Form 425 Bull Horn Holdings Corp. Filed by: Bull Horn Holdings Corp.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 6, 2022

BULL HORN HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| British Virgin Islands | 001-39669 | 98-1465952 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

801 S. Pointe Drive, Suite TH-1

Miami Beach, Florida 33139

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (305) 671-3341

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one Ordinary Share and one Redeemable Warrant | BHSEU | The Nasdaq Stock Market LLC | ||

| Ordinary Shares, par value $0.0001 per share | BHSE | The Nasdaq Stock Market LLC | ||

| Warrants, each whole warrant exercisable for one-half of one Ordinary Share for $11.50 per whole share | BHSEW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD.

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is an investor presentation (the “Investor Presentation”) that will be used by Bull Horn Holdings Corp., a special purpose acquisition company incorporated as a British Virgin Islands business company (“Bull Horn”), in connection with the transactions (the “Transactions”) contemplated by an Agreement and Plan of Merger dated effective as of April 18, 2022 (as may be further amended or supplemented from time to time, the “Merger Agreement”), with Coeptis Therapeutics, Inc., a Delaware corporation (“Coeptis”), and BH Merger Sub Inc., a Delaware corporation and a wholly-owned subsidiary of Bull Horn.

The Investor Presentation is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Additional Information

In connection with the Transactions, Bull Horn has filed with the Securities and Exchange Commission (the “SEC”) a Registration Statement on Form S-4, which includes a preliminary proxy statement/prospectus in connection with the proposed Transactions. The definitive proxy statement and other relevant documents will be mailed to Bull Horn security holders as of a record date to be established for voting on the Merger Agreement and the Transactions. Investors and security holders of Bull Horn and other interested persons are advised to read the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in connection with Bull Horn’s solicitation of proxies for the extraordinary general meeting of Bull Horn shareholders to be held to approve the Merger Agreement and the Transactions because these documents will contain important information about Bull Horn, Coeptis, the Merger Agreement and the Transactions. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the Transactions (when they become available), and any other documents filed by Bull Horn with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) or by writing to Bull Horn at: 801 S. Pointe Drive, Suite TH-1, Miami Beach, Florida 33139.

Forward-Looking Statements

This Current Report on Form 8-K contains, and certain oral statements made by representatives of Bull Horn and Coeptis and their respective affiliates, from time to time may contain, “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Bull Horn’s and Coeptis’ actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “might” and “continues,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Bull Horn’s and Coeptis’ expectations with respect to future performance and anticipated financial impacts of the Transactions contemplated by the Merger Agreement, the satisfaction of the closing conditions to the Transactions and the timing of the completion of the Transactions. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Most of these factors are outside of the control of Bull Horn or Coeptis and are difficult to predict. Factors that may cause such differences include but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (2) the inability to complete the Transactions, including due to the failure to obtain approval of the shareholders of Bull Horn or other conditions to closing in the Merger Agreement; (3) the inability to obtain or maintain the listing of Bull Horn’s securities on the Nasdaq Capital Market following the Transactions; (4) the risk of significant redemptions by Bull Horn’s public shareholders in connection with the closing of the Transactions, leaving the combined post-closing company with limited funds to finance its business plans; (5) the risk that the Transactions disrupt current plans and operations of Coeptis as a result of the announcement and consummation of the Transactions; (6) the inability to recognize the anticipated benefits of the Transactions, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth economically and hire and retain key employees; (7) the risks that Coeptis’ products in development fail clinical trials or are not approved by the U.S. Food and Drug Administration or other applicable regulatory authorities; (8) costs related to the Transactions; (8) changes in applicable laws or regulations; (10) the possibility that Bull Horn or Coeptis may be adversely affected by other economic, business, and/or competitive factors; and (11) the impact of the global COVID-19 pandemic on any of the foregoing risks and other risks and uncertainties identified in the proxy statement/prospectus relating to the Transactions, including those under “Risk Factors” therein, and in other filings with the SEC made by Bull Horn. The foregoing list of factors is not exclusive. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Bull Horn and Coeptis undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

1

Participants in the Solicitation

Bull Horn, Coeptis and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of Bull Horn securities in respect of the proposed Transactions. Information about Bull Horn’s directors and executive officers and their ownership of Bull Horn’s securities is set forth in Bull Horn’s filings with the SEC. Additional information regarding the interests of the participants in the definitive proxy solicitation will be included in the proxy statement pertaining to the proposed Transactions when it becomes available. These documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed Transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Investor Presentation, dated July 2022. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: July 6, 2022 | BULL HORN HOLDINGS CORP. | ||

| By: | /s/ Robert Striar | ||

| Name: | Robert Striar | ||

| Title: | Chief Executive Officer | ||

3

Exhibit 99.1

1 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis Therapeutics, Inc. Corporate Overview

2 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers This presentation (the “Presentation”) has been prepared for informational purposes only to assist interested parties in eval uat ing an investment in connection with a proposed business combination (the “Business Combination”) between Bull Horn Holdings Corp. ( “Bu ll Horn”) and Coeptis Therapeutics, Inc. (“Coeptis”). The closing of the Business Combination will be subject to satisfaction o f t he closing condition set forth therein. In connection with the closing of the Business Combination, Bull Horn will re - domesticate as a Del aware corporation and will change its name. The continuing combined entity is hereinafter referred to as the “Company”. No Offer or Solicitation: This Presentation is for informational purposes and does not constitute a “solicitation” pursuant to Section 14 of the Securities Exchange Act of 1934, as amended or the rules and regulations of the U.S. Securities and Exchange Commission (”SEC ”) promulgated pursuant thereto. This Presentation does not constitute (i) a solicitation of a proxy, consent, or authorization wi th respect to any securities or in respect of the Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a re com mendation to purchase any security of Bull Horn, Coeptis, or any of their respective affiliates nor shall there be any sale of securities, in vestment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qua lif ication under the securities laws of any such jurisdiction. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF ANY OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

3 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers cont’d. Participants in Solicitation: Bull Horn and Coeptis and their respective directors and executive officers may, under SEC rules, be deemed to be participants in the solicitation of proxies or consents of Bull Horn’s or Coeptis’ respective shareholders in connection w ith the Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the Bu sin ess Combination of Bull Horn’s and Coeptis’ respective directors and officers in Bull Horn’s and Coeptis’ filings with the SEC, i ncl uding Bull Horn’s and Coeptis’ respective Annual Reports on Form 10 - K for the fiscal year ended December 31, 2021. Information regarding the pers ons who may, under SEC rules, be deemed participants in the solicitation of proxies to Bull Horn’s or Coeptis’ shareholders in connec tio n with the Business Combination will be set forth in the proxy statement/prospectus included in the registration statement on Form S - 4 with respect to the Business Combination, which has been to be filed by Bull Horn with the SEC. Additional Information and Proxy Statement: In connection with the proposed Business Combination, Bull Horn has filed with th e S EC a Registration Statement on Form S - 4, containing a preliminary proxy statement/prospectus of Bull Horn and Coeptis and after the registration statement is declared effective, Bull Horn and Coeptis will mail a definitive proxy statement/prospectus relatin g t o the proposed Business Combination to their respective shareholders.

4 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers cont’d. This Presentation does not contain any information that should be considered by Bull Horn’s or Coeptis’ respective shareholde rs concerning the proposed Business Combination and is not intended to constitute the basis of any voting or investment decision in respect of the Business Combination or the securities of Bull Horn or Coeptis. Interested persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about Bull Horn, Coe pti s and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials relating to the pr oposed Business Combination will be mailed to shareholders of Bull Horn and Coeptis as of a record date to be established for voting on the proposed Business Combination. The information contained in the Presentation does not purport to be all - inclusive or to contain all information that may be req uired to make a full analysis of an investment in Bull Horn, Coeptis or the Business Combination, and you should conduct your own inde pen dent evaluation and due diligence with respect to Bull Horn, Coeptis and the terms of the Business Combination. The general explan ati ons included in this Presentation are not intended to, and cannot, address your specific investment objectives, financial situati ons or financial needs. You should consult with you own legal counsel and tax and financial advisors as to legal and related matters concerni ng the matters described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information conta ine d herein to make any investment decision.

5 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers cont’d. No Representation: Neither Bull Horn nor Coeptis, nor any of their respective subsidiaries, shareholders, affiliates, representatives, control persons, partners, members, managers, directors, officers, employees, advisers or agents make any representation or warranty, ex press or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. To the fullest e xte nt permitted by law, in no circumstances will Bull Horn, Coeptis or any of their respective subsidiaries, shareholders, affiliates, represent ati ves, control persons, partners, members, managers, directors, officers, employees, advisers or agents be responsible or liable for any dir ect , indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the inf ormation contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Date of Information: This Presentation speaks only as of the date hereof. Neither Bull Horn nor Coeptis intend to update or otherwise revise this Presentation following its distribution, except the extent required by law. Neither Bull Horn nor Coeptis makes any rep res entation or warranty, express or implied, as to the accuracy of completeness of any of the information contained in this Presentation. This Presentation is not a substitute for the proxy statement/prospectus or for any other document that Bull Horn or Coeptis may file with the SEC in connection with the Business Combination. INVESTORS AND SECURITYHOLDERS ARE ADVISED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders may obtain free copies of other documents filed with the SEC by Bull Horn or Coeptis through the website mai nta ined by the SEC at www.sec.gov .

6 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers cont’d. The below list of risk factors has been prepared as part of the Business Combination. The risks presented below are a subset of the general risks related to the business of Coeptis and the proposed Business Combination. and such list is not exhaustive. The list bel ow has been prepared solely for purposes of this presentation and not for any other purpose. The list below is qualified in its entirety by disclosures contained in documents previously or hereafter filed or furnished by Bull Horn or Coeptis with the SEC, and you should carefu lly consider these risks and uncertainties, together with the financial statements and related notes filed with the SEC. If Coeptis canno t a ddress any of the following risks and uncertainties effectively, or any other risks and difficulties that may arise in the future, its busi nes s. financial condition and results of operations could be materially and adversely affected. The risks described below are not the only risks that C oep tis or Bull Horn faces. Additional risks that are currently not known about or that are currently believed to be immaterial may also impa ir its business, financial condition or results of operations. You should review this presentation and perform your own due diligence and cons ult with your own financial and legal advisors prior to making any decision in respect of Bull Horn, Coeptis or the Company. Risks relating to the business of Coeptis and Bull Horn will be disclosed in future documents filed or furnished by Coeptis and/or Bull Horn with the SEC, i ncl uding the documents filed or furnished in connection with the proposed Business Combination. The risks presented in such filings will b e c onsistent with those that would be required for a public company in its SEC filings, including with respect to the business and securit ies of Coeptis and Bull Horn and the proposed Business Combination, and may differ significantly from, and be more extensive than, the follo win g risks presented below. - The consummation of the Business Combination is subject to a number of conditions, and if any of those conditions are not sat isfied or waived, Business Combination may not be completed; Risk Factors

7 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers cont’d. - If the Business Combination is consummated, there is no assurance that we will achieve the intended benefits of the Business Combination; - Adverse impacts from the pandemic involving the novel coronavirus known as COVID - 19; - The impact of damage to or interruption of our information technology systems due to cyber - attacks or other circumstances bey ond our control; - Business interruptions resulting from geographical actions, including war and terrorism; - We may not be able to successfully implement our growth strategy on a timely basis or at all; - We may have difficulties managing our anticipated growth, or we may not grow at all; - We have a history of losses, we expect to incur losses in the future and we may not be able to achieve or maintain profitabil ity; - We may not be able to initiate and complete preclinical studies and clinical trials for our product candidates which could ad ver sely affect our business; - We may not be able to obtain and maintain the third - party relationships that are necessary to develop, commercialize and manufac ture some or all of our product candidates; - We may encounter difficulties in managing our growth, which could adversely affect our operations; - We need to obtain financing in order to continue our operations, which may not be available on attractive terms or at all; - We may, for financing or other reasons, have to delay, scale back or discontinue some of our product candidate development pr ogr ams or future commercialization efforts; - There are no assurances that any of the opportunities described in this presentation (including VyGen - Bio, Inc.’s assets, the CA R - T technologies and the agonist platform), each of which is early - stage, pre - clinical or clinical, will result in a commercial prod uct or overcome the risks associated with early - stage biotech drug development: Risk Factors

8 © 2022 Coeptis Therapeutics, Inc. All rights reserved Important Legal Disclaimers cont’d. - The drug development and approval process is uncertain, time - consuming and expensive; - Competition in the biotechnology and pharmaceutical industries may result in competing products, superior marketing of other products and lower revenues or profits for us; - Federal laws or regulations on drug importation could make lower cost versions of our future products available, which could adversely affect our revenues, if any; - The regulatory approval process is costly and lengthy, and we may not be able to successfully obtain all required regulatory approvals; - Healthcare reform measures could adversely affect our business; - Protecting and defending against intellectual property claims may have a material adverse effect on our business; - Certain of our estimates of market opportunity and forecasts of market growth could prove to be inaccurate; - Potential legal proceedings in connection with the Business Combination, the outcome of which may be uncertain. could delay o r prevent the completion of the Business Combination; - If we are not able to retain our current senior management team and our scientific advisors or continue to attract and retain qu alified scientific, technical and business personnel, our business will suffer; and - There is a substantial doubt about our ability to continue as a going concern. Risk Factors

9 © 2022 Coeptis Therapeutics, Inc. All rights reserved Cautionary Note Regarding Forward - Looking Statements Certain statements in this Presentation, and statements by management or other persons acting by or on behalf of Bull Horn or Co eptis made in connection with this Presentation, constitute “forward - looking statements” within the meaning of the safe harbor provisi ons of the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements are neither historical facts nor ass urances of future performance. Because forward - looking statements relate to the future, they are inherently subject to significant known an d unknown risks, uncertainties and other factors that are difficult to predict and are beyond the control of both Bull Horn and Coeptis . The actual results, level of activity, performance or achievements of Bull Horn or Coeptis may be materially different from any future results, l eve ls of activity, performance or achievements expressed or implied by these forwards - looking statements. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticip ate,” “intend,” “expect,” “should,” “would,” “plan,” “future,” “outlook,” and similar expressions that predict or indicate future events or t ren ds. All statements that are not statements of historical matters are forward - looking statements. The forward - looking statements include, but are n ot limited to, statements concerning the expected terms and timing of the Business Combination and any financing undertaken in connectio n w ith the Business Combination. The forward - looking statements made in this Presentation are based on Coeptis’ current assumptions and judgments regarding futur e events and results. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Ma ny actual events and circumstances are beyond the control of Bull Horn and Coeptis. Some important factors that could cause actual res ult s to differ materially from those in any forward - looking statements could include changes in domestic and foreign business, market, financia l, political and legal conditions. These forward - looking statements are provided for illustrative purposes only and are not intended to serv e as, and must not be relied upon as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

10 © 2022 Coeptis Therapeutics, Inc. All rights reserved COEPTIS THERAPEUTICS We are a Pittsburgh, PA based pharmaceutical company founded by an experienced team developing innovative cell therapy platforms in oncology .

11 © 2022 Coeptis Therapeutics, Inc. All rights reserved MERGER AGREEMENT WITH BULL HORN HOLDINGS CD38+ CANCERS – INITIAL GEAR - NK TARGET OPTION FOR CAR - T PLATFORM WITH MULTIPLE APPLICATIONS OPTION FOR ENTOLIMOD – CLINICAL STAGE, TLR5 AGONIST Announced entry into definitive merger agreement with Bull Horn Holdings Corp. (Nasdaq: BHSE), a special purpose acquisition company (SPAC). Transaction expected to provide opportunity to enhance Coeptis' ability to progress its innovative cell therapy platforms for cancer and TLR5 agonist clinical pipeline. VyGen - Bio’s GEAR - NK enables development of modified NK cell - based therapeutics optimized to be co - administered with targeted antibodies. CD38 - GEAR - NK are modified NK cells that can avoid being ablated by therapies designed to target the CD38 antigen. Exclusive option agreement with University of Pittsburgh provides access to three potentially groundbreaking CAR - T technologies. CAR - T platform early - indications offer potential to target hematologic and solid tumors, including breast and ovarian cancer. Right to acquire toll - like receptor 5 (TLR5) agonist platform, including entolimod . Entolimod is a clinical - stage product currently being developed as a treatment for acute radiation syndrome. Corporate Highlights

12 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis entered into definitive merger agreement for a business combination that will result in Coeptis becoming a wholly - owned subsidiary of Bull Horn Holdings Corp. (Nasdaq: BHSE), a special purpose acquisition company (SPAC). Under the terms of the merger agreement, a wholly - owned subsidiary of Bull Horn will merge with and into Coeptis. At the close of the transaction, Bull Horn will be rebranded with “Coeptis” in its name and expects to be listed on Nasdaq under the ticker symbol “COEP.” Bull Horn to re - domesticate to Delaware. GO - FORWARD PLAN Merger provides Coeptis access to capital needed to advance product portfolio highlighted by CD38 - GEAR - NK and CD38 - Diagnostic; license/acquire Pitt and TLR5 agonist assets. David Mehalick to lead combined company as President and CEO. Chris Calise, CFO of Bull Horn, to join the combined company Board. KEY TRANSACTION TERMS MERGER AGREEMENT Coeptis Merger Agreement – Bull Horn Holdings

13 © 2022 Coeptis Therapeutics, Inc. All rights reserved Multiple Growth Drivers – Pre/Post Merger Business Combination values Coeptis at $175 million (subject to adjustments) . Business Combination value agreed to prior to TRL5 agonist and Pitt agreements, suggesting near - term and longer - range upside potential. Q2 ‘21 Q3 ’21 5/18/21 Coeptis Enters into Exclusive Option Agreements w/ VyGen - Bio 8/19/21 Coeptis Therapeutics Partners with VyGen - Bio, Inc. to Co - develop Two Assets Designed to Improve the Treatment of CD38 - Related Cancers 4/19/22 Coeptis Therapeutics, Inc. and Bull Horn Holdings Corp. Announce Merger Agreement 5/17/22 Coeptis Therapeutics Enters into Exclusive Option Agreement with University of Pittsburgh for Rights to CAR - T Technologies Q2 ‘21 4/13/22 Coeptis Therapeutics Announces Opportunity to Acquire TLR5 Agonist Platform, Including Clinical - Stage Asset Entolimod

14 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis entered into two exclusive option agreements with VyGen - Bio, Inc., a majority - owned subsidiary of Vycellix, Inc., involving technologies designed to improve the treatment of CD38 - related cancers. Coeptis will assist VyGen - Bio in its efforts to develop and commercialize: • CD38 - GEAR - NK , is a pre - clinical in vitro proof of concept product designed to protect CD38+ NK cells from destruction by anti - CD38 mAbs. • CD38 - Diagnostic , a discovery - stage product designed to analyze if cancer patients might be appropriate candidates for anti - CD38 mAb therapy. PARTNERSHIP STATUS Coeptis currently has a 50% (which could scale down to 25%) revenue stream interest and co - development rights for CD38 - GEAR - NK and a 50% revenue stream interest related to CD38 - Diagnostic from VyGen - Bio. Coeptis is entitled to receive future revenue from both products. DEVELOP & COMMERCIALIZE EXCLUSIVE OPTION AGREEMENT Coeptis Collaboration – VyGen - Bio

15 © 2022 Coeptis Therapeutics, Inc. All rights reserved IMMUNOTHERAPY CHALLENGES Various immunotherapies for CD38+ tumors are designed to find and kill cells that express the CD38 antigen; therefore, CD38+ NK cells are likely to become collateral damage and with their eradication, the overall anti - tumor response is suboptimal. THE GOAL To protect CD38+ Natural Killer (NK) cells so that functional disease - targeting NK cells will not be eradicated, enabling their co - existence with CD38 targeting therapies, and thus allowing for complementary tumor killing and immune surveillance. A NOVEL COMBINATORIAL APPROACH Modified NK cells that are co - administered with select monoclonal antibodies and/or other CD38 targeting immunotherapies are in pre - clinical development to enhance and maximize tumor kill via combinatorial approaches otherwise not possible. GEAR - NK (CD38) STRATEGY Animations herein are provided as visual aids to help articulate hypothesized proof - of - concept in a general manner and do not depict precise scientific mechanisms - of - action.

16 © 2022 Coeptis Therapeutics, Inc. All rights reserved Animations herein are provided as visual aids to help articulate hypothesized proof - of - concept in a general manner and do not de pict precise scientific mechanisms - of - action. Anti - CD38 mAbs (Infused antibodies from current cancer treatments) bind to CD38 proteins and kill both CD38+ Cancer cells and our body’s Natural Killer Cells. CD38 - GEAR - NK are modified, NK cells that can avoid being ablated by therapies designed to target the CD38 antigen, thus enabling the combination of passive immunity with innate active immunity to more efficiently target and eradicate CD38+ malignancies. CURRENT ANTI - CD38 PATHWAY PATHWAY WITH GEAR - NK (CD38) CELL THERAPY

17 © 2022 Coeptis Therapeutics, Inc. All rights reserved CD38 - GEAR - NK – Market Opportunity CD38 - GEAR - NK could change how CD38 - related cancers are treated by protecting CD38+ NK cells from destruction by anti - CD38 mAbs. Opportunity to improve the treatment of CD38 - related cancers, including multiple myeloma, chronic lymphocytic leukemia, and acute myeloid leukemia Multiple myeloma is expected to be the first cancer indication targeted with CD38 - GEAR - NK. The multiple myeloma market in the initial 8 target markets 1 was $16.27B in 2019 and is expected to increase through 2030. 2 2 Source: Delve Insight 1. US, UK, Germany, Spain, France, Italy, China, and Japan.

18 © 2022 Coeptis Therapeutics, Inc. All rights reserved CD38 - Diagnostic is an in vitro screening tool to be used prior to initiation of mAb therapy. Being developed to pre - determine which cancer patients are most likely to benefit from targeted anti - CD38 mAb therapies , either as monotherapy or in combination with CD38 - GEAR - NK. Potential to develop as platform technology beyond CD38 to identify patients likely to benefit for a broad range of mAb therapies across multiple indications . CD38 - Diagnostic – Product Overview 1 2 3

19 © 2022 Coeptis Therapeutics, Inc. All rights reserved CD38 - Diagnostic – Market Opportunity Could prevent patients from being subjected to ineffective therapy and enable significant savings to healthcare systems CD38 - Diagnostic provides opportunity to make more cost - effective medical decisions for the treatment of B cell malignancies with high CD38 expression including multiple myeloma. May help to avoid unnecessary administration of anti - CD38 therapies CD38 - Diagnostic designed to be offered as a companion diagnostic for determining patient suitability and likelihood of positive treatment outcomes for CD38 - GEAR - NK and/or CD38 monoclonal antibody therapies.

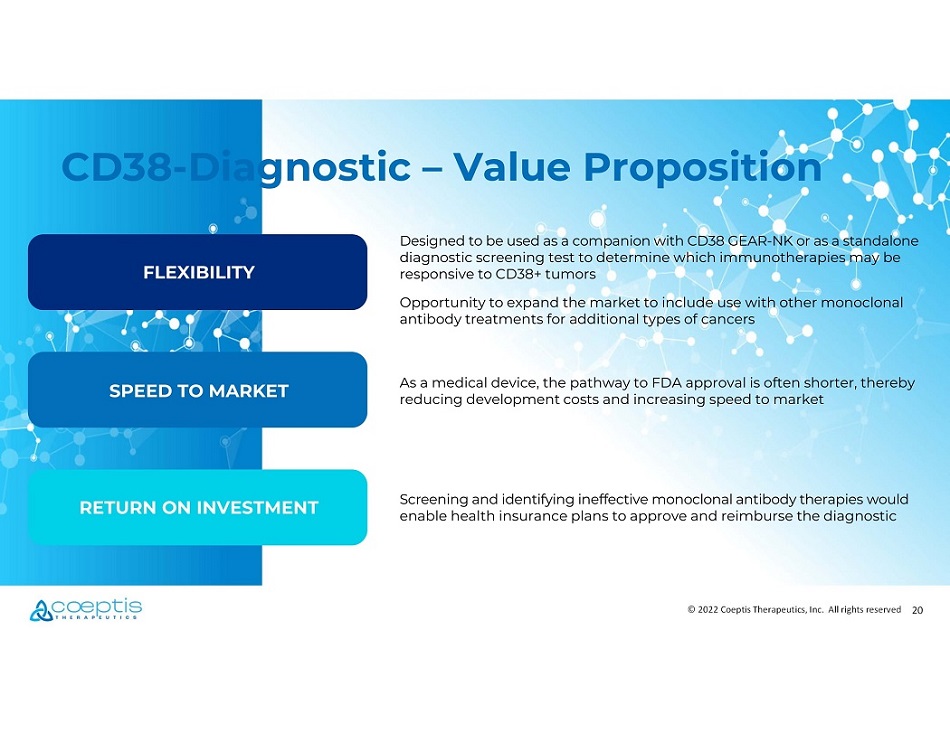

20 © 2022 Coeptis Therapeutics, Inc. All rights reserved FLEXIBILITY SPEED TO MARKET RETURN ON INVESTMENT Designed to be used as a companion with CD38 GEAR - NK or as a standalone diagnostic screening test to determine which immunotherapies may be responsive to CD38+ tumors Opportunity to expand the market to include use with other monoclonal antibody treatments for additional types of cancers As a medical device, the pathway to FDA approval is often shorter, thereby reducing development costs and increasing speed to market Screening and identifying ineffective monoclonal antibody therapies would enable health insurance plans to approve and reimburse the diagnostic CD38 - Diagnostic – Value Proposition

21 © 2022 Coeptis Therapeutics, Inc. All rights reserved Each GEAR platform being designed to be deployed independently or collectively to further bolster the likelihood of a durable therapeutic response . GEAR Diagnostic being designed to determine the most appropriate anti - CD38 mAb . GEAR NK being designed to help to protect the body’s NK cells from being eradicated during mAb therapy. GEAR PLATFORM ADVANTAGES 1 2 3 When deployed collectively, GEAR NK and GEAR DIAG may enable a more robust treatment option when compared to existing regimens for the treatment of CD38+ cancers.

22 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis entered into an exclusive option agreement with the University of Pittsburgh for the rights to negotiate licenses to three CAR - T technologies that offer the potential to address a range of hematologic and solid tumors. Exclusive option agreement involves the intellectual property rights to three technologies : • mSA2 affinity - enhanced biotin - binding CAR • Universal self - labeling SynNotch and CARs for programable antigen - targeting • Conditional control of universal CAR - T cells through stimulus - reactive adaptors PARTNERSHIP STATUS Coeptis has until October 29, 2022, to exercise the option. The option agreement may be extended an additional six months, subject to the agreement of both parties . DEVELOP & ADVANCE EXCLUSIVE OPTION AGREEMENT Coeptis Option – University of Pittsburgh

23 © 2022 Coeptis Therapeutics, Inc. All rights reserved CAR - T Platform – Market Opportunities CAR - T offers the potential to revolutionize cancer treatment; however, there remain shortcomings with current CAR - T therapies that could enable the technology to be utilized with additional types of cancer, including many solid tumors . Among the initial cancer indications under development are pre - clinical programs targeting breast cancer and ovarian cancer CAR - T cell therapy market size & share expected to reach $20.56 billion by 2029 from $1.96 billion in 2021, at a compound annual growth rate (CAGR) of 31.6% during forecast period 2022 to 2029. 1 1 Source: Polaris Market Research

24 © 2022 Coeptis Therapeutics, Inc. All rights reserved Creating a universal CAR - T system that maintains a high - binding affinity , while also offering greater control over toxicity . Developing a technology that can target multiple antigens simultaneously . CAR - T Platform – Core Opportunities 1 2 3 Enabling conditional cell receptor control for systemic control over CAR - T cells .

25 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis entered into a strategic agreement giving it the right to acquire toll - like receptor 5 (TLR5) agonist platform, including entolimod, a clinical - stage product currently being developed as a treatment for acute radiation syndrome. Coeptis is currently conducting its due diligence to explore this opportunity. Potential addition of TLR5 agonist platform, led by entolimod, a clinical - stage candidate, could significantly enhance Coeptis’ development pipeline . AGREEMENT TERMS If consummated, Coeptis would pay $6,000,000 (funded with a debt facility) and revenue - based milestone payments to be defined in the definitive agreement in exchange for a defined set of purchased assets that include rights to any product containing entolimod as an active ingredient and all other related TLR5 agonists DEVELOP & ADVANCE STRATEGIC AGREEMENT Coeptis Strategic Agreement – TLR5 Agonist Platform

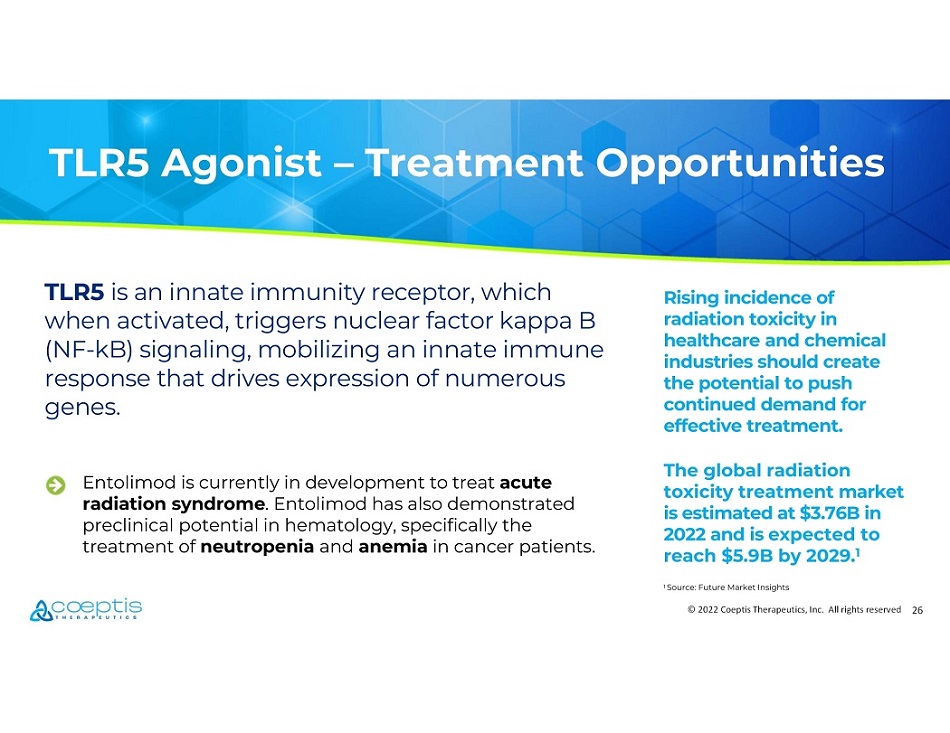

26 © 2022 Coeptis Therapeutics, Inc. All rights reserved TLR5 Agonist – Treatment Opportunities TLR5 is an innate immunity receptor, which when activated, triggers nuclear factor kappa B (NF - kB) signaling, mobilizing an innate immune response that drives expression of numerous genes . Entolimod is currently in development to treat acute radiation syndrome . Entolimod has also demonstrated preclinical potential in hematology, specifically the treatment of neutropenia and anemia in cancer patients. Rising incidence of radiation toxicity in healthcare and chemical industries should create the potential to push continued demand for effective treatment. The global radiation toxicity treatment market is estimated at $3.76B in 2022 and is expected to reach $5.9B by 2029. 1 1 Source: Future Market Insights

27 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis Scientific Advisory Board Head of the Gene and Cell Therapy Group, Division of Hematology, Department of Medicine, Karolinska Institutet, Karolinska University Hospital, Stockholm Evren Alici M.D., Ph.D. Arnika K. Wagner, Ph.D. Assistant Professor, Department of Medicine, Karolinska Institutet, Karolinska University Hospital, Stockholm Former Dean of Research, Karolinska Institutet and founder of the Center for Infectious Medicine, Department of Medicine, Karolinska Institutet, Karolinska University Hospital, Stockholm Hans - Gustaf Ljunggren, M.D., Ph.D.

28 © 2022 Coeptis Therapeutics, Inc. All rights reserved COEPTIS MANAGEMENT TEAM Dave Mehalick Co - Founder, President & CEO 30 years of diverse business experience in healthcare, information technology and finance including consulting, capital markets, private equity, and investments Christine Sheehy Co - Founder & CFO 30 years of finance and operational experience, mainly in pharmaceutical and life science startup companies leading design and development of global systems Gary Conte SVP Sales and Marketing 30 years of pharmaceutical experience including senior roles in sales, marketing, business development, training, managed care, analytics and reporting Dan Yerace Co - Founder & VP Operations 10+ years of pharmaceutical experience including roles in global supply chain, operations, business development, and procurement

29 © 2022 Coeptis Therapeutics, Inc. All rights reserved Anticipated Milestones Expand IP portfolio around GEAR - NK and GEAR Diagnostic Expand ownership of VyGen - Bio and entire GEAR Platform Complete merger agreement with Bull Horn Holdings COEP stock to begin trading on Nasdaq following Bull Horn merger Complete due diligence of TLR5 agonist platform and determine and execute on next steps Finalize licensing agreement with University of Pittsburgh for CAR - T platform Initiate IND enabling studies for GEAR - NK (Toxicology, Pharmacology, PK) Q2 Q3 Q4 Q1’23

30 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis Value Proposition Cell and gene therapies have the potential to “disrupt” current treatment paradigms. Early - stage development assets in this space are being routinely acquired by larger Pharma companies. Entolimod, if acquired, would add clinical - stage asset to development pipeline targeting a condition – acute radiation syndrome – of increasing need due to geopolitical climate. Merger with Bull Horn will advance COEP stock to Nasdaq and provide opportunity to strengthen access to capital.

31 © 2022 Coeptis Therapeutics, Inc. All rights reserved Coeptis Investor Relations Contact: Bill Borden Senior Vice President Tiberend Strategic Advisors Mobile: 732 - 910 - 1620 [email protected] coeptistx.com

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Man Group PLC : Form 8.3 - Barratt Developments plc

- Company announcement no 7/2024 Annual account 2023

- Form 8.3 - [abrdn EUROPEAN LOGISTICS INCOME PLC] - 25 04 2024 - (CGWL)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share