Form DEF 14A IR-Med, Inc. For: Nov 28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary proxy statement

☐ Confidential, For use of the Commission only (as permitted by Rule 14a-6(e)(2))

☒ Definitive proxy statement

☐ Definitive additional materials

☐ Soliciting material pursuant to Rule 14a-11(c) or Rule 14a-12

IR-MED, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)[need underscore above]

Payment of filing fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act rules 14a-6(i)(1) |

IR-MED, INC.

ZHR Industrial Zone

Rosh Pina, Israel 1231400

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

to be held December 12, 2022

To the Stockholders of IR-Med, Inc.:

The 2022 annual meeting of stockholders (the “Annual Meeting”) of IR-Med, Inc. (the “Company”) will be held at the offices of Aboudi Legal Group, PLLC, 5th Floor, 745 Fifth Avenue, New York, New York, 10151 on Monday December 12, 2022 at 9:00 a.m. local time for the following purposes:

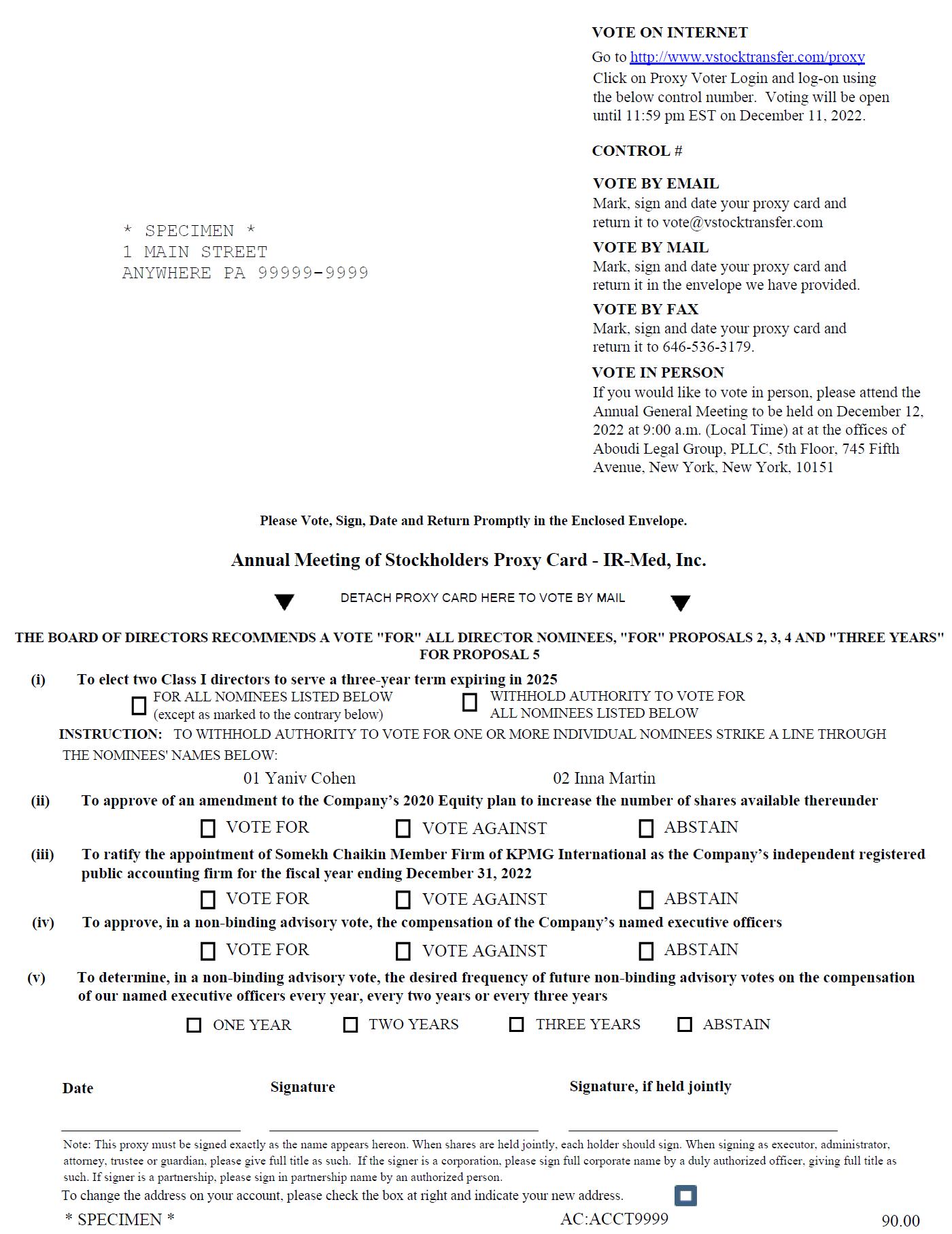

| i. | To elect two Class I directors to serve a three-year term expiring in 2025; |

| ii | To approve of an amendment to the Company’s 2020 Equity plan to increase the number of shares available thereunder;

|

| iii. | To ratify the appointment of Somekh Chaikin Member Firm of KPMG International as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| iv. | To approve, in a non-binding advisory vote, the compensation of the Company’s named executive officers; |

| v. | To determine, in a non-binding advisory vote, the desired frequency of future non-binding advisory votes on the compensation of our named executive officers every year, every two years or every three years; and |

| vi. | To consider and take action upon such other matters as may properly come before the meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement that accompanies this Notice. The Board has fixed the close of business on November 8, 2022 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof. Only stockholders of record at the close of business on the record date are entitled to notice of, and to vote at, the meeting.

Regardless of whether you plan to attend the Annual Meeting, please vote your shares as soon as possible so that your shares will be voted in accordance with your instructions. For specific voting instructions, please refer to the instructions on the proxy card that was mailed to you. If you attend the meeting, you will have the right to revoke the proxy and vote your shares in person.

| /s/ Oded Bashan | |

| Chairperson of the Board | |

| November 28, 2022 |

| 2 |

IR-MED, INC.

ZHR Industrial Zone

Rosh Pina, Israel 123400

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of the Board (the “Board”) of IR-Med,Inc., a Nevada corporation (the “Company”) for use at our 2022 annual meeting of stockholders (the “Annual Meeting”) to be held at the offices of Aboudi Legal Group PLLC, at 745 Fifth Avenue, 5th Floor, New York, New York, 10151 on December 12, 2022 at 9:00 a.m. Eastern Standard Time, and any adjournment thereof. We will bear the cost of soliciting proxies.

At the Annual Meeting, the stockholders will be asked to:

| i. | To elect two Class I directors to serve a three-year term expiring in 2025; |

| ii | To approve of an amendment to the Company’s 2020 Equity plan to increase the number of shares available thereunder;

|

| iii. | To ratify the appointment of Somekh Chaikin Member Firm of KPMG International as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| iv. | To approve, in a non-binding advisory vote, the compensation of the Company’s named executive officers; |

| v. | To determine, in a non-binding advisory vote, the desired frequency of future non-binding advisory votes on the compensation of our named executive officers every year, every two years or every three years; and |

| vi. | To consider and take action upon such other matters as may properly come before the meeting or any adjournment thereof. |

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

Our Board of Directors is soliciting your proxy to vote at the Annual Meeting, and any adjournments or postponements of the meeting to be held at 9:00 a.m. EST on December 12, 2022. This proxy statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting .

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders and the proxy card because you owned shares of our common stock on the record date. We intend to commence distribution of the proxy materials to stockholders on or about November 28, 2022.

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the Securities and Exchange Commission, or the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the annual meeting and help to conserve natural resources. If you received the Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

| 3 |

Who May Vote?

Only stockholders of record at the close of business on November 8, 2022 will be entitled to vote at the annual meeting. On this record date, there were 68,720,970 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

If on November 8, 2022 your shares of our common stock were registered directly in your name with our transfer agent, Vstock Transfer LLC (“Vstock”), then you are a stockholder of record.

If on November 8, 2022 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares at the annual meeting unless you request and obtain a valid proxy from your broker or other agent.

You do not need to attend the annual meeting to vote your shares. Shares represented by valid proxies, received in time for the annual meeting and not revoked prior to the annual meeting, will be voted at the annual meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted FOR or WITHHELD for each nominee for director, and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with our Board of Directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the annual meeting.

If your shares are registered directly in your name through our stock transfer agent, Vstock, or you have stock certificates registered in your name, you may vote:

| ● | By Internet or by telephone. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote over the Internet or by telephone. | |

| ● | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with our Board of Directors’ recommendations as noted below. | |

| ● | At the meeting. You may vote your shares electronically. You will need the control number(s) on your Notice or proxy card in order to vote at the meeting. Even if you plan to attend the annual meeting virtually, we encourage you to vote in advance so that your vote will be counted in the event you later decide not to attend, |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on Friday December 9, 2022.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers.

| 4 |

How Does Our Board of Directors Recommend that I Vote on the Proposals?

Our Board of Directors recommends that you vote as follows:

| ● | “FOR” the election of the nominees for director; | |

| ● | “FOR” the increase in the number of shares available under the Company’s 2020 Incentive Plan | |

| ● | “FOR” the ratification of the appointment of Somekh Chaikin, a member firm of KPMG International Limited, as our independent registered public accounting firm for our fiscal year ending December 31, 2022. | |

|

* |

FOR the approval of the non-binding advisory vote of the compensation of the Company’s named executive officers | |

|

* |

FOR the approval of the non-binding vote on the to be held every three years regarding compensation of the Company’s named executive officers. |

If any other matter is presented at the annual meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the annual meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the annual meeting. You may change or revoke your proxy in any one of the following ways:

| ● | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; | |

| ● | by re-voting by Internet or by telephone as instructed above; | |

| ● | by notifying IR-Med’s Secretary in writing before the annual meeting that you have revoked your proxy; or | |

| ● | by attending the annual meeting and voting at the meeting. Attending the annual meeting will not in and of itself revoke a previously submitted proxy. You must specifically request at the annual meeting that it be revoked. |

Your most current vote, whether by telephone, Internet or proxy card is the one that will be counted.

What is a proxy?

A proxy is a person you appoint to vote on your behalf. By using any of the methods discussed above, you will be appointing Yoram Drucker, a Company Director, and Moshe Gerber, our Chief Executive Officer, as your proxies. They may act together or individually on your behalf, and will have the authority to appoint a substitute to act as proxy. If you are unable to attend the Annual Meeting, please use the means available to you to vote by proxy so that your shares of common stock may be voted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

| 5 |

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 2 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| Proposal 1: Elect Directors |

|

The two nominees for director who receive the most votes will be elected.

You may vote either FOR all the nominees, WITHHOLD your vote from all the nominees or WITHHOLD your vote from any one or more of the nominees. Votes that are withheld will not be included in the vote tally for the election of the directors.

Brokerage firms do not have authority to vote stockholders’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes, as well as abstentions, will be counted as present for purposes of determining the presence of a quorum, but will have no effect on the results of this vote. | |

Proposal 2: Increase in Number of Shares Available under the 2020 Incentive Plan

|

The affirmative vote of the holders of a majority of the shares present or represented by proxy at the annual meeting is required to approve the amendment to the 2020 Incentive Plan to increase the number of shares available thereunder for issuance. | ||

Proposal 3: Ratify Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of the holders of a majority of the shares present or represented by proxy at the annual meeting is required to ratify the selection of our independent registered public accounting firm.

Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote stockholders’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Somekh Chaikin, as our independent registered public accounting firm for 2022, our Audit Committee of our Board of Directors will reconsider its selection. | ||

Proposal 4: Non-Binding Advisory Vote to Approve the Compensation of Our Named Executive Officers |

The affirmative vote of a majority of the votes cast at a meeting at which a quorum is present is required to approve this non-binding advisory proposal. You may vote “FOR” or “AGAINST” or “ABSTAIN” from voting on this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a stockholder on this proposal will be treated as a broker non-vote. Such broker non-votes, as well as abstentions, will be counted as present for purposes of determining the presence of a quorum, but will have no effect on the results of this vote. | ||

Proposal 5: Non-Binding Advisory Vote on the Frequency of the Vote To Approve Executive Compensation |

|

The determination of the frequency with which future advisory votes on executive compensation will take place will be determined by the preference (either every one, two or three years) that receives the highest number of votes cast. |

| 6 |

Who counts the votes?

We have engaged VStock Transfer LLC, our transfer agent, as our independent agent to tabulate stockholder votes. If you are a stockholder of record, and you choose to vote over the Internet, by telephone or fax VStock will access and tabulate your vote electronically, and if you choose to sign and mail your proxy card, your executed proxy card is returned directly to VStock for tabulation. As noted above, if you hold your shares through a broker, your broker (or its agent for tabulating votes of shares held in street name, as applicable) returns one proxy card to VStock on behalf of all its clients.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, facsimile or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, at the meeting or by proxy, of the holders of a majority of the shares of common stock outstanding on the record date entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Votes of stockholders of record who are present at the annual meeting or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Householding of Annual Disclosure Documents

Some brokers or other nominee record holders may be sending you, a single set of our proxy materials if multiple stockholders live in your household. This practice, which has been approved by the SEC, is called “householding.” Once you receive notice from your broker or other nominee record holder that it will be “householding” our proxy materials, the practice will continue until you are otherwise notified or until you notify them that you no longer want to participate in the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of November 8, 2022 for (a) the executive officers named in the Summary Compensation Table of this proxy statement, (b) each of our directors and director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Under the rules of the SEC, a stockholder is deemed to be a beneficial owner of any security of which that stockholder has the right to acquire beneficial ownership in 60 days of November 15, 2022. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 68,720,970 shares of common stock outstanding on November 8, 2022.

| Name and Address of Beneficial Owner | Number of Shares beneficially owned | Percentage Beneficially owned | ||||||

| 5% or more shareholders | ||||||||

| Yaakov Safren | 5,706,120 | (1) | 8.13 | % | ||||

| Paul Coulson | 5,625,000 | (2) | 7.9 | % | ||||

| Third Eye Investors LLC | 4,687,500 | (3) | 6.66 | % | ||||

| Isamar Margareten | 8,721,307 | (4) | 11.98 | % | ||||

| Officers and Directors | ||||||||

| Oded Bashan | 8,849,916 | (5) | 12.83 | % | ||||

| Aharon Klein | 8,099,110 | (6) | 11.74 | % | ||||

| Yaniv Cohen | 8,099,136 | (7) | 11.74 | % | ||||

| Yoram Drucker | 4,862,471 | (8) | 6.99 | % | ||||

| Ron Mayron | 240,000 | (9) | * | |||||

| Ohad Bashan | 240,000 | (9) | * | |||||

| Moshe Gerber | — | * | ||||||

| Aharon Binur (12) | 115,000 | (9) | * | |||||

| Sharon Levkoviz(13) | 251,978 | (9) | * | |||||

| Officers and Directors as a Group (9 persons) | 30,757,620 | 43.26 | % | |||||

* less than 1%

(1) Includes 1,406,119 shares issuable upon the exercise of stock options.

(2) Includes 1,875,000 shares issuable under a currently exercisable common stock warrant.

(3) Yitzchak Rokonsky, of Third Eye Investors LLC (“Third Eye”) has sole voting and dispositive power over shares held by Third Eye. Includes1,562,500 shares issuable under a currently exercisable common stock warrant.

(4) Includes 4,043,466 shares issuable under a currently exercisable common stock warrant.

(5) Represents (i) 8,609,916 shares owned by Med2Bwell Ltd. (“Med2Bwell”), of which Mr. Bashan has sole voting and dispositive power and (ii) 240,000 shares of common stock issuable upon the exercise of stock options

(6) Includes 240,000 shares issuable upon the exercise of stock options.

(7) Includes240,000 shares issuable upon the exercise of stock options

(8) Includes 812,471 shares issuable upon the exercise of stock options.

(9) Represents shares of common stock issuable upon the exercise of stock options.

| 7 |

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Compensation Overview

We qualify as a “smaller reporting company” under the rules promulgated by the SEC, and we have elected to comply with the disclosure requirements applicable to smaller reporting companies. Accordingly, this executive compensation summary is not intended to meet the “Compensation Discussion and Analysis” disclosure required of larger reporting companies.

Compensation Philosophy

Our rewards programs are designed to support our overarching goal of becoming a fully-integrated biotechnology company. We recognize that talented people are critical in driving us towards success in pursuing this goal, and that their total compensation should be commensurate with our success. As such, the objectives of our rewards programs are:

●To attract and retain talented individuals with an entrepreneurial mindset.

●To motivate these individuals towards high performance in pursuing our corporate strategies and to achieve our business goals.

●To recognize individual excellence.

●To align the interests of patients, employees, and stockholders.

● To be financially prudent, yet competitive.

●To further foster our core values of passion, integrity, excellence, responsibility, innovation and the spirit of collaboration

When establishing target pay levels, we seek to target the median of the market and allow for discretion to ensure we are hiring best in class talent, while providing future compensation opportunities that are commensurate with the market and reflect the individual’s role and experience. It is expected that some individuals will be positioned above or below market median based on particular facts and circumstances. Incentive pay outcomes (e.g., actual earned bonus) are not guaranteed, and actual pay will be reflective of success towards our stated Company and individual goals and objectives, as well as stockholder value creation.

Summary Compensation Table

The following table summarizes the compensation earned in each of our fiscal years that ended December 31, 2021 and 2020 by our named executive officers, which consists of our chief executive officer and our two next most highly compensated executive officers who earned more than $100,000 during the fiscal year ended December 31, 2021 and were serving as executive officers as of such date and our former chief executive officers. We refer to the executive officers listed below as the Named Executive Officers.

| 8 |

Summary Compensation Table

| Name and Principal Position | Year | Salary($) | Bonus ($) | Option Awards ($)(1) | All other compensation ($) (2) | Total($) | ||||||||||||||||||

| Dr. Rom Eliaz - Chief Executive Officer (3) | 2021 | 82,750 | 99,115 | $ | 38,077 | 219,942 | ||||||||||||||||||

| 2020 | - | - | $ | - | ||||||||||||||||||||

| Aharon Klein- Chief Technology Officer | 2021 | 145,525 | 50,637 | $ | 18,000 | 214,162 | ||||||||||||||||||

| 2020 | 75,074 | - | $ | - | 75,074 | |||||||||||||||||||

| Aharon Binur- Chief Development Officer | 2021 | 103,797 | 68,574 | $ | 33,820 | 206,191 | ||||||||||||||||||

| 2020 | - | - | $ | - | - | |||||||||||||||||||

| Limor Mund Davidson, former Chief Executive Officer (4) | 2021 | 70,506 | 15,750 | $ | 20,867 | 107,123 | ||||||||||||||||||

| 2020 | 11,406 | - | 3,388 | 14,794 | ||||||||||||||||||||

1. In accordance with SEC rules, the amounts in this column reflect the fair value on the grant date of the option awards granted to the named executive, calculated in accordance with ASC Topic 718. Stock options were valued using the Black-Scholes model. The grant-date fair value does not necessarily reflect the value of shares which may be received in the future with respect to these awards. The grant-date fair value of the stock options in this column is a non-cash expense for us that reflects the fair value of the stock options on the grant date and therefore does not affect our cash balance. The fair value of the stock options will likely vary from the actual value the holder receives because the actual value depends on the number of options exercised and the market price of our Common Stock on the date of exercise. For a discussion of the assumptions made in the valuation of the stock options, see Note 10.C to the Annual Report on Form 10-K for the year ended December 31, 2021.

2. For 2021 and 2020, represents the compensation as described under the caption “All Other Compensation” below.

3. Dr. Eliaz was appointed Chief Executive Officer on June 22, 2021.

4. Ms. Davidson resigned as Chief Executive Officer on April 6, 2021.

All Other Compensation

The following table provides information regarding each component of compensation for fiscal years 2021 and 2020 included in the All Other Compensation column in the Summary Compensation Table above. Represents amounts paid in New Israeli Shekels (NIS) and converted at average exchange rates for the year.

| Name | Year | Automobile and Related Expenses $ (1) | Social Benefits $ (2) | Total $ | ||||||||||||

| Dr. Rom Eliaz | 2021 | 13,199 | 24,878 | 38,077 | ||||||||||||

| 2020 | - | |||||||||||||||

| Aharon Klein | 2021 | 18,000 | 18,000 | |||||||||||||

| 2020 | - | |||||||||||||||

| Aharon Binur | 2021 | 7,449 | 26,371 | 33,820 | ||||||||||||

| 2020 | - | |||||||||||||||

| Limor Mund Dadvidson | 2021 | 20,867 | 20,867 | |||||||||||||

| 2020 | 3,388 | 3,388 | ||||||||||||||

| 1. | Represents a leased automobile expenses and reimbursement of travel expenses . | |

| 2. | These are comprised of contributions by us to savings, health, severance, pension, disability and insurance plans generally provided in Israel, including health, education, managerial insurance funds, and redeemed vacation pay. This amount represents Israeli severance fund payments, managerial insurance funds, disability insurance, supplemental education fund contribution and social securities. See discussion below under “Narrative Disclosure to Summary Compensation Table.” |

| 9 |

Outstanding Equity Awards at December 31, 2021

The following table sets forth information concerning equity awards held by each of our Named Executive Officers as of December 31, 2021.

| Name | Grant Date | Number of Securities Underlying Options (#) Exercisable | Number of Securities Underlying Options (#) Unexercisable | Option Exercise Price ($) | Option Expiration Date | |||||||||||

| Dr. Rom Eliaz, | June 20,2021 | 75,000 | 375,000 | 0.32 | * | |||||||||||

| Aharon Klein | June 20,2021 | 220,000 | 20,000 | 0.32 | * | |||||||||||

| Aharon Binur | June 20,2021 | 60,000 | 240,000 | 0.32 | * | |||||||||||

| Limor Mund Davidson | June 20,2021 | 75,000 | - | 0.32 | January 6, 2023 | |||||||||||

* Options expiration date is ten (10) years from vesting

Narrative Disclosure to Summary Compensation Table

Our Board follows the following processes and procedures for the consideration and determination of executive and director compensation:

In establishing compensation amounts for executives, we seek to provide compensation that is competitive in light of current market conditions and industry practices. Accordingly, we will generally review market data, which is comprised of proxy-disclosed data from peer companies and information from nationally recognized published surveys for the biopharmaceutical industry, adjusted for size. The market data helps the committee gain perspective on the compensation levels and practices at the peer companies and to assess the relative competitiveness of the compensation paid to our executives. The market data thus guides us in its efforts to set executive compensation levels and program targets at competitive levels for comparable roles in the marketplace. We then considers other factors, such as the importance of each executive officer’s role to the Company, individual expertise, experience, performance, retention concerns and relevant compensation trends in the marketplace, in making its final compensation determinations.

Elements of Compensation

In addition to each officer’s base salary, our executive officer compensation program consists of a cash incentive bonus plan and discretionary stock option awards in addition to customary benefits. The amounts of compensation awarded for each element of the Company’s compensation program (i.e., base salary, bonuses and stock options) are reviewed in connection with the Company’s performance.

Base Salary

Annual base salaries compensate our executive officers for fulfilling the requirements of their respective positions and provide them with a level of cash income predictability and stability with respect to a portion of their total compensation. We believe that the level of an executive officer’s base salary should reflect the executive’s performance, experience and breadth of responsibilities, our understanding of salaries for similar positions within our industry, and any other factors relevant to that particular job.

Base salaries are typically negotiated at the outset of an executive’s employment. Salary levels are considered annually as part of our performance review process, but also in cases including promotion or other changes in the job responsibilities of an executive officer. For named executive officers, initial base salaries generally are established in connection with negotiation of an offer of employment and employment agreement. Increases in base salary have several elements. In addition to promotion and increased responsibilities, merit and Company-wide general increases are also taken into consideration.

Stock-Based Awards

Historically, we have generally granted stock options to our employees, including our named executive officers, in connection with their initial employment with us. We also have historically granted stock options on an annual basis as part of annual performance reviews of our employees.

Our equity award program is the primary vehicle for offering long-term incentives to our executives. We do not have any equity ownership guidelines for our executives, which is consistent with other pre-commercial biotechnology companies that use stock options as the long-term incentive vehicle. Further, we believe that equity grants provide our executives with a strong link to our long-term performance, create an ownership culture and help to align the interests of our executives and our stockholders. In addition, the vesting feature of our equity awards contributes to executive retention by providing an incentive for our executives to remain in our employment during the vesting period. We expect that our Board will continue to use annual equity awards to compensate our executive officers. We may also make additional discretionary grants, typically in connection with the promotion of an employee, to reward an employee, for retention purposes or in other circumstances as the Board deems appropriate.

| 10 |

Employment and Severance Arrangements

We consider it essential to the best interests of our stockholders to foster the continuous employment of our key management personnel. In this regard, we recognize that the possibility of a change in control may exist and that the uncertainty and questions that it may raise among management could result in the departure or distraction of management personnel to the detriment of the Company and our stockholders. In order to reinforce and encourage the continued attention and dedication of certain key members of management, we have entered into written employment agreements with certain of our named executive officers that, while at-will, contain certain change in control and severance provisions.

Employment Agreements

Dr. Rom Eliaz -On June 22, 2021, Dr. Rom Eliaz, and IR Med Ltd entered into an employment agreement providing for the employment of Dr. Eliaz as Chief Executive Officer (the “Eliaz Employment Agreement”). Under the Eliaz Employment Agreement, Dr. Eliaz is entitled to an annual salary of the current New Israeli Shekel equivalent of approximately $149,000, payable on a monthly basis. Mr. Eliaz is also provided with a leased automobile. Under the Eliaz Employment Agreement, Dr. Eliaz is also entitled to the following: (i) Manager’s Insurance under Israeli law for the benefit of Dr. Rom Eliaz pursuant to which IR-Med Ltd contributes amounts equal to (a) 8-1/3% for severance payments, and 6.5%, or up to 7.5% (including disability insurance) designated for premium payment (and Dr. Eliaz contributes an additional 6%) of each monthly salary payment, and (b) 7.5% of his salary (with Dr. Eliaz contributing an additional 2.5%) to an education fund, a form of deferred compensation program established under Israeli law. The Eliaz Employment Agreement provides that his annual salary will be increased to the New Israeli Shekel equivalent of approximately $186,000 upon (i) the successful capital raise by the Company of at least $5.0 million in net proceeds, (ii) the successful completion of a prototype of the PressureSafe device, as determined by the Company’s board of directors and (iii) receipt by the Company of a letter of intent for the large scale commercial purchase/order of the PressureSafe device.

On April 25, 2022, Dr. Eliaz resigned from his position. In connection with his resignation, the Company agreed that Dr. Eliaz continued to receive his salary and benefits under his employment agreement through August 31, 2022. In addition, the Company agreed that Dr. Eliaz is entitled to the accelerated vesting of the next instalment of options (previously granted to in June 2021) which vested on June 30, 2022, for an aggregate total of options for 150,000 shares of the Company’s common stock and that such options may be exercised through the original exercise expiration date of July 31, 2027 at an exercise price per share of $0.32.

Aharon Klein. On December 24, 2020, our subsidiary and IR-Med Ltd. and Mr. Klein entered into an amended and restated consulting agreement (the “Klein Service Agreement”) replacing a service agreement dated October 1, 2019 between IR-Med Ltd. and the Company). The Klein Service Agreement provides for a continuous term and may be terminated by either party at any time, provided that if Mr. Klein resigns, he shall provide at least 30 days’ prior written notice. Pursuance to this agreement, Mr. Klein’s annual fee compensation was increased to $144,000 plus VAT, effective as of the closing of the Acquisition. In addition, Mr. Klein is eligible to receive an automobile allowance of New Israeli Shekel equivalent of approximately $1,525 per month. If Mr. Klein’s employment is terminated (i) by us without cause or (ii) by him for any, then we must pay Mr. Klein (a) the accrued obligations earned through the date of termination, (b) a lump-sum payment of an amount equal to one month of his base salary at the time of his termination.

The agreement contains (i) customary confidentiality obligations which are not limited by the term of the agreement, (ii) certain non-compete provisions during the term of the agreement and twelve months thereafter and (iii) certain non-solicitation provisions during the term of the agreement and for one year thereafter. Mr. Klein also agreed to assign certain intellectual property rights to IR-Med Ltd.

Aharon Binur. On March 2, 2021, IR-Med, Ltd. and Aharon Binur entered into an employment agreement pursuant to which Mr. Binur oversees the development of our product candidates which are in various stages of development. Under the agreement with Mr. Binur, he is paid an annual salary of the current New Israeli Shekel equivalent of approximately $128,040, payable on monthly basis. IR-Med Ltd. is authorized to terminate the employment agreement for any reason subject to payment of two months’ salary. Under the terms of the employment agreement with him, Mr. Binur also receives Manager’s Insurance under Israeli law for his to which IR-Med Ltd contributes amounts equal to (a) 8-1/3 percent for severance payments, and 6.5%, or up to 7.5% (including disability insurance) designated for premium payment (and Mr. Binur contributes an additional 6%) of each monthly salary and (b) 7.5% of his salary (with Mr. Binur contributing an additional 2.5%) to an education fund, a form of deferred compensation program established under Israeli law. Mr. Binur is also provided with a leased automobile. On June 20, 2021, Mr. Binur was awarded options under the Company’s employee stock option plan for 300,000 shares of the Company’s common stock at a per share price of $0.32, of which 15,000 were vested upon grant and the balance vest at the end of each calendar quarter at the rate of 15,000 shares per quarter, beginning with the quarter ended September 31, 2021, subject to his continued employment. The options are exercisable through the tenth anniversary of grant.

| 11 |

Limor Davidson Mund. On December 24, 2020, IR-Med Ltd. and Limor Davidson Mund, the Company’s former Chief Executive Officer, entered into an employment agreement providing for the employment (the “Limor Employment Agreement”) of Ms. Limor Davidson Mund as Chief Executive Officer. Under the Limor Employment Agreement, Ms. Davidson Mund was entitled to an annual salary of the current New Israeli Shekel equivalent of approximately $127,430, payable on monthly basis as well as an automobile allowance of New Israeli Shekel equivalent of approximately $450 per month. Under the Limor Employment Agreement, Ms. Davidson Mund was also entitled to the following: (i) Manager’s Insurance under Israeli law for the benefit of Ms. Davidson Mund pursuant to which IR-Med Ltd contributes amounts equal to (a) 8-1/3 percent for severance payments, and 6.5%, or up to 7.5% (including disability insurance) designated for premium payment (and Ms. Davidson Mund contributes an additional 6%) of each monthly salary payment, and (b) 7.5% of Ms. Davidson Mund’s salary (with Ms. Davidson Mund contributing an additional 2.5%) to an education fund, a form of deferred compensation program established under Israeli law.

On April 6, 2020, Ms. Davidson Mund resigned from her positions with the Company and IR-Med Ltd. In connection with her resignation, Ms. Davidson Mund was given a severance payment equal to three months’ salary (as required under the Limor Employment Agreement) and the Company undertook to issue to her under the Company employee stock option plan options for 75,000 shares of the Company’s common stock at a per share price of $0.32 which are exercisable till January 6 2023.

Moshe Gerber. The Company’s subsidiary IR. Med, Ltd. (“IR-Med Ltd.”) entered into an Employment Agreement (the “Agreement”) setting forth the terms of his employment and compensation. Under the Agreement, Mr. Gerber is entitled to an annual salary of the current New Israeli Shekel equivalent of approximately $155,000, payable on monthly basis. Mr. Gerber is also provided with a leased automobile. Under the Agreement, Mr. Gerber is also entitled to the following: (i) Manager’s Insurance under Israeli law to which IR Med Ltd contributes amounts equal to (a) 8-1/3 percent for severance payments, and 6.5%, or up to 7.5% (including disability insurance) designated for premium payment (and Mr. Gerber contributes an additional 6%) of each monthly salary payment, and (b) 7.5% of his salary (with Mr. Gerber contributing an additional 2.5%) to an education fund, a form of deferred compensation program established under Israeli law. If Mr. Gerber’s employment is terminated by us without cause on or prior to the first anniversary of his employment, then we must pay Mr. Gerber (a) the accrued obligations earned through the date of termination, (b) a lump-sum payment of an amount equal to two month of his base salary at the time of his termination; if such termination occurs after such date, then we must pay to Mr. Gerber (a) the accrued obligations earned through the date of termination, (b) a lump-sum payment of an amount equal to three months of his base salary at the time of his termination. Under the Agreement, Mr. Gerber was awarded options under the Company’s employee stock option plan for 1,300,000 shares of the Company’s common stock at a per share price of $0.32, vesting as follows: 25% of the option shares (i.e., 325,000 options shares) vest on the first anniversary of employment and the balance in six bi-annual instalments of 162,500 shares, beginning the first instalment on the bi-annual period ending October 31, 2023 and thereafter at the end of each subsequent six months, provided that Mr. Gerber is then in our employ.

The agreement contains (i) customary confidentiality obligations which are not limited by the term of the agreement, (ii) certain non-compete provisions du ring the term of the agreement and twelve months thereafter and (iii) certain non-solicitation provisions during the term of the agreement and for one year thereafter.

Potential Payments upon Change of Control or Termination following a Change of Control

Our agreements with our named executive officers provide incremental compensation in the event of termination, as described herein. Generally, we currently do not provide any severance specifically upon a change in control nor do we provide for accelerated vesting upon change in control. Termination of employment also impacts outstanding stock options.

Due to the factors that may affect the amount of any benefits provided upon the events described below, any actual amounts paid or payable may be different than those shown in this table. Factors that could affect these amounts include the basis for the termination, the date the termination event occurs, the base salary of an executive on the date of termination of employment and the price of our common stock when the termination event occurs.

The following table sets forth the compensation that would have been received by each of our executive officers had they been terminated as of December 31, 2021.

| Name | Salary $ | Social benefits $ | Total $ | |||||||||

| Dr. Rom Eliaz | 41,250 | 12,400 | 53,350 | |||||||||

| Aharon Klein | 12,000 | - | 12,000 | |||||||||

| Aharon Binur | 21,875 | 5,801 | 27,676 | |||||||||

| 12 |

Director Compensation

The following table sets forth for each non-employee director that served as a director during the year ended December 31, 2021:

Year Ended December 31, 2021

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($)(1) | Non Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Benefits ($) | All Other compensation ($) | Total ($) | |||||||||||||||||||||

| Oded Bashan | 10,632 | - | 50,637 | (2) | - | - | - | 61,269 | ||||||||||||||||||||

| Ohad Bashan | 10,682 | 50,637 | (2) | 61,319 | ||||||||||||||||||||||||

| David Lazar | 19,885 | - | 50,909 | (3) | - | - | - | 70,794 | ||||||||||||||||||||

| Ron Mayron | 13,233 | 50,909 | (3) | - | - | - | 64,142 | |||||||||||||||||||||

1. In accordance with SEC rules, the amounts in this column reflect the fair value on the grant date of the option awards granted to the named executive, calculated in accordance with ASC Topic 718. Stock options were valued using the Black-Scholes model. The grant-date fair value does not necessarily reflect the value of shares which may be received in the future with respect to these awards. The grant-date fair value of the stock options in this column is a non-cash expense for us that reflects the fair value of the stock options on the grant date and therefore does not affect our cash balance. The fair value of the stock options will likely vary from the actual value the holder receives because the actual value depends on the number of options exercised and the market price of our common stock on the date of exercise. For a discussion of the assumptions made in the valuation of the stock options, see Note 1. C (Stock Based Compensation) to our financial statements, which are included in this Annual Report on Form 10-K.

2. In respect of 240,000 options, all of which will vest as of June 30, 2022

3. In respect of 240,000 options, all of which will vest as of December 31, 2022

Compensation Policy for Non-Employee Directors.

In January 2021, the Board of Directors adopted an updated compensation policy for non-employee directors which replaced the previous non-employee director compensation terms and which became effective January 2021. Under the policy, each director is to receive an annual cash compensation of $5,000 and $1,000 per meeting or $500 for a virtual meeting.

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Our Audit Committee Charter requires all future transactions between us and any director, executive officer, holder of 5% or more of any class of our capital stock or any member of the immediate family of, or entities affiliated with, any of them, or any other related persons, as defined in Item 404 of Regulation S-K, or their affiliates, in which the amount involved is equal to or greater than $120,000, be approved in advance by our audit committee. Any request for such a transaction must first be presented to our audit committee for review, consideration and approval. In approving or rejecting any such proposal, our audit committee is to consider all available information deemed relevant by the audit committee, including, but not limited to, the extent of the related person’s interest in the transaction, and whether the transaction is on terms no less favorable to us than terms we could have generally obtained from an unaffiliated third party under the same or similar circumstances.

Related Party Transactions

Except as described below, since January 1, 2020, there has not been, nor is there currently proposed, any transaction to which we are or were a party in which the amount involved exceeds the lesser of $120,000 and 1% of the average of our total assets at year-end for the last two completed fiscal years, and in which any of our directors, executive officers, holders of more than 5% of any class of our voting securities or any of their respective affiliates or immediate family members, had, or will have, a direct or indirect material interest.

| 13 |

In 2015, our subsidiary IR-Med, Ltd received a loan from certain of the former IR-Med stockholders to fund its continuing operations. This loan bore interest at an annual rate ranging in 2020 and 2019, from 2.56%-2.62% annually. The aggregate loan amount was repayable only upon the approval of IR Med’s board of directors and when the Company’s profits reach an amount of NIS 1,500,000 (approximately $467,000 as of December 31, 2021) and upon such terms and such installments as shall be determined by the Company’s board of directors.

In 2017, our subsidiary IR Med, Ltd received a loan from certain of the former IR-Med stockholder to fund its continuing operations. This loan bear interest at an annual rate ranging in 2020 and 2019, from 2.56%-2.62% annually. The aggregate loan amount was repayable only upon the occurrence of an investment round greater than $500,000.

In March 2020, IR Med, Ltd and the lenders agreed to amend and restate the terms of the above referenced loans (“the Amended loan agreement”) pursuant to which the lender waived all rights to convert their respective outstanding loan amounts, and the repayment date was set to December 31, 2023, or such later date to be agreed between IR Med, Ltd and the lender. As of December 31, 2021 and 2020 the carrying amounts of these loans were $41 thousand and $38.5 thousand respectively.

On March 6, 2018, certain of IR. Med, Ltd.’s shareholders advanced to it a convertible bridge loan in the principal amount of NIS 379,000 ($113,000) (hereinafter, the “2018 CLA”), bearing a per annum interest rate of 3% compounded and accrued annually and, originally payable on December 31, 2018, or a later date agreed to by the then holders of 80% of the outstanding shares of IR Med Ltd. Under the terms of the 2018 CLA, the loan is convertible by the holders under certain specified circumstances and is automatically convertible upon other terms. In an Exit event (as deveined in the 2018 CLA), the loan is repayable at 200% the outstanding amount or converted, at the option of the majority lenders. In March 2020, the Company and the lenders agreed to amend and restate the 2018 CLA (“the Amended CLA”). According to the Amended CLA, the lenders waived any and all rights to convert their respective outstanding loan amounts, and the repayment date was set to December 31, 2023, or such later date to be agreed by IR Med and the lenders. In addition, in case of an Exit event, as described in the Amended CLA, the loan and all accrued interest will be fully repaid immediately following the exit event. As of December 31, 2021 and 2020, the carrying amounts of the loans were $136,000 and $128,000, respectively. The Company classified the 2018 CLA as a long term liability on its balance sheets.

For the years ended December 31, 2021 and 2020, the Company paid to two directors and one shareholder of the Parent Company an aggregate consideration of US$227 thousand and US$93 thousand, respectively, in respect of research and development services.

For the year ended December 31, 2021 the Company paid to the shareholder an aggregate consideration of US$60 thousand, in respect of such consulting services.

During 2021, IR Med Ltd. entered into an employment agreements with one of our directors and three officers. For the year ended December 31, 2021, salary and related expenses totaled to US$374 thousand, in respect thereof.

In the course of 2021 and 2020, IR-Med Ltd. paid US$51 thousand and US$15 thousand, , respectively, to an entity controlled by two of our directors in respect of rent and office services for our premises.

Following the adoption of the 2020 incentive stock plan (hereinafter the “Plan”) on December 23, 2020, and the adoption of the sub plan (the “Israeli appendix”) on April 29, 2021, we granted under the Plan to our directors, officers and one shareholder 4,423,960 options to purchase shares of Common Stock.

ELECTION OF DIRECTORS

(Proposal 1)

Our Amended and Restated Certificate of Incorporation classifies the Board into three classes, each having a staggered term expiring at successive annual meetings. Two Class I directors are to be elected at the Annual Meeting to serve a three-year term expiring at the 2025 Annual Meeting of Stockholder (and until their successors shall be elected and shall qualify). The term of our Class II directors, Ohad Bashan, Yoram Drucker and Ron Mayron shall expire at the 2023 Annual Meeting of Stockholders. The term of our Class III directors, Oded Bashan and Ronnie Klein, shall expire at the 2023 Annual Meeting of Stockholders.

| 14 |

The Board has nominated the persons named in the table below for election as Class I directors. Mr. Yaniv Cohen is an incumbent director and Ms. Inna Martin is standing for election.

Unless otherwise specified in the accompanying proxy, the shares voted pursuant to it will be voted for the persons named below as nominees for election as Class I directors. If, for any reason, at the time of the election, any of the nominees should be unable or unwilling to accept election, such proxy will be voted for the election, in such nominee’s place, of a substitute nominee recommended by the Board to the extent that such substitute nominee exists. However, the Board has no reason to believe that any nominee will be unable or unwilling to serve as a director.

| Name of Nominee | Principal Occupation | Age | Year became a Director | |||

| Yaniv Cohen | Director | 43 | 2020 | |||

| Inna Martin | Director | 47 | — |

The following describes at least the last five years of business experience of the directors standing for re-election and election. The descriptions include any other directorships at public companies held during the past five years by these directors. No family relationship exists between any director and executive officer of the Company.

Yaniv Cohen, age 43, co-founded IR. Med,. Ltd. in September 2013 and served as the R&D manager since then. Following the completion of the of IR. Med Ltd. by our company (the “Acquisition”), he was appointed to the Board. Mr. Cohen is an experienced electrical engineer with expertise in the fields of wave propagation and IR Spectroscopy for medical applications. Additionally, Mr. Cohen holds 4 patents in medical devices, co-authored eight articles in scientific journals as well as speaking in conferences around the globe. From 2010 to 2013, Mr. Cohen served as R&D manager for PIMS, an Israeli medical device company, focusing on IR imaging and spectral analysis for non-invasive cancer detection and identification. From 2008 to 2009, Mr. Cohen worked for Cisco as a system engineer. Prior to which, from 2006 to 2008, he worked as a service engineer for Intel Israel. Mr. Cohen is a Candidate of Sciences in the doctoral program, Informatics and Computer Engineering in the National Research University Higher School of Economics, School of Electronic Engineering Institute of Electronics and Mathematics (MIEM HSE), Moscow, Russia. Mr. Cohen holds a M.Sc. in Electrical Engineering from Holon Institute of Technology (2007).From 2009 to 2010, he attended the Ben-Gurion University of the Negev, Beer Sheva, Israel where he wrote a thesis in wave prorogation.

The Board believes that Mr. Cohen’s extensive knowledge and long standing involvement of the Company and his extensive knowledge of relevant technologies qualify him to serve on our Board.

Inna Martin, age 47 has been nominated by our Board to stand for election. Inna Martin is an experienced executive with more than 18 years of hands on experience in the development of new ventures, business consulting, and venture capital investments. Since 2020, Ms. Martin has been serving as a CEO and Director of Revium Recovery Inc., a company currently focusing on the development of a disruptive Clinical Decision Support software (CDS) for digital mental health area applications. In 2021, Mrs. Martin has successfully completed studies of AI in Healthcare course run by MIT Sloan School of Management. Prior to joining Revium, 2018-2020 Mrs. Martin founded a startup company in cardiovascular field. Under her management, the company successfully completed First in Human clinical studies and received FDA approval for its unique Stent Positioning Assistance System, SPAS™, - a novel proprietary tool developed for safer PCI procedure and precise stent positioning. From 2014 to 2018, Mrs. martin served as a Managing Director of Investments at RosNanoMedInvest, a $760 million sovereign fund initiative in innovation in healthcare field, partner of Domain Associates LLC (US). Prior to joining the fund, from 2007 to 2014, Ms. Martin provided business development and consulting services to a range of companies in pharma and medtech fields in Israel and Europe, including project opportunity assessment services, market analyses, sales forecasting, business planning, and strategic development planning.

The Board believes that Ms. Martin’s extensive experience in innovative healthcare-related ventures, international network of contacts, knowledge of implementation of AI in Healthcare fields brings to our Board needed experience in this field.

There are no family relationships between any of the above Class I directors standing for election.

| 15 |

Information Relating to Continuing Directors who are not Standing for Election or Re-election this Year

Oded Bashan, age 76, co-founded IR-Med Ltd with Aharon Klein and, since September 2013 has been serving as Chairman of IR. Med Ltd. Upon the effectiveness of our acquisition in December 2020 of IR. Med, Ltd. (the “Acquisition”), he was appointed to Board of Directors and on January 20, 2021, was appointed as Chairman of the Board and on April 6, 2021 he was appointed Chief Executive Officer on an interim basis following the resignation of Ms. Davidson Mund. Mr. Bashan has over 35 years of experience in managing, building and running technology companies. He was Founder, CEO & chairman of OTI Ltd. from 1990 to 2013, a Nasdaq traded global technology leader with more 250 employees. Since January 2013, together with his son Mr. Ohad Bashan, they have been managing several private companies engaged in biotech. Previously, Mr. Bashan served as the president of Electro-Galil form 1984 to1990. He was awarded the Leading Businessman Award in Management, Business and Economics by the Israeli Institute of Public Opinion. Mr. Bashan holds both B.Sc. and M.Sc. in Economics and Business management from the Hebrew University of Jerusalem.

The Board believes that Mr. Bashan’s extensive experience in United States public companies, his long standing involvement with IR-Med Ltd. and his knowledge of our product candidates ideally situate him to serve on our Board.

Aharon Klein, age 58, co-founded Ir. Med, Ltd in September 2013 and served as director since then and Chief Operating Officer from September 2013 until the date of the Acquisition. Upon the Acquisition, he was appointed Chief Technology Officer in. Mr. Klein is a medical device and biotech expert, with a strong clinical background. Prior to founding the Company, from 2004 to 200,7 Mr. Klein co-founded and served as CEO of Fertiligent, a start-up company focused on innovative fertility treatments, which was acquired by a United Kingdom based investment group in 2008. From 2008 to 2013, immediately prior to co-founding the Company, he founded a medical device company developing infrared based diagnostic tools for diagnosing colon cancer insito without the need for biopsies (optical biopsies). Mr. Klein graduated from the Faculty of Engineering in the Technion Israel Institute of Technology. Mr. Klein is experienced in initiating and running medical device start-up companies, including development running clinical trials and regulatory affairs.

The Board believes that Mr. Klein’s extensive knowledge and long standing involvement with the Company and his knowledge of the core technologies underlying our product candidates ideally situate him to serve on our Board.

Yoram Ducker, age 57, joined the Board of Directors in December 2019. Mr. Drucker is a serial entrepreneur, founding several companies over the last twenty years and focusing on the Israeli biotech industry. From October 2017 to the present time, Mr. Drucker founded and served as Vice President of Business Development for InnoCan Pharma Ltd., a company traded on the Canadian Stock Exchange. From September 2016 to April 2020, Mr. Drucker was the CEO and Co-founder of a biotech company, ViruCure, developing an oncolytic-virus based technology platform. Prior to this, he served as the CEO and Executive Chairman of Cell Source Ltd. from 2011 to 2014. Additionally, Mr. Drucker was a founding member of Brainstorm (NASDAQ: BCLI), a company publicly traded on the Nasdaq where he served as COO in 2004 and CEO from 2005 to 2007 and a founding member of Pluristem (NASDAQ: PSTI). Mr. Drucker currently serves on the board of directors of Innocan Pharma Corporation (CSE: INNO) and Nurexone Biologic Inc. (TSX: NRX). Mr. Drucker brings significant expertise in the management, operations, business development and product development in start-ups. He is also involved as a consultant and co-founder of other start-ups in different fields.

The Board believes that Mr. Drucker’s extensive experience in a managerial capacity with public companies brings to our board needed experience is functioning as a U.S. public company.

Ohad Bashan, age 51, Mr. Bashan joined the Board upon the completion of the Acquisition., Mr. Bashan is an entrepreneur, innovator and executive with a proven track record of more than 25 years of building, leading, running technology companies from startup to NASDAQ traded and experienced Director after serving on the boards of private and publicly traded companies, in the US, Israel, China, Poland and France. From 1998 to 2013, Mr. Bashan he held several senior positions at OTI, which was acquired by Nyax Ltd. Since 2013 to the present time, Mr. Bashan runs a management services business. Mr. Bashan holds a B.A. in business from the College of Business Management, Tel Aviv, with specializations in marketing and finance, and an M.B.A. from Pepperdine University, California.

The Board believes that Mr. Bashan’s wide ranging international business experience qualifies him to serve on our Board.

| 16 |

Ron Mayron, age 58, Mr. Mayron immediately following the Acquisition. Mr. Mayron has extensive experience in the pharmaceutical and medical equipment industries and has held various, significant senior management positions, both local and global, within Teva Pharmaceutical Industries Ltd. (“Teva”) over the last 21 years. During his career at Teva, Mr. Mayron served in various VP positions, most recently he was CEO of Teva Israel and VP Israel and Africa from June 2009 until September 2013. Mr. Mayron’s core expertise is in marketing, sales anddistribution, mergers and acquisitions, business development, global operation and supply chain and strategic development. Mr. Mayron currently serves on the board of directors of Innocan Pharma Corporation (CSE: INNO), Nurexone Biologic Inc. (TSX: NRX), IceCure Medical Ltd. (NASDAQ” ICCM), BioLight Life Sciences Ltd. (TASE: BOLT), Entera Bio (NASDAQ: ENTX) and Kadimastem Ltd. (TASE: KDST) Mr. Mayron holds a B.Sc. – Industrial Engineering & Management, Ben Gurion University and M.B.A from Tel-Aviv University.

The Board believes that Mr. Mayron’s extensive knowledge and experience with public companies qualify him to serve on our Board.

Family Relationships

Oded Bashan is the father of Ohad Bashan

The following table sets forth certain information regarding our executive officers who are not also directors.

| Name | Age | |||

| Moshe Gerber | 61 | Chief Executive Officer | ||

Sharon Levkoviz |

48 |

Chief Financial Officer | ||

| Aharon Binur | 59 | Chief Development Officer |

Moshe Gerber. Mr. Gerber, was appointed Chief Executive Officer on May 2, 2022 following the resignation of Dr. Rom Eliaz. Mr. Gerber possesses over 25 years’ experience in international business development, sales and operations across high-tech industries, including Artificial Intelligence (AI), software and medical devices, with wide ranging experience in product strategy and market analysis. From December 2020 until December 2021[what happened between December 2021 and May 2022], Mr. Gerber was Vice President, Business Development and Alliances at BeyondMinds Ltd., an Israel based company that delivers hyper-customized, production-grade AI platforms spanning several industries. Prior to that, from January 2019 through December 2020, he was the owner and CEO of Crispotech Ltd., a private company that provided business development services to companies in a variety of hi-tech areas: software, medical devices, digital health, particle accelerators, laser technology, 3D printing, cloud computing, and others. From September 2017 through November 2018 he served as CEO of Peak Medical trade, a company developing and marketing, among other things, medical devices for NICUs and OR’s. From July 2015 through May 2017, he worked as VP Business Development and Sales at Mennen Medical, a private company that develops and sells medical devices for hospitals worldwide, via offices in USA, UK, and Israel, where he managed business development, marketing and sales activities via direct sales force and distributors worldwide. From June 2011 through June 2015, Mr. Gerber established and managed a medical devices company (Gerium Medical), which developed a medical device for jaundice measurement and oversaw the sale of the company to Mennen Medical. Mr. Gerber has an MBA from San Jose State University in California, and B.Sc in Mathematics and Computer Science from Tel-Aviv University.

Sharon Levkoviz. Mr. Levkoviz was appointed to Chief Financial Officer upon the effectiveness of the Acquisition. Mr. Levkoviz served from 2011-2021 in Achdut Israel Ltd., an Israeli company providing accounting and economic consulting services, as regional manager. Prior to that period, Mr. Levkoviz served as a Chief Controller at OTI global company, Nasdaq traded company, from 2005 through 2011. Mr. Levkoviz received his CPA from Ramat Gan College and a B.A. in Business Administration from Rupin College in Israel. In addition Mr. Levkoviz served ten years as a chairman of finance and human resource committee at Ohalo College and also five years as a director at the development company of Katzrin, Mr. Levkoviz served eight years as a member of Katzrin plenum.

Aharon Binur, Mr. Aharon Binur was appointed as Chief Development Officer on April 29, 2021 to lead product development. Mr. Binur is an electronics engineer who graduated from the Technion in Haifa, Israel. He was an electronics engineer at OTI from November 1999 through February 2001 and became a development manager at a subsidiary of OTI March 2001 and has held several other positions at OTI through April 2013. Mr. Binur also served as CTO (August 2009 through November 2014) and VP of R&D (March 2017 through April 2021) at Lehavot- advanced fire protection systems. Mr. Binar has extensive experience in multidisciplinary technological management, including software, hardware and mechanics, development of final systems and products for the client, while maintaining high quality and international standards. Mr. Binar has a unique and creative approach to technology management, including patents registered on his name.

| 17 |

ADDITIONAL INFORMATION CONCERNING THE BOARD OF DIRECTORSBOARD MEETINGS

During the fiscal year ended December 31, 2021, the Board held four board meetings and acted by unanimous written consent on two occasions. Each of the directors attended 100% of the aggregate number of meetings of the Board and 100% of any committees of the Board on which they served.

The Board does not have a formal policy with respect to Board members’ attendance at annual stockholder meetings, although it encourages directors to attend and participate at all such meetings.

Board Leadership Structure and Role in Risk Oversight

In accordance with our Amended and Restated Articles of Incorporation, our Board of Directors is divided into three classes with staggered three-year terms. At each annual general meeting of stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election and qualification until the third annual meeting following the election. The authorized number of directors may be changed by resolution of the Board of Directors. Currently, two separate individuals serve in the positions of Chief Executive Officer and Chairman of the Board of Directors of the Company. We believe that our current leadership structure is optimal for the Company at this time.

Our Board of Directors currently has one independent member and five non-independent members. All of our independent directors have demonstrated leadership in other organizations and are familiar with board of director processes

Our management is principally responsible for defining the various risks facing the Company, formulating risk management policies and procedures, and managing our risk exposures on a day-to-day basis. The Board of Directors’ principal responsibility in this area is to monitor our risk management processes by informing itself concerning our material risks and evaluating whether management has reasonable controls in place to address the material risks, and to ensure that sufficient resources, with appropriate technical and managerial skills, are provided throughout the Company to identify, assess and facilitate processes and practices to address material risk. The involvement of the Board of Directors in reviewing our business strategy is an integral aspect of the Board of Directors’ assessment of management’s tolerance for risk and its determination of what constitutes an appropriate level of risk for the Company.

While the full Board of Directors has overall responsibility for risk oversight, the Board of Directors may elect to delegate oversight responsibility related to certain risks to the audit committee, which in turn would then report on the matters discussed at the committee level to the full Board of Directors. For instance, the Audit Committee could focus on the material risks facing the Company, including operational, market, credit, liquidity and legal risks.

Stockholder Communications to our Board of Directors

The Company has not, to date, implemented a policy or procedure by which its stockholders can communicate directly with its directors. Due to the small size of the Company and its resources, the Company believes that this is appropriate.

Committees of the Board of Directors

Our Board has established an audit committee which operates under a charter that has been approved by our board.

Our board has determined that all of the members of each of the board’s audit committees are independent as defined under the rules of the NASDAQ Capital Market. In addition, all members of the audit committee meet the independence requirements contemplated by Rule 10A-3 under the Exchange Act. We currently do not have a board member that qualifies as an “audit committee financial expert” as defined in Item 407(D)(5) of Regulation S-K.

| 18 |

We currently do not have a nominating or compensation committee. Our board of directors believe that it is not necessary to have such committees at this time because the full board of directors can adequately perform the functions of such committees.

Audit Committee

The audit committee’s main function is to oversee our accounting and financial reporting processes and the audits of our financial statements. This committee’s responsibilities include, among other things:

| ● | appointing our independent registered public accounting firm; | |

| ● | evaluating the qualifications, independence and performance of our independent registered public accounting firm; | |

| ● | approving the audit and non-audit services to be performed by our independent registered public accounting firm; | |

| ● | reviewing the design, implementation, adequacy and effectiveness of our internal accounting controls and our critical accounting policies; | |

| ● | discussing with management and the independent registered public accounting firm the results of our annual audit and the review of our quarterly unaudited financial statements; | |

| ● | reviewing, overseeing and monitoring the integrity of our financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters; | |

| ● | reviewing on a periodic basis, or as appropriate, any investment policy and recommending to our board any changes to such investment policy; | |

| ● | preparing the report that the SEC requires in our annual proxy statement; | |

| ● | reviewing and approving any related party transactions and reviewing and monitoring compliance with our code of conduct and ethics; and | |

| ● | reviewing and evaluating, at least annually, the performance of the audit committee and its members including compliance of the audit committee with its charter. |

The members of our audit committee are Ron Mayron and until his resignation in June 2022, David Lazar. All members of our audit committee meet the requirements for financial literacy under the applicable rules and regulations of the SEC and the NASDAQ Capital Market.

Nominations to the Board of Directors

Director candidates are considered based upon various criteria, including without limitation their broad-based business and professional skills and experiences, expertise in or knowledge of the life sciences industry and ability to add perspectives relating to that industry, concern for the long-term interests of our stockholders, diversity, and personal integrity and judgment. Our Board of Directors has a critical role in guiding our strategic direction and overseeing the management of our business, and accordingly, we seek to attract and retain highly qualified directors who have sufficient time to engage in the activities of our Board of Directors and to understand and enhance their knowledge of our industry and business plans.

REPORT OF AUDIT COMMITTEE

The Audit Committee of the Board of Directors, which consists entirely of directors who meet the independence and experience requirements of The Nasdaq Stock Market, has furnished the following report:

The Audit Committee assists the Board of Directors in overseeing and monitoring the integrity of our financial reporting process, compliance with legal and regulatory requirements and the quality of internal and external audit processes. This committee’s role and responsibilities are set forth in our charter [charters need to be posted on company’s website] adopted by the Board of Directors. This committee reviews and reassesses our charter annually and recommends any changes to the Board of Directors for approval. The Audit Committee is responsible for overseeing our overall financial reporting process, and for the appointment, compensation, retention, and oversight of the work of Somekh Chaikin. In fulfilling its responsibilities for the financial statements for fiscal year December 31, 2021, the Audit Committee took the following actions:

● Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2021 with management and Somekh Chaikin, a member of KPMG International Group, our independent registered public accounting firm;

| 19 |

● Discussed with Somekh Chaikin, a member of KPMG International Group the matters required to be discussed in accordance with Auditing Standard No. 16 - Communications with Audit Committees;

● Received written disclosures and the letter from Somehk Chaikin, a member of KPMG International Group regarding its independence as required by applicable requirements of the Public Company Accounting Oversight Board regarding Somekh Chaikin, a member of KPMG International Group communications with the Audit Committee and the Audit Committee further discussed with Somek Chaikin, a member of KPMG International Group their independence; and

● Considered the status of pending litigation, if any, internal controls, taxation matters and other areas of oversight relating to the financial reporting and audit process that the committee determined appropriate.