Form DEF 14A FEDEX CORP For: Sep 19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

FedEx Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): | ||

| ☑ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

2022

PROXY

STATEMENT

Monday | September 19, 2022

8:00 a.m. Central Time

Online at

www.virtualshareholdermeeting.com/FDX2022

FEDEX. DELIVER TODAY.

INNOVATE FOR TOMORROW.

FedEx was founded to connect people to possibilities. For almost 50 years, our ecosystem of networks and team members across over 220 countries and territories has kept our customers, global trade, and society moving.

| * | Map reflects both FedEx flights and interline flights. Routes into and out of Russia, Ukraine, and Belarus are currently suspended. |

| Corporate Culture | Workplace Priorities | Climate Change | ||||

| The FedEx culture enables a resilient workforce that can respond to the challenges of today, do the right thing, and create connections across the world. Our team members are united by our passion to deliver on the Purple Promise. This passion begins with our People-Service-Profit (PSP) philosophy and is driven by our Quality Driven Management (QDM) system. FedEx was founded on the full-circle philosophy that taking care of our team members results in outstanding service, which allows us to earn a fair profit and reinvest in our team members. | Our longstanding “Safety Above All” philosophy is the top priority across our enterprise and in our day-to-day work. We are committed to making our workplaces and communities safer for our team members, customers, and the public. As a global company, we see exceptional business and community value in the diversity of perspectives and experiences that our team members bring to work every day. We are committed to embracing diversity, equity, and inclusion (DEI) to make FedEx an inclusive, equitable, and growth-focused workplace where all team members have the opportunity to flourish. | FedEx understands the impacts climate change poses to our business. In March 2021, we announced our ambitious goal to achieve carbon neutral operations by 2040 across our global operations’ Scope 1 and 2 emissions and our Scope 3 contracted transportation greenhouse gas (GHG) emissions. Our path to carbon neutral operations includes focus on vehicle electrification, sustainable fuels, fuel conservation and aircraft modernization, and facilities. | ||||

|

The 2022 ESG Report discusses our environmental, social, and governance (“ESG”) strategies, programs, and progress toward our goals. Explore our goals and progress at fedex.com/en-us/sustainability/reports.html. * The information on the 2022 ESG Report webpage, the ESG Report, and any other information on the website that we may refer to herein is not incorporated by reference into, and does not form any part of, this proxy statement. Any targets or goals discussed in our ESG Report and above may be aspirational, and as such, no guarantees or promises are made that these goals will be met. Furthermore, statistics and metrics disclosed in this proxy statement and in the ESG Report are estimates and may be based on assumptions that turn out to be incorrect. We are under no obligation to update such information. |

A MESSAGE FROM OUR EXECUTIVE CHAIRMAN AND LEAD INDEPENDENT DIRECTOR

To our stockholders,

In connection with the FedEx 2022 Annual Meeting of Stockholders to be held on 19 September 2022, we would like to update you on how FedEx continues to deliver the highest standards of ethics, integrity, and reliability through our robust governance framework. FedEx is committed to exemplary corporate governance standards and practices, as evidenced by developments in the following areas:

Welcoming new leadership

As a result of rigorous succession planning, Raj Subramaniam was named in March as the company’s new President and CEO. As also announced in March, the newly established Executive Chairman position will focus on Board governance and important industry matters such as sustainability, public policy, and innovation. These transitions took effect 1 June 2022 — the start of the new fiscal year, one where we will celebrate the momentous 50th anniversary of FedEx.

Strengthening the FedEx Board of Directors and its committees

As part of this transition, the Board appointed R. Brad Martin as the non-executive Vice Chairman of the Board as well as designated successor for the Chairman position.

We have also named three highly qualified new members to the FedEx Board of Directors since last year’s annual meeting, and recommend two additional highly qualified nominees for election at this year’s annual meeting. These independent directors and nominees bring to FedEx a diversity of experience and expertise that will be valuable to the Board’s oversight of our company’s strategic objectives.

Earlier this year, FedEx also made changes to better reflect the committees’ areas of oversight and strengthen their alignment with the company’s priorities and values including a focus on safety strategies and programs as well as human resource management matters and public policy.

Dr. Shirley Ann Jackson will leave the Board following the expiration of her current term in September. Shirley’s counsel has been indispensable over the past 23 years — and her contributions to our Board, diversity initiatives, and learning and development opportunities have positioned FedEx for consistent recognition as one of the world’s most admired companies and best places to work. Simply put, FedEx is a better company because of Dr. Jackson.

Leading through ESG commitments

As detailed in the FedEx 2022 ESG Report released in April, we remain steadfast in our strategic approach to deliver a sustainable future. Our latest ESG Report covers progress and performance on ESG topics. This includes our performance metrics as we drive towards carbon neutral operations by 2040 and our efforts to support a diverse, thriving workforce with high-quality opportunities for growth.

Engaging our stockholders

Finally, following last year’s stockholders’ meeting, we continued thoughtful discussions on a number of topics including executive compensation and our political activities and expenditures. Based on the feedback we received, we made key changes to our executive compensation programs to enhance stockholder value and address stockholder concerns and increased our disclosures around FedEx public policy and advocacy.

We value your continued engagement and deeply appreciate your support as we continue our mission to connect people and possibilities around the world.

Sincerely,

|

|

| Frederick W. Smith Founder and Executive Chairman FedEx Corporation |

David P. Steiner Lead Independent Director FedEx Corporation |

| 2022 Proxy Statement | 3 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Items of Business

| Voting Proposal | Board Recommendation | |||

| 1 | Elect the fifteen nominees named in the proxy statement as FedEx directors for a one-year term |  |

FOR each director nominee | |

| 2 | Advisory vote to approve named executive officer compensation |  |

FOR | |

| 3 | Ratification of the appointment of Ernst & Young LLP as FedEx’s independent registered public accounting firm for fiscal year 2023 |  |

FOR | |

| 4 | Approval of the amendment to the FedEx Corporation 2019 Omnibus Stock Incentive Plan to increase the number of authorized shares |  |

FOR | |

| 5-9 | Act upon five stockholder proposals, if properly presented at the meeting |  |

AGAINST | |

Stockholders also will consider any other matters that may properly come before the meeting.

How to Attend the Virtual Annual Meeting

FedEx’s 2022 annual meeting of stockholders will be a virtual meeting, conducted exclusively via live audio webcast at www.virtualshareholdermeeting.com/FDX2022. There will not be a physical location for the annual meeting, and you will not be able to attend the meeting in person.

To attend the annual meeting of stockholders at www.virtualshareholdermeeting.com/FDX2022, you must enter the control number on your proxy card, voting instruction form, or Notice of Internet Availability. Whether or not you plan to attend the virtual annual meeting, we encourage you to vote and submit your proxy in advance of the meeting by one of the methods described to the right. During the meeting, you may ask questions and vote. To vote at the meeting, visit www.virtualshareholdermeeting.com/FDX2022. For more information, please see page 127.

Please Vote Your Shares

Your vote is very important. Please vote your shares whether or not you plan to attend the meeting.

By order of the Board of Directors,

MARK R. ALLEN

Executive Vice President,

General

Counsel and Secretary

August 8, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON SEPTEMBER 19, 2022:

The following materials are available at www.proxyvote.com:

|

The Notice of Annual Meeting of Stockholders to be held September 19, 2022; |

|

The FedEx 2022 Proxy Statement; and |

|

The FedEx Annual Report to Stockholders for the fiscal year ended May 31, 2022. |

A Notice Regarding the Internet Availability of Proxy Materials or the proxy statement, form of proxy, and accompanying materials are first being sent to stockholders on or about August 8, 2022.

LOGISTICS

|

Date and Time Monday, September 19, 2022, at 8:00 a.m. Central Time |

|

Location Online via webcast at www. virtualshareholdermeeting. com/FDX2022 |

|

Who Can Vote Stockholders of record at the close of business on July 25, 2022, may vote at the meeting or any postponements or adjournments of the meeting. |

HOW TO CAST YOUR VOTE

If you are a registered stockholder, you can vote by any of the following methods:

|

Online www.proxyvote.com up until 11:59 p.m. Eastern Time on 9/18/2022. For shares held in any FedEx or subsidiary employee stock purchase plan or benefit plan, vote by 11:59 p.m. Eastern Time on 9/14/2022. |

|

By phone 1-800-690-6903; Dial toll-free 24/7 up until 11:59 p.m. Eastern Time on 9/18/2022. For shares held in any FedEx or subsidiary employee stock purchase plan or benefit plan, vote by 11:59 p.m. Eastern Time on 9/14/2022. |

|

Proxy card Completing, signing, and returning your proxy card |

|

At the meeting You also may vote online during the annual meeting by following the instructions provided on the meeting website during the annual meeting. To vote at the meeting, visit www. virtualshareholdermeeting. com/FDX2022. |

If you are a beneficial owner and received a voting instruction form, please follow the instructions provided by your bank or broker to vote your shares.

| 4 |  |

| 2022 Proxy Statement | 5 |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find additional information in this proxy statement.

| Proposal

1 Election of Directors |

| DIRECTOR SINCE |

COMMITTEES | OTHER

PUBLIC DIRECTORSHIPS |

|||||||||

| NOMINEE AND POSITION | AGE | AFC | CHRC | CyTOC | GSPPC | ||||||

|

FREDERICK

W. SMITH Executive Chairman and Chairman of the Board of FedEx Corporation |

77 | 1971 | ||||||||

|

MARVIN

R. ELLISON  Chairman, President, and Chief Executive Officer of Lowe’s Companies, Inc. |

57 | 2014 |  |

|

Lowe’s Companies, Inc. | |||||

|

STEPHEN

E. GORMAN  Former Chief Executive Officer of Air Methods Corporation |

67 | — | Peabody Energy Corporation and ArcBest Corporation* | |||||||

|

SUSAN

PATRICIA GRIFFITH  President and Chief Executive Officer of The Progressive Corporation |

57 | 2018 |  |

|

The Progressive Corporation | |||||

|

KIMBERLY

A. JABAL  Former Chief Financial Officer of Unity Technologies |

53 | 2013 |  |

|

||||||

|

AMY

B. LANE  Former Managing Director and Group Leader, Retail Banking Group, Merrill Lynch & Co., Inc. |

69 | 2022 |  |

|

NextEra Energy, Inc. and TJX Companies Inc. | |||||

|

R.

BRAD MARTIN  Vice Chairman

Vice ChairmanChairman of RBM Venture Company |

70 | 2011 |  |

Riverview Acquisition Corp. | ||||||

|

NANCY

A. NORTON  Retired Vice Admiral, U.S. Navy |

57 | — | ||||||||

|

FREDERICK

P. PERPALL  Chief Executive Officer of The Beck Group |

47 | 2021 |  |

|

Starwood Property Trust, Inc. | |||||

|

JOSHUA

COOPER RAMO  Chairman and Chief Executive Officer, Sornay, LLC |

53 | 2011 |  |

|

Starbucks Corporation | |||||

|

SUSAN

C. SCHWAB  Professor Emerita at the University of Maryland School of Public Policy |

67 | 2009 |  |

|

Caterpillar Inc. and Marriott International, Inc. | |||||

|

DAVID

P. STEINER  Lead Independent Director

Lead Independent DirectorFormer Chief Executive Officer of Waste Management, Inc. |

62 | 2009 |  |

Vulcan Materials Company | ||||||

|

RAJESH

SUBRAMANIAM President and Chief Executive Officer of FedEx Corporation |

56 | 2020 | First Horizon National Corporation | |||||||

|

V.

JAMES VENA  Former Chief Operating Officer of Union Pacific Corporation |

63 | 2022 |  |

|

||||||

|

PAUL

S. WALSH  Executive Chairman of McLaren Group Limited |

67 | 1996 |  |

McDonald’s Corporation and Vintage Wine Estates, Inc. | ||||||

* Mr. Gorman will resign as a director of ArcBest Corporation if elected to the FedEx Board |

|||||||||||

| AFC – Audit and Finance Committee | CyTOC – Cyber and Technology Oversight Committee |  Member |

Independent |

||||||||

| CHRC – Compensation and Human Resources Committee | GSPPC – Governance, Safety, and Public Policy Committee |  Chair |

|||||||||

| See page 41 for committee memberships immediately following the annual meeting if all of the director nominees are elected. | |||||||||||

| Your Board of Directors recommends that you vote “FOR” the election of each of the fifteen nominees |

See page 12

| ||||||||||

| 6 |  |

Proxy Statement Summary – Director Nominee Highlights

Director Nominee Highlights*

Diversity of Tenure, Age, Gender, and Background

| Independent Director Nominee Tenure** | Age** | |

|

| |

| Board Refreshment | Diversity | |

|

|

* Statistics assume all director nominees are elected at the annual meeting.

** As of August 8, 2022

Director Nominee Experience, Qualifications, Attributes, and Skills

The Board believes that it is desirable that the following experience, qualifications, attributes, and skills be possessed by one or more of FedEx’s Board members because of their particular relevance to the company’s business and structure, and these were all considered by the Board in connection with this year’s director nomination process:

| Transportation/ Logistics/Supply Chain |

International | Financial | Marketing | Retail/ E-commerce |

|

|

|

|

|

| 7 Nominees | 8 Nominees | 8 Nominees | 7 Nominees | 6 Nominees |

| Technological/Digital/ Cybersecurity |

Energy | Human Resource Management |

Government | Risk Management |

|

|

|

|

|

| 4 Nominees | 5 Nominees | 2 Nominees | 4 Nominees | 8 Nominees |

| Leadership | ||||

|

||||

| 15 Nominees |

| 2022 Proxy Statement | 7 |

Proxy Statement Summary – Corporate Governance Highlights

Corporate Governance Highlights

You can find detailed information about our corporate governance policies and practices in the Corporate Governance Matters section of this proxy statement. You can also access our corporate governance documents under the ESG heading on the Investor Relations page of our website at investors.fedex.com. Information contained on our website is not deemed to be incorporated by reference as part of this proxy statement.

Corporate Governance Facts

|

|

| 8 |  |

Proxy Statement Summary – Proposal 2

| Proposal 2 Advisory Vote to Approve Named Executive Officer Compensation |

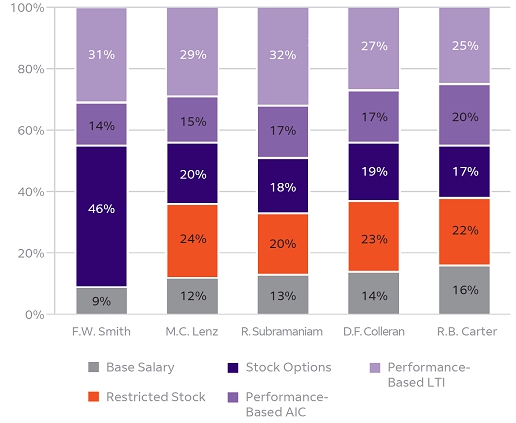

Executive Compensation Design Our executive compensation program is designed not only to retain and attract highly qualified and effective executives, but also to motivate them to substantially contribute to FedEx’s future success for the long-term benefit of stockholders and reward them for doing so. We believe there should be a strong relationship between pay and corporate performance, and our executive compensation program reflects this belief. In response to the lower level of support we received in the 2021 advisory vote on named executive officer compensation and the 62% vote in support of the stockholder proposal presented at our 2021 annual meeting regarding certain severance and post-termination payments, beginning in September 2021 and continuing through the end of fiscal 2022, we requested meetings with our largest 15 institutional investors who own, in the aggregate, over 40% of our outstanding common stock and engaged with investors owning, in the aggregate, more than 35% of our common stock, to solicit feedback on our executive compensation program, better understand the reasons behind the 2021 advisory vote on executive compensation outcome and support of the stockholder proposal, and discuss potential changes to our executive compensation program for consideration by the Compensation and Human Resources Committee (“Compensation & HR Committee”). For additional information on how we responded, please see “Corporate Governance Matters — The Board’s Role and Responsibilities — Stockholder Engagement — Board Responsiveness to 2021 Nonbinding Stockholder Proposals — Stockholder Proposal Regarding Shareholder Ratification of Termination Pay,” “Executive Compensation — Compensation Discussion and Analysis — 2021 Say-on-Pay Advisory Vote Outcome,” and “— Post-Employment Compensation — Limitation on Severance Benefits.” Elements of Compensation The elements of target total direct compensation for fiscal 2022 are presented below. |

|||

| ELEMENT AND FISCAL 2022 AVERAGE NEO TARGET PAY MIX(1) |

DESCRIPTION AND METRICS | |||||

|

Base Salary |  |

Fixed cash income to retain and attract highly marketable executives in a competitive market for executive talent. | |||

| Performance-Based AIC |  |

Annual cash incentive program designed

to motivate our executives to achieve annual financial goals and other business objectives and reward them accordingly. Total

amount paid was based on:

|

||||

|

Restricted Stock(2) |  |

Annual equity incentive awards designed to further align the interests of our executives with those of our stockholders by facilitating significant ownership of FedEx stock by the officers. The number of options and shares of restricted stock awarded is primarily based on:

|

|||

| Stock Options |  |

|||||

| Performance-Based LTI |  |

Long-term cash incentive program designed to motivate management to build long-term stockholder value and reward them accordingly. For the FY20-FY22 long-term incentive (“LTI”) plan, total payout opportunity was based on:

|

||||

| (1) | See page 53 for individual fiscal 2022 target total direct compensation components. | ||||

| (2) | This average excludes our Chairman of the Board and CEO in fiscal 2022 because restricted stock was not a component of his fiscal 2022 compensation. As a result, the percentages included in this table do not sum to 100%. | ||||

| Your Board of Directors recommends that you vote “FOR” this proposal. |

See page 46

|

| 2022 Proxy Statement | 9 |

Proxy Statement Summary – Proposal 3

Fiscal 2022 Compensation Highlights | |

|

Under the fiscal 2022 annual incentive compensation (“AIC”) plan, annual bonus payments were tied to achieving aggressive goals for adjusted consolidated operating income. We experienced revenue and operating income growth in fiscal 2022 resulting from yield management actions, including the favorable net impact of fuel. In addition, our results were positively affected by a mix shift to our higher yielding services due to strategic actions to improve revenue quality. However, our business was negatively affected by the coronavirus (“COVID-19”) pandemic, labor market challenges, and inflationary cost pressures. Labor market challenges contributed to global supply chain disruptions and affected the availability and cost of labor, resulting in network inefficiencies, higher purchased transportation costs, and higher wage rates. In addition, global recovery from the impacts of the COVID-19 pandemic slowed with the onset of new variants, which resulted in reduced shipping demand and caused network disruptions, particularly at FedEx Express during fiscal 2022. These challenges resulted in adjusted consolidated operating income that was below the target objective under our fiscal 2022 AIC plan. Accordingly, and consistent with our pay-for-performance philosophy, below-target payouts were earned by participants under the fiscal 2022 AIC plan, including the named executive officers. |

|

LTI plan payouts for fiscal 2022 were tied to meeting pre-established aggregate EPS goals over a three-fiscal-year period. While adjusted EPS growth was strong in fiscal 2021 and 2022, weaker-than-expected adjusted EPS growth in fiscal 2020 prevented us from achieving the three-year EPS goal required for any payout under the FY20–FY22 LTI plan. |

|

Officers realize value from the stock options included in the total direct compensation calculation only if the stock price appreciates after the grant date. The exercise price for the fiscal 2022 stock option grant to executive officers was $294.605. The closing price of FedEx common stock on July 25, 2022 was $228.17. |

|

Proposal 3 Ratification of the Appointment of Ernst & Young LLP as |

|

| FedEx’s Independent Registered Public Accounting Firm | ||

The Audit and Finance Committee is directly responsible for the appointment, compensation, retention, and oversight of our independent registered public accounting firm and has specific policies in place to ensure its independence. The Audit and Finance Committee has appointed Ernst & Young LLP (“Ernst & Young”) to serve as FedEx’s independent registered public accounting firm for fiscal 2023. Ernst & Young has been our independent registered public accounting firm since 2002. Fees paid to Ernst & Young for fiscal 2022 and 2021 are detailed on page 93. Representatives of Ernst & Young will attend the meeting, will be given the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions. | ||

| Your Board of Directors recommends that you vote “FOR” this proposal | See page 90 |

| 10 |  |

Proxy Statement Summary – Proposal 4

|

Proposal

4 Approval of the Amendment to the FedEx Corporation |

|

| 2019 Omnibus Stock Incentive Plan to Increase the Number of Authorized Shares |

||

FedEx relies on equity awards to retain and attract key employees and non-employee Board members and believes that equity incentives are necessary for FedEx to remain competitive in retaining and attracting highly qualified individuals upon whom, in large measure, the future growth and success of FedEx depend. Our stockholders originally approved FedEx’s 2019 Omnibus Stock Incentive Plan, as amended (the “2019 Plan”), at the 2019 annual meeting of stockholders. The 2019 Plan currently provides that the maximum number of shares of FedEx common stock that may be issued pursuant to awards granted under the 2019 Plan is 17,000,000 shares, of which no more than 1,500,000 shares may be issued as full-value awards (i.e., awards other than stock options or stock appreciation rights). In order to continue the practice of granting equity incentive awards, the Board of Directors is seeking stockholder approval of an amendment to the 2019 Plan to increase the number of shares authorized for issuance under the 2019 Plan. If approved by our stockholders, the amendment would authorize an additional 5,000,000 shares for issuance under the 2019 Plan. However, none of the additional shares will be issuable as full-value awards. The amendment would not make any other changes to the 2019 Plan. Absent an increase in the number of authorized shares under the 2019 Plan, we do not expect to have sufficient shares to meet our anticipated equity compensation needs for fiscal 2025, which begins on June 1, 2024. We believe that increasing the number of shares issuable under the 2019 Plan is necessary in order to allow FedEx to continue to utilize equity awards to retain and attract the services of key individuals essential to FedEx’s long-term growth and financial success and to further align their interests with those of FedEx’s stockholders. | ||

| Your Board of Directors recommends that you vote “FOR” this proposal | See page 96 |

|

Proposals

5-9 Five Stockholder Proposals, if properly presented |

|

| Your Board of Directors recommends that you vote “AGAINST” each of these proposals | See pages 107 – 121 |

Forward-Looking Statements

Certain statements in this proxy statement may be considered “forward-looking” statements within the meaning of the applicable securities laws. Forward-looking statements include those preceded by, followed by, or that include the words “will,” “may,” “could,” “would,” “should,” “believes,” “expects,” “forecasts,” “anticipates,” “plans,” “estimates,” “targets,” “projects,” “intends”, or similar expressions. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from historical experience or from future results expressed or implied by such forward-looking statements. Potential risks and uncertainties include, but are not limited to, the factors that can be found in FedEx’s and its subsidiaries’ press releases and FedEx’s filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for fiscal 2022. Any forward-looking statement speaks only as of the date on which it is made. FedEx does not undertake or assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

| 2022 Proxy Statement | 11 |

| Your Board of Directors recommends that you vote “FOR” the election of each of the fifteen nominees. |

Process for Selecting Directors

The Board is responsible for recommending director candidates for election by the stockholders and for electing directors to fill vacancies or newly created directorships. The Board has delegated the screening and evaluation process for director candidates to the GSPP Committee, which identifies, evaluates, and recruits highly qualified director candidates and recommends them to the Board.

Experience, Qualifications, Attributes, and Skills

The GSPP Committee seeks director nominees with the skills and experience needed to properly oversee the interests, risks, and businesses of the company. The Committee carefully evaluates each candidate to ensure that he or she possesses the experience, qualifications, attributes, and skills that the Committee has found are necessary for an effective Board member. These crucial qualities include, among others:

|

|

Willingness

to represent the best interests of all stockholders and objectively appraise management performance. Willingness

to represent the best interests of all stockholders and objectively appraise management performance. |

In addition to the qualifications that each director nominee must have, the Board believes that one or more of FedEx’s Board members should possess the experience and expertise listed below because of their particular relevance to the company’s business, strategy, and structure. These were all considered by the Board in connection with this year’s director nomination process.

| 12 |  |

Corporate Governance Matters – Process for Selecting Directors

|

TRANSPORTATION/LOGISTICS/SUPPLY CHAIN MANAGEMENT EXPERIENCE |  |

ENERGY EXPERTISE | Diversity: The Board is committed to having a membership that reflects a diversity of gender, race, ethnicity, age, and background. This commitment is demonstrated by the fact that the Board currently* includes five female directors and four directors who are racially or ethnically diverse. *As of August 8, 2022, and including Shirley Ann Jackson, who will retire from the Board immediately before the 2022 annual meeting. | ||

|

INTERNATIONAL EXPERIENCE |  |

HUMAN RESOURCE MANAGEMENT EXPERTISE | |||

|

FINANCIAL EXPERTISE |  |

GOVERNMENT EXPERIENCE | |||

|

MARKETING EXPERTISE |  |

RISK MANAGEMENT EXPERTISE | |||

|

RETAIL/E-COMMERCE EXPERTISE |  |

LEADERSHIP EXPERIENCE | |||

|

TECHNOLOGICAL/DIGITAL/CYBERSECURITY EXPERTISE |

Nomination Process

Nomination of Director Candidates

The GSPP Committee identifies, evaluates, and recruits director candidates, considers the advisability of adding new directors to the current composition of the Board, and evaluates and recommends existing director nominees to the Board as follows:

|

|

|

|

|

|

| |

| The GSPP Committee considers potential new candidates that may be proposed by current directors, management, professional search firms, stockholders, or other persons. The Committee may engage a third-party executive search firm to assist in identifying potential director candidates. The Committee considers and evaluates a director candidate recommended by a stockholder in the same manner as a nominee recommended by a Board member, management, search firm, or other sources. | The GSPP Committee evaluates a potential new director candidate thoroughly in considering whether the candidate meets the criteria that the Board seeks in all of its directors and how that candidate’s skills and experience would positively contribute to the Board. The process may include reviewing the candidate’s qualifications, interviewing the candidate, engaging an outside firm to gather additional information about the candidate, and making inquiries of persons with knowledge of the candidate. | In its evaluation of all director candidates, including the members of the Board eligible for reelection, the GSPP Committee considers the appropriate size, composition, skills, and contributions of current members and the needs of the Board of Directors and each of its committees. | AS A RESULT OF THIS PROCESS, IF ALL DIRECTOR NOMINEES ARE ELECTED AT THE ANNUAL MEETING, SIX NEW, INDEPENDENT, HIGHLY QUALIFIED DIRECTORS WILL HAVE JOINED THE FEDEX BOARD IN THE PAST FIVE YEARS. |

On June 13, 2022, FedEx entered into a cooperation agreement (the “Cooperation Agreement”) with D. E. Shaw Oculus Portfolios, LLC and D. E. Shaw Valence Portfolios, LLC (collectively, “D. E. Shaw”). Pursuant to the Cooperation Agreement, the Board initially elected Ms. Lane and Mr. Vena as members of the Board effective June 14, 2022. Also pursuant to the Cooperation Agreement, each of these new directors, together with Mr. Gorman, were nominated for election at the 2022 annual meeting of stockholders, with terms expiring at the 2023 annual meeting of stockholders.

| 2022 Proxy Statement | 13 |

Corporate Governance Matters – Process for Training and Evaluating Directors

Under the terms of the Cooperation Agreement, D. E. Shaw has agreed to abide by customary standstill restrictions (subject to certain exceptions relating to private communications to FedEx) from the date of the Cooperation Agreement until the date that is 30 calendar days prior to the notice deadline under FedEx’s Bylaws for the nomination of non-proxy-access director candidates for election to the Board at the 2023 annual meeting of stockholders (the “Cooperation Period”). The Cooperation Agreement provides that the standstill restrictions will terminate automatically upon certain events, including, among other things, FedEx’s material breach of the Cooperation Agreement.

Under the Cooperation Agreement, D. E. Shaw has agreed to appear in person or by proxy at any annual or special meeting of FedEx’s stockholders held during the Cooperation Period and to vote its shares of FedEx’s common stock (i) in favor of the slate of directors nominated by the Board for election, and in accordance with the recommendations of the Board on all other proposals, and (ii) against the removal of any incumbent directors or the election of any director nominees not recommended by the Board; provided that D. E. Shaw may vote in its sole discretion on any proposal with respect to an extraordinary transaction; provided, further, that if both Institutional Shareholder Services and Glass, Lewis & Co. recommend otherwise with respect to any of the company’s proposals at any such meeting (other than proposals relating to the election or removal of directors, the size of the Board, or filling vacancies on the Board), D. E. Shaw is permitted to vote in accordance with the ISS and Glass Lewis recommendation.

Stockholder Recommendations

The GSPP Committee will consider director nominees recommended by stockholders. To recommend a prospective director candidate for the GSPP Committee’s consideration, stockholders may submit the candidate’s name, qualifications, including whether the candidate satisfies the requirements set forth in our Corporate Governance Guidelines and discussed in “— Process for Selecting Directors — Experience, Qualifications, Attributes, and Skills,” and other relevant biographical information in writing to: FedEx Corporation Governance, Safety, and Public Policy Committee, c/o Corporate Secretary, 942 South Shady Grove Road, Memphis, Tennessee 38120. FedEx’s Bylaws require stockholders to give advance notice of stockholder proposals, including nominations of director candidates. For more information, please see “Stockholder Proposals and Director Nominations for 2023 Annual Meeting.”

Majority-Voting Standard For Director Elections

FedEx’s Bylaws require that we use a majority-voting standard in uncontested director elections and a resignation requirement for directors who fail to receive the required majority vote. The Bylaws also prohibit the Board from reverting to a plurality-voting standard without the affirmative vote of the holders of at least a majority of the voting power of all the shares of FedEx stock entitled to vote generally in the election of directors, voting together as a single class. Under the majority-voting standard, a director nominee must receive more votes cast “for” than “against” his or her election in order to be elected to the Board. In accordance with the majority-voting standard and resignation requirement, each director who is standing for reelection at the annual meeting has tendered an irrevocable resignation from the Board of Directors that will take effect if (i) the director does not receive more votes cast “for” than “against” his or her election at the annual meeting, and (ii) the Board accepts the resignation. FedEx’s Bylaws require the Board of Directors, within 90 days after certification of the election results, to accept the director’s resignation unless there is a compelling reason not to do so and to promptly disclose its decision (including, if applicable, the reasons for rejecting the resignation) in a filing with the SEC.

Process for Training and Evaluating Directors

New Director Orientation

FedEx has a New Director Orientation Program that enables new members of the Board to quickly become active and effective Board members. The program includes, among other things, an overview of fiduciary duties and responsibilities of directors, individual meetings with key members of the Board and executive management, facility tours, and attendance at committee meetings regardless of whether the new director is a member of those committees, in order to gain a better understanding of committee functions. The process is tailored to take into account the individual needs of each new director.

The GSPP Committee is responsible for overseeing the New Director Orientation Program and the Executive Vice President, General Counsel and Secretary is responsible for administering the program and reporting to the GSPP Committee the status of the orientation process with respect to each new director. The orientation process is designed to provide new directors with comprehensive information about the company’s business, strategy, capital structure, financial performance, risk oversight, evaluation of management, and executive compensation practices, as well as the policies, procedures, and responsibilities of the Board and its committees.

| 14 |  |

Corporate Governance Matters – Process for Training and Evaluating Directors

Continuing Director Education

FedEx provides continuing director education through individual speakers at Board meetings, generally four times per year. The company receives feedback from the directors on potential topics that would be useful for these discussions. In addition to facilitating these customized in-house programs, FedEx monitors pertinent developments in director education and recommends valuable outside programs for Board committee chairpersons to attend. The GSPP Committee reviews the company’s director education process on an annual basis to ensure the continuing education provided serves to further directors’ knowledge in their oversight responsibilities.

Board and Committee Evaluations

The GSPP Committee oversees an annual performance evaluation of each committee of the Board and the Board as a whole. Each Board member also completes an individual self-assessment, and those responses are provided to the Chairman of the Board and the chairperson of the GSPP Committee, who is our Lead Independent Director. The responses to the performance evaluations and individual self-assessments are compiled annually by a third party who distributes the results to the applicable recipients.

The GSPP Committee reviews and discusses the evaluation results for each committee and the Board as a whole. Each committee discusses its annual evaluation results and identifies any opportunities for improvement. The chairperson of the GSPP Committee reports the results to the Board of Directors, including any action plans. The chairperson also reports to the Board the results of the full Board assessment. The Chairman of the Board and chairperson of the GSPP Committee discuss any notable results from the individual director self-assessments with the relevant directors.

As part of the evaluation, our directors consider the Board’s processes to ensure, among other things, that its leadership structure remains effective, that Board and committee meetings are conducted in a manner that promotes candid and constructive dialogue, sufficient time has been allocated for such meetings, agenda items reflect key matters of importance to the company, and that the materials provided to the Board and the reports received from management are useful, comprehensive, and timely.

| 2022 Proxy Statement | 15 |

Corporate Governance Matters – Nominees for Election to the Board

Nominees for Election to the Board

Below you will find each nominee’s biography along with other pertinent information, including a selection of each Board nominee’s skills and qualifications. Following the biographies, we have included a chart that exhibits the collective experience, qualifications, attributes, and skills of our Board nominees.

FREDERICK W. SMITH

Age: 77 Director Since: 1971 Committees: None Other Public Company Directorships: None |

Mr. Smith is the company’s founder and has been Executive Chairman of FedEx since June 1, 2022, and Chairman of the Board since 1998. Mr. Smith was Chief Executive Officer of FedEx from 1998 through May 2022 and President of FedEx from 1998 through January 2017. He was Chairman, President, and Chief Executive Officer of FedEx Express from 1983 to 1998, Chief Executive Officer of FedEx Express from 1977 to 1998, and President of FedEx Express from 1971 to 1975. SKILLS AND QUALIFICATIONS

Transportation/Logistics/Supply Chain Management; Leadership Founder and former CEO of our company and the pioneer of the express transportation industry.

Energy Chairman Emeritus of the Energy Security Leadership Council.

International Founder and former CEO of our multinational company and has served on the board of the Council on Foreign Relations and as chairman of the U.S.-China Business Council and the French-American Business Council.

|

MARVIN R. ELLISON INDEPENDENT

Age: 57 Director Since: 2014 Committees: Audit and Finance Governance, Safety, and Public Policy Other Public Company Directorships: Lowe’s Companies, Inc. |

Mr. Ellison serves as Chairman of the Board, President, and Chief Executive Officer of Lowe’s Companies, Inc., a home improvement retailer, serving as Chairman since June 2021 and President and Chief Executive Officer since July 2018. Mr. Ellison served as Chairman of J. C. Penney Company, Inc., an apparel and home furnishings retailer, from August 2016 until May 2018, and Chief Executive Officer from August 2015 through May 2018 (J. C. Penney filed for reorganization in federal bankruptcy court on May 15, 2020). He served as President and CEO-Designee of J. C. Penney from November 2014 through July 2015. From August 2008 through October 2014, Mr. Ellison served as Executive Vice President – U.S. Stores of The Home Depot, Inc., a home improvement specialty retailer. From June 2002 to August 2008, he served in a variety of operational roles at The Home Depot, including as President – Northern Division and as Senior Vice President – Global Logistics. Prior to joining The Home Depot, Mr. Ellison spent 15 years at Target Corporation in a variety of operational roles. He is a former director of J. C. Penney Company, Inc. and H&R Block, Inc. SKILLS AND QUALIFICATIONS

Marketing; Retail/E-Commerce Marketing expert with significant retail and e-commerce expertise through his executive experience at Lowe’s, The Home Depot, and J. C. Penney.

Leadership Significant executive leadership experience gained from executive positions held at Lowe’s, J. C. Penney, and The Home Depot.

Transportation/Logistics/Supply Chain Management Served in a variety of logistics roles during his career, including as Senior Vice President – Global Logistics at The Home Depot.

|

| 16 |  |

Corporate Governance Matters – Nominees for Election to the Board

STEPHEN E. GORMAN INDEPENDENT

Age: 67 Director Since: — Committees: None Other Public Company Directorships: Peabody Energy Corporation ArcBest Corporation (Mr. Gorman will resign as a director of ArcBest Corporation if elected to the FedEx Board) |

Mr. Gorman is the former Chief Executive Officer of Air Methods Corporation, a leading domestic provider in the air medical market, a position he held from August 2018 until his retirement in January 2020. Prior to that, he served as the President and Chief Executive Officer of Borden Dairy Company, a fresh milk and value-added dairy processor and distributor, from 2014 until July 2017. Prior to joining Borden Dairy, he served as Executive Vice President and Chief Operating Officer of Delta Air Lines, Inc. from 2008 to 2014 and Executive Vice President – Operations of Delta Airlines from 2007 to 2008. Prior to that, Mr. Gorman served as the President and Chief Executive Officer of Greyhound Lines, Inc. from 2003 to 2007; the Executive Vice President, Operations Support and President, North America for Krispy Kreme Doughnuts, Inc. from 2001 to 2003; and Executive Vice President – Flight Operations & Technical Operations for Northwest Airlines Corp. in 2001. He previously served as a director of Greyhound Lines, Inc., Rohn Industries, Inc., Timco Aviation Services, Inc., and Pinnacle Airlines Corporation. SKILLS AND QUALIFICATIONS

Transportation/Logistics/Supply Chain Management Extensive experience in the transportation industry as CEO and COO of public companies in the aviation and transportation industries.

Financial As a public company CEO, had oversight of financial statements and strategic financial decisions, and led mergers and acquisitions and strategic restructuring activities.

Risk Management Extensive risk management expertise as CEO and COO of public companies in the aviation and transportation industries.

International Has extensive experience as an executive officer of large companies with global operations.

Leadership Extensive leadership in CEO and other executive officer leadership positions for several large public and private corporations and experience as a public company director, including service as Lead Independent Director (ArcBest Corporation). |

| 2022 Proxy Statement | 17 |

Corporate Governance Matters – Nominees for Election to the Board

SUSAN PATRICIA GRIFFITH INDEPENDENT

Age: 57 Director Since: 2018 Committees: Compensation and Human Resources Governance, Safety, and Public Policy Other Public Company Directorships: The Progressive Corporation |

Ms. Griffith currently serves as President and Chief Executive Officer of The Progressive Corporation, a leading property and casualty insurance company, positions she has held since July 2016. Prior to being named President and Chief Executive Officer, Ms. Griffith served as Progressive’s Personal Lines Chief Operating Officer from April 2015 through June 2016 and Vice President from May 2015 through June 2016. She joined Progressive as a claims representative in 1988 and has served in many key leadership positions during her tenure. Ms. Griffith held several managerial positions in the Claims division before being named Chief Human Resources Officer in 2002. In 2008, she returned to the Claims division as the group president, and prior to being named Personal Lines Chief Operating Officer, she was President of Customer Operations from April 2014 to March 2015. Ms. Griffith was named one of FORTUNE magazine’s “Most Powerful Women in Business” in 2016 and 2017. She is a former director of The Children’s Place, Inc. SKILLS AND QUALIFICATIONS

Marketing; Retail/E-Commerce Extensive executive and managerial experience in an industry that emphasizes distinctive advertising and marketing campaigns.

Leadership Has held a series of executive leadership positions at The Progressive Corporation, including her role as President and CEO.

Technological/Digital/Cybersecurity Executive and managerial experience at a company that relies heavily on its ability to adapt to change, innovate, develop, and implement new applications and other technologies.

Risk Management; Human Resource Management Extensive risk management expertise as President and CEO at The Progressive Corporation; has held several other managerial positions, including Chief Human Resources Officer, at The Progressive Corporation.

|

KIMBERLY A. JABAL INDEPENDENT

Age: 53 Director Since: 2013 Committees: Audit and Finance Cyber and Technology Oversight Other Public Company Directorships: None |

Ms. Jabal is the former Chief Financial Officer of Unity Technologies, a creator of real-time 3D development platforms, a position she held from March 2019 through May 2021. Prior to joining Unity Technologies in March 2019, Ms. Jabal was the Chief Financial Officer of Weebly, a small business software company, from November 2015 through December 2018. Prior to joining Weebly in November 2015, she served as Chief Financial Officer of Path, Inc. and as Vice President of Finance at Lytro, Inc., both early-stage technology companies. She served in various capacities at Google from 2003 to 2011, including as director of engineering finance, director of investor relations, and director of online sales finance. Prior to Google, Ms. Jabal spent two years at Goldman Sachs in technology investment banking and eight years with Accenture working in information technology. She is a former director of SVB Financial Group. SKILLS AND QUALIFICATIONS

Financial Former CFO of one public and two private software companies, sixteen years of experience in finance at software and internet companies, and two years of experience in technology investment banking. Earned an MBA from Harvard Business School.

Technological/Digital/Cybersecurity Has extensive information technology experience, having spent eight years serving in various capacities with Google and eight years with Accenture designing and building technical infrastructure for major information technology systems implementations at global companies. Ms. Jabal also holds a B.S. in engineering from the University of Illinois at Urbana-Champaign.

|

| 18 |  |

Corporate Governance Matters – Nominees for Election to the Board

AMY B. LANE INDEPENDENT

Age: 69 Director Since: 2022 Committees: Audit and Finance Compensation and Human Resources Other Public Company Directorships: NextEra Energy, Inc. and TJX Companies Inc. |

Ms. Lane is the former Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc., an investment banking firm, a position she held from 1997 until her retirement in 2002. Ms. Lane previously served as Managing Director at Salomon Brothers, Inc., an investment banking firm, where she founded and led the retail industry investment banking unit, having joined Salomon Brothers in 1989. Ms. Lane also previously served as a director of GNC Holdings, Inc. and as a member of the Board of Trustees of Urban Edge Properties. SKILLS AND QUALIFICATIONS

Financial Earned an MBA in Finance from The Wharton School, University of Pennsylvania. Has numerous years of experience in financial services, capital markets, finance, and accounting, and public company audit and finance committee experience, including as a chair.

Retail/E-Commerce Founded and led the retail industry investment banking units at Salomon Brothers and Merrill Lynch and is a member of the Board of TJX Companies Inc., a leading global off-price retailer.

Energy Member of the Board of NextEra Energy, Inc., a leading clean energy company.

Leadership Significant executive leadership, management, and strategy expertise as the former leader of two investment banking practices covering the global retailing industry and service as a director on numerous public company boards.

|

R. BRAD MARTIN INDEPENDENT — VICE CHAIRMAN

Age: 70 Director Since: 2011 Committees: Audit and Finance (Chairman) Other Public Company Directorships: Riverview Acquisition Corp. |

Mr. Martin is Chairman of RBM Venture Company, a private investment company, a position he has held since 2007. He also currently serves as Chairman and Chief Executive Officer of Riverview Acquisition Corp., an investment company, a position he has held since April 2021. Mr. Martin was formerly the Chairman of the Board of Chesapeake Energy Corporation, a producer of oil, natural gas, and natural gas liquids, a position he held from October 2015 to February 2021. He was Chairman and Chief Executive Officer of Saks Incorporated from 1989 to 2006 and remained Chairman until his retirement in 2007. He is the former Interim President of the University of Memphis, a position he held from July 2013 until May 2014. He was previously a director of Chesapeake Energy Corporation, First Horizon National Corporation, Caesars Entertainment Corporation, Dillard’s, Inc., Gaylord Entertainment Company, lululemon athletica inc., and Ruby Tuesday, Inc. SKILLS AND QUALIFICATIONS

Financial; Risk Management Earned an MBA from Vanderbilt University. As a former CEO of a public company, he actively supervised the CFO, and has significant public company audit committee experience, including as a chair. An audit committee financial expert, as determined by the Board. Former chair of the First Horizon National Corporation Executive and Risk Committee.

Marketing; Retail/E-Commerce Gained valuable retail marketing experience and successfully applied his marketing expertise as the former CEO of Saks, a leading department store retailer.

Energy; Transportation/Logistics/Supply Chain Management Member of the board of Pilot Travel Centers LLC and former Chairman of the Board of Chesapeake Energy Corporation.

Government Former Tennessee state representative.

|

| 2022 Proxy Statement | 19 |

Corporate Governance Matters – Nominees for Election to the Board

NANCY A. NORTON INDEPENDENT

Age: 57 Director Since: — Committees: None Other Public Company Directorships: None |

Vice Admiral Norton is the retired Director of the Defense Information Systems Agency (DISA), a U.S. Department of Defense combat support agency, and commander, Joint Force Headquarters Department of Defense Information Network, positions she held from February 2018 through February 2021 after serving as Vice Director of DISA from August 2017 through February 2018. Vice Admiral Norton served over 34 years of active duty service as an officer in the U.S. Navy. She served as the director, Command, Control, Communications and Cyber Directorate, U.S. Pacific Command; director of Warfare Integration for Information Warfare; and held commands and posts in multiple international locations. She is the recipient of numerous personal and campaign awards, including the National Security Agency’s Frank B. Rowlett Award for individual achievement in information security. SKILLS AND QUALIFICATIONS

Technological/Digital/Cybersecurity Served as Director of DISA, where her focus was providing information and cyber security tools and support for the U.S. Department of Defense; held numerous other communications and information security senior leadership positions while serving in the U.S. Navy.

Human Resource Management Led global teams as a Vice Admiral in the U.S. Navy and Director of DISA.

International Has extensive experience conducting technology and cyberspace operations as a U.S. Naval officer, including numerous international leadership positions.

Government Served for 34 years as an officer in the U.S. Navy; provided leadership and oversight of global team at DISA.

|

FREDERICK P. PERPALL INDEPENDENT

Age: 47 Director Since: 2021 Committees: Audit and Finance Governance, Safety, and Public Policy Other Public Company Directorships: Starwood Property Trust, Inc. |

Mr. Perpall currently serves as Chief Executive Officer of The Beck Group, one of the world’s largest integrated design-build firms, a position he has held since 2013. Mr. Perpall leads the firm’s domestic and international design, planning, and construction business. He also serves on the Board of Councilors for The Carter Center and is President-Elect of the United States Golf Association Executive Committee. Mr. Perpall has a bachelor’s and master’s degree from the University of Texas at Arlington and is a member of the American Institute of Architects College of Fellows, an alumnus of Harvard Business School’s Advanced Management Program, and a former Americas Fellow at The Baker Institute at Rice University. He previously served as a director of Triumph Bancorp, Inc. SKILLS AND QUALIFICATIONS

Risk Management Has extensive experience in an industry where oversight and management of risks related to safety and compliance are mission-critical functions.

Financial Alumnus of Harvard Business School’s Advanced Management Program; public company audit and investment committee member.

Leadership Nine years of service as Chief Executive Officer of The Beck Group.

|

| 20 |  |

Corporate Governance Matters – Nominees for Election to the Board

JOSHUA COOPER RAMO INDEPENDENT

Age: 53 Director Since: 2011 Committees: Audit and Finance Cyber and Technology Oversight (Chairman) Other Public Company Directorships: Starbucks Corporation |

Mr. Ramo is Chairman and Chief Executive Officer of Sornay, LLC, a strategic advisory firm, a position he has held since January 2021. He previously served as Vice Chairman, Co-Chief Executive Officer, of Kissinger Associates, Inc., a strategic advisory firm, from 2011 through 2020 (he was Vice Chairman since 2011 and Co-Chief Executive Officer since 2015). He served as Managing Director of Kissinger Associates from 2006 to 2011. Prior to joining Kissinger Associates, he was Managing Partner of JL Thornton & Co., LLC, a consulting firm. Before that, he worked as a journalist and served as Senior Editor, Foreign Editor, and then Assistant Managing Editor of TIME Magazine from 1995 to 2003. SKILLS AND QUALIFICATIONS

Leadership Chairman and Chief Executive Officer, Sornay, LLC; former Vice Chairman, Co-Chief Executive Officer, of Kissinger Associates.

International Has been a term member of the Council on Foreign Relations, Asia 21 Leaders Program, World Economic Forum’s Young Global Leaders, and Global Leaders of Tomorrow. He co-founded the U.S.-China Young Leaders Forum in conjunction with the National Committee on U.S.-China Relations.

|

SUSAN C. SCHWAB INDEPENDENT

Age: 67 Director Since: 2009 Committees: Compensation and Human Resources Cyber and Technology Oversight Other Public Company Directorships: Caterpillar Inc. and Marriott International, Inc. |

Ambassador Schwab is currently Professor Emerita at the University of Maryland School of Public Policy, a position she has held since June 2020. Prior to being named Professor Emerita, Ambassador Schwab was a Professor from January 2009 to May 2020. She has also served as a strategic advisor to Mayer Brown LLP, a law firm, since March 2010. She served as U.S. Trade Representative from 2006 to January 2009 and as Deputy U.S. Trade Representative from 2005 to 2006. She was Vice Chancellor of the University System of Maryland and President and Chief Executive Officer of the University System of Maryland Foundation from 2004 to 2005. She was Dean of the University of Maryland School of Public Policy from 1995 to 2003. She was Director of Corporate Business Development of Motorola, Inc., an electronics manufacturer, from 1993 to 1995. She was Assistant Secretary of Commerce for the U.S. and Foreign Commercial Service from 1989 to 1993. She is a former director of The Boeing Company. SKILLS AND QUALIFICATIONS

International; Government Former U.S. Trade Representative and former Director–General of the U.S. and Foreign Commercial Service (Assistant Secretary of Commerce), the export promotion arm of the U.S. government.

Leadership Former U.S. Trade Representative, former Director–General of the U.S. and Foreign Commercial Service (Assistant Secretary of Commerce), former President and Chief Executive Officer of the University System of Maryland Foundation, and former Dean of the University of Maryland School of Public Policy.

|

| 2022 Proxy Statement | 21 |

Corporate Governance Matters – Nominees for Election to the Board

DAVID P. STEINER INDEPENDENT — LEAD INDEPENDENT DIRECTOR

Age: 62 Director Since: 2009 Committees: Governance, Safety, and Public Policy (Chairman) Other Public Company Directorships: Vulcan Materials Company |

Mr. Steiner is the former Chief Executive Officer of Waste Management, Inc., a provider of integrated waste management services, serving as Chief Executive Officer from 2004 through October 2016. He was President of Waste Management, Inc. from 2010 through July 2016, Executive Vice President and Chief Financial Officer from 2003 to 2004, Senior Vice President, General Counsel and Corporate Secretary from 2001 to 2003, and Vice President and Deputy General Counsel from 2000 to 2001. He was a partner at Phelps Dunbar L.L.P., a law firm, from 1990 to 2000. Mr. Steiner was previously a director of TE Connectivity Ltd. and Waste Management, Inc. SKILLS AND QUALIFICATIONS

Transportation/Logistics/Supply Chain Management Former CEO of Waste Management, which transports waste materials.

Financial Has an accounting degree from Louisiana State University and was CFO of Waste Management before becoming its CEO.

Energy Former CEO of Waste Management, which has taken an industry leadership role in converting waste to renewable energy.

|

RAJESH SUBRAMANIAM

Age: 56 Director Since: 2020 Committees: None Other Public Company Directorships: First Horizon National Corporation |

Mr. Subramaniam serves as President and Chief Executive Officer of FedEx Corporation, a position he has held since June 2022. In this position, Mr. Subramaniam provides strategic direction for the FedEx portfolio of operating companies. During his more than 30-year tenure with FedEx, Mr. Subramaniam has served in a multitude of leadership roles, including President and Chief Executive Officer-Elect of FedEx Corporation from March 2022 to May 2022, President and Chief Operating Officer of FedEx Corporation from March 2019 to March 2022, President and Chief Executive Officer of FedEx Express, the world’s largest express transportation company, from January 2019 to March 2019, and Executive Vice President and Chief Marketing and Communications Officer of FedEx Corporation from January 2017 to December 2018. He served as Executive Vice President of Marketing and Communications at FedEx Services from 2013 to January 2017. SKILLS AND QUALIFICATIONS

Transportation/Logistics/Supply Chain Management Over 30 years of experience at FedEx in several operating companies.

International; Leadership Has held leadership roles at FedEx in the Asia-Pacific region and Canada. Serves on the U.S.-India Strategic Partnership Forum and the U.S.-China Business Council.

Marketing; Retail/E-Commerce Oversaw all aspects of FedEx’s global marketing and communications, including advertising, brand and reputation, product and business development, e-commerce, revenue and forecasting planning, retail marketing, and digital access.

Technological/Digital/Cybersecurity Responsible for several landmark developments at FedEx, including the continuing digital transformation of FedEx Services, and has had an instrumental role in recent technology upgrades to address the continued growth of e-commerce.

|

| 22 |  |

Corporate Governance Matters – Nominees for Election to the Board

V. JAMES VENA INDEPENDENT

Age: 63 Director Since: 2022 Committees: Audit and Finance Governance, Safety, and Public Policy Other Public Company Directorships: None |

Mr. Vena is the former Chief Operating Officer of Union Pacific Corporation, the parent company of Union Pacific Railroad Company, a position he held from 2019 until his retirement in 2021. Mr. Vena previously spent 40 years at Canadian National Railway Company (CN) where he held a number of senior leadership roles, most recently as Executive Vice President and Chief Operating Officer of CN from 2013 until his retirement in 2016. SKILLS AND QUALIFICATIONS

Transportation/Logistics/Supply Chain Management Over 40 years of experience in the railroad industry, most recently as COO of Union Pacific.

International; Leadership Has held leadership roles at Union Pacific and Canadian National Railway Company, including serving as COO of both companies.

Risk Management; Marketing Has extensive experience in an industry where oversight and management of risks related to safety, operations, and compliance are key, as well as marketing experience through senior roles in marketing and sales.

|

PAUL S. WALSH INDEPENDENT

Age: 67 Director Since: 1996 Committees: Compensation and Human Resources (Chairman) Other Public Company Directorships: McDonald’s Corporation and Vintage Wine Estates, Inc. |

Mr. Walsh is Executive Chairman of the Board of McLaren Group Limited, a luxury automotive, motorsport, and technology company, a position he has held since January 2020. He also currently serves as an advisor for L.E.K. Consulting, a global strategy consulting firm, and TPG Capital LLP, a private investment firm. Mr. Walsh formerly served as Operating Partner at Bespoke Capital Partners LLC, an investment company, and Executive Chairman of Bespoke Capital Acquisition Corp., in each case from August 2016 until June 2021, and he served as Chairman of the Board of Compass Group PLC, a food service and support services company, from February 2014 to December 2020. Mr. Walsh served as Chief Executive Officer of Diageo plc, a beverage company, from 2000 to June 2013 and then served as an advisor to the company from July 2013 through 2014. Mr. Walsh also is a director of Chime Communications Limited, where he serves as Chairman of the Board. He has been a member of the U.K. Prime Minister’s Business Advisory Group since July 2015 and has been a Business Ambassador on the U.K. government’s Business Ambassador Network since his appointment in August 2012. Mr. Walsh was Chairman, President, and Chief Executive Officer of The Pillsbury Company, a wholly owned subsidiary of Diageo plc, from 1996 to 2000, and Chief Executive Officer of The Pillsbury Company from 1992 to 1996. He was previously a director of Avanti Communications Group PLC, Centrica plc, Compass Group PLC, Diageo plc, HSBC Holdings plc, Ontex Group NV, Pace Holdings Corp., RM2 International S.A., TPG Pace Holdings Corp., Unilever PLC, and Bespoke Capital Acquisition Corp. SKILLS AND QUALIFICATIONS

International Former CEO of a U.K.–based, large multinational corporation.

Financial Has held executive finance positions, including CFO of a major division, at a U.K.–based public company.

Marketing; Retail/E-Commerce Led a company that owes much of its growth and success to highly effective marketing of its brands. His consumer-centric experience brings a vital and unique perspective to the Board.

Government Has held executive positions at companies where government interface is crucial.

|

| 2022 Proxy Statement | 23 |

Corporate Governance Matters – Nominees for Election to the Board

Summary of Director Nominee Experience, Qualifications, Attributes, and Skills

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

Transportation/Logistics/Supply Chain Management Experience is a positive attribute as it greatly increases a director’s understanding of our business operations and its management. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Experience is beneficial given our operations in over 220 countries and territories. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Expertise is important given our use of financial targets as measures of success and the importance of accurate financial reporting and robust internal auditing. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing Expertise is valuable because we emphasize promoting and protecting the FedEx brand, one of our most important assets. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail/E-Commerce Expertise is significant because we are strategically focused on the opportunity presented by this massive and fast-growing market. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technological/Digital/Cybersecurity Expertise is beneficial because attracting and retaining customers and competing effectively depend in part upon the sophistication and reliability of our technology. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Expertise is important as we are committed to protecting the environment and have initiatives under way to reduce our energy use and minimize our environmental impact. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Human Resource Management Expertise is important because our success depends on the talent, dedication, and well-being of our people — our greatest asset. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government Experience is useful in our highly regulated industry as we work constructively with governments around the world. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Management Expertise is important as we work to identify and manage risks to our business and operations in a complex global economy. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leadership Experience is critical because we want directors with the experience and confidence to capably advise our executive management team on a wide range of issues. |  |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 24 |  |

Corporate Governance Matters – Nominees for Election to the Board

Audit Committee Financial Expert

The Board of Directors has determined that R. Brad Martin is an audit committee financial expert as that term is defined in SEC rules.

Director Independence

The Board of Directors has determined that each member of the Audit and Finance, Compensation & HR, and GSPP Committees is independent. With the exception of Frederick W. Smith and Rajesh Subramaniam, each of the Board’s current members and director nominees (Marvin R. Ellison, Stephen E. Gorman, Susan Patricia Griffith, Kimberly A. Jabal, Shirley Ann Jackson, Amy B. Lane, R. Brad Martin, Nancy A. Norton, Frederick P. Perpall, Joshua Cooper Ramo, Susan C. Schwab, David P. Steiner, V. James Vena, and Paul S. Walsh) is independent and meets the applicable independence requirements of the New York Stock Exchange (including the additional requirements for Audit and Finance Committee and Compensation & HR Committee members, as applicable, with respect to current committee members and members who will serve on either committee if all of the director nominees are elected at the annual meeting) and the Board’s more stringent standards for determining director independence. Mr. Smith is FedEx’s Executive Chairman, and Mr. Subramaniam is FedEx’s President and Chief Executive Officer.

Under the Board’s standards of director independence, which are included in FedEx’s Corporate Governance Guidelines, available under the ESG heading on the Investor Relations page of our website at investors.fedex.com, a director will be considered independent only if the Board affirmatively determines that the director has no direct or indirect material relationship with FedEx, other than as a director. The standards set forth certain categories or types of transactions, relationships, or arrangements with FedEx, as follows, each of which (i) is deemed not to be a material relationship with FedEx, and thus (ii) will not, by itself, prevent a director from being considered independent:

|

Prior Employment of Director. The director was employed by FedEx or was personally working on FedEx’s audit as an employee or partner of FedEx’s independent auditor, and over five years have passed since such employment, partner, or auditing relationship ended. |

|

Prior Employment of Immediate Family Member. An immediate family member was an officer of FedEx or was personally working on FedEx’s audit as an employee or partner of FedEx’s independent auditor, and over five years have passed since such employment, partner, or auditing relationship ended. |

|

Current Employment of Immediate Family Member. An immediate family member is employed by FedEx in a non-officer position, or by FedEx’s independent auditor not as a partner and not personally working on FedEx’s audit. |

|

Interlocking Directorships. An executive officer of FedEx served on the board of directors of a company that employed the director or employed an immediate family member as an executive officer, and over five years have passed since either such relationship ended. |

|

Transactions and Business Relationships. The director or an immediate family member is a partner, greater than 10% shareholder, director, or officer of a company that makes or has made payments to, or receives or has received payments (other than contributions, if the company is a tax-exempt organization) from, FedEx for property or services, and the amount of such payments has not within any of such other company’s three most recently completed fiscal years exceeded one percent (or $1 million, whichever is greater) of such other company’s consolidated gross revenues for such year. |

|

Indebtedness. The director or an immediate family member is a partner, greater than 10% shareholder, director, or officer of a company that is indebted to FedEx or to which FedEx is indebted, and the aggregate amount of such debt is less than one percent (or $1 million, whichever is greater) of the total consolidated assets of the indebted company. |

|

Charitable Contributions. The director is a trustee, fiduciary, director, or officer of a tax-exempt organization to which FedEx contributes, and the contributions to such organization by FedEx have not within any of such organization’s three most recently completed fiscal years exceeded one percent (or $250,000, whichever is greater) of such organization’s consolidated gross revenue for such year. |

In determining each director nominee’s independence, the Board broadly considered all relevant facts and circumstances, including the following immaterial transactions, relationships, and arrangements:

| Mr. Ellison serves, and Mr. Martin served (through June 30, 2022), on the Board of Trustees of the University of Memphis, a non-profit entity to which FedEx makes payments and charitable contributions. The payments and charitable contributions made by FedEx to the University of Memphis in each of its 2021, 2020, and 2019 fiscal years represented less than one percent of the University’s consolidated gross revenue for the year. The Board determined that Messrs. Ellison and Martin are independent directors under the Board’s independence standards as neither of them has a direct or indirect material relationship with either FedEx or the University of Memphis, other than as a director or trustee, and neither of them derive any financial or other personal benefit from these transactions. |

| 2022 Proxy Statement | 25 |

Corporate Governance Matters – Nominees for Election to the Board

|

Mr. Steiner serves as an Advisory Director of Pritzker Private Capital, a private investment firm. FedEx has an ordinary course business relationship with Pritzker. The amount of payments received by FedEx from Pritzker in calendar 2021 was approximately 1.3% of Pritzker’s gross revenue for calendar 2021, and the amount of FedEx’s payments received from Pritzker (and vice versa) in each of calendar years 2020 and 2019 did not exceed one percent (or $1 million, whichever is greater) of its consolidated gross revenue. The Board determined that Mr. Steiner is an independent director under the Board’s independence standards as he does not have a direct or indirect material relationship with either FedEx or Pritzker, other than as a director or advisory director, and he does not derive any financial or other personal benefit from these transactions. |

|

FedEx has an ordinary course business relationship with Lowe’s Companies, Inc., an entity for which Mr. Ellison has served as Chairman of the Board since June 2021 and President and Chief Executive Officer and as a director since July 2018. The amount of the payments made by FedEx to Lowe’s (and vice versa) within any of its three most recently completed fiscal years has not exceeded one percent (or $1 million, whichever is greater) of its consolidated gross revenue for such year. |

|

FedEx has an ordinary course business relationship with The Progressive Corporation, an entity for which Ms. Griffith serves as President and Chief Executive Officer and as a director since July 2016. The amount of the payments made by FedEx to Progressive (and vice versa) within any of its three most recently completed fiscal years has not exceeded one percent (or $1 million, whichever is greater) of its consolidated gross revenue for such year. |

|