Form 8-K PINNACLE WEST CAPITAL For: Aug 05

| FOR IMMEDIATE RELEASE | August 5, 2021 | |||||||

| Media Contact: Analyst Contact: | Alan Bunnell (602) 250-3376 Stefanie Layton (602) 250-4541 | |||||||

| Website: | pinnaclewest.com | |||||||

PINNACLE WEST REPORTS 2021 SECOND-QUARTER RESULTS

•Electricity sales increase as businesses bounce back from COVID-related impacts of a year ago

•Strong customer growth and record-setting June temperatures also help drive improved results

•Award-winning energy efficiency programs, bill assistance, heat relief provide support to customers

PHOENIX – Pinnacle West Capital Corp. (NYSE: PNW) today reported consolidated net income attributable to common shareholders of $215.7 million, or $1.91 per diluted share of common stock, for the quarter ended June 30, 2021. This result compares with earnings of $193.6 million, or $1.71 per share, in the same 2020 period.

Increased retail sales and strong customer growth of 2.3% were the primary drivers in the quarter-over-quarter improvement, contributing to a $70.7 million, or 7.6%, increase in operating revenues. Record-setting heat during the month of June also contributed to the company’s bottom line, helping offset higher operations and maintenance expenses, an increase in depreciation expense and higher income taxes in the second quarter.

“Our operating and financial performance in the second quarter remained strong,” said Pinnacle West Chairman, President and Chief Executive Officer Jeff Guldner. “Combined with robust growth and an economy that is bouncing back from the worst of the COVID-19 pandemic, more customers used more energy this past quarter to cool their businesses and homes than a year ago.”

Residential sales increased 1.3% and commercial and industrial sales increased 10.3% compared to second quarter 2020, reflecting the reopening of businesses and return to in-person work versus a year ago when COVID-19 forced business closures and created a largely remote work environment.

Record-Setting Temperatures Increase Customer Energy Consumption

In addition to 5.7% weather-normalized sales growth, weather variations also spurred an increase in energy consumption. The average high and low temperatures were higher this year than last – and well over historical averages.

According to the National Weather Service, the average high temperature in the Phoenix area during the 2021 second quarter was 98.1 degrees – an increase of 2.6% over 10-year historical averages. Not only was the month of June the warmest on record with an average high temperature of 108.2 degrees, but the Phoenix area experienced an unprecedented six consecutive days of 115-degree-plus temperatures and three days approaching the company’s record peak demand of 7,660 megawatts, set in late-July of last year.

The number of residential cooling degree-days (a utility’s measure of the effects of weather) in this year’s second quarter increased 4.5% compared to the same timeframe a year ago and was a remarkable 17.7% higher than historical 10-year averages. June 2021, in fact, had 27.4% more cooling degree-days than in June 2020. | |||||

Operationally, APS employees continue to execute well, ensuring reliable customer service amidst the extreme summer temperatures and increased customer demand.

“At APS, we like to say that the summer season is when our year-round preparation really shines,” Guldner said. “For more than 136 years, our people and service have helped make it possible for Arizona to grow and prosper, continually attracting new residents and businesses.

“As temperatures intensify throughout the West, providing safe, reliable energy is more critical than ever to ensure Arizona remains a comfortable, livable and thriving environment.”

APS: Here to Help Customers Manage Their Energy Use, Bills, Heat

Arizona Public Service (APS) helps customers stay cool and manage their electric bills all summer with money-saving tips and programs. The Environmental Protection Agency (EPA) recognized APS earlier this year with the ENERGY STAR Partner of the Year Award for excellence in customer energy efficiency programs. This includes offerings such as APS Marketplace, a one-stop online shop for smart energy products at competitive prices, and the New Homes program, a partnership with Arizona builders to deliver homes that are at least 20% more energy-efficient than a typical new home.

In line with the APS commitment “to keep customers the focus of what we do,” Guldner highlighted that there is currently a seasonal hold on residential disconnections through October 15, and the company offers a variety of assistance programs for those who are struggling with their bill. These offerings include the Energy Support programs, which provide limited-income customers with a monthly discount on their bill; Crisis Bill Assistance, providing up to $800 annually to qualified limited-income customers who experience unexpected financial hardship; and Project SHARE, a Salvation Army-administered service providing up to $300 annually in emergency energy bill assistance.

Additionally, in the face of record temperatures and prolonged heat, APS is teaming up with community organizations to expand heat-relief initiatives. These customer resources include eviction protection, more cooling and hydration stations, free rides to cooling shelters, and emergency AC repair or replacement for qualifying seniors.

The company also participates in several forums to address heat-related impacts in Arizona, such as the Maricopa County Department of Health’s Energy Insecurity Workgroup. “It takes broad collaboration – beyond what any one entity or segment can do alone – to develop a support network for those who need it most,” added Guldner. “At APS, we’re committed to doing our part.”

APS customers needing aid are encouraged to visit aps.com/support for a full list of assistance programs, including up-to-date details on year-round financial resources and support.

Conference Call and Webcast

Pinnacle West invites interested parties to listen to the live webcast of management’s conference call to discuss 2021 second-quarter results, as well as recent developments, at noon ET (9 a.m. Arizona time) today, Aug. 5. The webcast can be accessed at pinnaclewest.com/presentations and will be available for replay on the website for 30 days. To access the live conference call by telephone, dial (877) 407-8035 or (201) 689-8035 for international callers. A replay of the call also will be available at pinnaclewest.com/presentations or by telephone until 11:59 p.m. ET, Thursday, Aug. 12, 2021, by calling (877) 481-4010 in the U.S. and Canada or (919) 882-2331 internationally and entering passcode 41816.

General Information

Pinnacle West Capital Corp., an energy holding company based in Phoenix, has consolidated assets of approximately $21 billion, about 6,300 megawatts of generating capacity and more than 6,000 employees in Arizona and New Mexico. Through its principal subsidiary, Arizona Public Service, the company provides retail electricity service to more than 1.3 million Arizona homes and businesses. For more information about Pinnacle West, visit the company’s website at pinnaclewest.com.

Earnings per share amounts in this news release are based on average diluted common shares outstanding. For more information on Pinnacle West’s operating statistics and earnings, please visit pinnaclewest.com/investors.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based on current expectations. These forward-looking statements are often identified by words such as "estimate," "predict," "may," "believe," "plan," "expect," "require," "intend," "assume," "project," "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution readers not to place undue reliance on these statements. Several factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to:

•the potential effects of the continued COVID-19 pandemic, including, but not limited to, demand for energy, economic growth, our employees and contractors, supply chain, expenses, capital markets, capital projects, operations and maintenance activities, uncollectable accounts, liquidity, cash flows or other unpredictable events;

•our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels;

•variations in demand for electricity, including those due to weather, seasonality, the general economy or social conditions, customer and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements;

•power plant and transmission system performance and outages;

•competition in retail and wholesale power markets;

•regulatory and judicial decisions, developments and proceedings;

•new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory and energy policy, nuclear plant operations and potential deregulation of retail electric markets;

•fuel and water supply availability;

•our ability to achieve timely and adequate rate recovery of our costs through our rates and adjustor recovery mechanisms, including returns on and of debt and equity capital investment;

•our ability to meet renewable energy and energy efficiency mandates and recover related costs;

•the ability of APS to achieve its clean energy goals (including a goal by 2050 of 100% clean, carbon-free electricity) and, if these goals are achieved, the impact of such achievement on APS, its customers, and its business, financial condition and results of operations;

•risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty;

•current and future economic conditions in Arizona, including in real estate markets;

•the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, droughts, or other catastrophic events, such as fires, explosions, pandemic health events, or similar occurrences;

•the development of new technologies which may affect electric sales or delivery;

•the cost of debt and equity capital and the ability to access capital markets when required;

•environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions;

•volatile fuel and purchased power costs;

•the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements;

•the liquidity of wholesale power markets and the use of derivative contracts in our business;

•potential shortfalls in insurance coverage;

•new accounting requirements or new interpretations of existing requirements;

•generation, transmission and distribution facility and system conditions and operating costs;

•the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region;

•the willingness or ability of our counterparties, power plant participants and power plant landowners to meet contractual or other obligations or extend the rights for continued power plant operations; and

•restrictions on dividends or other provisions in our credit agreements and Arizona Corporation Commission orders.

These and other factors are discussed in Risk Factors described in Part 1, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which readers should review carefully before placing any reliance on our financial statements or disclosures. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law.

# # #

PINNACLE WEST CAPITAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

(dollars and shares in thousands, except per share amounts)

| THREE MONTHS ENDED | SIX MONTHS ENDED | |||||||||||||||||||||||||

| JUNE 30, | JUNE 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Operating Revenues | $ 1,000,249 | $ 929,590 | $ 1,696,724 | $ 1,591,520 | ||||||||||||||||||||||

| Operating Expenses | ||||||||||||||||||||||||||

| Fuel and purchased power | 269,835 | 238,382 | 468,062 | 426,903 | ||||||||||||||||||||||

| Operations and maintenance | 229,690 | 219,392 | 459,745 | 440,710 | ||||||||||||||||||||||

| Depreciation and amortization | 158,750 | 152,482 | 316,570 | 306,561 | ||||||||||||||||||||||

| Taxes other than income taxes | 59,495 | 56,768 | 118,978 | 113,536 | ||||||||||||||||||||||

| Other expenses | 4,093 | 692 | 7,449 | 1,514 | ||||||||||||||||||||||

| Total | 721,863 | 667,716 | 1,370,804 | 1,289,224 | ||||||||||||||||||||||

| Operating Income | 278,386 | 261,874 | 325,920 | 302,296 | ||||||||||||||||||||||

| Other Income (Deductions) | ||||||||||||||||||||||||||

| Allowance for equity funds used during construction | 9,990 | 8,811 | 19,197 | 16,508 | ||||||||||||||||||||||

| Pension and other postretirement non-service credits - net | 28,175 | 14,142 | 55,966 | 28,053 | ||||||||||||||||||||||

| Other income | 12,207 | 16,670 | 24,636 | 29,239 | ||||||||||||||||||||||

| Other expense | (5,184) | (4,036) | (9,037) | (8,820) | ||||||||||||||||||||||

| Total | 45,188 | 35,587 | 90,762 | 64,980 | ||||||||||||||||||||||

| Interest Expense | ||||||||||||||||||||||||||

| Interest charges | 62,777 | 62,690 | 124,715 | 121,924 | ||||||||||||||||||||||

| Allowance for borrowed funds used during construction | (5,199) | (4,749) | (10,193) | (8,825) | ||||||||||||||||||||||

| Total | 57,578 | 57,941 | 114,522 | 113,099 | ||||||||||||||||||||||

| Income Before Income Taxes | 265,996 | 239,520 | 302,160 | 254,177 | ||||||||||||||||||||||

| Income Taxes | 46,560 | 41,061 | 42,210 | 20,852 | ||||||||||||||||||||||

| Net Income | 219,436 | 198,459 | 259,950 | 233,325 | ||||||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 3,739 | 4,874 | 8,612 | 9,747 | ||||||||||||||||||||||

| Net Income Attributable To Common Shareholders | $ 215,697 | $ 193,585 | $ 251,338 | $ 223,578 | ||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Basic | 112,882 | 112,638 | 112,855 | 112,616 | ||||||||||||||||||||||

| Weighted-Average Common Shares Outstanding - Diluted | 113,223 | 112,879 | 113,158 | 112,871 | ||||||||||||||||||||||

| Earnings Per Weighted-Average Common Share Outstanding | ||||||||||||||||||||||||||

| Net income attributable to common shareholders - basic | $ 1.91 | $ 1.72 | $ 2.23 | $ 1.99 | ||||||||||||||||||||||

| Net income attributable to common shareholders - diluted | $ 1.91 | $ 1.71 | $ 2.22 | $ 1.98 | ||||||||||||||||||||||

POWERING GROWTH DELIVERING VALUE Second Quarter 2021 Results August 5, 2021 1

Forward Looking Statements 2 This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project,” "anticipate," "goal," "seek," "strategy," "likely," "should," "will," "could," and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: the potential effects of the continued COVID-19 pandemic, including, but not limited to, demand for energy, economic growth, our employees and contractors, supply chain, expenses, capital markets, capital projects, operations and maintenance activities, uncollectable accounts, liquidity, cash flows, or other unpredictable events; our ability to manage capital expenditures and operations and maintenance costs while maintaining reliability and customer service levels; variations in demand for electricity, including those due to weather, seasonality, the general economy or social conditions, customer and sales growth (or decline), the effects of energy conservation measures and distributed generation, and technological advancements; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory and energy policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs through our rates and adjustor recovery mechanisms, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; the ability of APS to achieve its clean energy goals (including a goal by 2050 of 100% clean, carbon-free electricity) and, if these goals are achieved, the impact of such achievement on APS, its customers, and its business, financial condition and results of operations; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the direct or indirect effect on our facilities or business from cybersecurity threats or intrusions, data security breaches, terrorist attack, physical attack, severe storms, droughts, or other catastrophic events, such as fires, explosions, pandemic health events, or similar occurrences; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land- owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. Second Quarter 2021

EPS Variances Second Quarter 20213 1 Includes costs and offsetting operating revenues associated with renewable energy and demand side management programs, see slide 17 for more information. 2 Includes the deferral impacts of the Four Corners Selective Catalytic Reduction (SCR) equipment and Ocotillo Modernization Project (OMP), see slide 21 for more information. 3 The Effective Tax Rate is primarily impacted by the amortization of excess deferred taxes related to Federal Tax Reform, which is offset in Operating Revenue less Fuel and Purchased Power. 2Q 2020 2Q 2021 O&M1 & 2 $(0.07) $1.71 $1.91 Operating Revenue less Fuel and Purchased Power1 $0.26 Pension & OPEB Non- service Credits, net $0.09 Effective Tax Rate3 $0.01 Other, net2 $(0.04) D&A2 $(0.04) Other Taxes2 $(0.02) 2nd Quarter 2021 vs. 2nd Quarter 2020 Operating Revenue less Fuel and Purchased Power Sales/Usage Weather Other LFCR Transmission Federal Tax Reform3 $ $ $ $ $ 0.18 0.04 0.03 0.01 0.01 (0.01) Interest, net of AFUDC $0.01

Key Drivers & Guidance Second Quarter 20214 As of August 5, 2021 • Retail customer growth about 1.5-2.5% • Weather-normalized retail electricity sales growth of 1.0-2.0% on average1 2021 – 2023 Guidance 2021 Key Drivers • EPS guidance pending APS rate case conclusion • Retail customer growth about 1.5-2.5% • Weather-normalized retail electricity sales growth of 1.0%-2.0% • Transmission revenue • Operations and maintenance • Depreciation and amortization • Interest rates • AFUDC • Pension & OPEB 1 Excludes projected sales growth of large new manufacturing customers.

Long-Term Debt Maturity Profile Second Quarter 20215 ($MM) As of June 30, 2021 0 250 500 750 1,000 1,250 2021 2023 2025 2027 2029 2031 2033 2035 2037 2039 2041 2043 2045 2047 2049 APS Long-Term Debt PNW Long-Term Debt

Economic Development Second Quarter 20216 Arizona expected to add nearly 550,000 jobs between 2019 and 20291 Phoenix #1 among U.S. metros for new residents added in 20202 Phoenix's metro ranked 7th in the nation among large cities for its new business formation rate3 Phoenix metro ranked second in the nation for expected industrial space growth in 20214 Future Expansions Taiwan Semiconductor broke ground in 2021 and is expected to be operational by 2024. MLily selected Goodyear for their second U.S. factory. The nearly 650,000 square-foot facility is expected to add 424 new jobs and $33M in capital investment. UACJ Automotive Whitehall Industries selected Flagstaff for their fourth production plant. The planned $60M investment is expected to create an estimated 350 jobs. 1 Arizona Office of Economic Opportunity. 2 Redfin. February 4, 2021 3 Phoenix Business Journal. March 3, 2021 4 Phoenix Business Journal. April 14, 2021

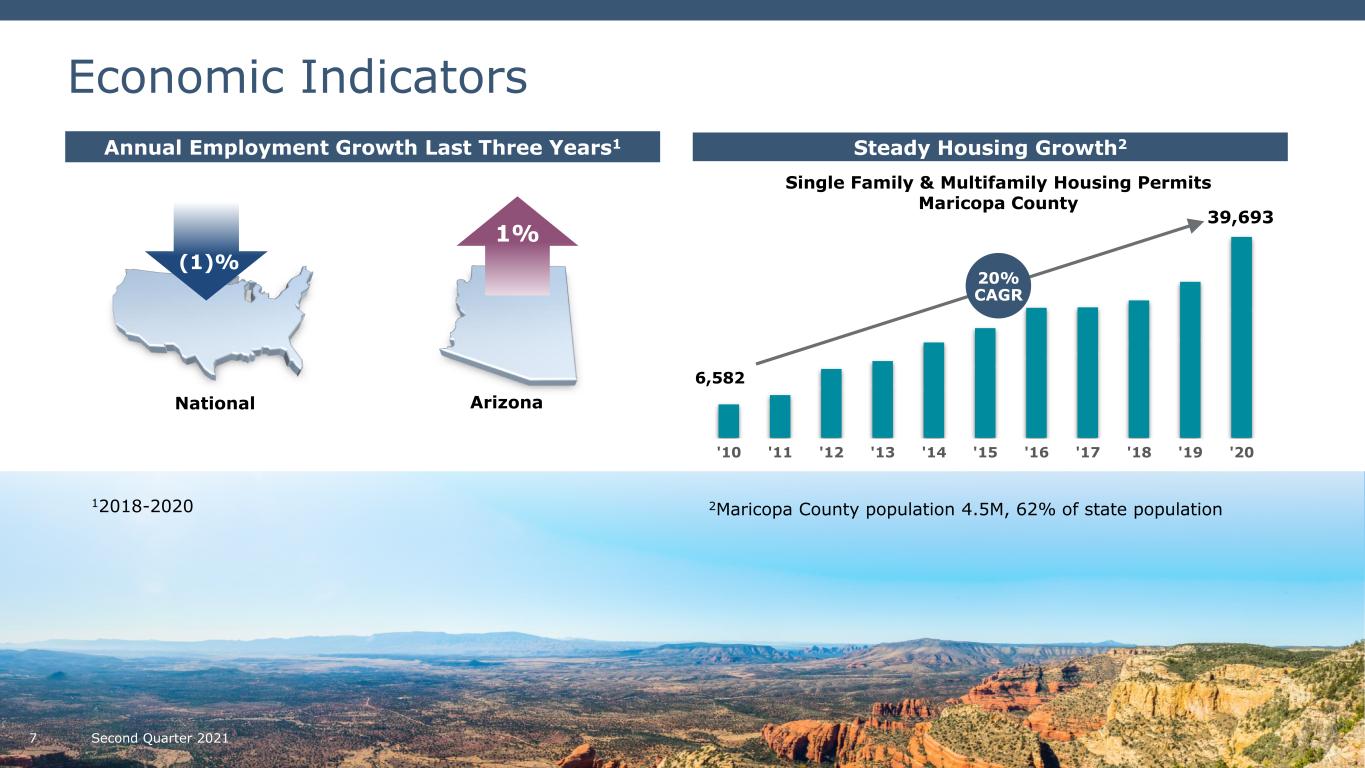

7 Economic Indicators Annual Employment Growth Last Three Years1 Steady Housing Growth2 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 Single Family & Multifamily Housing Permits Maricopa County 20% CAGR 6,582 39,693 National Arizona (1)% 1% Second Quarter 2021 2Maricopa County population 4.5M, 62% of state population12018-2020

APS Capital Expenditures Second Quarter 20218 Capital expenditures will support our growing customer base and our transition to a cleaner generation mix. $146 $221 $181 $179 $612 $577 $556 $549 $169 $185 $181 $179 $136 $314 $392 $406 $199 $203 $190 $187 $1,262 $1,500 $1,500 $1,500 $- $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2020 2021 2022 2023 Traditional Generation Clean Generation Transmission Distribution Other • 2021–2023 as disclosed in the Second Quarter 2021 Form 10-Q. $ in millions PROJECTED

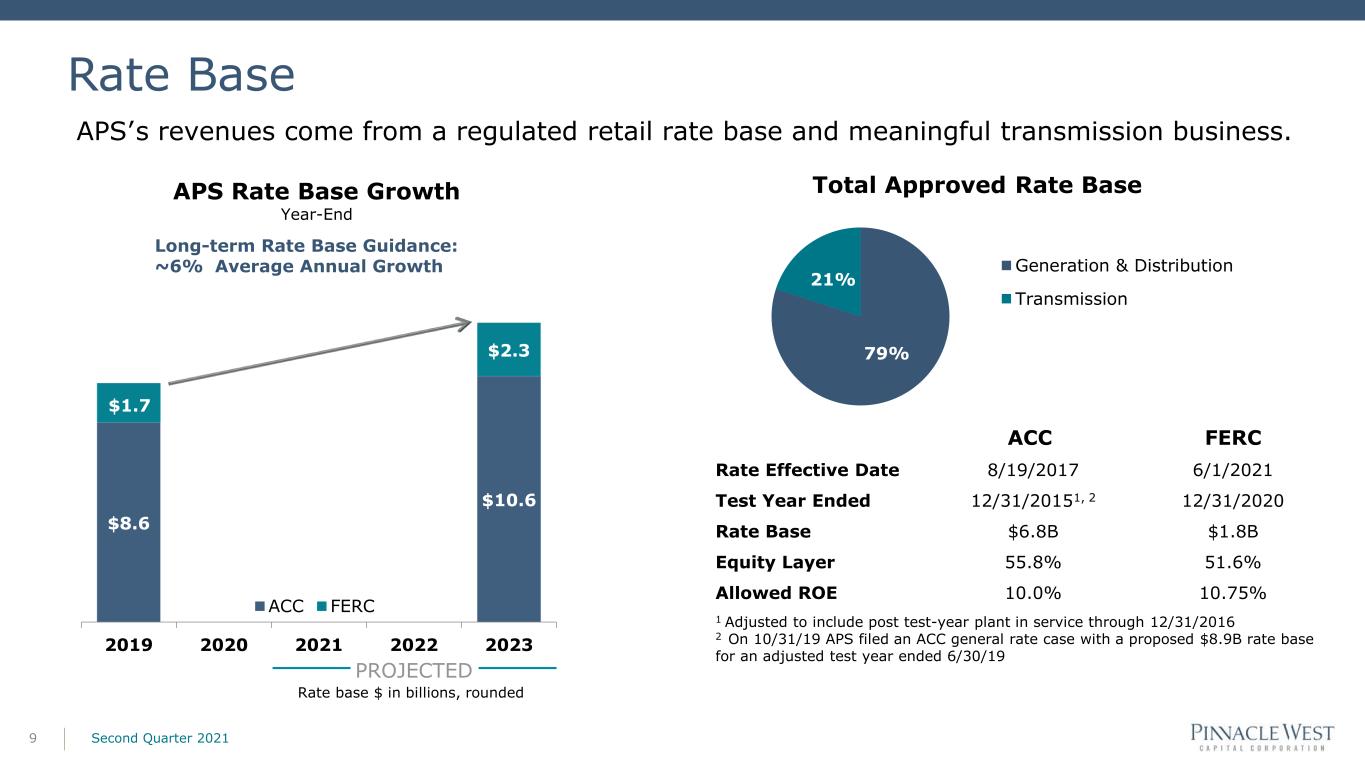

Rate Base Second Quarter 20219 $8.6 $10.6 $1.7 $2.3 2019 2020 2021 2022 2023 APS Rate Base Growth Year-End ACC FERC Total Approved Rate Base ACC FERC Rate Effective Date 8/19/2017 6/1/2021 Test Year Ended 12/31/20151, 2 12/31/2020 Rate Base $6.8B $1.8B Equity Layer 55.8% 51.6% Allowed ROE 10.0% 10.75% 1 Adjusted to include post test-year plant in service through 12/31/2016 2 On 10/31/19 APS filed an ACC general rate case with a proposed $8.9B rate base for an adjusted test year ended 6/30/19 79% 21% Generation & Distribution Transmission Rate base $ in billions, rounded APS’s revenues come from a regulated retail rate base and meaningful transmission business. Long-term Rate Base Guidance: ~6% Average Annual Growth PROJECTED

Operations & Maintenance Second Quarter 202110 795 859 808 841 63 74 48 45 $858 $933 $856 $886 2017 2018 2019 2020 PNW Consolidated ex RES/DSM Planned Fleet Outages 2 1 Excludes RES/DSM of $91 million in 2017, $104 million in 2018, $86 million in 2019, and $73 million in 2020. 2 $46 million of future O&M was pulled forward from future years to utilize above average weather benefit in 2020. $ in millions Goal is to keep O&M per kWh flat, adjusted for planned outages. 1

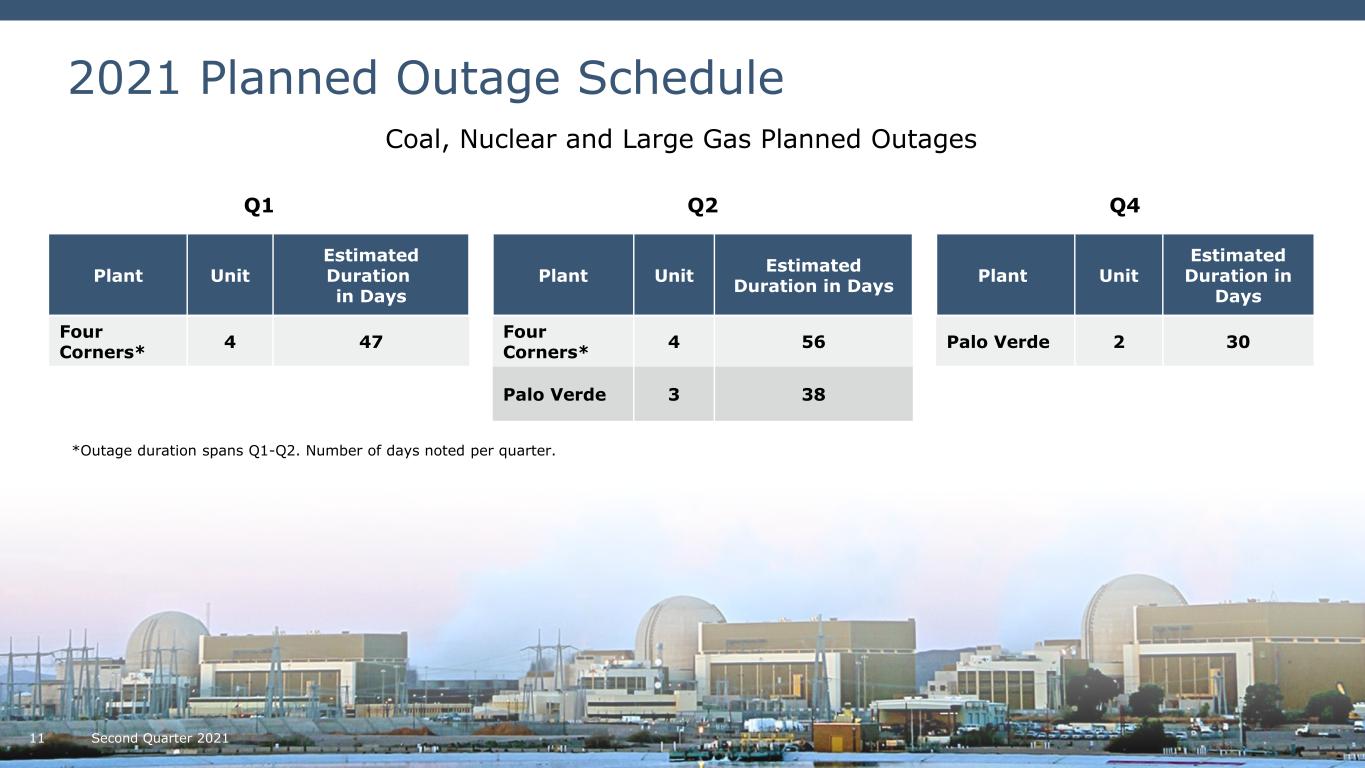

2021 Planned Outage Schedule Second Quarter 202111 Coal, Nuclear and Large Gas Planned Outages Q1 Q2 Q4 Plant Unit Estimated Duration in Days Plant Unit Estimated Duration in Days Plant Unit Estimated Duration in Days Four Corners* 4 47 Four Corners* 4 56 Palo Verde 2 30 Palo Verde 3 38 *Outage duration spans Q1-Q2. Number of days noted per quarter.

APPENDIX 12

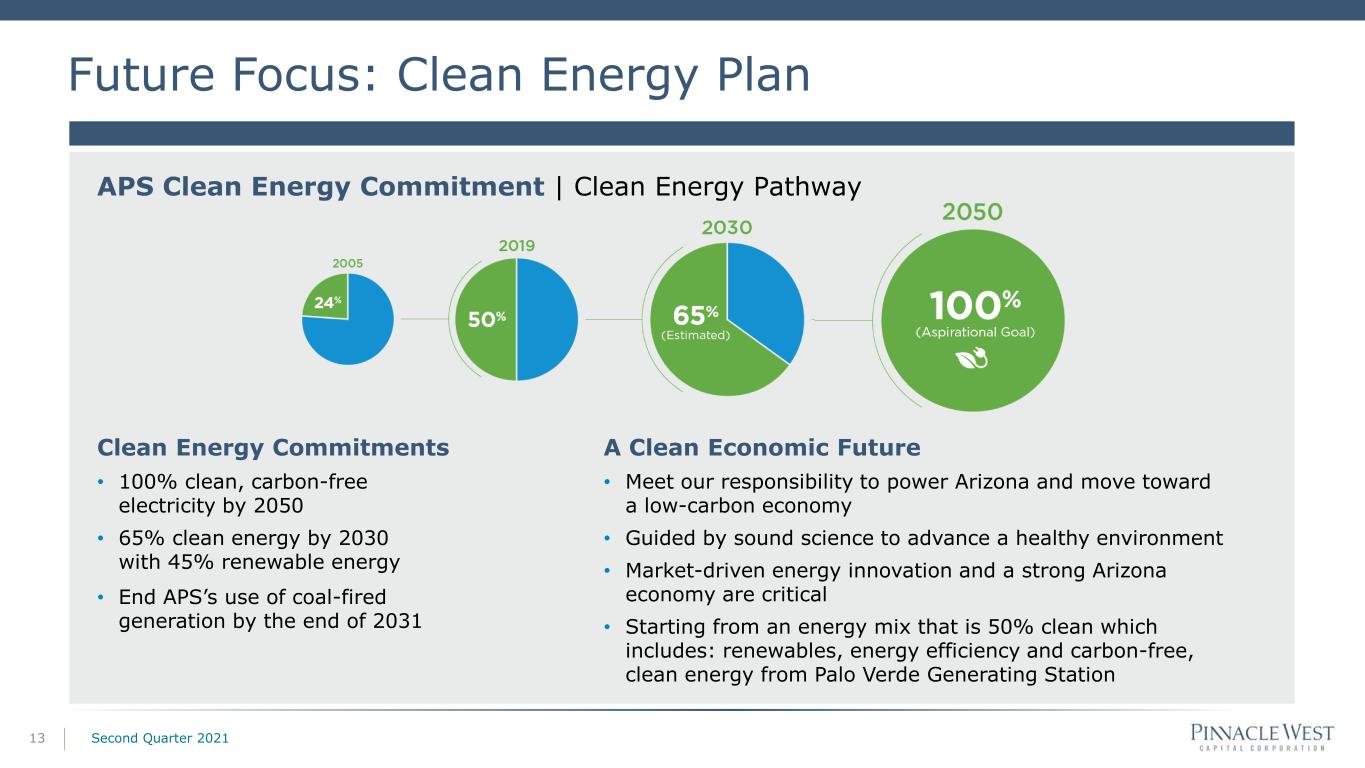

Future Focus: Clean Energy Plan Second Quarter 202113 Clean Energy Commitments • 100% clean, carbon-free electricity by 2050 • 65% clean energy by 2030 with 45% renewable energy • End APS’s use of coal-fired generation by the end of 2031 A Clean Economic Future • Meet our responsibility to power Arizona and move toward a low-carbon economy • Guided by sound science to advance a healthy environment • Market-driven energy innovation and a strong Arizona economy are critical • Starting from an energy mix that is 50% clean which includes: renewables, energy efficiency and carbon-free, clean energy from Palo Verde Generating Station APS Clean Energy Commitment | Clean Energy Pathway

Resource Planning Second Quarter 202114 Storage Contracted • 201 MW located on eight APS solar plant sites • Utility owned • Expected in service 2022 and 2023 Wind Contracted • 20-year PPA for 200 MW of wind resources • Re-power of existing wind facility • Expected in service in 2021 Demand Response Contracted • 5-year term beginning June 1, 2021 • 60 MW year 1 and 75 MW per year after • Up to 18 events per season (June-Sept) All-Source RFP • 600-800 MW renewable energy • 400-600 MW peaking capacity • Accepting proposals for utility ownership and PPA projects • To be in service in 2023 and 2024 Procurement Activities

Credit Ratings & Metrics Second Quarter 202115 Source: Standard & Poor’s APS Pinnacle West Corporate Credit Ratings1 Moody’s A2 A3 S&P A- A- Fitch A- A- Senior Unsecured1 Moody’s A2 A3 S&P A- BBB+ Fitch A A- S&P rates the outlooks for APS and Pinnacle West as Stable. Fitch & Moody’s rate the outlooks for both as Negative. 1 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. S&P Credit Metrics TME 3/31/21 APS FFO/Debt 21.0% Debt/EBITDA 4.0x Debt/Capitalization 50.5% Pinnacle West FFO/Debt 19.4% Debt/EBITDA 4.4x Debt/Capitalization 55.2%

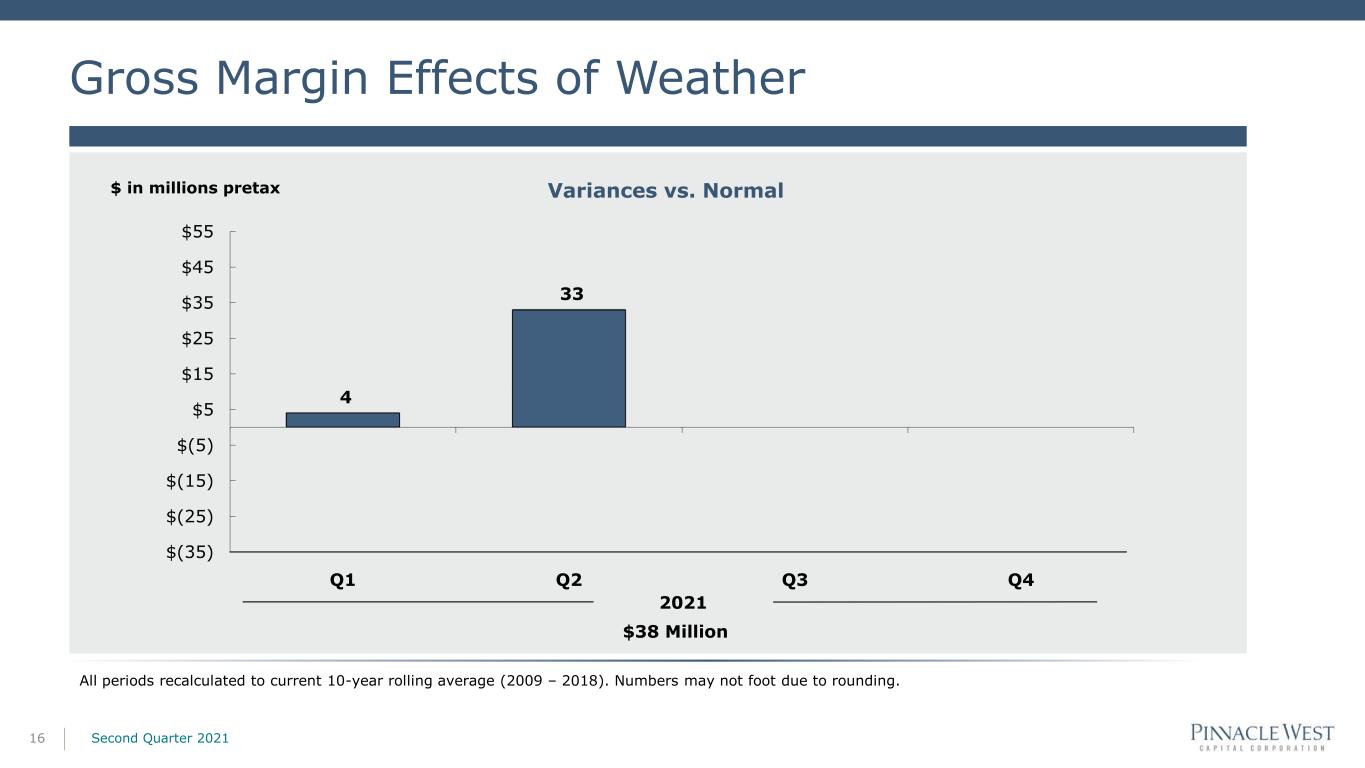

4 33 $(35) $(25) $(15) $(5) $5 $15 $25 $35 $45 $55 Q1 Q2 Q3 Q4 Gross Margin Effects of Weather Second Quarter 202116 Variances vs. Normal$ in millions pretax 2021 $38 Million All periods recalculated to current 10-year rolling average (2009 – 2018). Numbers may not foot due to rounding.

Renewable Energy & Demand Side Management Expenses1 Second Quarter 202117 $7 $3 $6 $9 $7 $6 $11 $12 $14 $11 $11 $12 $0 $10 $20 Q1 Q2 Q3 Q4 Q1 Q2 Demand Side Management Renewable Energy 2020 $73 Million 1 Renewable energy and demand side management expenses are offset by adjustment mechanisms. 2021 $36 Million

Residential PV Applications1 Second Quarter 202118 1Monthly data equals applications received minus cancelled applications. As of June 30, 2021 approximately 127,040 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 1,054 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site but are not included in the chart above Residential DG (MWdc) Annual Additions 0 500 1,000 1,500 2,000 2,500 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2018 Applications 2019 Applications 2020 Applications 2021 Applications 133 122 139 84 2018 2019 2020 2021

Regulatory 2021 Key Dates Second Quarter 202119 ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Power Supply Adjustor (PSA): E-01345A-16-0036 Approved March 24 50% Effective April 1 50% Effective November 1 Lost Fixed Cost Recovery: E-01345A-16-0036 Filed Feb 15 Increase denied April 13 Transmission Cost Adjustor: E-01345A-16-0036 Filed May 15 Effective Jun 1 2021 DSM/EE Implementation Plan: E-01345A-20-0151 Effective July 15 2021 RES Implementation Plan: E-01345A-20-0199 Effective July 1 2019 Rate Case: E-01345A-19-0236 Hearing Ended March 3 Briefs Filed April 6, 30 Resource Planning and Procurement: E-00000V-19-0034 Workshops March 15 and 18 Resource Comparison Proxy (RCP): E-01345A-20-0113 Effective October 1 Possible Modification to Commission’s Energy Rules: RU-00000A-18-0284 Preliminary Approval May 26 Proposed Termination of Service Rule Modifications: RU-00000A-19-0132 March 23 Open Meeting Preliminary Approval April 14

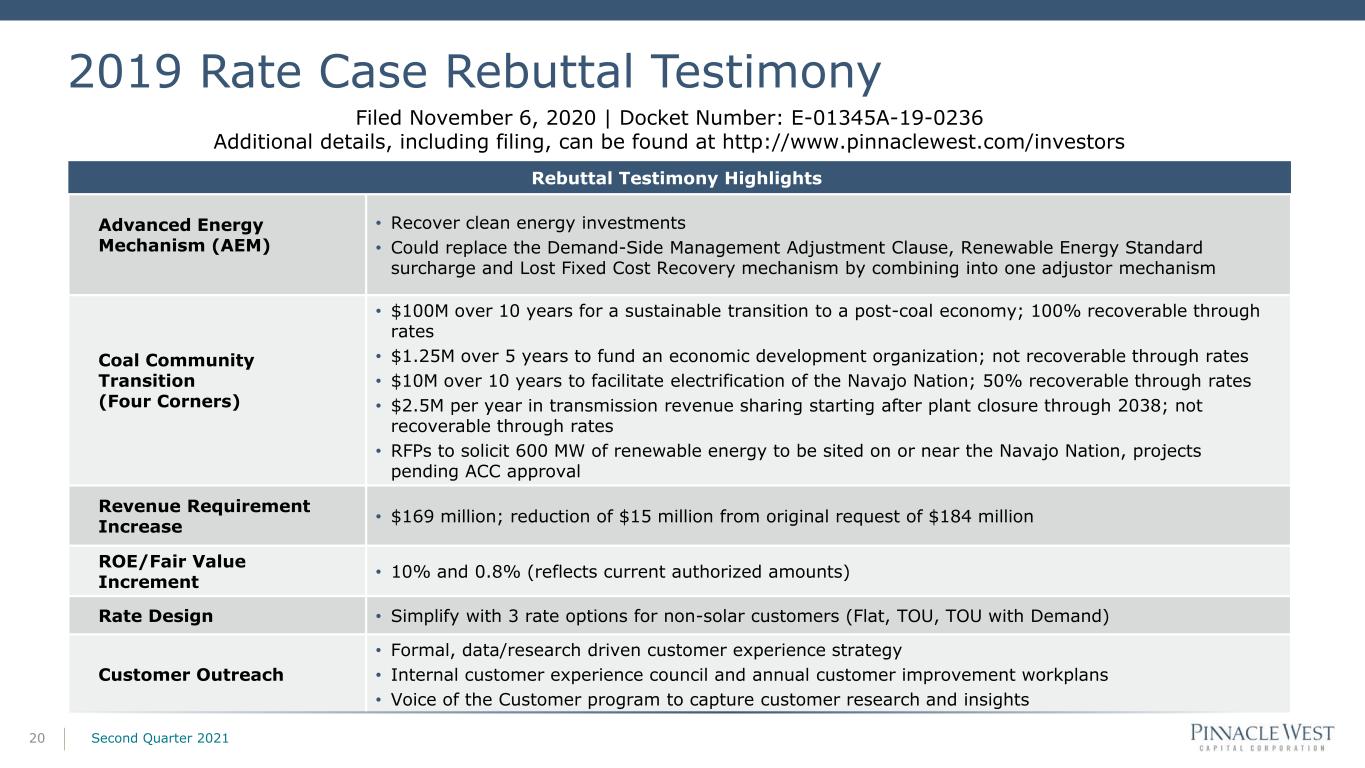

Rebuttal Testimony Highlights Advanced Energy Mechanism (AEM) • Recover clean energy investments • Could replace the Demand-Side Management Adjustment Clause, Renewable Energy Standard surcharge and Lost Fixed Cost Recovery mechanism by combining into one adjustor mechanism Coal Community Transition (Four Corners) • $100M over 10 years for a sustainable transition to a post-coal economy; 100% recoverable through rates • $1.25M over 5 years to fund an economic development organization; not recoverable through rates • $10M over 10 years to facilitate electrification of the Navajo Nation; 50% recoverable through rates • $2.5M per year in transmission revenue sharing starting after plant closure through 2038; not recoverable through rates • RFPs to solicit 600 MW of renewable energy to be sited on or near the Navajo Nation, projects pending ACC approval Revenue Requirement Increase • $169 million; reduction of $15 million from original request of $184 million ROE/Fair Value Increment • 10% and 0.8% (reflects current authorized amounts) Rate Design • Simplify with 3 rate options for non-solar customers (Flat, TOU, TOU with Demand) Customer Outreach • Formal, data/research driven customer experience strategy • Internal customer experience council and annual customer improvement workplans • Voice of the Customer program to capture customer research and insights 2019 Rate Case Rebuttal Testimony Second Quarter 202120 Filed November 6, 2020 | Docket Number: E-01345A-19-0236 Additional details, including filing, can be found at http://www.pinnaclewest.com/investors

Key Financials Second Quarter 202121 Test year ended June 30, 2019 Total Rate Base - Adjusted $11.2 Billion ACC Rate Base - Adjusted $8.9 Billion Allowed Return on Equity 10.0% Capital Structure Long-term debt 45.3% Common equity 54.7% Base Fuel Rate (¢/kWh) 3.1451 Post-test year plant period 12 months Overview of Rate Increase ($ in Millions) Total stated base rate increase (inclusive of existing adjustor transfers) $ 41 1.2% Plus: Transfer to base rates of various adjustors already in effect $ 115 3.5% Plus: Coal Community Transition funding through the AEM $ 13 0.4% Net Customer Bill Impact $ 169 5.1% Rebuttal Testimony SCR and Ocotillo Cost Deferrals $ in Millions Q2 2021 Q2 2020 Operating Cost Deferral Impacts: Depreciation and Amortization $6 $7 Operations and Maintenance $(1) $(0) Taxes Other Than Income Taxes $(3) $(3) Debt Return Deferral Impacts: Interest Charges $(10) $(11) Other Income $10 $11 See Note 4, Regulatory Matters, in Form 10-Q for the period ended June 30, 2021 for additional information related to the SCR and Ocotillo Modernization Project cost deferrals.

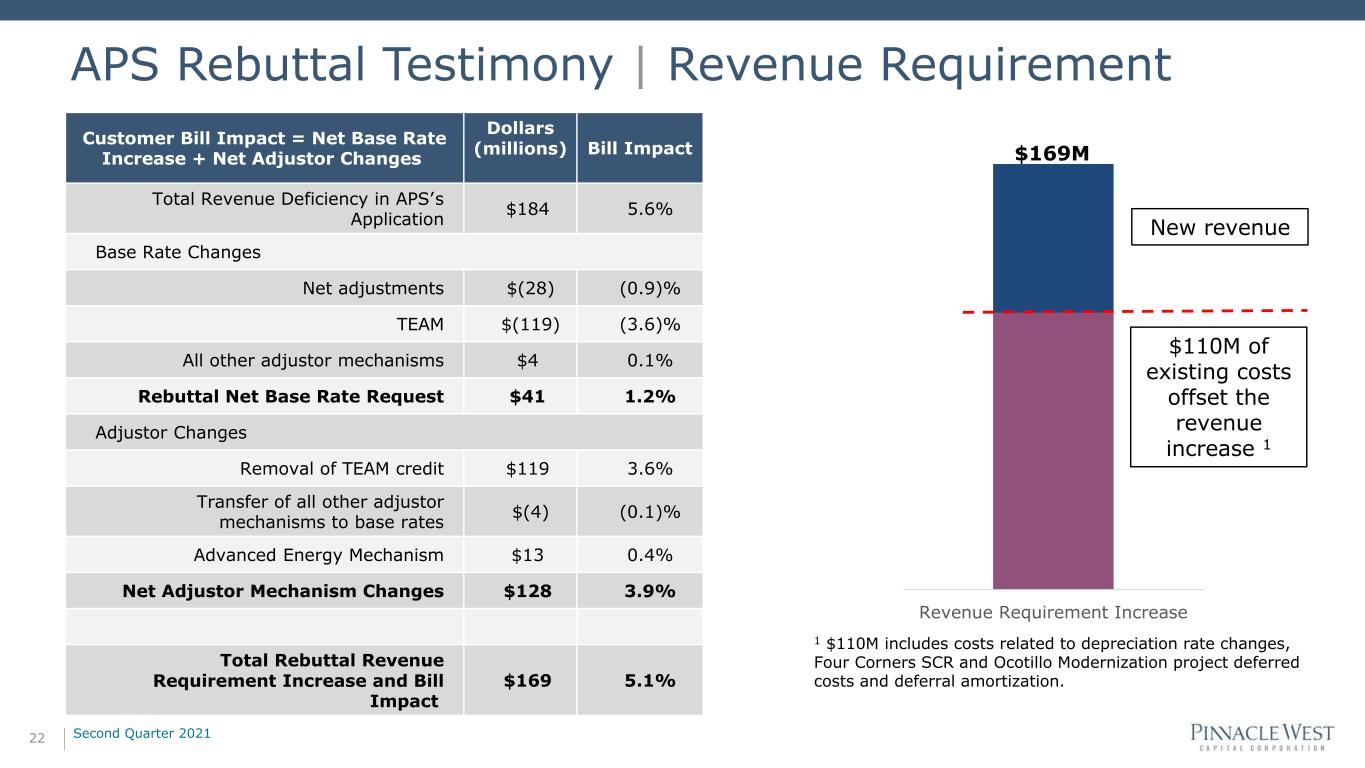

Customer Bill Impact = Net Base Rate Increase + Net Adjustor Changes Dollars (millions) Bill Impact Total Revenue Deficiency in APS’s Application $184 5.6% Base Rate Changes Net adjustments $(28) (0.9)% TEAM $(119) (3.6)% All other adjustor mechanisms $4 0.1% Rebuttal Net Base Rate Request $41 1.2% Adjustor Changes Removal of TEAM credit $119 3.6% Transfer of all other adjustor mechanisms to base rates $(4) (0.1)% Advanced Energy Mechanism $13 0.4% Net Adjustor Mechanism Changes $128 3.9% Total Rebuttal Revenue Requirement Increase and Bill Impact $169 5.1% APS Rebuttal Testimony | Revenue Requirement 22 Revenue Requirement Increase $110M of existing costs offset the revenue increase 1 $169M New revenue 1 $110M includes costs related to depreciation rate changes, Four Corners SCR and Ocotillo Modernization project deferred costs and deferral amortization. Second Quarter 2021

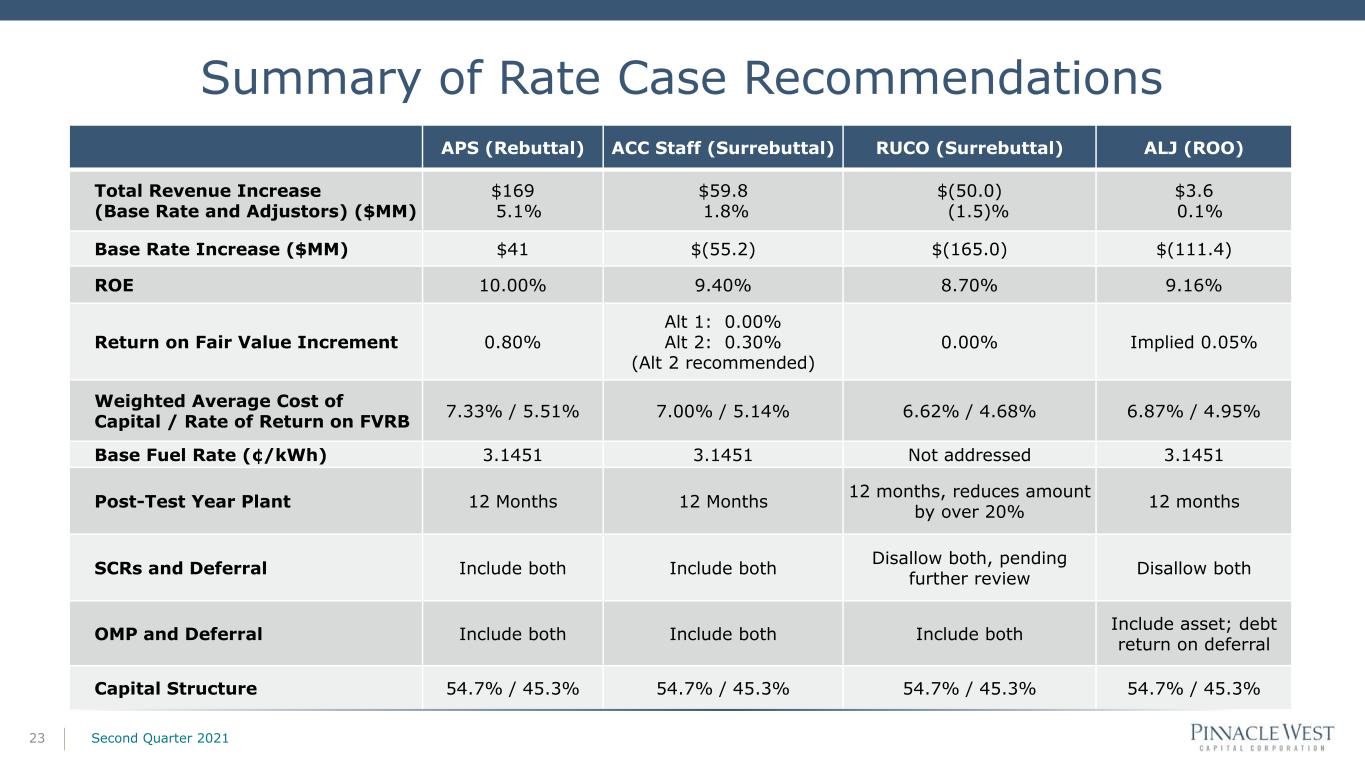

APS (Rebuttal) ACC Staff (Surrebuttal) RUCO (Surrebuttal) ALJ (ROO) Total Revenue Increase (Base Rate and Adjustors) ($MM) $169 5.1% $59.8 1.8% $(50.0) (1.5)% $3.6 0.1% Base Rate Increase ($MM) $41 $(55.2) $(165.0) $(111.4) ROE 10.00% 9.40% 8.70% 9.16% Return on Fair Value Increment 0.80% Alt 1: 0.00% Alt 2: 0.30% (Alt 2 recommended) 0.00% Implied 0.05% Weighted Average Cost of Capital / Rate of Return on FVRB 7.33% / 5.51% 7.00% / 5.14% 6.62% / 4.68% 6.87% / 4.95% Base Fuel Rate (¢/kWh) 3.1451 3.1451 Not addressed 3.1451 Post-Test Year Plant 12 Months 12 Months 12 months, reduces amount by over 20% 12 months SCRs and Deferral Include both Include both Disallow both, pending further review Disallow both OMP and Deferral Include both Include both Include both Include asset; debt return on deferral Capital Structure 54.7% / 45.3% 54.7% / 45.3% 54.7% / 45.3% 54.7% / 45.3% Summary of Rate Case Recommendations Second Quarter 202123

Recommended Opinion and Order Estimated Impacts Second Quarter 202124 Net Income • ROO, if approved, could decrease annual net income up to about $90 million Four Corners SCR Investment • As of June 30, 2021 SCR deferral balance was approximately $75 million1 • As of June 30, 2021 the SCR net book value was approximately $320 million1 1 Net of accumulated deferred income tax.

APS Rate Case Procedural Schedule Second Quarter 202125 Arizona Public Service Company Docket #E-01345A-19-0236 • Application Filed (October 31, 2019) • Staff/Intervenor Direct Testimony (October 2, 2020) • Staff/Intervenor Direct Testimony (Rate Design) (October 9, 2020) • APS Rebuttal Testimony (November 6, 2020) • Staff/Intervenor Surrebuttal Testimony (December 4, 2020) • APS Rejoinder Testimony (December 22, 2020) • Hearing Ended (March 3, 2021) • Initial Briefs (April 6, 2021) • Reply Briefs (April 30, 2021)

Consolidated Statistics Second Quarter 202126 3 Months Ended June 30 Numbers may not foot due to rounding. 3 Months Ended June 30 2021 2020 Incr (Decr) 2021 2020 Incr (Decr) ELECTRIC OPERATING REVENUES (Dollars in Millions) Retail Residential 532$ 515$ 17$ 873$ 840$ 32$ Business 421 381 40 736 684 51 Total Retail 953 896 56 1,608 1,525 84 Sales for Resale (Wholesale) 18 16 2 36 31 5 Transmission for Others 23 15 8 42 31 11 Other Miscellaneous Services 7 3 4 11 6 6 Total Operating Revenues 1,000$ 930$ 71$ 1,697$ 1,592$ 105$ ELECTRIC SALES (GWH) Retail Residential 3,799 3,670 129 6,380 6,180 200 Business 3,833 3,489 345 6,991 6,650 341 Total Retail Sales 7,632 7,159 474 13,371 12,830 541 Sales for Resale (Wholesale) 474 796 (322) 1,109 1,602 (494) Total Electric Sales 8,107 7,954 152 14,480 14,432 47 RETAIL SALES (GWH) - WEATHER NORMALIZED Residential 3,534 3,488 46 6,069 5,968 101 Business 3,767 3,418 349 6,934 6,614 320 Total Retail Sales 7,301 6,907 395 13,003 12,582 421 Retail sales (GWH) (% over prior year) 5.7% (0.7)% 3.3% 0.5% AVERAGE ELECTRIC CUSTOMERS Retail Customers Residential 1,172,488 1,145,060 27,428 1,171,410 1,144,899 26,511 Business 140,024 138,101 1,923 139,762 138,062 1,700 Total Retail 1,312,512 1,283,161 29,351 1,311,172 1,282,961 28,211 Wholesale Customers 46 44 2 43 45 (2) Total Customers 1,312,558 1,283,205 29,353 1,311,215 1,283,006 28,209 Total Customer Growth (% over prior year) 2.3% 2.4% 2.2% 2.3% RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer) Residential 3,014 3,047 (32) 5,181 5,213 (32) Business 26,901 24,751 2,150 49,612 47,905 1,707 3 Months Ended June 30, 6 Months Ended June 30,

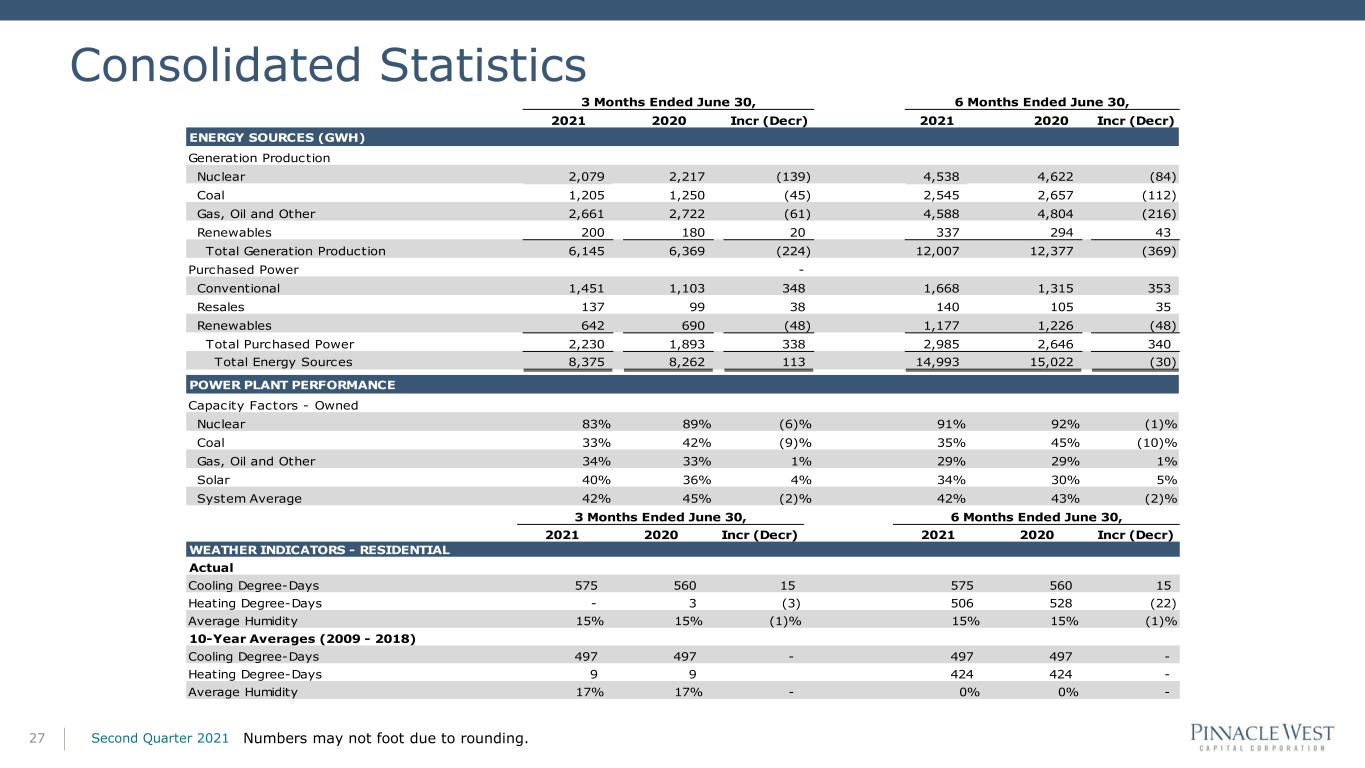

Consolidated Statistics Second Quarter 202127 Numbers may not foot due to rounding. 3 Months Ended June 30 2021 2020 Incr (Decr) 2021 2020 Incr (Decr) WEATHER INDICATORS - RESIDENTIAL Actual Cooling Degree-Days 575 560 15 575 560 15 Heating Degree-Days - 3 (3) 506 528 (22) Average Humidity 15% 15% (1)% 15% 15% (1)% 10-Year Averages (2009 - 2018) Cooling Degree-Days 497 497 - 497 497 - Heating Degree-Days 9 9 424 424 - Average Humidity 17% 17% - 0% 0% - 3 Months Ended June 30, 6 Months Ended June 30, 2021 2020 Incr (Decr) 2021 2020 Incr (Decr) ENERGY SOURCES (GWH) Generation Production Nuclear 2,079 2,217 (139) 4,538 4,622 (84) Coal 1,205 1,250 (45) 2,545 2,657 (112) Gas, Oil and Other 2,661 2,722 (61) 4,588 4,804 (216) Renewables 200 180 20 337 294 43 Total Generation Production 6,145 6,369 (224) 12,007 12,377 (369) Purchased Power - Conventional 1,451 1,103 348 1,668 1,315 353 Resales 137 99 38 140 105 35 Renewables 642 690 (48) 1,177 1,226 (48) Total Purchased Power 2,230 1,893 338 2,985 2,646 340 Total Energy Sources 8,375 8,262 113 14,993 15,022 (30) POWER PLANT PERFORMANCE Capacity Factors - Owned Nuclear 83% 89% (6)% 91% 92% (1)% Coal 33% 42% (9)% 35% 45% (10)% Gas, Oil and Other 34% 33% 1% 29% 29% 1% Solar 40% 36% 4% 34% 30% 5% System Average 42% 45% (2)% 42% 43% (2)% 3 Months Ended June 30, 6 Months Ended June 30,

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Introducing Altcat: Your AI Girlfriend Experience with Your Favorite Influencer

- Company announcement no 8 Idavang 2024 Annual General Meeting 26-04-2024

- PMD Device Solutions Publishes 2023 Annual Report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share