Form 485BPOS Matrix Advisors Funds

Filed with the U.S. Securities and Exchange Commission on October 28, 2019

1933 Act Registration File No 333-212637

1940 Act File No. 811-23175

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | x | ||

Pre-Effective Amendment No. | o | ||

Post-Effective Amendment No. | 6 | x | |

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | x | ||

Amendment No. | 7 | x | |

MATRIX ADVISORS FUNDS TRUST

(Exact Name of Registrant as Specified in Charter)

10 Bank Street, Suite 590

White Plains, NY 10606

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: 1-800-366-6223

David A. Katz |

Matrix Advisors Funds Trust |

10 Bank Street, Suite 590 |

White Plains, New York 10606 |

(Name and Address of Agent for Service)

Copy to:

Christopher M. Cahlamer, Esq. |

Godfrey & Kahn S.C. |

833 E. Michigan St., Suite 1800 |

Milwaukee, Wisconsin 53202 |

It is proposed that this filing will become effective (check appropriate box)

o | immediately upon filing pursuant to paragraph (b) |

x | on October 31, 2019 pursuant to paragraph (b) |

o | 60 days after filing pursuant to paragraph (a)(1) |

o | on (date) pursuant to paragraph (a)(1) |

o | 75 days after filing pursuant to paragraph (a)(2) |

o | on (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

o | This post-effective amendment designates a new effective date for a previously filed post- effective amendment. |

EXPLANATORY NOTE

This Post-Effective Amendment No. 6 to the Registration Statement of Matrix Advisors Funds Trust is being filed to add the audited financial statements and certain related financial information for the fiscal year ended June 30, 2019, and to make other permissible changes under Rule 485(b) of the Securities Act of 1933, as amended.

MATRIX ADVISORS DIVIDEND FUND

Ticker: MADFX

Matrix Advisors Funds Trust

10 Bank Street, Suite 590

White Plains, NY 10606

Prospectus

October 31, 2019

Beginning in February 2021 for the Fund, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you invest through a financial intermediary, you may elect to receive shareholder reports and other communications electronically from the Fund by contacting your financial intermediary. If you invest directly with the Fund, you will receive shareholder reports electronically beginning in February 2021.

You may elect to receive all future shareholder reports in paper free of charge. You can request to continue receiving paper copies of your shareholder reports by contacting your financial intermediary or, if you invest directly with the Fund, calling 1-800-366-6223 to let the Fund know of your request.

The Securities and Exchange Commission (the “SEC”) has not approved or disapproved of these securities or passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

Table of Contents

Summary Section

Investment Objective

The Matrix Advisors Dividend Fund (the “Fund”) seeks current income and capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Annual fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) | |

Management Fees | 0.60% |

Distribution and/or Service (12b-1) Fees | 0.00% |

Other Expenses | 1.20% |

Total Annual Fund Operating Expenses | 1.80% |

Less: Fee Waiver and/or Expense Reimbursement | -0.90% |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (1) | 0.90% |

(1)Matrix Asset Advisors, Inc. (the “Advisor”), the Fund’s investment adviser, has contractually agreed to reduce its fees and/or pay Fund expenses to limit the Fund’s Total Annual Fund Operating Expenses (excluding interest, acquired fund fees and expenses, distribution and/or service (12b-1) fees, leverage and tax expenses, dividend and interest expenses on short positions, brokerage commissions and extraordinary expenses and including organizational expenses) to 0.90% of the Fund’s average net assets (the “Expense Cap”). The Expense Cap will remain in effect until at least October 31, 2020. The agreement may be terminated only by, or with the consent of, the Trust’s Board of Trustees (the “Board” or “Board of Trustees”). The Advisor is permitted, with Board approval, to recoup fees waived and expenses reimbursed in the prior three fiscal years if such recoupment does not cause the Fund to exceed the lesser of (i) the Expense Cap in effect at the time of the waiver or reimbursement and (ii) the Expense Cap in effect at the time of recoupment. Currently, the Advisor has agreed not to seek reimbursement of such fee waivers and/or expense reimbursements.

Example

This Example is intended to help you compare the costs of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. The expenses below reflect the Expense Cap for the first year only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 Year | 3 Years | 5 Years | 10 Years |

$92 | $479 | $891 | $2,042 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year ended June 30, 2019, the Fund’s portfolio turnover rate was 23% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests primarily in dividend-paying common stocks or depositary receipts representing common stocks of U.S. companies and U.S.-listed international companies that the Advisor believes pay high and sustainable dividends, are financially strong, and meet specific valuation criteria using the principles of value investing based on Classic Valuation Analysis. Classic Valuation Analysis uses valuation models to analyze statistics such as earnings

1

growth, dividend growth, return on equity and book value versus their historical, current and projected levels to determine a company’s “Intrinsic Value.” The Advisor seeks securities the price of which is below their Intrinsic Value and the dividend yield of which is above that of the market as represented by the S&P 500® Index. Under normal circumstances, the Fund invests at least 80% of its net assets, plus borrowings for investment purposes, in dividend-paying stocks. Dividend-paying stocks are those that have declared or paid a dividend distribution within the prior 12-month period.

The Fund invests primarily in large capitalization companies, which the Advisor defines as companies with minimum market capitalizations of at least $5 billion at the time of purchase. Stocks will be sold when their dividend yield falls near or below that of the market as represented by the S&P 500® Index, there has been a significant decline in the strength of the issuer’s balance sheet or operating results, if a security needs to be sold to fund the purchase of a more attractive security with a higher dividend yield, or when the Advisor believes the market price of a security is no longer attractive compared to its Intrinsic Value. The Fund may invest in any sector. At times, the Advisor may overweight or underweight the Fund’s portfolio in one or more particular sectors.

Principal Investment Risks

The principal risks of investing in the Fund are summarized below. There is a risk that you could lose all or a portion of your investment in the Fund.

Common Stock Risk: Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change.

Cyber Security Risk. Investment companies, such as the Fund, and their service providers may be subject to operational and information security risks resulting from cyber-attacks. Cyber-attacks include, among other behaviors, stealing or corrupting data maintained online or digitally, denial of service attacks on websites, the unauthorized release of confidential information or various other forms of cyber security breaches. Cyber-attacks may interfere with the processing of shareholder transactions, impact the Fund’s ability to calculate its net asset value (“NAV”), cause the release of private shareholder information or confidential company information, impede redemptions, subject the Fund to regulatory fines or financial losses, and cause reputational damage. The Fund may also incur additional costs for cyber security risk management purposes. Similar types of cyber security risks are also present for issuers of securities in which the Fund invests.

Depositary Receipt Risk: Depositary receipts involve risks similar to those associated with investments in foreign securities and certain additional risks. Depositary receipts listed on U.S. exchanges are issued by banks or trust companies, and entitle the holder to all dividends and capital gains that are paid out on the underlying foreign shares (“Underlying Shares”). When the Fund invests in depositary receipts as a substitute for an investment directly in the Underlying Shares, the Fund is exposed to the risk that the depositary receipts may not provide a return that corresponds precisely with that of the Underlying Shares.

Dividend Strategy Risk: Strategies focusing on dividend-paying stocks may fall out of investor favor, which may negatively affect the performance of stocks that pay dividends regardless of whether the underlying companies’ business fortunes have changed. The Advisor may incorrectly judge whether a company will be able to continue paying dividends or the amount of such dividends, which may cause losses for the Fund.

Foreign Securities Risk: Securities of foreign companies and depositary receipts representing such securities (“Foreign Securities”) are subject to certain inherent risks, such as political or economic instability of the country of issue and government policies, tax rates, prevailing interest rates and credit conditions that may differ from those affecting domestic corporations. Foreign Securities may also be subject to currency fluctuations and controls and greater fluctuation in price than the securities of domestic corporations. Foreign companies generally are not subject to uniform auditing and financial reporting standards comparable to those applicable to domestic companies.

Large Capitalization Company Risk: Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative, smaller competitors. Also, large-capitalization companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

2

Management Risk: The risk that the Advisor may fail to successfully implement the Fund’s investment strategies and meet its investment objective.

Market Risk: The market price of a security may fluctuate, sometimes rapidly and unpredictably. These fluctuations may cause a security to be worth less than it cost when originally purchased or less than it was worth at an earlier time. The U.S. and international markets have experienced extreme price volatility, reduced liquidity and valuation difficulties in recent years. Continuing market problems may have adverse effects on the Fund.

Sector Emphasis Risk: Investing a substantial portion of the Fund’s assets in related industries or sectors may have greater risks, because companies in these sectors may share common characteristics and may react similarly to market developments.

Value Strategy Risk: The stock of value companies can continue to be undervalued for long periods of time and not realize its expected value. The Advisor may not be able to accurately determine the Intrinsic Value of a company, resulting in the purchase of an overvalued security or premature sale of an undervalued company. Additionally, the market may use different criteria to determine a company’s value, which could have unexpected effects on a company’s performance and cause losses for the Fund.

Performance

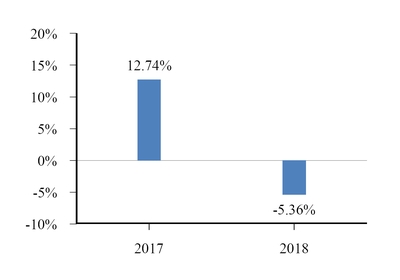

The following performance information provides some indication of the risks of investing in the Fund. The bar chart shows the Fund’s performance for the calendar year ended December 31, 2018. The table illustrates how the Fund’s average annual returns for the periods indicated compare with those of a broad measure of market performance. The Fund’s past performance (before and after taxes) is not necessarily an indication of how it will perform in the future. Updated performance information is available on the Fund’s website at www.matrixadvisorsdividendfund.com.

Calendar year ended December 31,

For the year-to-date period ended September 30, 2019, the Fund’s total return was 19.38%. During the period of time shown in the bar chart, the Fund’s highest quarterly return was 8.22% for the quarter ended September 30, 2018, and the Fund’s lowest quarterly return was -10.76% for the quarter ended December 31, 2018.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred or other tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. In certain cases, the figure representing “Return after taxes on distributions and sale of Fund shares” may be higher than the

3

other return figures for the same period since a higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

Average Annual Total Returns (for the periods ended December 31, 2018) | ||||||

1 Year | Since Inception October 13, 2016 | |||||

Matrix Advisors Dividend Fund | ||||||

Return before taxes | -5.36 | % | 5.96 | % | ||

Return after taxes on distributions | -5.92 | % | 5.34 | % | ||

Return after taxes on distributions and sale of Fund shares | -2.74 | % | 4.58 | % | ||

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | -4.38 | % | 9.74 | % | ||

Management

Investment Advisor

Matrix Asset Advisors, Inc.

Portfolio Managers | Position with the Advisor | Managed the Fund Since |

David A. Katz | President and Chief Investment Officer | 2016 (inception) |

Lon F. Birnholz | Senior Managing Director | 2016 (inception) |

Jordan F. Posner | Managing Director and Senior Portfolio Manager | 2016 (inception) |

Steven Roukis | Managing Director and Senior Portfolio Manager | 2016 (inception) |

Stephan J. Weinberger | Managing Director and Senior Portfolio Manager | 2016 (inception) |

Purchase and Sale of Fund Shares

You may purchase or redeem Fund shares on any business day by written request via mail (Matrix Advisors Dividend Fund, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, WI 53201- 0701), by wire transfer, by telephone at 1-866-209-1965, or through a financial intermediary. The minimum initial and subsequent investment amounts are shown in the table below.

Minimum Investments

To Open Your Account | To Add to Your Account | |

Regular Account | $1,000 | $100 |

Retirement Account | $500 | $100 |

Automatic Investment Plan | $500 | $100 |

Tax Information

The Fund’s distributions are taxed as ordinary income or long-term capital gains, unless you are investing through a tax-deferred or other tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case you may be subject to federal income tax upon withdrawal from such a tax-deferred arrangement.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

4

Additional Information about the Fund’s Investment Objective and Principal Investment Strategies

The Fund’s investment objective has been adopted as a non-fundamental investment policy and may be changed without shareholder approval upon 60 days’ written notice to shareholders. Additionally, the Fund’s policy of investing, under normal circumstances, at least 80% of its net assets, plus borrowings for investment purposes, in dividend-paying stocks has been adopted as a non-fundamental investment policy and may be changed without shareholder approval upon 60 days’ written notice to shareholders.

The Fund invests primarily in dividend-paying common stocks of large capitalization domestic and U.S.-traded international companies in developed markets. Dividend-paying stocks are those that have declared or paid a dividend distribution within the prior 12-month period. The Advisor selects investment securities that pay high and sustainable dividends, are financially strong, and meet specific valuation criteria using the principles of value investing based on Classic Valuation Analysis.

The depositary receipts in which the Fund principally invests are receipts that represent interests in foreign securities held on deposit by U.S. banks.

Classic Valuation Analysis

Classic Valuation Analysis is an investment methodology based on principles developed over 70 years ago by Benjamin Graham. Using valuation models, statistics such as earnings growth, dividend growth, return on equity and book value are analyzed versus their historical, current and projected levels to determine a company’s “Intrinsic Value.” Value criteria requires companies to have a strong financial position, as measured by balance sheet data, and current low stock market valuation in comparison to investment “Intrinsic Value” as measured by historic and current earnings, dividends, return on equity and book value.

Consistent with the principles of Classic Valuation Analysis, the Fund diversifies its portfolio over a range of companies and industries. The Fund may invest in any sector. At times, the Advisor may overweight the Fund’s portfolio in one or more particular sectors, and/or underweight the Fund’s portfolio or not invest in one or more particular sectors. Once a stock has been purchased for the Fund’s portfolio, it generally is sold for one of four reasons:

• | the dividend yield of the security is near or less than that of the S&P 500® Index; or |

• | the security no longer represents attractive value, as determined by the Advisor; or |

• | there has been a fundamental change in the issuer’s balance sheet or results of operations so that it no longer meets the Fund’s financial or valuation criteria; or |

• | a security needs to be sold to fund the purchase of a more attractive security with a superior dividend yield. |

In addition, the Fund may, in unusual circumstances, sell a security at a time when the sale is not indicated for one of the reasons above to avoid adverse tax consequences or to meet abnormally heavy redemption requests.

The Fund is expected to have a low rate of portfolio turnover, which may lead to lower transaction costs and may help to improve Fund performance. However, portfolio securities may be sold without regard to the length of time they have been held.

Temporary Defensive Strategies

Under normal market conditions, the Fund will stay fully invested in stocks. The Fund, however, may temporarily depart from its principal investment strategies by investing up to 100% of its assets in cash, cash equivalents, high quality short-term money market instruments or money market mutual funds in response to adverse market, economic or political conditions, or in other appropriate circumstances. If this type of defensive strategy is employed, the Fund may not achieve its investment objective.

5

Additional Information about the Principal Risks of Investing in the Fund

The principal risks that may adversely affect the Fund’s NAV or total return are summarized above under “Summary Section.” These risks are discussed in more detail below.

Common Stock Risk. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. Investor perceptions may impact the market and are based on various and unpredictable factors including expectations regarding government, economic, monetary and fiscal policies; inflation and interest rates; economic expansion or contraction; and global or regional political, economic and banking crises. If you hold common stocks of any given issuer, you would generally be exposed to greater risk than if you hold preferred stocks or debt obligations of the issuer because common stockholders generally have inferior rights to receive payments from issuers in comparison with the rights of preferred stockholders, bondholders and other creditors of such issuers.

Cyber Security Risk. Investment companies, such as the Fund, and their service providers may be subject to operational and information security risks resulting from cyber-attacks. Cyber-attacks include, among other behaviors, stealing or corrupting data maintained online or digitally, denial of service attacks on websites, the unauthorized release of confidential information or various other forms of cyber security breaches. Cyber-attacks affecting the Fund or the Advisor, custodian, transfer agent, intermediaries and other third-party service providers may adversely impact the Fund. For instance, cyber-attacks may interfere with the processing of shareholder transactions, impact the Fund’s ability to calculate its net asset value (“NAV”), cause the release of private shareholder information or confidential company information, impede redemptions, subject the Fund to regulatory fines or financial losses, and cause reputational damage. The Fund may also incur additional costs for cyber security risk management purposes. Similar types of cyber security risks are also present for issuers of securities in which the Fund invests, which could result in material adverse consequences for such issuers, and may cause the Fund’s investment in such portfolio companies to lose value.

Depositary Receipt Risk. The Fund may hold the securities of non-U.S. companies in the form of American Depositary Receipts (“ADRs”). ADRs are negotiable certificates issued by a U.S. financial institution that represent a specified number of shares in a foreign stock and trade on a U.S. national securities exchange, such as the New York Stock Exchange. Sponsored ADRs are issued with the support of the issuer of the foreign stock underlying the ADRs and carry all of the rights of common shares, including voting rights. The underlying securities of the ADRs in the Fund’s portfolio are usually denominated or quoted in currencies other than the U.S. Dollar. As a result, changes in foreign currency exchange rates may affect the value of the Fund’s portfolio. In addition, because the underlying securities of ADRs trade on foreign exchanges at times when the U.S. markets are not open for trading, the value of the securities underlying the ADRs may change materially at times when the U.S. markets are not open for trading, regardless of whether there is an active U.S. market for the shares.

Dividend Strategy Risk. Investor interest in strategies focusing on dividend-paying stocks may decline, as this strategy has generally performed well during the last few years. If this strategy falls from investor favor, stocks that pay strong dividends may not perform as well as they recently have, even if their businesses continue to post good operating performance.

Foreign Securities Risk. Foreign Securities involve certain risks that may not be present with investments in U.S. companies. For example, investments in Foreign Securities may be subject to risk of loss due to foreign currency fluctuations or to political or economic instability. There may be less information publicly available about a non-U.S. issuer than a U.S. issuer. Non-U.S. issuers may be subject to different accounting, auditing, financial reporting and investor protection standards than U.S. issuers. Investments in non-U.S. securities may be subject to withholding or other taxes and may be subject to additional trading, settlement, custodial, and operational risks. With respect to certain countries, there is the possibility of government intervention and expropriation or nationalization of assets. Because legal systems differ, there is also the possibility that it will be difficult to obtain or enforce legal judgments in certain countries. Since foreign exchanges may be open on days when the Fund does not price its shares, the value of the ADRs in the Fund’s portfolio may change on days when shareholders will not be able to purchase or sell the Fund’s shares. Conversely, Fund shares may trade on days when foreign exchanges are closed. Each of these factors can make investments in the Fund more volatile and potentially less liquid than other types of investments.

6

Large Capitalization Company Risk. Larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative, smaller competitors. Also, large-capitalization companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion.

Management Risk. Management risk means that your investment in the Fund varies with the success or failure of the Advisor’s investment strategies and the Advisor’s research, analysis and determination of portfolio securities. If the Advisor’s investment strategies do not produce the expected results, your investment could be diminished or even lost.

Market Risk. Market risk means that the price of the Fund’s portfolio may move up or down (sometimes rapidly and unpredictably) in response to general market and economic conditions, investor perception and anticipated events, as well as the activities of the particular issuer. Market risk may affect a single issuer, industry, sector of the economy or the market as a whole. Since the Fund invests in equity securities, its share price will change daily in response to stock market movements.

Sector Emphasis Risk. Investing a substantial portion of the Fund’s assets in related industries or sectors may have greater risks, because companies in these sectors may share common characteristics and may react similarly to market developments.

Value Strategy Risk. Undervalued stocks can react differently to issuer, political, market and economic developments than the market as a whole and other types of stocks. Undervalued stocks tend to be inexpensive relative to their earnings or assets compared to other types of stocks. However, these stocks can continue to be inexpensive for long periods of time and may not realize their full economic value.

The Fund may be appropriate for investors who:

• | Have a need for current income and are willing to take on some equity exposure to achieve it; |

• | Are pursuing a long-term goal such as retirement; |

• | Recognize a need to invest in equities, but desire lower risk than the market overall; |

• | Are dissatisfied with the income generated from low-risk fixed income investments; |

• | Want to add an investment in undervalued stocks to their equity portfolio; or |

• | Are willing to accept additional equity market risk to achieve higher income and the potential for long-term growth of capital. |

Similarly Managed Account Performance

The following table sets forth the historical composite performance data for all advisory accounts that have investment objectives, policies, strategies and risks substantially similar to those of the Fund (the “MDI Composite”). The MDI Composite accounts have been managed solely by the Advisor and the same portfolio management personnel as the Fund. The MDI Composite includes all fully discretionary accounts over $100,000 of the Advisor that invest in high-quality U.S. large cap value stocks that have historically paid high dividends.

Performance of the MDI Composite is historical and does not represent the future performance of the Fund or the Advisor.

All returns presented were calculated on a total return basis and include all dividends and interest, accrued income, and realized and unrealized gains and losses and are net of transaction costs. Returns reflect the reinvestment of income and are presented in U.S. dollars. MDI Composite (Net) performance reflects the deduction of all fees and expenses and any transaction costs, without provision for federal or state income taxes. Custodial fees, if any, were not included in the calculations.

The investment management fee schedule for the MDI Composite is 0.65% per annum on the first $5 million in assets invested and reduced rates at higher breakpoints. The “net” MDI Composite performance shown in the tables below reflects the maximum advisory fee charged on the MDI Composite accounts (0.65%). The “gross” MDI Composite performance shown in the tables below excludes the assessment of any advisory fees. Actual investment

7

advisory fees may vary. The MDI Composite’s performance would have been lower than that shown if the accounts included in the MDI Composite had been subject to the Fund’s net annual operating expenses. Further information on the fees can be found in Part 2A of the Advisor’s Form ADV. The MDI Composite is not subject to the diversification requirements, tax restrictions or investment limitations imposed on the Fund by the Investment Company Act of 1940, as amended (the “1940 Act”), or Subchapter M of the Internal Revenue Code of 1986, as amended. Consequently, the performance results of the MDI Composite could have been adversely affected if it had been regulated under the federal securities and tax laws. The standards used to calculate total return as presented in the following table, which are referred to as the Global Investment Performance Standards (GIPS®) developed by the CFA Institute, differ from the standards required by the SEC for calculation of average annual total return.

MDI Composite - Average Annual Total Returns

Year-to-Date (9/30/2019) | For the Periods Ended December 31, 2018 | |||

One Year | Three Years | Since Inception (1/1/2011) | ||

MDI Composite (Net) | 19.51% | -4.56% | 8.25% | 10.49% |

MDI Composite (Gross) | 20.06% | -3.93% | 8.94% | 11.19% |

S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 20.55% | -4.39% | 9.25% | 11.31% |

MDI Composite – Calendar Year Total Returns

Period Ended December 31 | MDI Composite (Net) | MDI Composite (Gross) | S&P 500® Index (reflects no deduction for fees, expenses or taxes) |

2011 | 13.07% | 13.79% | 2.11% |

2012 | 10.05% | 10.75% | 16.00% |

2013 | 26.64% | 27.42% | 32.39% |

2014 | 11.14% | 11.85% | 13.68% |

2015 | -0.04% | 0.61% | 1.37% |

2016 | 16.94% | 17.68% | 11.95% |

2017 | 13.63% | 14.35% | 21.82% |

2018 | -4.56% | -3.93% | -4.39% |

The Advisor claims compliance with the Global Investment Performance Standard (GIPS®). For a complete list and description of the Advisor’s composites, additional information regarding policies for valuing portfolios and calculating performance and/or complete presentation that adheres to the GIPS® standards, contact the Advisor at 10 Bank Street, Suite 590, White Plains, NY, 10606 or call 1-800-366-6223.

Portfolio Holdings

A description of the Fund’s policies and procedures regarding disclosure of the Fund’s portfolio securities is available in the Fund’s Statement of Additional Information (“SAI”).

Investment Advisor

Matrix Asset Advisors, Inc. is the investment adviser to the Fund. The Advisor’s address is 10 Bank Street, Suite 590, White Plains, NY 10606. The Advisor has provided investment advisory services to individuals, endowment, and pension accounts since 1986 and to another mutual fund, the Matrix Advisors Value Fund, Inc., since 1996. As of June 30, 2019, the Advisor managed assets of approximately $747 million. The Advisor provides the Fund with advice on buying and selling securities. The Advisor also furnishes the Fund with office space and certain administrative services and provides most of the personnel needed by the Fund. For its services, the Fund pays the Advisor a monthly management fee at an annual rate of 0.60% of the Fund’s average daily net assets. For the fiscal year ended June 30, 2019, the Advisor waived all management fees.

8

A discussion regarding the basis for the Board of Trustees’ approval of the investment advisory agreement with the Advisor is available in the Fund’s semi-annual report for the period ended December 31, 2018 and will be available in the Fund’s semi-annual report for the period ending December 31, 2019.

Portfolio Managers

The Fund is managed by a team of experienced investment professionals at the Advisor. The team is led by David A. Katz, its President and Chief Investment Officer, and also is composed of Lon F. Birnholz, Jordan F. Posner, Steven Roukis and Stephan J. Weinberger.

Mr. Katz, President and Chief Investment Officer of the Advisor, has overall responsibility for the Advisor’s investment efforts and is primarily responsible for the management of the Fund’s portfolio. He graduated summa cum laude from Union College with a Bachelor of Arts degree in Economics. He received a Master of Business Administration degree, with a concentration in Finance, from New York University Graduate School of Business in 1987, graduating with distinction. His numerous works on Value Investing have earned him various awards and distinctions at the undergraduate and graduate levels. Mr. Katz is a CFA charterholder. After initially working at Management Asset Corporation (Westport, CT), Mr. Katz co-founded Value Matrix Management with the late John M. Gates in 1986. He served as the firm’s Senior Vice President and Chief Investment Officer and was Head of the Investment Policy Committee. In 1990, he merged the Value Matrix Management organization into Matrix Asset Advisors, Inc. Mr. Katz chairs the Investment Policy Committee and is a Portfolio Manager/Analyst. He appears frequently as a guest on CNBC and Bloomberg Radio. He has been President and Chief Investment Officer of the Advisor and a principal shareholder of the Advisor for over thirty years.

Mr. Birnholz is Senior Managing Director of the Advisor. He has been at the Advisor since 1995 and serves as the firm’s Chief Financial Officer and is a member of the firm’s Investment Policy Committee. Mr. Birnholz graduated magna cum laude from New York University’s College of Business Administration with a B.S. degree in Accounting and Economics in 1983. He received his MBA in Finance from New York University’s Graduate School of Business Administration in 1987, graduating with distinction. Mr. Birnholz has been actively involved in the investment community since 1983. Prior to joining the Advisor, he held senior level positions at merchant banks including The Jesup Group, Inc., The International Harvest Group, Inc. and Edgewater Partners, Inc. where he focused on making principal investments in private as well as public corporations. In the mid 1980’s, Mr. Birnholz worked in the High Net-Worth Municipal Bond Group at Shearson Lehman Brothers.

Mr. Posner is a Managing Director/Senior Portfolio Manager of the Advisor, where he plays a key role in the firm’s research and portfolio management efforts and is a member of its Investment Policy Committee. He joined the firm in 2005 and has been managing dividend income equity portfolios for more than five years. He received his B.S. (1979) and M.Eng. (1980) from Rensselaer Polytechnic Institute, and his MBA from the University of Pennsylvania’s Wharton School in 1986. Prior to joining Matrix in 2005, Mr. Posner was a principal at David J. Greene & Co. in New York City, spending 17 years focused on equity research and portfolio management. Before joining David J. Greene & Co., he worked at Management Asset Corporation in Westport, CT for two years. He is a member of the Investment Policy Committee. Mr. Posner is also a member of the CFA Institute, CFA Society New York and the Media and Entertainment Analysts of New York. Mr. Posner is also licensed as a Professional Engineer in New York State.

Mr. Roukis is a Managing Director/Senior Portfolio Manager of the Advisor where he plays a key role in the firm’s research and portfolio management efforts. He graduated from the State University of New York at Buffalo with a B.A. in History in 1991. Mr. Roukis received an M.A. in Economics from New York University in 2000. He began his career in 1994 at the Advisor, is a member of the firm’s Investment Policy Committee, and has been managing dividend income equity portfolios for more than five years. Mr. Roukis is a CFA charter holder, member of the CFA Society New York and a member of the CFA Institute.

Mr. Weinberger is Managing Director/Senior Portfolio Manager of the Advisor. He is a member of the firm’s Investment Policy Committee. In addition to investment research, his responsibilities include business development and client service, and he has been managing dividend income equity portfolios for more than five years. He received his undergraduate degree in English Literature from the University of Colorado, a Higher Diploma in Anglo Irish

9

Literature from Trinity College, Dublin and an MBA from the University of Chicago. Prior to joining the Advisor, Mr. Weinberger was a Partner at Armstrong Shaw Associates in Connecticut, where he was a member of its Investment Committee for 14 years. Prior to joining Armstrong Shaw, Mr. Weinberger was a Partner and Portfolio Manager at Pecksland Associates L. P. and Pine Tree Capital as well as Head of Research at Management Asset Corporation where he worked with David Katz. He is a CFA charter holder.

The Fund’s SAI provides additional information about each portfolio manager’s compensation, other accounts managed by each portfolio manager and each portfolio manager’s ownership of securities of the Fund.

Fund Expenses

The Fund is responsible for its own operating expenses. The Advisor has contractually agreed to waive its management fees and/or reimburse expenses of the Fund to ensure that the Fund’s Total Annual Fund Operating Expenses (excluding interest, acquired fund fees and expenses, distribution and/or service (12b-1) fees, leverage and tax expenses, dividend and interest expenses on short positions, brokerage commissions and extraordinary expenses and including organizational expenses) will not exceed the Expense Cap. The operating expenses limitation agreement between the Fund and the Advisor (the “Waiver Agreement”) will remain in effect through at least October 31, 2020. However, the Waiver Agreement may be terminated at any time, and without payment of any penalty, by the Board, upon 60 days’ written notice to the Advisor. The Waiver Agreement may be terminated only by, or with the consent of, the Board. The Advisor is permitted to recoup fees waived and expenses reimbursed in the prior three fiscal years if such recoupment does not cause the Fund to exceed the lesser of (i) the Expense Cap in effect at the time of the waiver or reimbursement and (ii) the Expense Cap in effect at the time of recoupment. The Fund must pay its current ordinary operating expenses before the Advisor is entitled to any recoupment of fees waived and expenses reimbursed. As a result of the Waiver Agreement, for the fiscal year ended June 30, 2019, the Fund did not pay any management fees to the Advisor.

Shareholder Information

How to Buy Shares

You may open a Fund account with a minimum initial investment of $1,000, and add to your account at any time with a minimum subsequent investment of $100 or more. You may open a retirement account or Automatic Investment Plan account with a minimum initial investment of $500 and add to your account at any time with a minimum subsequent investment of $100 or more. The Fund may waive minimum investment requirements from time to time.

In compliance with the USA PATRIOT Act of 2001, please note that U.S. Bancorp Fund Services, LLC, the Fund’s transfer agent (the “Transfer Agent”) will verify certain information on your account application as part of the Fund’s anti-money laundering program. As requested on the application, you must supply your full name, date of birth, social security number and permanent street address. If you are opening the account in the name of a legal entity (e.g., partnership, limited liability company, business trust, corporation, etc.), you must also supply the identity of the beneficial owners or controlling persons at your legal entity prior to the opening of your account. Mailing addresses containing only a P.O. Box will not be accepted. Please contact the Transfer Agent at 1-866- 209-1965, if you need additional assistance when completing your application.

If we do not have a reasonable belief of the identity of a customer, the account will be rejected or the customer will not be allowed to perform a transaction on the account until such information is received. The Fund may also reserve the right to close the account within five business days if clarifying information/documentation is not received.

You may purchase shares of the Fund by check, wire or via electronic funds transfer through the Automated Clearing House (ACH) network. Your share purchase price will be at the NAV next determined after the Transfer Agent receives your order with complete information and meeting all of the requirements discussed in this Prospectus. For certain qualified brokers, when you place your order with such a broker or its authorized agent, your order is treated as if you had placed it directly with the Transfer Agent, and you will pay or receive the next share price calculated by the Fund. The Fund will be deemed to have received a purchase or redemption order when an authorized broker or, if applicable, a broker’s authorized designee, receives the order. All purchases by check must be in U.S. dollars, drawn on a U.S. financial institution. If your check does not clear you will be charged a return check fee and may

10

be responsible for any loss sustained by the Fund. The Fund will not accept payment in cash or money orders. To prevent check fraud, the Fund will not accept third party checks, Treasury checks, credit card checks, traveler’s checks or starter checks for the purchase of shares. The Fund is unable to accept post-dated checks or any conditional order or payment. The Fund does not issue share certificates.

The Fund reserves the right to reject any purchase order if, in the Fund’s discretion, it is in its best interest to do so. For example, a purchase order may be refused if it appears so large that it would disrupt the management of the Fund. Purchases may also be rejected from persons believed to be engaged in “frequent trading” as described under “Frequent Trading,” below. Investors will generally be notified of any purchase orders that are rejected within two business days.

Shares of the Fund have not been registered for sale outside of the United States.

By Check

If you are making an initial investment in the Fund, simply complete the Account Application included with this Prospectus and mail or send it via overnight delivery with a check made payable to “Matrix Advisors Dividend Fund” to:

Regular Mail Matrix Advisors Dividend Fund c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, WI 53201-0701 | Overnight Delivery Matrix Advisors Dividend Fund c/o U.S. Bank Global Fund Services 615 E. Michigan Street, 3rd Floor Milwaukee, WI 53202-5207 |

Please do not send letters by overnight delivery service or express mail to the P.O. Box address. The Fund does not consider the U.S. Postal Service or other independent delivery services to be its agents. Therefore, deposit in the mail or with such services, or receipt at the Transfer Agent post office box, of purchase orders or redemption requests does not constitute receipt by the Transfer Agent. Receipt of purchase orders or redemption requests is based on when the order is received at the Transfer Agent’s offices.

If you are making a subsequent purchase, please note that an Invest by Mail form is attached to the confirmation statement you will receive after each transaction. Detach the form from the confirmation statement and mail it together with a check made payable to “Matrix Advisors Dividend Fund” to the Fund in the envelope provided with your statement or to the address noted above. You should write your account number on the check.

You may also mail a letter together with a check to the Transfer Agent identifying the name of the Fund and indicating the dollar value of shares to be purchased. Please write your account number on the check.

By Wire

If you are making your first investment in the Fund, you must have a completed Account Application before you wire funds to the Transfer Agent. You can mail or overnight deliver your Account Application to the Transfer Agent at the above address. You may also fax the Account Application by calling the Transfer Agent at 1‑866‑209‑1965. Upon receipt of your completed Account Application, the Transfer Agent will establish an account for you. The account number assigned will be required as part of the instruction that should be provided to your bank to send the wire. Your bank must include the name of the Fund you are purchasing, the account number, and your name so that monies can be correctly applied.

11

Your bank should transmit funds by wire to:

U.S. Bank N.A.

777 E. Wisconsin Avenue

Milwaukee, WI 53202

ABA No.: 075000022

Credit: U.S. Bancorp Fund Services, LLC

Account No.: 112-952-137

Further Credit: Matrix Advisors Dividend Fund

Account name (shareholder name)

Shareholder account number

Before sending your wire, please contact the Transfer Agent at 1-866-209-1965 to advise it that you are intending to wire funds. This will ensure prompt and accurate credit upon receipt of your investment. Your bank may charge you a fee for sending a wire to the Fund. Wired funds must be received prior to 4:00 p.m., Eastern Time, to be eligible for the same day pricing. The Fund and U.S. Bank N.A. are not responsible for the consequences of delays resulting from the banking or Federal Reserve wire system, or from incomplete wiring instructions.

Telephone Purchase

Investors may purchase additional shares of the Fund by calling 1-866-209-1965. Unless you declined this option on your account application, telephone orders will be accepted via electronic funds transfer from your bank account through the Automated Clearing House (ACH) network. You must have banking information established on your account prior to making a purchase and your account must be open for at least 7 business days before the first telephone purchase. If your order is received prior to 4:00 p.m. Eastern time, your shares will be purchased at the NAV calculated on the day your order is placed.

Telephone trades must be received by or prior to market close. During periods of high market activity, shareholders may encounter higher than usual call waits. Please allow sufficient time to place your telephone transaction.

Investment Brokers or Dealers

You may buy or sell shares of the Fund through certain brokers (and their agents) that have made arrangements with the Fund to sell its shares. For certain qualified brokers, when you place your order with such a broker or its authorized agent, your order is treated as if you had placed it directly with the Transfer Agent, and you will pay or receive the next share price calculated by the Fund. The broker (or agent) generally holds your shares in an omnibus account in the broker’s (or agent’s) name, and the broker (or agent) maintains your individual ownership records. The Advisor may pay the broker (or its agent) for maintaining these records as well as providing other shareholder services. The broker (or its agent) may charge you a fee for handling your order. The broker (or agent) is responsible for processing your order correctly and promptly, keeping you advised regarding the status of your individual account, confirming your transactions and ensuring that you receive copies of the Fund’s prospectus.

Automatic Investment Plan

For your convenience, the Fund offers an Automatic Investment Plan (an “AIP”). The minimum initial investment is reduced to $500 for investors who wish to enroll in an AIP. Under an AIP, you authorize the Fund to withdraw a minimum amount of $100 from your bank on a monthly, quarterly, semi-annual, or annual basis. We are unable to debit or credit mutual fund or pass-through accounts. Please contact your financial institution to determine if it participates in the Automated Clearing House System (ACH). If your bank rejects your payment, the Transfer Agent will charge a $25 fee to your account. If you wish to enroll in an AIP, complete the appropriate section in the Account Application. The Fund may terminate or modify this privilege at any time. You may terminate your participation in the AIP at any time by notifying the Transfer Agent in writing or by telephone. Any changes should be submitted five days prior to effective date.

12

Retirement Plans

The Fund offers an Individual Retirement Account (“IRA”) plan. You may obtain information about opening an IRA plan account by calling the Transfer Agent at 1-866-209-1965.

How to Sell Shares

You may sell (redeem) your Fund shares on any date the Fund and the New York Stock Exchange (“NYSE”) are open for business. You may redeem your shares by sending a written request to the Transfer Agent or by telephone as discussed below. You should give your account number and state whether you want all or some of your shares redeemed. The letter should be signed by all of the shareholders whose names appear on the account registration, and include a signature guarantee(s), if applicable. Corporations, executors, administrators, trustees or guardians must submit documents evidencing their authority to act. Certain redemptions require a signature guarantee. Call the Transfer Agent for details. You should send your redemption request to:

Regular Mail Matrix Advisors Dividend Fund c/o U.S. Bank Global Fund Services P.O. Box 701 Milwaukee, WI 53201-0701 | Overnight Delivery Matrix Advisors Dividend Fund c/o U.S. Bank Global Fund Services 615 E. Michigan Street, 3rd Floor Milwaukee, WI 53202-5207 |

Please do not send letters by overnight delivery service or express mail to the P.O. Box address. The Fund does not consider the U.S. Postal Service or other independent delivery services to be its agents. Therefore, deposit in the mail or with such services, or receipt at the U.S. Bancorp Fund Services, LLC post office box, of purchase orders or redemption requests does not constitute receipt by the Transfer Agent. Receipt of purchase orders or redemption requests is based on when the order is received at the Transfer Agent’s offices.

The Fund typically expects to send the redemption proceeds on the next business day (a day when the NYSE is open for normal business) after the redemption request is received in good order and prior to market close, regardless of whether the redemption proceeds are sent via check, wire, or ACH transfer. Under unusual circumstances, the Fund may suspend redemptions, or postpone payment for up to seven days, as permitted by federal securities law. If you did not purchase your shares via wire, the Fund may delay payment of your redemption proceeds for up to 15 calendar days from date of purchase or until your purchase amount has cleared, whichever occurs first.

The Fund may redeem the shares in your account if the value of your account is less than $1,000 as a result of redemptions you have made. This does not apply to IRA or other retirement plans, or Uniform Gifts or Transfers to Minors Act accounts. You will be notified that the value of your account is less than $1,000 before the Fund makes an involuntary redemption. You will then have 30 days in which to make an additional investment to bring the value of your account up to at least $1,000 before the Fund takes any action. Redemption of your shares under these circumstances may result in a taxable gain or loss.

The Fund typically expects to meet redemption requests by paying out proceeds from cash or cash equivalent portfolio holdings, or by selling portfolio holdings. In stressed market conditions, redemption methods may include paying redemption proceeds to you in whole or in part by a distribution of securities from the Fund’s portfolio (a “redemption in-kind”). If the Fund pays your redemption proceeds by a distribution of securities, you could incur brokerage or other charges in converting the securities to cash and will bear any market risks associated with such securities until they are converted into cash. For federal income tax purposes, redemptions paid in securities are taxed in the same manner as redemptions paid in cash.

Shareholders may request that redemption proceeds of $1,000 or more be wired directly to a bank account or by electronic funds transfer via the ACH network to the bank account designated by you on your application. There is a $15 fee for each wire transfer.

Signature Guarantee

Your signature must be guaranteed, from either a Medallion program member or a non-Medallion program member, if: (a) the proceeds of any redemption exceed $50,000; (b) ownership on your account is being changed; (c) redemption

13

proceeds are payable or sent to any person, address or bank account not on record, (d) redemptions are transmitted by federal wire transfer (if not previously authorized on the account); or (e) a redemption is received by the Transfer Agent and the account address has changed within the last 30 calendar days. In addition to the situations described above, the Fund and/or the Transfer Agent may require a signature guarantee in other instances based on the circumstances relative to the particular situation. Non-financial transactions including establishing or modifying certain services on an account may require a signature guarantee, signature verification from a Signature Validation Program member, or other acceptable form of authentication from a financial institution source. Signature guarantees will generally be accepted from domestic banks, brokers, dealers, credit unions, national securities exchanges, registered securities associations, clearing agencies and savings associations as well as from participants in the Securities Transfer Agents Medallion Program (STAMP) and the New York Stock Exchange Medallion Signature Program (NYSE MSP). A notary public is not an acceptable signature guarantee. The Fund reserves the right to waive any signature requirement at its discretion.

Additional documentation may be required for the redemption of shares held in corporate, partnership or fiduciary accounts. In case of any questions, please contact the Fund in advance by calling 1-866-209-1965.

Telephone Transactions

Unless you specifically declined telephone options on the account application, you may redeem amounts of $50,000 or less by telephone. Proceeds redeemed will be mailed or sent via electronic funds transfer through the ACH network or wired only to an investor’s address or bank of record shown on the records of the Transfer Agent.

When you establish any telephone privileges, you are authorizing the Fund and its Transfer Agent to act upon the telephone instructions of the person or persons you have designated on your Account Application. Before acting on instructions received by telephone, the Fund and the Transfer Agent will use reasonable procedures to confirm that the telephone instructions are genuine. If an account has more than one owner or authorized person, the Fund will accept telephone instructions from any one owner or authorized person. These procedures may include recording the telephone call and asking the caller for a form of personal identification. The Fund reserves the right to refuse a telephone request if it believes that the person making the request is neither the record owner of the shares nor otherwise authorized by the shareholder to request the transaction. If the Fund and the Transfer Agent follow these procedures, they will not be liable for any loss, expense, or cost arising out of any telephone transaction request that is reasonably believed to be genuine. This includes any fraudulent or unauthorized request. Once a telephone transaction is placed, it cannot be cancelled or modified after the close of regular trading on the NYSE (generally 4:00 p.m., Eastern time). The Fund may change, modify or terminate these privileges at any time upon at least 60 days’ notice to shareholders.

To arrange for the telephone redemption privilege after an account has been opened, or to change the bank account or address designated to receive redemption proceeds, a written request must be sent to the Transfer Agent. The request must be signed by each shareholder of the account and may require a signature guarantee, a signature verification from a Signature Validation Program member, or other acceptable form of authentication from a financial institution source. Further documentation may be requested from corporations, executors, administrators, trustees and guardians.

Lost Shareholders, Inactive Accounts and Unclaimed Property

It is important that the Fund maintains a correct address for each investor. An incorrect address may cause an investor’s account statements and other mailings to be returned to the Fund. Based upon statutory requirements for returned mail, the Fund will attempt to locate the investor or rightful owner of the account. If the Fund is unable to locate the investor, then it will determine whether the investor’s account can legally be considered abandoned. Mutual fund accounts may be transferred to the state government of an investor’s state of residence if no activity occurs within the account during the “inactivity period” specified in the applicable state’s abandoned property laws, which varies by state. The Fund is legally obligated to escheat (or transfer) abandoned property to the appropriate state’s unclaimed property administrator in accordance with statutory requirements. The investor’s last known address of record determines which state has jurisdiction. Please proactively contact the Transfer Agent toll-free at 1-866-209-1965 at least annually to ensure your account remains in active status. Investors who are residents of the state of Texas

14

may designate a representative to receive legislatively required unclaimed property due diligence notifications. Please contact the Fund to complete a Texas Designation of Representative form.

Pricing of Fund Shares

The price of the Fund’s shares is the Fund’s NAV. This is calculated by dividing the Fund’s assets, minus its liabilities, by the number of shares outstanding. The Fund’s assets are the value of securities held in its portfolio, plus any cash and other assets. The Fund’s liabilities are fees and expenses owed by the Fund. The number of Fund shares outstanding is the amount of shares which have been issued to shareholders. The price you will pay to buy Fund shares or the amount you will receive when you sell your Fund shares is based on the NAV next calculated after your order is received by the Transfer Agent with complete information and meeting all the requirements discussed in this Prospectus. Applications for purchase of shares and requests for redemption of shares received after the close of trading on the NYSE will be based upon the NAV as determined as of the close of trading on the next day the NYSE is open.

The NAV of the Fund’s shares is determined as of the close of regular trading on the NYSE, generally 4:00 p.m., Eastern Time. Fund shares will not be priced on days that the NYSE is closed for trading (including weekends and certain U.S. holidays).

Fair Value Pricing

The Fund’s investments are valued principally according to market value when market quotations are readily available. Securities traded on a national securities exchange are valued at the last reported sale price at the close of regular trading on each day the exchanges are open for trading. Securities trading on the NASDAQ Stock Market Inc. (“NASDAQ”) are valued at the NASDAQ Official Closing Price. When a market quote is not readily available, the security’s value is based on “fair value” as determined in good faith by the Fund’s Pricing Committee using procedures established by the Board of Trustees. In determining fair value, the Fund will seek to assign a value to the security which it believes represents the amount that the Fund could reasonably expect to receive upon the security’s current sale. With respect to securities that are actively traded on U.S. exchanges, the Fund expects that market quotations will generally be available and that fair value might be used only in limited circumstances, such as when trading for a security is halted during the trading day or a security is thinly-traded. Fair value pricing involves judgments that are inherently subjective and inexact, and it is not possible to determine with certainty when, and to what extent, an event will affect a market price. As a result, there can be no assurance that fair value pricing will reflect actual market value and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security.

The value of any shares of open-end mutual funds held by the Fund will be calculated using the NAV of such funds. The prospectuses for any such open-end mutual funds should explain the circumstances under which the funds use fair value pricing and the effects of using fair value pricing.

Frequent Trading

The Fund discourages short-term or excessive trading (“frequent trading”) of its shares by shareholders and maintains procedures reasonably designed to detect and deter such frequent trading. The Board has adopted a policy and procedures that are designed to detect and deter frequent trading. Frequent trading is sometimes referred to as market timing. Market timing may take many forms but commonly refers to arbitrage activity involving the frequent buying and selling of mutual fund shares to take advantage of the fact that there may be a lag between a change in the value of a mutual fund’s portfolio securities and the reflection of that change in the mutual fund’s share price. Frequent trading may dilute the value of Fund shares held by long-term shareholders. Frequent trading may also interfere with the efficient management of the Fund’s portfolio, as it may result in the Fund maintaining higher cash balances than it otherwise would or cause the Fund to sell portfolio securities at a time it otherwise would not. Frequent trading may further result in increased portfolio transaction (or brokerage) costs, administrative and other operating costs and may cause the Fund to realize taxable capital gains or harvest capital losses at a time that it otherwise would not. For these reasons, frequent trading poses the risk of lower returns for long-term shareholders of the Fund. There is no guarantee that these policies and procedures will be effective in detecting and preventing frequent trading in whole or in part.

15

In addition, while the Fund has no present intention to invest a significant portion of its assets in foreign securities, to the extent that it does invest in foreign securities traded primarily on markets that close prior to the time the Fund determines its NAV, frequent trading by some shareholders may, in certain circumstances, dilute the value of Fund shares held by other shareholders. This may occur when an event that affects the value of the foreign security takes place after the close of the primary foreign market, but before the time that the Fund determines its NAV. Certain investors may seek to take advantage of the fact that there will be a delay in the adjustment of the market price for a security caused by this event until the foreign market reopens (referred to as price arbitrage). If this occurs, the market timers who attempt this type of price arbitrage may dilute the value of the Fund’s shares to the extent they receive shares or proceeds based upon NAVs that have been calculated using the closing market prices for foreign securities. In an effort to prevent price arbitrage, the Fund has procedures designed to adjust closing market prices of foreign securities before the Fund calculates its NAV when it believes such an event has occurred. Prices are adjusted to reflect what the Fund believes are the fair values of these foreign securities at the time the Fund determines its NAV (called fair value pricing). Fair value pricing, however, involves judgments that are inherently subjective and inexact, since it is not possible to always be sure when an event will affect a market price and to what extent. As a result, there can be no assurance that fair value pricing will always eliminate the risk of price arbitrage. The risk of price arbitrage also exists with thinly-traded securities in the United States, such as some small-capitalization equity securities. Such securities are typically less liquid and more thinly-traded than securities of large capitalization issuers. Developments affecting issuers of thinly-traded or less liquid securities will not be reflected in their market price until the security trades again in the marketplace. Frequent traders may seek to exploit this delay by engaging in price arbitrage, in this case by buying or selling shares of the Fund prior to the time of the adjustment of the market price of securities in its portfolio. This may result in the dilution of the value of the Fund’s shares. The Fund may employ fair value pricing to these types of securities if it determines that the last quoted market price no longer represents the fair value of the security.

The Fund monitors selected trades in an effort to detect excessive short-term trading activities. If, as a result of this monitoring, the Fund believes that a shareholder has engaged in excessive short-term trading, it may, in its discretion, ask the shareholder to stop such activities or refuse to process purchases in the shareholder’s accounts. In making such judgments, the Fund seeks to act in a manner that it believes is consistent with the best interests of shareholders. Due to the complexity and subjectivity involved in identifying abusive trading activity and the volume of shareholder transactions the Fund handles, there can be no assurance that the Fund’s efforts will identify all trades or trading practices that may be considered abusive. In addition, the Fund’s ability to monitor trades that are placed by individual shareholders within group, or omnibus, accounts maintained by financial intermediaries is severely limited because the Fund does not have simultaneous access to the underlying shareholder account information.

In compliance with Rule 22c-2 under the 1940 Act, Quasar Distributors, LLC, the Fund’s distributor, on behalf of the Fund, has entered into written agreements with each of the Fund’s financial intermediaries, under which the intermediary must, upon request, provide the Fund with certain shareholder and identity trading information so that the Fund can enforce its market timing policies.

The Fund will not accommodate frequent trading of Fund shares. As indicated above under “How to Buy Shares,” the Fund reserves the right to refuse any purchase order for its shares for any reasons, including transactions deemed by the Fund to represent frequent trading activity. The Fund may change its policies relating to frequent trading at any time without prior notice to shareholders.

Redemptions In-Kind

The Fund has made an election pursuant to Rule 18f-1 under the 1940 Act that obligates it to pay in cash all redemptions to any shareholder of record unless a shareholder requests a redemption, within a 90-day period, of shares having a value in excess of (i) $250,000, or (ii) 1% of the Fund’s NAV, whichever is less. In this case, the Fund is permitted to pay the redemption price in whole or in part by a distribution of securities from its portfolio. In that event, the value of the securities distributed would be equal to the amount redeemed, determined at the same time, and in the same manner, as the redemption price is determined. Shareholders who receive redemption payments in securities may incur brokerage costs in converting the securities they receive into cash and will bear any market risks associated with such securities until they are converted into cash. For federal income tax purposes, redemptions-in-kind are

16

taxed in the same manner as redemptions paid in cash. The subsequent sale of securities received in kind may also result in realized gains or losses for federal income tax purposes.

Distributions

The Fund expects to make distributions of net investment income quarterly, typically in March, June, September and December. If there is no net investment income during a quarter, or if it is a de minimis amount, a distribution will not be made. The Fund also expects to make a distribution of net capital gain, if any, annually, typically within the month of December. The Fund may make additional distributions if it deems such distributions necessary at any other time during the year.

All distributions will be reinvested in additional Fund shares unless you choose to receive either net investment income and/or net capital gain distributions in cash.

If you elect to receive distributions in cash and the U.S. Postal Service cannot deliver your check, or if a check remains uncashed for six-months, the Fund reserves the right to reinvest the distribution check in your account at the Fund’s then current NAV and to reinvest all subsequent distributions in your account.

If you wish to change your distribution option, write or call the Transfer Agent at least five days in advance of the payment date of the distribution. However, any such change will be effective only as to distributions for which the record date is five or more days after the Transfer Agent has received the written request.

Distribution Plan

The Board has adopted a Distribution and Service Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. In accordance with the Plan, the Fund is authorized to pay an amount up to 0.25% of its average daily net assets each year for certain distribution-related activities and shareholder services.

No Rule 12b-1 fees are currently paid by the Fund, and there are no plans to impose these fees. However, in the event Rule 12b-1 fees are charged in the future, because the fees are paid out of the Fund’s assets, over time these fees will increase the cost of your investment and may cost you more than certain other types of sales charges.

Tax Consequences

Changes in income tax laws, potentially with retroactive effect, could impact the Fund’s investments or the tax consequences to you of investing in the Fund.

Distributions of the Fund’s investment company taxable income (which includes, but is not limited to, interest, dividends, net gain from foreign currency transactions, and net short-term capital gain), if any, are generally taxable to the Fund’s shareholders as ordinary income. For non-corporate shareholders, to the extent that the Fund’s distributions of investment company taxable income are attributable to and reported as “qualified dividend” income, such income may be subject to tax at the reduced federal income tax rates applicable to long-term capital gains, if certain holding period requirements have been satisfied by the Fund and the shareholder. For corporate shareholders, a portion of the Fund’s distributions of investment company taxable income may be eligible for the intercorporate dividends-received deduction to the extent that the Fund receives dividends directly or indirectly from U.S. corporations, reports the amount as eligible for deduction, and the shareholder meets certain holding period requirements. To the extent the Fund’s distributions of investment company taxable income are attributable to net short-term capital gain, such distributions will be treated as ordinary income and cannot be offset by a shareholder’s capital losses from other investments.

Distributions of net capital gain (net long-term capital gain less net short-term capital loss) are generally taxable as long-term capital gains regardless of the length of time a shareholder has owned Fund shares. Distributions of net capital gain are not eligible for qualified dividend income treatment or the dividends-received deduction described above.

You will be taxed in the same manner whether you receive your distributions (of either investment company taxable income or net capital gain) in cash or reinvest them in additional Fund shares. Distributions are generally taxable when received. However, distributions declared in October, November, or December to shareholders of record and paid the following January are taxable as if received on December 31.

17

Shareholders that sell or redeem shares generally will have a capital gain or loss from the sale or redemption. The amount of the gain or loss and the applicable rate of federal income tax will depend generally upon the amount paid for the shares, the amount received from the sale or redemption (including redemptions paid in-kind) and how long the shares were held by a shareholder. Generally, capital gain or loss will be long-term if you have held your Fund shares for more than one year and short-term if you have held your Fund shares for one year or less. If you purchase Fund shares (through reinvestment of distributions or otherwise) within 30 days before or after selling or redeeming other Fund shares at a loss, all or part of that loss will not be deductible and will instead increase the basis of the new shares. Additionally, any loss realized upon a sale or redemption of shares held for six months or less will be treated as a long-term capital loss to the extent of any distributions of net capital gain received or deemed to be received with respect to those shares.

In addition to the federal income tax, certain individuals, trusts and estates may be subject to a Medicare tax of 3.8%. The Medicare tax is imposed on the lesser of (i) a taxpayer’s investment income, net of deductions properly allocable to such income, or (ii) the amount by which such taxpayer’s modified adjusted gross income exceeds certain thresholds ($250,000 for married individuals filing jointly, $200,000 for unmarried individuals, and $125,000 for married individuals filing separately). The Fund’s distributions are includable in a shareholder’s investment income for purposes of this Medicare tax. In addition, any capital gain realized on the sale or redemption of Fund shares is includable in a shareholder’s investment income for purposes of this Medicare tax.

The Fund may be required to withhold federal income tax from a shareholder’s distributions and redemption proceeds (at a rate set under Section 3406 of the Internal Revenue Code of 1986, as amended, for U.S. residents) if a shareholder fails to furnish the Fund with his or her correct Social Security number or other taxpayer identification number and certain certifications or the Fund receives a notification from the Internal Revenue Service (“IRS”) that the shareholder is subject to backup withholding.

Shareholders who hold their Fund shares through an IRA or other retirement plan must indicate on their written redemption request whether or not to withhold federal income tax. Redemption requests failing to indicate an election not to have tax withheld will generally be subject to 10% withholding. Shares held in IRA and other retirement accounts may be redeemed by telephone at 1-866-209-1965. Investors will be asked whether or not to withhold taxes from any distribution.

The Fund is required to report to certain shareholders and the Internal Revenue Service (“IRS”) the cost basis of Fund shares when such shareholder subsequently sells or redeems those shares. The Fund will determine the cost basis of such shares using the average cost method unless you elect in writing any alternative IRS-approved cost basis method. Please see the SAI for more information regarding cost basis reporting.