Form FWP CITIGROUP INC Filed by: CITIGROUP INC

Index Overview The Citi Dynamic Asset Selector 5 Excess Return Index (the “Index”) follows a rules - based, hypothetical investment methodology which dynamically allocates between two constituents : 1. S&P 500 ® Futures Excess Return Index (“U.S. Equity Futures Constituent”); and 2. S&P ® 10Y U.S. Treasury Note Futures Excess Return Index (“U.S. Treasury Futures Constituent”) each of which is a futures - based index . The Index uses signals based on equity price trend and equity volatility to determine the allocation between the two constituents on a daily basis . See “ Index Construction Summary“ on page 2 for further details on the construction of the Index . Index Methodology Rationale Risky asset classes such as equities can sometimes be characterized into different ‘market regimes’ – for example, periods of relatively low volatility with rising prices (which might be called a “stable - trending up” market regime) or periods of elevated volatility with falling prices (which might be called an “unstable - trending down” market regime) . A simple buy - and - hold strategy may expose investors to significant losses in the latter of these periods . In addition, elevated volatility and falling equity prices have at times in the past been associated with a flight - to - quality, during which perceived ‘safe - haven’ assets, such as U . S . Treasuries, have increased in demand, causing their prices to rise . Citi Dynamic Asset Selector 5 Excess Return Index Navigating U.S. equity market regimes. Index Attributes Multi - Asset Please refer to “Summary Risk Factors” on page 5 for more information about risks relating to the Index. This Index Factshee t i s only a summary of certain information about the Index. It is not intended to be used as the sole basis for an investment deci sio n in any financial instrument linked to the Index. Before investing in any financial instrument linked to the Index, you should c are fully review the disclosure materials, including risk disclosures, provided to you in connection with that investment. For more information about the Index and its related risks, see the Index disclosure document available at: INDEX SUPPLEMENT NO. IS - 02 - 03 Bloomberg Ticker CIISDA5N Index Currency USD Return Type Excess Return Volatility Target 5% Index Fee 0.85% p.a. Base Date 12 - Jan - 1998 Live Date 13 - Jun - 2016 Index Universe U . S . Equity Futures Index & U.S. Treasury Futures Index Rebalancing Frequency Up to Daily Index Administrator Citigroup Global Markets Limited Index Calculation Agent S&P Dow Jones Indices LLC 1 The Index seeks to identify the equity market regime on a daily basis and allocate greater exposure to U . S . equity futures in a market regime characterized by an upward equity price trend and relatively low equity volatility, and allocate lower or no exposure to U . S . equity futures, and greater exposure to U . S . Treasury futures, in market regimes characterized by a downward equity price trend and/or elevated equity volatility . Index Factsheet & Performance Update – 29 April 2022 Registration Statement Nos. 333 - 255302 and 333 - 255302 - 03 Filed Pursuant to Rule 433 FOR U.S. USE ONLY

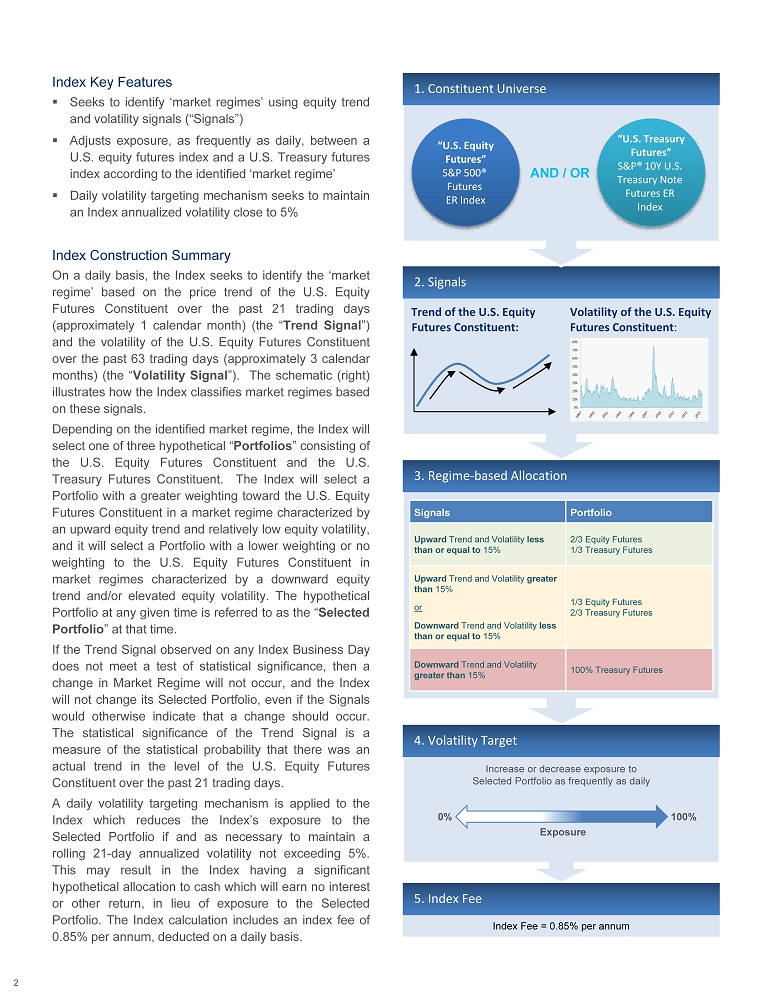

Index Construction Summary On a daily basis, the Index seeks to identify the ‘market regime’ based on the price trend of the U . S . Equity Futures Constituent over the past 21 trading days (approximately 1 calendar month) (the “ Trend Signal ”) and the volatility of the U . S . Equity Futures Constituent over the past 63 trading days (approximately 3 calendar months) (the “ Volatility Signal ”) . The schematic (right) illustrates how the Index classifies market regimes based on these signals . Depending on the identified market regime, the Index will select one of three hypothetical “ Portfolios ” consisting of the U . S . Equity Futures Constituent and the U . S . Treasury Futures Constituent . The Index will select a Portfolio with a greater weighting toward the U . S . Equity Futures Constituent in a market regime characterized by an upward equity trend and relatively low equity volatility, and it will select a Portfolio with a lower weighting or no weighting to the U . S . Equity Futures Constituent in market regimes characterized by a downward equity trend and/or elevated equity volatility . The hypothetical Portfolio at any given time is referred to as the “ Selected Portfolio ” at that time . If the Trend Signal observed on any Index Business Day does not meet a test of statistical significance, then a change in Market Regime will not occur, and the Index will not change its Selected Portfolio, even if the Signals would otherwise indicate that a change should occur . The statistical significance of the Trend Signal is a measure of the statistical probability that there was an actual trend in the level of the U . S . Equity Futures Constituent over the past 21 trading days . A daily volatility targeting mechanism is applied to the Index which reduces the Index’s exposure to the Selected Portfolio if and as necessary to maintain a rolling 21 - day annualized volatility not exceeding 5 % . This may result in the Index having a significant hypothetical allocation to cash which will earn no interest or other return, in lieu of exposure to the Selected Portfolio . The Index calculation includes an index fee of 0 . 85 % per annum, deducted on a daily basis . 2. Signals “U.S. Treasury Futures” S&P® 10Y U.S. Treasury Note Futures ER Index “U.S. Equity Futures” S&P 500® Futures ER Index AND / OR Signals Portfolio Upward Trend and Volatility less than or equal to 15% 2/3 Equity Futures 1/3 Treasury Futures Upward Trend and Volatility greater than 15% or Downward Trend and Volatility less than or equal to 15% 1/3 Equity Futures 2/3 Treasury Futures Downward Trend and Volatility greater than 15% 100% Treasury Futures 2 Trend of the U.S. Equity Futures Constituent: Volatility of the U.S. Equity Futures Constituent : Index Key Features ▪ Seeks to identify ‘market regimes’ using equity trend and volatility signals (“Signals”) ▪ Adjusts exposure, as frequently as daily, between a U . S . equity futures index and a U . S . Treasury futures index according to the identified ‘market regime’ ▪ Daily volatility targeting mechanism seeks to maintain an Index annualized volatility close to 5 % 1. Constituent Universe 3. Regime - based Allocation 4. Volatility Target 5. Index Fee Index Fee = 0.85% per annum Increase or decrease exposure to Selected Portfolio as frequently as daily 0% 100% Exposure

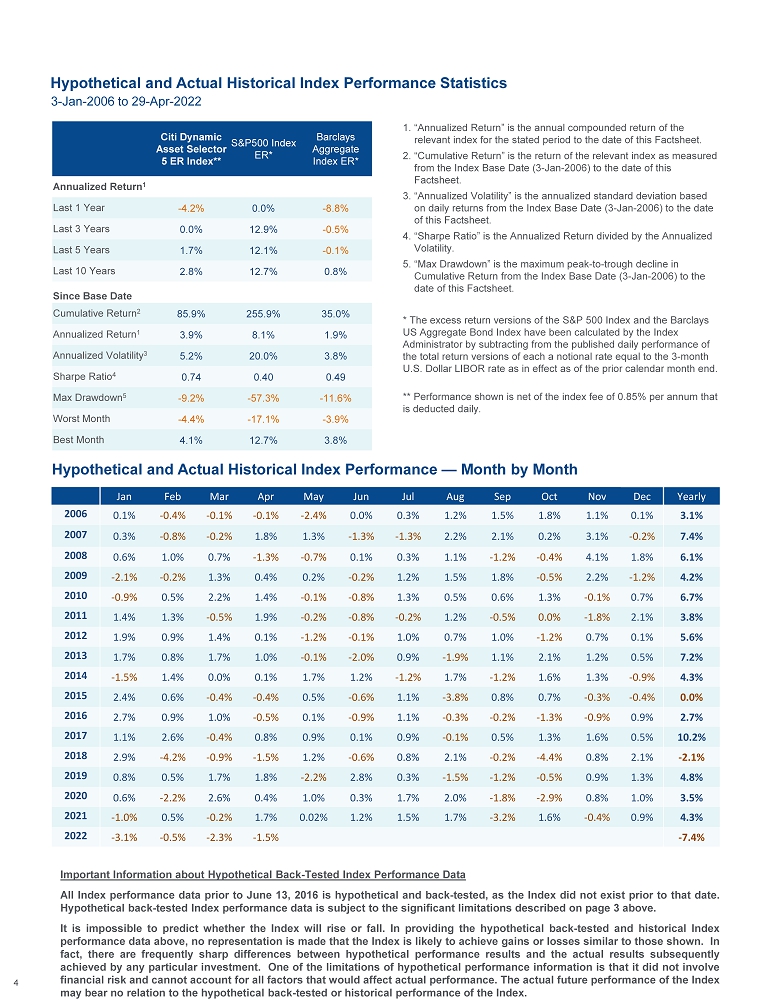

* The excess return versions of the S&P 500 Index and the Barclays US Aggregate Bond Index have been calculated by the Index Administrator by subtracting from the published daily performance of the total return versions of each a notional rate equal to the 3 - month U.S. Dollar LIBOR rate as in effect as of the prior calendar month end. Important Information about Hypothetical Back - Tested Index Performance Data All Index performance data prior to June 13 , 2016 is hypothetical and back - tested, as the Index did not exist prior to that date . Hypothetical back - tested Index performance data is subject to significant limitations . The Index Administrator developed the rules of the Index with the benefit of hindsight — that is, with the benefit of being able to evaluate how the Index rules would have caused the Index to perform had it existed during the hypothetical back - tested period . The fact that the Index generally appreciated over the hypothetical back - tested period may not therefore be an accurate or reliable indication of any fundamental aspect of the Index methodology . Furthermore, the hypothetical back - tested performance of the Index might look different if it covered a different historical period . The market conditions that existed during the hypothetical back - tested period may not be representative of market conditions that will exist in the future . In addition, because the Constituents were not published throughout the entire hypothetical back - tested period, the hypothetical back - tested performance of the Index is based on part on hypothetical back - tested performance data of the Constituents that was prepared by S&P and has not been independently verified by the Index Administrator . It is impossible to predict whether the Index will rise or fall . In providing the hypothetical back - tested and historical Index performance data above, no representation is made that the Index is likely to achieve gains or losses similar to those shown . In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular investment . One of the limitations of hypothetical performance information is that it did not involve financial risk and cannot account for all factors that would affect actual performance . The actual future performance of the Index may bear no relation to the hypothetical back - tested or historical performance of the Index . 3 Hypothetical and Actual Historical Index Performance 3 - Jan - 2006 to 29 - Apr - 2022 Live Date 13 - Jun - 2016 25 75 125 175 225 275 325 375 425 Normalized Index Level (Rebased to 100 on Jan 3, 2006) Citi Dynamic Asset Selector 5 ER Index S&P 500 ER Index* Barclays US Aggregate Bond ER Index*

Hypothetical and Actual Historical Index Performance — Month by Month 4 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Yearly 2006 0.1% - 0.4% - 0.1% - 0.1% - 2.4% 0.0% 0.3% 1.2% 1.5% 1.8% 1.1% 0.1% 3.1% 2007 0.3% - 0.8% - 0.2% 1.8% 1.3% - 1.3% - 1.3% 2.2% 2.1% 0.2% 3.1% - 0.2% 7.4% 2008 0.6% 1.0% 0.7% - 1.3% - 0.7% 0.1% 0.3% 1.1% - 1.2% - 0.4% 4.1% 1.8% 6.1% 2009 - 2.1% - 0.2% 1.3% 0.4% 0.2% - 0.2% 1.2% 1.5% 1.8% - 0.5% 2.2% - 1.2% 4.2% 2010 - 0.9% 0.5% 2.2% 1.4% - 0.1% - 0.8% 1.3% 0.5% 0.6% 1.3% - 0.1% 0.7% 6.7% 2011 1.4% 1.3% - 0.5% 1.9% - 0.2% - 0.8% - 0.2% 1.2% - 0.5% 0.0% - 1.8% 2.1% 3.8% 2012 1.9% 0.9% 1.4% 0.1% - 1.2% - 0.1% 1.0% 0.7% 1.0% - 1.2% 0.7% 0.1% 5.6% 2013 1.7% 0.8% 1.7% 1.0% - 0.1% - 2.0% 0.9% - 1.9% 1.1% 2.1% 1.2% 0.5% 7.2% 2014 - 1.5% 1.4% 0.0% 0.1% 1.7% 1.2% - 1.2% 1.7% - 1.2% 1.6% 1.3% - 0.9% 4.3% 2015 2.4% 0.6% - 0.4% - 0.4% 0.5% - 0.6% 1.1% - 3.8% 0.8% 0.7% - 0.3% - 0.4% 0.0% 2016 2.7% 0.9% 1.0% - 0.5% 0.1% - 0.9% 1.1% - 0.3% - 0.2% - 1.3% - 0.9% 0.9% 2.7% 2017 1.1% 2.6% - 0.4% 0.8% 0.9% 0.1% 0.9% - 0.1% 0.5% 1.3% 1.6% 0.5% 10.2% 2018 2.9% - 4.2% - 0.9% - 1.5% 1.2% - 0.6% 0.8% 2.1% - 0.2% - 4.4% 0.8% 2.1% - 2.1% 2019 0.8% 0.5% 1.7% 1.8% - 2.2% 2.8% 0.3% - 1.5% - 1.2% - 0.5% 0.9% 1.3% 4.8% 2020 0.6% - 2.2% 2.6% 0.4% 1.0% 0.3% 1.7% 2.0% - 1.8% - 2.9% 0.8% 1.0% 3.5% 2021 - 1.0% 0.5% - 0.2% 1.7% 0.02% 1.2% 1.5% 1.7% - 3.2% 1.6% - 0.4% 0.9% 4.3% 2022 - 3.1% - 0.5% - 2.3% - 1.5% - 7.4% Important Information about Hypothetical Back - Tested Index Performance Data All Index performance data prior to June 13 , 2016 is hypothetical and back - tested, as the Index did not exist prior to that date . Hypothetical back - tested Index performance data is subject to the significant limitations described on page 3 above . It is impossible to predict whether the Index will rise or fall . In providing the hypothetical back - tested and historical Index performance data above, no representation is made that the Index is likely to achieve gains or losses similar to those shown . In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular investment . One of the limitations of hypothetical performance information is that it did not involve financial risk and cannot account for all factors that would affect actual performance . The actual future performance of the Index may bear no relation to the hypothetical back - tested or historical performance of the Index . Citi Dynamic Asset Selector 5 ER Index** S&P500 Index ER* Barclays Aggregate Index ER* Annualized Return 1 Last 1 Year - 4.2% 0.0% - 8.8% Last 3 Years 0.0% 12.9% - 0.5% Last 5 Years 1.7% 12.1% - 0.1% Last 10 Years 2.8% 12.7% 0.8% Since Base Date Cumulative Return 2 85.9% 255.9% 35.0% Annualized Return 1 3.9% 8.1% 1.9% Annualized Volatility 3 5.2% 20.0% 3.8% Sharpe Ratio 4 0.74 0.40 0.49 Max Drawdown 5 - 9.2% - 57.3% - 11.6% Worst Month - 4.4% - 17.1% - 3.9% Best Month 4.1% 12.7% 3.8% Hypothetical and Actual Historical Index Performance Statistics 1. “Annualized Return” is the annual compounded return of the relevant index for the stated period to the date of this Factsheet. 2. “Cumulative Return” is the return of the relevant index as measured from the Index Base Date (3 - Jan - 2006) to the date of this Factsheet. 3. “Annualized Volatility” is the annualized standard deviation based on daily returns from the Index Base Date (3 - Jan - 2006) to the date of this Factsheet. 4. “Sharpe Ratio” is the Annualized Return divided by the Annualized Volatility. 5. “Max Drawdown” is the maximum peak - to - trough decline in Cumulative Return from the Index Base Date (3 - Jan - 2006) to the date of this Factsheet. * The excess return versions of the S&P 500 Index and the Barclays US Aggregate Bond Index have been calculated by the Index Administrator by subtracting from the published daily performance of the total return versions of each a notional rate equal to the 3 - month U.S. Dollar LIBOR rate as in effect as of the prior calendar month end. ** Performance shown is net of the index fee of 0.85% per annum that is deducted daily. 3 - Jan - 2006 to 29 - Apr - 2022

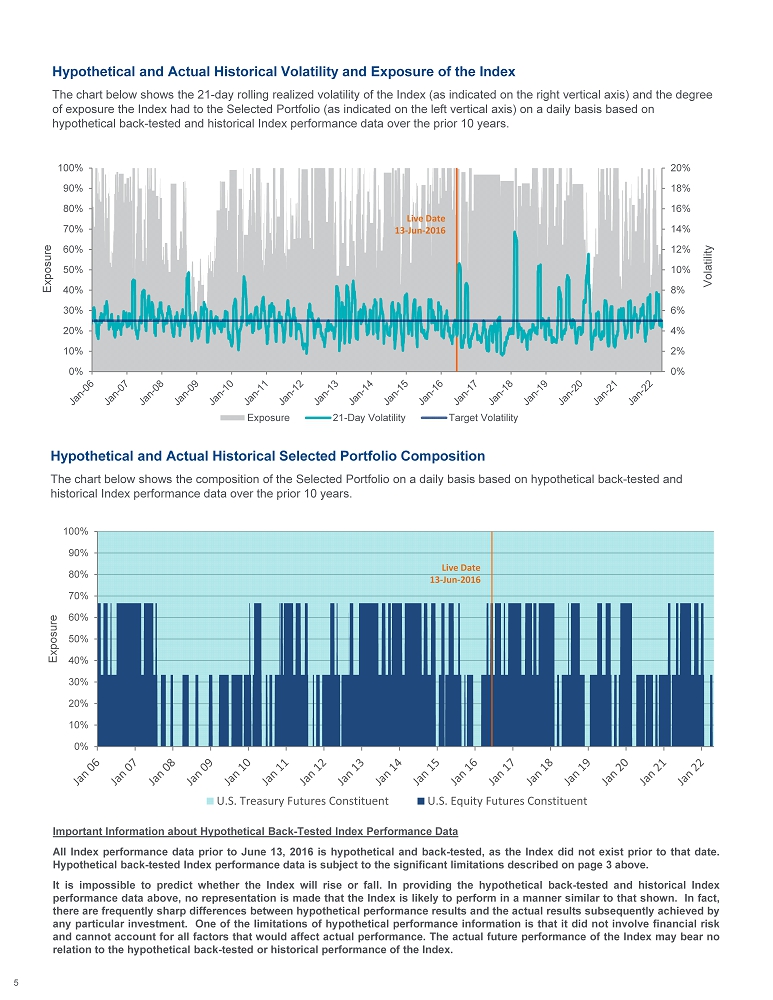

Important Information about Hypothetical Back - Tested Index Performance Data All Index performance data prior to June 13 , 2016 is hypothetical and back - tested, as the Index did not exist prior to that date . Hypothetical back - tested Index performance data is subject to the significant limitations described on page 3 above . It is impossible to predict whether the Index will rise or fall . In providing the hypothetical back - tested and historical Index performance data above, no representation is made that the Index is likely to perform in a manner similar to that shown . In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular investment . One of the limitations of hypothetical performance information is that it did not involve financial risk and cannot account for all factors that would affect actual performance . The actual future performance of the Index may bear no relation to the hypothetical back - tested or historical performance of the Index . Hypothetical and Actual Historical Selected Portfolio Composition The chart below shows the composition of the Selected Portfolio on a daily basis based on hypothetical back - tested and historical Index performance data over the prior 10 years. 5 Hypothetical and Actual Historical Volatility and Exposure of the Index The chart below shows the 21 - day rolling realized volatility of the Index (as indicated on the right vertical axis) and the degr ee of exposure the Index had to the Selected Portfolio (as indicated on the left vertical axis) on a daily basis based on hypothetical back - tested and historical Index performance data over the prior 10 years. 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% 20% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Volatility Exposure Exposure 21-Day Volatility Target Volatility Live Date 13 - Jun - 2016 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Exposure U.S. Treasury Futures Constituent U.S. Equity Futures Constituent Live Date 13 - Jun - 2016

Summary Risk Factors (1/2) 6 The Index will allocate exposure to the U . S . Equity Futures Constituent and/or the U . S . Treasury Futures Constituent based on the trend signal and the volatility signal, each measured daily . The Index’s allocation methodology is premised on the assumptions that the trend signal may provide an accurate indicator of the performance of the U . S . Equity Futures Constituent until the next change in market regime and that the volatility signal may be an indicator of future volatility of the U . S . Equity Futures Constituent . There is no guarantee that this will be the case, however . The trend signal is subject to a number of important limitations, including the following : • Past performance may not predict future performance . On any given day, the fact that the U . S . Equity Futures Constituent may have performed favorably over the prior month does not necessarily mean that it will continue to perform favorably going forward . Future market conditions may differ from past market conditions, and the conditions that may have caused the favorable performance may no longer exist . In addition, past appreciation may not necessarily be an indicator of future appreciation even if future market conditions do not differ materially from past market conditions because current prices may already reflect all available information . If the past performance of the U . S . Equity Futures Constituent proves not to be an accurate indicator of its actual performance over the next period, then the Index’s trend - following allocation methodology may perform poorly . • Time lag . The trend signal measures the performance of the U . S . Equity Futures Constituent over the last month and therefore suffers from a time lag, which may cause it to be late both in signaling an allocation to the U . S . Equity Futures Constituent and in signaling an allocation away from the U . S . Equity Futures Constituent . The trend signal may not identify the U . S . Equity Futures Constituent as being in an upward trend until long after the upward trend began . By the time the trend signal finally signals an allocation to the U . S . Equity Futures Constituent, the trend may already have run its course, and a period of decline may even have already begun . Because the trend signal may signal an allocation to the U . S . Equity Futures Constituent after it has already been trending upward for a significant period of time, the trend signal may effectively reflect a “buy high” strategy, which may lead to poor Index returns . • Measurement error . The way in which the Index measures the trend of the U . S . Equity Futures Constituent may not effectively capture it . For example, if the U . S . Equity Futures Constituent appreciated during the first half of the prior month and then depreciated over the next half – but the depreciation was not quite as pronounced as the appreciation – the Index might identify an upward trend even though the most recent trend has been downward . In addition, the Index will not change its Selected Portfolio if the trend signal is not deemed to be statistically significant, even if the signals would otherwise call for a change . Whether a given trend signal is deemed to be statistically significant or not is based on an arbitrary cut - off, which may not be the optimal cut - off to use for the Index . There are measurements that the Index will deem to be statistically significant that would not be deemed statistically significant if a higher cut - off were chosen . Alternatively, the Index may be overly restrictive and treat as statistically insignificant trend signals that in fact contain meaningful information . In this latter case, the Index may retain exposure to a particular Selected Portfolio long after the signals have been indicating that a new Portfolio should be selected . The volatility signal is subject to a number of important limitations, including the following : • Time lag . The volatility signal measures volatility over the last three months and therefore suffers from a time lag, which may cause it to be late both in signaling an allocation to the U . S . Equity Futures Constituent and in signaling an allocation away from the U . S . Equity Futures Constituent . The volatility signal may signal an allocation to the U . S . Equity Futures Constituent long after the U . S . Equity Futures Constituent has become increasingly volatile, which can result in a significant decline in the level of the Index over a significant period of time . Alternatively, the volatility signal may not identify the volatility of the U . S . Equity Futures Constituent as being low until long after volatility decreased . By the time the volatility signal finally signals an allocation to the U . S . Equity Futures Constituent, the volatility may have increased again . This may result in poor Index performance . • Historical measure . The Index uses realized volatility to determine the volatility signal, which is a historical measure of volatility that does not reflect volatility going forward . Realized volatility is not the same as implied volatility, which is an estimation of future volatility and may better reflect market expectations . The performance of each Constituent is expected to be reduced by an implicit financing cost, and any increase in this cost will adversely affect the performance of the Index . As a futures - based index, each Constituent is expected to reflect not only the performance of its corresponding underlying reference asset (the S&P 500 Index in the case of the U . S . Equity Futures Constituent and 10 - year U . S . Treasury Notes in the case of the U . S . Treasury Futures Constituent), but also the implicit cost of a financed position in that reference asset . As a result, each Constituent will underperform a direct investment in the relevant reference asset . Any increase in market interest rates would be expected to further increase this implicit financing cost, increasing the negative effect on the level of each Constituent and, therefore, the Index .

Summary Risk Factors (2/2) 7 The Index rules limit the exposure the Index may have to the U . S . Equity Futures Constituent and, as a result, the Index is likely to significantly underperform equities in rising equity markets . In no event will the weight of the U . S . Equity Futures Constituent exceed 66 . 66 % , and in two of the three possible Portfolios, the weight of the U . S . Equity Futures Constituent will only be either 33 . 33 % or 0 % . In addition, the Index uses 15 % as a threshold for elevated volatility, which is not unusually elevated from a historical perspective and may result in reduced or eliminated exposure to the U . S . Equity Futures Constituent at a time when equity markets are in fact relatively stable and rising . Furthermore, even at a time when the Selected Portfolio is the Equity - Focused Portfolio, the Index’s volatility - targeting feature may result in significantly reduced Index exposure to the Selected Portfolio (and, in turn, to the U . S . Equity Futures Constituent) because the Equity - Focused Portfolio is likely to have a realized volatility significantly exceeding 5 % . As a result, the Index is likely to significantly underperform the U . S . Equity Futures Constituent in rising equity markets . The Index’s allocation methodology may not be successful if the U . S . Equity Futures Constituent and the U . S . Treasury Futures Constituent decline at the same time . The thesis underlying the Index’s allocation methodology is that, if the Index determines that the U . S . Equity Futures Constituent is likely to decline, the Index may avoid losses and even potentially generate positive returns by allocating exposure to the U . S . Treasury Futures Constituent instead of the U . S . Equity Futures Constituent . If the U . S . Equity Futures Constituent and the U . S . Treasury Futures Constituent tend to decline at the same time — in other words, if they prove to be positively correlated — the Index’s allocation methodology will not be successful, and the Index may experience significant declines . The Index will have significant exposure to the U . S . Treasury Futures Constituent, which has limited return potential and significant downside potential, particularly in times of rising interest rates . The U . S . Treasury Futures Constituent will be included in all three of the possible Portfolios, and in two of the three possible Portfolios it will be either 66 . 66 % or 100 % of the weight of that Portfolio . Accordingly, the Index will always be significantly allocated, and will frequently be predominantly or even 100 % allocated, to the U . S . Treasury Futures Constituent . U . S . Treasury notes are generally viewed as low risk, low reward assets . Accordingly, the U . S . Treasury Futures Constituent offers only limited return potential, which in turn limits the return potential of the Index . Although U . S . Treasury notes themselves are generally viewed as safe assets, the U . S . Treasury Futures Constituent tracks the value of a futures contract on 10 - Year U . S . Treasury Notes, which may be subject to significant fluctuations and declines . In particular, the value of a futures contract on 10 - Year U . S . Treasury Notes is likely to decline if there is a general rise in interest rates . A general rise in interest rates is likely to lead to particularly large losses on the U . S . Treasury Futures Constituent because, in addition to reducing the value of the underlying U . S . Treasury notes, the rise in interest rates will increase the implicit financing cost discussed above . Index performance will be reduced by the index fee . The performance of the Index will be reduced on a daily basis by the deduction of the index fee at a rate of 0 . 85 % per annum . The Index’s volatility - targeting feature may adversely affect Index performance . The Index’s volatility - targeting feature will reduce the exposure of the Index to the Selected Portfolio if and as necessary to maintain a 21 - day rolling volatility of the Index not in excess of 5 % . At any time when the Index has less than 100 % exposure to the performance of the Selected Portfolio, the difference will be hypothetically allocated to cash and will not accrue any interest or other return . After giving effect to the index fee, any such portion not accruing any interest or other return will experience a net decline . The Index may fail to maintain a 5 % volatility . There is a time lag associated with the Index’s volatility targeting mechanism . As a result, it may be some period of time before a recent increase in the volatility of the performance of the Selected Portfolio is sufficiently reflected in the calculation of the 21 - day realized volatility of the current Selected Portfolio to cause a compensating adjustment in the Index’s exposure . During the intervening period, if the increased volatility is associated with a significant decline in the value of the Selected Portfolio, the Index may in turn experience a significant decline without any mitigating reduction in exposure . The Index will be calculated pursuant to a set of fixed rules and will not be actively managed . If the Index performs poorly, the Index Administrator will not change the rules in an attempt to improve performance . The Index has limited actual performance information . The Index launched on June 13 , 2016 . Accordingly, the Index has limited actual performance data . Because the Index is of recent origin with limited performance history, an investment linked to the Index may involve a greater risk than an investment linked to one or more indices with an established record of performance . The Index Administrator may have conflicts of interest with you . Although the Index is rules - based, there are certain circumstances in which the Index Administrator may be required to exercise judgment in calculating the Index . In exercising these judgments, the Index Administrator’s interests may be adverse to yours .

Citigroup Global Markets Holdings Inc . and Citigroup Inc . have filed a registration statement (including a prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for any offering to which this communication relates . You should read the prospectus supplement and prospectus in that registration statement (File Nos . 333 - 255302 and 333 - 255302 - 03 ) together with the other documents Citigroup Global Markets Holdings Inc . and Citigroup Inc . may provide to you in connection with an offering of any securities linked to the Index for more complete information about Citigroup Global Markets Holdings Inc . , Citigroup Inc . and that offering . You may get these documents for free by visiting EDGAR on the SEC’s website at www . sec . gov . Alternatively, you can request the prospectus supplement and prospectus and any other relevant offering documents by calling toll - free 1 - 800 - 831 - 9146 . This communication has been issued by Citigroup Global Markets Limited (registered number 1763297 ), which has its registered office at Citigroup Centre, Canada Square, Canary Wharf, London E 14 5 LB, UK and which is authorized in the UK by the Prudential Regulation Authority and regulated in the UK by the Financial Conduct Authority and the Prudential Regulation Authority (together, the “UK Regulator”) . This communication is not intended for distribution to, or to be used by, any person or entity in any jurisdiction in which such distribution or use would be contrary to law or jurisdiction . This communication is provided for information purposes only with respect to the index discussed herein (the “Index”) and does not constitute (i) a recommendation, an offer or a solicitation to deal in any financial product, enter into any transaction or adopt any investment strategy, or (ii) legal, tax, regulatory, financial or accounting advice . Neither the entity establishing and sponsoring the Index (the “Index Administrator”), nor the entity acting as calculation agent for the Index (the “Index Calculation Agent”), nor any of their respective directors, officers, employees, representatives, delegates or agents (together with the Index Administrator and the Index Calculation Agent, each a “Relevant Person”) makes any express or implied representation or warranty as to (i) the advisability of purchasing or entering into any financial product the performance of which is linked, in whole or in part, to the Index (an “Index Linked Product”), (ii) the levels of the Index at any particular time on any particular date, (iii) the results to be obtained by the issuer of, the counterparty to, or any investor in the Index Linked Product, or any other person or entity, from the use of the Index or any data included therein for any purpose, (iv) the merchantability or fitness for a particular purpose of the Index, or (v) any other matter . Each Relevant Person hereby expressly disclaims, to the fullest extent permitted by applicable law, all warranties of accuracy, completeness, merchantability or fitness for a particular purpose with respect to the Index and any information contained in this communication . No Relevant Person shall have any liability (direct or indirect, special, punitive, consequential or otherwise) to any person even if notified of the possibility of damages . Neither the Index Administrator nor the Index Calculation Agent is under any obligation to continue the calculation, publication and dissemination of the Index nor shall any of them have any liability for any error, omission, interruption or delay relating to the Index . The Index Administrator and the Index Calculation Agent shall each act as principal and not as agent or fiduciary of any other person . During the normal course of its business, any Relevant Person may enter into or promote, offer or sell transactions or investments (structured or otherwise) linked to the Index and/or any of its constituents . In addition, any Relevant Person may have, or may have had, long or short principal positions and/or actively trade, by making markets to its clients, positions in or relating to the Index or any of its constituents, or may invest or engage in transactions with other persons, or on behalf of such persons relating to any of these items . Relevant Persons may also undertake hedging transactions related to the initiation or termination of financial products or transactions, which may adversely affect the market price, rate or other market factor(s) underlying any constituent or the Index . Relevant Persons may have an investment banking or other commercial relationship with and access to information from the issuer(s) of constituents . Such activity may or may not have an impact on the level of the Index, but potential investors and counterparties should be aware that a conflict of interest could arise where anyone is acting in more than one capacity, and such conflict may have an impact (either positive or negative) on the level of the Index . The Index reflects the performance of notional investment positions in its constituents . There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest . The Index merely identifies certain hypothetical investment positions, the performance of which will be used as a reference point for the purpose of calculating the level of the Index . Past performance is not indicative of future performance . Any numbers or figures presented as past performance in this communication may include performances calculated from back - testing simulations . Any back - testing information provided herein is illustrative only and derived from proprietary models based on certain historic data and assumptions and estimates . Such back - testing information should not be considered indicative of the actual results that might be obtained from an investment or participation in an Index Linked Product . Any scenario analysis is for illustrative purposes only and does not represent the actual performance of the Index nor does it purport to describe all possible performance outcomes for the Index . Any trade or strategy ideas included in this communication are provided by our Sales and Trading department . Such material is therefore not a direct recommendation from our Research department and the directives on the independence of research do not apply . On the occasions where the information provided includes extracts or summary material derived from research reports published by our Research department, you are advised to obtain and review the original piece of research to see the research analyst’s full analysis . Any opinions attributed to us constitute our judgment as of the date of the relevant material and are subject to change without notice . Provision of information may cease at any time without reason or notice being given . Although all information has been obtained from, and is based upon, sources believed to be reliable, it may be incomplete or condensed and its accuracy cannot be guaranteed . The Index is described in full in the Index Rules, which are available upon request from us . Any decision to invest in an Index Linked Product should be based upon the information contained in the associated prospectus, offering document or other legal document, together with the Index Rules . The Index and the information contained in this communication are the Index Administrator’s proprietary and confidential material . No person may use the Index in any way or reproduce or disseminate the information contained in this communication without the prior written consent of the Index Administrator . This communication is not intended for distribution to, or use by any person in, a jurisdiction where such distribution is prohibited by applicable law or regulation . No Index is in any way sponsored, endorsed or promoted by the issuer or sponsor, as applicable, of any of its constituents . In addition, Citi may submit prices, rates, estimates or values to data sources that publish indices or benchmarks, which may be referenced in products, transactions or an Index discussed in this communication . Such submissions may have an impact on the level of the relevant index or benchmark and consequently on the value of the products, transactions or the Index . Citi will make such submissions without regard to your interests under a particular product, transaction or Index . Citi has adopted policies and procedures designed to mitigate potential conflicts of interest arising from such submissions and our other business activities . In light of the different roles performed by Citi you should be aware of such potential conflicts of interest . © 2022 Citigroup Global Markets Limited . All rights reserved . Citi, Citi and Arc Design are trademarks and service marks of Citigroup Inc . or its Affiliates and are used and registered throughout the world . 8 Important Information

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Traders push back timing of first rate cut to December

- T-Mobile (TMUS) and EQT Announce JV to Acquire Lumos

- T-Mobile (TMUS) and EQT Announce JV to Acquire Lumos

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

CitiSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share