Form 485BPOS Calvert Management Serie

As filed with the Securities and Exchange Commission on January 28, 2019

1933 Act File No. 002-69565

1940 Act File No. 811-03101

| SECURITIES AND EXCHANGE COMMISSION | ||

| WASHINGTON, D.C. 20549 | ||

| FORM N-1A | ||

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT of 1933 |

o | |

| POST-EFFECTIVE AMENDMENT NO. 105 | x | |

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

o | |

| AMENDMENT NO. 105 | x | |

| CALVERT MANAGEMENT SERIES | ||

| (Exact Name of Registrant as Specified in Charter) | ||

| 1825 Connecticut Ave NW, Suite 400, Washington, DC 20009 | ||

| (Address of Principal Executive Offices) | ||

| (202) 238-2200 | ||

| (Registrant’s Telephone Number) | ||

| MAUREEN A. GEMMA | ||

| Two International Place, Boston, Massachusetts 02110 | ||

| (Name and Address of Agent for Service) | ||

| It is proposed that this filing will become effective pursuant to Rule 485 (check appropriate box): | |||

| ¨ | immediately upon filing pursuant to paragraph (b) | ¨ | on (date) pursuant to paragraph (a)(1) |

| x | on February 1, 2019 pursuant to paragraph (b) | ¨ | 75 days after filing pursuant to paragraph (a)(2) |

| ¨ | 60 days after filing pursuant to paragraph (a)(1) | o | on (date) pursuant to paragraph (a)(2) |

| If appropriate, check the following box: | |||

| o | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. | ||

Calvert Floating-Rate Advantage Fund

Class A Shares - CFOAX Class I Shares - CFOIX Class R6 Shares - CFORX

Prospectus Dated

February 1, 2019

Important Note. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website (http://www.calvert.com/prospectus), and you will be notified by mail each time a report is posted and provided with a website address to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you are a direct investor, you may elect to receive shareholder reports and other communications from the Fund electronically by signing up for e-Delivery at calvert.com. If you own your shares through a financial intermediary (such as a broker-dealer or bank), you must contact your financial intermediary to sign up.

You may elect to receive all future Fund shareholder reports in paper free of charge. If you are a direct investor, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-800-368-2745. If you own these shares through a financial intermediary, you must contact your financial intermediary or follow instructions included with this disclosure, if applicable, to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Calvert funds held directly or to all funds held through your financial intermediary, as applicable.

The Securities and Exchange Commission (“SEC”) has not approved or disapproved these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Information in this Prospectus

| Page | Page | ||

| Fund Summary | 2 | Investment Objective & Principal Policies and Risks | 7 |

| Investment Objective | 2 | About Responsible Investing | 16 |

| Fees and Expenses of the Fund | 2 | Management and Organization | 17 |

| Portfolio Turnover | 2 | Valuing Shares | 18 |

| Principal Investment Strategies | 3 | Purchasing Shares | 18 |

| Principal Risks | 3 | Sales Charges | 22 |

| Performance | 5 | Redeeming Shares | 24 |

| Management | 6 | Shareholder Account Features | 25 |

| Purchase and Sale of Fund Shares | 6 | Additional Tax Information | 27 |

| Tax Information | 6 | Financial Highlights | 28 |

| Payments to Broker-Dealers and Other Financial Intermediaries | 6 | Appendix A – The Calvert Principles for Responsible Investment | 29 |

| Appendix B – Financial Intermediary Sales Charge Variations | 31 |

This Prospectus contains

important information about the Fund and the services

available to shareholders. Please save it for reference.

Fund Summary

Investment Objective

The Fund's investment objective is to provide a high level of current income.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. Investors may also pay commissions or other fees to their financial intermediary when they buy and hold shares of the Fund, which are not reflected below. You may qualify for a reduced sales charge on purchases of Class A shares if you invest, or agree to invest over a 13-month period, at least $50,000 in Calvert funds. Certain financial intermediaries also may offer variations in Fund sales charges to their customers as described in Appendix B – Financial Intermediary Sales Charge Variations in this Prospectus. More information about these and other discounts is available from your financial professional and under “Sales Charges” on page 22 of this Prospectus and page19 of the Fund’s Statement of Additional Information.

| Shareholder Fees (fees paid directly from your investment) | Class A | Class I | Class R6 |

| Maximum Sales Charge (load) Imposed on Purchases (as a percentage of offering price) | 3.75% | None | None |

| Maximum Deferred Sales Charge (load) (as a percentage of the lower of net asset value at purchase or redemption) | None | None | None |

| Annual Fund Operating Expenses (expenses you pay each year as a percentage of the value of your investment) | Class A | Class I | Class R6 |

| Management Fees(1) | 0.71% | 0.71% | 0.71% |

| Distribution and Service (12b-1) Fees | 0.25% | None | None |

| Other Expenses(2) | 1.24% | 1.24% | 1.18% |

| Total Annual Fund Operating Expenses | 2.20% | 1.95% | 1.89% |

| Expense Reimbursement(3) | (0.37)% | (0.37)% | (0.37)% |

| Total Annual Fund Operating Expenses after Expense Reimbursement | 1.83% | 1.58% | 1.52% |

| (1) | Management fees are charged on the Fund’s average daily gross assets and are estimated based on gross assets at the Fund’s most recent fiscal year end. |

| (2) | Includes estimated interest expenses and other borrowing costs of 0.81% based on the outstanding borrowings and related costs at the Fund’s most recent fiscal year end. |

(3) Calvert Research and Management (“CRM”) has agreed to reimburse the Fund’s other expenses (excluding interest expense and other borrowing cost) in excess of 0.06% annually for each class. This expense reimbursement will continue through January 31, 2020. Any amendment to or termination of this reimbursement would require approval of the Board of Trustees. The expense reimbursement relates to ordinary operating expenses only and does not include expenses such as: brokerage commissions, acquired fund fees and expenses of unaffiliated funds, interest expense and other borrowing cost, taxes or litigation expenses. Amounts reimbursed may be recouped by CRM during the same fiscal year to the extent actual expenses are less than the contractual expense cap during such year.

Example. This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, that the operating expenses remain the same and that any reimbursement arrangement remains in place for the contractual period. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class A shares | $554 | $1,003 | $1,478 | $2,786 |

| Class I shares | $161 | $576 | $1,018 | $2,245 |

| Class R6 shares | $155 | $558 | $987 | $2,181 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” the portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Annual Fund Operating Expenses or in the Example, affect the Fund’s performance. For the period from the Fund's inception on October 10, 2017 to September 30, 2018, the Fund's portfolio turnover rate was 35% of the average value of its portfolio.

| Calvert Floating-Rate Advantage Fund | 2 | Prospectus dated February 1, 2019 |

Principal Investment Strategies

Under normal circumstances, the Fund invests at least 80% of its net assets (plus any borrowings for investment purposes) in income producing floating rate loans and other floating rate debt securities. The Fund invests primarily in senior floating rate loans of domestic and foreign borrowers (“Senior Loans”). Senior Loans typically are secured with specific collateral and have a claim on the assets and/or stock of the borrower that is senior to subordinated debtholders and stockholders of the borrower. Loans usually are of below investment grade quality and have below investment grade credit ratings, which ratings are associated with securities having high risk, speculative characteristics (sometimes referred to as “junk”). The Fund also may borrow from banks for the purpose of acquiring additional income-producing investments (referred to as “leverage”).

The Fund may also invest in secured and unsecured subordinated loans, second lien loans and subordinated bridge loans (“Junior Loans”), other floating rate debt securities, fixed-income debt obligations and money market instruments. Other floating rate debt securities, fixed-income debt securities and money market instruments may include: bonds, notes and debentures issued by corporations; debt securities issued or guaranteed by the U.S. government or one of its agencies or instrumentalities; and commercial paper. Money market instruments with a remaining maturity of less than 60 days are deemed floating rate debt securities. Senior Loans and Junior Loans are referred to together herein as “loans.”

The Fund may invest up to 35% of its net assets in foreign Senior Loans. Foreign Senior Loans must be denominated in U.S. dollars, euros, British pounds, Swiss francs, Canadian dollars, or Australian dollars. The Fund may engage in derivative transactions (such as futures contracts and options thereon, forward foreign currency exchange contracts and other currency hedging strategies, and interest rate swaps) to seek to hedge against fluctuations in currency exchange rates and interest rates. There is no stated limit on the Fund’s use of derivatives.

The Adviser seeks to maintain broad borrower and industry diversification among the Fund’s loans. When selecting loans, the Adviser seeks to implement a systematic risk-weighted approach that utilizes fundamental analysis of risk/return characteristics. Loans may be sold, if in the opinion of the Adviser, the risk-return profile deteriorates or to pursue more attractive investment opportunities. In managing the Fund, the Adviser seeks to invest in a portfolio of loans that it believes will be less volatile over time than the general loan market.

Responsible Investing. In selecting investments for the Fund, CRM is guided by The Calvert Principles for Responsible Investment (a copy of which is included as an appendix to the Fund’s Prospectus), which provide a framework for considering environmental, social and governance (“ESG”) factors.

Principal Risks

Market Risk. The value of investments held by the Fund may increase or decrease in response to economic, political and financial events (whether real, expected or perceived) in the U.S. and global markets. The frequency and magnitude of such changes in value cannot be predicted. Certain securities and other investments held by the Fund may experience increased volatility, illiquidity, or other potentially adverse effects in reaction to changing market conditions. Actions taken by the U.S. Federal Reserve or foreign central banks to stimulate or stabilize economic growth, such as decreases or increases in short-term interest rates, could cause high volatility in markets. No active trading market may exist for certain investments, which may impair the ability of the Fund to sell or to realize the current valuation of such investments in the event of the need to liquidate such assets. Fixed-income markets may experience periods of relatively high volatility in an environment where U.S. treasury yields are rising.

Credit Risk. Investments in loans and other debt obligations (referred to below as “debt instruments”) are subject to the risk of non-payment of scheduled principal and interest. Changes in economic conditions or other circumstances may reduce the capacity of the party obligated to make principal and interest payments on such instruments and may lead to defaults. Such non-payments and defaults may reduce the value of Fund shares and income distributions. The value of debt instruments also may decline because of concerns about the issuer’s ability to make principal and interest payments. In addition, the credit ratings of debt instruments may be lowered if the financial condition of the party obligated to make payments with respect to such instruments deteriorates. In the event of bankruptcy of the issuer of a debt instrument, the Fund could experience delays or limitations with respect to its ability to realize the benefits of any collateral securing the instrument. In order to enforce its rights in the event of a default, bankruptcy or similar situation, the Fund may be required to retain legal or similar counsel, which may increase the Fund’s operating expenses and adversely affect net asset value. Due to their lower place in the borrower’s capital structure, Junior Loans involve a higher degree of overall risk than Senior Loans of the same borrower.

| Calvert Floating-Rate Advantage Fund | 3 | Prospectus dated February 1, 2019 |

Additional Risks of Loans. Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund’s ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. See also “Market Risk” above. It also may take longer than seven days for transactions in loans to settle. Due to the possibility of an extended loan settlement process, the Fund may hold cash, sell investments or temporarily borrow from banks or other lenders to meet short-term liquidity needs, such as to satisfy redemption requests from Fund shareholders. The types of covenants included in loan agreements generally vary depending on market conditions, the creditworthiness of the issuer, the nature of the collateral securing the loan and possibly other factors. Loans with fewer covenants that restrict activities of the borrower may provide the borrower with more flexibility to take actions that may be detrimental to the loan holders and provide fewer investor protections in the event of such actions or if covenants are breached. The Fund may experience relatively greater realized or unrealized losses or delays and expense in enforcing its rights with respect to loans with fewer restrictive covenants. Loans to entities located outside of the U.S. may have substantially different lender protections and covenants as compared to loans to U.S. entities and may involve greater risks. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments as described herein.

Lower Rated Investments Risk. Investments rated below investment grade and comparable unrated investments (sometimes referred to as “junk”) have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments typically are subject to greater price volatility and illiquidity than higher rated investments.

Borrowing Risk. Borrowing cash to increase investments (sometimes referred to as “leverage”) may exaggerate the effect on the Fund’s net asset value of any increase or decrease in the value of the security purchased with the borrowings. Successful use of a borrowing strategy depends on the investment adviser’s ability to predict correctly interest rates and market movements. There can be no assurance that the use of borrowings will be successful. In connection with its borrowings, the Fund will be required to maintain specified asset coverage with respect to such borrowings by applicable federal securities laws and the terms of its credit facility with the lender. The Fund may be required to dispose of portfolio investments on unfavorable terms if market fluctuations or other factors cause the required asset coverage to be less than the prescribed amount. Borrowings involve additional expense to the Fund.

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Generally, securities with longer maturities are more sensitive to changes in interest rates than shorter maturity securities, causing them to be more volatile. Conversely, fixed income securities with shorter maturities will be less volatile but may provide lower returns than fixed income securities with longer maturities. The impact of interest rate changes is significantly less for floating-rate instruments that have relatively short periodic rate resets (e.g., ninety days or less). In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate.

Foreign Investment Risk. Foreign investments can be adversely affected by political, economic and market developments abroad, including the imposition of economic and other sanctions by the United States or another country. Foreign markets may be smaller, less liquid and more volatile than the major markets in the United States, and as a result, Fund share values may be more volatile. Trading in foreign markets typically involves higher expense than trading in the United States. The Fund may have difficulties enforcing its legal or contractual rights in a foreign country.

Currency Risk. Exchange rates for currencies fluctuate daily. The value of foreign investments may be affected favorably or unfavorably by changes in currency exchange rates in relation to the U.S. dollar. Currency markets generally are not as regulated as securities markets and currency transactions are subject to settlement, custodial and other operational risks.

Money Market Instrument Risk. Money market instruments may be adversely affected by market and economic events, such as a sharp rise in prevailing short-term interest rates; adverse developments in the banking industry, which issues or guarantees many money market instruments; adverse economic, political or other developments affecting issuers of money market instruments; changes in the credit quality of issuers; and default by a counterparty.

| Calvert Floating-Rate Advantage Fund | 4 | Prospectus dated February 1, 2019 |

U.S. Government Securities Risk. Although certain U.S. Government-sponsored agencies (such as the Federal Home Loan Mortgage Corporation and the Federal National Mortgage Association) may be chartered or sponsored by acts of Congress, their securities are neither issued nor guaranteed by the U.S. Treasury. U.S. Treasury securities generally have a lower return than other obligations because of their higher credit quality and market liquidity.

Derivatives Risk. The Fund’s exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. The use of derivatives can lead to losses because of adverse movements in the price or value of the asset, index, rate or instrument underlying a derivative, due to failure of a counterparty or due to tax or regulatory constraints. Derivatives may create leverage in the Fund, which represents a non-cash exposure to the underlying asset, index, rate or instrument. Leverage can increase both the risk and return potential of the Fund. Derivatives risk may be more significant when derivatives are used to enhance return or as a substitute for a cash investment position, rather than solely to hedge the risk of a position held by the Fund. Use of derivatives involves the exercise of specialized skill and judgment, and a transaction may be unsuccessful in whole or in part because of market behavior or unexpected events. Changes in the value of a derivative (including one used for hedging) may not correlate perfectly with the underlying asset, rate, index or instrument. Derivative instruments traded in over-the-counter markets may be difficult to value, may be illiquid, and may be subject to wide swings in valuation caused by changes in the value of the underlying instrument. If a derivative’s counterparty is unable to honor its commitments, the value of Fund shares may decline and the Fund could experience delays in the return of collateral or other assets held by the counterparty. The loss on derivative transactions may substantially exceed the initial investment, particularly when there is no stated limit on the Fund’s use of derivatives. A derivative investment also involves the risks relating to the asset, index, rate or instrument underlying the investment.

Liquidity Risk. The Fund is exposed to liquidity risk when trading volume, lack of a market maker or trading partner, large position size, market conditions, or legal restrictions impair its ability to sell particular investments or to sell them at advantageous market prices. Consequently, the Fund may have to accept a lower price to sell an investment or continue to hold it or keep the position open, sell other investments to raise cash or give up an investment opportunity, any of which could have a negative effect on the Fund’s performance. These effects may be exacerbated during times of financial or political stress.

Risks Associated with Active Management. The success of the Fund’s investment strategy depends on portfolio management’s successful application of analytical skills and investment judgment. Active management involves subjective decisions.

Responsible Investing Risk. Investing primarily in responsible investments carries the risk that, under certain market conditions, the Fund may underperform funds that do not utilize a responsible investment strategy. The application of responsible investment criteria may affect the Fund’s exposure to certain sectors or types of investments, and may impact the Fund’s relative investment performance depending on whether such sectors or investments are in or out of favor in the market. An investment’s ESG performance or the investment adviser's assessment of such performance may change over time, which could cause the Fund to temporarily hold securities that do not comply with the Fund’s responsible investment criteria. In evaluating an investment, the investment adviser is dependent upon information and data that may be incomplete, inaccurate or unavailable, which could adversely affect the analysis of the ESG factors relevant to a particular investment. Successful application of the Fund’s responsible investment strategy will depend on the investment adviser's skill in properly identifying and analyzing material ESG issues.

General Fund Investing Risks. The Fund is not a complete investment program and there is no guarantee that the Fund will achieve its investment objective. It is possible to lose money by investing in the Fund. The Fund is designed to be a long-term investment vehicle and is not suited for short-term trading. Investors in the Fund should have a long-term investment perspective and be able to tolerate potentially sharp declines in value. Purchase and redemption activities by Fund shareholders may impact the management of the Fund and its ability to achieve its investment objective(s). In addition, the redemption by one or more large shareholders or groups of shareholders of their holdings in the Fund could have an adverse impact on the remaining shareholders in the Fund. The Fund relies on various service providers, including the investment adviser, in its operations and is susceptible to operational, information security and related events (such as cyber or hacking attacks) that may affect them or the services that they provide to the Fund. An investment in the Fund is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| Calvert Floating-Rate Advantage Fund | 5 | Prospectus dated February 1, 2019 |

Performance

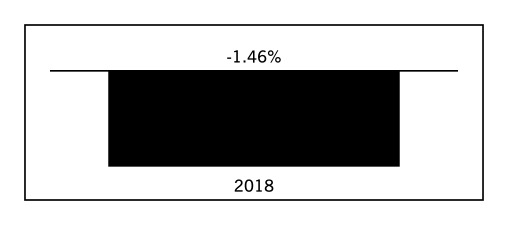

The following bar chart and table provide some indication of the risks of investing in the Fund by showing how the Fund’s average annual returns over time compare with those of a broad-based securities market index. The return in the bar chart is for Class A shares and does not reflect a sales charge. If the sales charge was reflected, the return would be lower. Past performance (both before and after taxes) is not necessarily an indication of how the Fund will perform in the future. The Fund’s performance reflects the effects of expense reductions. Absent these reductions, performance would have been lower. Updated Fund performance information can be obtained by visiting www.calvert.com.

For the period from December 31, 2017 through December 31, 2018, the highest quarterly total return for Class A was 1.54% for the quarter ended September 30, 2018 and the lowest quarterly return was -4.33% for the quarter ended December 31, 2018.

| Average Annual Total Returns as of December 31, 2018 | One Year | Life of Fund |

| Class A Return Before Taxes | -5.16% | -4.04% |

| Class A Return After Taxes on Distributions | -6.77% | -5.52% |

| Class A Return After Taxes on Distributions and Sale of Class A Shares | -3.03% | -3.96% |

| Class I Return Before Taxes | -1.25% | -0.76% |

| Class R6 Return Before Taxes | -1.31% | -0.87% |

| S&P/LSTA Leveraged Loan Index (reflects no deduction for fees, expenses or taxes) | 0.44% | 1.08% |

These returns reflect the maximum sales charge for Class A (3.75%). The Fund commenced operations on October 10, 2017. Investors cannot invest directly in an Index.

After-tax returns are calculated using the highest historical individual federal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and the actual characterization of distributions, and may differ from those shown. After-tax returns are not relevant to shareholders who hold shares in tax-deferred accounts or to shares held by non-taxable entities. After-tax returns for other Classes of shares will vary from the after-tax returns presented for Class A shares. Return After Taxes on Distributions for a period may be the same as Return Before Taxes for that period because no taxable distributions were made during that period. Also, Return After Taxes on Distributions and Sale of Fund Shares for a period may be greater than or equal to Return After Taxes on Distributions for the same period because of losses realized on the sale of Fund shares.

Management

Investment Adviser. Calvert Research and Management (“CRM” or the “Adviser”).

Portfolio Managers

Catherine C. McDermott, Vice President of CRM, has managed the Fund since April 2018.

Scott H. Page, Vice President of CRM, has managed the Fund since its inception in October 2017.

Craig P. Russ, Vice President of CRM, has managed the Fund since its inception in October 2017.

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange Fund shares on any business day, which is any day the New York Stock Exchange is open for business. You may purchase, redeem or exchange Fund shares either through your financial intermediary or directly from the Fund either by writing to the Fund, P.O. Box 219544, Kansas City, MO 64121-9544, or by calling 1-800-368-2745. The minimum initial purchase or exchange into the Fund is $1,000 for Class A, $250,000 for Class I and $1,000,000 for Class R6 (waived in certain circumstances). There is no minimum for subsequent investments.

| Calvert Floating-Rate Advantage Fund | 6 | Prospectus dated February 1, 2019 |

Tax Information

If your shares are held in a taxable account, the Fund’s distributions will be taxed to you as ordinary income and/or capital gains, unless you are exempt from taxation. If your shares are held in a tax-advantaged account, you will generally be taxed only upon withdrawals from the account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund’s shares through a broker-dealer or other financial intermediary (such as a bank) (collectively, “financial intermediaries”), the Fund, its principal underwriter and its affiliates may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| Calvert Floating-Rate Advantage Fund | 7 | Prospectus dated February 1, 2019 |

Investment Objective & Principal Policies and Risks

The investment objective and principal investment policies and risks of the Fund are described in its Fund Summary. Set forth below is additional information about such policies and risks, as well as information about other types of investments and practices in which the Fund may engage from time to time. See also “Strategies and Risks” in the Statement of Additional Information (“SAI”).

Definitions. As used herein, the following terms have the indicated meaning: “1940 Act” means the Investment Company Act of 1940, as amended; “1933 Act” means the Securities Act of 1933, as amended; “Code” means the Internal Revenue Code of 1986, as amended; “ERISA” means the Employee Retirement Income Security Act of 1974, as amended; and “investment adviser” means the Fund’s investment adviser but if the Fund is sub-advised, it refers to the sub-adviser(s) providing day-to-day management with respect to the investments or strategies discussed.

Loans. Loans may be primary, direct investments or investments in loan assignments or participation interests. A loan assignment represents a portion or the entirety of a loan and a portion or the entirety of a position previously attributable to a different lender. The purchaser of an assignment typically succeeds to all the rights and obligations under the loan agreement and has the same rights and obligations as the assigning investor. However, assignments through private negotiations may cause the purchaser of an assignment to have different and more limited rights than those held by the assigning investor. Loan participation interests are interests issued by a lender or other entity and represent a fractional interest in a loan. The Fund typically will have a contractual relationship only with the financial institution that issued the participation interest. As a result, the Fund may have the right to receive payments of principal, interest and any fees to which it is entitled only from the financial institution and only upon receipt by such entity of such payments from the borrower. In connection with purchasing a participation interest, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement, nor any rights with respect to any funds acquired by other investors through set-off against the borrower and the Fund may not directly benefit from the collateral supporting the loan in which it has purchased the participation interest. As a result, the Fund may assume the credit risk of both the borrower and the financial institution issuing the participation interest. In the event of the insolvency of the entity issuing a participation interest, the Fund may be treated as a general creditor of such entity. Most loans are rated below investment grade or, if unrated, are of similar credit quality.

Loan investments may be made at par or at a discount or premium to par. The interest payable on a loan may be fixed or floating rate, and paid in cash or in-kind. In connection with transactions in loans, the Fund may be subject to facility or other fees. Loans may be secured by specific collateral or other assets of the borrower, guaranteed by a third party, unsecured or subordinated. During the term of a loan, the value of any collateral securing the loan may decline in value, causing the loan to be under collateralized. Collateral may consist of assets that may not be readily liquidated, and there is no assurance that the liquidation of such assets would satisfy fully a borrower’s obligations under the loan. In addition, if a loan is foreclosed, the Fund could become part owner of the collateral and would bear the costs and liabilities associated with owning and disposing of such collateral.

Certain loans (“senior loans”) hold a senior position in the capital structure of a business entity, are typically secured with specific collateral and have a claim on the assets and/or stock of the borrower that is senior to that held by subordinated debtholders and stockholders of the borrower. Junior loans may be secured or unsecured subordinated loans, second lien loans and subordinated bridge loans. Floating-rate loans typically have rates of interest which are re-determined daily, monthly, quarterly or semi-annually by reference to a base lending rate, plus a premium. Floating-Rate loans held by the Fund typically have a dollar-weighted average period until the next interest rate adjustment of approximately 90 days or less.

A lender’s repayment and other rights primarily are determined by governing loan, assignment or participation documents, which (among other things) typically establish the priority of payment on the loan relative to other indebtedness and obligations of the borrower. A borrower typically is required to comply with certain covenants contained in a loan agreement between the borrower and the holders of the loan. The types of covenants included in loan agreements generally vary depending on market conditions, the creditworthiness of the issuer, and the nature of the collateral securing the loan. Loans with fewer covenants that restrict activities of the borrower may provide the borrower with more flexibility to take actions that may be detrimental to the loan holders and provide fewer investor protections in the event covenants are breached. The Fund may experience relatively greater realized or unrealized losses or delays and expense in enforcing its rights with respect to loans with fewer restrictive covenants. Loans to entities located outside of the U.S. (including to sovereign entities) may have substantially different lender protections and covenants as compared to loans to U.S. entities and may involve greater risks. In the event of bankruptcy, applicable law may impact a lender’s ability to enforce its rights under such documents.

Loans may be originated by a lending agent, such as a financial institution or other entity, on behalf of a group or “syndicate” of loan investors (the “Loan Investors”). In such a case, the agent administers the terms of the loan

| Calvert Floating-Rate Advantage Fund | 8 | Prospectus dated February 1, 2019 |

agreement and is responsible for the collection of principal, and interest payments from the borrower and the apportionment of these payments to the Loan Investors. Failure by the agent to fulfill its obligations may delay or adversely affect receipt of payment by the Fund. Furthermore, unless under the terms of a loan agreement or participation (as applicable) the Fund has direct recourse against the borrower, the Fund must rely on the agent and the other Loan Investors to pursue appropriate remedies against the borrower.

Although the overall size and number of participants in the market for many loans has grown over the past decade, such loans continue to trade in a private, unregulated inter-dealer or inter-bank secondary market and the amount of available public information about loans may be less extensive than that available for registered or exchange listed securities. With limited exceptions, the investment adviser will take steps intended to insure that it does not receive material nonpublic information about the issuers of loans that also issue publicly traded securities. Therefore, the investment adviser may have less information than other investors about certain of the loans in which it seeks to invest. Purchases and sales of loans are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may (i) impede the Fund’s ability to buy or sell loans, (ii) negatively impact the transaction price, (iii) impact the counterparty and/or credit risks borne by the Fund, (iv) impede the Fund’s ability to timely vote or otherwise act with respect to loans, (v) expose the Fund to adverse tax or regulatory consequences and/or (vi) result in delayed settlement of loan transactions. It may take longer than seven days for a transaction in loans to settle, which may impact the Fund’s process for meeting redemptions. See “Liquidity Risk.” This is partly due to the nature of manner in which loans trade and the contractual restrictions noted above, which require a written assignment agreement and various ancillary documents for each transfer, and frequently require discretionary consents from both the borrower and the administrative agent. In light of the foregoing, the Fund may hold cash, sell investments or temporarily borrow to meet its cash needs, including satisfying redemption requests.

Assignments of loans through private negotiations may cause the purchaser of an assignment to have different and more limited rights than those held by the assigning investor. In connection with purchasing a participation interest, the Fund generally will have no right to enforce compliance by the borrower with the terms of the loan agreement. In the event the borrower defaults, the Fund may not directly benefit from the collateral supporting the loan (if any) in which it has purchased the participation interest. As a result, the Fund may assume the credit risk of both the borrower and the financial institution issuing the participation interest. No active trading market may exist for certain loans, which may impair the ability of the Fund to realize full value in the event of the need to sell a loan and which may make it difficult to value the loan. To the extent that a secondary market does exist for certain loans, the market may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods.

In addition to the risks generally associated with debt instruments, such as credit, market, interest rate and liquidity risks, loans are also subject to the risk that the value of any collateral securing a loan may decline, be insufficient to meet the obligations of the borrower or be difficult to liquidate. The specific collateral used to secure a loan may decline in value or become illiquid, which would adversely affect the loan’s value. The Fund’s access to collateral may be limited by bankruptcy, other insolvency laws or by the type of loan the Fund has purchased. For example, if the Fund purchases a participation instead of an assignment, it would not have direct access to collateral of the borrower. As a result, a floating rate loan may not be fully collateralized and can decline significantly in value. Additionally, collateral on loan instruments may not be readily liquidated, and there is no assurance that the liquidation of such assets will satisfy a borrower’s obligations under the investment.

Loans are subject to the risk that a court, pursuant to fraudulent conveyance or other similar laws, could subordinate a loan to presently existing or future indebtedness of the borrower, or take other action detrimental to the holders of a loan including, in certain circumstances, invalidating a loan or causing interest previously paid to be refunded to the borrower. Any such actions by a court could negatively affect the Fund’s performance. Loans that are secured and senior to other debtholders of a borrower tend to have more favorable loss recovery rates as compared to more junior types of below investment grade debt obligations. Due to their lower place in the borrower’s capital structure and, in some cases, their unsecured status, junior loans involve a higher degree of overall risk than senior loans of the same borrower.

Investing in loans involves the risk of default by the borrower or other party obligated to repay the loan. In the event of insolvency of the borrower or other obligated party, the Fund may be treated as a general creditor of such entity unless it has rights that are senior to that of other creditors or secured by specific collateral or assets of the borrower. Fixed rate loans are also subject to the risk that their value will decline in a rising interest rate environment. This risk is mitigated for floating-rate loans, where the interest rate payable on the loan resets periodically by reference to a base lending rate.

| Calvert Floating-Rate Advantage Fund | 9 | Prospectus dated February 1, 2019 |

U.S. federal securities laws afford certain protections against fraud and misrepresentation in connection with the offering or sale of a security, as well as against manipulation of trading markets for securities. The typical practice of a lender in relying exclusively or primarily on reports from the borrower may involve the risk of fraud, misrepresentation, or market manipulation by the borrower. It is unclear whether U.S. federal securities law protections are available to an investment in a loan. In certain circumstances, loans may not be deemed to be securities, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. However, contractual provisions in the loan documents may offer some protections, and lenders may also avail themselves of common-law fraud protections under applicable state law.

Borrowing. The Fund is permitted to borrow for temporary purposes (such as to satisfy redemption requests, to remain fully invested in anticipation of expected cash inflows and to settle transactions). Any borrowings by the Fund are subject to the requirements of the 1940 Act. Borrowings are also subject to the terms of any credit agreement between the Fund and lender(s). Fund borrowings may be equal to as much as 331/3% of the value of the Fund’s total assets (including such borrowings) less the Fund’s liabilities (other than borrowings). The Fund is authorized to borrow to acquire additional investments when it believes that the interest payments and other costs with respect to such borrowings will be exceeded by the anticipated total return on such investments. The Fund has entered into a credit agreement (the “Agreement”) with a bank that currently permits the Fund to borrow approximately $45 million pursuant to a 364-day revolving line of credit. Borrowings under the Agreement are secured by the assets of the Fund. Interest is charged at a rate above the higher of prime rate or the Federal Funds rate, or at a rate above LIBOR and is payable monthly. Under the terms of the Agreement, the Fund also pays facility and upfront fees. Successful use of a borrowing strategy depends on the Adviser’s ability to predict correctly interest rates and market movements. There is no assurance that a borrowing strategy will be successful. Upon the expiration of the term of the Fund’s credit arrangement, the lender may not be willing to extend further credit to the Fund, may reduce amounts available under the facility or may only be willing to lend at an increased cost to the Fund. If the Fund is not able to extend its credit arrangement, it may be required to liquidate holdings to repay amounts borrowed under the credit facility.

In addition, the Fund will be required to maintain a specified level of asset coverage with respect to all borrowings and may be required to sell some of its holdings to reduce debt and restore coverage at times when it may not be advantageous to do so. The rights of the lender to receive payments of interest and repayments of principal of any borrowings made by the Fund under a credit facility are senior to the rights of holders of shares with respect to the payment of dividends or upon liquidation. In the event of a default under a credit arrangement, the lenders may have the right to cause a liquidation of the collateral (i.e., sell Fund assets) and, if any such default is not cured, the lenders may be able to control the liquidation as well.

Lower Rated Investments. Although the investment adviser considers security ratings when making investment decisions, it performs its own credit and investment analysis and does not rely primarily on the ratings assigned by the rating agencies. In evaluating the quality of a particular investment, whether rated or unrated, the investment adviser will normally take into consideration, among other things, the issuer’s financial resources and operating history, its sensitivity to economic conditions and trends, the ability of its management, its debt maturity schedules and borrowing requirements, and relative values based on anticipated cash flow, interest and asset coverage, and earnings prospects. Credit ratings are based largely on the issuer’s historical financial condition and a rating agency’s investment analysis at the time of rating: the rating assigned to any particular security is not necessarily a reflection of the issuer’s current financial condition. The rating assigned to a security or other instrument by a rating agency does not reflect assessment of the volatility of its market value or liquidity. Credit quality in the sectors of the market can change from time to time, and recently issued credit ratings may not fully reflect the actual risks posed by a particular investment.

Because of the greater number of investment considerations involved in investing in investments that receive lower ratings, investing in lower rated investments depends more on the investment adviser’s judgment and analytical abilities than may be the case for investing in investments with higher ratings. While the investment adviser will attempt to reduce the risks of investing in lower rated or unrated securities through active portfolio management, diversification, credit analysis and attention to current developments and trends in the economy and the financial markets, there can be no assurance that a broadly diversified portfolio of such securities would substantially lessen the risks of defaults brought about by an economic downturn or recession.

Investments in obligations rated below investment grade and comparable unrated securities (sometimes referred to as “junk”) generally entail greater economic, credit and liquidity risks than investment grade securities. Lower rated investments have speculative characteristics because of the credit risk associated with their issuers. Changes in economic conditions or other circumstances typically have a greater effect on the ability of issuers of lower rated investments to make principal and interest payments than they do on issuers of higher rated investments. An economic downturn generally leads to a higher non-payment rate, and a lower rated investment may lose significant value before a default occurs. Lower rated investments generally are subject to greater price volatility and illiquidity than higher rated investments.

| Calvert Floating-Rate Advantage Fund | 10 | Prospectus dated February 1, 2019 |

Interest Rate Risk. In general, the value of income securities will fluctuate based on changes in interest rates. The value of these securities is likely to increase when interest rates fall and decline when interest rates rise. Generally, securities with longer maturities are more sensitive to changes in interest rates than shorter maturity securities, causing them to be more volatile. Conversely, fixed income securities with shorter maturities will be less volatile but may provide lower returns than fixed income securities with longer maturities. In a rising interest rate environment, the duration of income securities that have the ability to be prepaid or called by the issuer may be extended. In a declining interest rate environment, the proceeds from prepaid or maturing instruments may have to be reinvested at a lower interest rate. The impact of interest rate changes is significantly less for floating-rate instruments that have relatively short periodic rate resets (e.g., ninety days or less). Variable and floating rate loans and securities generally are less sensitive to interest rate changes, but may decline in value if their interest rates do not rise as much or as quickly as interest rates in general. Conversely, variable and floating rate loans and securities generally will not increase in value as much as fixed rate debt instruments if interest rates decline. Because the Fund holds variable and floating rate loans and securities, a decrease in market interest rates will reduce the interest income to be received from such securities. In the event that the Fund has a negative average portfolio duration, the value of the Fund may decline in a declining interest rate environment.

Credit Risk. Rating agencies are private services that provide ratings of the credit quality of certain investments. In evaluating creditworthiness, the investment adviser considers ratings assigned by rating agencies and generally performs additional credit and investment analysis. Credit ratings issued by rating agencies are based on a number of factors including, but not limited to, the issuer’s financial condition and the rating agency’s credit analysis, if applicable, at the time of rating. The ratings assigned are not absolute standards of credit quality and do not evaluate market risks or necessarily reflect the issuer’s current financial condition or the volatility or liquidity of the security. An issuer’s current financial condition may be better or worse than the current rating indicates. A credit rating may have a modifier (such as plus, minus or a numerical modifier) to denote its relative status within the rating. The presence of a modifier does not change the security credit rating (for example, BBB- and Baa3 are within the investment grade rating) for purposes of the Fund’s investment limitations.

Foreign Investments. Investments in foreign issuers could be affected by factors not present in the United States, including expropriation, armed conflict, confiscatory taxation, lack of uniform accounting and auditing standards, less publicly available financial and other information, and potential difficulties in enforcing contractual obligations. Because foreign issuers may not be subject to uniform accounting, auditing and financial reporting standard practices and requirements and regulatory measures comparable to those in the United States, there may be less publicly available information about such foreign issuers. Settlements of securities transactions in foreign countries are subject to risk of loss, may be delayed and are generally less frequent than in the United States, which could affect the liquidity of the Fund’s assets. Evidence of ownership of certain foreign investments may be held outside the United States, and the Fund may be subject to the risks associated with the holding of such property overseas.

Foreign issuers may become subject to sanctions imposed by the United States or another country, which could result in the immediate freeze of the foreign issuers’ assets or securities. The imposition of such sanctions could impair the market value of the securities of such foreign issuers and limit the Fund’s ability to buy, sell, receive or deliver the securities. Trading in certain foreign markets is also subject to liquidity risks.

Foreign Currencies. The value of foreign assets and currencies as measured in U.S. dollars may be affected favorably or unfavorably by changes in foreign currency rates and exchange control regulations, application of foreign tax laws (including withholding tax), governmental administration of economic or monetary policies (in this country or abroad), and relations between nations and trading. Foreign currencies also are subject to settlement, custodial and other operational risks. Currency exchange rates can be affected unpredictably by intervention, or the failure to intervene, by U.S. or foreign governments or central banks or by currency controls or political developments in the United States or abroad. If the U.S. dollar rises in value relative to a foreign currency, a security denominated in that foreign currency will be worth less in U.S. dollars. If the U.S. dollar decreases in value relative to a foreign currency, a security denominated in that foreign currency will be worth more in U.S. dollars. A devaluation of a currency by a country’s government or banking authority will have a significant impact on the value of any investments denominated in that currency. Costs are incurred in connection with conversions between currencies.

The Fund may engage in spot transactions and forward foreign currency exchange contracts, purchase and sell options on currencies and purchase and sell currency futures contracts and related options thereon (collectively, “Currency Instruments”) to seek to hedge against the decline in the value of currencies in which its portfolio holdings are denominated against the U.S. dollar.

Fixed-Income Securities and Other Debt Instruments. Fixed-income securities and other debt instruments include all types of fixed and floating-rate bonds and notes, such as convertible securities and other hybrid securities (other than preferred stock); corporate commercial paper; mortgage-backed and other asset-backed securities; inflation-indexed bonds issued by both governments and corporations; structured notes, including “indexed” securities; loans; loan participations and assignments; delayed funding loans and revolving credit facilities; and bank certificates of deposit, fixed

| Calvert Floating-Rate Advantage Fund | 11 | Prospectus dated February 1, 2019 |

time deposits, bank deposits (or investments structured to provide the same type of exposure) and bankers’ acceptances of foreign and domestic banks and other debt instruments. Fixed-income securities and other debt instruments are issued by: foreign governments or their subdivisions, agencies and government-sponsored enterprises; international agencies or supranational entities; the U.S. Government, its agencies or government-sponsored enterprises (or guaranteed thereby); central or quasi-sovereign banks and U.S. and foreign corporations. Fixed-income securities and other debt instruments include deep discount bonds, such as zero coupon bonds, deferred interest bonds, bonds or securities on which the interest is payable in-kind (“PIK securities”), which are debt obligations that are issued at a significant discount from face value, and securities purchased on a forward commitment or when-issued basis. While zero coupon bonds do not make periodic payments of interest, deferred interest bonds provide for a period of delay before the regular payment of interest begins. PIK securities provide that the issuer thereof may, at its option, pay interest in cash or in the form of additional securities.

Derivatives. Generally, derivatives can be characterized as financial instruments whose performance is derived at least in part from the performance of an underlying reference instrument. Derivative instruments may be acquired in the United States or abroad consistent with the Fund’s investment strategy and may include the various types of exchange-traded and over-the-counter (“OTC”) instruments described herein and other instruments with substantially similar characteristics and risks. Fund obligations created pursuant to derivative instruments may give rise to leverage, which would subject the Fund to the requirements described under “Asset Coverage” in the Fund’s SAI. The Fund may invest in a derivative transaction if it is permitted to own, invest in, or otherwise have economic exposure to the reference instrument. A reference instrument could be a security, instrument, index, currency, commodity, economic indicator or event (“reference instruments”). The Fund may engage in derivative transactions to seek to hedge against fluctuations in currency exchange rates and interest rates. The Fund may trade in the specific types and/or combinations of derivative transactions listed below.

Derivative instruments are subject to a number of risks, including adverse or unexpected movements in the price of the reference instrument, and counterparty, liquidity, market, tax and leverage risks. Certain derivatives may also be subject to credit risk and interest rate risk. In addition, derivatives also involve the risk that changes in their value may not correlate perfectly with the assets, rates, indices or instruments they are designed to hedge or closely track. Use of derivative instruments may cause the realization of higher amounts of short-term capital gains (generally taxed at ordinary income tax rates) than if such instruments had not been used. Success in using derivative instruments to hedge portfolio assets depends on the degree of price correlation between the derivative instruments and the hedged asset. Imperfect correlation may be caused by several factors, including temporary price disparities among the trading markets for the derivative instrument, the reference instrument and the Fund’s assets. To the extent that a derivative instrument is intended to hedge against an event that does not occur, the Fund may realize losses.

OTC derivative instruments involve an additional risk in that the issuer or counterparty may fail to perform its contractual obligations. Some derivative instruments are not readily marketable or may become illiquid under adverse market conditions. In addition, during periods of market volatility, an option or commodity exchange or swap execution facility or clearinghouse may suspend or limit trading in an exchange-traded derivative instrument, which may make the contract temporarily illiquid and difficult to price. Commodity exchanges may also establish daily limits on the amount that the price of a futures contract or futures option can vary from the previous day’s settlement price. Once the daily limit is reached, no trades may be made that day at a price beyond the limit. This may prevent the closing out of positions to limit losses. The staff of the SEC takes the position that certain purchased OTC options, and assets used as cover for written OTC options, are illiquid. The ability to terminate OTC derivative instruments may depend on the cooperation of the counterparties to such contracts. For thinly traded derivative instruments, the only source of price quotations may be the selling dealer or counterparty. In addition, certain provisions of the Code limit the use of derivative instruments. Derivatives permit the Fund to increase or decrease the level of risk, or change the character of the risk, to which its portfolio is exposed in much the same way as the Fund can increase or decrease the level of risk, or change the character of the risk, of its portfolio by making investments in specific securities. There can be no assurance that the use of derivative instruments will benefit the Fund.

The regulation of the U.S. and non-U.S. derivatives markets has undergone substantial change in recent years. In particular, the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and related regulations require many derivatives to be cleared and traded on an exchange, expand entity registration requirements, impose business conduct requirements on counterparties, and impose other regulatory requirements that will continue to change derivatives markets as regulations are implemented. Additional future regulation of the derivatives markets may make the use of derivatives more costly, may limit the availability or reduce the liquidity of derivatives, and may impose limits or restrictions on the counterparties with which the Fund engages in derivative transactions. Fund management cannot predict the effects of any new governmental regulation that may be implemented, and future regulation may impair the effectiveness of the Fund’s derivative transactions and its ability to achieve its investment objectives.

| Calvert Floating-Rate Advantage Fund | 12 | Prospectus dated February 1, 2019 |

Forward Foreign Currency Exchange Contracts. A forward foreign currency exchange contract (“currency forward”) involves an obligation to purchase or sell a specific currency at a future date, which may be any fixed number of days from the date of the contract agreed upon by the parties, at a price set at the time of the contract. These contracts may be bought or sold to protect against an adverse change in the relationship between currencies or to increase exposure to a particular foreign currency.

Certain currency forwards may be individually negotiated and privately traded, exposing them to credit and counterparty risks. The precise matching of the currency forward amounts and the value of the instruments denominated in the corresponding currencies will not generally be possible. In addition, it may not be possible to hedge against long-term currency changes. Currency forwards are subject to the risk of political and economic factors applicable to the countries issuing the underlying currencies. Furthermore, unlike trading in most other types of instruments, there is no systematic reporting of last sale information with respect to the foreign currencies underlying currency forwards. As a result, available information may not be complete.

Options. Options may be traded on an exchange and OTC. By buying a put option on a particular instrument, the Fund acquires a right to sell the underlying instrument at the exercise price. By buying a put option on an index, the Fund acquires a right to receive the cash difference between the strike price of the option and the index price at expiration. A purchased put position also typically can be sold at any time by selling at prevailing market prices. Purchased put options generally are expected to limit the Fund's risk of loss through a decline in the market value of the underlying security or index until the put option expires. When buying a put option, the Fund pays a premium to the seller of the option. If the price of the underlying security or index is above the exercise price of the option as of the option valuation date, the option expires worthless and the Fund will not be able to recover the option premium paid to the seller.

The Fund may also write (i.e., sell) put options. The Fund will receive a premium for selling a put option, which may increase the Fund's return. In selling a put option on a security, the Fund has the obligation to buy the security at an agreed upon price if the price of such instrument decreases below the exercise price. By selling a put option on an index, the Fund has an obligation to make a payment to the buyer to the extent that the value of the index decreases below the exercise price as of the option valuation date. If the value of the underlying security or index on the option’s expiration date is above the exercise price, the option will generally expire worthless and the Fund, as option seller, will have no obligation to the option holder.

The Fund may purchase call options. By purchasing a call option on a security, the Fund has the right to buy the security at the option’s exercise price. By buying a call option on an index, the Fund acquires the right to receive the cash difference between the market price of the index and strike price at expiration. Call options typically can be exercised any time prior to option maturity or, sold at the prevailing market price.

The Fund may also write (i.e., sell) a call option on a security or index in return for a premium. A call written on a security obligates the Fund to deliver the underlying security at the option exercise price. Written index call options obligate the Fund to make a cash payment to the buyer at expiration if the market price of the index is above the option strike price. Calls typically can also be bought back by the Fund at prevailing market prices and the Fund also may enter into closing purchase transactions with respect to written call options. The Fund may write call options on securities that it owns (so-called covered calls).

The Fund’s options positions are marked to market daily. The value of options is affected by changes in the value and dividend rates of their underlying instruments, changes in interest rates, changes in the actual or perceived volatility of the relevant index or market and the remaining time to the options’ expiration, as well as trading conditions in the options market. The hours of trading for options may not conform to the hours during which the underlying instruments are traded. To the extent that the options markets close before markets for the underlying instruments, significant price and rate movements can take place in the markets that would not be reflected concurrently in the options markets.

The Fund's ability to sell the instrument underlying a call option may be limited while the option is in effect unless the Fund enters into a closing purchase transaction. As the seller of a covered call option or an index call option, the Fund may forego, during the option’s life, the opportunity to profit from increases in the market value of the underlying instrument covering the call option above the sum of the premium received by the Fund and the exercise price of the call. The Fund also retains the risk of loss, minus the option premium received, should the price of the underlying instrument decline.

Participants in OTC markets are typically not subject to the same credit evaluation and regulatory oversight as are members of “exchange-based” markets. OTC option contracts generally carry greater liquidity risk than exchange-traded contracts. This risk may be increased in times of financial stress, if the trading market for OTC options becomes restricted. The ability of the Fund to transact business with any one or a number of counterparties may increase the potential for losses to the Fund, due to the lack of any independent evaluation of the counterparties or their financial capabilities, and the absence of a regulated market to facilitate settlement of the options.

| Calvert Floating-Rate Advantage Fund | 13 | Prospectus dated February 1, 2019 |

Futures Contracts. Futures are standardized, exchange-traded contracts. Futures contracts on securities obligate a purchaser to take delivery, and a seller to make delivery, of a specific amount of the financial instrument called for in the contract at a specified future date at a specified price. An index futures contract obligates the purchaser to take, and a seller to deliver, an amount of cash equal to a specific dollar amount times the difference between the value of a specific index at the close of the last trading day of the contract and the price at which the agreement is made. No physical delivery of the underlying securities in the index is made. It is the practice of holders of futures contracts to close out their positions on or before the expiration date by use of offsetting contract positions, and physical delivery of financial instruments or delivery of cash, as applicable, is thereby avoided. An option on a futures contract gives the holder the right to enter into a specified futures contract.

Interest Rate Swaps. Interest rate swaps involve the exchange by the Fund with another party of their respective commitments to pay or receive interest, e.g., an exchange of fixed rate payments for floating rate payments.

Credit Default Swaps. Credit default swap agreements (“CDS”) enable the Fund to buy or sell credit protection on an individual issuer or basket of issuers (i.e., the reference instrument). The Fund may enter into CDS to gain or short exposure to a reference instrument. Long CDS positions are utilized to gain exposure to a reference instrument (similar to buying the instrument) and are akin to selling insurance on the instrument. Short CDS positions are utilized to short exposure to a reference instrument (similar to shorting the instrument) and are akin to buying insurance on the instrument.

Under a CDS, the protection “buyer” in a credit default contract is generally obligated to pay the protection “seller” an upfront or a periodic stream of payments over the term of the contract, provided that no credit event, such as a default, on a reference instrument has occurred. If a credit event occurs, the seller generally must pay the buyer the “par value” (full notional value) of the reference instrument in exchange for an equal face amount of the reference instrument described in the swap, or the seller may be required to deliver the related net cash amount, if the swap is cash settled. If the Fund is a buyer and no credit event occurs, the Fund may recover nothing if the swap is held through its termination date. As a seller, the Fund generally receives an upfront payment or a fixed rate of income throughout the term of the swap provided that there is no credit event. The Fund’s obligations under a CDS will be accrued daily (offset against any amounts owed to the Fund).

In response to market events, federal and certain state regulators have proposed regulation of the CDS market. These regulations may limit the Fund’s ability to use CDS and/or the benefits of CDS. CDS may be difficult to value and generally pay a return to the party that has paid the premium only in the event of an actual default by the issuer of the underlying obligation (as opposed to a credit downgrade or other indication of financial difficulty). The Fund may have difficulty, be unable or may incur additional costs to acquire any securities or instruments it is required to deliver under a CDS. The Fund many have limited ability to eliminate its exposure under a CDS either by assignment or other disposition, or by entering into an offsetting swap agreement. The Fund also may have limited ability to eliminate its exposure under a CDS if the reference instrument has declined in value.

Total Return Swaps. A total return swap is a contract in which one party agrees to make periodic payments to another party based on the change in market value of a referenced asset during the specified period, in return for periodic payments from the other party that are based on a fixed or variable interest rate or the total return of the referenced asset or another referenced asset. Total return swap agreements may be used to obtain exposure to a security or market without owning or taking physical custody of such security or investing directly in such market.

Leverage. Certain types of Fund transactions may give rise to economic leverage, which represents a non-cash exposure to the underlying asset, index, rate or instrument. Leverage can increase both the risk and return potential of the Fund.

The Fund is required to segregate liquid assets or otherwise cover the Fund’s obligation created by a transaction that may give rise to leverage. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage may cause the Fund’s share price to be more volatile than if it had not been leveraged, as certain types of leverage may exaggerate the effect of any increase or decrease in the value of the Fund’s portfolio securities. The loss on leveraged investments may substantially exceed the initial investment.

| Calvert Floating-Rate Advantage Fund | 14 | Prospectus dated February 1, 2019 |

Counterparty Risk. A financial institution or other counterparty with whom the Fund does business (such as trading or as a derivatives counterparty), or that underwrites, distributes or guarantees any instruments that the Fund owns or is otherwise exposed to, may decline in financial condition and become unable to honor its commitments. This could cause the value of Fund shares to decline or could delay the return or delivery of collateral or other assets to the Fund. Counterparty risk is increased for contracts with longer maturities.

Convertible Securities. A convertible security is a bond, debenture, note, preferred security, or other security that entitles the holder to acquire common stock or other equity securities of the same or a different issuer. A convertible security entitles the holder to receive interest paid or accrued or dividends paid until the convertible security matures or is redeemed, converted or exchanged. Before conversion, convertible securities have characteristics similar to nonconvertible income securities.

Holders of convertible securities generally have a claim on the assets of the issuer prior to the common stockholders but may be subordinated to other debt securities of the same issuer. Certain convertible debt securities may provide a put option to the holder, which entitles the holder to cause the securities to be redeemed by the issuer at a premium over the stated principal amount of the debt securities under certain circumstances. Certain convertible securities may include loss absorption characteristics that make the securities more debt-like. This is particularly true of convertible securities issued by companies in the financial services sector.

The value of a convertible security may be influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also may have an effect on the convertible security’s investment value. A convertible security may be subject to redemption at the option of the issuer at a price established in the convertible security’s governing instrument.

Preferred Stock. Preferred stock is a class of equity security that pays a specified dividend that typically must be paid before any dividends can be paid to common stockholders and takes precedence over common stock in the event of the issuer’s liquidation. Although preferred stocks represent an ownership interest in an issuer, preferred stocks generally do not have voting rights or have limited voting rights and have economic characteristics similar to fixed-income securities. Preferred stocks generally are issued with a fixed par value and pay dividends based on a percentage of that par value at a fixed or variable rate. Dividend payments on preferred stocks may be subordinate to interest payments on the issuer’s debt obligations. Certain preferred stocks may be convertible to common stock. Additionally, preferred stocks often have a liquidation value that generally equals the original purchase price of the preferred stock at the date of issuance.

Preferred stocks are subject to issuer-specific and market risks generally applicable to equity securities and credit and interest rate risks generally applicable to fixed-income securities. The value of preferred stock may react more strongly than bonds and other debt instruments to actual or perceived changes in the company’s financial condition or prospects.

Hybrid Securities. Hybrid securities generally possess certain characteristics of both equity and debt securities. These securities may at times behave more like equity than debt, or vice versa. Preferred stocks, convertible securities, trust preferred securities and certain debt obligations are types of hybrid securities. The investment adviser has sole discretion to determine whether an investment has hybrid characteristics and generally will consider the instrument’s preference over the issuer’s common shares, the term of the instrument at the time of issuance, and/or the tax character of the instrument’s distributions. Hybrid securities generally do not have voting rights or have limited voting rights. Hybrid securities may be subject to redemption at the option of the issuer at a predetermined price. Hybrid securities may pay a fixed or variable rate of interest or dividends. The prices and yields of nonconvertible hybrid securities generally move with changes in interest rates and the issuer’s credit quality, similar to the factors affecting debt securities. If the issuer of a hybrid security experiences financial difficulties, the value of such security may be adversely affected similar to the issuer’s outstanding common stock or subordinated debt instruments.