Form N-CSR FundX Investment Trust For: Sep 30

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Name and address of agent for service)

|

(a)

|

Annual Report

|

| Table of Contents |

| Annual Report 2021 | Fundxfunds.com | 1 |

| 1969 | FundX Investment Group (then called DAL) is a registered investment advisor (RIA). | ||

| 1976 | The firm starts publishing NoLoad FundX newsletter. | ||

| 2001 | The firm packages its most popular growth model as a mutual fund, introducing the FundX Upgrader Fund (FUNDX). | ||

| 2002 | Inception of three additional funds: FundX Aggressive Upgrader Fund (HOTFX), FundX Conservative Upgrader Fund (RELAX), and FundX Flexible Income Fund (INCMX). | ||

| 2017 | Inception of the FundX Sustainable Impact Fund (SRIFX), a fund that aims to help investors build wealth and a better world. |

|

Knowledgeable Portfolio Management We’ve been managing portfolios of noload mutual funds since 1969. We monitor thousands of mutual funds and ETFs and make timely portfolio changes.

A Strategy You Can Understand We developed the Upgrading strategy, which is designed to keep our portfolios invested in top-ranked funds. Upgrading ranks noload mutual funds and ETFs based on recent performance. We buy top performers and hold these funds only while they remain top ranked.

FundX Upgrader Funds The FundX Upgrader Funds are a series of mutual funds that invest in underlying mutual funds and exchange traded funds (ETFs) based on our Upgrading strategy. The Funds offer various levels of potential risk and reward.

A Portfolio that Responds to Market Changes Market trends rotate between large-cap and small-cap stocks, growth and value styles of investing, and geographic regions. Our Upgrading strategy aligns the FundX Upgrader Fund portfolios with these trends. The FundX Upgrader Funds have the flexibility to invest both domestically and globally in the sectors, regions and strategies that have strong recent returns. |

| 2 |  |

Annual Report 2021 |

Dear Fellow Shareholders,

US and global stocks markets brought in above-average returns for the trailing year and all of the FundX Funds posted gains.

Stocks remained resilient for most of the last 12 months, rising fairly steadily through the vaccine rollout, changing stock market trends, rising inflation, supply chain delays, and the emergence of the Covid-19 Delta variant. Stocks ended the Annual Report period on a volatile note as a widespread stock market decline in September 2021 resulted in third quarter losses for most market indexes and sectors.

The S&P 500 gained 30.00% for the Annual Report period, and global stocks, as measured by the Morningstar Global Market Large-Mid-Cap Index, were up 27.52%.

Stock market rotations & reversals

Market trends typically rotate between large- and small-cap stocks, growth and value styles, and foreign and US markets. These trends usually last years, but there can be shorter cycles and the Annual Report period saw significant rotations between large-caps and small-caps and growth and value stocks.

Markets had begun to shift away from US large-cap growth and technology stocks in late 2020 and toward smaller-cap and value stocks that tend to do well during economic recoveries. This trend continued through most of the first quarter of 2021, but then it reversed in mid-March as large-cap growth and tech bounced back and then stayed in favor through most of August. Smaller-caps and value stocks did better in September when markets pulled back.

Revolving trends like this are challenging for our investment approach, which is designed to capitalize on sustained cycles that typically last years, not months. The equity FundX Upgrader Funds, including the Upgrader Fund (FUNDX), Aggressive Upgrader Fund (HOTFX), and Sustainable Impact Fund (SRIFX), all brought in double-digit gains, but lagged the benchmarks for the trailing 12 months.

Navigating a low-yield environment

Our Flexible Income strategy was a bright spot over the trailing 12 months. The FundX Flexible Income Fund (INCMX) had one of its strongest periods of outperformance, up 8.63%, while the Bloomberg US Aggregate Bond Index lost -0.90% for the year ending September 30, 2021.

Bonds struggled as interest rates remained at historically low levels, inflation picked up, and the Federal Reserve announced it expected to reduce its monthly bond purchases starting in late 2021. But as usual, some areas of the bond market did better than others (namely high-yield and strategic bond funds) and that’s where we’re invested.

FundX joins One Capital Management

FundX is joining One Capital Management (OCM), a Southern California-based wealth management firm that shares our values and our commitment to putting investors first. On September 1st, the FundX Funds board and shareholders approved a new investment advisory agreement with OCM. There is no change in the day-to-day management of the Funds’ investment portfolios. My team and I continue to manage the funds using the same active investment approach we’ve used for decades.

Thank you for your investment in the FundX Funds. It is a privilege to help investors like you navigate today’s ever-changing markets and work toward your lifelong investment goals.

Janet Brown

Portfolio Manager

| Annual Report 2021 | Fundxfunds.com | 3 |

Past performance does not guarantee future results.

The information provided in this letter represents the opinion of the author and is not intended to be a forecast of future events, a guarantee of future results, nor investment advice.

Mutual fund investing involves risk. Principal loss is possible. The FundX Upgrader Funds (“Funds”) are considered “funds of funds” and an investor will indirectly bear the principal risks and its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than they would if they invested directly in the underlying funds. The Funds employ an “Upgrading” strategy whereby investment decisions are based on near-term performance, however, the Funds may be exposed to the risk of buying underlying funds immediately following a sudden, brief surge in performance that may be followed by a subsequent drop in market value. The Funds invest in underlying funds and these underlying funds may invest in securities of small companies, which involve greater volatility than investing in larger, more established companies, or they may invest in foreign securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods; these risks are greater for investments in emerging markets. The underlying funds may invest in debt securities, which typically decrease in value when interest rates rise; this risk is usually greater for longer-term debt securities. Lower-rated and non-rated securities present a greater risk of loss to principal and interest than higher rated securities. While the Upgrader Funds are diversified, the underlying funds may invest in a limited number of issuers and therefore may be considered non-diversified.The underlying funds may engage in short sales; an underlying fund’s investment performance may suffer if it is required to close out a short position earlier than intended. Some underlying funds may borrow money for leveraging and will incur interest expense. Some underlying funds may use derivatives,which involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. ETFs are subject to additional risks that do not apply to conventional mutual funds, including the risks that the market price of an ETF’s shares may trade at a discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a Fund’s ability to sell its shares. The underlying funds may invest in asset-backed and mortgage-backed securities, which involve additional risks such as credit risk, prepayment risk, possible illiquidity and default, and increased susceptibility to adverse economic developments. The underlying funds, particularly some ETFs, may use investment techniques considered to be aggressive, including using futures contracts, options on futures contracts, securities and indices, forward contracts, swap agreements and similar instruments.

Sector weighting and fund holdings are subject to change at any time and mention of them should not be construed as recommendations to buy or sell any security. Please refer to the Schedule of Investments in this report for further sector and holdings information.

Duration is an approximate measure of a bond’s price sensitivity to changes in interest rates.

References to other funds should not be interpreted as an offer of these securities.

Defensive funds typically invest in areas of the market that may hold up better in market declines, such as gold, real estate, utilities, and consumer staples. These funds also may invest in dividend-paying stocks, higher-quality stocks, or low-volatility stocks.

The S&P 500 Index is a broad based unmanaged Index of 500 U.S. stocks, which is widely recognized as representative of the U.S. equity market. The Morningstar Global Market Large-Mid Cap Index measures the performance of developed and emerging countries across the world, targeting the top 90% of stocks by market capitalization. The Bloomberg Barclays Aggregate Bond Index is a market-capitalization-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. You cannot invest directly in an index.

While the funds are noload, management fees and expenses still apply. Diversification does not assure a profit or protect against a loss in a declining market. Please refer to prospectus for further details.

Any new investment in a FundX Upgrader Fund must be preceded or accompanied by a prospectus.

The FundX Upgrader Funds are distributed by Quasar Distributors, LLC.

| 4 |  |

Annual Report 2021 |

The Upgrader Fund (FUNDX) is designed to be a core equity holding. Investors in FUNDX own a portfolio of diversified stock funds that are actively managed to navigate changing markets and capitalize on global market trends.

| Annual Report 2021 | Fundxfunds.com | 5 |

FUNDX was underweight value and small-cap during the last quarter of 2020 when these areas were rising, and inversely, FUNDX had a heavy allocation to value, small- and mid-caps as the trends reversed in the first half of 2021. This was a drag on performance.

What contributed positively to the fund’s performance?

The large-cap growth focused funds like Invesco Summit (ASMYX), Brown Advisory Sustainable Growth (BAFWX), Fidelity Blue Chip Growth (FBGRX) and Fidelity Advisor Growth (FAGCX) had a positive impact on FUNDX. The large-cap value funds that opportunistically captured the value trend like Ariel fund (ARAIX) and Fidelity Convertible Securities (FCCVX) also contributed to the fund’s performance.

Market trends build and develop over time, and there are often short-term reversals along the way. The Upgrading strategy aims to make portfolio changes gradually in an effort to capitalize on enduring trends. As a result, the equity approach may lag during transitions, but it typically pulls ahead over time. We believe our systematic approach is an advantage over longer periods.

| 6 |  |

Annual Report 2021 |

| FUNDX |  |

Upgrader Fund Growth Fund |

| FundX Upgrader Fund: Performance Summary |

Annualized Returns as of September 30, 2021

| As of 9/30/21 | 1 Year | 3 Year | 5 Year | 10 Year |

| FundX Upgrader Fund | 19.61% | 12.51% | 14.01% | 13.13% |

| Morningstar Global Market Large-Mid Cap Index | 27.52% | 12.50% | 13.16% | 11.97% |

| S&P 500 Index | 30.00% | 15.99% | 16.90% | 16.63% |

FundX Upgrader Fund Growth of $10,000 vs Morningstar Global Market Large-Mid Cap Index and S&P 500 Index

While the chart compares a mutual fund to an index, there are important differences between mutual funds and indexes. Market indexes are unmanaged and do not have expenses. The fund, on the other hand, is actively managed and seeks to meet a specific objective other than tracking the index, such as limiting risk or rotating among various sectors or investment styles. The fund also provides a wide range of services to shareholders, and it has transaction and other operational costs.

This chart illustrates the performance of a hypothetical $10,000 investment, including reinvested dividends and distributions, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced.

The performance data quoted above represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fundxfunds.com.

The Morningstar Global Market Large-Mid Cap Index measures the performance of developed and emerging countries across the world, targeting the top 90% of stocks by market capitalization. The S&P 500 Index is a broad based unmanaged index of 500 U.S. stocks, which is widely recognized as representative of the U.S. equity market. The figures above reflect all dividends reinvested but do not reflect any deductions for fees, expenses, or taxes. One cannot invest directly in an index.

| Annual Report 2021 | Fundxfunds.com | 7 |

| FUNDX |  |

Upgrader Fund Growth Fund |

0.3% Short-Term Investments,

Net of Other Liabilities

| # | Annualized seven-day yield as of September 30, 2021. | |

| The accompanying notes are an integral part of these financial statements. |

| 8 |  |

Annual Report 2021 |

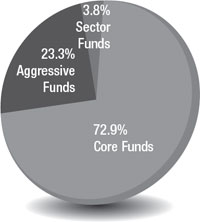

The Aggressive Upgrader Fund (HOTFX) focuses on concentrated stock funds, including sector and country-specific funds and ETFs, which typically have above-average risk and higher potential volatility. HOTFX is actively managed in an attempt to capitalize on sector rotations and global market trends.

| Annual Report 2021 | Fundxfunds.com | 9 |

What contributed positively to the fund’s performance?

Technology positions contributed to HOTFX’s gains. VanEck Semiconductor (SMH), one of the few tech positions we held throughout the Annual Report period, was the best performing position, strongly outperforming the Morningstar Global Market Large-Mid-Cap Index and the S&P 500 for the year. Fidelity Select Semiconductor (FSELX), another longtime position that we bought in 2019 and sold in April 2021, also added value.

| 10 |  |

Annual Report 2021 |

| HOTFX |  |

Aggressive Upgrader Fund Aggressive Growth Fund |

| FundX Aggressive Upgrader Fund: Performance Summary |

Annualized Returns as of September 30, 2021

| As of 9/30/21 | 1 Year | 3 Year | 5 Year | 10 Year |

| FundX Aggressive Upgrader Fund | 11.22% | 9.17% | 10.84% | 11.27% |

| Morningstar Global Market Large-Mid Cap Index | 27.52% | 12.50% | 13.16% | 11.97% |

| S&P 500 Index | 30.00% | 15.99% | 16.90% | 16.63% |

FundX Aggressive Upgrader Fund Growth of $10,000 vs Morningstar Global Market Large-Mid Cap Index and S&P 500 Index

While the chart compares a mutual fund to an index, there are important differences between mutual funds and indexes. Market indexes are unmanaged and do not have expenses. The fund, on the other hand, is actively managed and seeks to meet a specific objective other than tracking the index, such as limiting risk or rotating among various sectors or investment styles. The fund also provides a wide range of services to shareholders, and it has transaction and other operational costs.

This chart illustrates the performance of a hypothetical $10,000 investment, including reinvested dividends and distributions, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced.

The performance data quoted above represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fundxfunds.com.

The Morningstar Global Market Large-Mid Cap Index measures the performance of developed and emerging countries across the world, targeting the top 90% of stocks by market capitalization. The S&P 500 Index is a broad based unmanaged index of 500 U.S. stocks, which is widely recognized as ?representative of the U.S. equity market. The figures above reflect all dividends reinvested but do not reflect any deductions for fees, expenses, or taxes. One cannot invest directly in an index.

| Annual Report 2021 | Fundxfunds.com | 11 |

| HOTFX |  |

Aggressive Upgrader Fund Aggressive Growth Fund |

0.4% Short-Term Investments,

Net of Other Liabilities

| SCHEDULE OF INVESTMENTS AT SEPTEMBER 30, 2021 |

| Shares | Investment Companies: 99.6% | Value | ||||||

| Aggressive Funds: | ||||||||

| 20,170 | American Century Ultra Fund - Class I | $ | 1,829,405 | |||||

| 30,008 | Fidelity Advisor Series I - Fidelity Advisor Value Strategies | 1,523,181 | ||||||

| 5,300 | Invesco QQQ Trust Series 1 | 1,897,188 | ||||||

| 14,600 | iShares Russell 2000 Value ETF | 2,339,358 | ||||||

| 22,900 | iShares S&P Small-Cap 600 Value ETF | 2,305,343 | ||||||

| 74,020 | JPMorgan Small Cap Value Fund - Class I | 2,488,563 | ||||||

| 21,129 | Kinetics Paradigm Fund - Institutional Class | 1,520,227 | ||||||

| 69,478 | Oakmark International Small Cap Fund - Advisor Class | 1,386,775 | ||||||

| 41,542 | Oakmark Select Fund - Advisor Class | 2,584,746 | ||||||

| 43,910 | TCW Select Equities Fund - Class I | 1,841,160 | ||||||

| Total Aggressive Funds 54.0% | 19,715,946 | |||||||

| Sector Funds: | ||||||||

| 87,681 | Fidelity Consumer Finance Portfolio | 2,064,884 | ||||||

| 40,900 | Invesco Water Resources ETF | 2,238,048 | ||||||

| 155,340 | PIMCO RealEstateRealReturn Strategy Fund - Institutional Class | 1,368,544 | ||||||

| 27,500 | SPDR S&P Homebuilders ETF | 1,973,400 | ||||||

| 45,000 | SPDR S&P Regional Banking ETF | 3,048,750 | ||||||

| 25,400 | SPDR S&P Retail ETF | 2,294,128 | ||||||

| 14,300 | VanEck Vectors Semiconductor ETF | 3,664,661 | ||||||

| Total Sector Funds 45.6% | 16,652,415 | |||||||

| Total Investment Companies | ||||||||

| (Cost $35,682,688) | 36,368,361 | |||||||

| 12 |  |

Annual Report 2021 |

| HOTFX |  |

Aggressive Upgrader Fund Aggressive Growth Fund |

| SCHEDULE OF INVESTMENTS AT SEPTEMBER 30, 2021 |

| Shares | Value | ||||||||

| Short-Term Investments: 0.4% | |||||||||

| 169,392 | Fidelity Investments Money Market Government Portfolio - Institutional Class, 0.01% # | $ | 169,392 | ||||||

| Total Short-Term Investments | |||||||||

| (Cost $169,392) | 169,392 | ||||||||

| Total Investments: 100.0% | |||||||||

| (Cost $35,852,080) | 36,537,753 | ||||||||

| Liabilities in Excess of Other Assets: 0.0% | (14,987 | ) | |||||||

| Net Assets: 100.0% | $ | 36,522,766 | |||||||

| # | Annualized seven-day yield as of September 30, 2021. | ||||||||

| The accompanying notes are an integral part of these financial statements. | |||||||||

| Annual Report 2021 | Fundxfunds.com | 13 |

The Conservative Upgrader Fund (RELAX) is an active balanced fund that can invest in core stock funds, balanced funds, and bond funds. It typically owns core stock funds for growth, and includes bonds and total-return funds, such as balanced and low volatility equity funds, as a way to buffer stock market volatility.

RELAX is designed for investors who seek the growth potential of a stock fund combined with the lower volatility of a fixed income fund.

|

Janet Brown

Marty DeVault

Sean McKeon |

How did the markets change during the Annual Report period? US and global stock market indexes were fairly stable during the trailing 12 months, however, there were significant rotations between large- and small-cap stocks and growth and value sectors.

Markets shifted decisively away from large-cap growth and technology stocks in September 2020 through mid-March and toward smaller-cap and value stocks. Large-cap growth and tech then regained market favor from mid-March through most of August, and smaller-cap and value stocks held up better in the September 2021 pullback.

Bonds sank as interest rates remained at record lows (aside from a brief increase in the first quarter) and inflation increased. Lower-quality bonds, such as high yields, remained in favor during the year, while higher-quality bonds, like Treasuries, were barely positive.

How did the Fund try to respond to these changes? RELAX kept a consistent allocation to stock, bond, and balanced funds during the year, but we made some significant changes to the funds in each category, particularly on the equity portion. We diversified RELAX’s 30% stake in equities, reducing its large-cap growth positions in favor of mid-cap and value funds, such as Ariel (ARGFX), Fidelity Value (FDVLX), and Parnassus Endeavor (PFPWX).

We also added two value-oriented balanced funds: Oakmark Equity And Income (OAYBX) and Dodge and Cox Balanced (DODBX).

In fixed income, we sold higher-quality intermediate-term bond funds in the first half of the Annual Report period and steadily increased our exposure to lower quality funds, like Thompson Bond (THOPX) and Ivy High Income (IVHIX).

How did the fund perform? For the year ending September 30, 2021, RELAX gained 15.83% compared to 27.52% for the Morningstar Global Market Large-Mid-Cap Index, and -0.90% for the Bloomberg US Aggregate Bond Index. |

| 14 |  |

Annual Report 2021 |

What detracted from the fund’s performance?

Many of RELAX’s equity positions, which contributed to the fund’s gains in 2020, lagged in 2021. Growth funds detracted from RELAX’s returns in the first quarter of 2021, while the fund’s mid-cap and value positions lagged in the second and third quarters as large caps rallied.

SPDR Bloomberg Barclays Convertible Securities ETF (CWB), which we owned briefly in the first quarter, and FirstTrust Rising Dividend Achievers (RDVY), which we added in June 2021, were the fund’s weakest positions.

What contributed positively to the fund’s performance?

RELAX’s allocations to balanced and fixed income funds were the biggest contributors to the fund’s gains. The majority of RELAX’s balanced fund positions outpaced a 60/40 balanced index, and high-yield and strategic bond fund positions, such as Fidelity Capital and Income (FAGIX) and Osterweis Strategic Income (OSTIX), had double-digit gains for the year, while the bond market was down.

Fidelity Real Estate Income (FRIFX) and Permanent Portfolio (PRPFX) were some of the best performing positions, outpacing the bond market as well as a balanced 60/40 index for the year. These funds are part of a select group of low-volatility equity funds that are incorporated into RELAX’s fixed income allocation.

| Annual Report 2021 | Fundxfunds.com | 15 |

| RELAX |  |

Conservative Upgrader Fund Balanced Fund |

| FundX Conservative Upgrader Fund: Performance Summary |

Annualized Returns as of September 30, 2021

| As of 9/30/21 | 1 Year | 3 Year | 5 Year | 10 Year |

| FundX Conservative Upgrader Fund | 15.83% | 8.07% | 9.32% | 9.06% |

| Morningstar Global Market Large-Mid Cap Index | 27.52% | 12.50% | 13.16% | 11.97% |

| S&P 500 Index | 30.00% | 15.99% | 16.90% | 16.63% |

| Balanced Index (60% S&P 500 / 40% Bloomberg U.S. Aggregate Bond) | 16.92% | 12.10% | 11.43% | 11.24% |

| Bloomberg U.S. Aggregate Bond Index | -0.90% | 5.36% | 2.94% | 3.01% |

FundX Conservative Upgrader Fund Growth of $10,000 vs Morningstar Global Market Large-Mid Cap Index, S&P 500 Index, Balanced Index and Barclays Aggregate Bond Index

While the chart compares a mutual fund to an index, there are important differences between mutual funds and indexes. Market indexes are unmanaged and do not have expenses. The fund, on the other hand, is actively managed and seeks to meet a specific objective other than tracking the index, such as limiting risk or rotating among various sectors or investment styles. The fund also provides a wide range of services to shareholders, and it has transaction and other operational costs.

This chart illustrates the performance of a hypothetical $10,000 investment, including reinvested dividends and distributions, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced.

The performance data quoted above represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fundxfunds.com.

The Morningstar Global Market Large-Mid Cap Index measures the performance of developed and emerging countries across the world, targeting the top 90% of stocks by market capitalization. The S&P 500 Index is a broad based unmanaged index of 500 U.S. stocks, which is widely recognized as ?representative of the U.S. equity market. The Bloomberg U.S. Aggregate Bond Index is a market-capitalization-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The figures above reflect all dividends reinvested but do not reflect any deductions for fees, expenses, or taxes. One cannot invest directly in an index.

| 16 |  |

Annual Report 2021 |

| RELAX |  |

Conservative Upgrader Fund Balanced Fund |

0.3% Short-Term Investments,

Net of Other Liabilities

| SCHEDULE OF INVESTMENTS AT SEPTEMBER 30, 2021 |

| Shares | Investment Companies: 99.7% | Value | ||||||

| Bond Funds: | ||||||||

| 32,349 | Columbia Strategic Income Fund - Class I2 | $ | 795,471 | |||||

| 124,827 | Delaware Ivy High Income Fund - Class I | 890,014 | ||||||

| 79,929 | Fidelity Advisor High Income Advantage Fund - Class I | 962,345 | ||||||

| 164,991 | Fidelity Capital & Income Fund | 1,869,352 | ||||||

| 68,841 | Loomis Sayles Bond Fund - Institutional Class | 941,739 | ||||||

| 153,011 | Metropolitan West High Yield Bond Fund - Class I | 1,641,806 | ||||||

| 157,544 | Osterweis Strategic Income Fund | 1,816,478 | ||||||

| 15,000 | SPDR Bloomberg Barclays High Yield Bond ETF | 1,640,400 | ||||||

| 146,121 | Thompson Bond Fund | 1,614,634 | ||||||

| Total Bond Funds 13.6% | 12,172,239 | |||||||

| Core Funds: | ||||||||

| 33,670 | Ariel Fund - Institutional Class | 2,873,401 | ||||||

| 10,433 | Fidelity Advisor Growth Opportunities Fund - Class I | 1,805,810 | ||||||

| 11,644 | Fidelity Blue Chip Growth Fund | 2,027,312 | ||||||

| 179,702 | Fidelity Value Fund | 2,688,337 | ||||||

| 22,000 | First Trust Rising Dividend Achievers ETF | 1,044,340 | ||||||

| 18,500 | Invesco BuyBack Achievers ETF | 1,667,960 | ||||||

| 36,600 | Invesco S&P 500 Pure Value ETF | 2,774,646 | ||||||

| 27,000 | iShares S&P Mid-Cap 400 Value ETF | 2,782,080 | ||||||

| 25,202 | Oakmark Fund - Advisor Class | 2,912,853 | ||||||

| 47,874 | Parnassus Endeavor Fund - Institutional Class | 2,793,470 | ||||||

| 53,204 | Transamerica Capital Growth - Class I | 3,203,385 | ||||||

| Total Core Funds 29.7% | 26,573,594 | |||||||

| Annual Report 2021 | Fundxfunds.com | 17 |

| RELAX |  |

Conservative Upgrader Fund Balanced Fund |

| SCHEDULE OF INVESTMENTS AT SEPTEMBER 30, 2021 |

| Shares | Investment Companies: 99.7% | Value | |||||||

| Total Return Funds: | |||||||||

| 50,560 | Columbia Balanced Fund - Class I2 | $ | 2,667,022 | ||||||

| 43,324 | Dodge & Cox Balanced Fund | 4,967,097 | |||||||

| 199,937 | Fidelity Advisory Balanced Fund - Class I | 5,876,138 | |||||||

| 207,693 | Fidelity Asset Manager 70% Fund | 5,904,708 | |||||||

| 184,438 | Fidelity Puritan Fund | 5,308,135 | |||||||

| 524,580 | Fidelity Real Estate Income Fund | 7,045,117 | |||||||

| 146,183 | FPA Crescent Fund - Investor Class | 5,787,385 | |||||||

| 126,389 | Oakmark Equity and Income Fund - Advisor Class | 4,547,482 | |||||||

| 39,345 | Permanent Portfolio - Class I | 1,929,090 | |||||||

| 125,702 | T. Rowe Price Capital Appreciation Fund - Class I | 4,803,067 | |||||||

| 24,332 | Vanguard Wellesley Income Fund - Admiral Class | 1,727,316 | |||||||

| Total Total Return Funds 56.4% | 50,562,557 | ||||||||

| Total Investment Companies | |||||||||

| (Cost $82,997,130) | 89,308,390 | ||||||||

| Short-Term Investments: 0.5% | |||||||||

| 469,103 | Fidelity Investments Money Market Government Portfolio - Institutional Class, 0.01% # | 469,103 | |||||||

| Total Short-Term Investments | |||||||||

| (Cost $469,103) | 469,103 | ||||||||

| Total Investments: 100.2% | |||||||||

| (Cost $83,466,233) | 89,777,493 | ||||||||

| Liabilities in Excess of Other Assets: (0.2)% | (150,459 | ) | |||||||

| Net Assets: 100.0% | $ | 89,627,034 | |||||||

| # | Annualized seven-day yield as of September 30, 2021. | ||||||||

| The accompanying notes are an integral part of these financial statements. | |||||||||

| 18 |  |

Annual Report 2021 |

The Flexible Income Fund (INCMX) is primarily a bond portfolio, utilizing funds and ETFs rather than individual issues, and it may also invest a portion of its portfolio in total-return or alternative funds. Some investors use the fund as a standalone portfolio designed to deliver relatively low volatility returns over time. It is often used by investors as a lower-risk component of a balanced portfolio that would also include equity funds.

|

Janet Brown

Marty DeVault

Sean McKeon

|

How did the market change during the Annual Report period? Interest rates took a mostly upwards journey during this 12-month period, as the Covid-19 recovery brought inflation pressure. The benchmark 10-year Treasury rose from 0.69% at the start of the period to a peak of 1.74% six months later – a gain of over 150%. Yields retreated for several months in mid-2021, but never reached those low starting levels again before resuming their upward march in August. Bond prices move inversely to yields, so most bond funds lost value through September 30. Higher-quality bond funds, such as US Treasury funds, are more sensitive to interest rate moves, so they suffered more acutely than other areas of the debt market. Lower-quality debt, such as high-yield bonds and bank loans, remained in favor during the year.

How did the Fund try to respond to these changes? We sold higher-quality intermediate-term bond funds in the first half of the Annual Report period and steadily increased our exposure to lower quality funds like Thompson Bond (THOPX) and Ivy High Income (IVHIX). Our allocation to strategic funds rose from 14.9% to 32.7%, while high-yield bond funds increased from 22.7% to 37.0% of the portfolio.

How did the fund perform? For the year ending September 30, 2021, INCMX gained 8.63% compared to -0.90% for the Bloomberg US Aggregate Bond Index.

What detracted from the fund’s performance? Ironically, two of our losing holdings were short-lived positions in broad market index funds, Vanguard Total Bond Market ETF (BND) and iShares Core Aggregate Bond ETF (AGG). Both had negative returns for the time we held them.

What contributed positively to the fund’s performance? The weighting to high-yield funds worked favorably for a couple of reasons. The extra yield offered by bonds of lower credit quality buffered the downward pressure from a rising interest rate environment. Also, as investors sought alternatives to low-yielding government bonds and money-market instruments, they turned to high-yield bonds, thereby increasing prices.

Another star player was Fidelity Real Estate Income (FRIFX), which was a small (under 5%) position when we purchased it in September 2020. It gained more than 20% from the start of the reporting period through early June, when we added more to the position. As of September 30, 2021, FRIFX makes up 9.6% of the fund. |

| Annual Report 2021 | Fundxfunds.com | 19 |

| INCMX |  |

Flexible Income Fund Fixed Income |

| FundX Flexible Income Fund: Performance Summary |

Annualized Returns as of September 30, 2021

| As of 9/30/21 | 1 Year | 3 Year | 5 Year | 10 Year |

| FundX Flexible Income Fund | 8.63% | 3.21% | 3.13% | 3.60% |

| Bloomberg U.S. Aggregate Bond Index | -0.90% | 5.36% | 2.94% | 3.01% |

| BofA Merrill Lynch 3-Month U.S. Treasury Bill Index |

0.07% | 1.18% | 1.16% | 0.63% |

FundX Flexible Income Fund Growth of $10,000 vs Barclays Aggregate Bond Index and BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

While the chart compares a mutual fund to an index, there are important differences between mutual funds and indexes. Market indexes are unmanaged and do not have expenses. The fund, on the other hand, is actively managed and seeks to meet a specific objective other than tracking the index, such as limiting risk or rotating among various sectors or investment styles. The fund also provides a wide range of services to shareholders, and it has transaction and other operational costs.

This chart illustrates the performance of a hypothetical $10,000 investment, including reinvested dividends and distributions, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced.

The performance data quoted above represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fundxfunds.com.

The Bloomberg U.S. Aggregate Bond Index is a market-capitalization-weighted index of investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities, with maturities of at least one year. The BofA Merrill Lynch 3-Month U.S. Treasury Bill Index is an unmanaged market index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income. The figures above reflect all dividends reinvested but do not reflect any deductions for fees, expenses, or taxes. One cannot invest directly in an index.

| 20 |  |

Annual Report 2021 |

| INCMX |  |

Flexible Income Fund Fixed Income |

0.9% Short-Term Investments,

Inclusive of Other Assets

| Annual Report 2021 | Fundxfunds.com | 21 |

The Sustainable Impact Fund (SRIFX) integrates environmental, social, and governance (ESG) criteria into our longtime momentum-based investment approach. SRIFX invests primarily in core diversified stock funds that have strong ESG ratings and strong recent returns. It also may have limited exposure to more aggressive stock funds that meet our sustainability and performance standards.

|

Janet Brown

Marty DeVault

Sean McKeon

|

How did the market change during the Annual Report period? The trailing 12 months included significant market rotations between large- and small-cap stocks and growth and value sectors. Markets shifted decisively away from large-cap growth and technology stocks starting in the fourth quarter of 2020. But this rotation stalled in mid-March 2021, and large-cap growth and tech regained market favor. Large-caps led for most of the second and third quarters, while smaller-cap and value stocks held up better during the September 2021 pullback.

How did the Fund try to respond to these changes? As markets changed in the first half of the Annual Report period, we diversified SRIFX’s portfolio, adding positions in small-cap, mid-cap, and value funds that had stronger momentum, including Parnassus Endeavor (PFPWX), Nuveen ESG Small Cap ETF (NUSC), Shelton Green Alpha (NEXTX), and Ariel (ARAIX).

Large-cap sustainable funds like Calvert US Large-Cap Value Responsible Index Fund (CFJIX) and Fidelity Environment and Alternative Energy Fund (FSLEX) were added in the second quarter.

How did the fund perform? For the year ending September 30, 2021, SRIFX gained 11.56% compared to 27.52% for the Morningstar Global Market Large-Mid-Cap Index and 30.00% for the S&P 500 Index.

What detracted from the fund’s performance? SRIFX had significant exposure to small- and mid-cap value funds, which lagged in the second half of the Annual Report period as large-cap growth rallied.

Clean energy investments showed promise in early 2021, but soon lost ground and the fund’s small positions in more aggressive funds like First Trust NASDAQ Clean Edge Green Energy ETF (QCLN) and New Alternatives Fund (NALFX) were among its weakest holdings.

What contributed positively to the fund’s performance? SRIFX’s best performing position was Parnassus Endeavor (PFPWX), a large-cap sustainable value fund that handily outperformed the S&P 500 and Morningstar Global Market Large-Mid-Cap Index from the time we first added it to the portfolio in December 2020 through September 30, 2021. We made multiple purchases of PFPWX, in January, February, March and May.

Parnassus is a longtime sustainable fund company. Its Endeavor Fund invests in ESG companies, avoids fossil fuel investments, and also encourages positive change by engaging with company management and voting shareholder-driven proxies. |

| 22 |  |

Annual Report 2021 |

| SRIFX |  |

Sustainable Impact Fund Global Growth and Impact Fund |

| FundX Sustainable Impact Fund: Performance Summary |

Annualized Returns as of September 30, 2021

| As of 9/30/21 | 1 Year | 3 Year | Since Inception (3/31/17) |

| FundX Sustainable Impact Fund | 11.56% | 11.12% | 13.51% |

| Morningstar Global Market Large-Mid Cap Index | 27.52% | 12.50% | 12.74% |

| S&P 500 Index | 30.00% | 15.99% | 16.41% |

FundX Sustainable Impact Fund Growth of $10,000 vs Morningstar Global Market Large-Mid Cap Index and S&P 500 Index

While the chart compares a mutual fund to an index, there are important differences between mutual funds and indexes. Market indexes are unmanaged and do not have expenses. The fund, on the other hand, is actively managed and seeks to meet a specific objective other than tracking the index, such as limiting risk or rotating among various sectors or investment styles. The fund also provides a wide range of services to shareholders, and it has transaction and other operational costs.

This chart illustrates the performance of a hypothetical $10,000 investment, including reinvested dividends and distributions, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The returns reflect fee waivers in effect. In the absence of such waivers, total return would be reduced.

The performance data quoted above represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the funds may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting www.fundxfunds.com.

The Morningstar Global Market Large-Mid Cap Index measures the performance of developed and emerging countries across the world, targeting the top 90% of stocks by market capitalization. The S&P 500 Index is a broad based unmanaged index of 500 U.S. stocks, which is widely recognized as representative of the U.S. equity market. The figures above reflect all dividends reinvested but do not reflect any deductions for fees, expenses, or taxes. One cannot invest directly in an index.

| Annual Report 2021 | Fundxfunds.com | 23 |

| SRIFX |  |

Sustainable Impact Fund Global Growth and Impact Fund |

0.0% Short-Term Investments,

Net of Other Liabilities

| 24 |  |

Annual Report 2021 |

| SRIFX |  |

Sustainable Impact Fund Global Growth and Impact Fund |

| SCHEDULE OF INVESTMENTS AT SEPTEMBER 30, 2021 | |||||||||

| Shares | Value | ||||||||

| Short-Term Investments: 0.2% | |||||||||

| 39,157 | Fidelity Investments Money Market Government Portfolio - Institutional Class, 0.01% # | $ | 39,157 | ||||||

| Total Short-Term Investments | |||||||||

| (Cost $39,157) | 39,157 | ||||||||

| Total Investments: 100.2% | |||||||||

| (Cost $25,343,332) | 25,536,773 | ||||||||

| Liabilities in Excess of Other Assets: (0.2)% | (44,061 | ) | |||||||

| Net Assets: 100.0% | $ | 25,492,712 | |||||||

| * | Non-income producing. | ||||||||

| # | Annualized seven-day yield as of September 30, 2021. | ||||||||

| The accompanying notes are an integral part of these financial statements. | |||||||||

| Annual Report 2021 | Fundxfunds.com | 25 |

The accompanying notes are an integral part of these financial statements.

| 26 |  |

Annual Report 2021 |

| STATEMENT OF ASSETS AND LIABILITIES AT SEPTEMBER 30, 2021 | ||

| FundX Flexible Income Fund |

FundX Sustainable Impact Fund |

|

| Assets | ||

| Investments in securities, at value (identified cost $84,294,872, $25,304,175) (See Note 2) | $89,378,585 | $25,497,616 |

| Investments in short-term securities, at value (identified cost $607,954, $39,157) (See Note 2) | 607,954 | 39,157 |

| Total investments, at value (identified cost $84,902,826, $25,343,332) (See Note 2) | 89,986,539 | 25,536,773 |

| Cash | — | 2,840 |

| Receivables: | ||

| Fund shares sold | 193,555 | 1,992 |

| Dividends and interest | 59,804 | — |

| Prepaid expenses and other assets | 4,951 | 6,033 |

| Total assets | 90,244,849 | 25,547,638 |

| Liabilities | ||

| Payables: | ||

| Fund shares redeemed | 4,943 | 7,188 |

| Investment advisory fees, net | 51,923 | 18,797 |

| Administration and accounting fees | 13,405 | 5,347 |

| Audit fees | 24,500 | 16,400 |

| Custody fees | 850 | 400 |

| Transfer agent fees | 8,698 | 2,394 |

| Trustee fees | 6,362 | 1,883 |

| Other accrued expenses | 6,474 | 2,517 |

| Total liablities | 117,155 | 54,926 |

| Net Assets | $90,127,694 | $25,492,712 |

| Net assets applicable to shares outstanding | $90,127,694 | $25,492,712 |

| Shares outstanding; unlimited number of shares authorized without par value | 3,151,247 | 705,402 |

| Net asset value, offering and redemption price per share | $28.60 | $36.14 |

| Components of Net Assets | ||

| Paid-in capital | $88,784,059 | $18,467,817 |

| Total distributable earnings | 1,343,635 | 7,024,895 |

| Net assets | $90,127,694 | $25,492,712 |

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 27 |

The accompanying notes are an integral part of these financial statements.

| 28 |  |

Annual Report 2021 |

| STATEMENT OF OPERATIONS For The Fiscal Year Ended September 31, 2021 | ||

| FundX Flexible Income Fund |

FundX Sustainable Impact Fund |

|

| INVESTMENT INCOME | ||

| Dividends | $2,708,053 | $66,110 |

| Interest | 45 | 13 |

| Total investment income | 2,708,098 | 66,123 |

| EXPENSES | ||

| Investment advisory fees | 611,718 | 252,290 |

| Transfer agent fees | 47,211 | 13,372 |

| Administration and accounting fees | 78,827 | 31,859 |

| Reports to shareholders | 6,396 | 3,899 |

| Custody fees | 4,938 | 2,175 |

| Audit fees | 26,500 | 16,400 |

| Registration fees | 20,046 | 21,440 |

| Trustee fees | 24,929 | 7,442 |

| Miscellaneous expenses | 9,302 | 7,129 |

| Interest expense (Note 6) | 367 | 8 |

| Legal fees | 33,737 | 9,650 |

| Insurance expense | 5,808 | 1,508 |

| Total expenses | 869,779 | 367,172 |

| Less: fees waived | (4,268) | (26,573) |

| Less: expenses paid indirectly (Note 3) | (23,041) | (5,809) |

| Net expenses | 842,470 | 334,790 |

| Net investment gain (loss) | 1,865,628 | (268,667) |

| REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS | ||

| Net realized gain on investments | 759,560 | 6,831,066 |

| Capital gain distributions from regulated investment companies | 981,243 | 620,284 |

| Change in net unrealized appreciation / depreciation on investments | 3,554,164 | (4,691,188) |

| Net realized and unrealized gain on investments | 5,294,967 | 2,760,162 |

| Net increase in net assets resulting from operations | $7,160,595 | $2,491,495 |

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 29 |

| FUNDX |  |

Upgrader Fund Growth Fund |

(a) Summary of capital share transactions is as follows:

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | |||

| Shares | Paid-in Capital | Shares | Paid-in Capital | |

| Shares sold | 145,057 | $11,186,887 | 202,413 | $12,090,726 |

| Shares issued in reinvestment of distributions | 12,666 | 936,917 | 281,242 | 17,023,561 |

| Shares redeemed | (400,388) | (30,664,557) | (752,575) | (43,490,751) |

| Net change in shares outstanding | (242,665) | $(18,540,753) | (268,920) | $(14,376,464) |

The accompanying notes are an integral part of these financial statements.

| 30 |  |

Annual Report 2021 |

| HOTFX |  |

Aggressive Upgrader Fund Aggressive Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

|

| INCREASE (DECREASE) IN NET ASSETS FROM: | ||

| OPERATIONS | ||

| Net investment loss | $(129,909) | $(170,243) |

| Net realized gain on investments | 9,365,244 | 377,270 |

| Capital gain distributions from regulated investment companies | 1,330,549 | 427,693 |

| Change in net unrealized appreciation / depreciation on investments | (6,567,162) | 5,619,953 |

| Net increase in net assets resulting from operations | 3,998,722 | 6,254,673 |

| DISTRIBUTIONS TO SHAREHOLDERS | ||

| Net dividends and distributions to shareholders | (530,656) | (1,279,285) |

| Total distributions to shareholders | (530,656) | (1,279,285) |

| CAPITAL SHARE TRANSACTIONS | ||

| Net change in net assets derived from net change in outstanding shares (a) | (2,048,680) | (5,669,600) |

| Total change in net assets | 1,419,386 | (694,212) |

| NET ASSETS: | ||

| Beginning of year | 35,103,380 | 35,797,592 |

| End of year | $36,522,766 | $35,103,380 |

(a) Summary of capital share transactions is as follows:

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | |||

| Shares | Paid-in Capital | Shares | Paid-in Capital | |

| Shares sold | 21,753 | $1,720,885 | 10,452 | $613,521 |

| Shares issued in reinvestment of distributions | 6,922 | 527,803 | 20,752 | 1,273,140 |

| Shares redeemed | (55,090) | (4,297,368) | (126,898) | (7,556,261) |

| Net change in shares outstanding | (26,415) | $(2,048,680) | (95,694) | $(5,669,600) |

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 31 |

| RELAX |  |

Conservative Upgrader Fund Balanced Growth Fund |

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

|

| INCREASE IN NET ASSETS FROM: | ||

| OPERATIONS | ||

| Net investment income (loss) | $(111,443) | $420,378 |

| Net realized gain (loss) on investments | 11,804,378 | (1,325,978) |

| Capital gain distributions from regulated investment companies | 2,500,652 | 2,136,408 |

| Change in net unrealized appreciation / depreciation of investments | (1,411,978) | 2,587,579 |

| Net increase in net assets resulting from operations | 12,781,609 | 3,818,387 |

| DISTRIBUTIONS TO SHAREHOLDERS | ||

| Net dividends and distributions to shareholders | (359,435) | (3,230,437) |

| Total distributions to shareholders | (359,435) | (3,230,437) |

| CAPITAL SHARE TRANSACTIONS | ||

| Net change in net assets derived from net change in outstanding shares (a) | (6,206,249) | (16,444,606) |

| Total change in net assets | 6,215,925 | (15,856,656) |

| NET ASSETS: | ||

| Beginning of year | 83,411,109 | 99,267,765 |

| End of year | $89,627,034 | $83,411,109 |

(a) Summary of capital share transactions is as follows:

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | |||

| Shares | Paid-in Capital | Shares | Paid-in Capital | |

| Shares sold | 137,379 | 6,434,066 | 236,507 | 9,335,370 |

| Shares issued in reinvestment of distributions | 7,955 | 355,090 | 78,857 | 3,204,732 |

| Shares redeemed | (283,463) | (12,995,405) | (757,049) | (28,984,921) |

| Other transactions ^ | — | — | — | 213 |

| Net change in shares outstanding | (138,129) | $(6,206,249) | (441,685) | $(16,444,606) |

^ Reimbursement from U.S. Bank Global Fund Services due to shareholder activity.

The accompanying notes are an integral part of these financial statements.

| 32 |  |

Annual Report 2021 |

| INCMX |  |

Flexible Income Fund Fixed Income |

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

|

| INCREASE (DECREASE) IN NET ASSETS FROM: | ||

| OPERATIONS | ||

| Net investment income | $1,865,628 | $1,637,643 |

| Net realized income (loss) on investments | 759,560 | (2,763,248) |

| Capital gain distributions from regulated investment companies | 981,243 | 143,647 |

| Change in net unrealized appreciation / depreciation of investments | 3,554,164 | (1,583,042) |

| Net increase (decrease) in net assets resulting from operations | 7,160,595 | (2,565,000) |

| DISTRIBUTIONS TO SHAREHOLDERS | ||

| Net dividends and distributions to shareholders | (1,751,962) | (1,989,481) |

| Total distributions to shareholders | (1,751,962) | (1,989,481) |

| CAPITAL SHARE TRANSACTIONS | ||

| Net change in net assets derived from net change in outstanding shares (a) | (574,441) | (7,585,784) |

| Total change in net assets | 4,834,192 | (12,140,265) |

| NET ASSETS: | ||

| Beginning of year | 85,293,502 | 97,433,767 |

| End of year | $90,127,694 | $85,293,502 |

(a) Summary of capital share transactions is as follows:

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | |||

| Shares | Paid-in Capital | Shares | Paid-in Capital | |

| Shares sold | 621,537 | $17,335,366 | 389,876 | $10,704,459 |

| Shares issued in reinvestment of distributions | 63,513 | 1,747,885 | 71,168 | 1,983,442 |

| Shares redeemed | (702,589) | (19,657,942) | (755,866) | (20,273,685) |

| Other transactions ^ | — | 250 | — | — |

| Net change in shares outstanding | (17,539) | $(574,441) | (294,822) | $(7,585,784) |

^ Reimbursement from U.S. Bank Global Fund Services due to shareholder activity.

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 33 |

| SRIFX |  |

Sustainable Impact Fund Global Growth and Impact Fund |

| STATEMENTS OF CHANGES IN NET ASSETS | ||

| Year Ended September 30, 2021 |

Year Ended September 30, 2020 |

|

| INCREASE IN NET ASSETS FROM: | ||

| OPERATIONS | ||

| Net investment loss | $(268,667) | $(151,827) |

| Net realized gain on investments | 6,831,066 | 418,983 |

| Capital gain distributions from regulated investment companies | 620,284 | 412,588 |

| Change in net unrealized appreciation / depreciation on investments | (4,691,188) | 3,151,139 |

| Net increase in net assets resulting from operations | 2,491,495 | 3,830,883 |

| DISTRIBUTIONS TO SHAREHOLDERS | ||

| Net dividends and distributions to shareholders | (640,625) | (49,211) |

| Total distributions to shareholders | (640,625) | (49,211) |

| CAPITAL SHARE TRANSACTIONS | ||

| Net change in net assets derived from net change in outstanding shares (a) | 1,773,427 | (2,179,632) |

| Total change in net assets | 3,624,297 | 1,602,040 |

| NET ASSETS: | ||

| Beginning of year | 21,868,415 | 20,266,375 |

| End of year | $25,492,712 | $21,868,415 |

(a) Summary of capital share transactions is as follows:

| Year Ended September 30, 2021 | Year Ended September 30, 2020 | |||

| Shares | Paid-in Capital | Shares | Paid-in Capital | |

| Shares sold | 67,309 | $2,481,143 | 81,382 | $2,137,462 |

| Shares issued in reinvestment of distributions | 17,819 | 640,625 | 1,658 | 49,211 |

| Shares redeemed | (36,988) | (1,348,341) | (154,834) | (4,366,305) |

| Net change in shares outstanding | 48,140 | $1,773,427 | (71,794) | $(2,179,632) |

The accompanying notes are an integral part of these financial statements.

| 34 |  |

Annual Report 2021 |

| FUNDX |  |

Upgrader Fund Growth Fund |

| (1) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (2) | Does not include expenses of investment companies in which the Fund invests. |

| (3) | Including credits for expenses paid indirectly, the ratio of expenses to average net assets would have been 1.24%, 1.26%, 1.25%, 1.21% and 1.28%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (4) | Including credits for expenses paid indirectly, the ratio of net investment income (loss) to average net assets would have been (0.76)%, (0.47)%, (0.34)%, (0.55)% and 0.22%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (5) | Calculated using the average shares outstanding method. |

| (6) | Includes interest expense of $56 or 0.00%, $2,872 or 0.00%, $1,069 or 0.00%, $1,117 or 0.00% and $737 or 0.00% of average net assets for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30,2017, respectively. |

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 35 |

| HOTFX |  |

Aggressive Upgrader Fund Aggressive Growth Fund |

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value, beginning of year | $68.77 | $59.06 | $73.48 | $62.16 | $57.31 |

| INCOME FROM INVESTMENT OPERATIONS: | |||||

| Net investment loss (1) | (0.26) (5) | (0.31) (5) | (0.29) (5) | (0.55) (5) | (0.03) (5) |

| Net realized and unrealized gain (loss) on investments | 7.99 | 12.24 | (3.79) | 11.87 | 5.04 |

| Total from investment operations | 7.73 | 11.93 | (4.08) | 11.32 | 5.01 |

| LESS DISTRIBUTIONS: | |||||

| From net investment income | — | — | — | — | (0.16) |

| From net realized gain | (1.05) | (2.22) | (10.34) | — | — |

| Total distributions | (1.05) | (2.22) | (10.34) | — | (0.16) |

| Net asset value, end of year | $75.45 | $68.77 | $59.06 | $73.48 | $62.16 |

| Total return | 11.22% | 20.66% | (3.05)% | 18.21% | 8.77% |

| RATIOS/SUPPLEMENTAL DATA: | |||||

| Net assets, end of year (millions) | $36.5 | $35.1 | $35.8 | $44.9 | $43.4 |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS (2): | |||||

| Before fees waived and expenses absorbed | 1.40% (6) | 1.48% (6) | 1.44% (6) | 1.42% (6) | 1.45% (6) |

| After fees waived and expenses absorbed (3) | 1.35% (6) | 1.35% (6) | 1.35% (6) | 1.35% (6) | 1.35% (6) |

| RATIO OF NET INVESTMENT LOSS | |||||

| TO AVERAGE NET ASSETS (2): | |||||

| Before fees waived and expenses absorbed | (0.40)% (6) | (0.65)% (6) | (0.59)% (6) | (0.90)% (6) | (0.15)% (6) |

| After fees waived and expenses absorbed (4) | (0.35)% (6) | (0.52)% (6) | (0.50)% (6) | (0.83)% (6) | (0.05)% (6) |

| Portfolio turnover rate | 184% | 159% | 187% | 144% | 186% |

| (1) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (2) | Does not include expenses of investment companies in which the Fund invests. |

| (3) | Including credits for expenses paid indirectly, the ratio of expenses to average net assets would have been 1.34%, 1.33%, 1.34%, 1.33% and 1.34%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (4) | Including credits for expenses paid indirectly, the ratio of net investment income (loss) to average net assets would have been (0.33)%, (0.50)%, (0.49)%, (0.81)% and (0.05)%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018, and September 30, 2017, respectively. (Note 3) |

| (5) | Calculated using the average shares outstanding method. |

| (6) | Includes interest expense of $100 or 0.00%, $1,013 or 0.00%, $600 or 0.00%, $428 or 0.00% and $1,864 or 0.00% of average net assets for the years ended Septeember 30, 2021, September 30, 2020 September 30, 2019, September 30, 2018 and September 30, 2017, respectively. |

The accompanying notes are an integral part of these financial statements.

| 36 |  |

Annual Report 2021 |

| RELAX |  |

Conservative Upgrader Fund Balanced Fund |

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 (7) | 2018 | 2017 | |

| Net asset value, beginning of year | $41.43 | $40.43 | $41.40 | $40.41 | $36.87 |

| INCOME FROM INVESTMENT OPERATIONS: | |||||

| Net investment income (loss) (1) | (0.06) (5) | 0.19 (5) | 0.27 (5) | 0.26 (5) | 0.51 (5) |

| Net realized and unrealized gain on investments | 6.60 | 2.20 | 0.63 | 4.01 | 3.57 |

| Total from investment operations | 6.54 | 2.39 | 0.90 | 4.27 | 4.08 |

| LESS DISTRIBUTIONS: | |||||

| From net investment income | (0.18) | (0.46) | (0.16) | (0.52) | (0.54) |

| From net realized gain | — | (0.93) | (1.71) | (2.76) | — |

| Total distributions | (0.18) | (1.39) | (1.87) | (3.28) | (0.54) |

| Net asset value, end of year | $47.79 | $41.43 | $40.43 | $41.40 | $40.41 |

| Total return | 15.83% | 5.99% | 2.84% | 11.22% | 11.19% |

| RATIOS/SUPPLEMENTAL DATA: | |||||

| Net assets, end of year (millions) | $89.6 | $83.4 | $99.3 | $60.1 | $57.6 |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS (2): | |||||

| Before fees recaptured/waived and expenses absorbed | 1.31% (6) | 1.33% (6) | 1.35% (6) | 1.35% (6) | 1.40% (6) |

| After fees recaptured/waived and expenses absorbed (3) | 1.31% (6) | 1.35% (6) | 1.35% (6) | 1.35% (6) | 1.35% (6) |

| RATIO OF NET INVESTMENT INCOME (LOSS) | |||||

| TO AVERAGE NET ASSETS (2): | |||||

| Before fees waived and expenses absorbed | (0.16)% (6) | 0.48% (6) | 0.66% (6) | 0.61% (6) | 1.25% (6) |

| After fees waived and expenses absorbed (4) | (0.16)% (6) | 0.46% (6) | 0.66% (6) | 0.61% (6) | 1.30% (6) |

| Portfolio turnover rate | 84% | 172% | 151% | 92% | 129% |

| (1) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (2) | Does not include expenses of investment companies in which the Fund invests. |

| (3) | Including credits for expenses paid indirectly, the ratio of expenses to average net assets would have been 1.28%, 1.33%, 1.32%, 1.31% and 1.32%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (4) | Including credits for expenses paid indirectly, the ratio of net investment income to average net assets would have been (0.13)%, 0.48%, 0.69%, 0.65% and 1.33%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (5) | Calculated using the average shares outstanding method. |

| (6) | Includes interest expense of $152 or 0.00%, $3,077 or 0.00%, $1,536 or 0.00%, $734 or 0.00% and $366 or 0.00% of average net assets for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. |

| (7) | On July 26, 2019, shares of the FundX Tactical Upgrader Fund were reorganized into shares of the FundX Conservative Upgrader Fund. Activity after July 26, 2019 reflects the Funds’ combined operations. |

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 37 |

| INCMX |  |

Flexible Income Fund Fixed Income |

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout each year | |||||

| Year Ended September 30, | |||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |

| Net asset value, beginning of year | $26.92 | $28.13 | $28.50 | $29.16 | $28.61 |

| INCOME FROM INVESTMENT OPERATIONS: | |||||

| Net investment income (1) | 0.60 (5) | 0.49 (5) | 0.60 (5) | 0.84 (5) | 0.97 (5) |

| Net realized and unrealized gain (loss) on investments | 1.70 | (1.12) | 0.35 | (0.48) | 0.33 |

| Total from investment operations | 2.30 | (0.63) | 0.95 | 0.36 | 1.30 |

| LESS DISTRIBUTIONS: | |||||

| From net investment income | (0.62) | (0.58) | (1.32) | (1.02) | (0.75) |

| From net realized gain | — | — | — | — | — |

| Total distributions | (0.62) | (0.58) | (1.32) | (1.02) | (0.75) |

| Net asset value, end of year | $28.60 | $26.92 | $28.13 | $28.50 | $29.16 |

| Total return | 8.63% | (2.32)% | 3.66% | 1.25% | 4.74% |

| RATIOS/SUPPLEMENTAL DATA: | |||||

| Net assets, end of year (millions) | $90.1 | $85.3 | $97.4 | $99.9 | $98.1 |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS (2): | |||||

| Before fees waived and expenses absorbed | 1.00% (6) | 1.01% (6) | 1.01% (6) | 0.98% (6) | 1.03% (6) |

| After fees waived and expenses absorbed (3) | 0.99% (6) | 0.99% (6) | 1.00% (6) | 0.99% (6) | 0.99% (6) |

| RATIO OF NET INVESTMENT INCOME | |||||

| TO AVERAGE NET ASSETS (2): | |||||

| Before fees recaptured/waived and expenses absorbed | 2.10% (6) | 1.75% (6) | 2.14% (6) | 2.95% (6) | 3.35% (6) |

| After fees recaptured/waived and expenses absorbed (4) | 2.11% (6) | 1.77% (6) | 2.15% (6) | 2.94% (6) | 3.39% (6) |

| Portfolio turnover rate | 73% | 262% | 180% | 105% | 82% |

| (1) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (2) | Does not include expenses of investment companies in which the Fund invests. |

| (3) | Including credits for expenses paid indirectly, the ratio of expenses to average net assets would have been 0.96%, 0.98%, 0.97%, 0.98% and 0.96%, for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (4) | Including credits for expenses paid indirectly, the ratio of net investment income to average net assets would have been 2.13%, 1.78%, 2.18%, 2.95% and 3.41%, for the years ended September 30, 2021, September 30, 2020, September 30,2019, September 30, 2018 and September 30, 2017, respectively. (Note 3) |

| (5) | Calculated using the average shares outstanding method. |

| (6) | Includes interest expense of $367 or 0.00%, $1,916 or 0.00%, $10,082 or 0.01%, $1,173 or 0.00% and $999 or 0.00% of average net assets for the years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. |

The accompanying notes are an integral part of these financial statements.

| 38 |  |

Annual Report 2021 |

| SRIFX |  |

Sustainable Impact Fund Global Growth and Impact Fund |

| FINANCIAL HIGHLIGHTS For a capital share outstanding throughout the period/year | |||||

| Year Ended September 30, | March 31, 2017(*) through |

||||

| 2021 | 2020 | 2019 | 2018 | September 30, 2017 |

|

| Net asset value, beginning of period/year | $33.27 | $27.80 | $31.67 | $27.52 | $25.00 |

| INCOME FROM INVESTMENT OPERATIONS: | |||||

| Net investment loss (1) | (0.39) (6) | (0.23) (6) | (0.15) (6) | (0.18) (6) | (0.13) (6) |

| Net realized and unrealized gain on investments | 4.23 | 5.77 | 0.17 | 4.84 | 2.65 |

| Total from investment operations | 3.84 | 5.54 | 0.02 | 4.66 | 2.52 |

| LESS DISTRIBUTIONS: | |||||

| From net investment income | — | — | — | (0.40) | — |

| From net realized gain | (0.97) | (0.07) | (3.89) | (0.11) | — |

| Total distributions | (0.97) | (0.07) | (3.89) | (0.51) | — |

| Net asset value, end of period/year | $36.14 | $33.27 | $27.80 | $31.67 | $27.52 |

| Total return | 11.56% | 20.01% | 2.49% | 17.12% | 10.08% ^ |

| RATIOS/SUPPLEMENTAL DATA: | |||||

| Net assets, end of period/year (millions) | $25.5 | $21.9 | $20.3 | $19.7 | $10.8 |

| RATIO OF EXPENSES TO AVERAGE NET ASSETS (2): | |||||

| Before fees waived and expenses absorbed | 1.45% (4) | 1.52% (4) | 1.52% (4) | 1.55% (4) | 2.25% (4) + |

| After fees waived and expenses absorbed | 1.35% (3) (4) | 1.35% (3) (4) | 1.36% (3) (4) | 1.35% (4) | 1.35% (4) + |

| RATIO OF NET INVESTMENT LOSS | |||||

| TO AVERAGE NET ASSETS (2): | |||||

| Before fees waived and expenses absorbed | (1.19)% (4) | (0.96)% (4) | (0.72)% (4) | (0.81)% (4) | (1.85)% (4) + |

| After fees waived and expenses absorbed | (1.09)% (4) (5) | (0.79)% (4) (5) | (0.56)% (4) (5) | (0.61)% (4) | (0.95)% (4) + |

| Portfolio turnover rate | 154% | 156% | 190% | 161% | 27% ^ |

| * | The FundX Sustainable Impact Fund was incepted March 31, 2017. |

| (1) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (2) | Does not include expenses of investment companies in which the Fund invests. |

| (3) | Including credits for expenses paid indirectly, the ratio of expenses to average net assets would have been 1.33%, 1.34% and 1.35% for the period/years ended Septeember 30, 2021, September 30, 2020 and September 30, 2019. (Note 3) |

| (4) | Includes interest expense of $8 or 0.00% or $587 or 0.01%, $2,387 or 0.01%, $32 or 0.00% and $0 or 0.00% of average net assets for the period/years ended September 30, 2021, September 30, 2020, September 30, 2019, September 30, 2018 and September 30, 2017, respectively. |

| (5) | Including credit for expenses paid indirectly, the ratio of net investment loss to average net assets would have been (1.06)%, (0.78)% and (0.55)% for the period/years ended September 31, 2021, September 30, 2020 and September 30, 2019. (Note 3) |

| (6) | Calculated using the average shares outstanding method. |

| ^ | Not Annualized. |

| + | Annualized. |

The accompanying notes are an integral part of these financial statements.

| Annual Report 2021 | Fundxfunds.com | 39 |

| NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021 |

NOTE 1 – ORGANIZATION

FundX Investment Trust (the “Trust”) was organized as a Delaware business trust on March 12, 2014, and is registered under the Investment Company Act of 1940 (the “1940 Act”) as an open-end management investment company. The Funds comprising the Trust consist of FundX Upgrader Fund (“Upgrader Fund”), FundX Aggressive Upgrader Fund (“Aggressive Fund”), FundX Conservative Upgrader Fund (“Conservative Fund”), FundX Flexible Income Fund (“Flexible Income Fund”), and FundX Sustainable Impact Fund (“Sustainable Impact Fund”), collectively, the “Funds”. Effective March 31, 2017, the Trust launched the Sustainable Impact Fund. The Funds follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services – Investment Companies.” The Funds were organized to serve as Successor Funds to certain predecessor mutual funds that were previously part of another investment company, Professionally Managed Portfolios, which were also advised by the FundX Investment Group, LLC (the “Advisor”) and were merged with and into the Successor Funds as part of a reorganization transaction that became effective on August 4, 2014, except for the Sustainable Impact Fund.

The Upgrader Fund commenced operations on November 1, 2001. The Aggressive Fund, Conservative Fund and Flexible Income Fund commenced operations on July 1, 2002. The Sustainable Impact Fund commenced operations on March 31, 2017.

The investment objective of the Upgrader Fund and the Aggressive Fund is to maximize capital appreciation over the long term without regard to income. The investment objective of the Conservative Fund is to obtain capital appreciation over the long term while at times providing a low level of current income to reduce portfolio volatility. The investment objective of the Flexible Income Fund is to generate total return, which is capital appreciation plus current income. The investment objective of the Sustainable Impact Fund is to obtain long-term capital appreciation.

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A. Security Valuation. Investments in open-end mutual funds are valued at their respective net asset values on the valuation date. Security valuations for the Funds’ investments in investment companies are furnished by an independent pricing service that has been approved by the Funds’ board of directors. All equity securities that are traded on a national securities exchange, except those listed on the NASDAQ Global Market® (“NASDAQ”), are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on NASDAQ will be valued at the NASDAQ Official Closing Price (“NOCP”). If, on a particular day, an exchange-traded or NASDAQ security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used.

Short-term securities that have maturities of less than 60 days, at time of purchase, are valued at amortized cost, which when combined with accrued interest, approximates market value.

Exchange traded options are valued at the composite price, using the National Best Bid and Offer quotes (“NBBO”). NBBO consists of the highest bid price and lowest ask price across any of the exchanges on which an option is quoted, thus providing a view across the entire U.S. options marketplace. Composite option pricing calculates the mean of the highest bid price and lowest ask price across the exchanges where the option is traded.

Securities for which quotations are not readily available are valued at their respective fair values as determined in good faith or under the direction of the Board of Trustees. When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Funds’ Board of Trustees. Fair value pricing is an inherently subjective process, and no single standard exists for determining fair value. Different funds could reasonably arrive at different values for the same security. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations. As of September 30, 2021 the Funds did not hold fair valued securities.

The Funds may utilize various methods to measure the fair value of some of their investments. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuations methods. The three levels of inputs are:

| Level 1 – | Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| Level 2 – | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 – | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

| 40 |  |

Annual Report 2021 |

| NOTES TO THE FINANCIAL STATEMENTS SEPTEMBER 30, 2021, continued |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value the Funds’ investments as of September 30, 2021:

| FUNDX UPGRADER FUND | Level 1 | Level 2 | Level 3 | Total | ||||||

| Investment Companies | $231,613,832 | $ — | $ — | $231,613,832 | ||||||

| Short-Term Investments | 849,893 | — | — | 849,893 | ||||||

| Total Investments in Securities | $232,463,725 | $ — | $ — | $232,463,725 | ||||||

| FUNDX AGGRESSIVE UPGRADER FUND | Level 1 | Level 2 | Level 3 | Total | ||||||

| Investment Companies | $36,368,361 | $ — | $ — | $36,368,361 | ||||||

| Short-Term Investments | 169,392 | — | — | 169,392 | ||||||

| Total Investments in Securities | $36,537,753 | $ — | $ — | $36,537,753 | ||||||

| FUNDX CONSERVATIVE UPGRADER FUND | Level 1 | Level 2 | Level 3 | Total | ||||||

| Investment Companies | $89,308,390 | $ — | $ — | $89,308,390 | ||||||

| Short-Term Investments | 469,103 | — | — | 469,103 | ||||||

| Total Investments in Securities | $89,777,493 | $ — | $ — | $89,777,493 | ||||||

| FUNDX FLEXIBLE INCOME FUND | Level 1 | Level 2 | Level 3 | Total | ||||||

| Investment Companies | $89,378,585 | $ — | $— | $89,378,585 | ||||||