Form N-CSRS FIDELITY MASSACHUSETTS For: Jul 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-03361

Fidelity Massachusetts Municipal Trust

(Exact name of registrant as specified in charter)

245 Summer St., Boston, MA 02210

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette, Secretary

245 Summer St.

Boston, Massachusetts 02210

(Name and address of agent for service)

Registrant's telephone number, including area code:

617-563-7000

Date of fiscal year end: | January 31 |

Date of reporting period: | July 31, 2021 |

Item 1.

Reports to Stockholders

Fidelity® Massachusetts Municipal Income Fund

Fidelity® Massachusetts Municipal Money Market Fund

Semi-Annual Report

July 31, 2021

Contents

|

Fidelity® Massachusetts Municipal Income Fund | |

|

Fidelity® Massachusetts Municipal Money Market Fund | |

To view a fund's proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission's (SEC) web site at http://www.sec.gov.

You may also call 1-800-544-8544 to request a free copy of the proxy voting guidelines.

Standard & Poor's, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation.

Other third-party marks appearing herein are the property of their respective owners.

All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved.

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Funds. This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus.

A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. A fund's Forms N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information regarding the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

For a complete list of a fund's portfolio holdings, view the most recent holdings listing, semiannual report, or annual report on Fidelity's web site at http://www.fidelity.com, http://www.institutional.fidelity.com, or http://www.401k.com, as applicable.

NOT FDIC INSURED •MAY LOSE VALUE •NO BANK GUARANTEE

Neither the Funds nor Fidelity Distributors Corporation is a bank.

Note to Shareholders:

Early in 2020, the outbreak and spread of a new coronavirus emerged as a public health emergency that had a major influence on financial markets, primarily based on its impact on the global economy and the outlook for corporate earnings. The virus causes a respiratory disease known as COVID-19. On March 11, 2020 the World Health Organization declared the COVID-19 outbreak a pandemic, citing sustained risk of further global spread.

In the weeks following, as the crisis worsened, we witnessed an escalating human tragedy with wide-scale social and economic consequences from coronavirus-containment measures. The outbreak of COVID-19 prompted a number of measures to limit the spread, including travel and border restrictions, quarantines, and restrictions on large gatherings. In turn, these resulted in lower consumer activity, diminished demand for a wide range of products and services, disruption in manufacturing and supply chains, and – given the wide variability in outcomes regarding the outbreak – significant market uncertainty and volatility. Amid the turmoil, global governments and central banks took unprecedented action to help support consumers, businesses, and the broader economies, and to limit disruption to financial systems.

The situation continues to unfold, and the extent and duration of its impact on financial markets and the economy remain highly uncertain. Extreme events such as the coronavirus crisis are “exogenous shocks” that can have significant adverse effects on mutual funds and their investments. Although multiple asset classes may be affected by market disruption, the duration and impact may not be the same for all types of assets.

Fidelity is committed to helping you stay informed amid news about COVID-19 and during increased market volatility, and we’re taking extra steps to be responsive to customer needs. We encourage you to visit our websites, where we offer ongoing updates, commentary, and analysis on the markets and our funds.

Fidelity® Massachusetts Municipal Income Fund

Investment Summary (Unaudited)

Top Five Sectors as of July 31, 2021

| % of fund's net assets | |

| General Obligations | 21.7 |

| Education | 20.6 |

| Health Care | 16.5 |

| Special Tax | 16.2 |

| Transportation | 10.0 |

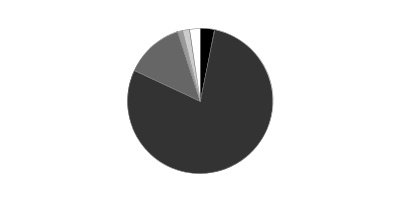

Quality Diversification (% of fund's net assets)

| As of July 31, 2021 | ||

| AAA | 3.3% | |

| AA,A | 78.6% | |

| BBB | 13.1% | |

| BB and Below | 1.1% | |

| Not Rated | 1.7% | |

| Short-Term Investments and Net Other Assets | 2.2% | |

We have used ratings from Moody's Investors Service, Inc. Where Moody's® ratings are not available, we have used S&P® ratings. All ratings are as of the date indicated and do not reflect subsequent changes.

Fidelity® Massachusetts Municipal Income Fund

Schedule of Investments July 31, 2021 (Unaudited)

Showing Percentage of Net Assets

| Municipal Bonds - 97.8% | |||

| Principal Amount | Value | ||

| Guam - 0.0% | |||

| Guam Int'l. Arpt. Auth. Rev. Series C, 5% 10/1/21 (Escrowed to Maturity) (a) | 455,000 | 458,335 | |

| Massachusetts - 97.6% | |||

| Amesbury Gen. Oblig. Series 2020, 5% 6/1/28 | 1,440,000 | 1,862,837 | |

| Attleboro Gen. Oblig. Series 70 B, 5% 10/15/29 | 1,585,000 | 2,055,316 | |

| Berkshire Wind Pwr. Coop. Corp. Series 2017 2: | |||

| 5% 7/1/22 | $350,000 | $365,304 | |

| 5% 7/1/25 | 505,000 | 590,961 | |

| 5% 7/1/26 | 925,000 | 1,116,789 | |

| 5% 7/1/27 | 700,000 | 869,080 | |

| 5% 7/1/30 | 480,000 | 590,170 | |

| Blue Hills Reg'l. Technical Series 2019, 4% 2/1/49 | 2,000,000 | 2,326,521 | |

| Boston Gen. Oblig.: | |||

| Series A, 4% 11/1/31 | 4,780,000 | 6,086,019 | |

| Series B: | |||

| 5% 11/1/35 | 6,000,000 | 8,096,306 | |

| 5% 11/1/40 | 5,205,000 | 6,936,264 | |

| Braintree Gen. Oblig. Series 2015: | |||

| 5% 5/15/26 | 2,300,000 | 2,803,896 | |

| 5% 5/15/27 | 2,000,000 | 2,514,568 | |

| 5% 5/15/28 | 600,000 | 774,367 | |

| Brookline Gen. Oblig. Series 2020, 5% 3/15/28 | 3,075,000 | 3,965,438 | |

| Cambridge Gen. Oblig. Series 12: | |||

| 5% 1/1/23 | 865,000 | 882,549 | |

| 5% 1/1/24 | 340,000 | 346,912 | |

| Framingham Gen. Oblig. Series 2012 A, 4% 12/1/24 | 1,360,000 | 1,428,835 | |

| Lowell Gen. Oblig. Series 2019: | |||

| 5% 9/1/28 | 1,215,000 | 1,581,740 | |

| 5% 9/1/29 | 700,000 | 905,010 | |

| Lynn Wtr. & Swr. Commission Gen. Rev. Series 2003 A, 5% 12/1/32 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 440,000 | 441,599 | |

| Massachusetts Bay Trans. Auth. Sales Tax Rev.: | |||

| Series 2003 C, 5.25% 7/1/23 | 3,950,000 | 4,338,994 | |

| Series 2004 B, 5.25% 7/1/30 | 5,000,000 | 6,581,168 | |

| Series 2005 B, 5.5% 7/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 4,000,000 | 5,450,767 | |

| Series 2006 A: | |||

| 5.25% 7/1/29 | 3,005,000 | 4,037,330 | |

| 5.25% 7/1/32 | 16,745,000 | 24,002,383 | |

| Series 2015 A: | |||

| 5% 7/1/40 | 14,570,000 | 17,081,677 | |

| 5% 7/1/45 | 14,125,000 | 16,561,492 | |

| Series 2021 A1, 4% 7/1/51 | 11,000,000 | 13,347,239 | |

| Massachusetts Clean Energy Coop. Corp. Series 2013: | |||

| 5% 7/1/25 | 2,795,000 | 3,040,041 | |

| 5% 7/1/30 | 3,725,000 | 4,032,808 | |

| Massachusetts Clean Wtr. Trust: | |||

| (Pool Prog.) Series 2004 A, 5.25% 2/1/24 | 1,170,000 | 1,319,757 | |

| Series 18: | |||

| 5% 2/1/28 | 3,500,000 | 3,921,528 | |

| 5% 2/1/29 | 6,355,000 | 7,111,901 | |

| Series 2012 B: | |||

| 5% 8/1/27 | 295,000 | 309,342 | |

| 5% 8/1/28 | 330,000 | 346,043 | |

| Series 2020, 5% 8/1/26 | 5,000,000 | 6,148,205 | |

| Series 2021 B, 5% 2/1/41 | 2,000,000 | 2,666,892 | |

| Series 22, 5% 8/1/37 | 4,110,000 | 5,350,774 | |

| Series 6, 5.5% 8/1/30 | 1,310,000 | 1,315,331 | |

| Massachusetts Commonwealth Trans. Fund Rev.: | |||

| (Accelerated Bridge Prog.) Series 2014 A, 5% 6/1/44 | 22,295,000 | 25,185,738 | |

| (Rail Enhancement & Accelerated Bridge Prog.) Series 2018 A: | |||

| 5% 6/1/35 | 2,885,000 | 3,665,322 | |

| 5% 6/1/36 | 3,035,000 | 3,846,856 | |

| (Rail Enhancement & Accelerated Bridge Progs.) Series 2018 A, 5.25% 6/1/43 | 14,575,000 | 18,608,238 | |

| (Rail Enhancement Prog.): | |||

| Series 2015 A, 5% 6/1/45 | 17,750,000 | 20,754,532 | |

| Series 2021 B, 5% 6/1/41 | 6,000,000 | 7,556,488 | |

| Series 2017 A, 5% 6/1/32 | 4,580,000 | 5,766,210 | |

| Series 2021 A: | |||

| 4% 6/1/50 | 1,050,000 | 1,253,149 | |

| 5% 6/1/51 | 5,435,000 | 6,988,527 | |

| Series 2021 B, 5% 6/1/46 | 1,555,000 | 2,008,041 | |

| Massachusetts Dept. of Trans. Metropolitan Hwy. Sys. Rev.: | |||

| Series A: | |||

| 5% 1/1/24 | 1,175,000 | 1,310,470 | |

| 5% 1/1/25 | 3,990,000 | 4,640,737 | |

| 5% 1/1/35 | 3,500,000 | 4,427,112 | |

| 5% 1/1/37 | 2,000,000 | 2,511,125 | |

| Series C, 5% 1/1/34 | 8,585,000 | 11,001,489 | |

| Massachusetts Dev. Fin. Agcy. Hosp. Rev. Series 2013: | |||

| 5.25% 11/15/36 (Pre-Refunded to 11/15/23 @ 100) | 3,000,000 | 3,341,300 | |

| 5.25% 11/15/41 (Pre-Refunded to 11/15/23 @ 100) | 4,620,000 | 5,145,601 | |

| Massachusetts Dev. Fin. Agcy. Multi-family Hsg. Rev. Bonds Series 2019, 1.39%, tender 2/1/22 (b) | 4,950,000 | 4,978,028 | |

| Massachusetts Dev. Fin. Agcy. Rev.: | |||

| (Babson College, MA. Proj.) Series 2017: | |||

| 5% 10/1/28 | 465,000 | 582,438 | |

| 5% 10/1/29 | 735,000 | 920,557 | |

| 5% 10/1/42 | 4,000,000 | 4,943,876 | |

| 5% 10/1/47 | 5,500,000 | 6,759,799 | |

| (Boston College Proj.) Series T: | |||

| 5% 7/1/37 | 1,415,000 | 1,731,546 | |

| 5% 7/1/38 | 3,685,000 | 4,509,309 | |

| 5% 7/1/39 | 4,450,000 | 5,447,842 | |

| 5% 7/1/42 | 2,805,000 | 3,426,451 | |

| (Broad Institute Proj.) Series 2017: | |||

| 5% 4/1/33 | 10,145,000 | 12,611,131 | |

| 5% 4/1/34 | 2,500,000 | 3,100,453 | |

| 5% 4/1/35 | 2,455,000 | 3,039,953 | |

| 5% 4/1/37 | 1,500,000 | 1,849,280 | |

| (Broad Institute Proj.) Series 2017, 5% 4/1/36 | 2,205,000 | 2,724,020 | |

| (Lesley Univ. Proj.) Series 2016: | |||

| 5% 7/1/29 | 1,640,000 | 1,956,544 | |

| 5% 7/1/32 | 1,905,000 | 2,259,402 | |

| (Newbridge On The Charles Proj.) Series 2017: | |||

| 4% 10/1/24 (c) | 500,000 | 546,777 | |

| 4% 10/1/25 (c) | 500,000 | 546,401 | |

| 4% 10/1/26 (c) | 500,000 | 545,650 | |

| 4% 10/1/27 (c) | 350,000 | 381,605 | |

| 4.125% 10/1/42 (c) | 2,500,000 | 2,702,990 | |

| 5% 10/1/37 (c) | 1,000,000 | 1,097,472 | |

| 5% 10/1/47 (c) | 1,000,000 | 1,094,848 | |

| 5% 10/1/57 (c) | 6,000,000 | 6,561,614 | |

| (Partners Healthcare Sys., Inc. Proj.) Series 2017 S: | |||

| 5% 7/1/25 | 1,000,000 | 1,183,006 | |

| 5% 7/1/31 | 21,180,000 | 26,643,459 | |

| 5% 7/1/32 | 985,000 | 1,237,549 | |

| 5% 7/1/34 | 750,000 | 939,839 | |

| (Suffolk Univ. Proj.) Series 2017: | |||

| 5% 7/1/22 | 875,000 | 912,518 | |

| 5% 7/1/23 | 2,420,000 | 2,636,516 | |

| 5% 7/1/24 | 2,000,000 | 2,266,531 | |

| 5% 7/1/25 | 1,500,000 | 1,761,059 | |

| 5% 7/1/26 | 1,935,000 | 2,345,588 | |

| 5% 7/1/27 | 2,085,000 | 2,599,530 | |

| 5% 7/1/28 | 4,300,000 | 5,328,499 | |

| (Suffolk Univ., Proj.) Series 2017, 5% 7/1/32 | 1,000,000 | 1,215,044 | |

| (UMASS Boston Student Hsg. Proj.) Series 2016: | |||

| 5% 10/1/29 | 3,120,000 | 3,645,107 | |

| 5% 10/1/30 | 1,100,000 | 1,280,388 | |

| 5% 10/1/31 | 1,200,000 | 1,394,207 | |

| 5% 10/1/32 | 1,240,000 | 1,437,356 | |

| 5% 10/1/33 | 1,235,000 | 1,428,258 | |

| (UMass Memorial Health Care Proj.) Series K: | |||

| 5% 7/1/28 | 1,260,000 | 1,539,445 | |

| 5% 7/1/29 | 1,320,000 | 1,603,935 | |

| 5% 7/1/30 | 1,390,000 | 1,680,318 | |

| 5% 7/1/38 | 3,750,000 | 4,509,009 | |

| (Univ. of Massachusetts Health Cr., Inc. Proj.) Series 2017 L, 4% 7/1/44 | 7,000,000 | 7,923,968 | |

| (Wentworth Institute of Technology Proj.) Series 2017: | |||

| 5% 10/1/34 | 1,425,000 | 1,694,283 | |

| 5% 10/1/35 | 1,495,000 | 1,774,729 | |

| 5% 10/1/46 | 4,250,000 | 4,970,170 | |

| (Wheaton College, MA. Proj.) Series 2017 H: | |||

| 5% 1/1/29 | 1,435,000 | 1,785,544 | |

| 5% 1/1/31 | 1,580,000 | 1,938,887 | |

| 5% 1/1/32 | 1,665,000 | 2,037,236 | |

| 5% 1/1/33 | 1,745,000 | 2,128,909 | |

| 5% 1/1/34 | 1,835,000 | 2,233,266 | |

| 5% 1/1/35 | 1,000,000 | 1,214,743 | |

| 5% 1/1/36 | 1,000,000 | 1,211,460 | |

| 5% 1/1/42 | 5,775,000 | 6,925,401 | |

| 5% 1/1/47 | 1,895,000 | 2,259,406 | |

| 5% 1/1/53 | 3,425,000 | 4,068,331 | |

| Bonds Series A1, 5%, tender 1/31/30 (b) | 15,280,000 | 20,075,622 | |

| Series 2008 B: | |||

| 0% 1/1/37 (Assured Guaranty Corp. Insured) | 1,745,000 | 1,262,224 | |

| 0% 1/1/40 (Assured Guaranty Corp. Insured) | 5,000,000 | 3,306,027 | |

| 0% 1/1/41 (Assured Guaranty Corp. Insured) | 5,000,000 | 3,206,226 | |

| 0% 1/1/42 (Assured Guaranty Corp. Insured) | 5,000,000 | 3,105,944 | |

| Series 2012 C: | |||

| 5.25% 7/1/25 | 1,000,000 | 1,044,618 | |

| 5.25% 7/1/26 | 1,000,000 | 1,043,610 | |

| Series 2012 G: | |||

| 5% 10/1/23 | 2,245,000 | 2,262,751 | |

| 5% 10/1/24 | 1,625,000 | 1,637,849 | |

| 5% 10/1/25 | 1,600,000 | 1,612,651 | |

| 5% 10/1/27 | 2,235,000 | 2,252,672 | |

| 5% 10/1/28 | 1,240,000 | 1,249,805 | |

| Series 2013 F: | |||

| 4% 7/1/32 | 2,050,000 | 2,151,408 | |

| 4% 7/1/43 | 21,685,000 | 22,605,906 | |

| 5% 7/1/27 | 1,300,000 | 1,408,856 | |

| 5% 7/1/37 | 3,925,000 | 4,190,288 | |

| Series 2013 G, 5% 7/1/44 | 10,320,000 | 11,184,153 | |

| Series 2013 P, 5% 7/1/43 | 12,320,000 | 13,355,528 | |

| Series 2013 X, 5% 10/1/48 | 14,920,000 | 16,310,581 | |

| Series 2014 A: | |||

| 5% 3/1/32 | 1,700,000 | 1,899,108 | |

| 5% 3/1/33 | 1,250,000 | 1,396,061 | |

| 5% 3/1/34 | 4,375,000 | 4,883,814 | |

| 5% 3/1/39 | 4,000,000 | 4,461,916 | |

| 5% 3/1/44 | 15,765,000 | 17,576,903 | |

| Series 2014 F: | |||

| 5% 7/15/22 | 400,000 | 414,484 | |

| 5% 7/15/23 | 350,000 | 375,753 | |

| 5% 7/15/24 | 400,000 | 434,521 | |

| 5% 7/15/25 | 550,000 | 596,341 | |

| 5% 7/15/26 | 500,000 | 541,035 | |

| 5% 7/15/27 | 200,000 | 215,970 | |

| 5% 7/15/28 | 320,000 | 344,798 | |

| 5.625% 7/15/36 | 800,000 | 858,128 | |

| 5.75% 7/15/43 | 4,700,000 | 5,032,504 | |

| Series 2014 P: | |||

| 5% 10/1/32 | 5,000,000 | 5,726,046 | |

| 5% 10/1/46 | 7,080,000 | 8,074,407 | |

| Series 2015 D, 5% 7/1/44 | 10,975,000 | 12,528,804 | |

| Series 2015 F, 5% 8/15/45 | 18,290,000 | 21,195,741 | |

| Series 2015 H1: | |||

| 5% 7/1/26 | 3,585,000 | 4,219,614 | |

| 5% 7/1/29 | 3,750,000 | 4,374,062 | |

| 5% 7/1/30 | 1,800,000 | 2,097,273 | |

| 5% 7/1/31 | 1,190,000 | 1,385,028 | |

| 5% 7/1/32 | 1,000,000 | 1,162,627 | |

| 5% 7/1/33 | 1,000,000 | 1,161,368 | |

| Series 2015 K, 4% 10/1/30 | 500,000 | 559,006 | |

| Series 2015 O2: | |||

| 5% 7/1/27 | 8,635,000 | 10,152,523 | |

| 5% 7/1/29 (Pre-Refunded to 7/1/25 @ 100) | 4,495,000 | 5,325,475 | |

| Series 2015 Q: | |||

| 5% 8/15/28 | 1,000,000 | 1,177,811 | |

| 5% 8/15/29 | 1,000,000 | 1,177,272 | |

| 5% 8/15/32 | 1,500,000 | 1,761,735 | |

| 5% 8/15/33 | 1,550,000 | 1,818,169 | |

| 5% 8/15/34 | 1,790,000 | 2,098,005 | |

| 5% 8/15/38 | 1,690,000 | 1,970,213 | |

| Series 2015: | |||

| 5% 1/1/25 | 3,525,000 | 4,066,001 | |

| 5% 1/1/27 | 2,695,000 | 3,084,683 | |

| 5% 1/1/28 | 1,850,000 | 2,108,587 | |

| 5% 1/1/29 | 2,945,000 | 3,341,193 | |

| Series 2016 A, 5.25% 1/1/42 | 7,000,000 | 8,304,730 | |

| Series 2016 E: | |||

| 5% 7/1/31 | 1,000,000 | 1,182,986 | |

| 5% 7/1/32 | 2,200,000 | 2,597,729 | |

| 5% 7/1/33 | 1,500,000 | 1,767,755 | |

| 5% 7/1/34 | 1,500,000 | 1,764,418 | |

| 5% 7/1/35 | 1,500,000 | 1,762,619 | |

| 5% 7/1/36 | 1,000,000 | 1,173,126 | |

| 5% 7/1/37 | 2,000,000 | 2,342,339 | |

| Series 2016 I: | |||

| 5% 7/1/25 | 510,000 | 595,518 | |

| 5% 7/1/27 | 1,150,000 | 1,392,203 | |

| 5% 7/1/27 | 1,100,000 | 1,322,219 | |

| 5% 7/1/29 | 1,680,000 | 2,006,047 | |

| 5% 7/1/30 | 2,400,000 | 2,862,452 | |

| 5% 7/1/31 | 2,400,000 | 2,859,409 | |

| 5% 7/1/32 | 1,960,000 | 2,332,908 | |

| 5% 7/1/34 | 3,035,000 | 3,632,363 | |

| 5% 7/1/36 | 2,000,000 | 2,389,338 | |

| 5% 7/1/37 | 1,470,000 | 1,754,785 | |

| 5% 7/1/38 | 1,000,000 | 1,192,659 | |

| 5% 7/1/41 | 14,790,000 | 17,445,204 | |

| Series 2016 N: | |||

| 5% 12/1/34 | 1,000,000 | 1,212,512 | |

| 5% 12/1/36 | 2,520,000 | 3,046,775 | |

| Series 2016: | |||

| 4% 10/1/36 | 1,250,000 | 1,424,971 | |

| 5% 7/1/26 | 1,710,000 | 2,073,769 | |

| 5% 7/1/29 | 2,000,000 | 2,396,661 | |

| 5% 7/1/30 | 2,000,000 | 2,386,437 | |

| 5% 7/1/31 | 1,700,000 | 2,026,315 | |

| 5% 10/1/32 | 1,760,000 | 2,117,281 | |

| 5% 9/1/33 | 475,000 | 573,837 | |

| 5% 10/1/33 | 1,500,000 | 1,802,517 | |

| 5% 10/1/34 | 1,500,000 | 1,799,260 | |

| 5% 9/1/35 | 375,000 | 451,303 | |

| 5% 10/1/35 | 1,500,000 | 1,797,274 | |

| 5% 7/1/36 | 3,000,000 | 3,576,051 | |

| 5% 9/1/36 | 315,000 | 378,527 | |

| 5% 9/1/37 | 840,000 | 1,009,050 | |

| 5% 10/1/37 | 2,000,000 | 2,395,540 | |

| 5% 10/1/39 | 5,000,000 | 5,977,235 | |

| 5% 7/1/40 | 5,325,000 | 6,337,735 | |

| 5% 7/1/41 | 5,145,000 | 6,125,505 | |

| 5% 10/1/43 | 5,000,000 | 5,901,146 | |

| 5% 9/1/46 | 3,235,000 | 3,886,740 | |

| 5% 10/1/46 | 4,000,000 | 4,769,749 | |

| 5% 10/1/48 | 1,000,000 | 1,132,221 | |

| 5% 9/1/52 | 9,115,000 | 10,842,773 | |

| Series 2017 A, 5% 1/1/35 | 1,000,000 | 1,221,588 | |

| Series 2017 H: | |||

| 5% 1/1/22 | 245,000 | 249,703 | |

| 5% 1/1/23 | 325,000 | 346,188 | |

| 5% 1/1/23 (Escrowed to Maturity) | 1,115,000 | 1,191,692 | |

| 5% 1/1/24 | 260,000 | 288,310 | |

| 5% 1/1/24 (Escrowed to Maturity) | 840,000 | 937,364 | |

| Series 2017: | |||

| 5% 7/1/22 | 180,000 | 187,769 | |

| 5% 7/1/25 | 1,105,000 | 1,293,094 | |

| 5% 7/1/26 | 160,000 | 193,864 | |

| 5% 7/1/27 | 1,000,000 | 1,241,542 | |

| 5% 7/1/37 | 600,000 | 709,275 | |

| 5% 7/1/42 | 2,110,000 | 2,471,865 | |

| 5% 7/1/47 | 2,250,000 | 2,622,707 | |

| Series 2018: | |||

| 5% 9/1/27 | 1,010,000 | 1,251,276 | |

| 5% 9/1/29 | 1,390,000 | 1,745,832 | |

| 5% 9/1/31 | 1,530,000 | 1,898,204 | |

| 5% 9/1/33 | 1,185,000 | 1,461,696 | |

| 5% 9/1/38 | 4,805,000 | 5,875,016 | |

| 5% 6/1/43 | 4,740,000 | 5,941,809 | |

| 5% 9/1/43 | 4,445,000 | 5,386,009 | |

| 5% 6/1/48 | 7,000,000 | 8,728,504 | |

| Series 2019 A: | |||

| 5% 7/1/30 | 1,350,000 | 1,708,089 | |

| 5% 7/1/31 | 1,350,000 | 1,701,125 | |

| 5% 7/1/32 | 2,000,000 | 2,513,442 | |

| 5% 7/1/33 | 2,300,000 | 2,882,423 | |

| 5% 7/1/34 | 1,400,000 | 1,749,753 | |

| 5% 7/1/34 | 1,015,000 | 1,284,731 | |

| 5% 7/1/36 | 1,120,000 | 1,411,854 | |

| 5% 7/1/38 | 735,000 | 922,297 | |

| 5% 7/1/44 | 2,250,000 | 2,799,831 | |

| 5% 7/1/49 | 3,500,000 | 4,332,669 | |

| Series 2019 K: | |||

| 4% 7/1/22 | 700,000 | 724,369 | |

| 5% 7/1/23 | 500,000 | 545,742 | |

| 5% 7/1/24 | 500,000 | 568,508 | |

| 5% 7/1/25 | 1,250,000 | 1,473,942 | |

| 5% 7/1/26 | 1,250,000 | 1,523,366 | |

| 5% 7/1/33 | 2,000,000 | 2,562,925 | |

| 5% 7/1/35 | 2,135,000 | 2,723,806 | |

| Series 2019 S1: | |||

| 5% 10/1/25 | 1,965,000 | 2,331,617 | |

| 5% 10/1/26 | 2,535,000 | 3,104,594 | |

| Series 2019 S2: | |||

| 5% 10/1/32 | 1,410,000 | 1,807,106 | |

| 5% 10/1/33 | 1,935,000 | 2,472,843 | |

| 5% 10/1/34 | 2,165,000 | 2,759,695 | |

| Series 2020 A: | |||

| 4% 7/1/39 | 2,455,000 | 2,912,359 | |

| 4% 7/1/40 | 7,920,000 | 9,370,248 | |

| Series 2021 B: | |||

| 4% 7/1/42 | 475,000 | 560,661 | |

| 4% 7/1/50 | 1,825,000 | 2,137,875 | |

| Series 2021: | |||

| 4% 7/1/40 | 2,160,000 | 2,555,070 | |

| 4% 7/1/45 | 1,200,000 | 1,394,870 | |

| 4% 7/1/50 | 1,750,000 | 2,025,732 | |

| Series A: | |||

| 4% 6/1/49 | 13,440,000 | 15,342,291 | |

| 5% 6/1/39 | 6,760,000 | 8,419,529 | |

| Series B, 0% 1/1/39 (Assured Guaranty Corp. Insured) | 3,200,000 | 2,180,829 | |

| Series BB1, 5% 10/1/46 | 355,000 | 427,664 | |

| Series G: | |||

| 5% 7/15/22 (c) | 230,000 | 238,328 | |

| 5% 7/15/23 (c) | 120,000 | 128,830 | |

| 5% 7/15/24 (c) | 130,000 | 144,899 | |

| 5% 7/15/25 (c) | 120,000 | 137,816 | |

| 5% 7/15/26 (c) | 160,000 | 188,693 | |

| 5% 7/15/27 (c) | 170,000 | 205,235 | |

| 5% 7/1/28 | 350,000 | 445,047 | |

| 5% 7/15/28 (c) | 175,000 | 215,566 | |

| 5% 7/15/29 (c) | 320,000 | 401,167 | |

| 5% 7/1/30 | 225,000 | 297,891 | |

| 5% 7/15/30 (c) | 320,000 | 407,432 | |

| 5% 7/15/31 (c) | 350,000 | 446,893 | |

| 5% 7/15/32 (c) | 400,000 | 509,164 | |

| 5% 7/1/33 | 550,000 | 736,733 | |

| 5% 7/15/33 (c) | 320,000 | 406,001 | |

| 5% 7/1/34 | 250,000 | 333,711 | |

| 5% 7/15/34 (c) | 300,000 | 379,418 | |

| 5% 7/15/35 (c) | 270,000 | 340,911 | |

| 5% 7/1/36 | 475,000 | 630,917 | |

| 5% 7/15/36 (c) | 235,000 | 295,908 | |

| 5% 7/1/37 | 1,275,000 | 1,688,304 | |

| 5% 7/15/37 (c) | 250,000 | 313,912 | |

| 5% 7/15/46 (c) | 6,150,000 | 7,581,991 | |

| 5% 7/1/50 | 1,900,000 | 2,456,205 | |

| Series J2: | |||

| 5% 7/1/43 | 11,540,000 | 14,232,628 | |

| 5% 7/1/53 | 4,500,000 | 5,518,187 | |

| Series K, 5% 7/1/27 | 1,150,000 | 1,413,001 | |

| Series N 2016: | |||

| 5% 12/1/41 | 14,700,000 | 17,681,932 | |

| 5% 12/1/46 | 7,000,000 | 8,421,379 | |

| Massachusetts Edl. Fing. Auth. Rev.: | |||

| Series 2014 I: | |||

| 5% 1/1/25 (a) | 2,660,000 | 3,060,425 | |

| 5% 1/1/27 (a) | 1,000,000 | 1,143,226 | |

| Series 2015 A, 5% 1/1/25 (a) | 5,450,000 | 6,270,420 | |

| Series 2016 J: | |||

| 5% 7/1/22 (a) | 6,350,000 | 6,633,035 | |

| 5% 7/1/23 (a) | 9,930,000 | 10,814,436 | |

| Series 2016, 5% 7/1/24 (a) | 7,105,000 | 8,036,356 | |

| Series 2017 A: | |||

| 5% 7/1/22 (a) | 3,325,000 | 3,473,203 | |

| 5% 7/1/23 (a) | 2,500,000 | 2,722,668 | |

| 5% 7/1/24 (a) | 3,000,000 | 3,393,254 | |

| 5% 7/1/25 (a) | 4,500,000 | 5,265,992 | |

| 5% 7/1/26 (a) | 3,920,000 | 4,722,247 | |

| Series 2018 B: | |||

| 5% 7/1/22 (a) | 2,055,000 | 2,146,596 | |

| 5% 7/1/27 (a) | 9,240,000 | 11,399,738 | |

| 5% 7/1/28 (a) | 2,325,000 | 2,931,537 | |

| Series 2019 B: | |||

| 5% 7/1/23 (a) | 500,000 | 544,534 | |

| 5% 7/1/24 (a) | 1,000,000 | 1,131,085 | |

| 5% 7/1/25 (a) | 1,365,000 | 1,597,351 | |

| 5% 7/1/26 (a) | 1,215,000 | 1,463,656 | |

| 5% 7/1/28 (a) | 1,000,000 | 1,260,876 | |

| 5% 7/1/29 (a) | 3,500,000 | 4,489,870 | |

| Series 2020 C: | |||

| 5% 7/1/28 (a) | 2,000,000 | 2,521,752 | |

| 5% 7/1/29 (a) | 1,950,000 | 2,501,499 | |

| 5% 7/1/30 (a) | 1,950,000 | 2,543,319 | |

| Series 2021 B: | |||

| 5% 7/1/27 (a) | 1,950,000 | 2,405,789 | |

| 5% 7/1/28 (a) | 1,850,000 | 2,334,026 | |

| 5% 7/1/29 (a) | 1,250,000 | 1,604,610 | |

| 5% 7/1/30 (a) | 1,125,000 | 1,467,299 | |

| 5% 7/1/31 (a) | 1,500,000 | 1,980,792 | |

| Massachusetts Fed. Hwy. (Accelerated Bridge Prog.) Series A, 5% 6/15/25 | 4,470,000 | 5,076,579 | |

| Massachusetts Gen. Oblig.: | |||

| Series 2004 A, 5.5% 8/1/30 | 2,000,000 | 2,799,246 | |

| Series 2007 A, 3 month U.S. LIBOR + 0.570% 0.688% 5/1/37 (b)(d) | 6,840,000 | 6,810,874 | |

| Series 2014 E: | |||

| 5% 9/1/29 | 7,500,000 | 7,893,370 | |

| 5% 9/1/30 | 5,000,000 | 5,262,247 | |

| 5% 9/1/31 | 8,000,000 | 8,415,121 | |

| Series 2015 C, 5% 7/1/40 | 12,730,000 | 14,929,889 | |

| Series 2016 A, 5% 3/1/46 | 12,985,000 | 14,526,390 | |

| Series 2016 B: | |||

| 5% 7/1/33 | 5,500,000 | 6,665,873 | |

| 5% 7/1/35 | 5,500,000 | 6,664,199 | |

| 5% 7/1/36 | 10,260,000 | 12,433,125 | |

| 5% 7/1/37 | 8,495,000 | 10,299,950 | |

| Series 2016: | |||

| 5% 3/1/31 | 1,500,000 | 1,684,358 | |

| 5% 3/1/32 | 7,500,000 | 8,420,011 | |

| Series 2017 A: | |||

| 5% 4/1/34 | 6,875,000 | 8,545,868 | |

| 5% 4/1/35 | 9,830,000 | 12,207,705 | |

| 5% 4/1/42 | 18,490,000 | 22,864,762 | |

| 5% 4/1/47 | 2,405,000 | 2,976,574 | |

| Series 2017 C, 5% 10/1/26 | 15,000,000 | 18,516,684 | |

| Series 2017 D, 5% 2/1/33 | 2,550,000 | 3,150,316 | |

| Series 2017 F: | |||

| 5% 11/1/38 | 10,000,000 | 12,620,652 | |

| 5% 11/1/39 | 10,000,000 | 12,605,615 | |

| Series 2018 B, 5% 1/1/32 | 5,000,000 | 6,317,634 | |

| Series 2019 A: | |||

| 5% 1/1/35 | 5,000,000 | 6,442,963 | |

| 5% 1/1/37 | 10,000,000 | 12,815,217 | |

| 5% 1/1/49 | 10,000,000 | 12,626,499 | |

| 5.25% 1/1/33 | 21,110,000 | 27,820,975 | |

| 5.25% 1/1/44 | 16,490,000 | 21,310,629 | |

| Series 2020 D: | |||

| 3% 11/1/42 | 3,500,000 | 3,876,187 | |

| 4% 11/1/36 | 1,500,000 | 1,870,155 | |

| 4% 11/1/37 | 12,820,000 | 15,923,160 | |

| 4% 11/1/41 | 10,630,000 | 12,964,725 | |

| 5% 7/1/48 | 18,695,000 | 24,188,576 | |

| Series A: | |||

| 5% 7/1/28 | 7,000,000 | 8,521,197 | |

| 5% 3/1/29 | 2,710,000 | 3,564,186 | |

| 5% 1/1/48 | 9,420,000 | 11,662,063 | |

| Series B: | |||

| 5% 7/1/33 | 3,500,000 | 4,668,958 | |

| 5% 7/1/34 | 2,000,000 | 2,659,449 | |

| Series C: | |||

| 3% 3/1/48 | 5,000,000 | 5,417,098 | |

| 5% 5/1/45 | 5,000,000 | 6,389,531 | |

| 5% 5/1/47 | 10,855,000 | 13,851,127 | |

| Series D, 5% 7/1/45 | 3,000,000 | 3,890,984 | |

| Series E: | |||

| 5% 9/1/29 | 7,115,000 | 9,215,835 | |

| 5% 11/1/45 | 5,355,000 | 7,001,002 | |

| 5% 11/1/50 | 20,980,000 | 27,302,342 | |

| Massachusetts Health & Edl. Facilities Auth. Rev. (Blood Research Institute Proj.) Series A, 6.5% 2/1/22 | 1,145,000 | 1,150,109 | |

| Massachusetts Hsg. Fin. Agcy. Hsg. Rev.: | |||

| Series 183, 3.5% 12/1/46 | 890,000 | 940,416 | |

| Series 2011, 3.5% 12/1/49 | 4,055,000 | 4,444,292 | |

| Series 2017, 4% 6/1/43 (a) | 1,035,000 | 1,116,838 | |

| Series 2020 A, 0.875% 12/1/23 | 3,250,000 | 3,265,228 | |

| Series 207, 4% 6/1/49 | 2,190,000 | 2,424,071 | |

| Series 214, 3.75% 12/1/49 | 5,450,000 | 6,030,233 | |

| Series 218, 3% 12/1/50 | 2,015,000 | 2,200,120 | |

| Massachusetts Hsg. Fin. Auth.: | |||

| Series 2021 221, 3% 12/1/50 | 3,900,000 | 4,305,062 | |

| Series 2021 A2: | |||

| 0.4% 6/1/24 | 875,000 | 875,873 | |

| 0.45% 12/1/24 | 1,000,000 | 1,001,427 | |

| Series 220: | |||

| 3% 12/1/50 | 3,650,000 | 4,002,979 | |

| 5% 12/1/22 | 405,000 | 431,312 | |

| 5% 6/1/23 | 300,000 | 326,605 | |

| 5% 12/1/23 | 100,000 | 111,172 | |

| 5% 6/1/24 | 150,000 | 170,040 | |

| 5% 12/1/24 | 215,000 | 248,422 | |

| 5% 6/1/25 | 425,000 | 500,034 | |

| 5% 12/1/25 | 150,000 | 179,538 | |

| 5% 6/1/26 | 100,000 | 121,497 | |

| 5% 12/1/26 | 125,000 | 153,771 | |

| 5% 6/1/27 | 100,000 | 124,525 | |

| 5% 12/1/27 | 185,000 | 233,432 | |

| 5% 6/1/28 | 75,000 | 95,640 | |

| 5% 12/1/28 | 230,000 | 296,714 | |

| 5% 6/1/29 | 100,000 | 130,334 | |

| Massachusetts Port Auth. Rev.: | |||

| Series 2014 B: | |||

| 5% 7/1/29 (a) | 1,270,000 | 1,431,558 | |

| 5% 7/1/39 (a) | 4,965,000 | 5,569,251 | |

| Series 2014 C: | |||

| 5% 7/1/28 | 3,000,000 | 3,397,754 | |

| 5% 7/1/29 | 4,205,000 | 4,763,448 | |

| 5% 7/1/30 | 3,000,000 | 3,398,777 | |

| Series 2015 A: | |||

| 5% 7/1/28 | 460,000 | 539,617 | |

| 5% 7/1/28 (a) | 500,000 | 583,366 | |

| 5% 7/1/29 (a) | 1,245,000 | 1,451,902 | |

| 5% 7/1/30 | 1,400,000 | 1,642,964 | |

| 5% 7/1/30 (a) | 1,450,000 | 1,687,541 | |

| 5% 7/1/40 (a) | 2,000,000 | 2,316,124 | |

| 5% 7/1/45 (a) | 3,500,000 | 4,050,663 | |

| 5% 7/1/45 | 5,570,000 | 6,530,797 | |

| Series 2016 A: | |||

| 5% 7/1/26 | 695,000 | 851,159 | |

| 5% 7/1/28 | 760,000 | 924,746 | |

| 5% 7/1/30 | 1,660,000 | 2,005,572 | |

| 5% 7/1/32 | 1,970,000 | 2,379,483 | |

| 5% 7/1/36 | 3,760,000 | 4,542,202 | |

| Series 2016 B: | |||

| 4% 7/1/46 (a) | 12,950,000 | 14,589,241 | |

| 5% 7/1/43 (a) | 6,410,000 | 7,635,523 | |

| Series 2017 A: | |||

| 5% 7/1/30 (a) | 1,280,000 | 1,570,487 | |

| 5% 7/1/31 (a) | 1,095,000 | 1,341,817 | |

| 5% 7/1/32 (a) | 1,370,000 | 1,675,113 | |

| 5% 7/1/33 (a) | 1,250,000 | 1,524,897 | |

| 5% 7/1/35 (a) | 2,000,000 | 2,431,456 | |

| 5% 7/1/36 (a) | 1,720,000 | 2,086,945 | |

| 5% 7/1/42 (a) | 4,540,000 | 5,453,695 | |

| Series 2019 A: | |||

| 5% 7/1/24 (a) | 4,140,000 | 4,700,769 | |

| 5% 7/1/30 (a) | 725,000 | 933,440 | |

| 5% 7/1/34 (a) | 2,605,000 | 3,310,653 | |

| 5% 7/1/37 (a) | 1,100,000 | 1,388,733 | |

| 5% 7/1/40 (a) | 950,000 | 1,192,347 | |

| Series 2019 C: | |||

| 5% 7/1/31 (a) | 3,500,000 | 4,486,807 | |

| 5% 7/1/38 (a) | 5,000,000 | 6,299,566 | |

| 5% 7/1/39 (a) | 5,000,000 | 6,286,167 | |

| 5% 7/1/49 (a) | 2,500,000 | 3,098,929 | |

| Series 2021 A: | |||

| 5% 7/1/38 | 2,125,000 | 2,862,601 | |

| 5% 7/1/39 | 1,125,000 | 1,511,576 | |

| 5% 7/1/40 | 1,045,000 | 1,400,045 | |

| Series 2021 B, 5% 7/1/39 (a) | 1,325,000 | 1,742,823 | |

| Series 2021 D: | |||

| 5% 7/1/46 | 3,180,000 | 4,201,858 | |

| 5% 7/1/51 | 5,740,000 | 7,548,835 | |

| Series 2021 E: | |||

| 5% 7/1/40 (a) | 4,000,000 | 5,246,270 | |

| 5% 7/1/41 (a) | 1,940,000 | 2,539,744 | |

| Massachusetts Port Auth. Spl. Facilities Rev. (Bosfuel Proj.) Series 2019 A: | |||

| 5% 7/1/22 (a) | 500,000 | 521,862 | |

| 5% 7/1/23 (a) | 360,000 | 392,862 | |

| 5% 7/1/24 (a) | 615,000 | 698,880 | |

| 5% 7/1/25 (a) | 1,000,000 | 1,177,019 | |

| 5% 7/1/28 (a) | 1,500,000 | 1,914,261 | |

| 5% 7/1/32 (a) | 500,000 | 643,496 | |

| 5% 7/1/34 (a) | 1,250,000 | 1,599,379 | |

| 5% 7/1/49 (a) | 5,620,000 | 7,008,715 | |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev.: | |||

| Series 2012 A: | |||

| 5% 8/15/23 | 15,000,000 | 15,759,596 | |

| 5% 8/15/24 | 4,120,000 | 4,326,335 | |

| Series 2016 A: | |||

| 5% 11/15/40 | 7,335,000 | 8,708,105 | |

| 5% 11/15/41 | 7,710,000 | 9,155,957 | |

| Series 2019 A: | |||

| 5% 2/15/23 | 640,000 | 687,876 | |

| 5% 2/15/44 | 21,510,000 | 27,243,962 | |

| Series A: | |||

| 5% 8/15/31 | 1,850,000 | 2,504,186 | |

| 5% 8/15/32 | 1,500,000 | 2,022,630 | |

| 5% 8/15/33 | 1,675,000 | 2,251,082 | |

| 5% 8/15/34 | 3,000,000 | 4,016,003 | |

| 5% 8/15/35 | 2,000,000 | 2,672,877 | |

| 5% 8/15/36 | 12,845,000 | 17,108,907 | |

| 5% 8/15/37 | 1,400,000 | 1,859,406 | |

| 5% 8/15/45 | 10,000,000 | 13,047,603 | |

| 5% 8/15/50 | 16,615,000 | 21,580,574 | |

| Series B, 5% 11/15/39 | 1,975,000 | 2,413,053 | |

| Series D, 5% 8/15/37 | 5,000,000 | 5,903,296 | |

| Massachusetts Spl. Oblig. Dedicated Tax Rev. Series 2005: | |||

| 5.5% 1/1/27 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 2,500,000 | 3,128,164 | |

| 5.5% 1/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 2,575,000 | 3,315,921 | |

| 5.5% 1/1/30 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 19,080,000 | 25,644,007 | |

| 5.5% 1/1/34 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 14,770,000 | 20,615,907 | |

| Massachusetts State College Bldg. Auth. Rev.: | |||

| Series 2002 A, 0% 5/1/22 (Escrowed to Maturity) | 2,250,000 | 2,246,988 | |

| Series 2003 B, 0% 5/1/28 (Assured Guaranty Corp. Insured) | 6,080,000 | 5,610,991 | |

| Series 2014 B: | |||

| 5% 5/1/39 (Pre-Refunded to 5/1/24 @ 100) | 2,500,000 | 2,832,689 | |

| 5% 5/1/44 (Pre-Refunded to 5/1/24 @ 100) | 13,935,000 | 15,789,406 | |

| Series 2014 D: | |||

| 5% 5/1/39 (Pre-Refunded to 5/1/25 @ 100) | 7,575,000 | 8,915,149 | |

| 5% 5/1/41 (Pre-Refunded to 5/1/25 @ 100) | 4,515,000 | 5,313,782 | |

| Series 2016 A: | |||

| 5% 5/1/38 (Pre-Refunded to 5/1/25 @ 100) | 11,450,000 | 13,475,703 | |

| 5% 5/1/41 (Pre-Refunded to 5/1/25 @ 100) | 7,960,000 | 9,368,262 | |

| 5% 5/1/49 (Pre-Refunded to 5/1/25 @ 100) | 12,015,000 | 14,140,661 | |

| Massachusetts Tpk. Auth. Metropolitan Hwy. Sys. Rev.: | |||

| Series 1997 C, 0% 1/1/23 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 1,800,000 | 1,789,787 | |

| Sr. Series A: | |||

| 0% 1/1/25 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 5,110,000 | 5,001,522 | |

| 0% 1/1/28 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 7,700,000 | 7,174,823 | |

| 0% 1/1/29 (Nat'l. Pub. Fin. Guarantee Corp. Insured) | 33,195,000 | 30,222,378 | |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev.: | |||

| Series 2016 B, 5% 8/1/40 | 4,625,000 | 5,609,661 | |

| Series 2016 C: | |||

| 5% 8/1/34 | 10,000,000 | 12,151,888 | |

| 5% 8/1/35 | 12,550,000 | 15,249,692 | |

| 5% 8/1/40 | 20,500,000 | 24,864,442 | |

| Series 2020 B: | |||

| 5% 8/1/41 | 3,155,000 | 4,157,838 | |

| 5% 8/1/42 | 7,415,000 | 9,739,465 | |

| Series B, 5.25% 8/1/26 | 3,000,000 | 3,720,974 | |

| Natick Gen. Oblig. Series 2020, 5% 6/15/29 | 1,755,000 | 2,331,376 | |

| Reading Gen. Oblig. Series 2012: | |||

| 5% 2/1/22 | 1,245,000 | 1,275,505 | |

| 5% 2/1/23 | 1,185,000 | 1,272,154 | |

| Shrewsbury Gen. Oblig. Series 2019, 5% 7/15/29 | 2,000,000 | 2,586,991 | |

| Springfield Gen. Oblig. Series 2017: | |||

| 5% 3/1/23 | 1,775,000 | 1,912,490 | |

| 5% 3/1/24 | 2,225,000 | 2,502,749 | |

| 5% 3/1/25 | 2,420,000 | 2,828,518 | |

| Univ. of Massachusetts Bldg. Auth. Facilities Rev.: | |||

| (Bldg. Auth. Proj.) Series 2015 1: | |||

| 5% 11/1/27 | 3,500,000 | 4,172,742 | |

| 5% 11/1/28 | 6,000,000 | 7,143,310 | |

| 5% 11/1/29 | 6,230,000 | 7,399,546 | |

| 5% 11/1/30 | 6,000,000 | 7,119,657 | |

| Series 2014 1: | |||

| 5% 11/1/44 (Pre-Refunded to 11/1/24 @ 100) | 16,620,000 | 19,216,150 | |

| 5% 11/1/44 (Pre-Refunded to 11/1/24 @ 100) | 3,825,000 | 4,422,489 | |

| Series 2020 1, 5% 11/1/50 | 4,015,000 | 5,141,342 | |

| Univ. of Massachusetts Bldg. Auth. Rev. Series 2019 1: | |||

| 5% 5/1/34 | 600,000 | 777,513 | |

| 5% 5/1/35 | 2,000,000 | 2,587,134 | |

| 5% 5/1/36 | 3,400,000 | 4,386,117 | |

| 5% 5/1/37 | 3,200,000 | 4,117,780 | |

| 5% 5/1/38 | 3,000,000 | 3,852,667 | |

| 5% 5/1/39 | 2,000,000 | 2,563,060 | |

| Westfield Gen. Oblig. Series 2014: | |||

| 5% 3/1/26 (Pre-Refunded to 3/1/24 @ 100) | 2,990,000 | 3,364,605 | |

| 5% 3/1/27 (Pre-Refunded to 3/1/24 @ 100) | 2,740,000 | 3,083,284 | |

| Worcester Gen. Oblig. Series 2021, 5% 2/15/27 | 1,575,000 | 1,965,569 | |

| TOTAL MASSACHUSETTS | 2,314,102,724 | ||

| Puerto Rico - 0.2% | |||

| Puerto Rico Hsg. Fin. Auth. Series 2020, 5% 12/1/27 | 4,435,000 | 5,564,873 | |

| TOTAL MUNICIPAL BONDS | |||

| (Cost $2,157,800,589) | 2,320,125,932 | ||

| Municipal Notes - 0.4% | |||

| Massachusetts - 0.4% | |||

| Massachusetts Dev. Fin. Agcy. Rev. Series R, 0.01% 8/2/21 (Liquidity Facility U.S. Bank NA, Cincinnati), VRDN (b) | |||

| (Cost $8,600,000) | 8,600,000 | 8,600,000 | |

| TOTAL INVESTMENT IN SECURITIES - 98.2% | |||

| (Cost $2,166,400,589) | 2,328,725,932 | ||

| NET OTHER ASSETS (LIABILITIES) - 1.8% | 43,834,103 | ||

| NET ASSETS - 100% | $2,372,560,035 |

Security Type Abbreviations

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

Legend

(a) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $25,819,521 or 1.1% of net assets.

(d) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

Investment Valuation

The following is a summary of the inputs used, as of July 31, 2021, involving the Fund's assets and liabilities carried at fair value. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used below, please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

| Valuation Inputs at Reporting Date: | ||||

| Description | Total | Level 1 | Level 2 | Level 3 |

| Investments in Securities: | ||||

| Municipal Securities | $2,328,725,932 | $-- | $2,328,725,932 | $-- |

| Total Investments in Securities: | $2,328,725,932 | $-- | $2,328,725,932 | $-- |

Other Information

The distribution of municipal securities by revenue source, as a percentage of total Net Assets, is as follows (Unaudited):

| General Obligations | 21.7% |

| Education | 20.6% |

| Health Care | 16.5% |

| Special Tax | 16.2% |

| Transportation | 10.0% |

| Others* (Individually Less Than 5%) | 15.0% |

| 100.0% |

* Includes net other assets

See accompanying notes which are an integral part of the financial statements.

Fidelity® Massachusetts Municipal Income Fund

Financial Statements

Statement of Assets and Liabilities

| July 31, 2021 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $2,166,400,589) | $2,328,725,932 | |

| Cash | 28,873,856 | |

| Receivable for fund shares sold | 518,529 | |

| Interest receivable | 19,230,470 | |

| Prepaid expenses | 1,736 | |

| Other receivables | 6,622 | |

| Total assets | 2,377,357,145 | |

| Liabilities | ||

| Payable for investments purchased | $1,866,442 | |

| Payable for fund shares redeemed | 367,828 | |

| Distributions payable | 1,648,791 | |

| Accrued management fee | 685,545 | |

| Other affiliated payables | 193,424 | |

| Other payables and accrued expenses | 35,080 | |

| Total liabilities | 4,797,110 | |

| Net Assets | $2,372,560,035 | |

| Net Assets consist of: | ||

| Paid in capital | $2,206,512,543 | |

| Total accumulated earnings (loss) | 166,047,492 | |

| Net Assets | $2,372,560,035 | |

| Net Asset Value, offering price and redemption price per share ($2,372,560,035 ÷ 186,649,208 shares) | $12.71 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended July 31, 2021 (Unaudited) | ||

| Investment Income | ||

| Interest | $29,004,693 | |

| Expenses | ||

| Management fee | $4,117,150 | |

| Transfer agent fees | 957,550 | |

| Accounting fees and expenses | 210,586 | |

| Custodian fees and expenses | 10,759 | |

| Independent trustees' fees and expenses | 3,067 | |

| Registration fees | 23,757 | |

| Audit | 25,022 | |

| Legal | 8,989 | |

| Miscellaneous | 6,097 | |

| Total expenses before reductions | 5,362,977 | |

| Expense reductions | (19,154) | |

| Total expenses after reductions | 5,343,823 | |

| Net investment income (loss) | 23,660,870 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 3,236,905 | |

| Total net realized gain (loss) | 3,236,905 | |

| Change in net unrealized appreciation (depreciation) on investment securities | 1,356,272 | |

| Net gain (loss) | 4,593,177 | |

| Net increase (decrease) in net assets resulting from operations | $28,254,047 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended July 31, 2021 (Unaudited) | Year ended January 31, 2021 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $23,660,870 | $51,327,666 |

| Net realized gain (loss) | 3,236,905 | 8,246,914 |

| Change in net unrealized appreciation (depreciation) | 1,356,272 | 6,393,985 |

| Net increase (decrease) in net assets resulting from operations | 28,254,047 | 65,968,565 |

| Distributions to shareholders | (28,156,107) | (55,163,828) |

| Share transactions | ||

| Proceeds from sales of shares | 186,726,034 | 412,020,704 |

| Reinvestment of distributions | 16,364,504 | 32,342,479 |

| Cost of shares redeemed | (216,770,877) | (438,074,516) |

| Net increase (decrease) in net assets resulting from share transactions | (13,680,339) | 6,288,667 |

| Total increase (decrease) in net assets | (13,582,399) | 17,093,404 |

| Net Assets | ||

| Beginning of period | 2,386,142,434 | 2,369,049,030 |

| End of period | $2,372,560,035 | $2,386,142,434 |

| Other Information | ||

| Shares | ||

| Sold | 14,804,431 | 33,066,374 |

| Issued in reinvestment of distributions | 1,301,141 | 2,587,749 |

| Redeemed | (17,185,875) | (35,617,937) |

| Net increase (decrease) | (1,080,303) | 36,186 |

See accompanying notes which are an integral part of the financial statements.

Financial Highlights

Fidelity Massachusetts Municipal Income Fund

| Six months ended (Unaudited) July 31, | Years endedJanuary 31, | |||||

| 2021 | 2021 | 2020 | 2019 | 2018 | 2017 | |

| Selected Per–Share Data | ||||||

| Net asset value, beginning of period | $12.71 | $12.62 | $11.95 | $12.07 | $11.99 | $12.61 |

| Income from Investment Operations | ||||||

| Net investment income (loss)A | .126 | .280 | .316 | .327 | .340 | .358 |

| Net realized and unrealized gain (loss) | .024 | .111 | .678 | (.075) | .107 | (.467) |

| Total from investment operations | .150 | .391 | .994 | .252 | .447 | (.109) |

| Distributions from net investment income | (.126) | (.280) | (.316) | (.327) | (.340) | (.358) |

| Distributions from net realized gain | (.024) | (.021) | (.008) | (.045) | (.027) | (.153) |

| Total distributions | (.150) | (.301) | (.324) | (.372) | (.367) | (.511) |

| Redemption fees added to paid in capitalA | – | – | – | – | – | –B |

| Net asset value, end of period | $12.71 | $12.71 | $12.62 | $11.95 | $12.07 | $11.99 |

| Total ReturnC,D | 1.20% | 3.16% | 8.41% | 2.15% | 3.75% | (.92)% |

| Ratios to Average Net AssetsE,F | ||||||

| Expenses before reductions | .46%G | .45% | .45% | .46% | .46% | .46% |

| Expenses net of fee waivers, if any | .46%G | .45% | .45% | .46% | .46% | .46% |

| Expenses net of all reductions | .45%G | .45% | .45% | .45% | .45% | .46% |

| Net investment income (loss) | 2.01%G | 2.24% | 2.56% | 2.75% | 2.80% | 2.85% |

| Supplemental Data | ||||||

| Net assets, end of period (000 omitted) | $2,372,560 | $2,386,142 | $2,369,049 | $2,140,001 | $2,169,782 | $2,127,315 |

| Portfolio turnover rateH | 10%G | 20% | 12% | 12% | 16% | 25% |

A Calculated based on average shares outstanding during the period.

B Amount represents less than $.0005 per share.

C Total returns for periods of less than one year are not annualized.

D Total returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

E Fees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses.

F Expense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment advisor, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

G Annualized

H Amount does not include the portfolio activity of any underlying mutual funds or exchange-traded funds (ETFs).

See accompanying notes which are an integral part of the financial statements.

Fidelity® Massachusetts Municipal Money Market Fund

Investment Summary/Performance (Unaudited)

Effective Maturity Diversification as of July 31, 2021

| Days | % of fund's investments |

| 1 - 30 | 81.9 |

| 31 - 60 | 3.5 |

| 61 - 90 | 1.9 |

| 91 - 180 | 5.7 |

| > 180 | 7.0 |

Effective maturity is determined in accordance with the requirements of Rule 2a-7 under the Investment Company Act of 1940.

Asset Allocation (% of fund's net assets)

| As of July 31, 2021 | ||

| Variable Rate Demand Notes (VRDNs) | 36.4% | |

| Tender Option Bond | 38.5% | |

| Other Municipal Security | 20.1% | |

| Investment Companies | 4.7% | |

| Net Other Assets (Liabilities) | 0.3% | |

Current 7-Day Yields

| 7/30/21 | |

| Fidelity® Massachusetts Municipal Money Market Fund | 0.01% |

Yield refers to the income paid by the Fund over a given period. Yield for money market funds is usually for seven-day periods, as it is here, though it is expressed as an annual percentage rate. Past performance is no guarantee of future results. Yield will vary and it's possible to lose money investing in the Fund. A portion of the Fund's expenses was reimbursed and/or waived. Absent such reimbursements and/or waivers the yield for the period ending July 31, 2021, the most recent period shown in the table, would have been (.41)%.

Fidelity® Massachusetts Municipal Money Market Fund

Schedule of Investments July 31, 2021 (Unaudited)

Showing Percentage of Net Assets

| Variable Rate Demand Note - 36.4% | |||

| Principal Amount | Value | ||

| Alabama - 0.8% | |||

| Decatur Indl. Dev. Board Exempt Facilities Rev. (Nucor Steel Decatur LLC Proj.) Series 2003 A, 0.1% 8/6/21, VRDN (a)(b) | $9,643,000 | $9,643,000 | |

| Arkansas - 0.0% | |||

| Blytheville Indl. Dev. Rev. (Nucor Corp. Proj.) Series 1998, 0.1% 8/6/21, VRDN (a)(b) | 400,000 | 400,000 | |

| Delaware - 0.0% | |||

| Delaware Econ. Dev. Auth. Rev. (Delmarva Pwr. & Lt. Co. Proj.) Series 1999 B, 0.06% 8/6/21, VRDN (a)(b) | 400,000 | 400,000 | |

| Kansas - 0.3% | |||

| Burlington Envir. Impt. Rev. (Kansas City Pwr. and Lt. Co. Proj.): | |||

| Series 2007 A, 0.1% 8/6/21, VRDN (b) | 2,200,000 | 2,200,000 | |

| Series 2007 B, 0.1% 8/6/21, VRDN (b) | 1,000,000 | 1,000,000 | |

| 3,200,000 | |||

| Massachusetts - 34.6% | |||

| Massachusetts Dept. of Trans. Metropolitan Hwy. Sys. Rev.: | |||

| Series 2010 A1, 0.02% 8/6/21, LOC Citibank NA, VRDN (b) | 19,480,000 | 19,480,000 | |

| Series 2010 A2, 0.01% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 32,440,000 | 32,440,000 | |

| Massachusetts Dev. Fin. Agcy. Rev.: | |||

| (Babson College Proj.) Series 2008 A, 0.01% 8/6/21, LOC Bank of America NA, VRDN (b) | 7,090,000 | 7,090,000 | |

| (Boston Univ. Proj.): | |||

| Series U-6E, 0.02% 8/2/21, LOC TD Banknorth, NA, VRDN (b) | 8,420,000 | 8,420,000 | |

| Series U3, 0.01% 8/6/21, LOC Northern Trust Co., VRDN (b) | 11,450,000 | 11,450,000 | |

| (Briarwood Retirement Cmnty. Proj.) Series 2004 A, 0.07% 8/6/21, LOC Manufacturers & Traders Trust Co., VRDN (b) | 10,595,000 | 10,595,000 | |

| (Clark Univ. Proj.) Series 2008, 0.02% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 23,350,000 | 23,350,000 | |

| (College of the Holy Cross Proj.) Series 2008 A, 0.03% 8/2/21, LOC Bank of America NA, VRDN (b) | 4,035,000 | 4,035,000 | |

| (Partners HealthCare Sys. Proj.) Series 2011 K2, 0.02% 8/6/21 (Liquidity Facility Barclays Bank PLC), VRDN (b) | 19,875,000 | 19,875,000 | |

| (Seven Hills Foundation and Affiliates Proj.): | |||

| Series 2008 A, 0.02% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 7,040,000 | 7,040,000 | |

| Series 2008 B, 0.02% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 3,230,000 | 3,230,000 | |

| (Wilber School Apts. Proj.) Series 2008 A, 0.02% 8/6/21, LOC Bank of America NA, VRDN (b) | 7,485,000 | 7,485,000 | |

| (Worcester Polytechnic Institute Proj.) Series 2008 A, 0.02% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 730,000 | 730,000 | |

| Series 2006, 0.03% 8/6/21, LOC PNC Bank NA, VRDN (b) | 21,180,000 | 21,180,000 | |

| Series 2010, 0.04% 8/6/21, LOC Manufacturers & Traders Trust Co., VRDN (b) | 6,005,000 | 6,005,000 | |

| Series 2019, 0.07% 8/6/21, LOC Manufacturers & Traders Trust Co., VRDN (b)(c) | 12,955,000 | 12,955,000 | |

| Massachusetts Gen. Oblig. (Central Artery Proj.) Series 2000 A, 0.02% 8/6/21 (Liquidity Facility Citibank NA), VRDN (b) | 6,030,000 | 6,030,000 | |

| Massachusetts Health & Edl. Facilities Auth. Rev.: | |||

| (Baystate Health Sys. Proj.) Series 2009 J1, 0.02% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 10,000,000 | 10,000,000 | |

| (Harvard Univ. Proj.) Series Y, 0.01% 8/6/21, VRDN (b) | 26,355,000 | 26,355,000 | |

| (Massachusetts Institute of Technology Proj.): | |||

| Series 2001 J1, 0.01% 8/6/21, VRDN (b) | 18,795,000 | 18,795,000 | |

| Series 2001 J2, 0.01% 8/6/21, VRDN (b) | 25,495,000 | 25,495,000 | |

| (Partners HealthCare Sys., Inc. Proj.) Series 2005 F, 0.03% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 7,140,000 | 7,140,000 | |

| Series 2009 O-1, 0.03% 8/6/21, LOC Fed. Home Ln. Bank of Boston, VRDN (b) | 10,130,000 | 10,130,000 | |

| Massachusetts Hsg. Fin. Agcy. Hsg. Rev.: | |||

| (Princeton Westford Proj.) Series 2015 A, 0.03% 8/6/21, LOC Bank of America NA, VRDN (b) | 21,955,000 | 21,955,000 | |

| Series 208, 0.02% 8/6/21 (Liquidity Facility Royal Bank of Canada), VRDN (b) | 2,400,000 | 2,400,000 | |

| Massachusetts Hsg. Fin. Agcy. Multi-Family Rev. Series 2013 F, 0.04% 8/6/21, LOC TD Banknorth, NA, VRDN (a)(b) | 23,015,000 | 23,015,000 | |

| Massachusetts Indl. Fin. Agcy. Indl. Dev. Rev. Series 1994, 0.03% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 500,000 | 500,000 | |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev.: | |||

| Series 1999 B, 0.01% 8/6/21, LOC TD Banknorth, NA, VRDN (b) | 6,400,000 | 6,400,000 | |

| Series 2008 C2, 0.03% 8/6/21 (Liquidity Facility Barclays Bank PLC), VRDN (b) | 3,425,000 | 3,425,000 | |

| FHLMC Massachusetts Dev. Fin. Agcy. Multi-family Hsg. Rev. (Tammy Brook Apts. Proj.) Series 2009, 0.05% 8/6/21, LOC Freddie Mac, VRDN (b) | 5,660,000 | 5,660,000 | |

| FNMA Massachusetts Dev. Fin. Agcy. Multi-family Hsg. Rev. (Avalon Acton Apts. Proj.) Series 2006, 0.05% 8/6/21, LOC Fannie Mae, VRDN (a)(b) | 45,000,000 | 45,000,000 | |

| 407,660,000 | |||

| Nebraska - 0.3% | |||

| Stanton County Indl. Dev. Rev.: | |||

| (Nucor Corp. Proj.) Series 1996, 0.1% 8/6/21, VRDN (a)(b) | 3,700,000 | 3,700,000 | |

| Series 1998, 0.1% 8/6/21, VRDN (a)(b) | 300,000 | 300,000 | |

| 4,000,000 | |||

| Tennessee - 0.2% | |||

| Memphis-Shelby County Indl. Dev. Board Facilities Rev. Series 2007, 0.1% 8/6/21, VRDN (a)(b) | 2,330,000 | 2,330,000 | |

| West Virginia - 0.2% | |||

| West Virginia Econ. Dev. Auth. Solid Waste Disp. Facilities Rev. (Appalachian Pwr. Co.- Mountaineer Proj.) Series 2008 A, 0.11% 8/6/21, VRDN (a)(b) | 1,700,000 | 1,700,000 | |

| TOTAL VARIABLE RATE DEMAND NOTE | |||

| (Cost $429,333,000) | 429,333,000 | ||

| Tender Option Bond - 38.5% | |||

| California - 0.6% | |||

| Dignityhealthxx Participating VRDN Series DBE 80 11, 0.2% 8/6/21 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(d)(e) | 6,700,000 | 6,700,000 | |

| Connecticut - 0.0% | |||

| Connecticut Gen. Oblig. Participating VRDN Series Floaters 016, 0.14% 9/10/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 400,000 | 400,000 | |

| Florida - 0.0% | |||

| Broward County Port Facilities Rev. Bonds Series G 115, 0.27%, tender 3/1/22 (Liquidity Facility Royal Bank of Canada) (a)(b)(d)(e)(f) | 500,000 | 500,000 | |

| Illinois - 0.1% | |||

| Illinois Fin. Auth. Rev. Participating VRDN Series Floaters 017, 0.14% 9/10/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 1,225,000 | 1,225,000 | |

| Indiana - 0.2% | |||

| Indiana Fin. Auth. Rev. Participating VRDN Series 2020 004, 0.17% 9/10/21 (Liquidity Facility Wells Fargo Bank NA) (b)(d)(e) | 1,970,000 | 1,970,000 | |

| Kentucky - 0.1% | |||

| CommonSpirit Health Participating VRDN Series MIZ 90 21, 0.12% 8/6/21 (Liquidity Facility Mizuho Cap. Markets Llc) (b)(d)(e) | 800,000 | 800,000 | |

| Maryland - 1.1% | |||

| Maryland Gen. Oblig. Participating VRDN Series DB 807, 0.09% 8/6/21 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(d)(e) | 12,645,000 | 12,645,000 | |

| Massachusetts - 35.5% | |||

| Billerica Gen. Oblig. Participating VRDN Series Solar 17 0027, 0.04% 8/2/21 (Liquidity Facility U.S. Bank NA, Cincinnati) (b)(d)(e) | 2,300,000 | 2,300,000 | |

| Boston Gen. Oblig. Participating VRDN Series Floaters XF 26 08, 0.03% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 2,400,000 | 2,400,000 | |

| Massachusetts Clean Wtr. Trust Participating VRDN Series Clipper 09 30, 0.07% 8/1/21 (Liquidity Facility State Street Bank & Trust Co., Boston) (b)(d)(e) | 3,600,000 | 3,600,000 | |

| Massachusetts Commonwealth Trans. Fund Rev. Participating VRDN: | |||

| Series Floaters XF 06 10, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 2,900,000 | 2,900,000 | |

| Series Floaters XF 26 06, 0.02% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 2,400,000 | 2,400,000 | |

| Series Floaters ZF 25 67, 0.03% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 3,300,000 | 3,300,000 | |

| Series Floaters ZF 25 68, 0.03% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 4,865,000 | 4,865,000 | |

| Series XF 09 23, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 2,065,000 | 2,065,000 | |

| Massachusetts Dev. Fin. Agcy. Rev. Participating VRDN: | |||

| Series 15 XF0245, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 9,135,000 | 9,135,000 | |

| Series 2016 XF2207, 0.06% 8/6/21 (Liquidity Facility Toronto-Dominion Bank) (b)(d)(e) | 1,600,000 | 1,600,000 | |

| Series 2016 XM0137, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 5,665,000 | 5,665,000 | |

| Series Floaters E 130, 0.05% 8/6/21 (Liquidity Facility Royal Bank of Canada) (b)(d)(e) | 22,600,000 | 22,600,000 | |

| Series Floaters XF 27 05, 0.02% 8/6/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 4,740,000 | 4,740,000 | |

| Series Floaters YX 10 74, 0.05% 8/6/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 1,200,000 | 1,200,000 | |

| Series Floaters ZF 07 60, 0.06% 8/6/21 (Liquidity Facility Royal Bank of Canada) (b)(d)(e) | 1,635,000 | 1,635,000 | |

| Series Floaters ZF 27 22, 0.05% 8/6/21 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(d)(e) | 8,600,000 | 8,600,000 | |

| Series Floaters ZM 05 72, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 4,000,000 | 4,000,000 | |

| Series MS 3373, 0.04% 8/6/21 (Liquidity Facility Toronto-Dominion Bank) (b)(d)(e) | 7,100,000 | 7,100,000 | |

| Series XF 28 91, 0.06% 8/6/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 2,795,000 | 2,795,000 | |

| Massachusetts Edl. Fing. Auth. Rev. Participating VRDN: | |||

| Series Floaters XF 25 11, 0.07% 8/6/21 (Liquidity Facility Barclays Bank PLC) (a)(b)(d)(e) | 1,685,000 | 1,685,000 | |

| Series Floaters XG 01 39, 0.09% 8/6/21 (Liquidity Facility Citibank NA) (a)(b)(d)(e) | 13,055,000 | 13,055,000 | |

| Series XM 07 57, 0.09% 8/6/21 (Liquidity Facility Royal Bank of Canada) (a)(b)(d)(e) | 8,000,000 | 8,000,000 | |

| Massachusetts Gen. Oblig. Participating VRDN: | |||

| Series 16 XM0221, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 1,900,000 | 1,900,000 | |

| Series 2021 XF 12 37, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 11,000,000 | 11,000,000 | |

| Series 2021 XG 03 15, 0.09% 8/6/21 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(d)(e) | 3,000,000 | 3,000,000 | |

| Series Clipper 09 37, 0.03% 8/6/21 (Liquidity Facility State Street Bank & Trust Co., Boston) (b)(d)(e) | 33,575,000 | 33,575,000 | |

| Series Clipper 09 67, 0.07% 8/6/21 (Liquidity Facility State Street Bank & Trust Co., Boston) (b)(d)(e) | 28,070,000 | 28,070,000 | |

| Series Clipper 09 69, 0.07% 8/6/21 (Liquidity Facility State Street Bank & Trust Co., Boston) (b)(d)(e) | 24,556,000 | 24,556,000 | |

| Series Floaters G4, 0.05% 8/6/21 (Liquidity Facility Royal Bank of Canada) (b)(d)(e) | 19,500,000 | 19,500,000 | |

| Series Floaters G9, 0.05% 8/6/21 (Liquidity Facility Royal Bank of Canada) (b)(d)(e) | 5,700,000 | 5,700,000 | |

| Series Floaters XF 05 28, 0.06% 8/6/21 (Liquidity Facility Toronto-Dominion Bank) (b)(d)(e) | 1,190,000 | 1,190,000 | |

| Series Floaters XF 05 30, 0.06% 8/6/21 (Liquidity Facility Toronto-Dominion Bank) (b)(d)(e) | 4,865,000 | 4,865,000 | |

| Series Floaters XF 25 74, 0.03% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 3,700,000 | 3,700,000 | |

| Series Floaters XF 27 06, 0.02% 8/6/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 15,800,000 | 15,800,000 | |

| Series Floaters ZF 26 95, 0.05% 8/6/21 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(d)(e) | 5,900,000 | 5,900,000 | |

| Series Floaters ZM 05 79, 0.05% 8/6/21 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(d)(e) | 2,235,000 | 2,235,000 | |

| Series XG 02 79, 0.04% 8/6/21 (Liquidity Facility Bank of America NA) (b)(d)(e) | 5,600,000 | 5,600,000 | |

| Massachusetts Health & Edl. Facilities Auth. Rev. Participating VRDN: | |||

| Series Clipper 09 39, 0.05% 8/6/21 (Liquidity Facility State Street Bank & Trust Co., Boston) (b)(d)(e) | 10,450,000 | 10,450,000 | |

| Series Floaters XM 02 32, 0.04% 8/6/21 (Liquidity Facility Bank of America NA) (b)(d)(e) | 2,895,000 | 2,895,000 | |

| Massachusetts Hsg. Fin. Agcy. Multi-Family Rev. Participating VRDN Series ZF 08 99, 0.05% 8/6/21 (Liquidity Facility Bank of America NA) (b)(d)(e) | 2,845,000 | 2,845,000 | |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Participating VRDN: | |||

| Series 15 XF2203, 0.06% 8/6/21 (Liquidity Facility Toronto-Dominion Bank) (b)(d)(e) | 9,260,000 | 9,260,000 | |

| Series 16 ZM0173, 0.05% 8/6/21 (Liquidity Facility Royal Bank of Canada) (b)(d)(e) | 11,540,000 | 11,540,000 | |

| Series EGL 15 0004, 0.04% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 45,460,000 | 45,460,000 | |

| Series Floaters XX 10 08, 0.05% 8/6/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 1,200,000 | 1,200,000 | |

| Series Floaters ZF 06 92, 0.05% 8/6/21 (Liquidity Facility Bank of America NA) (b)(d)(e) | 1,990,000 | 1,990,000 | |

| Series Solar 17 13, 0.03% 8/2/21 (Liquidity Facility U.S. Bank NA, Cincinnati) (b)(d)(e) | 1,880,000 | 1,880,000 | |

| Massachusetts Spl. Oblig. Dedicated Tax Rev. Bonds Series Floaters G 29, 0.2%, tender 1/3/22 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | 5,220,000 | 5,220,000 | |

| RBC Muni. Products, Inc. Trust Participating VRDN Series E 148, 0.05% 8/6/21 (Liquidity Facility Royal Bank of Canada) (b)(d)(e) | 10,000,000 | 10,000,000 | |

| Saugus Gen. Oblig. Participating VRDN Series Floaters XF 06 81, 0.06% 8/6/21 (Liquidity Facility Toronto-Dominion Bank) (b)(d)(e) | 4,615,000 | 4,615,000 | |

| Univ. of Massachusetts Bldg. Auth. Facilities Rev. Participating VRDN: | |||

| Series Floaters XF 25 88, 0.03% 8/6/21 (Liquidity Facility Citibank NA) (b)(d)(e) | 7,870,000 | 7,870,000 | |

| Series XF 22 96, 0.05% 8/6/21 (Liquidity Facility JPMorgan Chase Bank) (b)(d)(e) | 5,200,000 | 5,200,000 | |

| Series XL 0042, 0.04% 8/6/21 (Liquidity Facility Morgan Stanley Bank, West Valley City Utah) (b)(d)(e) | 16,380,000 | 16,380,000 | |

| 419,036,000 | |||

| Mississippi - 0.0% | |||

| Mississippi Bus. Fin. Corp. Rev. Participating VRDN Series 2021 XF 11 05, 0.12% 8/6/21 (Liquidity Facility Deutsche Bank AG New York Branch) (b)(d)(e) | 700,000 | 700,000 | |

| New York - 0.2% | |||

| New York City Gen. Oblig. Participating VRDN Series 2020 003, 0.22% 9/10/21 (Liquidity Facility Wells Fargo Bank NA) (b)(d)(e) | 300,000 | 300,000 | |

| New York City Transitional Fin. Auth. Rev. Participating VRDN Series 002, 0.17% 9/10/21 (Liquidity Facility Wells Fargo Bank NA) (b)(d)(e) | 1,600,000 | 1,600,000 | |

| 1,900,000 | |||

| Ohio - 0.1% | |||

| Ohio Hosp. Rev. Participating VRDN Series 002, 0.14% 9/10/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 1,000,000 | 1,000,000 | |

| Texas - 0.1% | |||

| Houston Arpt. Sys. Rev. Participating VRDN Series XF 11 11, 0.12% 8/6/21 (Liquidity Facility Deutsche Bank AG New York Branch) (a)(b)(d)(e) | 600,000 | 600,000 | |

| North Texas Tollway Auth. Rev. Bonds Series G-112, 0.22%, tender 1/3/22 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | 700,000 | 700,000 | |

| 1,300,000 | |||

| Virginia - 0.5% | |||

| Lynchburg Econ. Dev. Participating VRDN Series 2020 10, 0.14% 9/10/21 (Liquidity Facility Barclays Bank PLC) (b)(d)(e) | 3,200,000 | 3,200,000 | |

| Suffolk Econ. Dev. Auth. Hosp. Facilities Rev. Participating VRDN Series MIZ 90 25, 0.09% 8/6/21 (Liquidity Facility Mizuho Cap. Markets Llc) (b)(d)(e) | 1,930,000 | 1,930,000 | |

| Virginia Pub. Bldg. Auth. Pub. Facilities Rev. Bonds Series Floaters G 40, 0.22%, tender 2/1/22 (Liquidity Facility Royal Bank of Canada) (b)(d)(e)(f) | 300,000 | 300,000 | |

| 5,430,000 | |||

| TOTAL TENDER OPTION BOND | |||

| (Cost $453,606,000) | 453,606,000 | ||

| Other Municipal Security - 20.1% | |||

| Massachusetts - 20.1% | |||

| Andover Gen. Oblig. BAN Series 2021, 1% 12/17/21 | 2,300,000 | 2,307,183 | |

| Billerica Gen. Oblig. BAN Series 2021: | |||

| 1% 1/28/22 | 7,000,000 | 7,030,542 | |

| 2% 1/28/22 | 3,700,000 | 3,732,769 | |

| Bourne Gen. Oblig. BAN Series 2021, 2% 2/1/22 | 3,212,359 | 3,241,417 | |

| Brookline Gen. Oblig. BAN Series 2021, 1.5% 3/25/22 | 3,300,000 | 3,327,887 | |

| Dartmouth Gen. Oblig. BAN Series 2021, 1.5% 2/15/22 | 3,179,619 | 3,201,984 | |

| Easton Gen. Oblig. BAN Series 2021, 1.5% 6/17/22 | 4,300,000 | 4,350,780 | |

| Framingham Gen. Oblig. BAN Series 2021, 1% 12/17/21 | 13,800,000 | 13,847,773 | |

| Gloucester Gen. Oblig. BAN Series 2021, 1% 9/17/21 | 9,300,000 | 9,310,163 | |

| Hingham Gen. Oblig. BAN Series 2021, 2% 5/12/22 | 11,000,000 | 11,158,083 | |

| Holliston Gen. Oblig. BAN Series 2021, 2% 7/22/22 | 4,152,000 | 4,226,586 | |

| Lexington Gen. Oblig. BAN Series 2021: | |||

| 1.25% 2/11/22 | 2,200,000 | 2,212,974 | |

| 1.5% 2/11/22 | 1,374,347 | 1,383,598 | |

| Littleton Gen. Oblig. BAN Series 2020, 2% 11/19/21 | 4,900,000 | 4,923,974 | |

| Massachusetts Bay Trans. Auth. Sales Tax Rev. Bonds Series 2017, 4% 12/1/21 | 2,590,000 | 2,623,085 | |

| Massachusetts Dev. Fin. Agcy. Series 2021, 0.09% 10/1/21, LOC TD Banknorth, NA, CP | 2,095,000 | 2,095,000 | |

| Massachusetts Dev. Fin. Agcy. Elec. Util. Rev. Bonds Series 2007, 0.12% tender 8/4/21 (Massachusetts Elec. Co. Guaranteed), CP mode (a) | 11,500,000 | 11,500,000 | |

| Massachusetts Edl. Fing. Auth. Rev. Bonds: | |||

| Series 2014 I, 5% 1/1/22 (a) | 3,000,000 | 3,058,065 | |

| Series 2015 A, 5% 1/1/22 (a) | 10,000,000 | 10,198,397 | |

| Massachusetts Gen. Oblig. Bonds: | |||

| Series 2011 D: | |||

| 5% 10/1/21 (Pre-Refunded to 10/1/21 @ 100) | 1,030,000 | 1,038,229 | |

| 5% 10/1/21 (Pre-Refunded to 10/1/21 @ 100) | 110,000 | 110,871 | |

| 5% 10/1/21 (Pre-Refunded to 10/1/21 @ 100) | 575,000 | 579,572 | |

| Series 2013 B, 5% 8/1/21 | 730,000 | 730,000 | |

| Series 2013 E, 4.5% | 2,500,000 | 2,500,000 | |

| Series 2016 C, 5% 10/1/21 | 2,660,000 | 2,681,247 | |

| Series A, 5.25% 8/1/21 | 1,750,000 | 1,750,000 | |

| Series C, 4% | 345,000 | 345,000 | |

| Massachusetts Health & Edl. Facilities Auth. Rev. Bonds: | |||

| Series 2021 H1: | |||

| 0.09% tender 11/3/21, CP mode | 6,300,000 | 6,300,000 | |

| 0.1% tender 12/3/21, CP mode | 6,500,000 | 6,500,000 | |

| Series 2021 H2: | |||

| 0.09% tender 9/3/21, CP mode | 9,800,000 | 9,800,000 | |

| 0.09% tender 10/6/21, CP mode | 8,950,000 | 8,950,000 | |

| Series H1: | |||

| 0.1% tender 8/4/21, CP mode | 7,900,000 | 7,900,000 | |

| 0.11% tender 8/3/21, CP mode | 8,500,000 | 8,500,000 | |

| Series H2, 0.12% tender 8/5/21, CP mode | 6,230,000 | 6,230,000 | |

| Massachusetts Port Auth. Rev. Series 2012 A, 0.11% 1/13/22, LOC TD Banknorth, NA, CP | 11,000,000 | 11,000,000 | |

| Massachusetts School Bldg. Auth. Dedicated Sales Tax Rev. Bonds Series 2011 B, 5% 10/15/21 (Pre-Refunded to 10/15/21 @ 100) | 3,005,000 | 3,034,491 | |

| Massachusetts Wtr. Resources Auth. Wtr. & Swr. Rev.: | |||

| Bonds Series 2011 B, 5% | 510,000 | 510,000 | |

| Series 2021, 0.15% 9/16/21, LOC State Street Bank & Trust Co., Boston, CP | 12,500,000 | 12,500,000 | |

| Nantucket Gen. Oblig. BAN: | |||

| Series 2021 B, 1.25% 6/30/22 | 2,750,000 | 2,776,268 | |

| Series B, 1.25% 10/15/21 | 3,900,000 | 3,908,762 | |

| Natick Gen. Oblig. BAN Series 2021, 2% 6/10/22 | 1,987,101 | 2,017,006 | |

| North Reading Gen. Oblig. BAN Series 2021, 1.5% 5/27/22 | 2,735,577 | 2,765,538 | |

| Norwell Gen. Oblig. BAN Series 2021, 2% 2/17/22 | 2,300,000 | 2,322,373 | |

| Plymouth Gen. Oblig. Bonds Series 2021, 5% 5/1/22 | 1,600,000 | 1,658,298 | |

| Scituate Gen. Oblig. BAN Series 2021, 1.5% 3/4/22 | 2,000,000 | 2,015,280 | |

| Somerville Gen. Oblig.: | |||

| BAN Series 2021, 2% 6/3/22 | 9,000,000 | 9,142,502 | |

| Bonds Series 2021, 5% 6/1/22 | 835,000 | 868,831 | |

| Watertown Gen. Oblig. BAN Series 2021, 2% 6/24/22 | 3,132,738 | 3,183,986 | |

| Wellesley Gen. Oblig. BAN Series 2021, 2% 5/20/22 | 2,035,000 | 2,064,401 | |

| Westborough Gen. Oblig. BAN Series 2021, 2% 3/29/22 | 3,000,000 | 3,036,953 | |

| Westford Gen. Oblig. BAN Series 2021, 1.5% 6/22/22 | 3,600,000 | 3,642,857 | |

| Westwood Gen. Oblig. BAN Series 2021, 2% 4/8/22 | 2,200,000 | 2,226,912 | |

| 236,319,637 | |||

| Michigan - 0.0% | |||

| Kent Hosp. Fin. Auth. Hosp. Facilities Rev. Bonds (Spectrum Health Sys. Proj.) Series 2015 A, SIFMA Municipal Swap Index + 0.250% 0.27%, tender 2/25/22 (b)(g) | 100,000 | 100,000 | |

| TOTAL OTHER MUNICIPAL SECURITY | |||

| (Cost $236,419,637) | 236,419,637 | ||

| Shares | Value | ||

| Investment Company - 4.7% | |||

| Fidelity Municipal Cash Central Fund 0.04% (h)(i) | |||

| (Cost $55,640,896) | 55,637,566 | 55,640,896 | |

| TOTAL INVESTMENT IN SECURITIES - 99.7% | |||

| (Cost $1,174,999,533) | 1,174,999,533 | ||

| NET OTHER ASSETS (LIABILITIES) - 0.3% | 3,911,858 | ||

| NET ASSETS - 100% | $1,178,911,391 |

Security Type Abbreviations

BAN – BOND ANTICIPATION NOTE

CP – COMMERCIAL PAPER

VRDN – VARIABLE RATE DEMAND NOTE (A debt instrument that is payable upon demand, either daily, weekly or monthly)

The date shown for securities represents the date when principal payments must be paid, taking into account any call options exercised by the issuer and any permissible maturity shortening features other than interest rate resets.

Legend

(a) Private activity obligations whose interest is subject to the federal alternative minimum tax for individuals.

(b) Coupon rates for floating and adjustable rate securities reflect the rates in effect at period end.

(c) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At the end of the period, the value of these securities amounted to $12,955,000 or 1.1% of net assets.

(d) Provides evidence of ownership in one or more underlying municipal bonds.

(e) Coupon rates are determined by re-marketing agents based on current market conditions.

(f) Restricted securities (including private placements) - Investment in securities not registered under the Securities Act of 1933 (excluding 144A issues). At the end of the period, the value of restricted securities (excluding 144A issues) amounted to $6,720,000 or 0.6% of net assets.

(g) Coupon is indexed to a floating interest rate which may be multiplied by a specified factor and/or subject to caps or floors.

(h) Information in this report regarding holdings by state and security types does not reflect the holdings of the Fidelity Municipal Cash Central Fund.

(i) Affiliated fund that is available only to investment companies and other accounts managed by Fidelity Investments. The rate quoted is the annualized seven-day yield of the fund at period end. A complete unaudited listing of the fund's holdings as of its most recent quarter end is available upon request. In addition, each Fidelity Central Fund's financial statements are available on the SEC's website or upon request.

Additional information on each restricted holding is as follows:

| Security | Acquisition Date | Cost |

| Broward County Port Facilities Rev. Bonds Series G 115, 0.27%, tender 3/1/22 (Liquidity Facility Royal Bank of Canada) | 3/1/21 | $500,000 |

| Massachusetts Spl. Oblig. Dedicated Tax Rev. Bonds Series Floaters G 29, 0.2%, tender 1/3/22 (Liquidity Facility Royal Bank of Canada) | 7/1/21 | $5,220,000 |

| North Texas Tollway Auth. Rev. Bonds Series G-112, 0.22%, tender 1/3/22 (Liquidity Facility Royal Bank of Canada) | 7/1/21 | $700,000 |

| Virginia Pub. Bldg. Auth. Pub. Facilities Rev. Bonds Series Floaters G 40, 0.22%, tender 2/1/22 (Liquidity Facility Royal Bank of Canada) | 2/1/21 | $300,000 |

Affiliated Central Funds

Information regarding fiscal year to date income earned by the Fund from investments in Fidelity Central Funds is as follows:

| Fund | Income earned |

| Fidelity Municipal Cash Central Fund | $31,175 |

| Total | $31,175 |

Amounts in the income column in the above table include any capital gain distributions from underlying funds, which are presented in the corresponding line-item in the Statement of Operations, if applicable.

Fiscal year to date information regarding the Fund's investments in Fidelity Central Funds, including the ownership percentage, is presented below.

| Fund | Value, beginning of period | Purchases | Sales Proceeds | Realized Gain/Loss | Change in Unrealized appreciation (depreciation) | Value, end of period | % ownership, end of period |

| Fidelity Municipal Cash Central Fund 0.04% | $115,013,119 | $166,902,000 | $226,278,000 | $3,777 | $-- | $55,640,896 | 3.3% |

| Total | $115,013,119 | $166,902,000 | $226,278,000 | $3,777 | $-- | $55,640,896 |

Investment Valuation

All investments are categorized as Level 2 under the Fair Value Hierarchy. The inputs or methodology used for valuing securities may not be an indication of the risk associated with investing in those securities. For more information on valuation inputs please refer to the Investment Valuation section in the accompanying Notes to Financial Statements.

See accompanying notes which are an integral part of the financial statements.

Fidelity® Massachusetts Municipal Money Market Fund

Financial Statements

Statement of Assets and Liabilities

| July 31, 2021 (Unaudited) | ||

| Assets | ||

| Investment in securities, at value — See accompanying schedule: Unaffiliated issuers (cost $1,119,358,637) | $1,119,358,637 | |

| Fidelity Central Funds (cost $55,640,896) | 55,640,896 | |

| Total Investment in Securities (cost $1,174,999,533) | $1,174,999,533 | |

| Cash | 546 | |

| Receivable for fund shares sold | 3,535,255 | |

| Interest receivable | 846,171 | |

| Distributions receivable from Fidelity Central Funds | 2,474 | |

| Prepaid expenses | 831 | |

| Other receivables | 226 | |

| Total assets | 1,179,385,036 | |

| Liabilities | ||

| Payable for fund shares redeemed | $393,515 | |

| Distributions payable | 314 | |

| Accrued management fee | 42,471 | |

| Other affiliated payables | 10,923 | |

| Other payables and accrued expenses | 26,422 | |

| Total liabilities | 473,645 | |

| Net Assets | $1,178,911,391 | |

| Net Assets consist of: | ||

| Paid in capital | $1,179,480,350 | |

| Total accumulated earnings (loss) | (568,959) | |

| Net Assets | $1,178,911,391 | |

| Net Asset Value, offering price and redemption price per share ($1,178,911,391 ÷ 1,177,118,522 shares) | $1.00 |

See accompanying notes which are an integral part of the financial statements.

Statement of Operations

| Six months ended July 31, 2021 (Unaudited) | ||

| Investment Income | ||

| Interest | $469,982 | |

| Income from Fidelity Central Funds | 31,175 | |

| Total income | 501,157 | |

| Expenses | ||

| Management fee | $2,113,583 | |

| Transfer agent fees | 749,265 | |

| Accounting fees and expenses | 66,945 | |

| Custodian fees and expenses | 5,767 | |

| Independent trustees' fees and expenses | 1,604 | |

| Registration fees | 11,677 | |

| Audit | 19,083 | |

| Legal | 4,308 | |

| Miscellaneous | 2,402 | |

| Total expenses before reductions | 2,974,634 | |

| Expense reductions | (2,533,988) | |

| Total expenses after reductions | 440,646 | |

| Net investment income (loss) | 60,511 | |

| Realized and Unrealized Gain (Loss) | ||

| Net realized gain (loss) on: | ||

| Investment securities: | ||

| Unaffiliated issuers | 59,887 | |

| Fidelity Central Funds | 3,777 | |

| Total net realized gain (loss) | 63,664 | |

| Net increase in net assets resulting from operations | $124,175 |

See accompanying notes which are an integral part of the financial statements.

Statement of Changes in Net Assets

| Six months ended July 31, 2021 (Unaudited) | Year ended January 31, 2021 | |

| Increase (Decrease) in Net Assets | ||

| Operations | ||

| Net investment income (loss) | $60,511 | $3,832,576 |

| Net realized gain (loss) | 63,664 | 868,086 |

| Net increase in net assets resulting from operations | 124,175 | 4,700,662 |

| Distributions to shareholders | (682,397) | (4,730,549) |

| Share transactions | ||

| Proceeds from sales of shares | 46,104,227 | 193,709,183 |

| Reinvestment of distributions | 661,302 | 4,584,007 |

| Cost of shares redeemed | (125,091,735) | (449,346,757) |

| Net increase (decrease) in net assets and shares resulting from share transactions | (78,326,206) | (251,053,567) |

| Total increase (decrease) in net assets | (78,884,428) | (251,083,454) |

| Net Assets | ||

| Beginning of period | 1,257,795,819 | 1,508,879,273 |

| End of period | $1,178,911,391 | $1,257,795,819 |

| Other Information | ||

| Shares | ||

| Sold | 46,104,227 | 193,709,183 |

| Issued in reinvestment of distributions | 661,302 | 4,584,007 |

| Redeemed | (125,091,735) | (449,346,757) |

| Net increase (decrease) | (78,326,206) | (251,053,567) |