Form 424B5 ALLEGHENY TECHNOLOGIES

Table of Contents

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of each class of securities offered |

Amount to be registered |

Maximum offering price per unit |

Maximum aggregate offering price |

Amount of registration fee(1) | ||||

| 5.875% Senior Notes due 2027 |

$350,000,000 | 100% | $350,000,000 | $45,430.00 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Calculated in accordance with Rule 457(o) and Rule 457(r) under the Securities Act and relates to the Registration Statement on Form S-3 (File No. 333-224542) filed by Allegheny Technologies Incorporated on April 30, 2018. |

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-224542

P R O S P E C T U S S U P P L E M E N T

(To Prospectus Dated April 30, 2018)

$350,000,000

Allegheny Technologies Incorporated

5.875% Senior Notes due 2027

We are offering $350,000,000 aggregate principal amount of our 5.875% Senior Notes due 2027 (the “notes”). The notes will mature on December 1, 2027. Interest will accrue from November 22, 2019, and the first interest payment date will be June 1, 2020.

We may redeem the notes in whole or in part at any time at the applicable redemption prices set forth under “Description of Notes — Optional Redemption.” We must offer to repurchase the notes upon the occurrence of a change of control triggering event at the price described in this prospectus supplement in “Description of Notes — Purchase of Notes upon a Change of Control Repurchase Event.”

The notes will be our senior unsecured obligations, ranking equally in right of payment with all of our existing and future senior unsecured indebtedness and senior to our future subordinated indebtedness. The notes will be effectively subordinated to our existing and future secured indebtedness to the extent of the value of the assets securing that indebtedness and to the existing and future indebtedness and other liabilities of our subsidiaries. We conduct a significant portion of our business through our subsidiaries. None of our subsidiaries will guarantee the notes.

You should read this prospectus supplement and the accompanying prospectus carefully before you invest in our notes. Investing in our notes involves a high degree of risk. See “Risk Factors” beginning on page S-18 for a discussion of certain risks that you should consider in connection with an investment in the notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| Price to Public |

Underwriting Discounts |

Proceeds to Allegheny Technologies (before expenses)(1) |

||||||||||

| Per Note |

100.00 | % | 1.25 | % | 98.75 | % | ||||||

| Total |

$ | 350,000,000 | $ | 4,375,000 | $ | 345,625,000 | ||||||

| 1 | Plus accrued interest, if any, from November 22, 2019. |

The notes will not be listed on any securities exchange or automated quotation system.

We expect that delivery of the notes will be made to investors in book-entry form through The Depository Trust Company for the accounts of its participants, including Clearstream Banking, société anonyme, and Euroclear Banking, S.A./N.V., on or about November 22, 2019.

Joint Book-Running Managers

| BofA Securities | Citigroup |

Co-Managers

| PNC Capital Markets LLC | MUFG | J.P. Morgan | ||

| Wells Fargo Securities | HSBC | |||

The date of this prospectus supplement is November 19, 2019.

Table of Contents

Prospectus Supplement

| Page | ||||

| S-ii | ||||

| S-iii | ||||

| S-v | ||||

| S-1 | ||||

| S-18 | ||||

| S-24 | ||||

| S-25 | ||||

| S-26 | ||||

| S-42 | ||||

| S-47 | ||||

| S-51 | ||||

| S-51 | ||||

| Prospectus |

| |||

| i | ||||

| ii | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 12 | ||||

| 13 | ||||

| 17 | ||||

| 19 | ||||

| 19 |

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes certain matters relating to us and this offering. The second part, the accompanying prospectus dated April 30, 2018, gives more general information about debt securities we may offer from time to time, some of which may not apply to the notes offered by this prospectus supplement and the accompanying prospectus. For information about the notes, see “Description of Notes” in this prospectus supplement and “Description of Debt Securities” in the accompanying prospectus.

We are responsible for the information contained and incorporated by reference in this prospectus supplement and the accompanying prospectus and in any related free-writing prospectus we prepare or authorize. We have not authorized anyone to give you any other information, and we take no responsibility for any other information that others may give you. We are not, and the underwriters are not, making an offer of these notes in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference in this prospectus supplement or the accompanying prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

Before you invest in the notes, you should carefully read this prospectus supplement and the accompanying prospectus. You should also read the documents we have referred you to under “Where You Can Find More Information” for information about us. The shelf registration statement described in the accompanying prospectus, including the exhibits thereto, can be read at the Securities and Exchange Commission’s (the “SEC”) web site as described under “Where You Can Find More Information.”

If the information set forth in this prospectus supplement varies in any way from the information set forth in the accompanying prospectus, you should rely on the information contained in this prospectus supplement. If the information set forth in this prospectus supplement varies in any way from the information set forth in a document we have incorporated by reference, you should rely on the information in the more recent document.

Unless indicated otherwise, or the context otherwise requires, references in this document to “Allegheny Technologies,” “ATI,” “the Company,” “we,” “us” and “our” are to Allegheny Technologies Incorporated and its consolidated subsidiaries, and references to “dollars” and “$” are to United States dollars.

This prospectus supplement and accompanying prospectus include registered trademarks, trade names and service marks of the Company and its subsidiaries.

S-ii

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

Available Information

We file reports, proxy statements and other information with the SEC. The SEC maintains a web site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC, including us. The SEC’s web site is http://www.sec.gov. In addition, our common stock is listed on the New York Stock Exchange, and our reports and other information can be inspected at the offices of the New York Stock Exchange, 20 Broad Street, New York, New York 10005. Our web site is http://www.atimetals.com. Information contained on our web site is not part of, and should not be construed as being incorporated by reference into, this prospectus supplement and the accompanying prospectus.

Incorporation by Reference

The SEC allows us to “incorporate by reference” information that we file with it. This means that we can disclose important information to you by referring you to other documents. Any information we incorporate in this manner is considered part of this prospectus supplement and the accompanying prospectus except to the extent updated and superseded by information contained in this prospectus supplement and the accompanying prospectus. Some information that we file with the SEC after the date of this prospectus supplement and until we sell all of the securities covered by this prospectus supplement will automatically update and supersede the information contained in this prospectus supplement and the accompanying prospectus.

We incorporate by reference the following documents that we have filed with the SEC and any filings that we make with the SEC in the future under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), until we sell all of the securities covered by this prospectus supplement, including between the date of this prospectus supplement and the date on which the offering of the securities under this prospectus supplement is terminated, except as noted in the paragraph below:

| Our SEC Filings (File No. 1-12001) |

Period for or Date of Filing | |

| Annual Report on Form 10-K | Year Ended December 31, 2018 | |

| Quarterly Reports on Form 10-Q | Quarters Ended March 31, June 30 and September 30, 2019 | |

| Current Reports on Form 8-K | January 11, February 28, March 12, April 4, May 10 and 31, June 3 and 4, July 18 and 22, August 6, October 3 and November 19, 2019 | |

Pursuant to General Instruction B of Form 8-K, any information submitted under Item 2.02, Results of Operations and Financial Condition, or Item 7.01, Regulation FD Disclosure, of Form 8-K is not deemed to be “filed” for the purpose of Section 18 of the Exchange Act, and we are not subject to the liabilities of Section 18 with respect to information deemed furnished (and not filed) in accordance with SEC rules, including information submitted under Item 2.02 or Item 7.01 of Form 8-K. We are not incorporating by reference any information deemed furnished (and not filed) in accordance with SEC rules, including information submitted under Item 2.02 or Item 7.01 of Form 8-K, into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act or into this prospectus supplement or the accompanying prospectus.

Statements contained in this prospectus supplement or the accompanying prospectus as to the contents of any contract, agreement or other document referred to in this prospectus supplement or the

S-iii

Table of Contents

accompanying prospectus do not purport to be complete, and where reference is made to the particular provisions of that contract, agreement or other document, those references are qualified in all respects by reference to all of the provisions contained in that contract or other document. For a more complete understanding and description of each such contract, agreement or other document, we urge you to read the documents contained in the exhibits to the registration statement of which the accompanying prospectus is a part.

Any statement contained in a document incorporated by reference, or deemed to be incorporated by reference, into this prospectus supplement and the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement and the accompanying prospectus to the extent that a statement contained herein, therein or in any other subsequently filed document which also is incorporated by reference in this prospectus supplement and the accompanying prospectus modifies or supersedes that statement. Any such statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement and the accompanying prospectus.

We will provide without charge, upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus supplement and the accompanying prospectus and a copy of any or all other contracts, agreements or documents which are referred to in this prospectus supplement or the accompanying prospectus. Requests should be directed to: Allegheny Technologies Incorporated, 1000 Six PPG Place, Pittsburgh, PA 15222-5479, Attention: Corporate Secretary; telephone number: (412) 394-2800. You also may review a copy of the registration statement of which the accompanying prospectus is a part and its exhibits through the SEC’s web site.

S-iv

Table of Contents

You should carefully review the information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus. In this prospectus supplement and the accompanying prospectus, statements that are not reported financial results or other historical information are “forward-looking statements.” Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. They are based on our management’s expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements.

You can identify these forward-looking statements by the fact that they do not relate strictly to historic or current facts. They use words such as “anticipates,” “believes,” “estimates,” “expects,” “would,” “should,” “will,” “will likely result,” “forecast,” “outlook,” “projects,” and similar expressions in connection with any discussion of future operating or financial performance.

We cannot guarantee that any forward-looking statements will be realized, although we believe that we have been prudent in our plans and assumptions. Achievement of future results is subject to risks, uncertainties and assumptions that may prove to be inaccurate. Among others, the factors discussed in the “Risk Factors” section of our Annual Report on Form 10-K for our fiscal year ended December 31, 2018, as updated by the section entitled “Part II – Item 1A Risk Factors” in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019, and September 30, 2019, or under “Risk Factors” in this prospectus supplement could cause actual results to differ from those in forward-looking statements included in or incorporated by reference into this prospectus supplement and the accompanying prospectus or that we otherwise make. Important factors that could cause actual results to differ materially from those in the forward-looking statements include: (a) material adverse changes in economic or industry conditions generally, including global supply and demand conditions and prices for our specialty metals and changes in international trade duties and other aspects of international trade policy; (b) material adverse changes in the markets we serve; (c) our inability to achieve the level of cost savings, productivity improvements, synergies, growth or other benefits anticipated by management from strategic investments and the integration of acquired businesses; (d) volatility in the price and availability of the raw materials that are critical to the manufacture of our products; (e) declines in the value of our defined benefit pension plan assets or unfavorable changes in laws or regulations that govern pension plan funding; (f) labor disputes or work stoppages; (g) equipment outages and (h) other risk factors summarized in our Annual Report on Form 10-K for the year ended December 31, 2018, as updated by the section entitled “Part II – Item 1A Risk Factors” in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2019, June 30, 2019, and September 30, 2019, and in other reports filed with the SEC. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove to be inaccurate, actual results could vary materially from those anticipated, estimated or projected. You should bear this in mind as you consider any forward-looking statements.

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. You are advised, however, to consider any additional disclosures that we may make on related subjects in future filings with the SEC. You should understand that it is not possible to predict or identify all factors that could cause our actual results to differ. Consequently, you should not consider any list of factors to be a complete set of all potential risks or uncertainties.

S-v

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement. Because the following is only a summary, it does not contain all of the information that may be important to you. You should carefully read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference before deciding whether to invest in the notes.

Our Company

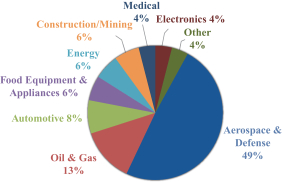

We are a global manufacturer of technically advanced specialty materials and complex components. Our largest markets are aerospace & defense, representing approximately 50% of our total sales, led by products for jet engines. Additionally, we have a strong presence in the oil & gas and energy markets. In the aggregate, these markets represent approximately 70% of our revenue. We are a market leader in manufacturing differentiated products that require our materials science capabilities and unique process technologies, including our new product development competence. Our capabilities range from cast/wrought and powder alloy development to final production of highly engineered finished components, including those used for next-generation jet engine forgings and 3D-printed aerospace products.

We operate in two business segments: High Performance Materials & Components (“HPMC”), and Flat Rolled Products (“FRP”). Over 75% of our HPMC segment’s sales in both the year ended December 31, 2018 and the nine months ended September 30, 2019 were to the aerospace & defense markets, and nearly half of our HPMC segment’s total sales in both the year ended December 31, 2018 and the nine months ended September 30, 2019 were products for commercial jet engines. Increasing demand for commercial aerospace products has been the main source of sales and segment operating profit growth for our HPMC segment over the last few years and is expected to continue to drive our HPMC segment’s results and our overall results for the next several years due to the ongoing expansion in production of next generation jet engines and airplanes. Our HPMC segment produces a wide range of high performance materials and components, including advanced metallic powder alloys, made from titanium and titanium-based alloys, nickel-based alloys and superalloys, and a variety of other specialty materials. These materials are made in a variety of product forms that include precision forgings, machined parts, 3D-printed parts and others.

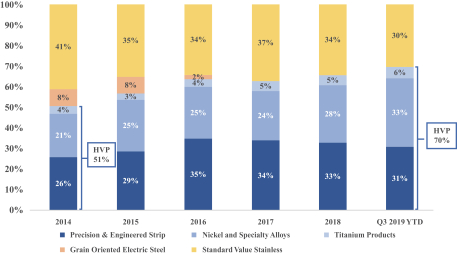

Over the past five years, we have focused on shifting our FRP segment’s product portfolio mix toward high-value products and the end markets that require these materials. While our FRP segment serves a diverse group of end markets, the oil & gas market, including chemical and hydrocarbon processing, and the aerospace & defense markets collectively represented approximately 40% of our total sales in both the year ended December 31, 2018 and the nine months ended September 30, 2019. Other major end markets for our FRP segment include automotive, food equipment & appliances, construction/mining, electronics, communication equipment and computers. Our FRP segment produces nickel-based alloys, specialty alloys, titanium and titanium-based alloys and stainless steel in a variety of product forms including plate, sheet, engineered strip and Precision Rolled Strip products.

S-1

Table of Contents

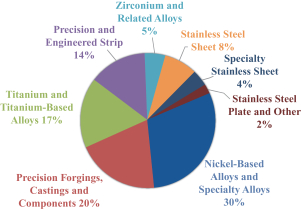

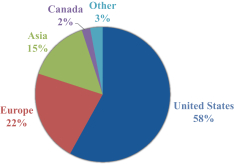

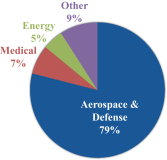

Below is our revenue by geography, product and market for the year ended December 31, 2018. As stated above, our product mix is primarily weighted to high-value products.

| By Product

|

By Geography

|

By Market

Business Segments

Our HPMC and FRP business segments accounted for 58% and 42%, respectively, of our total revenue in both the year ended December 31, 2018 and the nine months ended September 30, 2019. Information with respect to our business segments is presented below.

High Performance Materials & Components Segment (58% of 2018 revenue)

Our HPMC segment produces a wide range of high performance specialty materials, parts and components for several major end markets, including aerospace & defense, medical and electrical energy. 76% of our HPMC segment’s revenues in the year ended December 31, 2018 were derived from the aerospace & defense markets. Demand for our products is driven primarily by the commercial aerospace cycle. Large aircraft and jet engines are manufactured by a small number of companies, such as The Boeing Company, Airbus S.A.S. (an Airbus Group company), including the former operations of Bombardier Aerospace, Embraer (Empresa Brasileira de Aeronáutica S.A.) for airframes and GE Aviation (a division of General Electric Company), Rolls-Royce plc, Pratt & Whitney (a division of

S-2

Table of Contents

United Technologies Corporation), Snecma (SAFRAN Group) and various joint ventures that manufacture jet engines. These companies, and their suppliers, form a substantial part of our customer base in this business segment.

Our products are manufactured from a wide range of advanced materials including metallic powder alloys, made from titanium and titanium-based alloys, nickel-based alloys and superalloys, and a variety of other specialty materials. These materials are made into a variety of product forms that include precision forgings, machined parts and others. We are integrated across these alloy systems in melt, forging, finishing, and machining processes. Most of the products in this segment are sold directly to end-use customers, and a significant portion of our HPMC segment products are sold under multi-year agreements.

Our HPMC segment revenue by market and by product for the nine months ended September 30, 2019 is set forth below:

| Market

|

High-Value Products

|

| Aerospace & Defense Markets |

% of Revenue | |||

| Commercial Aero |

65% | |||

| Jet Engine |

44% | |||

| Airframe |

21% | |||

| Government & Defense |

14% | |||

|

|

|

|||

| Total Aerospace & Defense |

79% | |||

|

|

|

|||

Our HPMC segment’s principal competitors include: Berkshire Hathaway Inc., for nickel-based alloys and superalloys and specialty steel alloys, titanium and titanium-based alloys and precision forgings through its ownership of Precision Castparts Corporation and its subsidiaries; Arconic Inc., for titanium and titanium-based alloys and precision forgings through its ownership of RTI International Metals, Inc. and Firth Rixson; Carpenter Technology Corporation for nickel-based alloys and superalloys and specialty steel alloys; VSMPO-AVISMA for titanium and titanium-based alloys; and Aubert & Duval for precision forgings.

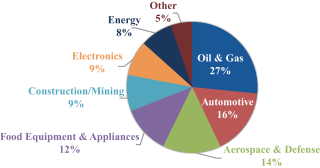

Flat Rolled Products Segment (42% of 2018 revenue)

Our FRP segment produces nickel-based alloys, specialty alloys, titanium and titanium-based alloys and stainless steel in a variety of product forms including plate, sheet, engineered strip, and Precision Rolled Strip® products. The major end markets for our flat-rolled products are oil & gas, automotive, aerospace & defense, food equipment & appliances, consumer electronics, and

S-3

Table of Contents

construction/mining. The operations in this segment include ATI Flat Rolled Products and the joint venture company known as Shanghai STAL Precision Stainless Steel Company Limited in China, in which we hold a 60% interest. Segment results also include our 50% interest in the industrial titanium joint venture known as Uniti LLC and our 50% interest in the Allegheny & Tsingshan Stainless joint venture.

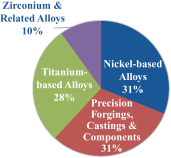

Our FRP segment’s revenue by market for the nine months ended September 30, 2019 is set forth below:

Our FRP segment produces a wide variety of products from several materials. Nickel-based alloy sheet and plate products are primarily used in oil & gas applications where customers require a high level of corrosion protection. Our titanium-based products are mainly used in aerospace & defense applications where material strength and light weight are paramount. Precision Rolled Strip® and engineered strip products, which are under 0.015 inches thick, are used by customers to fabricate a variety of products primarily in the consumer electronics, automotive, and construction markets. Our FRP segment’s standard stainless sheet products are used in a wide variety of industrial and consumer applications. In the year ended December 31, 2018, approximately 75% of our stainless sheet products by volume were sold to independent service centers, which have slitting, cutting or other processing facilities, with the remainder sold directly to end-use customers.

High-value products (“HVP”) make up 70% of our FRP segment’s revenue for the nine months ended September 30, 2019, compared to 51% for the twelve months ended December 31, 2014. Our FRP segment’s revenue by product over the past 5 years is set forth below:

S-4

Table of Contents

Our FRP segment’s principal competitors include domestic stainless steel competitors North American Stainless, Outokumpu Stainless USA, LLC and AK Steel Corporation, as well as imports from numerous foreign producers, including Aperam, based in Europe. Competitors for nickel-based alloys and superalloys and specialty steel alloys include Haynes International and VDM Metals GmbH.

Our End Use Markets

Aerospace & Defense (49% of 2018 revenue). We are a world leader in the production of specialty materials and components for both commercial and military jet engines and airframes supporting customer needs for initial build requirements and for spare parts. Through alloy development, internal growth efforts, and long-term supply agreements on current and next-generation jet engines and airframes, we are well positioned with a fully qualified asset base to meet the expected multi-year demand growth from the commercial aerospace market and we have well-developed relationships with global, blue-chip customers in the aerospace & defense markets, including all major aircraft and jet engine OEMs and their suppliers.

Typical aerospace applications for nickel-based alloys and superalloys and advanced metallic powders include jet engine shafts, discs, blades, vanes, rings and casings. Nickel-based alloys and superalloys remain extremely strong at high temperatures and resist degradation under extreme conditions. The next generation jet engines use advanced nickel-based superalloys and metallic powder alloys to meet increased fuel efficiency requirements delivered through hotter-burning engines. Our specialty materials are also used in the manufacture of aircraft landing gear and structural components.

We are a global industry leader in iso-thermal and hot-die forging technologies for the aerospace industry. We produce highly sophisticated components that have differing mechanical properties across a single product unit and that are highly resistant to fatigue and temperature effects. Our precision forgings are used for jet engine components, structural components for aircraft, helicopters, launch vehicles, and other demanding applications. We provide a full range of post-production inspection and machining with the certified quality needed to meet demanding application requirements.

Products and components made from titanium and titanium-based alloys including jet engine components such as blades, vanes, discs and casings, and airframe components such as structural members, landing gears, hydraulic systems, and fasteners, are critical in aerospace applications. These materials and components possess an extraordinary combination of properties that help to increase jet engine fuel efficiency and product longevity, including superior strength-to-weight ratio, elevated temperature resistance, low coefficient of thermal expansion, and extreme corrosion resistance.

Our specialty materials and components for government aerospace and defense applications include naval nuclear products, military jet engines, fixed wing and rotorcraft products and armor applications. We expect to increase our sales in government defense applications in future years, including through our long-term supply agreements with General Dynamics Land Systems for titanium-based armor plate products for both U.S. and U.K. military ground defense vehicles and with BWX Technologies to supply materials required for naval nuclear propulsion.

We continuously seek to develop and manufacture innovative new alloys to better serve the needs of the aerospace & defense markets. For example, ATI 718Plus® nickel-based superalloy, Rene 65 near-powder superalloy and our powder alloys have won significant share in the current and next-generation jet engines. Our metallic powder technology delivers alloy compositions and refined

S-5

Table of Contents

microstructures that offer increased performance and longer useful lives in high-temperature aerospace environments as well as improving the efficiency of jet engines. Our metallic powder products deliver the most uniform grain structure achievable in near-net shapes. We continue to increase our production capacity for advanced metallic powders for use in next-generation aerospace products, including additive manufacturing applications. In 2018, we acquired the assets of Addaero Manufacturing, a leader in metal alloy-based additive manufacturing, to expand our capabilities to provide comprehensive customer solutions ranging from the design of parts for additive manufacturing to the production of ready-to-install components. Our nickel-based powder alloy expansion in North Carolina was completed in 2017 and achieved initial commercial qualifications in early 2018. In 2018, we made capital investments for a titanium powder expansion located on the same site, as well as for the installation of our fourth iso-thermal press and expansion of our heat treating capacity at our Iso-Thermal Forging Center of Excellence in Cudahy, Wisconsin.

Over the past several years, we have entered into long-term agreements (each, an “LTA”) with certain of our customers for our specialty materials, including powders, parts and components, to reduce their supply uncertainty, including several LTAs with aerospace market OEMs. These LTAs are expected to drive our HPMC segment’s growth trajectory for the next several years and are for the sale of our specialty materials, parts and components that are required for both next-generation and legacy aircraft platforms, including jet engines. Our LTAs include, among others, a titanium products supply agreement for aircraft airframes and structural components with Boeing, which extends into the next decade. Revenues and profits associated with these titanium products covered by the Boeing LTA are included primarily in the results for our HPMC segment. We also have LTAs with GE Aviation for the supply of premium titanium alloys, nickel-based alloys and vacuum-melted specialty alloys products for commercial and military jet engine applications and with Snecma (Safran) for the supply of premium titanium alloys, nickel-based alloys, vacuum melted specialty alloys and titanium investment castings for commercial and military jet engine applications. In addition, we have LTAs with Rolls-Royce plc for the supply of disc-quality products and precision forgings for commercial jet engine applications. In 2017, we entered into a new LTA with United Technologies Corporation to supply its Pratt & Whitney subsidiaries with iso-thermal forgings and powder alloys for next-generation commercial and military jet engines, as well as for structural components for airframe applications. We also supply products to other important parts of the aviation market such as helicopters and rotary engine fixed wing aircraft.

Oil & Gas (13% of 2018 revenue). The environments in which oil & gas can be found in commercial quantities have become more challenging, involving deep offshore wells, high pressure and high temperature conditions in sour wells and unconventional sources, such as shale oil & gas and oil sands. The challenging offshore environments are often located further off the continental shelf, including locations in arctic and tropical waters, which present more difficult drilling conditions than many previously-sourced locations. These offshore drilling locations are often more than one mile below the water’s surface, and up to two miles below the ocean floor. We enable our customer’s success in these applications by developing and producing specialty materials for equipment that can operate for up to 30 years in these harsh environments.

Our specialty materials, including nickel-based alloys, stainless and duplex alloys and other specialty alloys, have the strength and corrosion-resistant properties necessary to meet these challenging operating conditions. Several of our strip and plate products meet NORSOK qualification standards, which are developed by the Norwegian petroleum industry and are intended to identify materials used in oil and gas applications that are safe and cost-effective.

S-6

Table of Contents

Energy (6% of 2018 revenue). Our specialty materials are widely used in the global electrical power generation and distribution industries. We believe energy needs and environmental policies and the electrification of developing countries will continue to drive demand for our specialty materials and products for use in this industry over the long term.

Our specialty materials, including corrosion-resistant alloys (“CRAs”), are used in coal, nuclear, natural gas and electrical power generation applications. In coal-fired plants, our CRAs are used for pipe, tube, and heat exchanger applications in water systems, as well as in pollution control scrubbers. Our CRAs are also used in pollution control scrubbers used in marine shipping applications, as well as in water systems, fuel cladding components, and process equipment for nuclear power plants. For nuclear power plants, we are an industry pioneer in producing nuclear reactor fuel cladding and structural components utilizing zirconium and hafnium alloys. We are a technology leader for large diameter components used in natural gas land-based turbines for power generation. For alternative energy generation, our alloys are used for solar, fuel cell and geothermal applications.

Medical (5% of 2018 revenue). Our advanced specialty materials are used in medical device products that enhance the quality of people’s lives around the world. Our specialty alloys are used for replacement knees, hips and other prosthetic devices. The use of our alloys in these replacement devices offer the potential of longer product lifespans versus previous implant generations. Our biocompatible nickel-titanium shape memory alloy is used for stents to support collapsed or clogged blood vessels. Reduced in diameter for insertion, these stents expand post-implant to the original tube-like shape due to the metal’s superelasticity. In addition, our ultra fine diameter (0.002 inch/0.051 mm) titanium wire is used for screens to prevent blood clots from entering critical areas of the body.

Manufacturers of magnetic resonance imaging (“MRI”) devices rely on our niobium-titanium superconducting wire to help produce electromagnetic fields that allow physicians to safely scan the body’s soft tissue. We recently announced that we entered into a joint technology development agreement with Bruker Energy & Supercon Technologies to advance state-of-the-art niobium-based superconductors, including those used in MRI magnets for the medical industry and preclinical MRI magnets used in the life-science tools industry.

S-7

Table of Contents

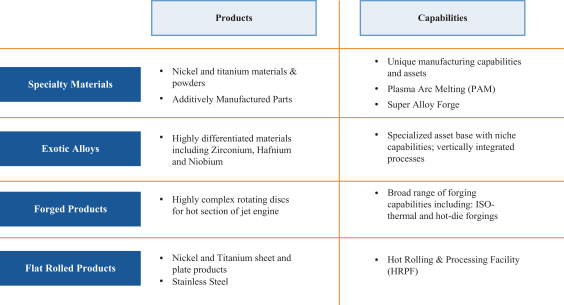

Our Competitive Advantages

We are a market leader in manufacturing differentiated products that require our materials science capabilities and unique process technologies, including our new product development competence. Our diverse and differentiated product line requires a multitude of capabilities that allows us to provide comprehensive customer solutions. The process capabilities of our diverse product portfolio are set forth below:

Backlog

We maintained a backlog of confirmed orders totaling $2.3 billion and $2.2 billion at September 30, 2019 and December 31, 2018, respectively. Due to the structure of our LTAs, approximately 75% of our backlog at September 30, 2019 represented booked orders with performance obligations that we expect to be satisfied within the next 12 months.

Our HPMC segment’s backlog of confirmed orders was approximately $2.0 billion at December 31, 2018 and $1.9 billion at December 31, 2017. We expect that approximately 85% of the confirmed orders on hand at December 31, 2018 for this segment will be filled during the year ending December 31, 2019. Our FRP segment’s backlog of confirmed orders was approximately $0.2 billion at both December 31, 2018 and December 31, 2017. We expect that all of the confirmed orders on hand at December 31, 2018 for this segment will be filled during the year ending December 31, 2019.

Raw Materials and Supplies

Substantially all raw materials and supplies required in the manufacture of our products are available from more than one supplier, and the sources and availability of raw materials essential to our businesses are currently adequate. The principal raw materials we use in the production of our specialty materials are scrap (including iron-, nickel-, chromium-, titanium- and molybdenum-bearing scrap), nickel, titanium sponge, zirconium sand and sponge, ferrochromium, ferrosilicon, molybdenum and molybdenum alloys, manganese and manganese alloys, cobalt, niobium, vanadium and other

S-8

Table of Contents

alloying materials. While we enter into raw materials futures contracts from time to time to hedge exposure to price fluctuations, such as for nickel, we cannot be certain that our hedge position adequately reduces exposure. We believe that we have adequate controls to monitor these contracts, but we may not be able to accurately assess exposure to price volatility in the markets for critical raw materials.

ATI has entered into long-term cost competitive supply agreements with several producers of premium-grade and standard-grade titanium sponge. Other raw materials, such as nickel, cobalt and ferrochromium, are available to us and our specialty materials industry competitors primarily from foreign sources. We purchase our nickel requirements principally from producers in Australia, Canada, Norway, Russia and the Dominican Republic. Zirconium raw materials are primarily purchased from the United States and China. Cobalt is purchased primarily from producers in Canada. More than 80% of the world’s reserves of ferrochromium are located in South Africa, Zimbabwe, Albania and Kazakhstan. Niobium is purchased principally from producers in Brazil, and our titanium sponge comes from sources in Japan and Kazakhstan.

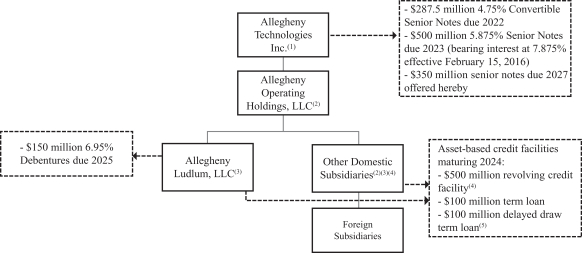

Organizational Structure

The following diagram depicts (on a condensed basis) our anticipated corporate structure as of September 30, 2019 after giving effect to the issuance of the notes offered hereby and the application of the net proceeds therefrom, together with cash on hand, to fund a redemption of all of our outstanding 2021 Notes (as described under “Use of Proceeds”):

| (1) | Allegheny Technologies Incorporated is a guarantor of the 6.95% Debentures due 2025 issued by Allegheny Ludlum LLC and a guarantor under our existing senior secured credit facilities. |

| (2) | Allegheny Operating Holdings, LLC and certain of our other domestic subsidiaries are guarantors under our existing senior secured credit facilities. |

| (3) | Allegheny Ludlum, LLC and certain of our other domestic subsidiaries are borrowers under our existing senior secured credit facilities. |

| (4) | Our asset-based revolving credit facility provides for aggregate borrowings of up to $500 million. Borrowing availability under the facility is reduced on a dollar-for-dollar basis by the amount of any outstanding letters of credit under the facility. As of September 30, 2019, we had no outstanding borrowings under the facility, and approximately $35.3 million of letters of credit were outstanding under the facility. |

S-9

Table of Contents

| (5) | Our delayed draw term loan facility is available until June 30, 2020. If drawn, term loans under the facility will mature on September 30, 2024. As of September 30, 2019, we had no outstanding loans under the facility. |

Corporate Information

We were incorporated in Delaware in 1996. Our principal executive offices are located at 1000 Six PPG Place, Pittsburgh, Pennsylvania, telephone (412) 394-2800. Our website address is www.atimetals.com. The information on or accessible through our website does not constitute part of this prospectus supplement or the accompanying prospectus.

S-10

Table of Contents

The Offering

| Issuer |

Allegheny Technologies Incorporated. |

| Securities Offered |

$350,000,000 aggregate principal amount of our 5.875% Senior Notes due 2027. |

| Maturity |

The notes will mature on December 1, 2027, unless earlier redeemed or repurchased. |

| Interest Rate |

The notes will bear interest at 5.875 percent per year. Interest will accrue from November 22, 2019. |

| Interest Payment Dates |

June 1 and December 1 of each year, beginning on June 1, 2020. |

| Optional Redemption |

Prior to December 1, 2022, we may redeem the notes at our option, at any time in whole or from time to time in part, at a redemption price equal to 100% of the principal amount of the notes redeemed plus the Applicable Premium (as defined herein) as of, and accrued and unpaid interest to but not including, the redemption date (subject to the right of holders of record on the relevant record date to receive interest due on the relevant interest payment date). |

| On and after December 1, 2022, we may redeem the notes at our option, at any time in whole or from time to time in part, at the redemption prices set forth in this prospectus supplement, plus accrued interest on the principal amount of the notes to be redeemed to, but not including, such redemption date. See “Description of Notes — Optional Redemption.” |

| In addition, at any time prior to December 1, 2022, we may, at our option and at any time, redeem up to 35.0% of the aggregate principal amount of notes at a redemption price equal to 105.875% of the aggregate principal amount thereof, plus accrued interest on the principal amount of the notes to be redeemed to, but not including, such redemption date, with the net proceeds of one or more Equity Offerings (as defined herein); provided that at least 65% of the aggregate principal amount of notes remain outstanding immediately after the occurrence of each such redemption. |

| See “Description of Notes — Optional Redemption.” |

| Offer to Repurchase upon a Change of Control Repurchase Event |

If a change of control repurchase event occurs with respect to the notes, we will be required, subject to certain conditions, to |

S-11

Table of Contents

| offer to repurchase the notes at a purchase price equal to 101% of the principal amount of the notes repurchased, plus accrued and unpaid interest to, but not including, the date of repurchase. See “Description of Notes — Purchase of Notes upon a Change of Control Repurchase Event.” |

| Covenants |

We will issue the notes under a senior indenture between us and The Bank of New York Mellon, as trustee. The senior indenture includes covenants that limit: |

| • | our ability and the ability of our domestic subsidiaries to create or permit liens; |

| • | our ability and the ability of our domestic subsidiaries to enter into sale and leaseback transactions; |

| • | the ability of our domestic subsidiaries to guarantee our indebtedness; and |

| • | our ability to consolidate or merge with or into other companies or sell all or substantially all of our assets. |

| These covenants will be subject to a number of important exceptions and qualifications described under “Description of Notes — Covenants” and “Description of Notes — Merger, Consolidation or Sale of Assets.” |

| Events of Default |

If there is an event of default under the notes, the principal amount of the notes, plus accrued and unpaid interest, may be declared immediately due and payable. These amounts automatically become due and payable if an event of default relating to certain events of bankruptcy, insolvency or reorganization occurs. |

| Ranking |

The notes will be our senior unsecured obligations, ranking equally in right of payment with all of our existing and future senior unsecured indebtedness and senior to our future subordinated indebtedness. The notes will be effectively subordinated to our existing and future secured indebtedness to the extent of the value of the assets securing that indebtedness and to the existing and future indebtedness and other liabilities of our subsidiaries. We conduct a significant portion of our business through our subsidiaries. None of our subsidiaries will guarantee the notes. |

S-12

Table of Contents

| As of September 30, 2019, after giving effect to this offering and the application of the proceeds from this offering as described under the caption “Use of Proceeds,” ATI would have had an aggregate of approximately $1.12 billion of indebtedness outstanding, none of which would be secured. As of September 30, 2019, our subsidiaries had an aggregate of approximately $269.4 million of indebtedness outstanding, principally comprised of the $100 million term loan outstanding under our existing senior secured credit facility and $150 million in unsecured 6.95% Debentures due 2025 issued by our wholly owned subsidiary Allegheny Ludlum LLC and guaranteed by ATI. In addition, our subsidiaries had ability to borrow an additional $564.7 million under the existing senior secured credit facility, which borrowings would be secured. See “Summary - Organizational Structure” and “Risk Factors.” |

| Use of Proceeds |

We intend to use the net proceeds of this offering, together with cash on hand, to redeem all of our outstanding 5.95% Senior Notes due 2021 (the “2021 Notes”). This prospectus supplement is not a notice of redemption with respect to the 2021 Notes. See “Use of Proceeds.” |

| Book-Entry Form |

The notes will be issued in book-entry form and will be represented by permanent global certificates deposited with, or on behalf of, DTC and registered in the name of a nominee of DTC. Investors may elect to hold interests in the notes through DTC, Clearstream or Euroclear if they are participants of such systems, or indirectly through organizations which are participants in such systems. Beneficial interests in any of the notes will be shown on, and transfers will be effected only through, records maintained by DTC or its nominee, and any such interests may not be exchanged for certificated securities, except in limited circumstances. |

| Absence of Public Market for the Notes |

The notes are new securities, and there is currently no established market for the notes. Accordingly, we cannot assure you as to the development or liquidity of any market for the notes. The underwriters have advised us that they currently intend to make a market in the notes. However, they are not obligated to do so, and they may discontinue any market making with respect to the notes without notice. |

| Material U.S. Federal Income Tax Considerations |

Holders are urged to consult their own tax advisors with respect to the federal, state, local and foreign tax consequences of purchasing, owning and disposing of the notes. See “Material U.S. Federal Income Tax Considerations.” |

S-13

Table of Contents

| Trustee |

The Bank of New York Mellon. |

| Risk Factors |

You should carefully consider the information set forth in the section entitled “Risk Factors” and the other information included or incorporated by reference into this prospectus supplement and the accompanying prospectus in deciding whether to purchase the notes. |

S-14

Table of Contents

Summary Consolidated Financial Data

We derived the summary consolidated financial data shown below as of December 31, 2016, 2017 and 2018 and for each of the years then ended from our audited consolidated financial statements. We derived the summary consolidated financial data as of September 30, 2019 and 2018 and for each of the nine month periods then ended from our unaudited consolidated financial statements. The unaudited consolidated financial statements from which we derived this data were prepared on the same basis as the audited consolidated financial data and include all adjustments, consisting only of normal recurring adjustments, necessary to present fairly our consolidated results of operations and financial condition as of the periods presented. The results of operations for interim periods are not necessarily indicative of the operating results for any future period. You should read the following financial information in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes in our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2019, which are incorporated by reference into this prospectus supplement and the accompanying prospectus.

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2016 | 2017 | 2018 | 2018 | 2019 | ||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||

| Sales |

$ | 3,134.6 | $ | 3,525.1 | $ | 4,046.6 | $ | 3,008.7 | $ | 3,103.9 | ||||||||||

| Cost of sales |

2,911.8 | 3,028.1 | 3,416.3 | 2,526.0 | 2,635.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Gross profit |

$ | 222.8 | $ | 497.0 | $ | 630.3 | $ | 482.7 | $ | 468.5 | ||||||||||

| Selling and administrative expenses |

240.8 | 248.0 | 268.2 | 195.3 | 200.9 | |||||||||||||||

| Impairment of goodwill |

— | 114.4 | — | — | — | |||||||||||||||

| Restructuring charges |

523.8 | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

$ | (541.8) | $ | 134.6 | $ | 362.1 | $ | 287.4 | $ | 267.6 | ||||||||||

| Nonoperating retirement benefit expense |

70.6 | 54.3 | 33.9 | 25.5 | 55.2 | |||||||||||||||

| Interest expense, net |

124.0 | 133.8 | 101.0 | 75.8 | 74.9 | |||||||||||||||

| Debt extinguishment charge |

— | 37.0 | — | — | — | |||||||||||||||

| Other income, net |

(2.4) | (4.0) | (20.5) | (22.4) | (82.9) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

$ | (734.0) | $ | (86.5) | $ | 247.7 | $ | 208.5 | $ | 220.4 | ||||||||||

| Income tax provision (benefit) |

(106.9) | (6.8) | 11.0 | 16.8 | 10.3 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (627.1) | $ | (79.7) | $ | 236.7 | $ | 191.7 | $ | 210.1 | ||||||||||

| Less: Net income attributable to noncontrolling interests |

13.8 | 12.2 | 14.3 | 10.4 | 9.0 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to ATI |

$ | (640.9) | $ | (91.9) | $ | 222.4 | $ | 181.3 | $ | 201.1 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Balance sheet data (at end of period): |

||||||||||||||||||||

| Working capital |

$ | 1,057.8 | $ | 1,203.1 | $ | 1,409.8 | $ | 1,391.8 | $ | 1,659.1 | ||||||||||

| Total assets |

5,170.0 | 5,185.4 | 5,501.8 | 5,389.0 | 5,628.9 | |||||||||||||||

| Long-term debt |

1,771.9 | 1,530.6 | 1,535.5 | 1,535.3 | 1,541.7 | |||||||||||||||

| Total debt |

1,877.0 | 1,540.7 | 1,542.1 | 1,551.9 | 1,553.8 | |||||||||||||||

| Cash and cash equivalents |

229.6 | 141.6 | 382.0 | 153.5 | 511.3 | |||||||||||||||

| Total ATI Stockholders’ equity |

1,355.2 | 1,739.4 | 1,885.7 | 1,980.2 | 2,168.0 | |||||||||||||||

S-15

Table of Contents

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2016 | 2017 | 2018 | 2018 | 2019 | ||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Cash flow information: |

||||||||||||||||||||

| Cash flow provided by (used in) operating activities |

$ | (43.7) | $ | 22.4 | $ | 392.8 | $ | 116.6 | $ | (10.0) | ||||||||||

| Cash flow provided by (used in) investing activities |

(200.0) | (119.6) | (145.1) | (109.1) | 149.4 | |||||||||||||||

| Cash flow provided by (used in) financing activities |

323.5 | 9.2 | (7.3) | 4.4 | (10.1) | |||||||||||||||

| Purchase of property, plant and equipment |

(202.2) | (122.7) | (139.2) | (101.3) | (98.1) | |||||||||||||||

| Other data: |

||||||||||||||||||||

| EBITDA (unaudited)(1) |

$ | (439.7) | $ | 208.1 | $ | 505.1 | $ | 401.4 | $ | 409.9 | ||||||||||

| Adjusted EBITDA (unaudited)(1) |

$ | 177.3 | $ | 359.5 | $ | 505.5 | $ | 401.8 | $ | 409.9 | ||||||||||

| (1) | We define EBITDA as net income (loss) before interest expense and income taxes, plus depreciation and amortization. We define Adjusted EBITDA as EBITDA excluding significant non-cash charges or credits, including goodwill impairment charges, restructuring charges including long-lived asset impairments, OPEB/pension curtailment and settlement gains and losses, qualification and excess operating costs for the Rowley, UT premium-quality (PQ) titanium sponge production facility, costs associated with work stoppage and return-to-work provisions of collective bargaining agreements, and debt extinguishment charges. EBITDA and Adjusted EBITDA are not measures of financial performance under generally accepted accounting principles. EBITDA and Adjusted EBITDA are not calculated in the same manner by all companies and, accordingly, are not necessarily comparable to similarly titled measures of other companies and may not be an appropriate measure of performance relative to other companies. Interest expense, net as presented includes reductions for interest expense capitalized on construction in progress and is net of interest income. We have presented EBITDA and Adjusted EBITDA in this prospectus supplement solely as supplemental disclosures because we believe they allow for a more complete analysis of our results of operations. We believe that EBITDA and Adjusted EBITDA are useful to investors because EBITDA and Adjusted EBITDA are commonly used to analyze companies on the basis of operating performance, leverage and liquidity. Furthermore, analogous measures are used by industry analysts to evaluate operating performance. EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management’s discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments and capital expenditures. EBITDA and Adjusted EBITDA are not intended to represent, and should not be considered more meaningful than, or as alternatives to, a measure of operating performance as determined in accordance with generally accepted accounting principles. The definitions of EBITDA and Adjusted EBITDA will differ from the amounts calculated under the definition of Consolidated EBITDA that is contained in our currently outstanding credit facility. EBITDA and Adjusted EBITDA are calculated as follows: |

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||||||

| 2016 | 2017 | 2018 | 2018 | 2019 | ||||||||||||||||

| (Dollars in millions) | ||||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| Net income (loss) |

$ | (627.1) | $ | (79.7) | $ | 236.7 | $ | 191.7 | $ | 210.1 | ||||||||||

| Interest expense, net |

124.0 | 133.8 | 101.0 | 75.8 | 74.9 | |||||||||||||||

| Income tax provision (benefit) |

(106.9) | (6.8) | 11.0 | 16.8 | 10.3 | |||||||||||||||

| Depreciation and amortization |

170.3 | 160.8 | 156.4 | 117.1 | 114.6 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA |

(439.7) | 208.1 | 505.1 | 401.4 | 409.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Restructuring costs(a) |

523.8 | — | — | — | — | |||||||||||||||

| Retirement benefits curtailment/settlement costs(b) |

3.4 | — | 0.4 | 0.4 | — | |||||||||||||||

| Titanium sponge PQ qualification/excess Rowley costs(c) |

41.0 | — | — | — | — | |||||||||||||||

| Work stoppage impact(d) |

48.8 | — | — | — | — | |||||||||||||||

| Impairment of goodwill(e) |

— | 114.4 | — | — | — | |||||||||||||||

| Debt extinguishment charge(f) |

— | 37.0 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 177.3 | $ | 359.5 | $ | 505.5 | $ | 401.8 | $ | 409.9 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

S-16

Table of Contents

| (a) | Restructuring costs for the year ended December 31, 2016 related primarily to the indefinite idling of the Rowley, Utah titanium sponge production facility. |

| (b) | Retirement benefits curtailment/settlement costs for the year ended December 31, 2016 related to both pension and other postretirement benefits for USW-represented employees associated with the permanent idling of our FRP segment’s Midland, Pennsylvania commodity stainless melt and finishing operations and Bagdad, Pennsylvania grain-oriented steel finishing facility that occurred in the fourth quarter of 2016. Retirement benefits curtailment/settlement costs for the year ended December 31, 2018 and for the nine months ended September 30, 2018 related to pension benefit increases for prior service for collectively bargained employees who were hard frozen in the pension plan as a result of the June 2018 collective bargaining. |

| (c) | Titanium sponge PQ qualification/excess Rowley costs for the year ended December 31, 2016 related to excess production costs following the indefinite idling of the Rowley, Utah titanium sponge production facility and related non-cash net realizable value inventory charges. |

| (d) | Work stoppage impact for the year ended December 31, 2016 related to operating inefficiencies and contractual obligations associated with the work stoppage and return to work of represented employees as a result of the seven-month work stoppage associated with USW labor agreement negotiations that concluded in March 2016, which predominantly affected our FRP segment’s operations. |

| (e) | Goodwill impairment for the year ended December 31, 2017 was for the Cast Products business in our HPMC segment, as disclosed in Note 5 to our audited consolidated financial statements in the 2018 Annual Report on Form 10-K. |

| (f) | The debt extinguishment charge for the year ended December 31, 2017 was for the full redemption of our 9.375% Senior Notes due 2019. |

S-17

Table of Contents

You should carefully consider the following factors and those described in our Annual Report on Form 10-K for our fiscal year ended December 31, 2018 and any of our subsequently filed Quarterly Reports on Form 10-Q, as well as the other information contained or incorporated by reference in this prospectus supplement, before deciding to invest in the notes. Any of these risks or other risks and uncertainties not presently known to us or that we currently deem immaterial could materially adversely affect our business, financial condition, results of operations and cash flow, which could in turn materially adversely affect the price of the notes. If any of the following risks and uncertainties develop into actual events, our business, financial condition, results of operations or cash flows could be materially adversely affected. In that case, the trading price of the notes could decline and you may lose all or part of your investment.

This prospectus supplement also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of the risks faced by us described below and elsewhere in this prospectus supplement and the documents incorporated by reference. Please see “Forward-Looking Statements.”

Risks Relating to the Notes

Our substantial indebtedness could adversely affect our business, financial condition or results of operations and prevent us from fulfilling our obligations under the notes.

We currently have and, after this offering, will continue to have a significant amount of indebtedness. As of September 30, 2019, after giving effect to this offering and the application of the proceeds from this offering as described under the caption “Use of Proceeds,” our total consolidated indebtedness would have been approximately $1.4 billion (excluding accounts payable, accrued expenses, other liabilities, variable interest entity liabilities and unfunded commitments, including $464.7 million of availability under our revolving credit facility and $100.0 million of availability under our delayed draw term loan). This substantial level of indebtedness increases the risk that we may be unable to generate enough cash to pay amounts due in respect of our indebtedness, including the notes.

Our substantial indebtedness could have important consequences to you and significant effects on our business. For example, it could:

| • | make it more difficult for us to satisfy our obligations with respect to the notes; |

| • | increase our vulnerability to general adverse economic and industry conditions; |

| • | require us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures, our strategic growth initiatives and development efforts and other general corporate purposes; |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

| • | restrict us from exploiting business opportunities; |

| • | place us at a competitive disadvantage compared to our competitors that have less indebtedness; and |

| • | limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy or other general corporate purposes. |

S-18

Table of Contents

In addition, the agreements that govern our current indebtedness contain, and the agreements that may govern any future indebtedness that we may incur may contain, financial and other restrictive covenants that will limit our ability to engage in activities that may be in our long-term best interests. Our failure to comply with those covenants could result in an event of default that, if not cured or waived, could result in the acceleration of all of our debt.

Despite our substantial current indebtedness, we and our subsidiaries may still be able to incur substantially more indebtedness. This could further exacerbate the risks associated with our substantial leverage.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future, including pursuant to a capital markets transaction such as a notes offering, as well as additional secured indebtedness that would be structurally senior to the notes. Furthermore, neither the base indenture nor the supplemental indenture establishing the terms of the notes limits the amount of debt that we or our subsidiaries may issue. As of September 30, 2019, after giving effect to this offering and the application of the proceeds from this offering as described under the caption “Use of Proceeds,” we and our subsidiaries would have had approximately $1.4 billion of total indebtedness outstanding on a consolidated basis. In addition, our subsidiaries would have had the ability to borrow an additional $564.7 million under the facility. Adding new indebtedness to current debt levels could make it more difficult for us to satisfy our obligations with respect to the notes.

Repayment of our debt, including the notes, is dependent on cash flow generated by our subsidiaries.

Our subsidiaries own a significant portion of our assets and conduct a significant portion of our operations. Accordingly, repayment of our indebtedness, including the notes, is dependent, to a significant extent, on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. None of our subsidiaries will initially guarantee the notes. Our subsidiaries do not have any obligation to pay amounts due on the notes or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the notes. Each subsidiary is a distinct legal entity and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the notes. As of September 30, 2019, our subsidiaries had approximately $269.4 million of total indebtedness outstanding and the ability to borrow an additional $564.7 million under the facility, to which the notes would have been structurally subordinated.

The notes will be structurally subordinated to all liabilities of our subsidiaries.

The notes will initially not be guaranteed by any of our subsidiaries and are therefore structurally subordinated to the indebtedness and other liabilities of our subsidiaries. These subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due pursuant to the notes, or to make any funds available therefor, whether by dividends, loans, distributions or other payments. Any right that we have to receive any assets of any of the subsidiaries upon the liquidation or reorganization of those subsidiaries, and the consequent rights of holders of notes to realize proceeds from the sale of any of those subsidiaries’ assets, will be effectively subordinated to the claims of those subsidiaries’ creditors, including trade creditors and holders of preferred equity interests of those subsidiaries. Accordingly, in the event of a bankruptcy, liquidation

S-19

Table of Contents

or reorganization of any of our subsidiaries, these subsidiaries will pay the holders of their debts, holders of preferred equity interests and their trade creditors before they will be able to distribute any of their assets to us.

The notes are subject to prior claims of secured creditors.

The notes will be unsecured, ranking equally in right of payment with our other unsecured and unsubordinated indebtedness and will be effectively subordinated in right of payment to any of our secured indebtedness, to the extent of the value of the assets securing such indebtedness. Our obligations under our existing credit facility are secured by each loan party’s respective (i) accounts receivable and inventory and (ii) solely to the extent related to such accounts receivable and inventory, proceeds, supporting obligations, chattel paper, documents, electronic chattel paper, general intangibles, instruments, deposit accounts, commercial tort claims, and letter-of-credit rights. The base indenture and supplemental indenture governing the notes and the credit agreement governing our existing credit facility permit us to incur secured indebtedness under specified circumstances, and the amounts incurred could be substantial. If we incur any indebtedness secured by our assets, these assets could be subject to the prior claims of secured creditors. As of September 30, 2019, after giving effect to this offering and the application of the proceeds from this offering as described under the caption “Use of Proceeds,” ATI would have had approximately $1.12 billion of total indebtedness outstanding, none of which is secured. As of September 30, 2019, our subsidiaries had an aggregate of approximately $269.4 million of indebtedness outstanding, principally comprised of the $100 million term loan outstanding under our existing senior secured credit facility and $150 million in unsecured 6.95% Debentures due 2025 issued by our wholly owned subsidiary Allegheny Ludlum LLC and guaranteed by ATI. In addition, our subsidiaries had the ability to borrow an additional $564.7 million under the facility, which borrowings would be secured.

In the event of a bankruptcy, liquidation or similar proceeding, our pledged assets would be available to satisfy obligations of the secured indebtedness before any payment could be made on the notes. As a result, the notes will be effectively subordinated to any secured indebtedness that we may have. To the extent that such pledged assets cannot satisfy such secured indebtedness, the holders of such indebtedness would have a claim for any shortfall that would rank equally in right of payment with the notes.

Some significant transactions may not constitute a change of control repurchase event for purposes of the notes in which case we would not be obligated to offer to repurchase the notes.

Upon the occurrence of a change of control repurchase event as described under “Description of Notes — Purchase of Notes upon a Change of Control Repurchase Event,” we will be required to offer to repurchase the notes. However, the change of control repurchase event provisions will not afford protection to holders of notes in the event of certain transactions. For example, any leveraged recapitalization, refinancing, restructuring or acquisition initiated by us will generally not constitute a change of control repurchase event requiring us to repurchase the notes. In the event of any such transaction, we will not be required to offer to repurchase the notes, even though any of these transactions could increase the amount of our indebtedness, or otherwise adversely affect our capital structure or credit ratings, thereby adversely affecting the holders of notes, including by decreasing the trading prices for the notes.

You may not be able to determine when a change of control repurchase event has occurred.

Unless we have exercised our right to redeem the notes, a change of control repurchase event, as defined in the indenture governing the notes, will require us to make an offer to repurchase all outstanding notes. The definition of change of control includes a phrase relating to the sale, lease or transfer or conveyance of “all or substantially all” of our assets. There is no precisely established

S-20

Table of Contents

definition of the phrase “substantially all” under applicable law. Accordingly, your ability to require us to repurchase your notes as a result of a sale, lease or transfer of less than all of our assets to another individual, group or entity may be uncertain. See “Description of Notes — Purchase of Notes upon a Change of Control Repurchase Event.”

We may not be able to repurchase the notes upon a change of control repurchase event.

Upon a change of control repurchase event, as defined in the indenture governing the notes, we will be required to make an offer to repurchase all outstanding notes at 101% of their principal amount, plus accrued and unpaid interest, unless we have previously given notice of our intention to exercise our right to redeem the notes. We may not have sufficient financial resources to purchase all of the notes that are tendered upon a change of control offer or to redeem the notes. A failure to make the applicable change of control offer or to pay the applicable change of control purchase price when due would result in a default under the indenture. The occurrence of a change of control repurchase event would also constitute an event of default under our revolving credit facility and may constitute an event of default under the terms of the agreements governing our other indebtedness. See “Description of Notes — Purchase of Notes upon a Change of Control Repurchase Event.”

The notes do not contain restrictive covenants requiring us to maintain any minimum financial results, and we may incur substantially more debt or take other actions that ultimately may affect our ability to satisfy our obligations under the notes.

Other than as described in this prospectus supplement under “Description of Notes — Covenants” and in the accompanying prospectus under “Description of Notes — Merger, Consolidation or Sale of Assets,” the notes are not subject to any restrictive covenants, and we are not restricted from paying dividends or issuing or repurchasing our securities. In addition, the limited covenants applicable to the notes do not require us to achieve or maintain any minimum financial results relating to our financial position or results of operations.

Our ability to recapitalize, incur additional debt, and take a number of other actions that are not limited by the terms of the notes could have the effect of diminishing our ability to make payments on the notes when due, and require us to dedicate a substantial portion of our cash flow from operations to make payments on our indebtedness, which would reduce the availability of cash flow to fund our operations, working capital and capital expenditures.

Further, holders of the notes should have a reasonable expectation that, subject to certain exceptions described in the indenture, the base indenture or the supplemental indenture establishing the terms of the notes, or the notes themselves, may be amended, supplemented or waived from time to time in accordance with their respective terms and that such amendments, supplements or waivers will be binding on all holders of each applicable series of notes. See “Description of Debt Securities — Modification of the Indentures” in the accompanying prospectus. For these reasons, you should not consider any covenants in the base indenture or the supplemental indenture establishing the terms of the notes as a significant factor in evaluating whether to invest in the notes.

Our board of directors may determine that a property of ours is not a Principal Property (as defined in the supplemental indenture) and therefore not subject to certain covenants applicable to the notes.

The supplemental indenture governing the notes will include covenants that, among other things, limit our ability to issue, assume or guarantee any indebtedness if that indebtedness is secured by any lien upon any Principal Property (as defined in the supplemental indenture), or portion thereof, of ours

S-21

Table of Contents

without effectively securing the notes equally and ratably with that indebtedness, so long as such indebtedness is so secured. Such covenants are the only limit in the notes on our ability to incur secured debt that would be effectively senior to the notes to the extent of the value of the collateral. See “Description of Notes — Covenants.” The supplemental indenture will provide that a Principal Property means any manufacturing plant or other similar facility owned by us, the book value of the real property, plant and equipment of which (as shown, without deduction of any depreciation reserves, on the books of the owner or owners) is not less than two percent of Consolidated Net Tangible Assets (as defined in the supplemental indenture) except (A) any such plant or facility which our board of directors determines is not of material importance to the total business conducted, or assets owned, by us as an entirety or (B) any portion of any such plant or facility which our board of directors determines not to be of material importance to the use or operation thereof. Although it has not yet done so, under the terms of the supplemental indenture governing the notes, our board of directors may determine from time to time after the issuance of the notes that a property of ours is not of material importance to the total business conducted, or assets owned, by us and our U.S. domestic, consolidated subsidiaries as an entirety and, therefore, is not a Principal Property, meaning that such property would no longer be subject to the covenant in the supplemental indenture that limits our ability to incur indebtedness secured by a lien on that property. Any such secured indebtedness incurred by us would be effectively and/or structurally senior to the notes.

There may be no active trading market for the notes.