Form 1-A Aureus Inc

1-A LIVE 0001624517 XXXXXXXX Aureus, Inc. NV 2013 0001624517 2020 47-1893698 2 0 1170 Peachtree Street #1200 Atlanta GA 30309 404-885-6045 John E. Lux, Esq. Other 2290.00 0.00 43373.00 41487.00 93513.00 526187.00 0.00 526187.00 -516425.00 93513.00 0.00 8183.00 5635.00 0.00 0.00 0.00 Common Stock 98250000 86845R207 OTCMarkets, Pink Open Market Series A Convertible Preferred 5000000 00000none none none 0 00000none none true true Tier1 Unaudited Equity (common or preferred stock) Y N N Y N N 38000000 98250000 0.0150 570000.00 0.00 0.00 0.00 570000.00 Accountant and Misc other 42500.00 John E. Lux, Esq. 25000.00 Various 2500.00 500000.00 true NY NY Aureus, Inc. Convertible debt 31050 0 31050 Section 4(a)(1)

Preliminary Offering Circular dated May 29, 2019

An Offering Statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the Offering Statement filed with the Commission is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the Offering Statement in which such Final Offering Circular was filed may be obtained.

Aureus Inc.

$570,000

38,000,000 SHARES OF COMMON STOCK

OFFERED BY THE COMPANY AT $0.015 PER SHARE

This is the public offering of securities of Aureus Inc., a Nevada corporation. We are offering 38,000,000 shares of our common stock, par value $0.001 ("Common Stock"), at an offering price of $0.015 per share (the "Offered Shares") by the Company. The minimum purchase requirement per investor is 100,000 Offered Shares ($1,500); however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

These securities are speculative securities. Investment in the Company’s stock involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. See the “Risk Factors” section on page 4 of this Offering Circular.

No Escrow

The proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best efforts basis. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

Subscriptions are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. The Company, by determination of the Board of Directors, in its sole discretion, may issue the Securities under this Offering for cash, promissory notes, services, and/or other consideration without notice to subscribers. All proceeds received by the Company from subscribers for this Offering will be available for use by the Company upon acceptance of subscriptions for the Securities by the Company.

Sale of these shares will commence within two calendar days of the qualification date and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

This Offering will be conducted on a “best-efforts” basis, which means our Officers will use their commercially reasonable best efforts in an attempt to offer and sell the Shares. Our Officers will not receive any commission or any other remuneration for these sales. In offering the securities on our behalf, the Officers will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended.

This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful, prior to registration or qualification under the laws of any such state.

Our Common Stock is traded in the OTCMarket under the symbol “ARSN.”

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 4 for a discussion of certain risks that you should consider in connection with an investment in our Common Stock.

| Per Share | Total Maximum | |||||||

| Public Offering Price (1)(2) | $ | 0.015 | $ | 570,000.00 | ||||

| Underwriting Discounts and Commissions (3) | $ | 0.00 | $ | 0 | ||||

| Proceeds to Company (4) | $ | 0.015 | $ | 570,000.00 | ||||

| (1) | We are offering shares on a continuous basis. See “Distribution – Continuous Offering.” | |

| (2) | This is a “best efforts” offering. The proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best efforts basis primarily through an online platform. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds. See “How to Subscribe.” | |

| (3) | We are offering these securities without an underwriter. | |

| (4) | Excludes estimated total offering expenses, including underwriting discount and commissions. Such expenses, will be approximately $70,000 assuming the maximum offering amount is sold. |

Our Board of Directors used its business judgment in setting a value of $0.015 per share to the Company as consideration for the stock to be issued under the Offering. The sales price per share bears no relationship to our book value or any other measure of our current value or worth.

THE U.S. SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

The date of this Offering Circular is May 29, 2019.

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by the federal securities laws.

In this Offering Circular, unless the context indicates otherwise, references to "U. S. Highland", "we", the "Company", "our" and "us" refer to the activities of and the assets and liabilities of the business and operations of Aureus Inc.

| i |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under "Summary", "Risk Factors", "Management's Discussion and Analysis of Financial Condition and Results of Operations", "Our Business" and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some cases, you can identify forward-looking statements by terms such as "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", "potential", "should", "will" and "would" or the negatives of these terms or other comparable terminology.

You should not place undue reliance on forward looking statements. The cautionary statements set forth in this Offering Circular, including in "Risk Factors" and elsewhere, identify important factors which you should consider in evaluating our forward-looking statements. These factors include, among other things:

| · | The speculative nature of the business we intend to develop; |

| · | Our reliance on suppliers and customers; |

| · | Our dependence upon external sources for the financing of our operations, particularly given that there are concerns about our ability to continue as a “going concern”; |

| · | Our ability to effectively execute our business plan; |

| · | Our ability to manage our expansion, growth and operating expenses; |

| · | Our ability to finance our businesses; |

| · | Our ability to promote our businesses; |

| · | Our ability to compete and succeed in highly competitive and evolving businesses; |

| · | Our ability to respond and adapt to changes in technology and customer behavior; and |

| · | Our ability to protect our intellectual property and to develop, maintain and enhance strong brands. |

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained, or that deviations from them will not be material and adverse. We undertake no obligation, other than as maybe be required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements.

| 1 |

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in the company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision. Some of the statements in this Offering Circular are forward-looking statements. See the section entitled "Cautionary Statement Regarding Forward-Looking Statements."

Company Information

Aureus Inc. offices are located at 1170 Peachtree Street, Suite 1200 , Atlanta, Georgia 30309. Our Website is http://www.aureusgnow.com. Our telephone number is 404-805-6044 and our Email address is [email protected].

We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

Section 15(g) of the Securities Exchange Act of 1934

Our shares are covered by section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser’s written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one-page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as bid and offer quotes, a dealers spread and broker/dealer compensation; the broker/dealer compensation, the broker/dealers’ duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers’ rights and remedies in cases of fraud in penny stock transactions; and, the FINRA’s toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

Dividends

The Company has not declared or paid a cash dividend to stockholders since it was organized and does not intend to pay dividends in the foreseeable future. The board of directors presently intends to retain any earnings to finance our operations and does not expect to authorize cash dividends in the foreseeable future. Any payment of cash dividends in the future will depend upon the Company's earnings, capital requirements and other factors.

Trading Market

Our Common Stock trades in the OTC Market Pink Open Market under the stock symbol “ARSN.”

| 2 |

______

| Issuer: | Aureus Inc. | |

| Securities offered: | A maximum of 3,000,000,000 shares of our common stock, par value $0.001 (“Common Stock”) at an offering price of $0.015 per share (the “Offered Shares”). (See “Distribution.”) | |

| Number of shares of Common Stock outstanding before the offering | 98,250,000 issued and outstanding as of May 15, 2019 | |

| Number of shares of Common Stock to be outstanding after the offering | 136,250,000 if the maximum amount of Offered Shares are sold | |

| Price per share: | $0.015 | |

| Maximum offering amount: | 38,000,000 shares at $0.015 per share, or $570,000 (See “Distribution.”) | |

| Trading Market: | We intend to apply to have our Common Stock trading on the OTC Markets. | |

| Use of proceeds: | If we sell all of the shares being offered, our net proceeds (after our estimated offering expenses) will be 500,000. We will use these net proceeds for working capital and other general corporate purposes. | |

| | ||

| Investing in our Common Stock involves a high degree of risk, including: | ||

| Immediate and substantial dilution. | ||

| Risk factors: | Limited market for our stock. | |

| Limited operational history in an emerging industry. | ||

| See “Risk Factors.” |

| 3 |

______

The following is only a brief summary of the risks involved in investing in our Company. Investment in our Securities involves risks. You should carefully consider the following risk factors in addition to other information contained in this Disclosure Document. The occurrence of any of the following risks might cause you to lose all or part of your investment. Some statements in this Document, including statements in the following risk factors, constitute “Forward-Looking Statements.”

The price of our common stock may be volatile.

If we are able to get a trading market for our stock, the trading price of our common stock is likely to remain highly volatile and could be subject to wide fluctuations in response to various factors, some of which are beyond our control or unrelated to our operating performance. In addition to the factors discussed in this “Risk Factors” section and elsewhere, these factors include: the operating performance of similar companies; the overall performance of the equity markets; the announcements by us or our competitors of acquisitions, business plans, or commercial relationships; threatened or actual litigation; changes in laws or regulations relating to the provision of health care or the sale of health insurance; any major change in our board of directors or management; publication of research reports or news stories about us, our competitors, or our industry or positive or negative recommendations or withdrawal of research coverage by securities analysts; large volumes of sales of our shares of common stock by existing stockholders; and general political and economic conditions.

In addition, the stock market in general, and the market for developing companies in particular, has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies’ securities This litigation, if instituted against us, could result in very substantial costs; divert our management’s attention and resources; and harm our business, operating results, and financial condition.

Doubts About Ability to Continue as a Going Concern

The Company is an early stage enterprise and has not commenced planned principal operations. The Company had no revenues to date and minimal capitalization. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or that funds will be available from external sources, such as debt or equity financings or other potential sources. The lack of additional capital resulting from the inability to generate cash flow from operations, or to raise capital from external sources would force the Company to substantially curtail or cease operations and would, therefore, have a material adverse effect on its business. Furthermore, there can be no assurance that any such required funds, if available, will be available on attractive terms or that they will not have a significant dilutive effect on the Company’s existing stockholders.

The Company intends to overcome the circumstances that impact its ability to remain a going concern through a combination of the commencement of revenues, with interim cash flow deficiencies being addressed through additional equity and debt financing. The Company anticipates raising additional funds through public or private financing, strategic relationships or other arrangements in the near future to support its business operations; however, the Company may not have commitments from third parties for a sufficient amount of additional capital. The Company cannot be certain that any such financing will be available on acceptable terms, or at all, and its failure to raise capital when needed could limit its ability to continue its operations. The Company’s ability to obtain additional funding will determine its ability to continue as a going concern. Failure to secure additional financing in a timely manner and on favorable terms would have a material adverse effect on the Company’s financial performance, results of operations and stock price and require it to curtail or cease operations, sell off its assets, seek protection from its creditors through bankruptcy proceedings, or otherwise. Furthermore, additional equity financing may be dilutive to the holders of the Company’s common stock, and debt financing, if available, may involve restrictive covenants, and strategic relationships, if necessary to raise additional funds, and may require that the Company relinquish valuable rights.

There are numerous material contingencies in our proposed acquisitions.

The Company intends to acquire other companies to expand its business. In connection with these acquisitions, including the currently proposed acquisition of Yuengling's, there are numerous material contingencies to consummation of these transactions, including, but not limited to, financing, satisfactory due diligence, and execution of a final purchase agreement. There is no assurance that any of these transactions will close, and if they close, that they will be successful.

| 4 |

Risks Related to the Food Business

Unfavorable publicity could harm our business.

Food businesses such as our proposed acquisitions can be adversely affected by publicity resulting from, among other things, complaints or litigation or general publicity regarding poor food quality, food-borne illness, personal injury, food tampering, team member relations, adverse health effects of consumption of various food products or high-calorie foods (including obesity), perceptions of corporate and social responsibility, or other concerns. Negative publicity from traditional or digital media, or from on-line social network postings may also result from actual or alleged incidents or events involving our products. Regardless of whether the allegations or complaints are valid, unfavorable publicity relating to our products could adversely affect public perception of the entire brand. Adverse publicity and its effect on overall consumer perceptions of food safety, or our failure to respond effectively to adverse publicity, could have a material adverse effect on our business.

Changes in consumer preferences or discretionary consumer spending could harm our performance.

The success of our proposed acquisitions depends, in part, upon the continued popularity of our concepts and shifts in these consumer preferences could negatively affect our future profitability. Negative publicity over the health aspects of certain food items may adversely affect consumer demand for our products and could result in a decrease in our revenues, which could materially harm our business. Additionally, our success depends, in part, on a consumer preference for eating our products and to an extent on numerous factors affecting discretionary consumer spending, including economic conditions, disposable consumer income and consumer confidence. A decline in consumer spending or in economic conditions could reduce guest traffic or impose practical limits on pricing, either of which could harm our business, financial condition, operating results or cash flow. We will be required to disclose calorie counts for our products, due to federal regulations, and this may have an effect on consumers’ eating habits. Shifts in consumer preferences could also be based on health concerns related to the cholesterol, carbohydrate, fat, calorie, sugar or salt content of certain food items, including items featured on our menu.

Litigation, including the defense and resolution of class and collective actions, could materially impact our business.

We could be subject to various lawsuits, administrative proceedings and claims that arise in the course of business. We could be party to class and collective actions, along with other complex legal disputes, that could materially impact our business by requiring, among other things, unanticipated management attention, significant attorney fee and settlement spend or operational adjustments implemented in response to a settlement, court order or in an effort to mitigate future exposure.

Increased wage and hour litigation, including claims relating to the Fair Labor Standards Act, analogous state laws, or other state wage and hour laws could result in significant attorney fee and settlement costs. Resolution of non-litigated alleged wage and hour violations could also negatively impact our performance. The potential settlement of, or awards of damages for, such claims also could materially impact our financial performance as could operational adjustments implemented in response to a settlement, court order or in an effort to mitigate future exposure. Additionally, an increased volume of alleged statutory violations or matters referred to an agency for potential resolution could result in significant attorney fee and settlement costs that could, in the aggregate, materially impact our financial performance.

We may have litigation in a variety of matters, some matters may be unpredictable or unanticipated, and the frequency and severity of litigation could increase. Our legal and regulatory environment includes matters such as food safety and food borne illness, premises liability, advertising and promotions, employment, franchise relations, shareholders, intellectual property, data privacy, and a variety of other matters. Because lawsuits are inherently unpredictable, assessing contingencies is highly subjective and requires judgments about future events. A judgment that is not covered by insurance or that is significantly in excess of our insurance coverage could materially adversely affect our financial condition or results of operations.

We may be unable to compete effectively in the food industry.

The food industry is intensely competitive and heavily saturated. We believe we compete primarily with ice cream products, and to a lesser extent to other desert products. In addition, independent owners of local or regional food companies establishments may enter our markets without significant barriers to entry and such establishments may provide price competition for our products. Competition in the relevant segments of the food industry is expected to remain intense with respect to price, quality, marketing and the type and quality of food. We also face intense competition for qualified management personnel.

| 5 |

We may not be able to attract and retain qualified team members and key executives to operate and manage our business.

Our success and the success of our business depends on our ability to attract, motivate, develop and retain a sufficient number of qualified key leaders and employees. The inability to recruit, develop and retain these individuals may delay the marketing of our products or result in high employee turnover, thus increasing our costs. This could inhibit our expansion plans and business performance and, to the extent that a labor shortage may force us to pay higher wages, harm our profitability. Volatility or a lack of positive performance in our stock price may adversely affect our ability to retain key employees, some of whom may be granted equity compensation. The loss of any of our key leaders could jeopardize our ability to meet our financial targets.

Changes in employment laws or regulation could harm our performance.

Various federal, state, regional and local labor laws govern our relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime pay, paid time off, work scheduling, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership, and sales taxes. As the regulatory landscape continues to change and become more complex, it can be difficult to know all of the regulations, understand them clearly, and comply timely and consistently. A number of factors could adversely affect our operating results, including additional government-imposed increases in minimum wages, scheduling laws, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, increased tax reporting and tax payment requirements for employees who receive tips, a reduction in the number of states that allow tips to be credited toward minimum wage requirements, or changing regulations from the National Labor Relations Board, other agencies or an administration occupying the White House.

We may be subject to increased labor costs.

Our operations are subject to federal and state laws governing such matters as minimum wages, working conditions, overtime, and tip credits. As federal, state, and local minimum wage rates increase, we may need to increase not only the wages of our minimum wage employees, but also the wages paid to employees already earning a wage rate above minimum wage. Labor shortages, increased employee turnover, and health care mandates also could increase our labor costs. This, in turn, could lead us to increase prices which could impact our sales. Competitive pressures beyond regulatory requirements may affect our cost to attract, reward and retain Team Members and managers. Conversely, if competitive pressures or other factors prevent us from offsetting increased labor costs by increases in prices, our profitability may decline.

Our strategic growth and innovation activities may not perform in accordance with our expectations.

Our ability to grow gross sales and increase profitability is dependent on designing and executing effective business strategies consistent with those described in our strategy. If we are delayed or unsuccessful in executing our strategies, or if our strategies do not yield the desired results, our business, financial condition, and results of operations may suffer.

Our brands may not be successful.

We will have a majority investment in our brands. If these brands do not succeed, we risk losing all or a substantial portion of our investment in that brand. In addition, our overall long-term growth may be affected by the level of success achieved by either of these products.

Shortages or interruptions in the availability and delivery of ingredients and other supplies may increase costs or reduce revenues.

Possible shortages or interruptions in the supply of ingredients and other supplies to us caused by inclement weather, terrorist attacks, natural disasters such as floods, drought and hurricanes, global warming, avian influenza, pandemics, the inability of our vendors to obtain credit in a tightened credit market, or other distribution dependencies, food safety warnings or advisories or the prospect of such pronouncements, or other conditions beyond our control, could adversely affect the availability, quality and cost of items we buy and our products. Our inability to effectively manage supply chain risk could increase our costs and limit the availability of products critical to our operations.

| 6 |

We are dependent on information technology and any material failure of that technology could impair our ability to efficiently operate our business.

We rely on information systems across our operations, including, for example, sale processing, management of our supply chain, collection of cash and credit and debit card payments, payment of obligations, and various other processes and procedures. Our ability to efficiently manage our business depends significantly on the reliability and capacity of these sometimes-complex systems, including reliance upon third-party service and technology providers. The failure of these systems to operate effectively, disputes with our technology vendors, problems with maintenance, upgrading or transitioning to replacement systems, or a breach in security of these systems could cause delays in customer service, reduce efficiency in our operations, require significant investment to remediate, require significant legal expense, or cause negative publicity that could damage our brand. Significant capital investments might be required to remediate any problems.

Risks Relating to Our Financial Condition

Our management has a limited experience operating a public company and are subject to the risks commonly encountered by early-stage companies.

Although management of Aureus Inc. has experience in operating small companies, current management has not had to manage expansion while being a public company. Many investors may treat us as an early-stage company. In addition, management has not overseen a company with large growth. Because we have a limited operating history, our operating prospects should be considered in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. These risks include:

| · | risks that we may not have sufficient capital to achieve our growth strategy; | |

| · | risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; | |

| · | risks that our growth strategy may not be successful; and | |

| · | risks that fluctuations in our operating results will be significant relative to our revenues. |

These risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business could be significantly harmed.

We have limited operational history in an emerging industry, making it difficult to accurately predict and forecast business operations.

As we have little or no operational history and have yet to generate revenue, it is extremely difficult to make accurate predictions and forecasts on our finances. This is compounded by the fact that we operate in transforming industries. There is no guarantee that our products or services will remain attractive to potential and current users as these industries undergo rapid change, or that potential customers will utilize our services.

As a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We have not yet produced a net profit and may not in the near future, if at all. While we expect our revenue to grow, we have not achieved profitability and cannot be certain that we will be able to sustain our growth rate or realize sufficient revenue to achieve profitability. Our ability to continue as a going concern may be dependent upon raising capital from financing transactions, increasing revenue throughout the year and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

We will require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all.

We intend to continue to make investments to support our business growth and may require additional funds to respond to business challenges, including the need to update our technology, improve our operating infrastructure or acquire complementary businesses and technologies. Accordingly, we will need to engage in continued equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity securities we issue could have rights, preferences and privileges superior to those of our common stock. Any debt financing that we secure in the future could involve restrictive covenants relating to our capital raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges could be impaired, and our business may be harmed.

| 7 |

We are highly dependent on the services of our key executives, the loss of whom could materially harm our business and our strategic direction. If we lose key management or significant personnel, cannot recruit qualified employees, directors, officers, or other personnel or experience increases in our compensation costs, our business may materially suffer.

We are highly dependent on our management, specifically Mr. Everett Dickson. As of March 31, 2019, we have an employment agreement in place with Mr. Dickson. If we lose key employees, our business may suffer. Furthermore, our future success will also depend in part on the continued service of our management personnel and our ability to identify, hire, and retain additional key personnel. We do not carry “key-man” life insurance on the lives of any of our executives, employees or advisors. We experience intense competition for qualified personnel and may be unable to attract and retain the personnel necessary for the development of our business. Because of this competition, our compensation costs may increase significantly.

We may be unable to manage growth, which may impact our potential profitability.

Successful implementation of our business strategy requires us to manage our growth. Growth could place an increasing strain on our management and financial resources. To manage growth effectively, we will need to:

| · | Establish definitive business strategies, goals and objectives; | |

| · | Maintain a system of management controls; and | |

| · | Attract and retain qualified personnel, as well as develop, train, and manage management-level and other employees. |

If we fail to manage our growth effectively, our business, financial condition, or operating results could be materially harmed, and our stock price may decline.

We operate in a highly competitive environment, and if we are unable to compete with our competitors, our business, financial condition, results of operations, cash flows and prospects could be materially adversely affected.

We operate in a highly competitive environment. Our competition includes all other companies that are in the food business. A highly competitive environment could materially adversely affect our business, financial condition, results of operations, cash flows and prospects.

We may not be able to compete successfully with other established companies offering the same or similar services and, as a result, we may not achieve our projected revenue and user targets.

If we are unable to compete successfully with other businesses in our existing market, we may not achieve our projected revenue and/or customer targets. We compete with both start-up and established companies. Compared to our business, some of our competitors may have greater financial and other resources, have been in business longer, have greater name recognition and be better established in our markets.

We expect to incur substantial expenses to meet our reporting obligations as a public company. In addition, failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage our expenses.

We estimate that it will cost approximately $50,000 annually to maintain the proper management and financial controls for our filings required as a public reporting company. In addition, if we do not maintain adequate financial and management personnel, processes and controls, we may not be able to accurately report our financial performance on a timely basis, which could cause a decline in our stock price and adversely affect our ability to raise capital.

| 8 |

Risks Relating to our Common Stock and Offering

If we are able to develop a market for our Common Stock, our Common Stock may be thinly traded, so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire to liquidate your shares.

If we are able to develop a market for our Common Stock, it may be thinly traded on the OTC Pink Open Market, meaning that the number of persons interested in purchasing our shares at, or near ask prices at any given time, may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer, which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained.

The market price for the common stock may be particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited operating history, and lack of revenue, which could lead to wide fluctuations in our share price. The price at which you purchase our shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares at or above your purchase price, which may result in substantial losses to you.

The market for our shares of common stock may be characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. The volatility in our share price is attributable to a number of factors. First, as noted above, our shares may be sporadically traded. As a consequence of this lack of liquidity, the trading of relatively small quantities of shares may disproportionately influence the price of those shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number of our shares is sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those sales without adverse impact on its share price. Secondly, we are a speculative investment due to, among other matters, our limited operating history and lack of revenue or profit to date, and the uncertainty of future market acceptance for our potential products. As a consequence of this enhanced risk, more risk-averse investors may, under the fear of losing all or most of their investment in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater discounts than would be the case with the securities of a seasoned issuer. The following factors may add to the volatility in the price of our shares: actual or anticipated variations in our quarterly or annual operating results; government regulations, announcements of significant acquisitions, strategic partnerships or joint ventures; our capital commitments and additions or departures of our key personnel. Many of these factors are beyond our control and may decrease the market price of our shares regardless of our operating performance. We cannot make any predictions or projections as to what the prevailing market price for our shares will be at any time, including as to whether our shares will sustain their current market prices, or as to what effect the sale of shares or the availability of shares for sale at any time will have on the prevailing market price.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The possible occurrence of these patterns or practices could increase the volatility of our share price.

| 9 |

The market price of our common stock may be volatile and adversely affected by several factors.

The market price of our common stock could fluctuate significantly in response to various factors and events, including, but not limited to:

| · | our ability to market our products and services; | |

| · | our ability to execute our business plan; | |

| · | operating results below expectations; | |

| · | our issuance of additional securities, including debt or equity or a combination thereof; | |

| · | announcements of technological innovations or new products by us or our competitors; | |

| · | loss of any strategic relationship; | |

| · | industry developments, including, without limitation, changes in healthcare policies or practices; | |

| · | economic and other external factors; | |

| · | period-to-period fluctuations in our financial results; and | |

| · | whether an active trading market in our common stock develops and is maintained. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock. Issuers using the Alternative Reporting standard for filing financial reports with OTC Markets are often subject to large volatility unrelated to the fundamentals of the company.

Natural disasters and geo-political events could adversely affect our business.

Natural disasters, including hurricanes, cyclones, typhoons, tropical storms, floods, earthquakes and tsunamis, weather conditions, including winter storms, droughts and tornadoes, whether as a result of climate change or otherwise, and geo-political events, including civil unrest or terrorist attacks, that affect us, or other service providers could adversely affect our business.

We do not expect to pay dividends in the future; any return on investment may be limited to the value of our common stock.

We do not currently anticipate paying cash dividends in the foreseeable future. The payment of dividends on our common stock will depend on earnings, financial condition and other business and economic factors affecting it at such time as the board of directors may consider relevant. Our current intention is to apply net earnings, if any, in the foreseeable future to increasing our capital base and development and marketing efforts. There can be no assurance that the Company will ever have sufficient earnings to declare and pay dividends to the holders of our common stock, and in any event, a decision to declare and pay dividends is at the sole discretion of our board of directors. If we do not pay dividends, our common stock may be less valuable because a return on your investment will only occur if its stock price appreciates.

Our issuance of additional shares of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership and voting rights.

We are entitled under our articles of incorporation to issue up to 500,000,000 shares of common stock. We have, as of the date of this Offering Circular, 98,250,000 issued and outstanding share of Common Stock. Our board may generally issue shares of common stock, preferred stock, options, or warrants, without further approval by our shareholders based upon such factors as our board of directors may deem relevant at that time. It is likely that we will be required to issue a large amount of additional securities to raise capital to further our development. It is also likely that we will issue a large amount of additional securities to directors, officers, employees and consultants as compensatory grants in connection with their services, both in the form of stand-alone grants or under our stock plans. We cannot give you any assurance that we will not issue additional shares of common stock, or options or warrants to purchase those shares, under circumstances we may deem appropriate at the time.

| 10 |

The elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and shareholders.

We may become involved in securities class action litigation that could divert management’s attention and harm our business.

The stock market in general, and the shares of early stage companies in particular, have experienced extreme price and volume fluctuations. These fluctuations have often been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations occur in the future, the market price of our shares could fall regardless of our operating performance. In the past, following periods of volatility in the market price of a particular company’s securities, securities class action litigation has often been brought against that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in this type of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As a public company, we may also from time to time make forward-looking statements about future operating results and provide some financial guidance to the public markets. Our management has limited experience as a management team in a public company and as a result, projections may not be made timely or set at expected performance levels and could materially affect the price of our shares. Any failure to meet published forward-looking statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits or other litigation, sanctions or restrictions issued by the SEC.

Our common stock will be deemed a “penny stock,” which will make it more difficult for our investors to sell their shares.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination, and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock if and when such shares are eligible for sale and may cause a decline in the market value of its stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading, and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities, and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

| 11 |

As an issuer of a “penny stock,” the protection provided by the federal securities laws relating to forward-looking statements does not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

Securities analysts may elect not to report on our common stock or may issue negative reports that adversely affect the stock price.

At this time, no securities analysts provide research coverage of our common stock, and securities analysts may not elect to provide such coverage in the future. It may remain difficult for our company, with its small market capitalization, to attract independent financial analysts that will cover our common stock. If securities analysts do not cover our common stock, the lack of research coverage may adversely affect the stock’s actual and potential market price. The trading market for our common stock may be affected in part by the research and reports that industry or financial analysts publish about our business. If one or more analysts elect to cover our company and then downgrade the stock, the stock price would likely decline rapidly. If one or more of these analysts cease coverage of our company, we could lose visibility in the market, which, in turn, could cause our stock price to decline. This could have a negative effect on the market price of our common stock.

A reverse stock split may decrease the liquidity of the shares of our common stock.

The liquidity of the shares of our common stock may be adversely affected by a reverse stock split given the reduced number of shares that will be outstanding following a reverse stock split, especially if the market price of our common stock does not increase as a result of the reverse stock split.

Following a reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although we believe that a higher market price of our common stock may help generate greater or broader investor interest, we cannot assure you that a reverse stock split will result in a share price that will attract new investors.

We are classified as an “emerging growth company” as well as a “smaller reporting company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies and smaller reporting companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Section 107 of the JOBS Act provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We could remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

| 12 |

Notwithstanding the above, we are also currently a “smaller reporting company.” Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

Because directors and officers currently and for the foreseeable future will continue to control Aureus Inc., it is not likely that you will be able to elect directors or have any say in the policies of Aureus Inc.

Our shareholders are not entitled to cumulative voting rights. Consequently, the election of directors and all other matters requiring shareholder approval will be decided by majority vote. The directors, officers and affiliates of Aureus Inc. beneficially own a majority of our outstanding common stock voting rights. Due to such significant ownership position held by our insiders, new investors may not be able to affect a change in our business or management, and therefore, shareholders would have no recourse as a result of decisions made by management.

In addition, sales of significant amounts of shares held by our directors, officers or affiliates, or the prospect of these sales, could adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

Since we intend to retain any earnings for development of our business for the foreseeable future, you will likely not receive any dividends for the foreseeable future.

We have never declared or paid any cash dividends or distributions on our capital stock. We currently intend to retain our future earnings to support operations and to finance expansion and therefore we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Risks Relating to Our Company and Industry

The following risks relate to our proposed business and the effects upon us assuming we obtain financing in a sufficient amount.

Intellectual property rights claims may adversely affect an investment in us.

We are not aware of any intellectual property claims that may prevent us from operating; however, third parties may assert intellectual property claims relating to our technology. Regardless of the merit of an intellectual property or other legal action, any legal expenses to defend or payments to settle such claims would be extremely expensive and be borne by us. Additionally, a meritorious intellectual property claim could prevent us from operating and force us to liquidate. As a result, an intellectual property claim against us could adversely affect an investment in us.

Statements Regarding Forward-looking Statements

______

This Disclosure Statement contains various "forward-looking statements." You can identify forward-looking statements by the use of forward-looking terminology such as "believes," "expects," "may," "will," "would," "could," “should," "seeks," "approximately," "intends," "plans," "projects," "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions. These statements may be impacted by a number of risks and uncertainties.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our Securities. For a further discussion of these and other factors that could impact our future results, performance or transactions, see the section entitled "Risk Factors."

| 13 |

_______

If we sell all of the shares being offered, our net proceeds (after our estimated offering expenses of $70,000) will be $500,000. We will use these net proceeds for the following.

Percentage of

| Offering

| Approximate Offering Expenses | Total Net Offering Proceeds | Principal Uses of Net Proceeds | ||||||||||||

| Bank Debt $47,000 | ||||||||||||||||

| Production/Inventory $47,000 | ||||||||||||||||

| SG&A $14,500 | ||||||||||||||||

| Marketing/Promotions $7,000 | ||||||||||||||||

| New Product Development $7,000 | ||||||||||||||||

| 25.00% | $ | 142,500 | $ | 20,000 | $ | 122,500 | $ | 122,500 | ||||||||

If 50% of the Shares offered are sold:

Percentage of

| Offering

| Approximate Offering Expenses | Total Net Offering Proceeds | Principal Uses of Net Proceeds | ||||||||||||

| Bank Debt $100,000 | ||||||||||||||||

| Production/Inventory $100,0000 | ||||||||||||||||

| SG&A $26,000 | ||||||||||||||||

| Marketing/Promotions $12,000 | ||||||||||||||||

| New Product Development $12,000 | ||||||||||||||||

| 50.00% | $ | 285,000 | $ | 35,000 | $ | 250,000 | $ | 250,000 | ||||||||

If 75% of the Shared offered are sold:

Percentage of

| Offering

| Approximate Offering Expenses | Total Net Offering Proceeds | Principal Uses of Net Proceeds | ||||||||||||

| Bank Debt $145,000 | ||||||||||||||||

| Production/Inventory $145,000 | ||||||||||||||||

| SG&A $40,500 | ||||||||||||||||

| Marketing/Promotions $21,000 | ||||||||||||||||

| New Product Development $21,000 | ||||||||||||||||

| 75.00% | $ | 427,500 | $ | 55,000 | $ | 372,500 | $ | 372,500 | ||||||||

If 100% of the Shares offered are sold:

Percentage of | Offering

| Approximate Offering Expenses | Total Net Offering Proceeds | Principal Uses of Net Proceeds | ||||||||||||

| Bank Debt $200,000 | ||||||||||||||||

| Production/Inventory $200,000 | ||||||||||||||||

| SG&A $50,000 | ||||||||||||||||

| Marketing/Promotions $25,000 | ||||||||||||||||

| New Product Development $25,000 | ||||||||||||||||

| 100.00% | $ | 570,000 | $ | 70,000 | $ | 500,000 | $ | 500,000 | ||||||||

| 14 |

As indicated in the table above, if we sell only 75%, or 50%, or 25% of the shares offered for sale in this offering, we would expect to use the resulting net proceeds for the same purposes as we would use the net proceeds from a sale of 100% of the shares, and in approximately the same proportions, until such time as such use of proceeds would leave us without working capital reserve. At that point we would expect to modify our use of proceeds by limiting our expansion, leaving us with the working capital reserve indicated.

The expected use of net proceeds from this offering represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve and change. The amounts and timing of our actual expenditures, specifically with respect to working capital, may vary significantly depending on numerous factors. The precise amounts that we will devote to each of the foregoing items, and the timing of expenditures, will vary depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering.

In the event we do not sell all of the shares being offered, we may seek additional financing from other sources in order to support the intended use of proceeds indicated above. If we secure additional equity funding, investors in this offering would be diluted. In all events, there can be no assurance that additional financing would be available to us when wanted or needed and, if available, on terms acceptable to us.

| 15 |

______

If you purchase shares in this offering, your ownership interest in our Common Stock will be diluted immediately, to the extent of the difference between the price to the public charged for each share in this offering and the net tangible book value per share of our Common Stock after this offering.

Our historical net tangible book value as of March 31, 2019 was a deficit of $432,675 or $(0.004) per share based on the 98,250,000 shares of our Common Stock outstanding on May 15, 2019. Historical net tangible book value per share equals the amount of our total tangible assets less total liabilities, divided by the total number of shares of our Common Stock outstanding, all as of the date specified.

The following table illustrates the per share dilution to new investors discussed above, assuming the sale of, respectively, 100%, 75%, 50% and 25% of the shares offered for sale in this offering (after deducting estimated offering expenses of $500,000, $375,000, $250,000 and $125,000, respectively):

| Percentage of shares offered that are sold | 100% | 75% | 50% | 25% | ||||||||||||

| Price to the public charged for each share in this offering | $ | 0.015 | $ | 0.015 | $ | 0.015 | $ | 0.00 | ||||||||

| Historical net tangible book value per share as of March 31, 2019 | $ | (0.004 | ) | $ | (0.004 | ) | $ | (0.004 | ) | $ | (0.004 | ) | ||||

| Increase in net tangible book value per share attributable to new investors in this offering (2) | $ | 0.005 | $ | 0.004 | $ | 0.003 | $ | 0.002 | ||||||||

| Net tangible book value per share, after this offering | $ | 0.001 | $ | 0.000 | $ | 0.000 | $ | (0.000 | ) | |||||||

| Dilution per share to new investors | $ | 0.014 | $ | 0.016 | $ | 0.017 | $ | 0.018 |

| 16 |

This Offering Circular is part of an Offering Statement that we filed with the SEC, using a continuous offering process. Periodically, as we have material developments, we will provide an Offering Circular supplement that may add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The Offering Statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the SEC and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports and information statements that we will file periodically with the SEC. See the section entitled “Additional Information” below for more details.

Pricing of the Offering

Prior to the Offering, there has been a limited public market for the Offered Shares. The initial public offering price was determined by the board of directors. The principal factors considered in determining the initial public offering price include:

| · | the information set forth in this Offering Circular and otherwise available; | |

| · | our history and prospects and the history of and prospects for the industry in which we compete; | |

| · | our past and present financial performance; | |

| · | our prospects for future earnings and the present state of our development; | |

| · | the general condition of the securities markets at the time of this Offering; | |

| · | the recent market prices of, and demand for, publicly traded common stock of generally comparable companies; and | |

| · | other factors deemed relevant by us. |

Offering Period and Expiration Date

This Offering will start on or after the Qualification Date and will terminate if the Maximum Offering is reached or, if it is not reached, on the Termination Date.

Procedures for Subscribing

When you decide to subscribe for Offered Shares in this Offering, you should go to our website, click on the "Invest Now" button and follow the procedures as described.

| 1. | Electronically receive, review, execute and deliver to us a subscription agreement; and |

| 2. | Deliver funds directly by wire or electronic funds transfer via ACH to the specified account maintained by us. |

| 17 |

Any potential investor will have ample time to review the subscription agreement, along with their counsel, prior to making any final investment decision. We shall only deliver such subscription agreement upon request after a potential investor has had ample opportunity to review this Offering Circular.

Right to Reject Subscriptions. After we receive your complete, executed subscription agreement and the funds required under the subscription agreement, we have the right to review and accept or reject your subscription in whole or in part, for any reason or for no reason. We will return all monies from rejected subscriptions immediately to you, without interest or deduction.

Acceptance of Subscriptions. Upon our acceptance of a subscription agreement, we will countersign the subscription agreement and issue the shares subscribed at closing. Once you submit the subscription agreement and it is accepted, you may not revoke or change your subscription or request your subscription funds. All accepted subscription agreements are irrevocable.

No Escrow

The proceeds of this offering will not be placed into an escrow account. We will offer our Common Stock on a best efforts basis primarily through an online platform. As there is no minimum offering, upon the approval of any subscription to this Offering Circular, the Company shall immediately deposit said proceeds into the bank account of the Company and may dispose of the proceeds in accordance with the Use of Proceeds.

| 18 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward Looking Statements

This Offering Circular contains forward-looking statements. For this purpose, any statements contained in this Offering Circular that are not statements of historical fact may be deemed to be forward-looking statements. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management, and other matters. You can identify forward-looking statements by those that are not historical in nature, particularly those that use terminology such as “may,” “will,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “continue” or the negative of these similar terms. The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking information to encourage companies to provide prospective information about themselves without fear of litigation so long as that information is identified as forward-looking and is accompanied by meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those projected in the information.

These forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In evaluating these forward-looking statements, you should consider various factors, including the following: (a) those risks and uncertainties related to general economic conditions, (b) whether we are able to manage our planned growth efficiently and operate profitable operations, (c) whether we are able to generate sufficient revenues or obtain financing to sustain and grow our operations, (d) whether we are able to successfully fulfill our primary requirements for cash, which are explained below under “Liquidity and Capital Resources”. We assume no obligation to update forward-looking statements, except as otherwise required under the applicable federal securities laws. Unless stated otherwise, terms such as the “Company,” “US Highland,” “we,” “us,” “our,” and similar terms shall refer to US Highland, Inc., an Oklahoma corporation, and its subsidiaries.

Results of Operations

The three-months ended March 31, 2019 compared to the three-months ended March 31, 2018

Revenues

The Company had no revenues.

Operating Expenses

General and administrative expenses increased from $27,176 for the three months ended March 31, 2018 to $8,183 for the three months ended March 31, 2019.

Net Loss

For the three months ended March 31, 2019, we had net loss of $13,818 compared to a net loss of $32,307 for the three months ended March 31, 2018.

| 19 |

Liquidity and Capital Resources

The Company's cash position rose from $687 on March 31, 2018 to $2,290 on March 31, 2019.

Going Concern

The Company has no revenues and has incurred net losses. In addition, at March 31, 2019, there was an accumulated deficit of $516,425. These factors raise substantial doubt about the Company's ability to continue as a going concern.

There can be no assurance that sufficient funds required during the next year or thereafter will be generated from operations or available from external sources such as debt or equity financings, or other potential sources. The inability to generate cash flow from operations or to raise capital from external sources will force the Company to substantially curtail and cease operations, therefore, having a material adverse effect on its business. Furthermore, there can be no assurance that any funds, if available, will possess attractive terms or not have a significant dilutive effect on the Company's existing stockholders.

Off Balance Sheet Arrangements

The Company has no off-balance sheet arrangements.

| 20 |

________

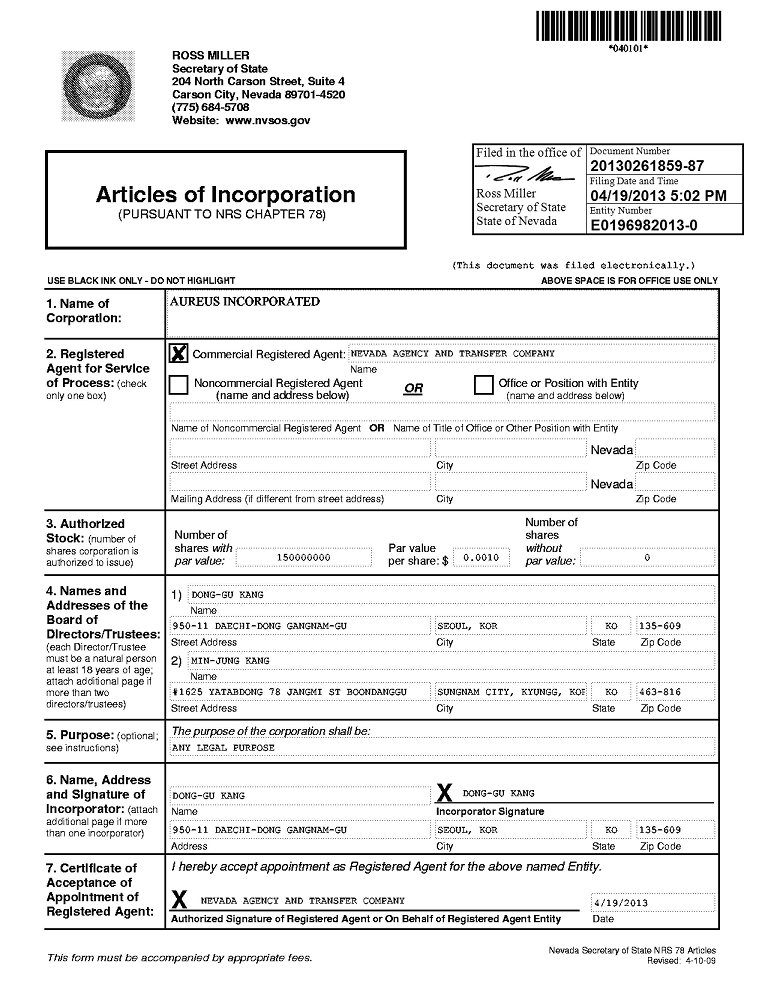

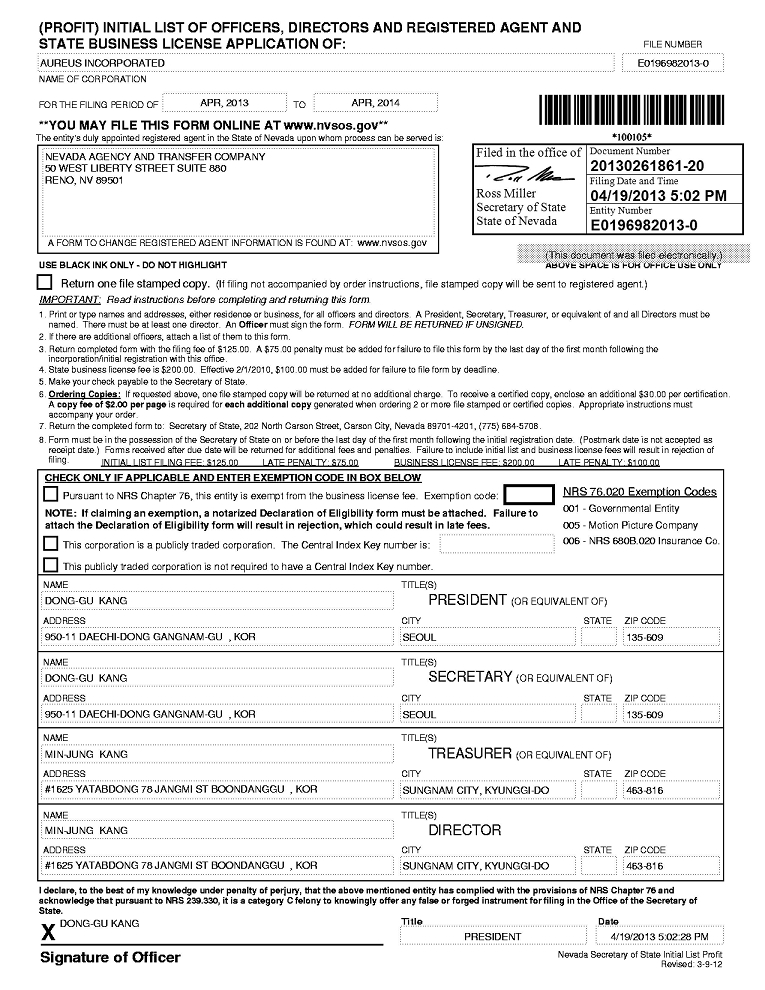

Aureus Inc.

Aureus Inc. (“Aureus” “ARSN,” “we,” or the “Company”) was incorporated in Nevada on September 5, 2017. Our offices are located at 1170 Peachtree Street #1200, Atlanta, GA 30309. Our website is located at www.aureusgold.com. Our telephone number is (877) 448-6321 and our email address is [email protected].

We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website a part of this Offering Circular.

We are a food brand development company that builds and represents popular food concepts throughout the United States as well as international markets. Management is highly experienced at business integration and re-branding potential. With little territory available for the older brands we intend to bring to our customers fresh innovative brands that have great potential. All of our brands will be unique in nature as we focus on niche markets that are still in need of developing.

History