Form 6-K BANK OF NOVA SCOTIA For: Mar 04

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

| For the month of: March, 2020 | Commission File Number: 002-09048 |

THE BANK OF NOVA SCOTIA

(Name of registrant)

44 King Street West, Scotia Plaza 8th floor, Toronto, Ontario, M5H 1H1

Attention: Secretary’s Department (Tel.: (416) 866-3672)

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

This report on Form 6-K shall be deemed to be incorporated by reference in The Bank of Nova Scotia’s registration statements on Form S-8 (File No. 333-199099) and Form F-3 (File No. 333-228614) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| THE BANK OF NOVA SCOTIA | ||||||

| Date: March 4, 2020 | By: | /s/ Nives Gaiotto | ||||

| Name: Nives Gaiotto | ||||||

| Title: Assistant Secretary | ||||||

EXHIBIT INDEX

| Exhibit |

Description of Exhibit | |

| 99.1 | Notice of the 188th Annual Meeting of Shareholders and Management Proxy Circular | |

| 99.2 | Form of Proxy | |

| 99.3 | Mandate of the Board of Directors | |

Table of Contents

Exhibit 99.1

Annual Meeting of Shareholders April 7, 2020 Banking the Americas Connecting Canada to the World Management Proxy Circular Your VOTE is important Please take some time to read this management proxy circular for important information about the business of the meeting and to learn more about Scotiabank.

Table of Contents

Scotiabank is a leading bank in the Americas.

We are here for every future. We help our customers, their families and their communities achieve success through a broad range of advice, products and services.

Table of Contents

Welcome to our 188th shareholder meeting

| Management proxy circular | 1 |

Table of Contents

Table of Contents

| Management proxy circular

You have received this management proxy circular because you owned Scotiabank common shares as of the close of business on February 11, 2020 (the record date), and are entitled to vote at our annual meeting.

|

|

1 ABOUT THE MEETING Read about the items of to vote your shares |

| |||

| Management is soliciting your proxy for the shareholder meeting on April 7, 2020.

This document tells you about the meeting, governance

We pay the

cost of proxy solicitation for all registered and |

In this document:

• we, us, our, the bank • you

and your mean • common shares and

|

|

|

2 GOVERNANCE Learn about our board’s governance |

| |||

|

Unless indicated otherwise, information in this management |

|

3 EXECUTIVE Find out what we paid our senior executives |

| |||||

|

FOR MORE INFORMATION

You can find financial information about Scotiabank in our 2019 consolidated financial statements and management’s discussion and analysis (MD&A). Financial information and other information about Scotiabank, including our annual information form (AIF) and quarterly financial statements are available on our website (www.scotiabank.com), SEDAR (www.sedar.com), or on the U.S. Securities and Exchange Commission (SEC) website (www.sec.gov).

Copies of these documents, this circular and any document incorporated by reference, are available for free by writing to:

Corporate Secretary of The Bank of Nova Scotia 44 King Street West Toronto, Ontario Canada M5H 1H1

You can also communicate with our board of directors by writing to the Chairman of the Board at [email protected].

|

| Management proxy circular | 3 |

Table of Contents

| 1. RECEIVE FINANCIAL STATEMENTS

Our consolidated financial statements and MD&A for the year ended October 31, 2019, together with the auditors’ report on those statements, will be presented at the meeting. You will find these documents in our annual report which is available on our website. |

||

| 2. ELECT DIRECTORS

Under our majority voting policy, you will elect 13 directors individually to serve on our board until the close of the next annual meeting or until their successors are elected or appointed. You can find information about the nominated directors beginning on page 9 and our majority voting policy on page 44. |

The board recommends you vote for each nominated director

The board recommends you vote for KPMG LLP as our independent auditors | |

| 3. APPOINT AUDITORS

You will vote on appointing the independent auditors. The board assessed the performance and independence of KPMG LLP (KPMG) and recommends that KPMG be re-appointed as the shareholders’ auditors until the close of the next annual meeting. KPMG has served continuously as one of our auditors since 1992, and as our sole auditor since March 2006. Last year, the vote was 99.01% for KPMG as auditors. A representative of KPMG will be in attendance at the meeting.

Auditors’ fees

The table below lists the services KPMG provides and the fees we paid to them for the fiscal years ended October 31, 2019 and 2018. The increase in 2019 is due to market-based adjustments and an increase in audit scope resulting from acquisitions. The audit and conduct review committee can pre-approve services as long as they are within the scope of the policies and procedures approved by the committee. | ||

| $ millions | 2019 | 2018 | ||||||

| Audit services |

32.6 | 28.7 | ||||||

| Audit services generally relate to the statutory audits and review of financial statements, regulatory required attestation reports, as well as services associated with registration statements, prospectuses, periodic reports and other documents filed with securities regulatory bodies or other documents issued in connection with securities offerings. | ||||||||

| Audit-related services |

1.3 | 1.0 | ||||||

| Audit-related services include special attest services not directly linked to the financial statements, review of controls and procedures related to regulatory reporting, audits of employee benefit plans and consultation and training on accounting and financial reporting. | ||||||||

| Tax services outside of the audit scope |

– | – | ||||||

| Tax services outside of the audit scope relate primarily to specified review procedures required by local tax authorities, attestation on tax returns of certain subsidiaries as required by local tax authorities, and review to determine compliance with an agreement with the tax authorities. | ||||||||

| Other non-audit services |

0.5 | 0.4 | ||||||

| Other non-audit services are primarily for the review and translation of English language financial statements into other languages and other services. | ||||||||

| Total |

|

34.4 |

|

|

30.1 |

| ||

| 4 | Scotiabank |

Table of Contents

ABOUT THE MEETING

| 4. ADVISORY VOTE ON OUR APPROACH TO EXECUTIVE COMPENSATION

You can have a “say on pay” by participating in an advisory vote on our approach to executive compensation.

Since 2010, we have held this annual advisory vote to give shareholders the opportunity to provide the board with important feedback. This vote does not diminish the role and responsibility of the board. Last year, the vote was 93.75% for our approach to executive compensation, and shareholder support has been 92.6% or higher each year.

The human resources committee chair’s letter on page 53 describes our approach to executive compensation in 2019. Our executive compensation program supports our goal of delivering strong, consistent and predictable results to shareholders over the longer term. Our practices meet the model policy on “say on pay” for boards of directors developed by the Canadian Coalition for Good Governance (CCGG).

You will be asked to vote on the following advisory resolution:

Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in this management proxy circular delivered in advance of the 2020 annual meeting of shareholders of the Bank. |

The board recommends you vote for our approach to executive compensation | |

| This is an advisory vote, which means the results are not binding on the board. The human resources committee and the board review the results after the meeting and as they consider future executive compensation decisions. If a significant number of shares are voted against the advisory resolution, the human resources committee will review our approach to executive compensation in the context of any specific shareholder concerns that have been identified and may make recommendations to the board. We will disclose the committee’s review process and the outcome of its review within six months of the shareholder meeting.

|

||

|

The human resources committee and the board welcome questions and comments about executive compensation at Scotiabank. We maintain an open dialogue with shareholders and consider all feedback. See the back cover for our contact information.

|

||

| 5. SHAREHOLDER PROPOSALS

This year you will be asked to consider four proposals. You can read the proposals and how and why the board recommends voting in relation to each proposal on page 23.

|

The board recommends you vote against the proposals | |

|

The deadline for submitting proposals to be considered at next year’s annual meeting is November 12, 2020. Proposals should be sent to the Corporate Secretary of The Bank of Nova Scotia, 44 King Street West, Toronto, Ontario, Canada M5H 1H1 or [email protected].

|

||

|

SHAREHOLDER APPROVAL

Each item being put to a vote requires the approval of a majority of votes cast in person or by proxy at the meeting. Directors are subject to our majority voting policy (see page 44).

You (or your proxyholder) can vote as you (or your proxyholder) wish on any other items of business properly brought before the meeting (or a reconvened meeting if there is an adjournment). As of the date of this circular, we are not aware of other matters that will be brought before the meeting.

Management does not contemplate that any nominated director will be unable to serve as a director. If, however, this does occur for any reason during or prior to the meeting, the individuals named in your proxy form or voting instruction form as your proxyholder can vote for another nominee at their discretion.

| ||

| Management proxy circular | 5 |

Table of Contents

WHO CAN VOTE

| You are entitled to one vote per common share held on February 11, 2020, the record date.

Shares beneficially owned by the following entities and persons cannot be voted (except in circumstances approved by the Minister of Finance): • the Government of Canada or any of its agencies • the government of a province or any of its agencies • the government of a foreign country or any political subdivision of a foreign country or any of its agencies • any person who has acquired more than 10% of any class of shares of the bank.

Also, if a person, or an entity controlled by a person, beneficially owns shares that in total are more than 20% of the eligible votes that may be cast, that person or entity may not vote any of the shares (unless permitted by the Minister of Finance).

Our directors and officers are not aware of any person or entity who beneficially owns, directly or indirectly, or exercises control or direction over, more than 10% of any class of our outstanding shares, as of the record date.

HOW TO VOTE

You can vote by sending in your vote in advance of the meeting, in person or you can appoint someone to attend the meeting and vote your shares for you (called voting by proxy). How you vote depends on whether you are a registered or a non-registered (beneficial) shareholder. You are a beneficial shareholder if the shares you own are registered for you in the name of an intermediary such as a securities broker, trustee or financial institution. You are a registered shareholder if the shares you own are registered directly in your name with our transfer agent, Computershare. If this is the case, your name will appear on a share certificate or a statement from a direct registration system confirming your shareholdings.

|

|

Outstanding

1,213,154,384 on

1,212,796,469 on

|

| |

| Non-registered (beneficial) shareholders |

Registered shareholders | |||||

|

Your intermediary has sent you a voting instruction form with this package. We may not have records of your shareholdings as a non-registered shareholder, so you must follow the instructions from your intermediary to vote.

|

We have sent you a proxy form with this package. A proxy is a document that authorizes someone else to attend the meeting and vote for you. | |||||

|

You want to vote but you cannot attend the meeting |

Complete the voting instruction form and return it to your intermediary.

Your intermediary may also allow you to do this online.

You can either mark your voting instructions on the voting instruction form or you can appoint another person (called a proxyholder) to attend the meeting and vote your shares for you.

|

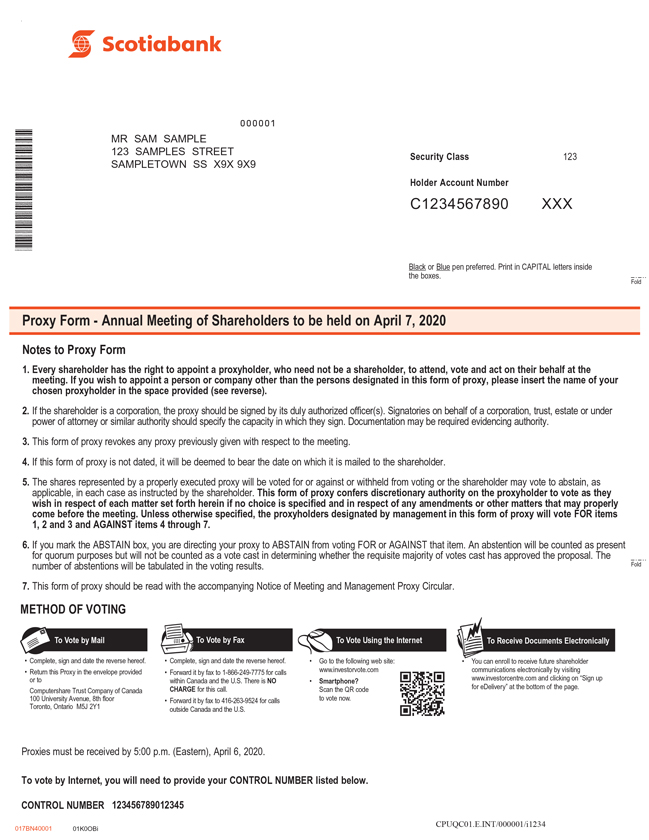

To vote online, follow the instructions on the proxy form.

Alternatively, you may complete the paper proxy form and return it to Computershare.

You can either mark your voting instructions on the proxy form or you can appoint another person (called a proxyholder) to attend the meeting and vote your shares for you. | ||||

|

You want to attend the meeting and vote in person |

Follow the instructions on the voting instruction form, including registering online.

In most cases, you will simply type or print your name in the space provided for appointing a proxyholder and return the voting instruction form as instructed by your intermediary. Do not complete the voting section of the voting instruction form, because you will be voting at the meeting.

If the voting instruction form does not provide a space for appointing a proxyholder, you may have to indicate on the voting instruction form that you wish to attend the meeting. Follow the instructions on the voting instruction form to make this request, and your intermediary will send you a legal proxy that you must return to our transfer agent, Computershare Trust Company of Canada (Computershare) by the proxy deadline of 5 p.m. (Eastern) on April 6, 2020.

Please register with Computershare when you arrive at the meeting.

|

Do not complete the proxy form or return it to us. Please bring it with you to the meeting.

Please register with Computershare when you arrive at the meeting. | ||||

| 6 | Scotiabank |

Table of Contents

ABOUT THE MEETING

| Non-registered (beneficial) shareholders |

Registered shareholders | |||||

|

Returning the form |

The voting instruction form tells you how to return it to your intermediary.

Remember that your intermediary must receive your voting instructions in sufficient time to act on them, generally one day before the proxy deadline below.

Computershare must receive your voting instructions from your intermediary by no later than the proxy deadline, which is 5 p.m. (Eastern) on April 6, 2020. |

The enclosed proxy form tells you how to submit your voting instructions.

Computershare must receive your proxy, including any amended proxy, by no later than the proxy deadline which is 5 p.m. (Eastern) on April 6, 2020.

You may return your proxy in one of the following ways: • by mail, in the envelope provided • by fax, to 1 (866) 249-7775 (if faxing within Canada and the United States) or (416) 263-9524 (other countries) • using the internet. Go to www.investorvote.com and follow the instructions online.

| ||||

|

Changing your mind |

If you have provided voting instructions to your intermediary and change your mind about how you want to vote, or you decide to attend the meeting and vote in person, contact your intermediary to find out what to do.

If your intermediary gives you the option of using the internet to provide your voting instructions, you can also use the internet to change your instructions, as long as your intermediary receives the new instructions in enough time to act on them before the proxy deadline. Contact your intermediary to confirm the deadline. |

If you want to revoke your proxy, you must deliver a signed written notice specifying your instructions to one of the following: • our Corporate Secretary, by 5 p.m. (Eastern) on the last business day before the meeting (or any adjourned meeting reconvenes). Deliver to: The Bank of Nova Scotia Executive Offices, 44 King Street West, Toronto, Ontario, Canada M5H 1H1 Attention: Julie Walsh, Senior Vice President, Corporate Secretary and Chief Corporate Governance Officer, Fax: (416) 866-5090 • Craig Thompson, Regional Senior Vice President, Atlantic Region, by 5 p.m. (Eastern) on the last business day before the meeting (or any adjourned meeting reconvenes). Deliver to: The Bank of Nova Scotia Head Office, 1709 Hollis Street, Halifax, Nova Scotia, Canada B3J 1W1 Fax: 1 (877) 841-9920 • the Chairman of the meeting, before the meeting starts or any adjourned meeting reconvenes.

You can also revoke your proxy in any other way permitted by law. You can change your voting instructions by voting again using the internet or fax. Your voting instructions must be received by Computershare by the proxy deadline noted above, or by voting in person at the meeting.

| ||||

| Management proxy circular | 7 |

Table of Contents

| Want to vote but can’t attend the meeting? Appointing your proxyholder Your proxy form or voting instruction form names Aaron Regent or Brian Porter, each a director of the bank, as your proxyholder. You may appoint anyone as your proxyholder to represent you at the meeting. Follow the instructions online if using the internet or simply print the person’s name in the blank space on the form. Your proxyholder does not have to be a shareholder of the bank. Your proxyholder must attend the meeting to vote for you.

We reserve the right to accept late proxies and to waive or extend the proxy deadline with or without notice, but are under no obligation to accept or reject a late proxy.

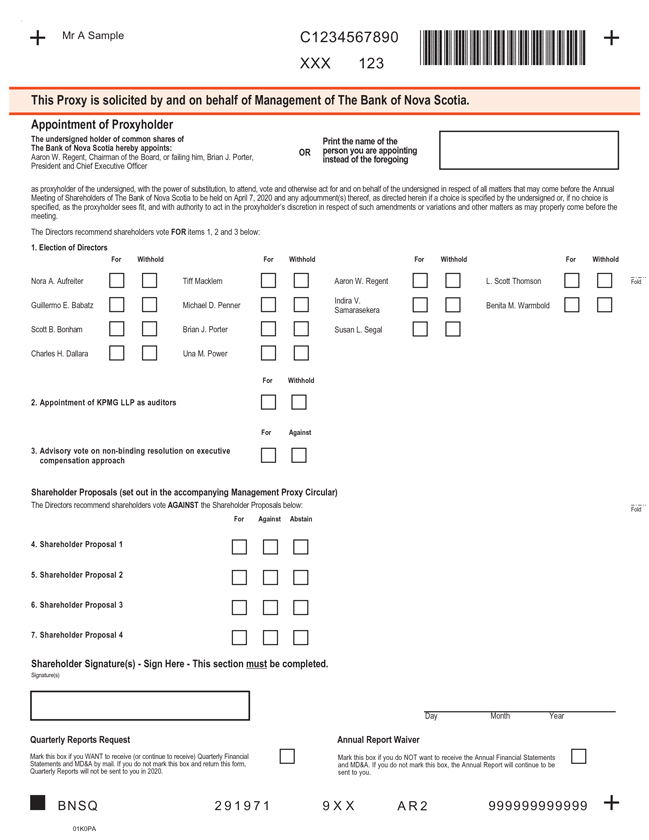

How your proxyholder will vote Your proxyholder must vote according to the instructions you provide on your proxy form or voting instruction form (for directors and the appointment of auditors, you may either vote for or withhold. For the advisory resolution on our approach to executive compensation you may vote for or against. For shareholder proposals, you may either vote for, against or abstain). If you do not specify how you want to vote, your proxyholder can vote your shares as he or she wishes. Your proxyholder will also decide how to vote on any amendment or variation to any item of business in the notice of meeting or any new matters that are properly brought before the meeting, or any postponement or adjournment.

If you properly complete and return your proxy form or voting instruction form, but do not appoint a different proxyholder, and do not specify how you want to vote, Aaron Regent or Brian Porter will vote for you as follows: • for the election of the nominated directors to the board • for the appointment of the shareholders’ auditors • for the advisory resolution on our approach to executive compensation • against the shareholder proposals.

CONFIDENTIALITY

To keep voting confidential, Computershare counts all proxies. Computershare only discusses proxies with us when legally necessary, when a shareholder clearly intends to communicate with management, or when there is a proxy contest.

QUORUM

A minimum of 25% of all eligible votes must be represented at the meeting for it to take place.

VOTING RESULTS

We will post the voting results (including details about the percentage of support received for each item of business) on our website and file them with securities regulators after the meeting.

RECEIVING SHAREHOLDER MATERIALS BY E-MAIL

Shareholders may sign up to receive shareholder materials by e-mail, including this circular, as follows: • Beneficial owners may go to www.proxyvote.com, use the control number provided on the voting instruction form and click on ‘Go Paperless’ to enroll • Registered shareholders who hold share certificates or receive statements from a direct registration system may go to www.investorcentre.com, use the holder account number on the form of proxy, and click on ‘Sign up for eDelivery’ to enroll.

QUESTIONS?

Please contact Computershare with any questions. See the back cover for their contact information. |

| 8 | Scotiabank |

Table of Contents

ABOUT THE MEETING

| This year 13 directors are proposed for election to our board.

They each bring a range of skills, experience and knowledge to the table. As a group, they have been selected based on their integrity, collective skills and ability to contribute to the broad range of issues the board considers when overseeing our business and affairs. You can learn more about our expectations for directors and how the board functions beginning on page 29.

INDEPENDENCE

Twelve of our 13 (92%) directors are independent and have never served as an executive of the bank. Having an independent board is one of the ways we make sure the board is able to operate independently of management and make decisions in the best interests of Scotiabank. Brian Porter is the only non-independent director as the bank’s President and Chief Executive Officer (President and CEO).

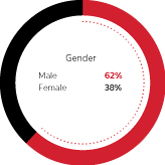

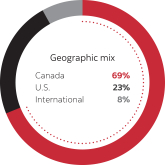

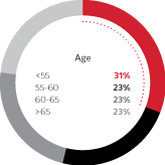

DIVERSITY

Each director has a wealth of experience in leadership and strategy development. The combination and diversity of their skills, experience, location, and gender are key as they bring unique perspectives to the board (read about how we broadly define diversity on page 41 and how these skills and experience are represented starting on page 10).

Key skills and experience

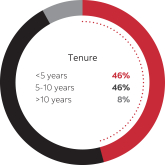

TENURE AND TERM LIMITS

Balancing the combination of longer serving directors with newer directors allows the board to have the insight of experience while also being exposed to fresh perspectives. Our average board tenure is 5.5 years (you can read more about tenure and term limits on page 43). |

| |||

| Management proxy circular | 9 |

Table of Contents

DIRECTOR PROFILES

| Each director has provided the information about the Scotiabank shares they own or exercise control or direction over. This information and the details about the director deferred share units (DDSUs) they hold are as of October 31, 2019. The value of common shares and DDSUs is calculated using $75.54 (the closing price of our common shares on the Toronto Stock Exchange (TSX) on October 31, 2019) for 2019 and $70.65 (the closing price of our common shares on the TSX on October 31, 2018) for 2018. The equity ownership requirement is five times the equity portion of the annual retainer ($725,000 for directors and $850,000 for the Chairman) and directors have five years to meet this requirement.

The attendance figures reflect the number of board and committee meetings held in fiscal 2019 and each nominee’s attendance for the time they served as a director or committee member. |

We have robust director | |

|

Aaron W. Regent

Toronto, Ontario, Canada Age 54 | Director since 2013 Independent

2019 votes for: 98.0%

Not eligible for re-election in April 2028 |

Aaron Regent is Chairman of the Board of Scotiabank. He is the Founding Partner of Magris Resources Inc. and Chairman and Chief Executive Officer of Niobec Inc., companies involved with the acquisition, development and operation of mining assets on a global basis. He was President and Chief Executive Officer of Barrick Gold Corporation from January 2009 to June 2012. Previously, Mr. Regent was Senior Managing Partner of Brookfield Asset Management and Co-Chief Executive Officer of the Brookfield Infrastructure Group, an asset management company, and President and Chief Executive Officer of Falconbridge Limited. Mr. Regent holds a B.A. from the University of Western Ontario and is a chartered accountant and a Fellow of CPA Ontario. |

| ||||||||||||||||||||||||||||||||||

| KEY SKILLS & EXPERIENCE |

|

|||||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Governance | Human resources and executive compensation | Risk management |

| |||||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 31 of 31 / 100% |

|

|||||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||||

| Board |

10 of 10 / 100% | Audit and conduct review |

3 of 3 / 100% | |||||||||||||||||||||||||||||||||

| Corporate governance |

4 of 4 / 100% | |||||||||||||||||||||||||||||||||||

| Human resources |

8 of 8 / 100% | |||||||||||||||||||||||||||||||||||

| Risk |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||||

|

|

2019 |

53,177 | 27,390 | 80,567 | $2,069,041 | $6,086,031 | 7.2 | |||||||||||||||||||||||||||||

| 2018 |

45,777 | 21,201 | 66,978 | $1,497,851 | $4,731,996 | 6.5 | ||||||||||||||||||||||||||||||

| Change |

7,400 | 6,189 | 13,589 | $571,190 | $1,354,035 | |||||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||||

| Nutrien Ltd. (2018 – present) |

|

Audit | Human resources & compensation | ||||||||||||||||||||||||||||||||||

| Potash Corporation of Saskatchewan Inc. (2015 – 2018) |

|

|||||||||||||||||||||||||||||||||||

| Effective April 9, 2019, Mr. Regent was appointed Chairman of the Board and joined the audit and conduct review and corporate governance committees. He ceased to be Chair of the human resources committee on April 9, 2019 but remains a member. |

| |||||||||||||||||||||||||||||||||||

| 10 | Scotiabank |

Table of Contents

ABOUT THE MEETING

|

Nora A. Aufreiter

Toronto, Ontario, Canada Age 60 | Director since 2014 Independent

2019 votes for: 99.6%

Not eligible for re-election in April 2030 |

Nora Aufreiter is a corporate director and a former senior partner of McKinsey and Company, an international consulting firm. Throughout her 27 year career at McKinsey, she held multiple leadership roles including Managing Director of McKinsey’s Toronto office, leader of the North American Digital and Omni Channel service line and was a member of the firm’s global personnel committees. She has worked extensively in Canada, the United States and internationally serving her clients in consumer-facing industries including retail, consumer and financial services, energy and the public sector. Ms. Aufreiter holds a B.A. (Honours) in business administration from the Ivey Business School at the University of Western Ontario and an M.B.A. from Harvard Business School. She was recognized in 2011 as one of “Canada’s Most Powerful Women: Top 100”. In June 2018, Ms. Aufreiter was awarded an Honorary Doctor of Laws at the University of Western Ontario. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Financial services | Governance | Human resources and executive compensation | Retail/consumer | Technology |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 23 of 24 / 96% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

9 of 10 / 90% | |

Corporate governance (chair) Human resources |

|

|

6 of 6 / 100% 8 of 8 / 100% |

| ||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

2,500 | 12,341 | 14,841 | $932,239 | $1,121,089 | 1.5 | ||||||||||||||||||||||||||||

| 2018 |

2,500 | 8,540 | 11,040 | $603,351 | $779,976 | 1.1 | ||||||||||||||||||||||||||||

| Change |

0 | 3,801 | 3,801 | $328,888 | $341,113 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| The Kroger Co. (2014 – present) |

|

Financial policy | Public responsibilities | ||||||||||||||||||||||||||||||||

| Effective April 9, 2019, Ms Aufreiter became Chair of the corporate governance committee. |

| |||||||||||||||||||||||||||||||||

|

Guillermo E. Babatz

Mexico City, Mexico Age 51 | Director since 2014 Independent

2019 votes for: 98.0%

Not eligible for re-election in April 2029 |

Guillermo Babatz is the Managing Partner of Atik Capital, S.C., an advisory firm that specializes in structuring financial solutions for its clients. Previously, he was the Executive Chairman of Comisión Nacional Bancaria y de Valores in Mexico from July 2007 to December 2012. Mr. Babatz holds a B.A. (in economics) from the Instituto Tecnológico Autónomo de México (ITAM) in Mexico City, and a Ph.D. (in economics) from Harvard University. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Financial services | Public policy | Risk management |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 24 of 24 / 100% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

10 of 10 / 100% | Human resources |

8 of 8 / 100% | ||||||||||||||||||||||||||||||

| Risk |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

1,800 | 12,116 | 13,916 | $915,243 | $1,051,215 | 1.4 | ||||||||||||||||||||||||||||

| 2018 |

1,800 | 9,640 | 11,440 | $681,066 | $808,236 | 1.1 | ||||||||||||||||||||||||||||

| Change |

0 | 2,476 | 2,476 | $234,177 | $242,979 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Fibra MTY, S.A.P.I. de C.V. (2015 – present) |

|

Investment | ||||||||||||||||||||||||||||||||

| Management proxy circular | 11 |

Table of Contents

|

Scott B. Bonham

Atherton, California, U.S.A. Age 58 | Director since 2016 Independent

2019 votes for: 98.2%

Not eligible for re-election in April 2028

|

Scott Bonham is a corporate director and the co-founder of Intentional Capital, a privately-held real estate asset management company. From 2000 to 2015, he was co-founder of GGV Capital, an expansion stage venture capital firm with investments in the U.S. and China. Prior to GGV Capital, he served as Vice President of the Capital Group Companies, where he managed technology investments across several mutual funds from 1996 to 2000. Mr. Bonham has a B.Sc. (in electrical engineering) from Queen’s University and an M.B.A. from Harvard Business School.

|

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Governance | Risk management | Technology |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 21 of 21 / 100% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

10 of 10 / 100% | |

Audit and conduct review Corporate governance |

|

|

5 of 5 / 100% 6 of 6 / 100% |

| ||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

1,500 | 12,591 | 14,091 | $951,124 | $1,064,434 | 1.5 | ||||||||||||||||||||||||||||

| 2018 |

1,500 | 8,904 | 10,404 | $629,068 | $735,043 | 1 | ||||||||||||||||||||||||||||

| Change |

0 | 3,687 | 3,687 | $322,056 | $329,391 | |||||||||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Loblaw Companies Limited (2016 – present) |

|

Audit | Risk and compliance | ||||||||||||||||||||||||||||||||

| Magna International Inc. (2012 – present) |

|

— | ||||||||||||||||||||||||||||||||

|

Charles H. Dallara, Ph.D.

Oak Hill, Virginia, U.S.A. Age 71 | Director since 2013 Independent

2019 votes for: 98.2%

Not eligible for re-election in April 2024 |

Charles Dallara is an Advisory Partner of Partners Group and Chairman of Partners Group Board of Directors, USA, a private market investment and asset management group, based in Switzerland. He has 43 years of industry experience. Dr. Dallara was Chairman of the Americas and a member of the Board of Directors of Partners Group Holding AG until 2019. Prior to joining the Partners Group in 2013, he was the Managing Director and Chief Executive Officer of the Institute of International Finance from 1993 to 2013. Previously, he was a Managing Director at J.P. Morgan & Co. In addition, Dr. Dallara has held senior positions in the U.S. Department of the Treasury and with the IMF. He holds a B.Sc. (in economics) from the University of South Carolina, a M.A., a M.A.L.D. (in law and diplomacy) and a Ph.D. from the Fletcher School of Law and Diplomacy at Tufts University. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Environmental and social responsibility | Financial services | Governance | Public policy | Risk management |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 21 of 21 / 100% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

10 of 10 / 100% | Audit and conduct review |

5 of 5 / 100% | |||||||||||||||||||||||||||||||

| Risk |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

1,500 | 12,353 | 13,853 | $933,146 | $1,046,456 | 1.4 | ||||||||||||||||||||||||||||

| 2018 |

1,500 | 9,867 | 11,367 | $697,104 | $803,079 | 1.1 | ||||||||||||||||||||||||||||

| Change |

0 | 2,486 | 2,486 | $236,042 | $243,377 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Partners Group Holding AG (2013 – 2019) |

|

|||||||||||||||||||||||||||||||||

| 12 | Scotiabank |

Table of Contents

ABOUT THE MEETING

|

Tiff Macklem, Ph.D.

Toronto, Ontario, Canada Age 58 | Director since 2015 Independent

2019 votes for: 99.7%

Not eligible for re-election in April 2031 |

Tiff Macklem is Dean of the Rotman School of Management at the University of Toronto. He recently served as Chair of Canada’s Expert Panel on Sustainable Finance. Previously, he served as Senior Deputy Governor and Chief Operating Officer of the Bank of Canada (from July 2010 to May 2014). Prior to his appointment at the Bank of Canada, Dr. Macklem served as Associate Deputy Minister of the federal Department of Finance and Canada’s finance deputy at the G7 and G20. He also served as Chair of the Standing Committee on Standards Implementation of the Financial Stability Board. Dr. Macklem holds a B.A. (Honours) in economics from Queen’s University, and a M.A. and a Ph.D. (in economics) from the University of Western Ontario. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

| |||||||||||||||||||||||||||||||||

| Accounting and finance | Environmental and social responsibility | Financial services | Public policy | Risk management |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 20 of 21 / 95% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

9 of 10 / 90% | Audit and conduct review |

5 of 5 / 100% | |||||||||||||||||||||||||||||||

| Risk (chair) |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

1,300 | 16,184 | 17,484 | $1,222,539 | $1,320,741 | 1.8 | ||||||||||||||||||||||||||||

| 2018 |

1,300 | 11,802 | 13,102 | $833,811 | $925,656 | 1.3 | ||||||||||||||||||||||||||||

| Change |

0 | 4,382 | 4,382 | $388,728 | $395,085 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| — |

|

— | ||||||||||||||||||||||||||||||||

|

Michael D. Penner

Westmount, Quebec, Canada Age 50 | Director since 2017 Independent

2019 votes for: 99.8%

Not eligible for re-election in April 2030 |

Michael Penner is a corporate director and the former Chairman of the Board of Directors of Hydro-Québec. Mr. Penner is Chairman and Lead Operating Director of both US Infrastructure Corporation and Enfragen Energy. He was the President and Chief Executive Officer of Peds Legwear prior to selling his company to Gildan Activewear Inc. in August 2016. Mr. Penner has been active in the community, on the Board of ICD Quebec and has served as a member of the Board of Directors of Les Grands Ballets Canadiens de Montréal, Selwyn House School, Hofstra University School of Law and McGill University Football. Mr. Penner holds a Bachelor of Arts degree from McGill University and a Juris Doctor from Hofstra University in New York. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

| |||||||||||||||||||||||||||||||||

| Environmental and social responsibility | Governance | Human resources and executive compensation | Public policy | Retail/consumer |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 21 of 21 / 100% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

10 of 10 / 100% | Audit and conduct review |

5 of 5 / 100% | |||||||||||||||||||||||||||||||

| Corporate governance |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

14,091 | 7,640 | 21,731 | $577,126 | $1,641,560 | 2.3 | ||||||||||||||||||||||||||||

| 2018 |

14,091 | 4,181 | 18,272 | $295,388 | $1,290,917 | 1.8 | ||||||||||||||||||||||||||||

| Change |

0 | 3,459 | 3,459 | $281,738 | $350,643 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| — |

|

— | ||||||||||||||||||||||||||||||||

| Management proxy circular | 13 |

Table of Contents

|

Brian J. Porter

Toronto, Ontario, Canada Age 61 | Director since 2013 Not independent

2019 votes for: 99.7%

Eligible for re-election while President and CEO |

Brian Porter is President and Chief Executive Officer of Scotiabank. He joined Scotiabank in 1981, and has progressed through a series of increasingly senior positions across the bank. Mr. Porter served as the bank’s Chief Risk Officer from 2005 to 2008, as Group Head of Risk and Treasury from 2008 to 2010 and as Group Head of International Banking from 2010 to 2012. He was appointed President of Scotiabank in November 2012. He assumed the role of Chief Executive Officer on November 1, 2013. Mr. Porter’s current board memberships include Business Council of Canada, the Council of the Americas, and the Washington-based Institute of International Finance (IIF) where he serves as Vice Chairman and Treasurer. He is also Chair of the University Health Network (UHN) Board of Trustees.

Mr. Porter earned a B.Comm. from Dalhousie University, and has been awarded an Honorary Doctor of Laws (LLD) from Dalhousie University (2008) and Ryerson University (2018). He is a graduate of the Advanced Management Program of the Harvard Business School. |

| ||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

| |||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Financial services | Retail/consumer | Risk management |

| |||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 10 of 10 / 100% |

| |||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||

| Board |

10 of 10 / 100% | — | — | |||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares, DSUs and PSUs |

|

|

Value of |

|

|

Value of common shares, DSUs and PSUs |

| ||||||||||||||||||||||

| Year | |

Common shares |

|

DSUs | PSUs | |||||||||||||||||||||||||||

| 2019 |

135,838 | 18,340 | 253,231 | 407,409 | 1,385,404 | 30,775,666 | ||||||||||||||||||||||||||

| 2018 |

122,906 | 17,494 | 254,273 | 394,673 | 1,235,960 | 27,883,647 | ||||||||||||||||||||||||||

| Change |

12,932 | 846 | (1,042) | 12,736 | 149,444 | 2,892,019 | ||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||

| — |

|

— | ||||||||||||||||||||||||||||||

| Mr. Porter has an equity ownership requirement of eight times his base salary and he exceeds the requirement. Common shares, DSUs, PSUs, and holdings through our Employee Share Ownership Plan count towards this requirement. See pages 60 and 80 for details. |

| |||||||||||||||||||||||||||||||

|

Una M. Power

Vancouver, British Columbia, Canada Age 55 | Director since 2016 Independent

2019 votes for: 99.5%

Not eligible for re-election in April 2028 |

Una Power is a corporate director and the former Chief Financial Officer of Nexen Energy ULC, a former publicly-traded energy company that is a wholly-owned subsidiary of CNOOC Limited. During her 24 year career with Nexen, Ms. Power held various executive positions with responsibility for financial and risk management, strategic planning and budgeting, business development, energy marketing and trading, information technology and capital investment. Ms. Power holds a B.Comm. (Honours) from Memorial University and CPA, CA and CFA designations. She has completed executive development programs at Wharton Business School and INSEAD.

|

| ||||||||||||||||||||||||||||||||||

| KEY SKILLS & EXPERIENCE |

|

|||||||||||||||||||||||||||||||||||

| Accounting and finance | Capital markets | Human resources and executive compensation | Risk management | Technology |

| |||||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 23 of 23 / 100% |

|

|||||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||||

| Board |

|

10 of 10 / 100% | |

Audit and conduct review (chair) Human resources |

|

|

5 of 5 / 100% 8 of 8 / 100% |

| ||||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||||

|

|

2019 |

5,783 | 13,176 | 18,959 | $995,315 | $ | 1,432,163 | 2 | ||||||||||||||||||||||||||||

|

|

2018 |

5,783 | 8,802 | 14,585 | $621,861 | $1,030,430 | 1.4 | |||||||||||||||||||||||||||||

|

|

Change |

0 | 4,374 | 4,374 | $373,454 | $401,733 | ||||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||||

| Teck Resources Limited (2017 – present) |

|

Audit | Compensation | ||||||||||||||||||||||||||||||||||

| TC Energy Corporation (2019 – present) |

|

Audit | Health, safety sustainability and environment | ||||||||||||||||||||||||||||||||||

| Kinross Gold Corporation (2013 – 2019) |

|

|||||||||||||||||||||||||||||||||||

| 14 | Scotiabank |

Table of Contents

ABOUT THE MEETING

|

Indira V. Samarasekera,

Vancouver, British Columbia, Canada Age 67 | Director since 2008 Independent

2019 votes for: 97.7%

Not eligible for re-election in April 2021 |

Indira Samarasekera is a senior advisor at Bennett Jones LLP, a law firm, and a corporate director. Dr. Samarasekera was President and Vice Chancellor of the University of Alberta from 2005 to 2015 and prior to that, the Vice President, Research at the University of British Columbia from 2000 to 2005. She is a member of the Trilateral Commission. Dr. Samarasekera holds a B.Sc. (in mechanical engineering) from the University of Ceylon (Sri Lanka), a M.Sc. (in mechanical engineering) from the University of California, as a Hayes Fulbright Scholar, and a Ph.D. (in metallurgical engineering) from the University of British Columbia. She is an Officer of the Order of Canada, a Foreign Associate of the US National Academy of Engineering, and was awarded an honorary D. Sc. at Queen’s University in May 2018.

| |||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||

| Environmental and social responsibility | Governance | Human resources and executive compensation | Public policy | Technology | ||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 24 of 24 / 100% |

|

|||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||

| Board |

10 of 10 / 100% | Corporate governance |

6 of 6 / 100% | |||||||||||||||||||||||||||

| Human resources |

8 of 8 / 100% | |||||||||||||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

Total value as a multiple of equity ownership target | |||||||||||||||||||

| Year |

|

Common shares |

|

DDSUs | ||||||||||||||||||||||||||

| 2019 |

1,948 | 39,748 | 41,696 | $3,002,564 | $3,149,716 | 4.3 | ||||||||||||||||||||||||

| 2018 |

1,948 | 35,998 | 37,946 | $2,543,259 | $2,680,885 | 3.7 | ||||||||||||||||||||||||

| Change |

0 | 3,750 | 3,750 | $459,305 | $468,831 | |||||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||

| Magna International Inc. (2014 – present) |

|

Corporate governance, compensation and nominating | ||||||||||||||||||||||||||||

| TC Energy Corporation (2016 – present) |

|

Audit | Human resources | ||||||||||||||||||||||||||||

| Stelco Holdings Inc. (2018 – present) |

|

Environment, health and safety (chair) | ||||||||||||||||||||||||||||

| Management proxy circular | 15 |

Table of Contents

|

Susan L. Segal

New York, New York, U.S.A. Age 67 | Director since 2011 Independent

2019 votes for: 99.6%

Not eligible for re-election in April 2023 |

Susan Segal was elected President and Chief Executive Officer of the Americas Society, an organization dedicated to education, debate and dialogue in the Americas, and Council of the Americas, a business organization whose members share a common interest in the western hemisphere, in August 2003. Previously, she was a banker for over 25 years with JPM Chase and its predecessor banks. Ms. Segal received a B.A. from Sarah Lawrence College and a M.B.A. from Columbia University. In 1999, she was awarded the Order of Bernardo O’Higgins, Grado de Gran Oficial in Chile. In 2009, President Alvaro Uribe of Colombia honored her with the Cruz de San Carlos award and in September 2012, Mexican President Calderón awarded her with the Aguila Azteca, the highest award given to a foreigner. In 2013, the North American-Chilean Chamber of Commerce recognized her as the Honorary Chilean of the Year. In 2018, Ms. Segal was awarded Peru’s Order of “Merit for Distinguished Services” in the rank of Grand Official on behalf of President Martĺn Vizcarra. |

| ||||||||||||||||||||||||||||||||

|

KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

| Capital markets | Financial services | Governance | Public policy | Risk management |

|

|||||||||||||||||||||||||||||||||

|

OVERALL BOARD AND COMMITTEE ATTENDANCE: 20 of 21 / 95% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

9 of 10 / 90% | Audit and conduct review |

3 of 3 / 100% | ||||||||||||||||||||||||||||||

| Corporate governance |

2 of 2 / 100% | |||||||||||||||||||||||||||||||||

| Risk |

6 of 6 / 100% | |||||||||||||||||||||||||||||||||

|

EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year |

|

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

1,839 | 30,303 | 32,142 | $2,289,089 | $2,428,007 | 3.3 | ||||||||||||||||||||||||||||

| 2018 |

1,839 | 25,595 | 27,434 | $1,808,287 | $1,938,212 | 2.7 | ||||||||||||||||||||||||||||

| Change |

0 | 4,708 | 4,708 | $480,802 | $489,795 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| MercadoLibre, Inc. (2012 – present) |

|

Audit | ||||||||||||||||||||||||||||||||

| Vista Oil and Gas S.A.B. de C.V. (2017 – present) |

|

Audit | Governance | Human resources | ||||||||||||||||||||||||||||||||

| Effective April 9, 2019, Ms. Segal joined the audit and conduct review committee and ceased to be the Chair and a member of the corporate governance committee. |

| |||||||||||||||||||||||||||||||||

| 16 | Scotiabank |

Table of Contents

ABOUT THE MEETING

|

L. Scott Thomson

Vancouver, British Columbia, Canada Age 50 | Director since 2016 Independent

2019 votes for: 97.0%

Not eligible for re-election in April 2028 |

Scott Thomson is the President and Chief Executive Officer of Finning International Inc., the world’s largest Caterpillar equipment dealer. Prior to joining Finning in 2013, Mr. Thomson was Chief Financial Officer of Talisman Energy Inc. with responsibility for finance, tax, treasury, investor relations, marketing, business development and strategy, planning and performance management from 2008 to 2013. Prior to Talisman, Mr. Thomson held several executive positions with Bell Canada Enterprises from 2003 to 2008 including the role of Executive Vice President, Corporate Development. Prior to Bell, Mr. Thomson was a Vice President at Goldman, Sachs & Co. Mr. Thomson holds a B.A. (in economics and political science) from Queen’s University and an M.B.A. from the University of Chicago. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

|

Accounting and finance | Capital markets | Financial services | Human resources and executive compensation | Technology |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 22 of 23 / 96% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

9 of 10 / 90% | |

Audit and conduct review Human resources (chair) Risk |

|

|

2 of 2 / 100% 8 of 8 / 100% 3 of 3 / 100% |

| ||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

8,070 | 12,158 | 20,228 | $918,415 | $1,528,023 | 2.1 | ||||||||||||||||||||||||||||

| 2018 |

6,570 | 8,122 | 14,692 | $573,819 | $1,037,990 | 1.4 | ||||||||||||||||||||||||||||

| Change |

1,500 | 4,036 | 5,536 | $344,596 | $490,033 | |||||||||||||||||||||||||||||

|

OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Finning International Inc. (2013 – present) |

|

Safety, environment & social responsibility | ||||||||||||||||||||||||||||||||

| Interfor Corporation (2012 – 2016) |

|

|||||||||||||||||||||||||||||||||

| Effective April 9, 2019, Mr. Thomson joined the risk committee, ceased to be a member of the audit and conduct review committee and became Chair of the human resources committee. |

| |||||||||||||||||||||||||||||||||

|

Benita M. Warmbold

Toronto, Ontario, Canada Age 61 | Director since 2018 Independent

2019 votes for: 98.1%

Not eligible for re-election in April 2031 |

Benita Warmbold is a corporate director and the former Senior Managing Director and Chief Financial Officer of Canada Pension Plan (CPP) Investment Board having retired in July 2017. Over her nine years at CPP Investment Board, Ms. Warmbold was responsible for finance, risk, performance, tax, internal audit, legal, technology, data and investment operations. Prior to joining CPP Investment Board in 2008, Ms. Warmbold held senior leadership positions with Northwater Capital, Canada Development Investment Corporation and KPMG. She is Chair of the Canadian Public Accountability Board. Ms. Warmbold holds a B.Comm. (Honours) from Queen’s University and is a chartered professional accountant and a Fellow of CPA Ontario. Ms. Warmbold has been recognized three times as one of “Canada’s Most Powerful Women – Top 100,” and in 2016 was inducted into the WXN Hall of Fame. |

| ||||||||||||||||||||||||||||||||

| KEY SKILLS AND EXPERIENCE |

|

|||||||||||||||||||||||||||||||||

|

Accounting and finance | Capital markets | Financial services | Risk management | Technology |

| |||||||||||||||||||||||||||||||||

| OVERALL BOARD AND COMMITTEE ATTENDANCE: 23 of 23 / 100% |

|

|||||||||||||||||||||||||||||||||

| Meeting attendance | Committees | Meeting attendance | ||||||||||||||||||||||||||||||||

| Board |

|

10 of 10 / 100% | |

Audit and conduct review Human resources |

|

|

5 of 5 / 100% 8 of 8 / 100% |

| ||||||||||||||||||||||||||

| EQUITY OWNERSHIP |

|

|

Total common shares and DDSUs |

|

|

Value of DDSUs |

|

|

Value of common shares and DDSUs |

|

|

Total value as a multiple of equity ownership target |

| |||||||||||||||||||||

| Year | |

Common shares |

|

DDSUs | ||||||||||||||||||||||||||||||

| 2019 |

3,000 | 3,145 | 6,145 | $237,573 | $464,193 | 0.6 | ||||||||||||||||||||||||||||

|

|

2018 |

2,000 | 26 | 2,026 | $1,837 | $143,137 | 0.2 | |||||||||||||||||||||||||||

| Change |

1,000 | 3,119 | 4,119 | $235,736 | $321,056 | |||||||||||||||||||||||||||||

| OTHER PUBLIC COMPANY DIRECTORSHIPS

DURING THE PAST FIVE YEARS |

|

Current board committee memberships | ||||||||||||||||||||||||||||||||

| Methanex Corporation (2016 – present) |

|

Audit, finance and risk (chair) | Corporate governance | ||||||||||||||||||||||||||||||||

| SNC-Lavalin Group Inc. (2017 – present) |

|

Audit (chair) | Human resources | ||||||||||||||||||||||||||||||||

| Having joined the board in 2018, Ms. Warmbold has until 2023 to meet her equity ownership requirement. |

| |||||||||||||||||||||||||||||||||

| Management proxy circular | 17 |

Table of Contents

Our directors are prominent business and community leaders. They bring a wealth of experience to the board, generate public confidence, know our businesses and are familiar with the markets in which we carry on business. The directors’ backgrounds, skills and experience, taken as a whole, equip the board to carry out its duties and supervise the bank’s business and affairs.

The board maintains a skills matrix to monitor the skills and experience necessary for the oversight of the bank today and in the future.

To serve on our board, directors must have considerable experience in leadership and strategy. In addition, each director has identified five other key areas of experience in consultation with the corporate governance committee. The committee developed the skills matrix below based on this consultation and agreement on each director’s key areas of experience, as well as an annual review (including international benchmarking) of key skills and experience necessary for the oversight of Scotiabank. Our director biographies highlight some of the formative experiences supporting these areas.

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||

| Leadership Experience in senior leadership roles (management and/or board) in an organization of significant size or complexity |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Strategy Experience in developing, implementing and delivering strategic business objectives in a large organization |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Accounting and finance Knowledge of and experience in financial accounting and reporting, corporate finance and familiarity with financial internal controls and GAAP/IFRS |

|

|

|

|

|

|

|

| ||||||||||||||||||

| Capital markets Experience in global financial markets, investment banking and/or mergers and acquisitions |

|

|

|

|

|

|

|

| ||||||||||||||||||

| Environmental and social responsibility Experience in corporate responsibility practices and sustainability matters relevant to an organization of significant size and complexity |

|

|

|

|

||||||||||||||||||||||

| Financial services Experience in the financial services industry and/or financial regulation |

|

|

|

|

|

|

|

| ||||||||||||||||||

| Governance Experience in corporate governance principles and practices in an organization of significant size |

|

|

|

|

|

|

|

|||||||||||||||||||

| Human resources and executive compensation Experience in people matters including workplace culture, management development, succession planning and compensation |

|

|

|

|

|

|

||||||||||||||||||||

| Public policy Experience in government and public policy matters |

|

|

|

|

|

|

||||||||||||||||||||

| Retail/consumer Experience in a consumer-facing industry |

|

|

|

|||||||||||||||||||||||

| Risk management Experience in identifying, assessing and managing financial and non-financial risks |

|

|

|

|

|

|

|

|

| |||||||||||||||||

| Technology An understanding of digital, data management, technology and/or cyber security issues in large, complex enterprises |

|

|

|

|

|

| ||||||||||||||||||||

The corporate governance committee also maintains a detailed matrix of each director’s general areas of experience (such as marketing, regulatory and compliance and government), education, language skills and business experience in geographic regions where we do business. It uses these matrices to assess board composition, plan board and chair succession, and assess potential director candidates.

| 18 | Scotiabank |

Table of Contents

ABOUT THE MEETING

The table below show the number of board and committee meetings held in fiscal 2019 and the overall meeting attendance of the relevant members for that period. Directors are expected to attend at least 75% of all board and committee meetings for those committees on which they serve.

You can find the details about each director’s meeting attendance in the director profiles beginning on page 10. All of the nominated directors attended the annual meeting in April 2019. Directors also held meetings with regulators, shareholders or shareholder representative groups, which are not shown in the table below.

| Meetings |

Attendance |

|||||||

| Board |

|

10 |

|

|

97% |

| ||

| Audit and conduct review |

|

5 |

|

|

100% |

| ||

| Corporate governance |

|

6 |

|

|

100% |

| ||

| Human resources |

|

8 |

|

|

100% |

| ||

| Risk |

|

6 |

|

|

97% |

| ||

| Total number of meetings |

|

35 |

|

|

99% |

| ||

The table below shows the board and committee meeting attendance in fiscal 2019 of directors who retired from the board.

| Meetings |

Attendance |

|||||||

| Tom O’Neill |

||||||||

| Board |

|

5 of 5 |

|

|

100% |

| ||

| Audit and conduct review |

|

2 of 2 |

|

|

100% |

| ||

| Corporate governance |

|

2 of 2 |

|

|

100% |

| ||

| Human resources |

|

4 of 4 |

|

|

100% |

| ||

| Risk |

|

3 of 3 |

|

|

100% |

| ||

| Eduardo Pacheco |

||||||||

| Board |

|

4 of 5 |

|

|

80% |

| ||

| Risk |

|

2 of 3 |

|

|

67% |

| ||

| Barbara Thomas |

||||||||

| Board |

|

7 of 7 |

|

|

100% |

| ||

| Corporate governance |

|

4 of 4 |

|

|

100% |

| ||

| Human resources |

|

6 of 6 |

|

|

100% |

| ||

| Our director compensation program is designed to attract and retain qualified individuals while aligning the interests of our directors and shareholders.

Annually, the corporate governance committee conducts an extensive review of director compensation against our Canadian bank and insurance company peer group (our comparator groups for executive compensation purposes) as well as several large-capitalization companies in the TSX 60 Index (including BCE, Canadian Tire, CN Rail, Magna, Suncor and TC Energy). The committee also considers trends and compensation structures at other comparable international financial institutions.

The committee reviews director compensation every year to make sure our program is appropriate so we can continue to retain and attract qualified professionals to our board and in terms of shareholder value given the risks, responsibilities, time commitment, work load, complexity of issues and decision-making, and the skills required of the board. |

Our director fee

Directors are

|

| Management proxy circular | 19 |

Table of Contents

The table below shows our fee schedule for fiscal 2019. The Chairman’s retainer is higher and committee chairs receive a chair retainer, to recognize their additional responsibilities in these leadership roles.

| Annual board retainers |

||||

| Chairman ($170,000 must be taken in common shares or DDSUs) |

$ |

450,000 |

| |

| All other directors ($145,000 must be taken in common shares or DDSUs) |

$ |

225,000 |

| |

| Annual committee chair retainers |

||||

| audit and conduct review | human resources | risk |

$ |

50,000 |

| |

| corporate governance |

$ |

35,000 |

| |

| Travel fee |

||||

| Directors whose principal residence is 300km or more from Toronto or outside of Canada |

$ |

10,000 |

|

In addition, directors are reimbursed for travel and other expenses they incur when they attend meetings or conduct bank business.

There are no changes to the fee schedule for fiscal 2020.

2019 DIRECTOR COMPENSATION TABLE

The table below shows the fees paid to directors in fiscal 2019. As President and CEO of the bank, Mr. Porter does not receive fees for serving as a director.

| Retainers | Total fees earned ($) |

Portion of total bank |

All other compensation ($) |

Total ($) |

||||||||||||||||||||||||||||

| Name | Board ($) |

Committee ($) |

Non-executive Chairman ($) |

Travel ($) |

||||||||||||||||||||||||||||

| N. Aufreiter 1 |

|

225,000 |

|

|

19,639 |

|

|

– |

|

|

– |

|

|

244,639 |

|

|

100 |

|

|

– |

|

|

244,639 |

| ||||||||

| G. Babatz 2 |

|

225,000 |

|

|

– |

|

|

– |

|

|

10,000 |

|

|

235,000 |

|

|

62 |

|

|

181,419 |

|

|

416,419 |

| ||||||||

| S. Bonham |

|

225,000 |

|

|

– |

|

|

– |

|

|

10,000 |

|

|

235,000 |

|

|

100 |

|

|

– |

|

|

235,000 |

| ||||||||

| C. Dallara 3 |

|

225,000 |

|

|

– |

|

|

– |

|

|

10,000 |

|

|

235,000 |

|

|

62 |

|

|

158,040 |

|

|

393,040 |

| ||||||||

| T. Macklem 4 |

|

225,000 |

|

|

50,000 |

|

|

– |

|

|

– |

|

|

275,000 |

|

|

100 |

|

|

184,380 |

|

|

459,380 |

| ||||||||

| T. O’Neill 5 |

|

– |

|

|

– |

|

|

198,750 |

|

|

– |

|

|

198,750 |

|

|

100 |

|

|

10,000 |

|

|

208,750 |

| ||||||||

| E. Pacheco 6 |

|

98,750 |

|

|

– |

|

|

– |

|

|

4,389 |

|

|

103,139 |

|

|

100 |

|

|

1,324,342 |

|

|

1,427,481 |

| ||||||||

| M. Penner |

|

225,000 |

|

|

– |

|

|

– |

|

|

10,000 |

|

|

235,000 |

|

|

100 |

|

|

– |

|

|

235,000 |

| ||||||||

| U. Power |

|

225,000 |

|

|

50,000 |

|

|

– |

|

|

10,000 |

|

|

285,000 |

|

|

100 |

|

|

– |

|

|

285,000 |

| ||||||||

| A. Regent 7 |

|

98,750 |

|

|

21,944 |

|

|

252,500 |

|

|

– |

|

|

373,194 |

|

|

100 |

|

|

– |

|

|

373,194 |

| ||||||||

| I. Samarasekera |

|

225,000 |

|

|

– |

|

|

– |

|

|

10,000 |

|

|

235,000 |

|

|

62 |

|

|

– |

|

|

235,000 |

| ||||||||

| S. Segal 8 |

|

225,000 |

|

|

15,361 |

|

|

– |

|

|

10,000 |

|

|

250,361 |

|

|

100 |

|

|

184,380 |

|

|

434,741 |

| ||||||||

| B. Thomas 9 |

|

146,875 |

|

|

– |

|

|

– |

|

|

6,528 |

|

|

153,403 |

|

|

100 |

|

|

5,000 |

|

|

158,403 |

| ||||||||

| S. Thomson 10 |

|

225,000 |

|

|

28,056 |

|

|

– |

|

|

10,000 |

|

|

263,056 |

|

|

100 |

|

|

– |

|

|

263,056 |

| ||||||||

| B. Warmbold |

|

225,000 |

|

|

– |

|

|

– |

|

|

– |

|

|

225,000 |

|

|

100 |

|

|

– |

|

|

225,000 |

| ||||||||

|

TOTAL |

|

2,819,375 |

|

|

185,000 |

|

|

451,250 |

|

|

90,917 |

|

|

3,546,542 |

|

|

2,047,561 |

|

|

5,594,103 |

| |||||||||||

| 20 | Scotiabank |

Table of Contents

ABOUT THE MEETING

| We believe it is important for our directors to have a significant stake in the bank and to align their interests with those of other shareholders. Equity ownership is looked at on a regular basis.

Our director equity ownership requirements are made up of three parts:

|

We have robust equity holding requirements.

All directors exceed the requirement to hold at least 1,000 common shares in the bank.

All directors exceed our equity holding requirements except Ms. Warmbold who joined in October 2018, and therefore, has five years from the date of her appointment to meet or exceed the requirements.

As President and CEO, Mr. Porter has an equity ownership requirement of 8x his base salary and he exceeds this requirement, holding 24x his base.

|

|

||||||||||

| Requirement | Directors | Chairman | ||||||||||

|

Required holdings in common shares and/or DDSUs to be met within five years of joining board and maintained while serving on board |

$725,000 (5x equity portion of annual retainer)

|

$850,000 (5x equity portion of annual retainer) |

||||||||||

|

Common share holding requirement to be met within six months of joining board |

1,000 | |||||||||||

|

Portion of annual board retainer paid in either DDSUs or bank common shares (by participating in the directors’ share purchase plan), even after equity ownership requirements have been met |

$145,000 | $170,000 | ||||||||||

|

All of the directors currently receive the equity portion of their retainer in DDSUs, which are only redeemable after they leave the board. Directors do not participate in the bank’s pension plans or any other compensation plans. We do not grant stock options to directors.

Director prohibitions against monetizing or hedging

Directors are not allowed to monetize or hedge their economic interest in Scotiabank securities. DDSUs are not transferable, and the use of short sales, calls or puts on the bank’s securities is prohibited under the Bank Act. |

||||||||||||

|

About DDSUs

DDSUs are notional units that have the same value as our common shares, and therefore have the same upside and downside risk.

Directors can redeem their DDSUs for cash only after they leave the board. Their redemption value is equal to the market value of our common shares at the time of redemption.

DDSUs earn dividend equivalents at the same rate as dividends are paid on our common shares, but do not give the holder voting or other shareholder rights.

|

| Management proxy circular | 21 |

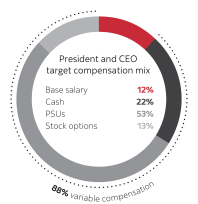

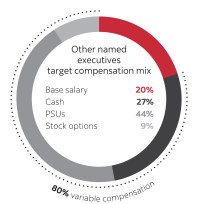

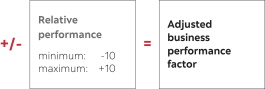

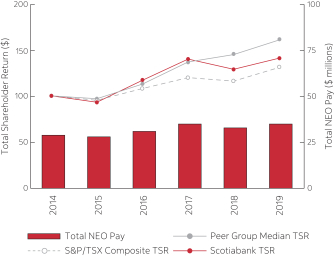

Table of Contents

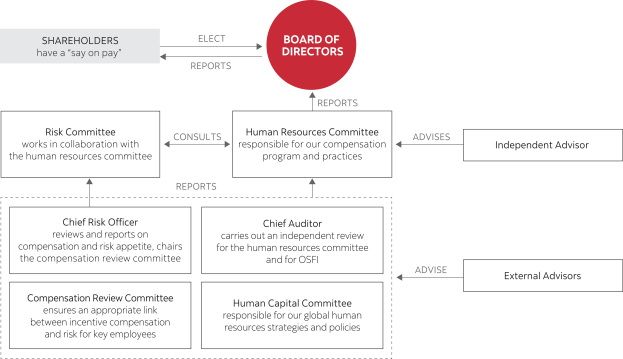

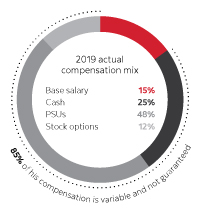

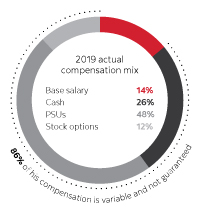

We are committed to constructive and open dialogue and engage with shareholders and investor groups throughout the year on a variety of issues, including the bank’s financial performance and business strategy, our approach to and policies on corporate governance, and our statements and strategies related to environmental and social impacts.