He has been engaged in the practice of law or government service for more than thirty-five years. Mr. Giffin was United States Ambassador to Canada from 1997 to 2001. Mr. Giffin is a member of the Board of Trustees of the Jimmy Carter Presidential Center and is a member of the Council on Foreign Relations and the Tri-Lateral Commission. In addition to serving on the public boards mentioned in the following table, Mr. Giffin serves on the Board of Counsellors of McLarty Global and on the boards of directors of CIBC USA Holdings Inc. Mr. Giffin holds a B.A. from Duke University and a J.D. from Emory University School of Law. AGE 70 (1) Georgia, U.S.A. DIRECTOR SINCE May 1, 2001 Independent PRINCIPAL COMPETENCIES Public Policy, Legal, Human Resources MEMBER OF (2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARDS Board Corporate Governance and Nominating Committee Environment, Safety and Security Committee Pension and Investment Committee (3) Strategic Planning Committee 100% 100% 100% 100% 100% Canadian Natural Resources Limited (Lead Director) TransAlta Corporation (Chair) OTHER PUBLIC BOARDS DURING PAST 5 YEARS (2002 - present) (2002 - present) ECN Capital Corp. Canadian Imperial Bank of Commerce Element Financial Corporation Just Energy Group Inc. (2016 - 2017) (2001 - 2017) (2013 - 2016) (2006 - 2015) 96.06% votes in favour in 2019 SECURITIES HELD Value at risk C$12,017,316 (4) Common Shares Owned or Controlled (5) 105,123 102,075 February 2020 February 2019 Julie Godin Co-Chair of the Board and Executive Vice-President, Strategic Planning and Corporate Development, CGI Inc. Ms. Godin is Co-Chair of the Board and Executive Vice-President, Strategic Planning and Corporate Development of CGI Inc. (“CGI”) (information technology consulting company) where she collaborates with the CGI Board to set the strategic direction of the company and maintain equilibrium among CGI’s three stakeholders — clients, employees (whom CGI calls members) and shareholders — to ensure each stakeholders’ long-term success. She also oversees the ongoing development of the CGI Management Foundation, which includes the key elements and best practices that define and guide the company’s actions, along with leading CGI’s strategic planning, marketing, communications and IP strategy functions. Previously Ms. Godin was Vice-Chair of the Board and Executive Vice-President, Chief Planning and Administration Officer, where Ms. Godin oversaw a number of functions across the company, including global security, mergers and acquisitions, and global human resources, including executive compensation and succession planning, as well as organizational model sustainability to secure organic growth. Before joining CGI, Ms. Godin founded Oxygen Corporate Health, a company that manages comprehensive health and wellness programs in the workplace. Oxygen merged its activities with those of CGI. In 2000, Ms. Godin co-founded the Godin Family Foundation, a non-profit organization that strives to reduce poverty, promote education and improve the health of children and teens in disadvantaged areas. Ms. Godin holds a B.A. from the Université de Sherbrooke. AGE 45 (1) Quebec, Canada DIRECTOR SINCE April 25, 2017 Independent PRINCIPAL COMPETENCIES Human Resources, Strategy, Finance/ Accounting MEMBER OF (2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARD Board Corporate Governance and Nominating Committee Environment, Safety and Security Committee (7) Finance Committee Human Resources and Compensation Committee Pension and Investment Committee(3)(6) Strategic Planning Committee 100% 100% 100% 100% 100% 100% 100% CGI Inc. (Co-Chair) (2013-present) SECURITIES HELD Value at risk C$1,525,650(4) Common Shares Owned or Controlled(5) 13,125 9,873 February 2020 February 2019 99.20% votes in favour in 2019 11 CN MANAGEMENT INFORMATION CIRCULAR 2020 NOMINEES FOR ELECTION TO THE BOARD

Edith E. Holiday Corporate Director & Trustee Ms. Holiday is a Corporate Director and Trustee and a former General Counsel, United States Treasury Department and former Secretary of the Cabinet, The White House. Ms. Holiday serves on the public boards mentioned in the following table. She was also the recipient of the DirectWomen’s 2009 Sandra Day O’Connor Board Excellence Award, which honours women who have served with distinction on the board of a public company and advanced the value of diversity in the workplace. She is also the recipient of the Secretary of the Treasury’s highest award, the Alexander Hamilton Award. Ms. Holiday holds a B.S. and a J.D. from the University of Florida, and she was admitted to the bars of the states of Florida, Georgia and the District of Columbia. AGE 68(1) Florida, U.S.A. DIRECTOR SINCE June 1, 2001 Independent PRINCIPAL COMPETENCIES Legal, Public Policy, Strategy MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARDS Board Pension and Investment Committee (Chair)(3) Audit Committee Finance Committee Strategic Planning Committee 100% 100% 100% 100% 100% Santander Consumer USA Holdings, Inc. White Mountains Insurance Group, Ltd. Franklin Templeton Group of Funds (various companies) (Lead Director) Hess Corporation OTHER PUBLIC BOARD DURING PAST 5 YEARS (2016 - present) (2004 - present) (1996 - present) (1993 - present) 88.22% votes in favour in 2019 RTI International Metals, Inc. (1999 - 2015) SECURITIES HELD Value at risk C$12,786,553(4) Common Shares Owned or Controlled(5) 111,852 109,066 February 2020 February 2019 V. Maureen Kempston Darkes, O.C., D. COMM., LL.D. Corporate Director Ms. Kempston Darkes is the retired Group Vice-President and President Latin America, Africa and Middle East, General Motors Corporation (“GM”). In 2009, she ended a 35-year career at GM during which she attained the highest operating position ever held by a woman at GM. From 1994 to 2001, she was President and General Manager of General Motors of Canada Limited and Vice-President of GM. She is an Officer of the Order of Canada, a member of the Order of Ontario and was ranked by Fortune magazine in 2009 as the 12th Most Powerful Woman in International Business and amongst the Women’s Executive Network’s 2012 Canada’s Most Powerful Women: Top 100 Award Winners. In 2006, she was the recipient of the Governor General of Canada’s Awards in Commemoration of the Persons Case and was inducted as a fellow of the Institute of Corporate Directors in 2011. She has also been an appointee of the Government of Canada to the Science, Technology and Innovation Council and the Advisory Council for Promoting Women on Boards. Ms. Kempston Darkes serves on the public boards mentioned in the following table. Ms. Kempston Darkes has received Honorary Doctor of Law Degrees from the University of Toronto and the University of Victoria, as well as an Honorary Doctor of Commerce from Saint Mary’s University. She holds a B.A. in history and political science from Victoria University in the University of Toronto and an LL.B. from the University of Toronto Faculty of Law. AGE 71(1) Ontario, Canada Florida, U.S.A. DIRECTOR SINCE March 29, 1995 Independent PRINCIPAL COMPETENCIES Transport Industry/ Safety, Sales/ Marketing, Human Resources MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARDS Board Audit Committee Corporate Governance and Nominating Committee Finance Committee Pension and Investment Committee(3) Strategic Planning Committee 100% 100% 100% 100% 100% 100% Enbridge Inc. Brookfield Asset Management Inc. OTHER PUBLIC BOARDS DURING PAST 5 YEARS (2010 - present) (2008 - present) Schlumberger Limited Balfour Beatty Plc. (2014 - 2019) (2012 - 2017) SECURITIES HELD 95.21% votes in favour in 2019 Value at risk C$22,899,048(4) Common Shares Owned or Controlled(5) 196,998 194,009 February 2020 February 2019 12 CN MANAGEMENT INFORMATION CIRCULAR 2020 NOMINEES FOR ELECTION TO THE BOARD

The Hon. Denis Losier, P.C., LL.D., C.M. Corporate Director The Honorable Denis Losier is the retired President and Chief Executive Officer of Assumption Life (life insurance company). Between 1989 and 1994, Mr. Losier held various cabinet level positions with the government of the Province of New Brunswick, including Minister of Fisheries and Aquaculture and Minister of Economic Development and Tourism. Mr. Losier was co-chair of the University of Moncton’s Excellence Campaign. In 2008, he was named a member of the Security Intelligence Review Committee of Canada, and, as such, was made a Member of the Queen’s Privy Council. In addition to serving on the public boards mentioned in the following table, Mr. Losier was a director of Enbridge Gas New Brunswick until 2017 and is the past chair of the board of directors of Invest N.B. He is also a past member and director of the New Brunswick Business Council and Canadian Blood Services, respectively. Mr. Losier was appointed a Member of the Order of Canada in 2011. Mr. Losier holds a Bachelor of Economics from the University of Moncton and a Masters of Economics from the University of Western Ontario. Mr. Losier was awarded an Honorary Doctorate Degree in Business Administration from the University of Moncton. AGE 67(1) New Brunswick, Canada DIRECTOR SINCE October 25, 1994 Independent PRINCIPAL COMPETENCIES Finance/Accounting, Human Resources, Sales/Marketing MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARD Board Corporate Governance and Nominating Committee (Chair) Donations and Sponsorships Committee(3) Pension and Investment Committee(3) Strategic Planning Committee 100% 100% 100% 100% 100% Plaza Retail REIT OTHER PUBLIC BOARD DURING PAST 5 YEARS (2007 - present) Capital DGMC Inc. (2013 - 2016) SECURITIES HELD Value at risk C$34,773,893(4) Common Shares Owned or Controlled(5) 299,156 295,796 93.52% votes in favour in 2019 February 2020 February 2019 The Hon. Kevin G. Lynch, P.C., O.C., PH.D., LL.D. Vice-Chair, BMO Financial Group The Honourable Kevin Lynch has been Vice Chairman of BMO Financial Group since 2010. Prior to joining BMO, Dr. Lynch had a distinguished career with the Government of Canada, serving as Clerk of the Privy Council, Secretary to the Cabinet, Deputy Minister of Finance, Deputy Minister of Industry as well as Executive Director for Canada at the International Monetary Fund. Dr. Lynch is the past Chancellor of the University of King’s College, the past Chair of the Board of Governors of the University of Waterloo, a Senior Fellow of Massey College and a Trustee of the Killam Trusts. In addition to serving on the public boards mentioned in the following table, Dr. Lynch is a director emeritus of the Governor General’s Rideau Hall Foundation and is a director of Communitech and the Asia Pacific Foundation of Canada, as well as a member of the World Economic Forum (WEF) Committee on “Balancing Financial Stability, Innovation and Economic Growth”. Dr. Lynch earned his BA from Mount Allison University, a Masters in Economics from the University of Manchester and a doctorate in Economics from McMaster University. He was made a Member of the Queen’s Privy Council for Canada in 2009, was appointed an Officer of the Order of Canada in 2011, has received 11 honorary doctorates from Canadian Universities and was awarded the Queen’s Golden and Diamond Jubilee Medals for public service. AGE 69 (1) Ontario, Canada DIRECTOR SINCE April 23, 2014 Independent PRINCIPAL COMPETENCIES Public Policy, Finance/ Accounting, Strategy MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARD Board Human Resources and Compensation Committee (Chair) Audit Committee Corporate Governance and Nominating Committee Pension and Investment Committee(3) Strategic Planning Committee 100% 100% 100% 100% 100% 100% SNC-Lavalin Group Inc. (Chairman) OTHER PUBLIC BOARDS DURING PAST 5 YEARS (2017 - present) CNOOC Limited Empire Company Limited (Sobeys, Inc.) (2014 - 2019) (2013 - 2017) SECURITIES HELD Value at risk C$3,262,392(4) Common Shares Owned or Controlled(5) 28,066 25,484 92.07% votes in favour in 2019 February 2020 February 2019 13 CN MANAGEMENT INFORMATION CIRCULAR 2020 NOMINEES FOR ELECTION TO THE BOARD

James E. O’Connor Corporate Director Mr. O’Connor is the retired chair of the board of directors of Republic Services, Inc., a leading provider of non-hazardous solid waste collection, recycling and disposal services in the United States. From 1998 to 2011, Mr. O’Connor was chair and Chief Executive Officer of Republic Services, Inc. Prior to 1998, he had held various management positions at Waste Management, Inc. In 2001, Mr. O’Connor was the recipient of the Ellis Island Medal of Honor from the National Ethnic Coalition of Organizations (NECO) which rewards Americans who exemplify outstanding qualities in both their personal and professional lives, while continuing to preserve the richness of their particular heritage. He was named to the list of America’s Best CEOs each year, between 2005 and 2010. In 2011, Mr. O’Connor was named to the Institutional Investors’ All American Executive Team. He is also active in many community causes, especially those that benefit children. Mr. O’Connor has served on the board of directors of the SOS Children’s Village. In addition to serving on the public boards mentioned in the following table, Mr. O’Connor serves on the board of directors of the South Florida P.G.A. of America Foundation. Mr. O’Connor holds a Bachelor of Science in Commerce (concentration in accounting) from DePaul University. AGE 70(1) Florida, U.S.A. DIRECTOR SINCE April 27, 2011 Independent PRINCIPAL COMPETENCIES Strategy, Engineering/ Environment, Human Resources MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARDS Board Strategic Planning Committee (Chair) Audit Committee Donations and Sponsorships Committee(3) Environment, Safety & Security Committee Finance Committee 100% 100% 100% 100% 100% 100% Casella Waste Systems, Inc. (Lead Director) Clean Energy Fuels Corp. (2015 - present) (2011 - present) SECURITIES HELD Value at risk C$4,050,927(4) Common Shares Owned or Controlled(5) 35,436 33,315 February 2020 February 2019 99.55% votes in favour in 2019 Robert Pace, D. COMM., C.M. Chair of the Board, CN President & CEO, The Pace Group Mr. Pace became Chair of the Board of Directors of CN in 2014 and is President and Chief Executive Officer, The Pace Group (radio broadcasting, real estate development and environmental services). He began his professional career practicing law in Halifax. In 1981, he accepted an appointment to act as the Atlantic Advisor to the Prime Minister of Canada, the Right Honorable Pierre Elliott Trudeau, in Ottawa. In addition to serving on the public boards mentioned in the following table, Mr. Pace is former Chairman of the Walter Gordon Foundation. He is also a director of the Atlantic Salmon Federation and former director of the Asia Pacific Foundation. Mr. Pace holds an MBA and an LL.B from Dalhousie University and holds an Honorary Doctor of Commerce Degree from Saint Mary’s University. He was appointed a Member of the Order of Canada in 2016. Mr. Pace has also completed Corporate Director education programs at both Harvard and Chicago Business Schools. AGE 65(1) Nova Scotia, Canada DIRECTOR SINCE October 25, 1994 Independent PRINCIPAL COMPETENCIES Human Resources, Transport Industry/ Safety, Strategy MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARD Board (Chair) Donations and Sponsorships Committee (Chair)(3) Corporate Governance and Nominating Committee Environment, Safety & Security Committee Strategic Planning Committee 100% 100% 100% 100% 100% High Liner Foods Incorporated (Chair) (1998 - present) SECURITIES HELD Value at risk C$39,480,335(4) Common Shares Owned or Controlled(5) 339,645 333,351 February 2020 February 2019 95.13% votes in favour in 2019 14 CN MANAGEMENT INFORMATION CIRCULAR 2020 NOMINEES FOR ELECTION TO THE BOARD

Robert L. Phillips President, R.L. Phillips Investments Inc. Mr. Phillips is the President of R.L. Phillips Investments Inc. and was previously President and Chief Executive Officer and director of British Columbia Railway Company Limited from 2001 to 2004. Mr. Phillips was Executive Vice-President, Business Development and Strategy for MacMillan Bloedel Ltd. and, before that, held the position of Chief Executive Officer at PTI Group and Dreco Energy Services Limited. He also enjoyed a prestigious career as a corporate lawyer and was appointed to the Queen’s Counsel in Alberta in 1991. Mr. Phillips was inducted as a fellow of the Institute of Corporate Directors in June 2017. Mr. Phillips serves on the public boards mentioned in the following table. Mr. Phillips received his Bachelor of Laws (Gold Medalist), and Bachelor of Science, Chemical Engineering (Hons) from the University of Alberta. AGE 69(1) British Columbia, Canada DIRECTOR SINCE April 23, 2014 Independent PRINCIPAL COMPETENCIES MEMBER OF(2) ATTENDANCE 2019 OTHER CURRENT PUBLIC BOARDS Board Finance Committee (Chair) Corporate Governance and Nominating Committee Environment, Safety & Security Committee Human Resources and Compensation Committee 100% 100% 100% 100% 100% Capital Power Corporation Maxar Technologies Inc. (and its predecessor, Maxar Technologies Ltd (formerly MacDonald Dettwiler & Associates Ltd.))* West Fraser Timber Co. Ltd. (Lead Director) Canadian Western Bank (Chair) OTHER PUBLIC BOARD DURING PAST 5 YEARS (2019 - present) (2003 - present) Transport Industry/ Safety, Strategy, Sales/ Marketing (2005 - present) (2001 - present) S trategic Planning Committee 100% Precision Drilling Corporation (2004 - 2017) 98.07% votes in favour in 2019 *Mr. Phillips is retiring from the Board of Maxar Technologies Inc. and is not standing for re-election at the May 2020 meeting. SECURITIES HELD Value at risk C$3,655,748(4) Common Shares Owned or Controlled(5) 31,450 28,807 February 2020 February 2019 Jean-Jacques Ruest President and Chief Executive Officer, CN Mr. Ruest was appointed President and Chief Executive Officer in July 2018, after having served as Interim President and CEO since March 2018. He was previously Executive Vice-President and Chief Marketing Officer since January 2010, with responsibility for providing the strategic direction and leadership for CN’s Sales, Marketing and CN Supply Chain Solutions groups. Mr. Ruest joined CN in 1996. Prior to this, Mr. Ruest worked for 16 years at a major international chemical company. Mr. Ruest holds a Masters in Business Administration in Marketing from HEC Montréal (Université de Montréal) and a Bachelor of Science degree in applied chemistry from Université de Sherbrooke. He also completed the executive program of the University of Michigan Business School, and CN’s Railroad MBA program. Over the course of his career, Mr. Ruest has been honoured many times by the business community, notably as 2019 Railroader of the Year and an Inductee to the International Maritime Hall of Fame in 2017. AGE 65(1) Quebec, Canada DIRECTOR SINCE July 24, 2018 Non-Independent PRINCIPAL COMPETENCIES Sales/Marketing, Transport Industry/ Safety, Strategy MEMBER OF(2) ATTENDANCE 2019 OTHER PUBLIC BOARD DURING PAST 5 YEARS Board Donations and Sponsorships Committee(3) Strategic Planning Committee 100% 100% 100% Nil SECURITIES HELD Value at risk C$39,448,950(4) Common Shares Owned or Controlled(5) 339,375 318,281 99.36% votes in favour in 2019 February 2020 February 2019 Stock Options Held(8) 741,559 605,559 February 2020 February 2019 15 CN MANAGEMENT INFORMATION CIRCULAR 2020 NOMINEES FOR ELECTION TO THE BOARD