Form 8-K OWENS & MINOR INC/VA/ For: May 23

1 Confidential & Proprietary to Owens & Minor, Inc. UBS Global Healthcare Conference May 23, 2022

2 Confidential & Proprietary to Owens & Minor, Inc. Safe Harbor This presentation is intended to be disclosure through methods reasonably designed to provide broad, non-exclusionary distribution to the public in compliance with the SEC's Fair Disclosure Regulation. This presentation contains certain ''forward-looking'' statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this presentation regarding our expectations with respect to our 2022 financial performance, the Apria transaction, including related synergies and the expected performance of the Apria business, as well as statements related to the impact of COVID-19 on the Company’s results and operations and the Company’s expectations regarding the performance of its business. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2021, filed with the SEC including the sections captioned “Cautionary Note Regarding Forward-Looking Statements” and “Item 1A. Risk Factors,” and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the Company’s actual results to differ materially from its current estimates. These filings are available at www.owens-minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward-looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. This presentation includes certain combined financial information which reflects the sum of the relevant financial information for the Company and Apria without any other adjustments and refer to such presentation as on a “combined” basis for the applicable period. This combination does not comply with U.S. GAAP or with the rules for pro forma presentation. As a result, the combined financial information included in this presentation may differ from pro forma financial information prepared in accordance with U.S. GAAP and the rules and regulations of the SEC, and any such differences could be material. Numerical figures included in this presentation have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them. As such, the corresponding percentage aggregations may not sum to 100%. We present certain potential cost savings as an adjustment to Combined Adjusted EBITDA because we expect them to be a permitted addback pursuant to agreements that govern our indebtedness. These potential cost savings are based on assumptions and estimates that could be proved to be incorrect, and accordingly should not be viewed as a projection of future performance. Certain financial measures included herein are not made in accordance with U.S. GAAP and use of such terms varies from others in the same industry. Management uses these non-GAAP financial measures internally to evaluate our performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation. Non-GAAP financial measures should not be considered as alternatives to measures derived in accordance with U.S. GAAP. Non-GAAP financial measures have important limitations as analytical tools and you should not consider them in isolation or as substitutes for results as reported under U.S. GAAP. The appendix to this presentation includes a reconciliation of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with U.S. GAAP.

3 Confidential & Proprietary to Owens & Minor, Inc. Owens & Minor (OMI) – A Leading Healthcare Solutions Provider A growth-focused, integrated healthcare solutions provider with broad medical distribution reach, proprietary products and services, and a leading home health business that empowers customers to advance healthcare ✓ 140 years of legacy service ✓ Large North American manufacturing footprint that helps serve PPE needs ✓ Extensive medical distribution platform and network of trusted relationships ✓ Supported by value-added services and technology solutions that drive recurring revenue and “sticky” partnerships ✓ Portfolio of proprietary products and emerging home health business that we expect will fuel growth ✓ Record of strong growth in Patient Direct business since acquiring Byram Healthcare, expected to be enhanced by strategic acquisition of Apria 20,000+ Teammates Worldwide 400+ Facilities Worldwide 1,200+ Branded Manufacturers 4,000+ Healthcare Providers Served

4 Confidential & Proprietary to Owens & Minor, Inc. Key Business Highlights Leading healthcare solutions company with competitive advantages in manufacturing, distribution and home health Apria acquisition expands OMI’s presence in the fast-growing direct to patient home health market, now accounting for ~50% of OMI’s annualized Pro Forma Adj. EBITDA Strong free cash flow generating businesses provide ability to quickly reduce debt over the next 18-24 months while allowing for continued organic investments to fuel organic revenue growth and margin expansion 140-year distribution business provides infrastructure to continue growing OMI’s higher-margin proprietary products Unique vertically-integrated business model and proven strategic plan expected to drive continued organic revenue growth and margin expansion for years to come

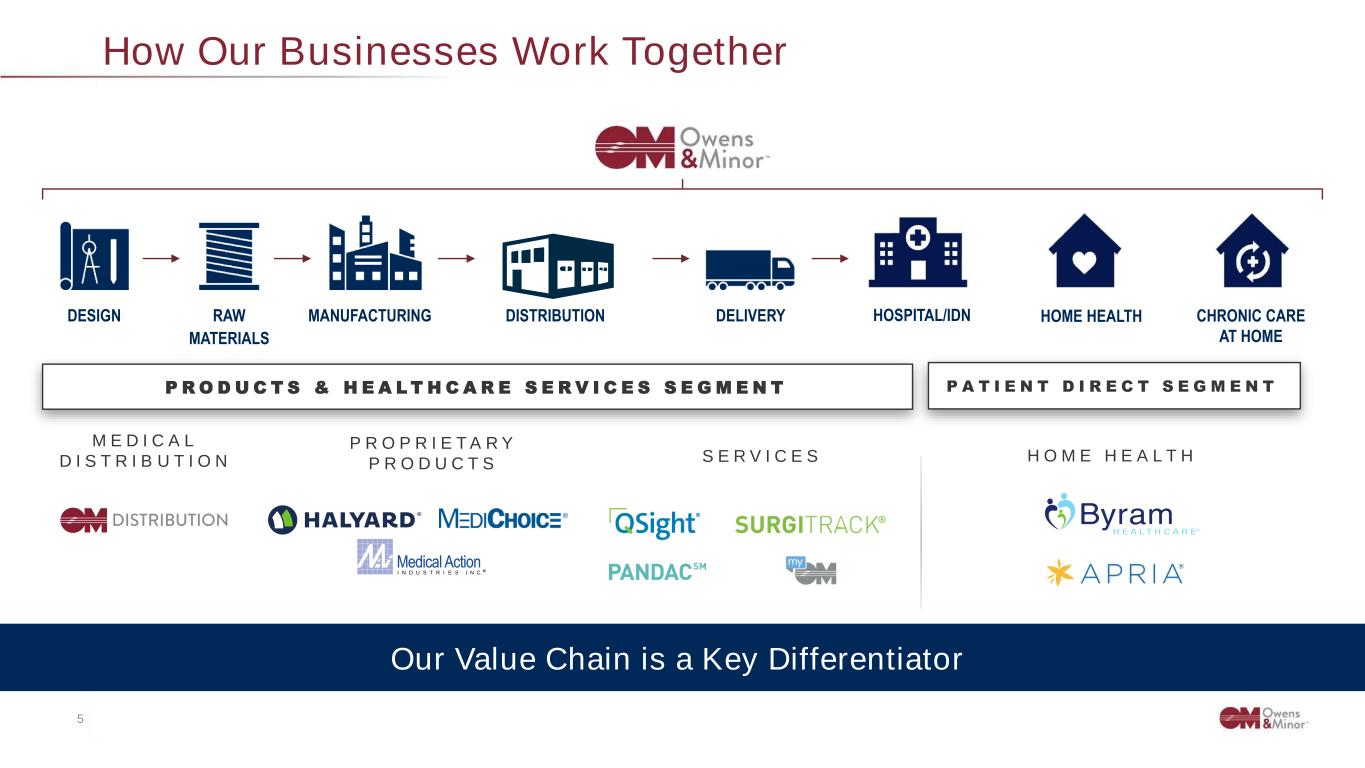

5 Confidential & Proprietary to Owens & Minor, Inc. How Our Businesses Work Together Our Value Chain is a Key Differentiator RAW MATERIALS DESIGN MANUFACTURING DISTRIBUTION DELIVERY HOSPITAL/IDN HOME HEALTH CHRONIC CARE AT HOME P A T I E N T D I R E C T S E G M E N TP R O D U C T S & H E A L T H C A R E S E R V I C E S S E G M E N T M E D I C A L D I S T R I B U T I O N S E R V I C E S P R O P R I E T A R Y P R O D U C T S H O M E H E A L T H

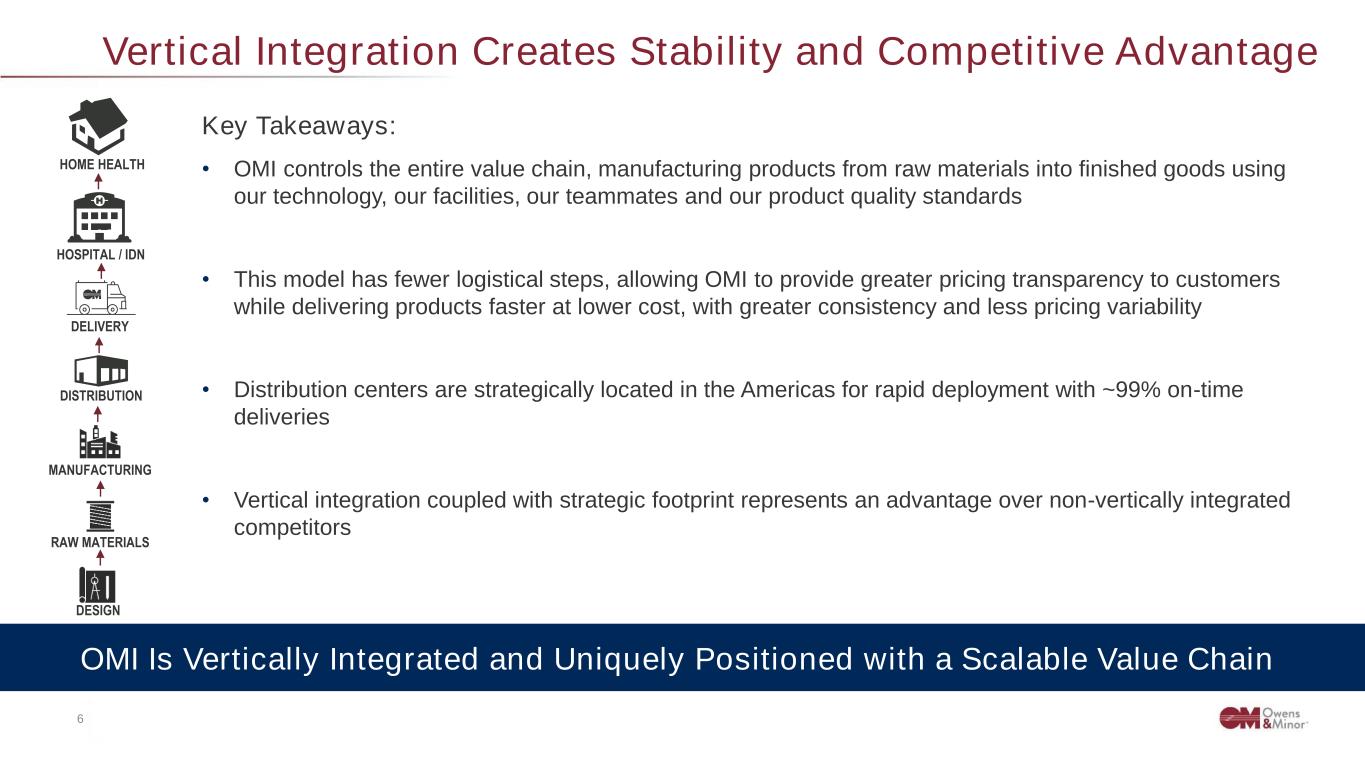

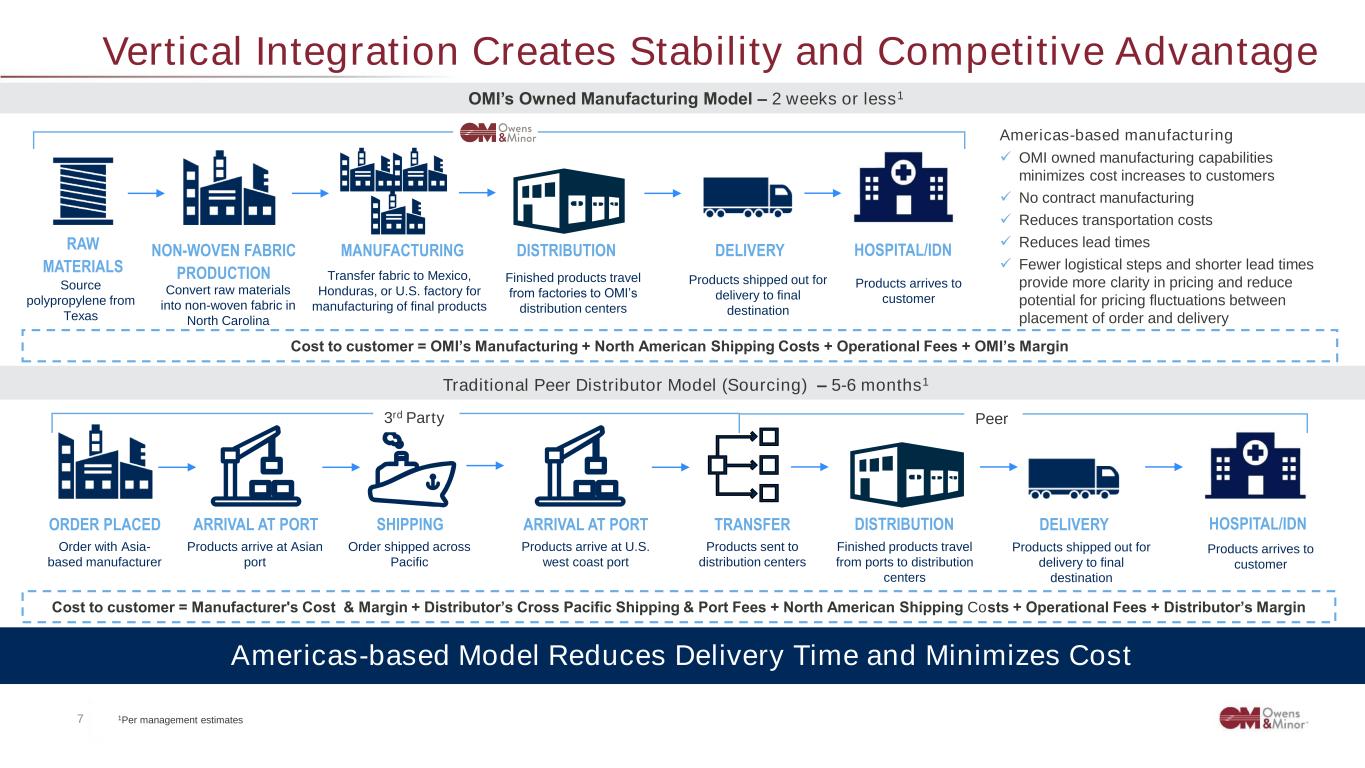

6 Confidential & Proprietary to Owens & Minor, Inc. OMI Is Vertically Integrated and Uniquely Positioned with a Scalable Value Chain Vertical Integration Creates Stability and Competitive Advantage DELIVERY DESIGN RAW MATERIALS MANUFACTURING DISTRIBUTION HOSPITAL / IDN HOME HEALTH Key Takeaways: • OMI controls the entire value chain, manufacturing products from raw materials into finished goods using our technology, our facilities, our teammates and our product quality standards • This model has fewer logistical steps, allowing OMI to provide greater pricing transparency to customers while delivering products faster at lower cost, with greater consistency and less pricing variability • Distribution centers are strategically located in the Americas for rapid deployment with ~99% on-time deliveries • Vertical integration coupled with strategic footprint represents an advantage over non-vertically integrated competitors

7 Confidential & Proprietary to Owens & Minor, Inc. HOSPITAL/IDN RAW MATERIALS NON-WOVEN FABRIC PRODUCTION DELIVERYDISTRIBUTION HOSPITAL/IDN Americas-based manufacturing ✓ OMI owned manufacturing capabilities minimizes cost increases to customers ✓ No contract manufacturing ✓ Reduces transportation costs ✓ Reduces lead times ✓ Fewer logistical steps and shorter lead times provide more clarity in pricing and reduce potential for pricing fluctuations between placement of order and delivery Traditional Peer Distributor Model (Sourcing) – 5-6 months1 OMI’s Owned Manufacturing Model – 2 weeks or less1 Source polypropylene from Texas ORDER PLACED SHIPPING ARRIVAL AT PORT MANUFACTURING Convert raw materials into non-woven fabric in North Carolina Transfer fabric to Mexico, Honduras, or U.S. factory for manufacturing of final products Products arrives to customer Finished products travel from factories to OMI’s distribution centers Products shipped out for delivery to final destination Finished products travel from ports to distribution centers DELIVERYDISTRIBUTION Products shipped out for delivery to final destination Order with Asia- based manufacturer Order shipped across Pacific ARRIVAL AT PORT Products arrive at Asian port Products arrive at U.S. west coast port TRANSFER Products sent to distribution centers Cost to customer = OMI’s Manufacturing + North American Shipping Costs + Operational Fees + OMI’s Margin Cost to customer = Manufacturer's Cost & Margin + Distributor’s Cross Pacific Shipping & Port Fees + North American Shipping Costs + Operational Fees + Distributor’s Margin 1Per management estimates 3rd Party Peer Vertical Integration Creates Stability and Competitive Advantage Americas-based Model Reduces Delivery Time and Minimizes Cost Products arrives to customer

8 Confidential & Proprietary to Owens & Minor, Inc. Patient Direct Growth Driven by Secular Trends Market Trends ◼U.S. population aged 65+ is expected to increase nearly 50% between 2019 and 20401Aging population ◼Home healthcare increasingly sought out as an attractive, cost-effective and clinically appropriate alternative to facility-based care ◼Pandemic environment further emphasized the need for home healthcare as a low-risk setting Continued shift toward home healthcare ◼Improved technology has increased number of treatments administered at home ◼Patients prefer the convenience of in-home care Preference for in-home care ◼The market remains highly fragmented with thousands of DME distributors Highly fragmented market ◼There are ~30 million people in the U.S. that have obstructive sleep apnea (OSA), ~80% of whom are undiagnosed2 ◼Increasing obesity rates and historically high prevalence of smoking will drive diagnosis rates for a number of chronic conditions ◼~50% of all Type 2 diabetics and ~80% of all those with clinically diagnosed obesity experience OSA Rising incidence of chronic diseases 1 2020 ACL/HHS Report: “2020 Profile of Older Americans” 2 American Academy of Sleep Medicine

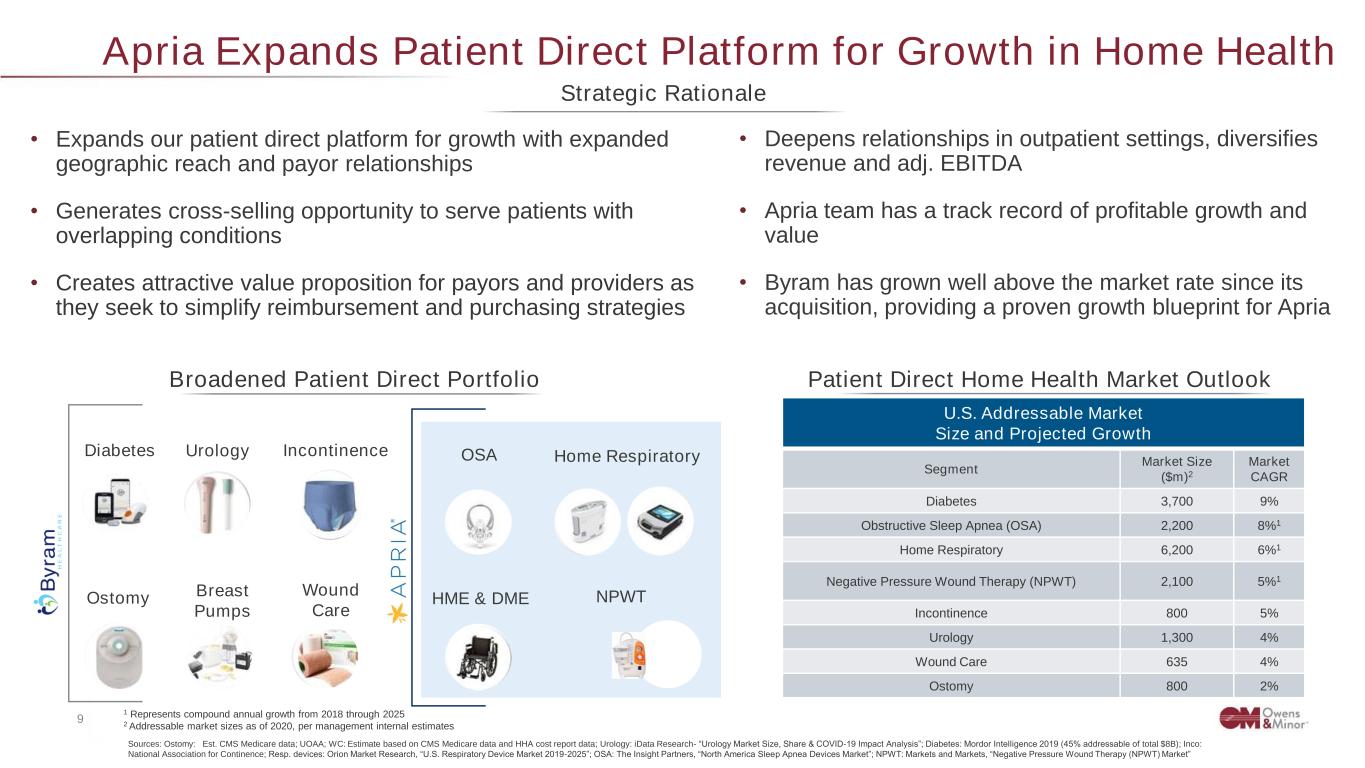

9 Confidential & Proprietary to Owens & Minor, Inc. Apria Expands Patient Direct Platform for Growth in Home Health Strategic Rationale • Expands our patient direct platform for growth with expanded geographic reach and payor relationships • Generates cross-selling opportunity to serve patients with overlapping conditions • Creates attractive value proposition for payors and providers as they seek to simplify reimbursement and purchasing strategies • Deepens relationships in outpatient settings, diversifies revenue and adj. EBITDA • Apria team has a track record of profitable growth and value • Byram has grown well above the market rate since its acquisition, providing a proven growth blueprint for Apria HME & DME NPWT Home RespiratoryOSA Breast Pumps Diabetes Incontinence Ostomy Urology Wound Care Broadened Patient Direct Portfolio U.S. Addressable Market Size and Projected Growth Segment Market Size ($m)2 Market CAGR Diabetes 3,700 9% Obstructive Sleep Apnea (OSA) 2,200 8%1 Home Respiratory 6,200 6%1 Negative Pressure Wound Therapy (NPWT) 2,100 5%1 Incontinence 800 5% Urology 1,300 4% Wound Care 635 4% Ostomy 800 2% Patient Direct Home Health Market Outlook Sources: Ostomy: Est. CMS Medicare data; UOAA; WC: Estimate based on CMS Medicare data and HHA cost report data; Urology: iData Research- “Urology Market Size, Share & COVID-19 Impact Analysis”; Diabetes: Mordor Intelligence 2019 (45% addressable of total $8B); Inco: National Association for Continence; Resp. devices: Orion Market Research, “U.S. Respiratory Device Market 2019-2025”; OSA: The Insight Partners, “North America Sleep Apnea Devices Market”; NPWT: Markets and Markets, “Negative Pressure Wound Therapy (NPWT) Market” 1 Represents compound annual growth from 2018 through 2025 2 Addressable market sizes as of 2020, per management internal estimates

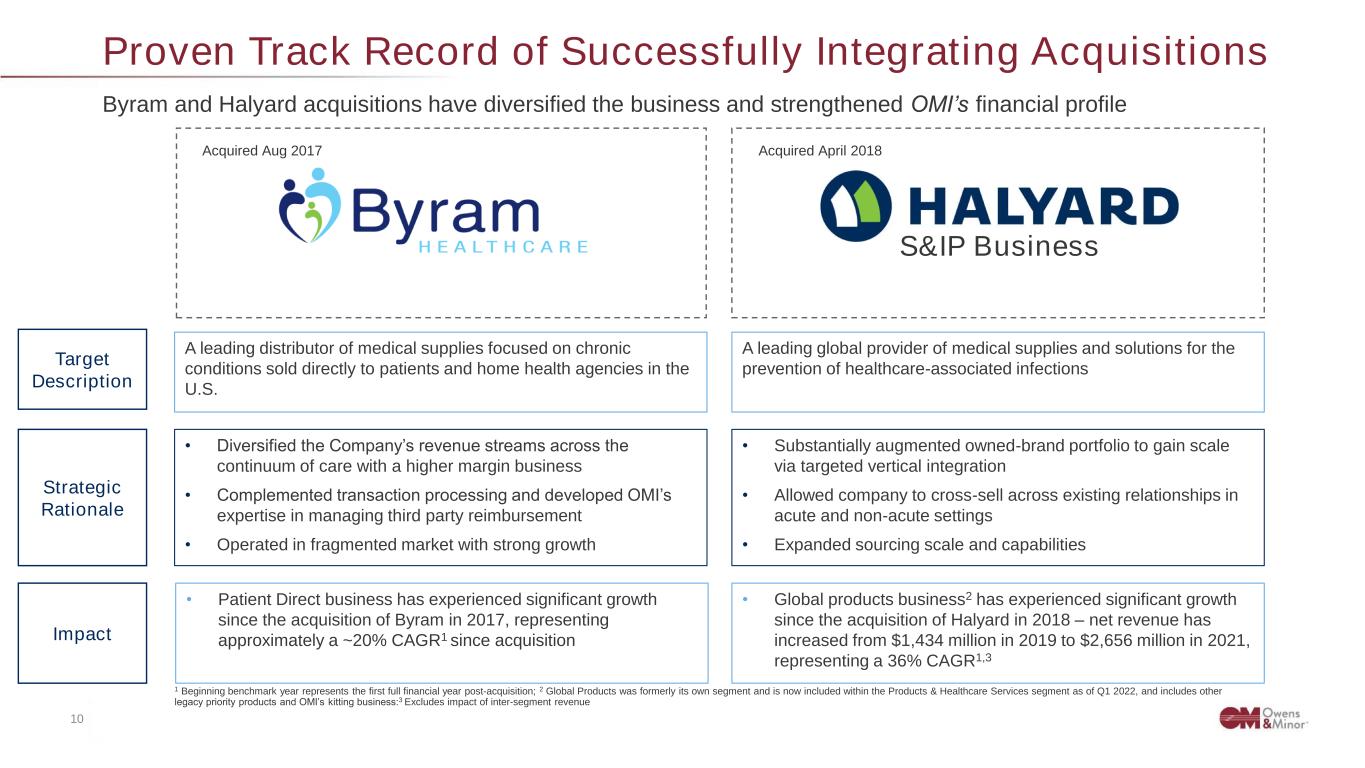

10 Confidential & Proprietary to Owens & Minor, Inc. Byram and Halyard acquisitions have diversified the business and strengthened OMI’s financial profile S&IP Business Acquired April 2018Acquired Aug 2017 A leading distributor of medical supplies focused on chronic conditions sold directly to patients and home health agencies in the U.S. A leading global provider of medical supplies and solutions for the prevention of healthcare-associated infections Target Description • Diversified the Company’s revenue streams across the continuum of care with a higher margin business • Complemented transaction processing and developed OMI’s expertise in managing third party reimbursement • Operated in fragmented market with strong growth • Substantially augmented owned-brand portfolio to gain scale via targeted vertical integration • Allowed company to cross-sell across existing relationships in acute and non-acute settings • Expanded sourcing scale and capabilities Strategic Rationale Impact • Patient Direct business has experienced significant growth since the acquisition of Byram in 2017, representing approximately a ~20% CAGR1 since acquisition • Global products business2 has experienced significant growth since the acquisition of Halyard in 2018 – net revenue has increased from $1,434 million in 2019 to $2,656 million in 2021, representing a 36% CAGR1,3 1 Beginning benchmark year represents the first full financial year post-acquisition; 2 Global Products was formerly its own segment and is now included within the Products & Healthcare Services segment as of Q1 2022, and includes other legacy priority products and OMI’s kitting business:3 Excludes impact of inter-segment revenue Proven Track Record of Successfully Integrating Acquisitions

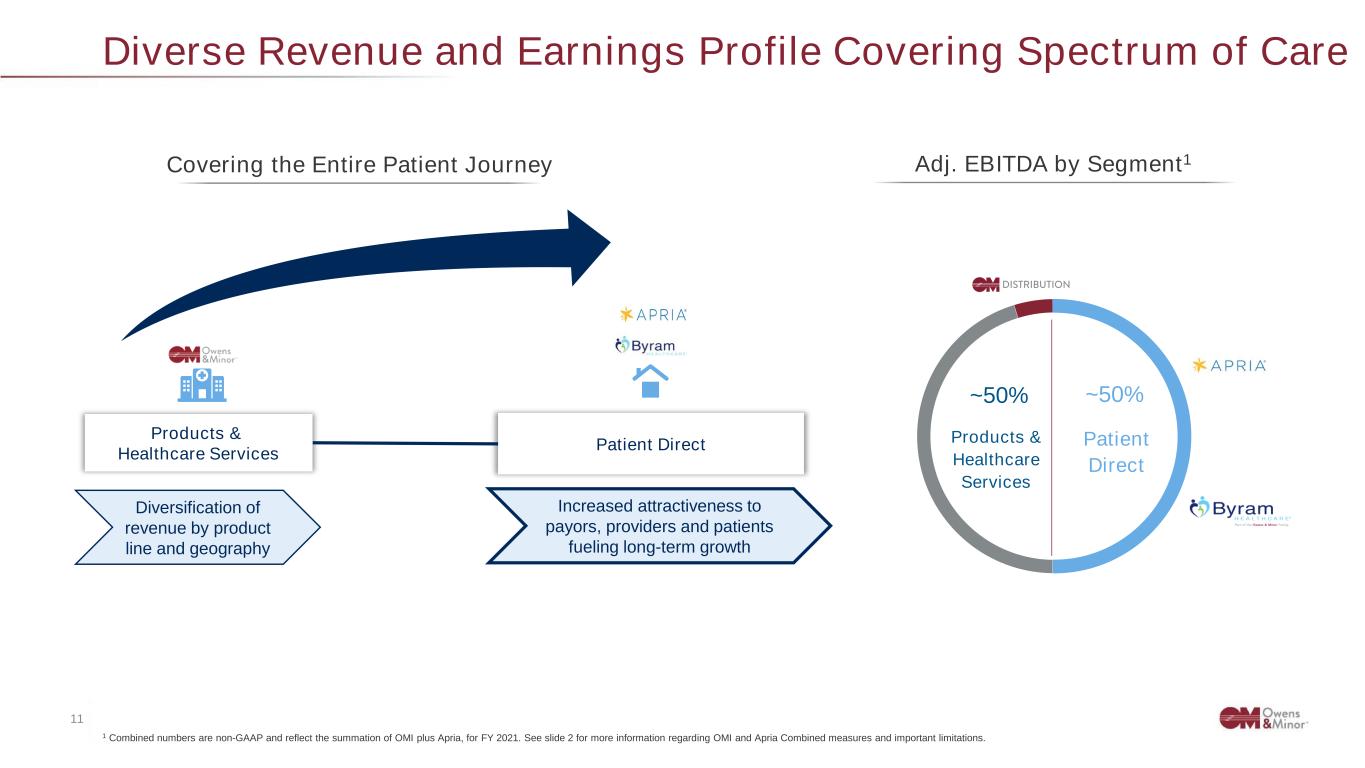

11 Confidential & Proprietary to Owens & Minor, Inc. Diverse Revenue and Earnings Profile Covering Spectrum of Care ~20% ~10% ~80% 1 Combined numbers are non-GAAP and reflect the summation of OMI plus Apria, for FY 2021. See slide 2 for more information regarding OMI and Apria Combined measures and important limitations. Diversification of revenue by product line and geography Increased attractiveness to payors, providers and patients fueling long-term growth Products & Healthcare Services Patient Direct ~50% Patient Direct Covering the Entire Patient Journey Adj. EBITDA by Segment1 ~50% Products & Healthcare Services

12 Confidential & Proprietary to Owens & Minor, Inc. Strong FCF Profile Provides Ability to Significantly Reduce Debt • Free Cash Flow2 has grown at a 36% CAGR under management team3 • Expecting to generate ~$400m of FCF in FY22 • Pro Forma TTM net leverage of 3.7x (post-Apria acquisition)4 • Capital allocation will prioritize debt reduction and reinvestment for long-term growth • Expect to return to target leverage range of 2x-3x within 18-24 months based on our strong FCF profile 1 Reconciliations for Non-GAAP measures, including Free Cash Flow, Pro Forma Adjusted EBITDA, and Net Debt are presented in the appendix 2 Free Cash Flow defined as Adjusted EBITDA less capital expenditures 3 Calculated from year-ended December 31, 2018 to year-ended December 31, 2021 4 Net leverage = Net Debt/Pro Forma Adjusted EBTIDA Balance Sheet and Cash Flow1

13 Confidential & Proprietary to Owens & Minor, Inc. First Quarter 2022 Highlights • Strong Q1 Performance • Momentum from record 2021 carried into Q1 • Revenue up in both segments year-over-year, including more than 25% revenue growth in Patient Direct • Sequential margin expansion vs Q4 2021 • 90 bps of sequential expansion in adjusted operating margin and adjusted EBITDA margin • 22% growth in Adjusted EBITDA to $118.5 million • Differentiated Business Model • Our unique, vertically-integrated business model and continued execution helped to minimize macro headwinds • Completed Acquisition of Apria • Largest acquisition in Company’s 140-year history • Strengths O&M’s position in the faster growing direct-to-patient home health market • Product portfolio perfectly complements Byram and helps further diversify the composition of adjusted EBITDA • Enhances our ability to serve patients through the hospital and into the home

14 Confidential & Proprietary to Owens & Minor, Inc. Our Commitment to ESG Means Doing Business the Right Way Driving Sustainable Value Through ESG Initiatives ✓ Reusable delivery totes ✓ Rechargeable battery systems ✓ Recycling programs ✓ Low energy lighting ✓ Motion-triggered lighting ✓ Insulated dock doors Measures Undertaken: ✓ Creation of BoD ESG Subcommittee ✓ Cross-function ESG Leadership Team ✓ SurgiTrack product returns ✓ Fuel-efficient fleet vehicles ✓ High efficiency routing guides ✓ Green supplier initiatives Owens & Minor 2021 Corporate Sustainability Report

15 Confidential & Proprietary to Owens & Minor, Inc. Owens & Minor (OMI) – Investment Thesis 1 Vertical Integration Creates Stability and Competitive Advantage 5 Strong cash flow profile provides ability to significantly reduce debt over the next 18-24 months 4 Diverse revenue and earnings profile 2 Favorable trends driving robust demand 6 Experienced management with proven track record of success 3 Acquisition of Apria broadens product portfolio and expands platform for growth

16 Confidential & Proprietary to Owens & Minor, Inc. Appendix

17 Confidential & Proprietary to Owens & Minor, Inc. Use of Non-GAAP Measures This presentation contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). In general, the measures exclude items and charges that (i) management does not believe reflect Owens & Minor, Inc.'s (the "Company") core business and relate more to strategic, multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company's performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation. Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on its financial and operating results and in comparing the Company's performance to that of its competitors. However, the non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.

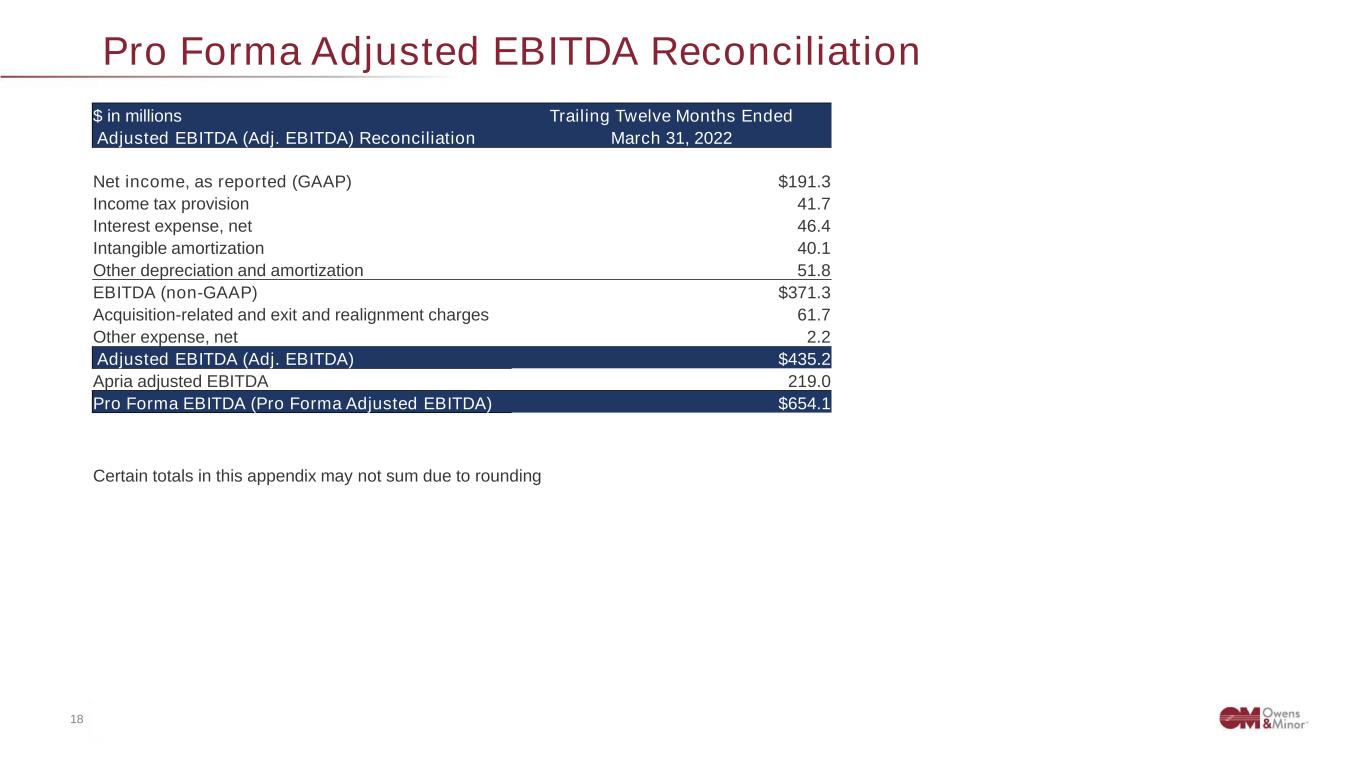

18 Confidential & Proprietary to Owens & Minor, Inc. Pro Forma Adjusted EBITDA Reconciliation Certain totals in this appendix may not sum due to rounding $ in millions Trailing Twelve Months Ended Adjusted EBITDA (Adj. EBITDA) Reconciliation March 31, 2022 Net income, as reported (GAAP) $191.3 Income tax provision 41.7 Interest expense, net 46.4 Intangible amortization 40.1 Other depreciation and amortization 51.8 EBITDA (non-GAAP) $371.3 Acquisition-related and exit and realignment charges 61.7 Other expense, net 2.2 Adjusted EBITDA (Adj. EBITDA) $435.2 Apria adjusted EBITDA 219.0 Pro Forma EBITDA (Pro Forma Adjusted EBITDA) $654.1

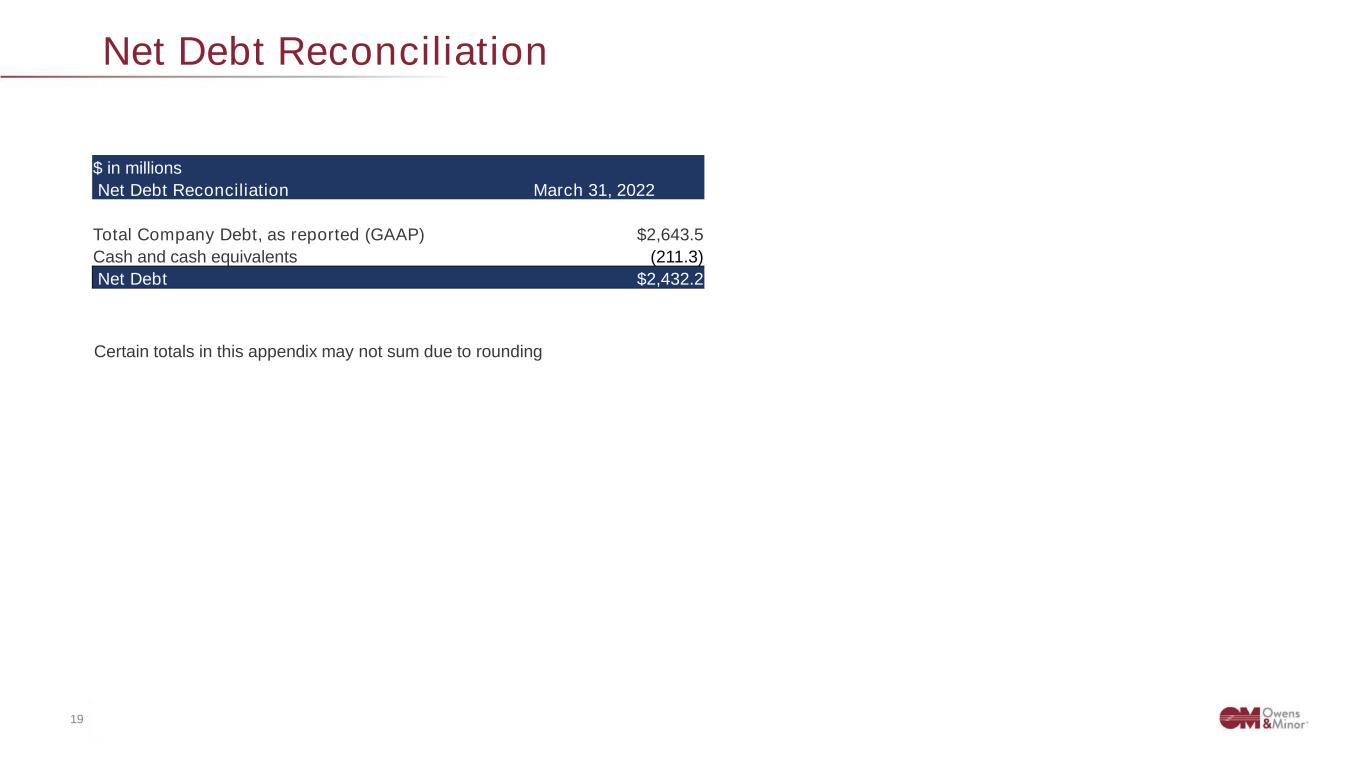

19 Confidential & Proprietary to Owens & Minor, Inc. Net Debt Reconciliation Certain totals in this appendix may not sum due to rounding $ in millions Net Debt Reconciliation March 31, 2022 Total Company Debt, as reported (GAAP) $2,643.5 Cash and cash equivalents (211.3) Net Debt $2,432.2

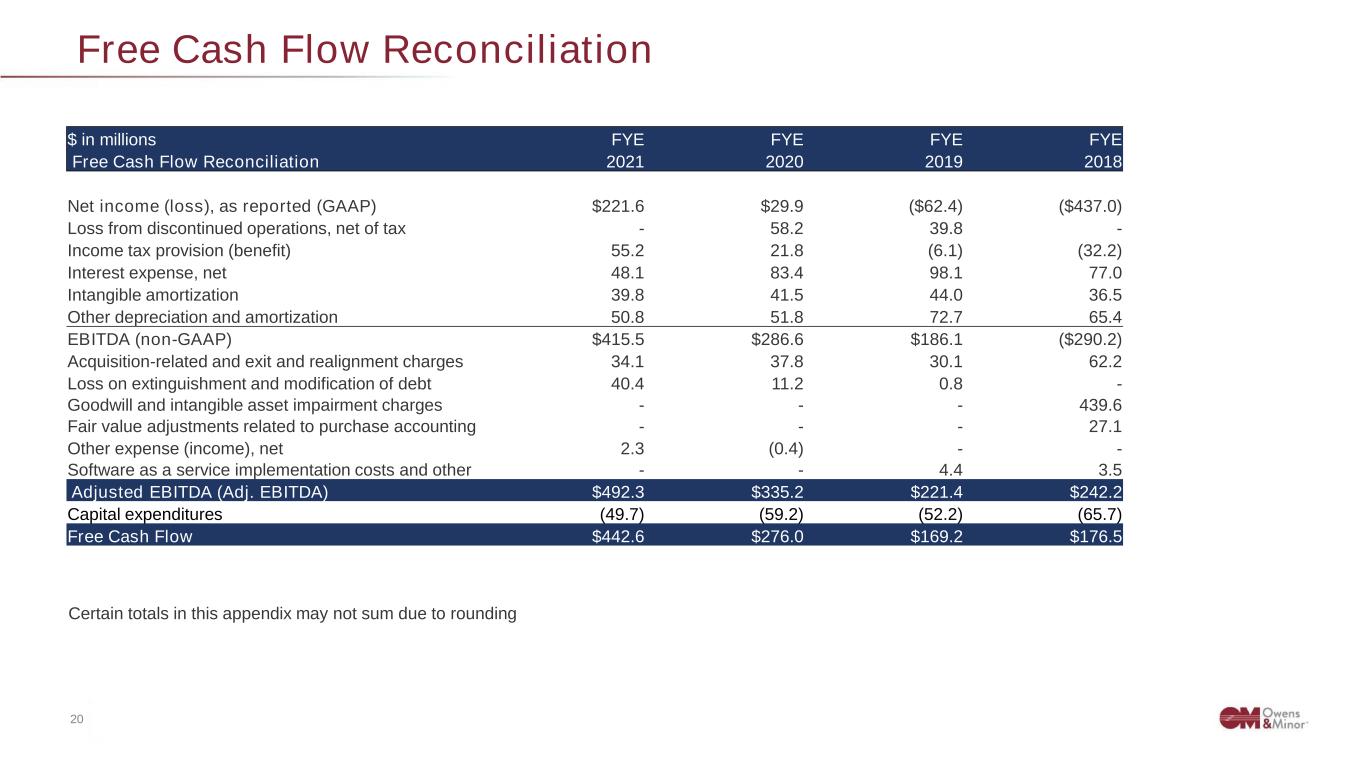

20 Confidential & Proprietary to Owens & Minor, Inc. Free Cash Flow Reconciliation Certain totals in this appendix may not sum due to rounding $ in millions FYE FYE FYE FYE Free Cash Flow Reconciliation 2021 2020 2019 2018 Net income (loss), as reported (GAAP) $221.6 $29.9 ($62.4) ($437.0) Loss from discontinued operations, net of tax - 58.2 39.8 - Income tax provision (benefit) 55.2 21.8 (6.1) (32.2) Interest expense, net 48.1 83.4 98.1 77.0 Intangible amortization 39.8 41.5 44.0 36.5 Other depreciation and amortization 50.8 51.8 72.7 65.4 EBITDA (non-GAAP) $415.5 $286.6 $186.1 ($290.2) Acquisition-related and exit and realignment charges 34.1 37.8 30.1 62.2 Loss on extinguishment and modification of debt 40.4 11.2 0.8 - Goodwill and intangible asset impairment charges - - - 439.6 Fair value adjustments related to purchase accounting - - - 27.1 Other expense (income), net 2.3 (0.4) - - Software as a service implementation costs and other - - 4.4 3.5 Adjusted EBITDA (Adj. EBITDA) $492.3 $335.2 $221.4 $242.2 Capital expenditures (49.7) (59.2) (52.2) (65.7) Free Cash Flow $442.6 $276.0 $169.2 $176.5

21 Confidential & Proprietary to Owens & Minor, Inc. Definitions of Non-GAAP Reconciliation items The following items have been excluded in our non-GAAP financial measures: Intangible amortization: Includes amortization of intangible assets established during purchase accounting for business combinations. These amounts are highly dependent on the size and frequency of acquisitions and are being excluded to allow for a more consistent comparison with forecasted, current and historical results and the results of our peers. Goodwill and intangible asset impairment charges: These charges were incurred as a result of a decline in market capitalization of the company and lower than projected financial results of certain reporting units due to customer losses and operational inefficiencies. Fair value adjustments related to purchase accounting: Includes an incremental charge to cost of goods sold from purchase accounting impacts related to the sale of acquired inventory that was written up to fair value in connection with the Halyard acquisition. Acquisition-related and exit and realignment charges: Acquisition-related charges consist primarily of transition costs for the Halyard and Byram acquisitions, as well costs associated with the Apria acquisition. Exit and realignment charges consist primarily of an increase in reserves associated with certain retained assets of Fusion5, wind-down costs related to Fusion5, IT restructuring charges, post closing costs associated with the Movianto divestiture, and other costs related to the reorganization of the U.S. commercial, operations and executive teams. Loss on extinguishment and modification of debt: Includes the write-off of deferred financing costs and third-party fees and amounts reclassified from accumulated other comprehensive loss as a result of the termination of our interest rate swaps. Software as a service implementation costs: These charges are associated with significant global IT platforms in connection with the redesign of our global information system strategy. Other expense (income), net: Includes interest costs and net actuarial losses related to our retirement plans. Tax Adjustments: Includes a tax adjustment associated with the estimated benefits under the Tax Cuts and Jobs Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Other depreciation and amortization: Includes depreciation expense for property and equipment and amortization for capitalized computer software. Apria adjusted EBITDA: Is presented in order to calculate pro forma adjusted EBITDA and pro forma leverage ratio of net debt to adjusted EBITDA for the twelve months ended March 31, 2022 as if Apria was acquired on April 1, 2021. The pro forma results are not necessarily indicative of the results that would have been if the acquisition had occurred on April 1, 2021. We have not separately presented the components of Apria adjusted EBITDA, as we determined that such presentation would not be meaningful.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Ownes & Minor (OMI) Announces Retirement of Dan J. Starck, EVP of Business Excellence

- LINCOLN ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Lincoln National Corporation and Encourages Investors to Contact the Firm

- TotalEnergies BWF Thomas & Uber Cup Finals 2024 to Kick Off in Chengdu

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share