Form 6-K Alio Gold Inc. For: Jun 12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2017

Commission File Number 001-35329

Alio Gold Inc.

(Translation of registrant’s name into English)

700 West Pender Street, Suite 615, Vancouver, British

Columbia V6C 1G8

(Address of principal executive

offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ ] Form 40-F [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ALIO GOLD INC. | ||

| Date: June 12, 2017 | By: | (signed) Greg McCunn |

| Greg McCunn | ||

| Chief Executive Officer |

EXHIBIT INDEX

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

DATE AND SIGNATURES PAGE

This report is dated effective 16 May 2017. See Appendix A, Pre-Feasibility Contributors and Professional Qualifications, for certificates of qualified persons. These certificates are considered the date and signature of this report in accordance with Form 43-101F1.

|

i |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

ANA PAULA PROJECT

FORM 43-101F1 TECHNICAL REPORT

PRELIMINARY FEASIBILITY STUDY

TABLE OF CONTENTS

|

ii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

iii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

iv |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

v |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

vi |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

vii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

viii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

ix |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

x |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

LIST OF FIGURES AND ILLUSTRATIONS

|

xi |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xiii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xiv |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

LIST OF TABLES

|

xv |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xvi |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xvii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xviii |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

xix |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

LIST OF APPENDICES

| APPENDIX | DESCRIPTION |

| A | Pre-Feasibility Study Contributors and Professional Qualifications |

| • Certificate of Qualified Person (“QP”) |

|

xx |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

1 SUMMARY

Alio Gold, Inc. (Alio Gold) has completed a preliminary feasibility study (PFS) of its wholly owned Ana Paula Project (“Ana Paula” or “the Project”), which is a gold resource development project located in the Guerrero Gold Belt in Guerrero, Mexico. This amended report replaces and supersedes the previous PFS for the Ana Paula Project in its entirety. The previous PFS was filed on the SEDAR website on May 26, 2017 and had an effective date of May 16, 2017. The highlights of the PFS include the following:

-

Proven & Probable Mineral Reserves of 13.4 million tonnes at 2.36 grams of gold per tonne for 1,021,000 contained ounces of gold

-

NPV5% = $223 million and IRR of 34% after taxes at $1,250 per ounce of gold

-

Initial Capital Cost of $137.2 million

-

First quartile operating costs with cash costs of $489 per ounce of gold and site All-in Sustaining Costs of $524 per ounce of gold

-

Gold recovery of 85%

-

Mine life of 7.5 years from an open pit producing 868,000 ounces of gold

-

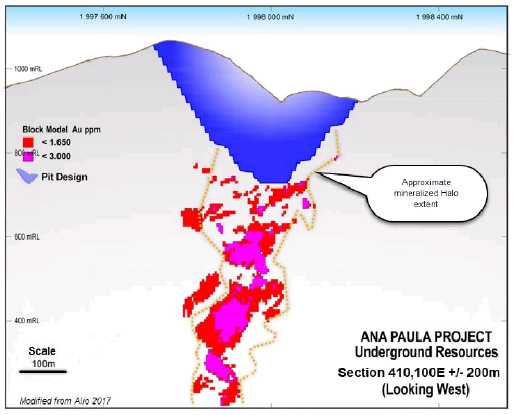

Underground potential highlighted with Measured & Indicated Resources below the proposed pit of 3.0 million tonnes at 2.8 grams of gold per tonne for 266,700 contained ounces

-

Feasibility Study to start in July and take approximately 9 months to complete

1.1 INTRODUCTION

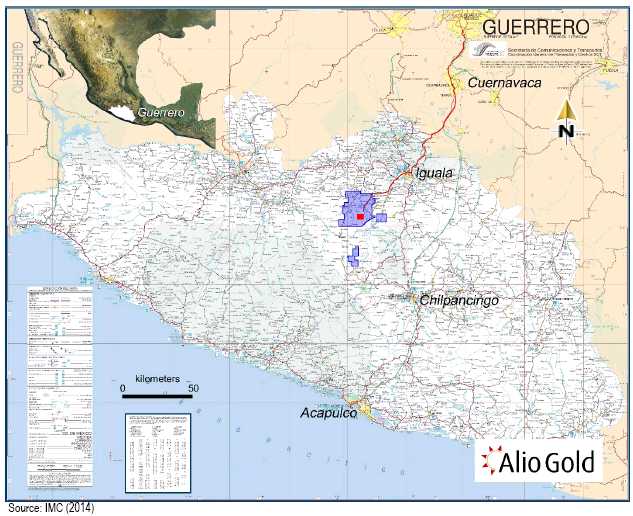

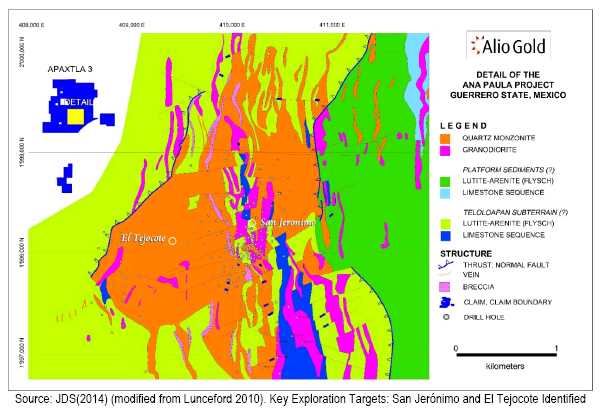

M3 Engineering & Technology Corp. (M3) was commissioned by Alio Gold Inc. to carry out a preliminary feasibility study (PFS) pursuant to Canadian Securities Administrators’ National Instrument 43-101 and Form 43-101F1 standards (collectively, “NI 43-101”) of the Ana Paula Project which is a gold resource development project located in Guerrero State, Mexico. The Project encompasses several gold occurrences within an exploration concession covering an area of more than 600 km2.

1.2 PROPERTY DESCRIPTION AND LOCATION

The Ana Paula Project is located in the north central part of the State of Guerrero in southern Mexico, roughly half way between the major cities of Mexico City and the Port of Acapulco. The Project centroid is located at UTM Q14N, WGS84, 409,027.8E and 1,997,632.6N or 99° 51’ 34.4 west longitude and 18° 3’ 55.2” north latitude near the municipality of Cuetzala del Progresos and Apaxtla del Castregon. The Project lies within the Sierra Madre mountain range where topography can range from moderate to rugged with elevations varying from 900 to over 1,460 meters above sea level (masl). The Balsas River, which divides the Sierra Madre Mountains into north and south ranges, flows just south of the project area.

The climate in the region is warm and humid, with temperatures ranging from 17º to 45º Celsius (ºC). Precipitation averages at 835 millimeters (mm) per year, mostly occurring between June and October during the monsoonal season, which is influenced by hurricanes from both the Atlantic and Pacific oceans. According to Mexican regulation NOM-141 SEMARNAT-2003, the Ana Paula site falls under seismic region C, where seismic events are common.

Alio Gold

(then Timmins Gold Corp.), acquired Newstrike Capital Inc. in an arrangement

that closed on May 26th, 2015. With the arrangement, Timmins Gold acquired

ownership of all of the issued and outstanding common shares of Newstrike

Capital Inc. its Canadian subsidiary Aurea Mining Inc. and its Mexican

subsidiary Minera Aurea S.A. de CV.

|

1 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

The Ana Paula Project area is contained within two concessions, Aplaxta 3 and Tembo, which total 4,238 hectares (ha). The concessions are owned by Alio Gold’s Mexican subsidiary Minera Aurea S.A. de CV (Minera Aurea). In addition to the Aplaxta 3 and Tembo concessions Minera Aurea holds eleven concessions surrounding the Ana Paula Project totaling 46,278 ha that form the Aurea Norte Property and two non-contiguous concessions totaling 4,293 ha which form the Aurea Sur Property.

Alio Gold, through its Mexican operating subsidiary Minera Aurea, entered an agreement to acquire a 100% interest in certain mineral rights and concessions from Desarrollos Mineros San Luis, S.A. de C.V. and Minera San Luis S.A. de C.V., wholly owned Mexican subsidiaries of Goldcorp Inc. for CAD 2.1 Million in cash and shares. In addition, the Company granted Goldcorp a three percent net smelter return (NSR) royalty. Alio Gold will have the right to purchase one third of the Goldcorp royalty upon completion of an NI 43-101 feasibility study.

As of May 15, 2017, Minera Aurea controls surface rights to 2,442 hectares overlying and surrounding the Ana Paula Project area, where 1,283 hectares are owned outright and approximately 154 hectares are under contract in 30-year access agreements. An additional 1,005 hectares are under exploration access agreements. Negotiations regarding surface rights agreements for the remaining land required for the Ana Paula Project are ongoing with the landowners and the communities.

1.3 GEOLOGY AND MINERALIZATION

Mineralization in the Guerrero Gold Belt (GGB) is characterized as a skarn porphyry mineralization related to an early Tertiary intrusive event. Ana Paula is located along the northwesterly trend of the GGB where it straddles a boundary between two older tectonic sub-terranes; a volcanic-volcaniclastic arc assemblage to the west and a thick carbonate platform sequence overlain by younger marine deposits to the east.

The stratigraphy of both sub-terranes was deformed during the compressive Laramide orogeny and subsequently intruded by a ±62-66 million year calc-alkali magmatic event that is currently thought to be associated with the timing of mineralization responsible for the gold deposits and showings of the GGB.

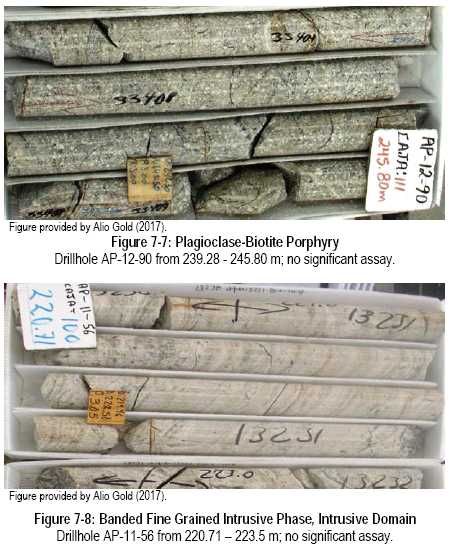

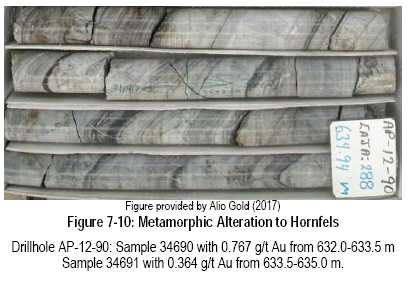

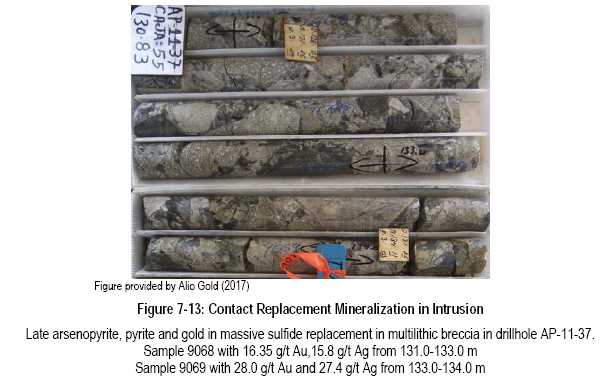

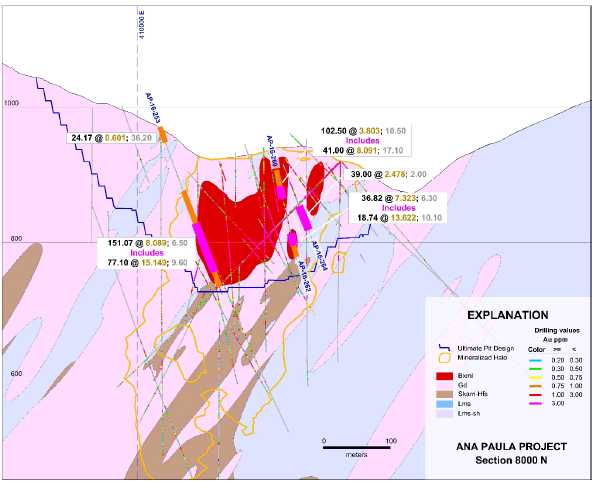

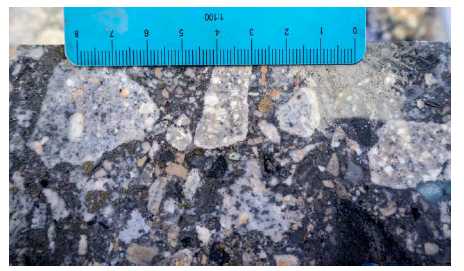

The geologic units underlying the Ana Paula project are primarily sedimentary rocks composed of an interbedded limestone and shale unit and a carbonaceous limestone unit that have been intruded by intermediate sills, dikes and stocks. Six principal geological domains within Ana Paula Deposit have been recognized: (1) Complex Breccia domain that sits in the core of the main Ana Paula deposit is a steeply dipping sub-vertical plug stretched gently in an east-west direction and dipping to south. (2) Intrusive suite domain is a package of several different intrusive phases that in a general sense appear to be similar in composition and age. (3) Monolithic breccia domain is essentially a brecciated intrusion composed of mostly monolithic fragments in a silica rich matrix with mixed sulphide-oxide mineralogy. It is located in the southern part of the deposit. (4) Sediments domain is characterized by light brown weathering, platy outcrops, with distinct gray and brown limestone beds which range from a few centimeters to as much as 25 centimeters thick. Also a massive to thin bedded laminated carbonaceous limestone is present in this domain. The sediments domain is located in the eastern part of the deposit. (5) Skarn-Hornfels domain is found in the deeper zones of the deposits and shows a down dip zonation from unaltered sedimentary limestone-shale to skarn-hornfels metamorphic rock. (6) Semi-massive sulphide domain is very localized and narrow, and it develops at the contacts between the skarn-hornfels domain and the intrusive suite domain.

In general, four gold depositional settings are recognized at Ana Paula, including:

| 1. |

Quartz-sulphide and quartz-carbonate-sulphide veinlets, stockworks with sulphide clots and disseminations in both intrusions and hornfels. | |

| 2. |

Narrow semi-massive sulphide contact replacement of limestone or hornfels/skarn at the intrusion contacts. |

|

2 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

| 3. |

Sulphide clots, rims and masses in narrow contact replacement of breccia hosted in intrusions at or near the sedimentary contacts and/or fault contacts (detachment faults). | |

| 4. |

Associated with a sulphide constituent within breccia matrix and with sulphide replacement textures within structurally controlled breccia formed oblique to the dominant northerly trending westerly dipping stratigraphy. |

The veinlets, stockwork, clots and disseminated mineralization, along with the contact replacement textures (settings 1, 2 and 3 above) are commonly observed contained within the intrusive and sediments domains that collectively make up a corridor of structurally controlled northerly trending and westerly dipping marine sediment and intrusive sill/dike stratigraphy that is host to a lower grade mineralization.

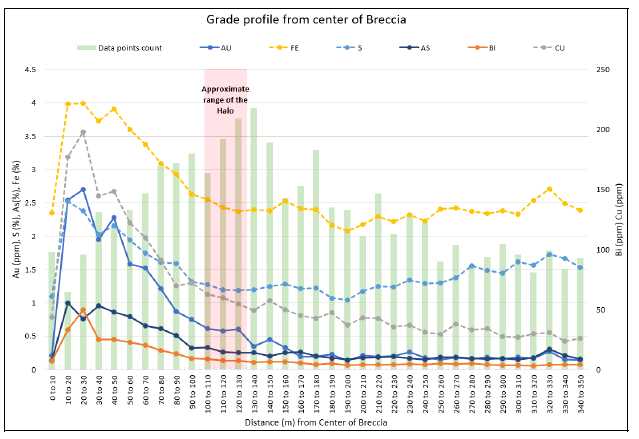

The bulk of the high-grade mineralization at Ana Paula occurs in the Complex Breccia domain. This lithological unit consists of a core of multi-lithic breccia in a steeply south plunging column surrounded by an alteration halo bearing high grade mineralization which is characterized by veins, fracture zones, and massive sulfide contact replacements. The vertical extent of the Complex Breccia has been modelled to a depth of 950 m below surface and it is currently limited by drilling. Horizontally, the high-grade mineralization extends between 200 m to 250 m away from the center of the Complex Breccia near surface. The horizontal extent gradually reduces at depth, down to between 20 m to 30 m at the lower extremity of the Breccia. Mineralization is continuous, and grade tends to be highest from the center of the complex breccia and extend into the sediments, intrusive, and hornfels lithology. Outside the halo, the mineralization is lower grade and occurs in stockwork, with sulphide clots and disseminations mainly in hornfeld and intrusive.

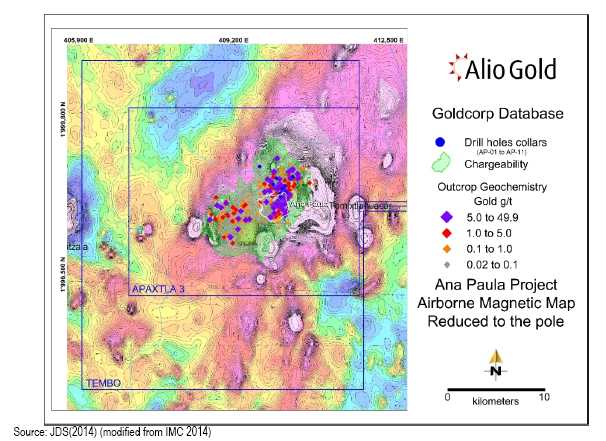

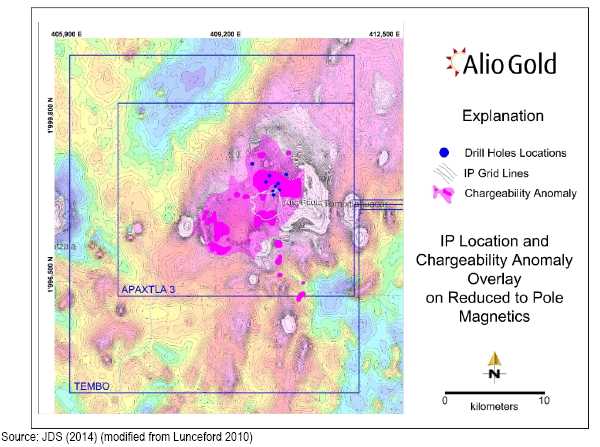

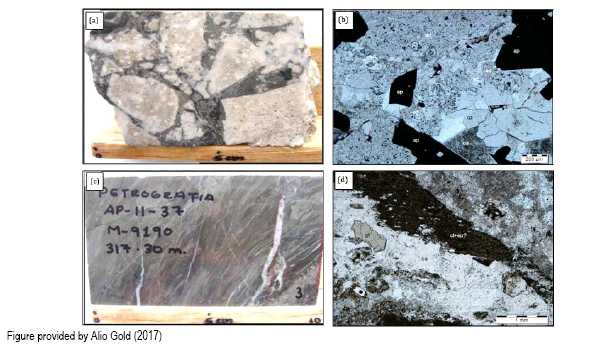

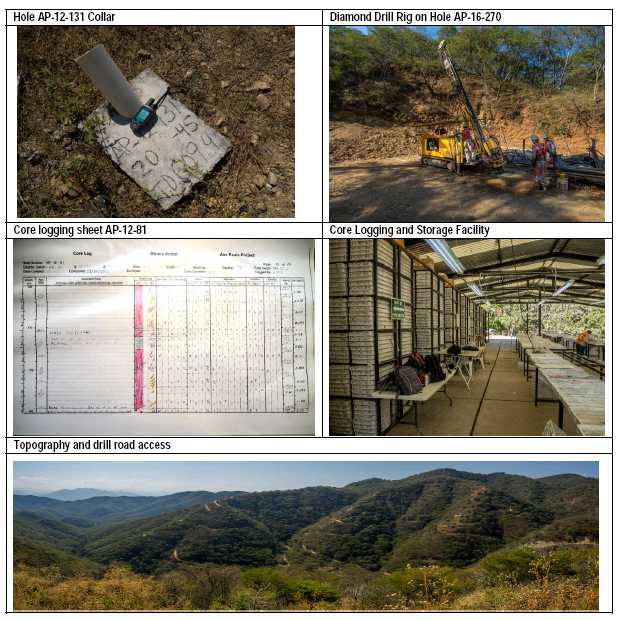

1.4 EXPLORATION AND DRILLING

Active exploration of the Ana Paula project began in 2005 and has taken place continuously since 2010. Exploration activities include surface mapping and sampling, geophysical surveys, and drilling. Surface mapping and sampling has been thorough and ongoing. Outcrop and road cut locations are registered on handheld GPS (WGS84 datum) and recorded along with lithologic, structure, mineralization, alteration and other relevant details on field map sheets of the same 1:2000 scale that are then transferred first by hand then digitally to the final map sheets. Geophysical surveys of the area have included aeromagnetics, airborne radiometrics (K, Th, U), induced polarization (IP), and an airborne Z-axis tipper electromagnetic (ZTEM) survey.

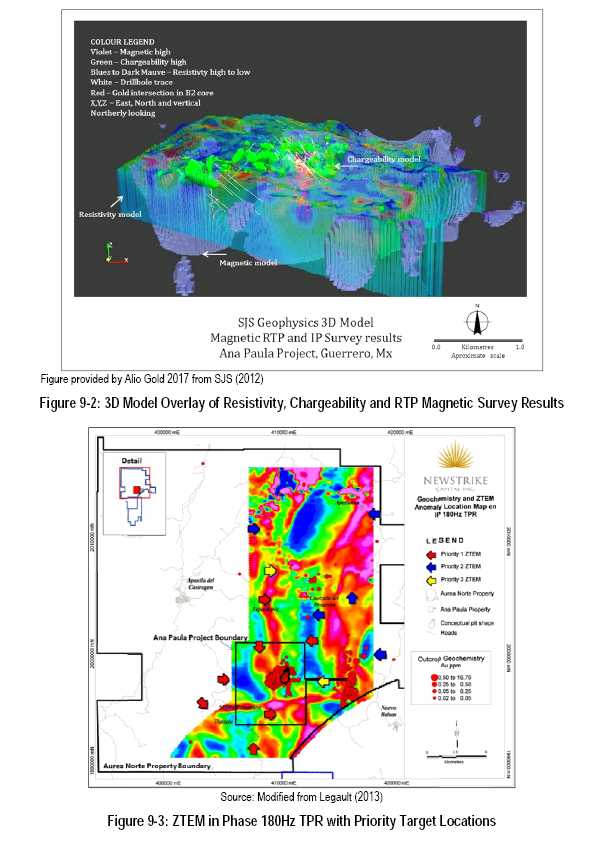

Upon acquiring the property in 2015, Alio Gold carried out an extensive review of the data delivered by Newstrike including field review of the existing geological maps by Alio Gold personnel and re-logging of 113 drill holes located in the vicinity of the pit design area and extending below the pit design. A total of 49,968.89 meters of core were re-logged by Alio Gold to provide detailed information across the entire mineralization system and unified lithological, structural and mineralized criteria with the goal to improve support for the geological model.

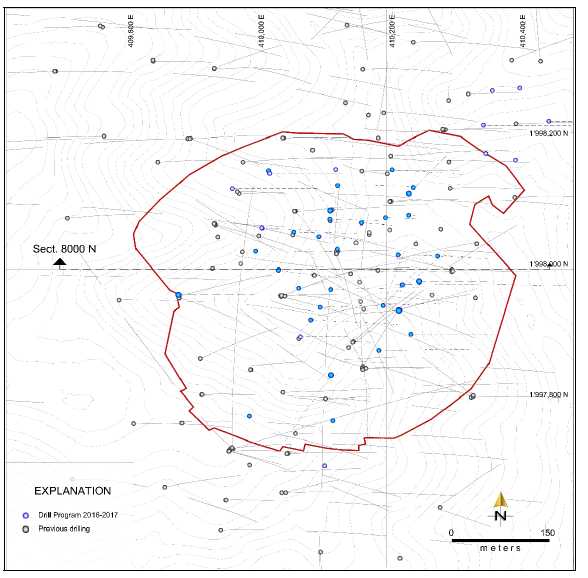

The primary means of exploration has been by core drilling from the surface. Drilling began with Goldcorp in 2005, continued with Newstrike 2010-2015, and continues with Alio Gold to the present. Table 1-1 shows the drilling.

Table 1-1: Drill Hole Summary by Year and Company

| Year | Company | Number of holes | Total length |

| 2005 | Goldcorp | 11 | 3,689.25 |

| 2010 | Newstrike | 12 | 5,227.02 |

| 2011 | Newstrike | 57 | 29,697.26 |

| 2012 | Newstrike | 72 | 41,260.24 |

| 2013 | Newstrike | 78 | 33,925.25 |

| 2014 | Newstrike | 2 | 1,517.90 |

| 2015 | Alio | 10 | 2,008.05 |

| 2016 | Alio | 31 | 7,304.07 |

| 2017 | Alio | 12 | 2,539.10 |

|

3 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

The average drill hole spacing is approximately 50 m in the main part of the Ana Paula deposit, with a range of from 20-50 m in the high-grade Breccia Zone and 50-150 m to the north and south pit extremities.

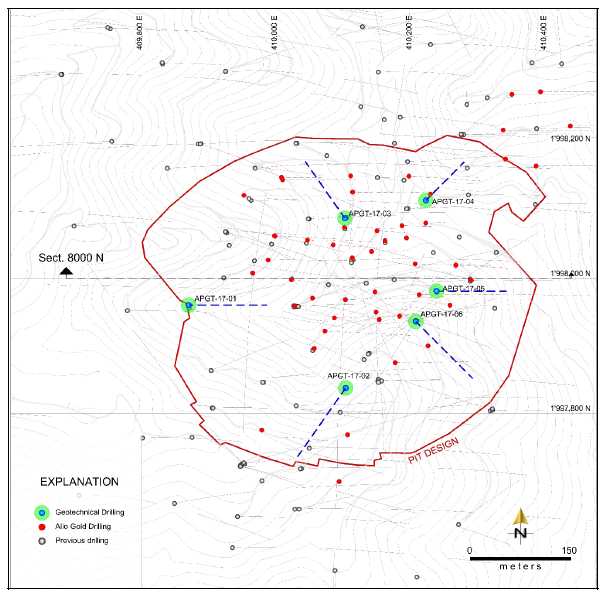

Drilling by Alio at the Ana Paula property consisted of a program in 2015 with two components: confirmation drilling and infill drilling. The 2015 program was followed by a major program in 2016-17 consisting of three main components: infill drilling, geotechnical drilling, and condemnation drilling.

The 2015 confirmation drilling consisted of a total of 606 m of core in three twinned drill holes. The results from the confirmation drilling were consistent with those from previous programs. The infill drilling consisted of 1,403 m of core from seven drill holes. All drilling was completed with HQ (63.5/93.5 mm) diameter diamond drill core rods.

The infill drilling results were very encouraging, as they continued to display Ana Paula’s high-grade gold mineralization and allowed for a greater understanding of the deposit.

The 2016-2017 infill drilling consisted of approximately 9,663 m of core in 37 holes. The infill drilling program significantly increased the delineation of the high-grade breccia zone and the mineralization halo surrounding the high-grade breccia.

1.5 METALLURGY

A series of metallurgical test programs were conducted on Ana Paula material in support of this study. New composites were selected by Alio Gold personnel to be representative of the main lithological domains: intrusive suite (granodiorite, GD); complex breccia (high-grade breccia, HGB); sediments + skarn-hornfels mix (LS); monolithic breccia (low-grade breccia, LGB). These composites were subjected to a variety of metallurgical tests including comminution testing, gravity concentration, whole ore flotation, whole ore cyanidation and pre-oxidation.

1.5.1 Comminution Tests

Comminution results suggest that Ana Paula material is moderately hard to hard. Comminution testwork consisted of JK RBT Lite tests, Bond Ball Work Index Tests, SMC tests and Abrasion index tests. Results are presented in Table 1-2. The SMC results indicate the material is somewhat harder than that suggested by the JK RBT Lite work. The SMC results therefore represent a more conservative approach to grinding circuit design. Abrasion testing results indicate that the Ana Paula material is mildly abrasive and that mill liner wear will not be extreme.

Table 1-2: Comminution Test Results

| Domain Composite | JK RBT Lite Unscaled

Parameter (A x b) |

SMC Results (Axb) | BWI (kWh/t) | Abrasion Index (Ai)

|

| Granodiorite (GD) | 43.3 | 34.8 | 19.4 | 0.189 |

| 0.203 | ||||

| High Grade Breccia (HGB) | 44.0 | 33.3 | 16.0 | 0.194 |

| Limestone Shale (LS) | 39.6 | N/A | 15.1 | 0.078 |

| Low Grade Breccia (LGB) | 55.6 | N/A | 16.2 | 0.081 |

1.5.2 Flotation Tests

A comprehensive flotation testwork program was completed on the three predominant domains (GD, LGB, and LS). The study evaluated the impacts of primary grind size, reagent scheme, pH, retention time, and pulp density. The following outcomes are summarized from this study.

- Gold recoveries ranged from 93% for LS to 96% for GD and HGB.

|

4 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

-

Primary grinds ranging from 75 to 160 micrometers (µm) were evaluated. The primary grind size had no impact on final flotation recoveries so the coarsest primary grind, 80% passing (P80) 160 µm, was selected for the process design criteria.

-

All composites required the addition of copper sulphate for pyrite and arsenopyrite activation. Copper sulphate was added at the rate of 100 grams per tonne of material (g/t).

-

Potassium Amyl Xanthate (PAX) was added as the primary sulphide mineral collector. Optimum dosage rates ranged from 60 to 110 g/t. PAX was necessary to ensure maximum gold recovery. Tests conducted with alternate primary collectors resulted in lower overall recovery.

-

3418A was added to the GD and HGB composites as a secondary collector. Highest recoveries were noted when dosage rates ranged from 40 to 50 g/t.

-

F-131A was identified as the preferred frother. Optimum dosages ranged from 64 to 128 g/t.

1.5.3 Gravity Gold Recovery

Ana Paula material responded well to gravity concentration. Extended Gravity Recoverable Gold (EGRG) tests were conducted on each domain composite. These tests are conducted with successively finer grind sizes culminating with a final grind of 80% passing 75 µm. Anticipated gravity circuit performance is dictated by grinding and gravity circuit design. Given that the primary grind size required for adequate flotation was 160 µm one may expect that gold recovery to gravity concentrate will be somewhat less than that reported by the EGRG results. Modelling of the gravity circuit was conducted by FLSmidth-Knelson and suggests that the average life-of-mine recovery of gold to the gravity concentrate will be approximately 20% at a P80 grind size of 160 µm, assuming the treatment of a 36% circulating load through the gravity circuit.

1.5.4 Whole Ore Cyanidation

A comprehensive set of whole ore cyanidation tests were conducted on the three main domain composites (GD, HGB and LS). This test program evaluated the effects of primary grind size, cyanide concentration, lead nitrate addition, dissolved oxygen content, pre-aeration, and residence time. Leach recoveries ranged from 59% to 70% for GD, 62% to 68% for HGB and 6% to 50% for LS. Preg-robbing carbonaceous material identified in the LS composite was used to explain the low gold recoveries in initial testing. LS recoveries improved to the mid- to high-40% range through the addition of activated carbon. The impact of this carbon addition is illustrated in Figure 1-1.

Figure 1-1: Effect of Carbon Addition during Whole Ore Cyanidation

|

5 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Ana Paula’s material was largely insensitive to primary grind size, residence time, cyanide concentration, lead nitrate addition and preaeration. The whole ore leach tests underscore the fact that gold recovery is limited by the refractory gold content in the material.

1.5.5 Pre-Oxidation Tests

The primary sulphide minerals at Ana Paula, pyrite and arsenopyrite, were both identified as being carriers of refractory gold. Increasing overall gold recovery requires breaking down the crystal structure of the sulphides by oxidation to make the gold available to the cyanide solution. Pressure oxidation and atmospheric oxidation were evaluated and compared to select the preferred process for recovery of the refractory gold.

Acidic pressure oxidation of both whole ore and flotation concentrates displayed overall gold recoveries in excess of 95%. Sulphide oxidation in these tests ranged from 96% to 98%. Due to the amount of acid consuming carbonate present in Ana Paula material, an alkaline pressure oxidation test was conducted, but alkaline oxidation up 50% less complete and gold recovery was limited to 75%.

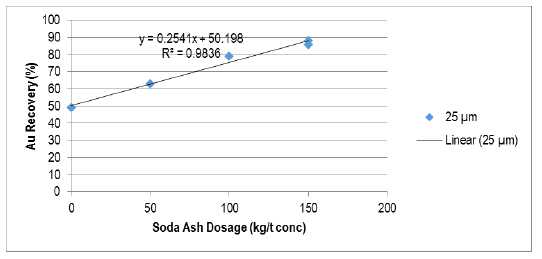

An atmospheric oxidation process was tested at ambient pressure and temperature of 75ºC in open tanks with a sodium based neutralizing agent. An initial screening program highlighted that overall gold recovery from the atmospheric oxidation process would yield an average overall gold recovery of approximately 85% to 86% using soda ash as the neutralizing agent. M3 Engineering completed a trade-off study comparing pressure oxidation of flotation concentrates to atmospheric oxidation of flotation concentrates. The higher capital cost, and additional technical complexity of pressure oxidation did not support the added recovery benefit. The atmospheric oxidation flowsheet was selected for further optimization.

Additional atmospheric oxidation testwork was focused on determining the optimum soda ash addition rates, verifying the concentrate regrind size and studying the effect of residence time on sulphide oxidation and gold recovery. A preliminary evaluation of domain specific oxidation tests was also carried out.

Soda ash addition had a direct relationship to gold recovery. This is highlighted in Figure 1-2 below. In the sample tested, which had a sulphur grade of 9.9%, 150 kg/t was sufficient to maintain a pH at the discharge of the oxidation test of approximately 7, suggesting that this dosage is sufficient to neutralize the acid produced. When lower soda ash dosages were applied, the pH within the oxidation circuit dropped below 7 for periods of time, and lower gold recoveries were noted. Carbonate, likely calcite, present in the flotation concentrate will dissolve in acidic conditions. The free calcium ions it will release likely precipitate as gypsum in the sulphate rich environment. This gypsum precipitate coats the sulphide particles resulting in their passivation and reducing the overall sulphide oxidation and gold recovery.

Figure 1-2: Relationship of Soda Ash Dosage and Gold Leach

Recovery of Gravity Tail/Flotation

Concentrates (25µm regrind size)

|

6 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

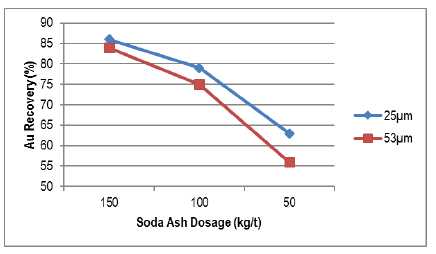

The impact of regrinding was tested at three soda ash addition levels. Other parameters, such as temperature and residence time were held constant. Finer regrind size yielded higher overall gold recoveries. This influence is stronger at lower soda ash dosages, possibly due to the passivating influence of insufficient soda ash, as shown in Figure 1-3.

Figure 1-3: Effect of Regrind Size on Gold Leach Recovery of Gravity Tail/Flotation Concentrates

Oxidation kinetics are relatively quick. An oxidation versus recovery profile was generated using the standard 150 kg/t soda ash dosage, with temperature and regrind size held constant at 75°C and 25µm respectively. Gold recovery was measured from carbon-in-leach bottle rolls that were conducted on samples that had been oxidized for 8, 24, 48 and 72 hours. Gold recovery increased from 83% after 8 hours of oxidation to 88% after 48 hours. No additional recovery was recorded from the 72-hour residence time, indicating that 48 hours of retention time is sufficient.

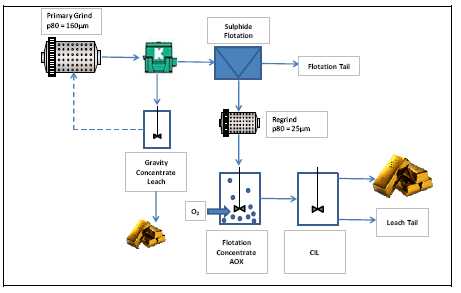

1.5.6 Overall Metallurgical Flowsheet

Based on the testwork described above the Ana Paula process flowsheet includes the following:

-

Primary grinding to 80% passing 160 µm

-

Gravity concentration

-

Intensive Leaching of Gravity Concentrates

-

Flotation

-

Regrinding of flotation concentrates to 80% passing 25µm

-

Atmospheric Oxidation of flotation concentrates

-

Carbon-in-Leach

-

Carbon Elution

-

Gold Electrowinning and smelting

Approximately 20% of the gold is expected to be recovered in the gravity circuit. The remainder of the ground material will feed a flotation plant where approximately 20% of the mass and 95% of the remaining gold will be recovered to concentrate. This concentrate is reground to 80% passing 25µm prior to being treated through the atmospheric oxidation circuit. Soda ash will be added to maintain the oxidation pH above 7. Following oxidation, the pH will be adjusted to 10.5 with lime, prior to the addition of cyanide in a Carbon-in-Leach (CIL) circuit. Gold will be recovered from loaded carbon through a standard elution process. This flowsheet is expected to yield an average overall gold recovery of 85%.

|

7 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

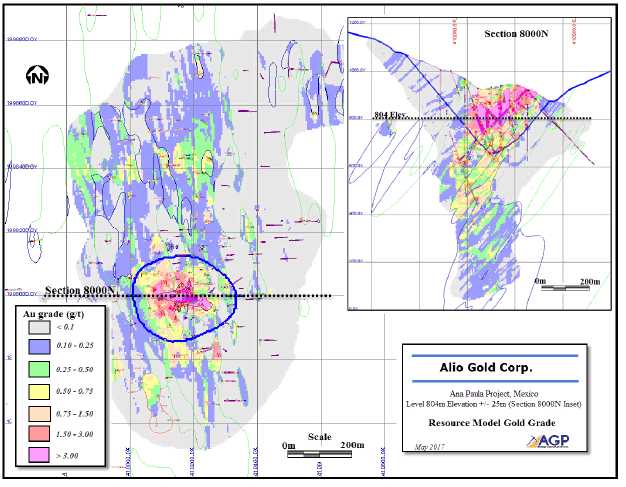

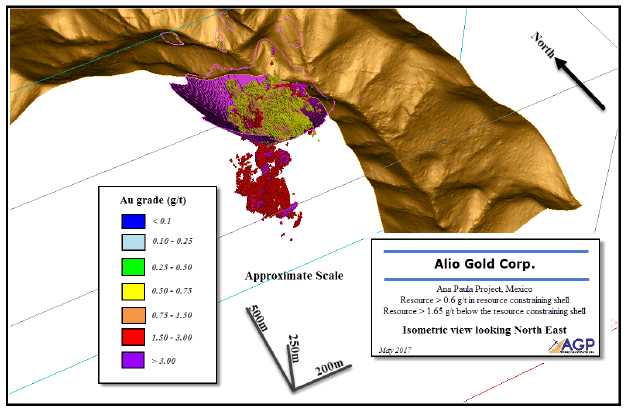

1.6 MINERAL RESOURCE ESTIMATE

The Ana Paula updated Mineral Resource Estimate (MRE) was developed in conformance with the CIM Mineral Resource definitions referred to in the NI 43-101 Standards of Disclosure for Mineral Projects. This mineral resource estimate is an update of the May 26, 2016 estimate completed by JDS Energy and Mining Inc. for the Ana Paula project.

The estimate was completed based on the concept of a small to medium scale open pit, with a possible resource for an underground operation for the material remaining below the pit bottom.

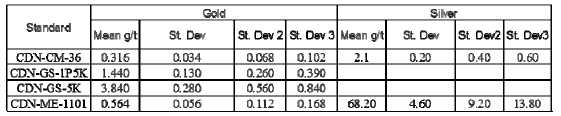

The Ana Paula drill database was thoroughly validated prior to the resource estimate and was found to be error free. All drill core samples were analyzed at internationally recognized and accredited laboratories which were independent from the company. Core handling, chain of custody, quality control and quality assurance were found to adhere to industry best practice.

The Ana Paula grade models were interpolated using 276 core holes completed by Goldcorp in 2005, Newstrike Capital from 2010 through 2015, and Alio Gold since 2015. The database totaled 123,268 m of core and contained 86,013 assays.

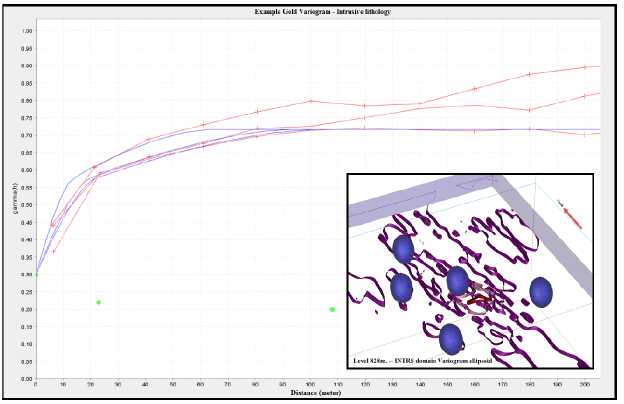

The 3D wireframes developed to control the grade interpolation of the resource model were based primarily on lithology with a probabilistic approach used for the high-grade mineralized halo and the high-grade zones in the lithologies outside the halo. The deposit has been modeled using an Ordinary Krige applied to 3 m gold and silver drill hole composite lengths which respected lithology units.

Densities were determined from a suite of 5,946 representative core samples using industry standard methods. The density was then interpolated in areas where the data was sufficiently abundant to honor localized variations. For the remaining areas, the average density for each of the lithological domains was applied.

The block model matrix size of 5 m x 5 m x 6 m (width x length x height) was selected in consultation with the engineering team from AGP, and was based on the size deemed suitable for a small to moderate open pit mining scenario with possible underground mining components below the pit.

The interpolation was carried out in multiple passes with increasing search ellipsoid dimensions. The classification was based primarily on the pass number and the average distance to the composites, followed by an adjustment based on diamond drilling density (core area), and the krige efficiency.

Under CIM definitions, Mineral Resources should have a reasonable prospect of economic extraction. A gold price of $1,350/ounce and a silver price of $17/ounce was used for the cut-off determination. For open pit resources, a cut-off of 0.6 g/t gold was used.

To further assess reasonable prospects of economic extraction, a Lerchs-Grossman optimized shell was generated to constrain the potential open pit material. Parameters used to generate this shell included:

-

49.5° overall slopes for the pit shell

-

USD $2.25/t mining, USD $19/t milling, USD $2.49/t G&A operating costs

-

88% gold recovery, and 30% silver recovery

|

8 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

-

Gold price of $1,350/ounce and $17/ounce silver price

-

Above criteria was applied to Measured, Indicated, and Inferred materials

To further assess reasonable prospects of economic extraction for the material below the resource constraining shell, a break-even cut-off of 1.65 g/t gold was selected based on the following parameters:

-

USD $36/t mining, USD $19/t milling, USD $2.49/t G&A operating costs

-

88% gold recovery and 30% silver recovery

-

Gold price of $1,350/ounce and $17/ounce silver price

-

Dilution considered for cut-off determination 5%

-

Above criteria was applied to Measured, Indicated, and Inferred materials

Based on the geometry of the deposit, the material amenable to underground extraction will possibly be using a bulk mining method such as long-hole or modified Avoca mining method. The break-even cut-off stated above is only applicable to the material in the vicinity of the mineralized HALO due to increase in development cost reaching blocks further away. A mining plan does not exist for the material amenable to underground extraction; therefore, stope size, level spacing and other underground mining criteria have not yet been established.

With an effective date of May 16, 2017 and based on the above criteria, a summary of the mineral resource is presented in Table 1-3, tabulated at a cut-off of 0.6 g/t gold within the resource constraining shell and 1.65 g/t gold below the shell.

Table 1-3: Ana Paula Resource Statement Effective May 16, 2017

| Area | Category | Cut-off (Au g/t) |

Tonnes | Au (g/t) |

Gold (ounces) |

Ag (g/t) |

Silver (ounces) |

| Resources

amenable to open pit extraction |

Measured | 0.6 | 7,541,000 | 2.43 | 590,000 | 5.1 | 1,236,000 |

| Indicated | 10,491,000 | 1.79 | 605,000 | 4.8 | 1,629,000 | ||

| Measured &

Indicated |

18,032,000 | 2.06 | 1,195,000 | 4.9 | 2,865,000 | ||

| Inferred* | 249,000 | 1.27 | 10,000 | 8.8 | 70,000 | ||

| Resources

amenable to underground extraction |

Measured | 1.65 | 41,000 | 2.07 | 2,800 | 4.3 | 6,000 |

| Indicated | 2,925,000 | 2.81 | 264,000 | 4.2 | 398,000 | ||

| Measured &

Indicated |

2,967,000 | 2.80 | 266,700 | 4.2 | 404,000 | ||

| Inferred* | 621,000 | 2.07 | 41,400 | 3.9 | 79,000 | ||

| Total Resources | Measured | OP 0.6

and UG 1.65 |

7,582,000 | 2.43 | 592,800 | 5.1 | 1,242,000 |

| Indicated | 13,416,000 | 2.01 | 869,000 | 4.7 | 2,027,000 | ||

| Measured &

Indicated |

20,998,000 | 2.17 | 1,461,800 | 4.8 | 3,269,000 | ||

| Inferred* | 870,000 | 1.84 | 51,400 | 5.3 | 149,000 |

The quantity and grade of reported Inferred resources in this

estimation are conceptual in nature, and are estimated based on limited

geological evidence and sampling. Geological evidence is sufficient to imply but

not verify geological and grade or quality continuity. For these reasons, an

Inferred Mineral Resources has a lower level of confidence than an Indicated

Mineral Resources and it is reasonably expected that the majority of Inferred

Mineral Resources could be upgraded to Indicated Mineral Resources with

continued exploration. Mineral Resources that are not

|

9 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Mineral Reserves do not have demonstrated economic viability. Rounding of tonnes as required by reporting guidelines may result in apparent differences between tonnes, grade, and contained metal content.

1.7 MINERAL RESERVE ESTIMATE

The reserves for Ana Paula are based on the conversion of the Measured and Indicated resources within the current Technical Report mine plan. Measured resources are converted directly to Proven Reserves and Indicated resources to Probable Reserves. The total reserves for Ana Paula are shown in Table 1-4.

Table 1-4: Proven and Probable Reserves – Ana Paula

| Category | Tonnes (kt) | Gold Grade (g/t) | Gold (ounces) | Silver Grade (g/t) | Silver (ounces) |

| Proven | 6,533 | 2.62 | 550,000 | 5.31 | 1,115,000 |

| Probable | 6,907 | 2.12 | 471,000 | 5.13 | 1,139,000 |

| Total | 13,440 | 2.36 | 1,021,000 | 5.22 | 2,254,000 |

The reserves are based solely on the Ana Paula open pit. The underground resources have not been converted and remain resources only for this Technical report.

1.8 MINING

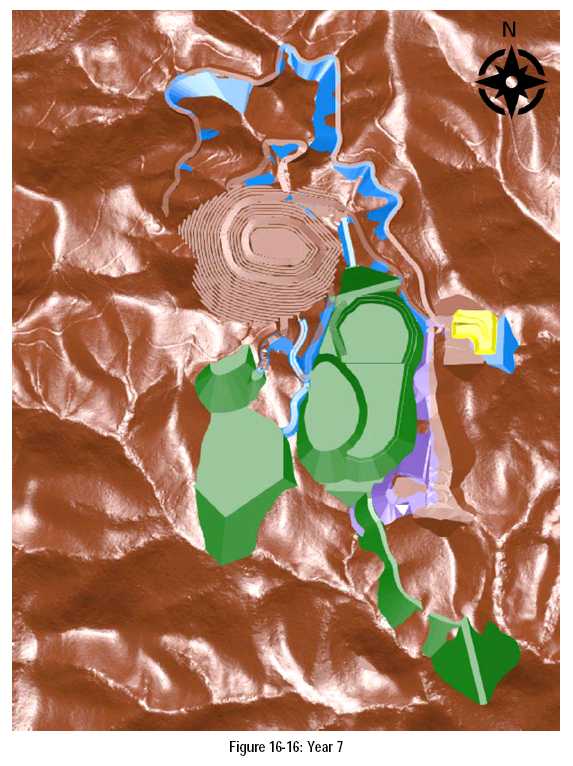

The Ana Paula project will be mined by open pit methods with a contractor using conventional truck and loader production equipment. Pit optimization and mine planning was carried out on that basis to support a plant capacity of 5,000 tonnes-per-day. The mine design work used only measured and indicated resources provided in the latest resource model dated May 16, 2017. Inferred material was considered as waste with zero grade applied.

A series of pit optimizations were examined at various metal prices with a base price of US$1200/oz for gold. Metal prices lower than this were examined to determine the best mixture of resource utilization, strip ratio and project economics. The pit design was created using a gold price of US$984/oz after completing the analysis.

The geologic model provided was a whole block, internally diluted grade model. AGP considered that contact dilution would also play a role in the ore sent to the mill. Dilution is calculated for each contact side using a 0.5 m contact dilution distance. If one side of the block is touching waste, then it is estimated that dilution of 9.1% would result. If two sides are contacting, it would rise to 16.7%, three sides are 23.1% and four sides is 28.6% . Four sides represent an isolated block of ore. The model was examined and the appropriate dilution percentage added to the model blocks at the contact dilution grade. Comparison of the in-situ to the diluted value for the design pit optimization shell showed ore tonnage dilution of 5.1% and gold grade dilution of 4.2% and silver grade dilution of 1.9% . Tonnes and grade for the pit designs and reserves are reported with the diluted tonnes and grade.

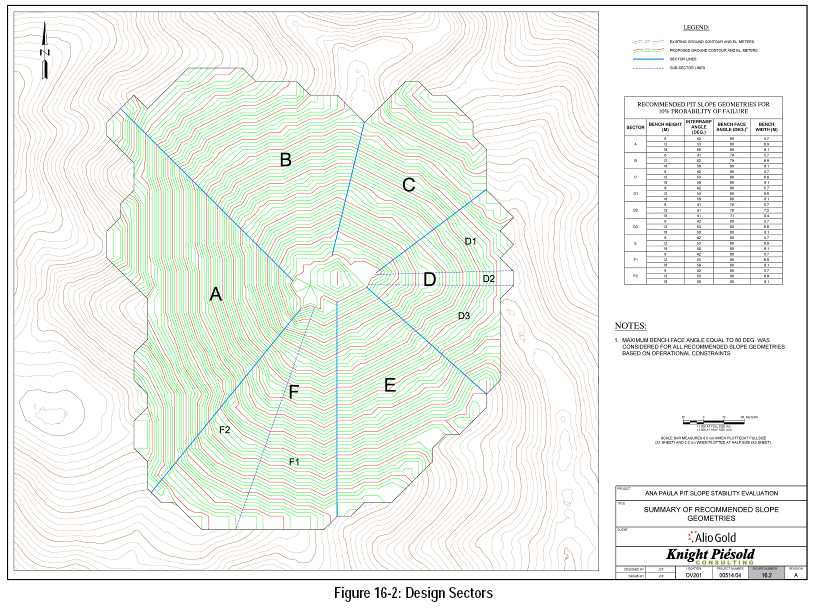

Three pit phases were designed for Ana Paula. Due to the topography present at the project site, access to each of the phases was considered crucial and was incorporated into the designs. Slopes for the pit design were based on Knight Piésold recommendations. They have safety benches of 8.1 m in width every 18 m vertically with an 80 degree bench face angle. This provides for a 58 degree inter-ramp angle in all sectors of the pit.

Equipment sizing for ramps and working benches is based on the use of 63 t rigid frame trucks although the final contractor will use 56t trucks. Single lane access is 17.8 m (2 x operating width plus berm and ditch) and double lane widths are 23.5 m (3 x operating width plus berm and ditch). Ramp gradients are 10% in the pit for uphill gradients and 8% uphill on the dump access roads. Working benches are designed for 35 to 40 m minimum on push backs.

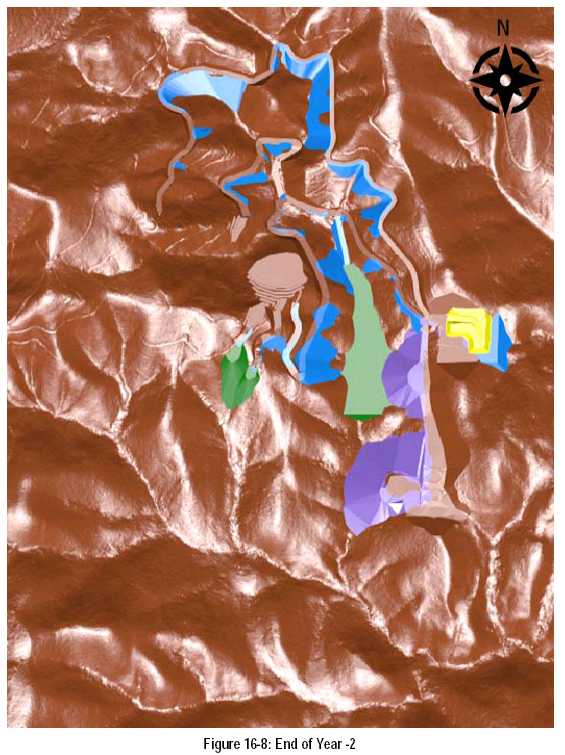

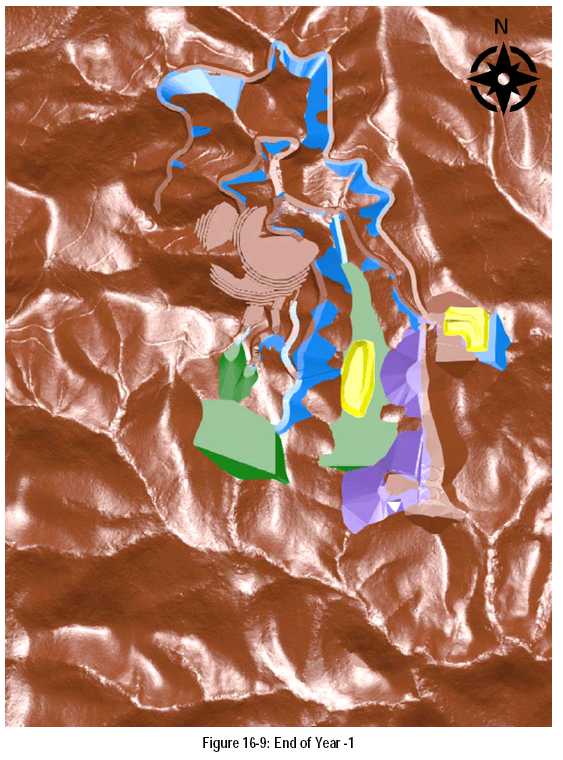

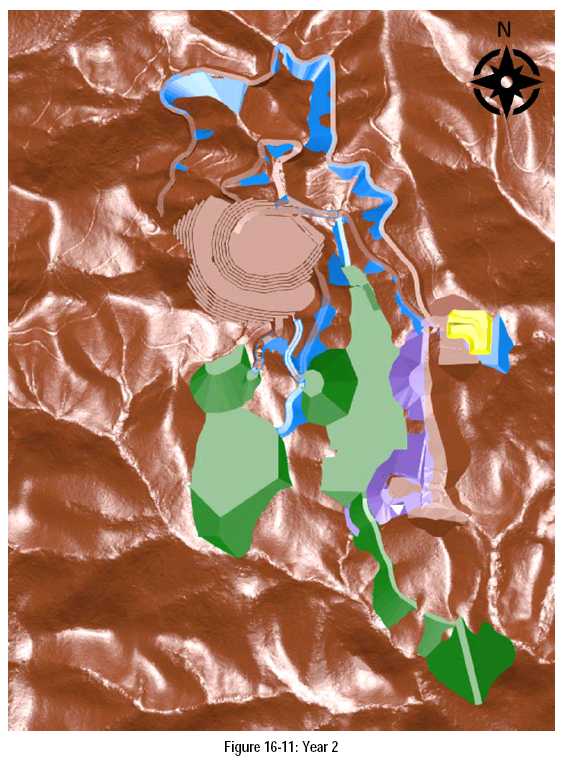

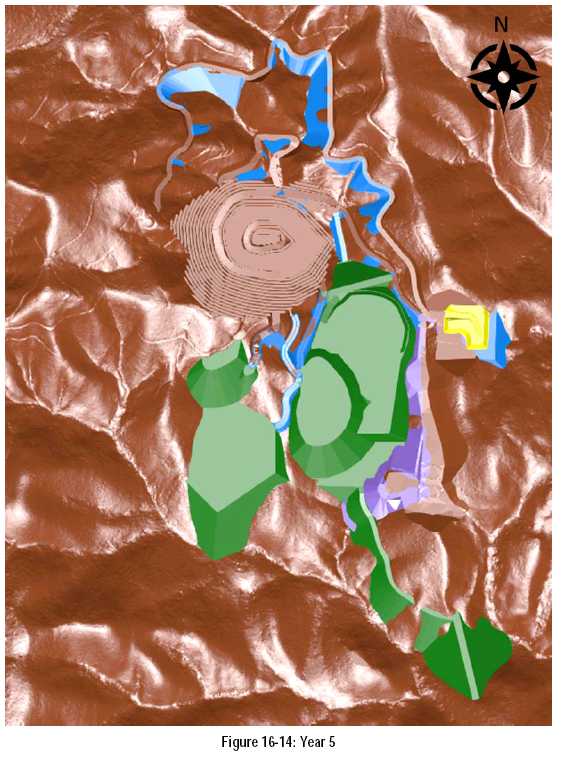

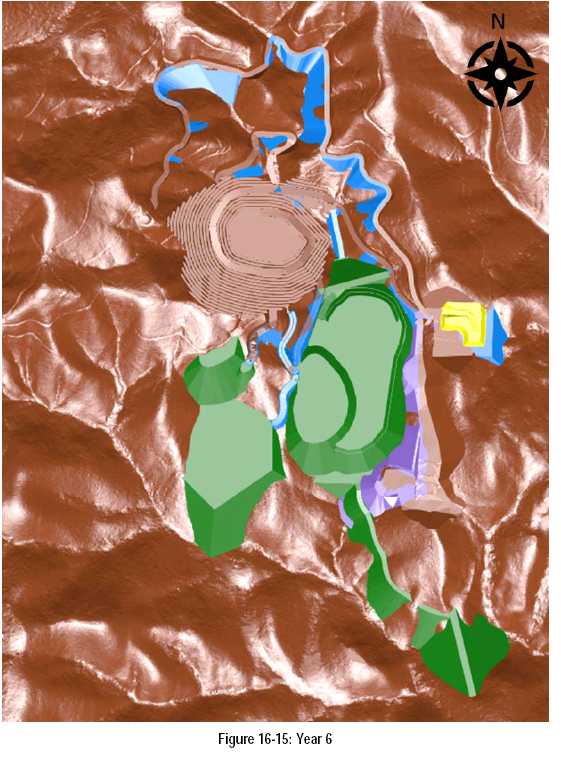

The project life will extend over a period of 10 years, including two years of pre-stripping followed by 8-years of production operations as shown in the mine production schedule provided in Table 1-5. The cut-off for the mine schedule are based on a gold only cut-off of 0.67 g/t gold. The LOM schedule delivers 13.44 Mt of ore grading 2.36 g/t gold and 5.13 g/t silver. Waste totals 43.74 Mt for a LOM strip ratio of 3.25:1.

|

10 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 1-5: Mine Production Schedule by Year

| Year | Mill Feed

(Mt) |

Au (g/t) |

Ag (g/t) |

Waste (Mt) |

Mine to Mill

(Mt) |

Mine to Stock

(Mt) |

Stock to

Mill (Mt) |

Total Material (Mt) |

Strip Ratio

(W:O) |

| -2 | - | - | - | 2.27 | - | 0.12 | - | 2.39 | - |

| -1 | - | - | - | 4.94 | - | 0.33 | - | 5.27 | - |

| 1 | 1.70 | 2.09 | 6.92 | 7.26 | 1.38 | 0.36 | 0.31 | 9.31 | 4.17 |

| 2 | 1.80 | 1.96 | 5.67 | 7.15 | 1.79 | 0.07 | 0.01 | 9.01 | 3.85 |

| 3 | 1.80 | 2.59 | 6.86 | 7.40 | 1.60 | - | 0.20 | 9.20 | 4.61 |

| 4 | 1.80 | 2.13 | 5.06 | 7.35 | 1.65 | - | 0.15 | 9.15 | 4.45 |

| 5 | 1.80 | 3.11 | 5.50 | 4.53 | 1.80 | - | - | 6.33 | 2.52 |

| 6 | 1.80 | 1.82 | 3.32 | 2.19 | 1.80 | - | - | 3.99 | 1.21 |

| 7 | 1.80 | 2.97 | 3.63 | 0.55 | 1.80 | - | - | 2.35 | 0.31 |

| 8 | 0.94 | 2.09 | 4.56 | 0.10 | 0.74 | - | 0.21 | 1.05 | 0.14 |

| Total | 13.44 | 2.36 | 5.13 | 43.74 | 12.56 | 0.88 | 0.88 | 58.06 | 3.25 |

The plant is anticipated to take 3 months to commission in Year 1. Lower grade material will be sent initially as the plant starts. Month 4 will see the plant at full capacity. Ore grades will fluctuate monthly depending on material available in the pit. Higher grade material is direct shipped to the mill with lower grade material stockpiled for later use to maximize the feed grade to the plant in the early years.

All mine equipment is modelled as provided by contractors. Total material movement peaks at approximately 9.3 million tonnes per year, which requires a modest production fleet of up to 8 conventional 56-tonne class haul trucks and two 6.4 m3 class wheel loaders. Drilling can be completed with two DTH drill rigs a single rotary machine capable of drilling 127 mm diameter holes.

During the mine life, two stockpiles will be required to manage the mill throughput. One will be a temporary location on the Valley WRF to be used in Year 1. The second will be located adjacent to the primary crusher for use as required during the mine life.

Underground mining was not considered for this PFS but warrants further investigation. It has the potential to add additional high grade tonnage to the mine plan. Alio has taken steps to develop an underground drift to allow access to the material beneath the design pit. This is proposed to be started in Q3 2017 with development, drilling and evaluation to follow.

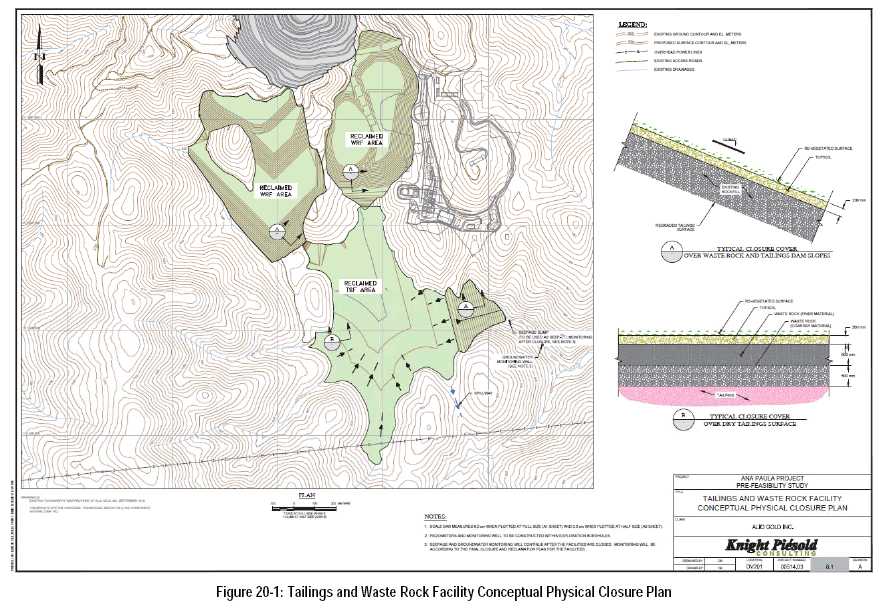

1.9 MINE ROCK MANAGEMENT

Rock management facilities (RMF) will be constructed during operations in various locations surrounding the open pit. As required, material mined in year 1 and onwards will also be used for tailing management facility (TMF) embankment construction. The various RMF will be designed at later stages to be reclaimed concurrent with operations to reduce ultimate liability upon mine closure.

In pre-production 7.2 million tonnes of mine rock and 0.45 million tonnes of mill-feed will be pre-stripped. Life- of-mine (LOM), a total of 43.7 million tonnes of mine rock will be moved at a strip ratio of 3.25 to 1.

1.10 RECOVERY METHODS

The Ana Paula processing facility will recover gold and silver by gravity concentration, flotation, oxidation of flotation concentrate and cyanidation of the oxidized concentrate by the carbon-in-leach process. The mill is designed at a nominal capacity of 5,000 t/d at 92% availability. Gold and silver adsorbed on activated carbon are desorbed into solution and then recovered by electrowinning. The recovered metals are smelted into doré bullions, which are the final product of the operations.

|

11 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

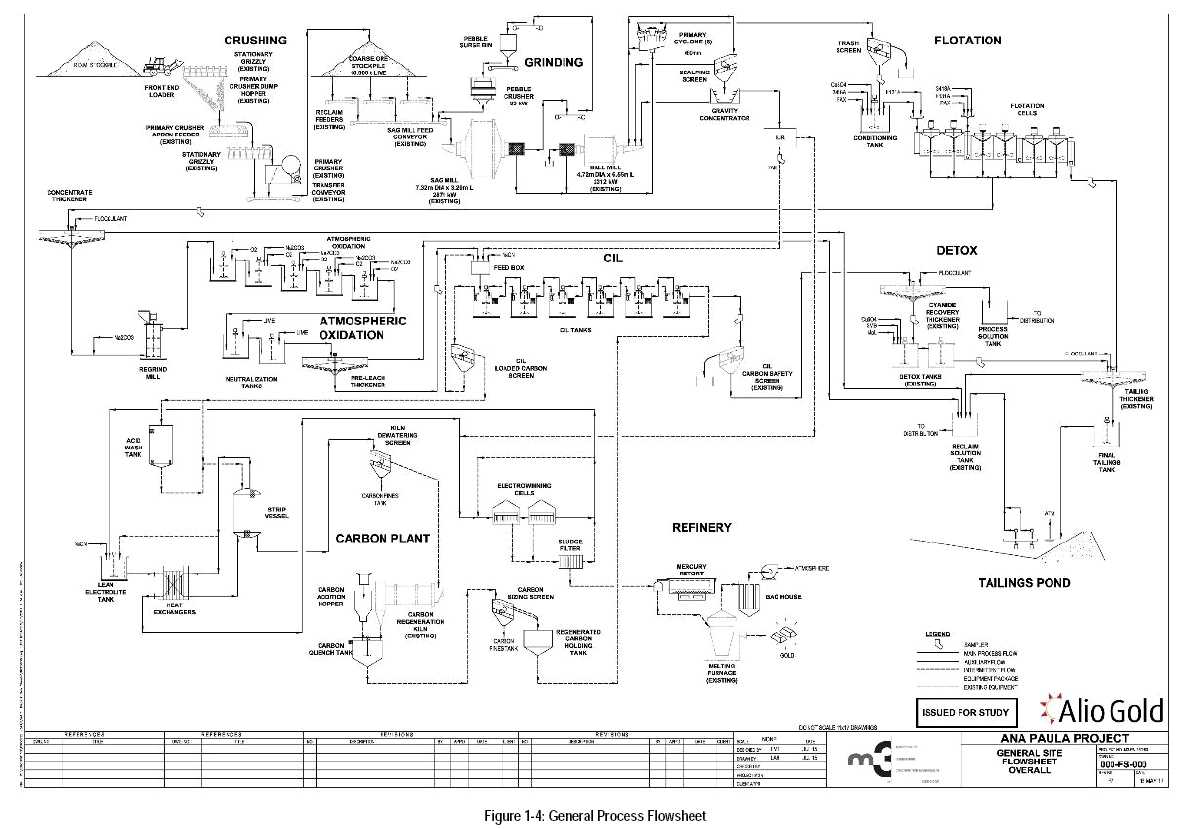

Figure 1-4 is a simplified schematic of the process for the Ana Paula process plant. The design of the plant and sizing of equipment were aided by the process mass balance that was developed using MetSim software.

|

12 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

13 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

1.10.1 Comminution and Stockpile

Run-of-Mine is delivered to the 42” x 48” Kolberg-Pioneer jaw crusher (187 kW or 250 hp) for primary crushing at a closed-side setting of 150 mm. Oversized rocks are removed from the feed with a stationary grizzly (opening: 800 mm). This is followed by a scalping grizzly, which bypasses rocks smaller than 100 mm to the transfer conveyor. The oversize of the second grizzly reports to the primary crusher, to where the crushed ore is discharged.

The transfer conveyor is also the stacking conveyor feeding the coarse-ore stockpile. The live capacity of the stockpile is 10,500 tonnes, which is nominally two days’ worth of feed to the mill.

Crushed ore is reclaimed via a reclaim tunnel beneath the stockpile, with three reclaim feeders (two operating and one standby) onto the SAG mill feed conveyor.

1.10.2 Grinding and Pebble Crushing

The grinding circuit for the Ana Paula Project is a conventional SABC circuit with one SAG mill, a pebble wash screen, one ball mill, one cyclone cluster, and a pebble crusher. The SAG mill is in a closed circuit with the screen and pebble crushing. The ball mill is in a closed circuit with the hydrocyclone cluster.

The SAG mill is an FFE Minerals mill, 7.32 m diameter by 2.74 m effective grinding length (24 ft x 9 ft EGL), powered by a new 2,872 kW (3,850 hp) drives on VFD. The ball mill was also supplied by FFE Minerals, 4.72 m diameter and 6.55 m long, driven by a fixed-speed 2,313 kW (3,100 hp) motor. Pebbles from the SAG mill is crushed by a cone crusher similar to a Metso HP100.

The SAG mill and ball mill share a common discharge sump. The combined discharge slurry is pumped from this sump to the hydrocyclone cluster by a 260-kW (350-hp) centrifugal pump on variable frequency drive. A second pump is installed as standby. The hydrocyclone cluster has five 26-inch hydrocyclones, with four operating and one on standby. The target grind size for the grinding circuit product is 80 percent finer than 160 microns.

1.10.3 Gravity Concentration

A split from the hydrocyclones overflow is processed for gold recovery by gravity concentration and intensive cyanidation. Gravity concentration is achieved using a centrifugal concentrator (Knelson KC-QS40 or equivalent). The gravity concentrate is then leached with cyanide in the presence of an oxidizer using an intensive leach package (Acacia CS200 ore equivalent). The pregnant solution produced is sent to the same electrowinning circuit serving the oxidized concentrate leach circuit.

1.10.4 Flotation

Sulfides in the ore is floated at the ore’s natural pH using potassium amyl-xanthate (PAX) as collector, AERO 3418A as promoter, copper sulfate as activator, and F131A as frother.

Flotation of sulfides is accomplished by single-stage rougher flotation. Cyclone overflow is first sent to a 41.2 m3 conditioning tank, then to a bank of six 70 m3 tank flotation cells. Each flotation cell mechanism is driven by a 93 kW (125 hp) motor through a gear reducer. Flotation air is supplied by a 70 kW (94 hp) blower, which can deliver 95 Nm3/min of air.

The tailing is pumped to one flotation tailing thickener (28 m

diameter high-rate thickener) to be thickened to 55% solids, in preparation for

pumping to the tailing storage facility.

|

14 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

1.10.5 Concentrate Thickening and Regrind

Concentrate from the rougher flotation circuit is dewatered in the 10.5 m diameter high-rate thickener to a pulp density of 55% solids. Underflow from the concentrate thickener is pumped using variable speed horizontal centrifugal slurry pumps to the regrind mill feed box. The thickener overflow, is pumped to the reclaim solution tank.

The concentrate regrind mill is a 900-kW tower mill with ceramic grinding media. It operates in open circuit while being monitored by an online particle size analyzer. The target grind of 80% finer than 25 microns is attained by controlling mill speed with a variable speed drive. The reground concentrate is pumped to the atmospheric oxidation feed box.

1.10.6 Atmospheric Oxidation

Atmospheric oxidation (AOX) of the sulfide concentrate is conducted in five agitated tanks. Each tank is 9 meters in diameter and 10 meters high (operating volume of 608 m3), made of 2205 duplex stainless steel. Each agitator is powered by a 56 kW (75 hp) motor through a gear reducer. Oxygen is injected into each tank through fine-bubble spargers.

The reaction kinetics was found to be optimized in the laboratory at around 75 oC. It is exothermic and expected to be autothermic if the feed concentrate grade is kept at 10% sulfide sulfur or higher. However, during cold startup, for example after a long shutdown, pulp in the first, and possibly the second AOX tank, will need to be preheated to get the reaction started and provide its own heat. The preheat temperature may be as low as 50 oC up to the actual minimum reaction temperature of 75 oC. The required preheat temperature will have to be established at the start of actual operation.

1.10.7 Carbon-in-Leach (Cyanidation)

The oxidized slurry neutralized to pH 10 to 10.5 with milk of lime. The neutralized slurry is then pumped to a pre-leach thickener (10.5 m diameter) to increase the pulp density to 55% solids. Once thickened, slurry is pumped to the carbon-in-leach feed tank where it combines dilution water, sodium cyanide reagent feed, and other process streams, into the first CIL tank.

Cyanide leaching is achieved in six CIL tanks (9.8 m diameter, 9.8 m high, 696 m3 operating capacity) for 48 hours. Each equipped with 30 kW (40 hp) agitators with two narrow-blade hydrofoil impellers. Air is delivered by a pipe under an inverted cone located directly below the agitator. After leaching, loaded activated carbon is sent to the carbon plant for stripping and electrowinning.

1.10.8 Carbon Handling Plant – Carbon Elution and Metal Recovery by Electrowinning

Loaded carbon is first acid washed with a dilute solution of hydrochloric acid to remove scale from the carbon, rinsed, and then pumped to the carbon stripping vessel. Five tonnes of carbon is stripped per batch, following the pressure Zadra procedure. Hot strip solution (135 oC) is introduced at the bottom of the carbon bed and overflows at the top of the vessel, carrying with it gold and silver that desorbs from the loaded carbon. Because of the elevated temperature, the strip vessel is kept at about 550 kPa to prevent boiling. The filtered residue is finally dried in retorts to remove and collect any mercury, and smelted in a tilting furnace. Metallic gold and silver melt is then poured into bullion molds to produce the final product of the operations – doré bullions.

1.10.9 Cyanide Destruction

Residual weak-acid dissociable (WAD) cyanide in the leach tailing is destroyed (detoxified) by oxidation using oxygen (from air) and sodium metabisulfite. Milk-of-lime is added to maintain a slurry pH in the range of 8.0 to 8.5. The reaction is catalyzed by copper (5 ppm), which will need to be supplied if the ore does not contain enough cyanide-soluble copper. The detoxified slurry is sampled prior to thickening to ensure that the WAD cyanide content meets the target discharge level (<50 ppm WAD cyanide, per the Cyanide Code).

|

15 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Slurry discharged from the detoxification circuit overflows into a discharge box, from where it is pumped to the tailing thickener (28 m diameter thickener)

1.10.10 Tailing Slurry Transport

Thickened tailing are discharged to a final tailing tank, from which the slurry is pumped to the tailing storage facility (TSF). The tailing pipeline will be a DN250/PN16 PE100 HDPE pipe, which is 2,700 m long, 250 mm bore, and will distribute tailing to Zone A spigots as well as to the dump spigot. This pipe connects to a 600 m long, 150 mm bore DN150/PN10 PE100 HDPE distribution header that will deposit tailing through Zones B and C spigots.

Solution from the pond reservoir is reclaimed by barge-mounted turbine pumps, one operating, and one standby to the reclaim solution tank) through a 700-m long DN225/PN20 PE100 HDPE pipe.

1.10.11 Sodium Carbonate Handling

Sodium carbonate is delivered to the site by trucks and off loaded to two 1700-tonne silo system. The aim is to provide enough storage capacity to supply 28 days of operation. This would provide sufficient buffer capacity for the supply and transport of sodium carbonate from the supplier to the mine site.

Sodium carbonate is added as a solution to the regrind ball mill and to the oxidation tanks, sodium carbonate is diluted in an automatic dilution system located bellow the silos.

1.10.12 Mill Power Consumption

The average total power consumption in the process plant is 733 million kWh. This translates to about 35.6 kWh/tonne of ore processed.

1.11 PROJECT INFRASTRUCTURE

1.11.1 Roads

The current mine access road is off of the main road between Cuetzala del Progresso and Nuevo Balsas. The access road is approximately 4.5 km from the main road to the plant site. The road from Cuetzala to the mine site will need to be improved to provide access for the larger loads required to construct the project.

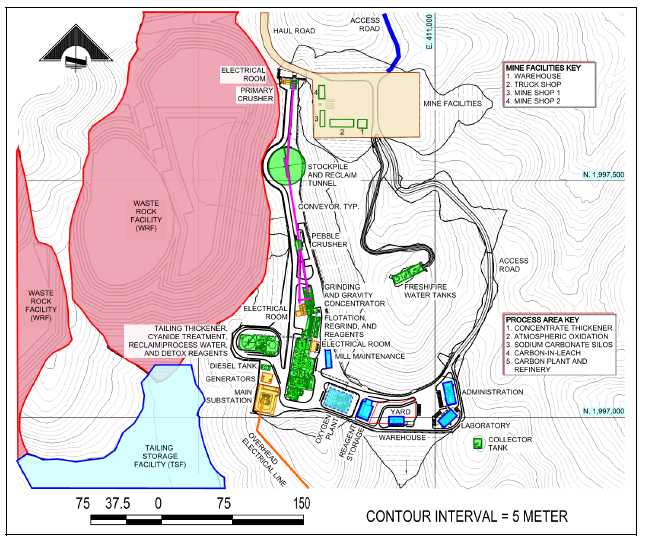

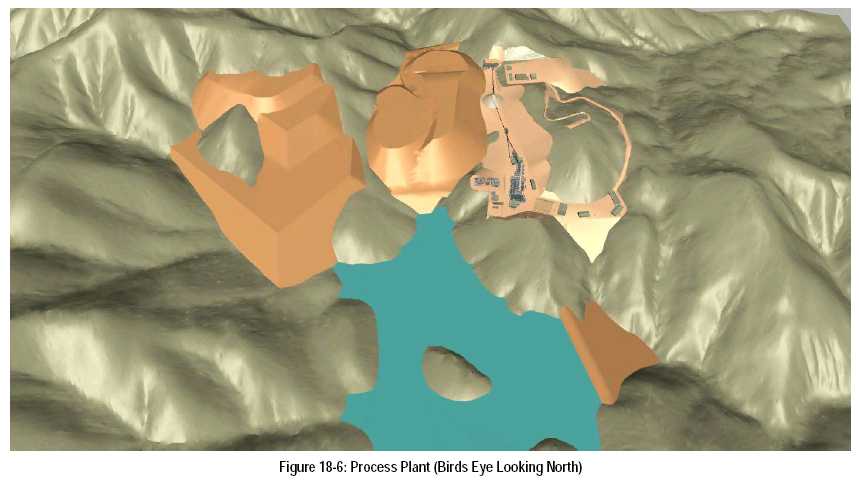

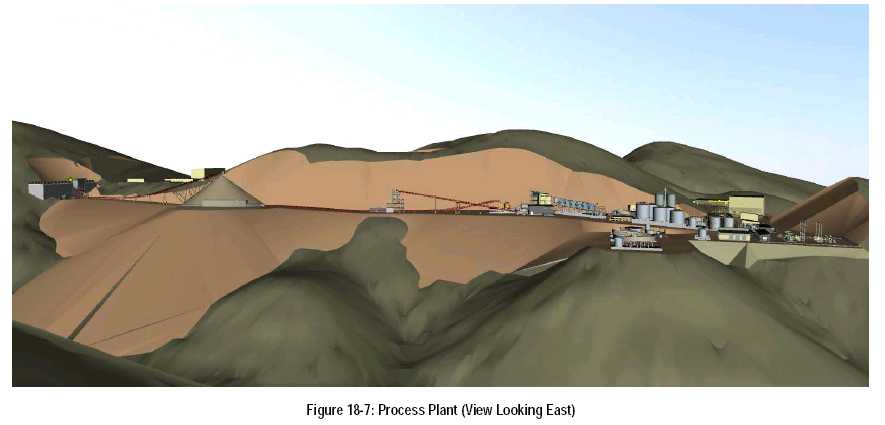

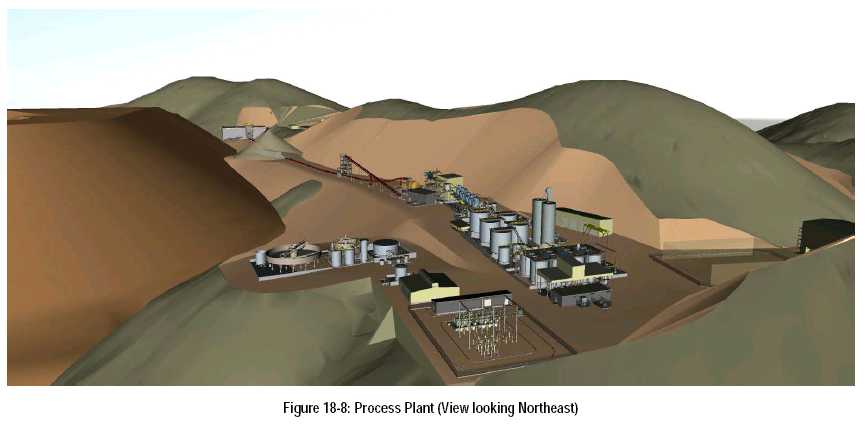

1.11.2 Process Plant Facilities

The process plant is located east of the waste rock management

(WRM) facilities and southeast of the mine pit. Process facilities include the

laydown area, initial crushed ore stockpile, primary crusher, mine support

buildings, mill area, gravity concentrator, reagents area, flotation, regrind,

concentrate thickener, atmospheric oxidation (AOX) leach tanks, carbon-in-leach

(CIL) tanks, carbon plant, refinery, cyanide treatment, tailing thickener,

oxygen plant, generator area, and electrical substation. Adequate warehouse and

office space have been accounted for along with sewage treatment and potable

water treatment facilities.

|

16 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

1.11.3 Camp and Ancillaries

Support and ancillary buildings for the site include a covered, partially enclosed equipment maintenance shop, administration office building, fuel storage/dispensing system, truck scale, warehouse, security gate and guard house. Some additional facilities may be brought in by the contract miner.

Mine support buildings include a warehouse, truck shop, and two mine shops.

The mine scenario evaluated in this study includes the construction of an on-site camp capable of housing up to approximately 790 people. The site camp area is intended to be developed initially for the construction camp and evolve into the permanent operations camp.

1.11.4 Power

Line power is available within 2.5 km of the proposed plant site and is supplied via a 115 kV line running generally east-west adjacent to the site property. A 1.5 km power line will be constructed with appropriate tie-ins and switching to deliver power at 115 kV to a substation that will be constructed in close proximity to the plant site. The substation will drop the supply voltage to 4,160 V for general distribution around the site and for distribution to the large motor loads such as the crusher facilities. Design power load has been estimated at approximately 15 megawatts (MW). The power supply for the operation of the well system will be carried out by an existing 34.5 kV overhead line.

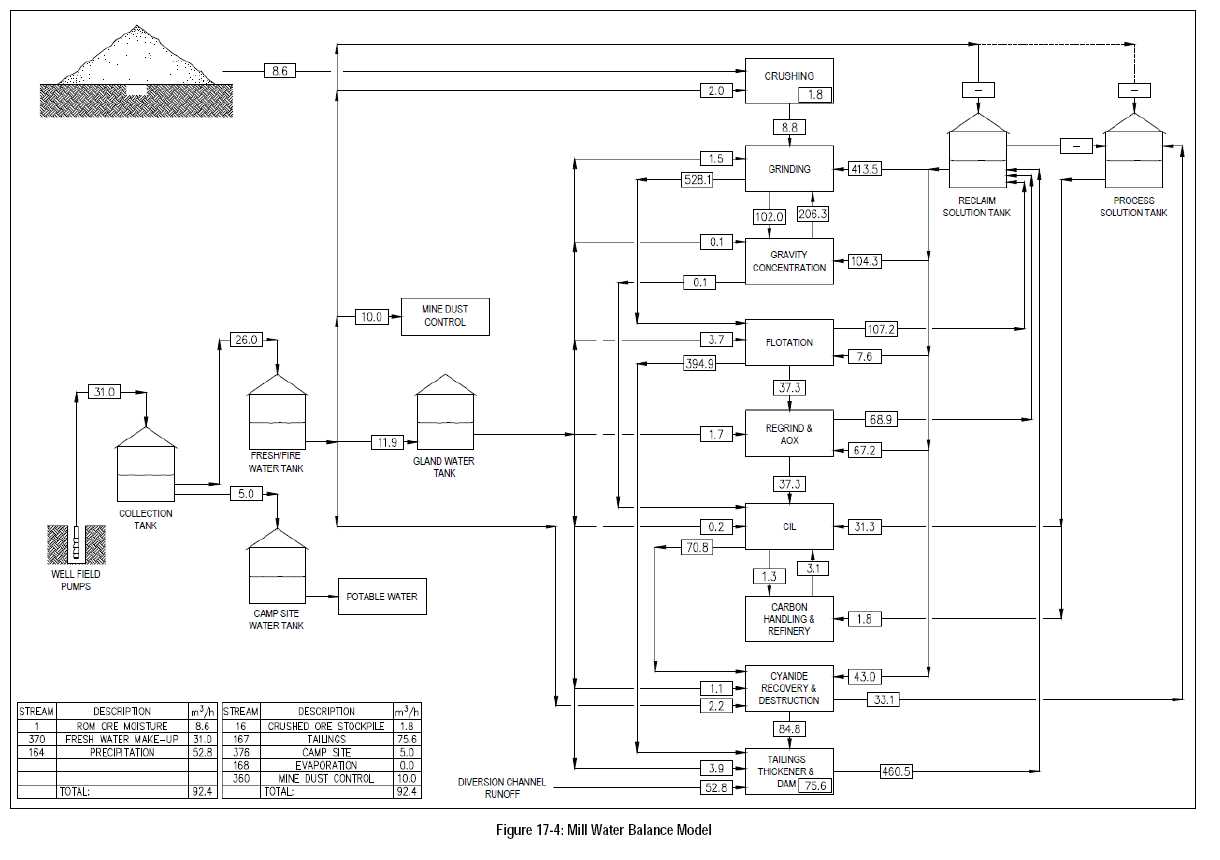

1.11.5 Water

An average of 84 m3/h of raw water will be required, which will comprise 31.6 m3/h from the well field and 53.2 m3/h from the rainfall diversion channel runoff.

Well water will be used for camp site potable water (4.9 m3/h), mine dust suppression (10 m3/h), gland seal water (12.5 m3/h), cyanide recovery (2.2 m3/h), and crushing dust suppression (2 m3/h). Fire protection water is stored is also derived from well water.

All runoff water is used as mill makeup water. It is introduced to the mill through the tailing thickener and reaches the reclaim water tank with the tailing thickener overflow.

A waste water treatment plant will handle sewer discharge; the effluent will discharge to the tailing storage facility. A smaller specialized treatment system will be installed at the food preparation facilities to mitigate oils and food solids entering the waste water treatment plant.

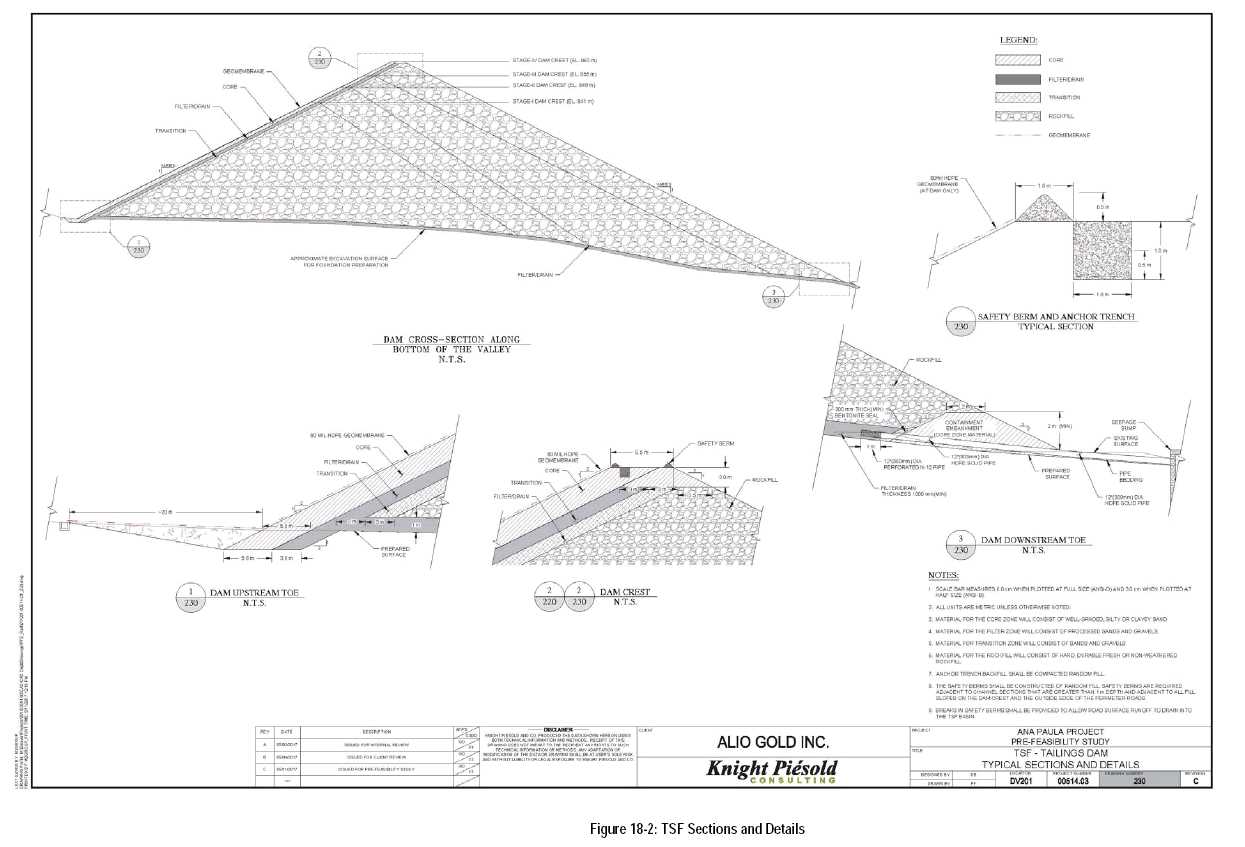

1.11.6 Tailing Storage Facility

The tailings storage facility was designed to contain tailings

and storm water runoff. It has been sized to provide storage capacity for

approximately 15.5 million tonnes of tailings and the 0.1 percent chance of

exceedance water volume. The maximum height of the dam will be approximately 100

m, which will be constructed in four stages over the life of the mine. The dam

will be a zoned earthfill/rockfill structure, with the upstream face lined with

80-mil HDPE geomembrane. The dam will be constructed using conventional

downstream methods, and the zone behind the upstream 80-mil HDPE geomembrane

liner will consist of, from upstream to downstream: (1) Core zone, (2)

Filter/drain zone, (3) Transition zone, and (4) Rockfill Zone. Both upstream and

downstream slopes will be 2H:1V. Based on the geochemical characterization and a

preliminary surface geology assessment, the basin is not expected to require a

liner; however, characteristics of leached concentrate tailings are needed prior

to finalizing management needs of these materials. Geotechnical analysis shows

that the structure will be stable under static conditions and will suffer

acceptable deformations under design seismic events.

|

17 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

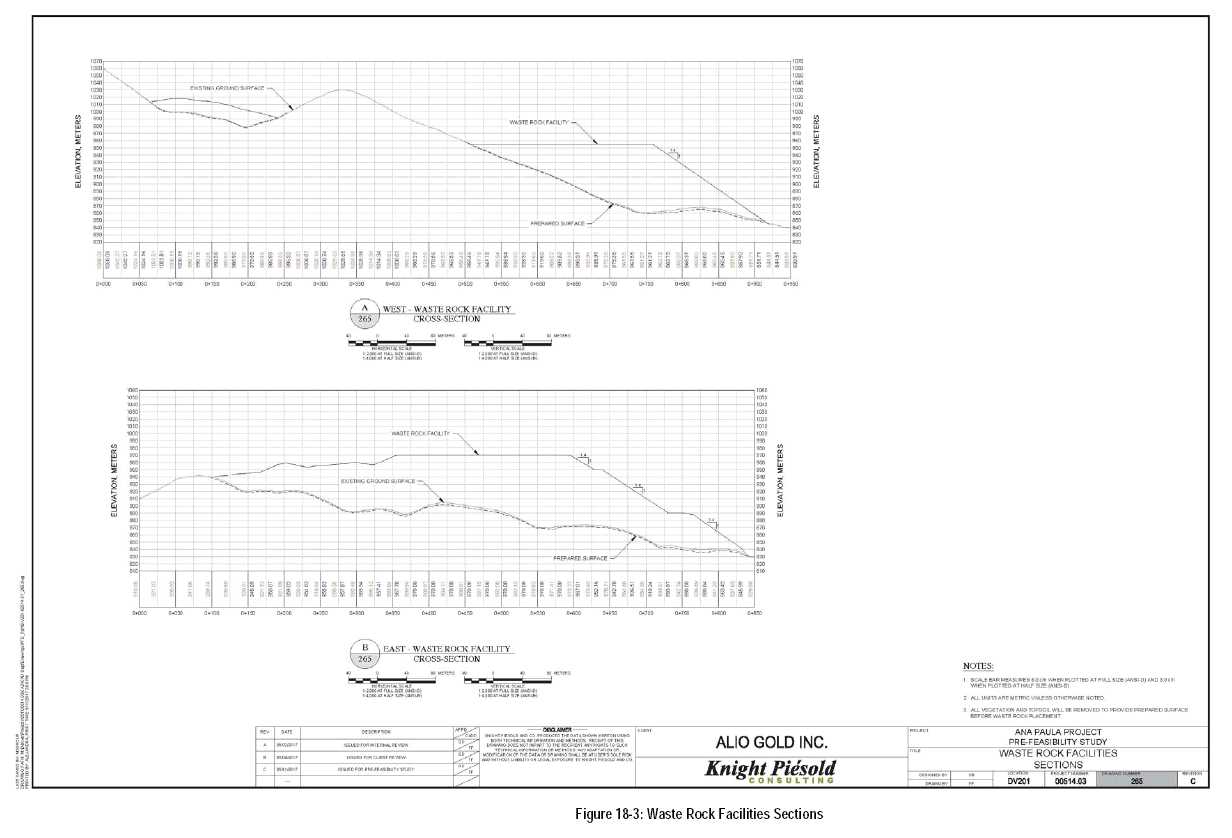

1.11.7 Waste Rock Facility

Two waste rock facilities (WRFs) have been located downgradient and south of the pit area which will have sufficient capacity to store 53 million tonnes of waste rock. Configurations for the WRFs (East and West WRFs) were developed by AGP Mining Consultants Inc. based on the mine plan for the project. The East facility will have the downstream toe at 840 meters above sea level (masl) and will reach a final elevation of 980 masl. The West facility will have the downstream toe at 848 masl and will reach a final elevation of 1,050 masl. Waste rock material in both facilities will be placed to form slopes of approximately 1.4H:1V. Slope stability and deformation analyses confirm that the proposed configurations meet commonly accepted minimum factors of safety and the estimated seismic-induced deformations for both facilities are acceptable. Geochemical analysis of waste rock samples tested indicate that this material will contain an excess of neutralization potential (NP) over acid potential (AP), with capacity to neutralize potential production of acid solutions; in addition, seepage from the waste rock is unlikely to contain mobilized metals at levels of concern; based on this the WRFs will not need a liner or containment system.

1.12 ENVIRONMENTAL CONSIDERATIONS AND PERMITTING

In April 2017, the Secretaría de Medio Ambiente y Recursos Naturales (SEMARNAT) approved the “Manifestación de Impacto Ambiental” (MIA), Environmental Impact Statement, submitted by Minera Aurea.

In September 2016, Mc. Terra Emprendimientos Sustentables (Terra) commenced the environmental baseline study for the Ana Paula Project. The study is expected to be completed in mid-2017.

No known environmental condition exists that would preclude development of the project.

1.13 CAPITAL COSTS

M3 Engineering & Technology Corp. was engaged by Alio Gold to compile the PFS, including estimation of the capital and operating costs. The capital cost estimate was completed by obtaining budgetary quotations for major equipment not already owned by Alio Gold. Installation costs were based on M3’s experience building mines in Guerrero State. The estimate is considered a Class 3 estimate which implies a level of accuracy of -10% to +30%. The capital cost estimate is shown in Table 1-6.

Table 1-6: Capital Cost Estimate

| Area | Capital (US$M) |

| Process Plant, General, Site Utilities | $67.2 |

| Indirects* | $9.6 |

| Tailings/Waste Facilities | $12.7 |

| Camps | $4.0 |

| EPCM | $12.9 |

| Owner’s Costs** | $8.3 |

| Pre-Strip and Mine Establishment | $19.9 |

| Contingency*** | $15.9 |

| Total Capital | $150.5 |

| Less Capital Spend in Year 1 | ($13.3) |

| Upfront Capital | $137.2 |

* Bussing, Mobilization, Construction

Camp Operating, Freight

** Used equipment refurbishment and transport to

site, misc. other owner’s costs

***Contingency calculated as 15% of Directs

+ Indirects + EPCM

|

18 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

1.14 OPERATING COSTS

The operating cost estimates are based on a combination of first-principles build-up, reference projects, budgetary quotes and factors as appropriate for a preliminary study.

These costs include direct mining and re-handle by a contractor, and processing and disposal of the mineralized feed to the plant including doré produced on-site and transportation and refining charges, Table 1-7.

Table 1-7: Operating Costs Summary

| Operating Cost | $/t processed | LOM $M |

| Mining | 8.01 | 107.7 |

| Processing | 20.25 | 272.2 |

| G&A | 2.56 | 34.4 |

| Total | 32.53 | 418.7 |

‡Mining Cost is based on $2.17/t mined

1.15 ECONOMIC ANALYSIS

An engineering economic model was developed to estimate annual cash flows and sensitivities of the project. Pre-tax estimates of project values were prepared for comparative purposes, while after-tax estimates were developed to approximate the true investment value. It must be noted that tax estimates involve many complex variables that can only be accurately calculated during operations and, as such, the after-tax results are approximations to represent an indicative value of the after-tax cash flows of the project.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. It includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the preliminary economic assessment will be realized.

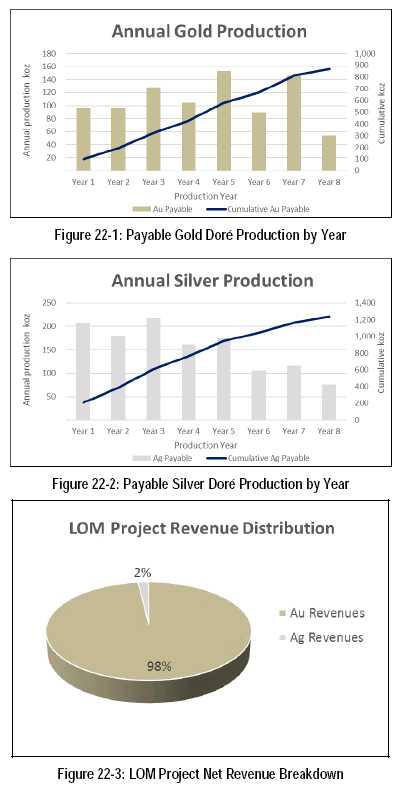

The results of the economic analysis are shown in Table 1-8.

|

19 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 1-8: Results of the Economic Analysis

| Summary of Results | Unit | Value |

| Mine Life | Years | 7.5 |

| Total Reserve | M tonnes | 13.4 |

| Total Waste | M tonnes | 36.5 |

| Total Capitalized Waste | M tonnes | 7.2 |

| Total Mined | M tonnes | 57.2 |

| Strip Ratio (Operations) | w:o | 2.81 |

| Mining Rate (Maximum) | t/d | 24,658 |

| Plant Throughput (Maximum) | t/d | 4,932 |

| Average Head Grades | ||

| Au | g/t | 2.36 |

| Ag | g/t | 5.22 |

| Metal produced | ||

| Au | LOM k oz | 868 |

| k oz/yr | 116 | |

| Ag | LOM k oz | 1,240 |

| k oz/yr | 166 | |

| NSR (Net of Royalties) | $M | 1,081 |

| $/t processed | 80.67 | |

| Operating Costs | $M | 445.4 |

| $/t processed | 33.14 | |

| Au Cash Cost | $/Au oz | 513 |

| Au Cash Cost (Net of By-Product) | $/Au oz | 489 |

| Capital Costs | ||

| Initial Capital excluding Contingency | $M | 134.6 |

| Initial Capital Contingency | $M | 15.9 |

| Total Initial Capital | $M | 150.5 |

| $/t processed | 11.20 | |

| Sustaining & Closure Capital | $M | 30.2 |

| Sustaining & Closure Contingency | $M | 0.0 |

| Total Sustaining & Closure Capital | $M | 30.2 |

| $/t processed | 2.25 | |

| Total Capital Costs Incl. Contingency | $M | 180.7 |

| $/t processed | 13.45 | |

| Pre-Tax Cash Flow | $M | 479.9 |

| Taxes | $M | 161.9 |

| After-Tax Cash Flow | $M | 318.0 |

| Economic Results | ||

| Pre-Tax NPV5% | $M | 347.2 |

| Pre-Tax IRR | % | 44% |

| Pre-Tax Payback | Years | 2.3 |

| After-Tax NPV5% | $M | 223.4 |

| After-Tax IRR | % | 34% |

| After-Tax Payback | Years | 2.6 |

Sensitivity analyses were performed on the Base Case economics

to determine which factors most affected the project performance. The analysis

revealed that the project is most and equally sensitive to metal prices and head

grades, followed by operating costs.

|

20 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Figure 1-5: Sensitivity Results for Base Case Scenario

1.16 CONCLUSIONS

It is the conclusion of the Qualified Persons preparing this technical report that the information contained within adequately supports the positive economic results obtained for the Ana Paula project. The project contains 13.4 million tonnes of gold-bearing sulphide mineralization that can be mined by open pit methods and recovered using common processing methods consisting of milling, gravity, flotation, atmospheric oxidation and cyanide leaching of flotation concentrates.

Based on the information contained in this report, the project is technically and economically viable; further study at a feasibility level should be performed in order to verify these conclusions.

As with any mining project, there are risks that could affect the economic viability of the project, as well as opportunities to improve the economics, timing, and/or permitting potential of the project. These risks and opportunities are detailed in Section 25 of this Technical Report.

1.17 RECOMMENDATIONS

M3 recommends that the Ana Paula project advance to a feasibility-level study, including associated test work, engineering and exploration. These recommendations, as provided by the Qualified Persons, are detailed in Section 26 of this Technical Report.

The feasibility study (FS) would encompass the following items:

-

Metallurgical testwork including pilot plant testing described herein to optimize the process flowsheet and quantify operating parameters and reagent consumptions.

-

Complete TSF and WRF engineering including hydrology model and site wide water balance.

-

Optimization studies on WRF (waste rock facility) design and sequencing should be completed, including design updates based on further geochemical and geotechnical information.

|

21 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

-

Alio should strongly consider exploring the underground mineralization beneath the proposed pit. The high grade breccia mineralization extends to depth with multiple intercepts with grade sufficient to support underground mining.

-

A surface exploration drilling program should be carried out to the north-east section of the proposed pit where potential resources have been identified.

It is recommended that environmental baseline study be completed and a socio-economic program also be initiated.

Further hydrologic studies including well tests to define water resources and make application for their use should be conducted.

Geochemical characterization of cyanide leach tailings must be completed to generate a basis for further engineering of storage methods and design.

Detailed costs of the recommended work are included in Section 26. Estimated costs for a FS-level study specific to the project total $16.59M and itemized in Table 1-9.

Table 1-9: Feasibility Study Estimated Costs

| Item | Cost in k$ | Description |

| Metallurgical Test Work | 1,280 |

Metallurgical Core Sampling, Pilot Plant Test Work, Analysis, and Interpretation |

| Tailings Management and Waste Rock, Facilities and Water Supply | 570 |

Geotechnical and Design Engineering for Tailing Management and Waste Rock Facilities. Hydrogeology and Geochemical |

| FS Engineering & Services | 700 |

FS-Level Mine, Infrastructure and Process Designs |

| Environment and Social Studies | 900 |

Geochemistry, Environmental and Social Impact Studies. |

| Other Studies | 386 |

Mining, Geology & Peer Review |

| Local Infrastructure Engineering | 350 |

Access Roads, Power Studies |

| EPCM Engineering | 750 |

Infrastructure & Plant Design and Engineering |

|

| ||

| Underground Exploration | 7,500 |

Underground Exploration Adit |

| Surface Exploration | 875 |

Delineation of High Grade Breccia |

| Hydrology Drilling | 640 |

Well Testing |

| Site G&A | 1,140 |

|

|

| ||

| Subtotal | 15,090 |

|

| Contingency (10%) | 1,500 |

|

| Total | 16,590 |

Excludes Owner’s Costs and Permitting Fees |

|

22 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

2 INTRODUCTION

2.1 BASIS OF TECHNICAL REPORT

This Technical Report was compiled by M3 Engineering & Technology Corporation (M3) for Alio Gold Inc. (Alio), formerly Timmins Gold Corp. The Ana Paula Project is controlled by Minera Aurea, S.A. de C.V. This technical report summarizes the results of the Preliminary Feasibility Study (PFS) and was prepared following the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 and Form 43-101F1.

2.2 TERMS OF REFERENCE

The previous Technical Report on the Project, entitled “Preliminary Economic Assessment on the Ana Paula Project, Guerrero State, Mexico”, was authored by JDS Mining & Energy Inc. and was issued by Timmins Gold Corp. (now Alio Gold) with an effective date of February 2, 2016. That Technical Report was filed on the System for Electronic Document Analysis and Retrieval (SEDAR, www.sedar.com), which is an electronic filing system developed for the Canadian Securities Administrators (CSA), and on its US equivalent, the System for Electronic Data Gathering, Analysis and Retrieval (EDGAR), developed for the US Securities and Exchange Commission.

All drill hole, geological and other technical information in the current Report is effective through May 16, 2017, which is the date of the Company’s press release outlining the Ana Paula PFS results.

2.3 SCOPE OF WORK

This report summarizes the work carried out by the Consultants, some of which are associated or affiliated with Alio Gold. The scope of work for each company is listed below. Combined, this comprises the total Project scope.

M3’s scope of work included:

-

Compile the technical report which includes the data and information provided by other consulting companies.

-

Design required site infrastructure, identify proper sites, plant facilities and other ancillary facilities.

-

Estimate OPEX and CAPEX for the Project.

-

Interpret the results and make conclusions that lead to recommendations to improve value and reduce risks.

Blue Coast Research’s (BCR) scope of work included:

- Designing and carrying out the metallurgical test program and flowsheet development program.

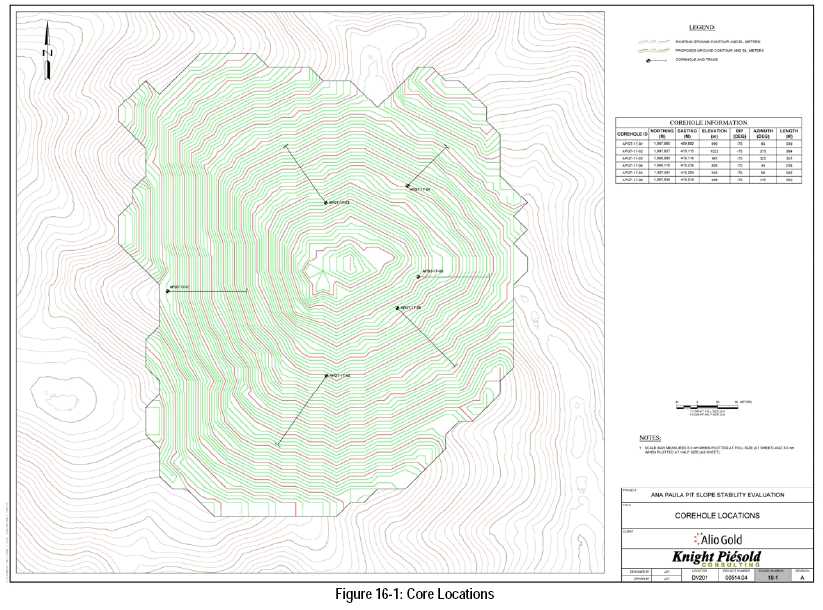

Knight Piésold’s (KP) scope of work included:

-

Design of the waste rock management and tailings storage facilities.

-

Design and oversee the pit slope stability (geotechnical) study.

-

Carrying out the site-wide water balance.

-

Design and oversee the geochemical characterization of waste / tails testing program.

|

23 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Alio Gold’s scope of work included:

-

Compile the environmental studies, permitting and social impact chapter using reports prepared by external consultants.

-

Prepare a financial model and conduct an economic evaluation, including sensitivity and Project risk analysis.

AGP Mining Consultants, Inc. (AGP) scope of work included:

-

Reviewing the Company’s drilling and exploration programs, including sample preparation, analysis, security and data verification protocols.

-

Preparing the Mineral Reserve & Resource Estimate Mine planning.

-

Pit design, optimization, and production schedule.

-

Mining equipment selection.

-

Establishing potentially mineable resources.

2.4 QUALIFIED PERSON RESPONSIBILITIES AND SITE INSPECTIONS

The Qualified Persons (QPs) preparing this technical report are specialists in the fields of geology, exploration, mineral resource and mineral reserve estimation and classification, geotechnical, environmental, permitting, metallurgical testing, mineral processing, processing design, capital and operating cost estimation, and mineral economics.

None of the QPs or any associates employed in the preparation of this report are insiders, associates, or affiliates or have any beneficial interest in Alio Gold with the exception of Mr. Taj Singh, who is subject to the terms of Alio Gold. The results of this technical report are not dependent upon any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings between Alio Gold and the QPs. The QPs are being paid a fee for their work in accordance with normal professional consulting practice.

The following individuals, by virtue of

their education, experience and professional association, are considered QPs as

defined in the NI 43-101, and are members in good standing of appropriate

professional institutions. The QPs are responsible for specific sections as

follows:

|

24 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 2-1: Qualified Person Responsibilities

| Qualified Person | Company | Site Visit Date | Report Section(s) of Responsibility |

| Daniel H. Neff | M3 | N/A | Sections 1.1, 1.2, 1.11, 1.14, 1.16, 1.17, 2, 3, 4, 18, 19, 21.1, 21.1.2, 21.1.3, 21.2.2, 21.2.3, 23, 24, 25.1, 25.2, and 27 |

| Art Ibrado | M3 | N/A | Sections 1.10 and 17 |

| Taj Singh | Alio Gold | Multiple visits, 2015-16 | Sections 1.12, 1.13, 1.15, 20, 21.1.1, 21.2.1, 22, and 26.6 |

| Andrew Kelly | Blue Coast | N/A | Sections 1.5, 13, 25.5, and 26.5 |

| Gordon Zurowski | AGP | December 2016 | Sections 1.7, 1.8, 1.9, 15, 16.1, 16.2, 16.4-16.11, 25.4, and 26.3 |

| Pierre DeSautels | AGP | December 2016 | Sections 1.3, 1.4, 1.6, 5, 6, 7, 8, 9, 10, 11, 12, 14, 25.3, 26.1, and 26.2 |

| Gilberto Dominguez | Knight Piésold | N/A | Sections 18.2, 18.3, 21.1.3, and 26.4 |

| James Cremeens | Knight Piésold | September 2016 | Sections 16.3, 16.12, 25.4, and 26.3 |

2.5 UNITS OF MEASURE, CURRENCY, AND ROUNDING

This study was conducted using mainly metric units following the International System of Units (SI) for unit terms and prefixes where possible. Unless otherwise noted, all weights are reported on a dry basis. Gold and silver grades are expressed in grams per metric ton (g/t).

2.6 UNITS, CURRENCY AND ROUNDING

Unless otherwise specified or noted, the units used in this technical report are metric. Every effort has been made to clearly display the appropriate units being used throughout this technical report. Currency is in United States dollars (US$ or $). Exchange rates are current as of the first quarter of 2017.

Table 2-2 below summarizes the units of measure used in this

report. Table 2-3 is a glossary of terms used in this report.

|

25 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

Table 2-2: Units of Measure

| Prefixes | M | mega | million |

| k | kilo | thousand | |

| c | centi | one hundredth | |

| m | milli | one thousandth | |

| µ | micro | one millionth | |

| Weight | g | gram | |

| kg | kilogram | 1,000 grams | |

| t | tonne, metric, dry basis | 1,000 kilograms | |

| st | short tonne, dry basis | 2,000 pounds | |

| kt | kilotonne | 1,000 tonnes, metric | |

| g/t | grams/tonne (metric) | ||

| oz | troy ounce | 31.103477 grams | |

| koz | kilo ounce | 1,000 troy ounces | |

| Moz | Million ounce | ||

| lb | US pound | ||

| klbs | kilo pounds | 1,000 US pounds | |

| Mlb | million pound | 1,000,000 US pounds | |

| Length | m | meter | |

| km | kilometer | 1,000 meters | |

| Volume | li | liter | 1,000 ml or cm3 |

| m3 | cubic meter | 1,000 liters | |

| Temperature | oC | degrees Celsius | |

| Pressure | Pa | pascal | |

| kPa | kilopascal | ||

| MPa | megapascal | ||

| psi | pounds per square inch | ||

| Power & Energy | W | watts | |

| kW | kilowatt | 1,000 watts | |

| MW | Megawatt | 1,000,000 watts | |

| kWh | Kilowatt-hour |

Table 2-3: Glossary of Terms

|

TERM |

DESCRIPTION |

|

% |

Percent |

|

< |

Less than |

|

> |

More than |

|

± |

More or less |

|

#N |

UTM grid measurement in meters north of the equator |

|

#E |

UTM grid measurement in meters east of the central Meridian |

|

Ag, As, Au, Bi, Co, Cu, Fe, Hg, K, Mo, Pb, Sb, Te, U, and Zn |

Chemical symbols from the periodic group of elements. silver (Ag), arsenic (As), gold (Au), bismuth (Bi), cobalt (Co), copper (Cu), iron (Fe), mercury (Hg), potassium (K), molybdenum (Mo), lead (Pb), antimony (Sb), tellurium (Te), uranium (U) and zinc (Zn). |

|

AuEq |

Equivalent gold. calculated as g/t gold + g/t silver/160, with the silver divisor calculated from the cost, price and recovery data listed |

|

ALS Chemex |

ALS Chemex, a division of ALS Global Ltd through Chemex De Mexico, S.A. De C.V., the primary analytical laboratory for the Ana Paula Project located in Guadalajara, Mexico. |

|

26 |

| ANA PAULA PROJECT |

| FORM 43-101F1 TECHNICAL REPORT |

|

TERM |

DESCRIPTION |

|

Alteration |

Physical and chemical changes to the original composition of rocks due to the introduction of hydrothermal fluids, of ore forming solutions, to changes in the confining temperature and pressures or to any combination of these. The original rock composition is considered “altered” by these changes, and the product of change is considered an “alteration”. (From Hacettepe University online dictionary, after AGI) |

|

Ana Paula Project |

The area inside the boundaries of the two contiguous mineral rights concessions known as the Tembo and Apaxtla 3 concessions, accruing 4,238 Ha in total. Referred to also as “Ana Paula” and the “Project”. |

|

ANFO |

Ammonium Nitrate and Fuel Oil |

|

Anomalous (anomaly) |

a. A departure from the expected or normal. b. The difference between an observed value and the corresponding computed value (background value). c. A geological feature, esp. in the subsurface, distinguished by geological, geophysical, or geochemical means, which is different from the general surroundings and is often of potential economic value; e.g., a magnetic anomaly. (From Hacettepe University online dictionary, after AGI) |

|

Minera Aurea |

Minera Aurea, S.A. De C.V., Alio Gold’s wholly owned Mexican operating subsidiary |

|

Aurea Norte Property |

Means the contiguous group of claims totaling 46,228 hectares and including the claims named: Tembo Dos (T225486), Tembo Tres (T231106), El Coyote (T222224), Cosmos I (T244793), Cosmos II (T244794), La Morinita (T224383), Don Jesus (T231103), R. Estefania (T244792), Estafania Frac. I (T2331105), R. Coyopancho (T244795), R. Cuetzala (T244796). |

|

Aurea Sur Property |

Means the contiguous group of claims totaling 5,819 hectares and including the claims named: Ottawa (T221781), El Consorcio (T222399), R. Coyopancho (T244795), R. Cuetzala (T244796). |

|

Background |

A measured or calculated geochemical, geophysical, petrological or other threshold considered representative of an area. The “Normal” or “not anomalous”. |

|

Breccia |

Means fragmental rocks whose components are angular and, therefore, as distinguished from conglomerates as not water worn. May be sedimentary or formed by crushing or grinding along faults or by hydrothermal explosions. |