Form 40-F SSR MINING INC. For: Dec 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

(Check One)

| ☐ | Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

or

| ☒ | Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2018

Commission File Number 001-35455

SSR MINING INC.

(Exact name of Registrant as specified in its charter)

| British Columbia | 1311 | Not applicable | ||

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number (if applicable)) |

(I.R.S. Employer Identification Number (if applicable)) |

Suite 800 – 1055 Dunsmuir Street

PO Box 49088, Bentall Postal Station

Vancouver, British Columbia

Canada V7X 1G4

(604) 689-3846

(Address and telephone number of Registrant’s principal executive offices)

CT Corporation System, 111 8th Avenue, New York, NY 10011

(212) 894-8940

(Name, address (including zip code) and telephone number

(including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

Name of each exchange on which registered | |

| Common Shares without par value | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

For annual reports, indicate by check mark the information filed with this Form:

| ☒ Annual Information Form | ☒ Audited Annual Financial Statements |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 120,741,162

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The Annual Report on Form 40-F shall be incorporated by reference into each of the following Registration Statements under the Securities Act of 1933, as amended: Form S-8 (File No. 333-219848, 333-185498, 333-196116 and 333-198092).

FORM 40-F

Principal Documents

The following documents, filed as Exhibits 99.1, 99.2 and 99.3 to this Annual Report on Form 40-F, are incorporated herein by reference:

| (a) | Annual Information Form for the fiscal year ended December 31, 2018; |

| (b) | Management’s Discussion and Analysis for the fiscal year ended December 31, 2018; and |

| (c) | Consolidated Financial Statements for the fiscal year ended December 31, 2018. |

Cautionary Note Regarding Differences in United States and Canadian Reporting Practices

SSR Mining Inc. (“SSR Mining” or the “Company”) is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada, to prepare this Annual Report on Form 40-F in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with this Annual Report on Form 40-F, in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. They may not be comparable to financial statements of United States companies.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this Annual Report on Form 40-F constitute “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. See “Introductory Notes – Cautionary Notice Regarding Forward-Looking Statements” in SSR Mining’s Annual Information Form for the fiscal year ended December 31, 2018, filed as Exhibit 99.1 to this Annual Report on Form 40-F, and “Cautionary Notes Regarding Forward-Looking Statements and Mineral Reserve and Mineral Resource Estimates” in Section 13 of SSR Mining’s Management’s Discussion and Analysis for the fiscal year ended December 31, 2018, filed as Exhibit 99.2 to this Annual Report on Form 40-F.

2

ADDITIONAL DISCLOSURE

Certifications and Disclosure Regarding Controls and Procedures.

| (a) | Certifications. See Exhibits 99.5, 99.6, 99.7 and 99.8 to this Annual Report on Form 40-F. |

| (b) | Disclosure Controls and Procedures. As of the end of SSR Mining’s fiscal year ended December 31, 2018, an evaluation of the effectiveness of SSR Mining’s “disclosure controls and procedures” (as such term is defined in Rules 13a-15(e) and 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) was carried out by SSR Mining’s management, with the participation of its principal executive officer and principal financial officer. Based upon that evaluation, SSR Mining’s principal executive officer and principal financial officer have concluded that as of the end of that fiscal year, SSR Mining’s disclosure controls and procedures were effective to ensure that information required to be disclosed by SSR Mining in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported within the time periods specified in Securities and Exchange Commission (the “Commission”) rules and forms and (ii) accumulated and communicated to SSR Mining’s management, including its principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure. |

It should be noted that while SSR Mining’s principal executive officer and principal financial officer believe that SSR Mining’s disclosure controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that SSR Mining’s disclosure controls and procedures or internal control over financial reporting will prevent all errors and fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met.

| (c) | Management’s Annual Report on Internal Control Over Financial Reporting. The required disclosure is included under the heading “Internal Control over Financial Reporting and Disclosure Controls and Procedures” in SSR Mining’s Management’s Discussion and Analysis for the fiscal year ended December 31, 2018, filed as Exhibit 99.2 to this Annual Report on Form 40-F. |

| (d) | Attestation Report of the Registered Public Accounting Firm. The required disclosure is included in the “Report of Independent Registered Public Accounting Firm” that accompanies SSR Mining’s Consolidated Financial Statements for the fiscal year ended December 31, 2018, filed as Exhibit 99.3 to this Annual Report on Form 40-F. |

3

| (e) | Changes in Internal Control Over Financial Reporting. During the fiscal year ended December 31, 2018, there were no changes in SSR Mining’s internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, SSR Mining’s internal control over financial reporting. |

Notices Pursuant to Regulation BTR.

None.

Audit Committee Financial Expert.

SSR Mining’s board of directors has determined that each of Richard D. Paterson and Beverlee F. Park, members of SSR Mining’s audit committee, qualifies as an “audit committee financial expert” (as such term is defined under Item 8(a) of General Instruction B to Form 40-F) and is “independent” as that term is defined under listing standards of the Nasdaq Global Market (“Nasdaq”).

Code of Ethics.

SSR Mining has adopted a “code of ethics” (as that term is defined under Item 9(a) of General Instruction B to Form 40-F), entitled the “Code of Business Conduct and Ethics” (the “Code of Conduct”), that applies to its principal executive officer, principal financial officer and other senior financial officers performing similar functions. The Code of Conduct is available for viewing on SSR Mining’s website at www.ssrmining.com.

No amendments were made to and no waivers, including implicit waivers, were granted from any provision of the Code of Conduct during the fiscal year ended December 31, 2018.

SSR Mining intends to disclose and summarize any amendment to, or waiver from, any provision of the Code of Conduct that is required to be disclosed and summarized, on its website at www.ssrmining.com.

Principal Accountant Fees and Services.

The required disclosure is included under the heading “Audit Committee – External Auditor Service Fees” in SSR Mining’s Annual Information Form for the fiscal year ended December 31, 2018, filed as Exhibit 99.1 to this Annual Report on Form 40-F.

4

Pre-Approval Policies and Procedures.

The required disclosure is included under the heading “Audit Committee – Pre-Approval Policies and Procedures” in SSR Mining’s Annual Information Form for the fiscal year ended December 31, 2018, filed as Exhibit 99.1 to this Annual Report on Form 40-F.

Off-Balance Sheet Arrangements.

With the exception of the Company’s operating lease commitments disclosed below, SSR Mining does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on its financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Tabular Disclosure of Contractual Obligations.

The following table summarizes our financial liabilities and moratorium commitments at December 31, 2018:

| Payments due by period (as at December 31, 2018) | ||||||||||||||||||||

| Contractual obligations | Less than one year |

1-3 years | 3-5 years | After 5 years | Total | |||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

| Trade and other payables |

70,003 | — | — | — | 70,003 | |||||||||||||||

| Moratorium |

4,570 | 14,428 | 59 | — | 19,057 | |||||||||||||||

| Convertible notes(i) |

— | 265,000 | — | — | 265,000 | |||||||||||||||

| Interest on convertible notes(i) |

7,619 | 3,809 | — | — | 11,428 | |||||||||||||||

| Operating lease obligations |

512 | 1,493 | 933 | 2,322 | 5,260 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total contractual obligations |

82,704 | 284,730 | 992 | 2,322 | 370,748 | |||||||||||||||

| (i) | The convertible notes mature in 2033 but are redeemable in part or in full at the option of the holder on February 1 at each of 2020, 2023, and 2028, or upon fundamental corporate changes. They are also redeemable by us in part or in full on and after February 1, 2018. The convertible notes bear interest of 2.875% per annum and are convertible into common shares upon specified events at a fixed conversion price of $20.00 per common share. |

Identification of the Audit Committee.

SSR Mining has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The members of the audit committee are Beverlee F. Park (Chair), Richard D. Paterson, Gustavo A. Herrero and Steven P. Reid.

5

Mine Safety Disclosure.

Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) requires that the Company disclose in this Annual Report on Form 40-F certain information about the Company’s U.S. mining operations, including the number of certain types of violations and orders issued under the Federal Mine Safety and Health Act of 1977 by the U.S. Labor Department’s Mine Safety and Health Administration. Information concerning such safety information related to the Company’s U.S. mining operations or other regulatory matters required by Section 1503(a) of the Financial Reform Act for the year ended December 31, 2018 is included as Exhibit 99.4 to this Annual Report on Form 40-F, which is incorporated herein by reference.

Nasdaq Global Market Disclosure.

SSR Mining is subject to a variety of corporate governance guidelines and requirements enacted by Canadian securities regulators, the Toronto Stock Exchange, Nasdaq and the Commission, and those mandated by the U.S. Sarbanes Oxley Act of 2002 and the Dodd-Frank Act.

SSR Mining’s common shares are listed on Nasdaq. Nasdaq Marketplace Rule 5615(a)(3) permits a foreign private issuer, such as SSR Mining, to follow its home country practice in lieu of most of the requirements of the 5600 Series of the Nasdaq Marketplace Rules. In order to claim such an exemption, SSR Mining must disclose the significant differences between its corporate governance practices and those required to be followed by U.S. domestic issuers under Nasdaq’s corporate governance requirements. Nasdaq Marketplace Rule 5635 requires shareholder approval of most equity compensation plans and material revisions to such plans. SSR Mining does not follow this Nasdaq Marketplace Rule. Instead, SSR Mining complies with the applicable Toronto Stock Exchange rules which only require that the creation of, or certain material amendments to, equity compensation plans require shareholder approval.

6

UNDERTAKING AND CONSENT TO SERVICE OF PROCESS

A. Undertaking.

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an Annual Report on Form 40-F arises; or transactions in said securities.

B. Consent to Service of Process.

The Registrant has filed a Form F-X in connection with the class of securities in relation to which the obligation to file this report arises.

Any change to the name or address of the agent for service of process of the Registrant shall be communicated promptly to the Commission by an amendment to the Form F-X referencing the file number of the Registrant.

7

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized, on March 11, 2019.

| SSR Mining Inc. | ||

| By: | /s/ Paul Benson | |

| Name: | Paul Benson | |

| Title: | President & Chief Executive Officer | |

| By: | /s/ Gregory J. Martin | |

| Name: | Gregory J. Martin | |

| Title: | Senior Vice President & Chief Financial Officer | |

8

EXHIBIT INDEX

| Exhibit |

Description | |

| 99.1 | Annual Information Form for the fiscal year ended December 31, 2018 | |

| 99.2 | Management’s Discussion and Analysis for the fiscal year ended December 31, 2018 | |

| 99.3 | Consolidated Financial Statements for the fiscal year ended December 31, 2018 | |

| 99.4 | Mine Safety Information Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act | |

| 99.5 | Certification of Chief Executive Officer pursuant to Rule 13a-14 or 15d-14 of the Securities Exchange Act of 1934 | |

| 99.6 | Certification of Chief Financial Officer pursuant to Rule 13a-14 or 15d-14 of the Securities Exchange Act of 1934 | |

| 99.7 | Certification of Chief Executive Officer pursuant to 18 U.S.C. Section 1350 | |

| 99.8 | Certification of Chief Financial Officer pursuant to 18 U.S.C. Section 1350 | |

| 99.9 | Consent of PricewaterhouseCoopers LLP, Chartered Professional Accountants | |

| 99.10 | Consent of Bruce Butcher | |

| 99.11 | Consent of F. Carl Edmunds | |

| 99.12 | Consent of Trevor J. Yeomans | |

| 99.13 | Consent of James N. Carver | |

| 99.14 | Consent of James Frost | |

| 99.15 | Consent of Karthik Rathnam | |

| 99.16 | Consent of Thomas Rice | |

9

| Exhibit |

Description | |

| 99.17 | Consent of Cameron Chapman | |

| 99.18 | Consent of Kevin Fitzpatrick | |

| 99.19 | Consent of Jeff Kulas | |

| 99.20 | Consent of Michael Selby | |

| 99.21 | Consent of Dominic Chartier | |

| 99.22 | Consent of Mark Liskowich | |

| 99.23 | Consent of Sebastien Bernier | |

| EX-101 | XBRL Files | |

10

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2018

SSR MINING INC.

March 11, 2019

SSR MINING INC.

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2018

TABLE OF CONTENTS

| Page | ||||

| INTRODUCTORY NOTES |

1 | |||

| Date of Information |

1 | |||

| Cautionary Notice Regarding Forward-Looking Statements |

1 | |||

| Currency and Exchange Rate Information |

2 | |||

| Scientific and Technical Information |

3 | |||

| Cautionary Notice Regarding Mineral Reserves and Mineral Resources Estimates |

3 | |||

| Notice Regarding Non-GAAP Measures |

5 | |||

| CORPORATE STRUCTURE |

5 | |||

| Name, Address and Incorporation |

5 | |||

| Intercorporate Relationships |

6 | |||

| GENERAL DEVELOPMENT OF THE BUSINESS |

6 | |||

| 2018 Developments |

6 | |||

| 2017 Developments |

7 | |||

| 2016 Developments |

9 | |||

| DESCRIPTION OF THE BUSINESS |

10 | |||

| General |

10 | |||

| Principal Products |

11 | |||

| Specialized Skills and Knowledge |

11 | |||

| Competitive Conditions |

11 | |||

| Operations |

12 | |||

| Corporate Social Responsibility |

13 | |||

| MINERAL PROPERTIES |

17 | |||

| Summary of Mineral Reserves and Mineral Resources Estimates |

17 | |||

| Marigold Mine |

20 | |||

| Seabee Gold Operation |

33 | |||

| Puna Operations |

47 | |||

| Projects |

47 | |||

| RISK FACTORS |

49 | |||

| Risks Related to Our Business and Our Industry |

49 | |||

| Risks Related to Our Common Shares |

65 | |||

| DIVIDENDS |

66 | |||

| DESCRIPTION OF CAPITAL STRUCTURE |

66 | |||

| Common Shares |

67 | |||

| Stock Options |

67 | |||

| Performance Share Units and Restricted Share Units |

69 | |||

| Deferred Share Units |

69 | |||

| Convertible Notes |

70 | |||

| MARKET FOR SECURITIES |

70 | |||

| Trading Price and Volume |

70 | |||

| PRIOR SALES |

71 | |||

| DIRECTORS AND EXECUTIVE OFFICERS |

72 | |||

| Directors |

72 | |||

| Executive Officers |

74 | |||

| Standing Committees of the Board |

75 | |||

| Code of Ethics |

76 | |||

| Cease Trade Orders or Bankruptcies |

76 | |||

| Penalties or Sanctions |

77 | |||

| Conflicts of Interest |

77 | |||

- ii -

| AUDIT COMMITTEE |

77 | |||

| Composition of the Audit Committee |

77 | |||

| Audit Committee Oversight |

77 | |||

| Reliance on Certain Exemptions |

78 | |||

| Pre-Approval Policies and Procedures |

78 | |||

| External Auditor Service Fees |

78 | |||

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

78 | |||

| TRANSFER AGENT AND REGISTRAR |

78 | |||

| MATERIAL CONTRACTS |

79 | |||

| INTERESTS OF EXPERTS |

79 | |||

| ADDITIONAL INFORMATION |

80 | |||

| SCHEDULE “A” AUDIT COMMITTEE CHARTER |

A-1 |

INTRODUCTORY NOTES

DATE OF INFORMATION

In this Annual Information Form, SSR Mining Inc., formerly Silver Standard Resources Inc., together with its subsidiaries, as the context requires, is referred to as “we,” “our,” “us,” the “Company” and “SSR Mining”. All information contained in this Annual Information Form is as at December 31, 2018, unless otherwise stated, being the date of our most recently completed financial year, and the use of the present tense and of the words “is,” “are,” “current,” “currently,” “presently,” “now” and similar expressions in this Annual Information Form is to be construed as referring to information given as of that date.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Information Form contains forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”) including, without limitation, forward-looking statements concerning our expected production and cost guidance for 2019, the anticipated operating and capital expenditures and reclamation costs at the Marigold mine, the Seabee Gold Operation and Puna Operations, our expected capital projects, including costs, results and timing of completion, and our planned exploration initiatives and expenditures for our projects in Argentina, Mexico, Peru, the United States and Canada. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Generally, forward-looking statements can be identified by the use of words or phrases such as “expects,” “anticipates,” “plans,” “projects,” “estimates,” “assumes,” “intends,” “strategy,” “goals,” “objectives,” “potential,” “believes,” or variations thereof, or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved, or the negative of any of these terms or similar expressions. These forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied, including, without limitation, the following risks and uncertainties referred to under the heading “Risk Factors”: uncertainty of production, development plans and cost estimates for the Marigold mine, the Seabee Gold Operation, Puna Operations and our projects; our ability to replace Mineral Reserves; commodity price fluctuations; political or economic instability and unexpected regulatory changes; currency fluctuations; the possibility of future losses; general economic conditions; counterparty and market risks related to the sale of our concentrates and metals; uncertainty in the accuracy of Mineral Reserves and Mineral Resources estimates and in our ability to extract mineralization profitably; differences in U.S. and Canadian practices for reporting Mineral Reserves and Mineral Resources; lack of suitable infrastructure or damage to existing infrastructure; future development risks, including start-up delays and cost overruns; our ability to obtain adequate financing for further exploration and development programs and opportunities; uncertainty in acquiring additional commercially mineable mineral rights; delays in obtaining or failure to obtain governmental permits, or non-compliance with our permits; our ability to attract and retain qualified personnel and management; the impact of governmental regulations, including health, safety and environmental regulations, including increased costs and restrictions on operations due to compliance with such regulations; unpredictable risks and hazards related to the development and operation of a mine or mineral property that are beyond our control; reclamation and closure requirements for our mineral properties; potential labour unrest, including labour actions by our unionized employees at Puna Operations; indigenous peoples’ title claims and rights to consultation and accommodation may affect our existing operations as well as development projects and future acquisitions; certain transportation risks that could have a negative impact on our ability to operate; assessments by taxation authorities in multiple jurisdictions; recoverability of value added tax (“VAT”) and Puna credits balance and significant delays in the collection process in Argentina; claims and legal proceedings, including adverse rulings in litigation against us and/or our directors or officers; compliance with anti-corruption laws and internal controls, and increased regulatory compliance costs; complying with emerging climate change regulations and the impact of climate change; fully realizing our interest in deferred consideration received in connection with recent divestitures; fully realizing the value of our shareholdings in our marketable securities, due to changes in price, liquidity or disposal cost of such marketable securities; uncertainties related to title to our mineral properties and the ability to obtain surface

- 2 -

rights; the sufficiency of our insurance coverage; civil disobedience in the countries where our mineral properties are located; operational safety and security risks; actions required to be taken by us under human rights law; competition in the mining industry for mineral properties; our ability to complete and successfully integrate an announced acquisition; reputation loss resulting in decreased investor confidence, increased challenges in developing and maintaining community relations and an impediment to our overall ability to advance our projects; risks normally associated with the conduct of joint ventures; an event of default under our convertible notes may significantly reduce our liquidity and adversely affect our business; failure to meet covenants under our senior secured revolving credit facility; information systems security threats; conflicts of interest that could arise from certain of our directors’ and officers’ involvement with other natural resource companies; and other risks related to our common shares. This list is not exhaustive of the factors that may affect any of our forward-looking statements. Our forward-looking statements are based on what management considers to be reasonable assumptions, beliefs, expectations and opinions based on information currently available to it. We cannot assure you that actual events, performance or results will be consistent with these forward-looking statements, and management’s assumptions may prove to be incorrect.

Assumptions have been made regarding, among other things, our ability to carry on our exploration and development activities, our ability to meet our obligations under our property agreements, the timing and results of drilling programs, the discovery of Mineral Resources and Mineral Reserves on our mineral properties, the timely receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction and operation of our projects, the price of the minerals we produce, the costs of operating and exploration expenditures, our ability to operate in a safe, efficient and effective manner, our ability to obtain financing as and when required and on reasonable terms, our ability to continue operating the Marigold mine, the Seabee Gold Operation and Puna Operations, dilution and mining recovery assumptions, assumptions regarding stockpiles, the success of mining, processing, exploration and development activities, the accuracy of geological, mining and metallurgical estimates, no significant unanticipated operational or technical difficulties, maintaining good relations with the communities surrounding the Marigold mine, the Seabee Gold Operation and Puna Operations, no significant events or changes relating to regulatory, environmental, health and safety matters, certain tax matters and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices, foreign exchange rates and inflation rates). You are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Our forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof and we do not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change other than as required by applicable law. For the reasons set forth above, you should not place undue reliance on forward-looking statements.

CURRENCY AND EXCHANGE RATE INFORMATION

All currency references in this Annual Information Form are in United States dollars unless otherwise indicated. References to “Canadian dollars” or the use of the symbol “C$” refers to Canadian dollars. References to “Argentine pesos” and “ARS” are to the lawful currency of Argentina.

The following table sets forth, for each period indicated, the high and low exchange rates for Canadian dollars expressed in United States dollars, the average of such exchange rates during such period, and the exchange rate at the end of such period. These rates are based on the indicative rate of exchange reported by the Bank of Canada.

| Fiscal Year Ended December 31, | ||||||

| 2016 | 2017 | 2018 | ||||

| Rate at the end of period |

$0.7448 | $0.7971 | $0.7330 | |||

| Average rate during period |

$0.7555 | $0.7708 | $0.7721 | |||

| Highest rate during period |

$0.7972 | $0.8245 | $0.8138 | |||

| Lowest rate during period |

$0.6854 | $0.7276 | $0.7330 | |||

- 3 -

On March 8, 2019, the exchange rate reported by the Bank of Canada was C$1.00 per US$0.74505. As of the same date, one Argentine peso equaled US$0.02428.

SCIENTIFIC AND TECHNICAL INFORMATION

Unless otherwise indicated, scientific and technical information in this Annual Information Form relating to our mineral properties, other than the Marigold mine and the Seabee Gold Operation, has been reviewed and approved by Bruce Butcher, P.Eng., our Director, Mine Planning, and F. Carl Edmunds, P.Geo., our Vice President, Exploration, each of whom is a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Unless otherwise indicated, scientific and technical information in this Annual Information Form relating to our Marigold mine has been reviewed and approved by James N. Carver, SME Registered Member, our Chief Geologist at the Marigold mine, and James Frost, P.E., our Technical Services Superintendent at the Marigold mine, each of whom is a qualified person under NI 43-101. Unless otherwise indicated, scientific and technical information in this Annual Information Form relating to our Seabee Gold Operation has been reviewed and approved by Cameron Chapman, P.Eng., our General Manager at the Seabee Gold Operation, Kevin Fitzpatrick, P.Eng., our Engineering Supervisor at the Seabee Gold Operation, and Jeffrey Kulas, P. Geo., our Manager Geology, Mining Operations at the Seabee Gold Operation, each of whom is a qualified person under NI 43-101. See “Interests of Experts”.

A “qualified person” for the purposes of NI 43-101 means an individual who is an engineer or geoscientist, holding the required accreditation, with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, has experience relevant to the subject matter of the mineral project, and is a member in good standing of a professional association.

CAUTIONARY NOTICE REGARDING MINERAL RESERVES AND MINERAL RESOURCES ESTIMATES

The disclosure included in this Annual Information Form uses Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and Mineral Resources estimates are made in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards on Mineral Reserves and Mineral Resources (the “CIM Standards”) adopted by the CIM Council on May 10, 2014, and NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators (“CSA”) that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The following definitions are reproduced from the CIM Standards:

A Mineral Resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

An Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation.

- 4 -

An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve. “Modifying Factors” are considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors.

A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve.

A Mineral Reserve is the economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at Pre-Feasibility or Feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully informed as to what is being reported. Mineral Reserves are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. The public disclosure of a Mineral Reserve must be demonstrated by a Pre-Feasibility Study or Feasibility Study.

A Probable Mineral Reserve is the economically mineable part of an Indicated, and in some circumstances, a Measured Mineral Resource. The confidence in the Modifying Factors applying to a Probable Mineral Reserve is lower than that applying to a Proven Mineral Reserve.

A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource. A Proven Mineral Reserve implies a high degree of confidence in the Modifying Factors.

Unless otherwise indicated, all Mineral Reserves and Mineral Resources estimates included in this Annual Information Form have been prepared in accordance with NI 43-101. These standards differ significantly from the requirements of the U.S. Securities and Exchange Commission (“SEC”) set out in SEC Industry Guide 7. Consequently, Mineral Reserves and Mineral Resources information included in this Annual Information Form is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC.

In particular, SEC Industry Guide 7 applies different standards in order to classify mineralization as a reserve. As a result, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC standards. Accordingly, Mineral Reserves estimates included in this Annual Information Form may not qualify as “reserves” under SEC standards.

In addition, this Annual Information Form uses the terms “Mineral Resources,” “Measured Mineral Resources,” “Indicated Mineral Resources” and “Inferred Mineral Resources” to comply with the reporting standards in Canada. SEC Industry Guide 7 does not recognize Mineral Resources and U.S. companies are generally not permitted to disclose resources in documents they file with the SEC. Furthermore, disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Investors are specifically cautioned not to assume that all or any part of the mineral

- 5 -

deposits in these categories will ever be converted into SEC-defined mineral reserves. Further, “Inferred Mineral Resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists. In accordance with Canadian rules, estimates of “Inferred Mineral Resources” cannot form the basis of feasibility or pre-feasibility studies. It cannot be assumed that all or any part of “Mineral Resources,” “Measured Mineral Resources,” “Indicated Mineral Resources” or “Inferred Mineral Resources” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part of the “Mineral Resources,” “Measured Mineral Resources,” “Indicated Mineral Resources” or “Inferred Mineral Resources” reported in this Annual Information Form is economically or legally mineable. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under reporting standards in Canada differ in certain respects from the standards of the SEC. For the above reasons, information included in this Annual Information Form that describes our Mineral Reserves and Mineral Resources estimates is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

NOTICE REGARDING NON-GAAP MEASURES

This Annual Information Form includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards as issued by the International Accounting Standards Board (“IASB”) and incorporated in the Handbook of the Canadian Institute of Chartered Accountants (“IFRS”), including cash costs and all-in sustaining costs per payable ounce of precious metals sold, realized metal prices, adjusted attributable income (loss) before tax, adjusted attributable net income (loss), adjusted basic attributable income (loss) per share, operating income and working capital. Non-GAAP financial measures do not have any standardized meaning prescribed under IFRS and, therefore, they may not be comparable to similar measures reported by other companies. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These non-GAAP measures should be read in conjunction with our financial statements. See “Non-GAAP Financial Measures” in our management’s discussion and analysis of the financial position and results of operations for the year ended December 31, 2018 for a more detailed discussion of how we calculate such measures and for a reconciliation of such measures to IFRS terms.

CORPORATE STRUCTURE

NAME, ADDRESS AND INCORPORATION

We were incorporated as a company in British Columbia, Canada, on December 11, 1946 under the name “Silver Standard Mines, Limited (NPL)” and changed our name to “Silver Standard Mines Limited” on July 18, 1979. We changed our name to “Consolidated Silver Standard Mines Limited” and consolidated our common shares on a 1-for-5 basis on August 9, 1984. We changed our name to “Silver Standard Resources Inc.” on April 9, 1990. On May 12, 2005, our shareholders adopted new articles as required by the new British Columbia Business Corporations Act (“BCBCA”), under which we are incorporated, and authorized an increase in our authorized capital from 100,000,000 common shares without par value to an unlimited number of common shares without par value. On May 4, 2017, our shareholders approved a name change to “SSR Mining Inc.”, and the name change became effective on August 1, 2017. All share data in this Annual Information Form refers to consolidated shares/data, unless otherwise indicated.

Our head office and registered and records office is located at Suite 800 – 1055 Dunsmuir Street, Vancouver, British Columbia, V7X 1G4.

- 6 -

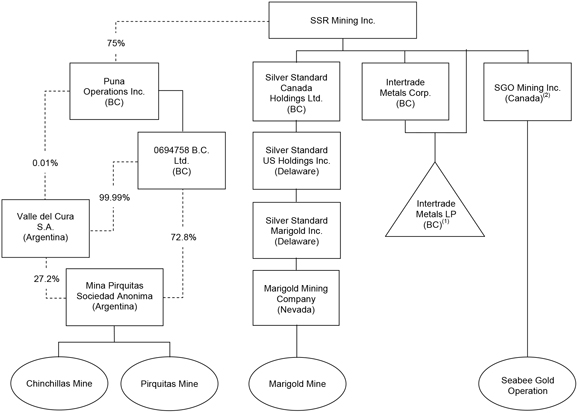

INTERCORPORATE RELATIONSHIPS

The following is a diagram of the intercorporate relationships among us and certain of our subsidiaries that hold operating mining properties, including their respective jurisdiction of incorporation. Except as indicated in the diagram below, all of our material subsidiaries noted below are wholly-owned.

Notes:

| (1) | Intertrade Metals Corp. is the General Partner and SSR Mining is the Limited Partner. |

| (2) | Formerly known as Claude Resources Inc. |

GENERAL DEVELOPMENT OF THE BUSINESS

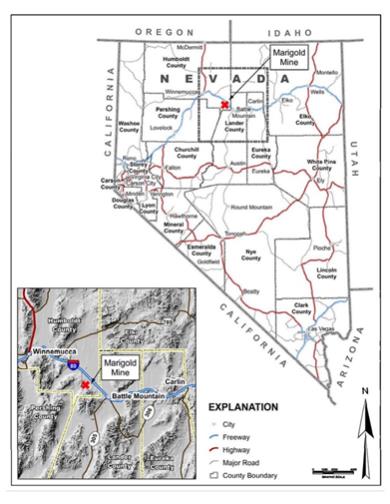

We are a Canadian-based resource company focused on the operation, acquisition, exploration and development of precious metal resource properties located in the Americas. We have three producing mines and a portfolio of precious metal dominant projects located throughout the Americas. Our focus is on safe, profitable gold and silver production from our Marigold mine in Nevada, U.S., our Seabee Gold Operation in Saskatchewan, Canada, and our 75%-owned Puna Operations in Jujuy, Argentina.

2018 DEVELOPMENTS

Change to Board of Directors

On January 1, 2018, we appointed Ms. Elizabeth A. Wademan and Mr. Simon A. Fish to our Board of Directors with the objective to strengthen the Board’s expertise in the areas of international capital markets and legal and corporate governance. See “Directors and Executive Officers – Directors” for additional information on each of Mr. Fish’s and Ms. Wademan’s prior experience.

- 7 -

Change to Chief Operating Officer

On May 3, 2018, we announced the appointment of Mr. Kevin O’Kane as Senior Vice President and Chief Operating Officer effective June 4, 2018, replacing Mr. Alan Pangbourne, who retired at the end of May 2018. See “Directors and Executive Officers – Directors” for additional information on Mr. O’Kane’s prior experience.

Updated Life of Mine Plan for the Marigold Mine

On June 18, 2018, we released an updated life of mine plan for the Marigold mine in Nevada, U.S., which outlined an anticipated mine-life of over ten-years based on Mineral Reserves as at December 31, 2017 and an after-tax net present value of $552 million. We filed a technical report titled “NI 43-101 Technical Report on the Marigold Mine, Humboldt County, Nevada USA” dated July 31, 2018 with an effective date of December 31, 2017 (the “Marigold Technical Report”) in support of the updated life of mine plan. See “Mineral Properties – Marigold Mine” for further details.

Sale of Pretium Shares

As of June 30, 2018, we sold our remaining position of 9.0 million common shares of Pretium Resources Inc. (“Pretium”) for pre-tax cash proceeds of approximately $63.4 million, and no longer hold any Pretium shares.

Declaration of Commercial Production at the Chinchillas Mine

On December 1, 2018, we declared commercial production at Puna Operations’ Chinchillas mine. Development of the mine, located approximately 45 kilometers from the Pirquitas plant, commenced in early 2018 and extends the life of the Pirquitas plant through mining of ore at Chinchillas, transporting the ore to Pirquitas and processing it through the existing Pirquitas plant.

Strategic Investment in SilverCrest Metals

On December 10, 2018, we completed a transaction with SilverCrest Metals Inc. (“SilverCrest”) to purchase, by way of private placement, a 9.7% ownership interest representing, 8,220,645 common shares of SilverCrest at a price of C$3.73 per common share for total consideration of C$30.7 million. SilverCrest owns the Las Chispas project, a high-grade development project, in Mexico.

2017 DEVELOPMENTS

Option of Candelaria Property

In January 2017, we agreed to option our Candelaria property in Nevada, U.S. to Silver One Resources Inc. (“Silver One”). To earn a 100% interest in the Candelaria property, Silver One has issued to us a total of $2.0 million worth of Silver One shares and is required to issue an additional annual installment of $1.0 million worth of shares of Silver One and assume the reclamation bond on the property immediately prior to its exercise of the option.

Change to Chairman of the Board

On March 27, 2017, we announced that, after serving over ten years on our Board of Directors, Mr. Peter W. Tomsett decided to retire from his position of Chairman at the close of our 2017 annual and special meeting of shareholders. The Board of Directors appointed Mr. A. E. Michael Anglin to assume the role of Chairman, effective as of May 4, 2017. Mr. Anglin has served as a member of our Board since 2008. See “Directors and Executive Officers – Directors” for additional information on Mr. Anglin’s experience.

- 8 -

Resolution of Export Duty Claim in Argentina

We entered into a fiscal stability agreement with the Federal Government of Argentina in 1998 for production from the Pirquitas mine. In December 2007, the National Customs Authority of Argentina (Dirección Nacional de Aduanas) (“Customs”) levied an export duty of approximately 10% from concentrate for projects with fiscal stability agreements pre-dating 2002 and Customs asserted that the Pirquitas mine was subject to this duty. We had previously challenged the legality of the export duty applied to silver concentrate.

On March 31, 2017, we entered into the tax moratorium system in Argentina to resolve this long-standing dispute. Under the conditions of the moratorium, which converts the export duty liability to Argentine pesos, we have agreed to pay approximately ARS 1 billion with 5% down payment initially and the balance in installments over 60 months. Outstanding ARS amounts are subject to interest at a minimum rate of 1.5% per month. Upon completion of these payments, all liabilities related to historical export duties and interest will be extinguished. We are no longer challenging the legality of the application of the export duty other than with respect to our right for reimbursement of the $6.6 million in export duties that we paid.

Sale of Berenguela Project

On May 2, 2017, we completed the sale of our Berenguela project in Peru to Valor Resources Limited (“VAL”), an Australian Securities Exchange listed company, for aggregate consideration of: cash payments of $12.0 million over five years; a 9.9% equity stake in VAL, with a free carry interest until VAL completes, in aggregate, a financing of $8.0 million; and a 1% net smelter returns (“NSR”) royalty on all metal production from the project.

Formation of Puna Operations Joint Venture

On May 31, 2017, we completed a joint venture with Golden Arrow Resources Corporation (“Golden Arrow”) for the development of the Chinchillas project in Jujuy, Argentina. The joint venture, named Puna Operations Inc., is comprised of the Pirquitas and Chinchillas properties of which we own 75% and are the operator. See “Mineral Properties – Puna Operations” for further details.

Amendment to Credit Facility

During the second quarter of 2017, we extended the maturity of our $75.0 million senior secured revolving credit facility (the “Credit Facility”) to June 8, 2020, and concurrently reduced applicable margins, increased covenant flexibility and added a $25.0 million accordion feature. Amounts that are borrowed under the Credit Facility will incur variable interest at London Interbank Offered Rate plus an applicable margin ranging from 2.25% to 3.75% determined based on our net leverage ratio. All debts, liabilities and obligations under the Credit Facility are guaranteed by certain of our material subsidiaries and secured by certain of our assets, certain of our material subsidiaries, and pledges of the securities of certain of our material subsidiaries. The Credit Facility may be used for reclamation bonding, working capital and other general corporate purposes.

Change of Name

Effective August 1, 2017, we changed our name to SSR Mining Inc. from Silver Standard Resources Inc. to better reflect our business focus as a precious metals producer.

Seabee Gold Operation PEA Supports Mine Expansion Plan

On September 7, 2017, we reported the results of a preliminary economic assessment (“PEA”) for the Seabee Gold Operation, which provided a mine expansion scenario. The PEA contemplated near-term production growth, extended production to 2024, expanded operating margins and improved processing plant performance while requiring low capital investment. We subsequently filed the technical report entitled “NI 43-101 Technical Report for the Seabee Gold Operation, Saskatchewan, Canada” dated October 20,

- 9 -

2017 (the “Seabee Gold Operation Technical Report”) in support of the PEA. See “Mineral Properties – Seabee Gold Operation” for further details.

2016 DEVELOPMENTS

Acquisition of Claude Resources and Change to Board of Directors

On May 31, 2016, we completed the acquisition of 100% of the issued and outstanding common shares of Claude Resources Inc. (“Claude Resources”), the owner and operator of the Seabee Gold Operation, for total consideration of approximately 37.4 million SSR Mining common shares and cash consideration of $0.2 million. The acquisition was carried out pursuant to the terms and conditions contained in an arrangement agreement dated March 7, 2016, as amended, between SSR Mining and Claude Resources. We filed a Business Acquisition Report on Form 51-102F4 in respect of this acquisition on June 24, 2016.

In connection with the acquisition, Mr. Brian R. Booth, the former Chairman of the Board of Directors of Claude Resources, was appointed to our Board of Directors on May 31, 2016. See “Directors and Executive Officers – Directors” for additional information on Mr. Booth’s prior experience.

Favorable Resolution of Tax Dispute with CRA

In 2016, the tax dispute with the Canada Revenue Agency (“CRA”) was settled in our favour. On August 24, 2016, the CRA issued a new notice of reassessment for each of our 2010 and 2011 taxation years reversing the Notice of Reassessment issued to us in January 2015 and, on September 2, 2016, refunded $18.2 million, being the deposit we paid to the CRA to appeal, plus accrued interest from the date of payment of the deposit. Following the receipt of the deposit, with accrued interest, the Department of Justice filed a notice of discontinuance of our appeal with the Tax Court of Canada.

Option to Explore Fisher Project

On October 6, 2016, we announced the signing of an option agreement with Eagle Plains Resources Ltd. (“Eagle Plains”) to acquire up to an 80% interest in the Fisher project, located in Saskatchewan, Canada, adjacent to our Seabee Gold Operation. The project consists of approximately 34,175 hectares and doubles our prospective land position at the Seabee Gold Operation. See “Mineral Properties – Projects – Fisher Project, Saskatchewan, Canada” for further details.

Sale of Parral Properties

On October 31, 2016, we completed the sale of our Parral properties in Mexico, including the Veta Colorada, La Palmilla and San Patricio properties, to Endeavour Silver Corp. (“Endeavour Silver”) for aggregate consideration of: 1,198,083 Endeavour Silver shares; the right to receive $0.2 million worth of Endeavour Silver shares for each 1 million silver ounces included in an estimate of Measured and Indicated Mineral Resources prepared by Endeavour Silver in respect of the San Patricio and La Palmilla properties; and a 1% NSR royalty on all mineral products from the San Patricio and La Palmilla properties.

Sale of Diablillos and M-18 Projects

On November 1, 2016, we completed the sale of our Diablillos and M-18 projects located in Argentina to Huayra Minerals Corporation (“Huayra”) for aggregate consideration of: cash payments of approximately $1.15 million over the first two years and $13.0 million over the following three to five years; a 19.9% equity stake in Huayra, with a free carry interest until the completion of a financing of $5.0 million or more; and a 1% NSR royalty on production from each of the projects. On April 24, 2017, Huayra completed its reverse take-over (“RTO”) of AbraPlata Resource Corp. (“AbraPlata”), a TSX Venture Exchange listed company. As a result of the RTO, our shares in Huayra were exchanged on a one-for-one basis for common shares in AbraPlata resulting in SSR Mining directly holding 19.9% of the total issued and outstanding common shares of AbraPlata. Effective as of the closing of the RTO, Mr. W. John DeCooman, our Senior Vice President, Business Development and Strategy, joined the Board of Directors of AbraPlata.

- 10 -

DESCRIPTION OF THE BUSINESS

GENERAL

SSR Mining has an experienced management team of mine-builders and operators with proven capabilities. We are engaged in the operation, acquisition, exploration and development of precious metal mineral properties located in the Americas. We are committed to delivering safe production through relentless emphasis on Operational Excellence. We are also focused on growing production and Mineral Reserves through the exploration and acquisition of assets for accretive growth, while maintaining financial strength.

In addition to the Marigold mine, the Seabee Gold Operation and the 75%-owned Puna Operations, we own two feasibility stage projects: the Pitarrilla project, a silver-lead-zinc project in Mexico; and the San Luis project, a high-grade gold-silver project in Peru. We also hold interests in several other properties in North and South America at various stages of exploration and development.

- 11 -

PRINCIPAL PRODUCTS

Our principal products are gold doré, bullion and metal concentrates. All of our gold doré and bullion is produced at the Marigold mine and the Seabee Gold Operation and sold primarily to bullion banks. Puna Operations produces silver, zinc and lead concentrates, which are sold to smelters or traders for further refining. During 2018, one concentrate customer accounted for 51% (2017 – 7%) of our total concentrate revenue.

Our revenue by product category for the financial years ended December 31, 2018 and December 31, 2017 was as follows:

|

Product Revenue

|

2018 | 2017 | ||

|

Gold

|

87% | 80% | ||

|

Silver

|

12% | 20% | ||

|

Zinc

|

1% | — | ||

|

Lead

|

— | — |

The market price of gold, as mined at our Marigold mine and Seabee Gold Operation, and silver, lead and zinc, as mined at our Puna Operations are key drivers to our profitability. The PM fix average gold price of $1,268 per ounce in 2018 was slightly higher than the 2017 average of $1,257 per ounce. The 2018 average silver fix of $15.71 per ounce was considerably lower than the 2017 average of $17.05 per ounce. The average price of lead and zinc for 2018 of $2,241 and $2,879 per tonne, respectively, were similar to the 2017 averages of $2,327 and $2,894 per tonne, respectively. The prices of lead and zinc had minimal impact on our 2018 financial results but will have a more significant impact in 2019 with the Chinchillas project reaching commercial production.

SPECIALIZED SKILLS AND KNOWLEDGE

Various aspects of our business require specialized skills and knowledge, including in areas of geology, engineering, drilling, metallurgy, permitting, logistics, planning and implementation of exploration programs as well as legal compliance, finance, accounting, environmental and community relations. We face competition for qualified personnel with these specialized skills and knowledge, which may increase our costs of operations or result in delays.

COMPETITIVE CONDITIONS

The precious and base metals mineral exploration and mining business is competitive. Competition is primarily for: (a) mineral properties that can be developed and produced economically; (b) technical experts that can find, develop and mine such mineral properties; (c) labour to operate the mineral properties; and (d) capital to finance exploration, development and operations.

We compete with other mining and exploration companies in the acquisition of mineral properties and in connection with the recruitment and retention of qualified employees. There is significant competition for mineral properties. Many larger competitors conduct business globally and thus have greater financial and technical resources available to them. If we are unsuccessful in acquiring additional mineral properties or qualified personnel, we may not be able to replace Mineral Reserves, maintain production or grow.

- 12 -

OPERATIONS

Employees and Contractors

As at December 31, 2018, we employed a total of 1,359 full-time employees and 271 contract employees. The table below sets out our employees at each of the following locations:

|

Location |

Number of Employees | |||

|

Full-time

|

Contract

| |||

|

Vancouver, Canada

|

42 | 2 | ||

|

Saskatchewan, Canada

|

314 | 4 | ||

|

U.S.

|

400 | 20 | ||

|

Argentina

|

583 | 239 | ||

|

Mexico

|

13 | 4 | ||

|

Peru

|

7 | 2 | ||

As at December 31, 2018, of the 583 full-time employees in Argentina, 351 were represented by a union.

Environmental Protection Requirements

We have certain reclamation obligations at our mineral properties, including the Marigold mine, the Seabee Gold Operation and Puna Operations. At the Marigold mine, we engage in concurrent reclamation practices and provide bonds for all permitted features, as part of the State of Nevada permitting process. Current bonding amounts are based on third party cost estimates to reclaim all permitted features at the Marigold mine, with the exception of a few features permitted as permanent, post-mining features. The Bureau of Land Management (“BLM”) and the State of Nevada both review and approve the bond estimate, and the BLM holds the financial instruments providing the bond backing. As at December 31, 2018, the Marigold mine had reclamation bond requirements totaling approximately $46.5 million.

At the Seabee Gold Operation, we also have an approved closure plan and financial assurance held by the Province of Saskatchewan. The closure plan addresses all final reclamation requirements as well as the longer term post-reclamation monitoring and maintenance phase. As required by our environmental permits, the closure plan is periodically updated. As at December 31, 2018, the Seabee Gold Operation had reclamation bond requirements totaling approximately $5.3 million.

At Puna Operations, the present value of the current closure and reclamation cost estimate for the Pirquitas property, to be spent over a number of years, using a discount rate of 9.9%, is approximately $24.0 million, excluding any salvage value, on a 100% basis. The undiscounted present value of our current closure and reclamation cost estimate for the Chinchillas property at the end of the life of mine is approximately $2.2 million, on a 100% basis.

We also have certain reclamation obligations at the Duthie property and the Silver Standard mine property, both located in British Columbia, Canada. In 2018, our reclamation work program at these properties was carried out at a cost of approximately $0.1 million.

Foreign Operations

Any changes in regulations or shifts in political attitudes in the foreign jurisdictions in which we operate, including Argentina, Mexico, Peru and the United States, are beyond our control and may adversely affect our business. Future development and operations may be affected in varying degrees by certain economic, political and other risks and uncertainties including, but not limited to: royalties and tax increases or claims by governmental bodies; restrictions on production; expropriation or nationalization; employee profit-sharing requirements; foreign exchange controls; restrictions on repatriation of profits; import and export regulations; cancellation or renegotiation of contracts; changing fiscal regimes and

- 13 -

uncertain regulatory environments; fluctuations in currency exchange rates; high rates of inflation; changes in royalty and tax regimes, including the elimination of tax exemptions; underdeveloped industrial and economic infrastructure; unenforceability of contractual rights and judgments; changes to environmental legislation; land claims of local people; and mine safety. We cannot accurately predict the effect of these factors. See “Risk Factors” for further details.

CORPORATE SOCIAL RESPONSIBILITY

For us, being a responsible corporate citizen means protecting the natural environment associated with our business activities, providing a safe workplace and work processes for our employees and contractors, and investing in the communities where we operate so that we can enhance the lives of those who work and live there beyond the life of such operations. We take a long-term view of our corporate responsibility, which is reflected in the policies that guide our business decisions, and in our corporate culture that fosters safe and ethical behavior across all levels of SSR Mining.

Safety Policy

Our safety policy (the “Safety Policy”) defines the organization’s safety values and is designed to guide us in advancing each of those values, to outline the values and standards for our health and safety systems; and to ensure that we develop and implement effective management systems to identify, minimize and manage health and safety risks. It is also used to promote and enhance employee commitment and accountability. The Safety Policy is available for viewing on our website at www.ssrmining.com.

Health and Safety

We reflect our commitment to the health and safety of our employees by creating and maintaining a safe working environment, equipment, work processes, effective safety and health management systems, and by complying with all applicable health and safety laws, rules and regulations. We acknowledge that there are inherent safety risks associated with our business and, through proactive risk management, continuously strive to minimize and control these risks.

Our safety vision is “Safe for Life”, and our ultimate goal is to deliver safe production every day. We seek to ensure our employees are safe both for their families and at work. Our safety framework puts emphasis on effective risk-centered management systems, positive and effective work cultures and proactive leadership to drive culture enhancement. We emphasize balancing the human and technical aspects of safety: blending leadership behaviors with traditional management activities to create a safe, productive culture. We ensure that our workers understand their individual contributions to safe production. In this way, our employees maintain safety awareness, recognizing hazards and analyzing risk in their daily activities. Each employee has established commitments related to their personal and work and off-the-job safety and health behaviors, and each employee is empowered to take the necessary actions to minimize risks. The technical aspects of safety are addressed by identifying critical tasks, assessing related risks, establishing systems, policies and procedures, providing appropriate training and verifying competencies. Performance measurement and accountability provides feedback and maintains focus on continuous improvement.

In 2018, we made a major commitment to improve leadership competencies among our line managers through the implementation of a customized leadership development system. In addition to defining critical competencies that impact safety and operations, a development program developed in 2018 will be executed in 2019 followed by additional site-specific leadership development activities designed to establish long-term improvement opportunities.

Safety and Sustainability Committee

Our Board of Directors has established a Safety and Sustainability Committee that, as part of its mandate, is responsible for reviewing our health, safety, security, environmental and community relations policies and practices and monitoring our performance in these areas. The Safety and Sustainability Committee meets and reports to the Board of Directors on a quarterly basis. Our Safety and Sustainability Committee charter is available for viewing on our website at www.ssrmining.com.

- 14 -

Environmental Policy

Under our environmental policy (the “Environmental Policy”), we are committed to undertaking a policy of sustainable resource development, which embodies the protection of human health and the natural environment, over the full life cycle of mining. The Environmental Policy is available for viewing on our website at www.ssrmining.com. Our Vice President, Environment and Community Relations oversees environmental management and reports directly to the Chief Operating Officer. The Chief Operating Officer reports directly to the Chief Executive Officer. Executive compensation and remuneration is based on the achievement of our corporate objectives, which include health, safety and environmental goals.

Environment and Sustainability

Our activities are subject to extensive laws and regulations governing the protection of the environment and natural resources. These laws address, among other things, emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. We are required to obtain governmental permits and, in some instances, provide bonding requirements under federal, state, or provincial air, water quality, and mine reclamation rules and permits. Violations of environmental laws are subject to civil sanctions and, in some cases, criminal sanctions, including the suspension or revocation of permits. The failure to comply with environmental laws and regulations could result in temporary or permanent closure of our mining operations, project development delays, material financial impacts or other material impacts to our projects and activities, fines, penalties, lawsuits by the government or private parties, revocability of property or material capital expenditures. Additionally, environmental laws in the countries in which we operate require that we periodically perform environmental impact studies and updates at our mines. These studies could reveal environmental impacts that would require us to make significant capital outlays or cause material changes or delays in our intended activities. See “Risk Factors”.

We comply with regulatory requirements and diligently apply appropriate methodologies to protect the environment throughout our exploration, development, mining, processing and closure activities. Our environmental obligations include, but are not limited to, obtaining and maintaining all environmental permits and approvals required for the conduct of our operations, the proper handling, storage and disposal of regulated materials and the timely and accurate submission of required reports to the appropriate government agencies.

In 2006, the Marigold mine became the first operating gold mine in the world certified as fully compliant with the International Cyanide Management Code. We maintained such distinction in 2018, with the Marigold mine’s fourth successful recertification.

Since reclamation commenced at our Duthie property, it has progressed from an inactive mine to an award-winning example of our environmental stewardship. We received a citation from a joint committee of the Mining Association of British Columbia and the B.C. Ministry of Energy and Mines for outstanding reclamation achievement at this site.

Community Engagement

Our community relations program is based on open and continuous communication with the members of communities located in our areas of operation. We take a shared-value approach to local development activities to promote sustainable long-term economic and social benefits. In addition, we strive to ensure that local stakeholders have an opportunity for input and dialogue. Projects aimed at assisting and advancing our communities include training and employment, development of infrastructure and support for education and medical services, among others. At all times, we work to be a partner in the long-term sustainability of the communities in which we operate.

- 15 -

Community support and engagement is well-established at our Marigold mine, and several of our employees are key participants in local development efforts. Our employees work closely with the University of Nevada, Reno in creating a graduate program in mining, in addition to providing internships for students and ongoing support to the university. We also support local high schools through scholarships, contribution of equipment and supplies and employee volunteer efforts. In addition, our Marigold emergency response team actively supports the emergency preparedness and wellness in the local community and has participated in various activities including training drills and delivering flu vaccinations at health fairs.

Our Seabee Gold Operation is located in northern Saskatchewan, within the traditional territories of the Lac La Ronge Indian Band and the Peter Ballantyne Cree First Nation. Since our acquisition of the operation in May 2016, we have identified training, education and employment of northern communities as priorities for community engagement. This has resulted in over 35% of our employees at the Seabee Gold Operation being self-identified as indigenous and over 20% from Northern Saskatchewan communities.

At Puna Operations in Argentina, we support the educational system in the Province of Jujuy through collaboration with local schools. We have assisted with the renovation of six local educational facilities and with a number of information sessions and educational activities held for students throughout the region. We have also collaborated with the Argentina Ministry of Education to create a program allowing members of local communities, including our employees, to complete their secondary education. Furthermore, our medical services and health campaigns provide higher health standards and practices in the remote areas in close proximity to the Pirquitas property. The Pirquitas health center provides emergency services for the local communities and we have initiated a general practitioner outreach program for local towns, commenced a dental care program and held numerous illness prevention workshops. We also built two sports centers in 2016 for the surrounding communities.

In addition, we commenced commercial production at our Chinchillas mine on December 1, 2018. As part of the development of Chinchillas, we have enhanced community engagement targeting education, training and employment opportunities. Over 300 employees have been trained and are working at Chinchillas and nearly 100% of these employees are from the local communities.

At our Pitarrilla project in Mexico, as part of our agreement with the Ejido Casas Blancas, we have funded the construction of Lienzo Charro, a traditional rodeo site, and supported health and cultural activities. As part of our agreement with the Ejido San Francisco De Asís, we have funded infrastructure and cultural activities.

Over the past years at our San Luis project in Peru, we have engaged in and funded several projects aimed at developing the social and economic conditions in local communities. We are currently coordinating with the Social Management Office of the Ministry of Mining and Energy and a local university to advance a training program for local residents, including a mining internship program.

Transparency

In 2018, we embarked on the development of our inaugural sustainability report, which we expect to publish in 2019. This included identification of material topics to be included within the report and stakeholder engagement. The report will be developed using the Global Reporting Initiative framework. In addition, we disclose certain categories of payments we make to domestic and foreign governments at all levels under the Canadian Extractive Sector Transparency Measures Act (“ESTMA”).

Diversity

Our Corporate Governance and Nominating Committee (the “CGN Committee”) has responsibility for recommending to the Board the nominees for election or re-election as directors at the annual meeting of Shareholders. As part of this process, our CGN Committee assesses the skills, expertise, experience and backgrounds of our directors annually, in light of the needs of our board, including the extent to which the current composition of our board reflects a diverse mix of identified competencies. Our CGN Committee charter is available for viewing on our website at www.ssrmining.com.

- 16 -

Our board of directors recognizes that a board composed of men and women with a mix of differing skills, experience, perspectives, age and characteristics leads to a more robust understanding of opportunities, issues and risks, and to stronger decision-making. In 2018, our board of directors adopted a board diversity policy (the “Board Diversity Policy”), which promotes the benefits of, and need for, board diversity. Our Board Diversity Policy is available for viewing on our website at www.ssrmining.com. In addition, each of our code of business conduct and ethics (the “Code of Conduct”) and our Employee Assistance Program promotes and supports diversity and inclusion. Our Code of Conduct is available for viewing on our website at www.ssrmining.com.

We are committed to a merit-based system for board composition within a diverse and inclusive culture, which solicits multiple perspectives and views and is free of conscious or unconscious bias and discrimination. We are also committed to improving the gender representation of our board, and undertake to work diligently towards, among others: achieving a board composition by 2022 in which at least thirty percent (30%) of our directors are women; ensuring that our CGN Committee includes women directors; and, if we maintain an ongoing list of potential director nominees, such list will include women candidates.