Form DEF 14A Quantum Computing Inc. For: Sep 21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________

SCHEDULE 14A

___________________

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant |

☒ |

|

|

Filed by a Party other than the Registrant |

☐ |

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

|

|

☒ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

QUANTUM COMPUTING INC.

(Name of Registrant as Specified in its Charter)

___________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a- 6(i)(1) and 0-11. |

QUANTUM COMPUTING INC.

August 12, 2022

Dear Fellow Quantum Computing Stockholders:

We invite you to attend the 2022 Annual Meeting of Stockholders of Quantum Computing Inc. to be held at the Quantum Computing corporate offices located at 215 Depot Court SE, Suite 215, Leesburg, VA 20175 on Wednesday, September 21, 2022, at 10:00 a.m. local time.

The Notice of the Annual Meeting and Proxy Statement accompanying this letter provide information concerning matters to be considered and acted upon at the meeting. Immediately following the meeting, a report on our operations will be presented, including a question-and-answer and discussion period. Our 2021 results are presented in detail in our Annual Report.

Your vote is very important. We encourage you to read all of the important information in the Proxy Statement and vote your shares as soon as possible. Whether or not you plan to attend, you can be sure your shares are represented at the Annual Meeting by promptly submitting your proxy or voting instructions by the Internet, by telephone or, if you request a paper copy of the proxy materials and receive a proxy card, by mail.

On behalf of the Board of Directors, thank you for your continued confidence and investment in Quantum Computing.

|

Sincerely, |

||

|

/s/ Robert Liscouski |

||

|

Robert Liscouski |

QUANTUM COMPUTING INC.

215 Depot Court SE, Suite 215

Leesburg, VA 20175

Telephone: (703) 436-2161

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held on Wednesday, September 21, 2022

To the Stockholders of Quantum Computing Inc.:

The 2022 Annual Meeting of the Stockholders (the “Annual Meeting”) of Quantum Computing Inc. a Delaware corporation (together with its subsidiaries, “Company”, “Quantum Computing”, “we”, “us” or “our”), will be held on Wednesday, September 21, 2022, at 10:00 a.m. local time at the Company’s offices at 215 Depot Court SE, Suite 215, Leesburg, VA 20175. The purpose of the meeting is to consider and act upon the following matters:

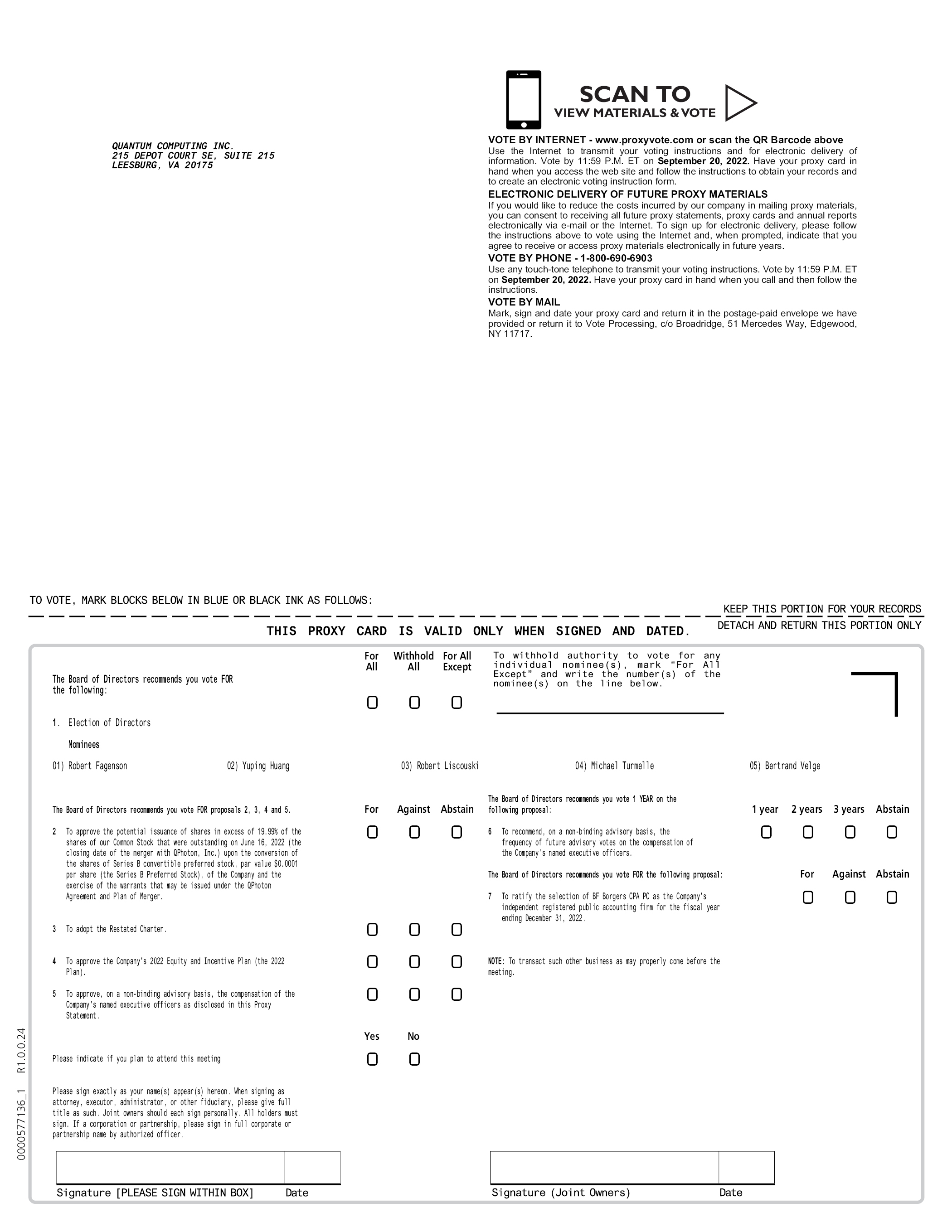

1. To elect five directors to serve until the next annual meeting of stockholders and until their respective successors shall have been duly elected and qualified (Proposal No. 1);

2. To approve the potential issuance of shares in excess of 19.99% of the shares of our common stock that were outstanding on June 16, 2022 (the closing date of the merger with QPhoton, Inc.) (the “Share Issuance Proposal”) upon the conversion of the shares of Series B convertible preferred stock of the Company and the exercise of the warrants that may be issued under the Agreement and Plan of Merger by and among the Company, QPhoton, Inc. and the other parties thereto (the “QPhoton Agreement and Plan of Merger”) (Proposal No. 2);

3. To adopt the Amended and Restated Certificate of Incorporation of the Company (the “Restated Charter”) (Proposal No. 3);

4. To approve the Quantum Computing Inc. 2022 Equity and Incentive Plan (the “2022 Plan”) (Proposal No. 4);

5. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement (Proposal No. 5);

6. To recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal No. 6);

7. To ratify the selection of BF Borgers CPA PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 7); and

8. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement that is attached and made a part of this Notice. Only stockholders of record of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), and Series A convertible preferred stock, par value $0.0001 per share (the “Series A Preferred Stock”), at the close of business on July 29, 2022 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. The holders of the Series A Preferred Stock are entitled to notice and to vote at the Annual Meeting pursuant to Section 14 of the Certificate of Designations, Preferences and Rights of the Series A Convertible Preferred Stock which entitles the Series A Preferred Stock holders to vote on any matter that adversely affects them which Proposal 2 falls within.

All stockholders are cordially invited to attend the Annual Meeting. We are providing proxy material access to our stockholders via the Internet at www.proxyvote.com. Please give the proxy materials your careful attention.

BY ORDER OF THE BOARD OF DIRECTORS

|

/s/ Robert Liscouski |

||

|

Robert Liscouski |

||

|

Chief Executive Officer and Chairman of the |

||

|

Leesburg, VA |

||

|

August 12, 2022 |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON WEDNESDAY, SEPTEMBER 21, 2022

The Notice and Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com.

Your vote is important. We encourage you to review all of the important information contained in the proxy materials before voting.

|

Page |

||

|

GENERAL INFORMATION ABOUT THE PROXY STATEMENT AND ANNUAL MEETING |

1 |

|

|

1 |

||

|

1 |

||

|

1 |

||

|

2 |

||

|

2 |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING |

5 |

|

|

10 |

||

|

10 |

||

|

12 |

||

|

12 |

||

|

12 |

||

|

16 |

||

|

16 |

||

|

16 |

||

|

18 |

||

|

18 |

||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

19 |

|

|

21 |

||

|

22 |

||

|

22 |

||

|

23 |

||

|

23 |

||

|

24 |

||

|

24 |

||

|

25 |

||

|

28 |

||

|

32 |

||

|

38 |

||

|

39 |

||

|

40 |

||

|

41 |

||

|

41 |

i

QUANTUM COMPUTING INC.

215 Depot Court SE, Suite 215

Leesburg, VA 20175

Telephone: (703) 436-2161

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, SEPTEMBER 21, 2022

GENERAL INFORMATION ABOUT THE PROXY

STATEMENT AND ANNUAL MEETING

General

The enclosed proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Quantum Computing Inc. (the “Company,” “we” or “us”), for use at the 2022 Annual Meeting of the Company’s stockholders (the “Annual Meeting”) to be held at 215 Depot Court SE, Suite 215, Leesburg, VA 20175, on Wednesday, September 21, 2022, at 10:00 a.m. local time, and at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Accompanying this Proxy Statement is a proxy/voting instruction form (the “Proxy”) for the Annual Meeting, which you may use to indicate your vote as to the proposals contained in this Proxy Statement. Whether or not you expect to attend the meeting in person, please submit your Proxy to vote your shares as promptly as possible to ensure that your vote is counted. It is contemplated that this Proxy Statement and the accompanying form of Proxy will first be mailed to the Company’s stockholders on or about August 12, 2022.

All Proxies which are properly completed, signed and returned prior to the Annual Meeting, and which have not been revoked, will be voted in favor of the proposals described in this Proxy Statement unless otherwise directed. A stockholder may revoke his or her Proxy at any time before it is voted either by filing with the Chief Executive Officer of the Company, at its principal executive offices located at 215 Depot Court SE, Suite 215, Leesburg, VA 20175, a written notice of revocation or a duly-executed Proxy bearing a later date or by attending the Annual Meeting and voting in person.

The Company will solicit stockholders by mail through its regular employees and will request banks and brokers and other custodians, nominees and fiduciaries, to solicit their customers who have stock of the Company registered in the names of such persons and will reimburse them for reasonable, out-of-pocket costs. In addition, the Company may use the service of its officers and directors to solicit proxies, personally or by telephone, without additional compensation.

Record Date

The holders of record of the outstanding shares of Common Stock and Series A Preferred Stock at the close of business on July 29, 2022 (the “Record Date”), will be entitled to receive notice of, attend and vote at the meeting.

As of July 29, 2022, there were 33,904,329 shares of Common Stock issued and outstanding and 1,500,004 shares of Series A Preferred Stock issued and outstanding, which constitutes all of the outstanding capital stock of the Company entitled to vote at the Annual Meeting. Holders of Common Stock and Series A Preferred Stock as of the Record Date are entitled to one vote for each share of Common Stock held by them as of the Record Date and one vote for each share of Series A Preferred Stock held by them as of the Record Date.

The presence in person or by proxy of the holders of a majority in interest of all stock of the Company issued and outstanding and entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. In the absence of a quorum at the meeting, the meeting may be adjourned from time to time without notice, other than

1

announcement at the meeting, until a quorum is formed. The enclosed Proxy reflects the number of shares that you are entitled to vote pursuant to such Proxy. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Annual Meeting in person or by proxy and who abstain, including broker non-votes (as described below), are considered stockholders who are present for purposes of determining the presence of a quorum.

Why am I being provided with these proxy materials?

The Notice and Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com in connection with the solicitation by our Board of proxies for the matters to be voted on at our Annual Meeting and at any adjournment or postponement thereof.

What do I do if my shares are held in “street name”?

If your shares are held in a brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other holder of record on how to vote your shares by following their instructions for voting. Please refer to information from your bank, broker or other nominee on how to submit your voting instructions.

What if other matters come up at the Annual Meeting?

At the date this Proxy Statement went to press, we did not know of any matters to be properly presented at the Annual Meeting other than those referred to in this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration, and you are a stockholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to vote on those matters for you.

All valid proxies to vote shares received prior to the Annual Meeting will be voted. The Board of Directors recommends that you submit a proxy to vote your shares even if you plan to attend the Annual Meeting. You can submit a proxy to vote your shares via Internet or mail. To submit a proxy via Internet, go to www.proxyvote.com and follow the instructions. To submit a proxy by mail, fill out the enclosed Proxy, sign and date it, and return it in the enclosed postage-paid envelope to Broadridge Financial Solutions, Inc. Voting by proxy will not limit your right to vote at the Annual Meeting if you attend the Annual Meeting and vote in person. However, if your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

Voting Procedures and Vote Required

Your vote is important no matter how many shares you own. Please take the time to submit a proxy to vote your shares. Take a moment to read the instructions below. Choose the way that is easiest and most convenient for you, and submit a proxy to vote your shares as soon as possible.

If you are the “record holder” of your shares, meaning that you own your shares in your own name and not through a bank, broker or other nominee, you may cause your shares to be voted in one of three ways:

• You may submit a proxy to vote your shares over the Internet or by Telephone. You may submit a proxy to vote your shares by following the “Vote by Internet” instructions on the accompanying proxy card or the “Vote by Phone” instructions on the accompanying proxy card. If you submit a proxy over the Internet, you do not need to submit a proxy by telephone or complete and mail your proxy card.

• You may vote in Person. You may vote your shares in person if you attend the Annual Meeting.

• You may submit a proxy to vote your shares by mail. If you requested a proxy card by mail, you may cause your shares to be voted by completing, dating and signing the proxy card delivered and promptly mailing it in the postage-paid envelope provided. If you submit a proxy by mail, you do not need to submit a proxy over the Internet or by telephone.

2

All proxies that are executed and returned or are otherwise submitted over the Internet or by telephone will be voted on the matters set forth in the accompanying Notice of Annual Meeting of Stockholders in accordance with the instructions set forth therein. However, if no choice is specified on a proxy as to one or more of the proposals, the proxy will be voted in accordance with the Board of Directors’ recommendations on such proposals as set forth in this proxy statement.

Votes Required to Approve a Proposal

The holders of a majority in interest of all stock issued, outstanding and entitled to vote at the Annual Meeting, present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock and Series A Preferred Stock represented in person or by proxy (including shares present in person or by proxy which abstain or do not vote with respect to one or more of the matters presented for stockholder approval and shares for which broker non-votes occur) will be counted for purposes of determining whether a quorum is present at the Annual Meeting. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

The following votes are required for approval of the proposals being presented at the Annual Meeting:

Proposal No. 1: Election of Directors. Votes may be cast: “FOR ALL” nominees, “WITHHOLD ALL” nominees or “FOR ALL EXCEPT” those nominees noted by you on the appropriate portion of your proxy or voting instruction card. At the Meeting, five directors are to be elected, which number shall constitute our entire Board, to hold office until the next annual meeting of stockholders and until their successors shall have been duly elected and qualified. Pursuant to our bylaws, as amended, directors are to be elected by a plurality of the votes cast at the Annual Meeting. This means that the five candidates receiving the highest number of affirmative votes at the Annual Meeting will be elected as directors. Proxies cannot be voted for a greater number of persons than the number of nominees named or for persons other than the named nominees. Shares for which a vote is withheld from a director nominee will not be voted with respect to the director nominee indicated and, assuming that any such vote withheld from the director nominee is not cast in favor of the election of another nominee, will have no impact on the election of directors although such shares will be counted for the purposes of determining whether there is a quorum. Broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 2: To Approve the Potential Issuance of shares in Excess of 19.99% of the Shares of our Common Stock that were Outstanding on June 16, 2022 (the closing date of the merger with QPhoton, Inc.) upon the Conversion of the Shares of Series B Convertible Preferred Stock of the Company and the Exercise of the Warrants that may be Issued under the QPhoton Agreement and Plan of Merger. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” In order to be approved, the Share Issuance Proposal must be approved by a majority of the votes cast for or against such proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 3: To Adopt the Restated Charter. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” The affirmative vote of the holders of each of (i) a majority of the outstanding shares of Common Stock entitled to vote thereon, (ii) a majority of the outstanding shares of Series A Preferred Stock entitled to vote thereon and (ii) a majority of the outstanding shares of Common Stock and Series A Preferred Stock entitled to vote the adoption of the Restated Charter, voting together as a single class, is required for the adoption of the Restated Charter. Abstentions and broker non-votes will have the effect of a vote against this proposal.

Proposal No. 4: To Approve the 2022 Plan. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” In order to be approved, the proposal to approve the 2022 Plan must be approved by a majority of the votes cast for or against such proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 5: To Approve the Compensation of the Company’s Named Executive Officers. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” The non-binding advisory proposal to approve the compensation of the Company’s named executive officers as disclosed in this Proxy Statement requires the approval of a majority of the votes cast for or against such proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 6: To Recommend the Frequency of Future Advisory Votes on Compensation. Votes may be cast: “ONE YEAR,” “TWO YEARS,” “THREE YEARS” or “ABSTAIN.” In order for the recommendation, on a non-binding advisory basis, of a one-year, two-year or three-year frequency for future advisory votes on the compensation of the Company’s named executive officers to be approved by the stockholders, the recommendation of such frequency must

3

be approved by a majority of the votes cast in favor of one of these three options for the frequency of future advisory votes on the compensation of the Company’s named executive officers. This is a non-binding advisory proposal, and to the extent that none of these three options are approved by sufficient votes for the recommendation of such option to have been duly approved by the stockholders, in that case the Board intends to consider the option receiving the greatest number of affirmative votes to be the option preferred by the stockholders. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal No. 7: To Ratify the Selection of BF Borgers CPA PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. Votes may be cast: “FOR,” “AGAINST” or “ABSTAIN.” The proposal to ratify the selection of BF Borgers CPA PC as the Company’s independent registered public accounting firm for its current fiscal year requires the approval of a majority of the votes cast for or against such proposal. Abstentions will have no effect on the outcome of this proposal. There will be no broker non-votes with respect to this proposal.

Tabulation and Reporting of Voting Results

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be tallied by the inspector of election after the taking of the vote at the Annual Meeting. The Company will publish the final voting results in a Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) within four business days following the Annual Meeting.

This proxy statement, the accompanying proxy card and our 2021 annual report to stockholders were first made available to stockholders on or about August 12, 2022.

A copy of our Annual Report on Form 10-K for the year ended December 31, 2021 as filed with the Securities and Exchange Commission, or SEC, except for exhibits, will be furnished without charge to any stockholder upon written or oral request to Quantum Computing Inc., 215 Depot Court SE, Suite 215, Leesburg, VA 20175.

Proxy Materials Are Available on the Internet

The Company uses the Internet as the primary means of furnishing proxy materials to stockholders. We send a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) to our stockholders with instructions on how to access the proxy materials online at www.proxyvote.com or request a printed copy of materials.

Stockholders may follow the instructions in the Notice of Internet Availability to elect to receive future proxy materials in print by mail or electronically by email. We encourage stockholders to take advantage of the availability of the proxy materials online to reduce environmental impact and mailing costs.

4

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board is soliciting your proxy to vote at the Annual Meeting of Stockholders. According to our records, you were a holder of shares of Common Stock or Series A Preferred Stock of the Company as of the end of business on July 29, 2022.

You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card.

The Company intends to mail these proxy materials on or about August 12, 2022 to all stockholders of record on the Record Date entitled to vote at the Annual Meeting.

What is included in these materials?

These materials include this proxy statement for the Annual Meeting and the proxy card.

What is the proxy card?

The proxy card enables you to appoint Robert Liscouski, our Chief Executive Officer, and Christopher Roberts, our Chief Financial Officer, as your representatives at the Annual Meeting, with full power of substitution and re-substitution. By completing and returning a proxy card, you are authorizing Mr. Liscouski and Mr. Roberts to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or not you attend the Annual Meeting.

When and where is the Annual Meeting being held?

The Annual Meeting will be held on September 21, 2022, commencing at 10:00 a.m., local time, at 215 Depot Court SE, Suite 215, Leesburg, VA 20175.

Can I view these proxy materials over the Internet?

Yes. The Notice of Meeting, this Proxy Statement and accompanying proxy card are available at www.proxyvote.com.

Who can vote at the Annual Meeting?

Only holders of record of outstanding shares of Common Stock and Series A Preferred Stock at the close of business on July 29, 2022 will be entitled to vote at the Annual Meeting. On this Record Date, there were 33,904,329 shares of Common Stock outstanding and entitled to vote and 1,500,004 shares of Series A Preferred Stock outstanding and entitled to vote.

The Annual Meeting will begin promptly at 10:00 a.m., local time. Check-in will begin one-half hour prior to the meeting. Please allow ample time for the check-in procedures.

Stockholder of Record: Shares Registered in Your Name

If on July 29, 2022 your shares of Common Stock or Series A Preferred Stock were registered directly in your name with Quantum Computing’s transfer agent, Worldwide Stock Transfer, LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on July 29, 2022 your shares or Common Stock or Series A Preferred Stock were held in an account at a brokerage firm, bank, dealer, or other similar organization, rather than in your name, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial

5

owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

The following matters are scheduled for a vote:

1. To elect five directors to serve until the next annual meeting of stockholders and until their respective successors shall have been duly elected and qualified (Proposal No. 1);

2. To approve the potential issuance of shares in excess of 19.99% of the shares of our Common Stock that were outstanding on June 16, 2022 (the closing date of the merger with QPhoton, Inc.) upon the conversion of the shares of Series B convertible preferred stock, par value $0.0001 per share (the “Series B Preferred Stock”), of the Company and the exercise of the warrants that may be issued under the QPhoton Agreement and Plan of Merger (Proposal No. 2)

3. To adopt the Restated Charter (Proposal No. 3);

4. To approve the Company’s 2022 Equity and Incentive Plan (the “2022 Plan”) (Proposal No. 4);

5. To approve, on a non-binding advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement (Proposal No. 5);

6. To recommend, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of the Company’s named executive officers (Proposal No. 6);

7. To ratify the selection of BF Borgers CPA PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 7); and

8. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

The Board is not currently aware of any other business that will be brought before the Annual Meeting.

How do I vote?

On all matters except Proposal No. 1 (the election of directors) and Proposal No. 6 (the non-binding advisory proposal regarding the frequency of future advisory votes on the compensation of the Company’s named executed officers), you may vote “FOR” or “AGAINST” or “ABSTAIN” from voting on the proposal. With respect to Proposal No. 1, for each nominee standing for election to the Board, you may for “FOR” such nominee’s election or “WITHHOLD” authority to vote for nominee’s election; provided that you may not vote any shares “FOR” the election of more than five nominees. With respect to Proposal No. 6, you may vote to recommend that future advisory votes on the compensation of the Company’s named executed officers be held every “ONE YEAR,” “TWO YEARS” or “THREE YEARS,” or you may “ABSTAIN” from voting on this proposal. The procedures for voting your shares in accordance with these options are summarized below:

Stockholder of Record: Shares Registered in Your Name

If you hold shares of Common Stock or Series A Preferred Stock of record as of the Record Date, you may vote in person at the Annual Meeting or vote by proxy using the enclosed proxy card or via telephone, or the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

• To vote in person, come to the Annual Meeting and we will give you a ballot when you arrive. You should be prepared to present photo identification for admittance. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the Annual Meeting and for a period of ten days prior to the Annual Meeting during regular business hours at our principal executive offices, which are located at 215 Depot Court SE, Suite 215, Leesburg, VA 20175.

6

• To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your completed and signed proxy card to us before the Annual Meeting, we will vote your shares as you direct.

• To submit a proxy via the Internet, follow the “Vote by Internet” instructions on the accompanying proxy card.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail your voting instructions as directed by your broker or bank to ensure that your vote is counted. Alternatively, you may be able to cause your shares to be voted by telephone or over the Internet by following instructions provided by your broker or bank. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of Common Stock you hold as of the Record Date and one vote for each share of Series A Preferred Stock you hold as of the Record Date.

What is a quorum for purposes of conducting the Annual Meeting?

The presence, in person or by proxy, of the holders of a majority in interest of all stock of the Company issued and outstanding and entitled to vote at the Annual Meeting is necessary to constitute a quorum to transact business. If a quorum is not present or represented at the Annual Meeting, the stockholders entitled to vote thereat, present in person or by proxy, may adjourn the Annual Meeting from time to time without notice, other than announcement at the meeting, until a quorum is present or represented.

What if I return a proxy card but do not make specific choices?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “FOR” the election of each of the nominees nominated by the Board as directors (Proposal No. 1), “FOR” approval of the potential issuance of shares in excess of 19.99% of the shares of our Common Stock that were outstanding on June 16, 2022 (the closing date of the merger with QPhoton, Inc.) upon the conversion of the shares of Series B Preferred Stock and the exercise of the warrants that may be issued under the QPhoton Agreement and Plan of Merger (Proposal No. 2), “FOR” adoption of the Restated Charter (Proposal No. 3), “FOR” approval of the 2022 Plan (Proposal No. 4), “FOR” approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers (Proposal No. 5), to recommend that the frequency of future advisory votes on the compensation of the Company’s named executive officers will be “ONE YEAR” (Proposal No. 6), and “FOR” ratification of the appointment of BF Borgers CPA PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 7), and if any other matter is properly presented at the meeting, your proxy holder (one of the individuals named on your proxy card) will vote your shares using his best judgment.

How does the Board recommend that I vote?

Our Board recommends that you vote your shares “FOR” the election of each of the nominees nominated by the Board as directors (Proposal No. 1), “FOR” approval of the potential issuance of shares in excess of 19.99% of the shares of our Common Stock that were outstanding on June 16, 2022 (the closing date of the merger with QPhoton, Inc.) upon the conversion of the shares of Series B Preferred Stock and the exercise of the warrants that may be issued under the QPhoton Agreement and Plan of Merger (Proposal No. 2), “FOR” adoption of the Restated Charter (Proposal No. 3), “FOR” approval of the 2022 Plan (Proposal No. 4), “FOR” approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers (Proposal No. 5), to recommend that the frequency of future advisory votes on the compensation of the Company’s named executive officers will be “ONE YEAR” (Proposal No. 6), and “FOR” ratification of the appointment of BF Borgers CPA PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022 (Proposal No. 7). Unless you provide other instructions on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board as set forth in this Proxy Statement.

7

Who is paying for this proxy solicitation?

We will bear the cost of mailing and solicitation of proxies. Proxies may be solicited by mail or personally by our directors, officers or employees, none of whom will receive additional compensation for such solicitation. Those holding shares as of record for the benefit of others, or nominee holders, are being asked to distribute proxy soliciting materials to, and request voting instructions from, the beneficial owners of such shares. We will reimburse nominee holders for their reasonable out-of-pocket expenses.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign and return each proxy card to ensure that all of your shares are voted.

I share the same address with another Quantum Computing Inc. stockholder. Why has our household only received one set of proxy materials?

The SEC’s rules permit us to deliver a single set of proxy materials to one address shared by two or more of our stockholders. This practice, known as “householding,” is intended to reduce the Company’s printing and postage costs. We have delivered only one set of proxy materials to stockholders who hold their shares through a bank, broker or other holder of record and share a single address, unless we received contrary instructions from any stockholder at that address. However, any such street name holder residing at the same address who wishes to receive a separate copy of the proxy materials may make such a request by contacting the bank, broker or other holder of record, or Broadridge Financial Solutions, Inc. at 866-540-7095 or in writing at Broadridge, Householding Department, 51 Mercedes Way, Edgewood, NY 11717. Street name holders residing at the same address who would like to request householding of Company materials may do so by contacting the bank, broker or other holder of record or Broadridge at the phone number or address listed above.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

• You may submit another properly completed proxy card with a later date or subsequently submit another proxy to vote your shares via the Internet or via telephone;

• You may send a timely written notice that you are revoking your proxy to the Company at 215 Depot Court SE, Suite 215, Leesburg, VA 20175, Attn: Chief Executive Officer; or

• You may attend the Annual Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the meeting. For each of Proposals No. 2, 3, 4 and 7, the inspector of elections will separately count “For” and “Against” votes, the number of shares that “Abstain” from voting on such proposal and, except with respect to Proposal No. 7 (for which no broker non-votes will occur), broker non-votes. For Proposal No. 1, the inspector of elections will separately count, with respect to each nominee standing for election, the number of votes cast “For” such nominee’s election, the number of votes for which the stockholders elected to “Withhold” authority to vote for such nominee and the number of broker non-votes. For Proposal No. 6, the inspector of elections will separately count the number of votes cast in favor of the recommendation of each of “One Year,” “Two Years” and “Three Year” frequency of future advisory votes on the compensation of the Company’s named executive officers, the number of shares that “Abstain” from voting on such proposal and the number of broker non-votes. Abstentions will not be counted as votes “For” or “Against” any matter.

8

Is my vote kept confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except:

• as necessary to meet applicable legal requirements;

• to allow for the tabulation and certification of votes; and

• to facilitate a successful proxy solicitation.

Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be disclosed in a Current Report on Form 8-K filed after the Annual Meeting.

9

Set forth below are the names of and certain biographical information about each member of our Board of Directors. The information presented includes each director’s principal occupation and business experience for the past five years and the names of other public companies of which he or she has served as a director during the past five years.

The Board of Directors, upon the recommendation of our Nominating and Corporate Governance Committee, has nominated: Robert Liscouski, Dr. Yuping Huang, Bertrand Velge, Robert Fagenson and Michael Turmelle for election as directors, each to hold office until the next annual meeting of stockholders of the Company and until their successors are elected and qualified or until their earlier resignation or removal.

|

Name |

Current |

Position |

||

|

Robert Liscouski |

68 |

Chairman of the Board of Directors, President, and Chief Executive Officer (Principal Executive Officer) |

||

|

Dr. Yuping Huang |

43 |

Chief Quantum Officer, Director |

||

|

Bertrand Velge |

62 |

Director |

||

|

Robert Fagenson |

74 |

Director |

||

|

Michael Turmelle |

63 |

Director |

The following noteworthy experience, qualifications, attributes and skills for each Board member, led to our conclusion that the person should serve as a director in light of our business and structure:

Robert Liscouski, President, Chief Executive Officer and Chairman of the Board

Mr. Liscouski, age 68, is the Chairman and CEO of Quantum Computing. Mr. Liscouski is CEO and Founder of Convergent Risk Group LLC and a proven security professional, thought leader and successful entrepreneur with over 35 years of senior level security operational and company leadership experience in government and public and private companies.

Mr. Liscouski is a recognized Security Industry leader in assessing, mitigating and managing physical and cyber security risk in private sector enterprises and state and federal government agencies. Mr. Liscouski has extensive experience in leading innovative start up and turn around companies as well as building programs for large government organizations and is recognized as a leader in identifying emerging security technologies. He serves as a “Trusted Advisor” to senior officials within government and private sector, providing guidance in areas such as physical and cyber security, crisis management, organizational development and strategic planning. Mr. Liscouski’s career has spanned local law enforcement, senior government and private sector positions from operations to senior leadership and Boards of Directors. He started his career as an undercover and homicide investigator, and Special Agent with the Diplomatic Security Service and progressed to senior federal government positions where he served as a senior advisor to the intelligence community and was appointed by President George W. Bush as the first Assistant Secretary for Infrastructure Protection at the Department of Homeland Security. He most recently was President of a public company that became a leader in the explosive trace detection industry culminating in the sale of the technology to L3 Communications. Mr. Liscouski is a frequent contributor to CNBC, CNN, Fox News, and other business and security media on Homeland Security and Terrorism issues.

Yuping Huang, Chief Quantum Officer, Director

Dr. Yuping Huang, the Company’s Chief Quantum Officer and Director, age 43, has over 20 years of experience in commercial and academic settings, with pioneering research in a wide spectrum of quantum physics, optics, and technology. Prior to joining the Company, Yuping founded QPhoton, Inc. (“QPhoton”), where he served as CEO from 2020 to 2022. QPhoton was a development stage company commercializing quantum photonic technology and devices to provide innovative and practical quantum solutions for critical challenges facing big data, cyber, remote sensing, and healthcare industries. Dr. Huang worked as a postdoctoral fellow, a research faculty member, and principal investigator at Northwestern University from 2009-2014. In 2014 he joined the faculty of Stevens Institute of Technology where he continues to serve to this date. Dr. Huang is the founding director of the Center for Quantum Science and Engineering and Gallagher Associate Professor of Physics at Stevens Institute of Technology. He received a Bachelor of Science in modern physics from the University of Science and Technology of China in 2004 and a PhD in quantum AMO physics in 2009 from Michigan State University.

10

The Board believes that Dr. Huang’s experience in quantum computing and technology makes him ideally qualified to help lead the Company towards continued growth and success as the Company continues to develop and commercialize its offerings and expand its business plan.

Bertrand Velge, Director

Mr. Velge, age 62, is the Managing Director of Graftyset, Ltd., a privately held company based in the United Kingdom. Graftyset is a wholesale distributor of wine, beer and other alcoholic and non-alcoholic beverage, based in Sidcup, Kent (UK). Mr. Velge has served as Managing Director since the company was incorporated in 2003 under the name of Otterden Vintners, Ltd. Mr. Velge also served as Director for Aliunde Ltd. since 2005. Mr. Velge has over twenty years of experience in multi-disciplinary venture investing and was managing director and co-founder of a fund that trades equities in Europe, Asia and the US focusing on IPOs. He speaks English, Flemish and French, and is a graduate of the Universite Catholique de Louvain.

Robert Fagenson, Director

Mr. Fagenson, age 74, serves as a member of the board of directors of National Holdings Corporation (“NHS”) since March 2012. He serves as vice chairman of the board of directors of NHS since September 2016. Mr. Fagenson previously served as co-chief executive officer of NHS from January 3, 2017 to January 31, 2017, as chief executive officer and chairman of the board of directors of NHS from December 2014 to September 2016, and as executive vice-chairman of the board of directors of NHS from July 2012 to December 2014. Mr. Fagenson has been a branch owner at NHS, an operating company of NHS, since 2012, and president of Fagenson & Co., Inc., a family investment company, since 1982. Mr. Fagenson spent the majority of his career at the New York Stock Exchange (NYSE), where he was managing partner of one of the exchange’s largest specialist firms. While at the NYSE, Mr. Fagenson served as a governor on the trading floor and was elected to the NYSE board of directors in 1993, where he served for six years, eventually becoming vice chairman of the NYSE board of directors from 1998 to 1999 and 2003 to 2004. Mr. Fagenson has served as director of the New York City Police Museum since 2005, and as director of the Federal Law Enforcement Officers Association Foundation since 2009. He has also served on the board of directors of Sigma Alpha Mu Foundation since 2011 and on the board of directors of New York Edge since 2015. In addition, Mr. Fagenson served as the non-executive chairman of Document Security Systems, Inc. from 2012 to 2018 (NYSEMKT: DSS). He is currently a member of the alumni board of the Whitman School of Business at Syracuse University.

Mr. Fagenson received his B.S. in Transportation Sciences & Finance from Syracuse University in 1970. The Board believes that Mr. Fagenson’s experience in the securities industry and knowledge of the Company as its former chief executive officer qualifies him to serve as a member of the board.

Michael Turmelle, Director

Mr. Turmelle, age 63, has served on the board of directors of Ideal Power Inc. since December 2017 and as Chairman of Ideal Power’s board as of 2021. Since January 2018, Mr. Turmelle has served as the Managing Director of Hayward Tyler, which he joined in February 2015. Hayward Tyler designs, manufactures and services performance-critical electric motors and pumps to meet the most demanding of applications for the global energy industry, as both an original equipment manufacturer supplier and trusted partner. Previously, Mr. Turmelle ran his own consulting company working with start-ups and turn-arounds in the areas of renewable energy, medical and other advanced technologies. Mr. Turmelle has served on numerous Board of Directors including the Board of Directors of Implant Sciences Corp., an explosive and narcotic trace detection company, where he served as Chairman of the Board from 2015 to 2017. Mr. Turmelle was Chief Financial Officer and Chief Operating Officer and a member of the Board of Directors of SatCon Technology Corporation. Mr. Turmelle was also on the Board of Directors of Beacon Power, a SatCon spin-off company dealing in flywheel energy storage. Mr. Turmelle has a BA in Economics from Amherst College and is a graduate of General Electric’s Financial Management Program. Mr. Turmelle brings to our Board years of public company executive experience as well as extensive experience in finance and operations and in the field of electrical technology.

Family Relationships

There are no family relationships between any of our directors or executive officers.

11

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires the Company’s executive officers and directors, and persons who own more than 10% of the Company’s common stock, to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC.

Based solely on the Company’s review of the copies of such Forms and written representations from certain reporting persons, the Company believes that all filings required to be made by the Company’s Section 16(a) reporting persons during the Company’s fiscal year ended December 31, 2021 were made on a timely basis, other than: a Form 3 filed by William J. McGann on November 5, 2021, and a Form 3 filed by Robert B Fagenson on November 10, 2021, a Form 4 filed by Justin Schreiber on April 1, 2021, reporting purchases of 250,000 shares of Common Stock back to January 21, 2021, a Form 4 filed by Robert Liscouski on May 19, 2021, reporting exercise of options to purchase 250,000 shares of Common Stock back to April 26, 2021, and a Form 4 filed by Christopher Roberts on May 19, 2021, reporting exercise of options to purchase 400,000 shares of Common Stock back to April 26, 2021.

The Company currently maintains a Code of Ethics which applies to all directors, officers, and employees. A copy of our Code of Ethics can be found on our website at www.quantumcomputinginc.com.

Board Composition and Director Independence

Our Board consists of five members. The directors will serve until our next annual meeting and until their successors are duly elected and qualified. The Company defines “independent” as that term is defined in Rule 5605(a)(2) of the NASDAQ listing standards.

In making the determination of whether a member of the Board is independent, our Board considers, among other things, transactions and relationships between each director and his immediate family and the Company, including those reported under the caption “Certain Relationships and Related-Party Transactions”. The purpose of this review is to determine whether any such relationships or transactions are material and, therefore, inconsistent with a determination that the directors are independent. On the basis of such review and its understanding of such relationships and transactions, our Board affirmatively determined that Bertrand Velge, Michael Turmelle and Robert Fagenson are qualified as independent and that they have no material relationship with us that might interfere with his or her exercise of independent judgment.

Board Committees; Audit Committee Financial Expert; Stockholder Nominations

Our Board has established an audit committee, a compensation committee and a nominating and corporate governance committee. Each committee has its own charter, which is available on our website at www.quantumcomputing.com. Each of the Board committees has the composition and responsibilities described below.

Members will serve on these committees until their resignation or until otherwise determined by our Board of Directors.

Bertrand Velge, Robert Fagenson and Michael Turmelle are our independent directors.

The members of each committee are, as follows:

Audit Committee: Bertrand Velge, Robert Fagenson and Michael Turmelle with Mr. Fagenson serving as the Chairman. Our Board has determined the Mr. Fagenson is currently qualified as an “audit committee financial expert”, as such term is defined in Item 407(d)(5) of Regulation S-K.

Compensation Committee: Bertrand Velge, Robert Fagenson and Michael Turmelle. Mr. Turmelle serves as Compensation Committee Chairman.

Nominating and Governance Committee: Bertrand Velge, Robert Fagenson and Michael Turmelle. Mr. Velge serves as Chairman of the Nominating and Governance Committee.

12

Audit Committee

The Audit Committee oversees our accounting and financial reporting processes and oversee the audit of our consolidated financial statements and the effectiveness of our internal control over financial reporting. The specific functions of this Committee include, but are not limited to:

• selecting and recommending to our Board the appointment of an independent registered public accounting firm and overseeing the engagement of such firm;

• approving the fees to be paid to the independent registered public accounting firm;

• helping to ensure the independence of the independent registered public accounting firm;

• overseeing the integrity of our financial statements;

• preparing an audit committee report as required by the SEC to be included in our annual proxy statement;

• resolving any disagreements between management and the auditors regarding financial reporting;

• reviewing with management and the independent auditors any correspondence with regulators and any published reports that raise material issues regarding the Company’s accounting policies;

• reviewing and approving all related-party transactions; and

• overseeing compliance with legal and regulatory requirements.

Compensation Committee

Our Compensation Committee assists the Board in the discharge of its responsibilities relating to the compensation of the board of directors and our executive officers.

The Committee’s compensation-related responsibilities include, but are not limited to:

• reviewing and approving on an annual basis the corporate goals and objectives with respect to compensation for our Chief Executive Officer;

• reviewing, approving and recommending to our Board on an annual basis the evaluation process and compensation structure for our other executive officers;

• determining the need for and the appropriateness of employment agreements and change in control agreements for each of our executive officers and any other officers recommended by the Chief Executive Officer or Board;

• providing oversight of management’s decisions concerning the performance and compensation of other company officers, employees, consultants and advisors;

• reviewing our incentive compensation and other equity-based plans and recommending changes in such plans to our Board as needed, and exercising all the authority of our Board with respect to the administration of such plans;

• reviewing and recommending to our Board the compensation of independent directors, including incentive and equity-based compensation; and

• selecting, retaining and terminating such compensation consultants, outside counsel or other advisors as it deems necessary or appropriate.

Nominating and Corporate Governance Committee

The purpose of the Nominating and Corporate Governance Committee is to recommend to the Board nominees for election as directors and persons to be elected to fill any vacancies or newly created directorships on the Board, develop and recommend a set of corporate governance principles and oversee the performance of the Board.

13

The Committee’s responsibilities include:

• recommending to the Board nominees for election as directors at any meeting of stockholders and nominees to fill vacancies or newly created directorships on the Board;

• considering candidates proposed by stockholders in accordance with the requirements in the Committee charter;

• overseeing the administration of the Company’s code of business conduct and ethics;

• reviewing with the entire Board, on an annual basis, the requisite skills and criteria for Board candidates and the composition of the Board as a whole;

• the authority to retain search firms to assist in identifying Board candidates, approve the terms of the search firm’s engagement, and cause the Company to pay the engaged search firm’s engagement fee;

• recommending to the Board on an annual basis the directors to be appointed to each committee of the Board;

• overseeing an annual self-evaluation of the Board and its committees to determine whether it and its committees are functioning effectively; and

• developing and recommending to the Board a set of corporate governance guidelines applicable to the Company.

The Nominating and Corporate Governance Committee may delegate any of its responsibilities to subcommittees as it deems appropriate. The Nominating and Corporate Governance Committee is authorized to retain independent legal and other advisors, and conduct or authorize investigations into any matter within the scope of its duties.

Code of Business Conduct and Ethics

We have adopted a code of business conduct and ethics applicable to our principal executive, financial and accounting officers and all persons performing similar functions. A copy of that code is available on our corporate website at www.quantumcomputinginc.com. We expect that any amendments to such code, or any waivers of its requirements, will be disclosed on our website.

Disclosure of Commission Position on Indemnification of Securities Act Liabilities

Our directors and officers are indemnified as provided by the Delaware corporate law and our bylaws. We have agreed to indemnify each of our directors and certain officers against certain liabilities, including liabilities under the Securities Act. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers and controlling persons pursuant to the provisions described above, or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than our payment of expenses incurred or paid by our director, officer or controlling person in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, we will, unless in the opinion of our counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

We have been advised that in the opinion of the SEC indemnification for liabilities arising under the Securities Act is against public policy as expressed in the Securities Act, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court’s decision.

14

Involvement in Certain Legal Proceedings.

Our Chief Executive Officer, Mr. Robert Liscouski, was President of Implant Sciences Corporation, which filed a petition for bankruptcy on October 11, 2016 in the Delaware Bankruptcy Court.

With the exception of the foregoing, to the best of our knowledge, none of our directors or executive officers has, during the past ten years:

• been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses);

• had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time;

• been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity;

• been found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

• been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

• been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Except as set forth in our discussion below in “Certain Relationships and Related Transactions,” none of our directors or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the Commission.

15

The following summary compensation table sets forth all compensation awarded to, earned by, or paid to the named executive officers paid by us during the years ended December 31, 2021 and 2020.

|

Name and Principal Position |

Year |

Salary |

Bonus |

Stock |

Option |

Non-Equity |

Non-Qualified |

All Other |

Total |

|||||||||

|

Robert Liscouski |

2021 |

361,900 |

190,000 |

0 |

1,712,500 |

0 |

0 |

0 |

2,264,400 |

|||||||||

|

Chief Executive |

2020 |

360,000 |

40,000 |

1,264,000 |

75,000 |

0 |

0 |

0 |

1,739,000 |

|||||||||

|

Officer (PEO) |

— |

— |

— |

— |

— |

— |

— |

— |

||||||||||

|

Christopher Roberts |

2021 |

214,170 |

0 |

0 |

2,740,000 |

0 |

0 |

0 |

2,954,170 |

|||||||||

|

Treasurer (PFO) |

2020 |

202,750 |

0 |

1,264,000 |

45,000 |

0 |

0 |

0 |

1,511,750 |

|||||||||

|

— |

— |

— |

— |

— |

— |

— |

— |

|||||||||||

|

William J. McGann |

2021 |

0 |

0 |

0 |

0 |

0 |

22,903 |

0 |

22,903 |

|||||||||

|

Chief Operating Officer |

2020 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||

|

and Chief Technology |

— |

— |

— |

— |

— |

— |

— |

— |

||||||||||

|

Officer(1) |

||||||||||||||||||

|

David Morris, |

2021 |

263,945 |

0 |

0 |

1,340,000 |

0 |

0 |

0 |

1,603,945 |

|||||||||

|

Chief Revenue |

2020 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|||||||||

|

Officer |

— |

— |

— |

— |

— |

— |

— |

— |

____________

(1) Mr. McGann was appointed as Chief Operating Officer of the Company on January 3, 2022.

Executive Employment Agreements

Mr. Liscouski Employment Agreement

On April 26, 2021, the Company entered into an amended and restated employment agreement (the “Liscouski Amended and Restated Employment Agreement”) with Mr. Robert Liscouski, the Company’s Chief Executive Officer. The Liscouski Amended and Restated Employment Agreement superseded and replaced Mr. Liscouski’s prior employment agreement with the Company. The Liscouski Amended and Restated Employment Agreement is for an initial term of three years and it will be automatically renewed for consecutive one-year terms at the end of the initial term. The Liscouski Amended and Restated Employment Agreement may be terminated with or without cause. Mr. Liscouski will receive an annual base salary of $400,000.00 and shall be eligible to earn a performance bonus of up to fifty percent (50%) of his base salary. Mr. Liscouski shall also receive 150,000 stock options per annum to purchase shares of Common Stock of the Company, beginning on the first anniversary of the Liscouski Amended and Restated Employment Agreement (the “Liscouski Equity Compensation”). The Liscouski Equity Compensation will vest over three years from date of its grant with one-third of the Liscouski Equity Compensation vesting on the date of grant, and the remainder of the Liscouski Equity Compensation vesting in equal monthly installments thereafter. To induce Mr. Liscouski to enter into the Liscouski Amended and Restated Employment Agreement, Mr. Liscouski received (i) 250,000 stock options to purchase shares of Common Stock of the Company (the “Liscouski Inducement Options”); and (ii) 250,000 stock options to purchase shares of Common Stock of the Company pursuant the Company’s listing on Nasdaq.

Upon termination of Mr. Liscouski without cause, or as a result of Mr. Liscouski’s resignation for Good Reason (as such term is defined in the Liscouski Amended and Restated Employment Agreement) the Company shall pay or provide to Mr. Liscouski severance pay equal to his then current monthly base salary for 12 months from the date of termination and all stock options granted by the Company and then held by Mr. Liscouski shall be accelerated and become fully vested and exercisable as of the date of Mr. Liscouski’s termination.

As a full-time employee of the Company, Mr. Liscouski will be eligible to participate in the Company’s benefit programs.

16

Mr. Roberts Employment Agreement

We entered into an employment agreement with Christopher Roberts, our Chief Financial Officer, on April 26, 2021 (the “Roberts Employment Agreement”) whereby Mr. Roberts is to provide the Company with financial and accounting and business strategy services. The agreement is for an indefinite term, subject to periodic review by the Board of Directors, stipulates a base salary of $300,000 per year. For the fiscal year ending December 31, 2021 and for subsequent fiscal years, the Roberts Employment Agreement allows for an annual incentive bonus in the amount up to $150,000 per year, subject to Mr. Roberts achieving certain performance based milestones that are established by the Board of Directors. In connection with the Roberts Employment Agreement, Mr. Roberts was issued 400,000 stock options to purchase shares of common stock of the Company (the “Roberts Stock Options”), which vest as follows: (i) 150,000 options vested immediately upon grant (ii) 83,333 options vested on the 12-month anniversary of the date of grant (iii), 83,333 options shall vest on the 24-month anniversary of the date of grant and (iv) 83,334 options shall vest on the 36-month anniversary of the date of grant.

Upon termination of Mr. Roberts without cause, or as a result of Mr. Roberts’ resignation for Good Reason (as such term is defined in the Roberts Employment Agreement) the Company shall pay or provide to Mr. Roberts severance pay equal to his then current monthly base salary for 12 months from the date of termination and all stock options granted by the Company and then held by Mr. Roberts shall be accelerated and become fully vested and exercisable as of the date of Mr. Roberts’ termination.

As a full-time employee of the Company, Mr. Roberts will be eligible to participate in the Company’s benefit programs.

Mr. McGann Employment Agreement

We entered into an employment agreement with William J. McGann, our Chief Operating Officer and Chief Technology Officer. Mr. McGann’s employment agreement is for an indefinite term and may be terminated with or without cause.

Pursuant to the McGann Employment Agreement, Mr. McGann will receive an annual base salary of $400,000. Mr. McGann shall be eligible to earn an annual cash bonus in an amount of up to thirty seven and one half percent (37.5%) of Base Salary, subject to achieving certain performance milestones that are to be established and approved by the Board. Pursuant to the McGann Employment Agreement, Mr. McGann was granted a stock option to purchase up to 535,000 shares of the Company’s Common Stock (the “McGann Stock Options”). The McGann Stock Options vest as follows (i) 178,333 options vested immediately upon grant (ii) 178,333 options shall vest on the 12-month anniversary of the date of grant (iii), 178,334 options shall vest on the 24-month anniversary of the date of grant. Upon termination of Mr. McGann without cause, the Company shall pay or provide to Mr. McGann severance pay equal to his then current monthly base salary for twelve (12) months from the date of termination. As a full-time employee of the Company, Mr. McGann will be eligible to participate in all of the Company’s benefit programs.

Mr. Morris Employment Agreement

We entered into an employment agreement with David Morris, our Chief Revenue Officer. Mr. Morris’s employment agreement (the “Morris Employment Agreement”) is for an initial term of three years and it may be terminated with or without cause.

Pursuant to the Morris Employment Agreement, Mr. Morris will receive an annual base salary of $415,000.00 and shall be eligible to earn a performance bonus subject to Mr. Morris achieving the performance milestones set forth in the Morris Employment Agreement. Mr. Morris shall also receive 200,000 stock options to purchase shares of Common Stock of the Company (the “Morris Options”), which vest as follows: (i) 50,000 options vested on the first anniversary of the Morris Employment Agreement (ii) 50,000 shall vest on the second anniversary of the Morris Employment Agreement (iii), 100,000 options shall vest on the third anniversary of the Morris Employment Agreement. Upon termination of Mr. Morris within twelve (12) months after a Change of Control (as such term is defined in the Morris Employment Agreement), the Company shall pay or provide to Mr. Morris severance pay equal to his then current monthly base salary for 6 months from the date of termination.

17

Outstanding Equity Awards at Fiscal Year End

The following table sets forth information regarding equity awards held by the Named Executive Officers as of December 31, 2021:

|

Option Awards(1) |

Stock Awards |

|||||||||||

|

Name |

Number of |

Number of |

Option |

Option |

Number of |

Market Value |

||||||

|

Robert Liscouski |

25,000 |

50,000 |

1.00 |

May 1, 2025 |

200,000 |

682,000 |

||||||

|

Robert Liscouski |

250,000 |

0 |

6.85 |

April 26, 2026 |

||||||||

|

Christopher Roberts |

15,000 |

30,000 |

1.00 |

May 1, 2025 |

200,000 |

682,000 |

||||||

|

Christopher Roberts |

150,000 |

250,000 |

6.85 |

April 26, 2026 |

||||||||

|

William J. McGann |

0 |

0 |

0 |

0 |

0 |

0 |

||||||

|

David Morris |

0 |

200,000 |

6.70 |

April 29, 2026 |

0 |

0 |

||||||

The Company’s independent directors received compensation of $5,000 per quarter for their services as directors in fiscal year 2021.

18

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of July 29, 2022 concerning the beneficial ownership of Common Stock for: (i) each director and director nominee, (ii) each Named Executive Officer in the Summary Compensation Table under “Executive Compensation” above, (iii) all executive officers and directors as a group, and (iv) each person (including any “group” as that term is used in Section 13(d)(3) of the Exchange Act) known by us to be the beneficial owner of 5% or more of our Common Stock. The address for each of the persons below who are beneficial owners of 5% or more of our Common Stock is our corporate address at 215 Depot Court SE #215, Leesburg, VA 20175.

Beneficial ownership has been determined in accordance with the rules of the SEC and is calculated based on 33,904,329 shares of our Common Stock issued and outstanding as of July 29, 2022. Shares of Common Stock subject to options, warrants, preferred stock or other securities convertible into Common Stock that are currently exercisable or convertible, or exercisable or convertible within 60 days of July 29, 2022, are deemed outstanding for computing the percentage of the person holding the option, warrant, preferred stock, or convertible security but are not deemed outstanding for computing the percentage of any other person.

Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of Common Stock that they beneficially own.

The following table sets forth, as of July 29, 2022, the number of shares of Common Stock owned of record and beneficially by our executive officers, directors and persons who hold 5% or more of the outstanding shares of Common Stock of the Company.

The amounts and percentages of our Common Stock beneficially owned are reported on the basis of SEC rules governing the determination of beneficial ownership of securities. Under the SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has the right to acquire beneficial ownership within 60 days through the exercise of any stock option, warrant or other right. Under these rules, more than one person may be deemed a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest. Unless otherwise indicated, each of the stockholders named in the table below, or his or her family members, has sole voting and investment power with respect to such shares of our Common Stock. Except as otherwise indicated, the address of each of the stockholders listed below is: c/o Quantum Computing Inc., 215 Depot Court SE #215, Leesburg, VA 20175.

19

Applicable percentage ownership is based on 33,904,329 shares of Common Stock outstanding as of July 29, 2022. In computing the number of shares of Common Stock beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares of Common Stock as held by that person or entity that are currently exercisable or that will become exercisable within 60 days of July 29, 2022.

|

Name and Address of Beneficial Owner |

Common Stock |

Percent of |

||

|

Named Executive Officers and Directors |

||||

|

Robert Liscouski, Chief Executive Officer and Chairman(1) |

1,337,500 |

3.91 |

||

|

Christopher Roberts, Chief Financial Officer(2) |

1,003,333 |

2.94 |

||

|

William J. McGann(3) |

178,333 |

0.52 |

||

|

David Morris(4) |

50,000 |

0.15 |

||

|

Bertrand Velge(5) |

2,167,888 |

6.39 |

||

|

Robert Fagenson(6) |

133,330 |

0.39 |

||

|

Michael Turmelle(7) |

0 |

0 |

||

|

Dr. Yuping Huang, Chief Quantum Officer and Director(8) |

4,699,786 |

13.86 |

||

|