Form SC TO-T Life Partners Position Filed by: CFunds Life Settlement, LLC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

________________________

LIFE PARTNERS POSITION HOLDER TRUST

LIFE PARTNERS IRA HOLDER PARTNERSHIP, LLC

(Name of Subject Company (Issuer))

CFunds Life Settlement, LLC

(Offeror)

________________________

Contrarian Funds, L.L.C.

(Parent of Offeror)

Contrarian Capital Management, L.L.C.

(Manager of Parent)

(Names of Filing Persons (identifying status as offeror, issuer, or other person)

Position Holder Trust Interests

IRA Partnership Interests

(Title of Class of Securities)

None

(CUSIP Number of Class of Securities)

Jennifer Diagonale

Contrarian Capital Management, L.L.C.

411 West Putnam Ave., Suite 425

Greenwich, Connecticut 06830

(203) 862-8200

(Name, Address, and Telephone numbers of person authorized

to receive notices and communications on behalf of filing persons)

Copy to:

Elizabeth Gonzalez-Sussman and Kenneth Schlesinger

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

________________________

CALCULATION OF FILING FEE

|

Transaction valuation*

|

Amount of filing fee** |

| $25,000,000 | $2,727.50 |

| * | For the purpose of calculating the filing fee pursuant to Rule 0-11(d) only, based on the purchase of 66,964,507 issued and outstanding interests of Life Partners Position Holder Trust and 99,702,160 issued and outstanding interests of Life Partners IRA Holder Partnership, LLC at the maximum tender offer price of $0.15 per Interest. |

| ** | The amount of filing fee is calculated in accordance with Rule 0-11 of the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory #1 for Fiscal Year 2021, effective October 1, 2020. Such fee equals .0001091 of the transaction value. |

| ☐ | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: None | None Filing Party: N/A |

| Form or Registration No.: N/A | Date Filed: N/A |

| ☐ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| ☒ | third-party tender offer subject to Rule 14d-1. |

| ☐ | issuer tender offer subject to Rule 13e-4. |

| ☐ | going-private transaction subject to Rule 13E-3. |

| ☐ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| ☐ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ☐ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

| 2 |

This Tender Offer Statement on Schedule TO (this “Schedule TO”) relates to the tender offers by CFunds Life Settlement, LLC, a Delaware limited liability company (“Offeror”), to purchase up to 66,964,507 of the outstanding position holder trust interests (the “Trust Interests”) of Life Partners Position Holder Trust, a trust organized under the laws of the State of Texas (the “Trust”), and up to 99,702,160 of the outstanding IRA partnership interests (the “Partnership Interests,” and, together with the Trust Interests, the “Interests”) of Life Partners IRA Holder Partnership, LLC, a Texas limited liability company (the “Partnership”). The tender offers are being made at a price per Trust Interest or Partnership Interest, as applicable, of $0.15, net to the seller in cash, without interest thereon, less any applicable withholding taxes and less the amount of any dividends, distributions and other remittances paid by the Trust or the Partnership, as applicable, based upon a record date occurring from the date hereof until the date and time the Trust Interests and the Partnership Interests are accepted for payment. The tender offers are subject to the conditions set forth in the Offers to Purchase, dated June 24, 2021 (the “Offers to Purchase”), and in the related Assignment Forms (the “Assignment Forms”), which together, as they may be amended or supplemented from time to time, constitute and are referred to as the “Offer.” While for convenience the offer to purchase the Trust Interests and the offer to purchase the Partnership Interests are referred to together as constituting the Offer, the two offers are separate. Each offer is subject to a separate maximum number of Interests that Offeror is offering to purchase, and each will be separately prorated if it is oversubscribed, without regard to subscriptions tendered in the other offer.

Contrarian Funds, L.L.C., a Delaware limited liability company (“Parent”), indirectly owns all issued and outstanding equity interests in Offeror. Contrarian Capital Management, L.L.C., a Delaware limited liability company, is the manager of Parent.

The Offer is being commenced on the date hereof by publishing a summary advertisement. To the extent any holder of Trust Interests or Partnership Interests, as applicable, requests tender offer materials pursuant to the summary advertisement or otherwise, the Offeror will mail the tender offer materials to such holder by first class mail or otherwise furnish such materials with reasonable promptness.

The information set forth in the Offers to Purchase and the Assignment Forms, copies of which are attached as Exhibits (a)(1)(A) and (a)(1)(B) and (a)(1)(C) to this Schedule TO, is hereby incorporated by reference in answer to Items 1 through 11 of this Schedule TO.

| 3 |

Item 12. Exhibits

| Exhibit Number | Description | |

| (a)(1)(A) | Offers to Purchase, dated June 24, 2021. | |

| (a)(1)(B) | Assignment Form for Position Holder Trust Interests. | |

| (a)(1)(C) | Assignment Form for IRA Partnership Interests. | |

| (a)(1)(D) | Letter to Holders of Position Holder Trust Interests of Life Partners Position Holder Trust. | |

| (a)(1)(E) | Letter to Holders of IRA Partnership Interests of Life Partners IRA Holder Partnership, LLC. | |

| (a)(1)(F) | Frequently Asked Questions Appearing on the Website for the Offer. | |

| (a)(1)(G) | Summary Advertisement as published in The Dallas Morning News, dated June 24, 2021. | |

| (a)(1)(H) | Text of Initial Email sent to Trust Interest Holders. | |

| (a)(1)(I) | Text of Initial Email sent to Partnership Interest Holders. | |

| (a)(1)(J) | Form of Email to be issued to Trust Interest Holders Prior to Expiration of the Offer. | |

| (a)(1)(K) | Form of Email to be issued to Partnership Interest Holders Prior to Expiration of the Offer. | |

| (a)(2) | None. | |

| (a)(3) | None. | |

| (a)(4) | None. | |

| (a)(5) | None. | |

| (b) | None. | |

| (d) | Form of Assignee’s Notice of Assignment and Assumption, and Indemnity Agreement - Tender Offer, among CFunds Life Settlement, LLC, Life Partners Position Holder Trust and Life Partners IRA Holder Partnership, LLC. | |

| (g) | None. | |

| (h) | None. |

| 4 |

Item 13. Information Required by Schedule 13E-3.

Not applicable.

| 5 |

Signatures

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated: June 24, 2021 | CFUNDS LIFE SETTLEMENT, LLC | ||

| By: | Contrarian Funds, L.L.C., as Parent to the Offeror | ||

| By: |

/s/ Jon R. Bauer | ||

| Name: | Jon R. Bauer | ||

| Title: | Authorized Signatory | ||

| CONTRARIAN FUNDS, L.L.C. | |||

| By: | Contrarian Capital Management, L.L.C., as manager | ||

| By: |

/s/ Jon R. Bauer | ||

| Name: | Jon R. Bauer | ||

| Title: | Managing Member | ||

| CONTRARIAN CAPITAL MANAGEMENT, L.L.C. | |||

| By: |

/s/ Jon R. Bauer | ||

| Name: | Jon R. Bauer | ||

| Title: | Managing Member | ||

| 6 |

EXHIBIT INDEX

| Exhibit Number | Description | |

| (a)(1)(A) | Offers to Purchase, dated June 24, 2021. | |

| (a)(1)(B) | Assignment Form for Position Holder Trust Interests. | |

| (a)(1)(C) | Assignment Form for IRA Partnership Interests. | |

| (a)(1)(D) | Letter to Holders of Position Holder Trust Interests of Life Partners Position Holder Trust. | |

| (a)(1)(E) | Letter to Holders of IRA Partnership Interests of Life Partners IRA Holder Partnership, LLC. | |

| (a)(1)(F) | Frequently Asked Questions Appearing on the Website for the Offer. | |

| (a)(1)(G) | Summary Advertisement as published in The Dallas Morning News, dated June 24, 2021. | |

| (a)(1)(H) | Text of Initial Email sent to Trust Interest Holders. | |

| (a)(1)(I) | Text of Initial Email sent to Partnership Interest Holders. | |

| (a)(1)(J) | Form of Email to be issued to Trust Interest Holders Prior to Expiration of the Offer. | |

| (a)(1)(K) | Form of Email to be issued to Partnership Interest Holders Prior to Expiration of the Offer. | |

| (a)(2) | None. | |

| (a)(3) | None. | |

| (a)(4) | None. | |

| (a)(5) | None. | |

| (b) | None. | |

| (d) | Form of Assignee’s Notice of Assignment and Assumption, and Indemnity Agreement - Tender Offer, among CFunds Life Settlement, LLC, Life Partners Position Holder Trust and Life Partners IRA Holder Partnership, LLC. | |

| (g) | None. | |

| (h) | None. |

| 7 |

Exhibit (a)(1)(A)

Offers to Purchase for Cash

Up to 66,964,507

Position Holder Trust Interests of

Life Partners Position Holder Trust

and

Up to 99,702,160

IRA Partnership Interests of

Life Partners IRA Holder Partnership, LLC

for

$0.15 Per Interest in Cash

by

CFunds Life Settlement, LLC

a wholly-owned subsidiary of

Contrarian Funds, L.L.C.

|

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON THURSDAY, JULY 29, 2021, UNLESS THE OFFER IS EXTENDED OR EARLIER TERMINATED.

|

The tender offers are being made by CFunds Life Settlement, LLC, a Delaware limited liability company, referred to as “Offeror.” Offeror is a wholly-owned subsidiary of Contrarian Funds, L.L.C., a Delaware limited liability company, referred to as “Parent.” Contrarian Capital Management, L.L.C., a Delaware limited liability company, is the non-member manager of Parent and an affiliate of Offeror, referred to as “CCM.” Offeror is offering to purchase up to 66,964,507 of the outstanding position holder trust interests of Life Partners Position Holder Trust, a trust organized under the laws of the State of Texas, referred to as the “Trust.” These interests are referred to as the “Trust Interests.” Offeror is also offering to purchase up to 99,702,160 of the outstanding IRA partnership interests of Life Partners IRA Holder Partnership, LLC, a Texas limited liability company, referred to as the “Partnership.” These interests are referred to as the “Partnership Interests.” The Trust Interests and the Partnership Interests are sometimes together referred to as the “Interests.” “We,” “our” or “us” refer to Offeror and/or Parent. “You” refers to holders of Trust Interests or Partnership Interests, to whom the tender offers are being made.

The Offers to Purchase and the related Assignment Forms, which may be amended or supplemented from time to time, together constitute, and are referred to as, the “Offer.” While for convenience we refer to the offer to purchase the Trust Interests and the offer to purchase the Partnership Interests together as constituting the Offer, the two offers are separate. Each offer is subject to a separate maximum number of Interests that Offeror is offering to purchase, and each will be separately prorated if it is oversubscribed, without regard to subscriptions tendered in the other offer. The two offers are, however, conditioned on one another. We will not close one without closing the other at the same time. Also, we will not extend one of the offers unless both are extended.

The Offer is being made at a price of $0.15 for each Trust Interest or Partnership Interest, net to you in cash, without interest thereon. However, we may deduct from the purchase price any applicable withholding taxes and the amount of any dividends, distributions and other remittances paid by the Trust or the Partnership, as applicable, based upon a record date occurring from the date of the Offers to Purchase, June 24, 2021, until the date and time the Trust Interests and the Partnership Interests are accepted by us for payment, subject to applicable law. For the avoidance of doubt, no deduction to the offer price of $0.15 shall be made on account of any cash distribution declared by the Trust or the Partnership prior to June 24, 2021 (the date of commencement of this Offer), including the distributions declared by the Trust and the Partnership on November 1, 2019, June 24, 2020 and March 19, 2021 (which was increased on April 13, 2021), which are described below. See Section 6—“Price Range of the Interests; Dividends” and Section 15—“Dividends and Distributions”.

The offer price of $0.15 per Interest represents a discount of approximately 31.5% from the net asset value of $0.22 per Interest on March 31, 2021, as disclosed in the Trust and Partnership’s last quarterly report on Form 10-Q filed with the Securities and Exchange Commission on May 13, 2021. The offer price takes into account, in our opinion, the many years it will take for the Trust to liquidate its assets and distribute the proceeds to its investors. According to the Trust’s public filings, the Trust was originally anticipated to terminate by December 2026, but the Bankruptcy Court can extend its life no more than four times, with each extension not exceeding five years, or potentially an additional 20 years. In 2019, the Trust requested and was granted a Motion by the Bankruptcy Court to extend the termination date to December 9, 2031. While the Partnership does not have an established termination date, the Partnership has disclosed in its public filings that it expects to be wound down by the Trustee as Manager when the liquidation of the Trust is complete.

If there are any liens on your Interests or you owe the Trust or the Partnership, or any of their respective agents, premiums, fees or catch-up payments, the Trust or the Partnership has the right to collect these payments from the distributions on the Interests that you own that may be made in the future. Unless these obligations are discharged, you will not be able to tender your Interests free and clear of any liens or encumbrances as we are requiring, and the Interests we are acquiring would be subject to deductions from distributions that we may receive in the future. Accordingly, if there are any liens on your Interests or you owe any such premiums, fees or catch-up payments, we intend to discharge those liens and obligations upon the consummation of the Offer by paying to the Trust or the Partnership, as the case may be, the amounts that you owe out of the purchase price payment that would otherwise be made to you. If this is applicable to you, by tendering your Interests, you are authorizing and directing Offeror to apply the requisite portion of the purchase price for the tendered Interests to the payment and discharge of such liens, premiums, fees or catchup payments on your behalf. Any such amounts paid to discharge such liens and obligations to the Trust or the Partnership will be deemed to have been paid to you in the Offer as part of the purchase price for your Interests.

| ii |

IMPORTANT NOTE: If you own any portion of your investment through your IRA, under IRS regulations you are required to have an independent custodian hold the investment on your behalf. Most IRA custodians charge fees to take any action with respect to your investment and may charge a fee to facilitate the tender of your Interests into the Offer. You are strongly encouraged to consult your IRA custodian before tendering your Interests into the Offer to understand the amount of fees, if any, that may be charged to you by your IRA custodian.

The Offer is only for the Interests received from the bankruptcy court specifically for polices you elected to contribute to the Trust or the Partnership. The Offer is not based on the amount you originally invested nor is it for policies you continue to pay premiums on.

THE OFFER IS NOT CONDITIONED UPON THE RECEIPT OF FINANCING, OR UPON ANY MINIMUM NUMBER OF TRUST INTERESTS OR PARTNERSHIP INTERESTS BEING TENDERED. THE OFFER IS SUBJECT TO OTHER CONDITIONS. SEE SECTION 12 — “CONDITIONS TO THE OFFER.”

Neither the Trust Interests nor the Partnership Interests are currently listed or traded on any exchange or any over-the counter-trading platform. Accordingly, you may not be able to obtain current quotations for your Interests.

If you have any questions regarding the Offer, please contact Offeror’s representatives, as follows: Rhoda Freeman at [email protected] and John Bright at [email protected], or call (800) 266-3810.

The date of the Offers to Purchase is June 24, 2021.

| iii |

IMPORTANT

If you desire to tender all or any portion of your Trust Interests or Partnership Interests to us pursuant to the Offer, you should:

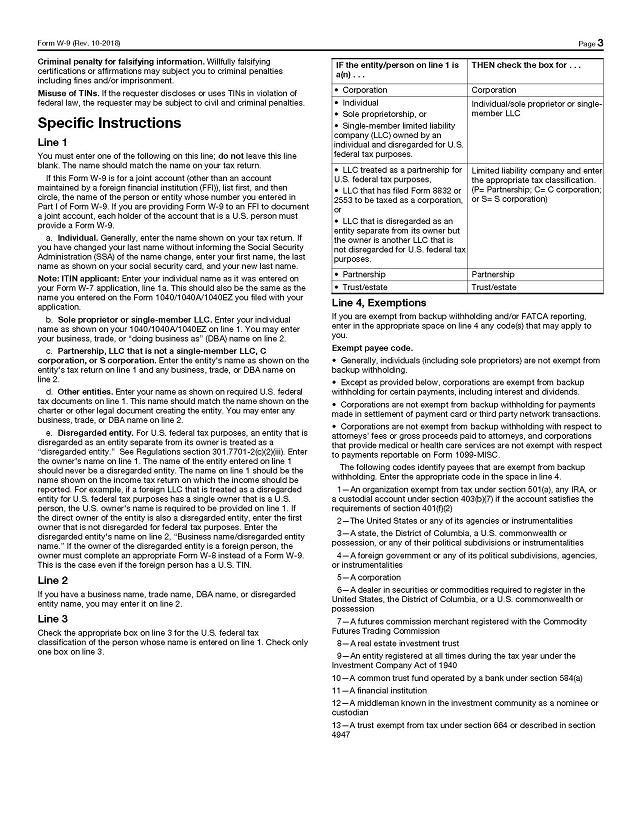

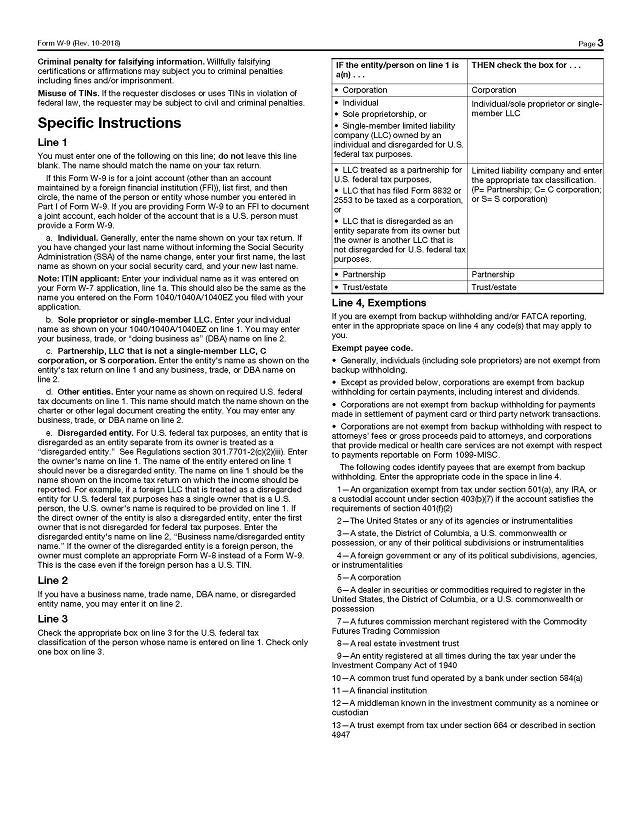

| · | Complete and sign the appropriate Assignment Form in accordance with the instructions in the Assignment Form and the Form W-9 provided (or other appropriate tax form) to prevent backup withholding. |

| · | If you are tendering Trust Interests, please use the WHITE Assignment Form labeled Position Holder Trust Interests. |

| · | If you are tendering Partnership Interests, please use the YELLOW Assignment Form labeled IRA Partnership Interests. |

| · | Include a copy of the Statement of Account that was sent to you with the Offers to Purchase and applicable Assignment Forms. |

| · | If you received the Offers to Purchase and applicable Assignment Forms by email, you should return a copy of that email which includes your Statement of Account. |

| · | If you received the Offers to Purchase and applicable Assignment Forms by physical mail, you should return the copy of the Statement of Account that was included in the package of materials sent to you. |

| · | Mail or deliver the Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form), and any other required documents to Continental Stock Transfer & Trust Company, which is acting as the Depositary for the Offer, to the address and in the manner described in Section 2 — “Procedure for Tendering Interests.” |

Your completed Assignment Form, IRS Form W-9 (or other appropriate tax form), and any other required documents, including the Statement of Account, must be received by the Depositary no later than 5:00 p.m. New York City time on July 29, 2021, which is the expiration time and date of the Offer. See Section 2 — “Procedure for Tendering Interests.”

If you are signing any Assignment Form in a representative capacity, you will also be required to furnish proof of your authority. For example, if you are signing as an officer of a corporation, you should submit an officer’s certificate to evidence your authority. If you are signing as a trustee of a trust, you should submit a certificate of incumbency. Also, you should note that only the IRA custodian, and not the beneficiary, can execute an Assignment Form on behalf of an individual retirement account. Execution by the beneficiary will not be valid. Checks for the purchase price of tendered interests held in an individual retirement account can only be mailed to the IRA custodian.

| iv |

If you hold and wish to tender both your Partnership Interests and Trust Interests, you must complete a separate Assignment Form and IRS Form W-9 (or other appropriate tax form) for each offer, and return a separate Statement of Account for each offer.

We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your Interests in the Offer. We have also not authorized anyone to provide you with information or to make any representation in connection with the Offer other than the information and representations contained in the Offers to Purchase. If anyone makes any recommendation or gives any such information or representation, you must not rely upon such recommendation, information or representation as having been authorized by us.

Questions and requests for assistance or for additional copies of the Offers to Purchase or the related Assignment Form may be directed to the Offeror’s representatives Rhoda Freeman at [email protected] and John Bright at [email protected], or call (800) 266-3810.

| v |

TABLE OF CONTENTS

| SUMMARY TERM SHEET | 1 |

| INTRODUCTION | 14 |

| THE TENDER OFFER | 16 |

| Section 1. Terms of the Offer; Proration | 16 |

| Section 2. Procedure for Tendering Interests | 18 |

| Section 3. Withdrawal Rights | 24 |

| Section 4. Acceptance for Payment and Payment | 24 |

| Section 5. U.S. Federal Income Tax Consequences | 25 |

| Section 6. Price Range of the Interests; Dividends | 27 |

| Section 7. Effect of the Offer on the Market for the Interests | 27 |

| Section 8. Information Concerning the Trust and the Partnership | 28 |

| Section 9. Information Concerning the Purchaser and its Affiliates | 29 |

| Section 10. Source and Amount of Funds | 32 |

| Section 11. Purpose of the Offer; Plans for the Trust and the Partnership | 33 |

| Section 12. Conditions to the Offer | 33 |

| Section 13. Legal Matters | 36 |

| Section 14. Fees and Expenses | 37 |

| Section 15. Dividends and Distributions | 37 |

| Section 16. Miscellaneous | 38 |

| vi |

SUMMARY TERM SHEET

The following summary highlights selected information regarding the Offer. We urge you to read the remainder of the Offers to Purchase and the appropriate Assignment Form carefully, because the information in the summary is not complete and the remainder of the Offers to Purchase and the Assignment Forms contain important information.

| Securities Sought |

Up to 66,964,507 of the outstanding position holder trust interests of Life Partners Position Holder Trust, referred to as the “Trust Interests”; and Up to 99,702,160 of the outstanding IRA partnership interests of Life Partners IRA Holder Partnership, LLC, referred to as the “Partnership Interests”. | ||

| Price Offered Per Interest |

$0.15 per Interest in cash, without interest. We may deduct from the purchase price: | ||

| · | any withholding taxes; and | ||

| · | the amount of any dividends, distributions and other remittances paid by the Trust or the Partnership, as applicable, based upon a date occurring from the date of the Offers to Purchase until the date and time the Trust Interests and the Partnership Interests are accepted by us for payment, subject to applicable law. For the avoidance of doubt, no deduction to the offer price of $0.15 shall be made on account of any cash distribution declared by the Trust or the Partnership prior to June 24, 2021 (the date of commencement of this Offer), including the distributions declared by the Trust and the Partnership on November 1, 2019, June 24, 2020 and March 19, 2021(which was increased on April 13, 2021), as described in greater detail in Section 6—“Price Range of the Interests; Dividends” and Section 15—“Dividends and Distributions”. | ||

| In addition, if there are any liens on your Interests or you owe any premiums, fees or catchup payments to the Trust or the Partnership, or any of their respective agents, in respect of any of your tendered Interests, we will deduct from the purchase price an amount to pay and discharge such liens or premiums, fees, and catch-up payments that you may owe in respect of any of the Interests you tender. | |||

| 1 |

| If you own any portion of your investment through your IRA, under IRS regulations you are required to have an independent custodian hold the investment on your behalf. Most IRA custodians charge fees to take any action with respect to your investment and may charge a fee to facilitate the tender of your Interests into the Offer. You are strongly encouraged to consult your IRA custodian before tendering your Interests into the Offer to understand the amount of fees, if any, that may be charged to you by your IRA custodian. | |||

| Acceptance of the Offer | To accept the Offer — | ||

| · | By mailing or hand delivery of the physical Assignment Form: (1) Holders of the Trust Interests should complete and return the WHITE Assignment Form labeled Position Holder Trust Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account; (2) Holders of the Partnership Interests should complete and return the YELLOW Assignment Form labeled IRA Partnership Interests and IRS Form W-9 and return the Statement of Account (or other appropriate tax form), and in each case (3) return them to the Depositary at the appropriate address set forth on the Offers to Purchase. | ||

| · | By fax: (1) Holders of the Trust Interests should complete and return the WHITE Assignment Form labeled Position Holder Trust Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account, (2) Holders of the Partnership Interests should complete and return the YELLOW Assignment Form labeled IRA Partnership Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account, and in each case (3) send them to the Depositary, by fax (212) 616-7610 | ||

| 2 |

| · | By email: (1) Holders of the Trust Interests should complete and return the WHITE Assignment Form labeled Position Holder Trust Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account, (2) Holders of the Partnership Interests should complete and return the YELLOW Assignment Form labeled IRA Partnership Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account, and in each case (3) they should be emailed to the Offeror as follows: Rhoda Freeman at [email protected] or John Bright at [email protected], who will then forward such documentation to the Depositary. | ||

| · | By secure website: (1) Holders of the Trust Interests should complete and return the WHITE Assignment Form labeled Position Holder Trust Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account, (2) Holders of the Partnership Interests should complete and return the YELLOW Assignment Form labeled IRA Partnership Interests and IRS Form W-9 (or other appropriate tax form) and return the Statement of Account, and in each case (3) upload them to a secure website at https://cstt.citrixdata.com/r-re8715e7bcef4efd8. | ||

|

|

A Statement of Account must be returned with the applicable Assignment Form and IRS Form W-9. If you received the Offers to Purchase and applicable Assignment Forms by email, you should return a copy of that email which includes your Statement of Account. If you received the Offers to Purchase and applicable Assignment Forms by physical mail, you should return the copy of the Statement of Account that was included in the package of materials sent to you. | ||

| 3 |

| If you are signing the Assignment Form in a representative capacity, you will also be required to furnish proof of your authority. For example, if you are signing as an officer of a corporation, you should submit an officer’s certificate to evidence your authority. If you are signing as a trustee of a trust, you should submit a certificate of incumbency. Also, you should note that only the IRA custodian, and not the beneficiary, can execute an Assignment Form on behalf of an individual retirement account. Execution by the beneficiary will not be valid. Checks for the purchase price of tendered interests held in an individual retirement account can only be mailed to the IRA custodian. | |

| Scheduled Expiration of Offer | Thursday, July 29, 2021 at 5:00 PM |

| Purchaser | CFunds Life Settlement, LLC, referred to as “Offeror,” a wholly owned subsidiary of Contrarian Funds, L.L.C., referred to as “Parent.” |

What is an Interest?

The term “Interest” refers to a position holder trust interest (referred to as the “Trust Interests”), represented by a unit of beneficial interest, in the Life Partners Position Holder Trust (referred to as the “Trust”); or to an IRA partnership interest (referred to as the “Partnership Interests”), represented by a unit of the Life Partners IRA Holder Partnership, LLC (referred to as the “Partnership”). See “Introduction”.

What is the Offer?

The Offer refers to both the offer to purchase the Trust Interests and the offer to purchase the Partnership Interests. While for convenience we refer to the offer to purchase the Trust Interests and the offer to purchase the Partnership Interests together as constituting the Offer, the two offers are separate. Each offer is subject to a separate maximum number of Interests that Offeror is offering to purchase, and each will be separately prorated if it is oversubscribed, without regard to subscriptions tendered in the other offer. The two offers are, however, conditioned on one another. We will not close one without closing the other at the same time. Also, we will not extend one of the offers unless both are extended.

The Offer is only for the Interests received from the bankruptcy court specifically for polices you elected to contribute to the Trust or the Partnership. The Offer is not based on the amount you invested nor is it for policies you continue to pay premiums on.

See “Introduction” and Section 1 — “Terms of the Offer; Proration.”

Who is offering to buy my Interests in the Offer?

CFunds Life Settlement, LLC is a Delaware limited liability company formed for the purpose of acquiring the Interests. In the materials you have received, CFunds Life Settlement, LLC is referred to as the “Offeror.” Offeror is a wholly owned subsidiary of Contrarian Funds, L.L.C., a Delaware limited liability company referred to as the “Parent” and Contrarian Capital Management, L.L.C. (referred to as “CCM”), a Delaware limited liability company, is the non-member manager of Parent. As of May 31, 2021, CCM had approximately $4.9 billion of assets under management, including assets of Parent and other investment funds managed by CCM.

| 4 |

The Offeror, CCM, Parent and their affiliates currently own 66,747,184 Trust Interests and 73,986,627 Partnership Interests that were primarily acquired as a result of the Life Partners Holdings, Inc. bankruptcy, prior tender offers that were undertaken by Offeror and an unaffiliated third party, Life Settlement Liquidity Option, LLC (the “Anchorage Offeror”), that expired on January 25, 2019 (the “First Offer”) and prior tenders offers that were undertaken by the Offeror, that expired on December 14, 2020 (the “Second Offer”, collectively with the First Offer, the “Prior Offers”).

See Section 9 — “Information Concerning the Purchaser and its Affiliates.”

Why are you making the Offer?

We are making the Offer because we believe that the Interests are an attractive long term investment. There is no trading market for the Interests and, according to the disclosures made by the Trust and Partnership, none is expected to develop. The Offer will provide liquidity to those holders of Interests desiring to sell, while giving us an opportunity to invest in the Interests, which we currently intend to hold as a long term investment. See Section 11 — “Purpose of the Offer; Plans for the Trust and the Partnership.”

How many Interests are you seeking in the Offer?

We seek to purchase up to 66,964,507 in the aggregate of Trust Interests and up to 99,702,160 in the aggregate of Partnership Interests that are tendered in the Offer. This Offer is not conditioned on any minimum number of Interests being tendered. See “Introduction” and Section 1 — “Terms of the Offer; Proration.”

How much are you offering to pay and what will be the form of payment?

We are offering to pay you $0.15 for each Trust Interest and for each Partnership Interest that is tendered in the Offer. However, we may deduct from the purchase price any withholding taxes and the amount of any dividends, distributions and other remittances paid by the Trust or the Partnership, as applicable, based upon a record date occurring from the date of the Offers to Purchase until the date and time the Trust Interests and the Partnership Interests are accepted by us for payment, subject to applicable law. For the avoidance of doubt, no deduction to the offer price of $0.15 shall be made on account of any cash distribution declared by the Trust or the Partnership prior to June 24, 2021 (the date of commencement of this Offer including the distributions declared by the Trust and the Partnership on November 1, 2019, June 24, 2020 and March 19, 2021 (which was increased on April 13, 2021), which are described below. See Section 6—“Price Range of the Interests; Dividends” and Section 15—“Dividends and Distributions.”

In addition, if there are any liens on your Interests or you owe any premiums, fees or catchup payments to the Trust or Partnership, or any of their respective agents, in respect of any of your tendered Interests, we will deduct from the purchase price an amount to pay and discharge such liens or premiums, fees, and catch-up payments that you may owe in respect of any of the Interests you tender.

| 5 |

If you own any portion of your investment through your IRA, under IRS regulations you are required to have an independent custodian hold the investment on your behalf. Most IRA custodians charge fees to take any action with respect to your investment and may charge a fee to facilitate the tender of your Interests into the Offer. You are strongly encouraged to consult your IRA custodian before tendering your Interests into the Offer to understand the amount of fees, if any, that may be charged to you by your IRA custodian.

See below —“Why will deductions be made to discharge liens or pay premiums, fees or catch-up payments?”

We will pay the purchase price for the Interests we purchase in cash. Payment will be made promptly following expiration of the Offer, in accordance with applicable law. We will not pay interest on the purchase price, even if there is a delay in making payment.

Why will deductions be made to discharge liens or pay premiums, fees or catch-up payments?

If there are any liens on your Interests or you owe the Trust or the Partnership, or any of their respective agents, premiums, fees or catch-up payments, the Trust or the Partnership has the right to collect these payments from the distributions on the Interests that you own that may be made in the future. Unless these obligations are discharged, you will not be able to tender your Interests free and clear of any liens or encumbrances as we are requiring, and the Interests we are acquiring would be subject to deductions from distributions that we may receive in the future. Accordingly, if there are liens on your Interests or you owe any such premiums, fees or catch-up payments, we intend to discharge those liens and obligations upon the consummation of the Offer by paying to the Trust or the Partnership, as the case may be, the amounts that you owe out of the purchase price payment that would otherwise be made to you. If this is applicable to you, by tendering your Interests, you are authorizing and directing Offeror to apply the requisite portion of the purchase price for the tendered Interests to the payment and discharge of such liens, premiums, fees or catchup payments on your behalf. Any such amounts paid to discharge your obligations to the Trust or the Partnership will be deemed to have been paid to you in the Offer as part of the purchase price for your Interests.

Will I have to pay brokerage commissions if I tender my Interests?

No. You will not have to pay brokerage commissions or similar expenses. However, if you own any portion of your investment through your IRA, under IRS regulations you are required to have an independent custodian hold the investment on your behalf. Most IRA custodians charge fees to take any action with respect to your investment and may charge a fee to facilitate the tender of your Interests into the Offer. You are strongly encouraged to consult your IRA custodian before tendering your Interests into the Offer to understand the amount of fees, if any, that may be charged to you by your IRA custodian.

| 6 |

What happens if holders of Interests tender more Interests than you are willing to buy?

We are offering to purchase up to 66,964,507 in the aggregate of Trust Interests and up to 99,702,160 in the aggregate of Partnership Interests. Under applicable rules of the Securities and Exchange Commission (referred to as the “SEC”), if holders of Interests tender more than 66,964,507 Trust Interests or more than 99,702,160 Partnership Interests, we may purchase up to an additional 2% of the outstanding Trust Interests and/or 2% of the outstanding Partnership Interests, respectively, without extending the Offer. Also, we may amend the Offer to purchase more Trust Interests or Partnership Interests, and extend the Offer as required by the rules of the SEC.

If holders of Trust Interests tender more than the number of Trust Interests that we are willing to buy, we will purchase the Trust Interests on a pro rata basis. Similarly, if holders of Partnership Interests tender more than the number of Partnership Interests that we are willing to buy, we will purchase the Partnership Interests on a pro rata basis. This means that we will purchase from you the number of Interests calculated by multiplying the number of Interests you properly tendered by a proration factor.

The proration factor will be calculated separately for the Trust Interests and for the Partnership Interests. In each case, the pro ration factor will equal the number of Interests we are willing to buy divided by the total number of Interests properly tendered by all holders of Trust Interests or Partnership Interests, as applicable. For example, assuming the number of Interests we agree to buy remains unchanged at 66,964,507 Trust Interests and 99,702,160 Partnership Interests, and 133,929,014 Trust Interests and 199,404,320 Partnership Interests are tendered, we will purchase 50% of the number of Trust Interests and 50% of the number of Partnership Interests that you tender. See Section 1 — “Terms of the Offer; Proration.”

If you prorate, when will I know how many Trust Interests and Partnership Interests will actually be purchased?

If proration of tendered Interests is required, we do not expect to announce the final results of proration or pay for any Trust Interests or Partnership Interests until at least five (5) trading days after the expiration date of the Offer. This is because we may not know the precise number of Trust Interests and Partnership Interests properly tendered until all supporting documentation for those tenders are reviewed. Preliminary results of proration will be announced by press release as promptly as practicable following the expiration date of the Offer.

Do you have the financial resources to make payment?

Yes. If 66,964,507 of Trust Interests and 99,702,160 of Partnership Interests are tendered in the Offer, Parent has committed in immediately available funds an amount sufficient to pay the purchase price for the Interests and to pay the expenses of the Offer. We expect to fund these costs from capital available to Parent via commitments from investors. See Section 10 — “Source and Amount of Funds.” The Offer is not subject to any financing condition.

| 7 |

How long do I have to tender my Interests?

You may tender your Interests until the Offer expires. The Offer will expire on July 29, 2021, at 5:00 p.m., New York City time, unless we extend it.

Can the Offer be extended and under what circumstances?

We may elect to extend the Offer beyond the initial expiration date of July 29, 2021 for any reason, although holders of Interests should not assume that we will necessarily do so. However, we will not extend the Offer past August 31, 2021. See Section 1 — “Terms of the Offer; Proration.”

How will I be notified if the Offer is extended?

If we extend the Offer, we will make a public announcement of the extension and the new expiration time. The announcement will be made no later than 9:00 a.m., New York City time, on the next business day after the day on which the Offer was scheduled to expire. See Section 1 — “Terms of the Offer; Proration.”

What are the most important conditions to the Offer?

Our obligation to accept and pay for your tendered Interests depends upon the conditions set forth in Section 12 — “Conditions to the Offer” (any of which may be waived by us), including but not limited to:

| · | if we determine, in our reasonable discretion, that the Trust or the Partnership will not accept or be able to register the assignment of the Interests accepted for payment in the Offer to the name of Offeror or its affiliate; |

| · | the threat or existence of litigation that seeks to challenge or delay the Offer or that adversely affects the Offer or our ability to exercise ownership rights with respect to the Interests; |

| · | the existence of any law limiting our ability to consummate the Offer; |

| · | a general suspension of trading in securities on any national securities exchange or in the over-the-counter markets in the United States; |

| · | the declaration of a banking moratorium or any suspension of payments in respect of our bank or other banks in the United States, whether or not mandatory; or |

| 8 |

| · | any natural disaster or the commencement or escalation, on or after June 24, 2021, of war, armed hostilities or other international or national calamity, including, but not limited to, any outbreak of a pandemic or contagious disease or an act of terrorism, directly or indirectly involving the United States (including the COVID-19 pandemic, to the extent that there is any material adverse development related thereto on or after June 24, 2021, such as any significant slowdown in economic growth, or any significant new precautionary or emergency measures, recommendations or orders taken or issued by any governmental authority or person in response to the COVID-19 pandemic which in our reasonable judgment is or may be materially adverse to us or otherwise makes it inadvisable for us to proceed with the Offer); |

Also, we will only close each of the offer to purchase the Trust Interests and the offer to purchase the Partnership Interests if we close both. So, for example, if the conditions to the Offer are satisfied with respect to the Trust Interests but not with respect to the Partnership Interests, we will not close either of the offers.

How do I tender my Interests?

You may tender your Interests using a physical Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) by mailing, delivering or faxing the appropriate Statement of Account, Assignment Form, and IRS Form W-9 (or other appropriate tax form) to the Depositary, or by emailing the appropriate Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) to the Offeror, who will forward such documentation to the Depositary.

In either case, to tender your Interests using an Assignment Form, you complete and deliver the appropriate Assignment Form and IRS Form W-9 (or other appropriate tax form), and should deliver the appropriate Statement of Account, attached to the Offers to Purchase, prior to the expiration of the Offer. The WHITE Assignment Form labeled Position Holder Trust Interests should be used to tender the Trust Interests, and the YELLOW Assignment Form labeled IRA Partnership Interests should be used to tender the Partnership Interests. If you hold and wish to tender both your Trust Interests and your Partnership Interests, you must complete a separate Assignment Form and IRS Form W-9 (or other appropriate tax form) for each and deliver a separate Statement of Account for each. The appropriate Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) must be received by the Depositary for the Offer no later than the expiration time of the Offer.

The address for delivery of the Statements of Account, Assignment Forms and the IRS Form W-9 (or other appropriate tax form) and any other required documents is:

| | If delivering by mail, hand, overnight or courier to the Depositary: |

| |

Continental Stock Transfer & Trust Company New York, New York 10004 |

You may also deliver your Statements of Account, Assignment Forms and IRS Form W-9 (or other appropriate tax form) by fax to the Depositary, as follows:

| 9 |

|

If delivering by fax to the Depositary: Continental Stock Transfer & Trust Company Reference: Life Partners Tender Offer Fax No.: (212) 616-7610 |

The Statements of Account, Assignment Forms and IRS Form W-9 (or other appropriate tax form) may also be emailed to the Offeror, as follows: Rhoda Freeman at [email protected] or John Bright at [email protected], who will then forward such documentation to the Depositary.

You may also deliver your Statements of Account, Assignment Forms, and IRS Form W-9 (or other appropriate tax form) to the Depositary via a secure website. Please type the following URL into your internet browser to access the upload area: https://cstt.citrixdata.com/r-re8715e7bcef4efd8. Note, when providing your information, we cannot accept “automated Word font signatures” and if using an electronic utility to gather a signature (such as Docusign) we will need the certificate of completion, as well. Additionally, in order to avoid processing delays, kindly label your documents with your name and date.

A Statement of Account must be returned with the applicable Assignment Form and IRS Form W-9. If you received the Offers to Purchase and applicable Assignment Forms by email, you should return a copy of that email which includes your Statement of Account. If you received the Offers to Purchase and applicable Assignment Forms by physical mail, you should return the copy of the Statement of Account that was included in the package of materials sent to you.

If you are signing the Assignment Form in a representative capacity, you will also be required to furnish proof of your authority. For example, if you are signing as an officer of a corporation, you should submit an officer’s certificate to evidence your authority. If you are signing as a trustee of a trust, you should submit a certificate of incumbency. Also, you should note that only the IRA custodian, and not the beneficiary, can execute an Assignment Form on behalf of an individual retirement account. See Section 2 — “Procedure for Tendering Interests.”

Are there any special provisions applicable to Interests held in an individual retirement account (IRA)?

Yes. Only the IRA custodian can execute an Assignment Form on behalf of an individual retirement account. Execution by the beneficiary will not be valid. Also, checks for the purchase price of tendered interests held in an individual retirement account can only be mailed to the IRA custodian. If you are the beneficiary of an IRA and you believe the Trust or the Partnership may not have an accurate address for your IRA custodian, you should contact Offeror’s representatives, as follows: Rhoda Freeman at [email protected] or John Bright at [email protected], or call (800) 266-3810.

| 10 |

If you own any portion of your investment through your IRA, under IRS regulations you are required to have an independent custodian hold the investment on your behalf. Most IRA custodians charge fees to take any action with respect to your investment and may charge a fee to facilitate the tender of your Interests into the Offer. You are strongly encouraged to consult your IRA custodian before tendering your Interests into the Offer to understand the amount of fees, if any, that may be charged to you by your IRA custodian.

Am I required to physically deliver my Interests?

No. The Trust Interests are recorded in book entry form on a register of the Trust maintained by NorthStar Life Services, LLC, which currently serves as Servicer for each of the Trust and the Partnership. The Partnership Interests are recorded in book entry form on a register of the Partnership maintained by the Servicer for this purpose. Accordingly, there are no certificates or other physical or electronic indicia of ownership of the Interests that tendering holders are required to deliver to the Depositary. However, by delivering to the Depositary the applicable Assignment Form, IRS Form W-9 (or other appropriate tax form), and any other required documents, including the Statement of Account, you will be deemed to have tendered your Interests for purposes of the Offer, and your tender may only be withdrawn as provided in Section 3 — “Withdrawal Rights.”

What are the consequences if the Trust or the Partnership makes a distribution on the Interests with a record date after the date of the Offer?

If the Trust or Partnership pays a dividend or makes a distribution or other remittance with respect to the Interests based on a record date occurring after the date of the Offers to Purchase until the date and time the Interests are accepted for payment by us, the purchase price per Interest in the Offer may be reduced by the cash paid per Interest, or if the dividend, distribution or other remittance consists of non-cash consideration, the purchase price per Interest may be reduced by the fair market value per Interest of the non-cash consideration, as determined by us in our reasonable discretion.

In addition, by tendering your Interests, you agree to assign to us all your rights to receive dividends, distributions and other remittances from the Trust or the Partnership, respectively, with respect to the tendered Interests with a record date from and after the time of acceptance of the Interests for payment pursuant to the Offer, even if the assignment of the Interests to us has not at the time been recorded on the register of ownership maintained on behalf of the Trust or the Partnership, as applicable, for this purpose.

Until what time can I withdraw previously tendered Interests?

You can withdraw Interests at any time before the expiration date of the Offer. You may also withdraw tendered Interests after the expiration date of the Offer if such Interests have not been accepted for payment by August 23, 2021. See Section 1 — “Terms of the Offer; Proration” and Section 3 — “Withdrawal Rights.”

How do I withdraw previously tendered Interests?

To withdraw Interests, you must deliver a written notice of withdrawal with the required information to the Depositary while you still have the right to withdraw the Interests at the address specified on the back page of the Offers to Purchase. The notice of withdrawal must specify the name of the person holding the Interests to be withdrawn and the type and number of Interests to be withdrawn. See Section 1 — “Terms of the Offer; Proration” and Section 3 — “Withdrawal Rights.”

| 11 |

If I decide not to tender, how will the Offer affect me?

If you decide not to tender your Interests, you will be unaffected by the Offer. You will still own the same amount of Interests, and the number of your Interests outstanding will not change. See Section 7 — “Effect of the Offer on the Market for the Interests.”

Do I have appraisal or dissenter’s rights?

There are no appraisal or dissenter’s rights available in connection with the Offer.

What does the trustee of the Trust and manager of the Partnership think of the Offer?

Mr. Michael Quilling is the trustee of the Trust and the manager of the Partnership. In that capacity, Mr. Quilling is required by law to communicate the views of the Trust and the Partnership regarding the Offer to holders of Interests no later than ten (10) business days from the date the Offer is commenced. Before you decide to accept or reject the Offer, you should read the Solicitation/Recommendation Statement on Schedule 14D-9 of the Trust and the Partnership in its entirety when it becomes available.

What is the market value of my Interests as of a recent date?

Offeror understands that there is no trading market for the Interests, which are not listed on any securities exchange or quoted on any trading platform. Accordingly, we are unable to provide any information on the market value of the Interests. However, in connection with the Prior Offers that expired on January 25, 2019 and December 14, 2020, we paid $0.16 per Interest tendered and $0.14 per Interest tendered, respectively. Since then, the Trust and the Partnership have made three distributions totaling approximately $0.06 per interest. The Trustee and Manager have also redeemed (i) Interests of all holders with fewer than 4,000 of such Interests, all holders outside the United States and Canada, and one other holder with special circumstances at a cash price of $0.19 per Interest, as of the record date of September 28, 2020, (ii) Interests from all holders who own 1,000 or less of the Interests at a price of $0.18 per Interest, as of the record date of June 8, 2020, and (iii) Interests from holders at a price of $0.19 per Interest, in the quarter ended March 31, 2021. Unlike the Trust and Partnership, the Offeror has no restrictions on the amount of Interests that can be tendered by any individual holder (other than as described in Section 1 — “Terms of the Offer; Proration.”). See Section 1 — “Terms of the Offer; Proration; Section 6 — “Price Range of the Interests; Dividends.”

| 12 |

The offer price of $0.15 per Interest represents a discount of approximately 31.5% from the net asset value of $0.22 per Interest on March 31, 2021, as disclosed in the Trust and Partnership’s last quarterly report on Form 10-Q filed with the SEC on May 13, 2021. The offer price takes into account, in our opinion, the many years it will take for the Trust to liquidate its assets and distribute the proceeds to its investors. According to the Trust’s public filings, the Trust was originally anticipated to terminate by December 2026, but the Bankruptcy Court can extend its life no more than four times, with each extension not exceeding five years, or potentially an additional 20 years. In 2019, the Trust requested and was granted a Motion by the Bankruptcy Court to extend the termination date to December 9, 2031. While the Partnership does not have an established termination date, the Partnership has disclosed in its public filings that it expects to be wound down by the Trustee as Manager when the liquidation of the Trust is complete.

Do you need to tender all of your Interests?

No. The Assignment Forms allow you to specify the number of Interests that you wish to tender. If you submit an Assignment Form without specifying the number of Interests you are tendering, you will be deemed to have tendered all your Interests of the particular type in the Offer.

What are the U.S. federal income tax consequences of tendering Interests in the Offer?

Your receipt of cash for Interests properly tendered in the Offer will be a taxable transaction for U.S. federal income tax purposes for taxable U.S. investors. Generally, you will recognize gain or loss in an amount equal to the difference between the cash that you receive in the Offer and your adjusted tax basis in the Interests that you surrender in the Offer. That gain or loss will be a capital gain or loss if the Interests are capital assets in your hands and if you meet certain additional requirements. Any capital gain or loss generally will be long-term capital gain or loss if you have held the Interests for more than one year at the time the Offer is completed. The tax consequences that the Offer will have on you may vary depending on your particular circumstances. For a summary of the federal income tax consequences of the Offer, see Section 5 — “U.S. Federal Income Tax Consequences.” We recommend that you consult with, and rely solely upon, your own tax advisor regarding the application of U.S. federal income tax laws, as well as the laws of any state, local or foreign taxing jurisdiction, to your particular situation.

Who can I talk to if I have questions about the Offer?

If you have any questions regarding the Offer, please contact Offeror’s representatives, as follows: Rhoda Freeman at [email protected] or John Bright at [email protected], or call (800) 266-3810.

| 13 |

INTRODUCTION

The tender offers are being made by CFunds Life Settlement, LLC, a Delaware limited liability company referred to as “Offeror.” Offeror is a wholly-owned subsidiary of Contrarian Funds, L.L.C., a Delaware limited liability company referred to as “Parent.” Contrarian Capital Management, L.L.C., a Delaware limited liability company, referred to as “CCM,” is the non-member manager of Parent and an affiliate of Offeror. Offeror is offering to purchase up to 66,964,507 in the aggregate of the outstanding position holder trust interests of Life Partners Position Holder Trust, a trust organized under the laws of the State of Texas, referred to as the “Trust.” These interests are referred to as the “Trust Interests” and are represented by units of beneficial interest in the Trust. Offeror is also offering to purchase up to 99,702,160 in the aggregate of the outstanding IRA partnership interests of Life Partners IRA Holder Partnership, LLC, a Texas limited liability company, referred to as the “Partnership.” These interests are referred to as the “Partnership Interests” and are represented by units of the Partnership. The Trust Interests and the Partnership Interests are sometimes together referred to as the “Interests.”

“We,” “our” or “us” refer to Offeror and/or Parent. “You” refers to holders of Trust Interests or Partnership Interests to whom the Offer is being made.

The Offers to Purchase and the related Assignment Forms, which may be amended or supplemented from time to time, together constitute and are referred to as the “Offer.” While for convenience we refer to the offer to purchase the Trust Interests and the offer to purchase Partnership Interests together as constituting the Offer, the two offers are separate. Each offer is subject to a separate maximum number of Interests that Offeror is offering to purchase, and each will be separately prorated if it is oversubscribed, without regard to subscriptions tendered in the other offer. The two offers are, however, conditioned on one another. We will not close one without closing the other at the same time. Also, we will not extend one of the offers unless both are extended.

The Offer is being made at a price of $0.15 for each Trust Interest or Partnership Interest, net to you in cash, without interest thereon. However, we may deduct from the purchase price any applicable withholding taxes and the amount of any distributions made by the Trust or the Partnership, as applicable, based upon a record date occurring from the date of the Offers to Purchase until the date and time the Trust Interests and the Partnership Interests are accepted by us for payment, subject to applicable law. For the avoidance of doubt, no deduction to the offer price of $0.15 shall be made on account of any cash distribution declared by the Trust or the Partnership prior to June 24, 2021 (the date of commencement of this Offer including the distributions declared by the Trust on November 1, 2019, June 24, 2020 and March 19, 2021 (which was increased on April 13, 2021), which are described below. See Section 6—“Price Range of the Interests; Dividends” and Section 15—“Dividends and Distributions”.

| 14 |

In addition, if there are any liens on your Interests or you owe the Trust or the Partnership, or any of their respective agents, premiums, fees or catch-up payments, the Trust or the Partnership has the right to collect these payments from the distributions on the Interests that you own that may be made in the future. Unless these obligations are discharged, you will not be able to tender your Interests free and clear of any liens or encumbrances as we are requiring, and the Interests we are acquiring would be subject to deductions from distributions that we may receive in the future. Accordingly, if there are any liens on your Interests or you owe any such premiums, fees or catch-up payments, we intend to discharge those liens and obligations upon the consummation of the Offer by paying to the Trust or the Partnership, as the case may be, the amounts that you owe out of the purchase price payment that would otherwise be made to you. If this is applicable to you, by tendering your Interests, you are authorizing and directing Offeror to apply the requisite portion of the purchase price for the tendered Interests to the payment and discharge of such liens, premiums, fees or catchup payments on your behalf. Any such amounts paid to discharge such liens and obligations to the Trust or the Partnership will be deemed to have been paid to you in the Offer as part of the purchase price for your Interests. Tendering holders of Interests will not be obligated to pay brokerage fees, commissions or stock transfer taxes on the purchase of Interests by us under the Offer. We will pay all fees and expenses of Continental Stock Transfer & Trust Company, which is acting as the Depositary for the Offer. See Section 14 of the Offers to Purchase, “Fees and Expenses.”

If you own any portion of your investment through your IRA, under IRS regulations you are required to have an independent custodian hold the investment on your behalf. Most IRA custodians charge fees to take any action with respect to your investment and may charge a fee to facilitate the tender of your Interests into the Offer. You are strongly encouraged to consult your IRA custodian before tendering your Interests into the Offer to understand the amount of fees, if any, that may be charged to you by your IRA custodian.

THE OFFER IS NOT CONDITIONED UPON THE RECEIPT OF FINANCING, OR UPON ANY MINIMUM NUMBER OF INTERESTS BEING TENDERED. OUR OBLIGATION TO ACCEPT AND PAY FOR INTERESTS VALIDLY TENDERED PURSUANT TO THE OFFER IS CONDITIONED UPON SATISFACTION OR WAIVER OF THE CONDITIONS SET FORTH IN SECTION 12 — “CONDITIONS TO THE OFFER.”

Mr. Michael Quilling is the trustee (the “Trustee”) of the Trust and the manager (the “Manager”) of the Partnership. In that capacity, Mr. Quilling is required by law to communicate the views of the Trust and the Partnership regarding the Offer to holders of Interests no later than ten (10) business days from the date the Offer is commenced. Before you decide to accept or reject the Offer, you should read the Solicitation/Recommendation Statement on Schedule 14 D-9 of the Trust and the Partnership in its entirety when it becomes available. See Section 9 — “Information Concerning the Purchaser and its Affiliates.”

According to the Form 10-Q of the Trust and the Partnership for the quarter ended March 31, 2021, there were 1,232,382,656 Trust Interests and 737,227,275 Partnership Interests outstanding as of March 31, 2021.

Section 5 — “U.S. Federal Income Tax Consequences” describes various United States federal income tax consequences of a sale of Interests under the Offer.

THIS OFFER TO PURCHASE AND THE RELATED ASSIGNMENT FORMS CONTAIN IMPORTANT INFORMATION THAT YOU SHOULD READ CAREFULLY BEFORE YOU MAKE ANY DECISION REGARDING THE OFFER.

| 15 |

THE TENDER OFFERS

| Section 1. | Terms of the Offer; Proration |

Upon the terms of, and subject to the conditions to, the Offer (including, if the Offer is extended or amended, the terms and conditions of such extension or amendment), we will purchase up to 66,964,507 Trust Interests and up to 99,702,160 Partnership Interests that are validly tendered prior to the expiration date, and not withdrawn, at a price of $0.15 per Interest, net to the seller in cash. The term “expiration date” means 5:00 p.m., New York City time, on July 29, 2021. However, we may, in our sole discretion, extend the period of time during which the Offer is open. If we do so, the term “expiration date” will mean the latest time and date on which the Offer, as so extended by us, will expire. We may elect to extend the Offer beyond the initial expiration date of July 29, 2021 for any reason, although holders of Interests should not assume that we will necessarily do so. However, we will not extend the Offer past August 31, 2021. The Offer is only for the Interests received from the bankruptcy court specifically for polices you elected to contribute to the Trust or the Partnership. The Offer is not based on the amount you originally invested nor is it for policies you continue to pay premiums on.

Under the terms of the organizational documentation governing the Trust and the Partnership, recordation of the assignment of Interests on their registers of ownership can be made only on August 31 of each calendar year. We have timed the expiration of the Offer so that following our acceptance of Interests for payment in the Offer, the assignment to Offeror of record ownership of the Interests accepted for payment may be recorded as of August 31, 2021.

Under applicable rules of the SEC, if holders of Interests tender more than 66,964,507 Trust Interests or more than 99,702,160 Partnership Interests, we may purchase up to an additional 2% of the outstanding Trust Interests or 2% of the outstanding Partnership Interests, respectively, without extending the Offer. Also, we may amend the Offer to purchase more Trust Interests or Partnership Interests, and extend the Offer as required by the rules of the SEC. If holders of Trust Interests tender more than the number of Trust Interests that we are willing to buy, we will purchase the Trust Interests on a pro rata basis. Similarly, if holders of Partnership Interests tender more than the number of Partnership Interests that we are willing to buy, we will purchase the Partnership Interests on a pro rata basis. This means that we will purchase the number of Interests calculated by multiplying the number of Interests properly tendered by a proration factor.

The proration factor will be calculated separately for the Trust Interests and for the Partnership Interests. In each case, the pro ration factor will equal the number of Interests we are willing to buy divided by the total number of Interests properly tendered by all holders of Trust Interests or Partnership Interests, as applicable. For example, assuming the number of Interests we agree to buy remains unchanged at 66,964,507 Trust Interests and 99,702,160 Partnership Interests, and 133,929,014 Trust Interests and 199,404,320 Partnership Interests are tendered, we will purchase 50% of the number of Trust Interests and 50% of the number of Partnership Interests that are tendered by a holder. All Interests not accepted for payment due to an oversubscription will continue to be owned by the tendering holders, as described in Section 4 — “Acceptance for Payment and Payment.”

| 16 |

We reserve the right to increase or decrease the number of Interests we are seeking in the Offer, subject to applicable laws and regulations of the SEC as described below.

Subject to the terms of the applicable rules and regulations of the SEC, we reserve the right, regardless of whether or not any of the conditions to the Offer are satisfied, to:

| · | extend the Offer beyond the then scheduled expiration date — and delay acceptance for payment of and payment for any Interests — by giving oral or written notice of that extension to the Depositary, provided that we will not extend the expiration date beyond August 31, 2021; and |

| · | amend the Offer in any other respect by giving oral or written notice of that amendment to the Depositary. |

UNDER NO CIRCUMSTANCES WILL WE PAY INTEREST ON THE PURCHASE PRICE FOR TENDERED INTERESTS, REGARDLESS OF ANY EXTENSION OF OR AMENDMENT TO THE OFFER OR ANY DELAY IN PAYING FOR SUCH INTERESTS.

There can be no assurance that we will exercise our right to extend the Offer. For the avoidance of any doubt, we will not extend either the offer to purchase the Trust Interests or the offer to purchase the Partnership Interests unless both are extended to the same expiration date. If by 5:00 p.m., New York City time, on July 29, 2021 (or any date or time then set as the expiration date), any or all of the conditions to the Offer has or have not been satisfied or waived, we reserve the right, subject to the applicable rules and regulations of the SEC:

| (i) | to terminate the Offer and not accept for payment or pay for any Interests and return all tendered Interests to tendering holders of Interests; |

| (ii) | to waive all the unsatisfied conditions and accept for payment and pay for all Interests validly tendered prior to the expiration date and not theretofore withdrawn; |

| (iii) | to extend the Offer and, subject to the right of holders of Interests to withdraw Interests, retain the Interests that have been tendered during the period for which the Offer is extended; or |

| (iv) | to amend the Offer. |

There will not be a subsequent offering period.

Any extension, waiver, amendment or termination will be followed as promptly as practicable by public announcement thereof. Rule 14e-l(d) under the Securities Exchange Act of 1934, as amended (referred to as the “Exchange Act”) requires that the announcement be issued no later than 9:00 a.m., New York City time, on the next business day after the previously scheduled expiration date. Rules 14d-4(d) and 14d-6(c) under the Exchange Act require that any material change in the information published, sent or given to holders of Interests in connection with the Offer must be promptly disseminated to holders of Interests in a manner reasonably designed to inform holders of Interests of such change. We intend to disseminate the information by issuing a press release.

| 17 |

If we extend the Offer, we are delayed in accepting for payment or paying for Interests, or we are unable to accept for payment or pay for Interests pursuant to the Offer for any reason, the Depositary may, on our behalf, retain all Interests tendered. Tendered Interests may not be withdrawn except as provided in Section 3 — “Withdrawal Rights.” Our reservation of the right to delay acceptance for payment of, or payment for, Interests is subject to applicable law, which requires that we pay the consideration offered or return the Interests deposited by or on behalf of holders of Interests promptly after the termination or withdrawal of the Offer.

If we make a material change in the Offer, or if we waive a material condition to the Offer, we will extend the Offer to the extent required by Rule 14e-1 under the Exchange Act. The minimum period during which the Offer must remain open following material changes in its terms, other than a change in price or the percentage of securities sought, will depend on the facts and circumstances then existing, including the materiality of the changed terms or information.

We may, in our sole discretion, decide to increase or decrease the consideration offered in the Offer or to change the percentage of Trust Interests or Partnership Interests we are seeking in the Offer. If, at the time that notice of any such changes is first published, sent or given to holders of Interests, the Offer is scheduled to expire at any time earlier than the tenth (10th) business day after (and including) the date of such notice, then the Offer will be extended at least until the expiration of such period of ten (10) business days. If, however, we increase the number of Interests we are seeking under the Offer by not more than 2% of the outstanding Trust Interests or Partnership Interests, as applicable, then pursuant to Rule 14e-1(b) under the Exchange Act, we would not be required to extend the expiration date of the Offer.

We will promptly furnish, at our expense, the Offers to Purchase, the related Statements of Account, Assignment Forms, the IRS Form W-9, and other relevant materials to those holders of Interests who request the materials from us.

As used in the Offers to Purchase, the term “business day” means any day other than Saturday, Sunday, any U.S. federal holiday or any day on which banking institutions in the City of New York, Borough of Manhattan, are closed.

| Section 2. | Procedure for Tendering Interests |

Valid Tender. For a holder of Interests to validly tender Interests under the Offer, the holder of Interests may tender its Interests using a physical Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) by mailing, delivering or faxing the appropriate Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) to the Depositary, or by emailing the appropriate Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) to the Offeror, who will forward such documentation to the Depositary.

| 18 |

In either case, to tender your Interests using an Assignment Form, you should complete and deliver the appropriate Assignment Form and IRS Form W-9 (or other appropriate tax form) and deliver the appropriate Statement of Account prior to the expiration of the Offer. The WHITE Assignment Form labeled Position Holder Trust Interests should be used to tender the Trust Interests, and the YELLOW Assignment Form labeled IRA Partnership Interests should be used to tender the Partnership Interests. If you hold and wish to tender both your Trust Interests and your Partnership Interests, you must complete a separate Assignment Form and IRS Form W-9 (or other appropriate tax form) for each and deliver as separate Statement of Account for each. The appropriate Statement of Account, Assignment Form and IRS Form W-9 (or other appropriate tax form) must be received by the Depositary for the Offer no later than the expiration time of the Offer.

The address for delivery of the Statements of Account, Assignment Forms and the IRS Form W-9 (or other appropriate tax form) and any other required documents is:

| If delivering by mail, hand, overnight or courier to the Depositary: |

|

Continental Stock Transfer & Trust Company New York, New York 10004 |

You may also deliver your Statements of Account, Assignment Forms and IRS Form W-9 (or other appropriate tax form) by fax to the Depositary, as follows:

|

If delivering by fax to the Depositary: Continental Stock Transfer & Trust Company Reference: Life Partners Tender Offer Fax No.: (212) 616-7610 |

The Statements of Account, Assignment Forms and IRS Form W-9 (or other appropriate tax form) may also be emailed to the Offeror, as follows: Rhoda Freeman at [email protected] or John Bright at [email protected], who will then forward such documentation to the Depositary.

You may also deliver your Statements of Account, Assignment Forms and IRS Form W-9 (or other appropriate tax form) to the Depositary via a secure website. Please type the following URL into your internet browser to access the upload area: https://cstt.citrixdata.com/r-re8715e7bcef4efd8. Note, when providing your information, we cannot accept “automated Word font signatures” and if using an electronic utility to gather a signature (such as Docusign) we will need the certificate of completion, as well. Additionally, in order to avoid processing delays, kindly label your documents with your name and date.

A Statement of Account must be returned with the applicable Assignment Form and IRS Form W-9. If you received the Offers to Purchase and applicable Assignment Forms by email, you should return a copy of that email which includes your Statement of Account. If you received the Offers to Purchase and applicable Assignment Forms by physical mail, you should return the copy of the Statement of Account that was included in the package of materials sent to you.

| 19 |

If you are signing the Assignment Form in a representative capacity, you will also be required to furnish proof of your authority. For example, if you are signing as an officer of a corporation, you should submit an officer’s certificate to evidence your authority. If you are signing as a trustee of a trust, you should submit a certificate of incumbency. Also, you should note that only the IRA custodian, and not the beneficiary, can execute an Assignment Form on behalf of an individual retirement account. Execution by the beneficiary will not be valid.

NorthStar Life Services, LLC currently serves as Servicer for each of the Trust and the Partnership. The Trust Interests are recorded in book entry form on a register of the Trust maintained by the Servicer for this purpose, and the Partnership Interests are recorded in book entry form on a register of the Partnership maintained by the Servicer for this purpose. Accordingly, there are no certificates or other physical or electronic indicia of ownership of the Interests that tendering holders are required to deliver to the Depositary. However, by delivering to the Depositary the applicable Assignment Form, IRS Form W-9 (or other appropriate tax form), and any other required documents, you will be deemed to have tendered your Interests for purposes of the Offer, and your tender may only be withdrawn as provided in Section 3 — “Withdrawal Rights.” The valid tender of Interests by you by the procedures described in this Section 2 will constitute a binding agreement between you and us on the terms of, and subject to the conditions to, the Offer, including as described in this paragraph.