Form 497K Milliman Variable Insura

| Summary Prospectus | April 29, 2022 |

Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund - Jan/Jul

Class 3 Shares

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find the Fund's prospectus, reports to shareholders, and other information about the Fund online at www.millimanfunds.com/prospectus. You can also get this information at no cost by calling 855-700-7959 or by sending an email request to [email protected]. The Fund’s prospectus and statement of additional information, both dated April 29, 2022 (as each may be amended or supplemented), are incorporated by reference into this Summary Prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Important Information About the Fund

please read before making an investment

| ■ | The Fund has characteristics unlike traditional investment products and will not be suitable for all investors. Carefully read this Summary Prospectus before determining whether the Fund may be a suitable investment. |

| ■ | The Fund seeks to provide exposure to the S&P 500 Index, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in the Fund’s portfolio, while providing a combination of the below two “Options Strategies,” which are designed to produce certain pre-determined outcomes (the “Outcomes”), over a six-month period (each, an “Outcome Period”). There is no guarantee that the Fund will be successful in its attempt to achieve its investment objective and/or Outcomes. There also is no guarantee that a particular Options Strategy will be successful. An investor may lose some or all of their investment in the Fund. |

| Options Strategies | Description |

| 1. Par Up Strategy | Designed to provide participation in the gains of the S&P 500 Index at a declared participation rate (the “Par Up Rate”) if the S&P 500 Index experiences gains during the Outcome Period. |

| 2. Par Down Strategy | Designed to limit losses in the Fund’s S&P 500 Index exposure at a declared participation rate (the “Par Down Rate”) if the S&P 500 Index experiences losses during the Outcome Period. |

| ■ | The Fund seeks to achieve its investment objective by transacting in FLexible EXchange® Options (“FLEX Options”) and by separately maintaining a collateral portfolio comprised of fixed income securities, including money market funds and other interest-bearing instruments, cash, exchange-traded funds (“ETFs”) that primarily invest in any of the foregoing instruments, and options on ETFs and options box spreads (the “Collateral Portfolio”). An options box spread is the combination of different options trades that have offsetting spreads (e.g., purchases and sales on the same underlying instrument, such as an index or an ETF, but with different strike prices and/or expiration dates) for the purpose of generating income. While the Fund will primarily transact in FLEX Options, the Fund may utilize over-the-counter (“OTC”) options if no FLEX Options are available or appropriate for use in the Fund. The Collateral Portfolio is designed primarily to serve as margin or collateral for the Fund’s options positions and secondarily to enhance the Fund’s upside S&P 500 Index options’ exposure (i.e., by utilizing anticipated income to measure the ability to purchase additional options contracts). FLEX Options are exchange-traded options contracts with uniquely customizable terms, that reference (i.e., derive their value from) either the S&P 500 Index or an ETF, including an ETF that seeks to track the performance of the S&P 500 Index, and are guaranteed for settlement by the Options Clearing Corporation (“OCC”). OTC options are traded and privately negotiated in the OTC market, and which also reference either the S&P 500 Index or an ETF, as well as being subject to counterparty risk of the writer of the options contract. The Fund will also transact in options contracts on fixed income securities and/or one or more ETFs that provide exposure to fixed income securities to create a put spread (i.e., writing and purchasing options contracts on the same underlying asset) (the “Put Spread Strategy”). The Put Spread Strategy may be used as part of the Collateral Portfolio or for other purposes consistent with the Fund’s investment strategy, such as to enhance the Fund’s upside S&P 500 Index options’ exposure. If the Collateral Portfolio and/or the Put Spread Strategy experiences losses, it could have the effect of reducing the impact of, or completely eliminating, the Par Down Rate on the Fund’s S&P 500 Index exposure. In certain market conditions, the performance of the Collateral Portfolio and/or the Put Spread Strategy could cause the Fund to significantly underperform the S&P 500 Index. Despite the intended Par Down Rate, an investor could lose their entire investment. Any stated Par Down Rate is not operative against losses in the Collateral Portfolio or the Put Spread Strategy. |

| ■ | Under normal circumstances (i.e., where the Fund’s investment adviser already has transacted in the options contracts necessary for the Fund to achieve its stated Outcomes), the Fund will not use defensive strategies or attempt to reduce its exposure to poorly performing positions during an Outcome Period. Therefore, in the event of a general market decline, the Fund’s value may fall more than the value of another fund that engages in a defensive strategy by reducing its exposure to poorly performing positions. |

| ■ | On the last business day of any stated Outcome Period, all of the Fund’s existing options contracts will expire and the Fund’s investment adviser will transact in a new set of options contracts on the same business day, which will commence a new Outcome Period beginning the following business day. Accordingly, shares of the Fund (“Shares”) can be held indefinitely if investors determine to participate in additional Outcome Periods. |

| ■ | The Fund’s website will provide information about the definitive Par Up Rate as of a specific time. This website will also provide information relating to the Outcomes of the Fund on a daily basis, including the Fund’s position relative to the Par Up Rate. Investors considering purchasing Shares should visit the Fund’s website before making an investment in the Fund. |

| ■ | The Fund’s investment strategy is designed to deliver returns that provide exposure to the S&P 500 Index if Shares are bought on the day on which the Fund enters into the options contracts and held until those options contracts expire at the end of the Outcome Period. In the event an investor purchases Shares after the date on which the options contracts were entered into or redeems Shares prior to the expiration of the options contracts, the returns realized by the investor will not match those that the Fund seeks to achieve. Investors considering purchasing Shares after an Outcome Period has begun or redeeming Shares prior to the end of the Outcome Period should visit the Fund’s website prior to making such a decision to fully understand their potential investment outcomes in the Fund at that time. |

Investor Suitability

An investment in Shares may be suitable for you only if all of the following apply to you:

| ■ | The Fund seeks to achieve specified Outcomes, but there is no guarantee that the Outcomes for an Outcome Period will be achieved. You fully understand the risks inherent in an investment in the Fund, including that you may lose some or all of your investment. |

| ■ | The Outcomes described in this Summary Prospectus are specifically designed to apply only if you hold Shares on the first day of the Outcome Period and continue to hold them on the last day of the Outcome Period. You therefore desire to invest in a product with a return that depends upon the performance of the S&P 500 Index over a full Outcome Period. |

| ■ | You are willing to hold Shares for the duration of the Outcome Period or, if you choose to purchase or redeem Shares during the Outcome Period, you understand the associated risks, including that you may receive a very different return based on the Fund’s value at the time of your purchase or redemption. Investors purchasing Shares of the Fund after the Outcome Period begins can access the Fund’s website at www.millimanfunds.com for additional information regarding possible Outcomes depending upon projected index performance. |

| ■ | At the end of any particular Outcome Period, the Fund will reset for a new Outcome Period tied to the S&P 500 Index and with the same Par Down Rate, but the Par Up Rate may change based on (i) evaluation by Milliman Financial Risk Management LLC, the Fund’s investment adviser (“Milliman”), of prevailing market conditions on the first day of the Outcome Period, and (ii) the total number of long call options contracts on the S&P 500 Index or corresponding ETF that Milliman is able to purchase at that time (the number of which will depend, in part, upon the expected income from the Collateral Portfolio and the Put Spread Strategy). |

| ■ | You can tolerate fluctuations in the value of the net asset value of the Shares prior to the end of the Outcome Period that may be similar to, or exceed, the downside fluctuations in the value of the S&P 500 Index. |

| ■ | You understand and accept the risks associated with the Collateral Portfolio and the Put Spread Strategy, including that either or both may (a) cause the Fund not to achieve its investment objective and/or Outcomes or (b) otherwise negatively impact the Fund’s Options Strategies. |

| ■ | You understand that the performance of the Collateral Portfolio and/or the Put Spread Strategy could cause the Fund to significantly underperform the S&P 500 Index. |

| ■ | You understand and accept that you may experience losses in excess of the Par Down Rate in the Fund’s S&P 500 Index exposure for the applicable Outcome Period at the time of your investment. |

| ■ | You understand and accept that your potential return is limited by the Par Up Rate in effect for the applicable Outcome Period at the time of your investment. |

| ■ | You understand that the Fund’s investment strategy is not expected to provide dividends to you. |

| ■ | You understand and accept the risks associated with the Fund’s investments in underlying investment companies (i.e., ETFs and money market funds). |

| ■ | You are willing to assume counterparty risk with the relevant counterparty to the Fund’s options positions. |

| ■ | You have visited the Fund’s website and understand the Outcomes available to you at the time of your purchase. |

Fund Summary: Milliman 6-Month Parred Down S&P 500 with Par Up Outcome Fund – Jan/Jul

Investment Objective

The Fund seeks to provide exposure to the S&P 500 Index, while limiting losses to 50% of the losses associated with S&P 500 Index performance and participating in S&P 500 Index gains at a declared rate, prior to taking into account any fees or expenses or the performance of any fixed income exposure included in the Fund’s portfolio, over a six-month period.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund (“Shares”). This table and the example below do not include any fees or sales charges imposed by your variable product. If they were included, the expenses listed below would be higher.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class 3 | |

| Management Fees | 0.49% |

| Distribution and Service (12b-1) Fees | 0.25% |

| Other Expenses(1) | 0.50% |

| Acquired Fund Fees and Expenses(1) | 0.02% |

| Total Annual Fund Operating Expenses | 1.26% |

| Fee Waiver and/or Expense Reimbursement(2)(3) | (0.27)% |

| Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement | 0.99% |

| (1) | “Other Expenses” and “Acquired Fund Fees and Expenses” are based on estimated amounts for the current fiscal year. |

| (2) | The Fund’s investment adviser, Milliman Financial Risk Management LLC (“Milliman”), has contractually agreed to waive advisory fees and/or reimburse expenses to the extent necessary to limit the Fund’s total annual Fund operating expenses (excluding taxes, interest, brokerage fees and commissions, Rule 12b-1 fees, acquired fund fees and expenses, short-sale dividend expenses, and extraordinary or non-routine expenses not incurred in the ordinary course of the Fund’s business) to 0.74% of the Fund's average daily net assets (the “Expense Limitation Agreement”) until at least April 30, 2023. During its term, the Expense Limitation Agreement cannot be terminated or amended to increase the applicable limit without approval of the Board of Trustees of the Trust (the “Board”). Milliman may recoup from the Fund any advisory fees waived or expenses reimbursed pursuant to the Expense Limitation Agreement for a period of three years from the date on which such waiver or reimbursement occurred; provided, however, that such recoupment shall not be made if it would cause the Fund’s total annual Fund operating expenses to exceed the lesser of (a) the expense limitation in effect at the time of the reimbursement, or (b) the expense limitation in effect at the time of recoupment, if any. |

| (3) | In addition to the Expense Limitation Agreement, Milliman has contractually agreed to waive its advisory fees in an amount equal to the Fund’s acquired fund fees and expenses until at least April 30, 2023 (the “Fee Waiver”). This contract cannot be terminated or modified without the consent of the Board. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. This example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your Shares at the end of those periods. This example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain at current levels and that the Expense Limitation Agreement and Fee Waiver remain in place for their contractual periods. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

| 1 Year | 3 Years | |

| Class 3 | $101 | $373 |

This example does not include any fees or sales charges imposed by your variable product. If they were included, the expenses listed above would be higher.

1

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional transaction costs. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, may affect the Fund’s performance. Because the Fund had not commenced investment operations as of the fiscal year ended December 31, 2021, no portfolio turnover information is available at this time.

Principal Investment Strategies

The Fund seeks to achieve its investment objective by transacting in FLexible EXchange® Options (“FLEX Options”) and by separately maintaining a collateral portfolio (the “Collateral Portfolio”), which is designed primarily to serve as margin or collateral for the Fund’s FLEX Options positions and secondarily to enhance the Fund’s upside S&P 500 Index FLEX Options’ exposure (i.e., by utilizing anticipated income to measure the ability to purchase additional FLEX Options). FLEX Options are exchange-traded options contracts with uniquely customizable terms. In general, an options contract is an agreement between a buyer and seller that gives the purchaser of the option the right to buy or sell a particular asset at a specified future date at an agreed upon price, commonly known as the “strike price.” The reference assets for the Fund’s FLEX Options positions will include the S&P 500 Index, which is a large-capitalization, market-weighted, U.S. equities index that tracks the price (excluding dividends) of 500 leading companies in leading industries of the U.S. economy, and certain exchange-traded funds (“ETFs”), including those that seek to track the performance of the S&P 500 Index (a “corresponding ETF”), as described further below.

The Collateral Portfolio may be invested in short-term fixed-income securities, including corporate bonds and other corporate debt securities, asset-backed securities (“ABS”), securities issued by the U.S. Government or its agencies and instrumentalities, securities issued by non-U.S. governments or their agencies and instrumentalities, money market securities and funds, other interest-bearing instruments, cash, ETFs that primarily invest in any of the foregoing instruments, options on ETFs and options box spreads. An options box spread is the combination of different options trades that have offsetting spreads (e.g., purchases and sales on the same underlying instrument, such as an index or an ETF, but with different strike prices and/or expiration dates) for the purpose of generating income. The Fund may invest in short-term fixed income securities or other instruments, including through ETFs, of any maturity and credit quality. The Fund may invest up to 35% of its net assets in one or more ETFs that provide exposure to investment grade corporate bonds.

Due to the unique mechanics of the Fund’s strategy, the return an investor can expect to receive from an investment in the Fund has characteristics that are distinct from the returns of many other investment vehicles. It is important that an investor understand these characteristics before making an investment in the Fund.

In seeking to achieve its investment objective, the Fund seeks to produce pre-determined outcomes (the “Outcomes”) that are based upon the performance of the S&P 500 Index over a six-month period (the “Outcome Period”). The initial Outcome Period for the Fund commenced on January 10, 2022. Following the initial Outcome Period, each subsequent Outcome Period will be a six-month period commencing upon the expiration of the prior Outcome Period. The Fund seeks to achieve the Outcomes by purchasing and writing (selling) FLEX Options to create layers within the Fund’s portfolio. One layer is designed to produce returns that correlate to those of the S&P 500 Index for the Outcome Period at a declared rate (the “Par Up Rate”) if the S&P 500 Index experiences gains during that time, as described below. A separate layer is designed to limit losses to 50% of the losses experienced by the S&P 500 Index for the Outcome Period (the “Par Down Rate”). There is no guarantee that the Fund will be successful in its attempt to produce returns that correlate to those of the S&P 500 Index at the Par Up Rate or limit losses that correlate to those of the S&P 500 Index at the Par Down Rate.

Milliman Financial Risk Management LLC (“Milliman”), the investment adviser of the Fund, seeks to establish the Par Down Rate by writing put FLEX Options on the S&P 500 Index or a corresponding ETF to achieve exposure equivalent to approximately 50% of the Fund’s net assets, with a strike price of such options that is equal to the value of the S&P 500 Index or corresponding ETF at the beginning of the Outcome Period.

2

Milliman seeks to establish the Par Up Rate by purchasing long call FLEX Options on the S&P 500 Index or a corresponding ETF with a strike price of such options approximately equal to the value of the S&P 500 Index or corresponding ETF at the beginning of the Outcome Period. Milliman purchases these FLEX Options with a portion of the Fund’s net assets plus (i) the cash received from writing the put FLEX Option designed to create the Par Down Rate, (ii) additional cash received by utilizing FLEX Options to create a put spread (the “Put Spread Strategy”) on fixed income securities and/or one or more ETFs that provide exposure to fixed income securities, and (iii) yield expected to be received from the Collateral Portfolio. Milliman seeks to achieve the Put Spread Strategy for the Fund by writing a put FLEX Option on an underlying asset at a strike price at or lower than the underlying asset’s market price or current value at the beginning of the Outcome Period, and buying a put FLEX Option on the same underlying asset at a lower strike price than the written put FLEX Option.

The Par Up Rate is the rate at which the Fund will seek to track any upside market performance of the S&P 500 Index. Milliman calculates the Par Up Rate based upon (i) its evaluation of prevailing market conditions on the first day of the Outcome Period and (ii) the total number of long call FLEX Options on the S&P 500 Index or corresponding ETF that it is able to purchase at that time. The Par Up Rate as of January 10, 2022 is provided below. Once calculated, the Par Up Rate for a particular Outcome Period will not change during that Outcome Period; however, in certain market conditions, the performance of the Collateral Portfolio and the Put Spread Strategy could reduce the impact of the Par Up Rate.

| Share Class | Par Up Rate* (As of January 10, 2022) |

| Prior

to Taking into Account Fund Fees and Expenses |

|

| Class 3 | 66.67% |

| * | The performance of the Fund’s upside S&P 500 Index FLEX Options’ exposure is calculated by multiplying the Par Up Rate by the positive returns of the S&P 500 Index for the Outcome Period. That performance is then reduced by the Fund's total net expenses. |

The Par Down Rate is the rate at which the Fund will seek to track any downside market performance of the S&P 500 Index. The Par Down Rate is designed to limit losses in the Fund’s S&P 500 Index exposure to 50% for the Outcome Period. The Fund seeks to limit losses against its S&P 500 Index exposure prior to taking into account any fees or expenses or the performance of the Collateral Portfolio or the Put Spread Strategy. The Par Down Rate is not operative against losses in the Collateral Portfolio or the Put Spread Strategy. If the Collateral Portfolio and/or the Put Spread Strategy experiences losses, it could have the effect of reducing the impact of, or completely eliminating, the Par Down Rate on the Fund’s S&P 500 Index exposure. In certain market conditions, the performance of the Collateral Portfolio and/or the Put Spread Strategy could cause the Fund to significantly underperform the S&P 500 Index. The following table reflects the Par Down Rate:

| Share Class | Par Down Rate* (As of January 10, 2022) |

| Prior

to Taking into Account Fund Fees and Expenses |

|

| Class 3 | 50% |

| * | The performance of the Fund’s downside S&P 500 Index FLEX Options’ exposure is calculated by multiplying the Par Down Rate by the negative returns of the S&P 500 Index for the Outcome Period. That performance is then reduced by the Fund's total net expenses. |

The definitive Par Up Rate and Par Down Rate will be set forth on the Fund’s website. The Fund’s website will also provide information relating to the Outcomes on a daily basis, including the Fund’s position relative to the Par Up Rate and the Par Down Rate. You may also contact your insurance company or other financial intermediary for more information.

Additionally, the Fund’s net asset value (“NAV”) will not increase or decrease at the same rate as the S&P 500 Index because the Fund’s strategy relies upon the performance of the Collateral Portfolio and the Put Spread Strategy, in addition to the value of the Fund’s FLEX Options positions on the S&P 500 Index or corresponding ETF. While Milliman anticipates that the Fund’s NAV will generally move in the same direction as the S&P 500 Index (meaning that the Fund’s NAV will generally increase if the S&P 500 Index experiences gains or decrease if the S&P 500 Index experiences losses), the Fund’s NAV will not decrease at the same rate as the S&P 500 Index (especially when factoring in the Par Down Rate and the performance of the Collateral Portfolio and the Put Spread Strategy) and will not increase at the same rate as the S&P 500 Index (especially when factoring in the Par Up Rate and the performance of the Collateral Portfolio and the Put Spread Strategy). Similarly, the amount of time remaining until the end of the Outcome Period also affects the impact of the Par Down Rate on the Fund’s NAV, because the Par Down Rate may not be in full effect prior to the end of the Outcome Period.

3

The FLEX Options utilized in the Fund’s portfolio are each set to expire on the last day of the Outcome Period. The customizable nature of FLEX Options will allow Milliman to select the strike price at which each FLEX Option will be exercised at the expiration of the FLEX Option term. At the commencement of the Outcome Period, Milliman will specifically select the strike price for each FLEX Option in a manner designed to achieve the Outcomes when the FLEX Options are exercised on the final day of the Outcome Period, depending on the anticipated performance of the S&P 500 Index, the Collateral Portfolio and the Put Spread Strategy over the duration of that Outcome Period.

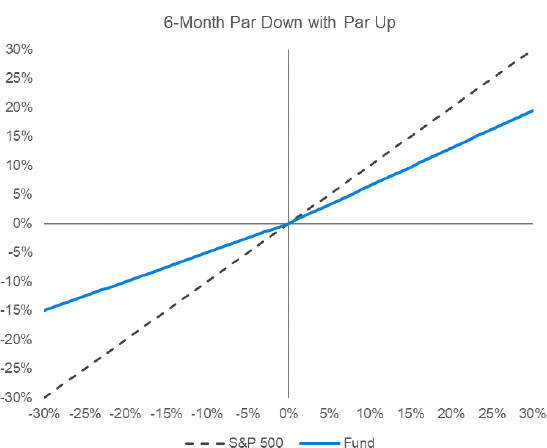

The hypothetical graphical illustrations provided below are designed to illustrate the Outcomes based upon the hypothetical performance of the S&P 500 Index for an investor who holds Shares for the entirety of the Outcome Period. The hypothetical graphical illustrations do not include any fees or expenses imposed by your variable product or expenses incurred by the Fund, and do not reflect the performance of the Collateral Portfolio or the Put Spread Strategy. Additional hypothetical graphical representations of the Outcomes are provided in “Additional Information About the Funds and the Risks of Investing.” There is no guarantee that the Fund will be successful in its attempt to achieve the Outcomes for the Outcome Period.

The following table contains hypothetical examples designed to illustrate the Outcomes the Fund seeks to achieve over the Outcome Period, based upon the performance of the S&P 500 Index from (100)% to 100% after taking into account the Par Up Rate and the Par Down Rate, but prior to taking into account any fees or expenses or the performance of the Collateral Portfolio or the Put Spread Strategy. The table is provided for illustrative purposes only and does not provide every possible performance scenario for Shares over the course of the Outcome Period. There is no guarantee that the Fund will be successful in its attempt to achieve the Outcomes for an Outcome Period. The table is not intended to predict or project the performance of the FLEX Options or the Fund. Investors should not take this information as an assurance of the expected performance of the S&P 500 Index or the Fund. Actual Fund performance will vary with fluctuations in the performance of the Collateral Portfolio and the Put Spread Strategy, in addition to the value of the Fund’s FLEX Options positions on the S&P 500 Index or corresponding ETF, during the Outcome Period, among other factors. The performance of the Collateral Portfolio and the Put Spread Strategy could significantly impact the performance of the Fund, which could prevent the Fund from achieving the Outcomes that it seeks to produce. The table does not reflect any fees or expenses imposed by your variable product or expenses incurred by the Fund. If it did, the returns shown for the Fund would be lower. Please refer to the Fund’s website, which provides updated information relating to this table on a daily basis throughout the Outcome Period. Please contact your insurance company or other financial intermediary for more information.

4

| Index/Fund | Hypothetical Performance1 | |||||||||||

| S&P 500 Index Price Performance | (100)% | (50)% | (20)% | (10)% | (5)% | 0% | 5% | 10% | 15% | 20% | 50% | 100% |

| Fund Performance at NAV | (50)%2 | (25)%2 | (10)%2 | (5)%2 | (2.5)%2 | 0% | 3.4%3 | 6.7%3 | 10.05%3 | 13.4%3 | 33.5%3 | 67%3 |

| 1 | Does not take into account any fees or expenses or the performance of the Collateral Portfolio or the Put Spread Strategy. |

| 2 | Reflects the impact of the Par Down Rate. |

| 3 | Reflects the impact of an assumed Par Up Rate of 67%. |

Understanding Outcomes. The Outcomes the Fund seeks to achieve are measured based upon the Fund’s NAV on the first day of the Outcome Period. The Outcome Period begins on the day Milliman transacts in the FLEX Options on behalf of the Fund, and ends on the day those FLEX Options expire. An investor who purchases Shares after the commencement of the Outcome Period will likely have purchased Shares at a different NAV than the NAV on the first day of the Outcome Period (the NAV upon which the Outcomes are based) and may experience investment outcomes very different from those the Fund seeks to achieve, especially when factoring in any fees or expenses or the performance of the Collateral Portfolio and the Put Spread Strategy. An investor who redeems Shares prior to the end of the Outcome Period may also experience investment outcomes very different from those the Fund seeks to achieve. The Outcomes are designed with the expectation that an investor will hold Shares on the day that Milliman transacts in the FLEX Options on behalf of the Fund, and on the day those FLEX Options expire. There is no guarantee that the Fund will be successful in its attempt to achieve the Outcomes.

Understanding the Par Up Rate. Unlike other investment products, the potential returns an investor can receive from an investment in the Fund are subject to the Par Up Rate. This means that if the S&P 500 Index experiences gains for the Outcome Period, an investor in the Fund will only experience a percentage of those gains (equal to the Par Up Rate multiplied by the S&P 500 Index gains). Milliman calculates the Par Up Rate for each Outcome Period based upon (i) its evaluation of prevailing market conditions on the first day of the Outcome Period and (ii) the total number of long call FLEX Options on the S&P 500 Index or corresponding ETF that it is able to purchase at that time. In certain market conditions, the performance of the Collateral Portfolio and the Put Spread Strategy could reduce the impact of the Par Up Rate. An investor should consider the amount and impact of the Par Up Rate, and the Fund’s position relative to it, before investing in the Fund.

Understanding the Par Down Rate. The Par Down Rate is intended to limit losses in the Fund’s S&P 500 Index exposure to 50% of the losses the S&P 500 Index experiences for the Outcome Period. While the Fund seeks to provide returns that are limited to 50% (prior to taking into account any fees or expenses or the performance of the Collateral Portfolio or the Put Spread Strategy) for investors who hold Shares for the entire Outcome Period, there is no guarantee it will successfully do so. In addition, the Par Down Rate is not operative against losses in the Collateral Portfolio or the Put Spread Strategy. If the Collateral Portfolio and/or the Put Spread Strategy experiences losses, it could have the effect of reducing the impact of, or completely eliminating, the Par Down Rate on the Fund’s S&P 500 Index exposure. In certain market conditions, the performance of the Collateral Portfolio and/or the Put Spread Strategy could cause the Fund to significantly underperform the S&P 500 Index. Investors who purchase Shares at the beginning of the Outcome Period may lose their entire investment. Investors who purchase Shares after the Outcome Period has begun may also lose their entire investment. An investment in the Fund is only appropriate for investors willing to bear those losses.

5

Fund Rebalance. Milliman implements the Fund’s strategy on a semi-annual basis, seeking to produce the Outcomes for an Outcome Period. On the last business day of any stated Outcome Period, all of the Fund’s existing FLEX Options, which includes those used to establish the Par Up Rate, the Par Down Rate and the Put Spread Strategy, will expire and Milliman will transact in a new set of FLEX Options on the same business day, which will commence a new Outcome Period beginning the following business day. At that same time, Milliman will also evaluate whether to make any adjustments to the Collateral Portfolio. Accordingly, Shares can be held indefinitely if investors determine to participate in additional Outcome Periods.

Approximately one week prior to the end of each Outcome Period, the Fund will file a prospectus supplement, which will notify existing investors of (i) the date on which the existing Outcome Period will end; (ii) the date on which the new Outcome Period will commence; and (iii) the anticipated range of the Par Up Rate that will be used for the new Outcome Period. Upon the commencement of the new Outcome Period, the Fund will file a prospectus supplement disclosing the Fund’s final Par Up Rate for the new Outcome Period. This information will also be available online at www.millimanfunds.com, and on your insurance company’s website. Please contact your insurance company or other financial intermediary for more information.

Fund Classification. The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended (the “1940 Act”).

Principal Risks

You could lose money by investing in the Fund. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency. There can be no assurance that the Fund’s investment objectives will be achieved.

Downside Loss Par Down Rate Risk. There can be no guarantee that the Fund will be successful in its strategy to limit losses in the Fund’s S&P 500 Index exposure to 50% of the losses experienced by the S&P 500 Index over the Outcome Period. The success of the Par Down Rate also depends upon the performance of the Collateral Portfolio and the Put Spread Strategy. If the Collateral Portfolio and/or the Put Spread Strategy experiences losses, it could have the effect of reducing the impact of, or completely eliminating, the Par Down Rate on the Fund’s S&P 500 Index exposure. In certain market conditions, the performance of the Collateral Portfolio and/or the Put Spread Strategy could cause the Fund to significantly underperform the S&P 500 Index. Despite the intended Par Down Rate, an investor could lose their entire investment. In the event an investor purchases Shares after the date on which Milliman transacted in the FLEX Options on behalf of the Fund, or redeems Shares prior to the expiration of those FLEX Options, the Par Down Rate that the Fund seeks to provide may not be available or fully applicable.

Risk of the Par Up Rate on Upside Returns. The Fund’s strategy is designed to produce returns that correlate to those of the S&P 500 Index at the Par Up Rate if Shares are bought on the day on which Milliman transacts in the FLEX Options on behalf of the Fund and held until those FLEX Options expire at the end of the Outcome Period. Accordingly, the Fund will not fully participate in any gains achieved by the S&P 500 Index. In addition, in the event an investor purchases Shares after the date on which Milliman transacted in the FLEX Options on behalf of the Fund, or redeems Shares prior to the expiration of those FLEX Options, the returns realized by that investor may not match those that the Fund seeks to achieve pursuant to the Par Up Rate. In certain market conditions, the performance of the Collateral Portfolio and the Put Spread Strategy could reduce the impact of the Par Up Rate. An investor should consider the amount and impact of the Par Up Rate, and the Fund’s position relative to it, before investing in the Fund.

Par Up Rate Change Risk. Because the Par Up Rate for each Outcome Period is calculated based upon (i) Milliman’s evaluation of prevailing market conditions on the first day of the Outcome Period and (ii) the total number of long call FLEX Options on the S&P 500 Index or corresponding ETF that Milliman is able to purchase at that time, the Par Up Rate may rise or fall from one Outcome Period to the next. Any change in the Par Up Rate could be significant and it is unlikely to remain the same for consecutive Outcome Periods.

6

FLEX Options Risk. The Fund will transact in FLEX Options issued and guaranteed for settlement by the OCC. The Fund bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts, which could result in significant losses to the Fund. In less liquid markets, terminating a FLEX Option may require the payment of a premium or acceptance of a discounted price, and may take longer to complete. In addition, a less liquid trading market may adversely impact the value of the Fund’s FLEX Options and therefore the NAV of the Fund. In addition, the value of the Fund’s FLEX Options positions is not anticipated to increase or decrease at the same rate as the reference asset; and while it is anticipated that they will generally move in the same direction, it is possible that they may move in different directions. Certain FLEX Options positions may also expire worthless. The use of FLEX Options involves leverage, which can cause the Fund’s portfolio to be more volatile than if the portfolio had not been leveraged. Leverage can significantly magnify the effect of price movements of the reference asset, disproportionately increasing the Fund’s losses and reducing the Fund’s opportunities for gains when the reference asset changes in unexpected ways. In some instances, such leverage could result in losses that exceed the original amount invested.

Investment Objective and Outcomes Risk. There is no guarantee that the Fund will be successful in its attempt to achieve its investment objective and/or the Outcomes, and an investor could lose some or all of their investment in the Fund. Certain circumstances under which the Fund might not achieve its objective and/or the Outcomes include, but are not limited to (i) if the Fund disposes of FLEX Options, (ii) if the Fund is unable to maintain the proportional relationship based on the number of FLEX Options in the Fund’s portfolio, (iii) significant accrual of Fund expenses in connection with effecting the Fund’s principal investment strategy, (iv) losses incurred by the Fund’s holdings in the Collateral Portfolio and/or losses resulting from the Put Spread Strategy, or (iv) adverse tax law changes affecting the treatment of FLEX Options.

Tax Risk. The Fund intends to elect, and to qualify each year, to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). As a RIC, the Fund will not be subject to U.S. federal income tax on the portion of its net investment income and net capital gain that it distributes to shareholders, provided that it satisfies certain requirements of the Code. To maintain its status as a RIC, the Fund must meet certain income, diversification and distributions tests. For purposes of the diversification test, the identification of the issuer (or, in some cases, issuers) of a particular Fund investment can depend on the terms and conditions of that investment. In particular, there is no published IRS guidance or case law on how to determine the “issuer” of certain derivatives that the Fund will enter into and the Fund has not received a private letter ruling on this point. Therefore, there is a risk that the Fund will not meet the Code’s diversification requirements and will not qualify, or will be disqualified, as a RIC. If the Fund does not qualify as a RIC for any taxable year and certain relief provisions are not available, the Fund’s taxable income will be subject to tax at the Fund level and to a further tax at the shareholder level when such income is distributed.

The Fund also intends to comply with the diversification requirements of Section 817(h) of the Code, and the regulations thereunder, relating to the tax-deferred status of variable accounts that are based on insurance company separate accounts (referred to as “segregated asset accounts” for federal income tax purposes). These diversification requirements apply in addition to the RIC diversification requirements discussed above. There also is no published guidance or case law on how to determine the “issuer” of the derivatives referred to above for purposes of the diversification requirements of Section 817(h) of the Code and the Fund has not received a private letter ruling on this point. If these requirements are not met, or under other circumstances, such as if the Fund does not qualify as a RIC for any taxable year, it is possible that the contract owners (rather than the insurance company) will be treated for federal income tax purposes as the taxable owners of the assets held by the segregated asset accounts.

Clearing Member Default Risk. The Fund will hold FLEX Options through accounts at members of clearing houses (“clearing members”) rather than a bank or a broker. Assets deposited by the Fund with any clearing member as margin for its FLEX Options positions may, in certain circumstances, be used to satisfy losses of other clients of the Fund’s clearing member where such assets may be held in commingled omnibus accounts. In addition, although clearing members guarantee performance of their clients’ obligations to the clearing house, there is a risk that the assets of the Fund might not be fully protected in the event of the clearing member’s bankruptcy, as the Fund would be limited to recovering only a pro rata share of all available funds segregated on behalf of the clearing member’s customers for the relevant account class.

7

Debt Securities Risk. The prices of debt securities will be affected by changes in interest rates, the creditworthiness of the issuer and other factors. These risks could affect the value of investments in which the Fund invests, possibly causing the Fund’s NAV to be reduced and fluctuate more than other types of investments. During periods of falling interest rates, an issuer of a callable bond may repay the security before its stated maturity, and the Fund may have to reinvest the proceeds in securities with lower yields, which would result in a decline in the Fund’s income, or in securities with greater risks or with other less favorable features. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, result in heightened market volatility and detract from the Fund’s performance to the extent the Fund is exposed to such interest rates. An increase in interest rates will generally cause the value of fixed-income securities held by the Fund to decline, may lead to heightened volatility in the fixed-income markets and may adversely affect the liquidity of certain fixed-income investments, including those held by the Fund. Risks associated with rising interest rates are heightened given that interest rates in the U.S. are near historic lows. Adjustable-rate instruments also react to interest rate changes in a similar manner, although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other factors). Interest rate sensitivity is generally more pronounced and less predictable in instruments with uncertain payment or prepayment schedules and also for those with longer maturities.

Foreign Securities and Credit Exposure Risk. U.S. dollar-denominated securities carrying foreign credit exposure may be affected by unfavorable political, economic or governmental developments that could affect payments of principal and interest. Furthermore, the value of the Fund’s foreign investments (whether direct or indirect) may be adversely affected by political and social instability in their home countries, by changes in economic or taxation policies in those countries, or by the difficulty in enforcing obligations in those countries. Foreign companies generally may be subject to less stringent regulations than U.S. companies, including financial reporting requirements and auditing and accounting controls. As a result, there generally is less publicly available information about foreign companies than about U.S. companies. Trading in many foreign securities may be less liquid and more volatile than U.S. securities due to the size of the market or other factors.

U.S. Government Securities Risk. U.S. Government securities are subject to interest rate risk but generally do not involve the credit risks associated with investments in other types of debt securities. As a result, the yields available from U.S. Government securities are generally lower than the yields available from other debt securities. U.S. Government securities are guaranteed only as to the timely payment of interest and the payment of principal when held to maturity. While securities issued or guaranteed by U.S. federal government agencies are backed by the full faith and credit of the U.S. Department of the Treasury, securities issued by government sponsored entities are solely the obligation of the issuer and generally do not carry any guarantee from the U.S. Government.

ABS Risk. ABS are subject to the general debt securities risks described above. In addition, ABS may be less liquid than other bonds, and may be more sensitive than other bonds to the market’s perception of issuers and creditworthiness of payees, which may result in the Fund experiencing difficulty selling or valuing these securities. ABS markets have experienced extraordinary weakness and volatility at various times in recent years, and may decline quickly in the event of a substantial economic or market downturn. Accordingly, these securities may be subject to greater risk of default during periods of economic downturn than other securities, which could result in possible losses to the Fund.

Issuer Risk. The performance of the Fund depends on the performance of individual securities to which the Fund has exposure. The Fund may be adversely affected if an issuer of underlying securities held by the Fund is unable or unwilling to repay principal or interest when due. Changes in the financial condition or credit rating of an issuer of those securities may cause the value of the securities to decline.

Management Risk. The Fund is subject to management risk because it is an actively managed portfolio. Milliman will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that the Fund will meet its investment objective and/or the Outcomes. In addition, under normal circumstances (i.e., where Milliman already has transacted in the options contracts necessary for the Fund to achieve its stated Outcomes), Milliman does not use defensive strategies or attempt to reduce the Fund’s exposures to poorly performing positions during an Outcome Period. Therefore, in the event of a general market decline, the Fund’s value may fall more than the value of another fund that engages in a defensive strategy by reducing its exposure to poorly performing positions.

8

Market Risk. The Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Assets may decline in value due to factors affecting financial markets generally or particular asset classes or industries represented in the markets. The value of a FLEX Option or other asset may also decline due to general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or due to factors that affect a particular issuer, country, region, market, industry, sector or asset class.

Non-Diversification Risk. The Fund may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the Fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly invested in certain issuers.

Large Shareholder Risk. At times, the Fund may experience adverse effects when certain large shareholders, including insurance company separate accounts, redeem large amounts of shares of the Fund. Large redemptions may cause the Fund to sell portfolio holdings at times when it would not otherwise do so and may increase transaction costs and/or result in an increase to the Fund’s expense ratio. A large redemption could be detrimental to the Fund and its remaining shareholders.

Risks of Investing in ETFs. In addition to the risks associated with the underlying assets held by the ETFs in which the Fund invests, investments in ETFs are also subject to the following additional risks: (i) only authorized participants may engage in transactions directly with ETFs but none are obligated to do so, which could result in an ETF’s shares trading at a premium or discount to its NAV or possibly face trading halts or delisting; (ii) certain ETFs seek to track the performance of an underlying index and will not attempt to take defensive positions under any market conditions, including declining markets, which could result in losses; and (iii) because ETF shares trade on the secondary market, there is not guarantee that an active market will be developed or maintained, which could result in the ETF’s shares trading at a premium or discount to its NAV. Investments in ETFs may involve duplication of management fees and certain other expenses, as the Fund indirectly bears its proportionate share of any expenses paid by the ETFs in which it invests.

Risks of Investing in Money Market Funds. Money market funds seek to preserve the value of shareholder investments at $1.00 per share, but shareholders, such as the Fund, may still lose money by investing in such funds. In addition, a money market fund may impose a fee upon the sale of its shares or may temporarily suspend the ability to sell shares if the fund’s liquidity falls below required minimums because of market conditions or other factors. The credit quality of a money market fund’s holdings can change rapidly in certain markets, and the default of a single holding could have an adverse impact on the fund’s share price. A money market fund’s share price can also be negatively affected during periods of high redemption pressures, illiquid markets, and/or significant market volatility.

Performance

As of the date of this Prospectus, the Fund is new and therefore does not have a performance history for a full calendar year. Once available, the Fund’s performance information will be accessible online at www.millimanfunds.com and will provide some indication of the risks of investing in the Fund.

Management

Investment Adviser

Milliman Financial Risk Management LLC (“Milliman”) serves as investment adviser to the Fund.

Portfolio Managers

The following persons serve as portfolio managers of the Fund.

9

| ▪ | Robert T. Cummings, Principal & Head of Portfolio Management at Milliman. |

| ▪ | Maria Schiopu, Principal & Head of Portfolio Management at Milliman. |

| ▪ | Jeff Greco, Principal & Head of Strategy Research at Milliman. |

| ▪ | Jordan Rosenfeld, Portfolio Manager at Milliman. |

Each portfolio manager is jointly and primarily responsible for the day-to-day management of the Fund’s portfolio and has served in such capacity since the Fund’s inception in 2022.

Purchase and Sale of Shares

Shares are available as underlying investment options for variable insurance contracts and variable life insurance policies (each, a “variable contract,” and, collectively, the “variable contracts”) issued by insurance companies. These insurance companies are the record owners of the separate accounts holding the Shares. You do not buy, sell or exchange Shares directly; rather, you choose investment options through your variable contracts. The insurance companies then cause the separate accounts to purchase and redeem Shares according to the investment options you choose.

Tax Information

The dividends and distributions paid by the Fund to the insurance company separate accounts will consist of ordinary income, capital gains, or some combination of both. Because Shares must be purchased through separate accounts used to fund variable contracts, such dividends and distributions will be exempt from current taxation by owners of variable contracts (each, a “contract owner,” and, collectively “contract owners”) if left to accumulate within a separate account. Consult the variable contract prospectus for additional tax information.

Payments to Insurance Companies and Other Financial Intermediaries

If you allocate contract value to the Fund through an insurance company or other financial intermediary, the Fund, Milliman, the Fund’s distributor or their related companies may pay the insurance company and/or its affiliates or other intermediary for the sale of Shares and related services. These payments may create a conflict of interest by influencing the insurance company or other intermediary and your salesperson to recommend an indirect investment in the Fund over another investment. The prospectus or other disclosure documents for the variable contracts may contain additional information about these payments, if any. You may also ask your salesperson or financial intermediary, or visit your financial intermediary’s website, for more information.

10

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- ROSEN, A LEADING INVESTOR RIGHTS LAW FIRM, Encourages Ocugen, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action First Filed by the Firm – OCGN

- StakingFarm Introduces Effortless Crypto Earnings with New Automated Staking

- Music Licensing, Inc. (SONG) (SONGD) Announces Implementation of 1-for-500,000 Reverse Stock Split and Reduction of Outstanding Common Shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share