Form 8-K Howmet Aerospace Inc. For: May 23

Exhibit 99.1

Howmet Aerospace Technology Day 2022 John Plant | Executive Chairman and Chief Executive Officer Ken Giacobbe | EVP and Chief Financial Officer May 23, 2022

Forward – Looking Statements This presentation contains statements that relate to future events and expectations and as such constitute forward - looking state ments within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include those containing such words as "anticipates," "beli eves," "could," "estimates," "expects," "forecasts," "goal," "guidance," "intends," "may," "outlook," "plans," "projects," "seeks," "sees," "should," "targets," "wil l," "would," or other words of similar meaning. All statements that reflect Howmet Aerospace’s expectations, assumptions or projections about the future, other than statements o f h istorical fact, are forward - looking statements, including, without limitation, statements, forecasts and outlook relating to the condition of end markets; future fi nancial results or operating performance; future strategic actions; and Howmet Aerospace's strategies, outlook, and business and financial prospects. These statements ref lect beliefs and assumptions that are based on Howmet Aerospace’s perception of historical trends, current conditions and expected future developments, as well as oth er factors Howmet Aerospace believes are appropriate in the circumstances. Forward - looking statements are not guarantees of future performance and are subje ct to risks, uncertainties and changes in circumstances that are difficult to predict, which could cause actual results to differ materially from those indicated by th ese statements. Such risks and uncertainties include, but are not limited to: (a) uncertainty of the duration, extent and impact of the COVID - 19 pandemic on Howmet Aerospace ’s business, results of operations, and financial condition; (b) deterioration in global economic and financial market conditions generally (including as a result of CO VID - 19 and its effects, among other things, on global supply, demand, and distribution disruptions); (c) unfavorable changes in the markets served by Howmet Aerospace; ( d) the impact of potential cyber attacks and information technology or data security breaches; (e) the loss of significant customers or adverse changes in customers’ bus iness or financial conditions; (f) manufacturing difficulties or other issues that impact product performance, quality or safety; (g) inability of suppliers to mee t obligations due to supply chain disruptions or otherwise; (h) the inability to achieve revenue growth, cash generation, cost savings, restructuring plans, co st reductions, improvement in profitability, or strengthening of competitiveness and operations anticipated or targeted; (i) inability to meet increased demand, production t arg ets or commitments; (j) competition from new product offerings, disruptive technologies or other developments; (k) geopolitical, economic, and regulatory risks r ela ting to Howmet Aerospace’s global operations, including geopolitical and diplomatic tensions, instabilities and conflicts, as well as compliance with U.S. and for eign trade and tax laws, sanctions, embargoes and other regulations; (l) the outcome of contingencies, including legal proceedings, government or regulatory inve sti gations, and environmental remediation, which can expose Howmet Aerospace to substantial costs and liabilities; (m) failure to comply with government co ntr acting regulations; (n) adverse changes in discount rates or investment returns on pension assets; and (o) the other risk factors summarized in Howmet Aerosp ace ’s Form 10 - K for the year ended December 31, 2021 and other reports filed with the U.S. Securities and Exchange Commission (SEC). Market projections are sub jec t to the risks discussed above and other risks in the market. The statements in this presentation are made as of the date of this presentation, even if subseque ntl y made available by Howmet Aerospace on its website or otherwise. Howmet Aerospace disclaims any intention or obligation to update publicly any forward - looking state ments, whether in response to new information, future events, or otherwise, except as required by applicable law. Important Information 2

Important Information (continued) Non - GAAP Financial Measures Some of the information included in this presentation is derived from Howmet Aerospace’s consolidated financial information b ut is not presented in Howmet Aerospace’s financial statements prepared in accordance with accounting principles generally accepted in the United States of Am erica (GAAP). Certain of these data are considered “non - GAAP financial measures” under SEC rules. These non - GAAP financial measures supplement our GAAP disclosures and should not be considered an alternative to the GAAP measure. Reconciliations to the most directly comparable GAAP financial measures and management’s rat ionale for the use of the non - GAAP financial measures can be found in the Appendix to this presentation. Howmet Aerospace has not provided reconciliations of any forward - looking non - GAAP financial measures (including adjusted EBITDA, adjusted EBITDA margin and adjusted earnings per share, each excluding special it ems, and free cash flow) to the most directly comparable GAAP financial measures because such reconciliations, as well as the directly comparable GAAP measur es, are not available without unreasonable efforts due to the variability and complexity of the charges and other components excluded from the non - GAAP measur es, such as the effects of foreign currency movements, gains or losses on sales of assets, taxes, and any future restructuring or impairment charges. Th ese reconciling items are in addition to the inherent variability already included in the GAAP measures, which includes, but is not limited to, price/mix and volume. How met Aerospace believes such reconciliations of forward - looking non - GAAP financial measures would imply a degree of precision that would be confusing or misl eading to investors. References to “Pro Forma” reflect metrics further adjusted for separation - related allocations, as if the Arconic Inc. separation transaction (effective as of 4/1/2020) had occurred at the beginning of the period presented. 3

Agenda 1. Company Overview 2. Engine Products 3. Fastening Systems 4. Engineered Structures 5. Forged Wheels 6. Financial Update 4

Today’s Presenters John Plant Executive Chairman & Chief Executive Officer Ken Giacobbe EVP and Chief Financial Officer 5

Unique Assets, Iconic Trusted Brand, Differentiated Technologies Iconic, Trusted Brand 80 + year history : M ajor presence in jet engines Leading market position: H igh barriers to entry Collaborative relationships : B lue - chip customer base Differentiated Technologies with Rich IP Portfolio and Process Know - How Deep customer relationships allow company to lead the technology curve Strategic global footprint with state - of - the - art facilities Nearly 1,150 granted and pending patents for parts, alloys, designs and production processes drive competitive advantage Mission - Critical Supplier in Growing Markets Able to supply over 90% of structural / rotating aero - engine parts Stability underpinned by ~70% of aerospace revenue under long - term agreements with strong engine spares demand Increased content on next - generation platforms 6

Howmet Aerospace Strategy Focus on what we are good at to drive growth above market rate Underpin strategy with commercial and operational discipline Prioritize major differentiated products for resource allocation Execute a disciplined capital allocation strategy 7

Four Segments: ~85% of Revenue from Number 1 or 2 Market Position Fastening Systems Forged Wheels Select Customers IGT Airfoils Engine Products ~$2.3B 2021 Revenue ~$1.0B 2021 Revenue ~$0.9B 2021 Revenue Global leader in jet engine components and seamless rolled rings 27 manufacturing plants and 1 dedicated R&D facility Global leader in fasteners 20 manufacturing plants and 2 d edicated R&D facilities Global leader in forged aluminum commercial vehicle wheels 6 manufacturing plants and 2 dedicated R&D facilities Seamless Rolled Rings Aerospace Fasteners N.A. Truck & Trailer Industrial Fasteners Forged Aluminum Wheels Engineered Structures ~$0.7B 2021 Revenue L eader in aerospace US defense structures 12 manufacturing plants and 1 dedicated R&D facility Aerospace Defense Structures Aerospace Airfoils Leading Global Provider of Advanced Engineered Solutions Select Customers Select Customers Select Customers 8 Aerospace Defense / Wheel and Brake Aerospace Ti Extrusions and Seat Tracks N.A. Utility Scale - Solar Aerospace Structural Castings Rankings reflect market positions

Differentiated Products Provide Our Customers with Innovative Solutions Customer Benefits: Innovative Solutions: Differentiated Products: Patented airfoils with advanced cooling and coatings for extreme temperature applications Specially - designed fasteners for lightweight composite airframe construction & reduced assembly costs, lightning strike protection Light Weight Aluminum Commercial Wheels Light Weight Better Fuel Efficiency Reduced Emissions Reduced Assembly & Maintenance Costs Smaller Carbon Footprint Lower Fuel Cost Lower Operating Cost (Assembly, Maintenance) Increased Safety 9

10

Aerospace Market 11

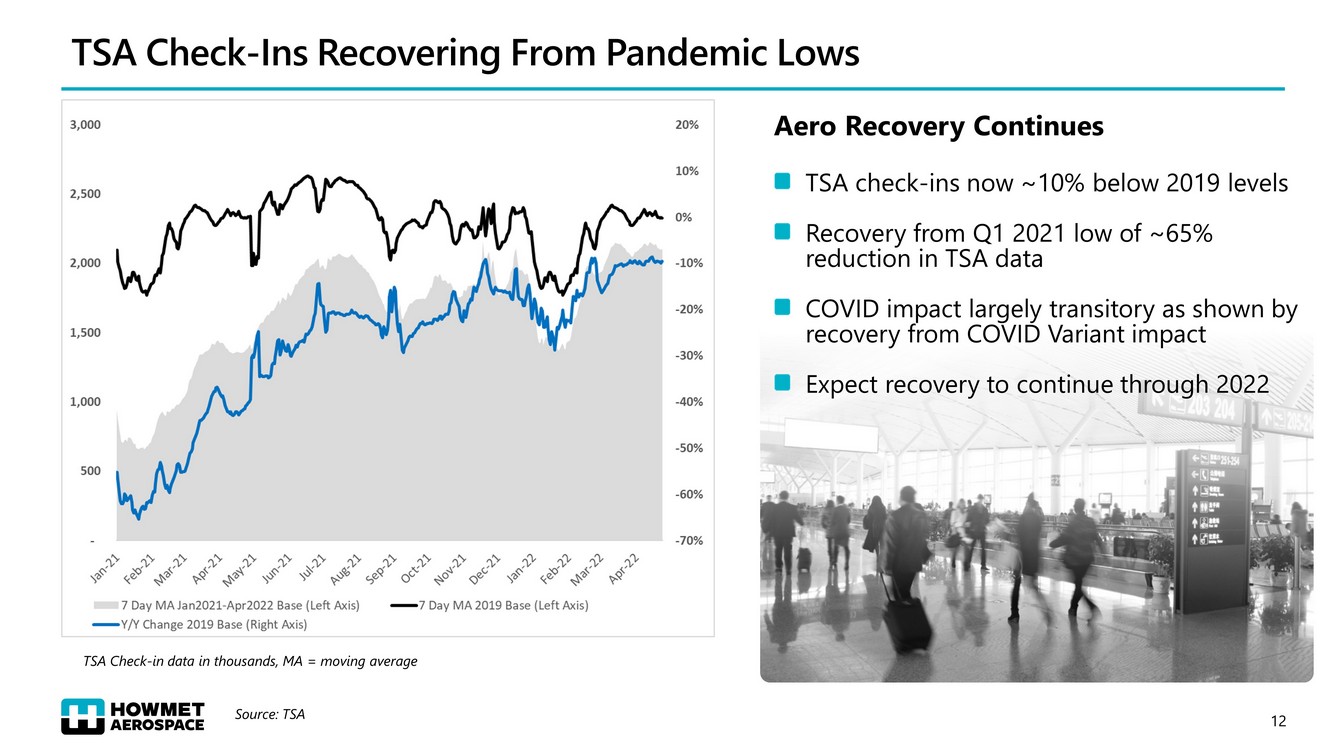

TSA Check - Ins Recovering From Pandemic Lows Aero Recovery Continues TSA check - ins now ~10% below 2019 levels Recovery from Q1 2021 low of ~65% reduction in TSA data COVID impact largely transitory as shown by recovery from COVID Variant impact Expect recovery to continue through 2022 Source: TSA TSA Check - in data in thousands, MA = moving average 12

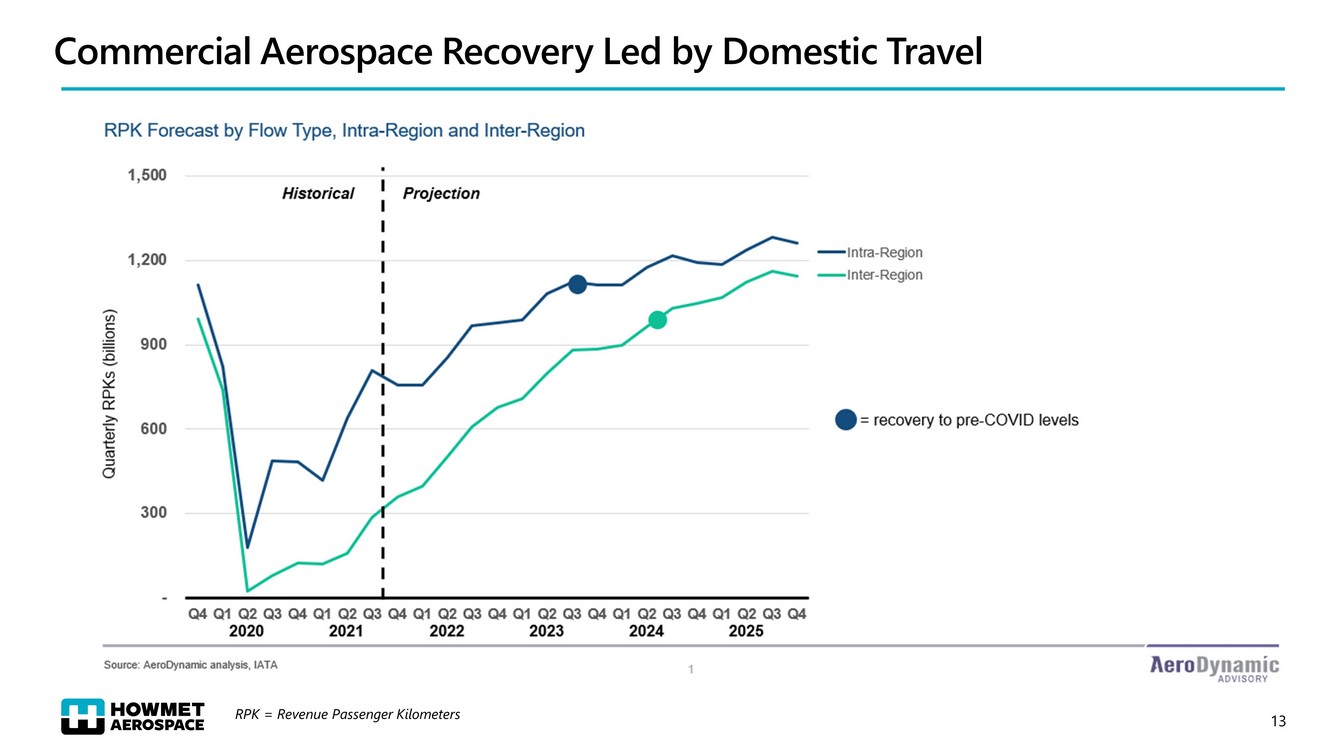

Commercial Aerospace Recovery Led by Domestic Travel 13 RPK = Revenue Passenger Kilometers

Near - Term Aerospace Growth Driven by Narrowbody Builds Narrowbody Expectations OE build rates surpassing pre - pandemic levels in 2024 Airbus A320 rate to exceed 2019 levels in 2024, Boeing 737 rate near pre - pandemic levels in 2025 Widebody Expectations Widebody expansion in 2023, 2024, & 2025 OE build rates signal ~60% of 2019 levels by 2026 Source: Teal Group Returns to ~1,400 Aircraft (Different Mix) Pre - Pandemic ~1,400 Aircraft Howmet Shipping volumes may not exactly match stated OE Delivery Rates 14

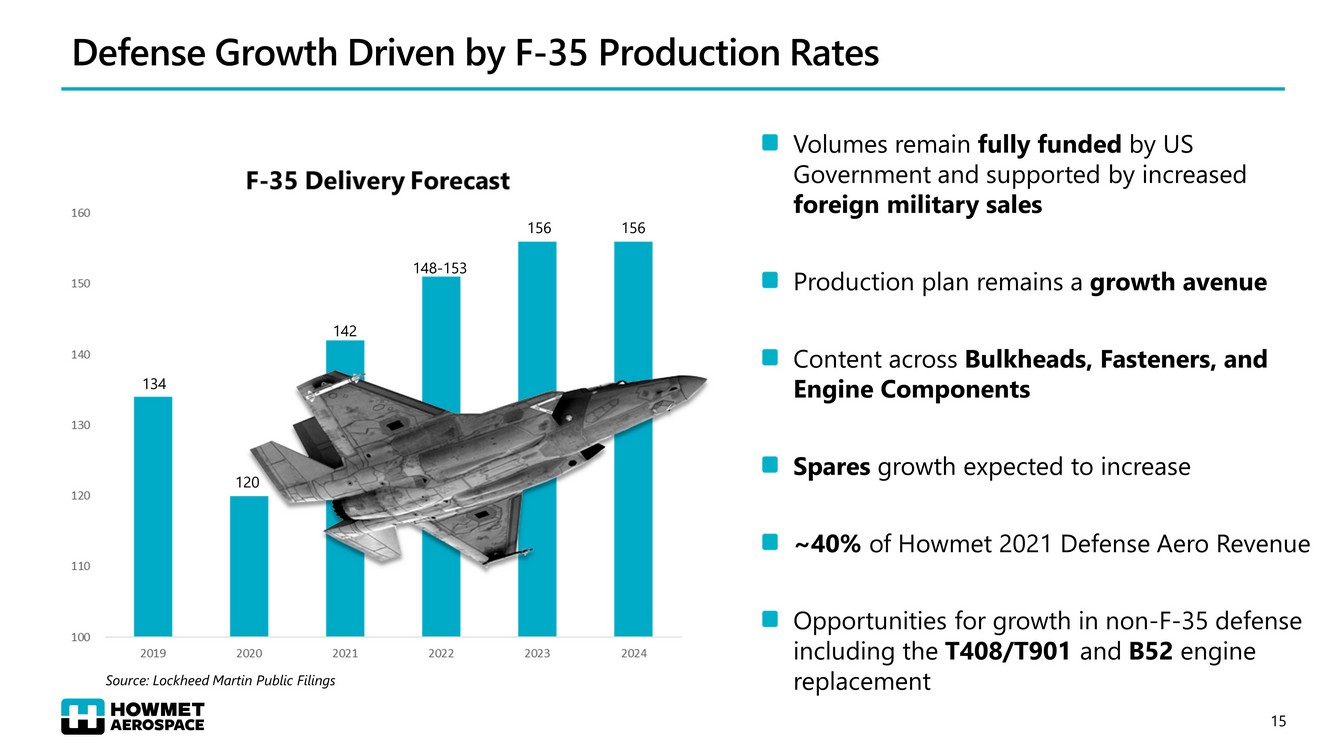

Defense Growth Driven by F - 35 Production Rates Volumes remain fully funded by US Government and supported by increased foreign military sales Production plan remains a growth avenue Content across Bulkheads, Fasteners, and Engine Components Spares growth expected to increase ~40% of Howmet 2021 Defense Aero Revenue Opportunities for growth in non - F - 35 defense including the T408/T901 and B52 engine replacement 134 120 142 148 - 153 156 156 Source: Lockheed Martin Public Filings 15

Engine Products 16

Engine Products Video 17

Engine Products: Multiple Techniques to Meet Customer Needs We Deliver Through: Major Drivers to Achieve: Market Needs: Improved Fuel Efficiency Reduced Emissions Reduced Weight Predictable Overhaul Cycles Fuel Flexibility Speed to Market Operating Temperature Aerodynamic Shapes Airflow Control Environmental Resistance Component Integrity Model Based Manufacturing Casting Techniques Cooling Techniques Complex Shapes Coating Techniques Enhanced Strength Digital Manufacturing and Automation 18

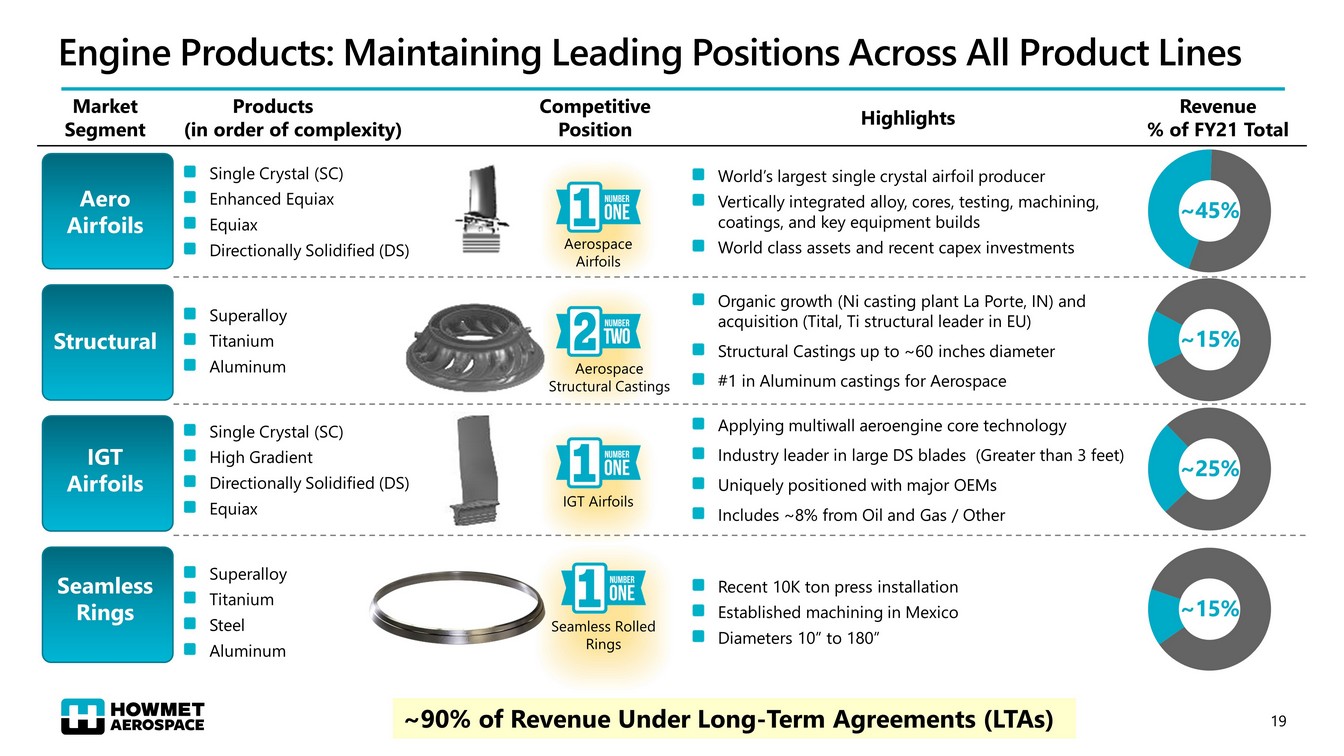

Engine Products: Maintaining Leading Positions Across All Product Lines Market Segment Products (in order of complexity) Competitive Position Highlights Revenue % of FY21 Total Aero Airfoils Single Crystal (SC) Enhanced Equiax Equiax Directionally Solidified (DS) World’s largest single crystal airfoil producer Vertically integrated alloy, cores, testing, machining, coatings, and key equipment builds World class assets and recent capex investments Structural Superalloy Titanium Aluminum Organic growth (Ni casting plant La Porte, IN) and acquisition (Tital, Ti structural leader in EU) Structural Castings up to ~60 inches diameter #1 in Aluminum castings for Aerospace IGT Airfoils Single Crystal (SC) High Gradient Directionally Solidified (DS) Equiax Applying multiwall aeroengine core technology Industry leader in large DS blades (Greater than 3 feet) Uniquely positioned with major OEMs Includes ~8% from Oil and Gas / Other Seamless Rings Superalloy Titanium Steel Aluminum Recent 10K ton press installation Established machining in Mexico Diameters 10” to 180” ~45% ~15% ~25% ~ 15 % ~90% of Revenue Under Long - Term Agreements (LTAs) Aerospace Airfoils IGT Airfoils Seamless Rolled Rings Aerospace Structural Castings 19

Increasing Temperature Capability Engine Products Materials Expertise Engine OEM is responsible for alloy selection, design, and specifications Produced to achieve targeted life, efficiency & emissions targets; highest operating temperature with maximum cooling Casting and rolling of over 100 different alloys across aluminum, titanium, and nickel alloys Materials selected based on temperature, strength, and weight requirements Over 80 years of experience INVESTMENT CASTINGS SEAMLESS RINGS Nickel Titanium Aluminum 20

Investment Casting Process Controls Microstructure and Properties Nickel base superalloys are complex : Greater than 15 element alloys, including refractory and rare earth elements Very tight control (Less than 1ppm) on tramp elements, which degrade properties Equiax and Directionally Solidified Alloys have Grain Boundary Strengtheners Single Crystal Alloys remove Grain Boundary Strengtheners and have highest melting points ▪ Random, fine grain structure ▪ Largest market, common process ▪ Structural, Aero low - pressure turbine (LPT), IGT, Rings ▪ Lower temperature capability ▪ Aligned grain structure ▪ Targeted / niche applications ▪ Aero LPT, IGT blades ▪ Medium temperature capability ▪ A single grain ▪ Premium process, growing market ▪ Most demanding temperature and strength applications Directionally Solidified Single Crystal Equiax 21

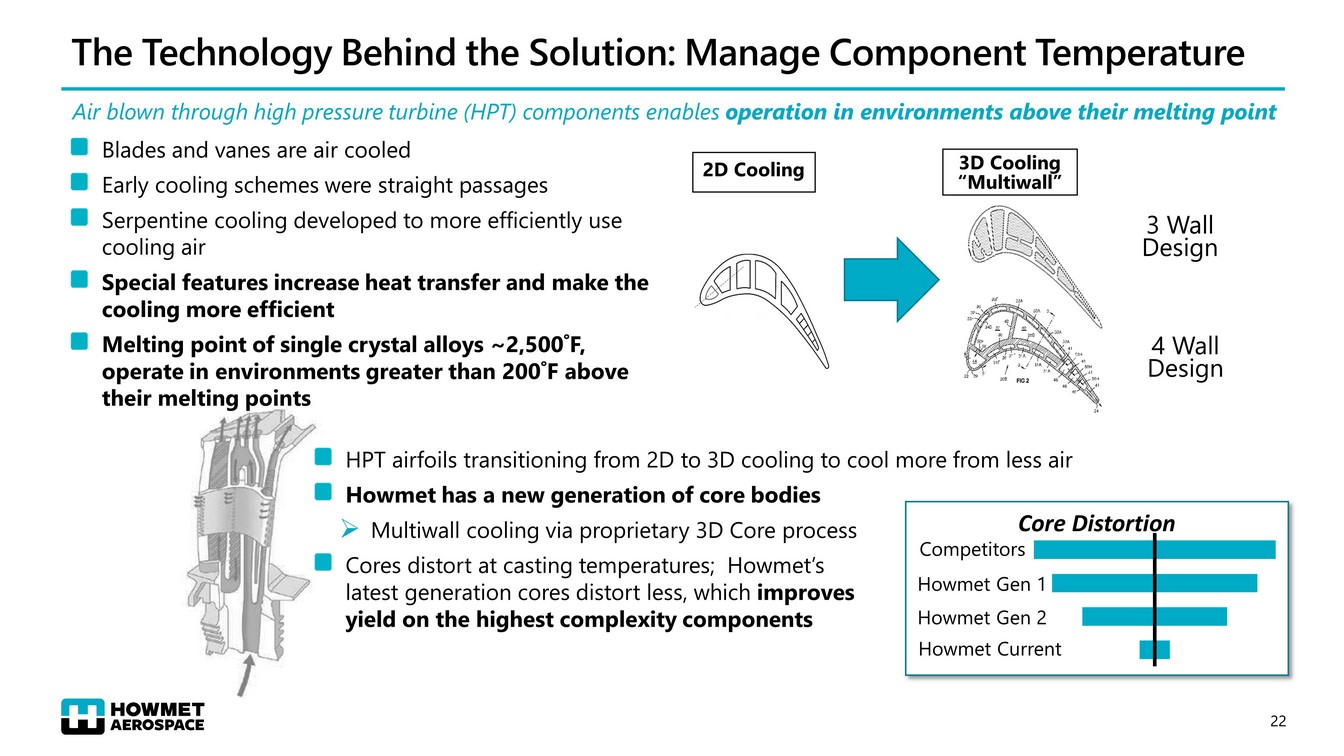

Air blown through high pressure turbine (HPT) components enables operation in environments above their melting point Competitors Howmet Gen 2 Howmet Gen 1 Howmet Current Core Distortion 3D Cooling “Multiwall” 2D Cooling The Technology Behind the Solution: Manage Component Temperature 3 Wall Design 4 Wall Design HPT airfoils transitioning from 2D to 3D cooling to cool more from less air Howmet has a new generation of core bodies » M ultiwall cooling via proprietary 3D Core process Cores distort at casting temperatures; Howmet’s latest generation cores distort less, which improves yield on the highest complexity components Blades and vanes are air cooled Early cooling schemes were straight passages Serpentine cooling developed to more efficiently use cooling air Special features increase heat transfer and make the cooling more efficient Melting point of single crystal alloys ~2,500˚F, operate in environments greater than 200˚F above their melting points 22

Sole Provider for Highest Temperature Engines in F - 35 (Joint Strike Fighter) 1) American Society of Engineers. 2) Fundamentals of Jet Propulsion with Applications , Cambridge Aerospace Series. Ronald D. Flack. 2005 FUTURE TECHNOLOGY FLOW Joint Strike Fighter’s F135 Turbine Inlet Temperature ~3,600 ° F 1 Modern Commercial Jet Turbine Inlet Temperature ~2,500 ° F 2 23 F135 Turbine Inlet Temperature is greater than 1,000˚F above alloy melting point

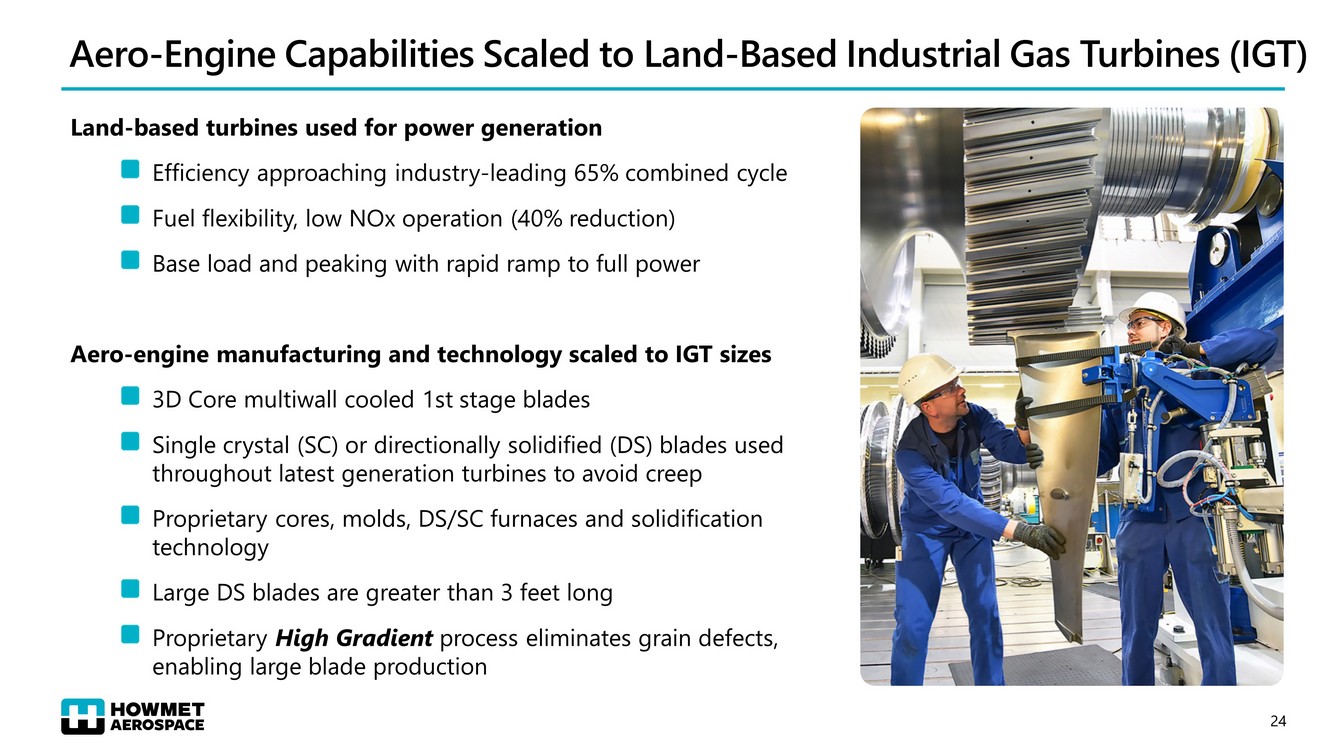

Aero - Engine Capabilities Scaled to Land - Based Industrial Gas Turbines (IGT) Land - based turbines used for power generation Efficiency approaching industry - leading 65% combined cycle Fuel flexibility, low NOx operation (40% reduction) Base load and peaking with rapid ramp to full power Aero - engine manufacturing and technology scaled to IGT sizes 3D Core multiwall cooled 1st stage blades Single crystal (SC) or directionally solidified (DS) blades used throughout latest generation turbines to avoid creep Proprietary cores, molds, DS/SC furnaces and solidification technology Large DS blades are greater than 3 feet long Proprietary High Gradient process eliminates grain defects, enabling large blade production 24

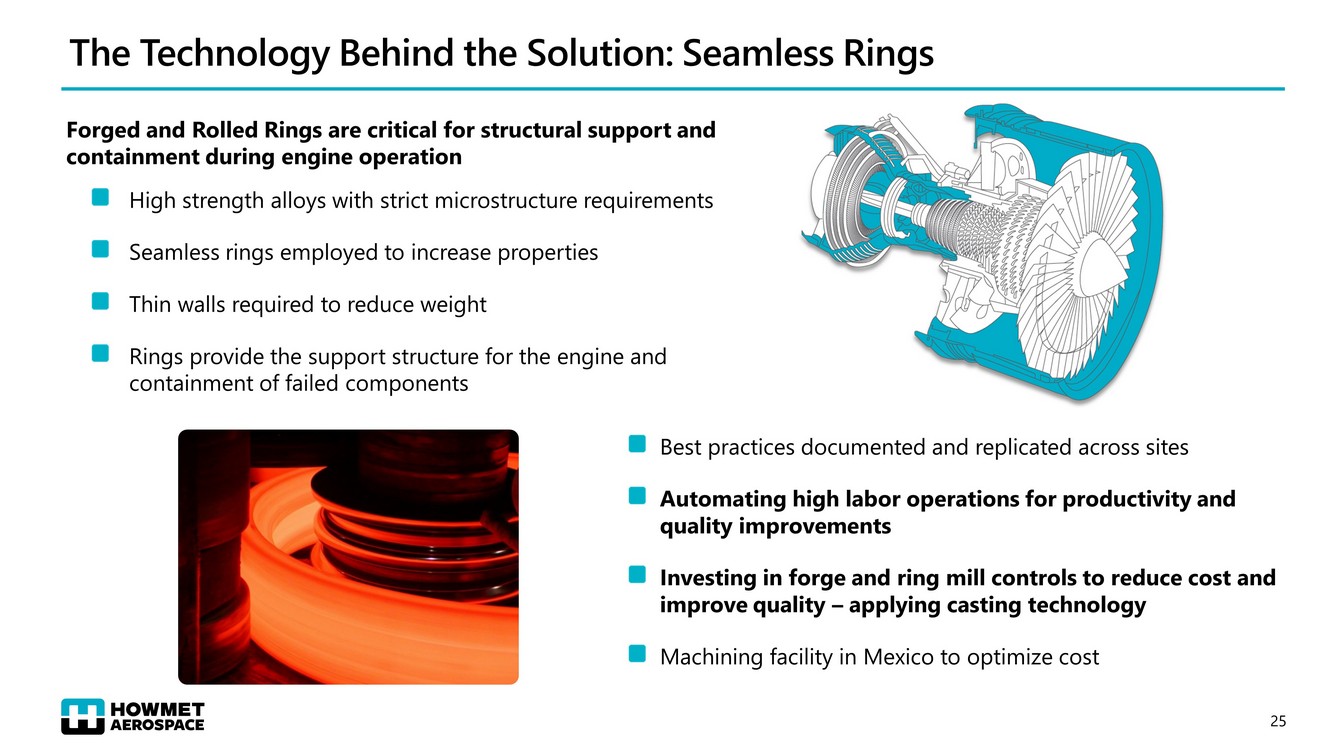

The Technology Behind the Solution: Seamless Rings Forged and Rolled R ings are critical for structural support and containment during engine operation High strength alloys with strict microstructure requirements Seamless rings employed to increase properties Thin walls required to reduce weight Rings provide the support structure for the engine and containment of failed components Best practices documented and replicated across sites Automating high labor operations for productivity and quality improvements Investing in forge and ring mill controls to reduce cost and improve quality – applying casting technology Machining facility in Mexico to optimize cost 25

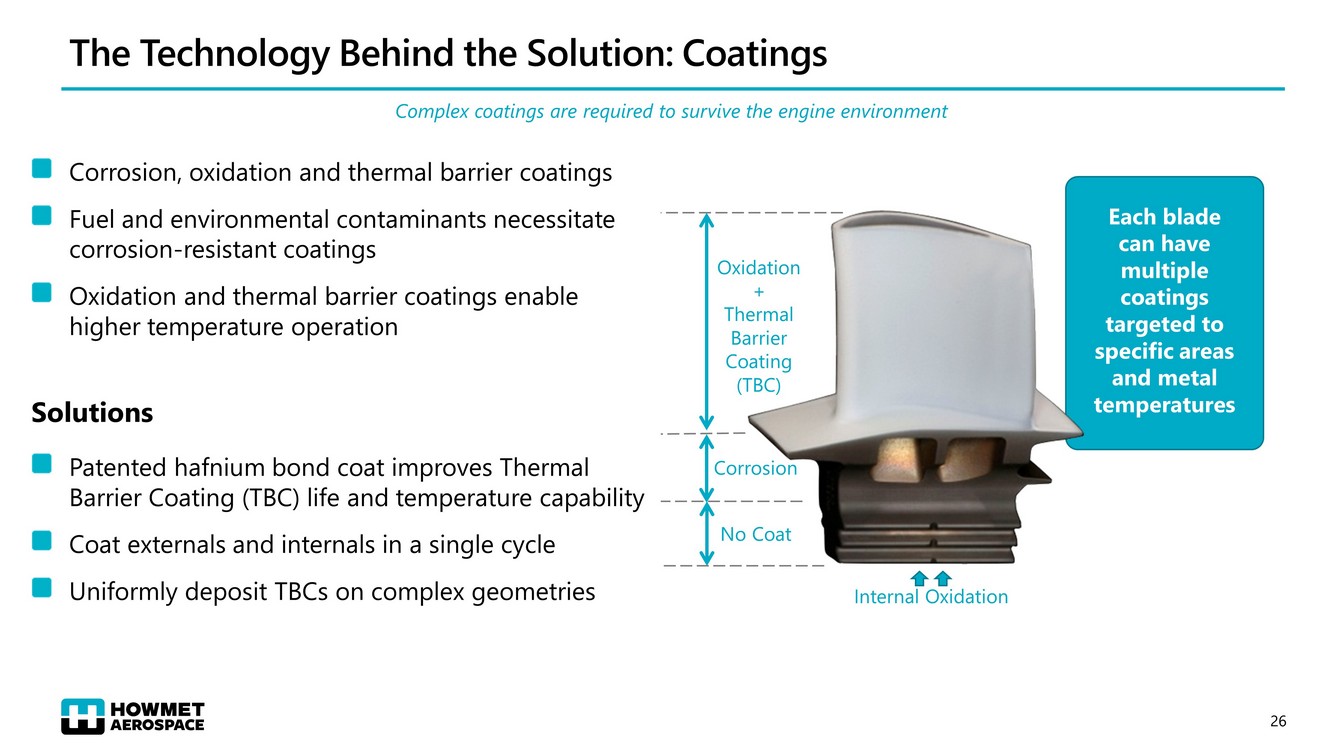

The Technology Behind the Solution: Coatings Corrosion, oxidation and thermal barrier coatings Fuel and environmental contaminants necessitate corrosion - resistant coatings Oxidation and thermal barrier coatings enable higher temperature operation Solutions Patented hafnium bond coat improves Thermal Barrier Coating (TBC) life and temperature capability Coat externals and internals in a single cycle Uniformly deposit TBCs on complex geometries Each blade can have multiple coatings targeted to specific areas and metal temperatures Oxidation + Thermal Barrier Coating (TBC) Corrosion No Coat Internal Oxidation Co mplex coatings are required to survive the engine environment 26

Next Generation Technologies Developed to Maintain Advantage Cast Film Cooling Holes Howmet has developed and patented a capability to cast film cooling holes Produce holes the diameter of “2 human hairs” Removes line - of - sight manufacturing constraint Produce complex, non - drillable shapes without damaging the surface for more effective film cooling Complex, Multiple Layer and Chemistry TBCs Most current generation TBC coatings are single layer and chemistry Next generation coatings are multi - layered and employ new unique rare earth chemistries ▪ Improve thermal resistance ▪ Operate in higher temperature environments ▪ Multiple layers improve life ▪ Improved oxidation resistance Single crystal alloy High pressure turbine components can have hundreds of cooling holes drilled into the casting Line - of - sight limits hole placement Drilling limits hole shape and damages surface 27

Superior Manufacturing Technology to Achieve Quality and Yields Start Ship Shell Wax Cast X - Ray (Incl. CT) Finish Cut Robotic Water Jet Cutting & Shell Removal High Speed CNC Finishing Blue Light Digital Measurement Automated Digital X - Ray, CT Advanced Wax Press / Tooling & 3 - D Printing Automated Casting with Advanced Controls SMART Manufacturing Automated Wall Gauge Inspect (Internal) Monoshell (Shell Build) Inspect (External) Raw Materials Core Removal Advanced Ceramic Cores, Specialty Wax, Advanced SC Alloys Heat Treat Start Ship Shell Wax Cast X - Ray (Incl. CT) Finish Cut Robotic Water Jet Cutting & Shell Removal High Speed CNC Finishing Blue Light Digital Measurement Automated Digital X - Ray, CT Advanced Wax Press / Tooling & 3 - D Printing Automated Casting with Advanced Controls SMART Manufacturing Automated Wall Gauge Inspect (Internal) Monoshell (Shell Build) Inspect (External) Raw Materials Core Removal Advanced Ceramic Cores, Specialty Wax, Advanced SC Alloys Heat Treat Data Analytics “ Variance Prevention” Rapid Prototyping “ Speed to Market” Automation “ Variance Reduction” 28

Engine Products: Key Messages Continue to develop and expand material, process, and manufacturing expertise Enable Turbine Performance by Controlling Shape, Structure, and Managing Temperature/Airflow Processes: Equiax, Directionally Solidified and Single Crystal Casting , Coatings , and Seamless Rolled Rings Materials: Nickel, Titanium, and Aluminum alloys Continue to develop and commercialize innovative technologies and techniques Collaborate with OEMs on Advanced Military and Commercial Designs Dedicated R&D Tightly Tied to Customers and Operations Rich Intellectual Property Protected by Trade Secrets, Patents, Material Developments, and Equipment Builds Vertical Integration of Materials, Manufacturing Processes, and Equipment Provides “ Moats ” of Protection Capex Investment: ~$360M in Growth Capex Installed S ince 2019 Focus on Increasing Automation in the Production P rocesses Differentiated technologies and solutions to continue driving content gains 29

Fastening Systems 30

Fastening Systems Video 31

Fastening Systems Advantage Broad Product Offering – One Stop Proprietary Products Industry leading brands including Camloc ® and Huck® Anti Vibration Ease of Assembly and Rework Low Profile (Stealth) ‘Faraday Cages’ – Composites Lower Maintenance Costs Automated Tools 32

Fastening Systems: Whole System Solutions to Meet Customer Needs We Deliver Through: Major Drivers to Achieve: Automated Assembly Ease of Assembly Composite Materials Aerodynamic Shapes One - Sided Installation (Blind Fasteners) Smart Installation Tools Lightning Strike Protection (LSP) Fasteners Leading R&D Capabilities Portable Installation Tooling Vibration - Resistant Fasteners Resistance Spot Riveting (RSR®) Technology Market Needs: Aerospace Efficiency of Assembly Aero/Fuel Efficiency Maintenance Accessibility Value Industrial Rapid Assembly In - the - Field I nstallation Maintenance - Free S olutions Speed to Market Complete Installation Tooling Solutions Vibration Resistance Multi - Material Joining Rapid Prototyping 33

Fastening Systems: Leading Positions Across All Market Segments Market Segment Products (In order of Complexity) Competitive Position Highlights Revenue % of FY21 Total Aerospace (Airframe, Engine, Specialty) Latches Panel Fasteners Single Sided Sleeved Pin Systems Lockbolts and Collars Threaded Pin Systems Inserts/Studs Nuts, Bolts, Screws Installation Tooling Broadest product offering (1M SKUs) 60% of revenue in LTAs 440+ patents 30% of revenue from patented or proprietary products Industry leader in quality Industrial (Commercial Transportation, Renewable Energy, Automotive, Material Handling) RSR® Technology Single Sided Lockbolts Specialty Fasteners Wire Thread Inserts Installation Tooling Niche, high value - add applications requiring vibration resistance and/or multi - material joining 40% of revenue from patented products Fastening System (Tool + Fastener) provides superior reliability and speed of installation Aerospace Fasteners N.A. Truck & Trailer Industrial Fasteners N.A. Utility - Scale Solar 67% 3 3% ~60% of Revenue Under Long - Term Agreements (LTAs) 34

Fastening Systems: Industry Leader in Innovation Industry Leading Brands Innovation Investment and Activity Outpacing Our Peers Camloc® Delron® Huck® Kaynar® Mairoll ® Major Peer Howmet ~2.7x Patents 1 Howmet Major Peer ~3.4x Trademarks 1 Pending Granted Strong Intellectual Property Position RAM® Recoil® Republic® Rosan® Screwcorp Simmonds® Tridair ® VT® Voi - Shan® 2013 Bobtail® Hucklock Huckspin FC - 43® Flite - Tite® B777X StreamTite rivet Bobtail 2® Ergo - Tech® Ergo - Tech MAX RSR® ▪ Consistent clamp ▪ Smaller diameters ▪ Speed/Ease of Use ▪ Single - sided install ▪ Flush breaking ▪ Lower weight ▪ Single - sided install ▪ Flush breaking ▪ CFRP compatible ▪ Consistent clamp ▪ Less material ▪ Speed/Ease of Use ▪ Corrosion resistant ▪ Positive lock ▪ Off sheet bulb ▪ Installation speed ▪ Consistent clamp ▪ High strength ▪ Ease of install ▪ Low mfg cost ▪ LS protection ▪ Simple installation ▪ Low assembly cost ▪ Aerodynamic ▪ Low assembly cost 2021 2 world - class R&D centers with dedicated teams State - of - the - art design and analysis technology and equipment Mechanical and metallurgical laboratory testing capabilities Collaborations with top research universities and associations 3 new product lines expected to be introduced by 2024 35 1) Internal Analysis from August 2021

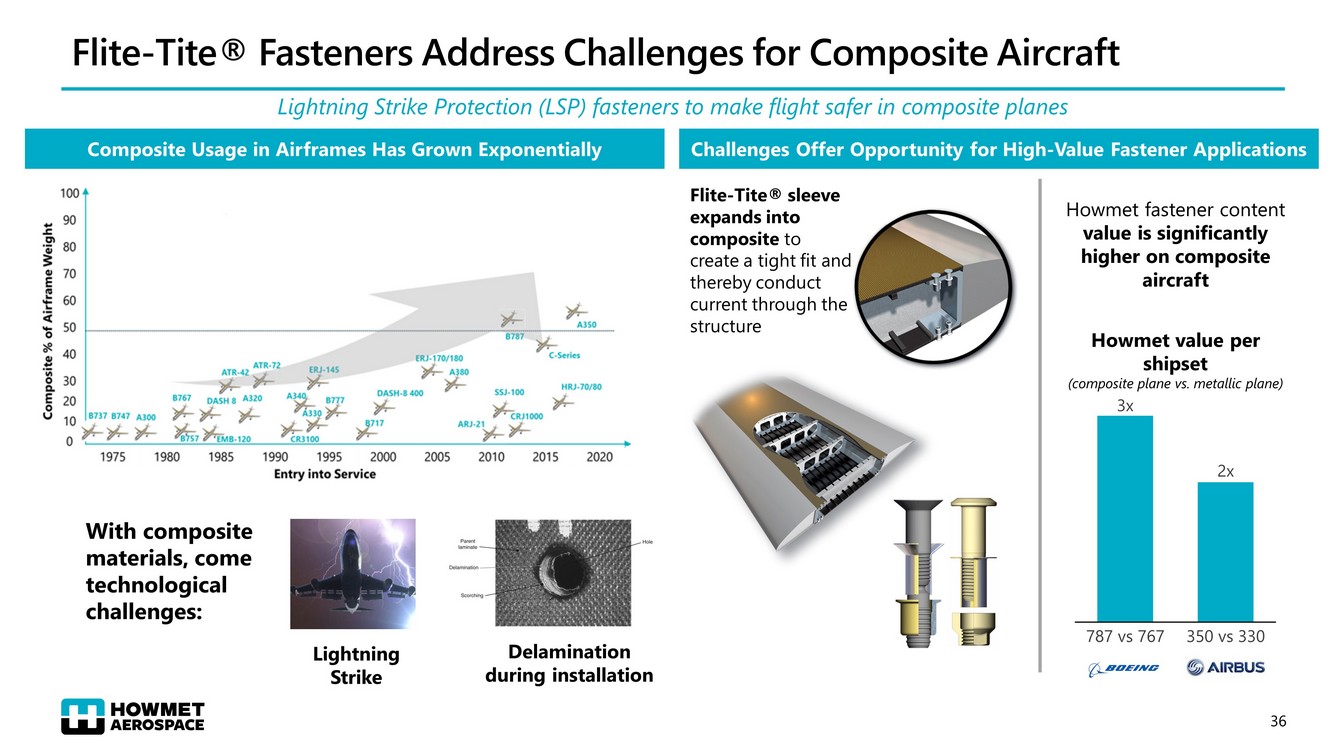

Flite - Tite® Fasteners Address Challenges for Composite Aircraft Composite Usage in Airframes Has Grown Exponentially Challenges Offer Opportunity for High - Value Fastener Applications 3x 2x 787 vs 767 350 vs 330 Howmet fastener content value is significantly higher on composite aircraft Howmet value per shipset (composite plane vs. metallic plane) With composite materials, come technological challenges: Lightning Strike Delamination during installation Lightning Strike Protection (LSP) fasteners to make flight safer in composite planes Flite - Tite® sleeve expands into composite to create a tight fit and thereby conduct current through the structure 36

Ergo - Tech® Blind Bolt Enables Automated Assembly One side access fastener for metallic or composite structures Ergo - Tech ® - Advantages Automation METALLIC COMPOSITE HYBRID 95 KSI SHEAR ALTERNATIVE TO PINS AND COLLARS Low Installed Cost – No secondary ops. Adaptable to Metallic, Composite, Hybrid Single Piece – A lternative to pins & collars Ideal for Automation – One - side Assembly Ergonomic for manual applications Mechanical Performance – E quivalent to solid 2 - piece alternatives From labor intensive two - sided assembly To automated one - sided assembly Integrated Ergo - Tech ® - 2 Installation Tool Sensor – based installation tool with data acquisition enables installation process monitoring 37

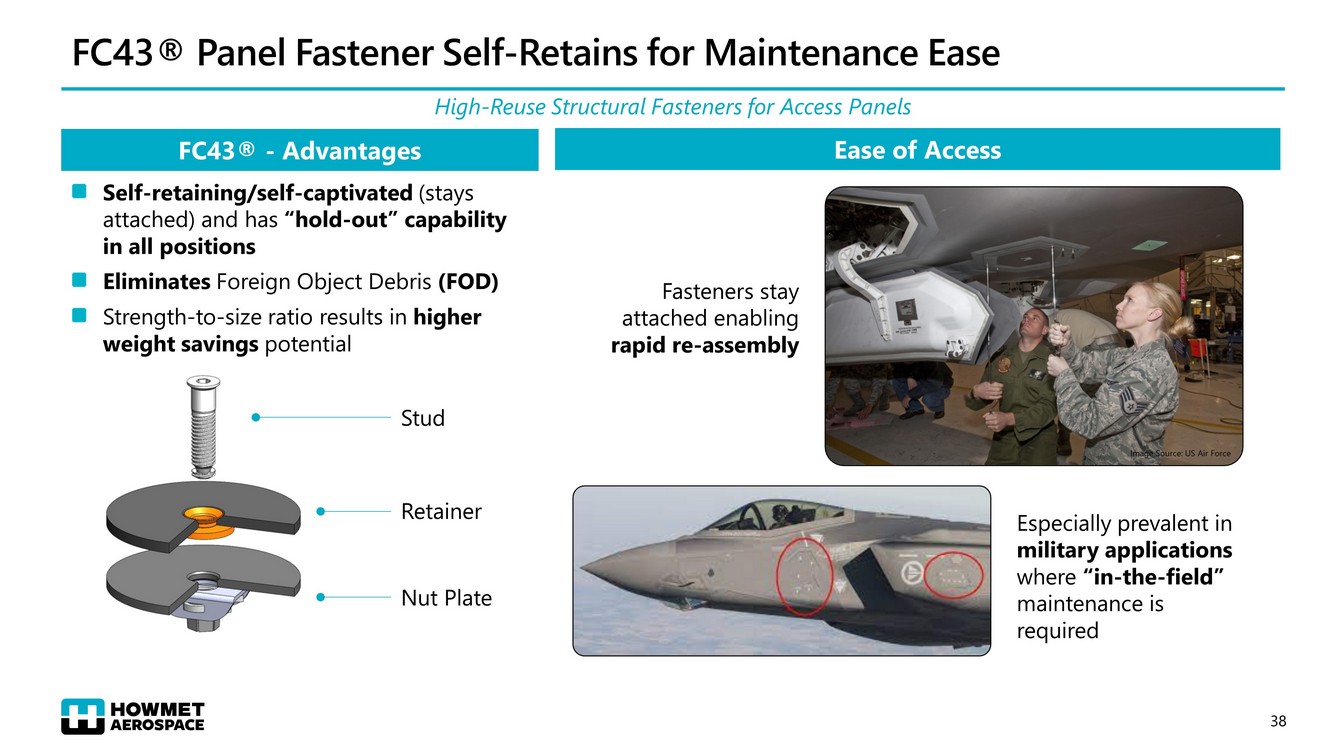

FC43® Panel Fastener Self - Retains for Maintenance Ease Self - retaining/self - captivated (stays attached) and has “hold - out” capability in all positions Eliminates Foreign Object Debris (FOD) Strength - to - size ratio results in higher weight savings potential FC43® - Advantages Ease of Access Stud Retainer Nut Plate Fasteners stay attached enabling rapid re - assembly Especially prevalent in military applications where “in - the - field” maintenance is required High - Reuse Structural Fasteners for Access Panels Image Source: US Air Force 38

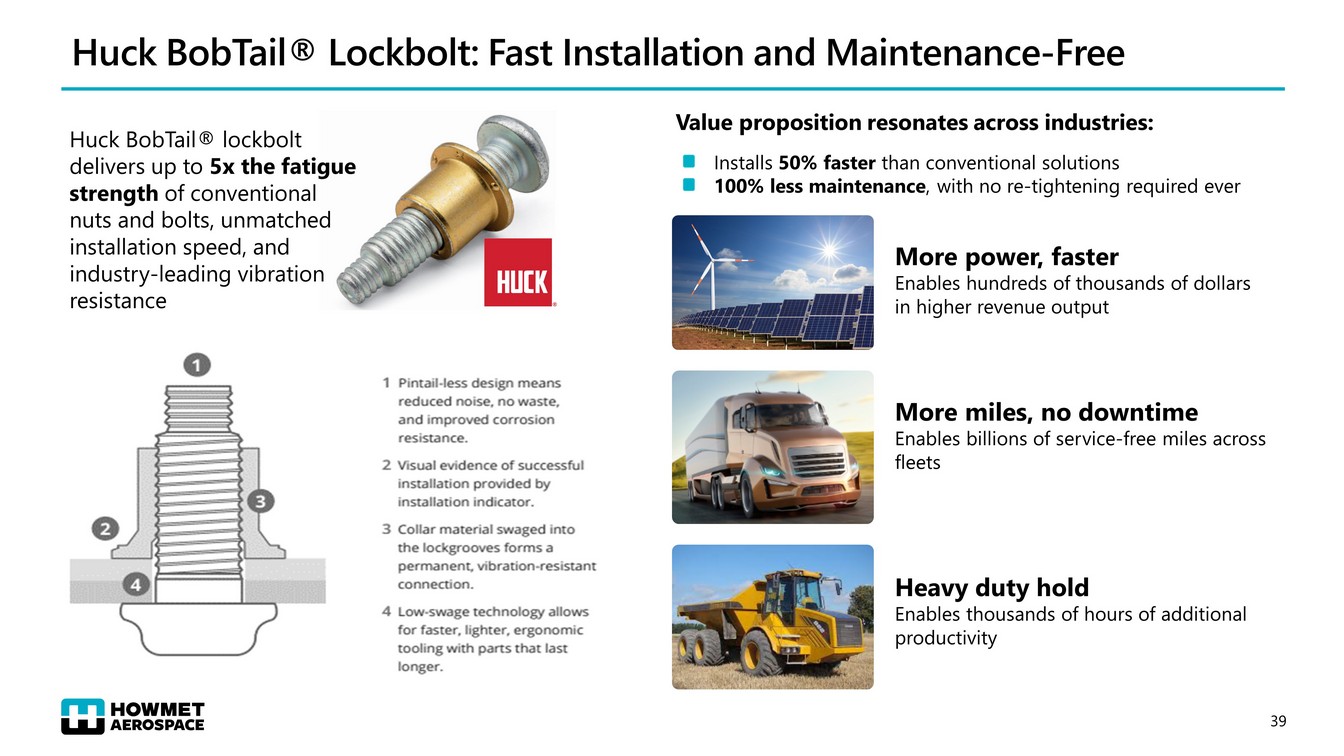

Huck BobTail® Lockbolt: Fast Installation and Maintenance - Free Huck BobTail® lockbolt delivers up to 5x the fatigue strength of conventional nuts and bolts, unmatched installation speed, and industry - leading vibration resistance More power, faster Enables hundreds of thousands of dollars in higher revenue output More miles, no downtime Enables billions of service - free miles across fleets Value proposition resonates across industries: Installs 50% faster than conventional solutions 100% less maintenance , with no re - tightening required ever Heavy duty hold Enables thousands of hours of additional productivity 39

Industrial Fasteners are a Growth Opportunity Key Customers Fasteners Advantage ▪ Rapid assembly ▪ Vibration resistance ▪ Maintenance - free 40

Fastening Systems: Key Messages Market Share Growth in Aerospace and Expansion into adjacent Industrial Markets Have broadest portfolio of customer - qualified sites and products Capability to provide system solution including fasteners, installation tooling, post - installation gauging, and customer support Continue to develop and commercialize innovative technologies and techniques Leader in innovation with strong Intellectual Property position Industry leading brands including Camloc ® and Huck® Dedicated R&D facilities Consistent track record of anticipating the needs of our customers Partner of choice for next generation applications Focus on Increasing Automation in the production process Differentiated technologies and solutions to continue driving content gains 41

Engineered Structures 42

Engineered Structures Video 43

Engineered Structures: Multiple Techniques to Meet Customer Needs We Deliver Through: Major Drivers to Achieve: Market Needs: Improved Fuel Efficiency Reduced Emissions Predictable Overhaul Cycles Speed to Market Operating Temperature Compatibility with Composites Environmental Resistance Component Integrity Model Based Manufacturing Reduced Weight & Near - Net - Shapes Monolithic Forgings Proprietary Ti, Al - Li & Al Alloys Ti Extrusions Hi Temp Super Alloy Forgings Digital Manufacturing and Automation F - 35 Bulkhead Al - Li Forged Fan Blade Seat Tracks Signature Stress Relief 15 Feet 44 Ti = Titanium, Al = Aluminum, Li = Lithium

Engineered Structures: Global Leader in Aerospace & Defense Structures Market Segment Products (In Order of Differentiation) Competitive Position Highlights Revenue % of FY21 Total Ti - Mill Structures Plate / Sheet Billet / Bloom Ingot Value Add Ti Services Vertically integrated with alloys, forging, extrusion, forming, machining and assembly solutions Al, Ti, Super Alloy Forgings Fan Blades Aero Wheel and Brake Large Al Engine Disks Large Ti Industry leader in large monolithic, wheel and brake, and fan blade forgings Proprietary Alloys and Processes: Al - Li fan blades, 7085 alloy for large monolithic forgings Ti Extrusions and Machining Seat Track Raw / Machined Large Ti Extrusions Machined Ti Plate Leader in vertical integrated solutions for Ti Extrusion Machining and assembly Al Machining and Assembly Radar Structures Machined Al Structures Machined Al Components Leader in large complex defense Al assemblies Expertise in machining and assembly of aerospace forgings, castings and plate ~40% ~40% ~10% ~10% ~80% of Revenue Under Long - Term Agreements (LTAs) 15 Feet Aerospace Defense Structures Aerospace Defense / Wheel and Brake Aerospace Ti Extrusions and Seat Tracks 45

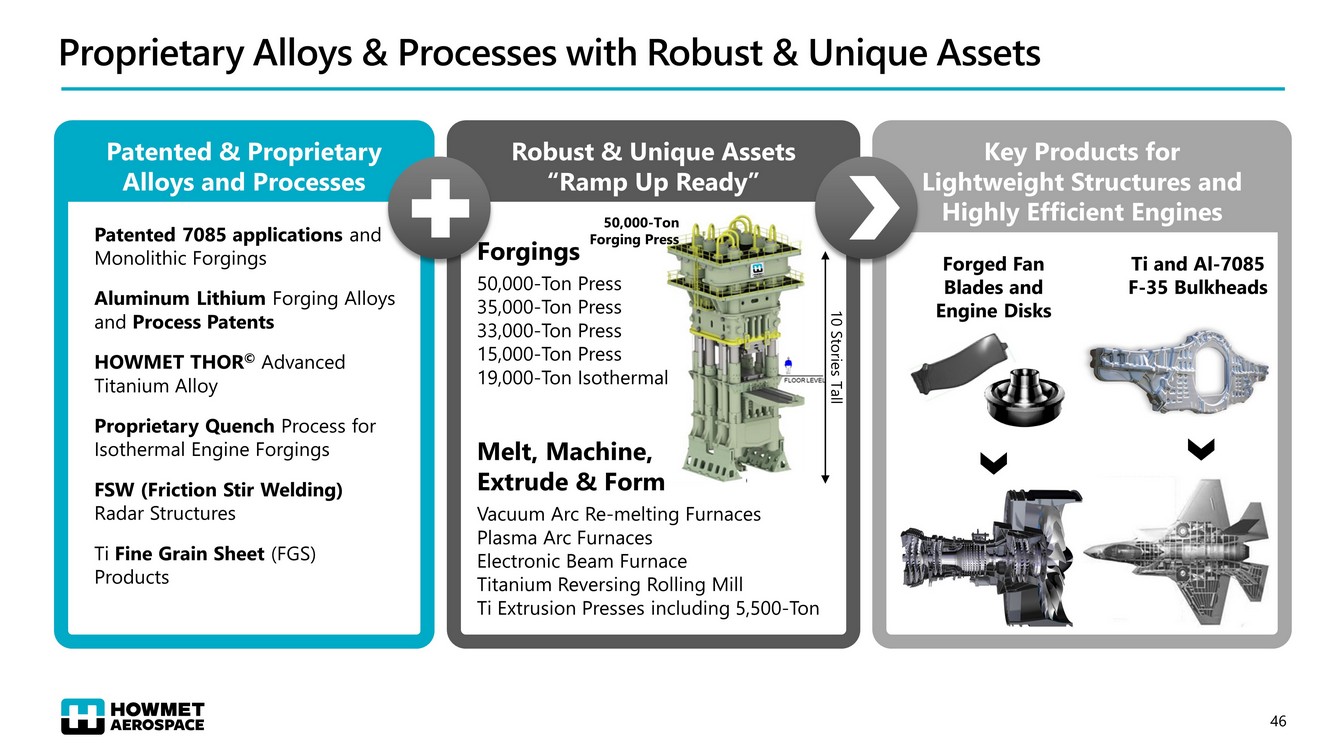

Key Products for Lightweight Structures and Highly Efficient Engines Proprietary Alloys & Processes with Robust & Unique Assets Ti and Al - 7085 F - 35 Bulkheads Forged Fan Blades and Engine Disks 50,000 - Ton Forging Press Robust & Unique Assets “Ramp Up Ready” Patented & Proprietary Alloys and Processes Patented 7085 applications and Monolithic Forgings Aluminum Lithium Forging Alloys and Process Patents HOWMET THOR © Advanced Titanium Alloy Proprietary Quench Process for Isothermal Engine Forgings FSW (Friction Stir Welding) Radar Structures Ti Fine Grain Sheet (FGS) Products 10 Stories Tall Forgings 50,000 - Ton Press 35,000 - Ton Press 33,000 - Ton Press 15,000 - Ton Press 19,000 - Ton Isothermal Melt, Machine, Extrude & Form Vacuum Arc Re - melting Furnaces Plasma Arc Furnaces Electronic Beam Furnace Titanium Reversing Rolling Mill Ti Extrusion Presses including 5,500 - Ton 46

Isothermal Forging Press and Heat Treat Cell Near - net shape isothermal forging in vacuum to meet newest jet engine requirements Unique isothermal forging press with “quick” die change capability High Speed Air System quench cell Allows localized control of quench rate to achieve required balance of material properties and residual stresses Unique Forging Capabilities for Most Challenging Engine Applications 47

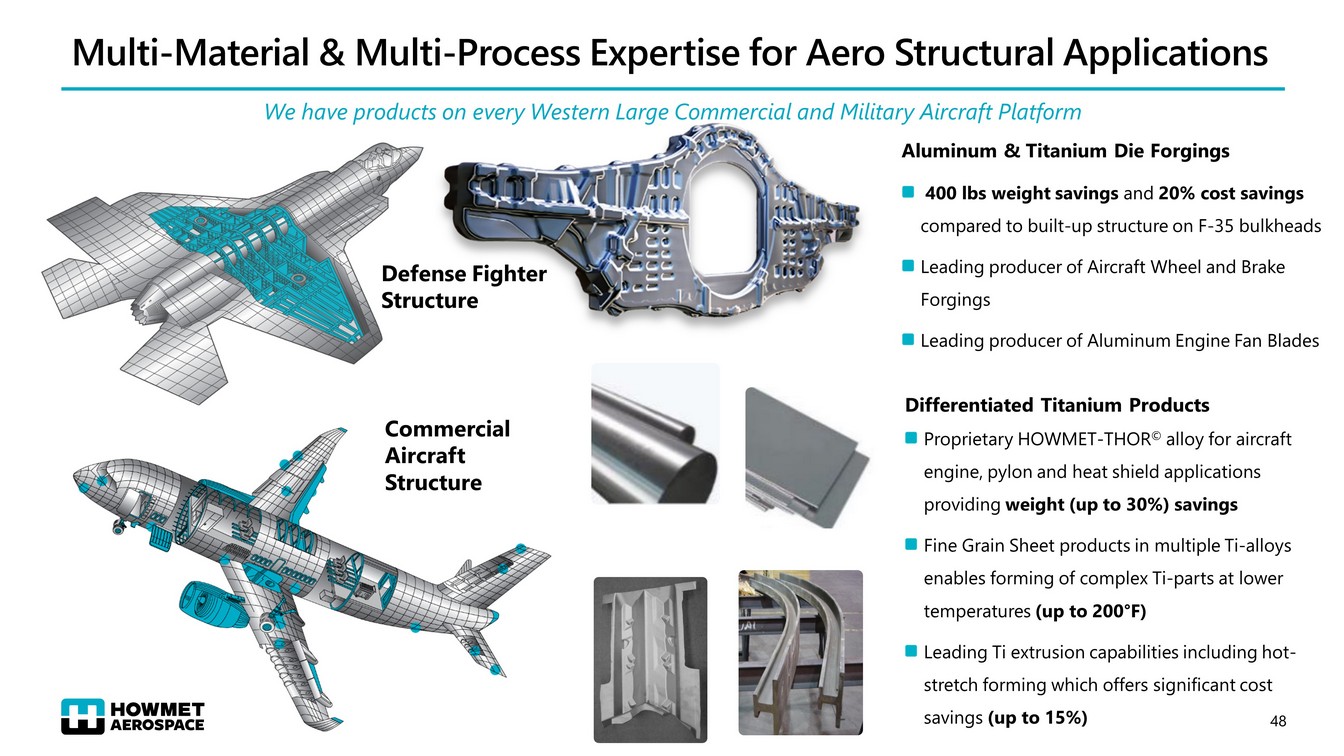

Aluminum & Titanium Die Forgings 400 lbs weight savings and 20% cost savings compared to built - up structure on F - 35 bulkheads Leading producer of Aircraft Wheel and Brake Forgings Leading producer of Aluminum Engine Fan Blades Multi - Material & Multi - Process Expertise for Aero Structural Applications Defense Fighter Structure Commercial Aircraft Structure We have products on every Western Large Commercial and Military Aircraft Platform Differentiated Titanium Products Proprietary HOWMET - THOR © alloy for aircraft engine, pylon and heat shield applications providing weight (up to 30%) savings Fine Grain Sheet products in multiple Ti - alloys enables forming of complex Ti - parts at lower temperatures (up to 200 ° F) Leading Ti extrusion capabilities including hot - stretch forming which offers significant cost savings (up to 15%) 48

Differentiated Ti - Sheet Products Mill - friendly Fine Grain Sheet in multiple Ti - alloys Targeted at pylon and heat shield applications Enables forming of complex Ti - parts at lower temperatures (up to 200 ° F) Enables more complex shapes and thinner gauges Provides cost savings and enhanced tool life Courtesy: Boeing Fine Grain Sheet Reduces Overall Cost of Superplastic Forming Titanium Complex Shapes 49

Engineered Structures: Key Messages Global Market Leader : ▪ Large Aluminum and Titanium Forgings ▪ Aircraft Wheel & Brake Forgings ▪ Forged Aluminum Fan Blades ▪ Ti Mill Products Leading market positions are supported by Patented and Proprietary Alloys and Processes supported by Robust & Unique Assets Well positioned for Growth on both Metal Intensive and Composite Structures through Differentiated Titanium and Aluminum solutions Unique capabilities for Critical Engine Applications including near - net shape isothermal forgings 50

Forged Wheels 51

Forged Wheels Video 52

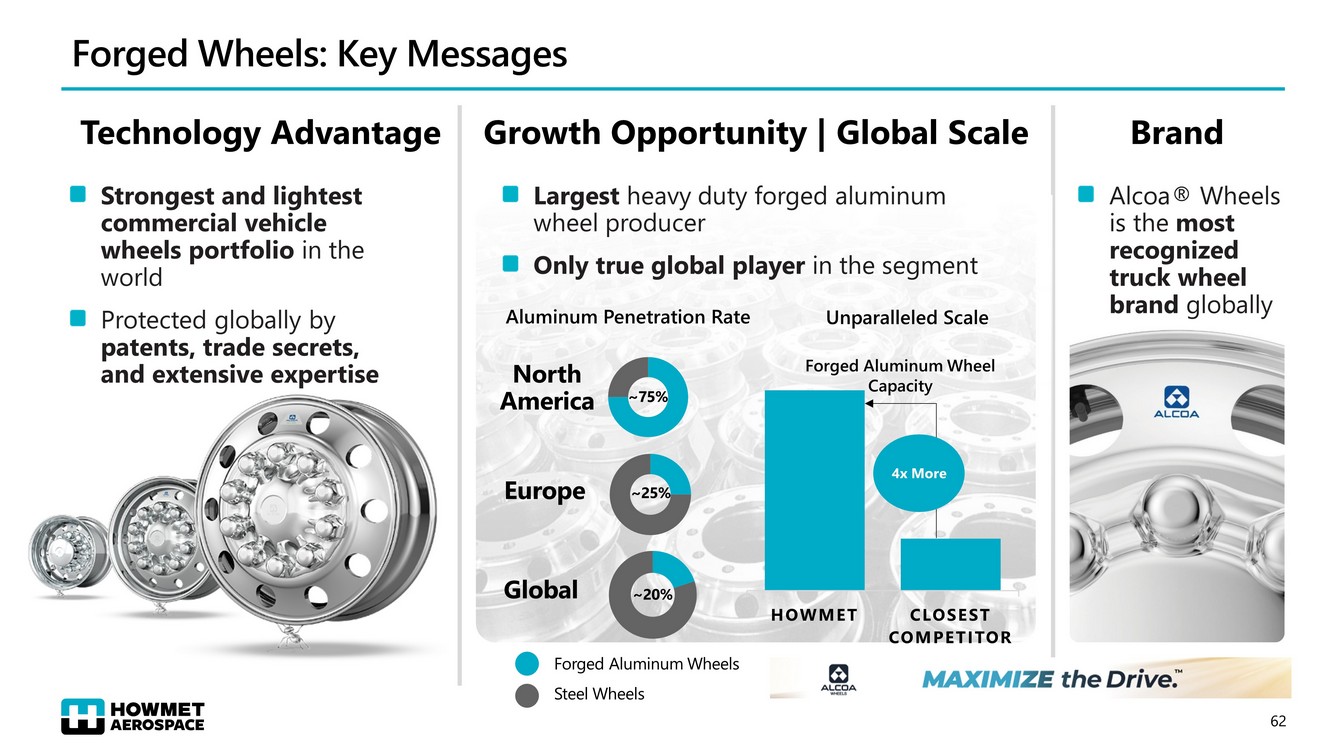

Forged Wheels Expertise and Market Position • Brand: Most recognized truck wheel globally • Patents: Over 150 patents and trade secrets • Unmatched Global Scale • Most applications, models, and wheel designs • Powertrains - > Fossil, electric, fuel cell • Megatrends require Aluminum Wheels Differentiation • Differentiated products ; Not make to print like automotive • Sold through to Major Fleets • 4X capacity of next global competitor through 6 major manufacturing locations 53

Forged Wheels: Meeting Multiple Customer Needs We Deliver Through: Major Drivers to Achieve: Market Needs: Fuel Efficiency Payload Reduced Emissions Enhanced Aesthetics Reduced Maintenance Reliability Resale Value Weight Optimization Product Integrity Value - Based Features Proprietary Alloy Engineering Expertise and Patented Features Advanced Forging Digital Manufacturing and Automation Proprietary Surface Treatments Flexible Global Footprint Up to 1,400 Pounds of Weight Savings from Replacing 18 Steel Wheels with Aluminum 54

Market Segment Products Competitive Position Highlights Revenue % of FY21 Total Ultra ONE® Dura - Bright® Integrated Aerodynamic Solutions vHub ® Bore Technology Howmet aluminum wheel market share ~75% Proprietary MagnaForce ® Alloy enables continued light - weighting across global portfolio 70+ years of Alcoa® Wheels brand development Dura - Bright® LvL ONE® Finish Ultra ONE® Howmet aluminum wheel market share ~90% Image - concious customer base drives high adoption of Dura - Bright ® surface treatment Expansion in Hungary adds low - cost global capacity Dura - Bright® LvL ONE® Finish Ultra ONE® Howmet aluminum wheel market share ~25% Expanding Dura - Bright® surface treatment portfolio offerings World - class competency in complying with rigorous local certification requirements North America Europe Other Regions Forged Wheels: Global Leader in Aluminum Forged Wheels Greater Than 50% of Revenue Under Long - Term Agreements (LTAs) 56% 29% 15% 55

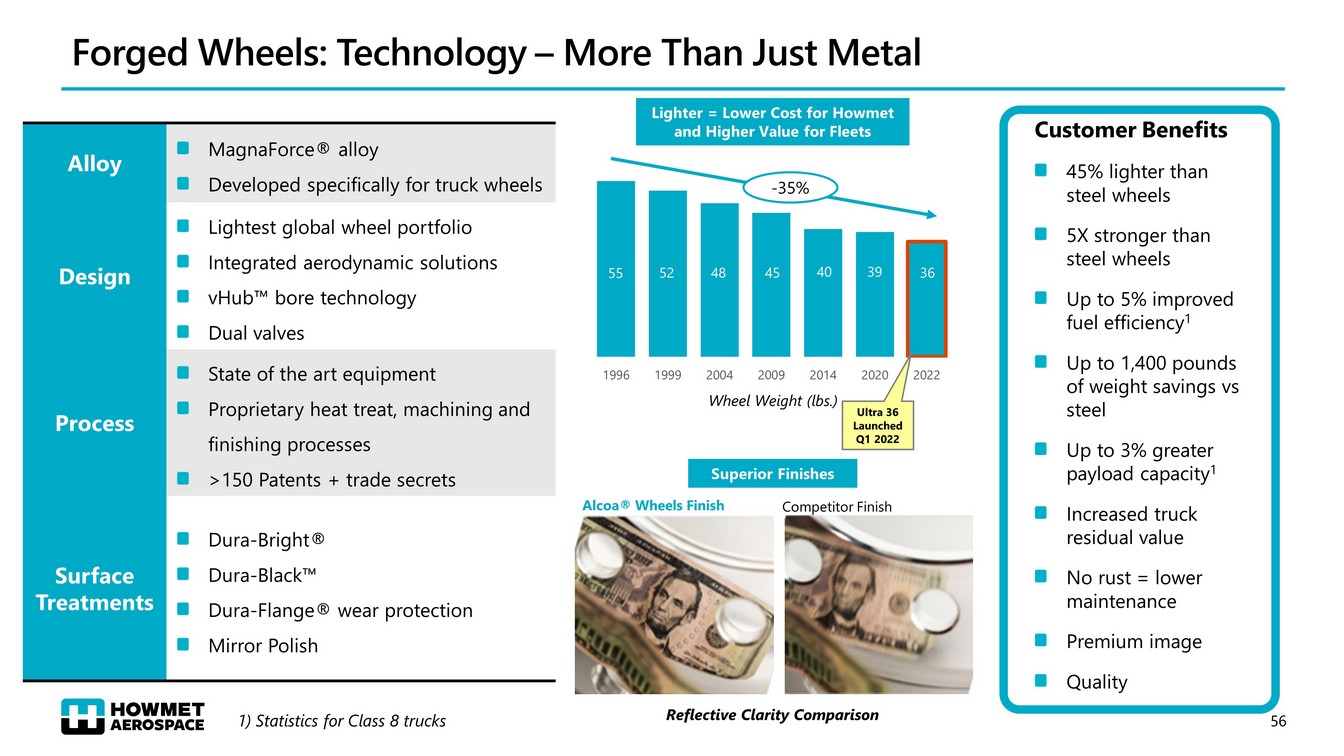

1996 1999 2004 2009 2014 2020 2022 Lighter = Lower Cost for Howmet and Higher Value for Fleets Forged Wheels: Technology – More Than Just Metal Competitor Finish Alcoa® Wheels Finish Superior Finishes Wheel Weight (lbs.) Reflective Clarity Comparison Customer Benefits 45% lighter than steel wheels 5X stronger than steel wheels Up to 5% improved fuel efficiency 1 Up to 1,400 pounds of weight savings vs steel Up to 3% greater payload capacity 1 Increased truck residual value No rust = lower maintenance Premium image Quality - 35% Alloy MagnaForce ® alloy Developed specifically for truck wheels Design Lightest global wheel portfolio Integrated aerodynamic solutions vHub bore technology Dual valves Process State of the art equipment Proprietary heat treat, machining and finishing processes >150 Patents + trade secrets Surface Treatments Dura - Bright® Dura - Black Dura - Flange® wear protection Mirror Polish 1) Statistics for Class 8 trucks 55 52 48 45 40 39 36 Ultra 36 Launched Q1 2022 56

Forged Wheels: Innovations ▪ 36 Pound Wheel with Patent pending design ▪ Proprietary MagnaForce ® Alloy ▪ 7,400 lbs load capacity ▪ Five year unlimited mile warranty Ultra ONE® 36: Industry’s Lightest Wheel ▪ Easy installation, maintenance and inspection ▪ Minimizes drag ▪ Improves fuel efficiency saving up to 1.3 gallons of fuel per 1,000 miles Aerodynamic Steer and Drive Cover 57

Forged Wheels: Product Integrity Long Term Durability Test High Impact Test ▪ Rigorous product validation and certification process ▪ Track testing and fleet trials ▪ Best in Class analysis and testing tools ▪ Product and Process 3 rd party certified ▪ Multiple regional wheel certification standards ▪ Quality: Single digit PPM 2,200 Lb weight dropped from 20 feet to test impact resistance 700,000 miles simulated - 2X normal loading to test durability Finite element analysis to optimize strength and weight 58 PPM = Parts Per Million

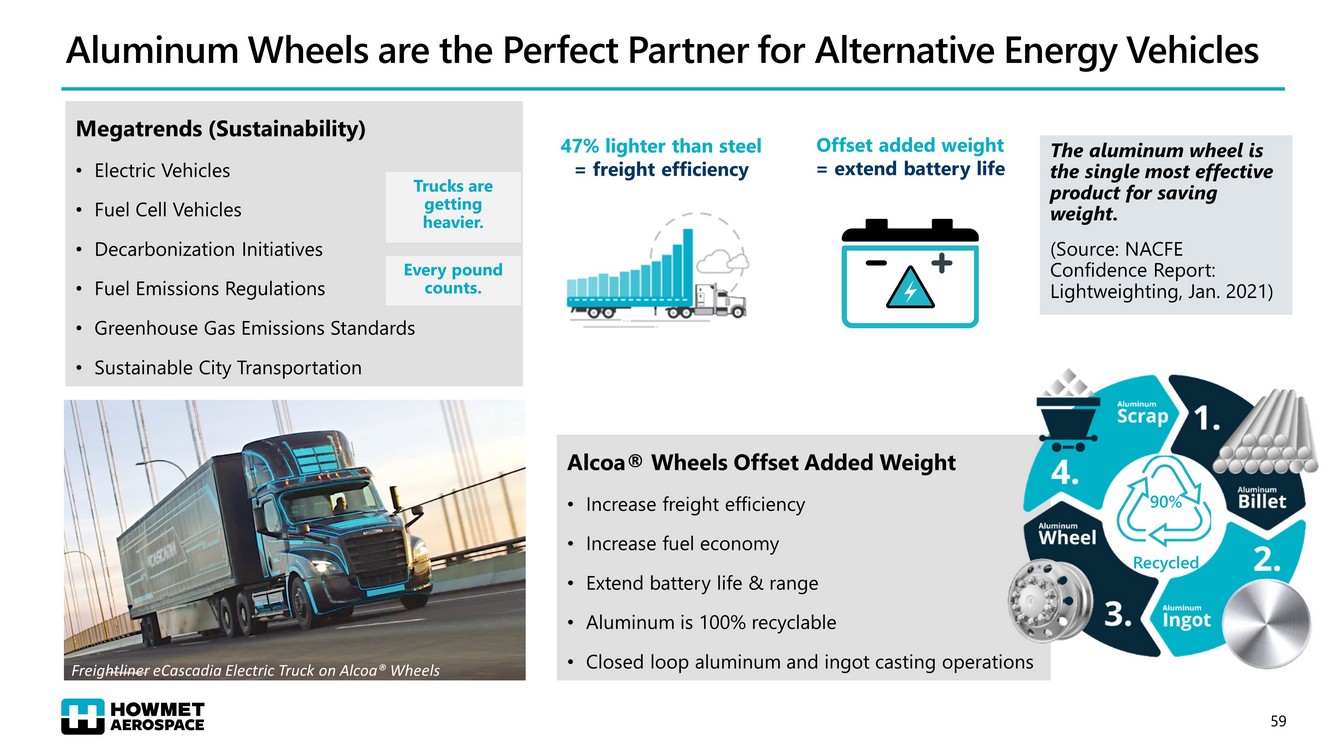

Aluminum Wheels are the Perfect Partner for Alternative Energy Vehicles Alcoa® Wheels Offset Added Weight • Increase freight efficiency • Increase fuel economy • Extend battery life & range • Aluminum is 100% recyclable • Closed loop aluminum and ingot casting operations 47% lighter than steel = freight efficiency Offset added weight = extend battery life Megatrends (Sustainability) • Electric Vehicles • Fuel Cell Vehicles • Decarbonization Initiatives • Fuel Emissions Regulations • Greenhouse Gas Emissions Standards • Sustainable City Transportation Freightliner eCascadia Electric Truck on Alcoa® Wheels 90% Recycled The aluminum wheel is the single most effective product for saving weight . (Source: NACFE Confidence Report: Lightweighting , Jan. 2021) Trucks are getting heavier. Every pound counts. 59

Emission Reduction Goals are a Secular Tailwind for Aluminum Wheels Governments are Mandating Environmental Policies • European Green D eal (2019); Target EU Greenhouse Gas neutral by 2050 • Truck OEMs responsible to reduce emissions by 50% in 2030 Zero Emission Vehicles to Increase in Prevalence • 51% 1 of European truck sales (light, medium, heavy duty) will be zero emissions by 2030 • Challenge: Fuel cell electric and battery electric trucks weigh significantly more than diesel trucks (Estimates are 6,000 - 12,000 pounds more) Weight and Aerodynamic Improvements Required • P owertrains are becoming heavier and more expensive • Light weighting and aerodynamic improvements required to meet range and payload capacity needs • OEMs face large fines for failing to meet the required standards 1) Source Boston Consulting Group Alcoa® Wheels offer a solution to OEMs striving to meet new requirements while retaining optimal performance 60

HOWMET CLOSEST COMPETITOR Forged Aluminum Wheel Capacity 4x More Global Scale - Unmatched Global Network Creates Cost Advantage MEXICO OHIO (2) BRAZIL SOUTH AFRICA HUNGARY JAPAN CHINA Distribution & Commercial Operations Manufacturing Operations 4x more capacity than next largest competitor Majority of capacity is in low - cost countries Full control of our value chain from molten metal to finished product Rapid global deployment of innovations like Ultra ONE® and Dura - Bright® Larger global commercial network than any competitor 61 AUSTRALIA

Forged Wheels: Key Messages Technology Advantage Brand Strongest and lightest commercial vehicle wheels portfolio in the world Protected globally by patents, trade secrets, and extensive expertise Alcoa® Wheels is the most recognized truck wheel brand globally Growth Opportunity | Global Scale Largest heavy duty forged aluminum wheel producer Only true global player in the segment ~75% ~25% ~20% North America Europe Global Forged Aluminum Wheels Steel Wheels Aluminum Penetration Rate Unparalleled Scale HOWMET CLOSEST COMPETITOR Forged Aluminum Wheel Capacity 4x More 62

Financial Overview 63

Progress 2019 - 2021 Gross debt reduction of ~$2.1B over last 3 years; ~ $845M in 2021 Annualized interest savings of ~$110M through debt actions over last 3 years; ~$70M in 2021 Share repurchases of ~$1.7B over last 3 years; $430M in 2021 Pension Net liability reduction of ~25% Pension and OPEB cash contributions expected to improve from ~$240M in 2020 to ~$60M in 2022 Capital Discipline Commercial / Operational Excellence 2021 Commercial Aerospace Revenue ~50% relative to 2019 Top decile Adjusted EBITDA Margin versus Aerospace Peers Improved Adjusted EBITDA Margin above pre - pandemic levels; from 22.1% in 2019 to 22.8% in 2021 ~$437M of structural cost savings in 3 years; ~$130M in 2021 ~$214M of price increases in 3 years; ~ $97M in 2021 114% Adj Free Cash Flow Conversion in 2020 & 117% in 2021 See Appendix for reconciliations 64

2019 1 vs 2022 2 : ~21% Revenue Reduction, ~ 9 0 bps Margin Increase; ~8 % Adjusted EPS Increase ~21% Reduction in Revenue 2019 1 ~ $5,640 M $7,106 M 2022 - 21% 2022 22.1% ~ 23.0% + 90 bps $1.29 2022 2019 ~$1.39 +8% ~9 0 bps Improvement in Adjusted EBITDA Margin ~8 % Increase in Adjusted EPS ~ 40 % reduction in Commercial Aerospace 1) 2019 Pro forma 2) 2022 Guidance 2019 1 See Appendix for reconciliations 65

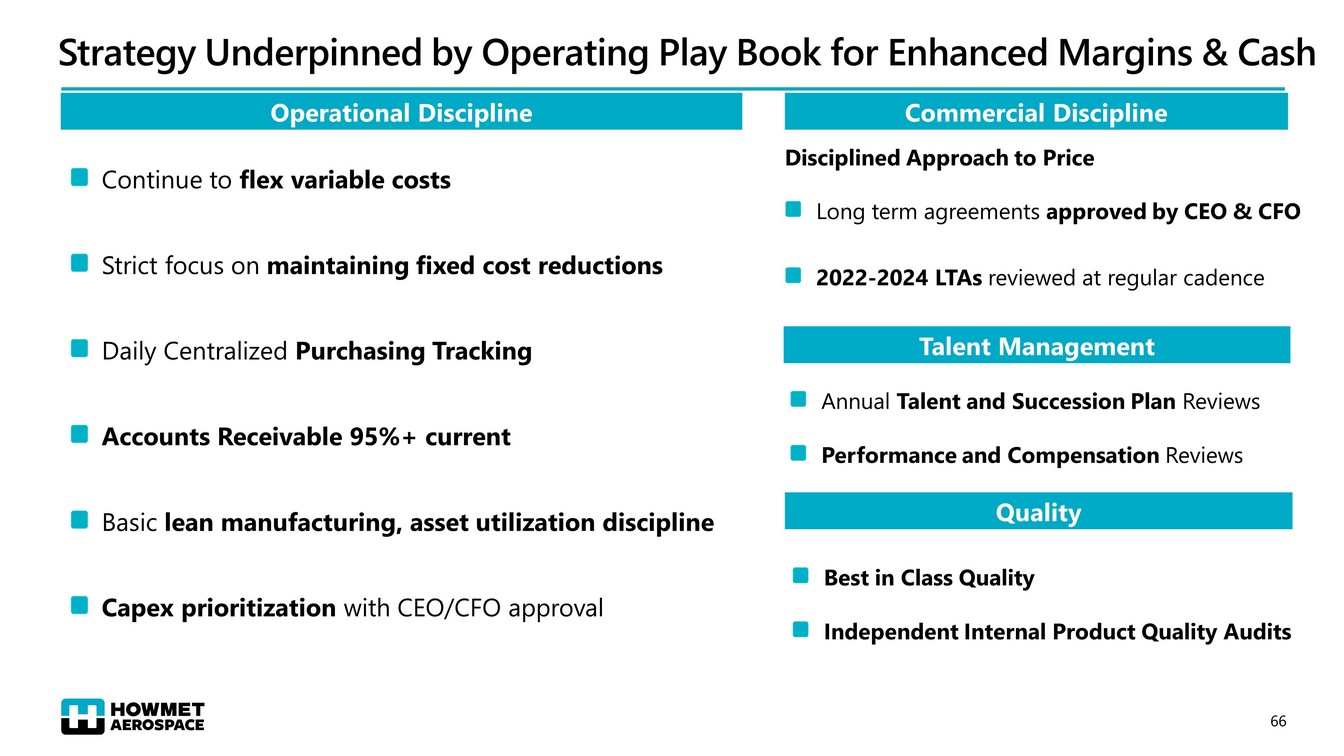

Strategy Underpinned by Operating Play Book for Enhanced Margins & Cash Operational Discipline Commercial Discipline Talent Management Continue to flex variable costs Strict focus on maintaining fixed cost reductions Daily Centralized Purchasing Tracking Accounts Receivable 95%+ current Basic lean manufacturing, asset utilization discipline Capex prioritization with CEO/CFO approval Disciplined Approach to Price Long term agreements approved by CEO & CFO 2022 - 2024 LTAs reviewed at regular cadence Annual Talent and Succession Plan Reviews Performance and Compensation Reviews Quality Best in Class Quality Independent Internal Product Quality Audits 66

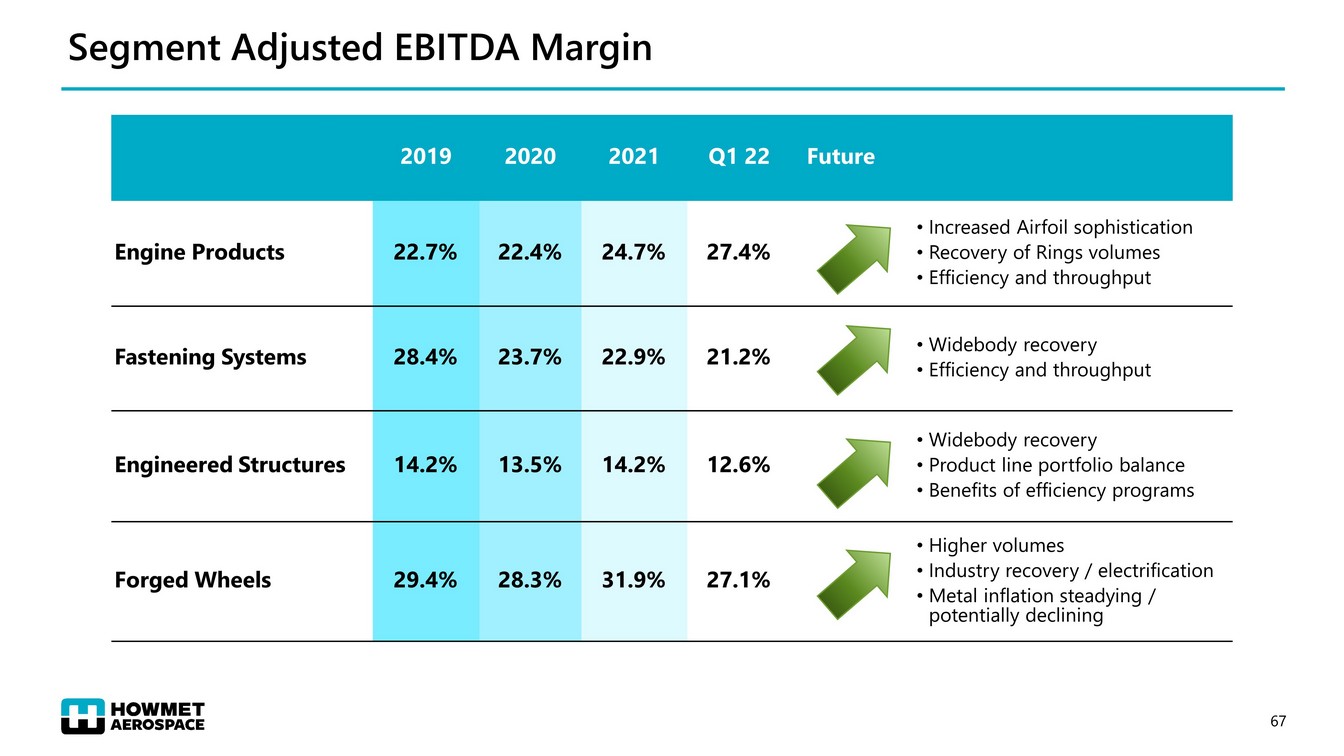

Segment Adjusted EBITDA Margin 2019 2020 2021 Q1 22 Future Engine Products 22.7% 22.4% 24.7 % 27.4 % • Increased Airfoil sophistication • Recovery of Rings volumes • Efficiency and throughput Fastening Systems 28.4% 23.7 % 22.9 % 21.2 % • Widebody recovery • Efficiency and throughput Engineered Structures 14.2% 13.5% 14.2% 12.6% • Widebody recovery • Product line portfolio balance • Benefits of efficiency programs Forged Wheels 29.4% 28.3% 31.9% 27.1% • Higher volumes • Industry recovery / electrification • Metal inflation steadying / potentially declining 67

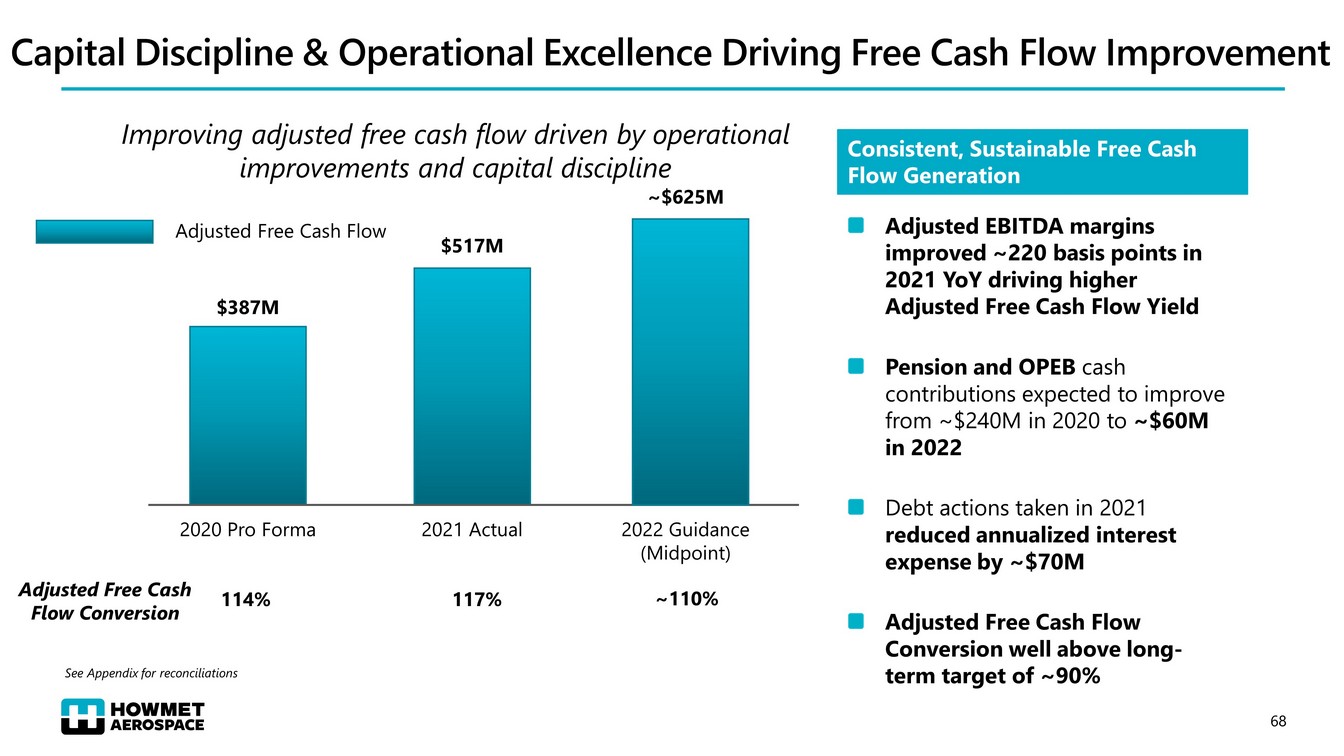

Capital Discipline & Operational Excellence Driving Free Cash Flow Improvement Adjusted EBITDA margins improved ~220 basis points in 2021 YoY driving higher Adjusted Free Cash Flow Y ield Pension and OPEB cash contributions expected to improve from ~$240M in 2020 to ~$60M in 2022 Debt actions taken in 2021 reduced annualized interest expense by ~$70M Adjusted Free Cash Flow Conversion well above long - term target of ~90% Consistent, Sustainable Free Cash Flow Generation Improving adjusted free cash flow driven by operational improvements and capital discipline $387M $517M ~$625M 114% 117% ~110% 2020 Pro Forma 2021 Actual 2022 Guidance (Midpoint) Adjusted Free Cash Flow Adjusted Free Cash Flow Conversion See Appendix for reconciliations 68

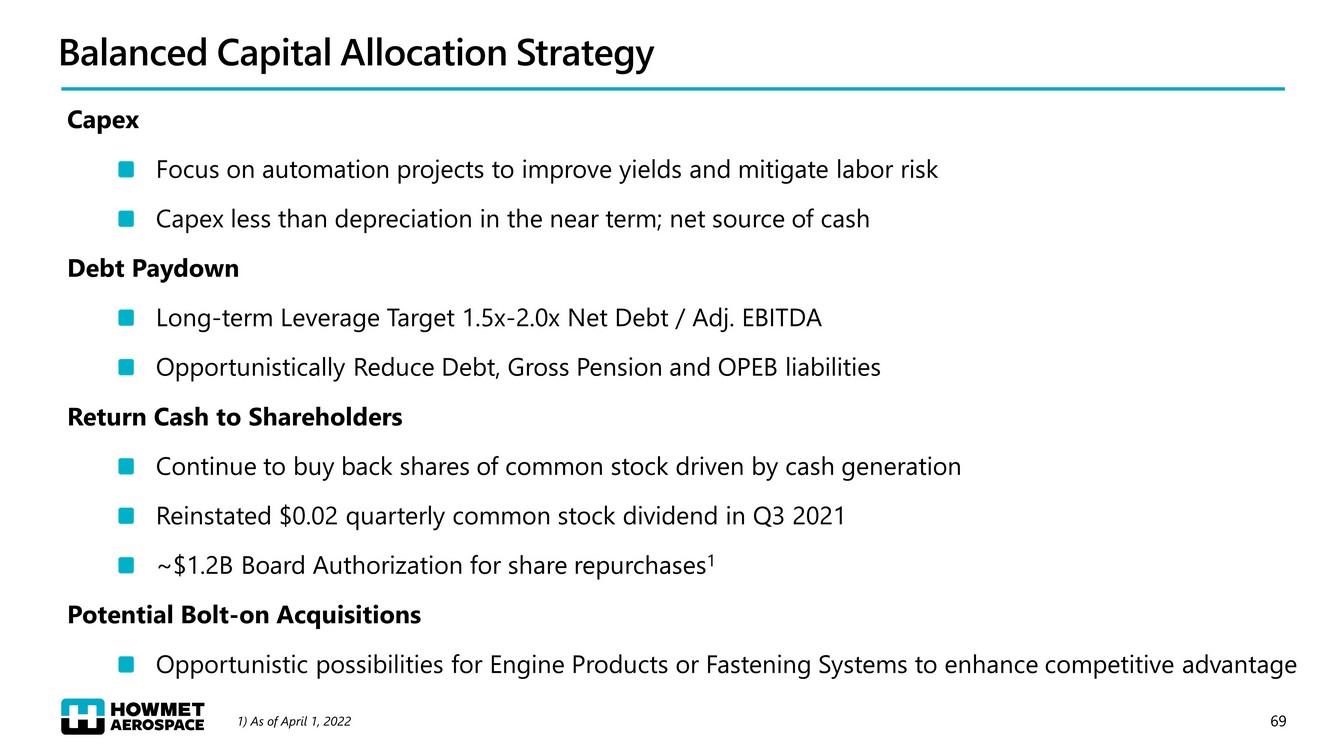

Balanced Capital Allocation Strategy Capex Focus on automation projects to improve yields and mitigate labor risk Capex less than depreciation in the near term; net source of cash Debt Paydown Long - term Leverage Target 1.5x - 2.0x Net Debt / Adj. EBITDA Opportunistically Reduce Debt, Gross Pension and OPEB liabilities Return Cash to Shareholders Continue to buy back shares of common stock driven by cash generation Reinstated $0.02 quarterly common stock dividend in Q3 2021 ~$1.2B Board Authorization for share repurchases 1 Potential Bolt - on Acquisitions Opportunistic possibilities for Engine Products or Fastening Systems to enhance competitive advantage 69 1) As of April 1, 2022

Howmet Aerospace Strategy Focus on what we are good at to drive growth above market rate Underpin strategy with commercial and operational discipline Prioritize major differentiated products for resource allocation Execute a disciplined capital allocation strategy 70

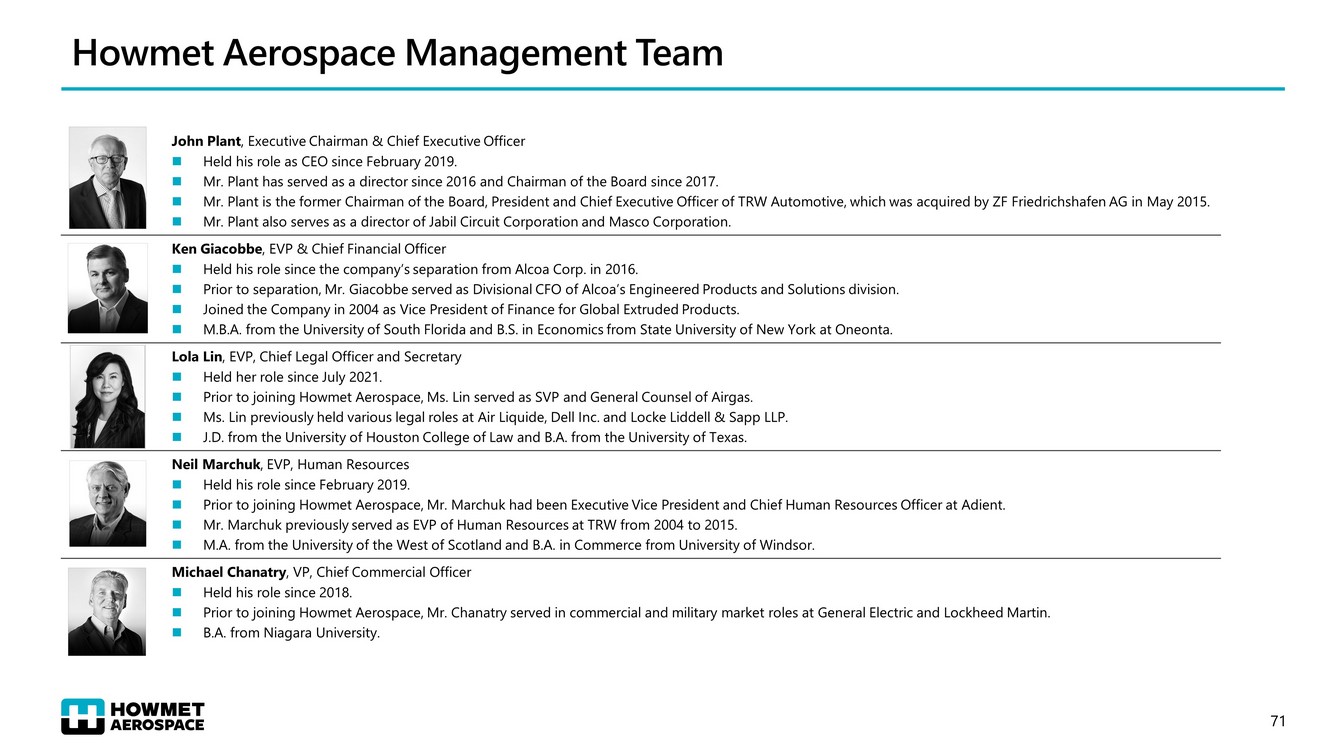

Howmet Aerospace Management Team John Plant , Executive Chairman & Chief Executive Officer Held his role as CEO since February 2019. Mr. Plant has served as a director since 2016 and Chairman of the Board since 2017. Mr. Plant is the former Chairman of the Board, President and Chief Executive Officer of TRW Automotive, which was acquired by ZF Friedrichshafen AG in May 2015. Mr. Plant also serves as a director of Jabil Circuit Corporation and Masco Corporation. Ken Giacobbe , EVP & Chief Financial Officer Held his role since the company’s separation from Alcoa Corp. in 2016. Prior to separation, Mr. Giacobbe served as Divisional CFO of Alcoa’s Engineered Products and Solutions division. Joined the Company in 2004 as Vice President of Finance for Global Extruded Products. M.B.A. from the University of South Florida and B.S. in Economics from State University of New York at Oneonta. Lola Lin , EVP, Chief Legal Officer and Secretary Held her role since July 2021. Prior to joining Howmet Aerospace, Ms. Lin served as SVP and General Counsel of Airgas. Ms. Lin previously held various legal roles at Air Liquide, Dell Inc. and Locke Liddell & Sapp LLP. J.D. from the University of Houston College of Law and B.A. from the University of Texas. Neil Marchuk , EVP, Human Resources Held his role since February 2019. Prior to joining Howmet Aerospace, Mr. Marchuk had been Executive Vice President and Chief Human Resources Officer at Adient . Mr. Marchuk previously served as EVP of Human Resources at TRW from 2004 to 2015. M.A. from the University of the West of Scotland and B.A. in Commerce from University of Windsor. Michael Chanatry , VP, Chief Commercial Officer Held his role since 2018 . Prior to joining Howmet Aerospace, Mr. Chanatry served in commercial and military market roles at General Electric and Lockheed Martin. B.A. from Niagara University. 71

Howmet Aerospace Management Team (continued) Merrick Murphy , President, Engine Products Held his current role since March 2022. Prior to this appointment, Mr. Murphy was President, Engineered Structures. Previously, Mr. Murphy was President, Forged Wheels. Mr. Murphy joined the company in 1997. B.A. in Business Administration from Loyola University, in Chicago. Vitaliy V. Rusakov , President, Fastening Systems Held his role since 2010. Mr. Rusakov had served as Chief Operating Officer for Arconic Engineered Products and Solutions. Mr. Ruskov began his career in the fastening business in 1998. M.B.A. from Georgetown University and INSEAD, B.A. in International Economics from Kiev University of Economics and B.A. in L ing uistics and Education from Kiev University of Linguistics. Randall Scheps , President, Forged Wheels Held his current role since March 2020. Joined the company in 2006. Previously held a variety of roles at Ford Motor Company and Visteon in product engineering, strategic planning and operation s l eadership. MBA from the University of Michigan and a B.A in Mechanical Engineering from the University of Texas. Ramiro Gutierrez , President, Engineered Structures Held his role since March 2022. Joined the company as Vice President Sales and Marketing, Engine Products in 2021. Previously he was Vice President of Sales in the Active Safety & User Experience Division at Aptiv . Degree in in Business Administration from Vigo & Santiago de Compostela University in Vigo, Spain, and graduate of Executive LEA D program University of Michigan’s Ross Business School. 72

Q&A John C. Plant Executive Chairman & CEO Ken Giacobbe EVP & Chief Financial Officer Vitaliy Rusakov President, Fastening Systems Merrick Murphy President, Engine Products Randall Scheps President, Forged Wheels Ramiro Gutierrez President, Engineered Structures 73

Appendix 74

2022 Guidance Q2 2022 Guidance FY 2022 Guidance What we expect in 2022 Low Midpoint High Low Midpoint High ▪ FY 2022 Revenue up ~13% vs. FY 2021, includes material pass through ▪ FY 2022 Adj EBITDA up ~15% vs. FY 2021 ▪ FY 2022 Adj EPS up ~38% vs. FY 2021 ▪ Pension/OPEB Contributions of ~$60M ▪ Capex of $220M - $250M vs. Depreciation and Amortization of ~$270M ▪ Free Cash Flow Conversion ~110% Revenue $1.350B $1.370B $1.390B $5.560B $5.640B $5.720B Adj EBITDA 1 $302M $310M $318M $1.265B $1.300B $1.335B Adj EBITDA Margin 1 22.4% 22.6% 22.9% 22.8% 23.0% 23.3% Adj Earnings per Share 1,2 $0.31 $0.32 $0.33 $1.33 $1.39 $1.45 Free Cash Flow $575M $625M $675M 75 1) Excluding special items 2) Assumes ~$2M per Quarter of deferred comp and other expenses in FY 2022

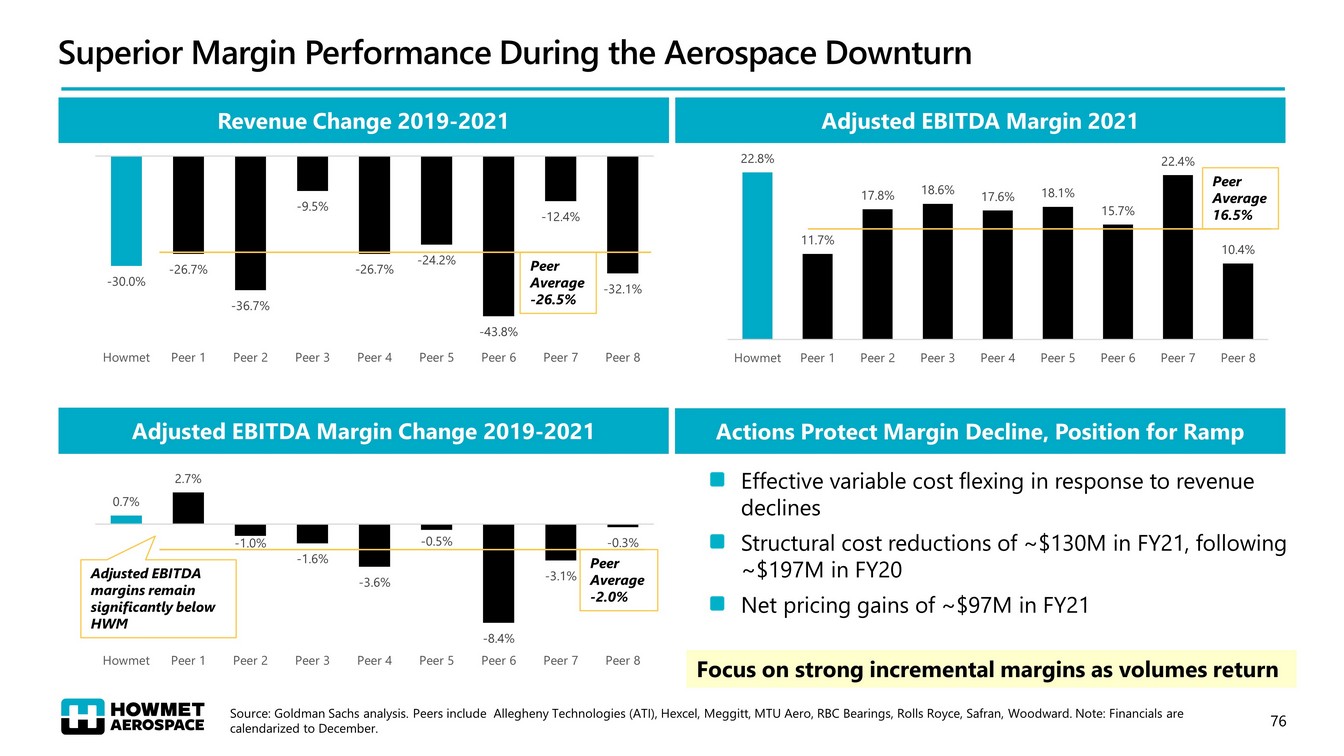

0.7% 2.7% - 1.0% - 1.6% - 3.6% - 0.5% - 8.4% - 3.1% - 0.3% Howmet Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 22.8% 11.7% 17.8% 18.6% 17.6% 18.1% 15.7% 22.4% 10.4% Howmet Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 - 30.0% - 26.7% - 36.7% - 9.5% - 26.7% - 24.2% - 43.8% - 12.4% - 32.1% Howmet Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Superior Margin Performance During the Aerospace Downturn Revenue Change 2019 - 2021 Adjusted EBITDA Margin 2021 Adjusted EBITDA Margin Change 2019 - 2021 Actions Protect Margin Decline, Position for Ramp Effective variable cost flexing in response to revenue declines Structural cost reductions of ~$130M in FY21, following ~$197M in FY20 Net pricing gains of ~$97M in FY21 Peer Average - 26.5% Peer Average 16.5% Peer Average - 2.0% Adjusted EBITDA margins remain significantly below HWM Focus on strong incremental margins as volumes return Source: Goldman Sachs analysis. Peers include Allegheny Technologies (ATI), Hexcel, Meggitt, MTU Aero, RBC Bearings, Rolls Royce, Safran, Woodward. Note: Financials are calendarized to December. 76

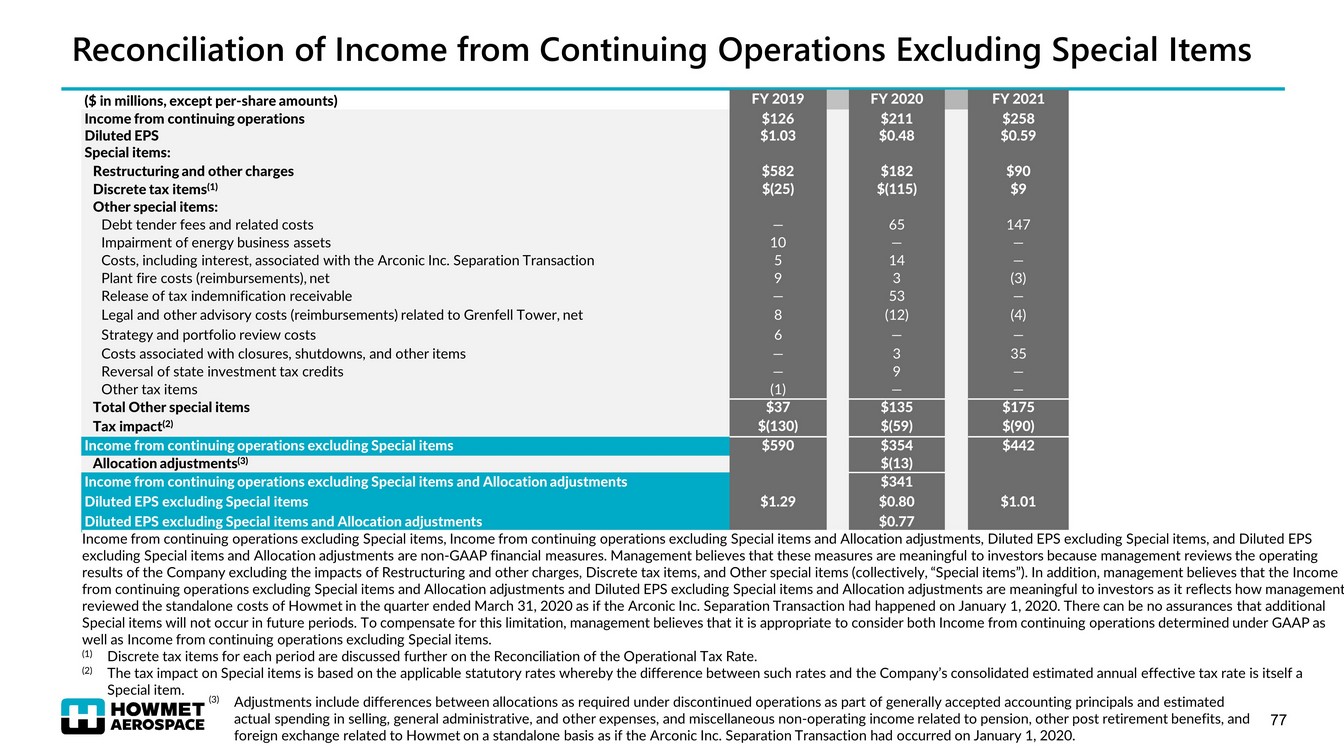

77 Reconciliation of Income from Continuing Operations Excluding Special Items ($ in millions, except per - share amounts) FY 2019 FY 2020 FY 2021 Income from continuing operations $126 $211 $258 Diluted EPS $1.03 $0. 48 $0.59 Special items: Restructuring and other charges $582 $182 $90 Discrete tax items (1) $(25) $(115) $9 Other special items: Debt tender fees and related costs — 65 147 Impairment of energy business assets 10 — — Costs, including interest, associated with the Arconic Inc. Separation Transaction 5 14 — Plant fire costs (reimbursements) , net 9 3 (3) Release of tax indemnification receivable — 53 — Legal and other advisory costs ( reimbursements ) related to Grenfell Tower, net 8 (12) (4) Strategy and portfolio review costs 6 — — Costs associated with closures, shutdowns, and other items — 3 35 Reversal of state investment tax credits — 9 — Other tax items (1) — — Total Other special items $37 $135 $175 Tax impact (2) $(130) $(59) $(90) Income from continuing operations excluding Special items $590 $354 $442 Allocation adjustments (3) $(13) Income from continuing operations excluding Special items and Allocation adjustments $341 Diluted EPS excluding Special items $1.29 $0.80 $1.01 Diluted EPS excluding Special items and Allocation adjustments $0.77 Income from continuing operations excluding Special items, Income from continuing operations excluding Special items and Allo cat ion adjustments, Diluted EPS excluding Special items, and Diluted EPS excluding Special items and Allocation adjustments are non - GAAP financial measures. Management believes that these measures are meaningful to investors because management reviews the operating results of the Company excluding the impacts of Restructuring and other charges, Discrete tax items, and Other special items (co llectively, “Special items”). In addition, management believes that the Income from continuing operations excluding Special items and Allocation adjustments and Diluted EPS excluding Special items and All oca tion adjustments are meaningful to investors as it reflects how management reviewed the standalone costs of Howmet in the quarter ended March 31, 2020 as if the Arconic Inc. Separation Transaction had happened on January 1, 2020. There can be no assurances that additional Special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Income from continuing operations determined under GAAP as well as Income from continuing operations excluding Special items. (1) Discrete tax items for each period are discussed further on the Reconciliation of the Operational Tax Rate. (2) The tax impact on Special items is based on the applicable statutory rates whereby the difference between such rates and the Com pany’s consolidated estimated annual effective tax rate is itself a Special item. (3) Adjustments include differences between allocations as required under discontinued operations as part of generally accepted a cco unting principals and estimated actual spending in selling, general administrative, and other expense s , and miscellaneous non - operating income related to pension, other post retirement benefits, and foreign exchange related to Howmet on a standalone basis as if the Arconic Inc. Separation Transaction had occurred on Januar y 1 , 2020.

Reconciliation of 2021 Adjusted Free Cash Flow ($ in millions) FY 2021 Cash provided from operations $449 Cash receipts from sold receivables 267 Capital expenditures (199) Adjusted free cash flow (1) $517 The net cash funding from the sale of accounts receivables was neither a use of cash nor a source of cash in the period presented . In the third quarter of 2021 , the Company restructured its accounts receivable securitization . As a result, going forward, Cash receipts from sold receivables (which had been included in the investing section of the Statement of Consolidated Cash Flows) will be $ 0 as the entire impact of the accounts receivable securitization program will be included in the Cash provided from operations section of the Statement of Consolidated Cash Flows . Consequently, for the fourth quarter 2021 and full year 2022 , the definition of Adjusted free cash flow is Cash provided from operations less Capital expenditures . Adjusted free cash flow is a non - GAAP financial measure. Management believes that this measures is meaningful to investors becau se management reviews cash flows generated from operations after taking into consideration capital expenditures (due to the fact that these expenditures are considered neces sar y to maintain and expand the Company's asset base and are expected to generate future cash flows from operations), as well as cash receipts from net sales of beneficial interest in so ld receivables. It is important to note that Adjusted free cash flow does not represent the residual cash flow available for discretionary expenditures since other non - discretionary expenditures, s uch as mandatory debt service requirements, are not deducted from the measure. (1) Record since April 2020 separation; FY 2021: Cash used for financing activities = ($1,444M) and Cash provided from investing act ivities = $107M . 78

Reconciliation of 2020 Adjusted Free Cash Flow ($ in millions) FY 2020 Cash provided from operations $9 Cash receipts from sold receivables 422 Capital expenditures (267) Adjusted free cash flow (1) $ 164 Costs associated with the Arconic Inc. Separation Transaction 77 Allocation adjustments (2) 146 Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction $ 387 Adjusted free cash flow and Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction are non - GAAP financial measures. Management believes that these measures are meaningful to investor s because management reviews cash flows generated from operations after taking into consideration capital expenditures (due to the fact th at these expenditures are considered necessary to maintain and expand the Company's asset base and are expected to generate future cash flows from operations), cash receipts from net sales of beneficial interest in sold receivab les , as well as costs associated with the Arconic Inc. Separation Transaction. It is important to note that Adjusted free cash flow and Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction, measures do not represent the residual cash flow available for discretionary expenditures since ot her non - discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. The net cash funding from the sale of accounts receivables was $329 million in the first quarter of 2020 which represented a $21 million use of cash in the first quarter. The net cash funding from the sale of accounts receivables was $299 million in the second quarter of 2020 which represented a $30 million use of cash in the second quarter. The net cash funding fr om the sale of accounts receivables was $255 million in the third quarter of 2020 which represented a $45 million use of cash in the third quarter. The net cash funding from the sale of accounts receivables was $250 million in the fourth quarter of 2020 which represented a $5 million use of cash in the fourth quarter. During the third quarter ended September 30, 2020, the Company identified a misclassification in the presentation of changes in accounts payable and capital expenditures in its previously issued Statement of Consolidated Cash Flows. Although management has determined that such misclassification did not materially misstate such prior financial statements, t he Company has revised its Statement of Consolidated Cash Flows for the twelve months ended December 31, 2019 resulting in an increase of $55 to previously reported capital expenditures within cash provided from investing activiti es with a corresponding offset in accounts payable, trade within cash used for operations. The Company also revised its Statement of Consolidated Cash Flows to increase its previously reported capital expenditures with a corresponding offset in accounts payable, trade of $74 which is reflected in the twelve months ended December 31, 2020 above. (2) Adjustments include differences between allocations as required under discontinued operations as part of generally accepted accounting pr inc iples and estimated actual spending in cash provided from operations and capital expenditures related to Howmet on a standalone basis as if the Arconic Inc. Separation Transaction had occurred on January 1, 2020. (1) 2Q 2020 – 4Q 2020 (GAAP): Cash used for financing activities = ($1,514M) and Cash provided from investing activities = $260M. FY 2020 (GAAP): Cash used for financing activities = ($369M) and Cash provided from investing activities = $271M. 79

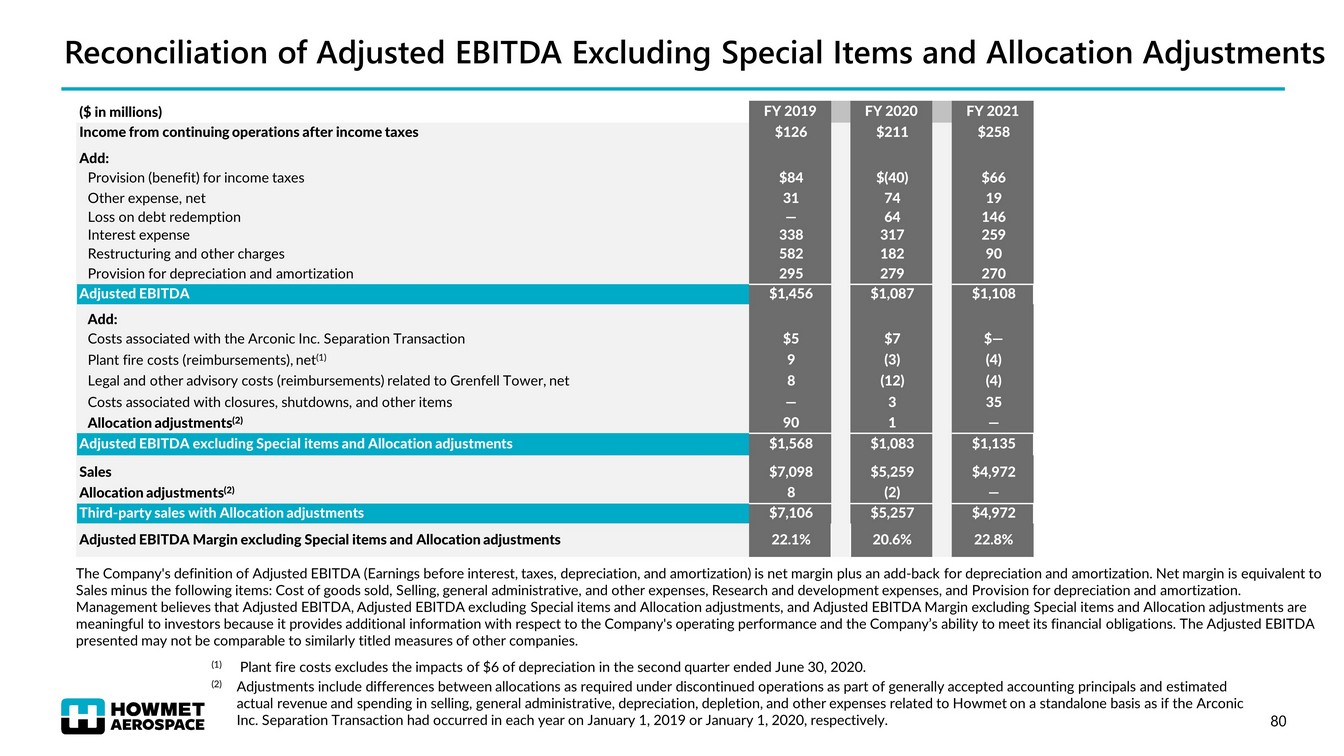

Reconciliation of Adjusted EBITDA Excluding Special Items and Allocation Adjustments ($ in millions) FY 20 19 FY 2020 FY 2021 Income from continuing operations after income taxes $ 126 $211 $258 Add: Provision (benefit) for income taxes $ 84 $(40) $66 Other expense, net 31 74 19 Loss on debt redemption — 64 146 Interest expense 338 317 259 Restructuring and other charges 582 182 90 Provision for depreciation and amortization 2 95 279 270 Adjusted EBITDA $1 ,456 $1,087 $1,108 Add: Costs associated with the Arconic Inc. Separation Transaction $ 5 $7 $ — Plant fire costs (reimbursements), net (1) 9 (3) (4) Legal and other advisory costs ( reimbursements ) related to Grenfell Tower , net 8 (12) (4) Costs associated with closures, shutdowns, and other items — 3 35 Allocation adjustments (2) 90 1 — Adjusted EBITDA excluding Special items and Allocation adjustments $1, 568 $1,083 $1,135 Sales $ 7,098 $5,259 $4,972 Allocation adjustments (2) 8 (2) — Third - party sales with Allocation adjustments $ 7,106 $5,257 $4,972 Adjusted EBITDA Margin excluding Special items and Allocation adjustments 2 2.1 % 20.6% 22.8% The Company's definition of Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin p lus an add - back for depreciation and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold, Selling, general administrative, and other expenses, Research and develo pme nt expenses, and Provision for depreciation and amortization. Management believes that Adjusted EBITDA, Adjusted EBITDA excluding Special items and Allocation adjustments, and Adjusted EB ITD A Margin excluding Special items and Allocation adjustments are meaningful to investors because it provides additional information with respect to the Company's operating performance and th e C ompany’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. (1) Plant fire costs excludes the impacts of $6 of depreciation in the second quarter ended June 30, 2020. (2) Adjustments include differences between allocations as required under discontinued operations as part of generally accepted a cc ounting principals and estimated actual revenue and spending in selling, general administrative, depreciation, depletion, and other expenses related to Howmet on a standalone basis as if the Arconic Inc. Separation Transaction had occurred in each year on January 1, 2019 or January 1, 2020 , respectively . 80

Reconciliation of 2021 Operational Tax Rate ($ in millions) Year ended December 31, 2021 As reported Special items (1)(2) As adjusted Income from continuing operations before income taxes $324 $265 $589 Provision for income taxes $66 $81 $147 Operational tax rate 20.4% 25.0% Operational tax rate is a non - GAAP financial measure. Management believes that this measure is meaningful to investors because m anagement reviews the operating results of the Company excluding the impacts of Special items. There can be no assurances that additional Special items will not occur in future per iod s. To compensate for this limitation, management believes that it is appropriate to consider both the Effective tax rate determined under GAAP as well as the Operational tax rate. (1) Sp ecial items for the year ended December 31, 2021 include debt tender fees and related costs $147, Restructuring and other cha rge s $90, and costs associated with closures, shutdowns, and other items $35, partially offset by ($4) reimbursement related to legal and advisory charges related to Grenfell Tower and ( $3) net reimbursement related to fires at two plants. (2) Tax Special items includes discrete tax items, the tax impact on Special items based on the applicable statutory rates, the d if ference between such rates and the Company’s consolidated estimated annual effective tax rate and other tax related items. Discrete tax items for the period included the following: • for the year ended December 31, 2021, a net benefit related to prior year amended returns and audit settlements ($14), a charge related to prior year foreign earni ngs distributed or no longer considered permanently reinvested $13, a net charge related to valuation allowance adjustments $9, and a net charge fo r o ther items $1. 81

Reconciliation of 2020 Operational Tax Rate ($ in millions) Year ended December 31, 202 0 As reported Special items (1)(2) As adjusted Income from continuing operations before income taxes $ 171 $ 317 $ 488 Provision for income taxes $ (40) $ 174 $ 134 Operational tax rate (23.4) % 2 7.5 % Operational tax rate is a non - GAAP financial measure. Management believes that this measure is meaningful to investors because m anagement reviews the operating results of the Company excluding the impacts of Special items. There can be no assurances that additional Special items will not occur in future per iod s. To compensate for this limitation, management believes that it is appropriate to consider both the Effective tax rate determined under GAAP as well as the Operational tax rate. (1) Special items for the year ended December 31, 2020 include Restructuring and other charges $182, debt tender fees and related co sts $65, costs including interest associated with the Arconic Inc. Separation Transaction $14, costs associated with closures, shutdowns, and other items $3, and $3 costs related to fires at two plants, net of reimbursement, partially offset by ($12) reimbursement related to legal and advisory charges related to Grenfell tower. (2) Tax Special items includes discrete tax items, the tax impact on Special items based on the applicable statutory rates, the d if ference between such rates and the Company’s consolidated estimated annual effective tax rate and other tax related items. Discrete tax items for the period included the following: • for the year ended December 31, 2020, a discrete tax benefit of ($64) related to the release of a reserve as a result of a favorable Spani sh tax case decision, a ($30) benefit related to the recognition of a previously uncertain U.S. tax position, a ($30) benefit for a U.S. tax law change, and a net ($3) benefi t f or a number of small items, offset by an $8 charge resulting from the remeasurement of deferred tax balances in various jurisdictions as a result of the Arconic Inc. Separation Transaction, and a $4 charge related to tax rates in various jurisdictions. The U.S. tax law change resulted from final regulations issued in July 2020 that provided an election to exclu de from global intangible low - taxed income any foreign earnings subject to a local country tax rate of at least 90% of the U.S. tax rate. 82

Reconciliation of 2020 Adjusted Free Cash Flow including Pre - Separation Allocations as a Percentage of Adjusted Income from Continuing Operations (Adjusted Free Cash Flow Conversion) ($ in millions) FY 2020 Cash provided from operations $ 9 Cash receipts from sold receivables 422 Capital expenditures (267) Adjusted free cash flow 164 Costs associated with the Arconic Inc. Separation Transaction 77 Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction and including pre - separation allocations $241 Allocation adjustments (1) (146) Adjusted free cash flow pro forma for Separation $ 387 Income from continuing operations $ 211 Special items: Restructuring and other charges 182 Discrete tax items (2) (115) Other special items: Debt tender fees and related costs 65 Costs, including interest, associated with the Arconic Inc. Separation Transaction 14 Plant fire costs, net 3 Release of tax indemnification receivable 53 Legal and other advisory reimbursements related to Grenfell Tower, net (12) Costs associated with closures, shutdowns, and other items 3 Reversal of state investment tax credits 9 Total Other special items $135 Tax impact (3) (59) Income from continuing operations, excluding Special items $354 Allocation adjustments (1) (13) Income from continuing operations excluding Special items and Allocation adjustments $ 341 Adjusted free cash flow and allocation adjustments for the separation as a percentage of adjusted income from continuing oper ati ons 114% Adjusted free cash flow; Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction and including pre - separation allocations are non - GAAP financial measures; and Adjusted free cash fl ow pro forma for separation. Management believes that these measures are meaningful to investors because management reviews cash flows generated from operations afte r t aking into consideration capital expenditures (due to the fact that these expenditures are considered necessary to maintain a nd expand the Company's asset base and are expected to generate future cash flows from operations), cash receipts from net sales of beneficial interest in sold receivables, as well as costs associated with the Arconic Inc. Separation Transaction. In addition, management believes that Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction and including pre - separation allocations is meaningful to investors as it reflects how management r eviewed cash flows of Howmet in the quarter ended March 31, 2020 as if the Arconic Inc. Separation Transaction had happened on January 1, 2020. It is important to note that Adjusted free cash flow; Adjusted f re e cash flow, excluding costs associated with the Arconic Inc. Separation Transaction; and Adjusted free cash flow, excluding costs associated with the Arconic Inc. Separation Transaction and including pre - separation allocations; and Adjusted free cash flow pro forma for separation meas ures do not represent the residual cash flow available for discretionary expenditures since other non - discretionary expenditures, such as mandatory debt service requirements, are not dedu cted from the measure. (2) Discrete tax items for the year ended December 31, 2020 included a benefit related to the release of a reserve as a result of a favorable Spanish tax case decision ($64), a benefit related to the recognition of a previously uncertain U.S. tax position ( $30 ), a benefit for a U.S. tax law change ($30), and a net benefit for a number of small tax items ($3), partially offset by charges resultin g f rom the remeasurement of deferred tax balances in various jurisdictions as a result of the Arconic Inc. Separation Transactions $8, and a charge related to tax rate changes in various jurisdictions $4. Income from continuing operations excluding Special items and Income from continuing operations excluding Special items and A llo cation adjustments are non - GAAP financial measures. Management believes that these measures are meaningful to investors because management reviews the operating results of the Company excluding the impacts of Restructuring and other charges, Dis cre te tax items, and Other special items (collectively, “Special items”). In addition, management believes that Income from cont inu ing operations excluding Special items and Allocation adjustments is meaningful to investors as it reflects how management review ed the standalone costs of Howmet in the quarter ended March 31, 2020 as if the Arconic Inc. Separation Transaction had happened on January 1, 2020. There can be no assurances that additional special items will not occur in future periods. To compensate for th is limitation, management believes that it is appropriate to consider both Income (loss) from continuing operations determine d u nder GAAP as well as Income (loss) from continuing operations excluding Special items. ( 1 ) Adjustments include differences between allocations as required under discontinued operations as part of general accepted acc oun ting principles and estimated actual spending in selling, general, administrative, and other expenses and miscellaneous non - oper ating income related to pension, other post retirement benefits, and foreign exchange related to Howmet on a standalone basis as if th e Arconic Inc. Separation Transaction had occurred on January 1, 2020. ( 3 ) The tax impact on Special items is based on the applicable statutory rates whereby the difference between such rates and the Com pany’s consolidated estimated annual effective tax rate is itself a special item. 83

Reconciliation of 2021 Adjusted Free Cash Flow as a Percentage of Income from Continuing Operations (Adjusted Free Cash Flow Conversion) ($ in millions) FY 2021 Cash provided from operations $449 Cash receipts from sold receivables 267 Capital expenditures (199) Adjusted free cash flow (a) $517 Income from continuing operations $258 Special items: Restructuring and other charges $90 Discrete tax items (1) $9 Other special items: Debt tender fees and related costs 147 Plant fire reimbursements, net (3) Legal and other advisory reimbursements related to Grenfell Tower, net (4) Costs associated with closures, shutdowns, and other items 35 Total Other special items $175 Tax impact (2) $(90) Income from continuing operations excluding Special items (b) $442 Adjusted free cash flow as a percentage of Income from continuing operations (a)/(b) 117% Adjusted free cash flow is a non - GAAP financial measure. Management believes that this measures is meaningful to investors becau se management reviews cash flows generated from operations after taking into consideration capital expenditures (due to the fact that these expenditures are considered necessary to maintain and expand t he Company's asset base and are expected to generate future cash flows from operations), as well as cash receipts from net sales of beneficial interest in sold receivables. It is important to note that Ad justed free cash flow does not represent the residual cash flow available for discretionary expenditures since other non - discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. Income from continuing operations excluding Special items is a non - GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews the operating results of the Company excluding the impacts of Restructuring and other charges, Discrete tax items, and Other special items (collective ly, “Special items”). There can be no assurances that additional special items will not occur in future periods. To compensate for this limitation, management believes that it is appropriate to consider both Income from co ntinuing operations determined under GAAP as well as Income from continuing operations excluding Special items. (1) Discrete tax items for the year ended December 31, 2021 included a net benefit related to prior year amended returns and audi t s ettlements ($14), a charge related to prior year foreign earnings distributed or no longer considered permanently reinvested $13, a net charge related to valuation allowance adjustments $9, and a net charge fo r other items $1. (2) The tax impact on Special items is based on the applicable statutory rates whereby the difference between such rates and the Com pany’s consolidated estimated annual effective tax rate is itself a Special item. 84

Calculation of Segment Adjusted EBITDA Margin ($ in millions) FY 2019 FY 2020 FY 2021 Q1 2022 Engine Products Third - party sales $ 3,320 $ 2,406 $ 2,282 $ 631 Segment Adjusted EBITDA $ 752 $ 540 $ 564 $ 173 Segment Adjusted EBITDA Margin 22.7 % 22.4 % 24.7 % 27.4 % Fastening Systems Third - party sales $ 1,561 $ 1,245 $ 1,044 $ 264 Segment Adjusted EBITDA $ 444 $ 295 $ 239 $ 56 Segment Adjusted EBITDA Margin 28.4 % 23.7 % 22.9 % 21.2 % Engineered Structures Third - party sales $ 1,255 $ 927 $ 725 $ 182 Segment Adjusted EBITDA $ 178 $ 125 $ 103 $ 23 Segment Adjusted EBITDA Margin 14.2 % 13.5 % 14.2 % 12.6 % Forged Wheels Third - party sales $ 969 $ 679 $ 921 $ 247 Segment Adjusted EBITDA $ 285 $ 192 $ 294 $ 67 Segment Adjusted EBITDA Margin 29.4 % 28.3 % 31.9 % 27.1 % 85

Calculation of Total Segment Adjusted EBITDA and Margin ($ in millions) FY 2019 FY 2020 FY 2021 Q1 2022 Third - party sales – Engine Products $3,320 $2,406 $2,282 $631 Third - party sales – Fastening Systems $1,255 $1,245 $1,044 $264 Third - party sales – Engineered Structures $1,561 $927 $725 $182 Third - party sales – Forged Wheels $969 $679 $921 $247 Total Segment third - party sales $7,105 $5,257 $4,972 $1,324 Total Segment Adjusted EBITDA (1) $1,659 $1,152 $1,200 $319 Total Segment Adjusted EBITDA margin 23.3% 21.9% 24.1% 24.1% (1) See Reconciliation of Total Segment Adjusted EBITDA to Consolidated Income (Loss) Before Income Taxes. Total Segment Adjusted EBITDA and Total Segment Adjusted EBITDA margin are non - GAAP financial measures. Management believes that these measures are meaningful to investors because Total Segment Adjusted EBITDA and Total Segment Adjusted EBITDA margin provide additional information with respect to th e operating performance and the Company’s ability to meet its financial obligations. The Total Segment Adjusted EBITDA presented may not be comparable to similarly titled meas ure s of other companies. Howmet’s definition of Total Segment Adjusted EBITDA (Earnings before interest, taxes, depreciation, and amortization) is net margin plus an add - back for dep reciation and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and develo pme nt expenses; and Provision for depreciation and amortization. Special items, including Restructuring and other charges, are also excluded from net margin and Segment Adjuste d E BITDA. Differences between the total segment and consolidated totals are in Corporate. Differences between the total segment and consolidated totals are in Corporate. On April 1, 2020, Arconic Inc. completed the separation of its businesses into two independent, publicly - traded companies: Howme t Aerospace Inc. (the new name for Arconic Inc.) and Arconic Corporation. The historical results of the businesses that comprise Arconic Corporation are presented as discontinued op erations in Howmet Aerospace’s consolidated financial statements. 86

Reconciliation of Total Segment to Consolidated Totals Reconciliation of Total Segment Adjusted EBITDA to Consolidated Income Before Income Taxes ($ in millions) FY 2019 FY 2020 FY 2021 Q1 2022 Income before income taxes $210 $171 $324 $171 Loss on debt redemption — 64 146 — Interest expense 338 317 259 58 Other expense, net 31 74 19 1 Operating income $579 $626 $748 $230 Segment provision for depreciation and amortization 269 262 261 65 Unallocated amounts: Restructuring and other charges 582 182 90 2 Corporate expense (1) 229 82 101 22 Total Segment Adjusted EBITDA $1,659 $1,152 $1,200 $319 (1) For the year ended December 31, 2019, Corporate expense included $10 of impairment of assets of the energy business, $9 of co sts related to fires at two plants, $8 of costs related to legal and advisory charges, $6 of strategy and portfolio review costs, and $5 of costs associated with the Arconic Inc. Separation Tran sac tion. For the year ended December 31, 2020, Corporate expense included ($12) of reimbursement related to legal and advisory charges, $7 of costs associated with the Arconic Inc. Separatio n T ransaction, $3 of costs related to fires at two plants, net of reimbursement, and $3 of costs associated with closures, shutdowns, and other items. For the year ended December 31, 2021, Co rpo rate expense included $35 of costs associated with closures, shutdowns, and other items, ($4) of reimbursement related to legal and advisory charges, and ($3) of net reimbursement relate d t o fires at two plants. For the quarter ended March 31, 2022, Corporate expense included $5 of costs related to fires at two plants and ($3) of reimbursement related to legal and advisory ch arges. Total Segment Adjusted EBITDA is a non - GAAP financial measure. Management believes that this measure is meaningful to investors because Total Segment Adjusted EBITDA provides additional information with respect to the operating performance and the Company’s ability to meet its financial obligations. The Total Seg ment Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies. Howmet’s definition of Total Segment Adjusted EBITDA (Earnings before interest, taxes, depreciat ion , and amortization) is net margin plus an add - back for depreciation and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrativ e, and other expenses; Research and development expenses; and Provision for depreciation and amortization. Special items, including Restructuring and other charges, are also excluded from net margin an d S egment Adjusted EBITDA. Differences between the total segment and consolidated totals are in Corporate. 87

88

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Notice of AGM

- Information relating to the total number of voting rights and shares making up the share capital at 26 April 2024 – post blocs acquisition by the Consortium

- PMD Device Solutions Publishes 2023 Annual Report

Create E-mail Alert Related Categories