Form 425 Caesars Acquisition Co Filed by: CAESARS ENTERTAINMENT Corp

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

April 12, 2017

Date of Report (Date of earliest event reported)

Caesars Entertainment Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 001-10410 | 62-1411755 | ||

| (State of Incorporation) | (Commission File Number) |

(IRS Employer Identification Number) |

One Caesars Palace Drive

Las Vegas, Nevada 89109

(Address of principal executive offices) (Zip Code)

(702) 407-6000

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 8.01 | Other Events. |

On April 12, 2017, Caesars Growth Properties Holdings, LLC (“CGPH”), a wholly-owned subsidiary of Caesars Growth Partners, LLC, a joint venture between Caesars Entertainment Corporation (“CEC”) and Caesars Acquisition Company (“CAC”), announced its intent to seek a repricing of its existing $1.14 billion term loan B due 2021 as well as to raise a $175 million add-on term loan to repay all outstanding amounts under The Cromwell’s property-specific term loan. CEC is filing as Exhibit 99.1 to this Current Report on Form 8-K the lender presentation that was provided on April 12, 2017 to CGPH’s lenders and potential lenders, which is incorporated herein by reference.

Forward-Looking Statements

This filing includes “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly to historical or current facts. These statements contain words such as, “will,” “would,” “expect,” and “propose” or the negative or other variations thereof or comparable terminology. In particular, they include statements relating to, among other things, the emergence from bankruptcy of Caesars Entertainment Operating Company, Inc. (“CEOC”) and the expected timing thereof, future actions that may be taken by CEC and others with respect thereto, the completion of the Merger (as defined below) and the financial position and actions of CEC post-emergence. These forward-looking statements are based on current expectations and projections about future events.

You are cautioned that forward-looking statements are not guarantees of future performance or results and involve risks and uncertainties that cannot be predicted or quantified and, consequently, the actual performance of CEC may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, the following factors, as well as other factors described from time to time in our reports filed with the SEC: the Merger may not be consummated or one or more events, changes or other circumstances that could occur that could give rise to the termination of the Merger Agreement (as defined below), CEC’s and CEOC’s ability (or inability) to meet any milestones or other conditions set forth in their restructuring support agreements, CEC’s and CEOC’s ability (or inability) to satisfy the conditions to the effectiveness of the Third Amended Joint Plan of Reorganization of CEOC and its Chapter 11 debtor subsidiaries, CEC’s ability (or inability) to secure additional liquidity to meet its ongoing obligations and its commitments to support the CEOC restructuring as necessary, CEC’s financial obligations exceeding or becoming due earlier than what is currently forecast and other risks associated with the CEOC restructuring and related litigation.

You are cautioned to not place undue reliance on these forward-looking statements, which speak only as of the date of this filing. CEC undertakes no obligation to publicly update or release any revisions to these forward-looking statements to reflect events or circumstances after the date of this filing or to reflect the occurrence of unanticipated events, except as required by law.

Important Additional Information

Pursuant to the Amended and Restated Agreement and Plan of Merger, dated as of July 9, 2016, between CEC and CAC, as subsequently amended on February 20, 2017 (as amended, the “Merger Agreement”), among other things, CAC will merge with and into CEC, with CEC as the surviving company (the “Merger”). In connection with the Merger, CEC and CAC filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a preliminary joint proxy statement/prospectus, as well as other relevant documents concerning the proposed transaction. The registration statement has not yet become effective. After the registration statement is declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to stockholders of CEC and CAC. Stockholders are urged to read the registration statement and joint proxy statement/prospectus regarding the Merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. You will be able to obtain a free copy of such joint proxy statement/prospectus, as well as other filings containing information about CEC and CAC, at the SEC’s website (www.sec.gov), from CEC Investor Relations (investor.caesars.com) or from CAC Investor Relations (investor.caesarsacquisitioncompany.com).

2

The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

CEC, CAC and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from CEC and CAC stockholders in favor of the business combination transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the CEC and CAC stockholders in connection with the proposed business combination transaction is set forth in the joint proxy statement/prospectus filed with the SEC on March 13, 2017 and Amendment No. 1 to the Annual Report on Form 10-K for CAC’s fiscal year ended December 31, 2016, filed on March 31, 2017, respectively. You can obtain free copies of these documents from CEC and CAC in the manner set forth above.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibit is being filed herewith:

| Exhibit |

Description | |

| 99.1 | Lender Presentation. | |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CAESARS ENTERTAINMENT CORPORATION | ||||||

| Date: April 12, 2017 | By: | /s/ SCOTT E. WIEGAND | ||||

| Name: | Scott E. Wiegand | |||||

| Title: | Senior Vice President, Deputy General Counsel and Corporate Secretary | |||||

4

EXHIBIT INDEX

| Exhibit No. |

Description | |

| 99.1 | Lender Presentation. | |

5

Caesars Growth Properties Holdings, LLC Presentation to Lenders April 12, 2017 Privileged & Confidential Exhibit 99.1

Legal disclaimer This presentation contains certain forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements may be made directly in this presentation. Some of the forward‐looking statements can be identified by the use of forward‐looking words. Statements that are not strictly historical in nature, including the words “anticipate,” “may,” “estimate,” “should,” “seek,” “expect,” “plan,” “believe,” “intend,” “will,” “project,” “might,” “could,” “would,” “continue,” “pursue,” and similar words, or the negatives or other variations of those words and comparable terminology, are intended to identify forward‐looking statements. Certain statements regarding the following particularly are forward‐looking in nature: Our business strategy; Future performance, developments, actions, new projects, market forecasts or projections and the outcome of contingencies; and Projected capital expenditures. All forward‐looking statements are based on our management’s current beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward‐looking statements are subject to a number of factors, risks, uncertainties and contingencies, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Although such forward‐looking statements have been prepared in good faith and are based on assumptions believed by our management to be reasonable, there is no assurance or guarantee that the expected results will be achieved. Our actual results may differ materially from the results discussed in forward‐looking statements. We make no representations or warranties as to the accuracy of any such forward-looking statements and we disclaim any obligation to update any forward-looking statements except as required by law. In addition, our discussion will include references to non-GAAP financial measures, including but not limited to EBITDA(M), Adj. EBITDA(M), Adjusted EBITDA(M) margin, and free cash flow. Such non-GAAP measures should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP. They are used by management during the strategic review of performance. The results are not necessarily indicative of future performance or the results that would be achieved should the reorganization of Caesars Entertainment Operating Company, Inc., as currently contemplated, be successfully completed. See the Appendix to this presentation for a these non-GAAP measures to their nearest GAAP measures. This presentation and all information provided or discussed in connection therewith are confidential and being provided to you for informational use solely in connection with your consideration of the financing transaction contemplated herein. Acceptance of these materials constitutes your agreement to hold the information contained herein in strict confidence in accordance with the confidentiality provisions agreed to by you in accepting the invitation to this meeting.

Rule 425 disclaimer (important additional information) Pursuant to the Amended and Restated Agreement and Plan of Merger, dated as of July 9, 2016, between Caesars Entertainment Corporation (“CEC”) and Caesars Acquisition Company (“CAC”), as subsequently amended on February 20, 2017 (as amended, the “Merger Agreement”), among other things, CAC will merge with and into CEC, with CEC as the surviving company (the “Merger”). In connection with the Merger, on March 13, 2017, CEC and CAC filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a preliminary joint proxy statement/prospectus, as well as other relevant documents concerning the proposed transaction. The registration statement has not yet become effective. After the registration statement is declared effective by the SEC, a definitive joint proxy statement/prospectus will be mailed to stockholders of CEC and CAC. Stockholders are urged to read the registration statement and joint proxy statement/prospectus regarding the Merger and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. You will be able to obtain a free copy of such joint proxy statement/prospectus, as well as other filings containing information about CEC and CAC, at the SEC’s website (www.sec.gov), from CEC Investor Relations (investor.caesars.com) or from CAC Investor Relations (investor.caesarsacquisitioncompany.com). The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. CEC, CAC and their respective directors, executive officers and certain other members of management and employees may be soliciting proxies from CEC and CAC stockholders in favor of the business combination transaction. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the CEC and CAC stockholders in connection with the proposed business combination transaction is set forth in the joint proxy statement/prospectus filed with the SEC on March 13, 2017 and Amendment No. 1 to the Annual Report on Form 10-K for CAC’s fiscal year ended December 31, 2016, filed on March 31, 2017, respectively. You can obtain free copies of these documents from CEC and CAC in the manner set forth above.

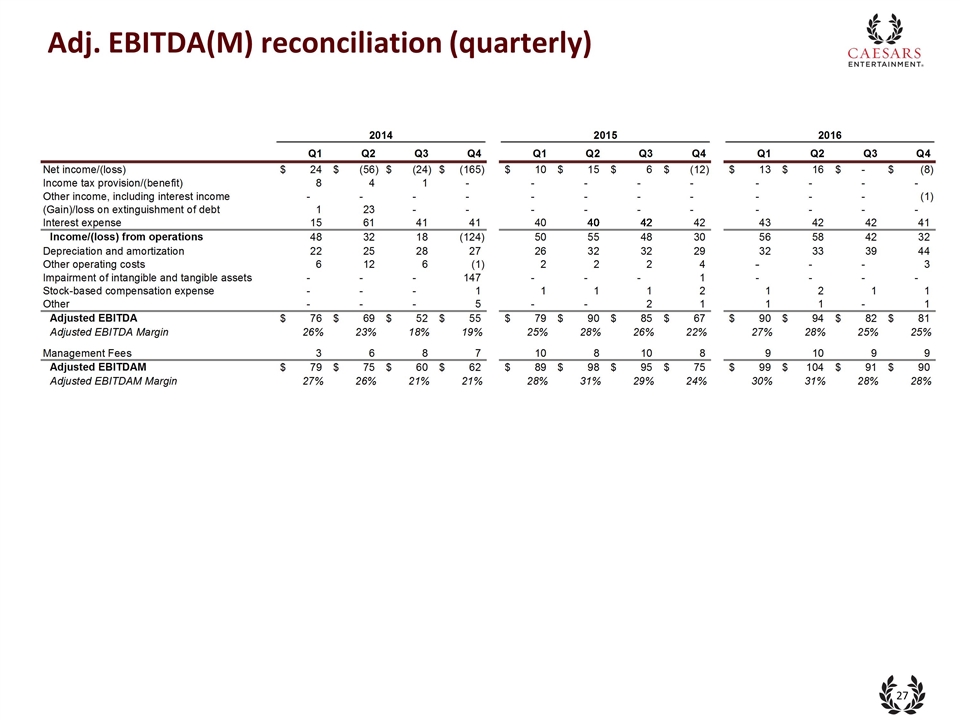

Use of Non-GAAP measures The following non-GAAP measures will be used in the presentation and discussed on the conference call which this presentation accompanies: Adj. EBITDA(M) and Adjusted EBITDA(M) Margin Definitions of these non-GAAP measures, reconciliations to their nearest GAAP measures, and the reasons management believes these measures provide useful information for investors, can be found in the Appendices to this presentation.

Caesars Entertainment Corporation Presenters Eric Hession Executive Vice President & Chief Financial Officer Jacqueline Beato Senior Vice President, Finance & Treasurer Joyce Thomas Vice President, Finance & Assistant Treasurer

1. Introduction

Caesars Growth Properties Holdings, LLC (“CGPH” or the “Company”) owns a portfolio of five well-positioned casino properties located in two destination markets Las Vegas Strip: Bally’s Las Vegas, Planet Hollywood, The LINQ and The Cromwell New Orleans: Harrah’s New Orleans CGPH 2016 net revenue of $1.4 billion and Adj. EBITDAM of $384 million (29% margin) CGPH is a wholly-owned subsidiary of Caesars Growth Partners, LLC (“CGP”) and, upon the emergence of Caesars Entertainment Operating Company, Inc. (“CEOC”) from bankruptcy and after the Merger, will become an indirect, wholly-owned subsidiary of Caesars Entertainment Corporation (“CEC”) CEOC’s exit financing facility has been fully syndicated and CEOC expects to exit bankruptcy in Q3 2017 Financing overview Transaction overview Company overview Reprice CGPH’s existing $1.14 billion term loan B due 2021 Seeking spread reduction from L + 525 bps (1.00% floor) to L + 325 bps (1.00% floor) Raise a $175 million fungible add-on term loan to repay all outstanding amounts under The Cromwell’s asset-specific term loan The Cromwell currently resides in a qualified non-recourse subsidiary with a $171 million term loan that is not included in the CGPH restricted group In connection with the refinancing of the Cromwell, it will become part of the CGPH restricted group Pro forma for the transaction, the Company will materially reduce annual interest expense, simplify its capital structure, and enhance asset and cash flow diversity by bringing The Cromwell into the restricted group 1 2

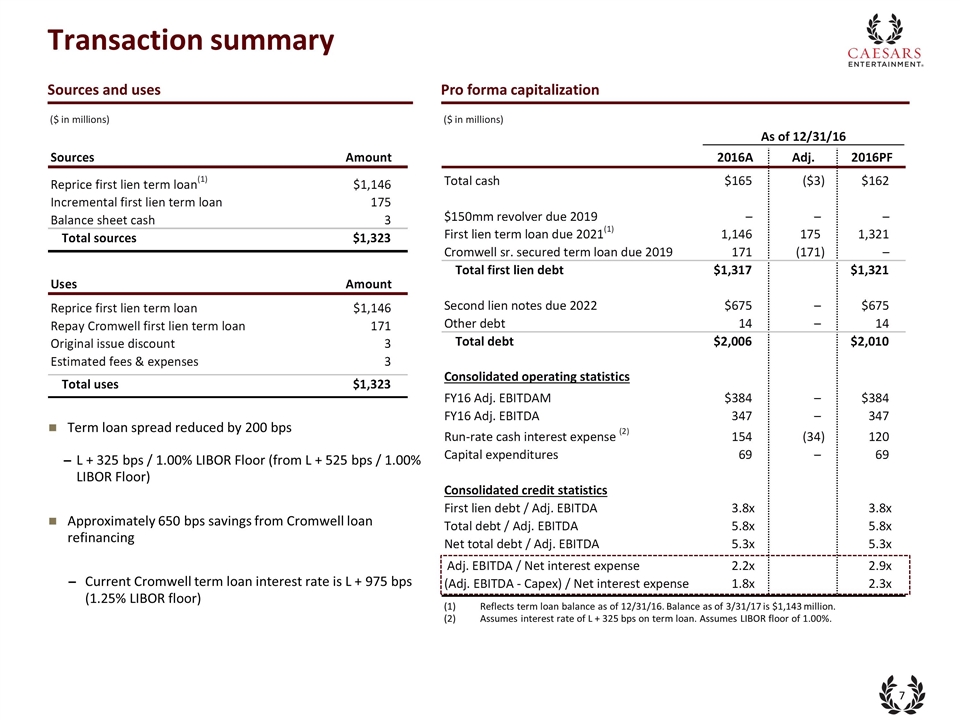

Transaction summary Sources and uses Pro forma capitalization Term loan spread reduced by 200 bps L + 325 bps / 1.00% LIBOR Floor (from L + 525 bps / 1.00% LIBOR Floor) Approximately 650 bps savings from Cromwell loan refinancing Current Cromwell term loan interest rate is L + 975 bps (1.25% LIBOR floor) (1)Reflects term loan balance as of 12/31/16. Balance as of 3/31/17 is $1,143 million. (2) Assumes interest rate of L + 325 bps on term loan. Assumes LIBOR floor of 1.00%.

2. Business Update

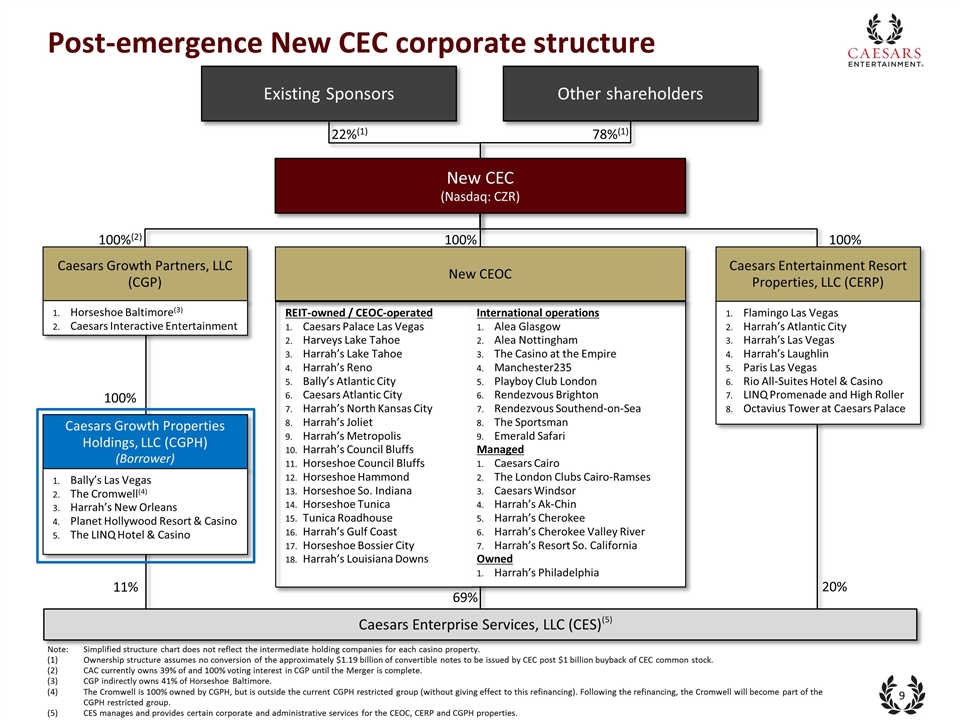

REIT-owned / CEOC-operated Caesars Palace Las Vegas Harveys Lake Tahoe Harrah’s Lake Tahoe Harrah’s Reno Bally’s Atlantic City Caesars Atlantic City Harrah’s North Kansas City Harrah’s Joliet Harrah’s Metropolis Harrah’s Council Bluffs Horseshoe Council Bluffs Horseshoe Hammond Horseshoe So. Indiana Horseshoe Tunica Tunica Roadhouse Harrah’s Gulf Coast Horseshoe Bossier City Harrah’s Louisiana Downs International operations Alea Glasgow Alea Nottingham The Casino at the Empire Manchester235 Playboy Club London Rendezvous Brighton Rendezvous Southend-on-Sea The Sportsman Emerald Safari Managed Caesars Cairo The London Clubs Cairo-Ramses Caesars Windsor Harrah’s Ak-Chin Harrah’s Cherokee Harrah’s Cherokee Valley River Harrah’s Resort So. California Owned Harrah’s Philadelphia Post-emergence New CEC corporate structure Caesars Entertainment Resort Properties, LLC (CERP) 100% 100% Note:Simplified structure chart does not reflect the intermediate holding companies for each casino property. (1) Ownership structure assumes no conversion of the approximately $1.19 billion of convertible notes to be issued by CEC post $1 billion buyback of CEC common stock. (2)CAC currently owns 39% of and 100% voting interest in CGP until the Merger is complete. (3)CGP indirectly owns 41% of Horseshoe Baltimore. (4) The Cromwell is 100% owned by CGPH, but is outside the current CGPH restricted group (without giving effect to this refinancing). Following the refinancing, the Cromwell will become part of the CGPH restricted group. (5)CES manages and provides certain corporate and administrative services for the CEOC, CERP and CGPH properties. Flamingo Las Vegas Harrah’s Atlantic City Harrah’s Las Vegas Harrah’s Laughlin Paris Las Vegas Rio All-Suites Hotel & Casino LINQ Promenade and High Roller Octavius Tower at Caesars Palace New CEOC 20% 11% 69% Caesars Enterprise Services, LLC (CES) (5) Existing Sponsors Other shareholders 22%(1) 78%(1) New CEC (Nasdaq: CZR) Caesars Growth Partners, LLC (CGP) 100%(2) Horseshoe Baltimore(3) Caesars Interactive Entertainment Caesars Growth Properties Holdings, LLC (CGPH) (Borrower) Bally’s Las Vegas The Cromwell(4) Harrah’s New Orleans Planet Hollywood Resort & Casino The LINQ Hotel & Casino 100%

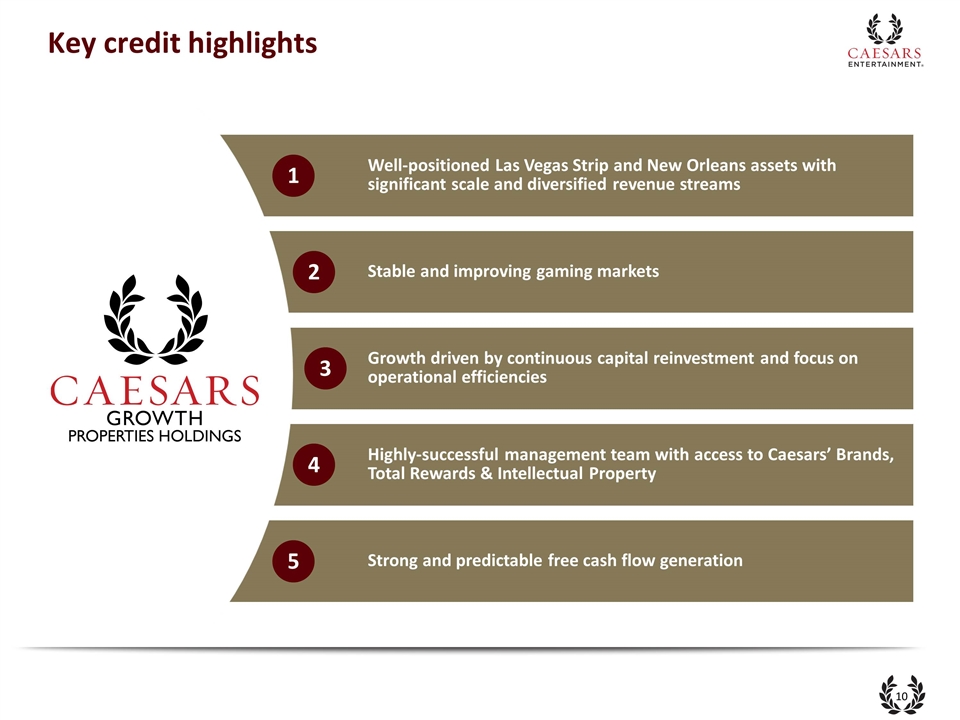

Well-positioned Las Vegas Strip and New Orleans assets with significant scale and diversified revenue streams Stable and improving gaming markets Growth driven by continuous capital reinvestment and focus on operational efficiencies Strong and predictable free cash flow generation Highly-successful management team with access to Caesars’ Brands, Total Rewards & Intellectual Property 1 2 5 3 Key credit highlights 4

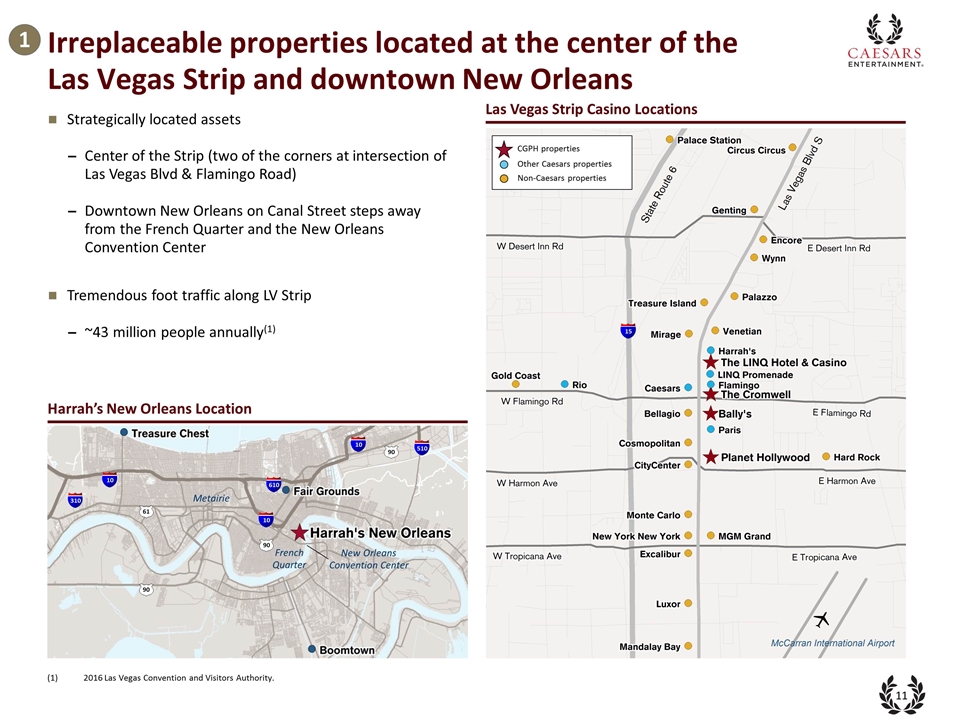

Irreplaceable properties located at the center of the Las Vegas Strip and downtown New Orleans 1 Strategically located assets Center of the Strip (two of the corners at intersection of Las Vegas Blvd & Flamingo Road) Downtown New Orleans on Canal Street steps away from the French Quarter and the New Orleans Convention Center Tremendous foot traffic along LV Strip ~43 million people annually(1) Las Vegas Strip Casino Locations CGPH properties Other Caesars properties Non-Caesars properties Harrah’s New Orleans Location (1)2016 Las Vegas Convention and Visitors Authority. CGPH properties Other Caesars properties Non-Caesars properties 15 10 90 10 610 10 310 510 90 90 61 French Quarter Metairie New Orleans Convention Center

Leading assets with significant scale Location Las Vegas Las Vegas New Orleans Las Vegas Las Vegas Year opened / renovated 2013 2014 2006 2007 2014 Rooms / suites 2,810 190 450 2,500 2,250 Slot machines 990 390 1,580 1,080 760 Gaming tables 70 50 150 100 70 Amenities / Property highlights 167,500 sq. feet of convention and trade show facilities Other amenities include several restaurants, Olympic-sized pool, spa, and retail shopping Upscale boutique hotel Exciting amenities to attract new, youthful and affluent patrons Drai’s Nightclub Other amenities include a number of restaurants and the Masquerade nightclub Louisiana’s only commercial land based casino Theater, called The AXIS, is currently home to Britney Spears' show, Jennifer Lopez and The Backstreet Boys Restaurants include Hash House A Go Go and Guy Fieri's 1st LV restaurant Frank Marino's Divas Las Vegas and Mat Franco - Magic Reinvented Nightly CGPH’s assets are well-established properties with significant brand value 1

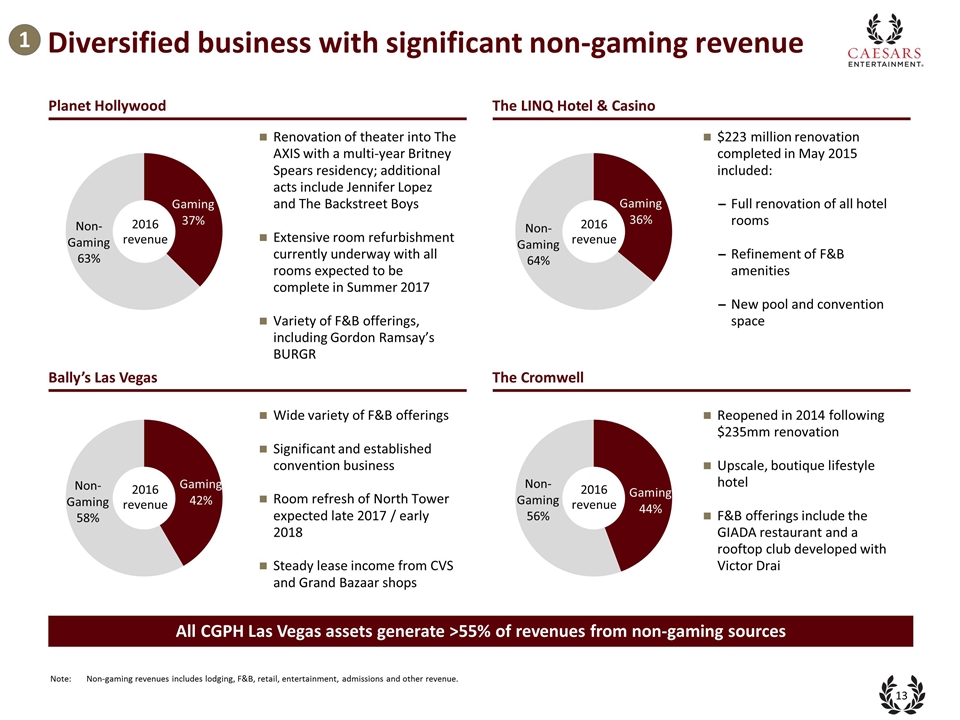

Diversified business with significant non-gaming revenue 1 All CGPH Las Vegas assets generate >55% of revenues from non-gaming sources Wide variety of F&B offerings Significant and established convention business Room refresh of North Tower expected late 2017 / early 2018 Steady lease income from CVS and Grand Bazaar shops $223 million renovation completed in May 2015 included: Full renovation of all hotel rooms Refinement of F&B amenities New pool and convention space Reopened in 2014 following $235mm renovation Upscale, boutique lifestyle hotel F&B offerings include the GIADA restaurant and a rooftop club developed with Victor Drai Renovation of theater into The AXIS with a multi-year Britney Spears residency; additional acts include Jennifer Lopez and The Backstreet Boys Extensive room refurbishment currently underway with all rooms expected to be complete in Summer 2017 Variety of F&B offerings, including Gordon Ramsay’s BURGR Bally’s Las Vegas The Cromwell The LINQ Hotel & Casino Planet Hollywood (1) (1) Note:Non-gaming revenues includes lodging, F&B, retail, entertainment, admissions and other revenue. 2016 revenue 2016 revenue 2016 revenue 2016 revenue

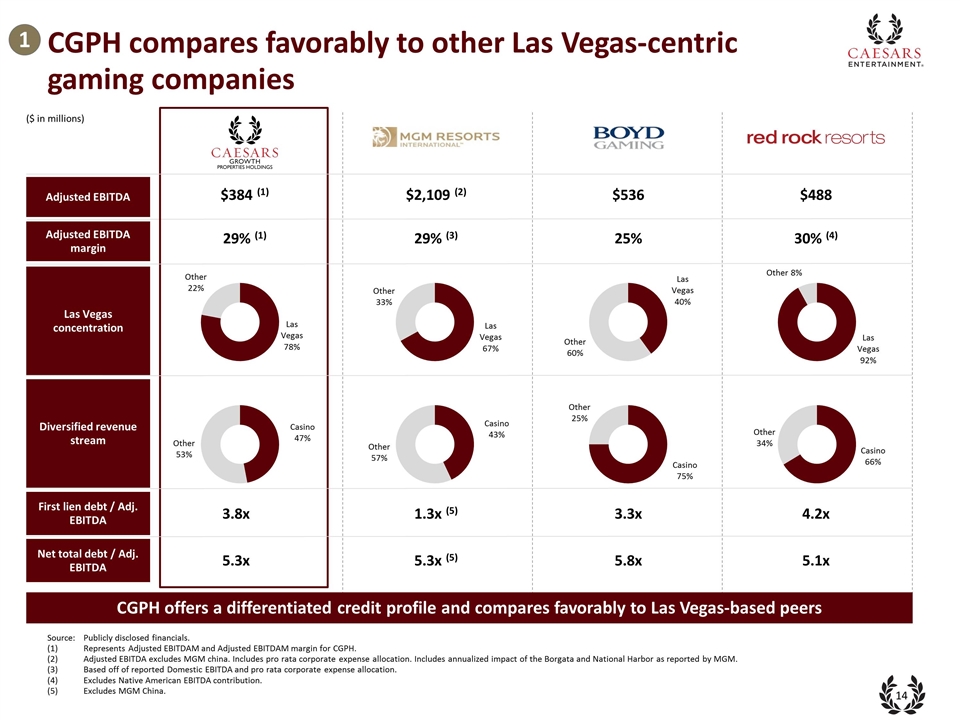

Adjusted EBITDA Adjusted EBITDA margin Las Vegas concentration Diversified revenue stream Net total debt / Adj. EBITDA First lien debt / Adj. EBITDA $384 (1) 29% (1) CGPH offers a differentiated credit profile and compares favorably to Las Vegas-based peers 3.8x 5.3x CGPH compares favorably to other Las Vegas-centric gaming companies ($ in millions) $2,109 (2) 29% (3) $536 25% $488 30% (4) 1.3x (5) 5.3x (5) 3.3x 5.8x 4.2x 5.1x 1 Source:Publicly disclosed financials. (1)Represents Adjusted EBITDAM and Adjusted EBITDAM margin for CGPH. (2)Adjusted EBITDA excludes MGM china. Includes pro rata corporate expense allocation. Includes annualized impact of the Borgata and National Harbor as reported by MGM. (3)Based off of reported Domestic EBITDA and pro rata corporate expense allocation. (4)Excludes Native American EBITDA contribution. (5)Excludes MGM China.

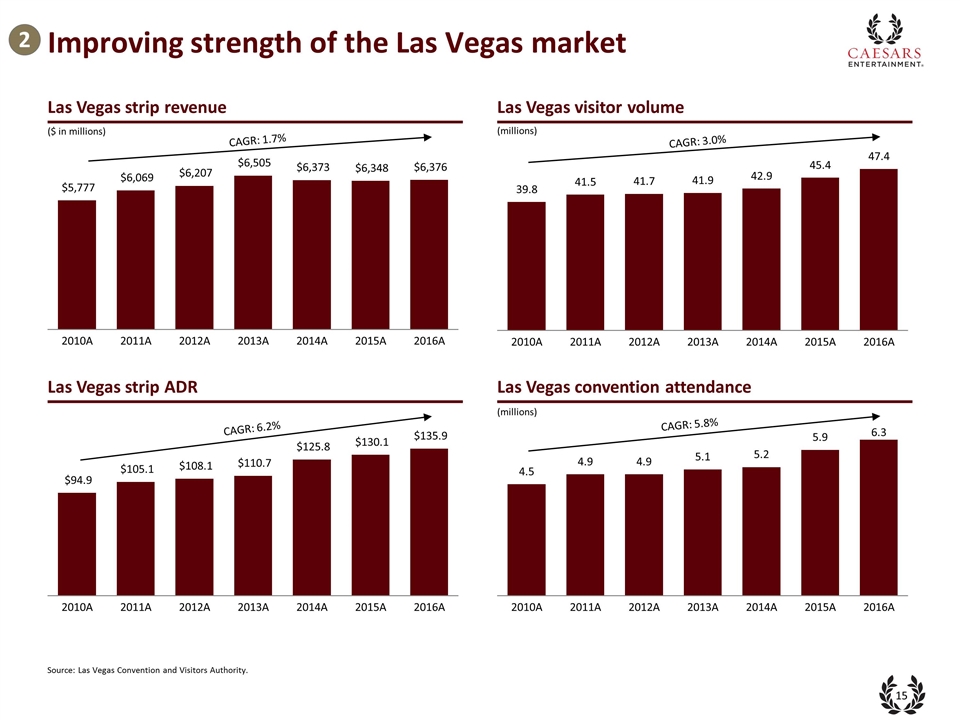

Improving strength of the Las Vegas market Las Vegas strip revenue ($ in millions) Las Vegas visitor volume (millions) Las Vegas strip ADR Las Vegas convention attendance (millions) CAGR: 1.7% CAGR: 3.0% CAGR: 6.2% CAGR: 5.8% 2 Source: Las Vegas Convention and Visitors Authority.

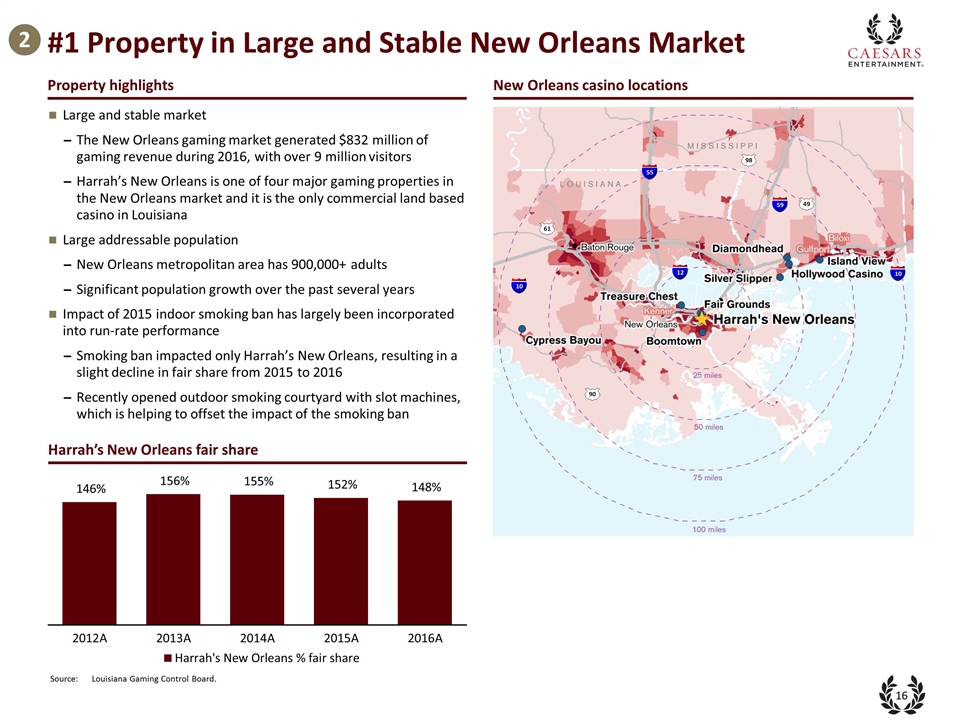

#1 Property in Large and Stable New Orleans Market 2 Property highlights New Orleans casino locations Harrah’s New Orleans fair share Large and stable market The New Orleans gaming market generated $832 million of gaming revenue during 2016, with over 9 million visitors Harrah’s New Orleans is one of four major gaming properties in the New Orleans market and it is the only commercial land based casino in Louisiana Large addressable population New Orleans metropolitan area has 900,000+ adults Significant population growth over the past several years Impact of 2015 indoor smoking ban has largely been incorporated into run-rate performance Smoking ban impacted only Harrah’s New Orleans, resulting in a slight decline in fair share from 2015 to 2016 Recently opened outdoor smoking courtyard with slot machines, which is helping to offset the impact of the smoking ban 10 12 10 98 49 90 55 59 61 Source:Louisiana Gaming Control Board. Confirm agreement with Harrah’s market figures

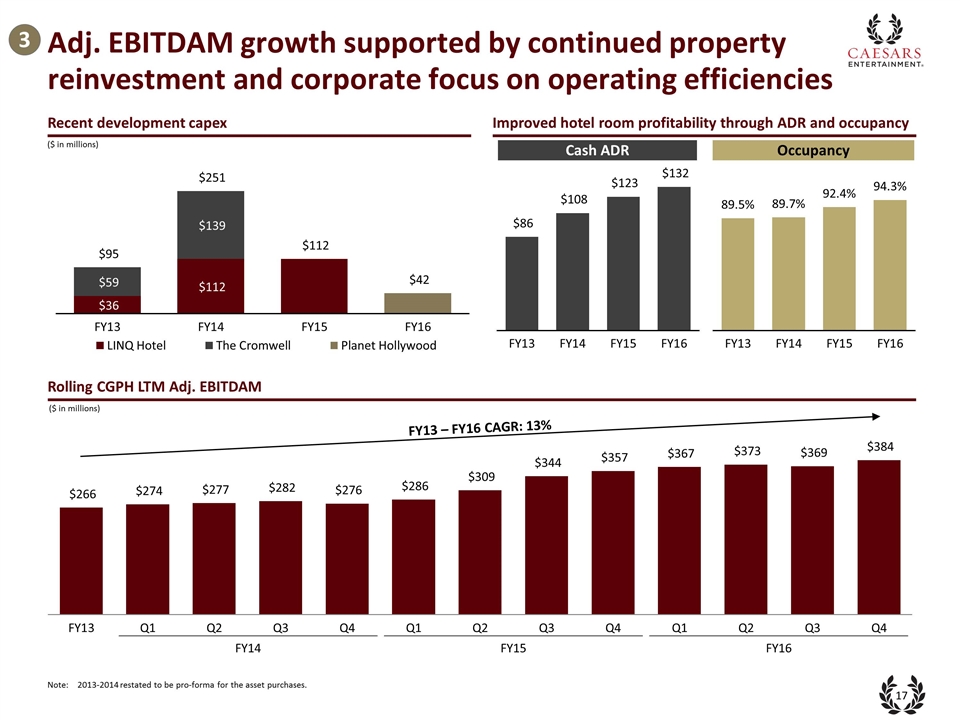

Adj. EBITDAM growth supported by continued property reinvestment and corporate focus on operating efficiencies 17 Rolling CGPH LTM Adj. EBITDAM FY13 – FY16 CAGR: 13% Note: 2013-2014 restated to be pro-forma for the asset purchases. ($ in millions) Recent development capex ($ in millions) Improved hotel room profitability through ADR and occupancy Cash ADR Occupancy FY14 FY15 FY16 3

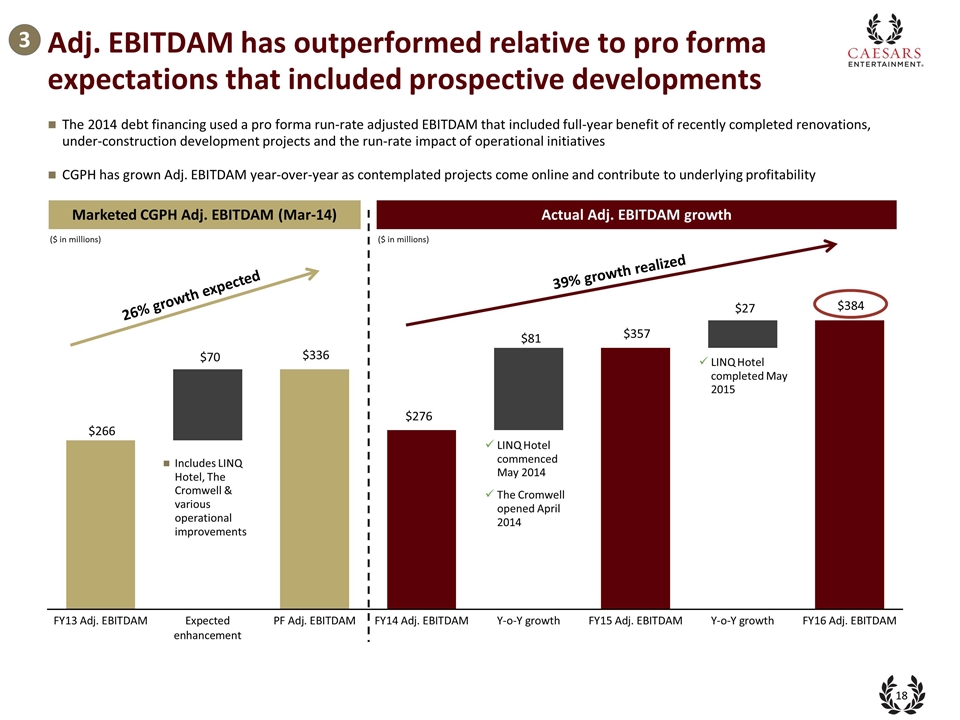

Adj. EBITDAM has outperformed relative to pro forma expectations that included prospective developments The 2014 debt financing used a pro forma run-rate adjusted EBITDAM that included full-year benefit of recently completed renovations, under-construction development projects and the run-rate impact of operational initiatives CGPH has grown Adj. EBITDAM year-over-year as contemplated projects come online and contribute to underlying profitability Marketed CGPH Adj. EBITDAM (Mar-14) Actual Adj. EBITDAM growth 3 ($ in millions) ($ in millions) Includes LINQ Hotel, The Cromwell & various operational improvements LINQ Hotel commenced May 2014 The Cromwell opened April 2014 26% growth expected 39% growth realized LINQ Hotel completed May 2015

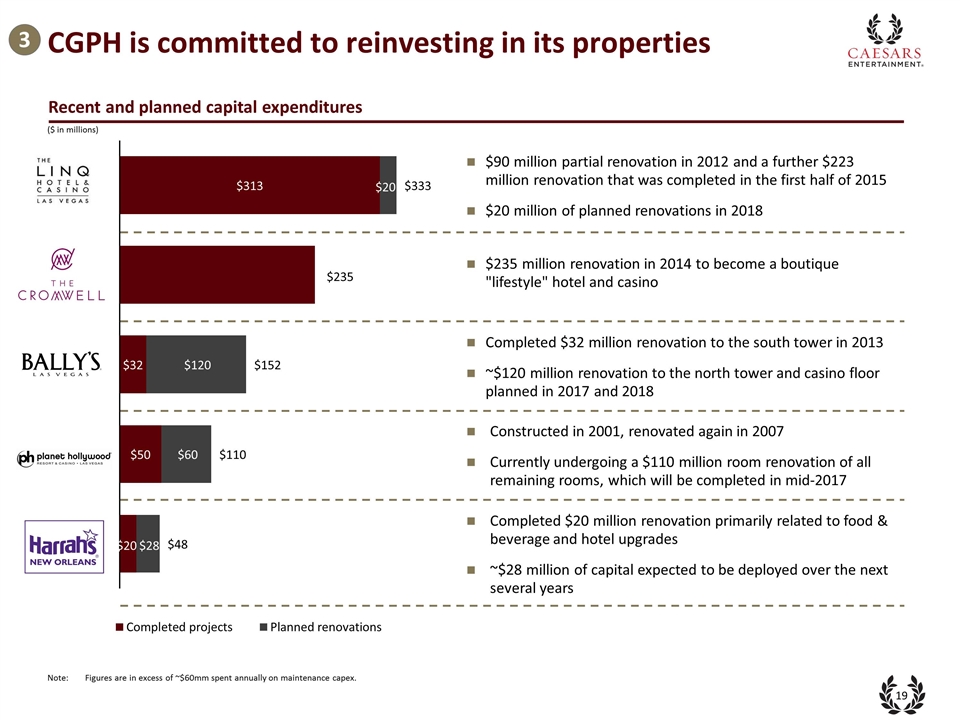

CGPH is committed to reinvesting in its properties Note: Figures are in excess of ~$60mm spent annually on maintenance capex. Constructed in 2001, renovated again in 2007 Currently undergoing a $110 million room renovation of all remaining rooms, which will be completed in mid-2017 Recent and planned capital expenditures $235 million renovation in 2014 to become a boutique "lifestyle" hotel and casino Completed $32 million renovation to the south tower in 2013 ~$120 million renovation to the north tower and casino floor planned in 2017 and 2018 $90 million partial renovation in 2012 and a further $223 million renovation that was completed in the first half of 2015 $20 million of planned renovations in 2018 3 ($ in millions) Completed $20 million renovation primarily related to food & beverage and hotel upgrades ~$28 million of capital expected to be deployed over the next several years

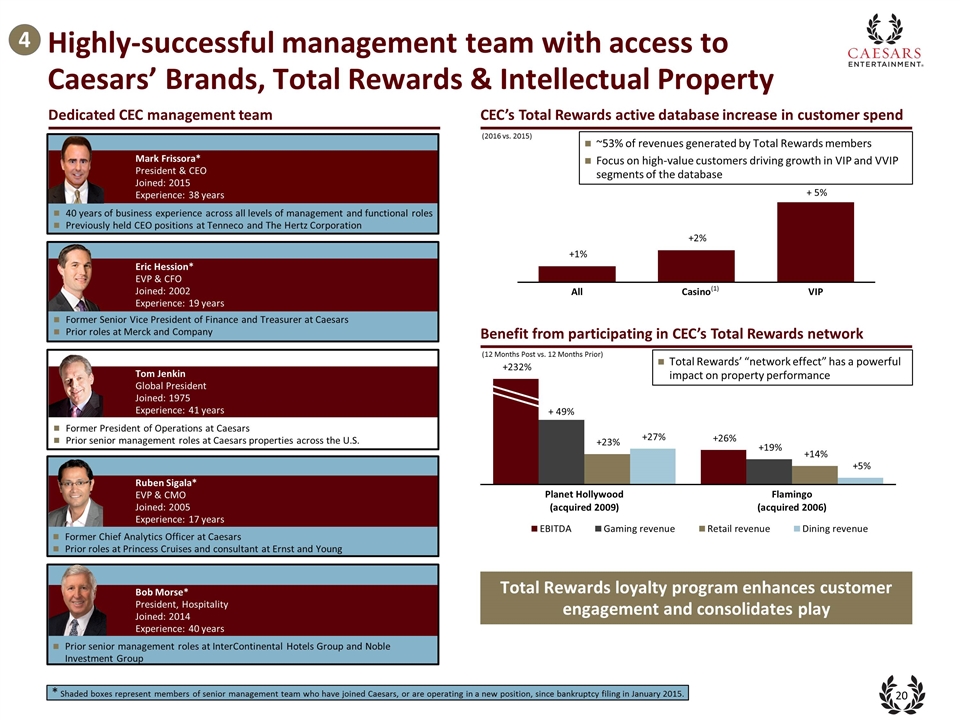

Ruben Sigala* EVP & CMO Joined: 2005 Experience: 17 years Former Chief Analytics Officer at Caesars Prior roles at Princess Cruises and consultant at Ernst and Young Former Senior Vice President of Finance and Treasurer at Caesars Prior roles at Merck and Company Eric Hession* EVP & CFO Joined: 2002 Experience: 19 years Highly-successful management team with access to Caesars’ Brands, Total Rewards & Intellectual Property 4 Former President of Operations at Caesars Prior senior management roles at Caesars properties across the U.S. Tom Jenkin Global President Joined: 1975 Experience: 41 years Mark Frissora* President & CEO Joined: 2015 Experience: 38 years 40 years of business experience across all levels of management and functional roles Previously held CEO positions at Tenneco and The Hertz Corporation Bob Morse* President, Hospitality Joined: 2014 Experience: 40 years Prior senior management roles at InterContinental Hotels Group and Noble Investment Group Dedicated CEC management team ~53% of revenues generated by Total Rewards members Focus on high-value customers driving growth in VIP and VVIP segments of the database CEC’s Total Rewards active database increase in customer spend (2016 vs. 2015) (1) Benefit from participating in CEC’s Total Rewards network Total Rewards’ “network effect” has a powerful impact on property performance (12 Months Post vs. 12 Months Prior) Total Rewards loyalty program enhances customer engagement and consolidates play * Shaded boxes represent members of senior management team who have joined Caesars, or are operating in a new position, since bankruptcy filing in January 2015.

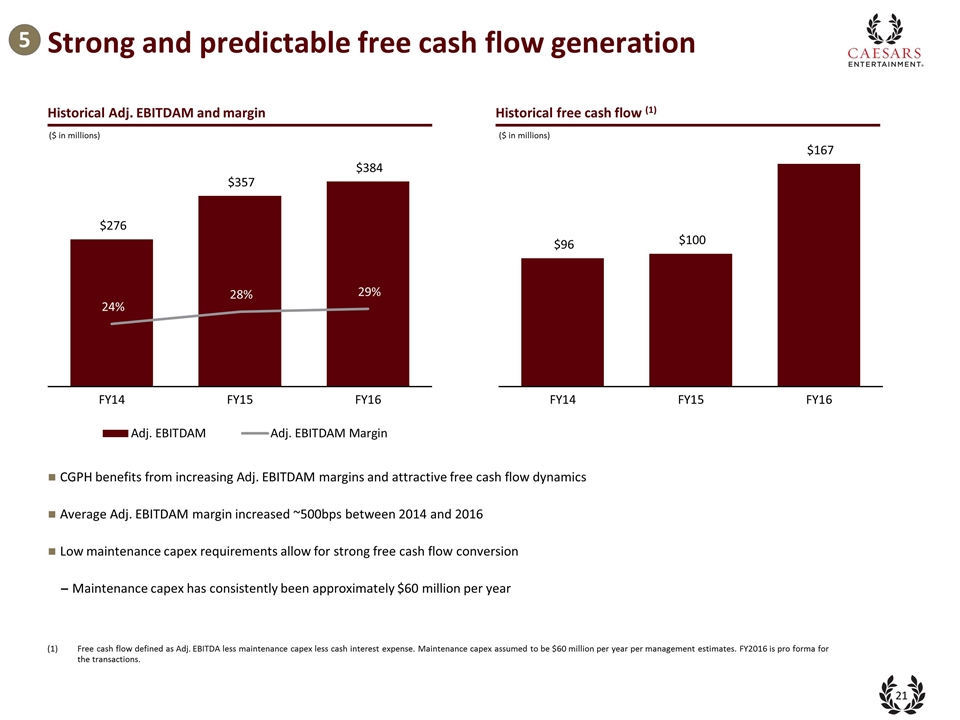

Strong and predictable free cash flow generation 21 CGPH benefits from increasing Adj. EBITDAM margins and attractive free cash flow dynamics Average Adj. EBITDAM margin increased ~500bps between 2014 and 2016 Low maintenance capex requirements allow for strong free cash flow conversion Maintenance capex has consistently been approximately $60 million per year ($ in millions) ($ in millions) Historical Adj. EBITDAM and margin (1)Free cash flow defined as Adj. EBITDA less maintenance capex less cash interest expense. Maintenance capex assumed to be $60 million per year per management estimates. FY2016 is pro forma for the transactions. Historical free cash flow (1) 5

3. Financial Performance Update

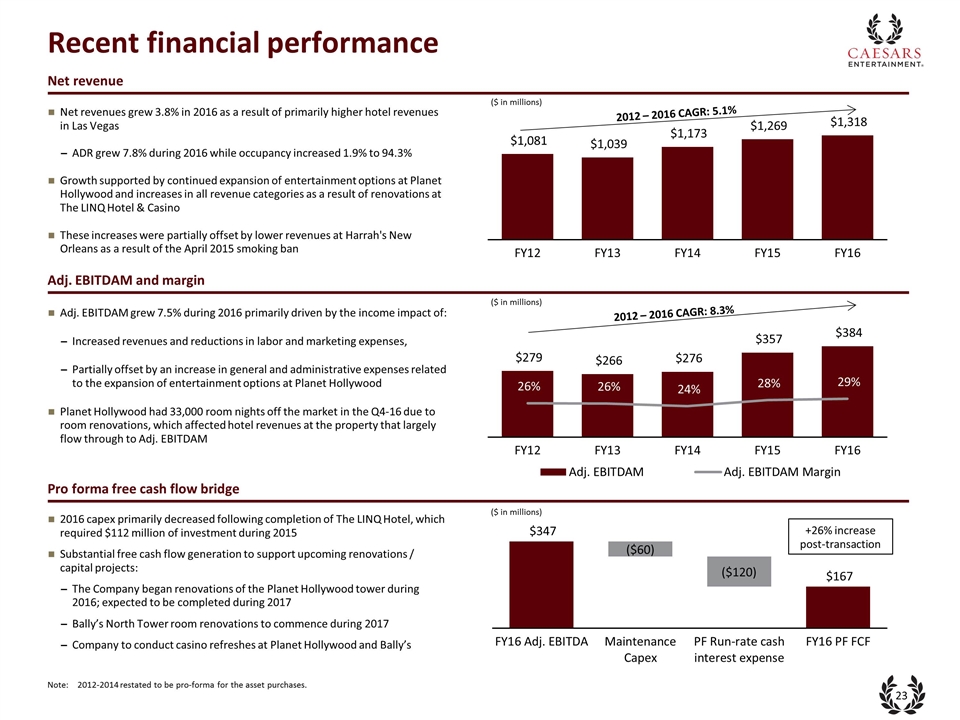

Recent financial performance Net revenues grew 3.8% in 2016 as a result of primarily higher hotel revenues in Las Vegas ADR grew 7.8% during 2016 while occupancy increased 1.9% to 94.3% Growth supported by continued expansion of entertainment options at Planet Hollywood and increases in all revenue categories as a result of renovations at The LINQ Hotel & Casino These increases were partially offset by lower revenues at Harrah's New Orleans as a result of the April 2015 smoking ban Adj. EBITDAM grew 7.5% during 2016 primarily driven by the income impact of: Increased revenues and reductions in labor and marketing expenses, Partially offset by an increase in general and administrative expenses related to the expansion of entertainment options at Planet Hollywood Planet Hollywood had 33,000 room nights off the market in the Q4-16 due to room renovations, which affected hotel revenues at the property that largely flow through to Adj. EBITDAM 2016 capex primarily decreased following completion of The LINQ Hotel, which required $112 million of investment during 2015 Substantial free cash flow generation to support upcoming renovations / capital projects: The Company began renovations of the Planet Hollywood tower during 2016; expected to be completed during 2017 Bally’s North Tower room renovations to commence during 2017 Company to conduct casino refreshes at Planet Hollywood and Bally’s ($ in millions) ($ in millions) ($ in millions) Net revenue Adj. EBITDAM and margin Pro forma free cash flow bridge Note: 2012-2014 restated to be pro-forma for the asset purchases. 2012 – 2016 CAGR: 5.1% 2012 – 2016 CAGR: 8.3% +26% increase post-transaction

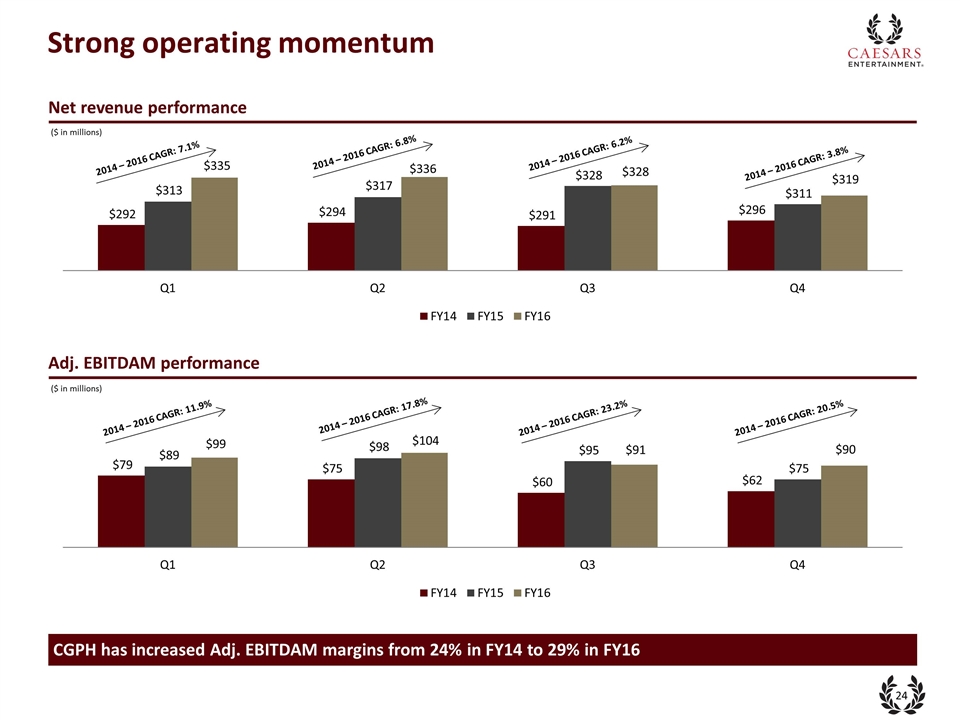

2014 – 2016 CAGR: 7.1% Strong operating momentum Net revenue performance Adj. EBITDAM performance CGPH has increased Adj. EBITDAM margins from 24% in FY14 to 29% in FY16 ($ in millions) ($ in millions) 2014 – 2016 CAGR: 6.8% 2014 – 2016 CAGR: 6.2% 2014 – 2016 CAGR: 3.8% 2014 – 2016 CAGR: 11.9% 2014 – 2016 CAGR: 17.8% 2014 – 2016 CAGR: 23.2% 2014 – 2016 CAGR: 20.5%

Appendix

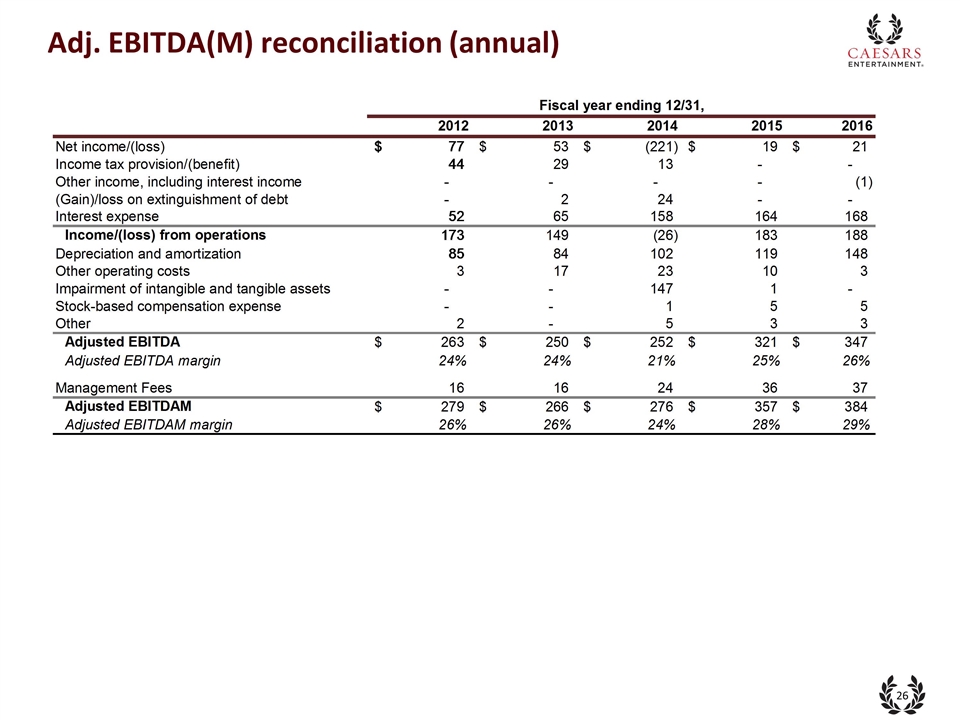

Adj. EBITDA(M) reconciliation (annual)

Adj. EBITDA(M) reconciliation (quarterly)

Notes to Non-GAAP information Note:About nine o'clock the moon was sufficiently bright for me to proceed on my way and I had no difficulty in following the trail at a fast walk, and in some places at a brisk trot until, about midnight, I reached the water hole where Powell had expected to camp. I came upon the spot unexpectedly, finding it entirely deserted, with no signs of having been recently occupied as a camp. Adj. EBITDA(M) is defined as EBITDA(M) further adjusted to exclude certain non-cash and other items as exhibited in the reconciliation, and is presented as a supplemental measure of CGPH’s performance. Management believes that Adjusted EBITDA(M) provide investors with additional information and allows a better understanding of the results of operational activities separate from the financial impact of decisions made for the long-term benefit of CGPH. In addition, compensation of management is in part determined by reference to certain of such financial information. As a result, we believe this supplemental information is useful to investors who are trying to understand the results of CGPH. Adj. EBITDA(M) Margin is the ratio of Adj. EBITDA(M) to Net Revenue and is presented for the same reasons as Adj. EBITDA(M) noted above. Because not all companies use identical calculations, the presentation of Adj. EBITDA(M) may not be comparable to other similarly titled measures of other companies.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Paramount Global (PARA) and Skydance are closer to a merger - CNBC

- Lithia Motors (LAD) PT Lowered to $310 at Craig-Hallum

- Owlet (OWLT) Forges Groundbreaking Partnership with Wheel to Launch Virtual TeleHealth Services Platform

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share