Form N-CSRS/A MainGate Trust For: May 31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

(a)

|

|

MainGate MLP Fund

Class A (AMLPX)

Class C (MLCPX)

Class I (IMLPX)

6075 Poplar Avenue, Suite 720 | Memphis, TN 38119 | 855.MLP.FUND (855.657.3863) | www.maingatefunds.com

Semi-Annual Report

May 31, 2022

(Unaudited) – Restated

SEMI - ANNUAL REPORT 2022 ● 3

Table of CONTENTS

MainGate mlp fund

The MainGate MLP Fund had the following performance as of May 31, 2022 compared to the S&P 500 Index and the Alerian MLP Total Return Index.

| cumulative returns | average annual returns | |||||||||||||

| Inception | Fiscal | Since | 1 | 5 | 10 | Since | ||||||||

| Date | YTD | Inception | Year | Year | Year | Inception | ||||||||

| MainGate MLP Fund – Class A | 2/17/11 | 34.54% | 45.94% | 36.60% | 1.75% | 3.43% | 3.41% | |||||||

| without load | ||||||||||||||

| MainGate MLP Fund – Class A | 2/17/11 | 26.90% | 37.55% | 28.77% | 0.56% | 2.81% | 2.87% | |||||||

| with 5.75% maximum front-end load | ||||||||||||||

| MainGate MLP Fund – Class I | 2/17/11 | 34.80% | 50.11% | 36.78% | 1.99% | 3.68% | 3.67% | |||||||

| S&P 500 Index | 2/17/11 | -8.85% | 285.61% | -0.30% | 13.38% | 14.40% | 12.71% | |||||||

| Alerian MLP Total Return Index | 2/17/11 | 32.43% | 34.68% | 27.52% | 2.62% | 2.60% | 2.67% | |||||||

| MainGate MLP Fund – Class C | 3/31/14 | 34.20% | -9.27% | 35.54% | 0.97% | NA | -1.18% | |||||||

| without load | ||||||||||||||

| MainGate MLP Fund – Class C | 3/31/14 | 33.20% | -9.27% | 34.54% | 0.97% | NA | -1.18% | |||||||

| with 1.00% Contingent Deferred | ||||||||||||||

| Sales Charge | ||||||||||||||

| S&P 500 Index | 3/31/14 | -8.85% | 158.11% | -0.30% | 13.38% | NA | 12.31% | |||||||

| Alerian MLP Total Return Index | 3/31/14 | 32.43% | -8.50% | 27.52% | 2.62% | NA | -1.08% | |||||||

Expense Ratios (Gross/Net): A Shares = 1.70%/1.70% | C Shares = 2.45%/2.45% | I Shares = 1.45%/1.45%. Net expense ratios represent the percentages paid by investors and reflect a 0.00% deferred income tax expense which represents the performance impact of accrued deferred tax liabilities across the Fund, not individual share classes, for the fiscal year ended November 30, 2021 (the Fund did not have a current tax expense or benefit due to a valuation allowance). The Fund’s adviser has contractually agreed to cap the Fund’s total annual operating expenses (excluding brokerage fees and commissions; Class A 12b-1 fees; borrowing costs; taxes, such as Deferred Income Tax Expense; and extraordinary expenses) at 1.50% through March 31, 2023. The performance data shown For Class C with load reflects the Class C maximum deferred sales charge of 1.00%. Deferred income tax expense/(benefit) represents an estimate of the Fund’s potential tax expense/(benefit) if it were to recognize the unrealized gains/(losses) in the portfolio. An estimate of deferred income tax expense/(benefit) depends upon the Fund’s net investment income/(loss) and realized and unrealized gains/(losses) on its portfolio, which may vary greatly on a daily, monthly and annual basis depending on the nature of the Fund’s investments and their performance. An estimate of deferred income tax expenses/(benefit) cannot be reliably predicted from year to year.

The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the information quoted. To obtain performance information current to the most recent month-end please call 855.MLP.FUND (855.657.3863). Performance data shown for Class A shares with load reflects the maximum sales charge of 5.75%. Performance data shown for Class C shares with load reflects the maximum deferred sales charge of 1.00%. Performance data shown for Class I shares does not reflect the deduction of a sales load or fee. Performance data shown “Without Load” does not reflect the deduction of the sales load or fee. If reflected, the load or fee would reduce the performance quoted.

SEMI - ANNUAL REPORT 2022 ● 5

Second Quarter 2022 – “Air Pocket”

The second quarter 2022 Alerian MLP Total Return Index (AMZX)1 performance of -7.4% did not match the strong quarterly operating results reported by Midstream companies during the quarter. If we had written this letter on May 31st, everything would have synced. But then June happened, and like the rest of the market, the AMZX was influenced during the month by several questions regarding the impacts of broader macro-economic forces and a resulting push/pull between fundamentals and market technicals.

Our companies had a terrific fundamental quarter. On a weighted average2 basis, the Portfolio:

| ● | Beat earnings before interest, taxes, depreciation and amortization (EBITDA)3 expectations by 6.5%, representing 11.2% year-over-year (Y/Y) growth, |

| ● | Saw estimated 2022 distributable cash flow (DCF)4 per unit/share (DCF/u) growth increase to 14.9%, +530 basis points (bps)5 quarter-over-quarter (Q/Q)6, |

| ● | Increased Distributions 6.3% Q/Q, and |

| ● | Had a 2.95x coverage ratio7 due to higher DCF/u. |

Portfolio positioning continues to favor natural gas and natural gas liquids (NGL) companies with fully integrated value chains, lower balance sheet leverage, and upside opportunities to increase equity holder returns through increases in distributions, increased buyback activity and special distributions/dividends.

We believe June’s performance was more a result of an “air pocket” that saw macro, multi-factor, and technical traders strongly de-grossing commodities, energy, and other sectors which had previously held up well year-to-date (YTD), as recession odds and rate hikes ticked higher, without enough buyer support to soak it up. Rarely is there ever counterbalancing support when sell-offs are that fast. Commentary from trading desks indicated new buyers who had waited for a pullback emerged mid-month. However, the Biden Administration floated several energy-related trial balloons in an attempt to jawbone consumer energy prices lower, which may have weakened sentiment and kept the AMZX from a meaningful recovery into quarter-end.

Let’s also keep perspective: Midstream and Energy in general have been solid performers in 2022. The S&P 500 Energy Sector Index8 and the AMZX are up 31.6% and 10.0% YTD, respectively, and fared even better relative to the broader market, which had its worst first half in 50 years with the S&P 500 Index9 down 20.0%. We expect we will look back at June 2022 as a recalibration that saw market participants reduce equity exposure in their portfolios, and allowed Energy to be better positioned for continued outperformance.

Fundamental catalysts remain in place, and we find the composition of S&P 500 earnings growth estimates to be striking in its underappreciation of the Energy sector. Analysts’ expectations for 2022 estimated earnings growth for the S&P 500 Index as a whole is 10.3%, with over 50% of the growth coming from Energy, which represents <5% of the index’s sector weight10. If we carry it forward on a next twelve months (NTM) basis, the Energy sector still contributes >20% of the estimated total earnings growth. How does this not play a bigger role in allocators’ decisions? We discussed in our May earnings recap that for all the talk about a recession, analysts are seeminly doing a poor job of decreasing estimates.

(1) Alerian MLP Index: A capitalization-weighted index of the most prominent energy Master Limited Partnerships. Visit http://www.alerian.com/indices/amz-index for more information, including performance. You cannot invest directly in an index. (2) Weighted Average: An calculation in which each quantity to be averaged is assigned a weight that represents its relative importance. (3) Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA): Essentially net income with interest, taxes, depreciation, and amortization added back to it; can be used to analyze and compare profitability between companies and industries because it eliminates the effects of financing and accounting decisions. (4) Distributable Cash Flow: Measured as earnings before interest, taxes, depreciation and amortization (EBITDA) available to pay unitholders after reserving for maintenance capital expenditures and payment of interest expense. (5) Basis Points (bps): A common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%. In decimal form, one basis point appears as 0.0001 (0.01/100). (6) Distributable cash flow growth refers to the estimated 2022 weighted average Distributable Cash Flow (DCF) growth rate. DCF growth rate for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio. DCF data is CCM-calculated consensus of Wall Street estimates. (7) Distribution Coverage Ratio: An MLP’s distributable cash flow divided by the total amount of distributions it paid out. (8) S&P 500 Utility Index: Comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard utilities sector. (9) S&P 500: A free-float capitalization-weighted index published since 1957 of the prices of 500 large-cap common stocks actively traded in the United States. (10) UBS Securities LLC as of 6/28/22.

6 | MainGate mlp fund

The chart below shows the dislocations between conjecture and earnings forecasts, and the evidence to date leads us to believe Energy earnings estimates should hold up better through next year and perhaps may be viewed more favorably than other sectors.

Earnings Estimates Are Most Wrong in Recessions

Bloomberg Markets Live, “Analysts Estimates are Mostly Wrong in Recessions”, June 29, 2022

Assuming the old rules of “buy things that are going up” and “buy things that are inexpensive” still hold, this has us believing even more strongly that Midstream could outperform as investors have gone through a cleansing in June, and Midstream could likely see upside in this scenario.

Interesting as well, we continued to receive incremental commentary from both Wall Street Energy analysts and broad market strategists saying the environmental, social, governance (ESG) headwind to Energy investment may be turning to a tailwind, particularly among European investors who have been the strongest adopters of ESG guidelines in their investment mandates. Since April, the analysts/strategists reported increased face-to-face exposure with a broad group of European investors who have suffered in performance due to a more stringent investment mandate, which has only become starker the past 4 months as Europe has found itself very poorly positioned for energy supplies. Relayed conversations indicated ESG mandates are expanding to include Energy companies, and, in particular, to increase exposure to companies focused on natural gas as it now presents a longer-term investment thesis, and remains a way to dissuade further use of coal.

Capacity Short

It’s All About Capacity

Allow us to cut through all the rhetoric about the supply of oil, such as what is OPEC’s11 spare capacity, are producers drilling enough, etc. The current high price of consumer fuels is a result of a lack of refining capacity brought about by global policy initiatives to incentivize an energy transition. These inept policies created a mismatch of supply and demand that was then further exacerbated by the Russia/Ukraine conflict.

(11) OPEC (Organization of the Petroleum Exporting Countries): An international organization and economic cartel whose mission is to coordinate the policies of the oil-producing countries. The goal is to secure a steady income to the member states and to collude in influencing world oil prices through economic means.

SEMI - ANNUAL REPORT 2022 ● 7

Looking at the U.S., refining capacity has declined back to levels last seen in 2014 after peaking at a little over 19 million barrels per day (MMBpd) in 2020. We can point to specific reasons why capacity has been reduced—hurricane damage, conversion to renewable fuels (diesel grade), etc. – but the overarching reason for less refining capacity is due to political headwinds discouraging new investment. Of course, new refining capacity could potentially be brought online to alleviate price pressure, but investing in new refining capacity requires a 30–40-year outlook and current policy signals an aggressive transition timeline to more electric vehicles and less refined products for transportation. It is no surprise with today’s policy backdrop, it is difficult for refiners to justify the investment.

Annual U.S. Refinery Atmospheric Crude Oil Distillation Capacity (2013-2022)

Million barrels per calendar day as of January 1

EIA, “Today in Energy: U.S. Refinery Capacity Decreased During 2021 for Second Consecutive Year”, June 26, 2022

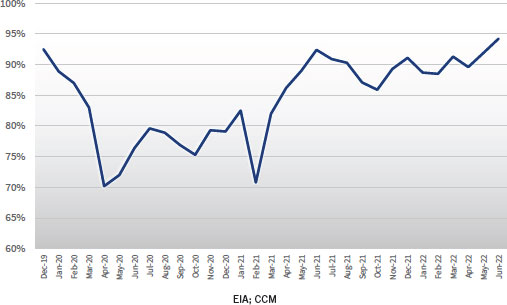

We should note U.S. refiners are doing their part to supply the market with product from existing capacity as utilization is at an all-time high:

U.S. Refinery Utilization

8 | MainGate mlp fund

Turning to global refining capacity, it has increased by 7.8 MMBpd since 2010, but two things underneath the surface are affecting flows. First, Russia is a major producer of diesel and its rejection by its former buyers in Europe has forced Russian refined products elsewhere. This has turned Europe into the incremental buyer for non-Russian products barrels on the global market. This is not much different from how Europe has become the incremental buyer for all liquefied natural gas (LNG) cargoes, being more or less price agnostic for both fuels. Second, the vast majority of the global refining capacity has been added in China which has added 7.4 MMBpd12. Even though China has bought relatively less crude oil during the past 6 months due to reduced activity from Covid-19 lockdowns, they have not placed their spare refined products barrels on the global market. Market speculation is they see the impact sanctions have had on Russia, and given they are a “hydrocarbon-poor” nation (relative to their scale), it’s in their national interest to store all refined products barrels they can.

The point of this capacity review is to acknowledge that, yes, the input costs on a price per barrel basis are higher, but the corresponding price-at-the-pump for gasoline is also dislocated even higher due to capacity limitations. Our analysis suggests deterred refinery investment has caused at least a $1.35+ premium per gallon of gas. We arrive at this conclusion by extrapolating the crack spread over time and interpolate that $105-110 per barrel of crude should deliver $3.25-3.50 per gallon of refined gasoline versus the current $4.85 national average13. This can also be put into context in the following chart:

Crude Oil vs Gasoline Prices

EIA, JPMAM; May 2022 from JP Morgan Asset Management, “Eye on the Market”, June 27, 2022

As much as commentators, journalists and the like want to compare this to the 1970s gasoline crisis, we believe the narratives are different. Yes, both economic events have soaring inflation and high gas prices; however, the 1970s energy crisis was one of supply due solely to the Arab oil embargo. Today’s event is mainly due to available capacity to refine. We expect inflation to ebb and flow with supply chains and consumer behaviors shifting as we continue to normalize societally, post-Covid. As we’ve written in previous newsletters, we can foresee constraints to supply without required investments, which are at least $1 trillion behind schedule according to Shell’s CEO14. J.P. Morgan analysts also presented a case this quarter estimating the U.S. may potentially undershoot supply by 20% through the end of the decade15.

(12) Citigroup Global Markets; CCM Analysis. (13) AAA National Average Gas Price, 6/30/22. https://gasprices.aaa.com/. (14) Bloomberg, LP “Shell’s CEO Paints a Bleak Picture on Global Energy Supply”, June 29, 2022. (15) JP Morgan, “Global Energy Outlook”, April 20, 2022; Bloomberg, LP.

SEMI - ANNUAL REPORT 2022 ● 9

Unfortunately, the capacity solutions being discussed in the near term are not great for consumers. Producing more oil doesn’t solve the capacity issue. A gasoline tax holiday would only incentivize more demand when refiners are having a hard time keeping up as is. Relaxing the summertime Reid Vapor Pressure (RVP) rules could add anywhere from 100–500 thousand barrels per day (MBpd) of capacity, but relaxing would increase emissions (not favored by the Biden Administration and many of its constituents), and could introduce safety hazards (not favored by anyone).

The only plausible solution in the medium to long term would be for the government to get into the refining business since they have a history of absorbing zero or negative returns for greater societal benefits. We have seen no such discussion of this idea, and, at current, it is pure fantasy.

Freeport LNG

On June 8th, Freeport LNG, a private company with 12 million tons per annum (MTPA) of capacity (2.1 billion cubic feet (Bcf) per day), experienced a fire at its Quintana Isle Liquefaction facility, which caused the company to take all the capacity offline. On June 14th, the company announced the facility would be offline for 90 days and they do not expect a full restart until the end of the year. This end of the year guidance also assumes they have met all the requirements laid out by the Pipeline Hazardous Materials Safety Administration (PHMSA) on June 30th.

The results from this fire are positive and negative, beyond the one overwhelming positive that no one was injured. Because U.S. capacity to export natural gas is reduced, this means more supplies at home which translates to lower (relatively) natural gas prices for consumers, and a greater supply of gas to be placed in gas storage ahead of winter, though we still forecast natural gas storage be near the bottom of 5-year inventory levels heading into heating season. Unfortunately for global customers, particularly those in Europe who need it most, prices have surged even higher and there’s less available to fill for winter supplies. This has caused Germany, the Netherlands and others to turn coal facilities back on to create electricity while gas is stored for winter usage across various industries beyond just power generation.

As it relates to Midstream, gas pipelines are predominantly full and are expected to remain so. There is still a strong bid for the remaining 10 Bcf/d of international demand, summer has started particularly warm, and coal remains logistically constrained (the most recent example of capacity constraint), which has caused it to rise in price with natural gas, not in substitution of gas. Therefore, even though gas spot prices ended June approximately 43% lower than where they were before the fire, they remain supportive enough for producers to grow supplies in a disciplined manner to a growing market.

Recession Fears – Demand Destruction?

Increased odds of a U.S. recession and fears of demand destruction are the primary culprits we can fundamentally link to the weak quarterly performance. The higher expectations for recession are based on the -1.9% Q1:22 final gross domestic product (GDP)16 reading, and the Atlanta Fed recently decreasing Q2:22 GDP growth to -1.0% from 0.0% previously17. While we think the fundamental set up for crude oil remains strong due to the aforementioned capacity issues, we’re respectful that market perceptions of a recession could continue to bleed into commodity prices, fundamentally justified or not. Most investors and allocators we talk to agree with the fundamental story regarding their Midstream investment, but most of them also have concerns about what a potential swift decrease in the price of oil could do towards correlative performance. Let us try to look through these concerns.

Demand is still recovering, and due to the lack of capacity described above it appears there are more tailwinds than headwinds to fuel consumption. “Revenge travel” remains a strong theme summer-to-date, particularly with the additional holiday observed this year with Juneteenth18. We have seen a slowing of the incremental growth rate of consumption due to seasonality, but we’re still seeing modest growth, not demand destruction. Additionally, jet travel has started off strong this summer and should continue through the next few months as travelers typically book months in advance. Pertaining to Midstream companies with refined products pipelines, even if the forecasted recession broke historical course and turned demand growth negative, these assets should see little impact to cash flows19 due to the implementation of the annual tariff increase, which this year is ~8.7% higher.

(16) Gross Domestic Product (GDP): The monetary value of all goods and services produced within a country’s borders in a specific time period (typically one year). (17) Federal Reserve Bank of Atlanta, GDP Now, June 30, 2022. https://www.atlantafed.org/cqer/research/gdpnow (18) WSJ, “How America’s Summer Vacation Came Back Stronger Than Ever”, July 1, 2022.

10 | MainGate mlp fund

We do not negate the potential for a swift decrease in the price of oil in this volatile market, but that is not our base case. If it happens, we expect any move lower to be more technical than fundamental, and therefore, we would expect a quick recovery. Many of you know our thesis — the era of cheap oil is over. It is increasingly being articulated at major bank and commodities research houses, and this backdrop may continue through the end of the decade. We also find the below chart to be helpful. Ultimately, the chart highlights a pretty stable price cycle.

Commodities Around Recessions

Bloomberg LP

Currently, we see increasing global demand support as China emerges from its enforced Covid lockdowns. This is confirmed by Saudi Aramco’s August pricing to Asia, which confirmed a nearly $10 premium to Brent, indicating there may be a dislocation between physical markets and trading markets20. There’s also the potential for EU nations and their allies to impose sanctions on Russian crude oil, which would take more barrels off the market (would place upward pressure on price), or for Russia to weaponize exports as has been rumored in the press.

As it affects Midstream companies, we would see little impact to volumes or cash flow. Even if the price falls to $60 or 70 per barrel, for instance, producers are adequately compensated to produce oil in accordance with their budgeted plans whether the oil is consumed in the U.S. or goes to international destinations through export docks. Midstream companies would continue to benefit from this growth primarily on a fee-based basis.

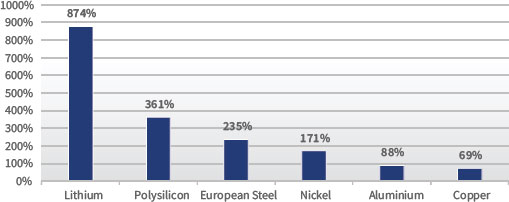

“Greenflation” Impacting Transition Technologies

As global investors begin to understand the ramifications of the end of zero percent rates, we’re also witnessing what happens to the cost of the commodity inputs of energy transition investments due to inflation, politicization, substitution, supply chain constraints, and other factors, all of which are conveniently summarized as “greenflation”. In an unfortunate combination of the two, Ford announced commodity costs and interest rate assumptions have already wiped out the profitability of their heralded Mustang Mach-E21 – that was fast. Unsurprisingly to us, reality is broadening to the entire EV market forecast. Stellantis, the maker of Dodge, Chrysler, Jeep, Fiat and many other brands (14 total worldwide), is calling for greater balance in the transition to EVs, predicting “doom” due to commodity prices if automakers are forced to comply with global policy makers’ plans to phase out internal combustion engines. To comply with policy goals, they forecast commodity prices need to decrease 40% by 2030, which looks quite precarious given the current pricing environment22.

(19) Cash Flow: A measurement of the cash generating capability of a company by adding non-cash charges (e.g. depreciation) and interest expense to pretax income. (20) Bloomberg, LP “Saudis Raise Oil Prices to Near Record as Demand Seems Robust”, July 5, 2022. (21) Bloomberg, LP, “Ford’s Mustang Mach-E Profit Wiped Out by Commodity Costs”, June 14, 2022.

SEMI - ANNUAL REPORT 2022 ● 11

Prices for Metals Needed for the Energy Transition

Have Risen Dramatically Since Jan ‘21 (Price Increase Since Jan ‘21)

Bloomberg Finance L.P. from JP Morgan, “Global Energy Outlook”, April 20, 2022

And if the commodity prices weren’t enough to rethink the economics of scaling into the transition, we’re also seeing increased examples of electric vehicles that aren’t quite ready for prime time. Whether it’s battery fires23, loss of power24, or simply the wheels falling off25, the road to this part of the transition story looks bumpier than forecasted. While the costs are one thing, automakers need reliable products to help consumers get over other fears such as refueling, total cost of ownership, and long-term reliability if EV forecasts are to be achieved.

We strongly reiterate our support of a transition to a cleaner energy future, just one that is better balanced to create less economic and societal disruption. We also believe Midstream remains an excellent, and inexpensive, way to play the growth in transition assets over the next decade. In this quarter alone, 8 new energy transition projects were announced bringing the total announced projects to 59 in the past 15 months.

Items Worth a Quick Comment

On June 30th, the U.S. Supreme Court found in favor of the plaintiffs in West Virginia v. Environmental Protection Agency (EPA)26, asserting the EPA overstepped its bounds when it instituted the Clean Power Plan (CPP)27 during the Obama Administration28.

In short, this decision places the authority previously asserted by the EPA back with the legislative branch, in this case Congress, which must legislate regulatory action on the scale of the CPP, rather than have an Administration circumvent this process. Our opinion of this decision is similar to a general theme expressed in this letter and in prior commentary: this brings balance back to Energy Transition plans. If this decision had ruled in favor of the EPA, it would’ve emboldened a more aggressive path towards the transition, and, as we highlighted in Greenflation, this could’ve been devastating to the U.S. economic system. If nothing else, even though this wasn’t the intent, the CPP has pushed traditional energy companies to accelerate their own plans towards a cleaner future, which we expect to continue.

(22) Bloomberg, LP, “Stellantis Warns of Car Market Collapse If EVs Don’t Get Cheaper”, June 29, 2022. (23) Bloomberg, LP, “GM Resurrects Bolt EV with Ad Blitz Amid Federal Battery Probe”, April 6, 2022. (24) Bloomberg, LP, “Ford Recalls 48,924 Mustang Mach-Es in Setback for EV Plan”, June, 14, 2022. (25) Bloomberg, LP, “The Wheels Have Come off Electric Vehicles”, June 29, 2022. (26) Environmental Protection Agency (EPA): An agency of the U.S. federal government which was created for the purpose of protecting human health and the environment by writing and enforcing regulations based on laws passed by Congress. (27) Clean Power Plan: An Obama administration policy aimed at combating anthropogenic climate change (global warming) that was first proposed by the Environmental Protection Agency in June 2014. (28) WSJ, “Supreme Court Puts Brakes on EPA in Far-Reaching Decision”, June 30, 2022.

12 | MainGate mlp fund

There has also been media attention on the subject of a windfall profits tax on “energy” companies. This is much more than a long putt because as legal experts surmise this would take congressional approval, and the Senate’s swing voter Senator Joe Manchin (D, WV) – not to say any other of his party constituents – has said it’s a non-starter. Assuming this idea was to circumvent established precedent, we don’t see a scenario where Midstream becomes ensnared due to the mostly fee-based nature of their contracts.

Potential Total Return Components

We covered valuation29 in depth in the first quarter 2022 newsletter, and we think it is helpful in this letter to consider the components of total return as we think they remain favorable. Needless to say, with improved results, and an improved outlook, valuation became even more attractive with the AMZX’s Price/DCF closing at 5.6x as of 6/30/22. We believe Midstream remains one of the best values in the market.

As of 6/30/22, the forecasted 2022e distribution/dividend yield on the Portfolio was 7.2%. Consensus estimates indicate a 35.8% weighted average distribution/dividend growth rate in 2022e and 9.8% in 2023e30. Much of the 2022e growth rate was announced in 1H:22, but there is potential for additional growth this year as evidenced by the growth rate ticking higher 300 bps Q/Q. For this analysis, we’ll focus on the 9.8% estimate. Adding the 7.2% yield31 and the 9.8% distribution/dividend growth rate for 2023e, it would imply a potential distribution/dividend-based yield + growth expectation of 17%, undiscounted.

Taking a slightly different view to focus on organic growth of cash flow instead of distribution/dividend growth (removing management capital allocation decisions), the consensus 2022e DCF/u growth rate is 14.9% and 2023e is 6.9%, both of which we believe reflect conservativism32. Using the average growth on a rolling two-year basis, we arrive at 10.8% DCF/u growth plus a 7.2% yield, which implies a potential expectation of 18.0% total return, undiscounted.

In addition to not assuming any change in valuation, we would reiterate the strength of the Portfolio’s coverage ratio at 2.95x, and continue to rhetorically ask “what will these companies do with all the excess cash flow?” There is ample coverage to increase the return of capital to equity holders, and thusly the total return profile is well-supported by management capital allocation levers. Our position is consistent and we strongly reiterate our preference for buybacks at current valuations, while increasing cash distribution and dividends at more favorable valuation levels.

Conclusion

Thank you to our investors. Although Midstream equities closed the second quarter on a weaker note than expected, with an impressive fundamental quarter and improved outlook, we believe forward return expectations have only strengthened.

We covered a lot of ground in this letter to address numerous questions coming in from a number of investors and other market participants. If you’d like to dial into any of these topics in greater depth, we encourage you, as always, to reach out to your MainGate representative as we look forward to more fulsome discussions with you.

Sincerely,

|

|

| Geoffrey P. Mavar, Chairman | Matthew G. Mead, CEO |

(29) Valuation: The process of determining the current worth of an asset or a company. (30) This is not a forecast of the portfolio’s future performance. Yield growth for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio. Distribution and dividend estimates sourced from Bloomberg, LP. (31) Yield: Refers to the interest or dividends received from a security and is usually expressed annually as a percentage based on the investment’s cost, its current market value or its face value. (32) Weighted average distributable cash flow growth refers to the estimated 2022 or 2023 (as indicated) weighted average Distributable Cash Flow (DCF) growth rate. DCF growth rate for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio. DCF data is CCM-calculated consensus of Wall Street estimates.

SEMI - ANNUAL REPORT 2022 ● 13

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

The information contained in this report is authorized for use when preceded or accompanied by a prospectus.

Mutual fund investing involves risk. Principal loss is possible. The Fund is nondiversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual stock volatility than a diversified fund.

The Fund will invest in Master Limited Partnerships (MLPs) which concentrate investments in the natural resource sector and are subject to the risks of energy prices and demand and the volatility of commodity investments. Damage to facilities and infrastructure of MLPs may significantly affect the value of an investment and may incur environmental costs and liabilities due to the nature of their business. MLPs are subject to significant regulation and may be adversely affected by changes in the regulatory environment.

MLPs are subject to certain risks inherent in the structure of MLPs, including complex tax structure risks, limited ability for election or removal of management, limited voting rights, potential dependence on parent companies or sponsors for revenues to satisfy obligations, and potential conflicts of interest between partners, members and affiliates. When the Fund invests in MLPs that operate energy-related businesses, its return on investment will be highly dependent on energy prices, which can be highly volatile.

Tax Risks: An investment in the Fund does not receive the same tax advantages as a direct investment in the MLP. The Fund is treated as a regular corporation or “C” corporation and is therefore subject to U.S. federal income tax on its taxable income at rates applicable to corporations (currently at a rate of 21%) as well as state and local income taxes. MLP Funds accrue deferred income taxes for future tax liabilities associated with the portion of MLP distributions considered to be a tax- deferred return of capital and for any net operating gains as well as capital appreciation of its investments. This deferred tax liability is reflected in the daily NAV and as a result the MLP Fund’s after-tax performance could differ significantly from the underlying assets even if the pre-tax performance is closely tracked. The potential tax benefits from investing in MLPs depend on them being treated as partnerships for federal income tax purposes. If the MLP is deemed to be a corporation then its income would be subject to federal taxation, reducing the amount of cash available for distribution to the Fund which could result in a reduction of the Fund’s value.

Investments in smaller companies involve additional risks, such as limited liquidity and greater volatility. Investments in foreign securities involve greater volatility and political, economic and currency risks and differences in accounting methods.

Chickasaw Capital Management, LLC gives no guarantees with respect to the success of its investment management services and has not authorized any person to represent or guarantee any particular investment results. Any historical data provided herein are solely for the purpose of illustrating past performance and not as a representation or prediction that such performance could or will be achieved in the future. Securities are subject to numerous risks, including market, currency, economic, political and business risks. Investments in securities will not always be profitable, and investors may lose money, including principal. Past performance is no guarantee of future results. This is not an offer or solicitation with respect to the purchase or sale of any security.

Chickasaw Capital Management, LLC does not provide legal, tax or accounting advice. Any statement contained in this communication concerning U.S. tax matters is not intended or written to be used, and cannot be used, for the purpose of avoiding penalties imposed on the relevant taxpayer. Clients of Chickasaw Capital Management, LLC should obtain their own independent tax advice based on their particular circumstances. Opinions expressed are current opinions as of the date appearing in this material only. No part of this material may be copied, photocopied or duplicated in any form, by any means, or redistributed without the prior written consent of Chickasaw Capital Management, LLC.

Opinions expressed are those of Chickasaw Capital Management, LLC and are subject to change, are not guaranteed, and should not be considered investment advice.

Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the schedule of investments for a complete listing of Fund holdings.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time (each, an “index”) are provided for your information only. Reference to this index does not imply that the portfolio will achieve returns, volatility or other results similar to the index. The composition of the index may not reflect the manner in which a portfolio is constructed in relation to expected or achieved returns, portfolio guidelines, restrictions, sectors, correlations, concentrations, volatility or tracking error targets, all of which are subject to change over time. Indices are unmanaged. The figures for the indices do not reflect the deduction of any fees or expenses which would reduce returns. Investors cannot invest directly in indices.

The Alerian MLP Index is a composite of the most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The index, which is calculated using a float-adjusted, capitalization-weighted methodology, is disseminated real-time on a price-return basis (NYSE: AMZ), and the corresponding total-return index is disseminated daily (NYSE: AMZX). Relevant data points such as dividend yield are also published daily. For index values, constituents, and announcements regarding constituent changes, please visit www.alerian.com.

“Alerian MLP Index”, “AlerianMLP Total Return Index”, “AMZ” and “AMZX” are service marks of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and their use is granted under a license from Alerian. Alerian does not guarantee the accuracy and/or completeness of the Alerian MLP Index or any data included therein and Alerian shall have no liability for any errors, omissions, interruptions or defects therein. Alerian makes no warranty, express or implied, representations or promises, as to results to be obtained by Licensee, or any other person or entity from the use of the Alerian MLP Index or any data included therein. Alerian makes no express or implied warranties, representations or promises, regarding the originality, merchantability, suitability, non-infringement, or fitness for a particular purpose or use with respect to the Alerian MLP Index or any data included therein. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of the Alerian MLP Index or any data included therein, even if notified of the possibility of such damages.

The Energy MLP Classification Standard (“EMCS”) was developed by and is the exclusive property (and a service mark) of GKD Index Partners, LLC d/b/a Alerian (“Alerian”) and its use is granted under a license from Alerian. Alerian makes no warranties, express or implied, or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and hereby expressly disclaims all warranties of originality, accuracy, completeness, merchantability, suitability, non-infringement, or fitness for a particular purpose with respect to any such standard or classification. No warranty is given that the standard or classification will conform to any description thereof or be free of omissions, errors, interruptions, or defects. Without limiting any of the foregoing, in no event shall Alerian have any liability for any indirect, special, incidental, or consequential damages (including lost profits), arising out of any such standard or classification, even if notified of the possibility of such damages.

S&P 500 Total Return Index tracks the total return of the S&P 500 Index, an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. Dividends are reinvested. The S&P 500 is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe.

The S&P 500 Energy comprises those companies included in the S&P 500 that are classified as members of the GICS® energy sector.

Brent is a blend of crude oil recovered from the North Sea in the early 1960s, whose price is used as a benchmark for the commodity’s prices.

Crack Spread: A crack spread refers to the overall pricing difference between a barrel of crude oil and the petroleum products refined from it. It is an industry-specific type of gross processing margin. The “crack” being referred to is an industry term for breaking apart crude oil into the component products, including gases like propane, heating fuel, gasoline, light distillates, like jet fuel, intermediate distillates, like diesel fuel, and heavy distillates, like grease.

Distributable Cash Flow (DCF) is calculated as net income plus depreciation and other noncash items, less maintenance capital expenditure requirements. Distributable cash flow (DCF) data is CCM calculated consensus of Wall Street estimates. The estimated consensus weighted average distributable cash flow (DCF) per unit growth rate for the AMZ and our Model Portfolio incorporates market expectations by using the average annual growth rate using rolling-forward 24-month data. DCF growth rate is not a forecast of the portfolio’s future performance. DCF growth rate for the portfolio’s holdings does not guarantee a corresponding increase in the market value of the holding or the portfolio.

Distribution Coverage Ratio is calculated as cash available to limited partners divided by cash distributed to limited partners. It gives an indication of an MLP’s ability to make dividend payments to limited partner investors from operating cash flows. MLPs with a coverage ratio of in excess of 1.0 times are able to meet their dividend payments without external financing.

Distributions are quarterly payments, similar to dividends, made to Limited Partner (LP) and General Partner (GP) investors. These amounts are set by the GP and are supported by an MLP’s operating cash flows.

EBITDA is earnings before interest rates taxes depreciation and amortization.

Leverage is net debt divided by EBITDA.

Yield refers to the cash dividend or distribution divided by the share or unit price at a particular point in time.

This material is provided for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell any security, product or service.

Investment Advisor: Chickasaw Capital Management, LLC | 6075 Poplar Avenue, Memphis, Tennessee 38119 | p 901.537.1866 or 800.743.5410, f 901.537.1890 | [email protected]

Portfolio Managers: Geoffrey P. Mavar, Principal | Matthew G. Mead, Principal Earnings Growth is not a measure of the Fund’s future performance. Distributed by Quasar Distributors, LLC.

14 | MainGate mlp fund

Hypothetical Growth of a $10,000 Investment | unaudited

This chart illustrates the performance of a hypothetical $10,000 investment during the time period shown. Assumes reinvestment of dividends and capital gains. This chart does not imply any future performance.

Hypothetical Growth of a $1,000,000 Investment | unaudited

This chart illustrates the performance of a hypothetical $1,000,000 investment made in Class I shares during the time period shown. Assumes reinvestment of dividends and capital gains. This chart does not imply any future performance.

SEMI - ANNUAL REPORT 2022 ● 15

Average Annual Returns | May 31, 2022 | unaudited

| 1 Year | 5 Year | 10 Year | Since Inception | Inception Date | ||||||

| Class A (without sales load) | 36.60% | 1.75% | 3.43% | 3.41% | 2/17/11 | |||||

| Class A (with sales load) | 28.77% | 0.56% | 2.81% | 2.87% | 2/17/11 | |||||

| Class C | 35.54% | 0.97% | NA | -1.18% | 3/31/14 | |||||

| Class C (with CDSC) | 34.54% | 0.97% | NA | -1.18% | 3/31/14 | |||||

| Class I | 36.78% | 1.99% | 3.68% | 3.67% | 2/17/11 | |||||

| S&P 500 Index | -0.30% | 13.38% | 14.40% | 12.71% | 2/17/11 | |||||

| S&P 500 Index | -0.30% | 13.38% | NA | 12.31% | 3/31/14 | |||||

| Alerian MLP Total Return Index | 27.52% | 2.62% | 2.60% | 2.67% | 2/17/11 | |||||

| Alerian MLP Total Return Index | 27.52% | 2.62% | NA | -1.08% | 3/31/14 |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 855.MLP.FUND (855.657.3863) or by visiting www.maingatefunds.com.

Class A (with sales load) performance reflects the maximum sales charge of 5.75%. Class C (with CDSC) performance reflects the 1.00% contingent deferred sales charge. Class I is not subject to a sales charge or CDSC.

The S&P 500 Index is a broad based unmanaged index of 500 stocks, which is widely recognized as representative of the equity market in general. The Alerian MLP Total Return Index is a capped, float-adjusted, capitaliziation-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities.

You cannot invest directly in an index.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of the Fund shares.

16 | MainGate mlp fund

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, or other distributions; and exchange fees; and (2) ongoing costs, including management fees; distribution and/or service (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the six-month period from December 1, 2021 to May 31, 2022.

Actual Expenses

For each class, the first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class, the second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expense you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or exchange fees. Therefore, the second line of the table for each class is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| Beginning Account Value (12/01/21) |

Ending Account Value (5/31/22) |

Expenses Paid During Period(1) (12/01/21 – 5/31/22) |

Net Annualized Expense Ratio(2) |

|||||

| Class A Actual | $1,000.00 | $1,336.92 | $9.90 | 1.70% | ||||

| Class A Hypothetical | $1,000.00 | $1,016.45 | $8.55 | 1.70% | ||||

| (5% return before expenses) | ||||||||

| Class C Actual | $1,000.00 | $1,329.78 | $14.23 | 2.45% | ||||

| Class C Hypothetical | $1,000.00 | $1,012.72 | $12.29 | 2.45% | ||||

| (5% return before expenses) | ||||||||

| Class I Actual | $1,000.00 | $1,340.77 | $8.46 | 1.45% | ||||

| Class I Hypothetical | $1,000.00 | $1,017.70 | $7.29 | 1.45% | ||||

| (5% return before expenses) |

| (1) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 182 days (the number of days in the most recent period)/365 days (to reflect the period), for Class A, Class C and Class I. |

| (2) | Annualized expense ratio excludes current and deferred income and franchise tax expense. |

SEMI - ANNUAL REPORT 2022 ● 17

Allocation of Portfolio Assets

May 31, 2022 | unaudited

(expressed as a percentage of total investments)

Natural Gas Gathering/Processing* Natural Gas Gathering/Processing* |

40.2% |

Crude/Refined Products Pipelines and Storage* Crude/Refined Products Pipelines and Storage* |

36.8% |

Natural Gas/Natural Gas Liquid Pipelines and Storage* Natural Gas/Natural Gas Liquid Pipelines and Storage* |

23.0% |

*Master Limited Partnerships and Related Companies

Schedule of Investments | May 31, 2022 | (as restated, note 10) | unaudited

| Master Limited Partnerships and Related Companies - 98.8%(1) | Shares | Fair Value | |||

| Crude/Refined Products Pipelines and Storage - 36.4%(1) | |||||

| Canada - 0.4%(1) | |||||

| Enbridge, Inc. | 80,000 | $3,692,000 | |||

| United States - 36.0%(1) | |||||

| Genesis Energy, L.P. | 1,675,000 | 20,502,000 | |||

| Magellan Midstream Partners, L.P. | 1,200,000 | 62,040,000 | |||

| MPLX, L.P. | 2,950,000 | 97,202,500 | |||

| Phillips 66 | 270,000 | 27,218,700 | |||

| Plains All American Pipeline, L.P. | 2,975,000 | 33,885,250 | |||

| Plains GP Holdings, L.P. | 3,750,000 | 44,850,000 | |||

| Shell Midstream Partners, L.P. | 1,400,000 | 19,796,000 | |||

| 305,494,450 | |||||

| Total Crude/Refined Products Pipelines and Storage | 309,186,450 | ||||

| Natural Gas/Natural Gas Liquid Pipelines and Storage - 22.7%(1) | |||||

| Canada - 0.4%(1) | |||||

| TC Energy Corporation | 60,000 | 3,470,400 | |||

| United States - 22.3%(1) | |||||

| Cheniere Energy, Inc. | 75,000 | 10,257,750 | |||

| Energy Transfer, L.P. | 7,700,000 | 89,782,000 | |||

| Enterprise Products Partners, L.P. | 2,325,000 | 63,751,500 | |||

| Kinder Morgan, Inc. | 425,000 | 8,368,250 | |||

| Williams Companies, Inc. | 480,000 | 17,788,800 | |||

| 189,948,300 | |||||

| Total Natural Gas/Natural Gas Liquid Pipelines and Storage | 193,418,700 | ||||

| Natural Gas Gathering/Processing - 39.7%(1) | |||||

| United States - 39.7%(1) | |||||

| Antero Midstream Corporation | 725,000 | 7,873,500 | |||

| Crestwood Equity Partners, L.P. | 400,000 | 11,656,000 | |||

| DCP Midstream, L.P. | 1,025,000 | 36,807,750 | |||

| Enlink Midstream, LLC | 6,900,000 | 78,660,000 | |||

| Targa Resources Corporation | 1,300,000 | 93,626,000 | |||

| Western Midstream Partners, L.P. | 3,940,000 | 108,941,000 | |||

| Total Natural Gas Gathering/Processing | 337,564,250 | ||||

| Total Master Limited Partnerships and Related Companies (Cost $392,510,396) | 840,169,400 | ||||

| Total Investments - 98.8% (Cost $392,510,396)(1) | 840,169,400 | ||||

| Other Assets in Excess of Liabilities - 1.2%(1) | 9,876,947 | ||||

| Net Assets - 100.0%(1) | $850,046,347 |

(1) Calculated as a percentage of net assets.

| 18 | | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. |

Statement of Assets and Liabilities

May 31, 2022 | (as restated, note 10) | unaudited

Assets

| Investments at fair value (cost $392,510,396) | $840,169,400 |

| Cash(1) | 10,367,621 |

| Receivable for Fund shares sold | 1,374,820 |

| Dividends receivable | 378,104 |

| Prepaid expenses | 219,716 |

| Total assets | 852,509,661 |

| Liabilities | |

| Payable for Fund shares redeemed | 1,137,979 |

| Payable to Adviser | 866,700 |

| Payable for 12b-1 distribution fee | 47,643 |

| Payable to Trustees | 23,868 |

| Payable to Custodian | 9,767 |

| Accrued expenses and other liabilities | 377,357 |

| Total liabilities | 2,463,314 |

| Net assets | $850,046,347 |

| Net Assets Consist of | |

| Additional paid-in capital | $1,084,408,704 |

| Total distributable earnings, net of deferred taxes | (234,362,357) |

| Net assets | $850,046,347 |

| (1) | The Fund maintains cash in bank accounts which, at times, may exceed United States Federally insured limits. |

| Unlimited shares authorized, no par value | Class A | Class C | Class I |

| Net assets | $37,372,214 | $20,585,685 | $792,088,448 |

| Shares issued and outstanding | 5,569,144 | 3,293,296 | 112,788,303 |

| Net asset value, redemption price and minimum offering price per share | $6.71 | $6.25 | $7.02 |

| Maximum offering price per share ($6.71/0.9425) | $7.12 | NA | NA |

For the Six Months Ended

May 31, 2022 | (as restated, note 10) | unaudited

Investment Income

| Distributions received from master limited partnerships | $21,767,313 |

| Less: return of capital on distributions from master limited partnerships | (21,767,313) |

| Distribution income received in excess of return of capital | |

| from master limited partnerships | — |

| Dividends from common stock(2,3) | 7,023,625 |

| Total Investment Income | 7,023,625 |

| (2) | The return of capital amount from C-Corporations was $3,341,521. (See Note 2) |

| (3) | Net of foreign withholding tax of $31,751. |

Expenses

| Advisory fees | 4,998,953 |

| Administrator fees | 278,315 |

| Transfer agent expense | 141,071 |

| Insurance expense | 114,661 |

| Professional fees | 67,353 |

| Trustees’ fees | 47,868 |

| Registration fees | 44,166 |

| Compliance fees | 33,655 |

| Reports to shareholders | 31,976 |

| Custodian fees and expenses | 24,476 |

| Franchise tax expense | 12,466 |

| Fund accounting fees | 529 |

| 12b-1 distribution fee - Class A | 42,516 |

| 12b-1 distribution fee - Class C | 93,816 |

| Other expenses | 374 |

| Total Expenses | 5,932,195 |

| Net Investment Gain, before taxes | 1,091,430 |

| Current and deferred tax benefit/(expense)(4) | — |

| Net Investment Gain, net of taxes | 1,091,430 |

| Realized and Unrealized Gain/(Loss) on Investments | |

| Net realized gain/(loss) on investments, before taxes | 46,557,039 |

| Current and deferred tax benefit/(expense)(4) | — |

| Net realized gain/(loss) on investments, net of taxes | 46,557,039 |

| Net change in unrealized appreciation/depreciation on investments, before taxes | 191,979,441 |

| Deferred tax benefit/(expense)(4) | — |

| Net change in unrealized appreciation/depreciation on investments, net of taxes | 191,979,441 |

| Net realized and unrealized gain/(loss) on investments | 238,536,480 |

| Increase in Net Assets Resulting from Operations | $239,627,910 |

| (4) | Any tax benefit/(expense) was fully offset by a valuation allowance recorded as of May 31, 2022. |

| The accompanying notes are an integral part of the financial statements. | SEMI - ANNUAL REPORT 2022 ● 19 |

Statements of Changes in Net Assets

| For the Six Months | ||

| Operations | Ended May 31, 2022 | | |

| (as restated, note 10) | unaudited | Year Ended November 30, 2021 | |

| Net investment gain/(loss), net of deferred tax benefit/(expense) | $1,091,430 | $(10,146,785) |

| Net realized gain/(loss) on investments, net of deferred tax benefit/(expense) | 46,557,039 | (18,854,705) |

| Net change in unrealized appreciation/depreciation on investments, net of deferred tax benefit/(expense) | 191,979,441 | 317,060,430 |

| Increase/(Decrease) in net assets resulting from operations | 239,627,910 | 288,058,940 |

|

Dividends and Distributions to Class A Shareholders |

||

| Net investment income | (398,264) | (385,041) |

| Return of capital | (739,633) | (2,181,901) |

| Dividends and Distributions to Class C Shareholders | ||

| Net investment income | (232,986) | (233,611) |

| Return of capital | (432,688) | (1,323,793) |

| Dividends and Distributions to Class I Shareholders | ||

| Net investment income | (8,344,284) | (8,832,111) |

| Return of capital | (15,496,526) | (50,048,630) |

| Total dividends and distributions to Fund shareholders | (25,644,381) | (63,005,087) |

|

Capital Share Transactions (Note 8) |

||

| Proceeds from shareholder subscriptions | 58,692,591 | 139,804,363 |

| Dividend reinvestments | 21,127,433 | 51,077,187 |

| Payments for redemptions | (176,974,392) | (475,247,699) |

| Increase/(Decrease) in net assets from capital share transactions | (97,154,368) | (284,366,149) |

| Total increase/(decrease) in net assets | 116,829,161 | (59,312,296) |

|

Net Assets |

||

| Beginning of period | 733,217,186 | 792,529,482 |

| End of period | $850,046,347 | $733,217,186 |

| 20 | | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. |

Financial Highlights: Class A Shares

| Per Share Data(1) | Six Months Ended May 31, 2022 | (as restated, note 10) | unaudited |

Year Ended November 30, 2021 |

Year Ended November 30, 2020 |

Year Ended November 30, 2019 |

Year Ended November 30, 2018 |

Year Ended November 30, 2017 |

| Net Asset Value, beginning of period | $5.15 | $3.91 | $5.65 | $7.17 | $8.25 | $9.89 |

| Income from Investment Operations | ||||||

| Net investment gain (loss)(2) | 0.00* | (0.07) | (0.06) | (0.05) | (0.09) | (0.11) |

| Net realized and unrealized gain (loss) on investments | 1.76 | 1.71 | (1.22) | (0.84) | (0.36) | (0.90) |

| Total increase (decrease) from investment operations | 1.76 | 1.64 | (1.28) | (0.89) | (0.45) | (1.01) |

| Less Distributions to Shareholders | ||||||

| Net investment income | (0.07) | (0.06) | — | — | — | — |

| Return of capital | (0.13) | (0.34) | (0.46) | (0.63) | (0.63) | (0.63) |

| Total distributions to shareholders | (0.20) | (0.40) | (0.46) | (0.63) | (0.63) | (0.63) |

| Net Asset Value, end of period | $6.71 | $5.15 | $3.91 | $5.65 | $7.17 | $8.25 |

| Total Investment Return | 34.54%(3) | 42.66% | (22.61)% | (13.71)% | (6.24)% | (10.86)% |

| Supplemental Data and Ratios | ||||||

| Net assets, end of period | $37,372,214 | $30,569,903 | $28,693,359 | $60,839,754 | $93,423,336 | $140,857,758 |

| Ratio of Expenses to Average Net Assets(4,5,6) | ||||||

| Net deferred income and franchise tax (benefit) expense | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ | 0.01% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.70% | 1.68% | 1.72% | 1.69% | 1.66% | 1.65% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 1.70% | 1.68% | 1.72% | 1.69% | 1.66% | 1.65% |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.70% | 1.70% | 1.73% | 1.70% | 1.66% | 1.66% |

| Net Fund Expenses(4,5,6) | 1.70% | 1.70% | 1.73% | 1.70% | 1.66% | 1.66% |

| Ratio of Net Investment Income (Loss) to Average Net Assets(4,5,6) | ||||||

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | 0.06% | (1.44)% | (1.32)% | (0.71)% | (1.05)% | (1.11)% |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | 0.06% | (1.44)% | (1.32)% | (0.71)% | (1.05)% | (1.11)% |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | 0.06% | (1.46)% | (1.33)% | (0.72)% | (1.05)% | (1.12)% |

| Net Investment Income (Loss)(4,5,6) | 0.06% | (1.46)% | (1.33)% | (0.72)% | (1.05)% | (1.12)% |

| Portfolio turnover rate(7) | 1.05%(3) | 20.80% | 36.65% | 66.39% | 44.57% | 19.35% |

* Less than one cent per share.

‡ Less than 0.01%.

(1) Information presented relates to a share of Class A for the entire period. (2) Calculated using average shares outstanding method. (3) Not annualized. (4) For periods less than one full year all income and expenses are annualized. (5) For the period from December 1, 2021 to May 31, 2022, the Fund accrued $12,466 in franchise tax expense, of which $530 is attributable to Class A. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $5,904 is attributable to Class A. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $3,733 is attributable to Class A. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $5,253 is attributable to Class A. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $1,982 is attributable to Class A. For the year ended November 30, 2017, the Fund accrued $148,000 in franchise tax expense, of which $14,756 is attributable to Class A. (6) The Fund did not accrue a deferred tax expense or benefit. (7) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

| The accompanying notes are an integral part of the financial statements. | SEMI - ANNUAL REPORT 2022 ● 21 |

Financial Highlights: Class C Shares

| Per Share Data(1) | Six Months Ended May 31, 2022 | (as restated, note 10) | unaudited |

Year Ended November 30, 2021 |

Year Ended November 30, 2020 |

Year Ended November 30, 2019 |

Year Ended November 30, 2018 |

Year Ended November 30, 2017 |

| Net Asset Value, beginning of period | $4.82 | $3.72 | $5.43 | $6.97 | $8.09 | $9.78 |

| Income from Investment Operations | ||||||

| Net investment loss(2) | (0.02) | (0.10) | (0.08) | (0.10) | (0.14) | (0.17) |

| Net realized and unrealized gain (loss) on investments | 1.65 | 1.60 | (1.17) | (0.81) | (0.35) | (0.89) |

| Total increase (decrease) from investment operations | 1.63 | 1.50 | (1.25) | (0.91) | (0.49) | (1.06) |

| Less Distributions to Shareholders | ||||||

| Net investment income | (0.07) | (0.06) | — | — | — | — |

| Return of capital | (0.13) | (0.34) | (0.46) | (0.63) | (0.63) | (0.63) |

| Total distributions to shareholders | (0.20) | (0.40) | (0.46) | (0.63) | (0.63) | (0.63) |

| Net Asset Value, end of period | $6.25 | $4.82 | $3.72 | $5.43 | $6.97 | $8.09 |

| Total Investment Return | 34.20%(3) | 41.02% | (22.99)% | (14.42)% | (6.88)% | (11.51)% |

| Supplemental Data and Ratios | ||||||

| Net assets, end of period | $20,585,685 | $17,119,406 | $16,108,024 | $33,310,916 | $52,049,211 | $62,803,141 |

| Ratio of Expenses to Average Net Assets(4,5,6) | ||||||

| Net deferred income and franchise tax (benefit) expense | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ | 0.01% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 2.45% | 2.43% | 2.46% | 2.44% | 2.41% | 2.40% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 2.45% | 2.43% | 2.46% | 2.44% | 2.41% | 2.40% |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 2.45% | 2.45% | 2.47% | 2.45% | 2.41% | 2.41% |

| Net Fund Expenses(4,5,6) | 2.45% | 2.45% | 2.47% | 2.45% | 2.41% | 2.41% |

| Ratio of Net Investment Income (Loss) to Average Net Assets(4,5,6) | ||||||

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.69)% | (2.19)% | (2.06)% | (1.46)% | (1.80)% | (1.86)% |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | (0.69)% | (2.19)% | (2.06)% | (1.46)% | (1.80)% | (1.86)% |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | (0.69)% | (2.21)% | (2.07)% | (1.47)% | (1.80)% | (1.87)% |

| Net Investment Income (Loss)(4,5,6) | (0.69)% | (2.21)% | (2.07)% | (1.47)% | (1.80)% | (1.87)% |

| Portfolio turnover rate(7) | 1.05%(3) | 20.80% | 36.65% | 66.39% | 44.57% | 19.35% |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class C for the entire period. (2) Calculated using average shares outstanding method. (3) Not annualized. (4) For periods less than one full year all income and expenses are annualized. (5) For the period from December 1, 2021 to May 31, 2022, the Fund accrued $12,466 in franchise tax expense, of which $292 is attributable to Class C. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $3,367 is attributable to Class C. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $2,149 is attributable to Class C. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $2,996 is attributable to Class C. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $1,007 is attributable to Class C. For the year ended November 30, 2017, the Fund accrued $148,000 in franchise tax expense, of which $5,467 is attributable to Class C. (6) The Fund did not accrue a deferred tax expense or benefit. (7) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

| 22 | | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. |

Financial Highlights: Class I Shares

| Per Share Data(1) | Six Months Ended May 31, 2022 | (as restated, note 10) | unaudited |

Year Ended November 30, 2021 |

Year Ended November 30, 2020 |

Year Ended November 30, 2019 |

Year Ended November 30, 2018 |

Year Ended November 30, 2017 |

| Net Asset Value, beginning of period | $5.37 | $4.06 | $5.83 | $7.36 | $8.43 | $10.07 |

| Income from Investment Operations | ||||||

| Net investment gain (loss)(2) | 0.01 | (0.06) | (0.05) | (0.03) | (0.07) | (0.08) |

| Net realized and unrealized gain (loss) on investments | 1.84 | 1.77 | (1.26) | (0.87) | (0.37) | (0.93) |

| Total increase (decrease) from investment operations | 1.85 | 1.71 | (1.31) | (0.90) | (0.44) | (1.01) |

| Less Distributions to Shareholders | ||||||

| Net investment income | (0.07) | (0.06) | — | — | — | — |

| Return of capital | (0.13) | (0.34) | (0.46) | (0.63) | (0.63) | (0.63) |

| Total distributions to shareholders | (0.20) | (0.40) | (0.46) | (0.63) | (0.63) | (0.63) |

| Net Asset Value, end of period | $7.02 | $5.37 | $4.06 | $5.83 | $7.36 | $8.43 |

| Total Investment Return | 34.80%(3) | 42.82% | (22.42)% | (13.48)% | (5.98)% | (10.66)% |

| Supplemental Data and Ratios | ||||||

| Net assets, end of period | $792,088,448 | $685,527,877 | $747,728,099 | $967,800,549 | $1,220,133,792 | $1,403,597,144 |

| Ratio of Expenses to Average Net Assets(4,5,6) | ||||||

| Net deferred income and franchise tax (benefit) expense | 0.00%‡ | 0.02% | 0.01% | 0.01% | 0.00%‡ | 0.01% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.45% | 1.43% | 1.46% | 1.44% | 1.41% | 1.40% |

| Expenses (excluding net deferred income and franchise tax (benefit) expense) after (waiver) recoupment | 1.45% | 1.43% | 1.46% | 1.44% | 1.41% | 1.40% |

| Expenses (including net deferred income and franchise tax (benefit) expense) before (waiver) recoupment | 1.45% | 1.45% | 1.47% | 1.45% | 1.41% | 1.41% |

| Net Fund Expenses(4,5,6) | 1.45% | 1.45% | 1.47% | 1.45% | 1.41% | 1.41% |

| Ratio of Net Investment Income (Loss) to Average Net Assets(4,5,6) | ||||||

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | 0.31% | (1.19)% | (1.07)% | (0.46)% | (0.80)% | (0.86)% |

| Net investment income (loss) (excluding net deferred tax benefit and franchise tax benefit (expense)) after waiver (recoupment) | 0.31% | (1.19)% | (1.07)% | (0.46)% | (0.80)% | (0.86)% |

| Net investment income (loss) (including net deferred tax benefit and franchise tax benefit (expense)) before waiver (recoupment) | 0.31% | (1.21)% | (1.08)% | (0.47)% | (0.80)% | (0.87% |

| Net Investment Income (Loss)(4,5,6) | 0.31% | (1.21)% | (1.08)% | (0.47)% | (0.80)% | (0.87)% |

| Portfolio turnover rate(7) | 1.05%(3) | 20.80% | 36.65% | 66.39% | 44.57% | 19.35% |

‡ Less than 0.01%.

(1) Information presented relates to a share of Class I for the entire period. (2) Calculated using average shares outstanding method. (3) Not annualized. (4) For periods less than one full year all income and expenses are annualized. (5) For the period from December 1, 2021 to May 31, 2022, the Fund accrued $12,466 in franchise tax expense, of which $11,643 is attributable to Class I. For the year ended November 30, 2021, the Fund accrued $149,925 in franchise tax expense, of which $140,654 is attributable to Class I. For the year ended November 30, 2020, the Fund accrued $87,319 in franchise tax expense, of which $81,437 is attributable to Class I. For the year ended November 30, 2019, the Fund accrued $85,100 in franchise tax expense, of which $76,851 is attributable to Class I. For the year ended November 30, 2018, the Fund accrued $26,903 in franchise tax expense, of which $23,914 is attributable to Class I. For the year ended November 30, 2017, the Fund accrued $148,000 in franchise tax expense, of which $127,777 is attributable to Class I. (6) The Fund did not accrue a deferred tax expense or benefit. (7) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

| The accompanying notes are an integral part of the financial statements. | SEMI - ANNUAL REPORT 2022 ● 23 |

May 31, 2022 | unaudited

1. Organization

MainGate MLP Fund (the “Fund”), a series of MainGate Trust (the “Trust”), is registered under the Investment Company Act of 1940 as an open-end, non-diversified investment company. The Trust was established under the laws of Delaware by an Agreement and Declaration of Trust dated November 3, 2010. The Fund’s investment objective is total return. Class A and Class I commenced operations on February 17, 2011. Class C commenced operations on March 31, 2014.

The Fund offers three classes of shares: Class A, Class C and Class I. Depending on the size of the initial purchase, Class A shares are subject to a maximum 5.75% front-end sales charge or a 1.00% contingent deferred sales charge if shares are redeemed within 18 months. Class C shares have no front-end sales charge, but are subject to a 1.00% contingent deferred sales charge within 12 months of redemption. Class I shares have no sales charge. Class A shareholders pay Rule 12b-1 fees at the annual rate of 0.25% of average daily net assets. Class C shareholders pay Rule 12b-1 fees at the annual rate of 1.00% of average daily net assets. For the period ended May 31, 2022, contingent deferred sales charges of $– and $17 were incurred by Class A and Class C shareholders, respectively.

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standards Board Codification Topic 946 Financial Services— Investment Companies.

2. Significant Accounting Policies

A. Use of Estimates. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the recognition of distribution income and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

B. Investment Valuation. The Fund uses the following valuation methods to determine fair value as either current market value for investments for which market quotations are available, or if not available, a fair value, as determined in good faith pursuant to such policies and procedures as may be approved by the Trust’s Board of Trustees (“Board of Trustees”) from time to time. The valuation of the portfolio securities of the Fund currently includes the following processes:

| ● | Equity Securities: Securities listed on a securities exchange or an automated quotation system for which quotations are readily available, including securities traded over the counter, will be valued at the last quoted sale price on the principal exchange on which they are traded on the valuation date (or at approximately 4:00 p.m. Eastern Time if a security’s principal exchange is normally open at that time), or, if there is no such reported sale on the valuation date, at the most recent quoted bid price. |

| ● | Fixed Income Securities: Debt and fixed income securities will be priced by independent, third-party pricing agents approved by the Board of Trustees. These third-party pricing agents will employ methodologies that they believe are appropriate, including actual market transactions, broker-dealer supplied valuations, matrix pricing, or other electronic data processing techniques. These techniques generally consider such factors as security prices, yields, maturities, call features, ratings and developments relating to specific securities in arriving at valuations. Debt obligations with remaining maturities of sixty days or less will be valued at their amortized cost, which approximates fair market value. |

| ● | Foreign Securities: Foreign securities are often principally traded on markets that close at different hours than U.S. markets. Such securities will be valued at their most recent closing prices on the relevant principal exchange even if the close of that exchange is earlier than the time of the Fund’s net asset value (“NAV”) calculation. However, securities traded in foreign markets which remain open as of the time of the NAV calculation will be valued at the most recent sales price as of the time of the NAV calculation. In addition, prices for certain foreign securities may be obtained from the Fund’s approved pricing sources. The Adviser also monitors for the occurrence of significant events that may cast doubts on the reliability of previously obtained market prices for foreign securities held by the Fund. The prices for foreign securities will be reported in local currency and converted to U.S. dollars using currency exchange rates. Exchange rates will be provided daily by recognized independent pricing agents. The exchange rates used for the conversion will be captured as of the London close each day. |

C. Security Transactions, Investment Income and Expenses. Security transactions are accounted for on the date the securities are purchased or sold (trade date). Realized gains and losses are reported on a specific identified cost basis. Interest income is recognized on the accrual basis, including amortization of premiums and accretion of discounts. Distributions are recorded on the ex-dividend date. Distributions received from the Fund’s investments in master limited partnerships (“MLPs”), including MLP general partnership interests, generally are comprised of ordinary income and return of capital. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and regulations.

| 24 | | MainGate mlp fund | The accompanying notes are an integral part of the financial statements. |

For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution income received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded, as the actual character of these distributions is not known until after the fiscal year end of the Fund.