Form 8-K Alussa Energy Acquisitio For: Jun 22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 22, 2021

ALUSSA ENERGY ACQUISITION CORP.

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-39145 | N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

PO Box 500, 71 Fort Street

Grand Cayman KY1-1106

Cayman Islands

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: +1 345 949 4900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one Class A Ordinary Share and one-half of one Redeemable Warrant | ALUS.U | The New York Stock Exchange | ||

| Class A Ordinary Shares, par value $0.0001 per share | ALUS | The New York Stock Exchange | ||

| Warrants, each whole warrant exercisable for one Class A Ordinary Share for $11.50 per share | ALUS.WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ADDITIONAL INFORMATION

FREYR Battery, a company organized under the laws of Luxembourg (“Pubco”), filed on March 26, 2021 with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (File No. 333-254743) which was amended on May 7, May 27 and June 9, 2021 (as amended, the “Registration Statement”), which includes a preliminary proxy statement of Alussa Energy Acquisition Corp., a Cayman Island exempted company (“Alussa”), and a prospectus in connection with the proposed business combination transaction (the “Business Combination”) involving Alussa, Pubco and FREYR A/S, a company organized under the laws of Norway (“FREYR”). The Registration Statement was declared effective on June 14, 2021, and the definitive proxy statement and other relevant documents have been mailed to shareholders of Alussa as of the close of business on April 30, 2021. Shareholders of Alussa and other interested persons are advised to read the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in connection with Alussa’s solicitation of proxies for the special meeting to be held to approve the Business Combination because these documents contain important information about Alussa, FREYR, Pubco and the Business Combination. Alussa shareholders and other interested persons will also be able to obtain copies of the Registration Statement and the proxy statement/prospectus, without charge, once available, on the SEC’s website at www.sec.gov or by directing a request to Alussa by contacting its Chief Executive Officer, Daniel Barcelo, c/o Alussa Energy Acquisition Corp. PO Box 500, 71 Fort Street, Grand Cayman KY1-1106, Cayman Islands, at +1(345) 949 4900.

Participants in the Solicitation

Alussa, Pubco and FREYR and certain of their respective directors, executive officers, other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies from the shareholders of Alussa in favor of the approval of the Business Combination. Shareholders of Alussa and other interested persons may obtain more information regarding the names and interests in the proposed transaction of Alussa’s directors and officers in Alussa’s filings with the SEC, including Alussa’s annual report on form 10-K for the year-ended December 31, 2020, which was filed with the SEC on March 1, 2021 and amended on May 6, 2021, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Additional information regarding the interests of such potential participants is also included in the Registration Statement and other relevant documents filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This Current Report on Form 8-K and the exhibits hereto do not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination. This Current Report on Form 8-K shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, or an exemption therefrom.

1

| Item 7.01 | Regulation FD Disclosure. |

Attached as Exhibit 99.1 is the Capital Markets Update presentation that will be used by Alussa and FREYR with respect to the Capital Markets Update webcast at 10:00 a.m. EDT/16:00 CEST on June 22, 2021.

The press release is being furnished pursuant to Item 7.01 and will not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. | Description | |

| 99.1 | Capital Markets Update Presentation, dated June 22, 2021 |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ALUSSA ENERGY ACQUISITION CORP. | |||

| By: | /s/ Daniel Barcelo | ||

| Name: | Daniel Barcelo | ||

| Title: | Chief Executive Officer and President | ||

| Dated: June 22, 2021 | |||

3

Exhibit 99.1

C a p i t a l M a r k e t s U p d a t e P r e s e n t a t i o n June 22, 2021 Clean Battery Solutions for a Better Planet

Legal Disclaimer 2 This presentation has been prepared for use by Alussa Energy Acquisition Corp. (“Alussa”) and FREYR AS (“FREYR”) in connection with their proposed business combination. This presentation is for information purposes only and is being provided to you solely in your capacity as a potential investor in considering an investment in Alussa and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Alussa and FREYR. Neither Alussa nor FREYR makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. This presentation is not intended to be all - inclusive or to contain all the information that a person may desire in considering an investment in Alussa and is not intended to form the basis of any investment decision in Alussa. You should consult your own legal, regulatory, tax, business, financial and accounting advisors to the extent you deem necessary, and must make your own investment decision and perform your own independent investigation and analysis of an investment in Alussa and the transactions contemplated in this presentation. This presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. The information contained in this presentation is only addressed to and directed at persons in member states of the European Economic Area and the United Kingdom (each a “Relevant State”) who are “qualified investors” within the meaning of the Prospectus Regulation (Regulation (EU) 2017/1129) (“Qualified Investors”). In addition, in the United Kingdom, the presentation is being distributed only to, and is directed only at, Qualified Investors who are persons (i) having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) (ii) falling within Article 49(2)(a) to (d) of the Order, or (iii) to whom it may otherwise lawfully be communicated (all such persons together being referred to as “Relevant Persons”). The information must not be acted on or relied on (i) in the United Kingdom, by persons who are not Relevant Persons, and (ii) in any Relevant State, by persons who are not Qualified Investors. Any investment or investment activity to which the information relates is available only to or will be engaged in only with, (i) Relevant Persons in the United Kingdom, and (ii) Qualified Investors in any Relevant State. NEITHER THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) NOR ANY STATE OR TERRITORIAL SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. Industry and Market Data . The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance or modeling contained herein is not an indication as to future performance. Alussa and FREYR assume no obligation to update the information in this presentation. Further, these financials were prepared by FREYR in accordance with private Company AICPA standards. FREYR is currently in the process of uplifting its financials to comply with public company and SEC requirements. Use of Projections . The financial projections, estimates and targets in this presentation are forward - looking statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Alussa’s and FREYR’s control. While all financial projections, estimates and targets are necessarily speculative, Alussa and FREYR believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the financial projections, estimates and targets. The inclusion of financial projections, estimates and targets in this presentation should not be regarded as an indication that Alussa and FREYR, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. Use of Non - GAAP Financial Measures . This presentation includes certain financial measures, including EBITDA and EBITDA Margin, and measures calculated based on these measures, that are not prepared in accordance with accounting principles generally accepted in the United States ("GAAP") and that may be different from non - GAAP financial measures used by other companies. These non - GAAP measures, and other measures that are calculated using these non - GAAP measures, are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to operating income, net income or any other performance measures derived in accordance with GAAP. FREYR believes that these non - GAAP measures of financial results (including on a forward - looking basis) provide useful supplemental information to investors about FREYR. FREYR’s management uses forward looking non - GAAP measures to evaluate FREYR’s projected financial and operating performance. However, there are a number of limitations related to the use of these non - GAAP measures and their nearest GAAP equivalents. For example other companies may calculate non - GAAP measures differently, or may use other measures to calculate their financial performance, and therefore FREYR’s non - GAAP measures may not be directly comparable to similarly titled measures of other companies. Additionally, to the extent that forward - looking non - GAAP financial measures are provided, they are presented on a non - GAAP basis without reconciliations of such forward - looking non - GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Additional Information; Participants in the Solicitation . FREYR Battery, a company organized under the laws of Luxembourg, filed on March 26, 2021 with the SEC a registration statement on Form S - 4 (File No. 333 - 254743) which was amended on May 7, May 27 and June 9, 2021 (as amended, the “Registration Statement”), which includes a preliminary proxy statement of Alussa and a prospectus in connection with the proposed business combination transaction involving Alussa, FREYR and FREYR Battery. The Registration Statement was declared effective on June 14, 2021, and the definitive proxy statement and other relevant documents has been mailed to shareholders of Alussa as of the close of business on April 30, 2021. Shareholders of Alussa and other interested persons are urged to read the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in connection with Alussa’s solicitation of proxies for the special meeting to be held to approve the business combination because these documents contain important information about Alussa, FREYR, FREYR Battery and the business combination. Alussa shareholders and other interested persons will be able to obtain free copies of the Registration Statement and proxy statement/prospectus, as well as other filings containing information about Alussa, FREYR and the business combination, without charge, at the SEC’s website located at www.sec.gov. Alussa, FREYR and FREYR Battery and certain of their respective directors, executive officers, other members of management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies from the shareholders of Alussa in favor of the approval of the business combination. Shareholders of Alussa and other interested persons may obtain more information regarding the names and interests in the proposed transaction of Alussa’s directors and officers in Alussa’s filings with the SEC, including Alussa’s annual report on form 10 - K for the year - ended December 31, 2020, which was filed with the SEC on March 1, 2021 and amended on May 6, 2021, as modified or supplemented by any Form 3 or Form 4 filed with the SEC since the date of such filing. Additional information regarding the interests of such potential participants is also included in the Registration Statement and other relevant documents when they are filed with the SEC. You may obtain free copies of these documents as described in the preceding paragraph. This Presentation does not contain all the information that should be considered in the contemplated business combination. It is not intended to form any basis of any investment decision or any decision in respect to the contemplated business combination. Forward Looking Statements . Certain statements in this presentation may constitute “forward - looking statements” within the meaning of the federal securities laws. Forward - looking statements include, but are not limited to, statements with respect to (i) FREYR’s Gigafactory development, including the expected cost, capacity and start date of such facilities, (ii) trends in the battery market, (iii) FREYR’s targeted customers and suppliers and the expected arrangement with them, (iv) FREYR’s projected operational performance, including relative to its competitors and (v) other statements regarding Alussa’s or FREYR’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “would” and similar expressions may identify forward - looking statements, but the absence of these words does not mean that a statement is not forward - looking. Forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Alussa’s registration statement on Form S - 1, the proxy statement/prospectus on Form S - 4 relating to the business combination filed by FREYR Battery with the SEC and other documents filed by Alussa from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements. Forward - looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - looking statements, and Alussa and FREYR assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. Neither Alussa nor FREYR gives any assurance that either Alussa or FREYR will achieve its expectations.

A g e n d a 3 ▪ Introduction Chi Chow, Investor Relations, Alussa Energy D a n i e l B a r c e l o , C E O , A l u ss a E ne r g y J a r a n d R y s t a d , C E O , R y s t a d E ne r g y T o m E i n a r J e n s e n , C E O , F R E Y R ▪ Business Combination Transaction Update ▪ E n e r g y T r a n s i t i o n a n d B a tt e r y I n d u s t r y O v e r v ie w ▪ F R E Y R B u s i n e s s S t r a t e g y U p d a t e ▪ Q&A

Business Combination Transaction Update Daniel Barcelo, CEO & President, Alussa Energy Acquisition Corp.

International Energy and Capital Markets Expertise, FREYR Director Nominees D a n i e l B a r c e l o C h i e f E x e c u t i v e O ff i c e r , P r e s i d e n t & D i r e c t o r ▪ Portfolio Manager, Moore Capital ▪ Managing Director, Renaissance Capital ▪ C F O , R u s p e t r o p l c , R u ss i a ▪ Co - Founder, Director, CFO, Invicti Terra Argentina Ltd G e r m á n C u r á Director ▪ Board of Directors & Vice Chairman of the Board, Tenaris ▪ P r e s i d e n t & C E O , M a ve r i c k T ub u l a r s ▪ P r e s i d e n t & C E O , H y d r i l E n c o m p a s s C a p i t al , A M e m b e r o f O u r S p o n s o r T o d d K a n t o r Founder, Managing Member & Portfolio Manager ▪ 20 years of experience in global energy markets ▪ P o r t f o l io M a n a g e r , P i o n e e r P a t h ( C i t a d e l L L C ) ▪ Analyst; Touradji Capital, Solstice Equity Management, JP Morgan Global Oil & Gas Investment Banking Alussa Energy Acquisition Corp. Overview ▪ Alussa Energy Acquisition Corp. is a NYSE listed SPAC which c o m p l e t e d i t s $ 2 8 7 m illi o n I P O i n N o ve m b e r 20 1 9 ▪ Over 100 years of combined experience of starting and operating public companies globally ▪ B o a r d m e m b e r s / m a n a g e m e n t h a ve o p e r a t e d c o m p a n i e s i n the US, Africa, Russia and the Middle East ▪ Encompass Capital Advisors LLC, a Member of our Sponsor, is a SEC registered investment advisor with a primary focus on investing across the energy eco - chain, including exploration and production, services, energy - related industrials, cyclicals, materials, alternative energy and renewables in the private and public markets Alussa Energy Due Diligence and Assessment Conducted on FREYR ▪ General corporate, legal, intellectual property, contract review, employment matters and benefits and capital structure due diligence conducted by Skadden Arps and Ellenoff Grossman & Schole ▪ Accounting and tax due diligence performed by Ernst & Young ▪ Environmental, governance and social communication strategy assessment performed by Sustainable Governance Partners ▪ Business due diligence and assessment performed by Alussa Energy and Rystad Energy 5 Alussa Energy Acquisition Corp. Overview

Transaction Overview Overview ▪ FREYR is a developer of clean, next - generation battery cells targeting ~43 GWh of capacity by 2025 ▪ Alussa Energy Acquisition Corp. is a Special Purpose Acquisition Company focused on global energy markets with $290 million in cash held in trust ▪ Alussa Energy and FREYR are combining with a goal to accelerate the development of FREYR’s clean, fully sustainable battery cell production in Norway ▪ FREYR will trade under the ticker symbol ‘FREY’ on the NYSE F R E Y R T e a m Proposed Transaction Summary Transaction Structure ▪ Equity capital retained for the execution of planned development of battery cell production capacity ▪ Fully committed PIPE of $600 million, including: – Strategic investors: Koch Strategic Platforms, Glencore – Institutional investors: Encompass Capital, Fidelity, Franklin Templeton, Sylebra Capital, Van Eck ▪ 100% of FREYR’s existing shares will roll over into the combined company ▪ Potential OSEBX listing within 12 - 24 months Valuation ▪ Transaction implies a post - transaction enterprise value of $544 million and equity value of $1.4 billion – 0.8x 2025e EBITDA of $703 million ▪ Highly attractive entry valuation relative to battery peer group metrics T o r s t e i n D a l e S j ø t v ei t E x e c u t i v e C h a i r m a n & F o un d e r Alussa Energy Acquisition Corp. Alussa Energy views FREYR as a strong early - stage opportunity to invest in one of the world’s cleanest, most advanced battery cell producers 6 T o m E in a r J e n s e n Chief Executive Officer & Co - Founder Steffen Føreid Chief Financial Officer P e t e r M a t r a i B o a r d M e m b e r & C o - F o un d e r James Musselman, Chairman of the Board D a n i e l B a r c e l o , C h i e f E x e c u t i v e O f f i c e r & P r e s i d en t Todd Kantor, Encompass Capital, A Member of our Sponsor

Illustrative Timeline to Transaction Close D a t e / E x p e c t e d D a t e April 30, 2021 June 14, 2021 June 18, 2021 June 28, 2021 June 30, 2021 Early July 2021 Event ▪ Alussa Energy Record Date ▪ FREYR Battery S - 4 Effective Date ▪ Proxy Mailing Date ▪ Alussa Energy Stockholder Redemption Date ▪ Alussa Energy Extraordinary General Meeting for Stockholder Vote Approval ▪ Cayman and Norway Merger Dates ▪ Expected Transaction Closing Early July 2021 7

Energy Transition and Battery Industry Overview Jarand Rystad, CEO & Founder, Rystad Energy

F R E Y R B u s i n e s s U p d a t e Tom Einar Jensen, CEO & Co - Founder, FREYR

T h e F R E Y R V i s i o n a n d M i s s i o n Accelerating the decarbonization of transportation and energy systems by delivering one of the world’s cleanest, most efficient and most cost - effective batteries Sustainability S c a l e 10 S p ee d Leveraging Norway’s abundant, low - cost renewable energy sources to target net zero carbon Supporting a localized Nordic supply chain ecosystem of sustainably - sourced active material and battery input supply Strategic partnering of commercially available next - generation battery t e c h n o l o g y t o m a x i m i z e speed to market of low - cost, low - carbon battery cells Initial focus on battery cell production to capitalize on the projected supply shortfall as electrification efforts accelerate Planning construction o f ~ 4 3 G W h o f c a p a c i t y by 2025 to position as one of Europe’s largest cell suppliers to transportation and energy storage markets Targeting major addressable markets for electrification – energy storage systems, electric vehicles and other commercial mobility

T h e F R E Y R J o u r n e y S o F a r 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 Corporate M i le s t o n e s Financing M i le s t o n e s F e b 2 01 8 FREYR Founded A p r 201 9 A n n o u n c e s S I N T E F & N T N U p a r t n e r s h i p s t o d ev e l o p b a tt e r y R& D c l u s t e r i n N o r w a y M o U s s i g n e d D e c 202 0 FREYR and 24M sign d e f i n i t i v e t e c h n o l o g y l i c e n s e & services agreement O c t / N o v 202 0 MoUs signed Jun 2019 €7.25 million investment from EIT InnoEnergy Jul 2020 C o m p l e t e d N O K 1 3 0 m i lli o n f i n a n c i n g t o c o m p l e t e t h e concept and technology s e l e c t i o n p r o c e s s Jan 2021 F R E Y R & A l u ss a E n e r g y enter into definitive b u s i n e ss c o m b i n a t i o n agreement F eb / Ma r 202 1 ▪ N O K 3 9 m ill i o n I nn o v a t i o n N o r w a y g r a n t ▪ N O K 14 2 m il l i o n E N O V A g r a n t J u n 202 1 Alussa Energy announces F R E Y R B a tt e r y r e g i s t r a t i o n d e c l a r e d e f f e c t i v e b y t h e S E C Jun 2021 A n n o u n c e s J V n e g o t i a t i o n s f o r North American b a tt e r y p r o d u c t i o n M o U s s i g n e d 11

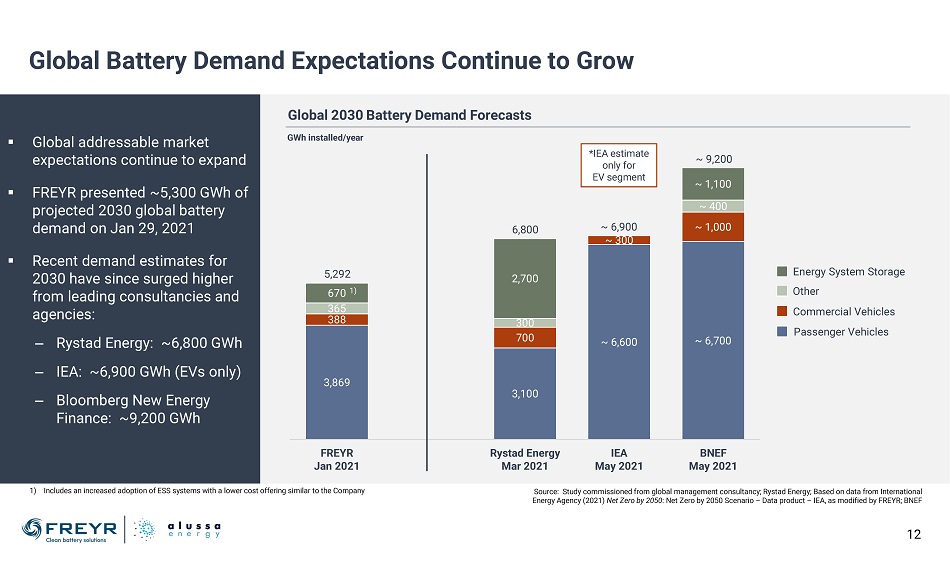

G l ob a l B a t t e r y D e m a n d E x p e c t a t i on s C o n t i nu e t o G r o w 3,869 3,100 ~ 6,600 ~ 6,700 388 700 ~ 1,000 365 300 ~ 400 2,700 ~ 1,100 FREYR J a n 2 02 1 R y s t a d E n e r g y M a r 2 02 1 IEA M a y 2 02 1 BNEF M a y 2 02 1 G W h i n s t al l e d / y e a r G l o b a l 203 0 B a t t e r y D e m a n d F o r e c a s t s Energy System Storage Other Commercial Vehicles Passenger Vehicles 12 5 , 2 9 2 6 , 8 0 0 ~ 6,900 ~ 300 ~ 9,200 ▪ Global addressable market expectations continue to expand ▪ F R E Y R p r e s e n t e d ~ 5 , 3 0 0 G W h o f projected 2030 global battery demand on Jan 29, 2021 ▪ Recent demand estimates for 2030 have since surged higher from leading consultancies and agencies: – Rystad Energy: ~6,800 GWh – I E A : ~ 6 , 9 0 0 G W h ( E V s o n l y ) – Bloomberg New Energy Finance: ~9,200 GWh * I E A e s t i m a t e only for E V s e g m e n t 670 1) Source: Study commissioned from global management consultancy; Rystad Energy; Based on data from International Energy Agency (2021) Net Zero by 2050 : Net Zero by 2050 Scenario – Data product – IEA, as modified by FREYR; BNEF 1) Includes an increased adoption of ESS systems with a lower cost offering similar to the Company

FREYR Targeting the Accelerating Energy Storage Markets in the United States Source: Rystad Energy, US ESS Battery Market Outlook , May 2021 United States ESS market demand estimated to surpass 900 GWh in installed capacity by 2030 The USA is positioned as a leading market for Energy Storage System (ESS) solutions globally Drivers of the ESS transition and market value: ▪ 2030 target of 3.6 Gt CO 2e reduction ▪ Solar & wind to replace fossil fuel ▪ Energy transition through scale ▪ Tax incentives for acceleration ▪ Unsubsidized renewable solar currently competitive with coal, nuclear & gas at $29 - $38/MWh 1) ▪ EV adoption & battery systems ▪ Higher ESS adoption via lower cost ▪ Incentives increase rate of adoption ▪ Acceleration of microgrids ▪ Arbitrage on carbon & cost ▪ Renewables need batteries ▪ Grid balancing from batteries ▪ Batteries reduce peak demand 1 Renewable Energy Generation 2 Market Costs 3 13 N e w E n e r g y A r c h i t e c t u r e s 1) Based on new - build Solar PV - Thin Film utility scale development

Aiming to be the Lowest Carbon Battery Cell Producer in the World 1 0 0 2 0 3 0 90 0 80 0 70 0 40 0 60 0 4 0 1 , 0 0 0 10 0 50 0 0 6 0 8 0 30 0 7 0 5 0 20 0 1,100 1,200 P l a n t s i z e , G W h O t h e r A s i a Other F R E Y R China N o r t h A m e r i c a Europe L i f e c y c l e e m i s s i o n s kg CO 2 e/kWh Source: Study commissioned from global management consultancy, Company estimate, press search ▪ Low - carbon battery cell production becoming an increasingly important topic in customer offtake discussions ▪ FREYR expects to have the lowest emissions in the industry ▪ European & North American producers projected to lead on emissions globally ▪ Majority of production will remain located in Asia, primarily in China P r o j e c t e d B a tt e r y C e l l L i f e C y c l e E m i ss i on s Sustainability 14

FREYR Advantage: Targeting 81% Lower CO 2 e Emissions ~ 8 0 1 F R E Y R ‘ n e t z e r o ’ c e l l p r od u c t i o n ( ~ 25 ) A c t i v e m a t e r i a l p r od u c t i o n i n N o r w a y / N o r d i c s 2 ) ( ~ 15 ) B u il d i n g a N o r d i c e c o s y s t e m o f additional supply 2) ( ~ 15 ) Packaging and recycling 2) ( ~ 10 ) = ~ 1 5 G l o b a l B a t t e r y I nd u s t r y C O 2 e B a s e l i n e 1 ) : Emissions k g C O 2 / k W h 2 3 4 F R E Y R T a r g e t C O 2 e E m i s s i on s L e v e l 3 ) : 1) Global battery industry average for 2020 2) Estimated medium - term benefits from localized supply chain 3) Company estimate 1 2 3 4 Global A ve r a g e F R E Y R Target 8 1 % C O 2 e Reduction - 31% - 19% - 13% - 19% T a r g e t e d F R E Y R C O 2 e F oo t p r i n t R e d u c t i o n 1 9 % Source: Study commissioned from global management consultancy Sustainability 15

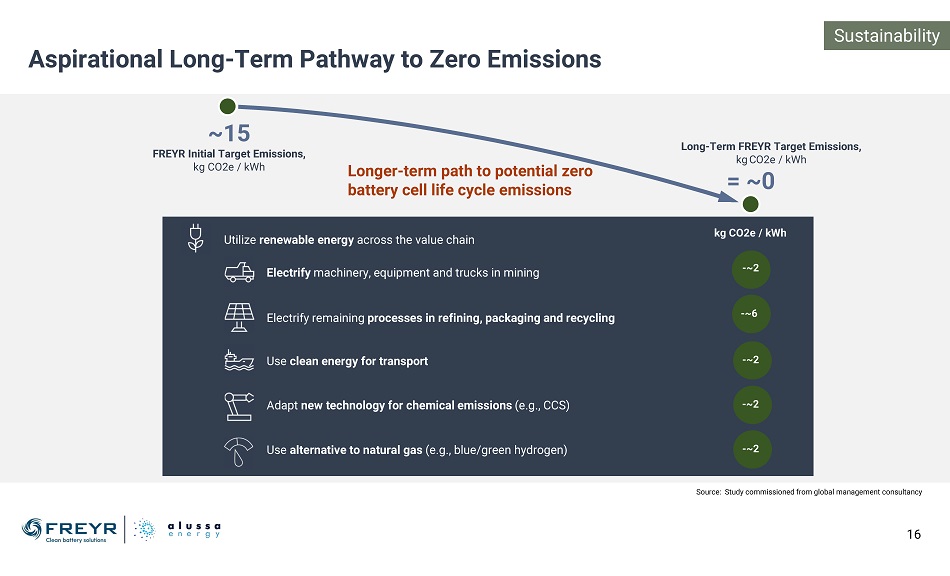

Aspirational Long - Term Pathway to Zero Emissions ~15 F R E Y R I n i t i a l T a r g e t E m i ss i o n s , kg CO2e / kWh L o n g e r - t e r m p a t h t o p o t e n t i a l z e r o battery cell life cycle emissions Utilize renewable energy across the value chain Electrify machinery, equipment and trucks in mining U s e c l e a n e n e r g y f o r t r a n s p o r t Adapt new technology for chemical emissions (e.g., CCS) Electrify remaining processes in refining, packaging and recycling - ~ 2 k g C O 2 e / k W h - ~ 2 - ~ 6 - ~ 2 L o n g - T e r m F R E Y R T a r g e t E m i ss i o n s , k g C O 2 e / k W h = ~0 Use alternative to natural gas (e.g., blue/green hydrogen) - ~ 2 Sustainability 16 Source: Study commissioned from global management consultancy

2022 N o r w ay ( N O 4 ) G e r m a n y N e t he r l a n d s U K N o r w a y ’ s A d v a n t a g e : L o w C a r bo n I n t en s i t y & E l e c t r i c i t y P r i c e s Carbon Intensity of Electricity Produced E l e c t r i c i t y P r i c e E s t i m a t e s , 2 0 2 2 - 4 0 1 ) Source: electricityMap.org, Dec 2020 FREYR has signed a MoU for the delivery of electricity in Mo i Rana 3) 1) Source: The Norwegian Water Resources and Energy Directorate (NVE), Oct 2019 2) Point estimates for 2022 and 2040 for these countries. Estimates for 2025 and 2030 are interpolations between the prices of 2022 and 2040; Eastern Europe is an average of prices in Poland, Estonia, Latvia and Lithuania 3) MOU Based on spot price + margin for up to 200GWh. Source: Company data 2025 S w e d e n 2 ) France 2030 Finland 2) 2040 E a s t e r n E u r o p e 2 ) E U R / M W h 50 45 40 35 30 25 20 Sustainability 17

E m e r g i n g E u r op e a n B a t t e r y S upp l y C h a i n S o u r c e s : B a tt e r y N o r w a y , F R A M E , C o m p a n y d a t a Development across all aspects of the emerging European battery supply chain, from raw materials to recycling Map of Energy Critical Elements: Cobalt, Lithium, Graphite E u r o p e P r e li m i n a r y R e s ul t , Ma y 2 01 9 Mo i Rana, Norway P r o j e c t d e v e l op m e n t O sl o , No r w a y Headquarters R a w - M a t e r ial P r o v i d e r s ▪ Glencore ▪ Elkem ▪ MRC ▪ Tiotech ▪ Hydro E S S P r o v id e r s S o la r & M a r i n e ▪ Siemens ▪ Corvus ▪ ZEM ▪ Kongsberg ▪ S c a t e c S o l a r R e s e a r c h O r g a n iz a t i on s ▪ NTNU ▪ SINTEF ▪ IFE ▪ UiO S upp o r t i v e N o r w a y B a t t e r y E c o s y s t e m F R E Y R ’ s A s p i r a t i on a l G o a l : Full - Cycle Sustainability Responsible sourcing of raw materials I m p r o v e d l a b o r c ond i t i o n s L o w w a t e r s t r e s s & e n h a n c ed biodiversity R e d u c e d t o x i c e m i ss i on s & waste Sustainability 18

Supply Chain Update ▪ P o t e n t i a l s upp ly c h a i n p a r t n e r s – Glencore: cobalt, nickel, copper and other cathode materials – One of the largest global chemical producers: active cathode materials – Talga: natural graphite anode materials – Elkem: active anode materials – Metalex: non - ferrous metals ▪ G l e n c o r e M o U – Feb 2021 LOI for supply up to 3,700 tonnes of sustainably sourced cobalt – High quality and purity of finished metals from Glencore’s Nikkelverk facility in Norway, the largest nickel refinery in the western hemisphere ▪ Significant progress achieved towards a localized and decarbonized supply chain – FREYR targeting a decarbonized supply chain from predominately Nordic sources by 2025 One of the world’s largest chemical producer, supply of active cathode materials MoU for sustainable - sourced battery raw materials with transparency and traceability based on blockchain technology Potential Supply Chain Partners Sustainability 19 Supply of active anode materials based on natural graphite produced in Northern Sweden Supply of active anode materials targeting high silicon content from Norway - based producer of environmentally responsible metals and materials One of the world’s largest chemical producer, supply of active cathode materials

2 4 M T e c hno l o g i e s : I n n o v a t i v e , D i s r up t i v e B a tt e r y T e c hno l o g y 24M Technology Advantages 1. Revolutionizing the lithium - ion cell manufacturing process and platform, allowing cell production for different battery applications within one facility 2. SemiSolid technology that provides a simpler, more reliable and safer manufacturing process that accelerates production while lowering costs of existing and next - generation cell technology 3. Chemistry - agnostic platform that supports current and next - generation cell technologies, such as Silicone Electrode, Dual Electrolyte System and Pre - Lithiation implementation ▪ MIT spin - off founded in 2010 by Yet - Ming Chiang – MIT Professor, Materials Science – P i o n e e r i n n e w m a t e r i a l d e v e l o p m e n t 1 ) – Founded A123 Systems & American Superconductor ▪ Developed new cell architecture, cost - optimized for large batteries ▪ 78+ issued patents, 108+ pending ▪ M a r k e t v a li d a t i o n 2 ) : C a m b r i d g e , M A H e a dq u a r t e r s Recognitions Source: 24M Technologies 1) 24M was recognized by Bloomberg New Energy Finance as a 2016 New Energy Pioneer, Source: Business Wire 2) Kyocera press release, January 6, 2020 S p ee d 20

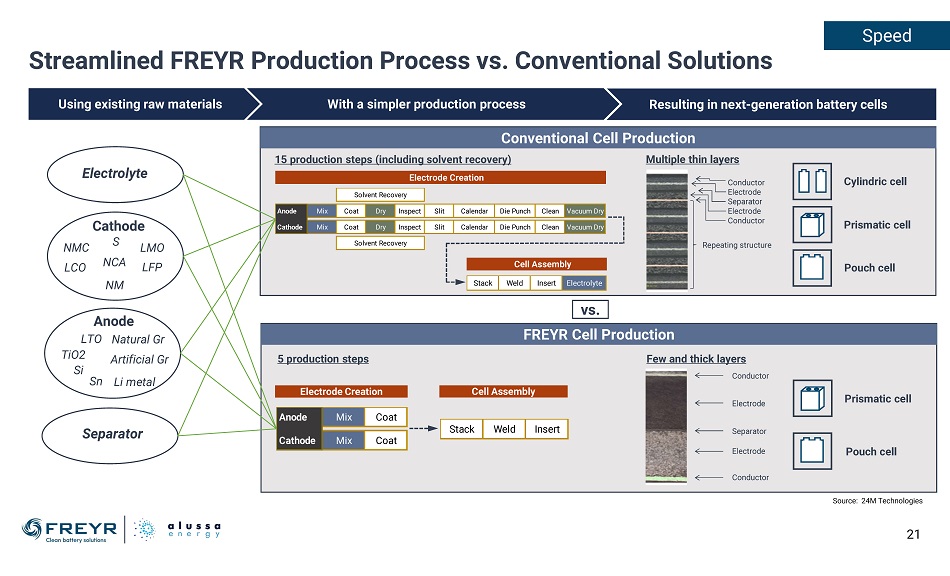

Streamlined FREYR Production Process vs. Conventional Solutions E l e c t r o ly t e Cathode Anode Separator N M C LCO S N C A NM L M O LFP LTO Natural Gr T i O 2 A r t i f i c i a l G r Si Sn Li metal Prismatic cell P o u c h c el l C y li n d r i c c el l C o n d u c t o r Electrode Separator Electrode C o n d u c t o r R e p e a t i n g s t r u c t u r e E l e c t r o de C r ea t i o n C e ll A ss e m b ly Stack Weld Insert Electrolyte A nod e M i x S l i t C a l e n d a r D i e P u n c h C l e a n V a c u u m D r y C a t h o d e M i x S l i t C a l e n d a r D i e P u n c h C l e a n V a c u u m D r y Solvent Recovery Coat Dry Inspect C o a t D r y I n s p e c t Solvent Recovery F e w a n d t hi c k l a y e r s Conductor Conductor E l e c t r o de Separator E l e c t r o de 5 production steps Stack Weld Insert C e l l A ss e m bl y E l e c t r o d e C r e a t i o n Anode Cathode Mix Coat Mix Coat Prismatic cell P o u c h c el l F R E Y R C e l l P r od u c t i o n Using existing raw materials With a simpler production process Resulting in next - generation battery cells Conventional Cell Production 15 production steps (including solvent recovery) Multiple thin layers vs. Source: 24M Technologies S p ee d 21

2 4 M : E x p e c t e d C o s t A d v a n t a g e O v e r C on v e n t i on a l T e c hno l o g y S p ee d ▪ 24M compatible with known chemistries with equivalent energy density potential as conventional technology ▪ 24M unlocks thick electrodes while maintaining power capability (ideal for ESS applications) delivering increased cost advantages relative to conventional LiB ▪ 24M technology is suitable for battery applications ▪ 24M process design will provide structural cost benefits for same raw material costs per KWh ESS Applications EV Applications Power Applications E x p e c t e d Battery Cost $/kWh Charge/Discharge 24M vs. Conventional Lithium - Ion Battery (LiB) Performance Comparison Thicker electrodes Thinner electrodes Conventional LiB coating b e c o m e s c o s t prohibitive Conventional LiB t e c h n o l o g y p l a t f o r m SemiSolid LiB t e c h n o l o g y p l a t f o r m S t r u c t u r al b e n e f i t f r o m c e ll design increases cost advantage (higher energy carrying material per volumetric unit) l a b o r ) E x p e c t ed s u p e r i o r 24 M S t r u c t u r al b e n e f i t f r o m performance to conventional process design (simplified Rate (C - rate) p r o c e s s f o r f a s t c h a r g e E V p r o d u c t i o n p r o c e ss l o w e r s requirements build at scale footprint, capex, energy and Conventional LiB EV solutions 2 4 M o p t i m i z e d design for ESS 24M target EV solution Source: 24M Technologies 22

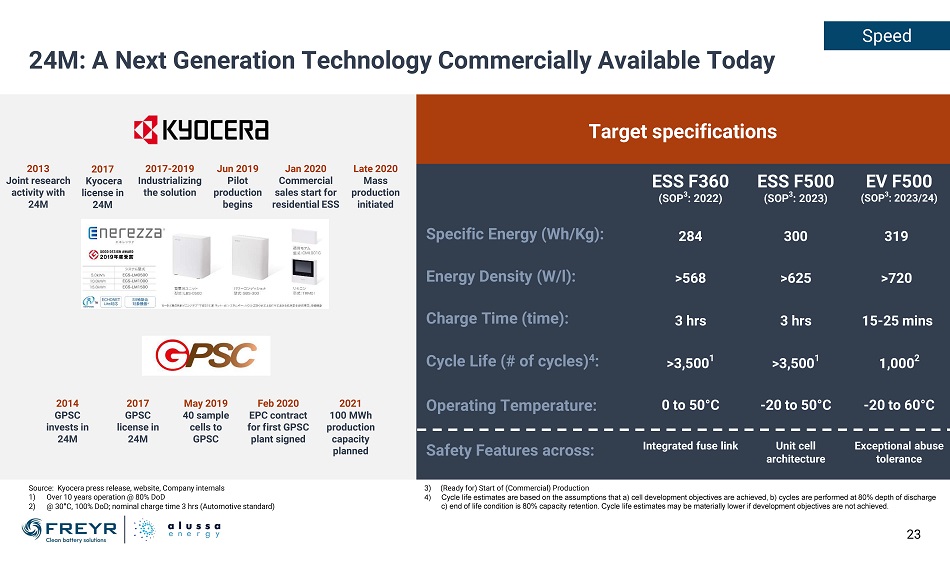

Source: Kyocera press release, website, Company internals 1) O v e r 1 0 y e a r s o pe r a t i o n @ 80% D o D 2) @ 30 ƒ C, 100% DoD; nominal charge time 3 hrs (Automotive standard) 24M: A Next Generation Technology Commercially Available Today T a r g e t s p e c i f i c a t i o n s Specific Energy (Wh/Kg): Energy Density (W/l): C h a r g e T i m e ( t i m e ) : Cycle Life (# of cycles) 4 : 20 1 3 20 1 7 20 1 7 - 20 1 9 J u n 201 9 J a n 2 0 2 0 L a t e 202 0 Joint research Kyocera Industrializing Pilot Commercial Mass a c t ivi t y w i t h li c e n s e i n t h e s o l u t i o n p r o d u c t i o n s a le s s t a r t f o r p r o d u c t i o n 24M 24M begins residential ESS initiated May 2019 Feb 2020 2021 4 0 s a m p l e E P C c o n t r a c t 10 0 M W h cells to for first GPSC production GPSC plant signed capacity planned 2017 GPSC li c e n s e in 24M Safety Features across: O pe r a t i n g T e m p e r a t u r e : E S S F 3 6 0 E S S F 50 0 E V F 5 0 0 ( S OP 3 : 2 022 ) ( S OP 3 : 2 023 ) ( S OP 3 : 2 0 23 /2 4 ) 284 300 319 >568 >625 >720 3 hrs 3 hrs 15 - 25 mins >3,500 1 >3,500 1 1,000 2 0 to 5 0 ƒ C - 2 0 to 5 0 ƒ C - 2 0 to 6 0 ƒ C Integrated fuse link U n i t c e l l a r c h it e c t u r e E x c e p tio n a l a b u s e tolerance 2014 GPSC i n ve s t s i n 24M S p ee d 23 3) (Ready for) Start of (Commercial) Production 4) Cycle life estimates are based on the assumptions that a) cell development objectives are achieved, b) cycles are performed at 80% depth of discharge c) end of life condition is 80% capacity retention. Cycle life estimates may be materially lower if development objectives are not achieved.

▪ S t r en g t h e n e d 24 M li c e n s i n g & s e r v i c e s a g r e e m e n t – Collaborative knowledge transfer from other 24M licensees – 24M development roadmap defined for LFP & NMC architectures – 24M raised $57 million in May 2021 financing led by Itochu and Fujifilm to commercialize and expand technology development programs ▪ Pilot/Customer Qualification Plant (CQP) Development Advances – Existing building at Mo i Rana Quay currently under retrofit construction for CQP – One 24M production line tendered for delivery and installation – Pilot/CQP plant to produce sample cells for customer qualification/certification – Expected 2H - 2022 production start - up ▪ F R E Y R T e c h no l o g y T e a m B u il d O u t – Ryuta Kawaguchi, Chief Technology Officer; ex - Dyson EV Battery and Nissan – Patrick Lee, EVP of Technology; ex - WM Motor, LG Chem, Samsung SDI – Dr. Motoaki Nishijima, Head of R&D, ex KRI, Sharp – Sachiya Inagaki, VP Battery Materials; ex - Yano Institute – Kenneth Yan, VP Operations; ex - CHAM Battery and A123 Systems T e c hno l o g y U p d a t e ▪ M o I n d u s t r i a l P a r k - Q u a y , M o i R a n a , N o r w a y ▪ Pilot/CQP installed as an upgrade of an existing building ▪ Platform to optimize and industrialize 24M technology ▪ Planned offtake from OEM, ESS and other mobility customers ▪ Arena for training and development of new and improved technologies and processes F R E Y R I ni t i a l P r odu c t i o n F a c il i t y : P i l o t / C u s t o m e r Q u a li f i c a t i on P l a n t S p ee d 24

P o t e n t i a l O f f t a k e C u s t o m e r s : A cc e l e r a t i n g M o m e n t u m B u i l d i n g Scale GWh/year FREYR 2025 Potential Battery Cell Capacity & Potential Aggregate Customer Demand E SS / C o m m e r c ia l M o b i li t y E l e c t r i c V e h i c l e s A c t i v e P o s s i b l e E SS / C o m m e r c ia l M o b i li t y O f f t a k e C u s t o m e r P r o c e s s e s : 4 5 ▪ 59 active discussions ongoing with potential offtake partners across targeted market segments: – EV – ESS – Mobility ▪ Unmet demand from current processes are above FREYR’s 2025 production capacity ▪ FID on Gigafactories likely to proceed once >50% offtake secured for ~3 years of given production capacity ▪ Currently planning out production line lay - out against optimized customer portfolio 1) Assumes FREYR Gigafactories 1 & 2 allocated primarily to ESS/Commercial Mobility battery cell production. 2) Assumed FREYR Gigafactories 3 & 4 and JV Gigafactory 1 allocated primarily to EV battery cell production. 1 3 G W h 8 6 G W h FREYR P o t e n t i a l 2 02 5 ESS/Mobility Capacity 1) Potential ESS/Mobility C u s t o m e r D e m a n d 3 0 G W h 43 6 G W h FREYR P o t e n t i a l 2 02 5 E V C a p a c i t y 2 ) P o t e n t i a l EV C u s t o m e r D e m a n d A c t iv e P o ss i b l e E V O f f t a k e C u s t o m e r Processes: 14 7x 15x 25

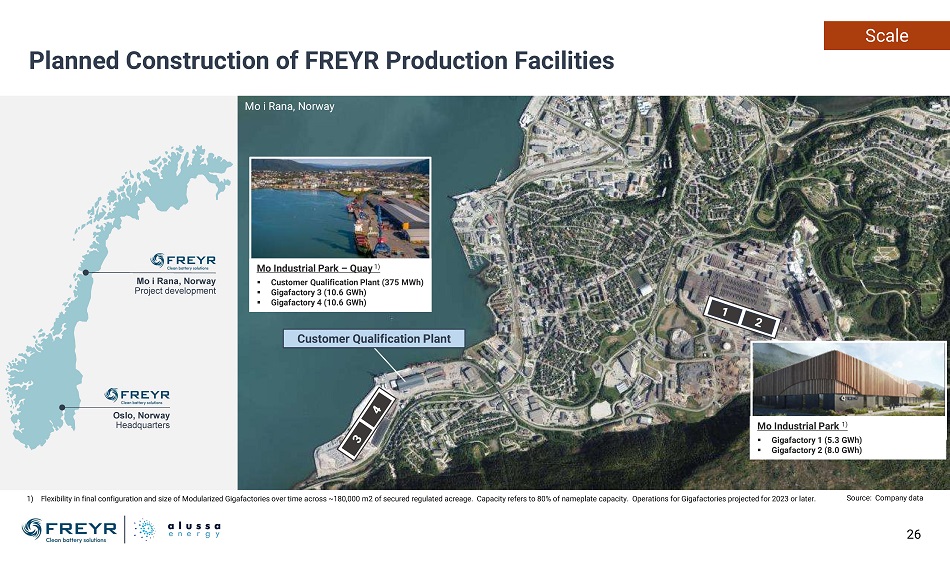

M o In d u s t r i al Pa r k 1 ) ▪ Gigafactory 1 (5.3 GWh) ▪ Gigafactory 2 (8.0 GWh) M o In d u s t r i al Pa r k – Q u a y 1 ) ▪ Customer Qualification Plant (375 MWh) ▪ Gigafactory 3 (10.6 GWh) ▪ Gigafactory 4 (10.6 GWh) Planned Construction of FREYR Production Facilities Mo i Rana, Norway Mo i Rana, Norway P r o j e c t d e v e l op m e n t O sl o , No r w a y Headquarters S o u r c e : C o m p a n y d a t a 1) Flexibility in final configuration and size of Modularized Gigafactories over time across ~180,000 m2 of secured regulated acreage. Capacity refers to 80% of nameplate capacity. Operations for Gigafactories projected for 2023 or later. C u s t o m e r Q u a l i f i c a t i o n P la n t Scale 26

0 1 0 2 0 3 0 5 0 6 0 20 2 2 20 2 3 2 0 2 4 2 0 2 5 20 2 6 20 2 7 20 2 8 2 0 2 9 20 2 5 T a r g e t I n s t a lle d C a p a c i t y : 4 3 G W h 40 FREYR’s Phased Gigafactory Development Capex Capac i t y 1 ) Operational Asset ( $ m i l li o ns) (GWh) Start Customer Qualification Plant $35 0.2 2022 Gigafactory 1 $275 5 2023 Gigafactory 2 $310 8 2024 Joint Venture Gigafactory 1 $565 8 2024 Gigafactory 3 $380 11 2025 Gigafactory 4 $380 11 2025 Gigafactory 5 $775 16 2026 Joint Venture Gigafactory 2 $565 8 2027 Gigafactory 6 $775 16 2028 TOTAL $4,060 83 Note: Company projection based on 24M data; the indicated outlook should not be construed as estimates or guidance for future developments of the Company 1) Capacity refers to 80% of nameplate capacity for Gigafactories and 100% of nameplate capacity for Joint Venture Gigafactories S o u r c e : C o m p a n y d a t a G i g a f a c t o r y 1 G i g a f a c t o r y 2 G i g a f a c t o r y 3 G i g a f a c t o r y 4 G i g a f a c t o r y 5 FREYR Battery Manufacturing Facility Development In s t a ll e d C a p a c i t y GWh 90 20 2 8 T a r g e t I n s t a lle d C a p a c i t y : 8 3 G W h 80 G i g a f a c t o r y 6 70 J o i n t V e n t u r e G i g a f a c t o r y 1 J o i n t V e n t u r e G i g a f a c t o r y 2 Scale 27

Potential Geographic and Product Offering Expansions ▪ F R E Y R N o r t h A m e r i c a E x p a n s i o n D i s c u s s i on s – Joint venture negotiations with a subsidiary of a major multinational industrial conglomerate – Potential joint venture project to build battery production and possible related facilities in North America – T a r g e t e d s c a l e o f a t l e a s t 5 0 G W h b y 2 0 3 0 – MoU provides framework to utilize 24M Technologies’ cell design and manufacturing platform ▪ Positioning for Downstream Vertical Integration into Battery Module Manufacturing – MoU signed in May 2021 with Eguana Technologies for ESS modules – Eguana offers a complete line of ESS systems for residential and commercial applications, focusing on markets in Europe, Australia and North America Announced Emerging Complementary Strategic Opportunities Scale 28

F R E Y R L o n g - T e r m M a r g i n A d va n t a g e ▪ Technology Strategy – Partnership with 24M Technologies – 24M process technology offers significant advantages for manufacturing costs ▪ Partnership Strategy – Limits need for internal R&D – Partnering for low - cost materials ▪ Nordic Ecosystem – Low cost, 100% renewable power – Lower logistics costs to Europe $48 $16 $14 G l ob a l A v e r a g e in 2025 I ll u s t r a t i ve 2 0 2 5 B a t t e r y C e l l C o s t 1 ) B r e a k do w n Materials Costs M a n u f a c t u r i n g C o s t s C o r p o r a t e & P r o f i t $78 $ 6 2 $43 $8 - 50% - 10% C e l l C o s t $/kWh FREYR strategic advantages target 20% lower battery cell costs vs. the projected global average in 2025 1) T o t a l c o s t i n c l ud e s c o n s i s t e n t p r o f i t m a r g i n s a n d l o n g - t e r m a v e r a g e r a w m a t e r i a l p r i c e s f o r a l l i n d u s t r y p l a y e r s e v a l u a t ed 3 ) I n c l ud e s R & D a n d li c e n s e f ee s 2) C o m p a n y e s t i m a t e b a s ed o n 24 M d a t a FREYR P r o d u c t i on C o s t in 2025 2) F R E Y R A i m s t o D e l i v e r M a r ke t L e a d i n g C o s t s a n d M a r g i n s Source: Study commissioned from global management consultancy Scale $11 3) 29 - 21% Cell design im p ro v eme n t P r o du c t ion pr o c e s s improvement Business 3 m ) odel improvement

FREYR Positioned as a Low - Cost Producer Projected 2025 Global Battery Cell Cost 1) F R E Y R v s B o t t o m 5 FREYR C h i n a USA Europe S ou t h K o r e a Japan Other C e l l C o s t $/kWh 1) Total cost including profit to ensure ROI for various battery cell manufacturing factories based on outside - in estimates 2) FREYR P&L result divided by capacity produced in 2025 for all materials except for cathode, based on data from 24M FREYR projected cost leadership in 2025 is intended to be achieved by: ▪ Utilizing state - of - the - art production technology to significantly simplify manufacturing process & reduce raw material costs ▪ Leveraging a deep partnership model to unlock value chain innovation & lower costs ▪ Catalyzing a Nordic ecosystem that leverages low - cost renewable energy Source: Study commissioned from global management consultancy 12 0 0 80 0 60 0 40 0 900 1,000 1,100 P l a n t S i z e , G W h 6 0 10 0 0 50 0 30 0 20 0 4 0 14 0 8 0 10 0 2 0 70 0 - 5 3 % 2 ) Scale 30

FREYR’s Experienced Execution Team A r e B r a u t a s e t C h i e f L e g a l O f f i c e r ▪ 20 years practice as in - house counsel in the energy sector ▪ Head of Legal and Compliance, Statoil Tanzania ▪ Chief Legal Officer, Aker Energy and Vice President Legal, Equinor T o r s t ei n D a l e S j ø t ve i t E x e c u t i v e C h a ir & F o un d e r ▪ 35+ years of experience in utility, shipbuilding & upstream energy businesses ▪ Former CEO, Sarawak Energy, Malaysia ▪ President and CEO, Aker Yards T o m E i n a r J e n s e n C h i e f E x e c u t i v e O ff i c e r & C o - F o u n d e r ▪ 25 years of experience in energy, industry, agriculture and sustainability ▪ Partner & Co - Founder, EDGE Global LLC, Senior Advisor, SYSTEMIQ ▪ CEO Agrinos and various commercial roles in Norsk Hydro ASA J a n A r v e H a u g a n D e p u t y C E O & C hi ef O p e r a t in g O f f i c e r ▪ 35 years project leadership in global process and energy industries ▪ CEO, Aker Energy and Kværner ASA ▪ Various senior level roles at Norsk Hydro ASA, including CEO of Qatalum R y u t a K a w a g u c h i C h i e f T e c hn o lo g y O f f i c e r ▪ 25 years of experience in battery engineering and technology development ▪ Solution Owner, Dyson EV Battery ▪ Senior Manager Battery & ePT Strategy Planning, Nissan S t e f f e n F ø r e i d C h i e f F in a n c i a l O f f i c e r ▪ 20 years finance experience within LNG, engineering, fabrication and energy industries ▪ CEO/CFO, Höegh LNG Partners LP and CFO, Höegh LNG Holdings Ltd ▪ C F O , Gr e n l a nd Gr o u p A S A E i n a r K ild e Executive Vice President Projects ▪ 30+ years experience in large - scale development projects, energy and renewables industries ▪ EVP Project Execution, Sarawak Energy, Malaysia ▪ E V P P r o j e c t s , R E C 31 T o v e N il s e n L j u n g q u i s t Executive Vice President Operations ▪ 30 years experience in global manufacturing and oil & gas businesses ▪ CEO, Agility Subsea Fabrication / Agility Group ▪ Managing Director, Hydro Aluminum Clervaux Pa t r i c k L e e Executive Vice President of Technology ▪ 20 years experience for Li - Ion Battery and BEV company (S. Korea, USA and China) ▪ Head & Expert on LiB R&D center for LiB business division of WM Motor (China) ▪ Leadership roles in LiB technology R&D at LG Chem, Hyosung R&D, A123 Systems, Samsung SDI and GWM H e g e N o r h ei m Executive Vice President Human Resources, ESG & Communications ▪ 25 years experience in oil & gas executive and Norwegian government positions ▪ Chief Sustainability Officer, Head of Communications and Public Affairs, Norsk Hydro ASA and Equinor ▪ Senior Advisor in the Office of the Prime Minister and Minister of Finance, Norway G e r y B on d u e ll e E x e c u t i v e V i c e P r e s i d e n t P ro d u c t D e v e l o p me n t a n d S a l e s ▪ 25 years energy sector experience in engineering, product development and operations ▪ Vice President Sales EMEA and APAC, Enersys

FREYR Post - Transaction Identified Board of Director Appointees Torstein Dale Sjøtveit, FREYR Director ▪ Executive Chairman and Founder, FREYR ▪ 35+ years of experience in utility, shipbuilding & upstream energy businesses ▪ C E O , S a r a w a k E n e r g y , M a l a y s i a ▪ P r e s i d e n t a n d C E O , A k e r Y a r d s ▪ E V P A l u m i nu m M e t a l , N o r s k H y d r o A S A P e t e r M a t r a i , FR E Y R a n d E D G E G l o b a l Director ▪ Director and Co - Founder, FREYR ▪ 20 years of experience in finance, technology commercialization and operations within bioenergy and sustainability ventures ▪ C F O , J o u l e U n li m i t e d , U S ▪ C F O , Bu t a m a x ( B P - D u P o n t J V ) O l a u g Sv a r v a , D N B a n d N o r f u n d Director ▪ Extensive experience with financial markets, record of ESG - focused investing and executive and board experience ▪ C h a i r o f t h e B o a r d o f D i r e c t o r s , D N B A S A ▪ Chair of the Board of Directors, Norfund ▪ C E O , F o l k e t r y g d f o n d e t M i m i B e r d a l , E M G S a n d G o od t e c h Director ▪ Attorney and former law partner, 20+ years of experience in business development, non - executive board work, corporate governance and transactions ▪ Chair of the Board of Directors, Electromagnetic Geoservices (EMGS) ASA ▪ Chair of the Board of Directors, Goodtech ASA Daniel Barcelo, Alussa Energy Director ▪ 25+ years of experience in international energy finance and emerging markets ▪ CEO, President & Director, Alussa Energy Acquisition Corp. ▪ Portfolio Manager, Moore Capital ▪ Managing Director, Renaissance Capital ▪ C F O , R u s p e t r o p l c , R u ss i a Germán Curá, Tenaris and Alussa Energy Director ▪ Extensive operational and executive experience in the steel and energy industries ▪ Board of Directors and Vice Chairman of the Board, Tenaris ▪ President and CEO, Maverick Tube Corp. ▪ P r e s i d e n t a n d C E O , H y d r i l ▪ D i r e c t o r , A l u ss a E n e r g y A c q u i s i t i o n C o r p . Jeremy Bezdek, Koch Industries Director ▪ 24 years of experience in finance and commercial roles in Koch Industries ▪ Managing Director, Koch Strategic Platforms ▪ B o a r d o f D i r e c t o r s , W i l d c a t D i s c o ve r y T e c hn o l o g i e s M o n i c a T i úb a , T e n a r i s Director ▪ 20+ years of professional experience within international and European Union tax law in Brazil and Luxembourg ▪ B o a r d o f D i r e c t o r s , T e n a r i s ▪ Senior Tax Manager, PricewaterhouseCoopers Luxembourg 32

Rapidly Expanding Presence Across the Battery Value Chain 1) Percentage of total value added per value chain step, based on expected 2030 demand from transportation, energy storage and consumer electronics applications + battery pack prices 2 8 % 1 1 % 4 % Value add: 1) = 100 % M i n i n g a n d Refining Active m a t e r i a l s Cell 32% Pack/ M o d u l e s 25% R e c y c l i n g I ni t i a l F o c u s Partnership - based value chain integration strategy 33 Source: Study commissioned from global management consultancy D e v e lo p i n g F R E Y R Pa r t n e r s h i p s : A dd e d F o c u s North American Additional JV process potential partner underway discussions underway Potential partner discussions underway

FREYR: Disruptive, Commercially Introduced Technology In Favored Location ▪ Primary differentiating factor for battery cell production at scale: driving down conversion costs ▪ 24M technology offers a potential improvement in solutions across key cost drivers: 1. Energy: primary cost driver on a value chain basis – FREYR targeting establishing a full Norway/Nordic supply chain 2. Capex: second most important cost driver – 24M offers a potential meaningful reduction compared to conventional solutions 3. Labor: third most important cost driver – 24M likely offers a significant reduction in labor compared to conventional solutions – Highly competent workforce is necessary for further digitalisation and automatisation M i n e r a l s 30% Active m a t e r i a l s 40% 1 6 % 1 6 % 3 3 % 1 4 % 1 4 % 2 3 % 4 5 % 2 4 % 4 4 % 3 3 % 7% 3% 1 0 % 4% 7% E x t r a c t i on Chemical p r o c e s s i n g Cell p r odu c t i o n T o t a l Non - active materials Plant/machinery investments E n e r g y c o s t L a b o r O t h e r Ma t e r i al Costs C o n v e r s i o n Costs L o c a l s o u r c i n g (energy intensive) L o w C a p e x , Smaller Footprint U l t r a l o w - c o s t g r een e n e r g y sourced in Norway Fewer e m p l o y ee s , h i g h digitalization Source: Rystad Energy research and analysis; Yuan/Deng/Li/Yang, Manufacturing energy analysis of lithium on battery pack for electric vehicles S u s t a i n a b il i t y S c a l e S p ee d 34 Cost Breakdown of the EV Battery Value Chain, 2020 Global Average A d v a n t a g e s

P r o F o r m a F i n a n c i a l P r o j e c t i o n s 1) Non - GAAP financial metric – EBITDA defined as earnings before interest expense, interest income and other income, taxes, depreciation, amortization and stock - based compensation Projected annual free cash flow of ~$1.6 billion upon completion of FREYR’s Gigafactory build - out plan ( $ m illi o n s ) 2021 2022 2023 2024 2025 2026 2027 2028 I n c o m e S t a t e m e n t I t e m s C u s t o m e r Q u a li f i c a t i o n Pl a n t $0 $11 $16 $16 $16 $16 $16 $16 Gigafactories 0 0 305 877 2,154 2,869 3,451 4,073 Jo i n t V e n t u r e G i g a f a c t o r i e s 0 0 0 499 705 687 1,132 1,307 T o t a l R e v e nu e $0 $11 $321 $1,392 $2,875 $3,573 $4,600 $5,396 % G r o w t h n m nm nm 333% 107% 24% 29% 17% COGS $0 $9 $257 $951 $1,980 $2,358 $3,131 $3,693 G r o s s P r o f i t $0 $1 $65 $441 $895 $1,215 $1,468 $1,703 G r o s s P r o f i t M a r g i n % n m 13.0% 20.1% 31.7% 31.1% 34.0% 31.9% 31.6% T e c h no l o g y L i c e n s i n g F e e s $0 $1 $13 $36 $87 $116 $139 $164 O t h er Ex p e n s es a n d S G & A 35 45 45 66 105 113 125 127 E B I T D A 1 ) ($35) ($44) $7 $339 $703 $986 $1,205 $1,412 E B I T D A M a r g i n % nm nm nm 24.4% 24.4% 27.6% 26.2% 26.2% B a l a n c e S h e e t an d C a s h F l o w I t e m s Debt $0 $120 $896 $1,493 $2,011 $2,497 $2,743 $3,203 N e t D e b t / E B I T D A nm nm nm 3.0x 1.9x 1.6x 1.6x 1.5x C a pi t al E x p e n d i t u r e s $144 $517 $832 $609 $612 $880 $996 $1,110 % o f R e v e nu e s nm nm nm 44% 21% 25% 22% 21% 35

6 . 9 x ' 27 e ' 25 e ' 25 e 3 1 . 7 x 2 8 . 1 x 1 4 . 6 x 7 . 5 x 4 . 5 x 2 . 6 x n m 0 . 8 x 0 . 5 x 0 . 4 x ' 25 e ' 26 e ' 27 e 6 6 . 0 x 3 1 . 3 x 1 6 . 4 x 5 9 . 3 x 3 2 . 0 x 1 7 . 7 x 1 0 . 2 x 8 . 5 x 5 . 2 x 4 . 1 x 2 . 9 x ' 25 e ' 27 e ' 25 e Asian Battery Comps (‘21 EV/EBITDA) 3) U S B a tt e r y C o m p s A t D e a l 2 ) F u e l C e l l C o m p s ( ‘ 2 5 EV / E B I T D A ) 3 ) U S E l e c t r i c V e h i c l e C o m p s ( ‘ 2 4 E V / E B I T D A ) 3 ) U S B a tt e r y C o m p s C u r r e n t FREYR 1) A v g . 25 . 6 x A v g . 13 . 7 x 6 . 8 x 2 ) 1) Presented multiples are based upon current year enterprise value; adjusted enterprise value for future net debt balances would imply ’25e multiple of 3.4x, ’26e multiple of 2.8x, and ’27e multiple of 2.5x 2) Valuation is based upon current year enterprise value and public management EBITDA forecasts at time of SPAC merger announcement and securities prices as of June 18, 2021, unless otherwise noted 3) Valuation is based upon current year enterprise value and consensus EBITDA estimates as of June 18, 2021, unless otherwise noted 36 S o u r c e : B l o o m be r g , C o m p a n y r e p o r t s 1 0 . 2 x 3 ) 3 ) 7 . 9 x 2 ) 2 ) A tt r a c t i v e V a l u a t i o n Me t r i c s : B a t t e r y C o m p s E V / E B I T D A

“As a society, we must substantially accelerate our efforts to reduce CO 2 emissions at scale over the next ten years. Electrification and batteries are instrumental parts of the solution, representing one of the most exciting and sustainable growth vectors in the market.” T o r s t e i n D a l e S j ø t v ei t F R E Y R E x e c u t i v e C h a i r m a n & F o u n d e r T h a n k Y o u

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Dicello Levitt LLP Announces Investor Class Action Lawsuit Filed Against QuidelOrtho Corp. f/k/a Quidel Corp. (NASDAQ: QDEL) And Lead Plaintiff Deadline

- Bragar Eagel & Squire, P.C. Reminds Investors That Class Action Lawsuits Have Been Filed Against HireRight, and Doximity Innovations and Encourages Investors to Contact the Firm

- Stockholder Alert: Robbins LLP Informs Investors of the Class Action Filed Against Compass Minerals International, Inc. (CMP)

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share