Form DEFA14A PIMCO Flexible Municipal

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☑ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Joint Proxy Statement | |

| ☑ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

PIMCO Flexible Credit Income Fund

PIMCO Flexible Municipal Income Fund

PIMCO Managed Accounts Trust

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☑ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

|

| ||||

| (2) | Aggregate number of securities to which transaction applies: | |||

|

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

|

| ||||

| (4) | Proposed maximum aggregate value of transaction: | |||

|

| ||||

| (5) | Total fee paid: | |||

|

| ||||

| ☐ | Fee paid previously with preliminary materials: | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

|

| ||||

| (2) | Form, Schedule or Registration Statement No.: | |||

|

| ||||

| (3) | Filing Party: | |||

|

| ||||

| (4) | Date Filed: | |||

|

| ||||

|

FUND

FACT SHEET FOR:

PIMCO MANAGED ACCOUNTS TRUST OR

INTERVAL FUNDS |

| JOINT SPECIAL MEETING IMPORTANT DATES | JOINT SPECIAL MEETING LOCATION | |||||||||

| Record Date | APRIL 1, 2021 |

OFFICES OF PACIFIC INVESTMENT MANAGEMENT COMPANY LLC

650 NEWPORT CENTER DRIVE

NEWPORT BEACH, CALIFORNIA 92660 | ||||||||

| Mail Date | April 29, 2021 | |||||||||

| Meeting Date | JUNE 8, 2021 @ 9:00 AM (PT) | |||||||||

| ADDITIONAL INFORMATION | CONTACT INFORMATION | |||||||||

| PMAT, PFLEX & PMFLX |

Tickers |

SEE PAGE 2 | Inbound Line | 1-877-864-5059 | ||||||

| CUSIPs | SEE PAGE 2 | Website | www.pimco.com | |||||||

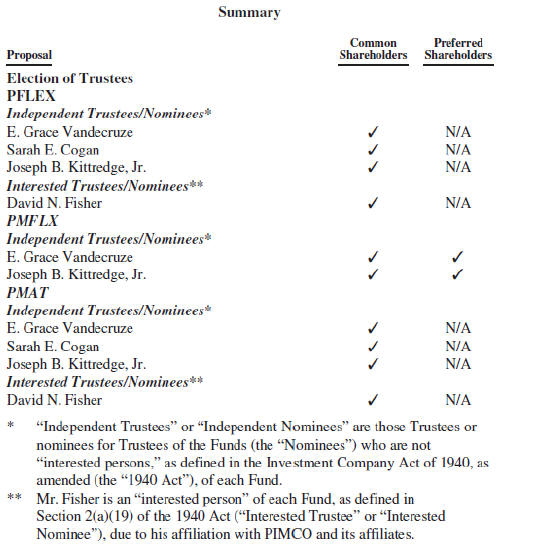

What are Shareholders being asked to vote on?

| 1. | Election of Trustees; |

BOARD OF TRUSTEES’ RECOMMENDATION – “FOR”

PROPOSAL 1: Election of Trustees;

| COMMON |

| NAME OF NOMINEE | TRUSTEE SINCE |

YEAR OF BIRTH |

FUNDS | |||

| (01) E. Grace Vandecruze | Nominee | 1963 |

PIMCO Flexible Credit Income Fund (“PFLEX”)

PIMCO Managed Accounts Trust (“PMAT”)

| |||

| (02) Sarah E. Cogan | 2019 | 1956 | ||||

| (03) Joseph B. Kittredge, Jr. | 2020 | 1954 | ||||

| (04) David N. Fisher | 2019 | 1968 |

| COMMON & PREFERRED |

| NAME OF NOMINEE | TRUSTEE SINCE |

YEAR OF BIRTH |

FUND | |||

| (01) E. Grace Vandecruze | Nominee | 1963 |

PIMCO Flexible Municipal Income Fund (“PMFLX”) | |||

| (02) Joseph B. Kittredge, Jr. | 2020 | 1954 |

THE BOARD OF TRUSTEES RECOMMENDS A VOTE “FOR” PROPOSAL 1

VOTING METHODS

| PHONE: |

To cast your vote by telephone with a proxy specialist, call the toll-free number found on your proxy card. Representatives are available to take your voting instructions Monday through Friday 9:00 a.m. to 10:00 p.m. Eastern Time. |

| For Internal Distribution Only | Page 1 |

| MAIL: | To vote your proxy by mail, check the appropriate voting box on the proxy card, sign and date the card and return it in the enclosed postage-paid envelope. | |

| TOUCH-TONE: | To cast your vote via a touch-tone voting line, call the toll-free number and enter the control number found on your proxy card. | |

| INTERNET: | To vote via the Internet, go to the website on your proxy card and enter the control number found on the proxy card. | |

Proxy Materials Are Available Online:

| PFLEX and PMFLX | PMAT | |

| www.pimco.com/en-us/capabilities/interval-funds | www.pimco.com/en-us/investments/fish | |

and at

https://vote.proxyonline.com/PIMCOFunds/docs/PMAT_INT_PROXY.pdf

| Fund Name | Share class | Symbol | CUSIP | |||

| PIMCO Fixed Income SHares: Series C | C | FXICX | 01882B205 | |||

| PIMCO Fixed Income SHares: Series LD | LD | FXIDX | 01882B700 | |||

| PIMCO Fixed Income SHares: Series M | M | FXIMX | 01882B304 | |||

| PIMCO Fixed Income SHares: Series R | R | FXIRX | 01882B403 | |||

| PIMCO Fixed Income SHares: Series TE | TE | FXIEX | 01882B601 | |||

| PIMCO Flexible Credit Income Fund | A-1 | PFAIX | 72202M502 | |||

| PIMCO Flexible Credit Income Fund | A-2 | PFALX | 72202M304 | |||

| PIMCO Flexible Credit Income Fund | A-3 | PFASX | 72202M403 | |||

| PIMCO Flexible Credit Income Fund | A-4 | PFFLX | 72202M205 | |||

| PIMCO Flexible Credit Income Fund | INST | PFLEX | 72202M106 | |||

| PIMCO Flexible Municipal Income Fund | A-1 | PMAAX | 72203E608 | |||

| PIMCO Flexible Municipal Income Fund | A-2 | PMALX | 72203E301 | |||

| PIMCO Flexible Municipal Income Fund | A-3 | PMFAX | 72203E202 | |||

| PIMCO Flexible Municipal Income Fund | INST | PMFLX | 72203E103 | |||

| PIMCO Flexible Municipal Income Fund | PREFD-VMTP | N/A | 72203E400 | |||

| PIMCO Flexible Municipal Income Fund | PRFD-RVMTP | N/A | 72203E707 | |||

| PIMCO Flexible Municipal Income Fund | PRFD-RVMTP | N/A | 72203E806 | |||

| PIMCO Flexible Municipal Income Fund | PRFD-RVMTP | N/A | 72203E509 |

| For Internal Distribution Only | Page 2 |

|

PIMCO Managed Accounts Trust or Interval Funds Level I Call Guide (CONFIRM RECEIPT OF PROXY MATERIAL) |

Good (morning, afternoon, evening), my name is (AGENT’S FULL NAME).

May I please speak with (SHAREHOLDER’S FULL NAME)?

(Re-Greet If Necessary)

I am calling on a recorded line regarding your current investment with PIMCO Managed Accounts Trust or Interval Funds. I wanted to confirm that you have received the proxy materials for the Joint Special Meeting of Shareholders scheduled to take place on June 8, 2021.

Have you received the information?

(Pause for response)

If “Yes” or positive response:

If you’re not able to attend the meeting, I can record your voting instructions by phone. Your Board of Trustees is recommending a vote “In Favor” of the proposal.

If “No” or negative response:

I would be happy to review the meeting agenda and record your voting instructions by phone. The Board of Trustees is recommending a vote “In Favor” of the proposal.

Would you like to vote along with the Board’s recommendation?

(Pause For Response)

(Review Voting Options with Shareholder If Necessary)

If we identify any additional accounts you own with PIMCO Managed Accounts Trust or Interval Funds before the meeting takes place, would you like to vote those accounts in the same manner as well?

(Pause For Response)

*Confirmation – I am recording your (Recap Voting Instructions). Today (Today’s Date & Time).

For confirmation purposes:

| • | Please state your full name. (Pause) |

| • | According to our records, you reside in (city, state, zip code). (Pause) |

| • | To ensure that we have the correct address for the written confirmation, please state your street address. (Pause) |

Thank you. You will receive written confirmation of this vote within 3 to 5 business days. Upon receipt, please review and retain for your records. If you should have any questions,

| FOR INTERNAL DISTRIBUTION ONLY | Updated 04-23-2021 |

|

PIMCO Managed Accounts Trust or Interval Funds Level I Call Guide (CONFIRM RECEIPT OF PROXY MATERIAL) |

please call the toll free number listed on the confirmation. Mr. /Ms. ___________, your vote is important and your time is greatly appreciated. Thank you and have a good (morning, afternoon, evening.)

IF THE SHAREHOLDER WOULD NOT LIKE VOTE RECORDED BY PHONE:

I am sorry for the inconvenience. Please be aware that as a shareholder, your vote is important. Please fill out and return your proxy card at your earliest convenience. You can also vote via the other methods outlined in the proxy materials. Thank you again for your time today, and have a good (morning, afternoon, evening).

| FOR INTERNAL DISTRIBUTION ONLY | Updated 04-23-2021 |

PIMCO Managed Accounts Trust or Interval Funds

Level I Answering Machine Script

Hello.

I am calling on behalf of your investment with PIMCO Managed Accounts Trust or Interval Funds.

The Joint Special Meeting of Shareholders is scheduled to take place on June 8, 2021. All shareholders are being asked to consider and vote on an important matter. As of today, your vote has not been registered.

Please contact us as soon as possible at 1-877-864-5059 Monday through Friday between the hours of 9:00am and 10:00pm Eastern Time.

Your vote is very important. Thank you and have a good day.

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

Key Points and Background Information:

On April 21, 2021, PIMCO Flexible Credit Income Fund (“PFLEX”), PIMCO Flexible Municipal Income Fund (“PMFLX” and, together with PFLEX, the “Interval Funds”) and PIMCO Managed Accounts Trust (“PMAT”) (each individual series thereof, a “Portfolio” and, together with the Interval Funds, the “Funds”) filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement relating to the election of Trustees to the Board of Trustees of such Funds. The Notice of the Joint Special Meeting of Shareholders, the proxy statement and the proxy cards were first sent to shareholders on or about April 29, 2021. Shareholder approval of the election of trustees will be sought at a meeting scheduled for Tuesday, June 8, 2021. A list of Funds and identifiers can be found in Appendix B at the end of this document.

This Q&A is intended to be used when answering client questions and should not be used to solicit proxies/votes. Clients may hear about the filing and ask for more information. You may direct clients to the proxy statement at https://vote.proxyonline.com/PIMCOFunds/docs/PMAT_INT_PROXY.pdf. You must not send copies of any of the proxy materials, or any other documents, to callers. However, you may provide a client with the link to the proxy statement, if requested, with no other commentary in the email.

You should not solicit proxies/votes. If a client wishes to vote his or her proxy or would like additional information regarding a Fund, please ask him or her to contact AST Fund Solutions, LLC at 877.864.5059 Monday through Friday from 9:00 a.m. to 10:00 p.m., Eastern Time.

You must not make any statements that are inconsistent with the proxy statement or otherwise misleading. You must not provide anyone with any written materials (including emails) regarding the proposal in the proxy statement unless those materials have been cleared for use by Legal & Compliance.

If you have any questions or concerns, please contact:

| Legal: | Funds Business Group: | |

| Timothy Bekkers | Colleen McLaughlin | |

| [email protected] | [email protected] | |

| 949.720.7754 | 212.597.1172 | |

The following is a Q&A that may be used to help you answer client inquiries about the proposal for which the Funds are seeking shareholder approval.

Q&A:

| 1. | What is happening? |

Shareholders of Interval Funds and PMAT are being asked to elect trustees to the Board of Trustees of each Fund at a joint special meeting of shareholders scheduled for June 8, 2021. The Governance and Nominating Committee and the Board of each Fund have recommended the Nominees listed below for election as Trustees by the Shareholders of such Fund. Additional information on the Board of Trustees and nominees is provided in Appendix A.

The Board of Trustees of each Fund is currently composed of eight Trustees, six of whom are Independent Trustees and two of whom are Interested Trustees. The current Trustees are Hans W. Kertess, Deborah A.

1

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

DeCotis, Joseph B. Kittredge, Jr., John C. Maney, William B. Ogden, IV, Sarah E. Cogan, David N. Fisher and Alan Rappaport. Ms. Vandecruze is the only Nominee who is not currently serving as a Trustee of the Funds.

In light of the current composition of each Fund’s Board, the Funds are holding the Meeting to request that shareholders elect Ms. Vandecruze to serve as a Trustee of each Fund, and are also taking this opportunity to ask Shareholders to elect the other Fund Trustees who have not previously been elected by Shareholders (Sarah E. Cogan, David N. Fisher and Joseph B. Kittredge, Jr.) in furtherance of the Funds’ current and future compliance with requirements under Section 16(a) of the 1940 Act. If all of the Nominees are approved by Shareholders of the Funds, the Board of Trustees of each Fund will consist of nine Trustees, two of whom will be Interested Trustees and seven of whom will be Independent Trustees.

| 2. | What role does the Board play? |

The Trustees serve as the shareholders’ representatives. Members of the Board are fiduciaries and have an obligation to serve the best interests of shareholders. The Trustees oversee the Funds’ activities, including

2

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

investment performance, compliance and the risks associated with the Funds activities, review fund performance, oversee fund activities, and review contractual arrangements with companies that provide services to the funds.

| 3. | What is the affiliation of the Board and PIMCO? |

The current Board consists of eight individuals. Currently, there are two Interested Trustees and six Independent Trustees. Trustees are determined to be “Interested” by virtue of, among other things, their affiliation with PIMCO. If the proposal is approved by shareholders, the Board will consist of nine individuals – two Interested Trustees and seven Independent Trustees.

| 4. | Are Board members paid? |

Interested Trustees are compensated by PIMCO. Independent Trustees have no affiliation with PIMCO and are compensated by the Funds. Each Independent Trustee receives a fee for his or her service on the Board. You can find the compensation table, which details these fees for the current Trustees, in the proxy statement.

| 5. | What funds are included in this proxy? |

Please see Appendix B for a complete list of Funds and identifiers.

| 6. | What will my clients receive in the mail? |

Proxy materials, including the notice, proxy statement and proxy card. The Board of Trustees of each Fund has fixed the close of business on April 1, 2021 as the record date for the determination of shareholders entitled to receive notice of, and to vote at, the meeting or any adjournment(s) or postponement(s) thereof. Proxy statements and proxy cards were mailed to shareholders starting on or about April 29, 2021.

| 7. | Will shareholders be called? |

Yes, phone solicitation may occur. As we get closer to the meeting date on June 8, 2021, phone solicitation may increase to ensure quorum is met.

Please note: if requested, shareholders can be added to a “Do Not Call” list with the proxy solicitor. If you receive a call from a concerned shareholder and/or financial advisor, please request the underlying shareholder information (full name, address and telephone number) and send the request to [email protected]. The proxy solicitor only has underlying shareholder information, not the corresponding financial advisor information.

| 8. | How do shareholders vote their shares? |

Shareholders can refer to the voting instructions included in their proxy statement and proxy card. They can reach the proxy solicitor at 877.864.5059 Monday through Friday from 9:00 a.m. to 10:00 p.m., Eastern Time.

| 9. | How can I find the proxy statement on the SEC’s website? |

Go to www.sec.gov and click Company Filings below the search bar in the upper right hand corner of the page, then type “PIMCO Managed Accounts Trust,“ “PIMCO Flexible Credit Income Fund” or “PIMCO Flexible Municipal Income Fund” and click Search. Look for a Filing DEF 14A.

| 10. | Can I find the proxy statement on any other websites? |

The proxy statements can be found here: https://vote.proxyonline.com/PIMCOFunds/docs/PMAT_INT_PROXY.pdf

3

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

The proxy statements are also available on our website, pimco.com, under the individual fund pages. Below are links to the key homepages.

www.pimco.com/en-us/capabilities/interval-funds

www.pimco.com/en-us/investments/fish

| 11. | Why should shareholders vote? |

The proposal has been carefully reviewed by the Board of Trustees. The Trustees are responsible for protecting the interests of shareholders. The Trustees believe that the proposal is in the best interests of shareholders.

| 12. | When and where will the meeting take pace? |

The meeting will be held at PIMCO, 650 Newport Center Drive, Newport Beach, California 92660 on June 8, 2021 at 9:00 a.m., Pacific Time.

This communication is for internal use only to keep employees educated and informed. It is not a script, and should not be distributed or communicated in whole or in part to anyone outside the firm. This information is neither investment advice nor a recommendation of the products or services discussed. All investments involve risk, including loss of principal. Targets, if any, are inherently limited and not a prediction of future performance.

APPENDIX A

The following table provides information concerning the Trustees/Nominees of the Funds as of April 1, 2021.

4

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

| Name,

Address,

Year of Birth (1)

|

Position(s)

Held

with the

Funds

|

Term of

Office and

Length of

Time Served

(2)

|

Principal Occupation(s)

During the Past 5 Years

|

Number of

Portfolios

in Fund

Complex(5)

Overseen by

Trustee/

Nominee

|

Other

Directorships

Held by

Trustee/

Nominee

During the

Past 5 Years

| |||||

|

Independent Trustees/Nominees

| ||||||||||

| Deborah A.

DeCotis

1952 |

Chair of the Board, Trustee | PFLEX –

Since 2017

PMFLX –

Since 2018

PMAT – Since 2011

Chair – Since

2019

|

Advisory Director, Morgan Stanley & Co., Inc. (since 1996); Member, Circle Financial Group (since 2009); Member, Council on Foreign Relations (since 2013); Trustee, Smith College (since 2017); and Director, Watford Re (since 2017). Formerly, Co-Chair Special Projects Committee, Memorial Sloan Kettering (2005-2015); Trustee, Stanford University (2010- 2015); Principal, LaLoop LLC, a retail accessories company (1999-2014); Director, Helena Rubenstein Foundation (1997-2010); and Director, Armor Holdings (2002-2010). | 29 |

Trustee, Allianz Funds (2011-2021); Trustee, Virtus Funds (2021-Present) | |||||

| Sarah E. Cogan

1956 |

Trustee, Nominee | Since 2019 | Retired Partner, Simpson Thacher & Bartlett LLP (law firm); Director, Girl Scouts of Greater New York, Inc. (since 2016); and Trustee, Natural Resources Defense Council, Inc. (since 2013). Formerly, Partner, Simpson Thacher & Bartlett LLP (1989-2018). | 29 | Trustee, Allianz Funds (2019-2021); Trustee, Virtus Funds (2021-Present) | |||||

5

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

| Name,

Address,

Year of Birth (1)

|

Position(s)

Held

with the

Funds

|

Term of

Office and

Length of

Time Served

(2)

|

Principal Occupation(s)

During the Past 5 Years

|

Number of

Portfolios

in Fund

Complex(5)

Overseen by

Trustee/

Nominee

|

Other

Directorships

Held by

Trustee/

Nominee

During the

Past 5 Years

| |||||

| Hans W.

Kertess

1939 |

Trustee | PFLEX –

Since 2017

PMFLX –

Since 2018

PMAT –

Since 2005

|

President, H. Kertess & Co., a financial advisory company; and Senior Adviser (formerly, Managing Director), Royal Bank of Canada Capital Markets (since 2004). | 29 | Trustee, Allianz Funds (2004-2021); Trustee, Virtus AllianzGI Closed-End Funds (2021-Present) | |||||

| Joseph B.

Kittredge, Jr.

1954 |

Trustee,

Nominee |

Since 2020 | Trustee, Vermont Law School (since 2019); Director and Treasurer, Center for Reproductive Rights (since 2015). Formerly, Director (2013 to 2020) and Chair (2018 to 2020), ACLU of Massachusetts; General Counsel, Grantham, Mayo, Van Otterloo & Co. LLC (2005-2018) and Partner (2007-2018); President, GMO Trust (institutional mutual funds) (2009-2018); Chief Executive Officer, GMO Trust (2009-2015); President and Chief Executive Officer, GMO Series Trust (platform based mutual funds) (2011-2013). | 29 | Trustee, GMO Trust (2010-2018); Chairman of the Board of Trustees, GMO Series Trust (2011-2018). | |||||

6

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

| Name,

Address,

Year of Birth (1)

|

Position(s)

Held

with the

Funds

|

Term of

Office and

Length of

Time Served

(2)

|

Principal Occupation(s)

During the Past 5 Years

|

Number of

Portfolios

in Fund

Complex(5)

Overseen by

Trustee/

Nominee

|

Other

Directorships

Held by

Trustee/

Nominee

During the

Past 5 Years

| |||||

| William B.

Ogden, IV

1945 |

Trustee | PFLEX –

Since 2017

PMFLX –

Since 2018

PMAT –

Since 2006 |

Retired. Formerly, Asset Management Industry Consultant; and Managing Director, Investment Banking Division of Citigroup Global Markets Inc. | 29 | Trustee, Allianz Funds (2006-2021); Trustee, Virtus AllianzGI Closed-End Funds (2021-Present). | |||||

| Alan

Rappaport

1953 |

Trustee | PFLEX –

Since 2017

PMFLX –

Since 2018

PMAT –

Since 2010 |

Adjunct Professor, New York University Stern School of Business (since 2011); Lecturer, Stanford University Graduate School of Business (since 2013); and Director, Victory Capital Holdings, Inc., an asset management firm (since 2013). Formerly, Advisory Director (formerly, Vice Chairman), Roundtable Investment Partners (2009-2018); Member of Board of Overseers, NYU Langone Medical Center (2015-2016); Trustee, American Museum of Natural History (2005-2015); Trustee, NYU Langone Medical Center (2007-2015); and Vice Chairman (formerly, Chairman and President), U.S. Trust (formerly, Private Bank of Bank of America, the predecessor entity of U.S. Trust) (2001-2008). | 29 | Trustee, Allianz Funds (2010-2021); Trustee, Virtus AllianzGI Closed-End Funds (2021-Present) | |||||

7

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

| Name,

Address,

Year of Birth (1)

|

Position(s)

Held

with the

Funds

|

Term of

Office and

Length of

Time Served

(2)

|

Principal Occupation(s)

During the Past 5 Years

|

Number of

Portfolios

in Fund

Complex(5)

Overseen by

Trustee/

Nominee

|

Other

Directorships

Held by

Trustee/

Nominee

During the

Past 5 Years

| |||||

| E. Grace

Vandecruze

1963 |

Nominee | N/A | Founder and Managing Director, Grace Global Capital LLC, a strategic advisory firm to the insurance industry (since 2006); Director and Member of the Audit Committee and the Wealth Solutions Advisory Committee, M Financial Group, a life insurance company (since 2015); Director, The Doctors Company, a medical malpractice insurance company (since 2020); Chief Financial Officer, Athena Technology Acquisition Corp, a special purpose acquisition company (since 2021); Director, Link Logistic REIT, a real estate company (since 2021); Director and Member of the Investment & Risk Committee, Resolution Life Group Holdings, a global life insurance group (since 2021); and Director, Wharton Graduate Executive Board. Formerly, Director, Resolution Holdings (2015-2019). Formerly, Director, SBLI USA, a life insurance company (2015-2018). | 0 | None |

8

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

| Name,

Address,

Year of Birth (1)

|

Position(s)

Held

with the

Funds

|

Term of

Office and

Length of

Time Served

(2)

|

Principal Occupation(s)

During the Past 5 Years

|

Number of

Portfolios

in Fund

Complex(5)

Overseen by

Trustee/

Nominee

|

Other

Directorships

Held by

Trustee/

Nominee

During the

Past 5 Years

| |||||

|

Interested Trustees/Nominees

| ||||||||||

| David N.

Fisher(4)

1968

650 Newport Center Drive, Newport Beach, CA 92660 |

Trustee,

Nominee |

Since January

2019 |

Managing Director and Co-Head of U.S. Global Wealth Management Strategic Accounts, PIMCO (since 2021); Managing Director and Head of Traditional Product Strategies, PIMCO (2015-2021); and Director, Court Appointed Special Advocates (CASA) of Orange County, a non-profit organization (since 2015). Formerly, Global Bond Strategist, PIMCO (2008-2015); and Managing Director and Head of Global Fixed Income, HSBC Global Asset Management (2005-2008).

|

29 | None | |||||

| John C.

Maney(4)

1959

650 Newport Center Drive, Newport Beach, CA 92660 |

Trustee | PFLEX –

Since 2017

PMFLX –

Since 2018

PMAT –

Since 2006 |

Consultant to PIMCO (since January 2020); Non-Executive Director and a member of the Compensation Committee of PIMCO Europe Ltd (since 2017). Formerly, Managing Director of Allianz Asset Management of America L.P. (2005-2019); member of the Management Board and Chief Operating Officer of Allianz Asset Management of America L.P (2006-2019); Member of the Management Board of Allianz Global Investors Fund Management LLC (2007-2014) and Managing Director of Allianz Global Investors Fund Management LLC (2011-2014).

|

29 | None | |||||

9

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

| (1) | Unless otherwise indicated, the business address of the persons listed above is c/o Pacific Investment Management Company LLC, 1633 Broadway, New York, New York 10019. |

| (2) | Under each Fund’s Agreement and Declaration of Trust, a Trustee serves during the continued lifetime of each Fund until he or she dies, resigns or is removed, or, if sooner, until the election and qualification of his or her successor. |

| (3) | Ms. Vandecruze does not currently serve as a Trustee of any Fund and is standing for initial election to each Fund’s Board at the Meeting. Ms. Vandecruze has been nominated to stand for election by the Governance and Nominating Committee and the Board of each Fund. |

| (4) | Each of Messrs. Fisher and Maney is an Interested Trustee of each Fund due to his affiliation with PIMCO and its affiliates. |

| (5) | The Term “Fund Complex” as used herein includes the Funds and any other registered investment company (i) that holds itself out to investors as a related company for purposes of investment and investor services; or (ii) for which PIMCO or an affiliate of PIMCO serves as primary investment adviser. Prior to February 1, 2021, the Fund Complex would have included a number of open- and closed-end funds advised by Allianz Global Investors U.S. LLC (“AllianzGI”), an affiliate of PIMCO. Effective February 1, 2021 (and February 26, 2021 with respect to Virtus AllianzGI Artificial Intelligence & Technology Opportunities Fund), however, Virtus Investment Advisers, Inc. (“Virtus”) became the primary investment adviser of those funds (such Virtus-advised funds, the “Former Allianz-Managed Funds”), and therefore they are no longer included within the definition of Fund Complex as used herein. AllianzGI has been appointed to serve as sub-adviser to most of the remaining Former Allianz-Managed Funds. |

10

|

Proxy Vote: Election of Trustees

| |||

| pimco.com | Interval Funds & Managed Accounts | INTERNAL AND SS&C USE ONLY | ||

APPENDIX B

| Trust | Fund Name | Share class | Symbol | CUSIP | TA Fund # | |||||

| FISH | PIMCO Fixed Income SHares: Series C | C | FXICX | 01882B205 | 2755 | |||||

| FISH | PIMCO Fixed Income SHares: Series LD | LD | FXIDX | 01882B700 | 2761 | |||||

| FISH | PIMCO Fixed Income SHares: Series M | M | FXIMX | 01882B304 | 2756 | |||||

| FISH | PIMCO Fixed Income SHares: Series R | R | FXIRX | 01882B403 | 2757 | |||||

| FISH | PIMCO Fixed Income SHares: Series TE | TE | FXIEX | 01882B601 | 2760 | |||||

| PIF | PIMCO Flexible Credit Income Fund | A-1 | PFAIX | 72202M502 | 9458 | |||||

| PIF | PIMCO Flexible Credit Income Fund | A-2 | PFALX | 72202M304 | 9455 | |||||

| PIF | PIMCO Flexible Credit Income Fund | A-3 | PFASX | 72202M403 | 9457 | |||||

| PIF | PIMCO Flexible Credit Income Fund | A-4 | PFFLX | 72202M205 | 9451 | |||||

| PIF | PIMCO Flexible Credit Income Fund | INST | PFLEX | 72202M106 | 9450 | |||||

| PIF | PIMCO Flexible Municipal Income Fund | A-1 | PMAAX | 72203E608 | 9456 | |||||

| PIF | PIMCO Flexible Municipal Income Fund | A-2 | PMALX | 72203E301 | 9453 | |||||

| PIF | PIMCO Flexible Municipal Income Fund | A-3 | PMFAX | 72203E202 | 9454 | |||||

| PIF | PIMCO Flexible Municipal Income Fund | INST | PMFLX | 72203E103 | 9452 | |||||

| PIF | PIMCO Flexible Municipal Income Fund | PREFD-VMTP | N/A | 72203E400 | N/A | |||||

| PIF | PIMCO Flexible Municipal Income Fund | PRFD-RVMTP | N/A | 72203E707 | N/A | |||||

| PIF | PIMCO Flexible Municipal Income Fund | PRFD-RVMTP | N/A | 72203E806 | N/A | |||||

| PIF | PIMCO Flexible Municipal Income Fund | PRFD-RVMTP | N/A | 72203E509 | N/A |

11

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Pacific Investment Management Company, LLC (PIMCO)Sign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share