Form 424B5 Natura &Co Holding S.A.

Table of Contents

Filed Pursuant to 424(b)(5)

File No. 333-249198

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Class of securities offered | Amount to be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee | ||||

| Common Shares, no par value (including common shares represented by American Depositary Shares) (1) |

121,400,000 | U.S.$8.23 | U.S.$999,122,000 | U.S.$109,004(2) | ||||

|

| ||||||||

|

| ||||||||

| (1) | American Depositary Shares, each representing two common shares, are traded on the New York Stock Exchange. A separate Registration Statement on Form F-6 (File No. 333-233972) was filed on September 27, 2019. The Registration Statement on Form F-6 relates to the registration of American Depositary Shares, or “ADSs,” issuable upon deposit of the common shares registered hereby. |

| (2) | The registration fee is calculated in accordance with Rule 457(r) of the Securities Act of 1933. |

Table of Contents

Prospectus supplement

(To prospectus dated October 1, 2020)

121,400,000 Common Shares

Natura &Co Holding S.A.

(Incorporated in the Federative Republic of Brazil)

We are offering common shares in a global offering, which consists of an international offering in the United States and other countries outside the Federative Republic of Brazil, or Brazil, and a concurrent offering in Brazil. In the aggregate, 121,400,000 new common shares, which may be represented by American Depositary Shares, or the ADSs, are being offered by us in the global offering. Each ADS represents two common shares. The offering of the ADSs is being underwritten by the international underwriters named in this prospectus supplement. The common shares purchased by investors outside Brazil will be settled in Brazil and paid for in reais, and underwritten by the Brazilian placement agents named elsewhere is this prospectus supplement. The closings of the international and Brazilian offerings are conditioned upon each other.

ADSs representing our common shares are listed on the New York Stock Exchange, or NYSE, under the symbol “NTCO.” The closing price of the ADSs on the NYSE on October 8, 2020 was U.S.$16.80 per ADS. Our common shares are listed and trade on the Novo Mercado segment of the São Paulo Stock Exchange (B3 S.A.—Brasil, Bolsa, Balcão), or the B3, under the symbol “NTCO3.” The closing price of the common shares on the B3 on October 8, 2020 was R$47.00 per share.

Investing in our common shares and ADSs involves risks. See “Risk Factors” beginning on page S-26 of this prospectus supplement.

| Per ADS | Per common share |

Total(1)(2) | ||||||||||

| Public offering price |

U.S.$ | 16.4591 | R$ | 46.2500 | U.S.$ | 999,066,153 | ||||||

| Underwriting discounts and commissions |

U.S.$ | 0.4074 | R$ | 1.1447 | U.S.$ | 24,727,569 | ||||||

| Proceeds, before expenses, to us |

U.S.$ | 16.0517 | R$ | 45.1053 | U.S.$ | 974,338,584 | ||||||

| (1) | Amounts in reais have been translated into U.S. dollars at the selling exchange rate reported by the Central Bank of Brazil (Banco Central do Brasil) as of October 8, 2020, or R$5.620 to U.S.$1.00. |

| (2) | Total amounts reflect the sum of (i) the per-ADS price multiplied by the number of common shares (25,069,000) being sold represented by ADSs plus (ii) the per common share price multiplied by the number of common shares (96,331,000) being sold directly converted to U.S. dollars based on the R$5.620 per U.S.$1.00 exchange rate. |

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the ADSs will be made through the book-entry facilities of The Depository Trust Company, or DTC, on or about October 14, 2020. Delivery of our common shares will be made in Brazil through the book-entry facilities of the B3 on or about October 14, 2020.

| BofA Securities | Morgan Stanley | Bradesco BBI | Citigroup | Itaú BBA |

The date of this prospectus supplement is October 8, 2020.

Table of Contents

Prospectus Supplement

| Page | ||||

| Certain Defined Terms and Conventions Used in This Prospectus Supplement |

S-iii | |||

| S-vi | ||||

| S-vii | ||||

| S-xi | ||||

| S-1 | ||||

| S-13 | ||||

| S-17 | ||||

| S-26 | ||||

| S-68 | ||||

| S-70 | ||||

| S-72 | ||||

| S-74 | ||||

| S-76 | ||||

| S-78 | ||||

| S-83 | ||||

| S-90 | ||||

| S-95 | ||||

| S-149 | ||||

| S-171 | ||||

| S-176 | ||||

| S-178 | ||||

| S-180 | ||||

| S-188 | ||||

| S-200 | ||||

| S-201 | ||||

| S-202 | ||||

| S-203 | ||||

| S-204 | ||||

| Prospectus | ||||

| Certain Defined Terms and Conventions Used in This Prospectus |

ii | |||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 8 | ||||

| 9 | ||||

| Description of Natura &Co Holding Shares and Natura &Co Holding By-Laws |

10 | |||

| Description of American Depositary Shares and Deposit Agreement |

24 | |||

| 33 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

We have not authorized anyone to provide any information other than that contained in this prospectus supplement or in any free writing prospectus prepared by or on behalf of us or to which we may have referred

S-i

Table of Contents

you. We do not take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we, nor any of the international underwriters or the Brazilian placement agents have authorized any other person to provide you with different or additional information. Neither we, nor the international underwriters nor the Brazilian placement agents are making an offer to sell the common shares or the ADSs in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere outside of Brazil solely on the basis of the information contained in this prospectus supplement. You should assume that the information appearing in this prospectus supplement is accurate only as of the date on the front cover of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of the common shares or the ADSs. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus supplement.

For investors outside the United States: Neither we, nor any of the international underwriters nor Brazilian placement agents have done anything that would permit this offering or possession or distribution of this prospectus supplement in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of our common shares and ADSs and the distribution of this prospectus supplement outside the United States.

We own or have rights to trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name, logos and website names. Other trademarks, service marks and trade names appearing in this prospectus supplement are the property of their respective owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus supplement are listed without the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our trademarks, service marks and trade names.

Market and Industry Data

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations, market position, market size and growth rates of the markets in which we participate, is based on information from various sources, including Euromonitor International Limited, or “Euromonitor International,” on our assumptions and calculations that we have made that are based on those data and other similar sources and on our knowledge of the markets for our products and services. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports. Although we are not aware of any misstatements regarding the industry data that we present in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors,” “Cautionary Statement Regarding Forward-Looking Statements” in this prospectus, “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Natura &Co” incorporated by reference into this prospectus from the Natura &Co Holding MD&A/Financials Form 6-K and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Avon” incorporated by reference into this prospectus from the Avon MD&A/Financials Form 6-K.

Information in this prospectus on the beauty and personal care market is from independent market research carried out by Euromonitor International but should not be used be relied upon in making, or refraining from making, any investment decision.

Some market data and statistical information contained in this prospectus are also based on management’s estimates and calculations, which are derived from our review and interpretation of the independent sources, our internal market and brand research and our knowledge of the beauty and personal care industry. Information that is based on estimates, forecasts, projections or similar methodologies is inherently subject to uncertainties, and actual events or circumstances may differ materially from events and circumstances that are assumed in this information.

S-ii

Table of Contents

CERTAIN DEFINED TERMS AND CONVENTIONS USED IN THIS PROSPECTUS SUPPLEMENT

All references in this prospectus supplement to the “Company,” “we,” “us” and “our” refer to Natura &Co, as defined below, unless the context otherwise requires. All references herein to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references to “U.S. dollars,” “dollars” or “U.S.$” are to United States dollars, the official currency of the United States. All references to “pounds,” “pound sterling” or “£” are to the British pound sterling, the official currency of the United Kingdom.

In addition, as used in this prospectus supplement, the following defined terms have the following respective meanings:

“ABIHPEC” means the Brazilian Personal Hygiene, Perfumery and Cosmetics Association (Associação Brasileira da Indústria de Higiene Pessoal, Perfumaria e Cosméticos).

“ADSs” means American Depositary Shares, each representing two Natura &Co Holding Shares.

“Aesop” means Emeis Holding Pty Ltd and its consolidated subsidiaries.

“Avon” means Avon Products, Inc., a New York corporation, and its consolidated subsidiaries.

“Avon Shares” means shares of both Avon Common Shares and Avon Preferred Shares.

“Avon Common Shares” means the shares of common stock, par value U.S.$0.25 per share, of Avon.

“Avon Preferred Shares” means the shares of Series C Preferred Stock, par value U.S.$1.00 per share, of Avon.

“B3” means the B3 S.A.—Brasil, Bolsa, Balcão, or São Paulo Stock Exchange.

“BNDES” means the Banco Nacional de Desenvolvimento Econômico e Social, or the Brazilian National Economic and Social Development Bank.

“Brazil” means the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil.

“Brazilian Central Bank” means the Central Bank of Brazil (Banco Central do Brasil).

“Brazilian Corporation Law” means the Brazilian Law No. 6,404/76, as amended.

“CDI,” or the Interbank Deposit Certificate (Certificado de Depósito Interbancário), means the “over extra group” daily average rate for interbank deposits, expressed as an annual percentage, based on 252 business days, calculated daily and published by B3, or any other index as may be further used in substitution thereof.

“CMN” means the Conselho Monetário Nacional, or the Brazilian Monetary Council.

“consultants” are independent sales representatives who, although they are not employed by Natura &Co, sell Natura &Co products to customers of Natura &Co.

“CVM” means the Comissão de Valores Mobiliários, or the Brazilian Securities Commission.

“DOJ” means the United States Department of Justice.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

S-iii

Table of Contents

“FGV” means the Fundação Getulio Vargas.

“FTC” means the United States Federal Trade Commission.

“IASB” means the International Accounting Standards Board.

“IBGE” means the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística).

“IFRS” means International Financial Reporting Standards as issued by the IASB.

“Natura” means Natura Cosméticos S.A., a corporation (sociedade anônima) incorporated under the laws of Brazil, and its consolidated subsidiaries (excluding Aesop, The Body Shop and their respective subsidiaries).

“Natura &Co” means (1) prior to the completion of the Transaction, Natura Cosméticos S.A. and its consolidated subsidiaries, and (2) after the completion of the Transaction, Natura &Co Holding S.A. and its consolidated subsidiaries, including Natura and Avon.

“Natura &Co Holding” means Natura &Co Holding S.A., a corporation (sociedade anônima) incorporated under the laws of Brazil, excluding its subsidiaries.

“Natura &Co Holding By-Laws” means the by-laws of Natura &Co Holding.

“Natura &Co Holding Shares” means common shares of Natura &Co Holding.

“Natura Cosméticos” means Natura Cosméticos S.A., a corporation (sociedade anônima) incorporated under the laws of Brazil.

“Natura Cosméticos Shares” means common shares of Natura Cosméticos.

“Natura Entities” means Natura &Co, Natura &Co Holding, Nectarine Merger Sub I, Inc. and Nectarine Merger Sub II, Inc., collectively.

“Natura Indústria” means Indústria e Comércio de Cosméticos Natura Ltda.

“Novo Mercado Rules” means the listing rules of the Novo Mercado segment of the B3.

“NYSE” means the New York Stock Exchange.

“Merger Sub I” means Nectarine Merger Sub I, Inc., a Delaware corporation and a direct wholly owned subsidiary of Natura &Co Holding.

“Merger Sub II” means Nectarine Merger Sub II, Inc., a Delaware corporation and a direct wholly owned subsidiary of Merger Sub I.

“Merger Subs” means Merger Sub I and Merger Sub II, collectively.

“Sales representatives” or “representatives” means independent contractors who are not employees of Avon or any of its subsidiaries, but directly or indirectly purchase products or services from Avon or any of its subsidiaries.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

S-iv

Table of Contents

“Shareholders’ Agreement” means the Shareholders’ Agreement of Natura &Co Holding which was entered into on September 4, 2019.

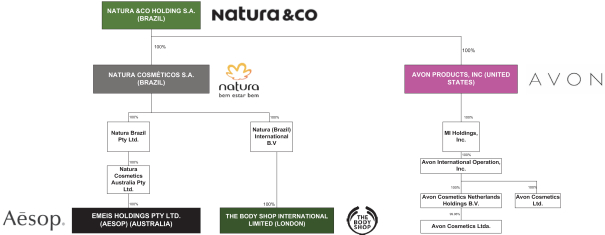

“The Body Shop” means The Body Shop International Limited, a private limited company registered in England and Wales and its subsidiaries.

“Transaction” means the transaction effected by the Agreement and Plan of Mergers, dated May 22, 2019, as amended on October 3, 2019 and as may be further amended from time to time in accordance with its terms (the “Merger Agreement”) entered into by Avon Products, Natura Cosméticos, Natura &Co Holding and the Merger Subs pursuant to which (i) Natura &Co Holding, after the completion of certain restructuring steps, held all issued and outstanding shares of Natura Cosméticos, (ii) Merger Sub II merged with and into Avon, with Avon surviving the merger, and (iii) Merger Sub I merged with and into Natura &Co Holding, with Natura &Co Holding surviving the merger, and as a result of which each of Avon and Natura Cosméticos became a wholly owned direct subsidiary of Natura &Co Holding.

“United Kingdom” or “UK” means the United Kingdom of Great Britain and Northern Ireland.

“United States” or “U.S.” means the United States of America.

“U.S. GAAP” or “GAAP” means generally accepted accounting principles in the U.S.

S-v

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of an automatic shelf registration statement that we filed with the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. Under the automatic shelf registration statement, we may, from time to time, offer and sell any combination of the securities described in the accompanying prospectus in one or more offerings. This document consists of two parts. The first part is the prospectus supplement, which describes the specific terms of this offering and supplements information contained in the accompanying prospectus and certain documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information about us and the securities we may offer from time to time under our shelf registration statement, some of which may not be applicable to this offering.

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any previously filed document incorporated by reference into this prospectus supplement or the accompanying prospectus, on the other hand, you should rely on the information in this prospectus supplement.

You should carefully read the accompanying prospectus, this prospectus supplement, the documents incorporated by reference in the accompanying prospectus and in this prospectus supplement, and any free writing prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision, together with additional information described below under the heading “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

S-vi

Table of Contents

PRESENTATION OF FINANCIAL AND CERTAIN OTHER INFORMATION

Financial Statements

Natura &Co Holding

Natura &Co Holding, formerly Natura Holding S.A., was incorporated on January 21, 2019 as part of a corporate restructuring process initiated by Natura Cosméticos on May 22, 2019, as described below under “—The Transaction.”

On November 13, 2019, the controlling shareholders of Natura Cosméticos contributed to Natura &Co Holding shares corresponding to approximately 57.3% of Natura Cosméticos’ capital. On November 13, 2019, all of the Natura Cosméticos shares held by the noncontrolling shareholders and not previously held by Natura &Co Holding were contributed to Natura &Co Holding in exchange for shares of Natura &Co Holding, and Natura Cosméticos became a wholly owned subsidiary of Natura &Co Holding (collectively referred to as the “Corporate Restructuring”). This contribution became effective on December 17, 2019.

Prior to the Corporate Restructuring, Natura &Co Holding had limited or no assets, operations or activities, or liabilities, and no material contingent liabilities or commitments.

The Corporate Restructuring was accounted for using the predecessor method of accounting, through which the historical operations of Natura &Co are deemed to be those of Natura &Co Holding. Accordingly, the consolidated financial statements incorporated by reference into this prospectus supplement reflect:

| • | the historical operating results and financial position of Natura &Co prior to the Corporate Restructuring; |

| • | the consolidated results of Natura &Co Holding and Natura &Co following the Corporate Restructuring; |

| • | the assets and liabilities of Natura &Co at their historical cost; and |

| • | Natura &Co Holding’s earnings per share for all periods presented. |

| • | The number of common shares issued by Natura &Co Holding, as a result of the Corporate Restructuring is reflected retroactively as of January 1, 2017, for purposes of calculating earnings per share in all prior periods presented. |

The consolidated financial information presented in this prospectus supplement has been derived from the following:

| • | unaudited interim condensed consolidated financial statements as of June 30, 2020 and for the three and six months ended June 30, 2020 and 2019 and the related notes thereto of Natura &Co Holding, using the predecessor method of accounting, as explained above, included in the Natura &Co Holding MD&A/Financials Form 6-K incorporated by reference in this prospectus supplement; |

| • | the audited consolidated financial statements as of December 31, 2019 and 2018 and for each year in the three-year period ended December 31, 2019 and the related notes thereto of Natura &Co Holding, using the predecessor method of accounting, as explained above, included in the Natura &Co Holding MD&A/Financials Form 6-K incorporated by reference in this prospectus supplement; and |

| • | the audited consolidated financial statements as of and for the years ended December 31, 2017, 2016 and 2015 and the related notes thereto of Natura &Co, not included or incorporated by reference in this prospectus supplement. |

Any statement contained in our 2019 Form 20-F will be deemed to be modified or superseded for purposes hereof to the extent that a statement contained herein, in the Natura &Co Holding MD&A/Financials Form 6-K or the Avon MD&A/Financials Form 6-K modifies or supersedes that statement.

S-vii

Table of Contents

The consolidated financial statements of Natura &Co Holding and Natura &Co are prepared in accordance with IFRS as issued by the IASB and are presented in Brazilian reais. The unaudited condensed interim consolidated financial statements of Natura &Co Holding are prepared in accordance with IAS 34 – Interim Financial Reporting as issued by the IASB and are presented in Brazilian reais.

We maintain our books and records in Brazilian reais, which is the functional currency and presentation currency of the consolidated financial statements of Natura &Co Holding and Natura &Co. Unless otherwise noted, our financial information presented herein as of June 30, 2020, as of December 31, 2019 and 2018, for the six months ended June 30, 2020 and 2019, and for the years ended December 31, 2019, 2018 and 2017 is stated in Brazilian reais, our reporting currency.

Avon

Avon’s annual consolidated financial information as of December 31, 2019 and 2018 and for each of the three years period ended December 31, 2019 presented herein have been derived from the audited consolidated financial statements of Avon and the related notes thereto included in the Avon MD&A/Financials Form 6-K and incorporated herein by reference.

The consolidated financial statements of Avon are prepared in accordance with U.S. GAAP and are presented in U.S. dollars.

In 2020, Avon changed its reportable segments to align them with how the business is operated and managed since the merger with Natura &Co, which are reportable segments based on geographic operations: Avon International and Avon Latin America. Prior to this change, Avon reported four segments: Europe, Middle East & Africa, Asia Pacific, South Latin America and North Latin America. We have not recast the segments in the Avon MD&A/Financials Form 6-K incorporated herein by reference because we do not believe the change in reporting segments is material to the assessment of Avon’s performance.

The Transaction

Avon Products, Natura Cosméticos, Natura &Co Holding and the Merger Subs entered into an Agreement and Plan of Mergers, dated May 22, 2019, as amended on October 3, 2019 and November 5, 2019, or the Merger Agreement, pursuant to which (i) Natura &Co Holding, after the completion of certain restructuring steps, held all issued and outstanding shares of Natura Cosméticos, (ii) Merger Sub II merged with and into Avon, with Avon surviving the merger, and (iii) Merger Sub I merged with and into Natura &Co Holding, with Natura &Co Holding surviving the merger, and as a result of which each of Avon and Natura Cosméticos became a wholly owned direct subsidiary of Natura &Co Holding.

The Transaction was consummated on January 3, 2020. Accordingly, our results of operations and financial condition for the historical periods discussed in this section prior to the Transaction do not reflect or include the results of operations or any assets or liabilities of Avon as well as certain critical accounting policies and estimates related to goodwill, intangible assets and purchase accounting related to the Transaction. We began consolidating Avon and its subsidiaries as from January 3, 2020, and, accordingly, our results of operations and financial condition of and for the six-months ended June 30, 2020 and future periods may not necessarily be comparable to our results of operations and financial condition for historical periods prior to the Transaction, including those discussed below.

Currency Conversions

On June 30, 2020, the exchange rate for reais into U.S. dollars was R$5.476 to U.S.$1.00, based on the selling rate as reported by the Brazilian Central Bank. The selling rate was R$5.476 to U.S.$1.00 as of June 30, 2020, R$4.031 to U.S.$1.00 as of December 31, 2019, R$3.875 to U.S.$1.00 as of December 31, 2018, R$3.308

S-viii

Table of Contents

to U.S.$1.00 as of December 29, 2017, R$3.259 to U.S.$1.00 as of December 30, 2016 and R$3.905 to U.S.$1.00 as of December 31, 2015, in each case, as reported by the Brazilian Central Bank. The real/U.S. dollar exchange rate fluctuates widely, and the selling rate as of June 30, 2020 may not be indicative of future exchange rates. See “Exchange Rates” for information regarding exchange rates for the Brazilian currency since January 1, 2015.

Solely for the convenience of the reader, we have translated certain amounts included in this prospectus supplement from reais into U.S. dollars using the exchange rate as reported by the Brazilian Central Bank as of June 30, 2020 for reais into U.S. dollars of R$5.476 per U.S.$1.00. The U.S. dollar equivalent information presented in this prospectus supplement is provided solely for the convenience of investors and should not be construed as implying that the amounts in reais represent, or could have been or could be converted into, U.S. dollars at such rates or any other rate. See “Exchange Rates” for further information about exchange rates.

Rounding

We have made rounding adjustments to reach some of the figures included in, or incorporated by reference into, this prospectus supplement. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that precede them.

Special Note Regarding Non-IFRS Financial Measures

In this prospectus supplement, we present EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Indebtedness, Gross Debt and Net Debt, in each case, on a consolidated basis, all of which are Non-IFRS financial measures. EBITDA is defined as net income plus net finance income, which includes interest gains, interest expenses, gain or losses on derivative financial instruments and foreign exchange gains or losses, income tax and social contribution, and depreciation and amortization, as defined by our Brazilian regulator, the CVM, pursuant to CVM Instruction No. 527/2012. Adjusted EBITDA is EBITDA further adjusted to reflect the effect of certain non-recurring transactions that in management’s judgment are not expected to have a continued impact on the Company’s operating activities or do not necessarily occur on a regular basis. We consider EBITDA and Adjusted EBITDA to be operating performance measures.

We define (i) EBITDA Margin as EBITDA divided by net revenue, expressed as a percentage, and (ii) Adjusted EBITDA Margin as Adjusted EBITDA divided by net revenue, expressed as a percentage.

Indebtedness is defined as the sum of current and noncurrent borrowings, financing and debentures and current and noncurrent lease. Gross Debt is defined as the sum of our Indebtedness, current and noncurrent derivative financial instruments less current and noncurrent lease. Net Debt is calculated as the sum of Gross Debt less cash and cash equivalents and current and noncurrent short-term investments. We consider Indebtedness, Gross Debt and Net Debt to be liquidity measures.

Our management believes that EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Indebtedness, Gross Debt and Net Debt, along with comparable IFRS measures, provide useful information to potential investors, financial analysts and the public in their review of our operating performance. Our management uses these financial measures, along with the most directly comparable IFRS financial measures, in evaluating our operating performance. However, EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Indebtedness, Gross Debt and Net Debt are not measures under IFRS and should not be considered as a substitute for net income or loss, cash flow from operations or other measures of operating performance or liquidity determined in accordance with IFRS. Other companies may calculate these measures differently than we do, and therefore, our presentation may not be comparable to similarly titled measures of other companies. EBITDA, Adjusted EBITDA, EBITDA Margin, Adjusted EBITDA Margin, Indebtedness, Gross Debt and Net Debt are not intended to represent funds available for dividends or other discretionary uses by us because those funds are required for debt service, capital expenditures, working capital needs and other commitments and contingencies. The Non-IFRS financial measures described in this prospectus supplement are not a substitute for the IFRS measures of earnings, for which our management has responsibility.

S-ix

Table of Contents

For more information on the Non-IFRS measures presented in this prospectus supplement, see “Summary Consolidated Financial and Other Information—Non-IFRS Financial Measures.

For a reconciliation of our EBITDA, Adjusted EBITDA, EBITDA Margin and Adjusted EBITDA Margin, see “Summary Financial and Other Information—Non-IFRS Financial Measures—Reconciliation of our Net Income to EBITDA, Adjusted EBITDA, EBITDA Margin and Adjusted EBITDA Margin.” For a reconciliation of our Indebtedness, Gross Debt and Net Debt, see “Summary Financial and Other Information—Non-IFRS Financial Measures—Reconciliation of our Indebtedness, Gross Debt and Net Debt.”

For information on the Non-GAAP measures used by Avon and presented in this prospectus supplement, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Avon—Non-GAAP Financial Measures” in the Avon MD&A/Financials Form 6-K.

Market Data

We obtained market and competitive position data, including market forecasts, used throughout this prospectus supplement from market research, publicly available information and industry publications, as well as internal surveys. We include data from reports prepared by the Brazilian Central Bank, the B3, the IBGE, the ABIHPEC, the BNDES, the FGV and Euromonitor International. We believe that all market data in this prospectus supplement is reliable, accurate and complete.

S-x

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning Natura &Co Holding, its wholly-owned subsidiaries, Avon, and Natura &Co, and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial conditions, or other matters, based on current beliefs of our management as well as assumptions made by, and information currently available to, our management. Forward-looking statements can be identified by the fact that they do not relate only to historical or current facts and may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “would,” “should,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions, although the absence of any such words or expressions does not mean that a particular statement is not a forward-looking statement. These statements are subject to various risks and uncertainties, many of which are outside the parties’ control. Therefore, you should not place undue reliance on these statements. Factors that could cause actual plans and results to differ materially from those in these statements include, but are not limited to, risks and uncertainties detailed in the section of this prospectus supplement entitled “Risk Factors,” and in Natura &Co Holding’s Annual Report on Form 20-F and other periodic filings with the SEC, and the following factors:

| • | global economic conditions; |

| • | risks associated with tax liabilities, or changes in U.S., Brazilian or other international tax treaties or laws or interpretations to which they are subject; |

| • | events and risk perception in relation to corruption allegations involving Brazilian companies and politicians, as well as the impacts of the resulting investigation on the Brazilian economy and political outlook as a whole; |

| • | reductions in customer spending, a slowdown in customer payments and changes in customer demand for products and services; |

| • | unanticipated changes relating to competitive factors in the industries in which the companies operate; |

| • | ability to hire and retain key personnel; |

| • | operating costs, customer loss or business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, distributors or suppliers) being greater than expected since the completion of the Transaction (as defined in “Presentation of Financial and Certain Other Information—The Transaction”); |

| • | ability to attract new clients and retain existing clients in the manner anticipated; |

| • | the impact of acquisitions the companies have made or may make; |

| • | reliance on and integration of information technology systems; |

| • | changes in legislation or governmental regulations affecting the companies; international, national or local economic, social or political conditions that could adversely affect the companies or their clients; |

| • | conditions in the stock and credit markets; |

| • | risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; |

| • | our international operations, which are subject to the risks of currency fluctuations and foreign exchange controls; |

| • | risks that the new businesses will not be integrated successfully or that the cost, time and effort required to integrate the newly combined businesses may be greater than anticipated; |

S-xi

Table of Contents

| • | failure to effectively manage the newly combined business, or that we will not realize estimated cost savings, value of certain tax assets, estimated synergies and growth or that such benefits may take longer to realize than the five years during which we currently expect to realize them; |

| • | developments with respect to the COVID-19 pandemic in Brazil and globally; |

| • | the inability to achieve the estimated benefits and synergies of our combined operations since the completion of the Transaction over the next five years as we currently expect or the effects of the Transaction on our financial condition, operating results and cash flows; |

| • | our inability to meet expectations regarding the accounting and tax treatments with respect to the Transaction; |

| • | risks relating to unanticipated costs of integration; |

| • | diversion of the attention of our management from ongoing business concerns; |

| • | the outcome of any legal proceedings that have been or may be instituted against Avon, Natura &Co, Natura &Co Holding and/or others relating to the Transaction; |

| • | the potential impact of the consummation of the Transaction on relationships with third parties, including clients, employees, consultants, sales representatives and competitors; |

| • | interruptions in our main information technology systems; |

| • | material weaknesses in our internal control over financial reporting; |

| • | the market price for Natura &Co Holding Shares potentially being affected, since the completion of the Transaction, by factors that historically have not affected the market price of Natura Cosméticos Shares or Natura &Co Holding Shares (during the short period prior to the completion of the Transaction) or shares of common stock of Avon as shares of stand-alone companies; and |

| • | other risk factors as set forth under “Risk Factors” in this prospectus supplement. |

The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the parties’ businesses, including those described in this prospectus supplement, and information contained in this prospectus supplement.

Nothing in this prospectus supplement is intended, or is to be construed, as a profit projection or to be interpreted to mean that earnings per share for the current or any future financial years will necessarily match or exceed the historical published earnings per Natura Cosméticos Share or Avon Share, as applicable.

We are under no obligation, and each expressly disclaims any obligation, to update, alter or otherwise revise any forward-looking statements, whether written or oral, which may be made from time to time, whether as a result of new information, future events or otherwise. Persons reading this document are cautioned not to place undue reliance on these forward-looking statements, which only speak as of the date hereof.

S-xii

Table of Contents

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying prospectus as well as the documents incorporated by reference. This summary may not contain all the information that may be important or relevant to you, and we urge you to read this entire prospectus supplement carefully, including the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Natura &Co” in the Natura &Co Holding MD&A/Financials Form 6-K and “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Avon” in the Avon MD&A/Financials Form 6-K and our consolidated financial statements incorporated by reference in this prospectus supplement, the accompanying prospectus as well as the documents incorporated by reference, before deciding to invest in our common shares or the ADSs.

Natura &Co is grounded in the following purpose, beliefs and aspiration:

| • | Purpose: To nurture beauty and relationships for a better way of living and doing business. |

| • | Beliefs: We are passionate agents of change. We build relationships based on transparency, collaboration and diversity. We are committed to integrity and hold ourselves accountable. We find the courage to challenge the status quo and go beyond. We honor and respect the interdependent nature of all things. |

| • | Aspiration: We will dare to innovate to promote positive economic, social and environmental impact. |

Our Reason for Being

Since 1969, when Natura Cosméticos was founded, our Reason for Being is to create and commercialize products and services that promote the harmonious relationship of the individual with himself/herself, with his/her own body, with others and with the nature he/she is part of. In 2014, we launched the Sustainability Vision 2050 and undertook commitments to be transformed into a company that makes a positive impact; in other words, to ensure that the company’s operations help to improve the environment and society, going beyond the current paradigm of merely reducing and mitigating impacts. We have received several awards for the Sustainability Vision project, the primary ones of which are set out below:

In the face of new challenges and the current scenario, in June 2020, we announced our 2030 Vision Commitment to Life, which sets out our commitments and actions within a 10-year time frame, to tackle some of the world’s most pressing issues: addressing the climate crisis and protecting the Amazon, ensuring equality and inclusion, and shifting our business towards circularity and regeneration, reaching in excess of 95% of renewable or natural ingredients and biodegradable formulas. Our approach calls for an all-encompassing business model that gives back more than it takes. Through three pillars, Natura &Co’s Commitment to Life aims to:

| (1) | Address climate change and protect the Amazon by: (i) achieving Net Zero GHG emissions by 2030 for its four brands, 20 years ahead of the UN Commitment; (ii) building a strong track record of adhering to the UN Convention of Biological Diversity; and (iii) stepping up its actions to protect the Amazon by building on Natura´s over 20 years’ of experience in the region, fostering zero deforestation by 2025, and increasing our share of bio-ingredients products. |

| (2) | Defend human rights and be human-kind by: (i) creating better, kinder, and more inclusive conditions for our networks to thrive in, with the commitment to increase diversity to 30% of under-represented |

S-1

Table of Contents

| groups (including gender, race, sexual diversity and gender identity, socio-economically disadvantaged, physical or mental disability balance and equitable pay); (ii) widening our network by promoting our business model to enable gains for our consultants / representatives and their communities (earnings, education, health and digital inclusion) and (iii) upholding intolerance on human rights infringement in line with UN Guiding Principles by 2023 for its entire network, particularly for its supply chain. |

| (3) | Embrace circularity and regeneration by: (i) moving towards and beyond a circular economic model to create more than it takes ensuring packaging and formula circularity by 2030; and (ii) further developing regenerative solutions including fair trade communities, regenerative extraction systems, and waste-to-plastic solutions by 2030. |

Overview

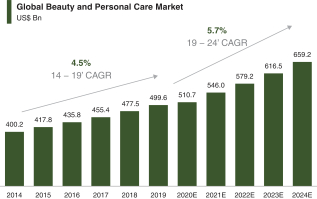

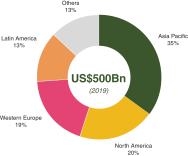

We are purpose-driven group made up of four iconic beauty companies: Natura, The Body Shop, Aesop and Avon. We are united in the belief that there is a better way of living and doing business, and committed to generating positive economic, social and environmental impact. We are the fourth-largest pure play beauty group in the world with a 2.4% global market share as of 2019 as a result of our sizeable operations in Asia Pacific, Europe, North America, Oceania and Latin America considering data compilation by Natura &Co based on Euromonitor International data and internal estimates by Natura &Co using other sources.

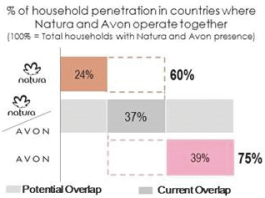

We are a global direct-to-consumer beauty company with approximately 6.8 million consultants (net of overlapping available consultants and representatives shared by Natura and Avon) as of June 30, 2020, 1.8 million consultants for Natura and approximately 5.4 million representatives for Avon and approximately 3,700 owned and franchised stores as of June 30, 2020. We have strong presence in emerging markets, as well as parts of Europe and Asia. We are present in more than 100 countries, in 2019 we employed more than 40,000 employees and associates and served more than 200 million consumers. Our vast expertise in the development, manufacture, distribution and resale of cosmetics, fragrances and personal care products has established our differentiated value proposition to customers and reinforced our leadership in the global beauty segment.

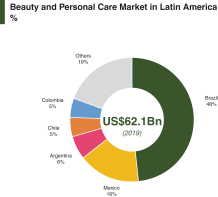

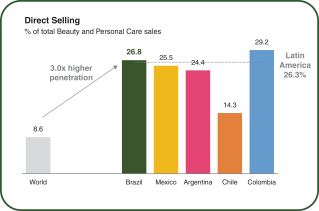

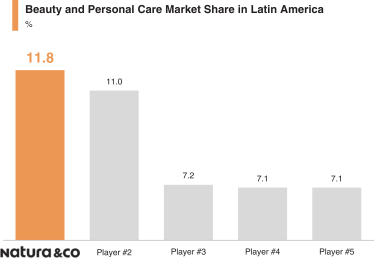

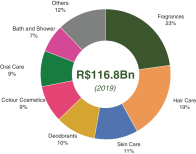

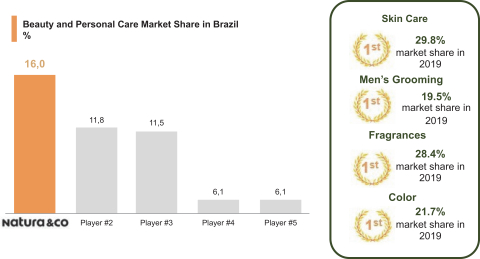

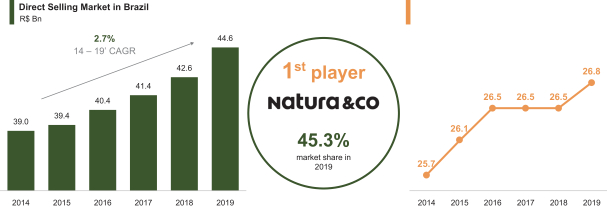

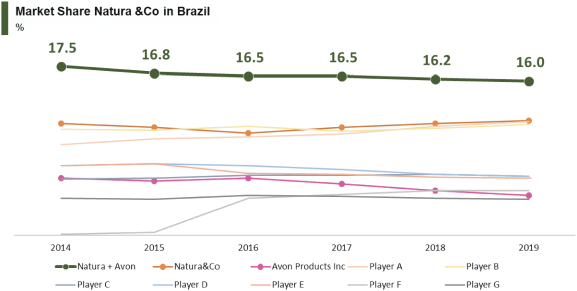

In addition to our global footprint, we have an undisputed leadership in the Latin American beauty and personal care market. Our ability to reach a broad universe of customers through our omni-channel and multi-brand operations results in an 7.7% market share in the region and 11.9% in Brazil as of 2019 based on Euromonitor International data (Beauty and Personal Care 2020, Natura umbrella brand retail value sales, including taxes, U.S. dollars fixed exchange rates, current 2019 terms). According to a data compilation by Natura &Co based on Euromonitor International data, by adding the market shares of Natura &Co and Avon in Brazil and in Latin America, Natura &Co and Avon, together, account for 11.8% market share in the region and 16% in Brazil in 2019. We have a strong footprint and leadership in Latin America which forms a backbone for our internationalization. We intend to leverage Avon’s footprint to grow Natura in the nine countries in Latin America where among our brands, only Avon is currently present. These countries are Ecuador, Guatemala, El Salvador, Costa Rica, Uruguay, Panamá, Paraguay, Honduras, Dominican Republic, which represent 8.7% of the U.S.$62 billion beauty and personal care market in Latin America.

Our track record of more than 50 years of expertise in the segment started with the launch of Natura in 1969 as a direct selling beauty and personal care brand. After our subsequent expansion to Latin America and the first store opening outside Brazil in 2006, we realized the opportunity to expand our business to other geographies and revisited our strategy to focus on internationalization and inorganic growth opportunities.

In 2016, we acquired 100% of Aesop (following the purchase of an initial 65% stake in 2013), a luxury cosmetics company founded in Australia, and in 2017, we acquired The Body Shop, founded in the UK. In May

S-2

Table of Contents

2019, we announced the historic agreement for the acquisition of Avon. This 134-year-old company, which created the direct selling model in cosmetics and is one of the best-known brands on the planet, helped us to expand our reach to 102 million customers in 78 countries. In addition to countless new business opportunities, we now have the chance to further extend the causes that we advocate—including the campaign against domestic violence, promoting women’s rights and celebrating the invaluable role women have in the construction of society.

Below, we further detail each of our brands:

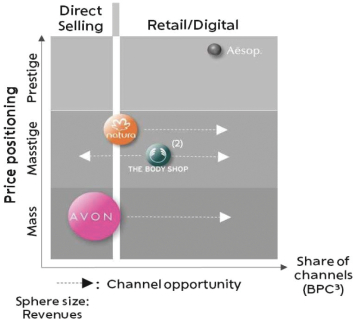

| • | Natura: Founded in 1969 in São Paulo (Brazil), Natura is among the world’s 10 largest direct sales companies. Under this brand, the majority of our products are natural in origin, crafted from ingredients from the biodiversity in Brazil and distributed predominantly through direct sales by our consultants and focused on the intermediary market segment, which we refer to as the “masstige” market. We also operate through e-commerce and have an expanded network of owned physical stores, with 59 stores in Brazil and nine abroad (in the United States, France, Malaysia, Argentina and Chile) and more than 400 franchise stores as of June 30, 2020. |

| • | Avon: Incorporated in 1916 in New York (United States), with operations since 1886, Avon is a global manufacturer and marketer of beauty and related products. Under this brand, our products are distributed predominantly through direct sales by our representatives for beauty, fashion and home segments focused on mass markets. |

| • | The Body Shop: Founded in 1976 in Brighton (United Kingdom), The Body Shop is a developer, distributor and seller of naturally inspired beauty products, makeup and skin care. Under this brand, we distribute and sell our products based on a franchise distribution model and through our owned shops, home sales, and e-commerce present in 73 countries, outlets, travel retail and third-party franchised channels, and the products are available in major markets. The Body Shop is focused on the masstige intermediary market segment. As of June 30, 2020, we had 2,826 stores. |

| • | Aesop: Founded in 1987 in Melbourne (Australia), Aesop is a luxury cosmetics brand, with a unique portfolio of skin care and hair products, among others. Under this brand, our products are distributed predominantly through signature stores with unique designs, department stores and e-commerce in 23 countries directly and four countries through distributors. As of June 30, 2020, we had 247 signature stores and 92 counters in department stores. |

We believe that the combination of these four unique brands allows us to offer a portfolio with strong synergies and cover a broad range of quality products, based on natural ingredients. We supply product categories for both women and men, including skin care products for face and body, hair care and treatment products, cosmetics, fragrances, bath, sunscreen, oral hygiene, and baby and child care.

We believe our brands are among the most recognized in the cosmetics, fragrances and toiletries industry. Our combined businesses consolidate our strong position in body care and also further strengthen our unique value proposition for fragrance.

Natura &Co’s purpose, beliefs and aspiration have been important in our growth and in the development of our strong reputation. We expect that our purpose will also drive our growth in the future. Our brands share the same mission and similar values, with strong belief in ethics, commitment to sustainability and scientific and social innovation. This vision helps us attract and retain our extensive channels of distribution and promote a corporate culture that produces innovative marketing concepts and products, increasing the attractiveness of our products.

We have consolidated our multi-channel, direct to consumer model with a recent acceleration in the online channel through e-commerce across all our four brands and in digital social selling, especially across our Natura

S-3

Table of Contents

and Avon brands. Our relationship with consultants and representatives, who sell Natura and Avon products in Brazil and Latin America, is based on more than simple operations, since we seek to ensure that our business objectives also promote the human and social development of our network, through education, digital inclusion and access to health, creating a strong value proposition.

We have also improved our digital sales and e-commerce platform. In the three months ended June 30, 2020, Natura &Co experienced an acceleration in digital social selling and e-commerce, growing approximately 220% as compared to the same period of the prior year, in constant currency, (including an increase of approximately 150% for Natura and Avon on a combined basis, 430% for Aesop and 230% for The Body Shop, in constant currency). Sales via representatives sharing e-brochures more than doubled at Avon globally in the three months ended June 30, 2020 as compared to the same period of 2019 and in the UK e-brochure sales were up more than 600% in the same period, where 70% of representatives were accessing digital platforms. In addition, Avon International experienced a threefold increase in sales effected through its digital brochure when compared to the same period of 2019. At Natura, content sharing grew by more than 70%, the number of orders tripled and the number of consultant’s online stores increased by 65% in the three months ended June 30, 2020 when compared to the same period of 2019.

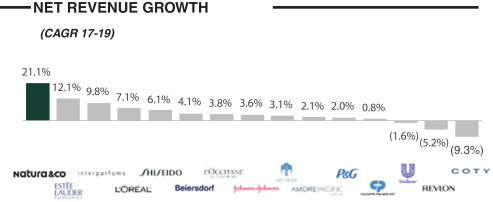

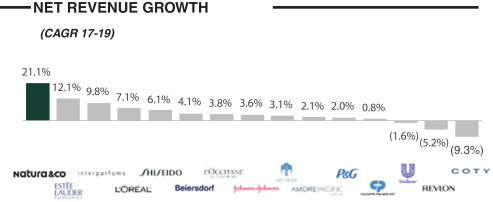

We believe that our strategy has been successfully translated into growth in the past two years. We recorded a 21.1% compound annual growth rate between 2017 and 2019, without taking our acquisition of Avon into account. This growth positions us as having the highest historical revenue growth along beauty and personal care publicly listed companies in the past two fiscal years in reported currency, as shown in the chart below.

The combination with Avon is expected result in annual recurring synergies, which we actually raised from our initial target, including new revenue synergies at Natura &Co Latam and cost synergies at Avon International. We expect these synergies to come from four key areas, mainly in Latin America: sourcing, manufacturing and distribution, administrative and revenues. We estimate the synergies to be fully achieved in five years and estimate we will incur non-recurring costs in connection with these synergies each year within the same period. The synergies are expected to enable investments across the group, in three strategic areas: digital and e-commerce, research and development and brand initiatives. The five-year term indicated is an estimate and should not be interpreted as a guarantee of future results. In this sense, we clarify that the actual results referring to the synergies and costs mentioned may differ materially from those described above.

Our distinctive corporate culture, which values our relationships with our customers, our consultants, our suppliers and others, underscores our commitment to generate positive economic, social and environmental impact. For instance, in 2019, we contributed to the conservation of 1.8 million hectares in the Amazon, a region in which we maintain relations with over 5,000 families in supplier communities.

S-4

Table of Contents

We believe that our strong brand recognition, combined with our comprehensive product offering through a singular multichannel approach, has driven our significant growth, allowing us to cement our leadership across the global beauty and personal care market.

Our Strengths

We are a purpose-driven group that aims to nurture beauty and relationships for a better way of living and doing business.

Our four brands form a group focused on creating value through five key drivers:

| • | Multibrand mode: We have various brands that offer a wide range of products, which target different types of consumers, from low-end to high-end, on a global level. The model allows us to conduct our business in a unique way, maintaining an agile and decentralized business model that balances autonomy with interdependence. |

| • | Leveraging group scale: Group synergies may be achieved in procurement, scale and other initiatives. We created three networks of excellence (in our approaches to digital, retail and sustainability), which enable the dissemination of best practices. |

| • | Strong corporate governance: Our strong corporate governance and experienced leadership also reflect the strength of our group to operate globally and promote sustainable long-term value. |

| • | Omnichannel growth across the globe: We believe we can unlock growth synergies and also rebalance the global footprint by leveraging our existing operations. There is space to grow in different sales channels. |

| • | Innovation and sustainability: We seek to innovate and develop a unique and complementary brand portfolio with best practices shared between the four brands, such as the passion for connecting people and communities in sustainable relations, and living up to the highest standard of social, environmental and economic impact. |

The quality of our relationships with our consultants and representatives, clients, employees, communities and suppliers is one of our strongest advantages. We believe the high value we place on these relationships, as well as our commitment to social responsibility and sustainable development, have contributed to making our group a respected global beauty company.

We offer products which we believe to be of a high quality, and which are linked to concepts that reflect our values. We believe this increases the attractiveness of our goods and encourages customers to be loyal to our brands.

Our Strategy

Our objective is to be viewed by our consumers, consultants, representatives, employees, suppliers, shareholders and other businesses as synonymous with quality, integrity, innovation and socially conscious business practices. We are engaged in maintaining a permanent process that guides us in accomplishing our financial, social and environmental goals.

Our strategy seeks to optimize our performance, while prioritizing important values, such as sustainable development, fair trade and human well-being, and is composed of the following:

| • | Multibrand model: We have developed a multibrand model company that pursues synergic business growth on a global scale by offering innovative and sustainable products through multiple sales channels. Our brands have an international presence and complementary expertise and are present in diverse market segments. |

S-5

Table of Contents

| • | Integrated corporate structure: Our corporate structure is integrated with a limited number of hierarchical levels, which we believe promotes collaboration among our strategic areas of digital, sustainability and retail by sharing best practices and building joint action forces among the executives of these areas. |

| • | Global procurement: We believe that our global procurement organization strategy benefits from our scale by enabling us to negotiate with suppliers from a better position. |

| • | Multi-channel: We operate via multiple channels and we intend to increase this throughout 2020 by accelerating our growth in digital platforms, as well as our brands’ geographical expansion. |

We have different strategic opportunities for each of our brands, including, but not limited to: a successful integration of Natura &Co and Avon; expanding multichannel presence and accelerating the business’s digital transformation for Natura; increasing penetration in markets across the globe, in Asia, notably China (a fast growing premium beauty market), Japan (the third largest beauty market in the world) and Malaysia, and the United States (the largest beauty market in the world), and also to other markets leveraging Avon’s footprint to expand both Natura and The Body Shop brands in key markets over time; launching innovative products for Aesop; and rejuvenating the brand, optimizing retail operations and improving operational efficiency for The Body Shop.

In 2021, we plan to set up a legal entity in China (the second largest beauty market in the world), map opportunities to register products in partnership with Cruelty Free International to ensure that our stand against animal testing is protected, launch an experience center there in which to generate demand for our products prior to launching retail operations, and to also roll out our digital and social selling model there. In Japan, we intend to leverage the acquisition of a franchisee to strengthen the presence of The Body Shop and Aesop by opening new stores in key metropolitan areas. In Malaysia we are piloting an omnichannel market entry strategy under the Natura brand. We launched Natura’s digital platform globally in 2020 with a focus on social selling launched globally in 2020, and we intend to leverage the existing platform (The Body Shop franchisee) for market entry and replicate this model in other markets. We also believe there are opportunities for omnichannel expansion of The Body Shop’s at-home sales from the third quarter of 2020 across all states in the U.S. with a focus on social selling and the leveraging thereof across other sales channels by leveraging our social selling expertise to drive growth.

Building on the post-lockdown momentum, Natura &Co has experienced growth, supported by digital sales performance which continue to grow despite the reopening of brick-and-mortar stores across various markets, the performance of the Natura brand, the expansion of The Body Shop’s and Aesop’s multi-channel platforms, the turnaround of Avon Latam and the strengthening of fundamentals at Avon International.

Recent Events

COVID-19 Pandemic

During 2020, we have been closely monitoring the evolution of the COVID-19 pandemic in order to take preventive measures to minimize the spread of the virus, ensure the continuity of operations and safeguard the health and safety of our personnel.

Management Response

We have a multidisciplinary group of executives from our various businesses, and its mission is to monitor the evolution of the COVID-19 pandemic on a daily basis and outline the most immediate actions that we must take. Our executive leadership team also meets daily, through electronic conferences to follow the work of this group, receive updates about the status of our factories and employees, discuss the external scenario, and make any necessary decisions.

S-6

Table of Contents

Measures Implemented

We have implemented various measures in line with guidance received from the applicable authorities, including:

| • | providing incentives and putting in place protocols for our personnel to work remotely, while also focusing our production and logistics operations on what is essential, in order to ensure that as many employees as possible can remain home; |

| • | adopting new safety procedures for factory employees, such as the use of face shields, goggles and fabric masks, increasing distance between people and monitoring body temperature; |

| • | minimizing the amount of time members of our research and development team spend in laboratories, by implementing a rotation system, as well as focusing our research and development team’s work on essential hygiene items; |

| • | transportation of our products in cardboard boxes, one of the materials on which the COVID-19 virus survives for the shortest time; |

| • | delivery of hygiene kits to drivers transporting our products, including sanitizing products and cleaning cloths as well as information guides on COVID-19 and preventive measures required to prevent its spread; |

| • | authorizing deliveries to be made without the recipient’s signature in order to minimize social contact; |

| • | adjusting our sales cycles; |

| • | daily communication with employees and sales force through e-mails, booklets and live internet presentations; |

| • | measures to make our sales channel more digital, including providing additional digital spaces for our sales force and increasing the number of courses and training; |

| • | sales force events have been canceled, rescheduled or held online; |

| • | wide dissemination of our digital magazine; |

| • | use of emergency funds to assist our sales force; |

| • | preparing sales force leaders to deal with illness, death and other issues relating to COVID-19 that sales teams may encounter; |

| • | monitoring the social impact arising from the fall in our sales force’s revenue; |

| • | changing the rules applicable to minimum orders and initial kits; |

| • | renegotiating beauty consultants’ payments terms (by extending payment days); |

| • | providing health benefits, telemedicine and aid to our sales force; |

| • | changing transportation routes that we provide to our sales force in order to minimize the need for public transport, and putting in place new cleaning protocols before and after such journeys; |

| • | wide dissemination of wellness, health, meditation and psychological support applications; |

| • | broad disclosure and alerts concerning internet fraud; |

| • | daily monitoring of suppliers, interruptions in supply and available inventory; |

| • | reviewing the media budget available to social matters; |

| • | providing transportation for employees; |

S-7

Table of Contents

| • | mapping critical processes and identifying critical people and their substitutes; |

| • | supporting information technology systems for remote working; |

| • | closing stores in certain locations; and |

| • | monitoring the impact of increased usage of our information technology systems. |

As described above, we have taken and may continue to take temporary precautionary measures intended to help minimize the impact of the COVID-19 virus on our operations.

We believe that these actions enable us to continue to operate our business despite the ongoing slowdown in economic activity across all sectors and its direct impact on physical retail.

Impact on Our Business

At the beginning of the second quarter of 2020, we retooled our operations across our brands to step up our production of essential products (such as soap and hand sanitizer) by 30%, while also optimizing available capacity at Avon plants. Our perfume factories started producing hand sanitizer gel and liquid alcohol, and we have donated part of the production. As of the date of this prospectus supplement, all our factories are operating with a focus on the production of essential personal care and hygiene items, although the manufacturing of other products has resumed, where allowed by local legislation.

As a result of the lockdown due to COVID-19 virus, we experienced a significant increase in e-commerce and digital sales, that enabled us to turn in a resilient performance, outperforming the global cosmetics, fragrances and toiletries market in the second quarter in terms of net revenue growth. For the period between April 1, 2020 to July 30, 2020, Natura, Aesop and The Body Shop on a combined basis, in constant currency, reported an increase of 250% in digital sales and Avon doubled its digital sales, in constant currency, when compared with the same period of 2019.

We had R$3.5 billion and R$1.2 billion of finished products in our inventory as of June 30, 2020 and December 31, 2019, respectively. Nevertheless, a prolonged downtime in our factory production may jeopardize our supply.

Lockdown restrictions and store closures. The adoption of enhanced tools and features, enabled by the accelerated adoption of digital working practices, has enabled our consultants and representatives to continue their activity despite lockdown restrictions. We have our own stores and franchised stores distributed across our different brands and geographies that were impacted by lockdowns throughout the second quarter of 2020. At The Body Shop, lockdown restrictions led to the closure of 87% of retail stores at the end of April 2020, progressing to 16% of stores closed at the end of June 2020 once restrictions were lifted. We were able to offset 83% of the impact of COVID-19 on sales through significant growth in online and At-Home channels and the gradual reopening of stores. At Aesop, during most of the second quarter of 2020, up to 90% of stores were closed across most markets. We offset 86% of COVID-19’s impact on sales with strong growth in digital sales and progressive reopening of stores. At Natura, all shopping mall stores were closed during most of the second quarter of 2020, and by the end of June, approximately 60% of all retail stores, including franchisee stores, were reopened (generally with restrictions in place).

Cash and liquidity. We took steps to address liquidity concerns. As presented at the meeting of our board of directors held on June 30, 2020, we increased our capital stock by successfully raising R$2 billion in a private placement, subscribed by our controlling shareholders, selected investors and non-controlling shareholders. We also raised R$750 million in new debt financing, with maturity in May 2021, to increase liquidity, with no impact on our net debt. We also adopted stricter cost discipline, including over capital expenditure and discretionary spending. By June 30, 2020 we had with a very strong cash position of R$4,820 million in cash and cash equivalents, resulting in further deleveraging and ensuring compliance with the financial covenants.

S-8

Table of Contents

We believe that as a result of the measures we have taken, we outperformed global peers in the cosmetics, fragrances and toiletries market based on management estimates of net revenue growth for such peer companies in the period from April 1, 2020 to June 30, 2020 compared to the same period in 2019.

See also “Risk Factors—Risks Relating to Our Business and Industries in Which We Operate—Our business, operations and results may be adversely impacted by COVID-19.”

&Co Pay

We will launch &Co Pay, a complete, global financial services platform for our 3.8 million Latin America consultants and representatives (net of overlapping available consultants and representatives shared by Natura and Avon) as of June 30, 2020, that seeks to address many of the concerns our consultants and representatives have raised regarding security, relationships and financial management. &Co Pay is intended to allow our consultants and representatives to make or receive payments and transfers, and benefit from many other services, including loans, microcredit and loyalty programs. &Co Pay seeks to digitalize the consultants and representatives’ business and provide them with greater financial inclusion and education.

We believe this is a scalable model, which is soon to be launched first in Brazil at Natura, with plans to expand to Avon, followed by expansion to Latin America and eventually across the group. We believe that &Co Pay has the potential to create value from the existing base of our consultants.

We will launch &Co Pay in 2020 with front-end solutions supported by licensed partners, a phasing out of previous partnerships in this area and by making a debit card available for consultants. We intend to support our top selling consultants with access to online stores, to be expanded to all consultants in Brazil. This process will be supported backed by the PIX payment system of the Brazilian Central Bank. We are anticipating expanding &Co Pay to Avon Brazil and Natura &Co Latam in the period from 2020 to 2023. In parallel, we are looking to provide financial education, credit cards and microcredit to our consultants. We expect to implement &Co Pay to Natura &Co globally in 2023.

Open Up and Grow: Growth enabling model

The objective of our Open Up & Grow plan for Avon International is to reset, fix, grow and multiply. We intend to achieve this through the following:

| • | Optimizing our commercial model. We believe we can optimize our commercial model though (i) segmentation and a focus on lifetime value in addition to building a sales strategy based on relationships in relation to which we have already observed some early positive trends in the United Kingdom; (ii) capturing quick wins in price positioning and field incentives; and (iii) by sharpening the product portfolio architecture. |

| • | Watch me now: We intend to build the relevance of the Avon brand through a more streamlined set of innovations and a prioritization of certain key aspects of the brand. Avon just launched its new brand campaign, Watch Me Now, and is working on streamlining its portfolio with fewer, better product launches and a simplified campaign cycle. |

| • | Digital: We intend to make Avon a digital-enabled company, by enhancing the omnichannel experience, increasing digital tools for representatives, while also growing social-selling and e-commerce. We have so far experienced a 70% increase in the adoption of our digital assets in the United Kingdom. |

S-9

Table of Contents

Repayment of Certain Indebtedness and Repurchases of Certain Outstanding Securities

Purchase of 6.95% Notes due 2043

In September 2020, Avon repurchased an aggregate amount of U.S.$27.8 million (R$152.2 million using the exchange rate as reported by the Brazilian Central Bank as of June 30, 2020 for reais into U.S. dollars of R$5.476 per U.S.$1.00) of the Avon 6.95% senior notes due 2043.

Preliminary Net Revenue for the Third Quarter of 2020

Our financial results for the three-month period ended September 30, 2020 are not yet finalized. The following information reflects our preliminary net revenue for this period:

Three Months Ended September 30, 2020

Our total net revenue for the three months ended September 30, 2020 is expected to grow between 25% and 30% over the same period of the last year on a pro forma basis after giving effect to the Avon acquisition in the same period of three months, representing between R$9.9 billion and R$10.3 billion. On a constant currency basis, this represents a growth of between 5% and 10% versus the same period of last year.

Cautionary Statement Regarding Preliminary Net Revenue

The net revenue for the three-month period ended September 30, 2020 are preliminary, unaudited and subject to completion, reflect our management’s current views and may change as a result of our management’s review of results and other factors, including a wide variety of significant business, economic and competitive risks and uncertainties. Such preliminary net revenue for the three months ended September 30, 2020 are subject to the finalization and closing of our accounting books and records (which have yet to be performed), and should not be viewed as a substitute for full quarterly financial statements prepared in accordance with IFRS. We caution you that the preliminary net revenue for three months ended September 30, 2020 and net revenue growth rate compared to the same period in 2019 should not be construed as an indication of performance of any other line item in our income statements and is not a guarantee of future performance or outcomes and that actual results may differ materially from those described above. For more information regarding factors that could cause actual results to differ from those described above, please see “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” We do not undertake any obligation to update publicly or to revise any forward-looking statements after we distribute this prospectus because of new information, future events or other factors. You should read this information together with the sections of this prospectus entitled “Summary Financial and Other Information,” “Selected Financial and Other Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations of Natura &Co” in the Natura &Co Holding MD&A/Financials Form 6-K incorporated by reference this prospectus supplement, “Unaudited Pro Forma Condensed Statement of Income for the year ended December 31, 2019” in the Natura &Co Holding MD&A/Financials Form 6-K incorporated by reference this prospectus supplement, our unaudited interim condensed consolidated financial statements as of June 30, 2020 and for the three and six months ended June 30, 2020 and 2019 and the related notes thereto, included in the Natura &Co Holding MD&A/Financials Form 6-K and incorporated by reference this prospectus supplement, and our audited consolidated financial statements as of December 31, 2019 and 2018 and for each of the years in the three-year period ended December 31, 2019 and the related notes thereto, included in Natura &Co Holding MD&A/Financials Form 6-K and incorporated by reference this prospectus supplement.

The preliminary financial data included in this prospectus supplement has been prepared by and are the sole responsibility of our management. PricewaterhouseCoopers Auditores Independentes has not audited, reviewed,

S-10

Table of Contents

compiled, or applied agreed-upon procedures with respect to the accompanying preliminary financial data. Accordingly, PricewaterhouseCoopers Auditores Independentes does not express an opinion or any other form of assurance with respect thereto.

Summary of Risk Factors

An investment in our common shares and ADSs is subject to a number of risks, including risks relating to our business and industry, risks related to Brazil and risks related to the offering and our common shares and ADSs. The following list summarizes some, but not all, of these risks. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Risks Relating to Our Business and Industries in Which We Operate

| • | Our business, operations and results may be adversely impacted by COVID-19. |

| • | Our business depends on highly recognized brands. We may not be able to maintain and enhance our brands, or we may receive unfavorable customer complaints or negative publicity, which could adversely affect our brands. |

| • | Our industry is highly competitive and strategic actions by our competitors may weaken our competitive position and negatively affect our profitability. |

| • | Interruption of our research and development, production and distribution units may materially adversely affect our business, financial condition and results of operations. |

| • | Interruption in our main information technology, or IT systems, could adversely affect our business, financial conditions, operating results and reputation, and increase our costs. |

| • | Third-party suppliers provide, among other things, the raw materials required for our products, and the loss of these suppliers, a supplier’s inability to supply a raw material or a finished product, or a disruption or interruption in the supply chain may adversely affect our business. |

| • | Our success depends, in part, on the quality, safety and efficacy of our products and the risk of product contamination resulting in product liability may materially adversely affect our business. |

| • | The expected benefits from operating as a combined enterprise with Avon may not be achieved and we may face challenges with integration. |

| • | We may experience financial and strategic difficulties and delays or unexpected costs in completing Open Up & Grow Avon and any other restructuring and cost-savings initiatives, including achieving any anticipated savings and benefits of these initiatives. |