Form 497 PRUDENTIAL INVESTMENT

PGIM Real Assets Fund

Formerly, Prudential Real Assets Fund

PROSPECTUS — December

27, 2017 (AS REISSUED JUNE 14, 2018)

Objective

Long-term real return

| PGIM REAL ASSETS FUND | ||||

| A: PUDAX | B: PUDBX | C: PUDCX | Z: PUDZX | R6: PUDQX |

| The Securities and Exchange Commission and the Commodity Futures Trading Commission have not approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.Mutual funds are distributed by Prudential Investment Management Services LLC, a Prudential Financial company, member SIPC. QMA is the primary business name of Quantitative Management Associates LLC, a wholly owned subsidiary of PGIM, Inc. (PGIM), a Prudential Financial company. © 2018 Prudential Financial, Inc. and its related entities. The Prudential logo and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide. CoreCommodity Management, LLC, is a subadviser of the Fund and not a Prudential Financial company. |

|

To enroll in e-delivery, go to

pgiminvestments.com/edelivery

Table of Contents

FUND SUMMARY

INVESTMENT OBJECTIVE

The investment objective of the

Fund is to seek long-term real return.

FUND FEES AND EXPENSES

The tables below describe the sales

charges, fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts if you and an eligible group of related investors purchase, or agree to purchase in the

future, $25,000 or more in shares of the Fund or other funds in the PGIM Funds family. More information about these discounts as well as other waivers or discounts is available from your financial professional and is

explained in Reducing or Waiving Class A's and Class C’s Sales Charges on page 44 of the Fund's Prospectus, Appendix A: Waivers and Discounts Available From Certain Financial Intermediaries on page 66 of the Fund's Prospectus and in Rights of Accumulation on page 68 of the Fund's Statement of Additional Information (SAI).

| Shareholder Fees (fees paid directly from your investment) | |||||

| Class A | Class B | Class C | Class Z | Class R6† | |

| Maximum sales charge (load) imposed on purchases (as a percentage of offering price) | 5.50% | None | None | None | None |

| Maximum deferred sales charge (load) (as a percentage of the lower of original purchase price or net asset value at redemption) | 1.00% | 5.00% | 1.00% | None | None |

| Maximum sales charge (load) imposed on reinvested dividends and other distributions | None | None | None | None | None |

| Redemption fee | None | None | None | None | None |

| Exchange fee | None | None | None | None | None |

| Maximum account fee (accounts under $10,000) | $15 | $15 | $15 | None* | None |

*Direct Transfer Agent

Accounts holding under $10,000 of Class Z shares are subject to the $15 fee.

†Formerly known as Class Q.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |||||

| Class A | Class B | Class C | Class Z | Class R6(1) | |

| Management fees | 0.60% | 0.60% | 0.60% | 0.60% | 0.60% |

| Distribution and service (12b-1) fees | 0.30% | 1.00% | 1.00% | None | None |

| Other expenses(2) | 0.78% | 3.16% | 0.93% | 0.41% | 0.32% |

| Acquired Fund fees and expenses(3) | 0.51% | 0.51% | 0.51% | 0.51% | 0.51% |

| Total annual Fund operating expenses | 2.19% | 5.27% | 3.04% | 1.52% | 1.43% |

| Fee waiver and/or expense reimbursement | (0.90)% | (3.07)% | (1.03)% | (0.58)% | (0.58)% |

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement(4,5) | 1.29% | 2.20% | 2.01% | 0.94% | 0.85% |

(1) Formerly known as Class Q.

(2) Includes management fees of 0.60% of the average daily net assets of PGIM Real Assets Subsidiary, Ltd., the Fund’s wholly-owned Cayman Islands subsidiary (the Cayman

Subsidiary) (0.11% of the average daily net assets of the Fund, including the Cayman Subsidiary). Other expenses are based on estimates.

(3) Includes tax expense, if any, related to the underlying PGIM Jennison MLP Fund.

(4) PGIM Investments LLC (PGIM Investments) has contractually agreed through February 28, 2019 to limit net annual operating expenses and acquired fund fees and expenses (exclusive

of distribution and service (12b-1) fees, interest, dividend and interest expense on short sales (including acquired fund dividend and interest expense on short sales), brokerage, taxes (such as income and foreign

withholding taxes, stamp duty and deferred tax expenses (including acquired fund taxes), transfer agency expenses (including sub-transfer agency and networking fees), and extraordinary expenses) of each class of

shares to 0.85% of the Fund’s average daily net assets. Fees and/or expenses waived and/or reimbursed by PGIM Investments may be recouped by PGIM Investments within the same fiscal year during which such waiver

and/or reimbursement is made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This waiver may not be terminated prior to February 28,

2019 without the prior approval of the Fund’s Board of Trustees. Separately, PGIM Investments has contractually agreed, through February 29, 2020 to limit transfer agency, shareholder servicing, sub-transfer

agency, and blue sky fees, as applicable, to the extent that such fees cause the Total Annual Fund Operating Expenses to exceed 2.20% of average daily net assets for Class B shares. This contractual expense limitation

excludes interest, brokerage, taxes (such as income and foreign withholding taxes, stamp duty and deferred tax expenses) extraordinary expenses, and certain other Fund expenses such as dividend and interest expense

and broker charges on short sales. Fees and/or expenses waived and/or reimbursed by PGIM Investments may be recouped by PGIM Investments within the same fiscal year during which such waiver and/or reimbursement is

made if such recoupment can be realized without exceeding the expense limit in effect at the time of the recoupment for that fiscal year. This expense limitation may not be terminated prior to February 29, 2020

without the prior approval of the Fund’s Board of Trustees. Separately, PGIM Investments has contractually agreed to waive any management fees it receives from the Fund in an amount equal to the management fees

paid by the Cayman Subsidiary. This waiver will remain in effect for as long as the Fund remains invested or intends to invest in the Cayman Subsidiary.

(5) The distributor of the Fund has contractually agreed until February 28, 2019 to reduce its distribution and service (12b-1) fees applicable to Class A shares to 0.25% of the

average daily net assets of Class A shares. This waiver may not be terminated prior to February 28, 2019 without the prior approval of the Fund’s Board of Trustees.

| Visit our website at www.pgiminvestments.com | 3 |

Example. The following hypothetical example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. It assumes that you invest $10,000 in

the Fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year, that the Fund's operating expenses remain

the same (except that fee waivers or reimbursements, if any, are only reflected in the 1-Year figures) and that all dividends and distributions are reinvested. Your actual costs may be higher or lower.

| If Shares Are Redeemed | If Shares Are Not Redeemed | |||||||

| Share Class | 1 Year | 3 Years | 5 Years | 10 Years | 1 Year | 3 Years | 5 Years | 10 Years |

| Class A | $674 | $1,116 | $1,582 | $2,868 | $674 | $1,116 | $1,582 | $2,868 |

| Class B | $723 | $1,309 | $2,216 | $3,933 | $223 | $1,009 | $2,116 | $3,933 |

| Class C | $304 | $843 | $1,506 | $3,283 | $204 | $843 | $1,506 | $3,283 |

| Class Z | $96 | $423 | $774 | $1,763 | $96 | $423 | $774 | $1,763 |

| Class R6† | $87 | $395 | $726 | $1,663 | $87 | $395 | $726 | $1,663 |

†Formerly known as Class Q.

Portfolio Turnover. The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher

transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance.

During the Fund's most recent fiscal year, the Fund's portfolio turnover rate was 96% of the average value of its portfolio.

INVESTMENTS, RISKS AND

PERFORMANCE

Principal Investment

Strategies. The Fund seeks to achieve its investment objective by investing primarily in real assets that may perform well in periods of high inflation. Real return is the rate of return after

adjusting for inflation. The Fund invests in real assets through its investments within the following asset classes: commodities; domestic and international real estate; utilities/infrastructure; natural resources;

master limited partnerships (MLPs); fixed income instruments; and gold/defensive.

The Fund gains exposure to the

real asset classes by investing in varying combinations of other PGIM mutual funds (the Underlying Funds); the Cayman Subsidiary; and direct investments in securities (such as equity and equity-related securities,

including common stock, convertible securities, nonconvertible preferred stock, American Depositary Receipts, warrants and other rights that can be exercised to obtain stock, preferred stocks, exchange-traded funds

(ETFs), notes and bonds and certain financial and derivative instruments, including futures). The Fund is non-diversified, which means it may invest in a smaller number of issuers than a diversified fund.

The Fund’s asset allocation

strategy is determined by Quantitative Management Associates LLC (QMA), one of the Fund’s subadvisers. QMA utilizes a dynamic asset allocation strategy among the real asset classes to seek to provide attractive

risk adjusted real return. QMA utilizes a dynamic asset allocation process that makes tactical allocation decisions based on portfolio management judgment which incorporates factors such as current market and economic

conditions, risk, and valuation. This analyzes the momentum of asset class prices, their volatility and their correlations to each other and adapts the asset class allocations to reflect the current market

environment. Finally, QMA’s portfolio managers overlay their judgment over the analysis to incorporate data and information that they believe may also impact future asset class returns.

QMA may tactically adjust the

asset allocation ranges among the real asset classes within the following approximate ranges: commodities (0% to 50%), real estate (0% to 50%), utilities/infrastructure (0% to 40%), natural resources (0% to 40%),

fixed income (0% to 60%), MLPs (0% to 20%), and gold/defensive (0% to 40%). Additionally, the Fund’s investments in the Underlying Funds may range from 0% to 100% of the Fund’s assets. As of October 31,

2017, the Fund’s assets were allocated approximately to each asset class as follows: commodities (15.48%), real estate (24.65%), utilities/infrastructure (13.36%), natural resources (11.30%), fixed income

(26.18%), MLPs (5.24%), and gold/defensive (3.79%).

| 4 | PGIM Real Assets Fund |

Commodity Asset Class. The Fund gains exposure to the commodities asset class through investment of the Fund’s assets directly or in the Cayman Subsidiary. The manager has retained QMA to serve as

subadviser for the commodity asset class. Their strategy seeks to generate returns over a market cycle in excess of the Bloomberg Commodity Index using a systematic, factor-based investment process.

The Fund gains exposure to the

commodity markets primarily through exchange-traded futures on commodities held by the Cayman Subsidiary. The Fund may invest up to 25% of the Fund’s total assets in the Cayman Subsidiary. The Cayman Subsidiary

may invest in commodity investments without limit. The Fund invests in the Cayman Subsidiary in order to gain exposure to commodities within the limitations of the federal tax law requirements applicable to regulated

investment companies (RICs) such as the Fund. The Cayman Subsidiary is subject to the same investment restrictions and limitations, and follows the same compliance policies and procedures, as the Fund. The Fund and

the Cayman Subsidiary will test for compliance with certain investment restrictions and limitations on a consolidated basis. If QMA, as asset allocator, directs more than approximately 25% of the Fund’s total

assets to the commodity asset class, then QMA may invest the Fund’s assets directly. The Fund may obtain exposure to commodity markets by investing directly in commodity-linked structured notes (CLNs), ETFs and

exchange traded notes (ETNs) whose returns are linked to commodities or commodity indices within the limits of applicable tax law.

Segregation of Assets. As an open-end investment company registered with the Securities and Exchange Commission (SEC), the Fund is subject to the federal securities laws, including the Investment Company Act of

1940, as amended (the 1940 Act), the rules thereunder, and various interpretive positions of the SEC and the staff of the SEC. In accordance with these laws, rules and positions, the Fund must set aside unencumbered

cash or liquid securities, or engage in other measures, to “cover” open positions with respect to certain kinds of derivative instruments. This practice is often referred to as “asset

segregation.” In the case of futures contracts that are not contractually required to cash settle, for example, the Fund must set aside liquid assets equal to such contracts’ full notional value while the

positions are open, except as described below. With respect to futures contracts that are contractually required to cash settle, however, the Fund is permitted to set aside liquid assets in an amount equal to the

Fund’s daily mark-to-market net obligations (i.e., the Fund’s daily net liability) under the contracts, if any, rather than such contracts’ full notional value. Futures contracts and forward

contracts that settle physically will be treated as cash settled for asset segregation purposes when the Fund has entered into contractual arrangements with third party futures commission merchants or other

counterparties or brokers that provide for cash settlement of these obligations.

The Fund reserves the right to

modify its asset segregation policies in the future to comply with any changes in the positions from time to time articulated by the SEC or its staff regarding asset segregation. The Fund generally will use its

unencumbered cash and cash equivalents to cover its obligations as required by the 1940 Act, the rules thereunder, and applicable SEC and SEC staff interpretive positions. The manager and the subadviser will monitor

the Fund’s use of derivatives or other investments that require asset segregation and will take action as necessary for the purpose of complying with the asset segregation policy stated above. Such actions may

include the sale of the Fund’s portfolio investments.

Real Estate,

Utilities/Infrastructure, Natural Resources, MLPs, and Fixed Income Asset Classes. The Fund invests in the shares of the named Underlying Funds to obtain exposure to the real asset classes as noted: real estate (PGIM US Real Estate Fund, PGIM Global Real Estate Fund,

PGIM Select Real Estate Fund and/or PGIM Real Estate Income Fund), utilities/infrastructure (PGIM Jennison Global Infrastructure Fund and/or PGIM Jennison Utility Fund), natural resources (PGIM Jennison Natural

Resources Fund), and MLPs (PGIM Jennison MLP Fund). For the fixed income asset class, QMA may select from the following Underlying Funds to obtain fixed income exposure in addition to the direct investments made in

the fixed income asset class, as further described below: PGIM Short-Term Corporate Bond Fund, PGIM Absolute Return Bond Fund, PGIM Short Duration High Yield Income Fund and PGIM Floating Rate Income Fund. Each

Underlying Fund invests primarily in securities or other instruments suggested by such Underlying Fund’s name. Each Underlying Fund is managed by PGIM Investments LLC. Each of the Underlying Funds that may be

used in the fixed income asset class is subadvised by PGIM Fixed Income, a business unit of PGIM, Inc. (PGIM). The PGIM US Real Estate Fund, the PGIM Global Real Estate Fund, the PGIM Select Real Estate Fund and the

PGIM Real Estate Income Fund are each subadvised by PGIM Real Estate, a business unit of PGIM. The PGIM Jennison

| Visit our website at www.pgiminvestments.com | 5 |

Utility Fund, the PGIM Jennison Natural Resources

Fund and the PGIM Jennison MLP Fund are each subadvised by Jennison Associates LLC. More detailed information appears in the section entitled “More About the Fund’s Principal and Non-Principal Investment

Strategies, Investments and Risks.”

The Fund invests in the Class R6

shares of the named Underlying Funds. If any Underlying Fund does not offer Class R6 shares, the Fund will invest in Class Z shares of such Underlying Fund.

Fixed Income Asset Class. In addition to the Underlying Funds noted above, the Fund invests directly in inflation-indexed bonds issued by the US Government, its agencies and instrumentalities, consisting

principally of US Treasury Inflation-Protected Securities (referred to herein collectively as TIPS). PGIM Fixed Income manages the Fund’s direct assets that are allocated to this asset class, and serves as the

subadviser to each of the Underlying Funds that are investment options for this asset class. For its direct investments, PGIM Fixed Income utilizes a conservative, quantitatively-driven strategy that seeks minimal

risk versus the Bloomberg Barclays US Treasury Inflation Protected Index, while attempting to capture excess return through security selection. The asset class may also gain indirect exposure to TIPS through

derivative transactions (such as utilizing zero coupon inflation swaps) and may purchase or sell securities on a when-issued or delayed delivery basis. This asset class will invest in bonds with varying maturities.

The asset class will directly purchase only those bonds rated at least investment grade (bonds rated Baa and higher by Moody’s Investors Service or BBB and higher by S&P Global Ratings or, if unrated,

determined to be of comparable quality by PGIM Fixed Income).

Gold/Defensive Asset Class. The Fund gains exposure to the gold/defensive asset class through investment of the Fund’s assets directly or in the Cayman Subsidiary. QMA manages the Fund’s assets that are

allocated to the gold/defensive asset class. The objective of the gold/defensive asset class is to provide exposure to gold-related securities and other defensive assets. To obtain the desired gold exposure, QMA may

invest the Fund’s assets that are allocated to this asset class in a portfolio of relatively large, liquid gold mining stocks, most of which are included in the NYSE Arca Gold Miners Index. To reduce the equity

exposure associated with these stocks, the gold/defensive asset class may obtain exposure to the Chicago Board Options Exchange Volatility Index (VIX) and cash or cash equivalents. The VIX measures the implied

volatility (i.e., estimated future volatility) of the S&P 500 Index options. The Fund may also invest in ETFs, swaps, futures contracts and other derivatives and/or ETNs. QMA also may invest through the Cayman

Subsidiary in gold-related derivatives that would otherwise generate non-qualifying income for purposes of the Internal Revenue Code of 1986, as amended (the Code) (e.g., gold futures).

Principal Risks. All investments have risks to some degree. An investment in the Fund is not guaranteed to achieve its investment objective; is not a deposit with a bank; is not insured, endorsed or

guaranteed by the Federal Deposit Insurance Corporation or any other government agency; and is subject to investment risks, including possible loss of your original investment.

Set forth below is a description

of the principal risks associated with an investment in the Fund either through direct investments or indirectly through the Fund’s investments in the Underlying Funds.

Market Risk. Securities markets may be volatile and the market prices of the Fund’s securities may decline. Securities fluctuate in price based on changes in an issuer’s financial condition

and overall market and economic conditions. If the market prices of the securities owned by the Fund fall, the value of your investment in the Fund will decline.

Asset Allocation Risk. Asset allocation risk is the risk that the Fund’s assets may be allocated to an asset class that underperforms other asset classes. For example, fixed income securities may

underperform equities.

Fund of Funds Risk. The value of an investment in the Fund will be related, to a degree, to the investment performance of the Underlying Funds in which it invests. Therefore, the principal risks of investing

in the Fund are closely related to the principal risks associated with these Underlying Funds and their investments. Because the Fund’s allocation among different Underlying Funds and direct investments in

securities and derivatives will vary, an investment in the Fund may be subject to any and all of these risks at different times and to different degrees. Investing in an Underlying

| 6 | PGIM Real Assets Fund |

Fund will also expose the Fund to a pro rata

portion of the Underlying Fund’s fees and expenses. In addition, one Underlying Fund may buy the same securities that another Underlying Fund sells. Therefore, the Fund would indirectly bear the costs of these

trades without accomplishing the investment purpose.

Affiliated Funds Risk. The Fund’s manager serves as the manager of the Underlying Funds. It is possible that a conflict of interest among the Fund and the Underlying Funds could impact the manager and

subadvisers. Because the amount of the investment management fees to be retained by the manager and the subadvisers may differ depending upon the Underlying Funds in which the Fund invests, there is a conflict of

interest for the manager and the subadvisers in selecting the Underlying Funds. In addition, the manager and the subadvisers may have an incentive to take into account the effect on an Underlying Fund in which the

Fund may invest in determining whether, and under what circumstances, to purchase or sell shares in that Underlying Fund. Although the manager and the subadvisers take steps to address the conflicts of interest, it is

possible that the conflicts could impact the Fund. In addition, the subadvisers may invest in Underlying Funds that have a limited or no performance history.

Asset Class Variation Risk. The Underlying Funds invest principally in the securities constituting their asset class (i.e., domestic or international real estate, utilities, infrastructure, natural resources, MLPs

and various types of fixed-income investments). However, under normal market conditions, an Underlying Fund may vary the percentage of its assets in these securities (subject to any applicable regulatory

requirements). Depending upon the percentage of securities in a particular asset class held by the Underlying Funds at any given time and the percentage of the Fund’s assets invested in the Underlying Funds, the

Fund’s actual exposure to the securities in a particular asset class may vary substantially from its allocation to that asset class.

Management Risk. Actively managed mutual funds are subject to management risk. The subadvisers will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can

be no guarantee that these techniques will produce the desired results. Additionally, the securities or Underlying Funds selected by the manager and/or subadvisers may underperform the markets in general, the

Fund’s benchmarks and other mutual funds with similar investment objectives.

Deflation Risk. During periods of deflation, prices throughout the economy may decline over time, which may have an adverse effect on the creditworthiness of issuers in whose securities the Fund invests.

Additionally, since the Fund makes investments that may perform well in periods of rising inflation, during periods of no inflation or deflation an investment in the Fund may underperform broad market measures and may

lose value.

Credit Risk/Counterparty Risk. The ability, or perceived ability, of the issuer or guarantor of a debt security, or the counterparty (the party on the other side of the transaction) to a derivatives contract or other

financial contract, to meet its financial obligations will affect the value of the security or derivative. Counterparty risk is especially important in the context of privately negotiated instruments. The Fund expects

to enter into certain privately negotiated agreements where the counterparty assumes the physical settlement obligations of the Fund under such transactions. Under this type of arrangement, there is a risk that the

relevant counterparty or intermediary would, due to insolvency or other reasons, be unable to or fail to assume the physical settlement obligations of the Fund, in which case the Fund could be required to sell

portfolio instruments at unfavorable times or prices or could have insufficient assets to satisfy its physical settlement obligations.

Interest Rate Risk. Interest rate increases can cause the price of a debt security to decrease. In addition, if a security that the Fund holds is prepaid during a period of falling interest rates, the Fund

may have to reinvest the proceeds in lower-yielding investments. Interest rate risk is generally greater in the case of securities with longer durations and in the case of portfolios of securities with longer average

durations. The Fund may face a heightened level of interest rate risk since the US Federal Reserve Board has ended its quantitative easing program and may continue to raise rates. The Fund may lose money if short-term

or long-term interest rates rise sharply or in a manner not anticipated by the subadviser.

| Visit our website at www.pgiminvestments.com | 7 |

Inflation-indexed bonds, such as

TIPS, generally decline in value when real interest rates rise. In certain interest rate environments, such as when real interest rates are rising faster than nominal interest rates, TIPS may experience greater losses

than other fixed income securities with similar durations. In addition, any increase in principal value of an inflation-indexed bond caused by an increase in the price index is taxable in the year the increase occurs,

even though the Fund generally will not receive cash representing the increase at that time. As a result, the Fund could be required at times to liquidate other investments, including when it is not advantageous to do

so, in order to satisfy its distribution requirements as a regulated investment company under the Code. Also, to the extent that the Fund invests in inflation-indexed bonds, income distributions are more likely to

fluctuate.

Liquidity Risk. The Fund may invest in instruments that trade in lower volumes and are less liquid than other investments. Liquidity risk exists when particular investments made by the Fund are difficult

to purchase or sell. Liquidity risk also includes the risk that the Fund may make investments that may become less liquid in response to market developments or adverse investor perceptions. If the Fund is forced to

sell these investments to pay redemption proceeds or for other reasons, the Fund may lose money. In addition, when there is no willing buyer and investments cannot be readily sold at the desired time or price, the

Fund may have to accept a lower price or may not be able to sell the instrument at all. The reduction in dealer market-making capacity in the fixed-income markets that has occurred in recent years also has the

potential to reduce liquidity. An inability to sell a portfolio position can adversely affect the Fund's value or prevent the Fund from being able to take advantage of other investment opportunities.

Commodity Risk. The values of commodities and commodity-linked investments are affected by events that might have less impact on the value of stocks and bonds. Such investments may be speculative. Prices

of commodities and related contracts may fluctuate significantly over short periods for a variety of reasons, including weather, crop or livestock disease, investment speculation, resource availability, fluctuations

in industrial and commercial supply and demand, US agricultural, fiscal, monetary and exchange control programs, embargoes, tariffs, and international political, economic, military and regulatory developments. These

risks may subject the Fund to greater volatility than investments in traditional instruments or securities. In addition, the commodities markets are subject to temporary distortions or other disruptions due to a

variety of factors, including participation of speculators, government intervention and regulation, and certain lack of liquidity in the markets.

Real Estate Risk. The Fund’s investment in certain Underlying Funds will expose the Fund to the performance of the real estate markets. The value of real estate securities in general, and real estate

investment trusts (REITs) in particular, is subject to the same risks as direct investments in real estate and mortgages, and their value will depend on the value of the underlying properties or the underlying loans

or interests. The underlying loans may be subject to the risks of default or of prepayments that occur earlier or later than expected, and such loans may also include so-called “subprime” mortgages. The

value of these securities will rise and fall in response to many factors, including economic conditions, the demand for rental property, interest rates and, with respect to REITs, the management skill and

creditworthiness of the issuer. In particular, the value of these securities may decline when interest rates rise and will also be affected by the real estate market and by the management of the underlying properties.

REITs may be more volatile and/or more illiquid than other types of equity securities. The Fund will indirectly bear a portion of the expenses, including management fees, paid by each REIT in which it invests, in

addition to the expenses of the Fund.

Real Estate Investment Trust

Risk. The Fund’s investment in certain Underlying Funds will expose the Fund to the risk of REITs. An investment in a REIT may be subject to risks similar to those associated with direct

ownership of real estate, including losses from casualty or condemnation, and changes in local and general economic conditions, supply and demand, interest rates, zoning laws, regulatory limitations on rents, property

taxes and operating expenses. In addition, an investment in a REIT is subject to additional risks, such as poor performance by the manager of the REIT, adverse changes to the tax laws or failure by the REIT to qualify

for tax-free pass-through of income under the Code, and to the effect of general declines in stock prices. In addition, some REITs have limited diversification because they invest in a limited number of properties, a

narrow geographic area, or a single type of property. Also, the organizational documents of a REIT may contain provisions that make changes in control of the REIT difficult and time-consuming. As a shareholder in a

REIT, the Fund and its shareholders could bear its ratable share of the REIT’s expenses and would at the same time continue to pay its own fees and expenses. In addition, REITs may incur significant amounts of

leverage.

| 8 | PGIM Real Assets Fund |

Utilities/Infrastructure Investment

Risk. The Fund’s investments in certain Underlying Funds will expose the Fund to potential adverse economic, regulatory, political and other changes affecting infrastructure investments,

particularly investments in the utilities sector. In most countries and localities, the utilities industry is regulated by governmental entities, which can increase costs and delays for new projects and make it

difficult to pass increased costs on to consumers. In certain areas, deregulation of utilities has resulted in increased competition and reduced profitability for certain companies, and increased the risk that a

particular company will become bankrupt or fail completely. Reduced profitability, as well as new uses for or additional need of funds (such as for expansion, operations or stock buybacks), could result in reduced

dividend payout rates for utilities companies. In addition, utilities companies face the risk of increases in the cost and reduced availability of fuel (such as oil, coal, natural gas or nuclear energy) and

potentially high interest costs for borrowing to finance new projects. Issuers in other types of infrastructure-related businesses also are subject to a variety of factors that may adversely affect their business or

operations, including high interest costs in connection with capital construction programs, costs associated with environmental and other regulations, the effects of economic slowdown and surplus capacity, increased

competition from other providers of services, uncertainties concerning the availability of fuel at reasonable prices, the effects of energy conservation policies, and other factors.

Natural Resources Investment

Risk. The Fund’s investments in certain Underlying Funds will expose the Fund to the risk of investment in natural resource companies. The market value of securities of natural resource

companies may be affected by numerous factors, including events occurring in nature, inflationary pressures and international politics. For example, events occurring in nature (such as earthquakes or fires in prime

natural resource areas) and political events (such as coups, military confrontations or acts of terrorism) can affect the overall supply of a natural resource and the value of companies involved in such natural

resource. Political risks and the other risks to which non-US securities are subject may affect domestic companies if they have significant operations or investments in non-US countries. In addition, rising interest

rates and general economic conditions may affect the demand for natural resources.

Non-US Securities Risk. The Fund’s investments in securities of non-US issuers or issuers with significant exposure to non-US markets and its investments in Underlying Funds that have exposure to non-US

markets involve additional risk. Non-US countries in which the Fund may invest may have markets that are less liquid, less regulated and more volatile than U.S. markets. The value of the Fund’s investments may

decline because of factors affecting the particular issuer as well as non-US markets and issuers generally, such as unfavorable government actions, and political or financial instability. Lack of information may also

affect the value of these securities.

Emerging Markets Risk. The risks of foreign investments are greater for investments in or exposed to emerging markets. Emerging market countries typically have economic and political systems that are less fully

developed, and can be expected to be less stable, than those of more developed countries. For example, the economies of such countries can be subject to rapid and unpredictable rates of inflation or deflation. Low

trading volumes may result in a lack of liquidity and price volatility. Emerging market countries may have policies that restrict investment by non-US investors, or that prevent non-US investors from withdrawing their

money at will. Countries with emerging markets can be found in regions such as Asia, Latin America, Eastern Europe and Africa.

Cayman Subsidiary Risk. By investing in the Cayman Subsidiary, the Fund is indirectly exposed to the risks associated with the Cayman Subsidiary’s investments. The Cayman Subsidiary is not registered as an

investment company under the 1940 Act, and, unless otherwise noted in this Prospectus, is not subject to all the investor protections of the 1940 Act. The IRS has proposed regulations that if finalized in current form

would require the Cayman Subsidiary to distribute its income on an annual basis in order for such income to be considered qualifying RIC income for tax purposes. Changes in the laws of the Cayman Islands, under which

the Cayman Subsidiary is incorporated, could result in the inability of the Fund to effect its desired commodity investment strategy.

Commodity-Linked Notes Risk. The Fund may invest in leveraged or unleveraged CLNs to gain exposure to the commodities markets. CLNs are subject to counterparty risk. The value of the CLNs may fluctuate significantly

because the values of the investments to which they are linked are volatile. In addition, the terms of a CLN may create economic leverage by requiring payment by the issuer of an amount that is a multiple of the price

increase or decrease of the

| Visit our website at www.pgiminvestments.com | 9 |

underlying commodity, commodity index or other

economic variable. Economic leverage increases the volatility of CLNs and their value may increase or decrease more quickly than the value of the underlying commodity, commodity index or other economic variable.

Non-Diversified Investment Company

Risk. The Fund and certain of the Underlying Funds are “non-diversified,” meaning they can invest more than 5% of their assets in the securities of any one issuer. Funds that are

“non-diversified” for purposes of the 1940 Act, such as the Fund and certain of the Underlying Funds, may invest a greater percentage of their assets in securities of a single issuer. Because the Fund

invests in a smaller number of issuers, it may be more susceptible to risks associated with a single economic, political or regulatory event than a diversified fund might be.

Derivatives Risk. Derivatives involve special risks and costs and may result in losses to the Fund and the Underlying Funds. The successful use of derivatives requires sophisticated management, and, to the

extent that derivatives are used, the Fund and the Underlying Funds will depend on the subadvisers’ ability to analyze and manage derivatives transactions. The prices of derivatives may move in unexpected ways,

especially in abnormal market conditions. Some derivatives are “leveraged” and therefore may magnify or otherwise increase investment losses to the Fund. The Fund’s use of derivatives may also

increase the amount of taxes payable by shareholders.

Other risks arise from the

potential inability to terminate or sell derivatives positions. A liquid secondary market may not always exist for the Fund’s or an Underlying Fund’s derivatives positions. In fact, many over-the-counter

derivative instruments will not have liquidity beyond the counterparty to the instrument. Over-the-counter derivative instruments also involve the risk that the other party will not meet its obligations to the

Fund.

The US Government and foreign

governments are in the process of adopting and implementing regulations governing derivatives markets, including mandatory clearing of certain derivatives, margin and reporting requirements. The ultimate impact of the

regulations remains unclear. Additional regulation of derivatives may make derivatives more costly, limit their availability or utility, or otherwise adversely affect their performance or disrupt markets.

Distribution Risk. The Fund’s distributions may consist of net investment income, if any, and net realized gains, if any, from the sale of investments and/or return of capital. The Fund will provide to

shareholders early in each calendar year the final tax character of the Fund’s distributions for the previous year. Also, at such time that a Fund distribution is expected to be from sources other than current

or accumulated net income, a notice to shareholders may be required.

Leverage Risk. Certain transactions in which the Fund or an Underlying Fund may engage may give rise to leverage. The use of leverage exaggerates the effect of any increase or decrease in the value of

the Fund’s holdings, and makes any change in the Fund’s net asset value (NAV) greater than it would be without the use of leverage. This could result in increased volatility of investment

returns.

Currency Risk. The Fund’s and the Underlying Funds' NAVs could decline as a result of changes in exchange rates, which could adversely affect the Fund’s investments in currencies, or in

securities that trade in, and receive revenues related to currencies, or in derivatives that provide exposure to currencies. Certain foreign countries may impose restrictions on the ability of issuers of foreign

securities to make payment of principal and interest or dividends to investors located outside the country, due to blockage of foreign currency exchanges or otherwise.

Hedging Risk. The decision as to whether and to what extent the Fund or an Underlying Fund will engage in hedging transactions to hedge against certain risks, such as market risk and issuer risk, will

depend on a number of factors, including prevailing market conditions, the composition of the portfolio of the Fund or the Underlying Fund, and the availability of suitable transactions. Hedging transactions involve

costs and may result in losses. There is no guarantee that any of these hedging instruments would work as anticipated, and in certain cases the Fund or an Underlying Fund might be better off had it not used a hedging

instrument. There can be no assurance that the Fund or the Underlying Fund will engage in hedging transactions at any given time or from time to time, even under volatile market environments, or that any such

strategies, if used, will be successful.

| 10 | PGIM Real Assets Fund |

Tax Risk. In order to qualify as a RIC under the Code, the Fund must meet certain requirements regarding the source of its income, the diversification of its assets and the distribution of its

income. If the Fund were to fail to qualify as a RIC, the Fund could be subject to federal income tax on its net income at regular corporate rates (without reduction for distributions to shareholders). When

distributed, that income would also be taxable to shareholders as an ordinary dividend to the extent attributable to the Fund’s earnings and profits. If the Fund were to fail to qualify as a RIC and become

subject to federal income tax, shareholders of the Fund would be subject to diminished returns.

The Fund has received a private

letter ruling from the Internal Revenue Service (the IRS) stating that income derived from the Fund’s investment in the Cayman Subsidiary will constitute qualifying income to the Fund. The Cayman Subsidiary will

not be subject to US federal income tax. The Cayman Subsidiary will, however, be considered a controlled foreign corporation, and the Fund will be required to include as income annually amounts earned by the Cayman

Subsidiary during that year. The IRS has proposed regulations that if finalized in current form would require the Cayman Subsidiary to distribute its net profit to the Fund on an annual basis in order for such income

to be considered qualifying RIC income for tax purposes. Furthermore, the Fund will be subject to the distribution requirement applicable to open-end investment companies on such Cayman Subsidiary income, whether or

not the Cayman Subsidiary makes a distribution to the Fund during the taxable year.

One of the Underlying Funds, the

PGIM Jennison MLP Fund, is taxed as a regular corporation, or “C” corporation, for federal income tax purposes. This means that the PGIM Jennison MLP Fund is generally subject to US federal income tax on

its taxable income at the rates applicable to corporations and also subject to state and local income taxes. This is a relatively new strategy for mutual funds and may have unexpected and potentially significant

consequences for shareholders, including the Fund.

Multi-Manager Risk. While the manager monitors the investments of each subadviser and monitors the overall management of the Fund, each subadviser makes investment decisions for the asset classes it manages

independently from one another. It is possible that the investment styles used by a subadviser in an asset class will not always be complementary to those used by others, which could adversely affect the performance

of the Fund.

Commodity Regulatory Risk. The Fund is deemed a “commodity pool” and the manager is considered a “commodity pool operator” with respect to the Fund under the Commodity Exchange Act. The

manager, directly or through its affiliates, is therefore subject to dual regulation by the Securities and Exchange Commission (the “SEC”) and the Commodity Futures Trading Commission (the

“CFTC”). The regulatory requirements governing the use of commodity futures (which include futures on broad-based securities indexes, interest rate futures and currency futures), options on commodity

futures, certain swaps or certain other investments could change at any time.

Energy Sector Risk. The Fund’s investments in certain Underlying Funds will expose the Fund to the risks of adverse economic, environmental, business, regulatory or other occurrences affecting the

energy sector. The energy sector has historically experienced substantial price volatility. MLPs and other companies operating in the energy sector are subject to specific risks, including, among others, fluctuations

in commodity prices; reduced consumer demand for commodities such as oil, natural gas or petroleum products; reduced availability of natural gas or other commodities for transporting, processing, storing or delivering;

slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Additionally, changes in the regulatory environment for energy companies may adversely

impact their profitability. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of energy companies.

Master Limited Partnerships

Risk. The Fund’s investments in certain Underlying Funds will expose the Fund to the risks of MLPs. An MLP is an investment that combines the tax benefits of a limited partnership with the

liquidity of publicly-traded securities. The risks of investing in an MLP are generally those involved in investing in a partnership as opposed to a corporation. For example, state law governing partnerships is often

less restrictive than state law governing corporations. Accordingly, there may be fewer protections afforded investors in an MLP than investors in a corporation. Investments held by MLPs may be relatively illiquid,

limiting the MLPs’ ability to vary their portfolios promptly in response to changes in economic or other conditions. MLPs may have limited financial resources, their securities may trade infrequently and in

limited volume, and they may be subject to more abrupt or erratic price

| Visit our website at www.pgiminvestments.com | 11 |

movements than securities of larger or more

broadly-based companies. Investments by the Fund in certain Underlying Funds that invest in MLPs may also subject the Fund to the risks associated with the specific industry or industries in which the MLPs invest,

risks related to limited control and limited rights to vote on matters affecting the MLP, risks related to potential conflicts of interest between the MLP and the MLP’s general partner, cash flow risks, dilution

risks and risks related to the general partner’s right to require unit-holders to sell their common units at an undesirable time or price. MLPs are generally considered interest-rate sensitive investments.

During periods of interest rate volatility, these investments may not provide attractive returns. Since MLPs generally conduct business in multiple states, through its investment in certain Underlying Funds, the Fund

may be subject to income or franchise tax in each of the states in which the partnership does business. The additional cost of preparing and filing the tax returns and paying the related taxes may adversely impact the

Fund’s return on its investment in certain Underlying Funds.

Bond Obligations Risk. As with credit risk, market risk and interest rate risk, the Fund's holdings, share price, yield and total return may fluctuate in response to bond market movements. The value of bonds may

decline for issuer-related reasons, including management performance, financial leverage and reduced demand for the issuer’s goods and services. Certain types of fixed-income obligations also may be subject to

“call and redemption risk,” which is the risk that the issuer may call a bond held by the Fund for redemption before it matures and the Fund may not be able to reinvest at the same level and therefore would

earn less income.

Risks of Small and Medium Sized

Companies. Small and medium capitalization companies usually offer a smaller range of products and services than larger companies. Smaller companies may also have limited financial resources and may

lack management depth. As a result, their prices may fluctuate more than the stocks of larger, more established companies. Historically, small and mid-cap companies have sometimes gone through extended periods when

they did not perform as well as larger companies. Small and mid-cap companies generally are less liquid than larger companies, which may make such investments more difficult to sell at the time and price that the Fund

would like.

Mortgage-Backed and Asset-Backed

Securities Risk. Mortgage-backed and asset-backed investments tend to increase in value less than other debt securities when interest rates decline, but are subject to similar risk of decline in market

value during periods of rising interest rates. The values of mortgage-backed and asset-backed securities become more volatile as interest rates rise. In a period of declining interest rates, the Fund may be required

to reinvest more frequent prepayments on mortgage-backed and asset-backed investments in lower-yielding investments. In addition to interest rate risk, investments in mortgage-backed securities composed of subprime

mortgages may be subject to a higher degree of credit risk, valuation risk and liquidity risk.

US Government and Agency Securities

Risk. US Government and agency securities are subject to market risk, interest rate risk and credit risk. Not all US Government securities are insured or guaranteed by the full faith and credit

of the US Government; some are only insured or guaranteed by the issuing agency, which must rely on its own resources to repay the debt. In addition, Connecticut Avenue Securities issued by Fannie Mae and Structured

Agency Credit Risk issued by Freddie Mac carry no guarantee whatsoever and the risk of default associated with these securities would be borne by the Fund or an Underlying Fund. The maximum potential liability of the

issuers of some US Government securities held by the Fund may greatly exceed their current resources, including their legal right to support from the US Treasury. It is possible that these issuers will not have the

funds to meet their payment obligations in the future. In addition, the value of US Government securities may be affected by changes in the credit rating of the US Government.

Junk Bonds Risk. High-yield, high-risk bonds have predominantly speculative characteristics, including particularly high credit risk. Junk bonds tend to be less liquid than higher-rated securities. The

liquidity of particular issuers or industries within a particular investment category may shrink or disappear suddenly and without warning. The non-investment grade bond market can experience sudden and sharp price

swings and become illiquid due to a variety of factors, including changes in economic forecasts, stock market activity, large sustained sales by major investors, a high profile default or a change in the market's

psychology.

| 12 | PGIM Real Assets Fund |

Economic and Market Events

Risk. Events in the US and global financial markets, including actions taken by the US Federal Reserve or foreign central banks to stimulate or stabilize economic growth, may at times result in

unusually high market volatility, which could negatively impact performance. Reduced liquidity in credit and fixed income markets could adversely affect issuers worldwide.

Risk of Increase in Expenses. Your actual cost of investing in the Fund may be higher than the expenses shown in the expense table for a variety of reasons. For example, expense ratios may be higher than those shown if

average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile. Active and frequent trading of Fund securities can increase

expenses.

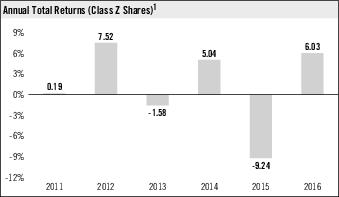

Performance. The following bar chart shows the Fund's performance for Class Z shares for each full calendar year of operations or for the last 10 calendar years, whichever is shorter. The

following table shows the average annual returns of each of the Fund’s share classes and also compares the Fund’s performance with the average annual total returns of an index or other benchmark and a

group of similar mutual funds. The bar chart and table demonstrate the risk of investing in the Fund by showing how returns can change from year to year.

Past performance (before and after

taxes) does not mean that the Fund will achieve similar results in the future. Updated Fund performance information is available online at www.pgiminvestments.com.

The performance for periods prior

to January 6, 2014 shown below does not reflect the implementation of certain investment strategies for the Fund, which became effective on or about that date.

1 Prior to this year, the annual returns bar chart displayed returns for the Fund’s Class A shares. The Fund now shows annual returns for Class Z shares in light of the

relative growth of assets in this share class. Without the contractual expense limitation, the annual returns would have been lower. The total return for Class Z shares from January 1, 2017 to September 30, 2017 was

2.61%.

| Average Annual Total Returns % (including sales charges) (as of 12-31-16) | ||||

| Return Before Taxes | One Year | Five Years | Ten Years | Since Inception |

| Class A shares | -0.01% | -0.04% | N/A | -0.04% (12-30-10) |

| Class B shares | -0.04% | 0.17% | N/A | 0.16% (12-30-10) |

| Class C shares | 4.07% | 0.36% | N/A | 0.16% (12-30-10) |

| Class R6 shares† | 6.12% | N/A | N/A | -2.63% (1-23-15) |

| Class Z Shares % | ||||

| Return Before Taxes | 6.03% | 1.36% | N/A | 1.16% (12-30-10) |

| Return After Taxes on Distributions | 5.53% | 0.65% | N/A | 0.50% (12-30-10) |

| Return After Taxes on Distributions and Sale of Fund Shares | 3.54% | 0.92% | N/A | 0.77% (12-30-10) |

°

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax

situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

After-tax returns are shown only for the indicated share class. After-tax returns for other classes will vary due to differing sales charges and expenses.

| Visit our website at www.pgiminvestments.com | 13 |

†Formerly known as Class Q shares.

| Index % (reflects no deduction for fees, expenses or taxes) | ||||

| Customized Blend Index | 6.69% | 0.45% | N/A | - |

| Bloomberg Barclays US TIPS Index | 4.68% | 0.89% | N/A | - |

| Lipper Average % (reflects no deduction for sales charges or taxes) | ||||

| Lipper Flexible Portfolio Funds Average* | 7.00% | 5.68% | N/A | - |

| Lipper Customized Average* | 10.48% | 0.34% | N/A | - |

*The Fund’s

performance is compared to a custom Lipper Universe of real assets funds, although Lipper classifies the Fund in its Flexible Portfolio Funds performance universe. The Fund is compared to a custom Lipper Universe of

real assets funds because the Fund’s investment manager believes that these funds provide a more appropriate basis for Fund performance comparisons.

MANAGEMENT OF THE FUND

| Investment Manager | Subadviser | Portfolio Managers | Title | Service Date |

| PGIM Investments LLC | Quantitative Management Associates LLC | Ted Lockwood, MBA, MS | Managing Director | December 2010 |

| Edward F. Keon, Jr., MBA | Managing Director and Portfolio Manager | December 2010 | ||

| Edward L. Campbell, MBA, CFA | Managing Director and Portfolio Manager | December 2010 | ||

| Joel M. Kallman, MBA, CFA | Vice President and Portfolio Manager | December 2010 | ||

| Rory Cummings, MBA, CFA | Vice President and Portfolio Manager | April 2015 | ||

| Yesim Tokat-Acikel, PhD | Portfolio Manager | April 2018 | ||

| Marco Aiolfi, PhD | Portfolio Manager | April 2018 | ||

| PGIM Fixed Income | Robert Tipp, CFA | Managing Director, Chief Investment Strategist and Head of Global Bonds | December 2010 | |

| Craig Dewling | Managing Director | December 2010 | ||

| Erik Schiller, CFA | Managing Director | January 2016 | ||

| Gary Wu, CFA | Principal | January 2016 |

BUYING AND SELLING FUND

SHARES

| Class A** | Class C** | Class Z** | Class R6† | |

| Minimum initial investment* | $2,500 | $2,500 | Institutions: $5 million Group Retirement Plans: None | Institutions: $5 million Group Retirement Plans: None |

| Minimum subsequent investment* | $100 | $100 | None | None |

* Note: Class B shares are

closed to new purchases except for exchanges from Class B shares of another fund. Please see “How to Buy, Sell and Exchange Fund Shares—Closure of Class B Shares” in the Prospectus for more

information.

** Certain share classes were generally

closed to investments by new group retirement plans effective on or about June 1, 2018. Please see “How to Buy, Sell and Exchange Fund Shares—Closure of Certain Share Classes to New Group Retirement

Plans” in the Prospectus for more information.

†Formerly known as Class Q.

For Class A and Class C shares,

the minimum initial investment for retirement accounts and custodial accounts for minors is $1,000 and the minimum subsequent investment is $100. For Class A and Class C shares, the minimum initial and subsequent

investment for Automatic Investment Plan purchases is $50. Class R6 shares are generally not available for purchase by individuals. Class Z shares may be purchased by certain individuals, subject to minimum investment

and/or other requirements. Please see “How to Buy, Sell and Exchange Fund Shares—How to Buy Shares—Qualifying for Class Z Shares,” and “—Qualifying for Class R6 Shares” in the

Prospectus for purchase eligibility requirements.

| 14 | PGIM Real Assets Fund |

Your financial intermediary may

impose different investment minimums. You can purchase or redeem shares on any business day that the Fund is open through the Fund's transfer agent or through servicing agents, including brokers, dealers and other

financial intermediaries appointed by the distributor to receive purchase and redemption orders. Current shareholders may also purchase or redeem shares through the Fund's website or by calling (800) 225-1852.

TAX INFORMATION

Dividends, Capital Gains and

Taxes. The Fund's dividends and distributions are taxable and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan

or an individual retirement account. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

PAYMENTS TO FINANCIAL

INTERMEDIaries

If you purchase Fund shares through

a financial intermediary such as a broker-dealer, bank, retirement recordkeeper or other financial services firm, the Fund or its affiliates may pay the financial intermediary for the sale of Fund shares and/or for

services to shareholders. This may create a conflict of interest by influencing the financial intermediary or its representatives to recommend the Fund over another investment. Ask your financial intermediary or

representative or visit your financial intermediary’s website for more information.

| Visit our website at www.pgiminvestments.com | 15 |

MORE ABOUT THE FUND'S PRINCIPAL AND NON-PRINCIPAL

INVESTMENT STRATEGIES, INVESTMENTS AND RISKS

INVESTMENTS AND INVESTMENT

STRATEGIES

The Fund’s investment

objective is to seek long-term real return.

Real return is the rate of return

after adjusting for inflation. The Fund seeks to achieve its investment objective by investing primarily in real assets that may perform well during periods of high inflation. The Fund invests in real assets through

its investments in the following asset classes: commodities; domestic and international real estate; utilities/infrastructure; natural resources; master limited partnerships (MLPs); fixed income instruments; and

gold/defensive. The Fund gains exposure to the real return asset classes by investing in varying combinations of: Underlying PGIM Funds; the Cayman Subsidiary; and securities (such as equity and equity related

securities, including common stock, convertible securities, nonconvertible preferred stock, American Depositary Receipts, warrants and other rights that can be exercised to obtain stock, preferred stocks, ETFs, notes

and bonds) and certain financial and derivative instruments. The Fund is non-diversified, which means it may invest in a smaller number of issuers than a diversified fund.

The Fund’s investment

objective is not a fundamental policy, and therefore may be changed by the Board without shareholder approval. The Board can change investment policies that are not fundamental without shareholder approval.

Asset Allocation

The Fund’s asset allocation

strategy is determined by Quantitative Management Associates LLC (QMA), one of the Fund’s subadvisers. QMA utilizes a dynamic asset allocation strategy among the real asset classes to seek to provide attractive

risk adjusted real return. QMA utilizes a dynamic asset allocation process that makes tactical allocation decisions based on portfolio management judgment which incorporates factors such as current market and economic

conditions, risk, and valuation. This analyzes the momentum of asset class prices, their volatility and their correlations to each other and adapts the asset class allocations to reflect the current market

environment. Finally, QMA’s portfolio managers overlay their judgment over the analysis to incorporate data and information that they believe may also impact future asset class returns.

QMA may tactically adjust the

asset allocation ranges among the real asset classes within the following approximate ranges: commodities (0% to 50%), real estate (0% to 50%), utilities/infrastructure (0% to 40%), natural resources (0% to 40%),

fixed income (0% to 60%), MLPs (0% to 20%), and gold/defensive (0% to 40%). Additionally, the Fund’s investments in the Underlying PGIM Funds may range from 0% to 100% of the Fund’s assets. As of October

31, 2017, the Fund’s assets were allocated approximately to each asset class as follows: commodities (15.48%), real estate (24.65%), utilities/infrastructure (13.36%), natural resources (11.30%), fixed income

(26.18%), MLPs (5.24%), and gold/defensive (3.79%).

Commodity Asset Class. The Fund gains exposure to the commodities asset class through investment of the Fund’s assets directly or in the Cayman Subsidiary. The manager has retained QMA to serve as

subadviser for the commodity asset class. Their strategy seeks to generate returns over a market cycle in excess of the Bloomberg Commodity Index using a systematic, factor-based investment process.

The Fund expects that most of its

investments in the commodity asset class will be through exchange-traded futures on commodities held by its Cayman Subsidiary. The Fund may also invest directly in CLNs linked to commodity indices, ETFs and ETNs whose

returns are linked to commodities or commodity indices, within the limits of applicable tax law. The Fund has received a private letter ruling from the IRS that income and gains earned from investments in a certain

type of CLN substantially similar to CLNs in which the Fund may invest constitute qualifying income under the Code.

| 16 | PGIM Real Assets Fund |

Cayman Subsidiary. The Fund gains exposure to commodity markets by investing up to 25% of its total assets in the Cayman Subsidiary. The Cayman Subsidiary invests primarily in exchange traded futures on

commodities in order to track the performance of the Bloomberg Commodity Index, as determined by QMA, among other assets and investments. The Cayman Subsidiary will also invest in high quality, short-term instruments,

which may include positions in US Treasury securities, government agency debt and money market funds, which are intended to serve as margin or collateral for the Cayman Subsidiary’s futures positions. To the

extent that the Fund invests in the Cayman Subsidiary, the Fund may be subject to the risks associated with those futures positions and other securities, which are discussed elsewhere in this prospectus.

The Cayman Subsidiary is

managed pursuant to compliance policies and procedures that are the same, in all material respects, as the policies and procedures adopted by the Fund. As a result, the manager and subadviser, in managing the Cayman

Subsidiary’s portfolio, are subject to the same investment policies and restrictions that apply to the management of the Fund, and, in particular, to the requirements relating to portfolio leverage, liquidity,

brokerage, and the timing and method of the valuation of the Cayman Subsidiary’s portfolio investments and shares of the Cayman Subsidiary. These policies and restrictions are described in detail in the

Fund’s Statement of Additional Information. The Fund’s Chief Compliance Officer oversees implementation of the Cayman Subsidiary’s policies and procedures, and makes periodic reports to the

Fund’s Board of Trustees regarding the Cayman Subsidiary’s compliance with its policies and procedures. The Fund and the Cayman Subsidiary will test for compliance with certain investment restrictions on a

consolidated basis.

The Cayman Subsidiary has

entered into separate contracts with the manager and QMA whereby the manager and subadviser provide investment advisory and other services to the Cayman Subsidiary. The Cayman Subsidiary has also entered into separate

contracts for the provision of custody, transfer agency, and audit services with the same or with affiliates of the same service providers that provide those services to the Fund.

The Fund has received a private

letter ruling from the IRS stating that income earned by the Cayman Subsidiary will constitute qualifying income when deemed distributed to the Fund. The Cayman Subsidiary will not be subject to US federal income tax.

The Cayman Subsidiary will, however, be considered a controlled foreign corporation, and the Fund will be required to include as income annually amounts earned by the Cayman Subsidiary during that year. The IRS has

proposed regulations that if finalized in current form would require the Cayman Subsidiary to distribute its net profit to the Fund on an annual basis in order for such income to be considered qualifying RIC income

for tax purposes. Furthermore, the Fund will be subject to the distribution requirement applicable to open-end investment companies on such Cayman Subsidiary income, whether or not the Cayman Subsidiary makes a

distribution to the Fund during the taxable year.

The financial statements of the

Cayman Subsidiary are consolidated with those of the Fund, which appear in the Fund’s Annual and Semi-Annual Reports to shareholders. The Fund’s Annual and Semi-Annual Reports are distributed to

shareholders, and copies of the reports will be provided without charge upon request as indicated on the back cover of this prospectus. Please refer to the Statement of Additional Information for additional

information about the organization and management of the Cayman Subsidiary.

The Fund will not concentrate in

any one industry, provided that investment companies are not considered an industry for purposes of this policy, and provided further that the Fund’s investment in an investment company that concentrates its

investments in a particular industry or group of industries will not be considered an investment by the Fund in that particular industry or group of industries. The Fund will consider the individual commodities that

comprise the Bloomberg Commodity Index to be separate industries for purposes of the concentration policy.

Real Estate,

Utilities/Infrastructure, Natural Resources, MLPs and Fixed-Income Asset Classes. The Fund invests in shares of certain Underlying Funds to obtain exposure to the following asset classes:

| Visit our website at www.pgiminvestments.com | 17 |

| Underlying Funds | ||

| Asset Class | Name of Underlying Fund | Investment Objective and Investment Strategies of Underlying Fund |

| Real Estate | PGIM US Real Estate Fund(1) | The Fund seeks capital appreciation and income. The Fund normally invests at least 80% of its investable assets (net assets plus any borrowings made for investment purposes) in equity-related securities of real estate companies operating in the United States, principally REITs and other real estate securities. The Fund may invest up to 20% of its investable assets in other securities, including equity-related securities of foreign real estate companies. The Fund is non-diversified. |

| PGIM Global Real Estate Fund(1) | The Fund seeks capital appreciation and income. The Fund normally invests at least 80% of its investable assets (net assets plus any borrowings made for investment purposes) in equity-related securities of real estate companies, principally REITs and other real estate securities. The Fund invests globally in real estate investments. Under normal circumstances, the Fund invests in at least three different countries and at least 40% of its total assets in non-US securities. The Fund is non-diversified. | |

| PGIM Select Real Estate Fund(1) | The Fund seeks capital appreciation and income. The Fund normally invests at least 80% of its investable assets in equity-related securities of real estate companies, principally REITs and other real estate securities. The Fund is non-diversified. | |

| PGIM Real Estate Income Fund(1) | The Fund seeks income and capital appreciation. The Fund normally invests at least 80% of its investable assets in equity and equity-related securities of real estate companies, principally REITs and other real estate securities. The Fund invests 25% or more of its total assets in real estate securities. The Fund may invest without limit in equity and equity-related securities of non-US real estate companies, including those in emerging markets. The Fund is non-diversified. | |

| Utilities/Infrastructure | PGIM Jennison Utility Fund(2) | The Fund seeks total return through a combination of capital appreciation and current income. The Fund normally invests at least 80% of its investable assets in equity and equity-related and investment-grade debt securities of utility companies. Utility companies include electric utilities, gas utilities, water utilities, multi-utilities, independent power producers, diversified telecommunication services, wireless telecommunication services, and oil & gas storage and transportation. Some of these securities are issued by foreign companies. The Fund follows a value investment style. The Fund is non-diversified. |

| PGIM Jennison Global Infrastructure Fund(2) | The Fund seeks total return. The Fund normally will invest at least 80% of its investable assets in securities of US and foreign (non-US based) infrastructure companies. The Fund will consider a company an infrastructure company if the company is categorized, based on the Global Industry Classification Standards (“GICS”) industry classifications, as they may be amended from time to time, within the following industries: Aerospace and Defense, Air Freight and Logistics, Airlines, Building Products, Commercial Services and Supplies, Communications Equipment, Construction and Engineering, Construction Equipment, Diversified Telecommunication Services, Electrical Equipment, Electric Utilities, Energy Equipment and Services, Gas Utilities, Health Care Providers and Services, Independent Power Producers and Energy Traders, Industrial Conglomerates, Machinery, Marine, Metals and Mining, Multi-Utilities, Oil, Gas and Consumable Fuels, Rail and Road, Transportation Infrastructure, Water Utilities and Wireless Telecommunication Services. Examples of assets held by infrastructure companies include toll roads, airports, rail track, shipping ports, telecom infrastructure, hospitals, schools, utilities such as electricity, gas distribution networks and water, and oil and gas pipelines. | |

| Natural Resources | PGIM Jennison Natural Resources Fund, Inc.(2) | The Fund seeks long-term growth of capital. The Fund normally invests at least 80% of investable assets in equity and equity-related securities of natural resource companies and in asset-based securities. Natural resource companies are US and non-US companies that own, explore, mine, process or otherwise develop, or provide goods and services with respect to, natural resources. Asset-based securities are securities, the values of which are related to the market value of a natural resource. The Fund is non-diversified. |

| MLPs | PGIM Jennison MLP Fund(2) | The Fund seeks to provide total return through a combination of current income and capital appreciation. The Fund normally invests at least 80% of its investable assets in master limited partnerships (MLPs) and MLP related investments (together, MLP investments). |

| 18 | PGIM Real Assets Fund |

| Underlying Funds | ||

| Asset Class | Name of Underlying Fund | Investment Objective and Investment Strategies of Underlying Fund |

| Fixed Income | PGIM Absolute Return Bond Fund(3) | The Fund seeks positive returns over the long term, regardless of market conditions. The Fund has a flexible investment strategy and will invest in a variety of securities and instruments. The Fund will also use a variety of investment techniques in pursuing its investment objective, which may include managing duration, credit quality, yield curve positioning and currency exposure, as well as sector and security selection. Under normal market conditions, the Fund will invest at least 80% of its investable assets (net assets plus borrowings for investment purposes, if any) in debt securities and/or investments that provide exposure to bonds. |

| PGIM Floating Rate Income Fund(3) | The primary investment objective of the Fund is to maximize current income. Capital appreciation is a secondary investment objective, but only when consistent with the Fund's primary investment objective of seeking to maximize current income. Under normal market conditions, the Fund will invest at least 80% of its investable assets (net assets plus borrowings for investment purposes, if any) in floating rate loans and other floating rate debt securities. Floating rate loans are debt obligations that have interest rates which adjust or “float” periodically (normally on a monthly or quarterly basis) based on a generally recognized base rate such as the London Interbank Offered Rate (LIBOR) or the prime rate offered by one or more major US banks. | |

| PGIM Short-Term Corporate Bond Fund, Inc.(3) | The Fund seeks high current income consistent with the preservation of principal. The Fund invests, under normal circumstances, at least 80% of its investable assets in bonds of corporations with varying maturities. For purposes of this policy, bonds include all fixed-income securities, other than preferred stock, and corporations include all private issuers. The effective duration of the Fund's portfolio will generally be less than three years. The Fund will buy and sell securities to take advantage of investment opportunities based on the subadviser's fundamental credit research, as well as analysis of market conditions, interest rates and general economic factors. | |