Form 485APOS DOMINI INVESTMENT TRUST

As filed with the Securities and Exchange Commission on September 14, 2018

Registration Nos. 33-29180

and 811-05823

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

POST-EFFECTIVE AMENDMENT NO. 64

AND

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

AMENDMENT NO. 66

DOMINI INVESTMENT TRUST

(Exact Name of Registrant as Specified in Charter)

180 Maiden Lane, Suite 1302, New York, New York 10038-4925

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: 212-217-1100

Amy Domini Thornton

Domini Impact Investments LLC

180 Maiden Lane, Suite 1302

New York, New York 10038-4925

(Name and Address of Agent for Service)

Copy To:

Roger P. Joseph, Esq.

Morgan Lewis & Bockius LLP

One Federal Street

Boston, Massachusetts 02110

It is requested that this filing become effective on November 14, 2018, pursuant to paragraph (a)(1) of Rule 485 under the Securities Act of 1933, as amended.

* This filing relates solely to the Domini Impact Equity Fund, a series of the Registrant.

[INSERT DATE], 2018

DOMINI IMPACT EQUITY FUNDSM

INVESTOR SHARES (DSEFX), CLASS A SHARES (DSEPX),

CLASS R SHARES (DSFRX), INSTITUTIONAL SHARES (DIEQX)

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a crime.

| 1 |

The Fund at a Glance | |

| A summary of the Fund’s investment objective, fees and expenses, portfolio turnover, investment strategies, risks, investment results, and management. | ||

| 5 |

Purchase and Sale of Fund Shares, Tax Information, and Payments to Broker-Dealers and Other Financial Intermediaries | |

| 6 |

More on the Fund’s Investment Objectives and Strategies | |

| 9 |

More on the Risks of Investing in the Fund | |

| 11 |

Impact Investing | |

| 12 |

Portfolio Holdings Information | |

| 13 |

Who Manages the Fund? | |

| 15 |

The Fund’s Distribution Plan | |

| A-1 |

Shareholder Manual | |

| Information about buying, selling, and exchanging shares of the Fund, how Fund shares are valued, Fund distributions, the tax consequences of an investment in the Fund, and how applicable sales charges are calculated. | ||

| B-1 |

Financial Highlights | |

| C-1 |

Intermediary-Defined Sales Charge Waiver Policies | |

| D-1 |

For Additional Information | |

DOMINI IMPACT EQUITY FUNDsm

Investment objective: The Fund seeks to provide its shareholders with long-term total return.

Fees and expenses of the Fund: The table below describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for Class A sales charge discounts if you and your family invest, or agree to invest in the future, at least $50,000 in the Investor or Class A shares of the Fund. More information about these and other discounts is available from your financial professional or in the Fund’s prospectus on page A-XX under the heading “How Sales Charges Are Calculated for Class A Shares” and on page C-1 under the heading “Intermediary-Defined Sales Charge Waiver Policies,” and in the Fund’s Statement of Additional Information (“SAI”) on page XX under the heading “Additional Information Regarding Class A Sales Charges.” If you invest in Institutional or Class R shares of the Fund through an investment professional or financial intermediary, that investment professional or financial intermediary may charge you a commission in an amount determined and separately disclosed to you by that investment professional or financial intermediary.

|

Shareholder fees (paid directly from your investment) |

| |||||||||||||||

| Share classes |

Investor | Class A | Institutional | Class R | ||||||||||||

| Maximum sales charge (load) imposed on purchases as a percentage of offering price |

None | 4.75% | None | None | ||||||||||||

| Maximum sales charge (load) imposed on purchases as a percentage of purchase or redemption |

None | $ |

None1 (under 1 million) |

|

None | None | ||||||||||

| Redemption fee on shares held less than 30 days (as a percentage of amount redeemed, if applicable) |

2.00% | 2.00% | 2.00% | 2.00% | ||||||||||||

| Paper document delivery fee (choose e-delivery to avoid this fee)2 |

$ | 15/year | $ | 15/year | $ | 15/year | $ | 15/year | ||||||||

|

Annual Fund operating expenses (expenses that you pay each year as a percentage of the value of your investment) |

| |||||||||||||||

| Share classes |

Investor | Class A | Institutional | Class R | ||||||||||||

| Management fees3 |

0.20% | 0.20% | 0.20% | 0.20% | ||||||||||||

| Distribution (12b-1) fees |

0.25% | 0.25% | None | None | ||||||||||||

| Other expenses |

||||||||||||||||

| Sponsorship fee |

[0.45%] | [0.45%] | [0.45%] | [0.45%] | ||||||||||||

| Other miscellaneous expenses |

[0.16%] | [0.44%] | [0.07%] | [0.15%] | ||||||||||||

| Total other expenses |

[0.61%] | [0.89%] | [0.52%] | [0.60%] | ||||||||||||

| Total annual Fund operating expenses |

[1.10%] | [1.38%] | [0.76%] | [0.84%] | ||||||||||||

| Fee waiver and expense reimbursements4 |

[-0.01%] | [-0.29%] | [-0.02%] | [-0.04%] | ||||||||||||

| Total annual Fund operating expenses after fee waiver and expense reimbursements |

1.09% | 1.09% | 0.74% | 0.80% | ||||||||||||

| 1 | Investments of $1 million or more are not subject to a front-end sales charge, but generally will be subject to a deferred sales charge of 1.00% if redeemed within one year of purchase. |

| 2 | Paper document delivery fee applies to direct Fund accounts with balances below $10,000 and may be avoided by choosing e-delivery of Fund statements, prospectuses, and reports. |

| 3 | Restated to reflect current fees. |

| 4 | The Fund’s adviser has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor, Class A and Institutional share expenses to 1.09, 1.09%, 0.74%, and 0.80%, respectively. The Investor, Class A, Institutional, and Class R share agreement expires on November 30, 2019, absent an earlier modification by the Fund’s Board. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated, that your investment has a 5% return each year, and that the Fund’s operating expenses (reflecting applicable contractual fee waivers and expense reimbursement arrangements) remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be as follows:

|

Share classes (whether or not shares ar eredeemed) |

1 Year | 3 Years | 5 Years | 10 Years | ||||||||||||

| Investor |

$ | 111 | $ | [349] | $ | [605] | $ | [1,339] | ||||||||

| Class A |

$ | 581 | $ | [864] | $ | [1,168] | $ | [2,030] | ||||||||

| Institutional |

$ | 76 | $ | [241] | $ | [420] | $ | [940] | ||||||||

|

Class R |

$ | 82 | $ | [264] | $ | [462] | $ | [[1,033] |

Portfolio turnover: The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s

1

performance but are already reflected in its total returns. During the most recent fiscal year, the Fund’s portfolio turnover rate was [85%] of the average value of its portfolio.

Principal investment strategies: Under normal circumstances, the Fund primarily invests in the equity securities of mid- and large-capitalization U.S. companies. Under normal circumstances, at least 80% of the Fund’s net assets (plus the amount of borrowings, if any, for investment purposes) will be invested in equity securities and related investments with similar economic characteristics including derivative instruments such as futures and options. For purposes of the Fund’s investment policies, equity securities include common stocks, depositary receipts, warrants, rights, preferred shares, equity interests in real estate investment trusts (REITs), and funds that invest primarily in equity securities. The Fund may also invest in companies organized or traded outside the U.S. The Fund may have significant exposure to securities of issuers in the technology, financial, health care and consumer discretionary sectors. The Fund may hold cash or other short-term investments to provide the Fund with the flexibility to meet redemptions and expenses and to readjust its portfolio holdings.

The Fund will invest in companies that Domini Impact Investments LLC (“Domini”) believes have strong environmental and social profiles. The Fund may also invest in companies that Domini believes help create products and services that provide sustainability solutions and are evaluated using fundamental analysis. The Fund may sell a security if the issuer fails to meet Domini’s social and environmental standards or sustainability themes. The Fund’s subadviser will purchase and sell securities to implement Domini’s investment selections and manage the amount of the Fund’s assets to be held in short-term investments.

In the course of pursuing their financial objectives, impact investors seek to use their investments to create a more fair and sustainable world. Domini believes that by factoring social and environmental sustainability standards into their investment decisions, investors can encourage greater corporate accountability. Domini evaluates the Fund’s potential investments against its social and environmental standards based on the businesses in which an issuer engages, as well as on the quality of the issuer’s relations with key stakeholders, including communities, customers, ecosystems, employees, investors, and suppliers. Domini’s interpretation and application of its social and environmental standards are subjective and may evolve over time.

Principal Risks: Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly in the short and long term. An investment in the Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. You may lose all or part of your investment in the Fund or your investment may not perform as well as other similar investments. There is no guarantee that the Fund’s investment objective will be achieved. The following is a summary description of certain risks of investing in the Fund.

| • | Cybersecurity Risk. Cybersecurity failures or breaches by the Fund’s adviser, transfer agent, distributor, custodian, fund accounting agent and other service providers may disrupt Fund operations, interfere with the Fund’s ability to calculate its NAV, prevent Fund shareholders from purchasing, redeeming or exchanging shares or receiving distributions, cause loss of or unauthorized access to private shareholder information, and result in financial losses, regulatory fines, penalties, reputational damage, or additional compliance costs. |

| • | Foreign Investing Risk. Investments in foreign regions or in securities of issuers with significant exposure to foreign markets may be more volatile and less liquid than U.S. investments due to adverse political, social, and economic developments, such as nationalization or expropriation of assets, imposition of currency controls or restrictions, confiscatory taxation, terrorism and political or financial instability; regulatory differences such as accounting, auditing, and financial reporting standards and practices; natural disasters; and the degree of government oversight and supervision. |

| • | Impact Investing Risk. The application of the adviser’s social and environmental standards will affect the Fund’s exposure to certain issuers, industries, sectors, regions, and countries and may impact the relative financial performance of the Fund — positively or negatively — depending on whether such investments are in or out of favor. |

| • | Information Risk. There is a risk that information used by the adviser to evaluate the social and environmental performance of issuers, industries, markets, sectors, and regions may not be readily available, complete, or accurate, which could negatively impact the adviser’s ability to apply its social and environmental standards, which may negatively impact Fund performance. This may also lead the Fund to avoid investment in certain issuers, industries, markets, sectors, or regions. |

| • | Liquidity Risk. The Fund may make investments that are illiquid or that become illiquid after purchase. The liquidity and value of investments can deteriorate rapidly, and they may become difficult to purchase or sell, or may be illiquid, particularly during times of market turmoil. Illiquid securities also may be difficult to value. Markets may become illiquid when, for instance, there are few, if any, interested buyers or sellers or when dealers are unwilling or unable to make markets for certain securities. Due to limitations on investments in illiquid securities, the Fund may be unable to achieve its desired level of exposure to certain sectors. If the Fund is forced to sell an illiquid investment to meet redemption requests or other cash needs, the Fund may be forced to sell such securities at a loss. |

| • | Market Risk. The value of Fund securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets or adverse investor sentiment. If the value of the securities owned by the Fund fall, the value of your investment will decline. In the past decade, financial markets throughout the world have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. Governmental and non-governmental |

2

| issuers have defaulted on, or been forced to restructure, their debts. These conditions may continue, recur, worsen or spread. Events that have contributed to these market conditions include, but are not limited to, major cybersecurity events; geopolitical events (including wars and terror attacks); measures to address budget deficits; downgrading of sovereign debt; declines in oil and commodity prices; dramatic changes in currency exchange rates; and public sentiment. The U.S. government and the Federal Reserve, as well as certain foreign governments and their central banks, have taken steps to support financial markets, including by keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The Federal Reserve has reduced its market support activities and recently has begun raising interest rates. Certain foreign governments and central banks are implementing so-called negative interest rates (e.g., charging depositors who keep their cash at a bank) to spur economic growth. Further Federal Reserve or other U.S. or non-U.S. governmental or central bank actions, including interest rate increases or contrary actions by different governments, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Fund invests. |

| • | Mid- to Large-Cap Companies Risk. The market prices of companies at different capitalization levels may go up or down due to general market conditions and cycles. The value of your investment will be affected by the Fund’s exposure to mid- and large-cap companies. |

| • | Portfolio Turnover Risk. If the Fund does a lot of trading it may incur additional operating expenses which would reduce performance, and could cause shareowners to incur a higher level of taxable income or capital gains. |

| • | Redemption Risk. The Fund may experience heavy redemptions that could cause it to liquidate its assets at inopportune times or at a loss or depressed value, which could cause the value of your investment to decline. |

| • | Market Sector Risk. The Fund may hold a large percentage of securities in a single market sector. To the extent the Fund holds a large percentage of securities in a single sector, its performance will be tied closely to and affected by the performance of that sector, and the Fund will be subject to a greater degree to any market price movements, regulatory or technological change, economic conditions or other developments or risks affecting such market sector than a fund without the same focus |

| - | Technology Sector Risk. Securities in the technology sector, such as information technology, communications equipment, computer hardware and software, and office and scientific equipment, are generally subject to risks of rapidly evolving technology, short product lives, rates of corporate expenditures, falling prices and profits, competition from new market entrants, and general economic conditions. |

| - | Financial Sector Risk. Issuers in the financial sector, such as banks, insurance companies and broker-dealers, may be sensitive to changes in interest rates and general economic activity and are generally subject to extensive government regulation. |

| - | Health Care Sector Risk. Securities in the health care sector, such as health care supplies, health care services, biotechnology and pharmaceuticals, may be significantly affected by government regulation and reimbursement rates, approval of products by government agencies, and patent expirations and litigation. |

| - | Consumer Discretionary Sector Risk. Securities in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly affected by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes. . |

| • | Valuation Risk. The sales price the Fund could receive for any particular portfolio investment may differ from the Fund’s valuation of the investment, particularly for securities that trade in thin or volatile markets or that are valued using a fair value methodology. Investors who purchase or redeem Fund shares on days when the Fund is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the Fund had not fair-valued the securities or had used a different valuation methodology. The Fund’s ability to value its investments may be impacted by technological issues and/or errors by pricing services or other third party service providers. |

These and other risks are discussed in more detail later in this prospectus or in the SAI. Please note that there are many other factors that could adversely affect your investment and that could prevent the Fund from achieving its goals.

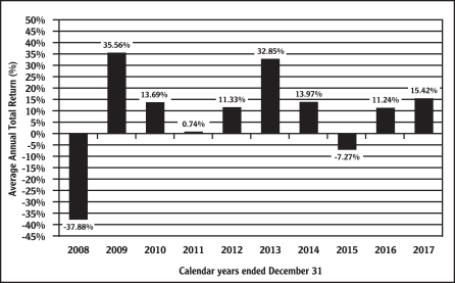

Investment results: The bar chart and table below provide some indication of the risks of investing in the Fund by showing changes in the Fund’s performance from year to year for Investor shares and by showing how the Fund’s average annual total returns for 1, 5, and 10 years compare with those of a broad measure of market performance, the Standard and Poor’s 500 Index (S&P 500), an unmanaged index of common stocks. SSGA FM commenced subadvisory services for the Fund on December 1, 2018. A different subadviser served as the Fund’s subadviser for periods prior to December 1, 2018. The performance shown for periods prior to December 1, 2018, reflects the investment strategies employed during those periods. The returns for each class of the Fund will differ from Investor shares because of the different expenses applicable to those share classes. The returns presented in the table for periods prior to the inception of the Class A and Institutional shares, are those of the Investor shares. Class A shares and Institutional shares commenced operations on November 28, 2008.

3

These returns have not been adjusted to take into account the lower expenses applicable to Class A and Institutional shares, but for Class A shares, the returns in the table reflect a deduction for the maximum sales charge. Updated information on the Fund’s investment results can be obtained by visiting www.domini.com/performance or by calling 1-800-582-6757.

The Fund’s past results (before and after taxes) are not necessarily an indication of how the Fund will perform in the future.

Highest/lowest quarterly results during this time period were: 20.58% (quarter ended 6/30/09) and –24.04% (quarter ended 12/31/08). The Fund’s year-to-date results as of the most recent calendar quarter ended 09/30/2018 were [–0.70]%.

| Average annual total returns for periods ended December 31, 2017 (with maximum sales charge for Class A shares) | ||||||

| 1 Year | 5 Years | 10 Years | ||||

| Domini Impact Equity Fund |

||||||

| Investor shares: |

||||||

| Return before taxes |

15.42% | 12.51% | 6.83% | |||

| Return after taxes on distributions |

14.02% | 11.27% | 6.18% | |||

| Return after taxes on distributions and sale of shares |

9.85% | 9.84% | 5.43% | |||

| Class A shares return before taxes |

9.96% | 11.41% | 6.31% | |||

| Institutional shares return before taxes |

15.80% | 12.93% | 6.83% | |||

| Class R shares return before taxes |

15.85% | 12.87% | 7.19% | |||

| S&P 500 (reflects no deduction for fees, expenses, or taxes) |

21.83% | 15.79% | 8.50% | |||

After-tax returns are shown only for Investor shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the highest individual marginal federal income tax rates in effect during each year of the periods shown and do not reflect the impact of state and local taxes. Your actual after-tax returns depend on your individual tax situation and likely will differ from the results shown above. In addition, after-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as a 401(k) plan or individual retirement account (IRA).

Investment adviser: Domini Impact Investments LLC (“Domini”)

Portfolio managers: Amy Domini Thornton, Chair and Co-Manager of Domini (portfolio manager of the Fund since December 1, 2018); Carole M. Laible, CEO and Co-Manager of Domini (portfolio manager of the Fund since December 1, 2018);

Subadviser: SSGA Funds Management, Inc. (“SSGA FM”)

Portfolio manager: Kathleen Morgan, CFA, Vice President of SSGA FM and a Senior Portfolio Manager in the Global Equity Beta Solutions Group (portfolio manager of the Fund since December 1, 2018).

For important information about purchase and sale of Fund shares, tax information, and financial intermediary compensation, please turn to “Purchase and Sale of Fund Shares, Tax Information, and Payments to Broker-Dealers and Other Financial Intermediaries” on page XX of the Fund’s prospectus.

4

PURCHASE AND SALE OF FUND SHARES, TAX INFORMATION, AND PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

Purchase and Sale of Fund Shares. You may redeem shares of the Fund each day the New York Stock Exchange (NYSE) is open. You should contact your financial intermediary or Service Organization, or if you hold your shares directly, you should contact the Fund by phone (Shareholder Services at 800-582-6757 for Investor, Institutional, and Class R shares or Fund Services at 800-498-1351 for Class A shares), by mail (Domini Funds, P.O. Box 9785, Providence, RI 02940-9785), or online by visiting www.domini.com and selecting “Account Access.”

The Fund’s initial and subsequent investment minimums for eligible shareholders generally are as follows:

| Investment

minimum Initial/Additional Investment |

||||||||

|

Investor (DSEFX/ DOMIX/ |

Class A (DSEPX/ DOMAX) |

Institutional (DIEQX/ |

Class R (DSFRX) | |||||

| Individual and Joint Accounts (nonretirement) |

$2500/$100 | $2500/$100 | $500,000/ None |

N/A | ||||

| Retirement Accounts (e.g., IRA, SEP-IRA, SIMPLE IRA) |

$1500/$100 | $1500/$100 | $500,000/ None |

N/A | ||||

| Uniform Gifts/Transfers to Minor Accounts (UGMA/ UTMA); Coverdell Education Savings Accounts |

$1500/$100 | $1500/$100 | $500,000/ None |

N/A | ||||

| Accounts for Organizations (e.g.,401k, trust, corporation, partnership, foundation, endowment, or other entity) |

$2500/$100 | $2500/$100 | $500,000/ None |

None |

Investment minimums are $1500/$50 for Investor Class and Class A purchases through Automatic Investment Plans. Minimums may be waived for purchases through certain omnibus accounts or may be at a different level established by your broker-dealer, financial institution, or financial intermediary.

Tax information. The Fund’s distributions are generally taxable, and will be taxed as ordinary income, qualified dividend income, or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Withdrawal of monies from those accounts may be subject to tax. For additional information, please see “Taxes” in the Shareholder Manual and “Taxation” in the Statement of Additional Information.

Payments to broker-dealers and other financial intermediaries. The Fund and its related companies may pay broker-dealers or other financial intermediaries (such as a bank) for the sale of Fund shares and related services. These payments create a conflict of interest by influencing your broker-dealer or other intermediary or its employees or associated persons to recommend the Fund over another investment. Ask your financial adviser or visit your financial intermediary’s website for more information.

5

MORE ON THE FUND’S INVESTMENT OBJECTIVES AND STRATEGIES

Investment Objective

The Fund’s investment objective may be changed by the Fund’s Board of Trustees without shareholder approval, but shareholders will be given notice at least 30 days before any change to the investment objective is implemented. Management currently has no intention to change the Fund’s investment objective.

DOMINI IMPACT EQUITY FUND

The investment objective of the Domini Impact Equity Fund (the Fund) is to provide its shareholders with long-term total return. Total return is comprised of current income and capital appreciation.

As a primary strategy, under normal circumstances the Fund invests at least 80% of the Fund’s net assets (plus the amount of borrowings, if any, for investment purposes) in equity securities and related investments with similar economic characteristics including derivative instruments such as futures and options. The Fund will provide shareholders with at least 60 days’ prior written notice if it changes this 80% policy. For purposes of the Fund’s investment policies, equity securities include common stocks, depositary receipts, warrants, rights, preferred shares, equity interests in real estate investment trusts (REITs), and funds that invest primarily in equity securities. The Fund may invest in companies of any capitalization, but under normal market conditions will invest primarily in mid-cap to large-cap U.S. companies. Domini defines mid- and large-cap companies to be those companies with a market capitalization at the time of purchase between $2 and $10 billion, or greater than $10 billion, respectively. It is expected that at least 80% of the Fund’s assets will be invested in mid- to large-cap companies under normal market conditions.

As a primary strategy, under normal circumstances the Fund invests in stocks of U.S. companies. While Domini expects that most of the securities held by the Fund will be traded in U.S. securities markets, as an additional strategy some could be traded outside the U.S. The Fund may hold up to 15% of its assets in issuers tied economically to countries outside the U.S.

A security will be deemed to be tied economically to a country if: (1) the issuer is organized under the laws of, or has a principal place of business in that country; or (2) the principal listing of the issuer’s securities is in a market that is in that country; or (3) the issuer derives at least 50% of its total revenues or profits from goods that are produced or sold, investments made, or services performed in that country; or (4) the issuer has at least 50% of its assets located in that country.

The Fund may have significant exposure to securities of issuers in the technology, financial, health care and consumer discretionary sectors. The Fund may hold cash or other short-term investments to provide the Fund with the flexibility to meet redemptions and expenses and to readjust its portfolio holdings.

The Fund will invest in securities that Domini believes have strong environmental and social profiles. The Fund may also invest in companies that Domini believes help create products and services that provide sustainability solutions and are evaluated using fundamental analysis. The Fund may sell a security if the issuer fails to meet Domini’s social and environmental standards or sustainability themes. SSGA FM will purchase and sell securities to implement Domini’s investment selections and manage the amount of the Fund’s assets to be held in short-term investments. The Fund’s investment strategies and policies may be changed from time to time without shareholder approval, unless specifically stated otherwise in this Prospectus or in the SAI.

Application of Domini’s Impact Investment Standards

In the course of pursuing their financial objectives, impact investors seek to use their investments to create a more fair and sustainable world. Domini believes that by factoring social and environmental sustainability standards into their investment decisions, investors can encourage greater corporate accountability. The Fund’s holdings are selected from a universe of eligible investments that Domini has identified based on its evaluation against Domini’s social and environmental standards. Domini evaluates the Fund’s potential investments against its social and environmental standards based on the businesses in which an issuer engages, as well as on the quality of the issuer’s relations with key stakeholders, including communities, customers, ecosystems, employees, investors, and suppliers, and determines the strength of a company’s social and environmental profile. Domini’s interpretation and application of its social and environmental standards are subjective and may evolve over time. Fund holdings may also be selected from a universe of securities Domini determines are creating products and services that provide sustainability solutions.

Subadviser

The Fund’s subadviser invests in securities Domini has selected and notified the subadviser are eligible for investment. The subadviser will purchase or sell securities at a time determined appropriate by the subadviser and in accordance with, but not necessarily identically to, the weights provided with Domini’s investment selections, or as necessary to manage the amount of the Fund’s assets to be held in short term investments.

6

OTHER FUND INVESTMENT STRATEGIES

Use of Depositary Receipts

Securities of foreign issuers may be purchased directly or through depositary receipts, such as American Depositary Receipts (ADRs), European Depositary Receipts (EDRs), and Global Depositary Receipts (GDRs), or other securities representing underlying shares of foreign companies. Generally, ADRs, in registered form, are designed for use in U.S. securities markets, and EDRs and GDRs, in bearer form, are designed for use in European and global securities markets. ADRs are receipts typically issued by a U.S. bank or trust company evidencing ownership of the underlying securities. EDRs and GDRs are European and global receipts, respectively, evidencing a similar arrangement. The use of all such instruments is subject to Domini’s social and environmental standards.

Use of Options, Futures, and Other Derivatives

Although it is not a principal investment strategy, the Fund may purchase and sell futures, options, swap agreements, currency forwards, and/or utilize other derivative contracts and securities with respect to stocks, bonds, groups of securities (such as financial indexes), foreign currencies, interest rates, or inflation indexes. The Fund may also utilize derivative instruments, such as equity-linked securities, to gain exposure to certain emerging-markets, but not as a principal investment strategy. These techniques, which are incidental to the Fund’s primary strategy, permit the Fund to gain exposure to a particular security, group of securities, currency, interest rate, or index, and thereby have the potential for the Fund to earn returns that are similar to those that would be earned by direct investments in those securities or instruments. The Fund may choose not to make use of derivatives for a variety of reasons, and any use may be limited by applicable laws and regulations. The use of all such instruments is subject to Domini’s social and environmental standards.

These techniques are also used to hedge against adverse changes in the market prices of securities, interest rates, or currency exchange rates. Hedging techniques may not always be available to the Fund, and it may not always be feasible for the Fund to use hedging techniques even when they are available.

Derivatives are instruments whose value depends on, or is derived from, the value of an underlying asset, reference rate or index. Derivatives may be riskier than other types of investments because they may be more sensitive to changes in economic or market conditions than other types of investments and could result in losses that significantly exceed the Fund’s original investment. If the issuer of the derivative instrument does not pay the amount due, the Fund could lose money on the instrument. In addition, the underlying security or investment on which the derivative is based, or the derivative itself, may not perform the way the Fund’s subadviser expected. Certain derivatives may be less liquid, which may reduce the returns of the Fund if it cannot sell or terminate the derivative at an advantageous time or price. The Fund also may have to sell assets at inopportune times to satisfy its obligations. The Fund may be unable to terminate or sell its derivative positions, In fact, many over-the-counter derivative instruments will not have liquidity beyond the counterparty to the instrument. Some derivatives may involve the risk of improper valuation.

Successful use of derivative instruments by the Fund depends on the Subadviser’s judgment with respect to a number of factors and the Fund’s performance could be worse and/or more volatile than if it had not used these instruments. In addition, the fluctuations in the value of derivatives may not correlate perfectly with the value of any portfolio assets being hedged, the performance of the asset class to which the Subadviser seeks exposure, or the overall securities markets. As a result, the use of these techniques may result in losses to the Fund or increase volatility in the Fund’s performance.

Some derivatives are sophisticated instruments that typically involve a small investment of cash relative to the magnitude of risks assumed. Some derivatives have the potential for unlimited loss, regardless of the size of the Fund’s initial investment. Derivatives may have a leveraging effect on the Fund’s portfolio. Leverage generally magnifies the effect of a change in the value of an asset and creates a risk of loss of value in a larger pool of assets than the Fund would otherwise have had. Derivative securities are subject to market risk, which could be significant for those that have a leveraging effect. Use of derivatives or similar instruments may have different tax consequences for the Fund than an investment in the underlying security, and those differences may affect the amount, timing and character of income distributed to shareholders, including the proportion of income consisting of exempt-interest dividends.

When the Fund enters into derivative transactions, it may be required to segregate assets, or enter into offsetting positions, in accordance with applicable regulations. Such segregation will not limit the Fund’s exposure to loss, however, and the Fund will have investment risk with respect to both the derivative itself and the assets that have been segregated to cover the Fund’s derivative exposure. If the segregated assets represent a large portion of the Fund’s portfolio, this may impede portfolio management or the Fund’s ability to meet redemption requests or other current obligations.

The Fund’s use of derivatives may also increase the amount of taxes payable by shareholders. Suitable derivatives may not be available in all circumstances or at reasonable prices. Risks associated with the use of derivatives are magnified to the extent that a large portion of the Fund’s assets are committed to derivatives in general or are invested in just one or a few types of derivatives.

The U.S. government and foreign governments are in the process of adopting and implementing regulations governing derivative markets, including mandatory clearing of certain derivatives, margin and reporting requirements. The ultimate impact of the regulations remains unclear. Additional regulation of derivatives may make derivatives more costly, may limit their availability or

7

utility or otherwise adversely affect their performance, or may disrupt markets. The Fund may be exposed to additional risks as a result of the additional regulations. The extent and impact of the regulations are not yet fully known and may not be for some time. In addition, the SEC has proposed a new rule that would change the regulation of the use of derivatives by registered investment companies, such as the Fund. If the proposed rule takes effect, it could limit the ability of the Fund to invest in derivatives.

For derivatives that are required to be traded through a clearinghouse or exchange, the Fund also will be exposed to the credit risk of the clearinghouse and the broker that submits trades for the Fund. It is possible that certain derivatives that are required to be cleared, such as certain swap contracts, will not be accepted for clearing. The Fund will be required to maintain its positions with a clearing organization through one or more clearing brokers. The clearing organization will require the Fund to post margin and the broker may require the Fund to post additional margin to secure the Fund’s obligations. The amount of margin required may change from time to time. In addition, cleared transactions may be more expensive to maintain than over-the-counter transactions and may require the Fund to deposit larger amounts of margin. The Fund may not be able to recover margin amounts if the broker has financial difficulties. Also, the broker may require the Fund to terminate a derivatives position under certain circumstances. This may cause the Fund to lose money.

The Adviser has claimed an exclusion from registration as a commodity pool operator. CFTC rules therefore limit the ability of the Fund to use futures, options on futures, or engage in swap transactions. The use of certain derivatives in some circumstances will require that the Fund segregate cash or other liquid assets to the extent the Fund’s obligations are not otherwise “covered” through ownership of the underlying security, financial instrument, or currency.

Cash Reserves

Although the Fund seeks to be fully invested at all times, each keeps a percentage of its assets in cash or cash equivalents. These reserves provide the Fund with flexibility to meet redemptions and expenses, and to readjust its portfolio holdings. The Fund may hold these cash reserves uninvested or may invest them in high-quality, short-term debt securities issued by agencies or instrumentalities of the U.S. government, bankers’ acceptances, commercial paper, certificates of deposit, bank deposits, or repurchase agreements. Some of the investments may be with community development banks and financial institutions and may not be insured by the FDIC. All such securities are subject to Domini’s social and environmental standards.

Temporary Investments

The Fund may temporarily use a different investment strategy for defensive purposes in response to adverse market conditions, economic factors, or other occurrences, and may invest part or all of its assets in securities with remaining maturities of less than one year or cash equivalents, or may hold cash. This may adversely affect the Fund’s performance. During such periods, it may be more difficult for the Fund to achieve its investment objective. You should note, however, that the Fund has not used a different investment strategy for defensive purposes in the past and may decide not to do so in the future — even in the event of deteriorating market conditions.

Securities Lending

Consistent with applicable regulatory policies, including those of the Board of Governors of the Federal Reserve System and the SEC, the Fund may make loans of its securities to member banks of the Federal Reserve System and to broker-dealers. These loans would be required to be secured continuously by collateral consisting of securities, cash, or cash equivalents maintained on a current basis at an amount at least equal to the market value of the securities loaned. The Fund would have the right to terminate a loan and obtain the securities loaned at any time on three days’ notice. During the existence of a loan, the Fund would continue to collect the equivalent of the dividends paid by the issuer on the securities loaned and would also receive interest on investment of cash collateral. The Fund may pay finders and other fees in connection with securities loans. The Fund will continue to have market risk and other risks associated with owning the securities on loan, as well as the risks associated with the investment of the cash collateral received in connection with the loan. Securities lending also is subject to other risks, including the risk that the borrower fails to return a loaned security, and/or there is a shortfall on the collateral posted by the borrower, and the risk that the Fund is unable to recall a security in time to exercise voting rights or sell the security.

Additional Information

The Fund is not required to use every investment technique or strategy listed in this prospectus or in the Statement of Additional Information. For additional information about the Fund’s investment strategies and risks, the Fund’s Statement of Additional Information is available, free of charge, from Domini, or online at www.domini.com/funddocuments.

8

MORE ON THE RISKS OF INVESTING IN THE FUND

The value of your investment the Fund changes with the values of its investments. Many factors can positively or negatively affect those values. The factors that are most likely to have a material negative effect on your investment are called “Principal Risks.” The Principal Risks of the Fund are identified in the “Funds at a Glance” section and are described in more detail below. The Fund may be subject to additional risks other than those described below because the types of investments made by the Fund can change over time.

Additional investment policies and risks of the Fund are set forth in the Statement of Additional Information of the Fund, which is available upon request.

Consumer Discretionary Sector Risk. The investment of the Fund of a large percentage of its holdings in securities of issuers in the consumer discretionary sector will subject the Fund to a greater degree to any market price movements, regulatory or technological change, economic conditions or other developments affecting the issuers or companies in the consumer discretionary sector. Securities in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly affected by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes.

Cybersecurity Risk. Cybersecurity failures or breaches by the Fund’s adviser, transfer agent, distributor, custodian, fund accounting agent and other service providers may disrupt Fund operations, interfere with the Fund’s ability to calculate its NAV, prevent Fund shareholders from purchasing, redeeming or exchanging shares or receiving distributions, cause loss of or unauthorized access to private shareholder information, and result in financial losses, regulatory fines, penalties, reputational damage, or additional compliance costs. Substantial costs may be incurred in order to prevent any cyber incidents in the future. The Fund and its shareholders could be negatively impacted as a result.

Financial Sector Risk. The investment of the Fund of a large percentage of its holdings in securities of issuers in the financials sector will subject the Fund to a greater degree to any market price movements, regulatory or technological change, economic conditions or other developments affecting the issuers or companies in the financial -sector. Issuers in the financial sector, such as banks, insurance companies and broker-dealers, may be sensitive to changes in interest rates and general economic activity and are generally subject to extensive government regulation.

Foreign Investing Risk. The investment of the Fund in securities of issuers tied economically to a foreign country or foreign regions may represent a greater degree of risk than investment in U.S. securities due to political, social, and economic developments, such as nationalization or expropriation of assets, confiscatory taxation, natural disasters, terrorism, and political or financial instability. Additionally, there is risk resulting from the differences between the regulations to which U.S. and foreign issuers and markets are subject, such as accounting, auditing, and financial reporting standards and practices, and the degree of government oversight and supervision. These factors can make foreign investments more volatile and potentially less liquid than U.S. investments. In addition, foreign markets can perform differently from the U.S. market. A governmental entity may delay, or refuse or be unable to pay, interest or principal on its sovereign debt due to cash flow problems, insufficient foreign currency reserves, political considerations, the relative size of the governmental entity’s debt position in relation to the economy or the failure to put in place economic reforms. Some markets in which the Fund may invest are located in parts of the world that have historically been prone to natural disasters that could result in a significant adverse impact on the economies of those countries and investments made in those countries. China and other developing market Asia-Pacific countries may be subject to considerable degrees of economic, political and social instability. A number of countries in the European Union (EU) have experienced, and may continue to experience, severe economic and financial difficulties. In addition, voters in the United Kingdom have approved withdrawal from the European Union. Other countries may seek to withdraw from the European Union and/or abandon the euro, the common currency of the European Union.

Health Care Sector Risk. The investment of the Fund of a large percentage of its holdings in securities of issuers in the health care sector will subject the Fund to a greater degree to any market price movements, regulatory or technological change, economic conditions or other developments affecting the issuers or companies in the health care sector. Securities in the health care sector, such as health care supplies, health care services, biotechnology and pharmaceuticals, may be significantly affected by government regulation and reimbursement rates, approval of products by government agencies, and patent expirations and litigation.

Impact Investing Risk. Since the Fund seeks to make sustainable investments that are consistent with Domini’s social and environmental standards, it may choose to sell, or not purchase, investments that are otherwise consistent with its investment objective. In general, the application of the adviser’s social and environmental standards will affect the Fund’s exposure to certain issuers, industries, sectors, regions, and countries and may impact the relative financial performance of the Fund — positively or negatively — depending on whether such investments are in or out of favor.

Information Risk. Domini generally relies on information that is provided by third parties or is self-reported by issuers to apply its social and environmental standards to issuers and/or certain industries, markets, sectors or regions for the Fund. Therefore, there is a risk in certain circumstances that sufficient information may not be readily available, complete, or accurate, or may be biased. This

9

may affect the way Domini’s standards are applied in a particular situation, which may negatively impact Fund performance. In certain circumstances, this may also lead Domini to avoid certain issuers, markets, industries, sectors, or regions.

Liquidity Risk. Liquidity risk exists when particular investments are difficult to purchase or sell. When the Fund holds these types of investments, the Fund’s portfolio may be more difficult to value, especially during periods of market turmoil. Markets may become illiquid when there are few, if any, interested buyers or sellers or when dealers are unwilling or unable to make a market for certain securities. When the Fund holds illiquid investments, the Fund’s portfolio may be harder to value, especially in changing markets. Investments by the Fund in derivatives tend to involve greater liquidity risk. If the Fund is forced to sell or unwind these investments to meet redemptions or for other cash needs, the Fund may suffer a loss. Additionally, the market for certain investments may become illiquid under adverse market or economic conditions independent of any specific adverse changes in the conditions of a particular issuer. In such cases, the Fund, due to limitations on investments in illiquid securities and the difficulty in purchasing and selling such securities, may be unable to achieve its desired level of exposure to certain sectors. Further, certain securities, once sold, may not settle for an extended period. The Fund will not receive its sales proceeds until that time, which may constrain the Fund’s ability to meet its obligations (including obligations to redeeming shareholders).

Market Risk. The value of the Fund’s securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets or adverse investor sentiment. If the value of the securities owned by the Fund fall, the value of your investment in the Fund will decline. In the past decade, financial markets throughout the world have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. Governmental and non-governmental issuers have defaulted on, or been forced to restructure, their debts. These conditions may continue, recur, worsen or spread. Events that have contributed to these market conditions include, but are not limited to, major cybersecurity events; geopolitical events (including wars and terror attacks); measures to address budget deficits; downgrading sovereign debt; declines in oil and commodity prices; dramatic changes in currency exchange rates; and public sentiment. The U.S. government and the Federal Reserve, as well as certain foreign governments and their central banks, have taken steps to support financial markets, including by keeping interest rates at historically low levels. This and other government intervention may not work as intended, particularly if the efforts are perceived by investors as being unlikely to achieve the desired results. The Federal Reserve has reduced its market support activities and recently has begun raising interest rates. Certain foreign governments and central banks are implementing or discussing so-called negative interest rates (e.g., charging depositors who keep their cash at a bank) to spur economic growth. Further Federal Reserve or other U.S. or non-U.S. governmental or central bank actions, including interest rate increases or contrary actions by different governments, could negatively affect financial markets generally, increase market volatility and reduce the value and liquidity of securities in which the Fund invests. Policy and legislative changes in the U.S. and in other countries are affecting many aspects of financial regulation, and may in some instances contribute to decreased liquidity and increased volatility in the financial markets. The impact of these changes on the markets, and the practical implications for market participants, may not be fully known for some time. Economies and financial markets throughout the world are increasingly interconnected. Economic, financial or political events, trading and tariff arrangements, terrorism, natural disasters and other circumstances in one country or region could have profound impacts on global economies or markets. As a result, whether or not the Fund invests in securities of issuers located in or with significant exposure to the countries directly affected, the value and liquidity of the Fund’s investments may be negatively affected. The Fund may experience a substantial or complete loss on any individual security or derivative position.

Market Sector Risk. The Fund may hold a large percentage of securities in a single market sector. To the extent the Fund holds a large percentage of securities in a single sector, its performance will be tied closely to and affected by the performance of that sector and the Fund will be subject to a greater degree to any market price movements, regulatory or technological change, economic conditions or other developments affecting the issuers or companies in such market sectors. For example, securities in the consumer discretionary sector, such as consumer durables, hotels, restaurants, media, retailing and automobiles, may be significantly affected by the performance of the overall economy, interest rates, competition, consumer confidence and spending, and changes in demographics and consumer tastes. Securities in the industrials sector, such as companies engaged in the production, distribution or service of products or equipment for manufacturing, agriculture, forestry, mining and construction, can be significantly affected by general economic trends, including such factors as employment and economic growth, interest rate changes, changes in consumer spending, legislative and governmental regulation and spending, import controls, commodity prices, and worldwide competition. Securities in the technology sector, such as information technology, communications equipment, computer hardware and software, and office and scientific equipment, are generally subject to risks of rapidly evolving technology, short product lives, rates of corporate expenditures, falling prices and profits, competition from new market entrants, and general economic conditions. Securities in the health care sector, such as health care supplies, health care services, biotechnology and pharmaceuticals, may be significantly affected by government regulation and reimbursement rates, approval of products by government agencies, and patent expirations and litigation.

Mid- to Large-Cap Companies Risk. Under normal circumstances, the Fund (the Fund) will invest primarily in mid-cap to large-cap companies. Mid-cap and large-cap stocks tend to go through cycles when they do better, or worse, than other asset classes or the stock market overall. The performance of the shareholder’s investment will be affected by these market trends. The Fund reserves the right to invest in companies of any capitalization, including small-cap companies that are more likely to have more limited product lines, fewer capital resources, and less depth of management than larger companies.

10

Portfolio Turnover Risk. If the Fund does a lot of trading, the Fund may incur additional operating expenses, which would reduce performance, and could cause shareowners to incur a higher level of taxable income on capital gains. These effects of higher than normal portfolio turnover may adversely affect Fund performance.

Redemption Risk. The Fund may experience periods of heavy redemptions that could cause the Fund to liquidate its assets at inopportune times or at a loss or depressed value, particularly during periods of declining or illiquid markets. Redemption risk is greater to the extent that the Fund has investors with large shareholdings, short investment horizons, or unpredictable cash flow needs. In addition, redemption risk is heightened during periods of overall market turmoil. The redemption by one or more large shareholders of their holdings in the Fund could hurt performance and/or cause the remaining shareholders in the Fund to lose money. Further, if one decision maker has control of fund shares owned by separate Fund shareholders, including clients or affiliates of the fund’s adviser, redemptions by these shareholders may further increase the Fund’s redemption risk. If the Fund is forced to liquidate its assets under unfavorable conditions or at inopportune times, the Fund’s share price could decline.

Small-Cap Companies Risk. Compared to large companies, small-size companies, and the market for their equity securities, may be more sensitive to changes in earnings results and investor expectations, have more limited product lines and capital resources, experience sharper swings in market values, have limited liquidity, be harder to value or to sell at the times and prices the adviser thinks appropriate, and offer greater potential for gain and loss. Technology Sector Risk. The investment of the Fund of a large percentage of its holdings in securities of issuers in the technology sector will subject the Fund to a greater degree to any market price movements, regulatory or technological change, economic conditions or other developments affecting the issuers or companies in the technologysector. Securities in the technology sector, such as information technology, communications equipment, computer hardware and software, and office and scientific equipment, are generally subject to risks of rapidly evolving technology, short product lives, rates of corporate expenditures, falling prices and profits, competition from new market entrants, and general economic conditions.

Valuation Risk. Many factors may influence the price at which the Fund could sell any particular portfolio investment. The sales price the Fund (the Fund) could receive for any particular portfolio investment may well differ from the Fund’s valuation of the investment, and such differences could be significant, particularly for securities that trade in relatively thin markets and/or markets that experience volatility. If markets make it difficult to value some investments, the Fund may value these investments using more subjective methods, such as fair valuation methodologies. Investors who purchase or redeem Fund shares on days when the Fund is holding fair-valued securities may receive fewer or more shares or lower or higher redemption proceeds than they would have received if the Fund had not fair-valued the securities or had used a different valuation methodology. The value of foreign securities, certain fixed-income securities and currencies, as applicable, may be materially affected by events after the close of the market on which they are valued, but before the Fund determines its net asset value. The Fund’s ability to value its investments may be impacted by technological issues and/or errors by pricing services or other third party service providers.

In the course of pursuing their financial objectives, impact investors seek to use their investments to create a more fair and sustainable world. Domini believes that by factoring social and environmental sustainability standards into their investment decisions, investors can encourage greater corporate accountability. The use of social and environmental standards may also help to identify companies that are led by more enlightened management, are focused on the creation of long-term value, and are better able to meet the needs of their stakeholders and of the planet.

Domini’s social and environmental standards are incorporated into its investment process. Domini believes the use of these standards in the investment process helps to more effectively align the financial markets with societal needs, build demand for data on corporate social and environmental performance, and communicate the expectations of impact investors to corporations and other investors. When appropriate, Domini engages in dialogue with the management of companies urging them to address the social and environmental impacts of their operations. In addition, Domini seeks to vote all company proxies in accordance with Domini’s published guidelines, which cover a wide range of social, environmental, and corporate governance matters.

The Social and Environmental Standards

Applied to the Domini Funds

Domini believes that its standards can help identify strong long-term investments, as well as highlight companies and other issuers that enrich society and the environment. Domini seeks to understand each company’s response to what Domini determines to be the key social and environmental challenges it faces.

Domini’s social and environmental standards are designed to reflect many of the standards widely used by impact investors. However, you may find that some Fund holdings do not reflect your social or environmental standards. You may wish to review a list of the holdings in the Fund’s portfolio to decide if they meet your personal standards. To learn how to obtain portfolio holdings information, please refer to “Portfolio Holdings Information.”

11

Domini’s interpretation and application of its social and environmental standards are subjective and may evolve over time. In addition, Domini may determine that it is necessary to reinterpret or customize its social and environmental standards for a particular region in response to business practices in different regions of the world.

Domini’s standards may limit the Fund’s investment in certain geographic areas due to prevailing political conditions that Domini believes affect the social and environmental performance of companies in those regions. In addition, Domini’s standards currently prohibit investment by the Fund in U.S. Treasuries, the general obligation securities issued by the U.S. government. While Domini recognizes that these securities support many public goods essential for our society, it has adopted this policy to reflect serious concerns about the risks posed by our country’s nuclear weapons arsenal and continuing large military expenditures.

Evaluation of Equity Investments

Domini considers whether a company has a strong environmental and social profile. Domini evaluates potential equity investments against its standards based on the core businesses in which a company engages, as well as on the quality of the company’s relations with key stakeholders, including communities, customers, ecosystems, employees, investors, and suppliers. Domini seeks to determine the degree of alignment between a company’s goods and services and its standards’ long term objective of universal human dignity and environmental sustainability. Domini believes that certain goods and services are misaligned with its standards and therefore ineligible for investment by the Fund.

Domini will seek to avoid investment in firms that it determines to be sufficiently involved with such goods and services to warrant exclusion. These goods and services include, but may not be limited to, alcohol, tobacco, gambling, weapons, nuclear power as well as owners and producers of oil or natural gas and companies substantially involved in coal mining. Major producers of synthetic pesticides and agricultural chemicals are also typically excluded, as are for profit companies substantially involved in the operation of prisons.

Domini will often determine that an investment is consistent with its standards even when the issuer’s profile reflects a mixture of positive and negative social and environmental characteristics. Domini recognizes that relationships with key stakeholders are complicated and that even the best of companies often run into problems day to day. Domini’s approach recognizes that a company with a mixed record may still be effectively grappling with the important issues in its industry and may determine that a company with a combination of controversies and praiseworthy initiatives is eligible for investment.

Fund holdings may also be selected from a universe of securities Domini determines are creating products and services that provide sustainability solutions.

Engagement

Each year, the Domini Funds seek to raise issues of social and environmental performance with the management of certain companies through proxy voting, dialogue with management, and by filing shareholder proposals, where appropriate. In foreign regions including European and Asia-Pacific countries, various barriers, including regulatory systems, geography, and language, may impair the Fund’s ability to use its influence effectively. In particular, due to onerous regulatory barriers, the Fund does not generally expect to file shareholder proposals outside the United States.

***

Domini’s interpretation and application of its social and environmental standards are subjective and may evolve over time. Domini may, at its discretion, choose to change its social or environmental standards, add additional standards, or modify the application of the standards to its investment process at any time. Changes to Domini’s investment process, including changes to Domini’s social or environmental standards or the application of the standards to Domini’s investment process, may impact investments held by the Fund, and may cause certain companies, sectors, industries, or countries to be dropped from or added to the Fund’s portfolio. Domini may vary the application of these standards to the Fund, depending, for example, on such factors as asset class, industry and sector representation, market capitalization, investment style, access to quality data on an issuer’s social or environmental performance, and cultural and political factors that may vary by region or country.

PORTFOLIO HOLDINGS INFORMATION

A description of the Fund’s policies and procedures with respect to the disclosure of the Fund’s portfolio securities is available in the Fund’ Statement of Additional Information and at www.domini.com/funddocuments. Currently, disclosure of the Fund’s holdings is required to be made within 60 days of the end of each fiscal semi-annual period (each July 31 and January 31) in the Annual Report and the Semi-Annual Report to Fund shareholders and as of the end of its first and third fiscal quarters (each October 31 and April 30) in publicly available filings of Form N-Q with the SEC.

To obtain copies of Annual and Semi-Annual Reports, free of charge, call 1-800-582-6757. Each Annual, Semi-Annual, and Form N-Q is available online at www.domini.com/funddocuments and on the EDGAR database on the SEC’s website, www.sec.gov.

12

Investment Adviser

Domini Impact Investments LLC) (Domini or the Adviser), 180 Maiden Lane, Suite 1302, New York, NY 10038, has been managing money since November 1997. As of September 30, 2018, Domini managed more than [$2.38] billion in assets for individual and institutional investors who are working to create positive change in society by using social and environmental standards in their investment decisions. Domini provides the Fund with investment supervisory services, overall operational support, and administrative services. Prior to November 30, 2016, Domini was known as Domini Social Investments LLC.

Domini uses proprietary social and environmental research to select the Fund’s investments. Domini’s social and environmental research is conducted by a team of analysts led by Amy Domini and Carole Laible, who serve as the Fund’s portfolio managers on behalf of Domini. The development and oversight of Domini’s social and environmental standards is the responsibility of its Standards Committee which may be convened as necessary for interpretation of Domini’s social and environmental standards. The Standards Committee currently includes Amy Domini, Carole Laible, and may include other Domini employees or industry experts.

The Fund employs a “manager of managers” structure under which the Adviser has responsibility to oversee any investment subadvisers and to recommend their hiring, termination, and replacement, subject to the oversight of the Board of Trustees of the Fund (the “Board”). The Fund has obtained an exemptive order from the SEC that permits the Adviser, upon approval of the Board, to change subadvisers without obtaining shareholder approval. Within 90 days of hiring any new subadviser, affected shareholders will be furnished with the information that would be included in a proxy statement regarding a new subadviser. The Adviser will not enter into a subadvisory agreement with an affiliated subadviser without shareholder approval.

Domini has claimed an exclusion from registration as a “commodity pool operator” with respect to the Fund under the Commodity Exchange Act, and therefore is not subject to registration or regulation with respect to the Fund under the Commodity Exchange Act.

Investment Subadviser

The Adviser employs a subadviser, SSGA Funds Management, Inc. (SSGA FM or the Subadviser), to purchase and sell securities to implement Domini’s investment selections and manage the amount of the Fund’s assets to be held in short-term investments. The Subadviser is paid out of the fees paid to the Adviser.

SSGA FM is the Subadviser of the Fund. SSGA FM is a wholly-owned subsidiary of State Street Global Advisors, Inc. which itself is a wholly-owned subsidiary of State Street Corporation (“State Street”), a publicly traded financial holding company organized in Massachusetts. SSGA FM is registered with the U.S. Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940, as amended. SSGA FM and certain other affiliates of State Street make up State Street Global Advisors (“SSGA”). SSGA is one of the world’s largest institutional money managers and the investment management arm of State Street. As of July 31, 2018, SSGA FM managed approximately $509.19 billion in assets and SSGA managed approximately $2.78 trillion in assets. SSGA FM’s principal business address is One Iron Street, Boston, Massachusetts 02210.

Portfolio Managers

Amy Domini Thornton and Carole M. Laible of Domini, and Kathleen Morgan of SSGA FM, are primarily responsible for the day-to-day management of the Fund. Ms. Domini and Ms. Laible are assisted by Domini’s research analysts. Ms. Morgan is assisted by other members of SSGA’s Global Equity Beta Solutions Group. Each of Ms. Domini, Ms. Laible and Ms. Morgan has been a portfolio manager of the Fund since December 1, 2018.

Domini

Amy Domini Thornton, CFA and Co-Manager, is the founder and Chair of Domini. She has served as Chair since 2016 and Chief Executive Officer from 2002 to 2015. Ms. Domini has also served as Chair of the Board of Trustees of the Domini Funds since 1990 and was President of the Domini Funds from 1990 through 2017. She has served as portfolio manager for Domini’s separately managed account since 2013. Ms. Domini also serve as a Private Trustee (since 1987) of Loring Wolcott & Coolidge as well as a Partner (since 1994) with Loring Wolcott & Coolidge Fiduciary Advisors LLP, a registered investment adviser. In this capacity she has responsibility for the investments of private trust accounts and works with individuals to integrate social or ethical criteria into their investments.

Carole M. Laible, CPA and Co-Manager, is the Chief Executive Officer of Domini (since 2016), and President of Domini Funds (since 2017). She previously served as the President of Domini from 2005 to 2015, Chief Operating Officer of Domini 2002 to 2011, and also serves as the Treasurer of the Domini Funds from 1997 through 2017.

Ms. Domini and Ms. Laible currently serve on Domini’s Standards Committee which may be convened as necessary for interpretation of Domini’s social and in this capacity are responsible for the development and oversight of Domini’s social and environmental standards, along with other members of the Committee.

13

SSGA FM

Kathleen Morgan, CFA, Vice President of SSGA FM and SSGA, and a Senior Portfolio Manager in the Global Equity Beta Solutions Group, joined SSGA as an investment professional in 2017 and has been a member of the Global Equity Beta Solutions Group since that time. In this capacity, Ms. Morgan is responsible for the management of various equity index funds that are benchmarked to both domestic and international strategies. Prior to joining SSGA, Ms. Morgan worked in Equity Product Management at Wellington Management from 2015 to 2017 conducting independent risk oversight and developing investment product marketing strategy. She has been working in the investment management field since 2006. Ms. Morgan’s prior experience also includes index equity portfolio management at BlackRock.

The Statement of Additional Information contains additional information about the portfolio managers’ compensation, other accounts managed by them, and their ownership of the securities of the Fund.

Management and Sponsorship Fees

The Fund pays Domini fees for managing the Fund and for providing certain services. For managing the Fund, Domini’s annual fee is equal to 0.20% of the first $2 billion of net assets managed, 0.19% of the next $1 billion, and 0.18% of net assets managed in excess of $3 billion. The current management fee schedule took effect December 1, 2018. For the period from May 1, 2017 through November 30, 2018, the Fund paid a management fee equal to 0.245% of the first $250 million of net assets managed, 0.24% of the next $250 million, and 0.235% of the next $500 million, and 0.23% of net assets managed in excess of $1 billion. Prior to May 1, 2017, the Fund paid a management fee equal to 0.30% of the first $2 billion of net assets managed, 0.29% of the next $1 billion, and 0.28% of net assets managed in excess of $3 billion.

Domini, and not the Fund, pays a portion of the management fee it receives from the Fund to SSGA FM as compensation for SSGA FM’s subadvisory services to the Fund.

Under the Sponsorship Agreement between Domini and the Fund for administrative services provided to the Fund, Domini’s fee is equal to 0.45% of the first $2 billion of net assets managed, 0.44% of the next $1 billion, and 0.43% of net assets managed in excess of $3 billion.

Domini has contractually agreed to waive certain fees and/or reimburse certain ordinary operating expenses in order to limit Investor, Class A, Institutional and Class R share expenses to 1.09%, 1.09%, 0.74%, and 0.80% through November 30, 2019, absent an earlier modification by the Fund’s Board.

During the fiscal year ended July 31, 2018, the Fund paid a total of [0.74%] of its average daily net assets for investment advisory and administrative services, after waivers.

A discussion regarding the basis of the Board of Trustees’ approval of the Continuation of the Fund’s Management Agreement with Domini is available in the Fund’s Annual Report to shareholders for the fiscal year ended July 31, 2018. A discussion regarding the basis of the Board of Trustees’ approval of the Fund’s Submanagement Agreement with SSGA FM will be available in the Fund’s Semi-Annual Report to shareholders for the fiscal period ended January 31, 2019.

14

DSIL Investment Services LLC, a wholly owned subsidiary of Domini, is the distributor of the Fund’s shares. The Fund has adopted a Rule 12b-1 plan with respect to its Investor shares and Class A shares that allows the Fund to pay its distributor on an annual basis for the sale and distribution of the Investor shares and the Class A shares and for services provided to shareholders. These annual distribution and service fees may equal up to 0.25% of the average daily net assets of the Fund’s Investor shares and Class A shares. The Fund does not pay any distribution fees with respect to the Class R shares or the Institutional shares. Because distribution and service fees are paid out of the assets of the Investor shares and Class A shares, respectively, on an ongoing basis, over time the fee will increase the cost of your investment and may cost you more than paying other types of sales charges.

For more information about the Fund’s distribution plan relating to Investor shares and Class A shares, see the expense tables in the “Funds at a Glance” section and the Statement of Additional Information.

ADDITIONAL PAYMENTS TO FINANCIAL INTERMEDIARIES