Form 6-K Brookfield Infrastructur For: Nov 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2021

Commission File Number: 001-39250

BROOKFIELD INFRASTRUCTURE CORPORATION

(Exact name of Registrant as specified in its charter)

250 Vesey Street, 15th Floor

New York, New York 10281

United States

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Exhibits 99.1 and 99.2 included in this Form 6-K are incorporated by reference into the registrant’s registration statement on Form F-3 (File No. 333-255051).

EXHIBIT INDEX

The following documents, which are attached as exhibits hereto, are incorporated by reference herein:

|

Exhibit |

Title | |

| 99.1 | Investor presentation, dated November 10, 2021. | |

| 99.2 | Press release, dated November 10, 2021. | |

| 99.3 | Press release, dated November 11, 2021. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| BROOKFIELD INFRASTRUCTURE CORPORATION | ||

| Date: November 12, 2021 | By: |

/s/ Michael Ryan |

| Name: Michael Ryan | ||

| Title: Corporate Secretary | ||

Exhibit 99.1

Brookfield Infrastructure Partners PRESENTATION TO INVESTORS NOVEMBER 10, 2021 Final base shelf prospectuses and registration statements (including prospectuses) containing important information relating to the securities described in this document have been filed by each of Brookfield Infrastructure Partners L.P. and Brookfield Infrastructure C orp oration with the securities regulatory authorities in each of the provinces and territories of Canada and the U.S. Securities and Exchange Com mis sion, respectively. Copies of such final base shelf prospectuses, any amendment to such final base shelf prospectuses and any appl ica ble shelf prospectus supplements that have been filed, are required to be delivered with this document. This document does not provide full disclosure of all material facts relating to the securities offered. Investors should rea d e ach final base shelf prospectus together with any amendment and any applicable shelf prospectus supplement thereto for disclosure of those facts, esp ecially risk factors relating to the securities offered, before making an investment decision.

2 Important Notice DISCLAIMER This presentation has been prepared for informational purposes only from information supplied by Brookfield Infrastructure Pa rtn ers L.P. (“BIP”) and Brookfield Infrastructure Corporation (“BIPC”, and together with BIP, “Brookfield Infrastructure”, “we” or “our”) and fro m t hird - party sources indicated herein. Such third - party information has not been independently verified. Brookfield Infrastructure makes no represent ation or warranty, expressed or implied, as to the accuracy or completeness of such information. CAUTION REGARDING FORWARD - LOOKING STATEMENTS This presentation contains forward - looking statements and information within the meaning of applicable securities laws. The word s “will”, “plan”, “grow”, “expect”, “would”, “could”, “anticipate”, “may”, “sustainable”, “grow”, “expect”, “look”, “pipeline”, “estimate”, “co nti ngent”, “intend”, “backlog”, “potential”, “target”, derivatives thereof and other expressions which are predictions of or indicate future events, trends o r p rospects and which do not relate to historical matters identify the above mentioned and other forward - looking statements. Forward - looking statements a nd information in this presentation include statements regarding expansion of Brookfield Infrastructure’s business, growth in FFO, the likeliho od and timing of successfully completing the acquisitions, investment opportunities and capital recycling initiatives referred to in this pres ent ation, including the acquisition of AusNet Services Limited and other potential acquisitions comprising Brookfield Infrastructure’s near - term investment pipeline, completion of our organic growth projects and future growth initiatives, future commitment of capital to additional projects, po tential future investment opportunities, including projections related to Brookfield Infrastructure’s backlog of organic growth initiatives, th e future performance of acquired businesses and growth initiatives, including Inter Pipeline Ltd. and AusNet Services Limited, and the level of distribution growth and our expectations regarding returns. These forward - looking statements and information are not historical facts but reflect our current expectations regarding future results or events and are based on information currently available to us and on assumptions we believe are reasonable. Although we believe that our an ticipated future results, performance or achievements expressed or implied by these forward - looking statements and information are based on reaso nable assumptions and expectations, the reader should not place undue reliance on forward - looking statements and information because t hey involve assumptions, known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achi eve ments to differ materially from anticipated future results, performance or achievements expressed or implied by these forward - looking statements and information. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are k now n to us or are within our control. If a change occurs, our business, financial condition, liquidity and results of operations and our plans and strategies may vary materially from those expressed in the forward - looking statements and information herein. Factors that could cause actual results of Brookfield Infrastructure to differ materially from those contemplated or implied by the statements in this presentation include, without limitation, general economic conditions and risks relating to the economy, the ability to achie ve growth within Brookfield Infrastructure’s businesses and, in particular, timing and price for the completion of unfinished projects, commod ity risks and Brookfield Infrastructure’s ability to finance its operations, the availability of equity and debt financing for Brookfield Infrastructu re, the ability to effectively complete new acquisitions in the competitive infrastructure space (including the ability to complete acquisitions in the time fra me or in the manner contemplated, or at all) and to realize the expected benefits of our acquisitions, the effect of alternative technologies on the demand for, or use of, the businesses and assets that we own and operate, and factors described in the documents filed by BIP and BIPC with the secu rit ies regulators in Canada and the United States including under “Risk Factors” in each of BIP and BIPC’s most recent Annual Report on Form 20 - F and the prospectuses for the offerings to which this presentation relates and other risks and factors that are described therein. Exc ept as required by law, Brookfield Infrastructure undertakes no obligation to publicly update or revise any forward - looking statements or information, w hether as a result of new information, future events or otherwise.

3 Important Notice (cont’d) IMPORTANT NOTE REGARDING NON - IFRS FINANCIAL MEASURES To measure performance we focus on net income as well as funds from operations (“FFO”), FFO per unit, adjusted funds from ope rat ions (“AFFO”), adjusted EBITDA, and invested capital, which we refer to throughout this presentation. We define FFO as net income excluding the impac t o f depreciation and amortization, deferred income taxes, breakage and transaction costs, and non - cash valuation gains or losses. We define AFFO as FFO less capita l expenditures required to maintain the current performance of our operations (maintenance capital expenditures). We define adjusted EBITDA as net incom e e xcluding the impact of depreciation and amortization, interest expense, current and deferred income taxes, breakage and transaction costs and non - cash valuation gains or losses. We define invested capital as partnership capital removing the following items: non - controlling interest in operating subsidiaries, retained earnings or deficit, accumulated other comprehensive income and ownership changes. We measure return on invested capital as AFFO, less estimated r etu rns of capital on operations that are not perpetual in life, divided by the weighted average invested capital for the period. These measures ar e n ot calculated in accordance with, and do not have any standardized meaning prescribed by, International Financial Reporting Standards (“IFRS”) and therefore ar e u nlikely to be comparable to similar measures presented by other issuers and have limitations as analytical tools. See the Reconciliation of Non - IFRS Financi al Measures in the Appendix to this presentation, as well as reconciliations in BIP and BIPC’s most recent Annual Report on Form 20 - F and BIP and BIPC’s most r ecent interim report for more information on certain of these measures, including reconciliations to the most directly comparable IFRS measures. PRESENTATION OF FINANCIAL INFORMATION All references to “$” or “US$” are to U.S. dollars, unless stated otherwise. MORE INFORMATION BIP and BIPC have filed Registration Statements on Form F - 3 (including prospectuses) with the United States Securities and Excha nge Commission (the “SEC”) in respect of the limited partnership units offered to the public (the “LP Unit Offering”) and the class A exchangeable subor din ate voting shares offered to the public (the “Exchangeable Share Offering”). Before you invest, you should read the prospectus in the relevant Registration Statement an d other documents that BIP and BIPC have filed with the SEC for more complete information about Brookfield Infrastructure, the LP Unit Offering and the Exch ang eable Share Offering. Each of BIP and BIPC will also be filing a prospectus supplement relating to the LP Unit Offering and the Exchangeable Share Offering , r espectively, with securities regulatory authorities in Canada. You may get any of these documents for free by visiting EDGAR on the SEC website at www.sec .go v or via SEDAR at www.sedar.com. Also, the Partnership, BIPC, any underwriter or any dealer participating in the Offerings will arrange to send yo u the prospectuses or you may request them in the United States from RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281 - 8098, Attention : Equity Syndicate, Phone: 877 - 822 - 4089, Email: [email protected], or from BMO Nesbitt Burns Inc. at BMO Capital Markets Corp., Attention: Equity Syndicate Department, 151 W 42nd St, New York, NY 10036, or by telephone at 1 - 800 - 414 - 3627 or by email at [email protected], or from CIBC World Market s Corp, 425 Lexington Ave, 5th Floor, New York, NY, Phone: (800) 282 - 0822, Email: [email protected], or from National Bank Financial Inc. at Nati onal Bank of Canada Financial Inc., 65 East 55th Street, 8th Floor, New York, N.Y. 10022, Attention: ECM Syndication, Phone: 212 - 632 - 8500, Email: N BF - [email protected], or from Wells Fargo Securities, LLC, 375 Park Avenue, New York, New York 10152, Attention: Equity Syndicate Department, Phone: (800) 326 - 5897, Email: [email protected]; or in Canada from RBC Dominion Securities Inc., 180 Wellington Street West, 8th Floor, Toront o, ON M5J 0C2, Attention: Distribution Centre, Phone: (416) 842 - 5349, Email: [email protected], or from BMO Nesbitt Burns Inc. at BMO Capital M arkets, Attention: Brampton Distribution Centre C/O The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2, or by telephone at 1 - 905 - 791 - 3151 Ext 4312 or by email at [email protected], or from CIBC World Markets Inc., Attention: Michelene Dougherty, [email protected] or 416 - 956 - 3636, or from National Bank Financial Inc., 130 King Street West, 4th Fl. Podium, Toronto, Ontario, M5X 1J9, Attention: ECM S ynd ication, Phone: 416 - 869 - 6534, Email: NBF - [email protected], or from Wells Fargo Securities Canada, Ltd., 22 Adelaide St. W., Suite 2200 Toronto ON M5H 4E3, A ttention: Akshay Pattni , Phone: 416 775 2954, Email: [email protected].

4 Brookfield Infrastructure Overview

5 Brookfield Infrastructure Overview Generates a current yield of ~3.4% 2 and has a strong track record of growing distributions We are one of the largest, globally diversified infrastructure owners in the world with operations in North and South America, Asia Pacific and Europe • Our assets are comprised of essential infrastructure networks over which energy, water, goods, people and data flow or are stored • We target a 12 - 15% total annual return on invested capital measured over the long term 1) For the 12 - month period ended September 30, 2021. 2) Based on the current quarterly distribution of $0.51 and the BIP closing price at November 5, 2021. • Proven management team & strategy • Attractive sector • High quality assets • Sustainable cash flows • Strong financial position INVESTMENT HIGHLIGHTS Our Adjusted EBITDA is: • ~90% 1 regulated/contracted • ~70% 1 indexed to inflation • ~40% 1 direct exposure to GDP growth CASH FLOW ATTRIBUTES

6 $0.64 $0.66 $0.79 $0.90 $1.04 $1.15 $1.27 $1.40 $1.57 $1.69 $1.81 $1.94 $2.04 ~10% CAGR Strong performance since inception over a decade ago TSX: BIP.UN / BIPC NYSE: BIP / BIPC MARKET SYMBOL ~$30B 1 MARKET CAPITALIZATION ~27% Equity Interest 2 ; GP & Manager BROOKFIELD PARTICIPATION BIP DISTRIBUTION GROWTH 3 1) Combined market capitalization of BIP and BIPC , b ased on the BIP and BIPC closing price, respectively, at November 5, 2021. Includes Redeemable Partnership Units held by Brookfiel d. 2) Calculated on a fully - exchanged basis, assuming the exchange of all Redeemable Partnership Units, Exchangeable Shares, BIP Excha ngeable LP units, and BIPC Exchangeable LP Units (each as defined in the prospectuses). 3) Annual distribution amounts have been adjusted for the 3 - for - 2 stock split effective September 14, 2016 and the special distribu tion of BIPC shares effective March 31, 2020. Prior to March 31, 2020, the distributions were paid only by BIP. 4) Implied yield calculated as the BIP share price as at November 5, 2021 divided by the current distribution. 5) Represents compounded annualized total return for BIP (NYSE) including reinvestment of unit distributions as at September 30, 20 21 as referenced in the table above. BIP KEY METRICS Current Distribution $2.04 Implied Yield 4 3.4% Target Annual Distribution Growth 5 – 9% Total Return Since Inception 5 18% ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21

7 Brookfield Infrastructure is launching a $1 billion equity offering 1 • Record deployment into highly accretive new investments in 2021 ‒ Invested ~$2.5 billion into Inter Pipeline Ltd. (“IPL”), a critical Canadian midstream operation with an attractive going - in FFO yield and significant growth associated with Heartland ‒ Announced the acquisition of AusNet Services Ltd (“ AusNet ”), a portfolio of high - quality, regulated utility businesses in Australia, with BIP committing ~$500 million 2 • Unprecedented investment landscape through an infrastructure growth - cycle ‒ Governments and corporates have added significant incremental debt, as well as an unmatched data upgrade investment opportunity driving record levels of new investment deal flow • Robust pipeline of near - term investment and growth capital opportunities 2 ‒ Actively pursuing ~$1.5 billion of opportunities that are in varying stages of diligence; targeting a diverse range of high - quality investments, most notably in utilities and data ‒ Building platform value at many of our large franchises will be capital intensive but we expect will result in enhanced returns 1) Including private placement to Brookfield Asset Management. 2) There is no certainty that any or all of these investments will be completed or that the additional funds will be committed to additional investments. Refer to “Caution Regarding Forward - Looking Statements” on page 2 for further information. With strong support from Brookfield Asset Management investing $400 million, Brookfield Infrastructure is raising equity to fund significant growth opportunities:

8 Use of Proceeds 1 • Record level of organic growth capital investment - Expect to deploy $1B+ in growth capital over the next twelve months building platforms; will require additional equity funding of ~$0.4B • Secured accretive investment in high - quality regulated utility - Announced the acquisition of AusNet , a high - quality portfolio of regulated utilities with significant growth potential • Robust pipeline of near - term investment opportunities - Significant pipeline of late - stage investments made through BIP’s commitment to Brookfield's flagship infrastructure fund; predominantly in data infrastructure and utilities 1) There is no certainty that any or all of these investments will be completed or that the additional funds will be committed t o a dditional investments. Refer to “Caution Regarding Forward - Looking Statements” on page 2 for further information. 2) This represents equity required from Brookfield Infrastructure, incremental to organic growth capital expenditures funded thr oug h cash retained in the businesses. 3) There is no certainty that any or all of the capital recycling initiatives will be completed or that the anticipated proceeds wi ll be received. Refer to “Caution Regarding Forward Looking Statements” on page 2 for further information. US$ BILLIONS Organic growth capital expenditures (equity component) 2 $ 0.4 ) Secured Transactions - AusNet Services 0.5 ) Late - stage investment opportunities ~ 1.0 ) Expected use of proceeds $ 1.9 ) Proceeds from advanced near - term capital recycling 3 ~ (1.0) Net Use of Proceeds $ 0.9 )

9 Highlights

10 Brookfield Infrastructure is well positioned to build upon recent success Our business has demonstrated two important attributes in the last 24 months: ‒ Resilience underpinned by regulated or contracted cash flows (90%+) ‒ Significant embedded growth in our business led to record 17% YTD FFO growth 1 in 2021 Advanced several strategic priorities, including the privatization of a marquee Canadian midstream business Outlook is very favorable, for both new investment opportunities and organic growth (YTD organic FFO growth of 9% 1 , with strong tailwinds) Attractive opportunity to invest additional capital to create further platform value in our flagship operations AusNet provides an excellent example of acquiring a high - quality regulated utility with minimal volume risk and a significant transition opportunity 1) Represents FFO per unit growth for the nine - month period ended September 30, 2021, from the nine - month period ended September 30 , 2020. Please refer to Appendix for a reconciliation of net income attributable to partnership and net income per limited partnership unit to FFO and FFO per unit.

11 Significant opportunity to deploy capital creating platforms Building platforms will provide us with the opportunity to invest significant capital in businesses and markets we know well We are targeting deployment of over $5 billion 1 over the next five years building platforms in these eight areas Brazilian Electricity Transmission U.K. Last - Mile Business N.A. Sub - Metering Global Data Centers Residential Infrastructure Global Fiber Networks U.K. Ports Telecom Towers 1) There is no certainty that any or all of these investments will be completed or that the additional funds will be committed t o a dditional investments. Refer to “Caution Regarding Forward - Looking Statements” on page 2 for further information.

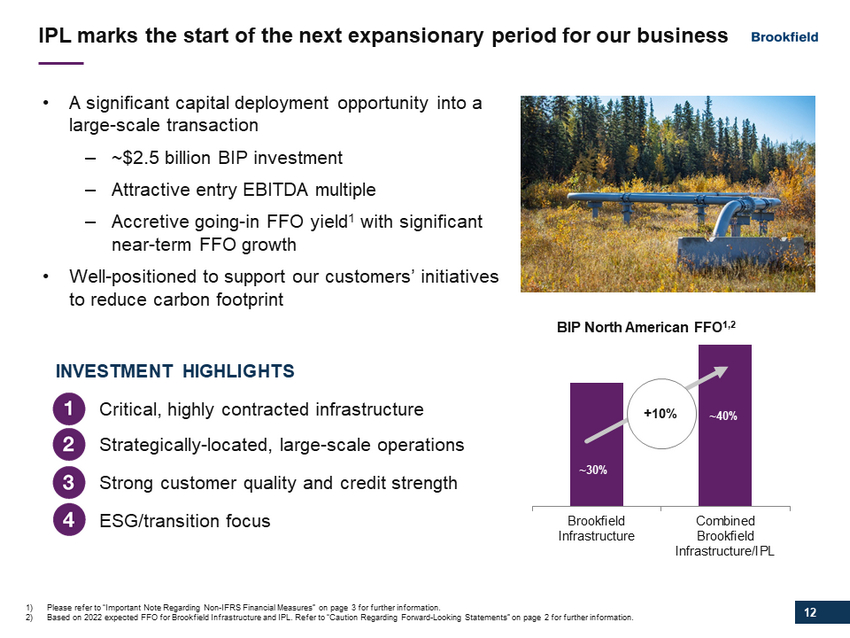

12 Brookfield Infrastructure Combined Brookfield Infrastructure/IPL ~30% ~40% IPL marks the start of the next expansionary period for our business • A significant capital deployment opportunity into a large - scale transaction ‒ ~$2.5 billion BIP investment ‒ Attractive entry EBITDA multiple ‒ Accretive going - in FFO yield 1 with significant near - term FFO growth • Well - positioned to support our customers’ initiatives to reduce carbon footprint INVESTMENT HIGHLIGHTS Critical, highly contracted infrastructure Strategically - located, large - scale operations Strong customer quality and credit strength ESG/transition focus +10% BIP North American FFO 1,2 1) Please refer to “Important Note Regarding Non - IFRS Financial Measures” on page 3 for further information. 2) Based on 2022 expected FFO for Brookfield Infrastructure and IPL. Refer to “Caution Regarding Forward - Looking Statements” on pag e 2 for further information.

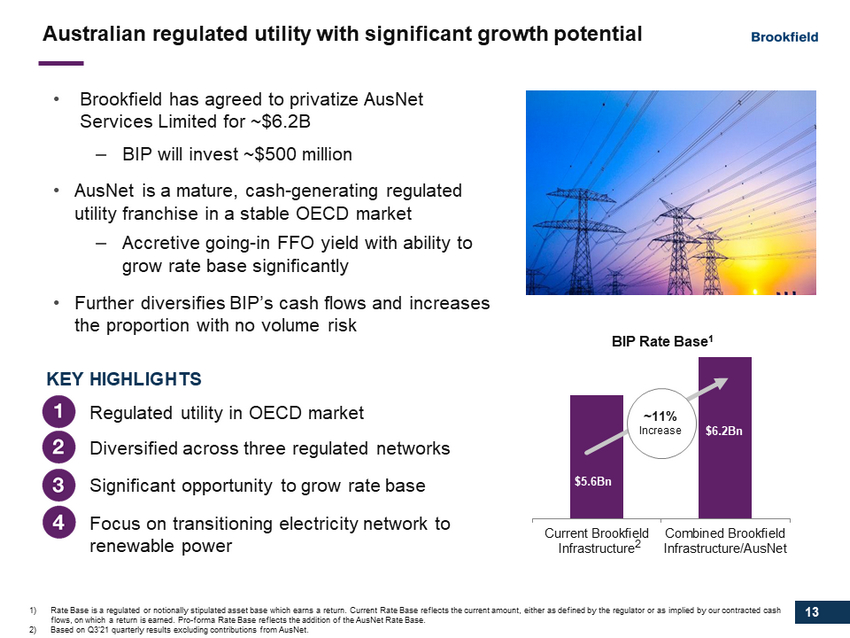

13 Australian regulated utility with significant growth potential • Brookfield has agreed to privatize AusNet Services Limited for ~$6.2B ‒ BIP will invest ~$500 million • AusNet is a mature, cash - generating regulated utility franchise in a stable OECD market ‒ Accretive going - in FFO yield with ability to grow rate base significantly • Further diversifies BIP’s cash flows and increases the proportion with no volume risk KEY HIGHLIGHTS Regulated utility in OECD market Diversified across three regulated networks Significant opportunity to grow rate base Focus on transitioning electricity network to renewable power Current Brookfield Infrastructure Combined Brookfield Infrastructure/AusNet $5.6Bn $6.2Bn ~11% Increase 2 1) Rate Base is a regulated or notionally stipulated asset base which earns a return. Current Rate Base reflects the current amo unt , either as defined by the regulator or as implied by our contracted cash flows, on which a return is earned. Pro - forma Rate Base reflects the addition of the AusNet Rate Base. 2) Based on Q3’21 quarterly results excluding contributions from AusNet . BIP Rate Base 1

14 Offer Summary

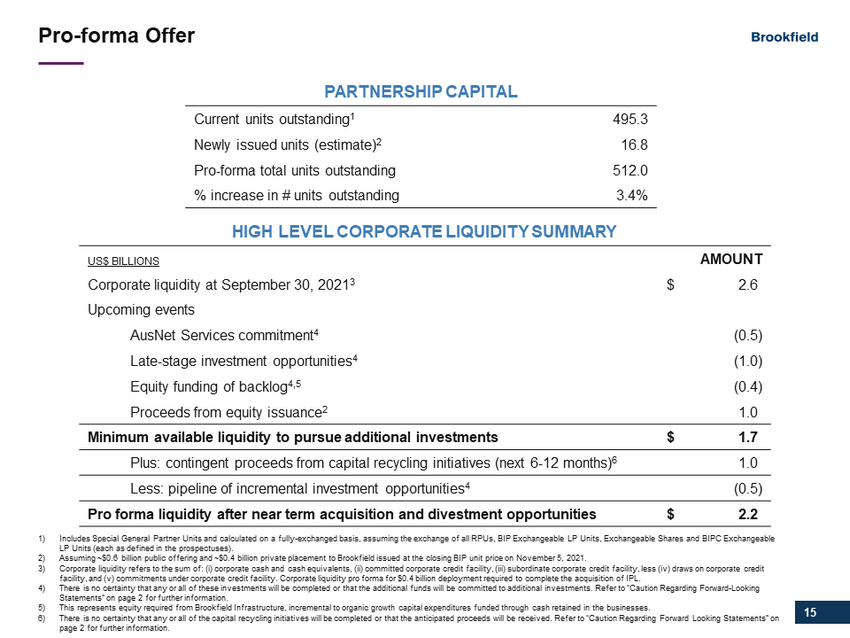

15 Pro - forma Offer PARTNERSHIP CAPITAL Current units outstanding 1 495.2 Newly issued units (estimate) 2 16.8 Pro - forma total units outstanding 512.0 % increase in # units outstanding 3.4% HIGH LEVEL CORPORATE LIQUIDITY SUMMARY US$ BILLIONS AMOUNT Corporate liquidity at September 30, 2021 3 $ 2.6 ) Upcoming events AusNet Services commitment 4 (0.5) Late - stage investment opportunities 4 (1.0) Equity funding of backlog 4,5 (0.4) Proceeds from equity issuance 2 1.0 ) Minimum a vailable liquidity to pursue additional investments $ 1.7 ) Plus: contingent proceeds from capital recycling initiatives (next 6 - 12 months) 6 1.0 ) Less: pipeline of incremental investment opportunities 4 (0.5) Pro forma liquidity after near term acquisition and divestment opportunities $ 2.2 ) 1) Includes Special General Partner Units and calculated on a fully - exchanged basis, assuming the exchange of all RPUs, BIP Exchang eable LP Units, Exchangeable Shares and BIPC Exchangeable LP Units (each as defined in the prospectuses). 2) Assuming ~$0.6 billion public offering and ~$0.4 billion private placement to Brookfield issued at the closing BIP unit price on November 5, 2021. 3) Corporate liquidity refers to the sum of: (i) corporate cash and cash equivalents, (ii) committed corporate credit facility, (ii i) subordinate corporate credit facility, less (iv) draws on corporate credit facility, and (v) commitments under corporate credit facility. Corporate liquidity pro forma for $0.4 billion deployment requ ire d to complete the acquisition of IPL. 4) There is no certainty that any or all of these investments will be completed or that the additional funds will be committed t o a dditional investments. Refer to “Caution Regarding Forward - Looking Statements” on page 2 for further information. 5) This represents equity required from Brookfield Infrastructure, incremental to organic growth capital expenditures funded thr oug h cash retained in the businesses. 6) There is no certainty that any or all of the capital recycling initiatives will be completed or that the anticipated proceeds wi ll be received. Refer to “Caution Regarding Forward Looking Statements” on page 2 for further information.

16 Brookfield Infrastructure provides two issuers to enhance flexibility Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a subsidiary of BIP, was created to offer an economically equivalent security to BIP, but in the form of a more traditional corporate structure BIPC BIP Dividends/Distributions x x • Distributions are identical in amount and timing Exchangeable x N/A • BIPC shares are exchangeable 1:1 for BIP units at anytime Structure and Index Eligibility Canadian Corporation Bermuda Limited Partnership • As a corporation, BIPC is eligible for many equity indexes that exclude limited partnerships Tax Reporting U.S.: 1099 Form Canada: T5 Form U.S.: K - 1 Slip Canada: T5013 Slip • For U.S. shareholders, subject to certain requirements, dividends paid by BIPC are generally expected to be “qualified dividends” • For Canadian shareholders, unless otherwise stated, dividends paid by BIPC are generally expected to be “eligible dividends”

17 Appendix

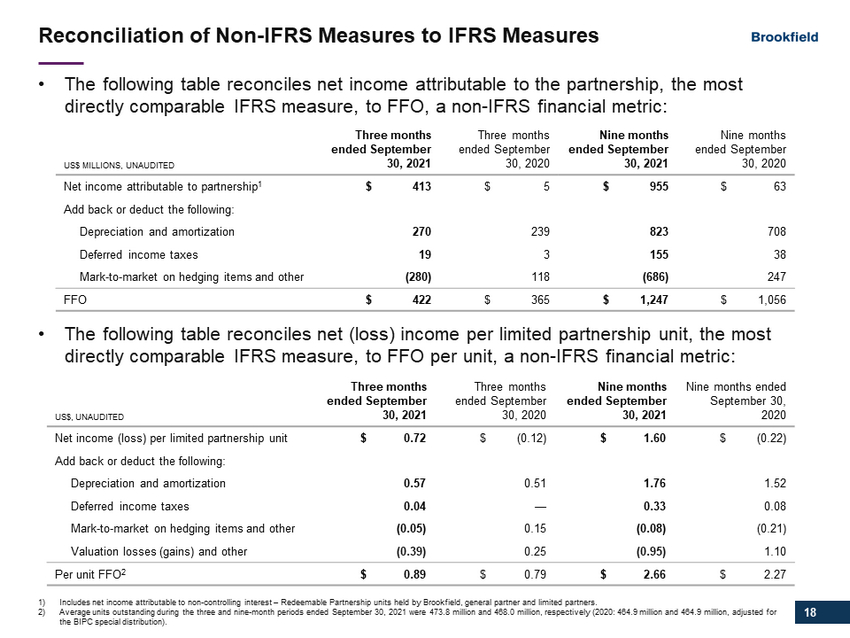

18 Reconciliation of Non - IFRS Measures to IFRS Measures • The following table reconciles net income attributable to the partnership, the most directly comparable IFRS measure, to FFO, a non - IFRS financial metric: • The following table reconciles net (loss) income per limited partnership unit, the most directly comparable IFRS measure, to FFO per unit, a non - IFRS financial metric: 1) Includes net income attributable to non - controlling interest – Redeemable Partnership units held by Brookfield, general partner and limited partners. 2) Average units outstanding during the three and nine - month periods ended September 30, 2021 were 473.8 million and 468.0 million, respectively (2020: 464.9 million and 464.9 million, adjusted for the BIPC special distribution). US$ MILLIONS, UNAUDITED Three months ended September 30, 2021 Three months ended September 30, 2020 Nine months ended September 30, 2021 Nine months ended September 30, 2020 Net income attributable to partnership 1 $ 413 $ 5 $ 955 $ 63 Add back or deduct the following: Depreciation and amortization 270 239 823 708 Deferred income taxes 19 3 155 38 Mark - to - market on hedging items and other (280) 118 (686) 247 FFO $ 422 $ 365 $ 1,247 $ 1,056 US$, UNAUDITED Three months ended September 30, 2021 Three months ended September 30, 2020 Nine months ended September 30, 2021 Nine months ended September 30, 2020 Net income (loss) per limited partnership unit $ 0.72 $ (0.12) $ 1.60 $ (0.22) Add back or deduct the following: Depreciation and amortization 0.57 0.51 1.76 1.52 Deferred income taxes 0.04 — 0.33 0.08 Mark - to - market on hedging items and other (0.05) 0.15 (0.08) (0.21) Valuation losses (gains) and other (0.39) 0.25 (0.95) 1.10 Per unit FFO 2 $ 0.89 $ 0.79 $ 2.66 $ 2.27

Exhibit 99.2

PRESS RELEASE

All amounts in U.S. dollars

BROOKFIELD INFRASTRUCTURE PARTNERS AND BROOKFIELD

INFRASTRUCTURE

CORPORATION ANNOUNCE US$1 BILLION EQUITY OFFERING

HAMILTON, Bermuda, November 10, 2021 – Brookfield Infrastructure Partners L.P. (the “Partnership”) (NYSE: BIP; TSX: BIP.UN) and Brookfield Infrastructure Corporation (NYSE: BIPC; TSX: BIPC) (“BIPC”, and together with the Partnership, “Brookfield Infrastructure”) today announced concurrent equity offerings for aggregate gross proceeds of US$600 million (the “Offerings”) on a bought deal basis by a syndicate of underwriters (the “Underwriters”) co-led by RBC Capital Markets, BMO Capital Markets, CIBC Capital Markets, National Bank Financial Inc. and Wells Fargo Securities Canada, Ltd.

The Offerings will be comprised of a combination of Partnership limited partnership units (“LP Units”) and BIPC class A exchangeable subordinate voting shares (“Exchangeable Shares”) in amounts determined by the Underwriters. The LP Units are offered at a price of US$58.65 per LP Unit (the “LP Unit Offering Price”), and the Exchangeable Shares are offered at a price of US$62.70 per Exchangeable Share (the “Exchangeable Share Offering Price”). The number of Exchangeable Shares and LP Units to be issued in the Offerings will be determined on November 11, 2021, pre-market open.

Concurrently, a subsidiary of Brookfield Asset Management Inc. (NYSE/TSX: BAM) will purchase US$400 million in the aggregate of either (i) redeemable partnership units of Brookfield Infrastructure L.P., the Partnership’s holding limited partnership, at the LP Unit Offering Price (net of underwriting commissions) (the “Concurrent Unit Private Placement”) and/or (ii) Exchangeable Shares at the Exchangeable Share Offering Price (net of underwriting commissions) (the “Concurrent Exchangeable Share Private Placement”).

The aggregate gross proceeds of the LP Unit Offering, the Exchangeable Share Offering, the Concurrent Unit Private Placement and the Concurrent Exchangeable Share Private Placement will be US$1 billion.

Brookfield Infrastructure intends to use the net proceeds of the LP Unit Offering and the Exchangeable Share Offering, together with the proceeds of the Concurrent Unit Private Placement and the Concurrent Exchangeable Share Private Placement, to fund an active and advanced pipeline of new investment opportunities, including near-term organic growth capital requirements, and for general working capital purposes.

The LP Unit Offering, the Exchangeable Share Offering, the Concurrent Unit Private Placement and the Concurrent Exchangeable Share Private Placement are expected to close on or about November 17, 2021.

In addition, the Partnership and BIPC have granted the Underwriters over-allotment options, exercisable in whole or in part for a period of 30 days following closing of the Offerings, to purchase up to 15% in additional LP Units or Exchangeable Shares at the respective offering prices. If the over-allotment options are exercised in full, the aggregate gross offering size would increase to US$1.09 billion.

Offer Documents

The Partnership and BIPC have filed Registration Statements on Form F-3 (including prospectuses) with the United States Securities and Exchange Commission (the “SEC”) in respect of the LP Unit Offering and the Exchangeable Share Offering. Before you invest, you should read the prospectus in the relevant Registration Statement and other documents that the Partnership and BIPC have filed with the SEC for more complete information about Brookfield Infrastructure and the LP Unit Offering and the Exchangeable Share Offering. Each of the Partnership and BIPC will also be filing a prospectus supplement relating to the LP Unit Offering and the Exchangeable Share Offering, respectively, with securities regulatory authorities in Canada. You may get any of these documents for free by visiting EDGAR on the SEC website at www.sec.gov or via SEDAR at www.sedar.com. Also, the Partnership, BIPC, any underwriter or any dealer participating in the Offerings will arrange to send you the prospectuses or you may request them in the United States from RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, Attention: Equity Syndicate, Phone: 877-822-4089, Email: [email protected], or from BMO Nesbitt Burns Inc. at BMO Capital Markets Corp., Attention: Equity Syndicate Department, 151 W 42nd St, New York, NY 10036, or by telephone at 1-800-414-3627 or by email at [email protected], or from CIBC World Markets Corp, 425 Lexington Ave, 5th Floor, New York, NY, Phone: (800) 282-0822, Email: [email protected], or from National Bank Financial Inc. at National Bank of Canada Financial Inc., 65 East 55th Street, 8th Floor, New York, N.Y. 10022, Attention: ECM Syndication, Phone: 212-632-8500, Email: [email protected], or from Wells Fargo Securities, LLC, 375 Park Avenue, New York, New York 10152, Attention: Equity Syndicate Department, Phone: (800) 326-5897, Email: [email protected]; or in Canada from RBC Dominion Securities Inc., 180 Wellington Street West, 8th Floor, Toronto, ON M5J 0C2, Attention: Distribution Centre, Phone: (416) 842-5349, Email: [email protected], or from BMO Nesbitt Burns Inc. at BMO Capital Markets, Attention: Brampton Distribution Centre C/O The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2, or by telephone at 1-905-791-3151 Ext 4312 or by email at [email protected], or from CIBC World Markets Inc., Attention: Michelene Dougherty, [email protected] or 416-956-3636, or from National Bank Financial Inc., 130 King Street West, 4th Fl. Podium, Toronto, Ontario, M5X 1J9, Attention: ECM Syndication, Phone: 416-869-6534, Email: [email protected], or from Wells Fargo Securities Canada, Ltd., 22 Adelaide St. W., Suite 2200 Toronto ON M5H 4E3, Attention: Akshay Pattni, Phone: 416 775 2954, Email: [email protected].

*****

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities of Brookfield Infrastructure in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Brookfield Infrastructure is a leading global infrastructure company that owns and operates high-quality, long-life assets in the utilities, transport, midstream and data sectors across North and South America, Asia Pacific and Europe. We are focused on assets that have contracted and regulated revenues that generate predictable and stable cash flows. Investors can access its portfolio either through Brookfield Infrastructure Partners L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership, or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a Canadian corporation.

Brookfield Infrastructure Partners is the flagship listed infrastructure company of Brookfield Asset Management, a global alternative asset manager with US$650 billion of assets under management.

For more information, please contact:

Media: Sebastien Bouchard |

Investors: Kate White Manager, Investor Relations Tel: (416) 956-5183 |

Note: This news release contains forward-looking statements and information within the meaning of applicable securities laws. The words, “will”, “intend” and “expect” or derivations thereof and other expressions which are predictions of or indicate future events, trends or prospects, and which do not relate to historical matters, identify forward-looking statements. Forward-looking statements in this news release include statements regarding the LP Unit Offering, the Exchangeable Share Offering, the Concurrent Unit Private Placement and the Concurrent Exchangeable Share Private Placement, the use of proceeds and closing of the LP Unit Offering, the Exchangeable Share Offering, the Concurrent Unit Private Placement and the Concurrent Exchangeable Share Private Placement. Although Brookfield Infrastructure believes that these forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on them, or any other forward-looking statements or information in this news release. The future performance and prospects of Brookfield Infrastructure are subject to a number of known and unknown risks and uncertainties. Factors that could cause actual results of Brookfield Infrastructure to differ materially from those contemplated or implied by the statements in this news release are described in the documents filed by Brookfield Infrastructure with the securities regulators in Canada and the United States including under “Risk Factors” in each of the Partnership’s and BIPC’s most recent Annual Report on Form 20-F and other risks and factors that are described therein and in, or incorporated by reference in, the Partnership’s and BIPC’s Registration Statements and prospectus supplements. Except as required by law, Brookfield Infrastructure undertakes no obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise.

Exhibit 99.3

PRESS RELEASE

All amounts in U.S. dollars

BROOKFIELD INFRASTRUCTURE PARTNERS AND BROOKFIELD INFRASTRUCTURE

CORPORATION ANNOUNCE US$1 BILLION EQUITY OFFERING ALLOCATIONS

Brookfield, News, November 11, 2021 – Brookfield Infrastructure Partners L.P. (the “Partnership”) (NYSE: BIP; TSX: BIP.UN) and Brookfield Infrastructure Corporation (NYSE: BIPC; TSX: BIPC) (“BIPC”, and together with the Partnership, “Brookfield Infrastructure”) are pleased to provide an update on the concurrent equity offerings announced November 10, 2021 for aggregate gross proceeds of US$600 million (the “Offerings”) on a bought deal basis by a syndicate of underwriters (the “Underwriters”) co-led by RBC Capital Markets, BMO Capital Markets, CIBC Capital Markets, National Bank Financial Inc. and Wells Fargo Securities Canada, Ltd.

The Offerings are comprised of 8,240,800 Partnership limited partnership units (“LP Units”) and 1,860,900 BIPC class A exchangeable subordinate voting shares (“Exchangeable Shares”). The LP Units were sold at a price of US$58.65 per LP Unit (the “LP Unit Offering Price”), and the Exchangeable Shares were sold at a price of US$62.70 per Exchangeable Share (the “Exchangeable Share Offering Price”).

Concurrently, a subsidiary of Brookfield Asset Management Inc. (NYSE/TSX: BAM) has agreed to purchase 7,104,300 redeemable partnership units of Brookfield Infrastructure L.P., the Partnership’s holding limited partnership, at the LP Unit Offering Price (net of underwriting commissions) (the “Concurrent Unit Private Placement”) for total gross proceeds of approximately US$400 million.

The aggregate gross proceeds of the LP Unit Offering, the Exchangeable Share Offering and the Concurrent Unit Private Placement will be approximately US$1 billion.

Brookfield Infrastructure intends to use the net proceeds of the LP Unit Offering and the Exchangeable Share Offering, together with the proceeds of the Concurrent Unit Private Placement, to fund an active and advanced pipeline of new investment opportunities, including near-term organic growth capital requirements, and for general working capital purposes.

The LP Unit Offering, the Exchangeable Share Offering and the Concurrent Unit Private Placement are expected to close on or about November 17, 2021.

The Partnership and BIPC have granted the Underwriters over-allotment options, exercisable in whole or in part for a period of 30 days following closing of the Offerings, to purchase up to approximately 1,236,100 additional LP Units and 279,100 additional Exchangeable Shares at the respective offering prices. If the over-allotment options are exercised in full, the aggregate gross offering size would increase to approximately US$1.09 billion.

Offer Documents

The Partnership and BIPC have filed Registration Statements on Form F-3 (including prospectuses) with the United States Securities and Exchange Commission (the “SEC”) in respect of the LP Unit Offering and the Exchangeable Share Offering. Before you invest, you should read the prospectus in the relevant Registration Statement and other documents that the Partnership and BIPC have filed with the SEC for more complete information about Brookfield Infrastructure and the LP Unit Offering and the Exchangeable Share Offering. Each of the Partnership and BIPC will also be filing a prospectus supplement relating to the LP Unit Offering and the Exchangeable Share Offering, respectively, with securities regulatory authorities in Canada. You may get any of these documents for free by visiting EDGAR on the SEC website at www.sec.gov or via SEDAR at www.sedar.com. Also, the Partnership, BIPC, any underwriter or any dealer participating in the Offerings will arrange to send you the prospectuses or you may request them in the United States from RBC Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, Attention: Equity Syndicate, Phone: 877-822-4089, Email: [email protected], or from BMO Nesbitt Burns Inc. at BMO Capital Markets Corp., Attention: Equity Syndicate Department, 151 W 42nd St, New York, NY 10036, or by telephone at 1-800-414-3627 or by email at [email protected], or from CIBC World Markets Corp, 425 Lexington Ave, 5th Floor, New York, NY, Phone: (800) 282-0822, Email: [email protected], or from National Bank Financial Inc. at National Bank of Canada Financial Inc., 65 East 55th Street, 8th Floor, New York, N.Y. 10022, Attention: ECM Syndication, Phone: 212-632-8500, Email: [email protected], or from Wells Fargo Securities, LLC, 375 Park Avenue, New York, New York 10152, Attention: Equity Syndicate Department, Phone: (800) 326-5897, Email: [email protected]; or in Canada from RBC Dominion Securities Inc., 180 Wellington Street West, 8th Floor, Toronto, ON M5J 0C2, Attention: Distribution Centre, Phone: (416) 842-5349, Email: [email protected], or from BMO Nesbitt Burns Inc. at BMO Capital Markets, Attention: Brampton Distribution Centre C/O The Data Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2, or by telephone at 1-905-791-3151 Ext 4312 or by email at [email protected], or from CIBC World Markets Inc., Attention: Michelene Dougherty, [email protected] or 416-956-3636, or from National Bank Financial Inc., 130 King Street West, 4th Fl. Podium, Toronto, Ontario, M5X 1J9, Attention: ECM Syndication, Phone: 416-869-6534, Email: [email protected], or from Wells Fargo Securities Canada, Ltd., 22 Adelaide St. W., Suite 2200 Toronto ON M5H 4E3, Attention: Akshay Pattni, Phone: 416 775 2954, Email: [email protected].

*****

This news release does not constitute an offer to sell or a solicitation of an offer to buy any securities of Brookfield Infrastructure in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Brookfield Infrastructure is a leading global infrastructure company that owns and operates high-quality, long-life assets in the utilities, transport, midstream and data sectors across North and South America, Asia Pacific and Europe. We are focused on assets that have contracted and regulated revenues that generate predictable and stable cash flows. Investors can access its portfolio either through Brookfield Infrastructure Partners L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership, or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a Canadian corporation.

Brookfield Infrastructure Partners is the flagship listed infrastructure company of Brookfield Asset Management, a global alternative asset manager with US$650 billion of assets under management.

For more information, please contact:

|

Media: Sebastien Bouchard |

Investors: Kate White Manager, Investor Relations Tel: (416) 956-5183 |

Note: This news release contains forward-looking statements and information within the meaning of applicable securities laws. The words, “will”, “intend” and “expect” or derivations thereof and other expressions which are predictions of or indicate future events, trends or prospects, and which do not relate to historical matters, identify forward-looking statements. Forward-looking statements in this news release include statements regarding the LP Unit Offering, the Exchangeable Share Offering and the Concurrent Unit Private Placement, the use of proceeds and closing of the LP Unit Offering, the Exchangeable Share Offering and the Concurrent Unit Private Placement. Although Brookfield Infrastructure believes that these forward-looking statements and information are based upon reasonable assumptions and expectations, the reader should not place undue reliance on them, or any other forward-looking statements or information in this news release. The future performance and prospects of Brookfield Infrastructure are subject to a number of known and unknown risks and uncertainties. Factors that could cause actual results of Brookfield Infrastructure to differ materially from those contemplated or implied by the statements in this news release are described in the documents filed by Brookfield Infrastructure with the securities regulators in Canada and the United States including under “Risk Factors” in each of the Partnership’s and BIPC’s most recent Annual Report on Form 20-F and other risks and factors that are described therein and in, or incorporated by reference in, the Partnership’s and BIPC’s Registration Statements and prospectus supplements. Except as required by law, Brookfield Infrastructure undertakes no obligation to publicly update or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Information relating to the total number of voting rights and shares making up the share capital at 26 April 2024 – post blocs acquisition by the Consortium

- Dimensional Fund Advisors Ltd. : Form 8.3 - Irish Residential Properties REIT PLC

- Notice of AGM

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share