Form 6-K ASML HOLDING NV For: Dec 31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

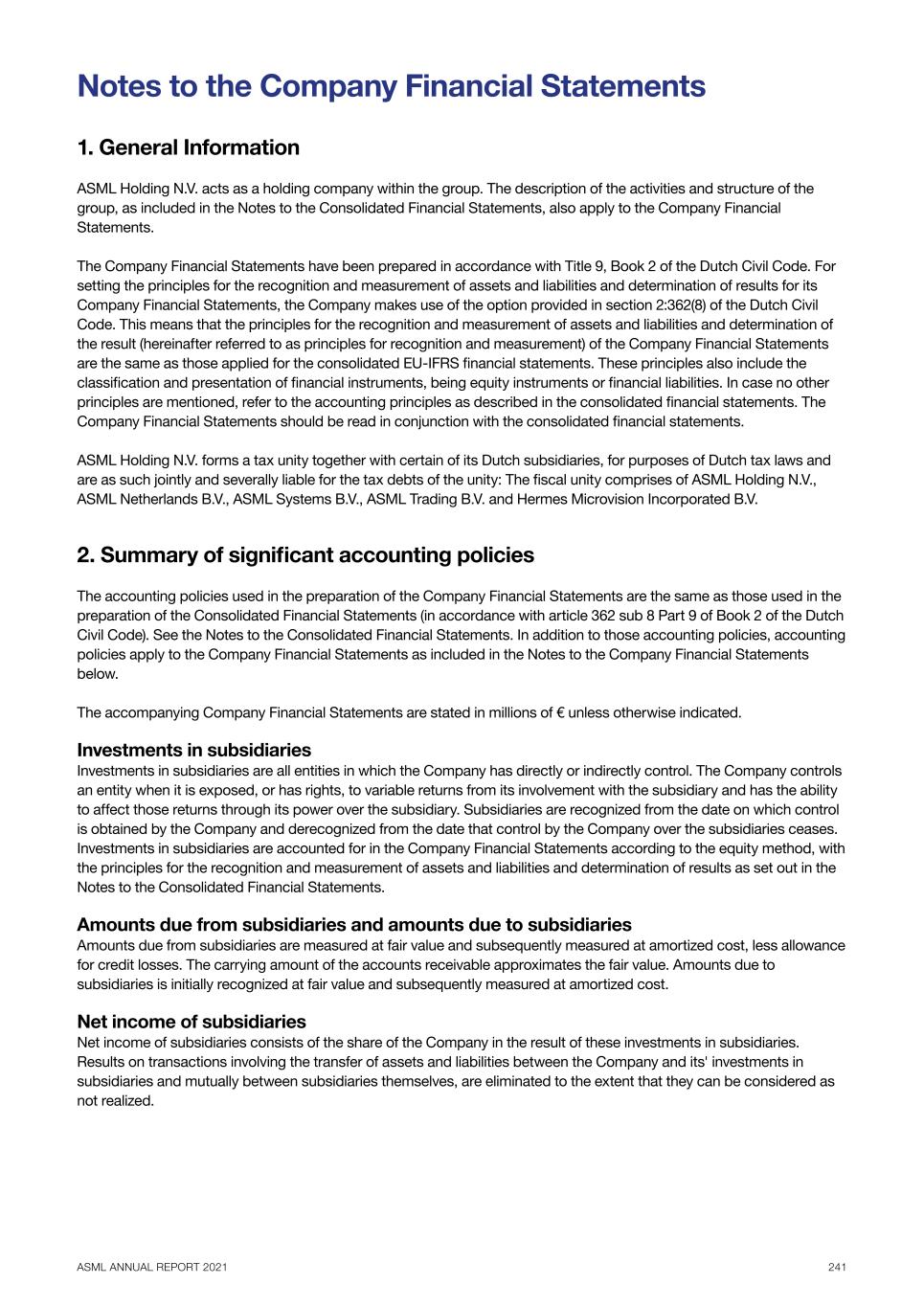

______________________

FORM 6-K

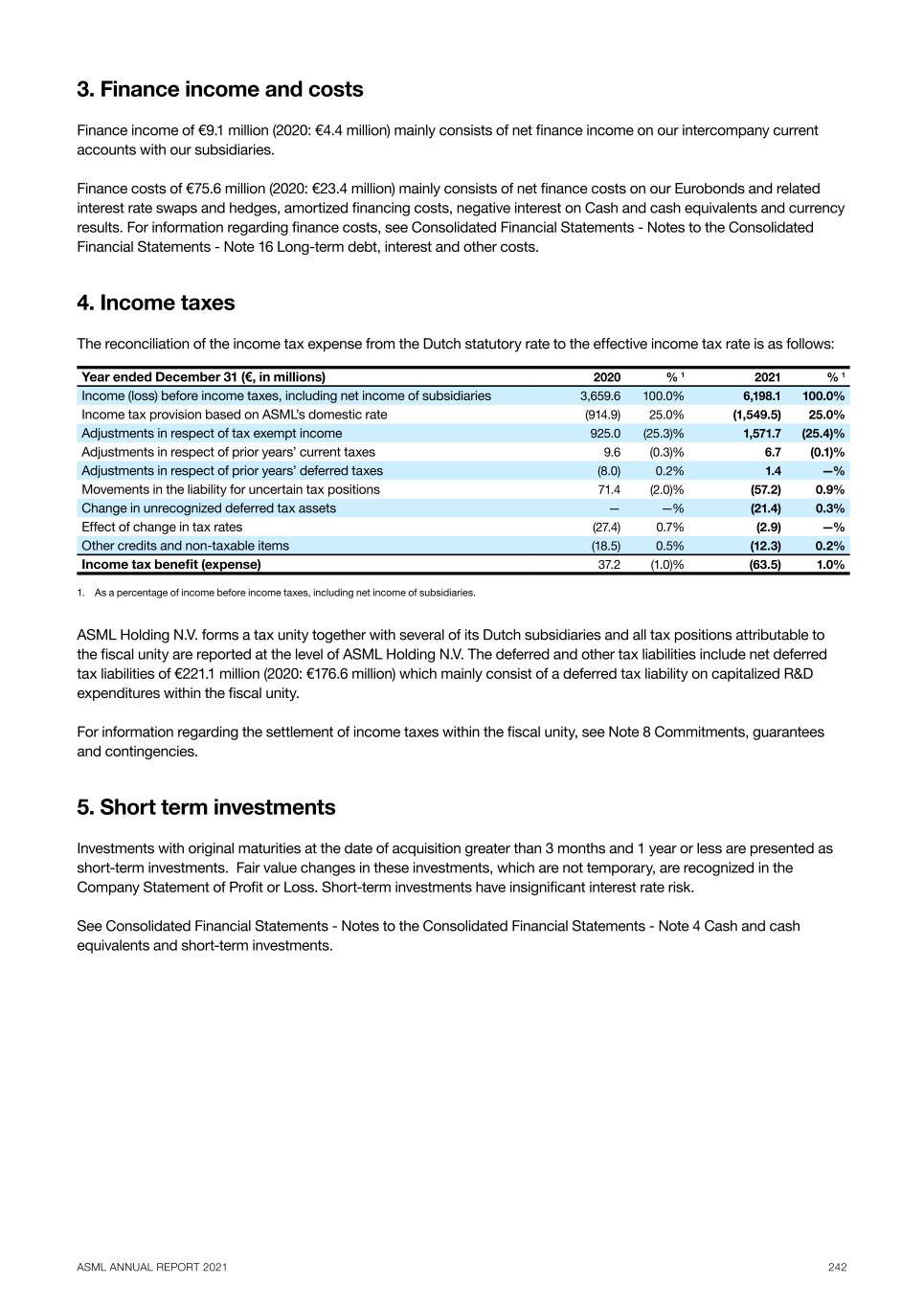

REPORT OF A FOREIGN ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For February 9, 2022

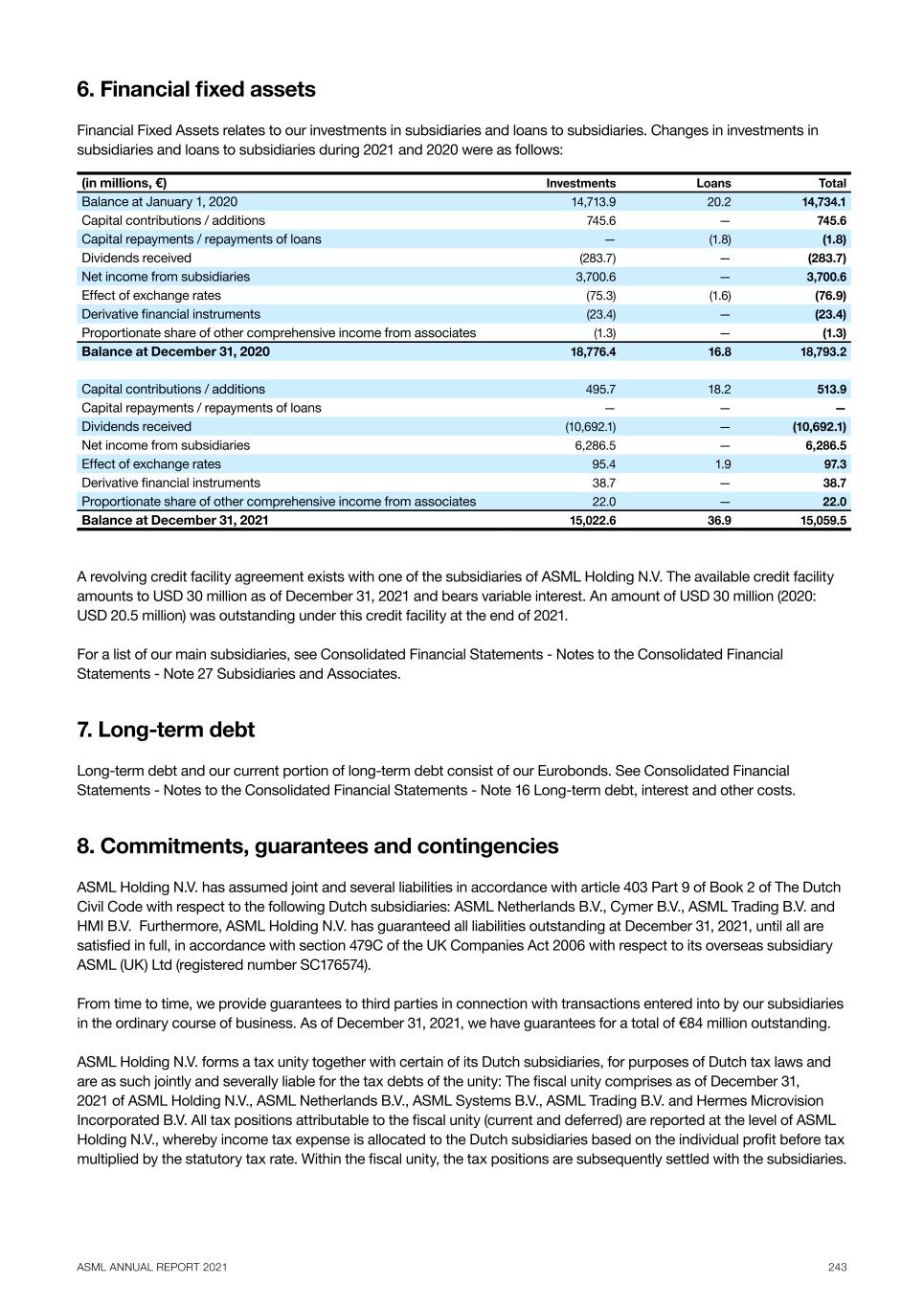

Commission File Number 001-33463

______________________

ASML Holding N.V.

De Run 6501

5504 DR Veldhoven

The Netherlands

(Address of principal executive offices)

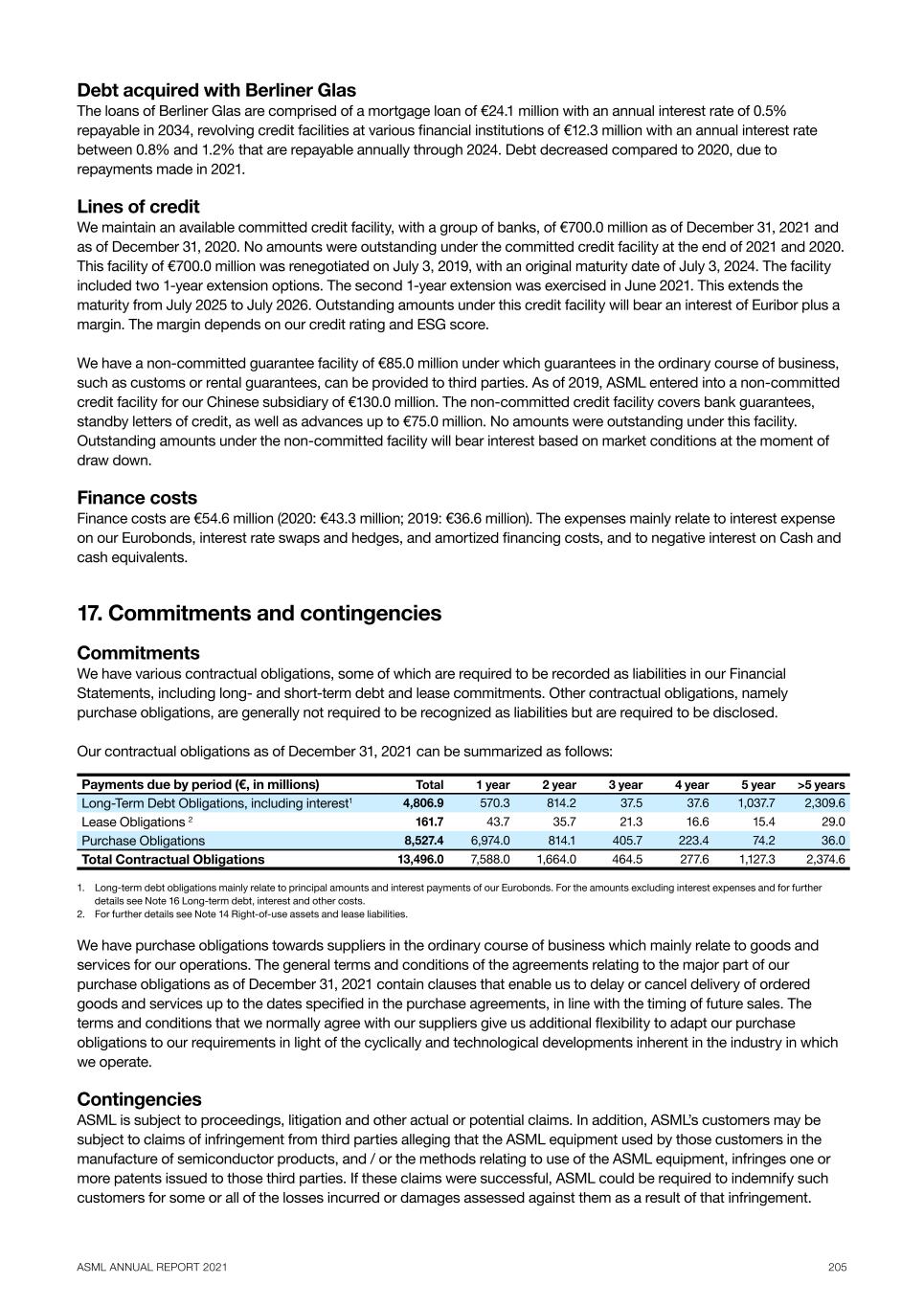

______________________

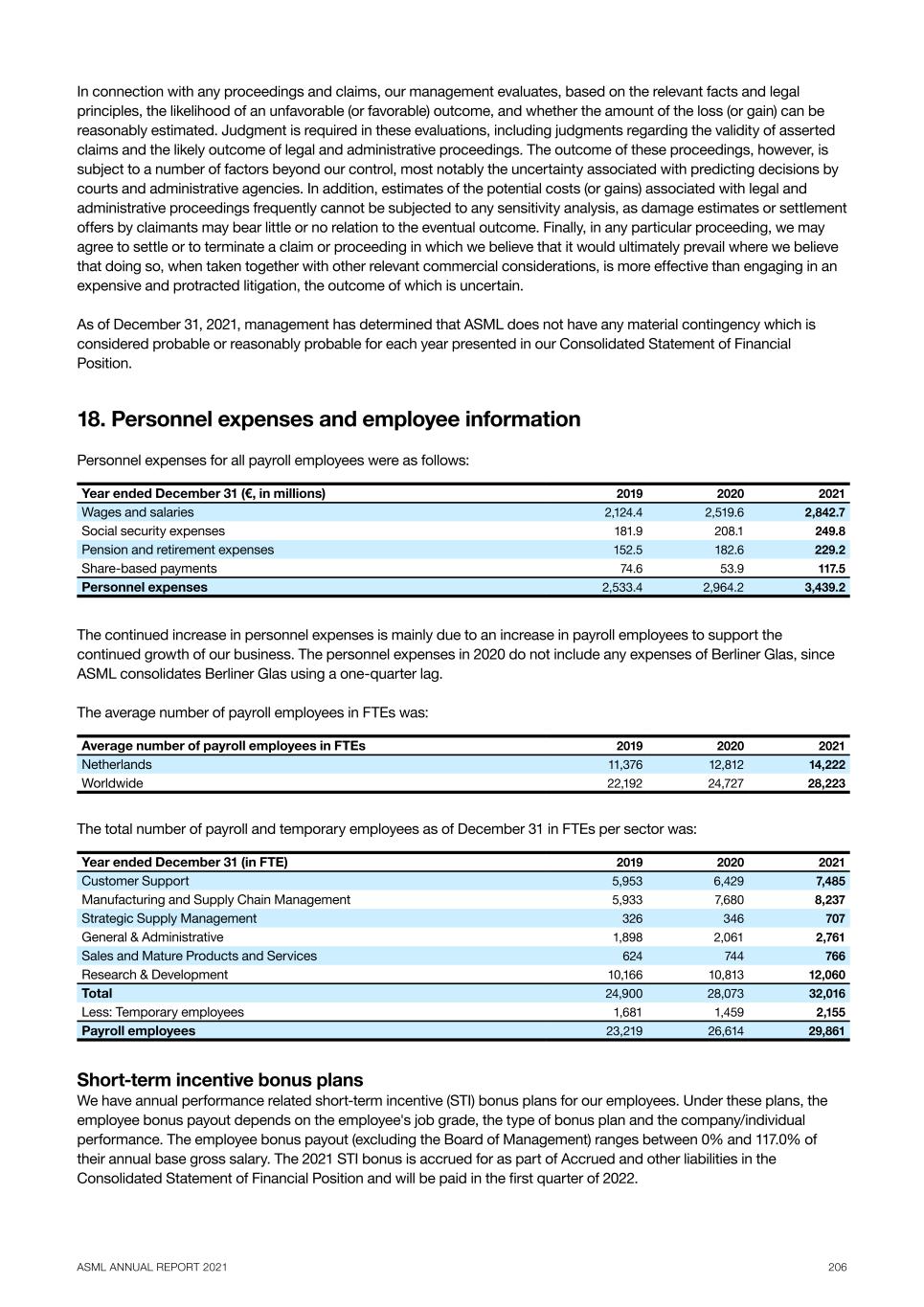

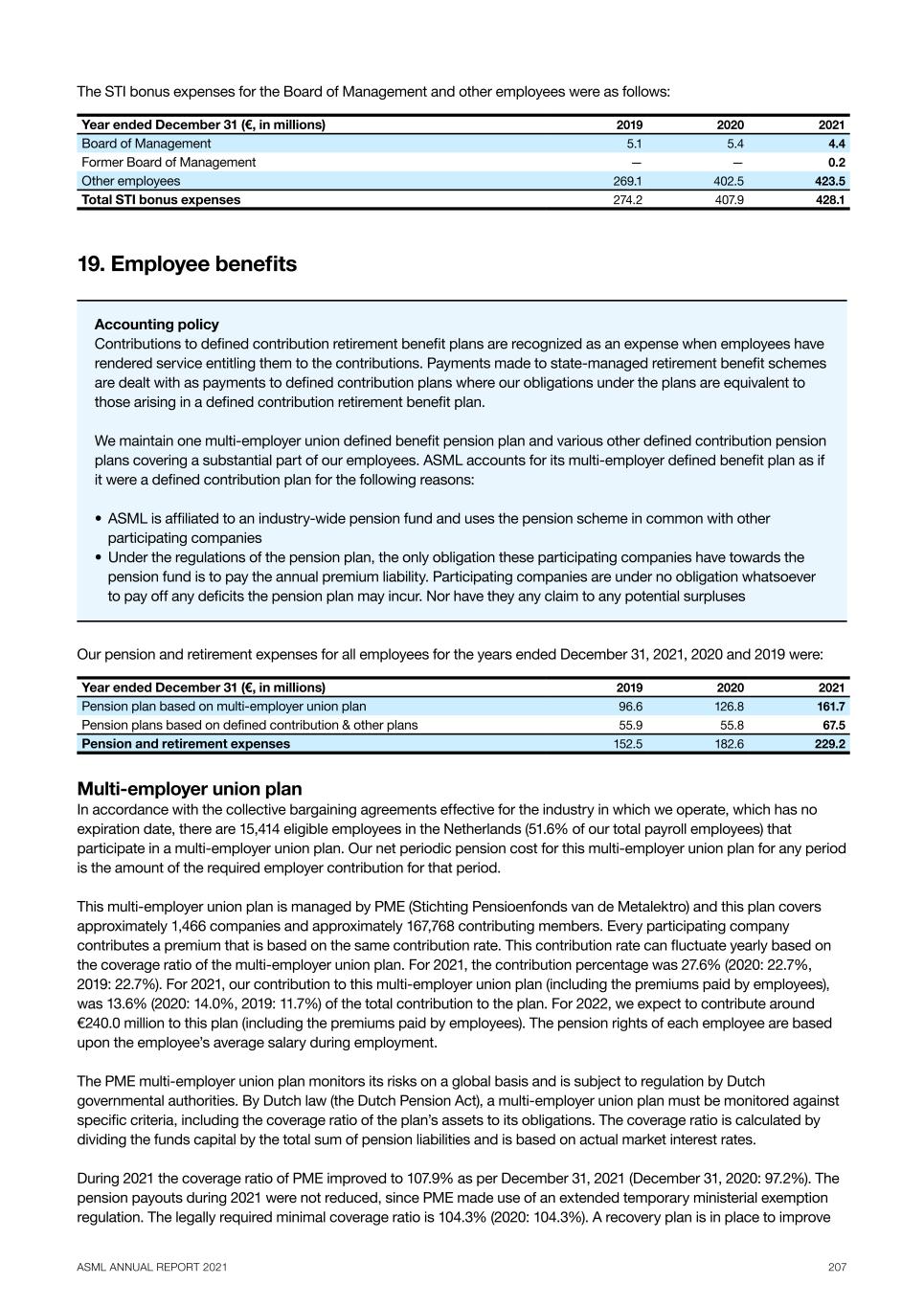

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

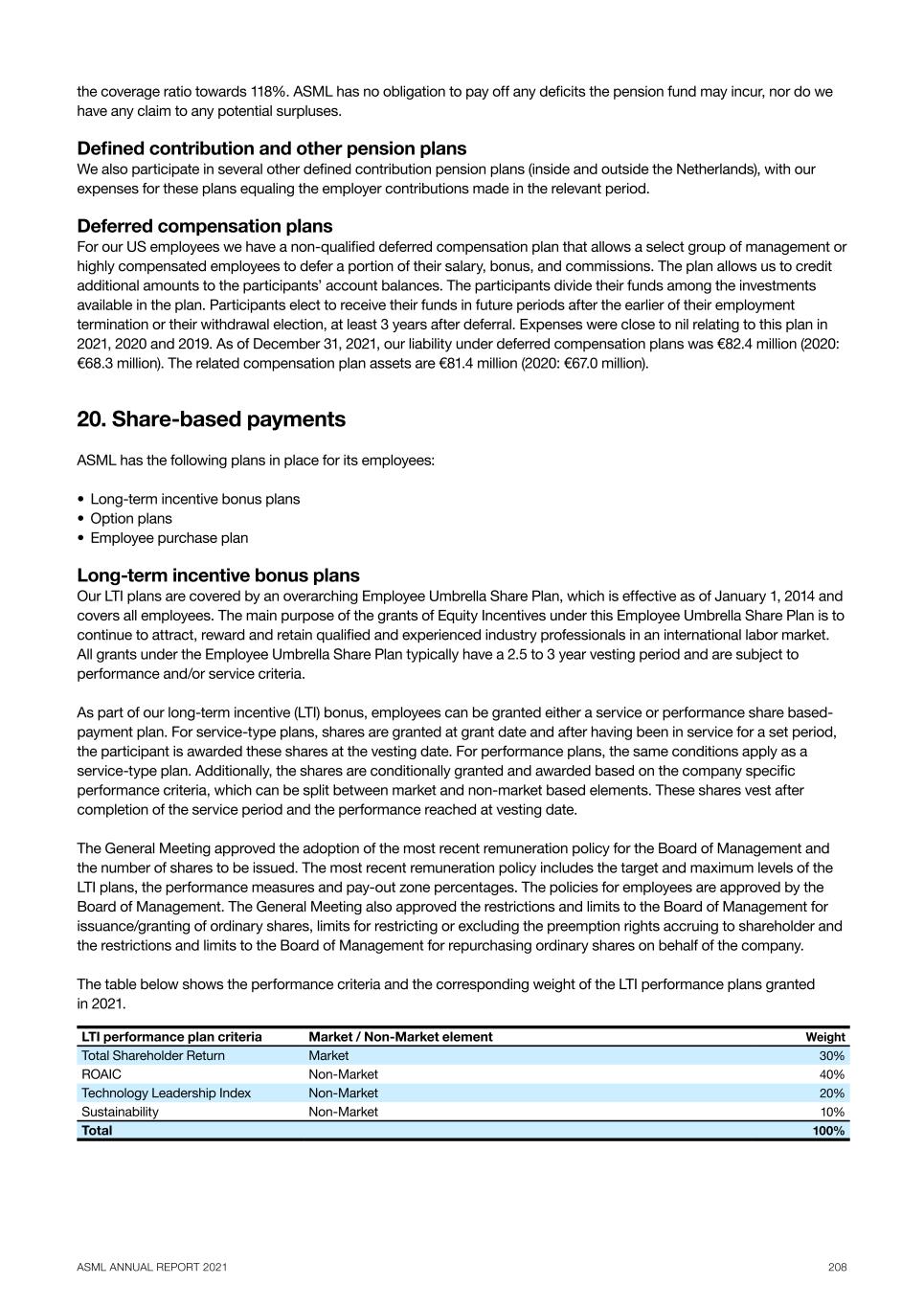

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Exhibits

99.1 2021 Annual Report based on IFRS

99.2 "ASML Publishes 2021 Annual Reports", press release dated February 9, 2022

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ASML HOLDING N.V. (Registrant)

Date: February 9, 2022 By: /s/ Peter T.F.M. Wennink

Peter T.F.M. Wennink

Chief Executive Officer

ASML ANNUAL REPORT 2021 1 Annual Report 2021 ’ 1 Exhibit 99.1

ASML ANNUAL REPORT 2021 2 Contents 2021 at a glance Message from the CEO 2021 Highlights Who we are and what we do Our company Message from the CTO How we innovate Customer intimacy Our products and services Our position in the semiconductor value chain Our markets Semiconductor industry trends and opportunities Our strategy Our performance in 2021 How we create value Financial Message grom the CFO Financial performance Long-term growth opportunities Environmental Climate and energy Circular economy Social Our people Community engagement Innovation ecosystem Our supply chain Governance Corporate governance How we manage risk Risk factors Responsible business Supervisory Board Message from the Chair of our Supervisory Board Supervisory Board report Remuneration report Directors’ Responsibility Statement Consolidated Financial Statements Consolidated Statement of Profit or Loss Consolidated Statement of Comprehensive Income Consolidated Statement of Financial Position Consolidated Statement of Changes in Equity Consolidated Statements of Cash Flows Notes to the Consolidated Financial Statements Company Financial Statements Company Balance Sheet Company Statement of Profit or Loss Notes to the Company Financial Statements Other Information Appropriation of profits Adoption of Financial Statements Voting rights Branch offices Independent auditor’s report Non-financial statements Assurance Report of the Independent Auditor About the non-financial information EU Taxomony Non-financial indicators Materiality assessment Stakeholder engagement Other appendices Definitions 5 7 9 14 16 20 22 27 28 32 38 41 43 48 51 60 68 78 84 88 95 110 115 125 142 144 160 174 177 178 179 180 181 182 239 240 241 248 249 250 251 252 261 263 267 269 283 287 290 293 A definition or explanation of abbreviations, technical terms and other terms used throughout this Annual Report can be found in the chapter Definitions. In some cases numbers have been rounded for readers' convenience. This report comprises regulated information within the meaning of articles 1:1 and 5:25c of the Dutch Financial Markets Supervision Act (Wet op het Financieel Toezicht). The sections Who we are and what we do, Our position in the semiconductor value chain, Our performance in 2021, Governance, Supervisory Board, Directors’ Responsibility Statement and EU Taxonomy together form the Management Report within the meaning of Section 2:391 of the Dutch Civil Code (and related Decrees). In this report the name ‘ASML’ is sometimes used for convenience in contexts where reference is made to ASML Holding N.V. and/or any of its subsidiaries, as the context may require. References to our website in this Annual Report are for reference only and none nor any portion thereof are incorporated by reference in this report. This document is the PDF/printed version of the 2021 Annual Report of ASML Holding N.V. in the European single electronic reporting format (ESEF) and has been prepared for ease of use. The ESEF reporting package is available on the company's website at https://www.asml.com. In any case of discrepancies between this PDF version and the ESEF reporting package, the latter prevails. © 2022, ASML Holding N.V. All Rights Reserved.

ASML ANNUAL REPORT 2021 3 Special note regarding forward-looking statements In addition to historical information, this Annual Report contains statements relating to our expected business, results projections, business trends and other matters that are "forward-looking" within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify these statements by the use of words like "may", "will", "could", "should", "project", "believe", "anticipate", "expect", "plan", "estimate", "forecast", "potential", "intend", "continue" and variations of these words or comparable words. They appear in a number of places throughout this Annual Report and include statements with respect to our expected trends and outlook, strategies, corporate priorities, expected semiconductor industry trends, R&D and capital expenditures and 2030 market opportunities and roadmap and revenue potential and other statements under the section titled “Semiconductor industry trends and opportunities”, expected trends in markets served by our customers, expected market growth and drivers of such trends and growth, expected financial results, including expected sales, service revenue, expected trends in working capital, gross margin, expected capital expenditures, R&D and SG&A expenses, cash conversion cycle, target and expected effective annualized tax rate, sales targets and outlook for 2022 and other statements under "-Trend Information", annual revenue opportunity and potential and growth outlook for 2025, expected growth in 2022, outlook for 2025 and 2030 and other statements under the section titled “Long-term growth opportunities”, expected continued growth in free cash flow generation, investments in the future and cash returned to shareholders, our Strengths, Weaknesses, Opportunities and Threats (SWOT), expected demand for upgrades, semiconductor industry dynamics and industry opportunities, expected trends in customer demand and demand for particular systems and upgrades and expected trends in end markets, including Memory, Logic and Foundry, including the continuation of investment by Logic customers in ramping new nodes and stronger lithography demand from memory customers, expected benefits of High-NA and planned target to start shipment of High-NA systems and high-volume production of systems using High-NA by 2025-2026, market opportunities for semiconductor industry end markets, expected innovation drivers, expected drivers of long-term stakeholder value, expected trends in DUV systems revenue, expected DUV sales and the expectation that DUV will continue to drive value for our customers and be used in production in most layers of their chips, expected benefits of Holistic Lithography and expected installed based management revenues, our supply chain strategies and goals, customer, partner and industry roadmaps, ASML’s applications business, expected development of High-NA and its benefits, including the expected timing for development of future generation EUV systems, expected growth in EUV sales compared to sales of DUV, expected benefits of the indirect interest in Carl Zeiss SMT GmbH and the acquisition of Berliner Glas, expected EUV adoption, expected EUV margins and margin improvement in our systems and service via cost reduction and value delivery, expected productivity and benefits of our tools, systems, and projects, EUV productivity targets and goals, potential future innovations and system performance, expected shipments of our tools and systems, including demand for and timing of shipments, statements with respect to DUV and EUV competitiveness, the development of EUV technology and EUV industrialization, expected productivity upgrade releases, enabling high-volume production of next generation chips and expected designs of such chips and their benefits, and revenue recognition, predicted growth in wafer production, sustainability targets, goals and strategies, shrink being a key driver supporting innovation and providing long-term industry growth, lithography enabling affordable shrink and delivering value to customers, environmental, diversity and sustainability strategy, ambitions, goals and targets, including circular procurement goals, targeted greenhouse gas emission and waste reduction, recycling and refurbishment initiatives, investments and goals and energy-saving strategies and targets, including statements on targeting zero carbon emissions and indirect emissions from energy use across operations and reducing intensity of all other emissions in the value chain from the making and use of ASML’s products by 2025, charity goals, the impact of the fire at our facility in Berlin on our production, repair center expansion and targets, our expectation of the continuation of Moore’s Law and that EUV will continue to enable Moore’s Law and drive long-term value for ASML well beyond the current decade, tax strategy, capital allocation policy, dividend policy, our expectation to continue to return cash to our shareholders through share buybacks and dividends including our proposed dividend for 2021 and statements relating to our share buyback program for 2021-2023, and statements with respect to the expected impact of accounting standards. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and our future financial results and readers should not place undue reliance on them. Forward-looking statements do not guarantee future performance, and actual results may differ materially from projected results as a result of certain risks, and uncertainties. These risks and uncertainties include, without limitation, those described under How we manage risk - Risk factors. These forward-looking statements are made only as of the date of this Annual Report. We do not undertake to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

ASML ANNUAL REPORT 2021 4 2021 at a glance

ASML ANNUAL REPORT 2021 5 Message from the CEO Peter Wennink (President, Chief Executive Officer and Chair of the Board of Management) Dear Stakeholder, 2021 was a very challenging year, with strong growth in a dynamic environment. The semiconductor industry has reached new records of output and sales amid an ongoing global pandemic while still being unable to satisfy the demand for semiconductors. Industries around the world are severely affected by this lack of supply. And despite these challenging circumstances, I’m proud to say that at ASML we continued to grow and have welcomed many new colleagues. ASML reached €18.6 billion in net sales, and we welcomed our 30,000th employee in Giheung, South Korea. By now we’re at over 32 thousand people, and we expect that growth to continue. This is all due to the significant continued growth of our industry, driven by the accelerated digital transformation, of course partly due to the effects of the pandemic and the transition to working from home. In addition to this, we are witnessing a stronger-than-expected growth of Internet of Things (IoT) applications fueling the need for more and more distributed computing solutions. This global trend made us take another look at our future potential scenarios and as a result, we see an opportunity to achieve a step-up in our previously communicated revenue potential, which is now at €30 billion based on a high-market scenario in 2025. None of this would be possible without the people at ASML and our partners. First of all our people – with their creativity, perseverance, resilience and ingenuity in difficult times, they are crucial to the success of our business. In addition, we rely on partnerships with our customers as well as partnerships with our dedicated suppliers, despite the setbacks they faced during the COVID-19 crisis. We rely on national and local governments to facilitate a social and economic infrastructure that allows us to be successful. We value our partnerships with research institutions who, like us, understand the importance of innovation and education. And not to forget our shareholders, who provide us with the backing to keep executing our technology innovation roadmap, and finally, our partnerships with the communities around us, without whom we would not thrive. Global megatrends are driving growth in the semiconductor industry There are several megatrends in the electronics industry that are shaping our digital, connected world and are expected to continue to fuel growth across the semiconductor market, such as artificial intelligence, 5G, virtual reality, gaming, simulation and visualization applications, and the intelligent cloud and edge. With a growing number of mobile and sensor-enabled applications and services, our society will rely more and more heavily on distributed computing and storage solutions. The electronics industry is booming – there are around 40 billion connected devices in use today, and that number is expected to grow to 350 billion in the next ten years based on external source data. The most important end markets driving ASML’s growth are the smartphone market and the data center, server and storage market, but at the same time we are also seeing a huge increase in microchip demand in the automotive and industrial electronics markets. Mature solutions are in demand Another aspect of the growth we’re seeing today is that it’s not only in the most advanced nodes – a lot of the distributed computing and storage solutions I mentioned above require mature lithography technology to manufacture. We expect that by 2025, about two-thirds of our total system sales will be EUV and the rest will be DUV and metrology and inspection. This expected EUV percentage is lower than what we predicted in 2018, but that doesn't mean that the EUV market has shrunk – as a matter of fact, it is expected to grow. But the DUV and metrology and inspection markets are expected to grow even faster. Countries are pushing for technological sovereignty The global pandemic has alerted governments around the world that global supply chains can create significant geographical dependencies on services, raw materials and end products. Governments increasingly realize that this now also turns out to be true for semiconductors. Since semiconductors play an increasingly important role in the growth and continuity of large industrial complexes and the importance of the semiconductor industry is likely only going to increase, governments have turned their attention to securing sufficient semiconductor supply to support their local industries, creating higher levels of

ASML ANNUAL REPORT 2021 6 technological sovereignty and planning significant investments in the semiconductor industry. The US, China and the EU, as well as Japan and South Korea, are expected to nearly double the industry’s (2021) annual capital expenditures (CAPEX) of $150 billion based on external source data. We are aware that this has created concerns about potential oversupply. However, we believe that the significant growth prospects of the semiconductor industry do require substantially more capacity and that given the high levels of capital expenditure to support all this, industry partners will apply sufficient effort to sustain an accessible and efficient innovation ecosystem. Growing into the next decade We believe that the advantages of scaling as expressed by Moore’s Law will continue throughout this decade and beyond. We will therefore relentlessly invest in innovation. In addition, we strive to ensure that ASML and its supply chain will be able to fulfill the increasing demand for more wafers to support advanced and mature technology. We will do this by increasing the productivity of all our machine types and by adding more manufacturing capacity. To increase our own production capacity, we will focus on building more machines by driving down cycle time for both EUV and DUV, on adding more people and tooling, and on increasing our production space. Together with our supply chain partners, we are actively adding capacity to meet future customer demand. Our product portfolio is very much aligned with our customers’ roadmaps. We will continue to deliver cost- effective solutions that provide value in EUV, in DUV, in applications, metrology and inspection, and in installed base management. With great influence comes great responsibility ASML operates in an industry that has considerable innovation power. Digital technology itself can help drive societal progress and has the potential to help cut global greenhouse gas emissions. ASML’s increasingly advanced lithography technology helps our customers to continue to produce microchips – with fewer materials and less energy consumption – that are three times more energy-efficient every two years. We clearly recognize that climate change is a global challenge that requires urgent action by everyone, including us. That is why we are stepping up our focus on ESG (environmental, social and governance) sustainability, which we have expanded from five focus areas to a nine- part strategy aimed at contributing to the United Nations’ Sustainable Development Goals. We’re doing this because we recognize ESG’s increasing importance to all our stakeholders, but first and foremost because it’s simply the right thing to do. Driven by our values and commitment to corporate responsibility, we want to have a positive role in society – for our employees, the communities around us, and everyone involved in our innovation ecosystem and supply chain. We are expanding on our community engagement, and with our new diversity and inclusion strategy, we want to improve our performance in this regard. Building on our achievements so far, we have increased our environmental ambitions. Our climate goal is to strive toward zero waste disposal by 2030 and net zero value chain emissions by 2040, focusing on our manufacturing and buildings, business travel and commuting, and on our supply chain and product use. Again, we won’t be able to achieve this alone, but will rely on strong and successful ongoing collaboration with our partners, suppliers and customers. Thank you The last couple of years have posed new challenges to all of us that have required agility, patience and perseverance to overcome. As a global society we are faced with unparalleled challenges, but with its great workforce, partnerships and innovative power, ASML is looking toward the future with confidence, preparing for even more sustainable growth. We can only do that by continuing to be a trusted partner for all our stakeholders – we would like to thank them for their commitment and support. As I have said many times before, we are looking at a bright future, but we cannot do this alone. Peter Wennink Chief Executive Officer

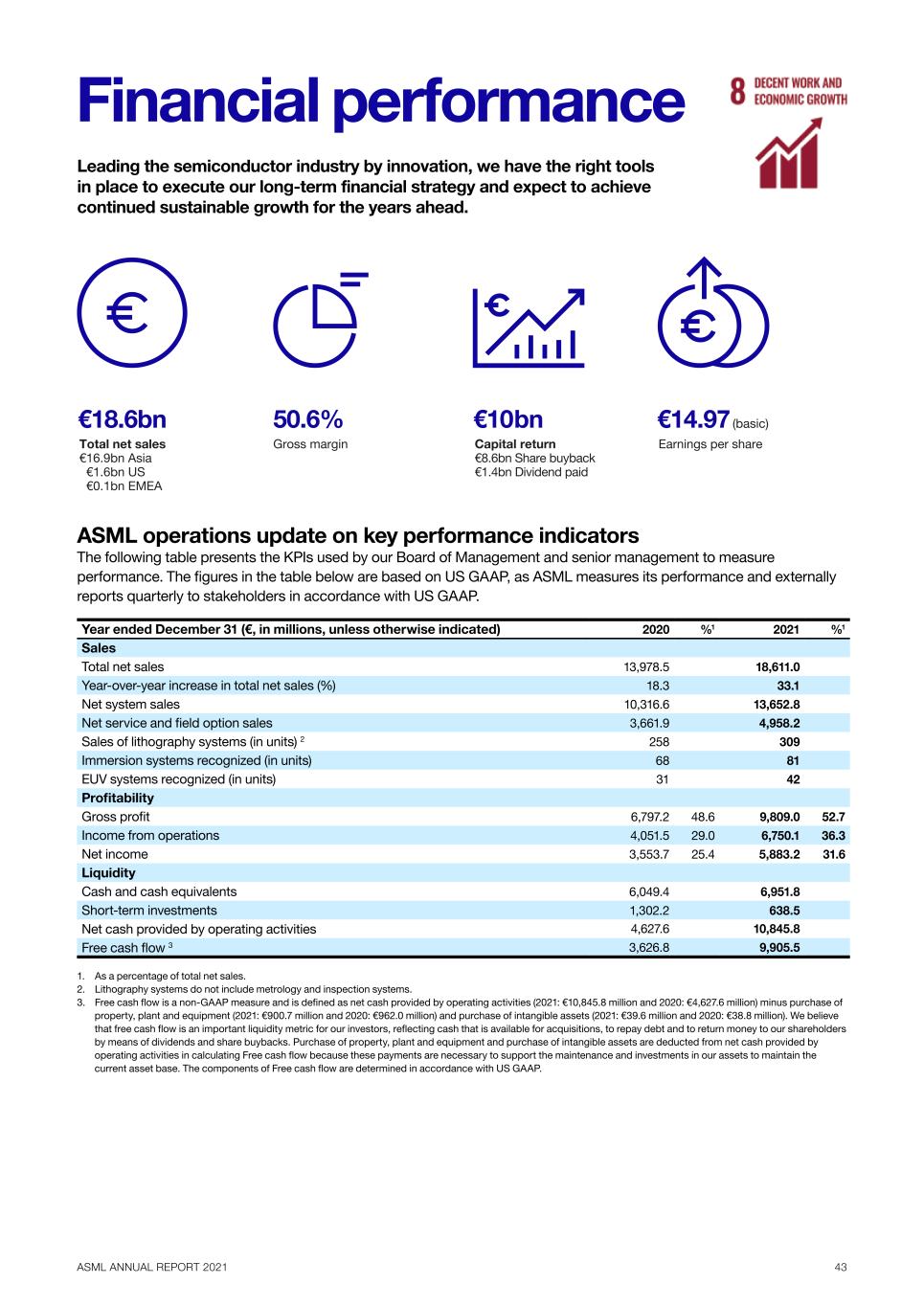

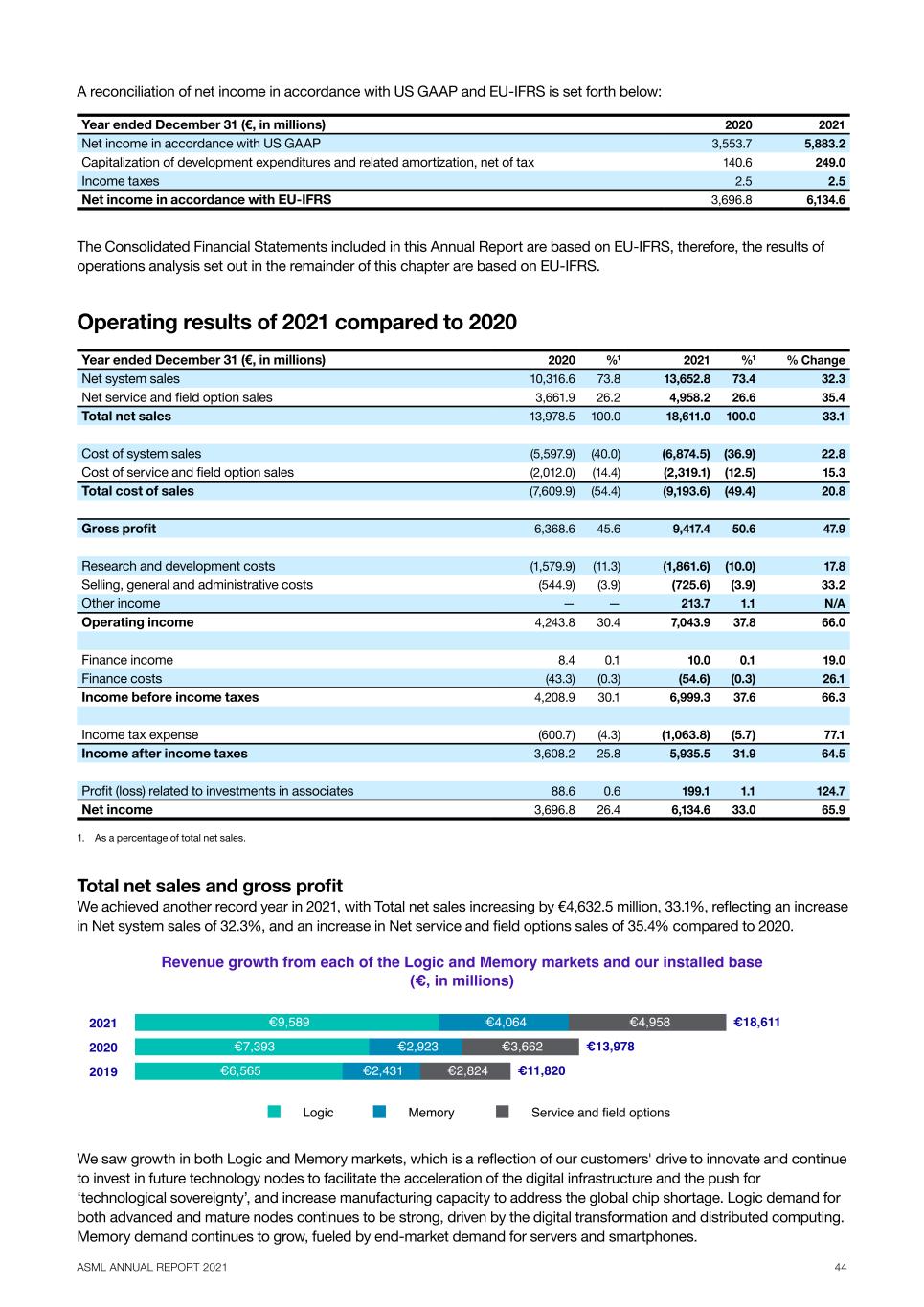

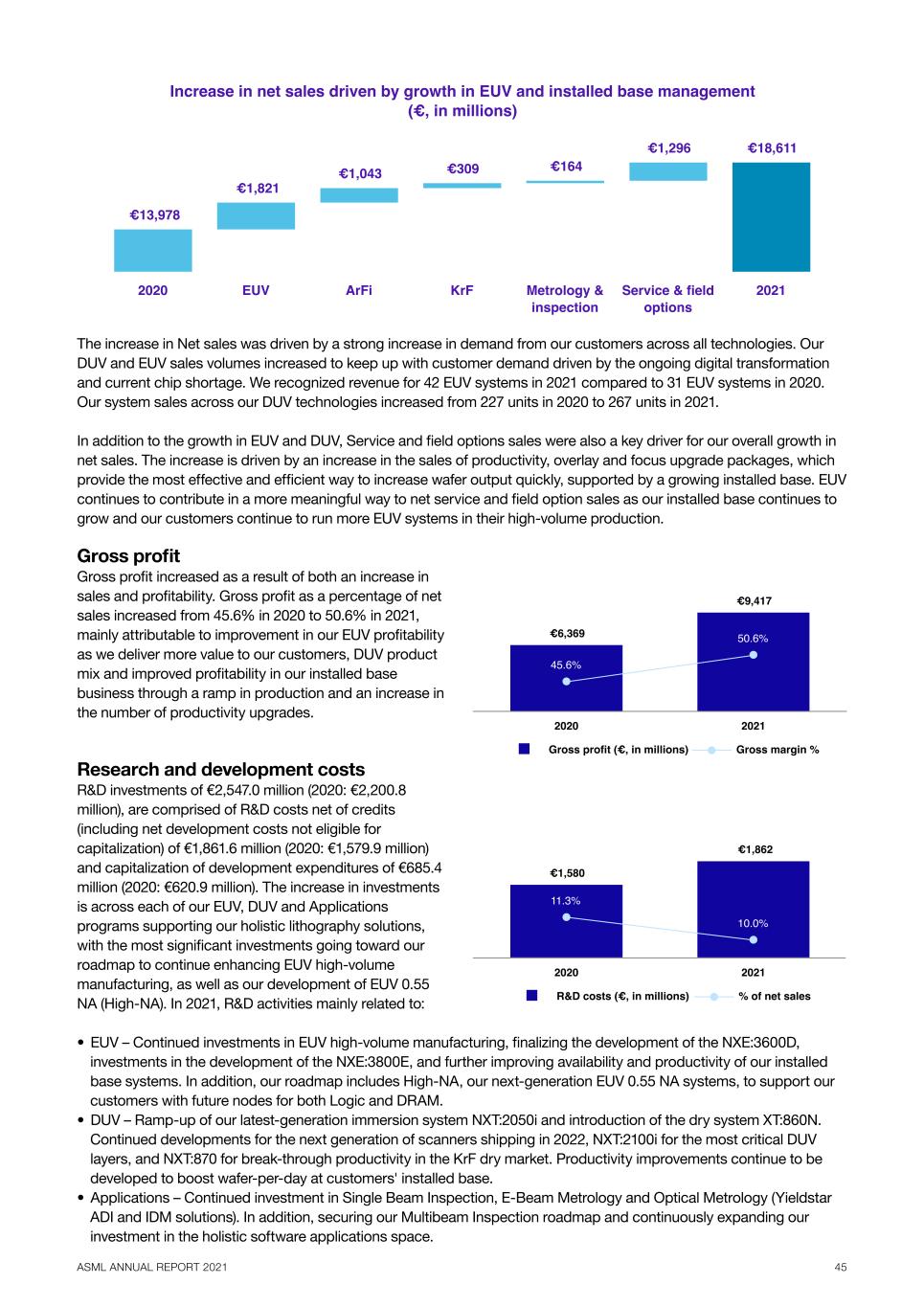

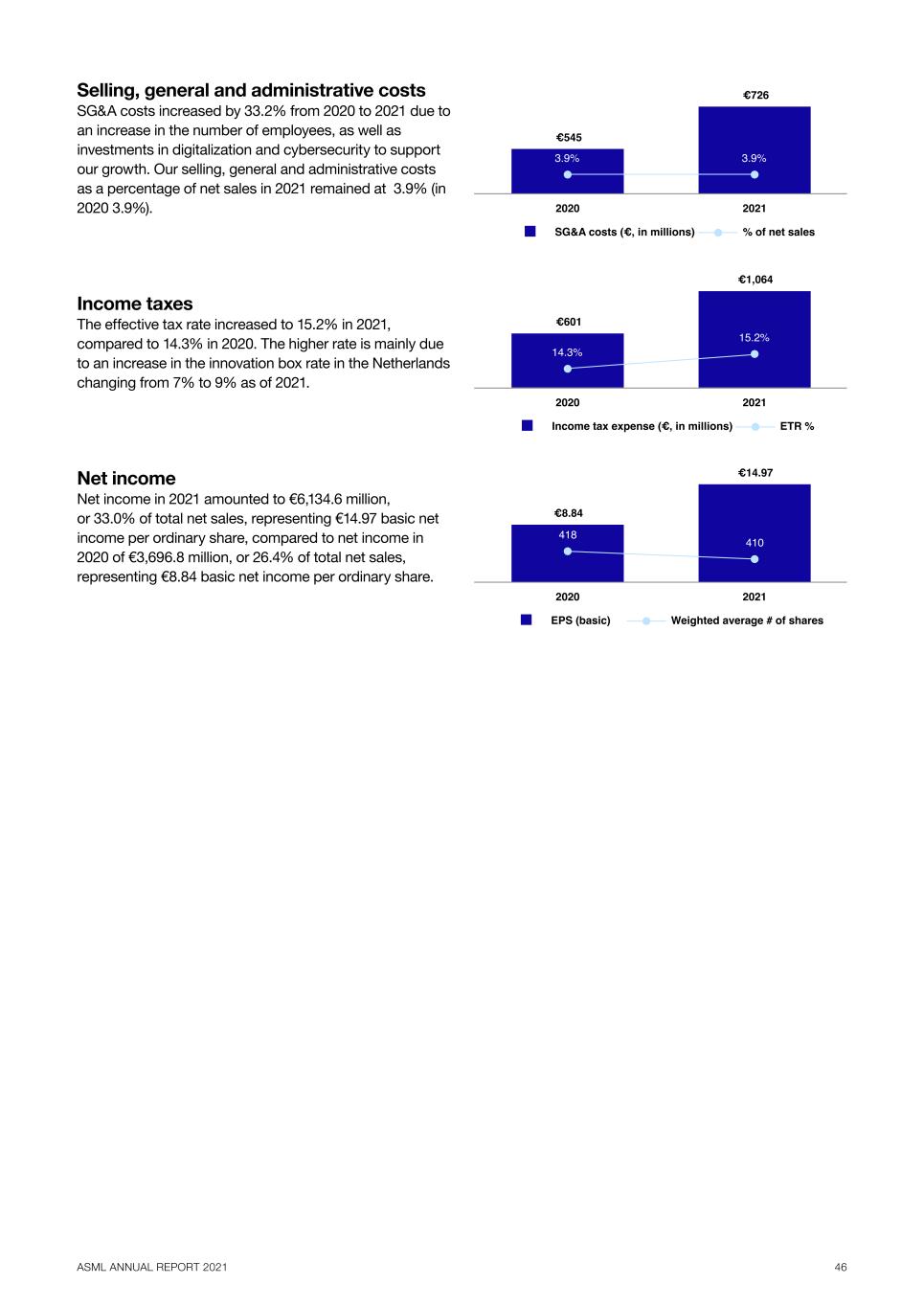

ASML ANNUAL REPORT 2021 7 2021 Highlights Financial Total net sales Gross margin Dividend per share Earnings per share Net incomeR&D costs €18.6bn (€14.0bn in 2020) 50.6% (45.6% in 2020) €6.1bn (€3.7bn in 2020) €2.5bn (€2.2bn in 2020) based on US GAAP €5.50 (€2.75 in 2020) (proposed) (basic)€14.97 (€8.84 in 2020) Lithography systems soldShare buyback 309 (258 in 2020) €8.6bn (€1.2bn in 2020) Social Total employees Engagement score Community engagement Attrition rate Nationalities 32,016 FTE (28,073 FTE in 2020) 78% (80% in 2020) 5.4% (3.8% in 2020) (120 in 2020) 122 €10.4m (€4.0m in 2020) Contribution to EU research projects €30.3m (€28.5m in 2020) ASML Foundation projects supported 22 (22 in 2020) Governance CEO versus average per FTEfemale members Supervisory Board diversity Internal pay ratio 38% (33% in 2020) 40 (38 in 2020) (229 in 2020) Speak-up reports 396 Environmental Energy consumption EUV Energy use per wafer pass EUV -6% (-6% in 2020) compared to baseline -37% (-26% in 2020) compared to baseline Value of parts re-used Systems refurbished €1.2bn (€1.2bn in 2020) 23 (22 in 2020) Reporting scope 57 (20 in 2020) locations CO2 emissions footprint Waste intensity 39.4 kt (15.4 kt in 2020) scope 1 & 2 305 kg (360 kg in 2020) per €m revenue Material recycling rate 77% (85% in 2020)

ASML ANNUAL REPORT 2021 8 Who we are and what we do

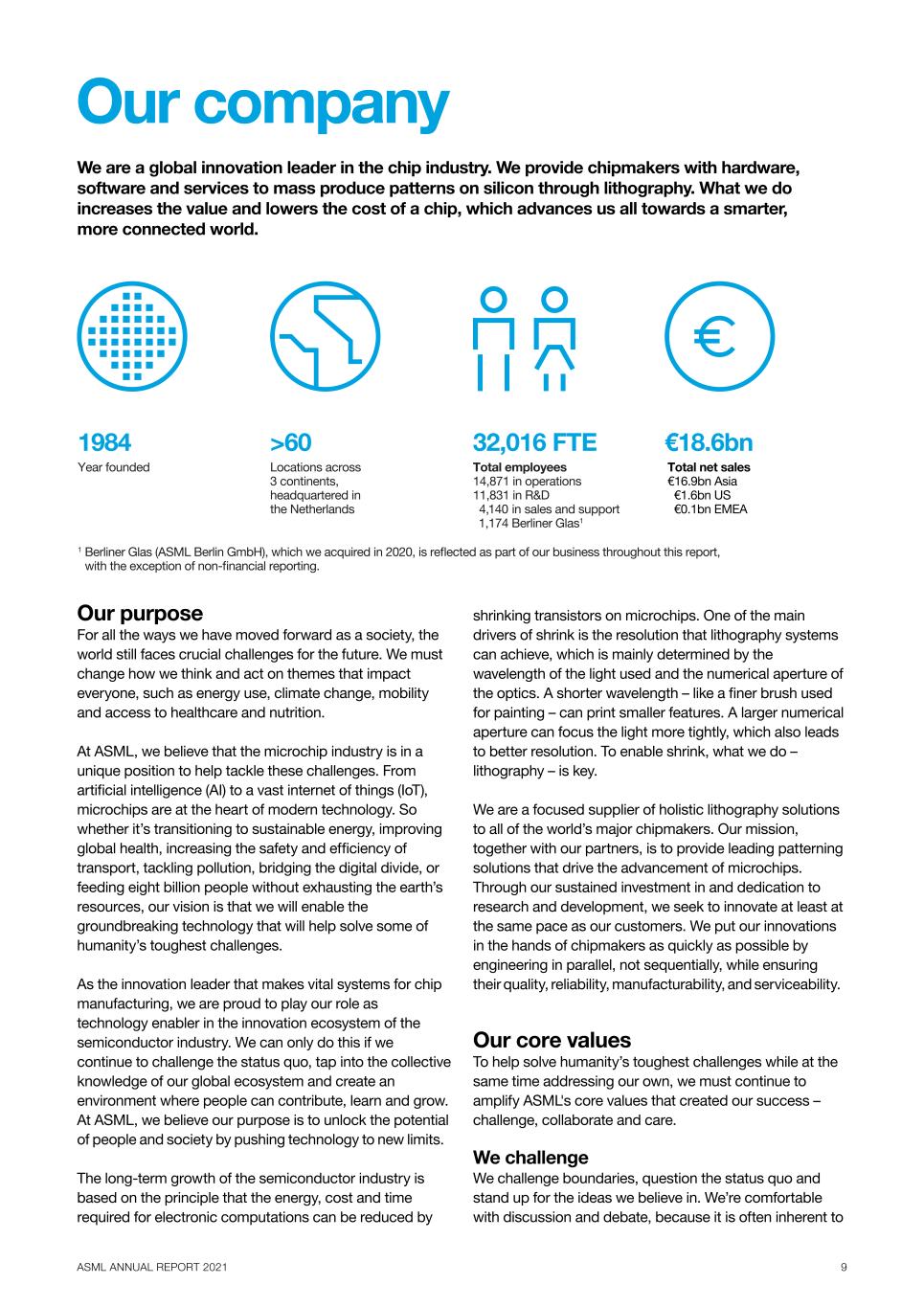

ASML ANNUAL REPORT 2021 9 Our company 1984 Year founded >60 Locations across 3 continents, headquartered in the Netherlands 32,016 FTE Total employees 14,871 in operations 11,831 in R&D 4,140 in sales and support 1,174 Berliner Glas1 €18.6bn Total net sales €16.9bn Asia €1.6bn US €0.1bn EMEA We are a global innovation leader in the chip industry. We provide chipmakers with hardware, software and services to mass produce patterns on silicon through lithography. What we do increases the value and lowers the cost of a chip, which advances us all towards a smarter, more connected world. 1 Berliner Glas (ASML Berlin GmbH), which we acquired in 2020, is re ected as part of our business throughout this report, with the exception of non-

nancial reporting. Our purpose For all the ways we have moved forward as a society, the world still faces crucial challenges for the future. We must change how we think and act on themes that impact everyone, such as energy use, climate change, mobility and access to healthcare and nutrition. At ASML, we believe that the microchip industry is in a unique position to help tackle these challenges. From artificial intelligence (AI) to a vast internet of things (IoT), microchips are at the heart of modern technology. So whether it’s transitioning to sustainable energy, improving global health, increasing the safety and efficiency of transport, tackling pollution, bridging the digital divide, or feeding eight billion people without exhausting the earth’s resources, our vision is that we will enable the groundbreaking technology that will help solve some of humanity’s toughest challenges. As the innovation leader that makes vital systems for chip manufacturing, we are proud to play our role as technology enabler in the innovation ecosystem of the semiconductor industry. We can only do this if we continue to challenge the status quo, tap into the collective knowledge of our global ecosystem and create an environment where people can contribute, learn and grow. At ASML, we believe our purpose is to unlock the potential of people and society by pushing technology to new limits. The long-term growth of the semiconductor industry is based on the principle that the energy, cost and time required for electronic computations can be reduced by shrinking transistors on microchips. One of the main drivers of shrink is the resolution that lithography systems can achieve, which is mainly determined by the wavelength of the light used and the numerical aperture of the optics. A shorter wavelength – like a finer brush used for painting – can print smaller features. A larger numerical aperture can focus the light more tightly, which also leads to better resolution. To enable shrink, what we do – lithography – is key. We are a focused supplier of holistic lithography solutions to all of the world’s major chipmakers. Our mission, together with our partners, is to provide leading patterning solutions that drive the advancement of microchips. Through our sustained investment in and dedication to research and development, we seek to innovate at least at the same pace as our customers. We put our innovations in the hands of chipmakers as quickly as possible by engineering in parallel, not sequentially, while ensuring their quality, reliability, manufacturability, and serviceability. Our core values To help solve humanity’s toughest challenges while at the same time addressing our own, we must continue to amplify ASML's core values that created our success – challenge, collaborate and care. We challenge We challenge boundaries, question the status quo and stand up for the ideas we believe in. We’re comfortable with discussion and debate, because it is often inherent to

ASML ANNUAL REPORT 2021 10 stress-testing and championing an idea. This is what enables us to push technology forward, keep things simple and do things with care and attention. We continue to challenge ourselves to add value for our customers, ensuring that we continually improve across key aspects, such as safety, quality, efficiency and cost. We collaborate As a system architect and system integrator, we collaborate to tap into our collective potential. Together with our partners in our ecosystem, we expand our knowledge and skills, learn from each other, and share approaches to deliver the best results. What we do is unique, and we need each other to make it possible. As we continue to grow and our ecosystem of partners expands, this collaborative mindset becomes even more essential to success. We care As we push technology further together, we have to do so with care. As an industry leader, we realize that our impact extends from people, to society, to the planet. We care not only for those we work with, but for our customers, suppliers, the world we live in, and the communities where we do business. We believe in integrity and respect for people and their human rights. We take personal responsibility to create a safe, inclusive and trusting environment where people from all backgrounds are encouraged and enabled to speak up, contribute, learn, make mistakes, and grow. We also seek to be clear in how we organize ourselves to achieve our goals, making sure we have a clear framework for what we do and how we do it. We believe that these values will help our company and our employees to make smart decisions that will benefit all stakeholders. Our purpose and values, together with the great responsibility we have as an industry leader, make us optimistic for the future. Where we come from Our company was founded in 1984 in Eindhoven under the name of ASM Lithography, a joint venture between Philips and ASM International. As they moved into their new space near the Philips factories at Strijp-T in Eindhoven, our first employees could never have imagined that in just three decades, ASML would be a global innovation leader. We’ve grown from our humble beginnings to a global force through relentless focus on innovation, sheer customer focus through tough times, and a willingness to rely on others to come to a better result. Although we’re constantly looking to the future, where we have come from is just as important to us as we evolve. These pioneering behaviors have been key to our success over the past 37 years, and they’ve become even more important to us as we continue to define our purpose and articulate the values that underpin everything we do. Understanding what made us successful in the past will help us maintain our success in the future. What guides us Innovation is rarely a straight line. We've always known that it takes laser focus, multidisciplinary teamwork and a keen eye for how we can best help our customers. And even then, we've had to show grit. It took a decade of tenacity to get our technology off the ground. We've all cared for this company unconditionally and are proudly committed to its success. We believed then as we do now that even the biggest challenge can be overcome through perseverance, if necessary with thousands of people over many years. We also learned to rely on others to come to a better result – without losing focus. That meant expanding our own knowledge and skills by building an ecosystem of expert suppliers, strategic partners, academia and service providers. We also acquired leading companies with unique technologies that strengthened our ability to deliver better solutions to our customers. We started to see ourselves as architects and integrators, inspiring our partners to innovate on the cutting edge of engineering while sharing risk and reward. And like us, some of our earliest customers are now leaders in the chip industry. We are geared towards providing long-term value to our customers and other stakeholders. Our direct value chain consists of our R&D partners, supply chain and customers, as well as our own manufacturing and service activities. Together we enable product and service manufacturers, so-called Original Equipment Manufacturers (OEMs), and Original Design Manufacturers (ODMs) to create end-use devices and services for the consumer market.

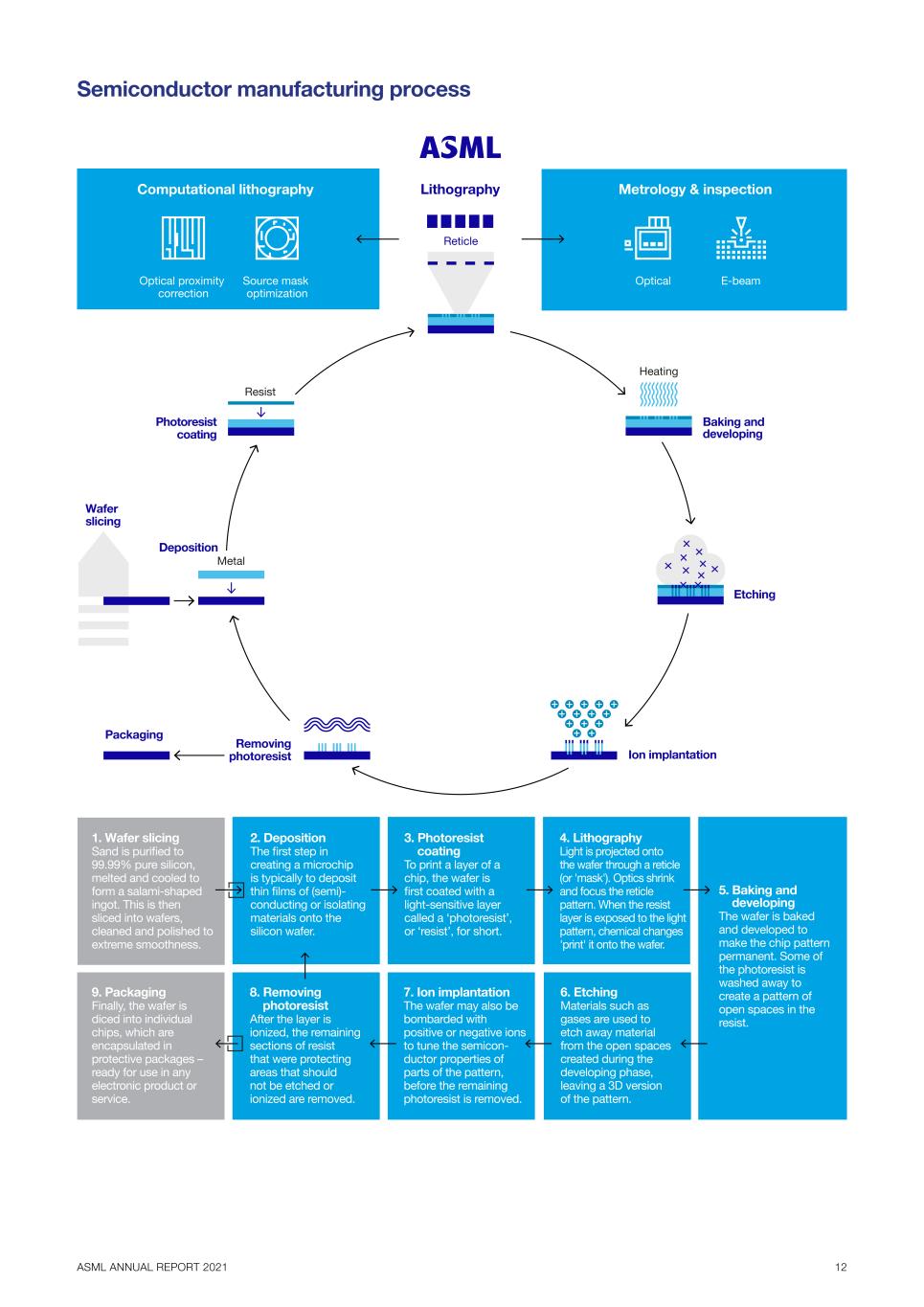

ASML ANNUAL REPORT 2021 11 Our position in the semiconductor industry Semiconductor materials Semiconductor design Indirect supply Mining and materials manufacturing Suppliers Customers R&D partners and supply chain (direct) Lithography equipment manufacturer Foundries and IDMs (semiconductor manufacturers) ConsumersManufacturers Devices and software (OEMs and ODMs) End-use products and services The role of lithography Lithography is a driving force in the creation of more powerful, faster and cheaper chips. Today’s most advanced processors, based on the Logic N5 node, contain billions of transistors. Shrinking transistors further is becoming increasingly difficult, but we aren’t as close to the fundamental limits of physics as some would think. Next-generation chip designs will include more advanced materials, new packaging technologies, and more complex 3D designs, which will create the electronics of the future. The manufacturing of chips becomes increasingly complex as semiconductor feature sizes shrink, while the imperative to mass produce at the right cost remains. Our holistic lithography product portfolio helps to optimize production and enable affordable shrink by integrating lithography systems with computational modeling, as well as metrology and inspection solutions. Our computational models enable our customers to optimize their mask design and tape-out time (the time to send the final design to the manufacturer for production). This works through mask-correction software to prepare and modify the design for optimized exposures, while the metrology and inspection solutions help in analyzing and controlling the manufacturing process in real time. A lithography system is essentially a projection system. Light is projected through a blueprint of the pattern that will be printed (known as a ‘mask’ or ‘reticle’). With the pattern encoded in the light, the system’s optics shrink and focus the pattern onto a photosensitive silicon wafer. After the pattern is printed, the system moves the wafer slightly and makes another copy on the wafer. This process is repeated until the wafer is covered in patterns, completing one layer of the wafer’s chips. To make an entire microchip, this process is repeated layer after layer, stacking the patterns to create an integrated circuit (IC). The simplest chips have around 40 layers, while the most complex can have over 150 layers. The size of the features to be printed varies depending on the layer, which means that different types of lithography systems are used for different layers – our latest-generation EUV systems for the most critical layers with the smallest features, and ArFi, ArF, KrF and i-line systems for less critical layers with larger features. Taking a closer look inside a fab A semiconductor fabrication plant, commonly known as a ‘fab’, is a factory where microchips are manufactured. The making of a microchip involves a multiple-step sequence including lithography to create a pattern in the photoresist and chemical processing steps such as deposition, photoresist coating, ion implantation and etching, during which electronic circuits are gradually created on a silicon wafer. Microchips are made of layers about 50 to 150 nm thick that are built on the semiconductor substrate one layer at a time. Some microchips can have up to 150 or more layers of varying complexity. Typically, the most complex layers are at the bottom and the least complex at the top. The most advanced chips require EUV and DUV immersion lithography tools to make them. Simpler microchips, such as sensors for IoT applications, can be produced using DUV dry machines. After adding material for a new layer during deposition, the desired pattern is exposed onto it, which after development leaves lines and geometric shapes positioned precisely in the desired locations. Then the layer is etched, making these designs permanent on the wafer. The entire manufacturing process of microchips – from start to tested and packaged device, ready for shipment – can take between 18 and 26 weeks, depending on their complexity. The heart of a fab is the cleanroom. All fabrication steps take place here, so the environment is controlled to eliminate dust on a nanoscale. Under the cleanroom floor is the so-called sub fab, which contains auxiliary equipment such as the drive laser. The utility fab – where the pumping and abatement systems for vacuum and cooling are located – is usually found one floor below this.

ASML ANNUAL REPORT 2021 12 5. Baking and developing The wafer is baked and developed to make the chip pattern permanent. Some of the photoresist is washed away to create a pattern of open spaces in the resist. Metrology & inspectionLithography E-beamOptical Computational lithography Source mask optimization Optical proximity correction Reticle Metal Resist Heating Ion implantation Removing photoresist Deposition Packaging Wafer slicing 1. Wafer slicing Sand is puri ed to 99.99% pure silicon, melted and cooled to form a salami-shaped ingot. This is then sliced into wafers, cleaned and polished to extreme smoothness. Photoresist coating Baking and developing Etching 2. Deposition The rst step in creating a microchip is typically to deposit thin lms of (semi)- conducting or isolating materials onto the silicon wafer. 3. Photoresist coating To print a layer of a chip, the wafer is rst coated with a light-sensitive layer called a ‘photoresist’, or ‘resist’, for short. 4. Lithography Light is projected onto the wafer through a reticle (or 'mask'). Optics shrink and focus the reticle pattern. When the resist layer is exposed to the light pattern, chemical changes 'print' it onto the wafer. 9. Packaging Finally, the wafer is diced into individual chips, which are encapsulated in protective packages – ready for use in any electronic product or service. 8. Removing photoresist After the layer is ionized, the remaining sections of resist that were protecting areas that should not be etched or ionized are removed. 7. Ion implantation The wafer may also be bombarded with positive or negative ions to tune the semicon- ductor properties of parts of the pattern, before the remaining photoresist is removed. 6. Etching Materials such as gases are used to etch away material from the open spaces created during the developing phase, leaving a 3D version of the pattern. Semiconductor manufacturing process

ASML ANNUAL REPORT 2021 13 The Rayleigh criterion that drives Moore’s Law Moore’s Law, a prediction made over half a century ago, sets the pace for our industry. Gordon Moore predicted that computing would dramatically increase in power, and decrease in relative cost, at an exponential pace. In other words, the number of transistors (tiny electrical switches) on an integrated circuit will double every two to three years at the same cost. This opens up two options to make microchips faster and more powerful: by using the same number of transistors on a chip at half the cost, or by doubling the number of transistors at the same cost. Even today, the power of this prediction is the fundamental principle of the semiconductor industry and the driving force for innovations that benefit our daily lives. At ASML, our job is to help the industry continue Moore’s Law. Our goal has always been to reduce the critical dimension (CD) – the smallest structure that a lithography system can print. This is defined by the Rayleigh criterion, the equation on which all our innovations are based: CD = k1 x λ NA • CD is the critical dimension, a measure of how small the smallest structures are that the lithography system can print. • λ (lambda) is the wavelength of the light source used and the smaller the wavelength the smaller the structures that can be printed. Our deep ultraviolet (DUV) lithography systems, known as the industry workhorse, dive deep into the UV light spectrum to print the tiny features that form the basis of the microchip. Over the years, ASML made several wavelength steps and our DUV lithography systems range from 365 nm (i-line), 248 nm (KrF) to 193 nm (ArF). With the extreme ultraviolet (EUV) systems, we provide highest-resolution lithography in high-volume manufacturing as these systems make a major step in wavelength. With EUV tin plasma, we generate EUV light which has a wavelength of just 13.5 nm. • NA is the numerical aperture, indicating the entrance angle of the light – with larger NA lenses/mirrors, smaller structures can be printed. Besides larger lenses, ASML increased the NA of our ArF systems by maintaining a thin film of water between the last lens element and the wafer, using the breaking index of the water to increase the NA (so-called immersion systems). After the wavelength step to EUV, ASML is developing the next- generation EUV systems, called EUV 0.55 NA (High-NA) where we push the numerical aperture from 0.33 to 0.55. • k1 is a factor relating to optical and process optimizations. Together with our computational lithography and patterning control software solutions, we provide the control loops for our customers to optimize their mask designs and illumination conditions. ASML's goal has always been to reduce the critical dimension. By reducing the wavelength and increasing the numerical aperture, our systems can print IC structures in increasingly smaller feature sizes. If our customers can print smaller structures, the chips can be smaller and the costs per transistor become cheaper, which in turn makes it more profitable for our customers. Extending Moore’s Law is becoming increasingly complex and costly. What will always be needed is a way to mass produce IC designs at the right cost. That’s where the full scope of ASML’s product portfolio will continue to play a big role to ensure affordable transistor shrink. We continue to push our entire system portfolio to new productivity levels and imaging performance. We believe that our EUV 0.33 and 0.55 NA lithography will help enable tomorrow’s most advanced chips. In our computational lithography solutions, we’re bringing machine learning and big data to the forefront in predicting both lithography and metrology processes, striving for 100% accuracy. We have developed an entirely new class of e-beam inspection systems to help our customers control defectivity in manufacturing in next-generation chip nodes, as those smaller structures can hardly be detected with optical inspection. CD = k1 x λ NA

ASML ANNUAL REPORT 2021 14 Message from the CTO Martin van den Brink (President, Chief Technology Officer and Vice Chair of the Board of Management) Dear Stakeholder, I’ve been asked the question many times, but let me assure you: Moore’s Law is still alive and well. And we believe it will stay with us for quite some time. Over the past 40 years, we have gradually evolved from the era of PCs and mobile devices into the cloud era, where almost every aspect of our lives is now stored and managed online. The next step of our digital future will be about distributed intelligence, driven by the seamless integration of communication, computation and artificial intelligence (AI). All these trends require more computing power, which in turn is accelerating the demand for more powerful and energy-efficient microchips. With our customers, we share a commitment to increase the energy efficiency performance of microchips. Together, we have a vision of the next 20 years to improve energy efficiency three-fold every two years, through system scaling including ongoing improvements in the resolution of our lithography systems, and through microchip device, material and transistor innovations. Moore’s Law has evolved and it is not only about printing the smallest lines. System scaling is driving innovation Over the last 15 years, the main driver of innovation in the semiconductor industry has expanded from pure lithography-enabled shrink (dimensional scaling) to microchip system scaling. This is achieved through new transistor structures and associated materials (device-level scaling), optimized circuit designs (circuit scaling) and innovative microchip architectures – such as 3D structures (architectural scaling) – as well as shrinking the microchip device footprint. Advancing holistic lithography ASML remains focused on enabling system scaling through shrink. We are integrating our complete product portfolio into a holistic lithography solution to optimize and control the lithography process. We do this through optimizing litho parameters, overlay, critical dimension (CD) and optical proximity correction (OPC), and by reducing the edge placement error (EPE) as well as improving our defect inspection capabilities. We are uniquely able to help our customers find, measure, and correct for patterning variations. Our main focus is on improving EPE (the difference between the intended and the printed feature edge of a microchip layout), which is one of the keys to improving yield. This is because the lithography systems at our customers not only measure every single wafer that goes through the fab, but they also expose every single field on every single wafer and die individually. This allows our customers to set the actuation values of all of the control knobs that they have on our lithography systems in an optimal way. How do we achieve that? We use scanner metrology, optical metrology, e-beam metrology and inspection to bring data from every relevant step in the process flow together. By analyzing all data in a single framework, our applications can then provide a feedback loop to the lithography system to make the required corrections, thereby delivering real value for our customers. DUV innovation continues Our deep ultraviolet (DUV) products are the industry backbone, supporting all semiconductor market segments. We keep innovating on all wavelengths. Our immersion and dry systems lead the industry in productivity, imaging and overlay performance for the high-volume manufacturing of the most advanced Logic and Memory chips. We continue to systematically develop our product portfolio to optimize the installed base for our customers, while increasing our focus on productivity and performance upgrades and additional services to support our customers’ wafer demand. Cost-efficient scaling with EUV Our extreme ultraviolet (EUV) product roadmap will help us drive affordable scaling well into the next decade. Our EUV 0.33 NA platform extends our customers’ Logic and DRAM roadmaps. Chip manufacturing with EUV helps reduce the amount of critical lithography masks (-40%) and process steps (-30%) when compared to non-EUV manufacturing. This results in significant defect, cost and cycle time reductions for our customers. We expect that adoption of EUV will

ASML ANNUAL REPORT 2021 15 continue to grow, with all advanced node chipmakers expected to use EUV in production by 2024. With our next-generation EUV 0.55 NA platform, we will continue to enable cost-efficient scaling for future nodes. The novel optics design with a higher numerical aperture will enable 60% smaller features and increase microchip density by a factor of almost 3 times. Our first early- access system is expected to be available in 2023 and we expect our customers will start their R&D in the 2024-2025 timeframe. High-volume manufacturing is projected to start in 2025-2026. Customers first In everything we do, a trusted relationship with our customers is key. Our comprehensive product portfolio is therefore aligned with our customers' roadmaps to deliver cost-effective solutions in support of all their applications, from advanced to mature nodes. We are aware that commonality across our DUV and EUV platforms allows faster and more cost-effective innovation, production and maintenance. That is why we increasingly focus on using common technology across our portfolio. We are investing in the energy efficiency of our products to help reduce the energy needed to produce a wafer. In addition, we have a strong roadmap to reduce waste. We are committed to re-using parts, tools and packaging whenever possible in our value chain. We are working together with our customers and suppliers to remanufacture used system parts, re-using them as new parts to prevent unnecessary waste. I strongly believe that we have a solid roadmap for the coming 10 years that will drive the continuation of Moore’s Law. Enabled by shrink, ongoing system scaling on all levels – on device, circuit, dimensional and architectural level – will require substantial innovation across our whole portfolio. This will be key to increasing the circuit density and energy efficiency of microchips while lowering their cost for many years to come. Martin van den Brink Chief Technology Officer

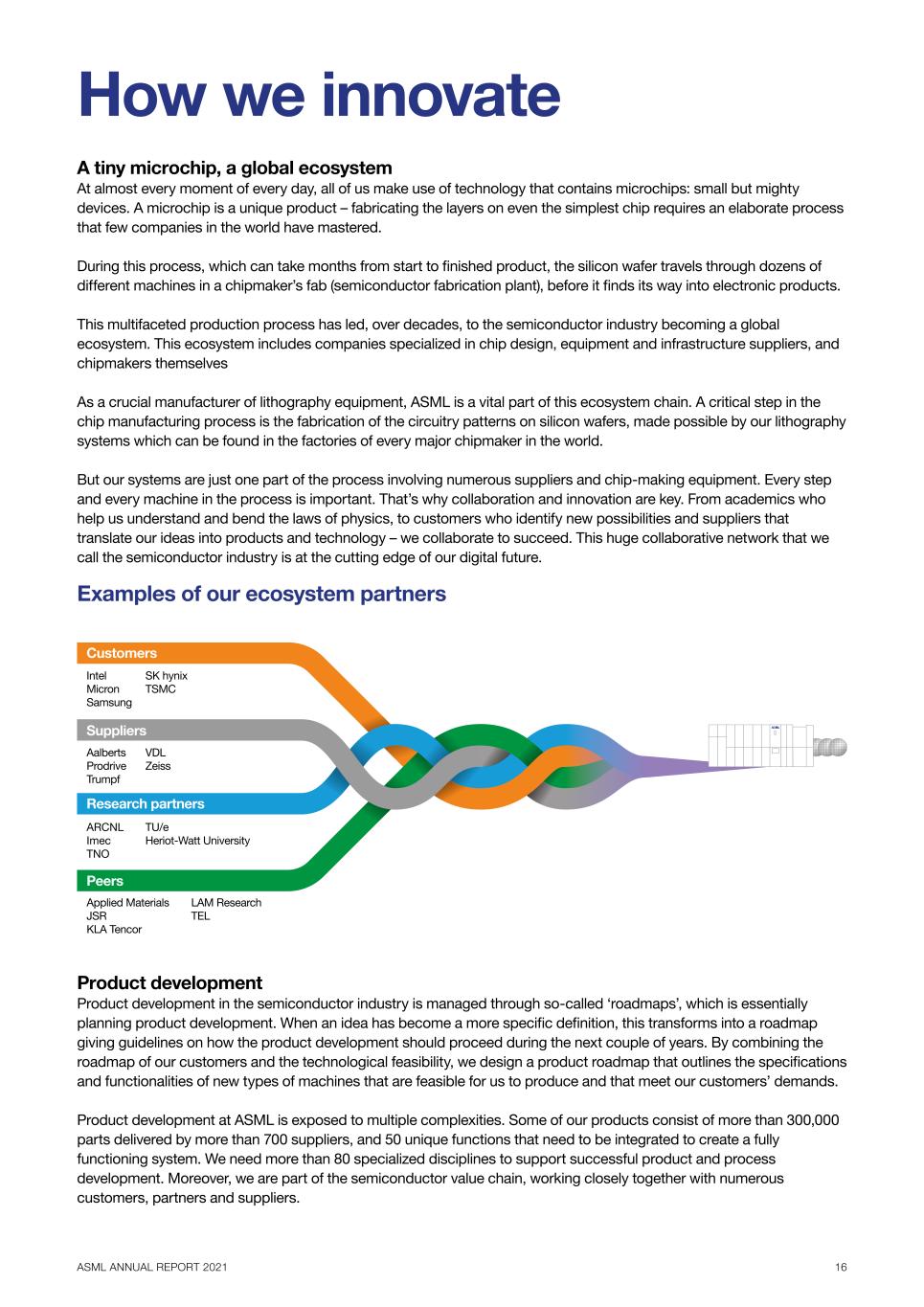

ASML ANNUAL REPORT 2021 16 How we innovate Customers Suppliers Research partners Peers Intel Micron Samsung Aalberts Prodrive Trumpf LAM Research TEL ARCNL Imec TNO Applied Materials JSR KLA Tencor TU/e Heriot-Watt University VDL Zeiss SK hynix TSMC Product development Product development in the semiconductor industry is managed through so-called ‘roadmaps’, which is essentially planning product development. When an idea has become a more specific definition, this transforms into a roadmap giving guidelines on how the product development should proceed during the next couple of years. By combining the roadmap of our customers and the technological feasibility, we design a product roadmap that outlines the specifications and functionalities of new types of machines that are feasible for us to produce and that meet our customers’ demands. Product development at ASML is exposed to multiple complexities. Some of our products consist of more than 300,000 parts delivered by more than 700 suppliers, and 50 unique functions that need to be integrated to create a fully functioning system. We need more than 80 specialized disciplines to support successful product and process development. Moreover, we are part of the semiconductor value chain, working closely together with numerous customers, partners and suppliers. A tiny microchip, a global ecosystem At almost every moment of every day, all of us make use of technology that contains microchips: small but mighty devices. A microchip is a unique product – fabricating the layers on even the simplest chip requires an elaborate process that few companies in the world have mastered. During this process, which can take months from start to finished product, the silicon wafer travels through dozens of different machines in a chipmaker’s fab (semiconductor fabrication plant), before it finds its way into electronic products. This multifaceted production process has led, over decades, to the semiconductor industry becoming a global ecosystem. This ecosystem includes companies specialized in chip design, equipment and infrastructure suppliers, and chipmakers themselves As a crucial manufacturer of lithography equipment, ASML is a vital part of this ecosystem chain. A critical step in the chip manufacturing process is the fabrication of the circuitry patterns on silicon wafers, made possible by our lithography systems which can be found in the factories of every major chipmaker in the world. But our systems are just one part of the process involving numerous suppliers and chip-making equipment. Every step and every machine in the process is important. That’s why collaboration and innovation are key. From academics who help us understand and bend the laws of physics, to customers who identify new possibilities and suppliers that translate our ideas into products and technology – we collaborate to succeed. This huge collaborative network that we call the semiconductor industry is at the cutting edge of our digital future. Examples of our ecosystem partners

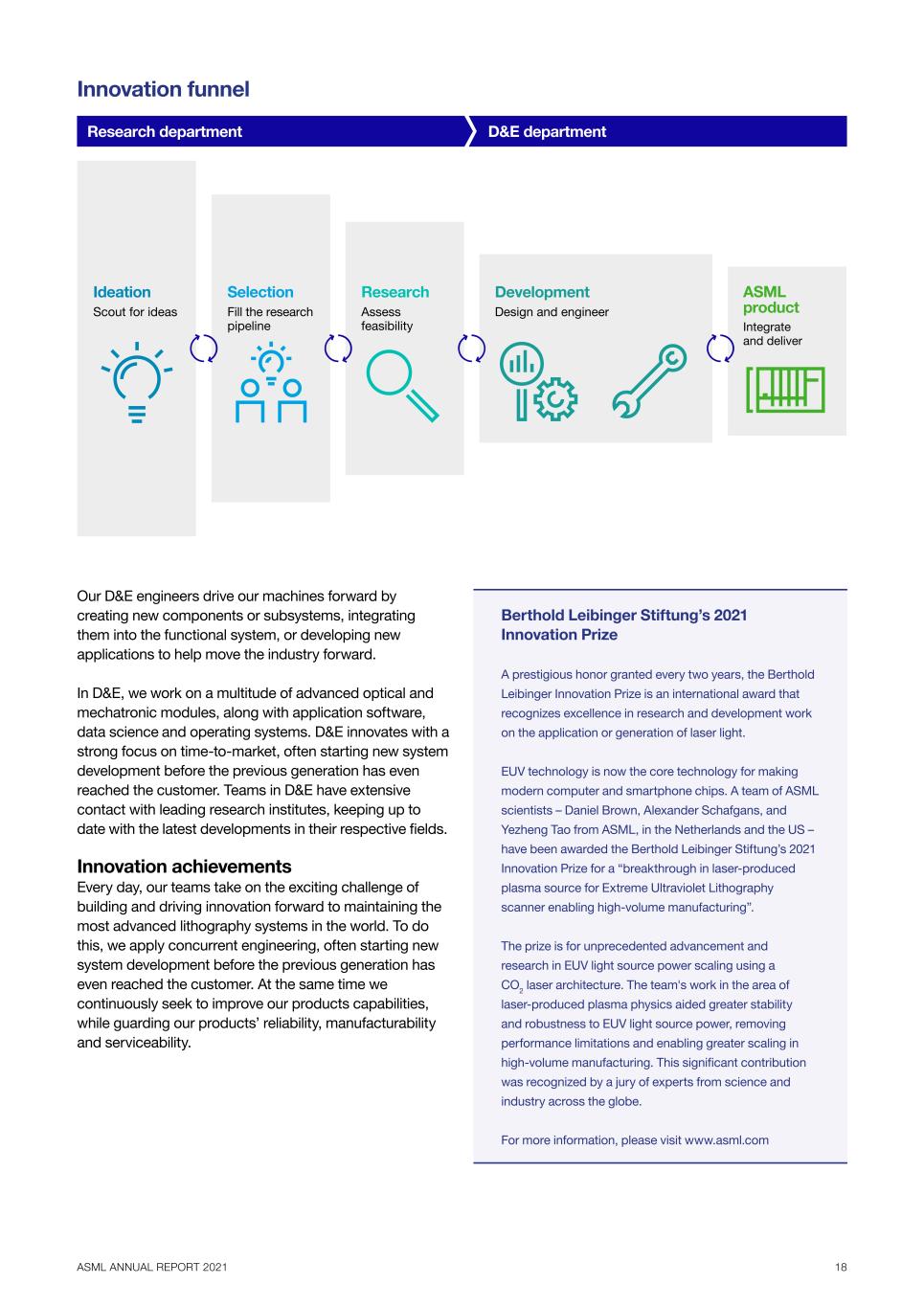

ASML ANNUAL REPORT 2021 17 ASML's success depends on the timely delivery of innovative and complex products. This brings uncertainty and risk, and the positive and negative impact of decisions made throughout product development can be huge. Compare it to a sailing race: The goal is clear, but the route is not. There are numerous variables to be managed, at high speed. Every piece of information is crucial to plan and reach the goal. For more than a decade, we have applied our tailor-made modular innovation and product development process, which we call the Product Generation Process (PGP). PGP describes the way we develop products at ASML, how we introduce these products to the market, and eventually how we phase them out. PGP is a decision-based process. There are 15 sequenced Key Decisions that determine the main stream of the product development. This means that PGP enables decisions to be made as to whether or not the development of a product should continue. The modular design of our products allows us to work out solutions to technological challenges independently of projects. This independent work enables us to consistently improve our solutions and it leads to an efficiency in development through reuse of system design and architecture. Our ecosystem partners We innovate through partnerships. Our innovation philosophy is one where we see ourselves as architects and integrators, working with partners in an innovation ecosystem. We develop our technology in close collaboration with our customers to ensure we build today what they need tomorrow. Our machines are developed based on their input, and we engage closely with them to help achieve technology and cost roadmaps. Read more in: Customer intimacy. In the same way, we work closely with our suppliers, trusting them to manufacture parts and modules for our systems. Many of them are deeply involved in developing new technology and achieving the innovations we seek. With some of these so-called ‘farmout suppliers’, we work as co-investors. Read more in: Our performance in 2021 - Social - Our supply chain. We have been in a partnership with Carl Zeiss SMT Holding GmbH & Co. KG for over three decades and we also hold an interest in the company. This partnership runs according to the principle of ‘two companies, one business’ working together to drive operational excellence in innovation and technology. Read more in: Our performance in 2021 - Social - Our supply chain. We co-develop expertise within a wide network of technology partners, such as universities and research institutions. Some of our partners include imec in Belgium, the technical universities in Twente, Delft and Eindhoven in the Netherlands, and the Advanced Research Center for Nanolithography (ARCNL), also in the Netherlands. Read more in: Our performance in 2021 - Social - Innovation ecosystem. Managing innovation Every day at ASML, more than 11,000 of the brightest minds in R&D take on the exciting challenge to innovate the most advanced lithography systems in the world. We manage this process by balancing our customers’ needs, product capabilities and technology solutions. To stay ahead, we invest heavily in R&D. In 2021, we spent €2.5 billion on R&D, compared to €2.2 billion in 2020. These amounts are based on US GAAP as our defined indicator relates to US GAAP and not to EU-IFRS. Our Research department’s focus is to generate and explore ideas and demonstrate their feasibility in the long term. The department also helps to find technological solutions to challenges in our products and applications that have moved into development. Our researchers continuously scout for technological innovations and solutions – within the semiconductor industry and beyond – to assess if they can be applied in ASML’s technology roadmap to support our customers to drive the semiconductor device roadmap. We encourage our experts to build a wide network in the broader technology space. The constant stream of new ideas is crucial to fill our technology pipeline that flows through the so-called ‘innovation funnel’. Here we select new ideas that have the potential to advance our products and customer application. Ideas that successfully pass the ‘proof of concept’ stage in our Research department are transferred to the Development & Engineering (D&E) department. D&E takes them on into our Product Generation Process (PGP) for product development. We then build and test system prototypes in the necessary environments. Prototypes that pass these tests may eventually lead to new product releases.

ASML ANNUAL REPORT 2021 18 Innovation funnel ASML product Integrate and deliver Development Design and engineer Research Assess feasibility Ideation Scout for ideas Selection Fill the research pipeline Research department D&E department Our D&E engineers drive our machines forward by creating new components or subsystems, integrating them into the functional system, or developing new applications to help move the industry forward. In D&E, we work on a multitude of advanced optical and mechatronic modules, along with application software, data science and operating systems. D&E innovates with a strong focus on time-to-market, often starting new system development before the previous generation has even reached the customer. Teams in D&E have extensive contact with leading research institutes, keeping up to date with the latest developments in their respective fields. Innovation achievements Every day, our teams take on the exciting challenge of building and driving innovation forward to maintaining the most advanced lithography systems in the world. To do this, we apply concurrent engineering, often starting new system development before the previous generation has even reached the customer. At the same time we continuously seek to improve our products capabilities, while guarding our products’ reliability, manufacturability and serviceability. Berthold Leibinger Stiftung’s 2021 Innovation Prize A prestigious honor granted every two years, the Berthold Leibinger Innovation Prize is an international award that recognizes excellence in research and development work on the application or generation of laser light. EUV technology is now the core technology for making modern computer and smartphone chips. A team of ASML scientists – Daniel Brown, Alexander Schafgans, and Yezheng Tao from ASML, in the Netherlands and the US – have been awarded the Berthold Leibinger Stiftung’s 2021 Innovation Prize for a “breakthrough in laser-produced plasma source for Extreme Ultraviolet Lithography scanner enabling high-volume manufacturing”. The prize is for unprecedented advancement and research in EUV light source power scaling using a CO2 laser architecture. The team's work in the area of laser-produced plasma physics aided greater stability and robustness to EUV light source power, removing performance limitations and enabling greater scaling in high-volume manufacturing. This significant contribution was recognized by a jury of experts from science and industry across the globe. For more information, please visit www.asml.com

ASML ANNUAL REPORT 2021 19 Modular wafer clamp We don’t say 'no' to a challenge. Our global research and D&E teams were challenged to create a new wafer clamp design that could be manufactured faster while meeting tighter specifications. After two years of research, design and engineering, our team launched the first full-scale prototype of the modular wafer clamp, ready for qualification in an EUV scanner. This achievement is a true testimony of cross-continental challenge and collaboration. Wafer table coating Unlike any other module in the scanner, the wafer table is the only scanner part in direct contact with the wafer during exposure. The requirements for flatness and surface stability are therefore rigorous. Thousands of wafers with different shapes and process characteristics are clamped to it on a daily basis as it moves under high acceleration forces, leading to unwanted drift and leaving behind a clamping fingerprint which affects the overlay performance. Our teams sought a solution to these fundamental issues affecting wafer table performance and found a more effective coating solution which ensures stability and also has substantial lifetime improvement benefits. Water-cooled EUV mirrors EUV systems use several mirrors instead of lenses to guide the EUV light to the wafer, shrinking the reticle pattern by a factor of four. When EUV light travels through the machine, part of it is absorbed into each reflecting mirror. This gives rise to so-called mirror heating, which influences imaging and overlay performance. Our researchers and engineers investigated new ways of thermal conditioning for the mirrors. Simulation and modelling showed good results on water-cooled mirrors. Testing of bonded substrates with water channels is underway, with encouraging results. In 2021, our research and D&E teams showed great achievements. A few examples are provided below.

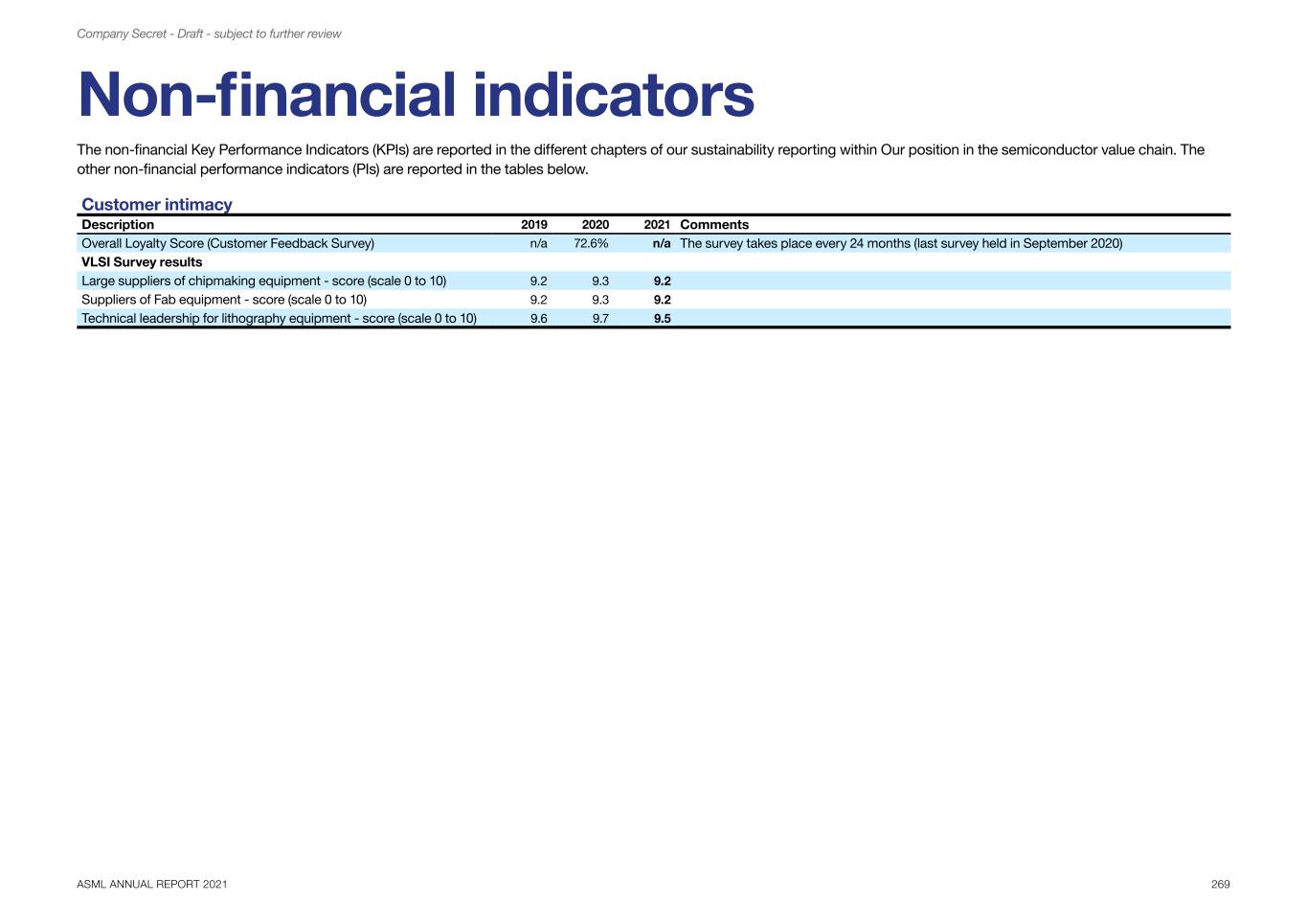

ASML ANNUAL REPORT 2021 20 Customer intimacy It’s crucial to be in a true partnership with our customers, to share in the risks and rewards of what we do. Trust and a shared vision are at the heart of this. Staying close to our customers To support and sustain our partnerships with customers, we have a structure of customer interactions across various channels in the organization, including, for example, customer alignment meetings. Here, members of our Board of Management, senior managers and customer representatives come together to make sure our product development plans are in line with our customers' business goals and needs. We run regular customer alignment meetings with our key customers. These meetings include our Executive Review Meetings, at which members of our senior management team and Board of Management discuss business and strategies with customers; Technology Review Meetings, at which our senior technology experts and our Chief Technology Officer discuss technology roadmaps and requirements with customers; and Operational Review Meetings, where we review topics related to our customers’ operational activities. We have a dedicated Sales and Customer Management department, which is responsible for building and maintaining our customer relationships and ensuring all relevant ASML departments contribute to meeting their needs. We market and sell our products directly to our customers, without agencies or other intermediaries. Our account managers, field and application engineers, and service and technical support specialists are located close to our customer locations throughout Asia, the US and Europe. Another focus area is training – boosting the capabilities of the local customer service teams as well as enhancing local technical expertise. The travel restrictions, among others, highlighted just how essential the need is for well- trained engineers in the regions where we operate. With the help of remote control capabilities, we were able to increase the self-sufficiency of the local field engineers. Measuring our approach Our Voice of the Customer program helps ensure our employees hear firsthand about our customers’ needs and challenges. This is especially important for employees without direct access to customers. To reach as many of our people as possible, the program makes use of different channels of communication: live presentations and Q&As with senior customer representatives, recorded customer interviews, online articles, and personal engagement with customer representatives. As one of the world’s leading manufacturers of chip- making equipment, we enable our customers to create the patterns that define the electronic circuits on a chip. Our customers are the world’s leading microchip manufacturers, and our success is inextricably linked with theirs. We collaborate with our customers to understand how our technology best fits their needs and challenges. For this reason, we engage with our customers at all levels: building partnerships, sharing knowledge and risks, and aligning our investments in innovation. We develop our solutions based on their input, engage in helping them achieve their technology and cost roadmaps, and work together, often literally in the same team, to make sure our solutions match. Despite continued travel restrictions and mandatory quarantine and workforce constraints, thanks to our collaborative efforts across the company and our business partners, we were able to maintain a high level of engagement with our customers and prevent any major impact on their business requirements. Customers around the world have recognized our additional support efforts and interventions during the pandemic. We were presented with several ‘customer awards’ in recognition of our rapid response to their needs and good overall customer service. In 2021, the demand for chips substantially increased driven by market fundamentals such as distributed computing, sensor technology, 5G, AI and digitalization accelerated by the pandemic. This also meant that the need for our customers to increase their capacity was at a record high. Rapidly increasing the number of systems shipped is challenging in our business, requiring seamless coordination with our suppliers who are also experiencing their own supply constraints. While we still managed to produce significantly more systems in 2021, we continued to work in close collaboration with our customers to weather the supply and delivery challenges by optimizing the installed base productivity. Achieving customer intimacy To us, customer intimacy is about the entire customer relationship across all channels, from the early stages of innovation onwards. We aim to foster loyalty, advocacy and continuous engagement with the goal of achieving complete customer satisfaction. We aim to leverage our innovation leading to more sophisticated solutions and interactions with our customers. As customer requirements become more complex, it takes longer to align, so we need to start earlier. Transparency is key in this process, and our customer intimacy strategy supports this.

ASML ANNUAL REPORT 2021 21 In 2021, travel restrictions and other mitigation measures related to COVID-19 continued to limit our in-person interactions to a large extent. Our account teams adapted quickly, introducing alternative solutions such as more local Voice of the Customer initiatives and remote customer interviews. Local account and support teams visited our customers at their locations, interviewed them on video, and then shared feedback with teams at ASML. Except for live presentations with large audiences, we were able to adhere to our regular schedule of interactions throughout the year. Another valuable customer feedback tool is our biennial Customer Feedback Survey, which asks our customers to rate our performance. We also use this opportunity to collect open feedback. The direct ratings and frank comments provide valuable insight into customers’ successes and challenges. We carefully analyze the results per customer, check our gained insights with the customer, and then define targeted, continuous improvement plans together with them, taking their priorities into account. Key elements in this process are: truly understanding what customers need from us, validating that we are on the right track with the right improvements, and updating our customers regularly on progress being made. In 2021, we continued deploying the improvement actions identified from the survey results of 2020. The next survey will be sent out in September 2022. We also set ourselves a target of achieving a VLSI top- three ranking among large suppliers of semiconductor equipment. The VLSI research annual Customer Satisfaction Survey benchmarks the performance of suppliers across the semiconductor industry based on three key factors: supplier performance, customer service and product performance. We moved up to second place in the 2021 VLSI research Customer Satisfaction ranking of the ’10 Best Large Suppliers of Chip Making Equipment’. We've maintained our position in the top three overall ‘Large Suppliers of Chipmaking Equipment’ and also in the top three individual categories: number one in ‘Best Suppliers of Fab Equipment’, ‘Wafer to Foundation Chipmakers’, and ‘Wafer Fabrication Equipment to Specialty Chipmakers’. In line with our business strategy, we continued in 2021 to work towards securing our full product portfolio that will sustain our company into the future. This includes working with our customers to increase the adoption of EUV in high-volume manufacturing environment, engaging with our customers to introduce EUV 0.55 NA platform, securing our products in mature markets and optimizing the installed base for our customers. Our product portfolio is aligned with industry trends and our customers’ detailed product roadmaps, which require lithography-enabled solutions. Our customers are showing their trust in us by investing in our newest technology, supporting the industry driver of shrink beyond the current decade.

ASML ANNUAL REPORT 2021 22 Our products and services The semiconductor industry is driven by affordable scaling (the ability to make smaller more energy efficient transistors at the right price). Our holistic lithography product portfolio is geared toward lithography-enabled shrink far beyond the current decade, to allow our customers to generate the greatest value per silicon wafer. Our product offerings in our holistic product portfolio provide patterning solutions for every possible wavelength – from the most advanced 13.5 nm EUV wavelength to the industry’s workhorse DUV wavelengths of 193 nm, 248 nm and 365 nm. This comprehensive portfolio supports customers across the semiconductor industry from mass- producing advanced Logic and Memory chips to creating novel ‘More than Moore’ applications or cost-effective manufacturing of mature chip technologies. To make sure that every individual pattern on an integrated circuit is connected flawlessly, we provide advanced process control solutions through our metrology and inspection systems and computational lithography solutions. In addition, we support our growing installed base with best-in-class customer support. Our highly differentiated solutions provide unique value drivers for our customers and ASML, working together to enable affordable shrink well into the next decade. Extreme ultraviolet (EUV) lithography systems More than two decades ago, we started developing EUV technology. It was "no walk in the park" and, since the start, we have invested billions in R&D, acquired Cymer to accelerate EUV source technology, and helped solve several technical challenges to enable the EUV infrastructure that our customers need for high-volume manufacturing. We succeeded by innovating in close cooperation with our customers and suppliers. This partially explains why ASML is the world’s only manufacturer of EUV lithography systems. Since its introduction, our EUV installed based produced more than 59 million wafers by end of 2021, compared to 26 million wafers produced by end of 2020. EUV 0.33 NA Our EUV platform extends our customers’ Logic and Memory roadmaps by delivering resolution improvements, state-of-the-art overlay performance and year-on-year cost reductions. EUV lithography uses light with a wavelength of just 13.5 nm and a numerical aperture of 0.33. This is a wavelength reduction of almost 15 times compared to the next most advanced lithography solution used in advanced chipmaking – deep ultraviolet (DUV) argon fluoride (ArF) lithography with its 193 nm light. This allows our customers to use EUV in a single exposure, rather than complex multiple patterning strategies with ArF immersion, and allows them to further shrink microchip structures. Our EUV product roadmap is intended to drive affordable scaling to 2030 and beyond. The TWINSCAN NXE:3600D is our latest-generation EUV 0.33 NA lithography system. It combines the highest resolution with 15-20% increased productivity and around 30% better overlay compared to its predecessor the TWINSCAN NXE:3400C, while also improving system availability. TWINSCAN NXE:3600D EUV 0.55 NA (High-NA) After five years of engineering, we have started to build the next generation of EUV lithography systems that further improves resolution with a higher numerical aperture (NA) of 0.55 compared to the 0.33 NA of our current EUV platform. To reduce technological introduction risk and R&D costs, the EUV 0.55 NA (High-NA) platform maximizes commonality with the EUV 0.33 NA platform. The capabilities of our EUV 0.55 NA system, called EXE:5000, bring considerable benefits to our customers by enabling lithography simplification for future nodes, higher yield and decreased defect density for both Logic and DRAM. With its larger optics, it can print smaller features with higher density, reducing patterning costs for customers significantly. EUV 0.55 NA helps our customers to extend their shrink roadmap and minimize double or triple patterning compared to 0.33 NA, leading to reduced patterning complexity, lower risk of defects and a shorter cycle time. We believe this technology will enable affordable geometric scaling well into the next decade as EUV 0.55 NA offers higher resolution that enables 1.7x smaller features and 2.9x increased density compared to EUV 0.33 NA. EUV 0.55 NA is expected to enter high-volume manufacturing at our customers in 2025–2026.

ASML ANNUAL REPORT 2021 23 Deep ultraviolet (DUV) lithography systems DUV lithography systems are the workhorses of the industry. Supporting numerous market segments, DUV systems produce the majority of layers in a customer device today and will remain important for future devices. We offer immersion as well as dry lithography solutions for all DUV wavelengths currently used in the semiconductor industry – i-line using 365 nm wavelength, KrF using 248 nm and ArF using 193 nm. These systems help manufacture a broad range of semiconductor nodes and technologies, and support the industry’s cost- and energy-efficient scaling. Our DUV immersion and dry systems lead the industry in productivity, imaging and overlay performance for high- volume manufacturing of the most advanced Logic and Memory chips in combination with EUV, while continuing to deliver value for mature nodes and lower-volume applications. Immersion systems ArF immersion lithography maintains a thin film of water between the lens and the wafer, increasing NA and improving resolution to support further shrink. Our immersion systems are suitable for both single-exposure and multiple-patterning lithography, and can be used in seamless combination with EUV systems to print different layers of the same chip. The TWINSCAN NXT:2050i is our current state-of-the-art immersion system and is being used in high-volume manufacturing of the 5 nm Logic and fourth generation of 10 nm DRAM nodes. The NXT:2050i is based on a new version of the NXT platform, which includes new developments in the reticle stage, wafer stage, projection lens, and exposure laser. Thanks to these innovations, the system delivers better overlay control at higher productivity than its predecessor. TWINSCAN NXT:2050i Dry systems Not every layer on a chip necessarily needs the latest and greatest immersion lithography systems to produce them. There may be more complicated layers that are made using more advanced lithography systems, but the rest can often be printed using ‘older’ technology such as dry lithography systems. Our dry systems product portfolio offers more cost-effective solutions for all types of wavelengths for our customers. The TWINSCAN NXT:1470 is our latest dry ArF lithography system, offering a record productivity of 300 wafers per hour with a 4 nm overlay capability. It is also the first dry NXT system, building on our successful immersion platform, and delivers improvements in matched machine overlay, productivity and its fab space. With an 0.80 NA, the TWINSCAN XT:860N is our new- generation KrF system, supporting high-volume 200 mm and 300 mm wafer production at and below 110 nm resolution. The XT:860N features the new Large Range Level Sensor that allows customers to measure high topology 3D NAND wafers at increased productivity of 260 wafers per hour – up from the 240 wafers per hour capability of the XT:860M. For more critical KrF layers, the 0.93 NA TWINSCAN XT:1060K is our most advanced KrF lithography system, and offers best-in-class resolution at and below 80 nm and overlay. XT:860N The TWINSCAN XT:400L is our latest i-line lithography system, which can print features down to a resolution of 220 nm for 200 mm and 300 mm wafer production. Mature products and services Before EUV, before immersion, and even before our TWINSCAN systems, there was the PAS. In 1991, seven years after the company was founded, we launched the PAS 5500, which turned out to be our breakthrough platform. This system was able to dramatically reduce manufacturing times for our customers, and its modular design enabled them to produce multiple generations of advanced chips using the same system.

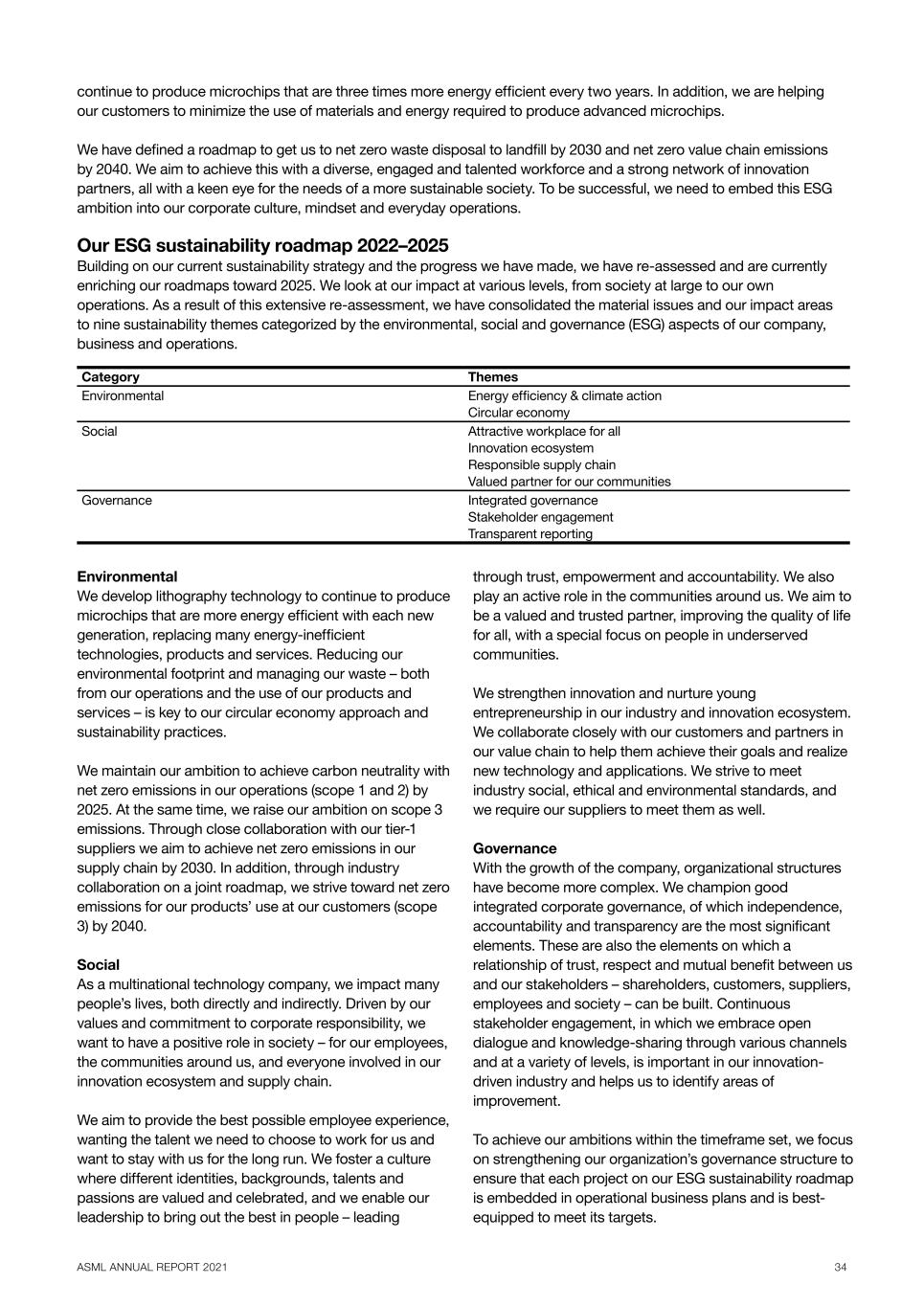

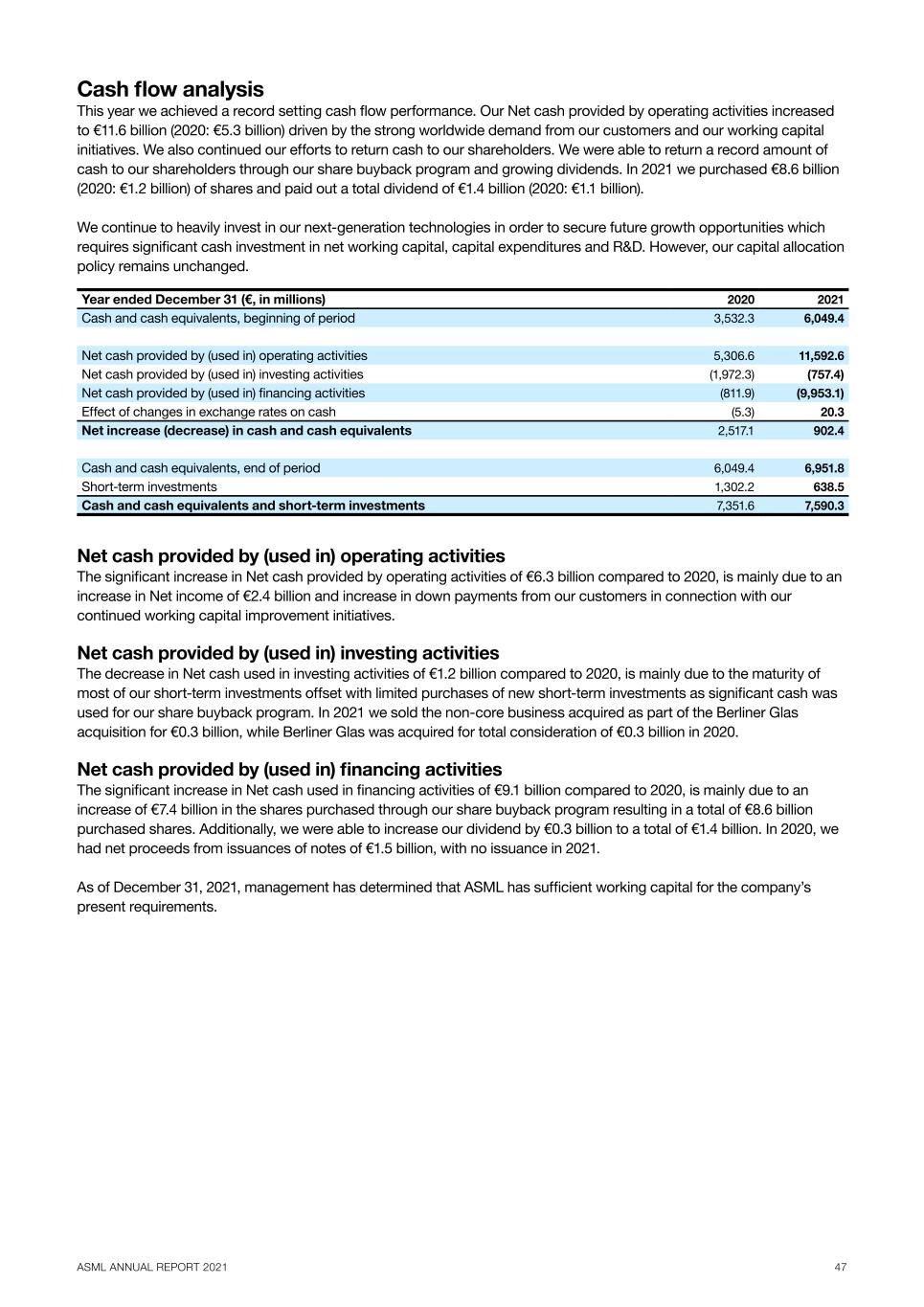

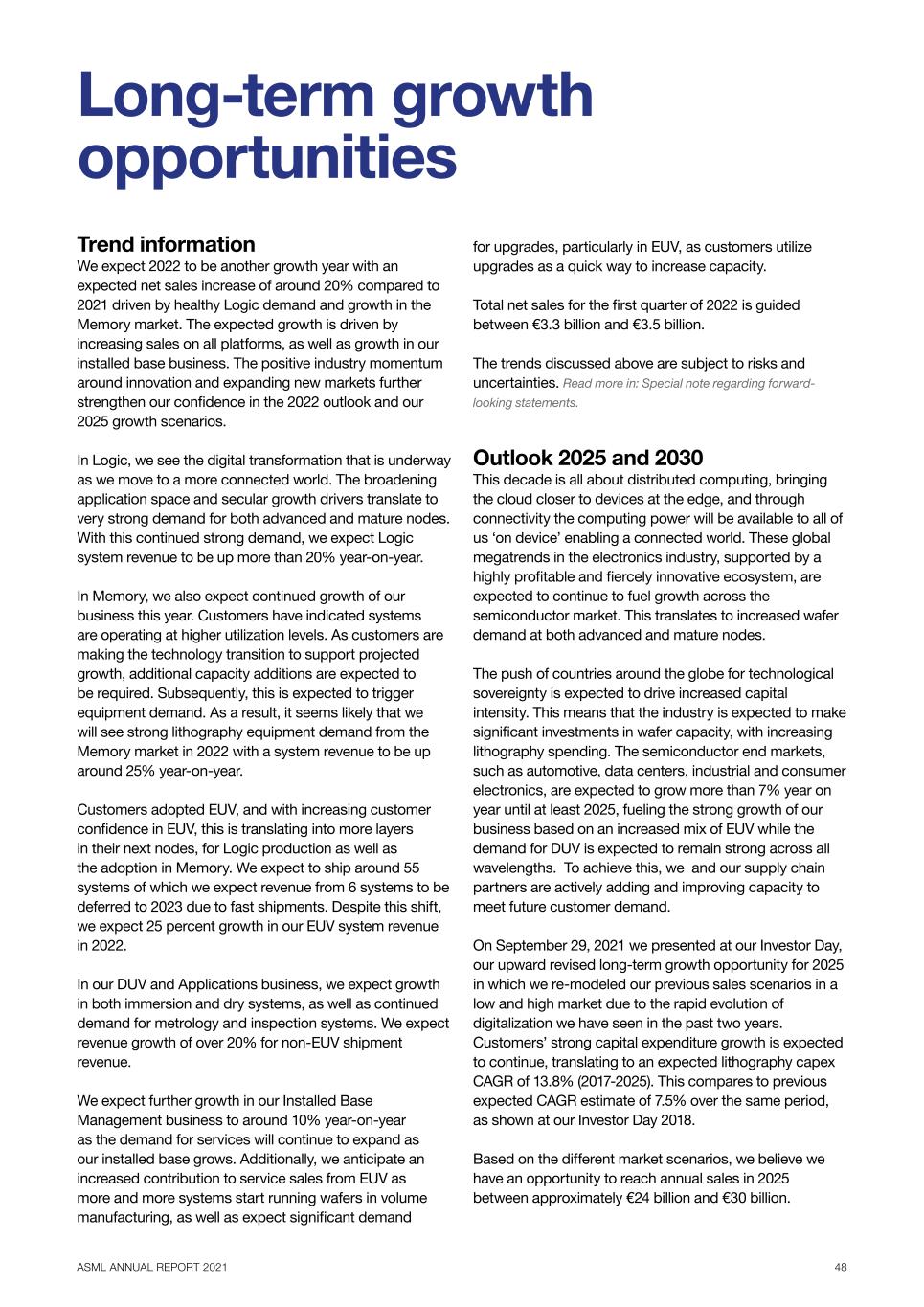

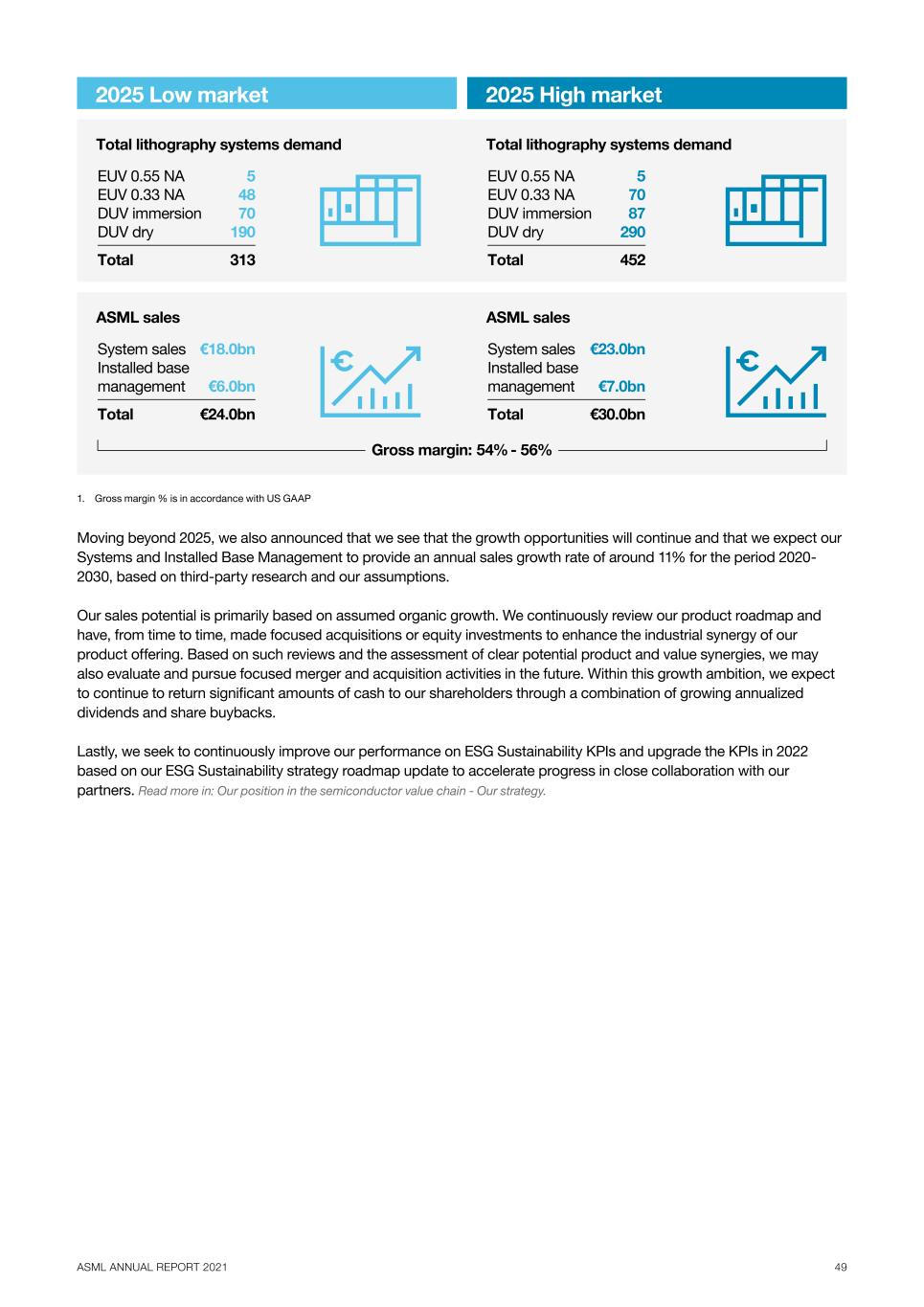

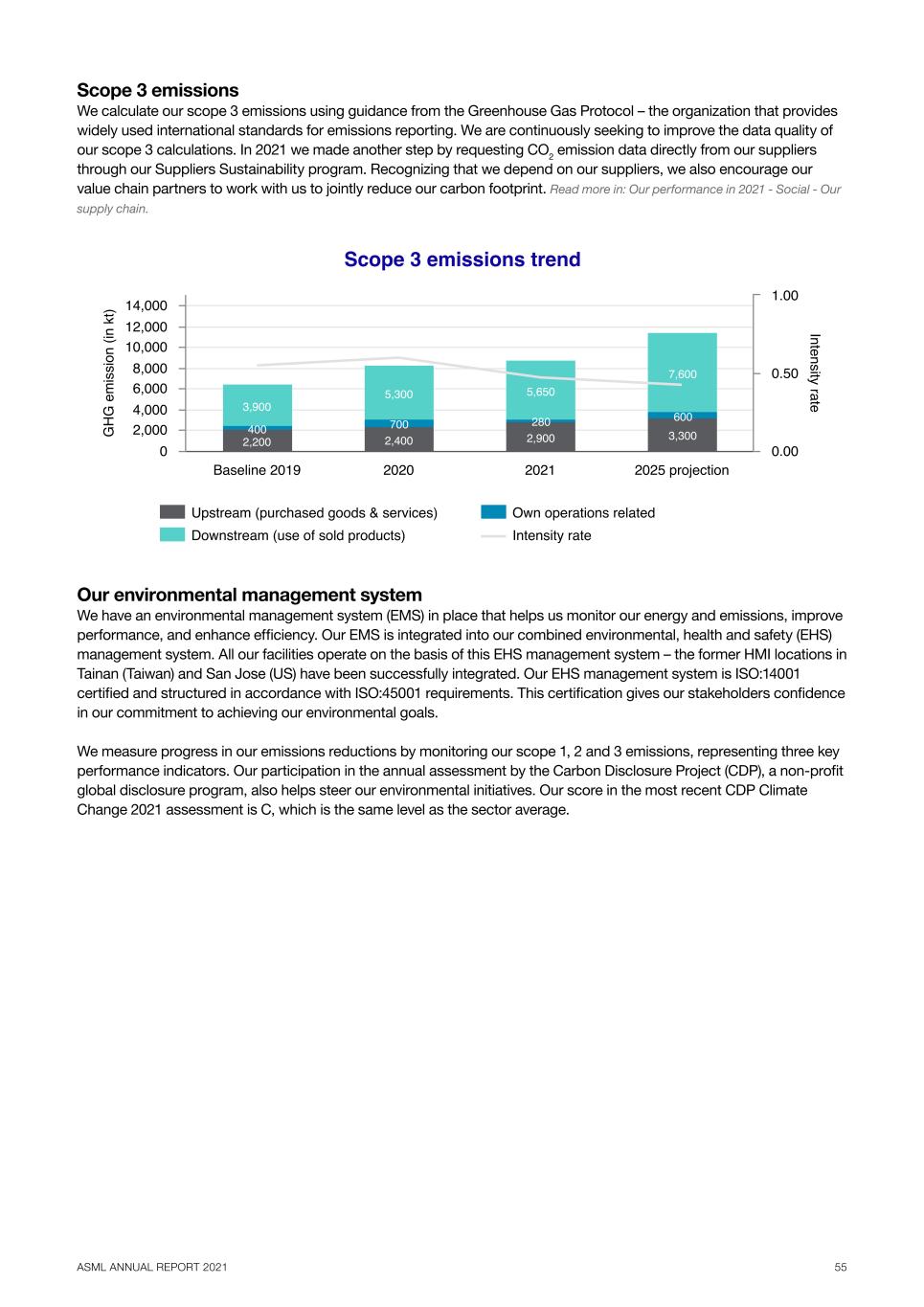

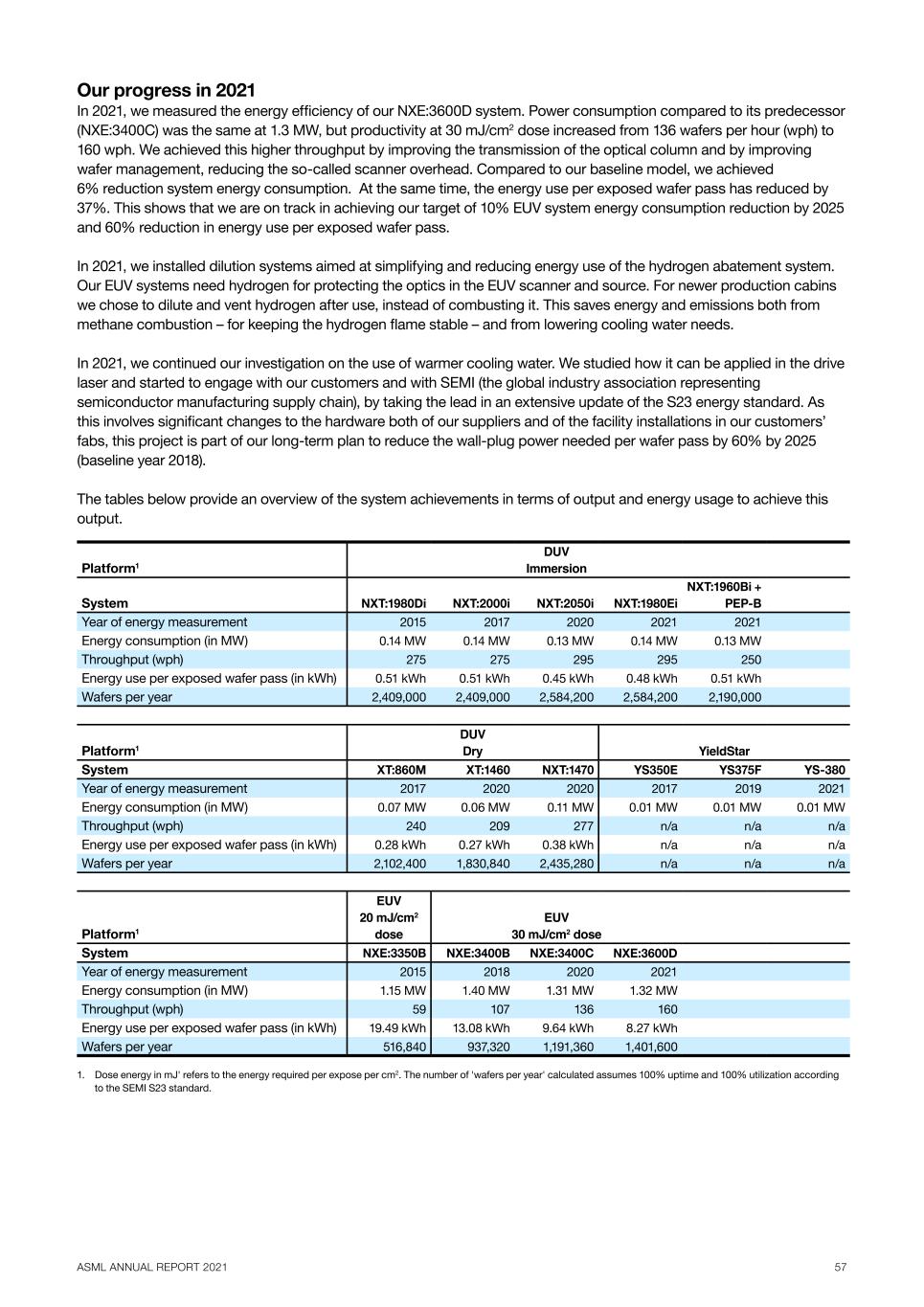

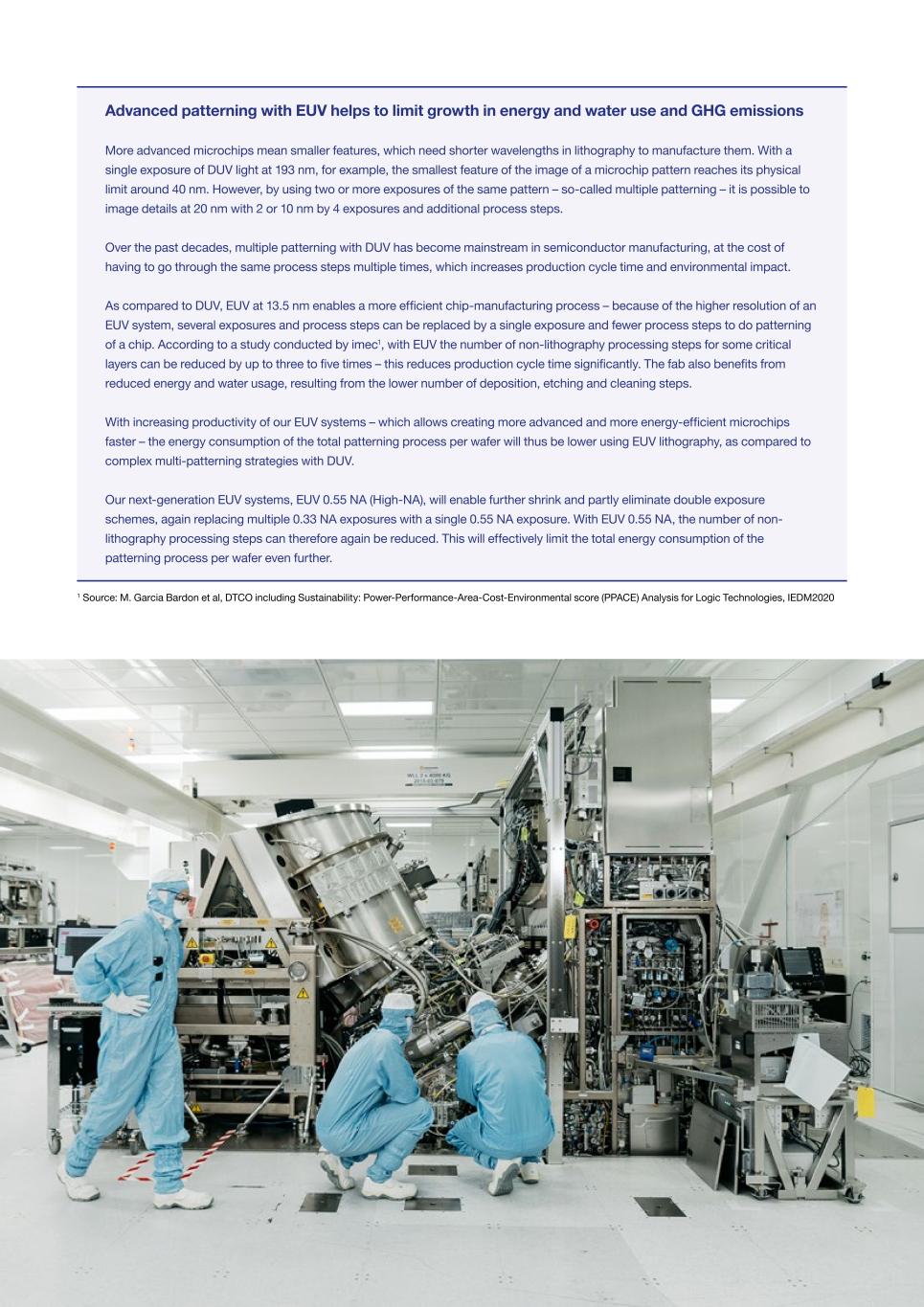

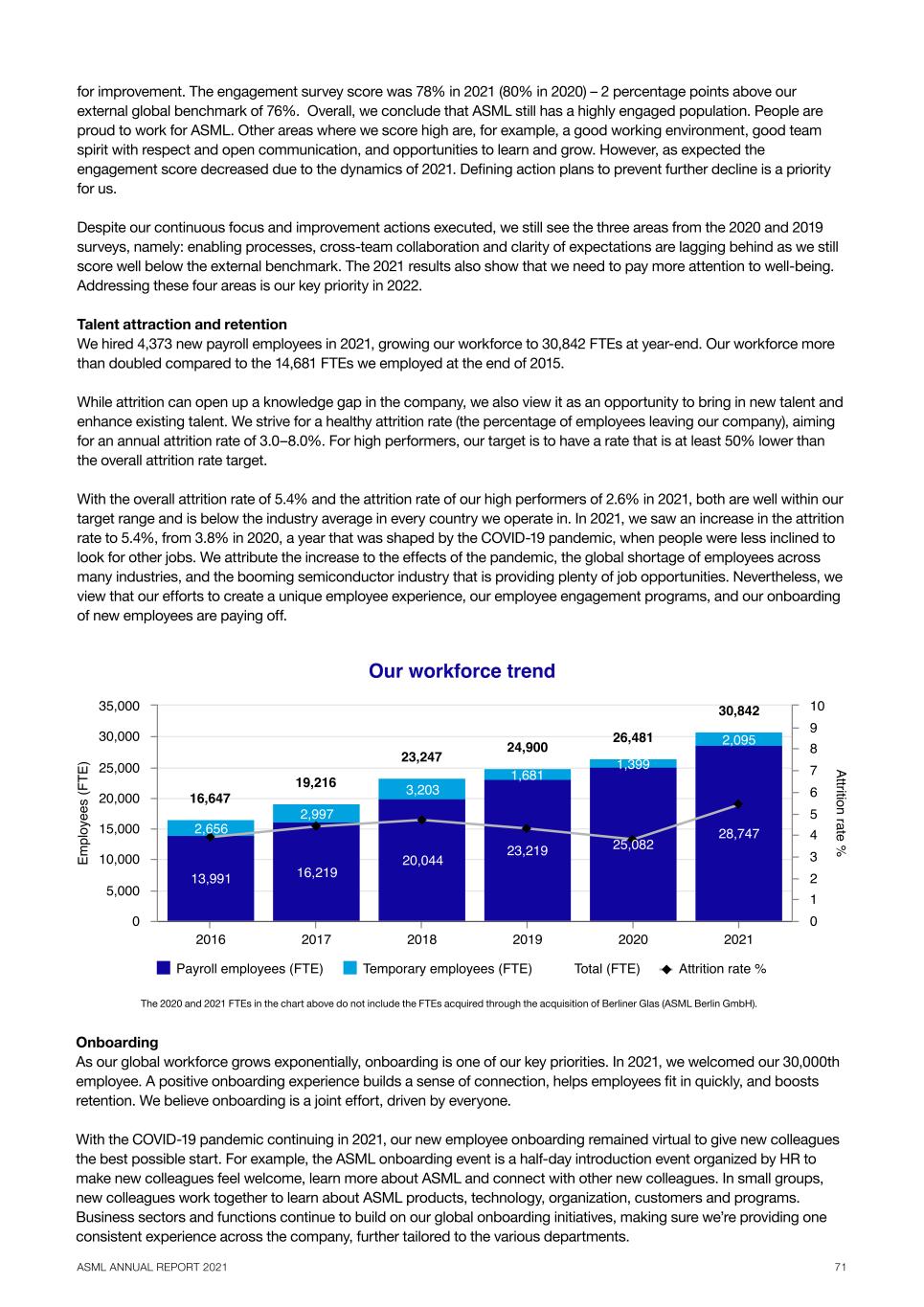

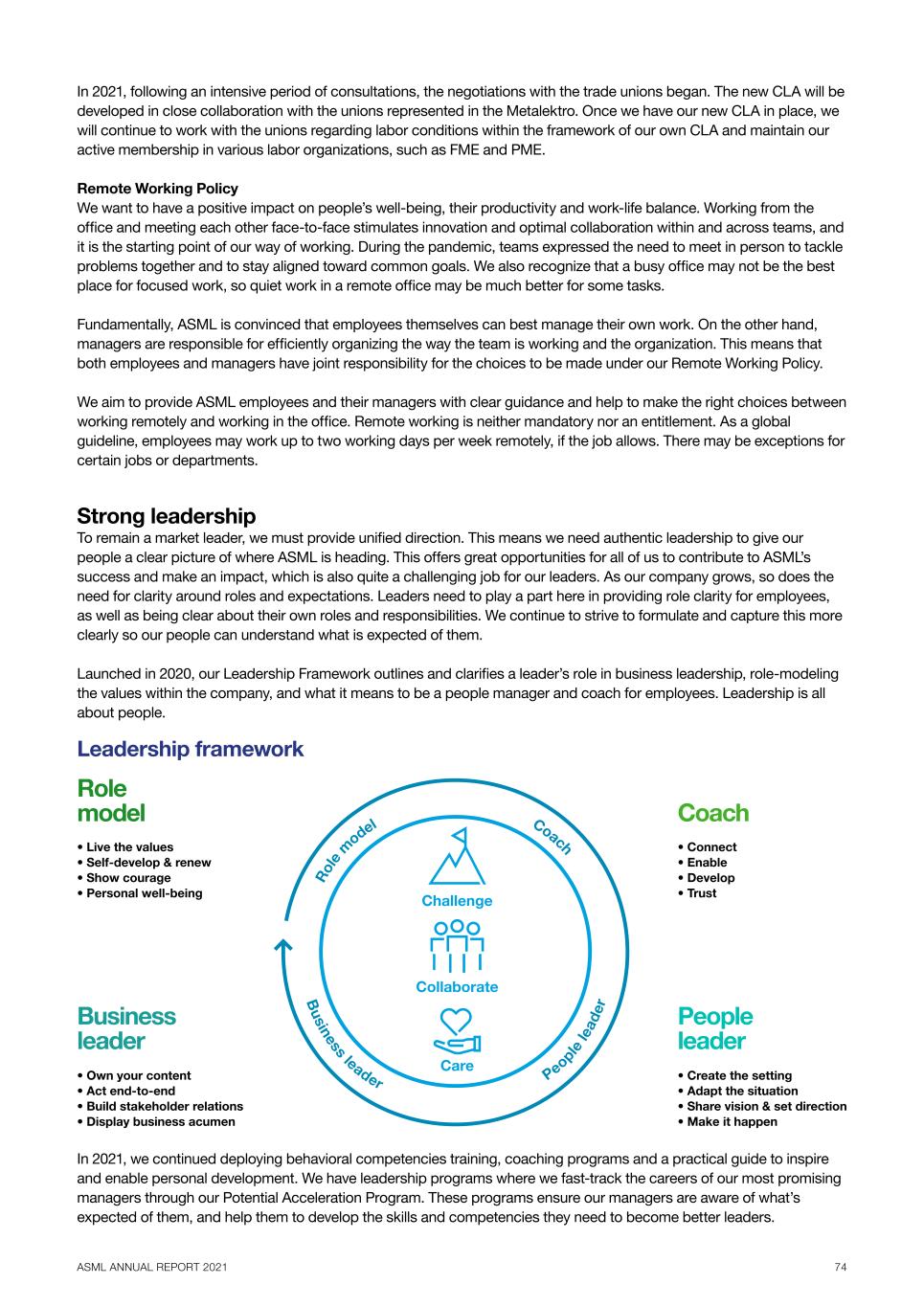

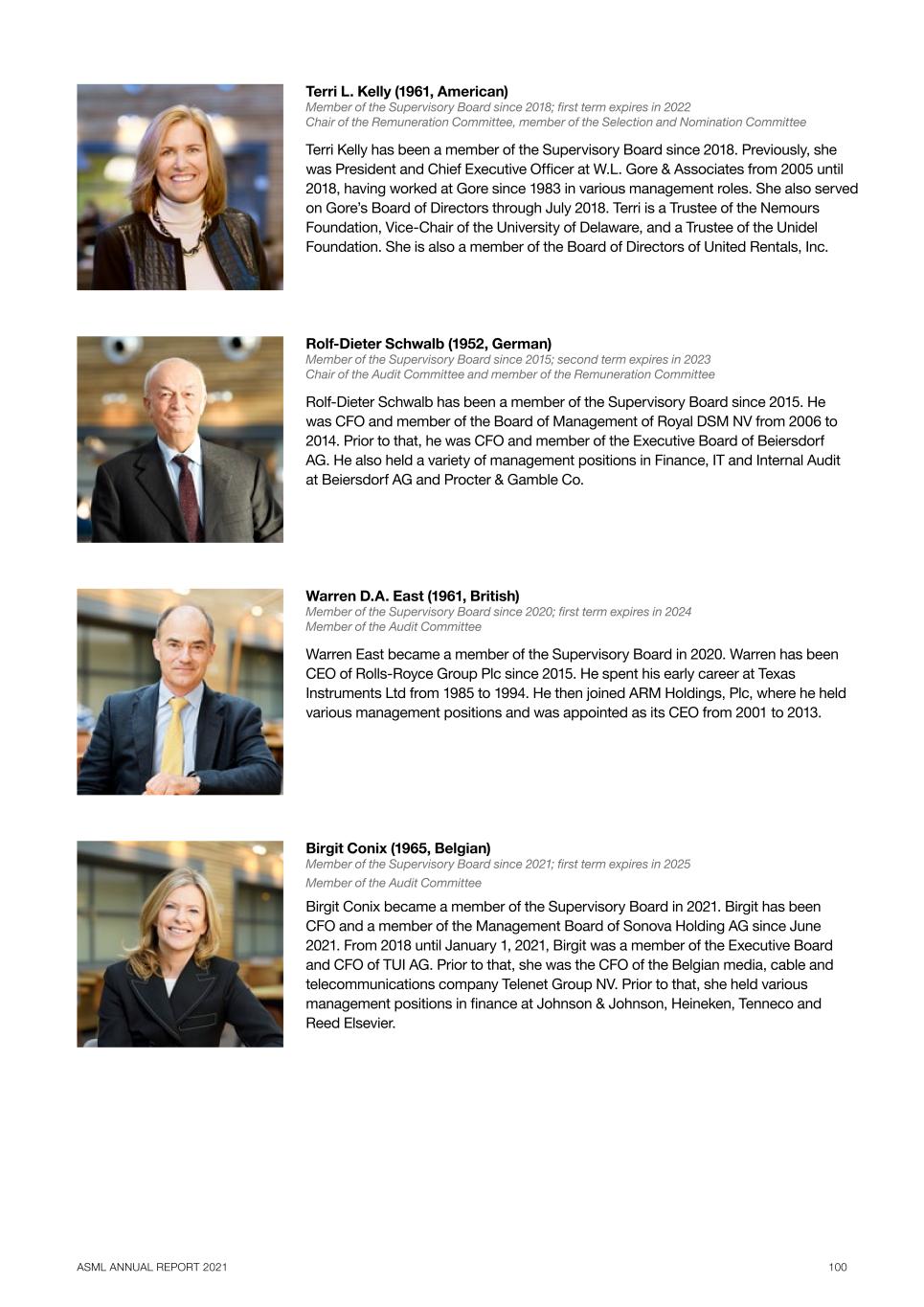

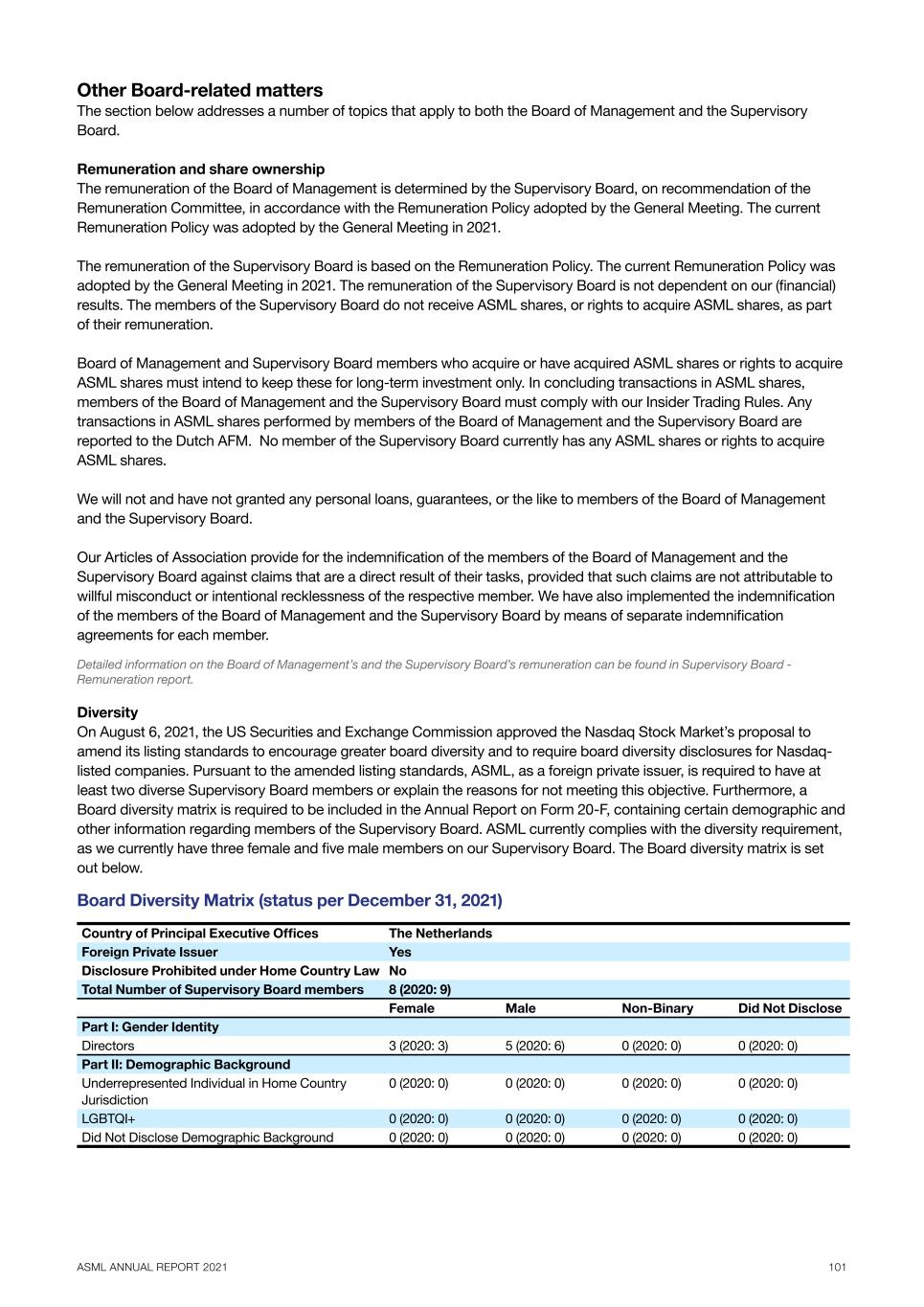

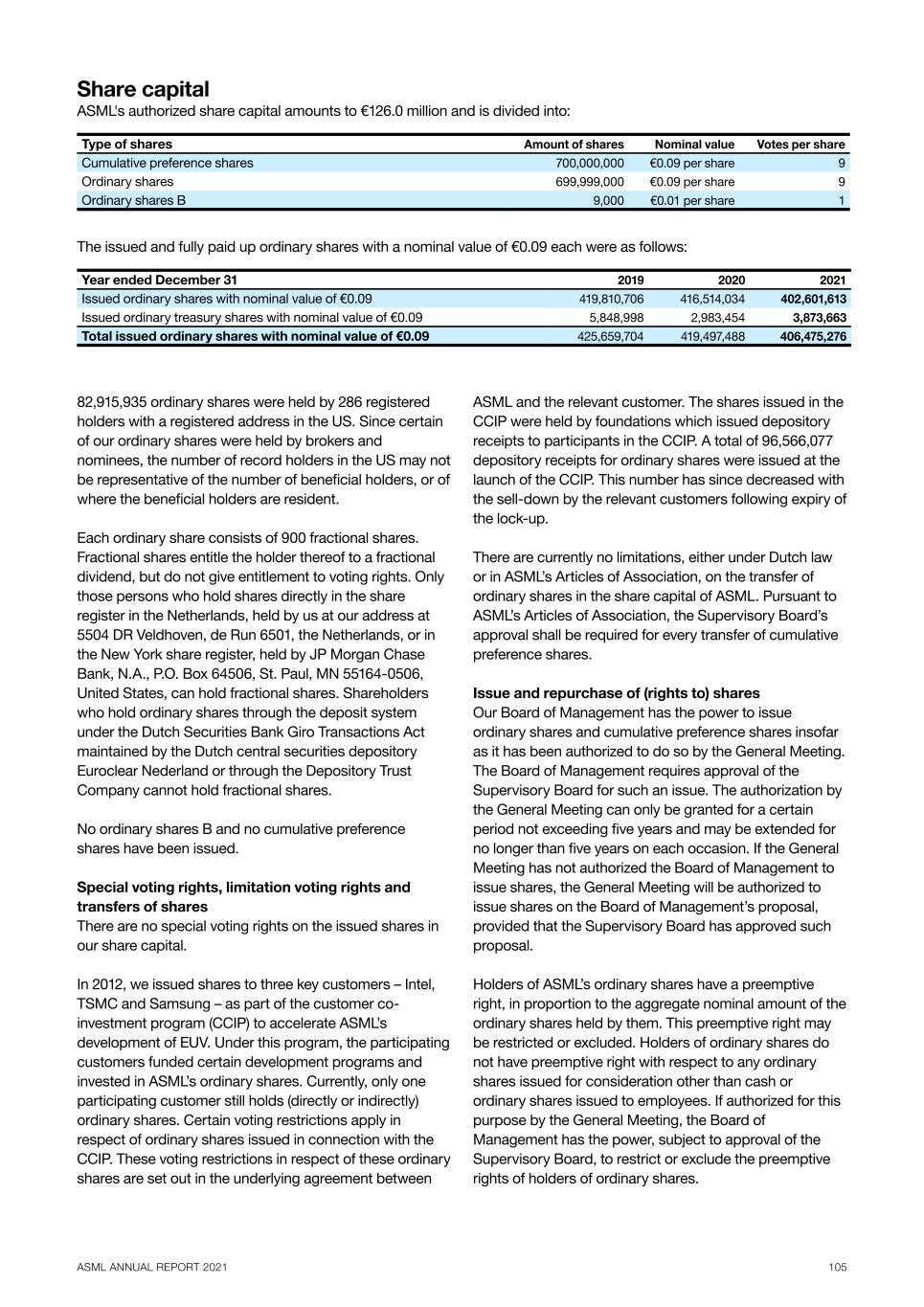

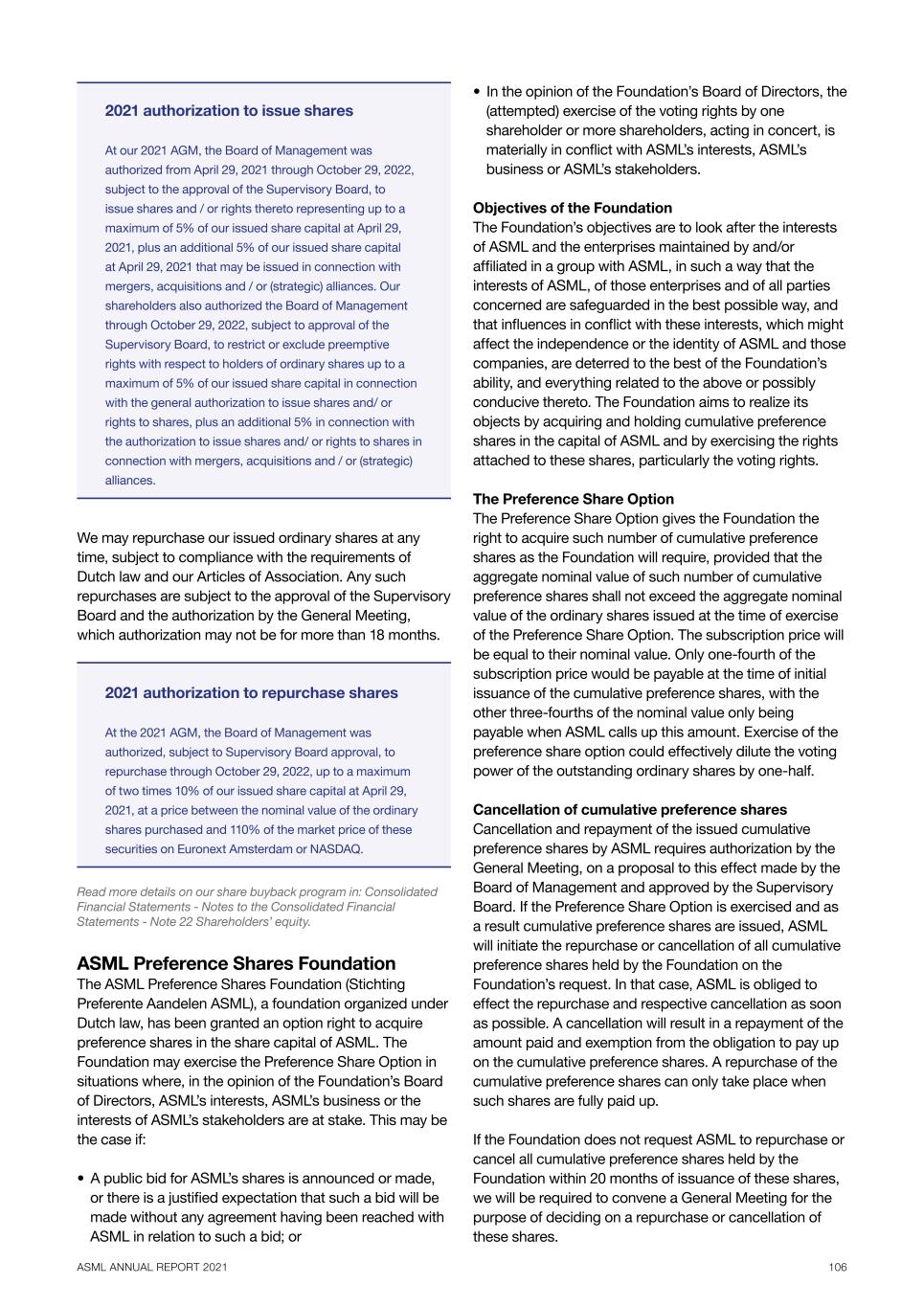

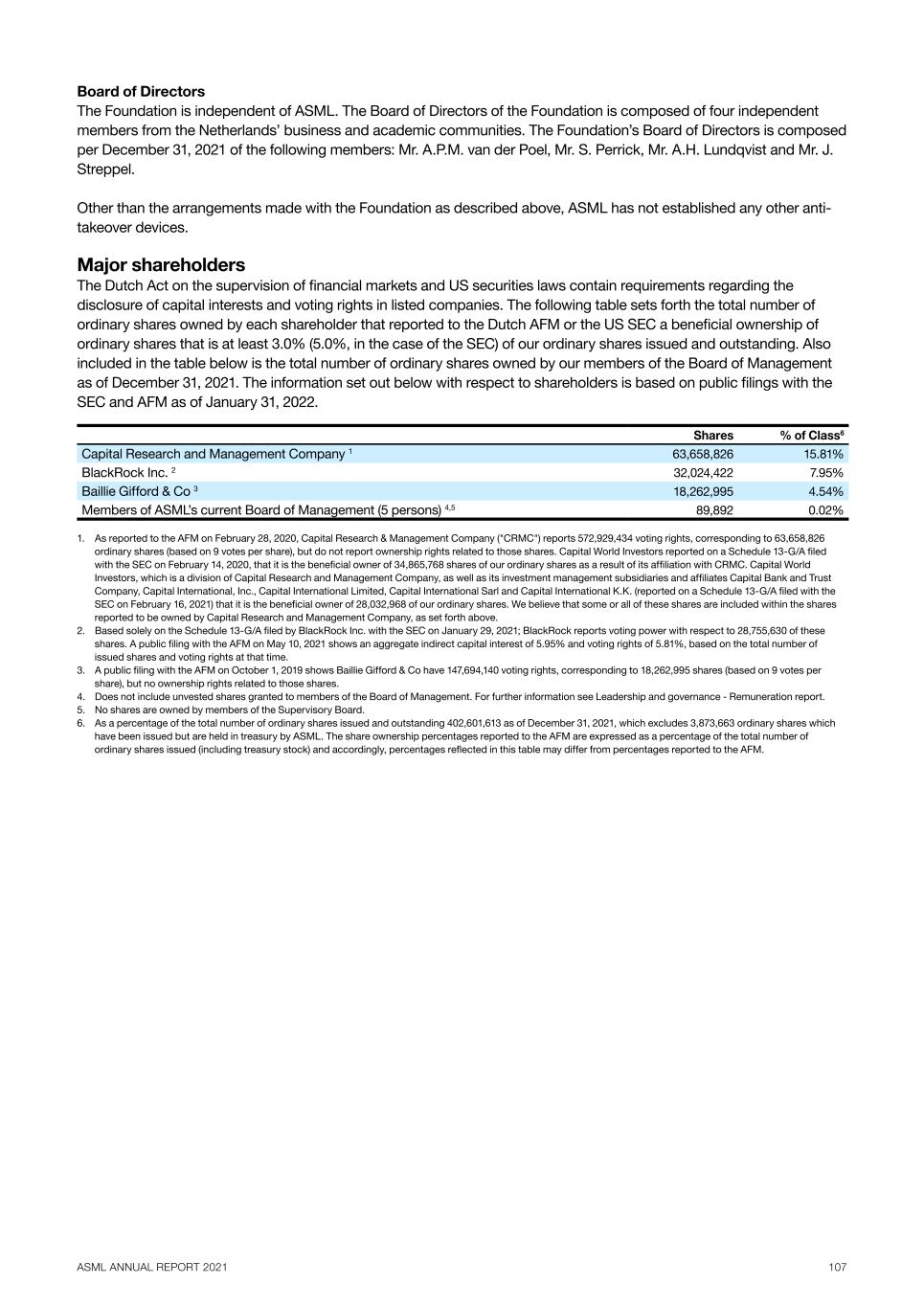

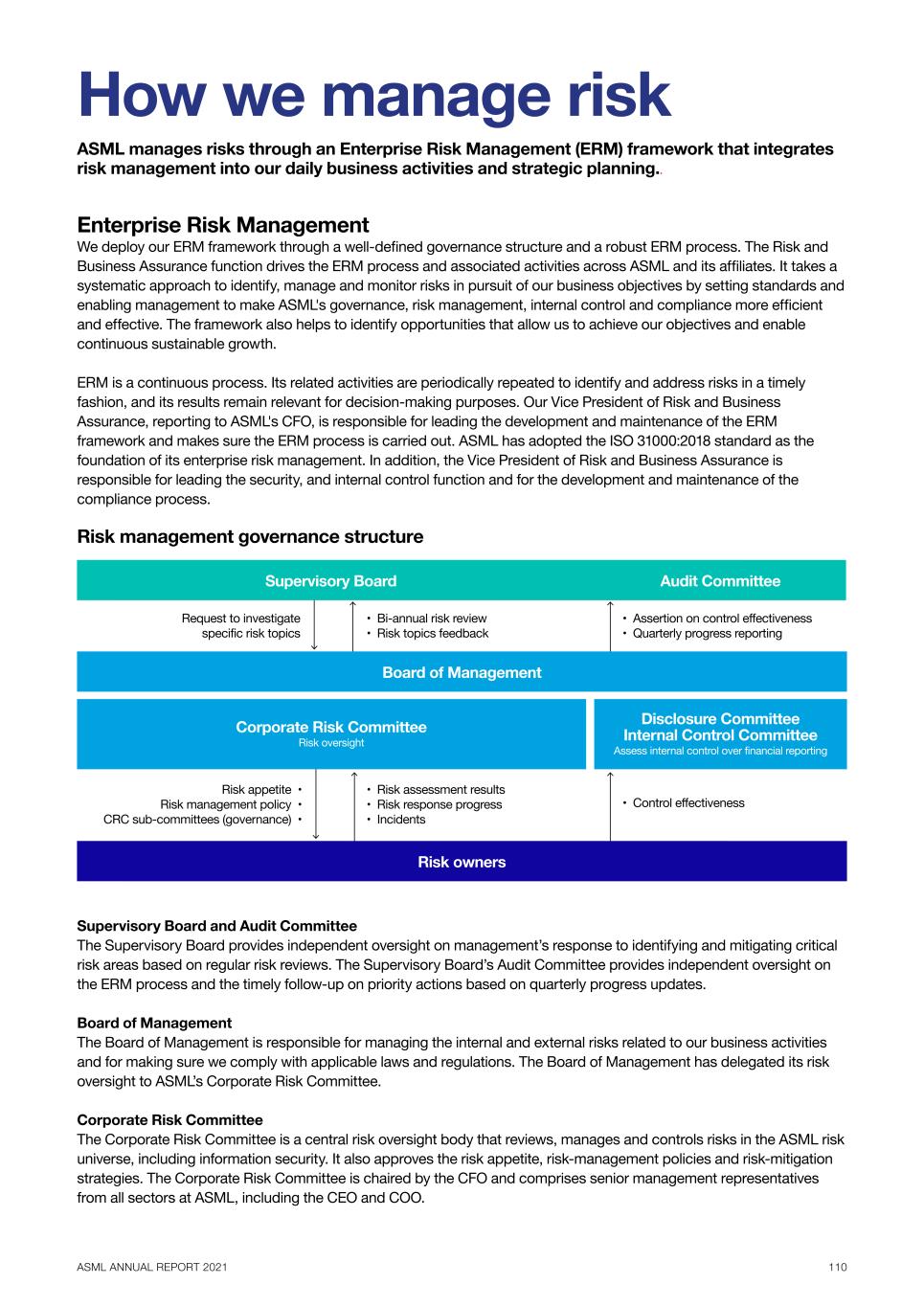

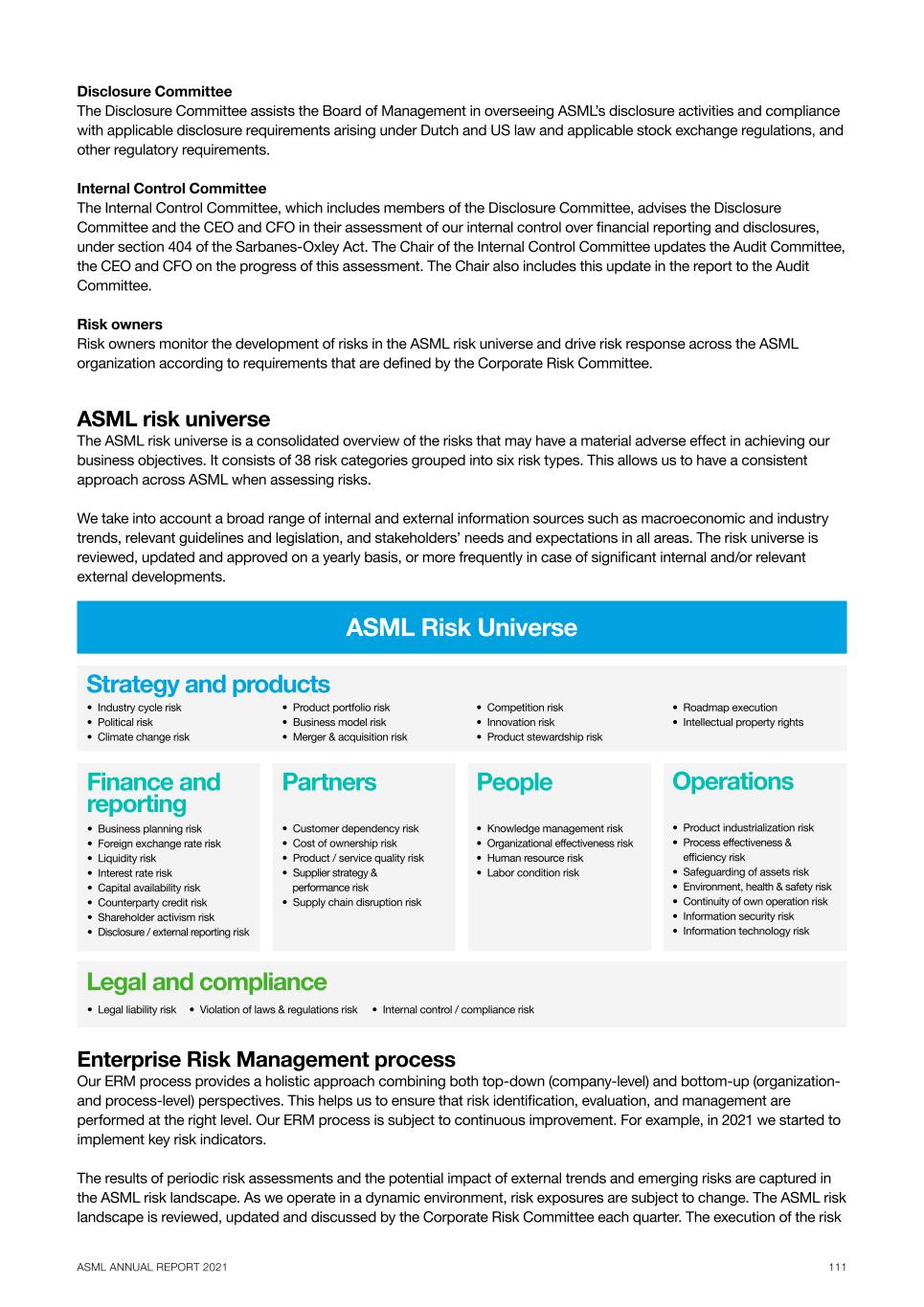

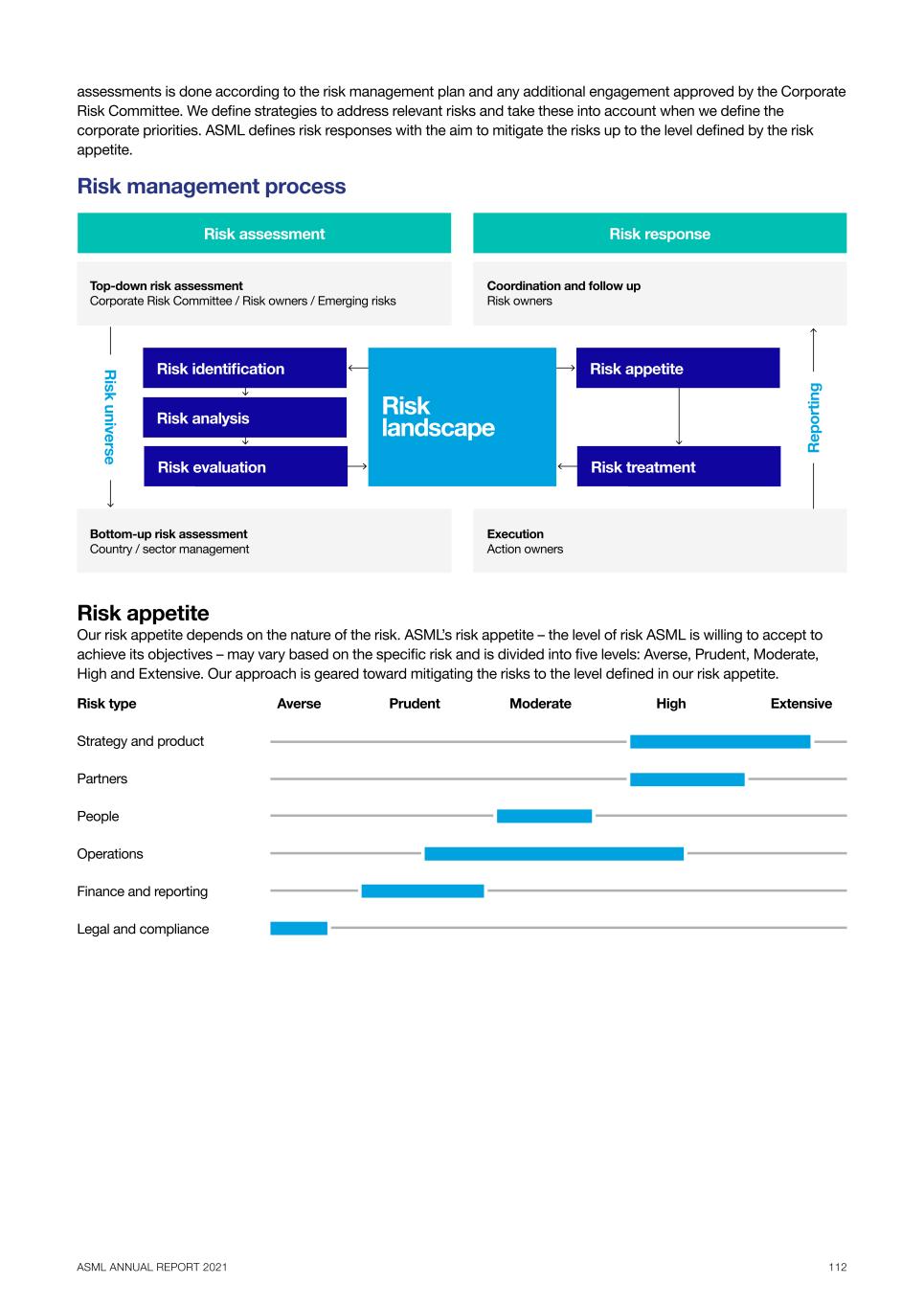

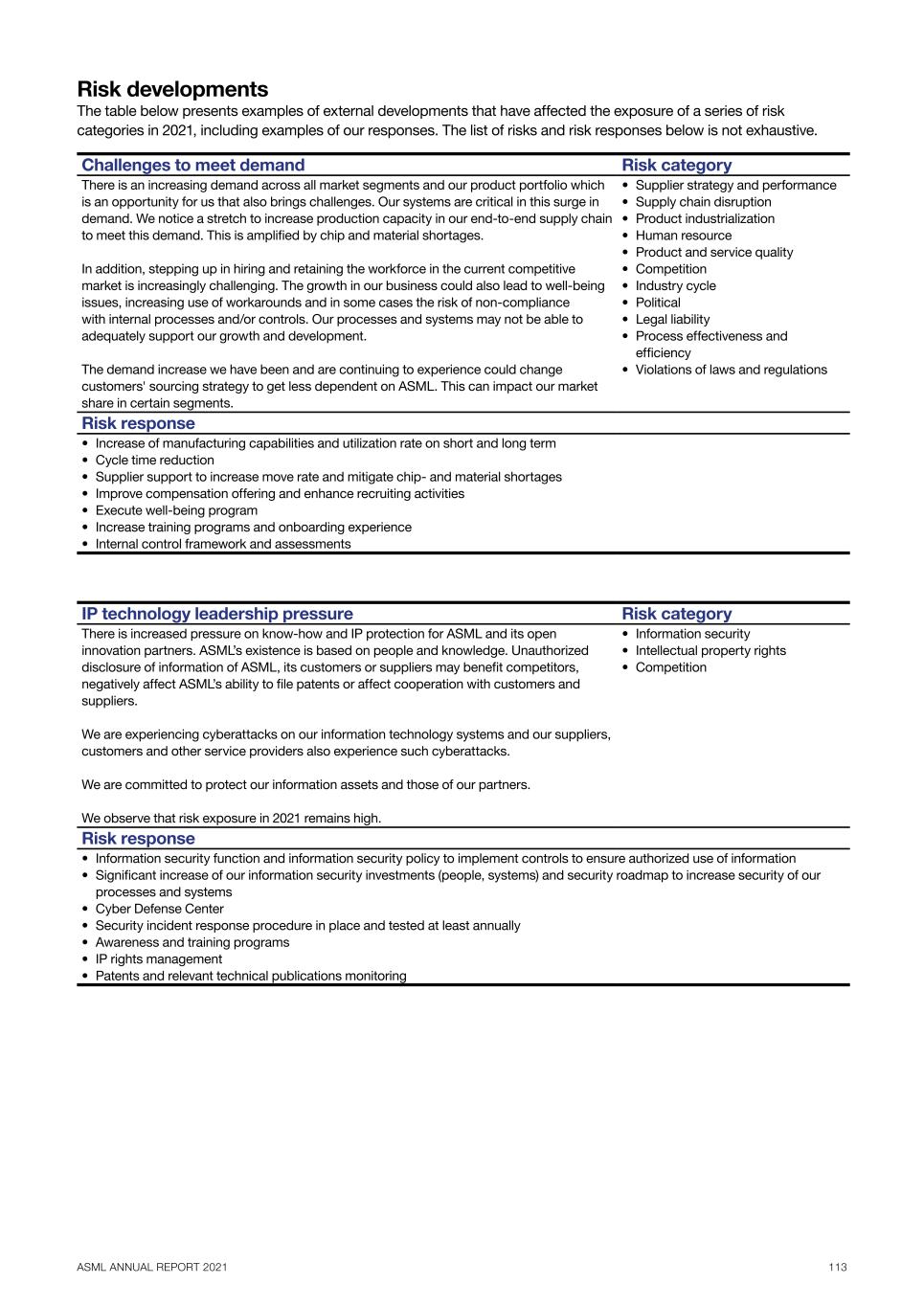

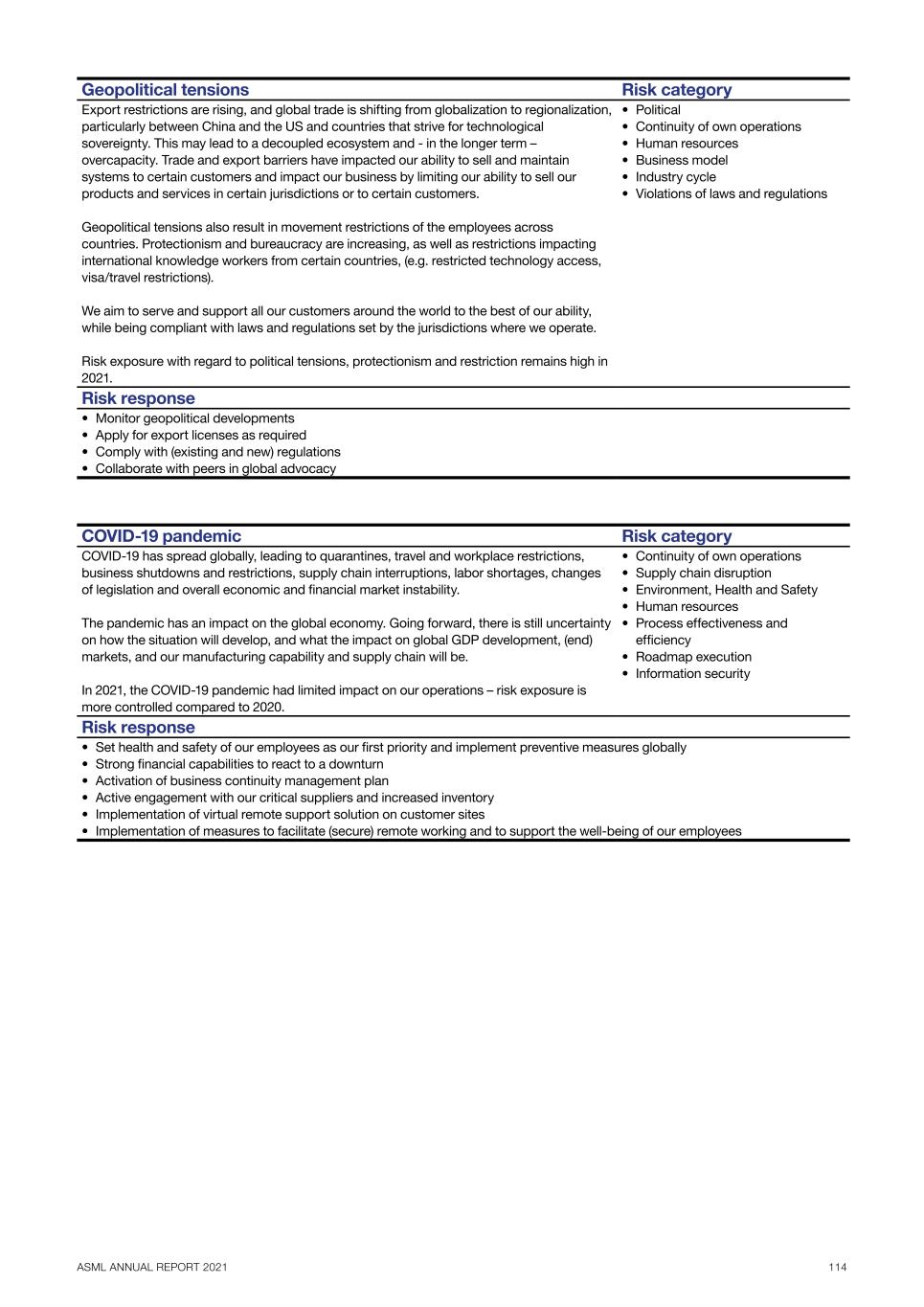

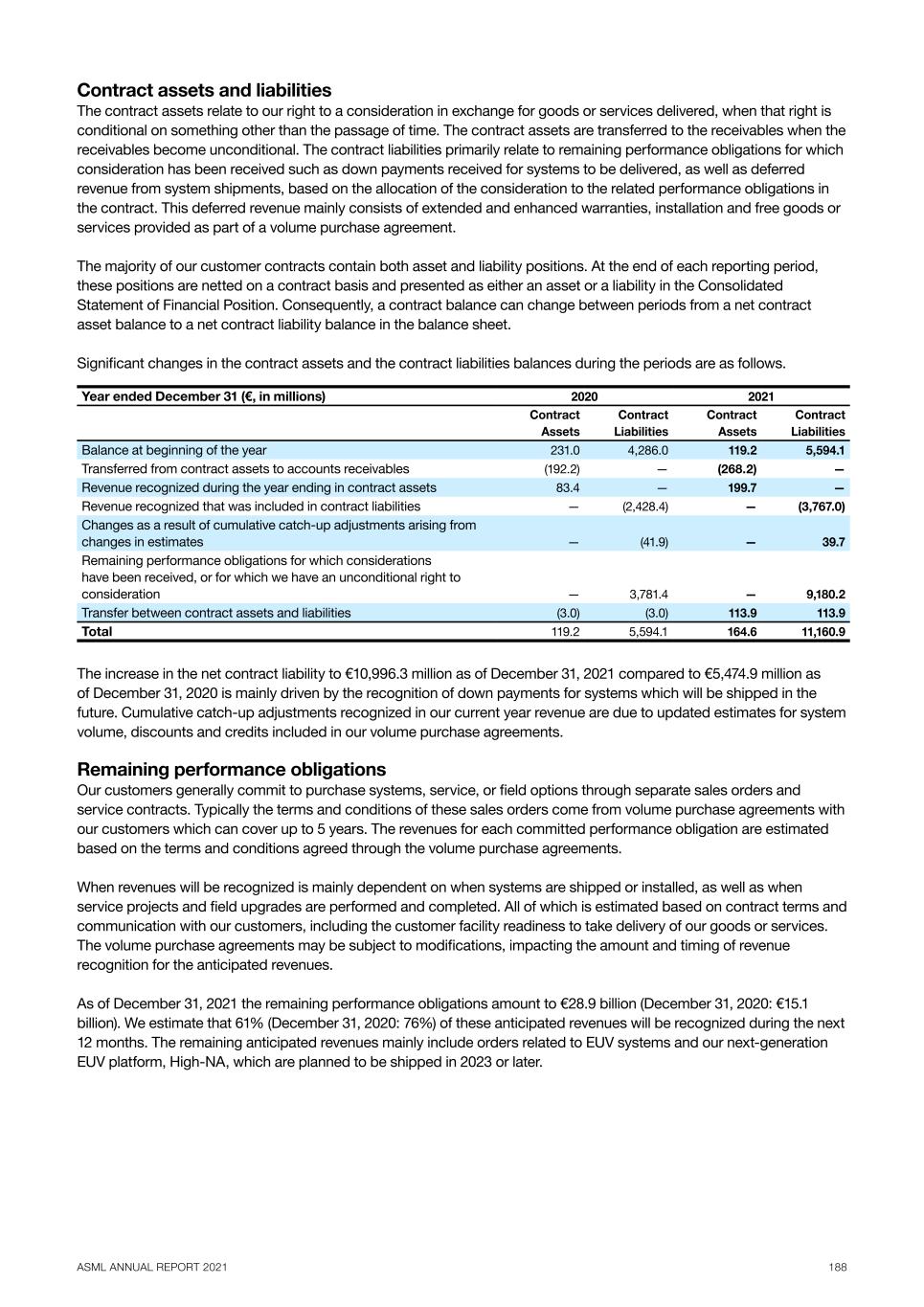

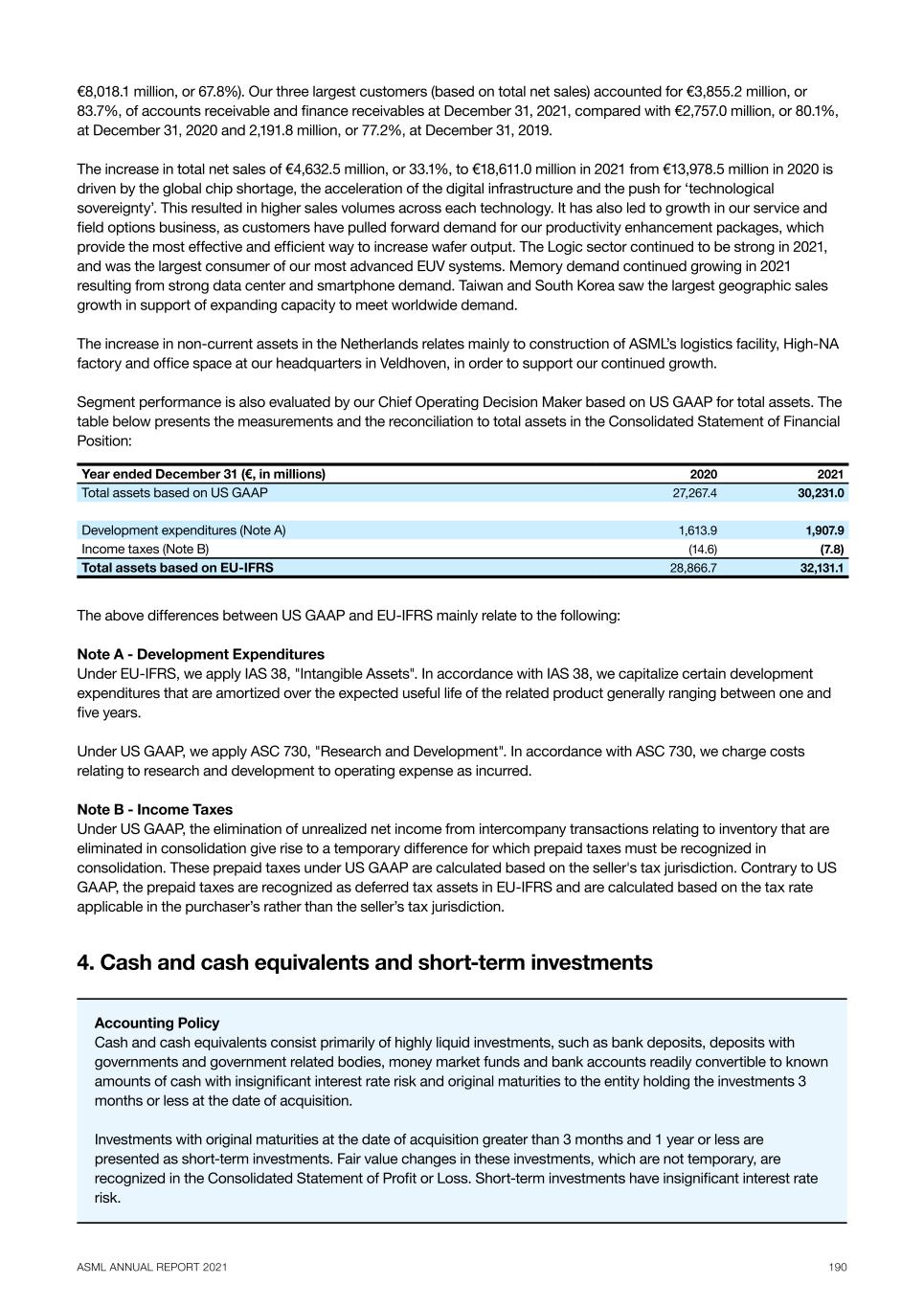

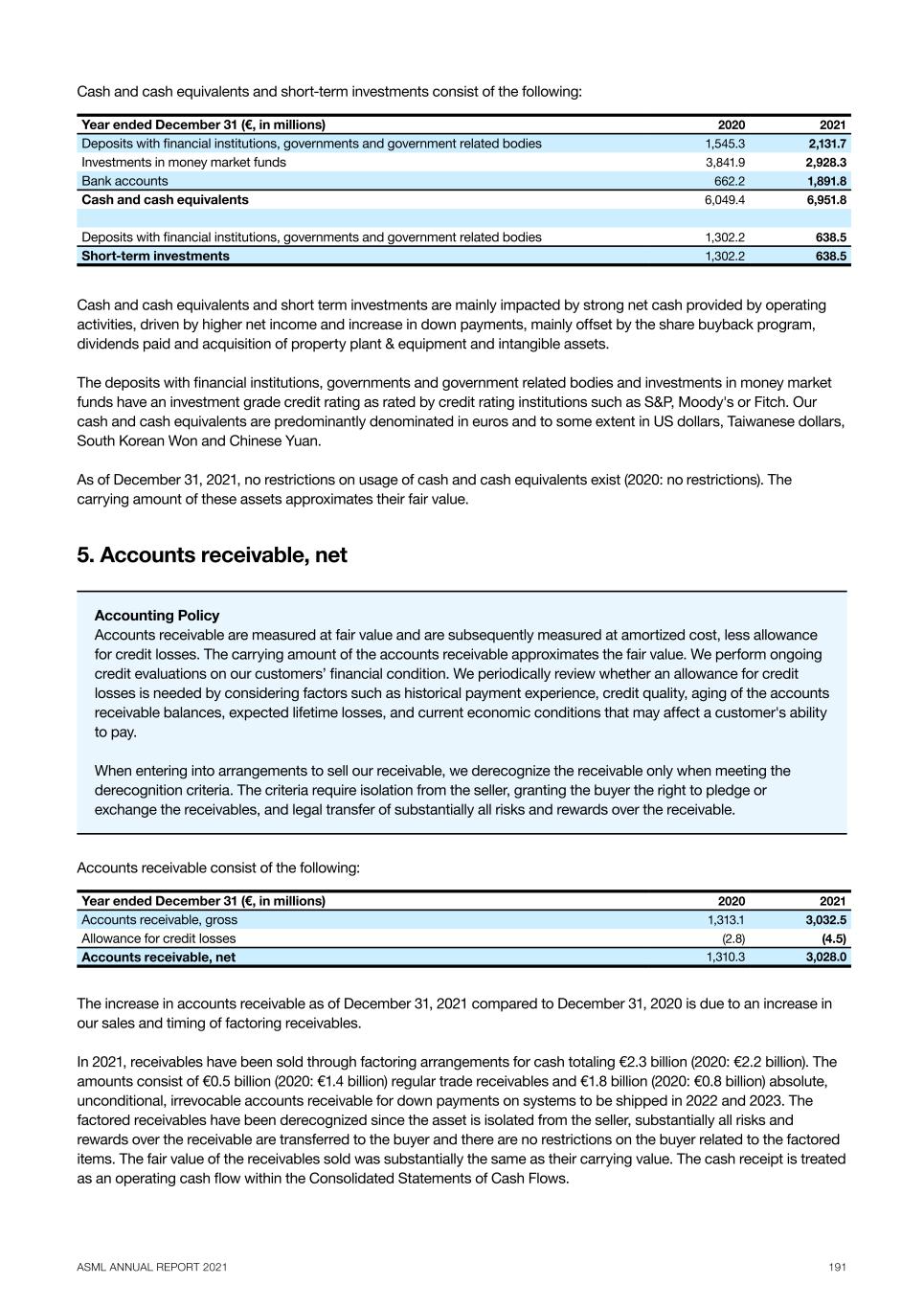

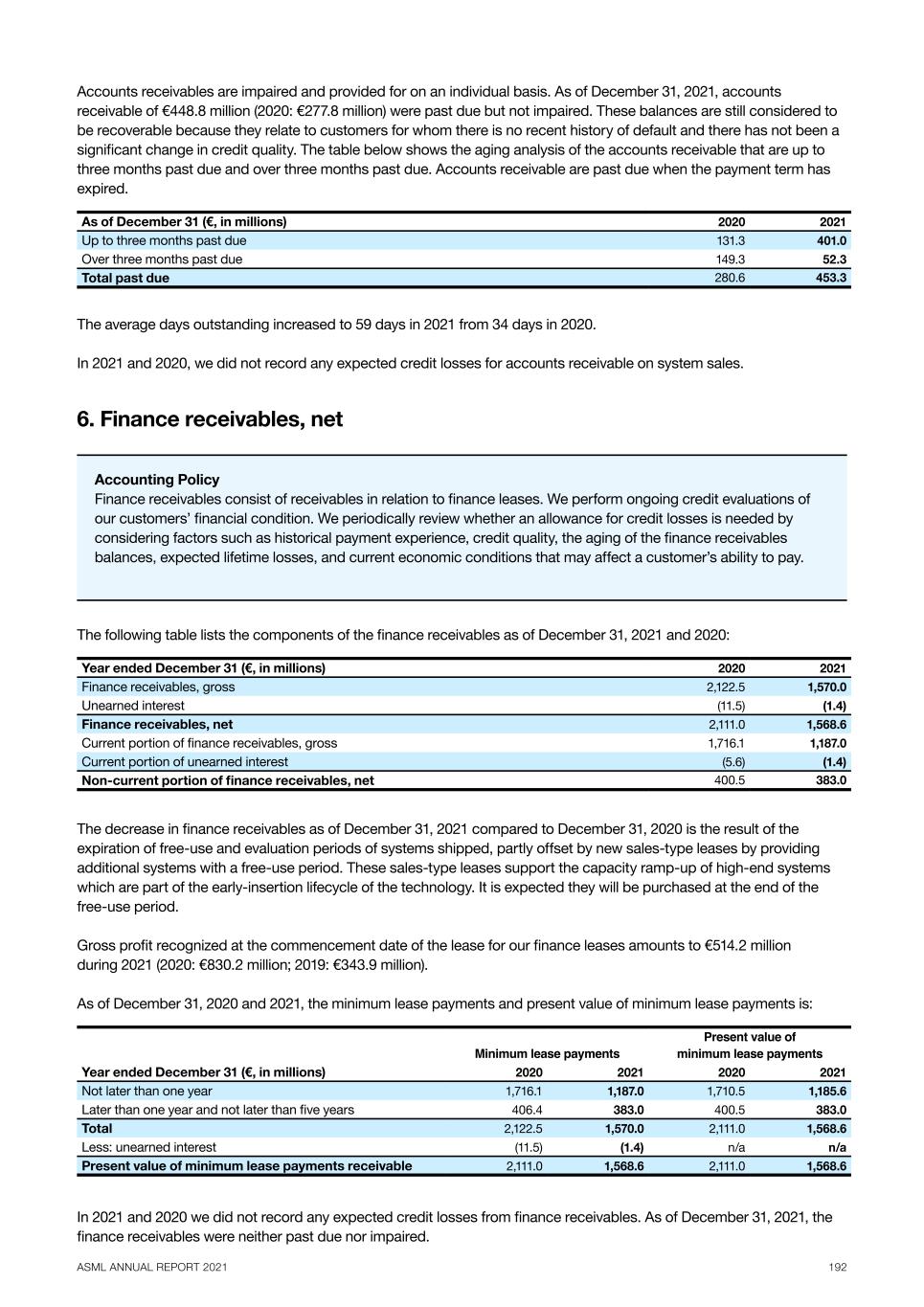

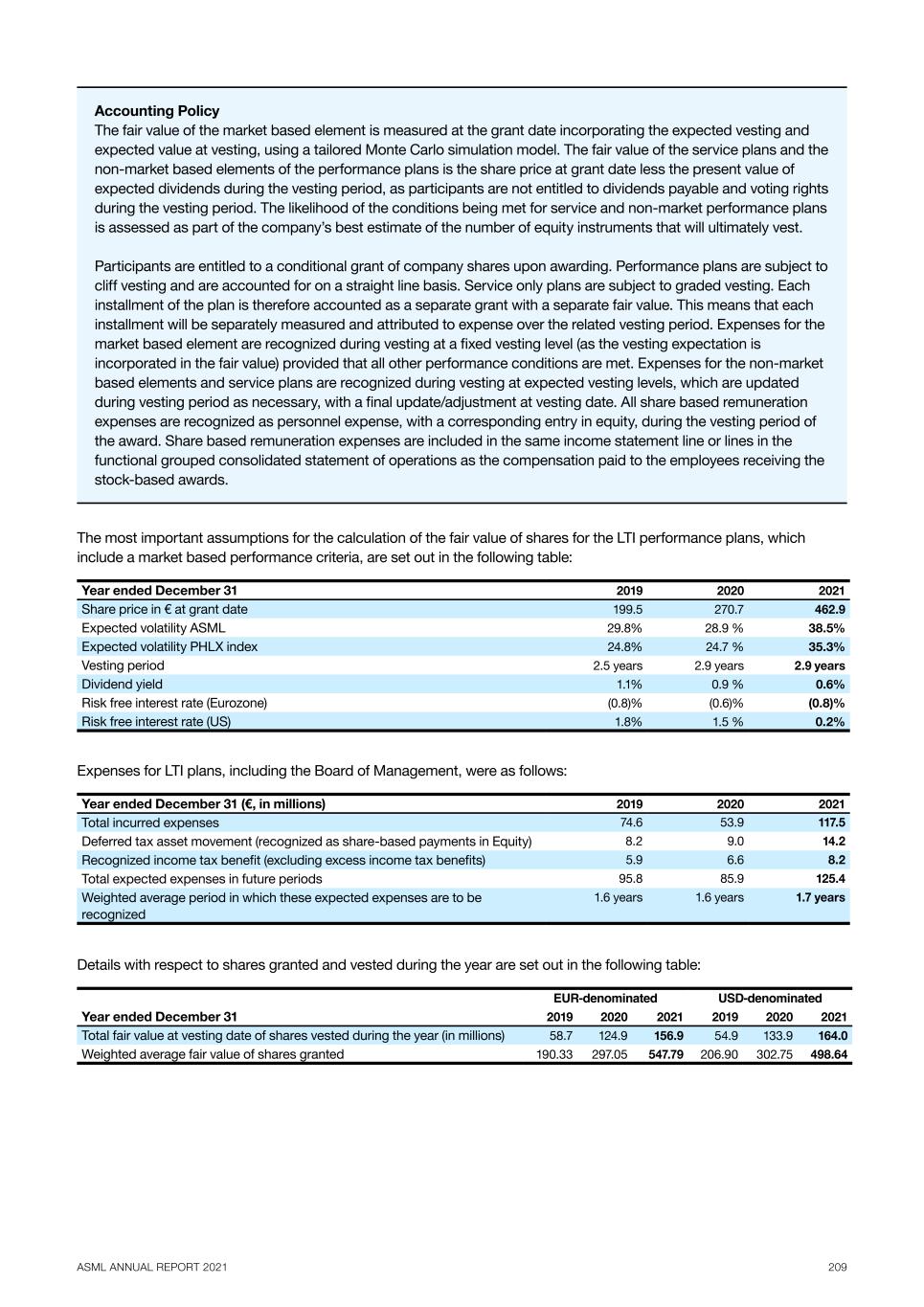

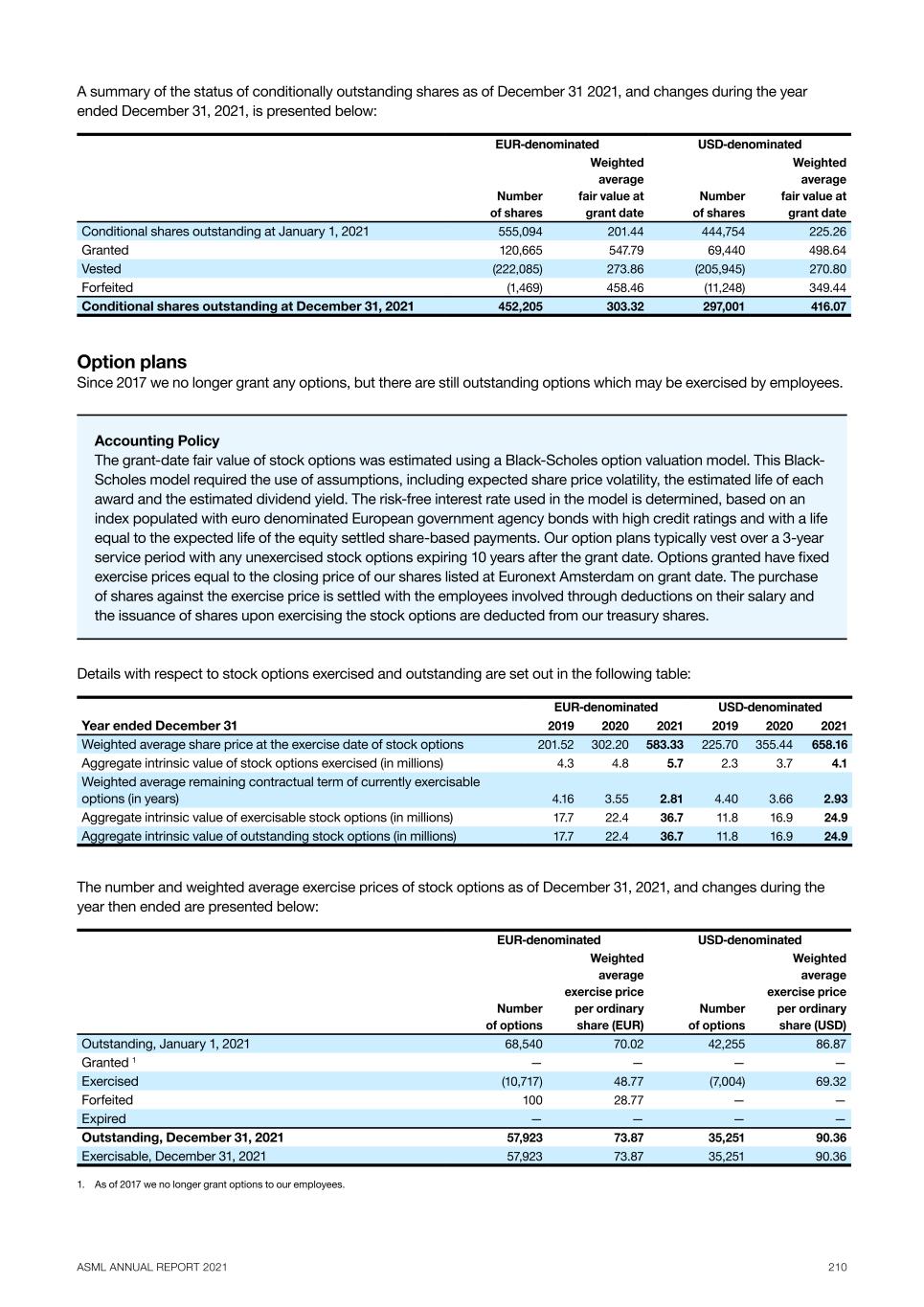

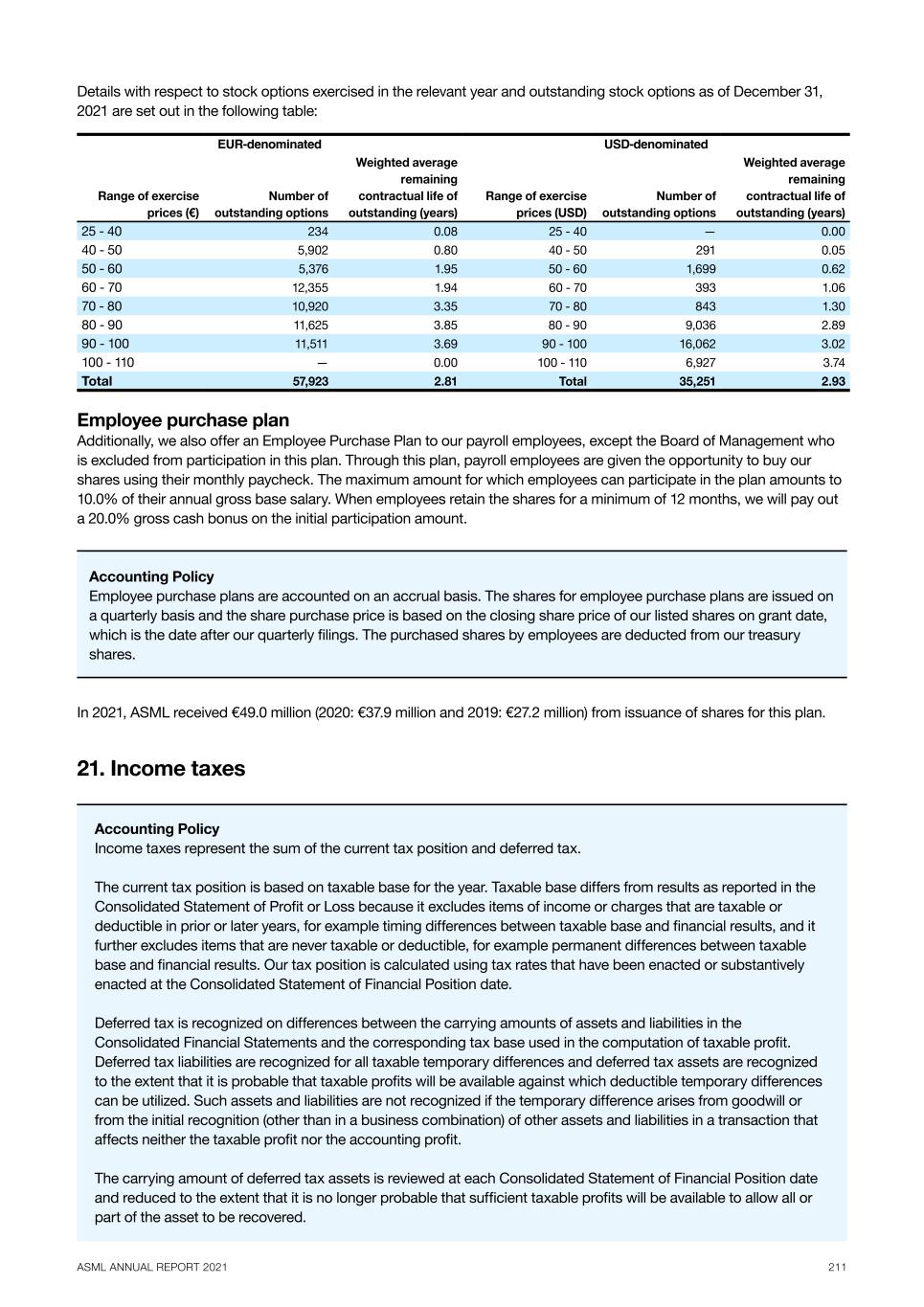

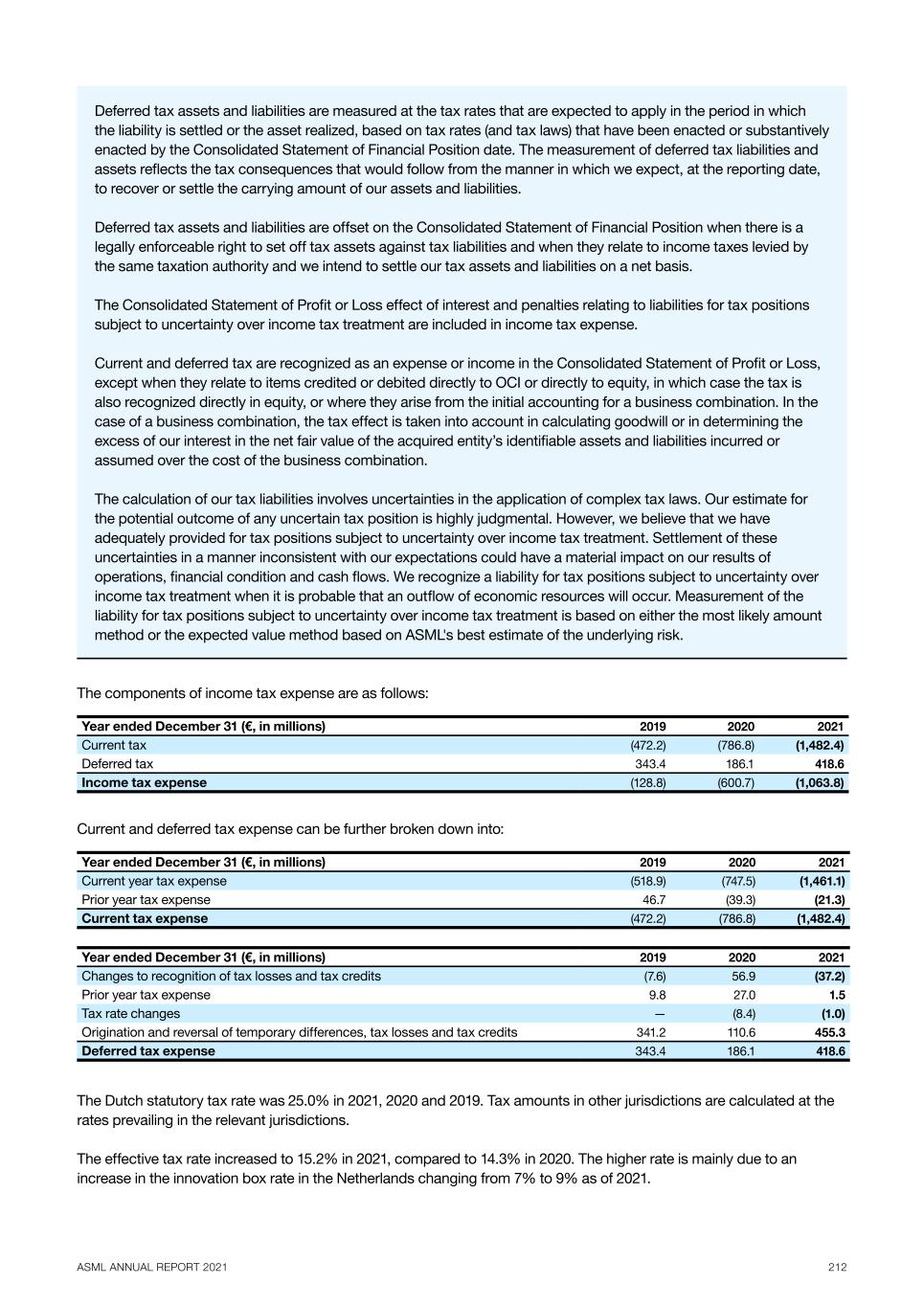

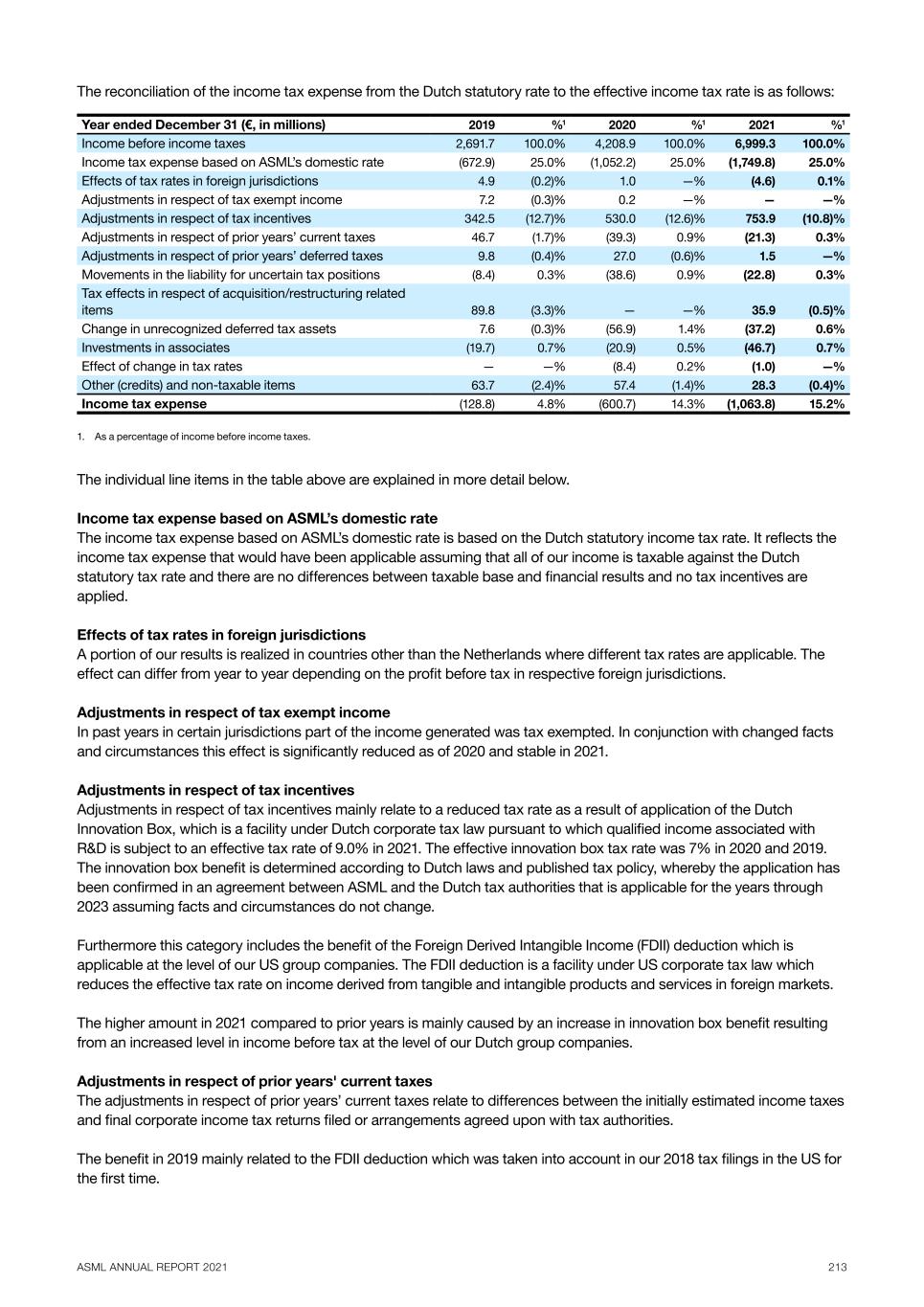

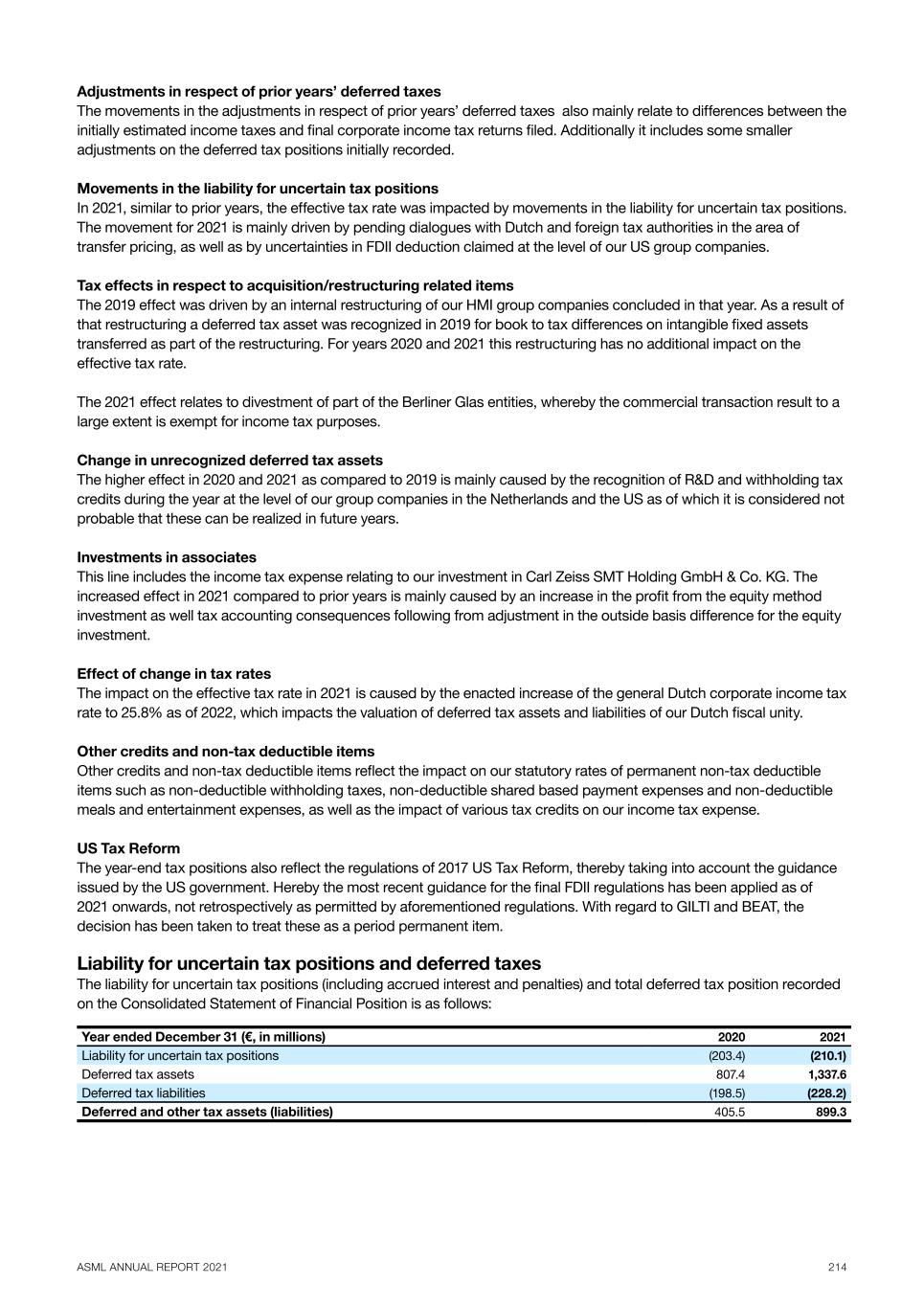

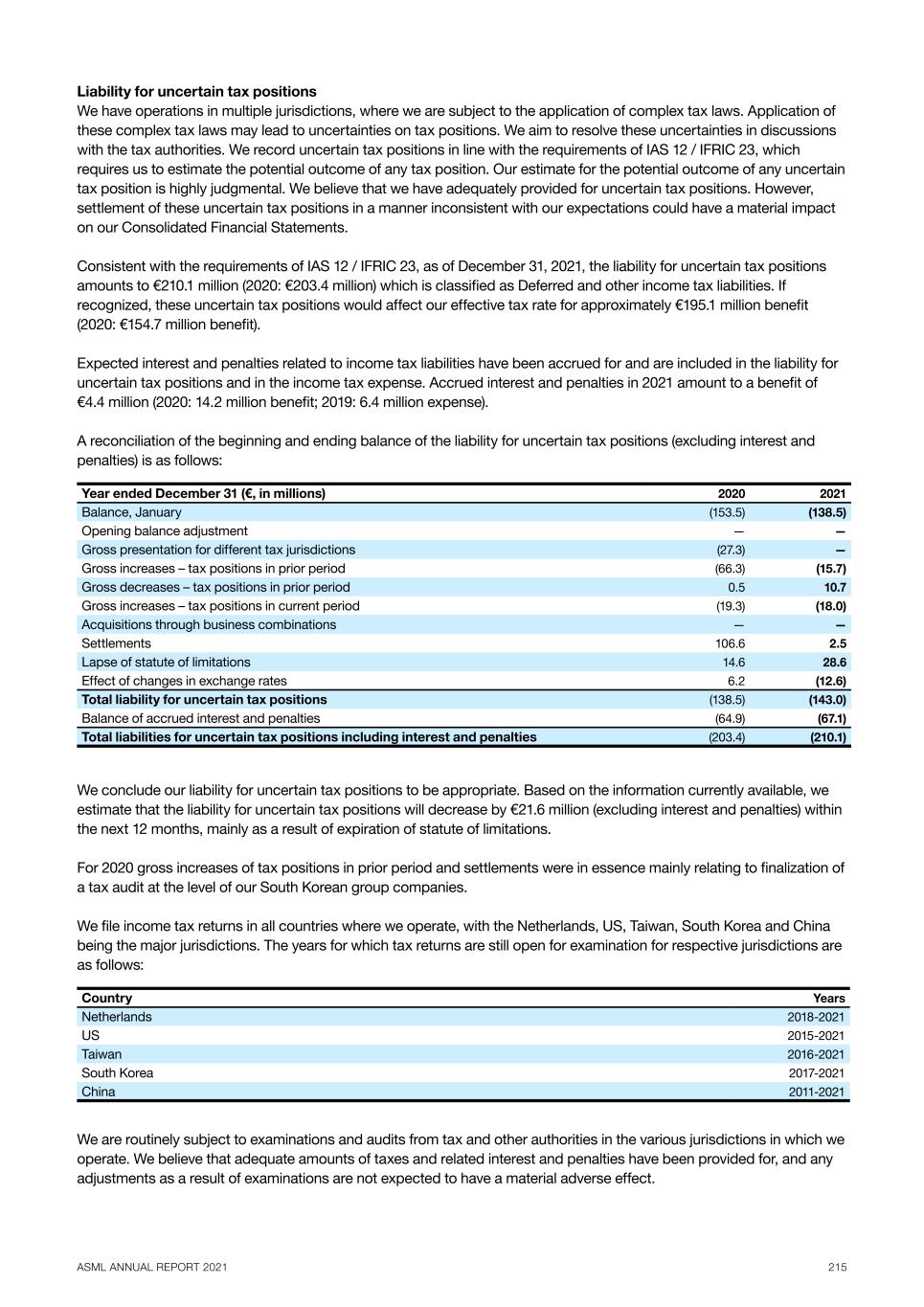

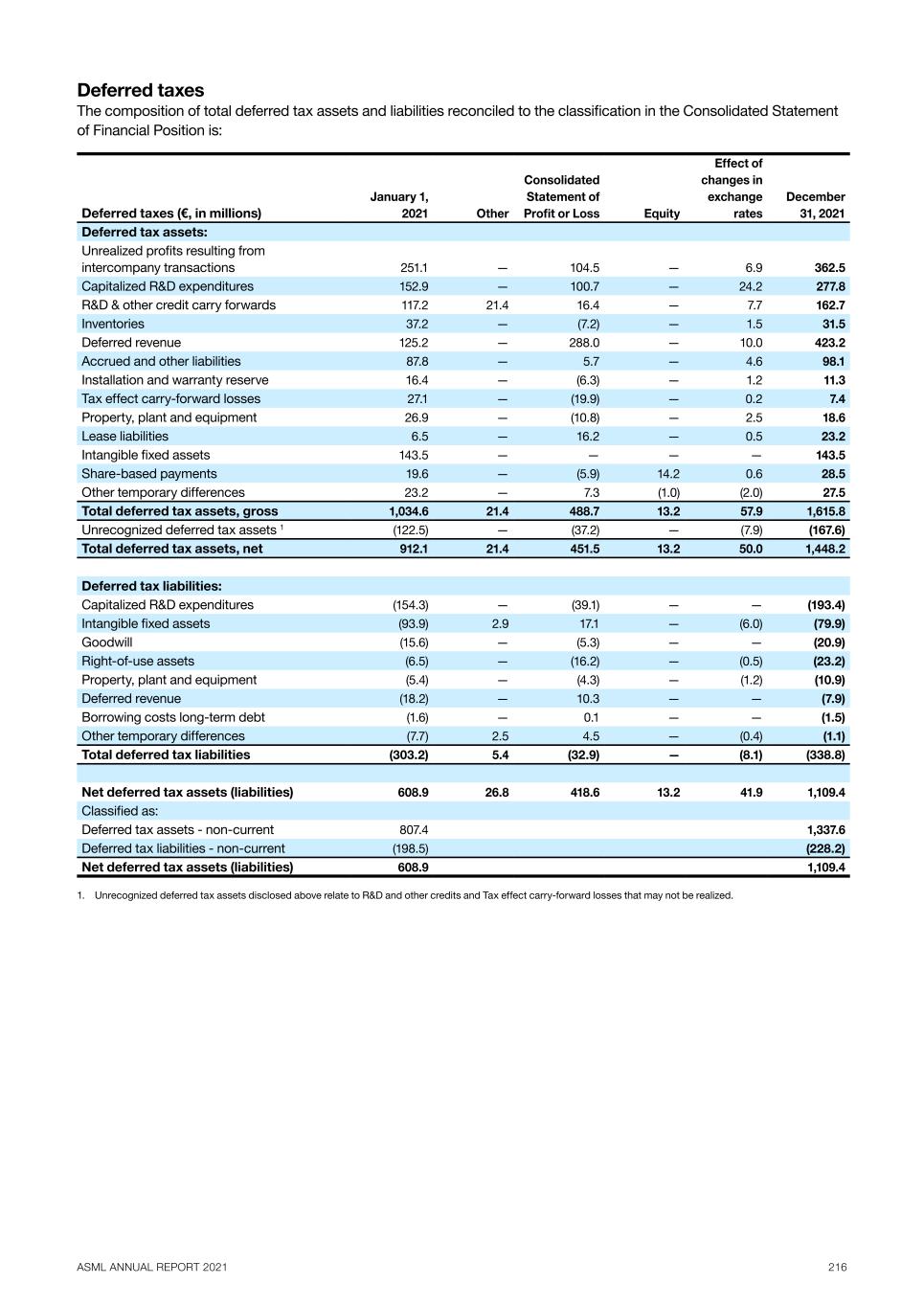

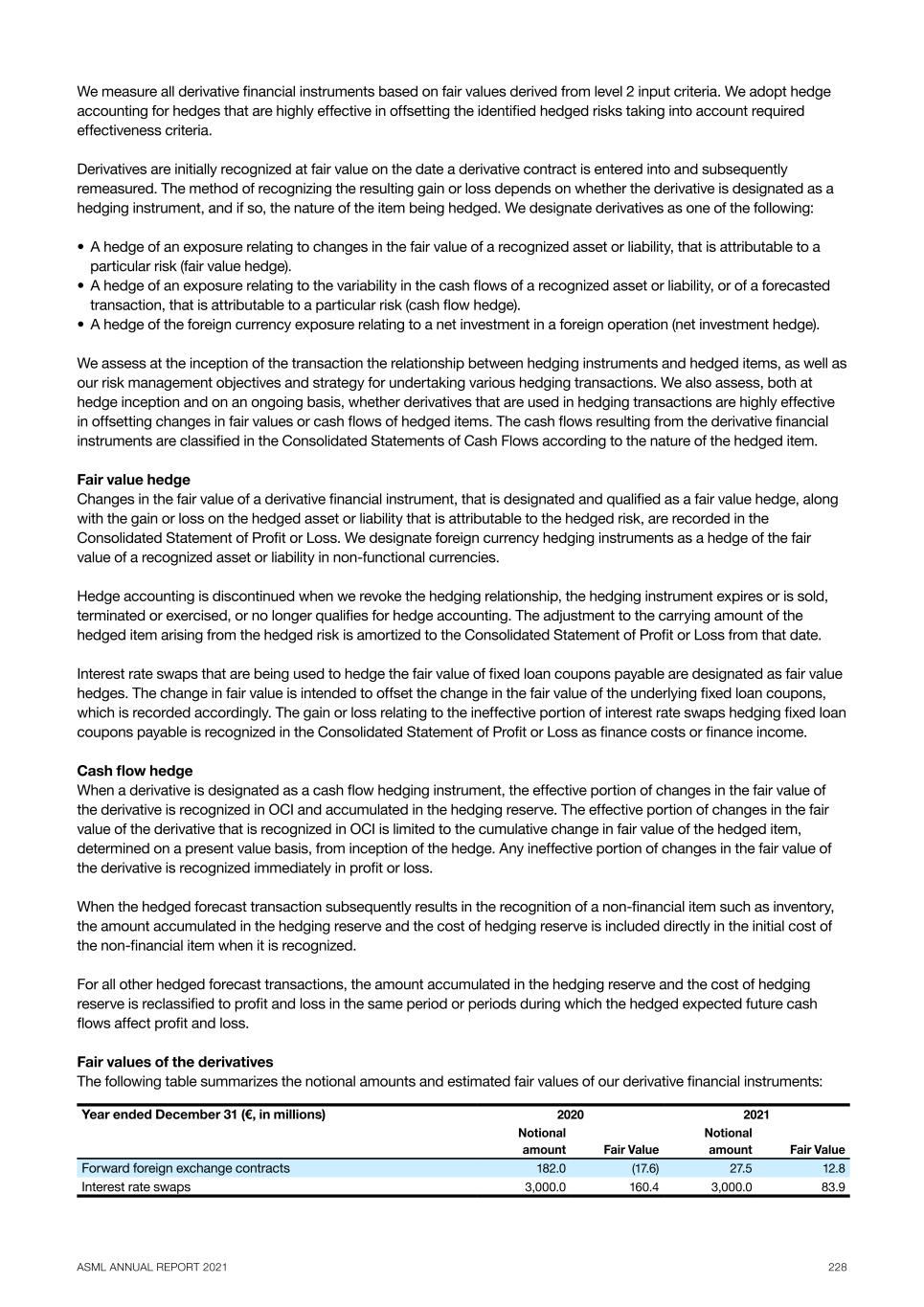

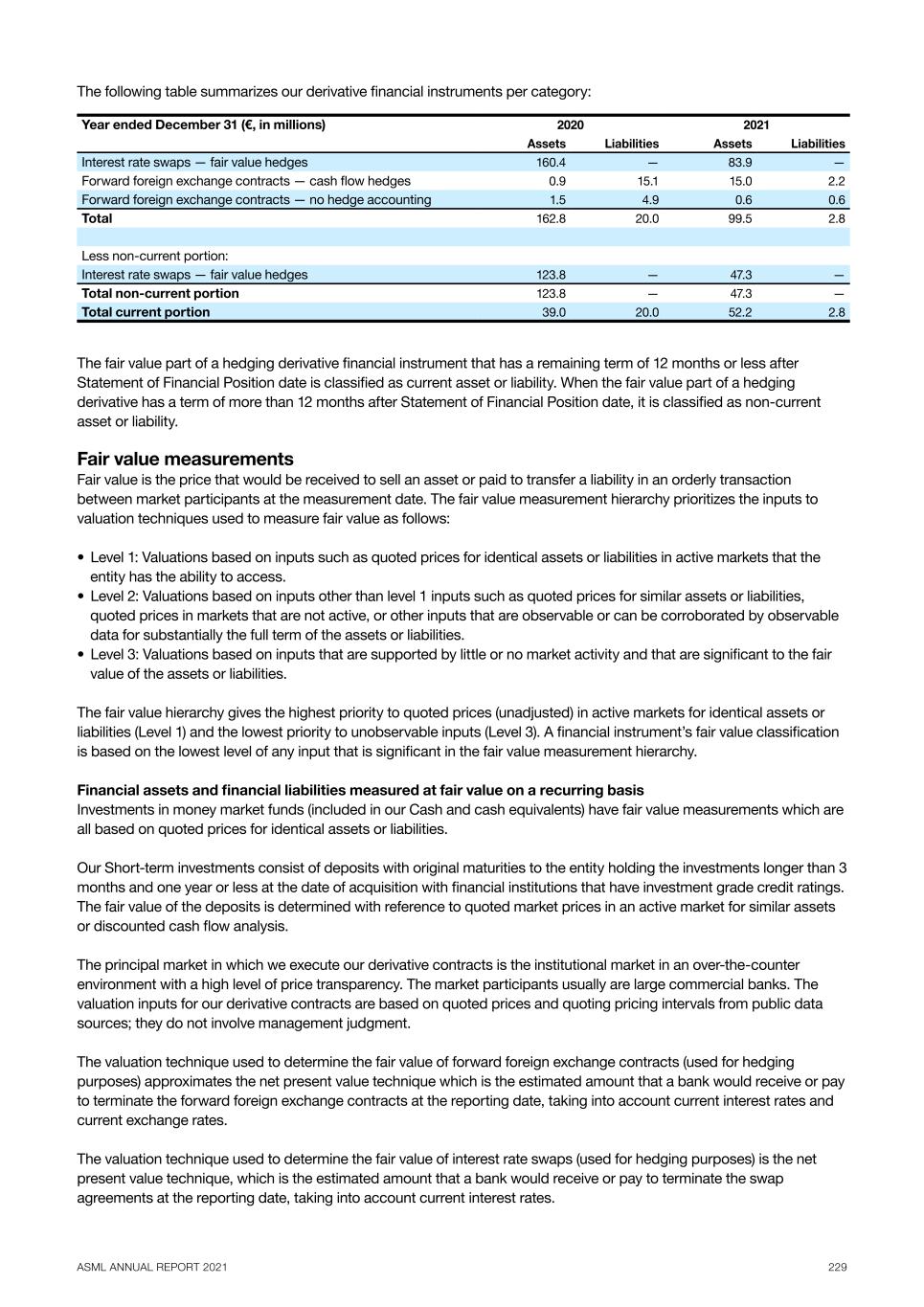

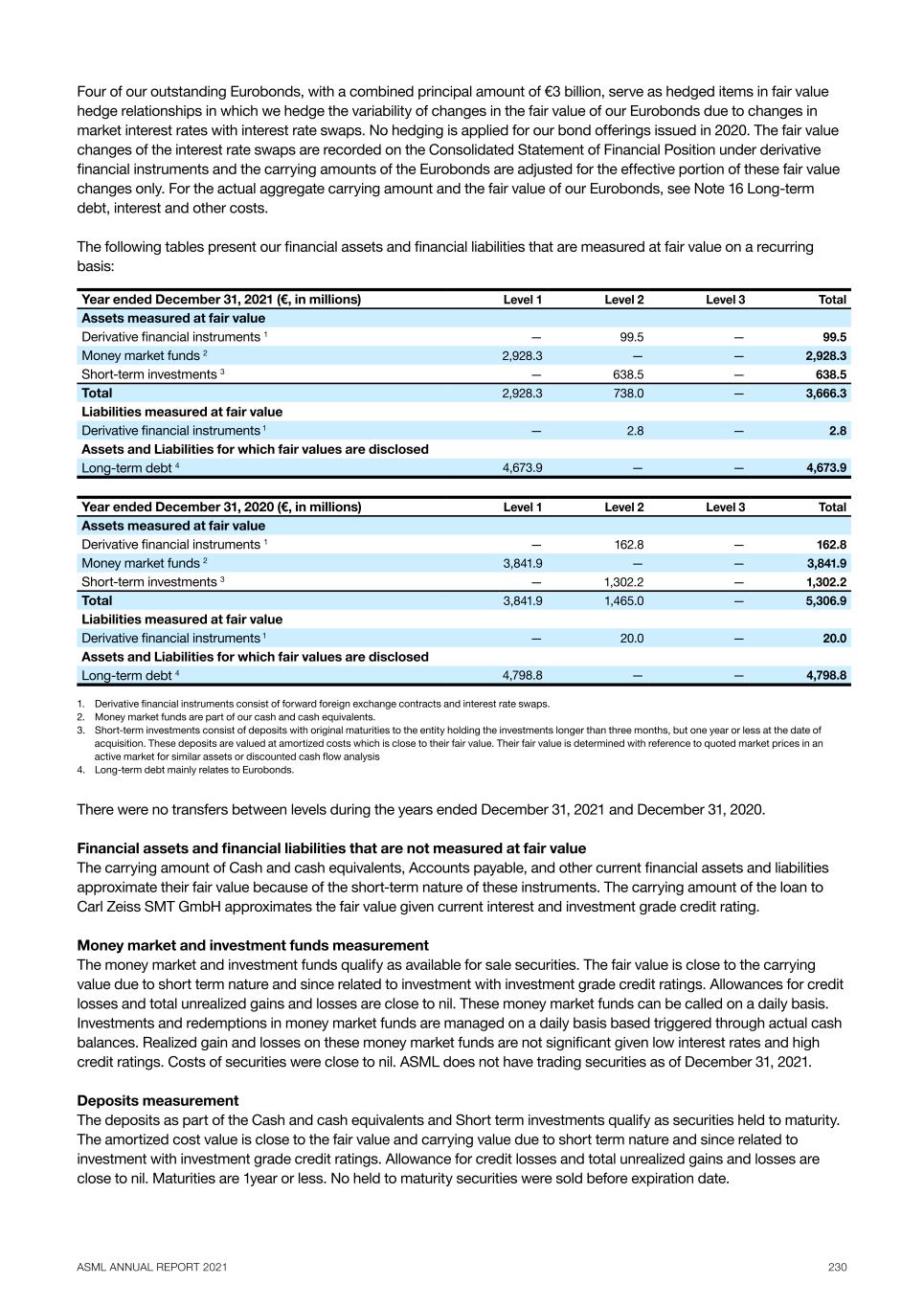

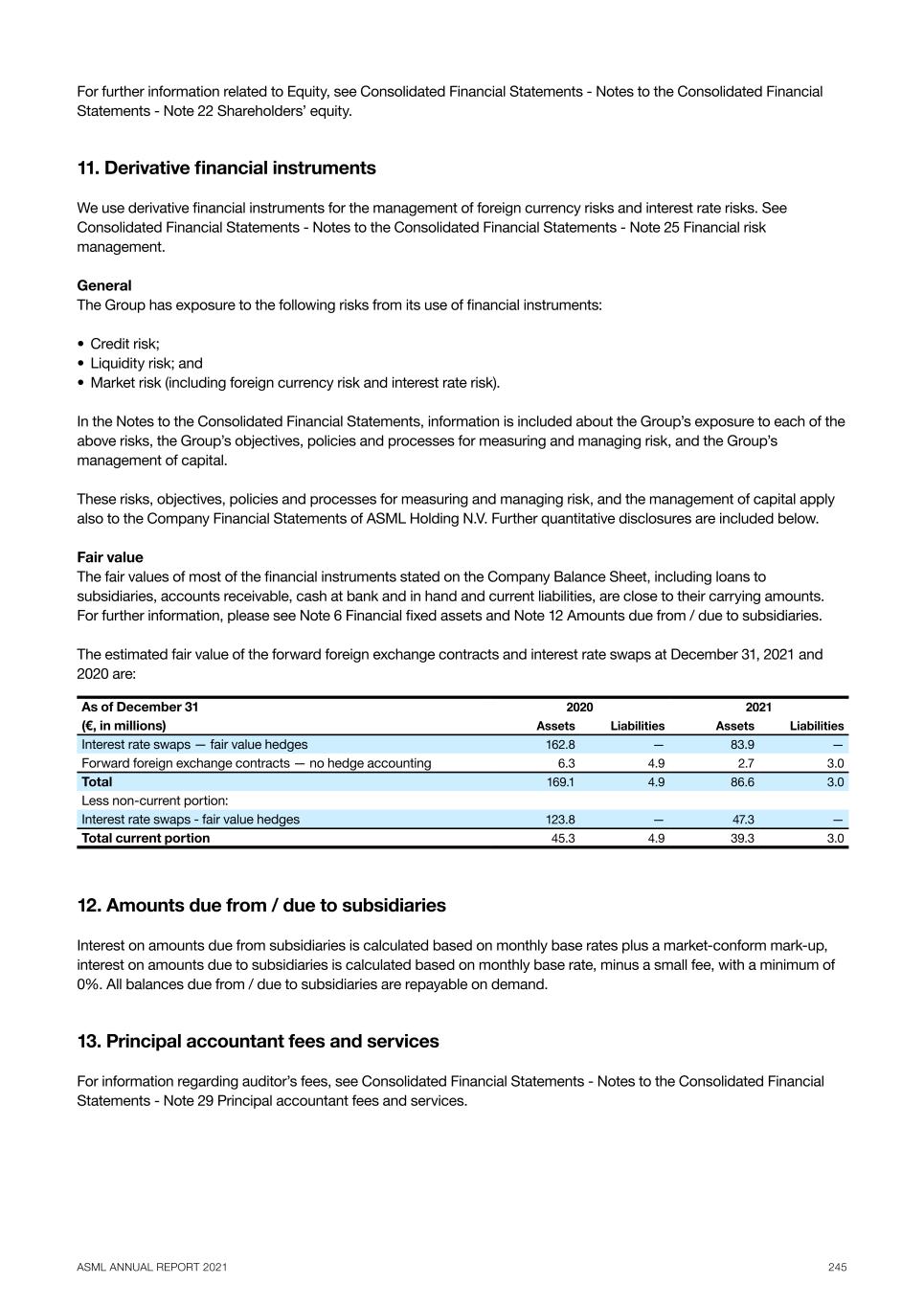

ASML ANNUAL REPORT 2021 24 Our refurbished products business, known as Mature Products and Services (MPS), refurbishes and upgrades our older lithography systems to extend their lives and offer associated services. MPS’s customer base is wide and active in a variety of markets, especially in the 'More than Moore' space. ASML systems have a very long operational lifetime that often exceeds their role at the initial customer. As a result, many customers are able to generate value by selling off systems that are no longer required. To support this sustainable product use and ensure used systems deliver the quality that ASML stands for, ASML is actively involved in the used system market through our refurbishment and associated services. Over 90% of the PAS systems ASML has ever sold are still in use. We offer refurbished systems of the PAS 5500 and first- generation AT, XT and NXT systems. Through our refurbishment and associated services, we extend the lifespan of our customers' installed base, drawing value from their capital and contributing to sustainable product use. Read more in: Our performance in 2021 - Environmental - Circular economy - Recycle mature products through refurbishment. Metrology and inspection systems Our metrology and inspection systems allow chipmakers to measure the patterns that they actually print on the wafer to see how well they match the pattern intended. Our portfolio covers every phase of bringing a chip to market, from R&D to mass production, and each step of the manufacturing process – allowing them to assess the performance of the entire process. The systems offer the speed and accuracy to create automated control loops via our process control solutions, optimizing the lithography system settings for each exposure to reduce edge placement error (EPE), enlarge the process window and achieve the highest yield and best performance in mass production. Optical metrology Our YieldStar optical metrology solutions allow chipmakers to assess the quality of patterns on the wafer in volume production, through fast and accurate overlay measurements. Overlay, or how well one layer of a chip is aligned with the previous one, is an important measure of lithography performance and a key contribution to EPE. As structures on microchips get smaller and smaller, overlay and EPE become more and more important. The YieldStar 385H offers the latest in-resist post- lithography (pre-etch) overlay and focus metrology, with enhanced throughput and accuracy. Compared to previous systems, key enhancements include a faster stage and faster wavelength changing. This enables highly accurate overlay measurements and tool matching using multiple wavelengths without impacting throughput. Our latest model, the YieldStar 1385H, provides the ability to measure after-etch device patterns enabling extended yield control capability for our customers. The YieldStar 1385H delivers improved accuracy and around 50% productivity improvement capability over the previous model YieldStar 1375F. The YieldStar 1385H is the optical tool on the market for fast, accurate in-device overlay and metrology and has the capability of measuring multiple layers at once which helps customers to improve yield through post-etch process control. YieldStar 1385H E-beam metrology and inspection Our HMI e-beam solutions allow customers to locate and analyze individual chip defects amid billions of printed features, extending the possibilities for process control. Historically, e-beam solutions were too slow to monitor volume production processes. However, ASML has made progress in various methods for increasing the throughput of e-beam systems. ASML continues to extend market leadership in voltage contrast inspection and physical defect inspection with the widely adopted single-beam platform. The eScan 430 is our latest single-beam inspection system, delivering more than 35% throughput improvement across various applications in logic, DRAM and 3D NAND. Our high-resolution e-beam metrology system eP5 offers world-class 1 nm resolution with large field-of-view capabilities at more than 10 times the speed of existing technologies. It outputs critical dimension (CD) and edge placement error (EPE) data in high volume with a quality level that customers need for monitoring and control. EPE is becoming more critical for device patterning and yield with shrinking design rules and the adoption of EUV lithography. We also released an EPE metrology application software product on eP5. It is capable of local and global EPE measurements on device, both intralayer and interlayer.