Form 8-K Conifer Holdings, Inc. For: Aug 10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event Reported):

Conifer Holdings Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 10, 2022, Conifer Holdings, Inc. (the "Company") publicly announced results for the second quarter of 2022. A copy of the Company's news release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The information in this Item 2.02 and the attached exhibit shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as shall be expressly stated by specific reference in such filing.

|

Item 9.01. Financial Statements and Exhibits. |

|

|

Exhibit 99.1 |

|

|

Exhibit 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Conifer Holdings Inc. |

|

|

|

|

|

|

|

Date: August 12, 2022 |

|

By: |

/s/ BRIAN J. RONEY |

|

|

|

|

Brian J. Roney |

|

|

|

|

President |

Exhibit 99.1

News Release

For Further Information:

Jessica Gulis, 248.559.0840

Conifer Holdings Reports 2022 Second Quarter Financial Results

Company to Host Conference Call at 8:30 AM ET on Thursday, August 11, 2022

Birmingham, MI, August 10, 2022 - Conifer Holdings, Inc. (Nasdaq: CNFR) (“Conifer” or the “Company”) today announced results for the second quarter ended June 30, 2022.

Second Quarter 2022 Financial Highlights (compared to the prior year period)

|

• |

Gross written premium increased 7.0% to $37.4 million |

|

• |

Commercial Lines gross written premium increased 3.6% to $32.1 million |

|

• |

Personal Lines gross written premium increased 32.4% to $5.3 million |

|

• |

Net earned premium remained steady at $24.6 million |

|

• |

Expense ratio decreased to 39.0%, down 230 basis points from Q2 2021 |

|

• |

Book value per share of $1.75 as of June 30, 2022 |

Subsequent to the end of the second quarter, the Company completed a private placement of 2,500,000 shares of common stock at $2.00 per share, which was sold to the Company’s management and Board of Directors for proceeds of $5.0 million. Taking this transaction into account, on a pro forma basis, the Company’s total shareholders’ equity as of June 30, 2022 would have been $22.0 million, and its book value per share would have been $1.80.

James Petcoff, Executive Chairman and Co-CEO, commented, “While we are pleased to report continued top-line growth in our most profitable lines of business, we must recognize that these achievements were generally obscured by persistent adverse development from select lines. As a result, we have taken numerous prudent actions to strengthen our reserves overall and we look forward to reporting the beneficial results of those initiatives in the very near future. ”

Conifer Holdings, Inc.Page 2

August 10, 2022

2022 Second Quarter Financial Results Overview

Gross Written Premiums

Gross written premiums increased 7.0% in the second quarter of 2022 to $37.4 million, compared to $35.0 million in the prior year period. The increase reflects a combination of rate increases and continued expansion into select specialty lines, specifically in the Company’s small business programs. Personal lines premium, specifically Conifer’s low-value dwelling line of business, continues to bolster Conifer’s profitable top line growth.

Net Earned Premiums

Net earned premiums decreased 1.1% to $24.6 million for the second quarter of 2022, compared to $24.8 million for the prior year period. The Company expects net earned premium to increase throughout 2022 as consistent increases in gross written premium over the past several quarters continue to earn ratably through the year.

Conifer Holdings, Inc.Page 3

August 10, 2022

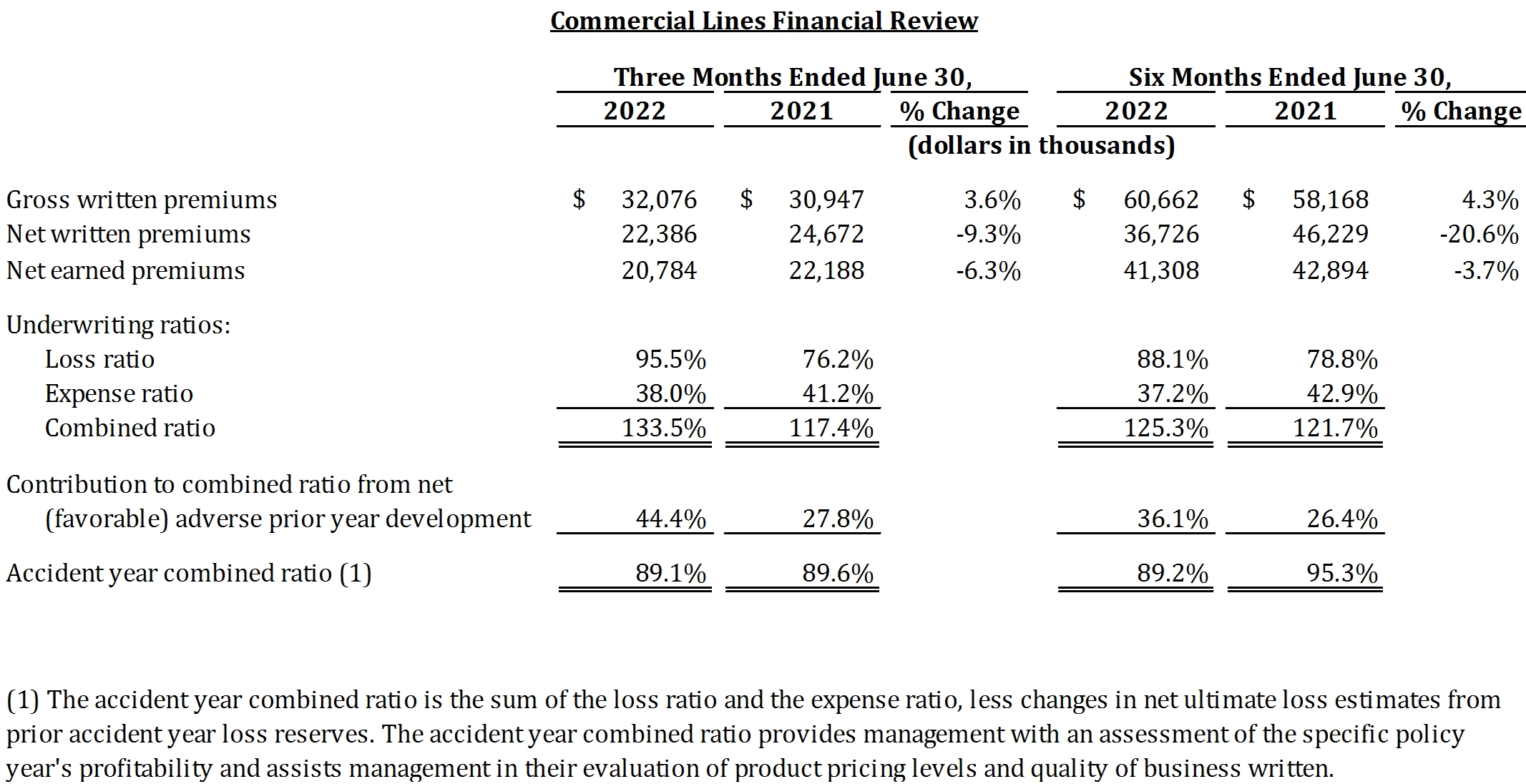

Commercial Lines Financial and Operational Review

The Company’s commercial lines of business, representing 85.7% of total gross written premium in the second quarter of 2022, primarily consists of property and liability coverage offered to owner-operated small- to mid-sized businesses.

Commercial lines gross written premium increased 3.6% in the second quarter of 2022 to

$32.1 million, reflecting the Company’s continued emphasis on expansion in its most profitable specialty lines.

The commercial lines combined ratio was 133.5% for the three months ended June 30, 2022, compared to 117.4% in the prior year period. The loss ratio was 95.5% for the second quarter of 2022, compared with 76.2% in the prior year period. Adverse prior year development contributed 44.4% to the commercial lines loss ratio for the second quarter, stemming largely from quick service restaurant and other discontinued or significantly deemphasized lines of business. The Company anticipates marked improvement in the near term as deemphasized lines of business roll off the Company’s books. Moreover, the Company has undertaken a number of targeted loss mitigation initiatives over the course of the second quarter, expected to significantly benefit the Company’s bottom line in the months to come.

The commercial lines expense ratio for the second quarter was 38.0%, down from 41.2% during the prior year period, reflecting the Company’s commitment to sustained expense management and profitable top line growth.

The commercial lines accident year combined ratio was 89.1% for the second quarter of 2022.

Conifer Holdings, Inc.Page 4

August 10, 2022

Personal Lines Financial and Operational Review

Personal lines, representing 14.3% of total gross written premium for the second quarter of 2022, consists largely of low-value dwelling homeowner’s insurance.

Personal lines gross written premium increased 32.4% to $5.3 million in the second quarter of 2022 compared to $4.0 million in the prior year period. This increase was led by growth in the Company’s low-value dwelling line of business in Oklahoma and Texas.

The personal lines combined ratio was 106.1% for the three months ended June 30, 2022, compared to 78.6% in the prior year period. Personal lines loss ratio was 61.4%, compared to 36.6% in the prior year period.

The personal lines accident year combined ratio was 99.1% for the second quarter of 2022.

Conifer Holdings, Inc.Page 5

August 10, 2022

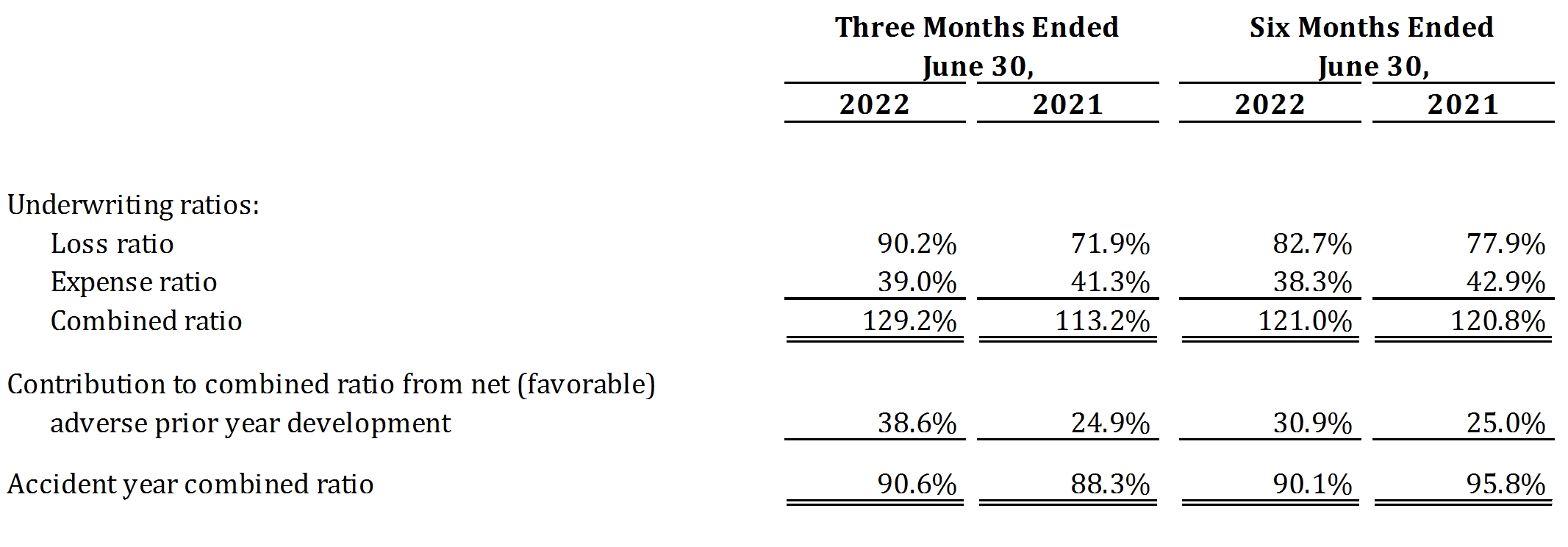

Combined Ratio Analysis

Combined Ratio

The Company's combined ratio was 129.2% for the quarter ended June 30, 2022, compared to 113.2% for the same period in 2021. The Company’s accident year combined ratio for the quarter ended June 30, 2022 was 90.6%, compared to 88.3% in the prior year period.

Loss Ratio:

The Company’s losses and loss adjustment expenses were $22.3 million for the three months ended June 30, 2022, compared to $17.9 million in the prior year period. This resulted in a loss ratio of 90.2%, compared to 71.9% in the prior year period.

Before adverse development, the loss ratio for the second quarter of 2022 was 51.6%, which aligns with the Company’s target loss ratio in its select specialty lines of business. As deemphasized business continues to roll off the books, and as statutes expire in difficult jurisdictions, the Company fully anticipates that the loss ratio will improve correspondingly.

Moreover, the Company has taken important steps to restrict the bottom-line effects of adverse prior year development from these deemphasized lines of business, and expects to see the beneficial results of these initiatives in the near term.

Expense Ratio:

The expense ratio was 39.0% for the second quarter of 2022, compared to 41.3% in the prior year period.

Conifer Holdings, Inc.Page 6

August 10, 2022

Net Investment Income

Net investment income was $564,000 during the quarter ended June 30, 2022, compared to $503,000 in the prior year period.

Net Realized Investment Income

Net realized investment losses during the second quarter were $1.4 million, compared to net realized investment gains of $1.1 million in the prior year period.

Change in Fair Value of Equity Securities

During the second quarter, the Company reported a gain of $317,000 from the change in fair value of equity investments, compared to a loss of $525,000 in the prior year period.

Net Income

In the second quarter of 2022, the Company reported a net loss of $8.4 million, or $0.86 per share, compared to net income of $5.6 million, or $0.57 per share, in the prior year period.

Adjusted Operating Income

In the second quarter of 2022, the Company reported an adjusted operating loss of $7.3 million, or $0.75 per share, compared to an adjusted operating loss of $3.9 million, or $0.40 per share, for the same period in 2021. See Definitions of Non-GAAP Measures.

Earnings Conference Call and Webcast with Accompanying Slide Presentation

The Company will hold a conference call/webcast on Thursday, August 11, 2022 at 8:30 a.m. ET to discuss results for the second quarter ended June 30, 2022.

Investors, analysts, employees and the general public are invited to listen to the conference call via:

Webcast:On the Event Calendar at IR.CNFRH.com

Conference Call:844-868-8843 (domestic) or 412-317-6589 (international)

The webcast will be archived on the Conifer Holdings website and available for replay for at least one year.

About the Company

Conifer Holdings, Inc. is a specialty insurance holding company, offering customized coverage solutions tailored to the needs of our insureds. Nationwide, Conifer markets largely through independent agents, and is traded on the NASDAQ exchange under the symbol “CNFR”. Additional information is available on the Company’s website at www.CNFRH.com.

Conifer Holdings, Inc.Page 7

August 10, 2022

Definitions of Non-GAAP Measures

Conifer prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). Statutory data is prepared in accordance with statutory accounting rules as defined by the National Association of Insurance Commissioners' (NAIC) Accounting Practices and Procedures Manual, and therefore is not reconciled to GAAP data.

We believe that investors’ understanding of Conifer’s performance is enhanced by our disclosure of adjusted operating income. Our method for calculating this measure may differ from that used by other companies and therefore comparability may be limited. We define adjusted operating income (loss), a non-GAAP measure, as net income (loss) excluding after-tax net realized investment gains and losses, excluding the tax effect of changes in unrealized gains and losses, excluding the after-tax change in fair value of equity securities. We use adjusted operating income as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance.

Reconciliations of adjusted operating income and adjusted operating income per share:

Conifer Holdings, Inc.Page 8

August 10, 2022

Forward-Looking Statement

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating performance, and include Conifer’s expectations regarding premiums, earnings, its capital position, expansion, and growth strategies. The forward-looking statements contained in this press release are based on management’s good-faith belief and reasonable judgment based on current information. The forward-looking statements are qualified by important factors, risks and uncertainties, many of which are beyond our control, that could cause our actual results to differ materially from those in the forward-looking statements, including those described in our form 10-K (“Item 1A Risk Factors”) filed with the SEC on March 10, 2022 and subsequent reports filed with or furnished to the SEC. Any forward-looking statement made by us in this report speaks only as of the date hereof or as of the date specified herein. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by any applicable laws or regulations.

Conifer Holdings, Inc.Page 9

August 10, 2022

Conifer Holdings, Inc.Page 10

August 10, 2022

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Fluxys hydrogen appointed as “Hydrogen Network Operator” in Belgium

- Burning Rock Announces ADS Ratio Change

- PMD Device Solutions Publishes 2023 Annual Report

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share