Form 6-K/A FURY GOLD MINES LTD For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K /A

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May 2022

Commission File No. 001-38145

| Fury Gold Mines Limited |

| (Translation of registrant’s name into English) |

1630-1177 West Hastings Street, Vancouver, BC, V6E 2K3 Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ☐

Explanatory Note

The Registrant is furnishing this amended Form 6-K in order to include a revised Exhibit 99.2 – “Management’s Discussion and Analysis For the Three Months Ended March 31, 2022”. The Exhibit 99.2 included with the Company’s original Form 6-K dated May 12, 2022 inadvertently included two references to “Q1 2021 Highlights”. The revised Exhibit 99.2 has corrected these references to “Q2 2022 Highlights”. There were no other amendments to the Exhibit 99.2 and no financial figures have changed.

SUBMITTED HEREWITH

Exhibits

|

| Condensed Interim Consolidated Financial Statements (Unaudited) For The Three Months Ended March 31, 2022 | |

|

| Management’s Discussion And Analysis For The Three Months Ended March 31, 2022 | |

|

| CEO certification of interim filings | |

|

| CFO certification of interim filings |

| 2 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| Fury Gold Mines Limited |

| |

|

|

|

|

|

| Date: May 12, 2022 | By: | /s/ Lynsey Sherry |

|

|

|

| Lynsey Sherry |

|

|

|

| Chief Financial Officer |

|

| 3 |

EXHIBIT 99.1

(An exploration company)

CONDENSED INTERIM

CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

FOR THE THREE MONTHS ENDED MARCH 31, 2022

| Fury Gold Mines Limited |

|

| |||

| Condensed Interim Consolidated Statements of Financial Position | |||||

| (Expressed in thousands of Canadian dollars – Unaudited) | |||||

| At March 31 |

|

| At December 31 |

| ||||||||

|

|

| Note |

|

| 2022 |

|

| 2021 | ||||

| Assets | ||||||||||||

| Current assets: | ||||||||||||

| Cash | $ | 4,998 | $ | 3,259 | ||||||||

| Marketable securities | 4 | 650 | 605 | |||||||||

| Accounts receivable | 265 | 322 | ||||||||||

| Prepaid expenses and deposits | 550 | 502 | ||||||||||

| 6,463 | 4,688 | |||||||||||

| Non-current assets: | ||||||||||||

| Restricted cash | 130 | 130 | ||||||||||

| Accounts receivable | - | 50 | ||||||||||

| Prepaid expenses and deposits | 198 | 266 | ||||||||||

| Property and equipment | 1,108 | 1,191 | ||||||||||

| Mineral interests | 5 | 143,872 | 160,693 | |||||||||

| Investment in associate | 6 | 59,990 | - | |||||||||

| 205,298 | 162,330 | |||||||||||

| Total assets | $ | 211,761 | $ | 167,018 | ||||||||

| Liabilities and Equity | ||||||||||||

| Current liabilities: | ||||||||||||

| Accounts payable and accrued liabilities | $ | 1,266 | $ | 1,888 | ||||||||

| Lease liability | 110 | 104 | ||||||||||

| Flow-through share premium liability | 7 | 2,721 | 3,124 | |||||||||

| 4,097 | 5,116 | |||||||||||

| Non-current liabilities: | ||||||||||||

| Lease liability | 326 | 357 | ||||||||||

| Provision for site reclamation and closure | 3,848 | 4,190 | ||||||||||

| Total liabilities | $ | 8,271 | $ | 9,663 | ||||||||

| Equity: | ||||||||||||

| Share capital | 9 | $ | 295,464 | $ | 295,464 | |||||||

| Share option and warrant reserve | 10 | 19,139 | 18,640 | |||||||||

| Deficit | (111,113 | ) | (156,749 | ) | ||||||||

| Total equity | $ | 203,490 | $ | 157,355 | ||||||||

| Total liabilities and equity | $ | 211,761 | $ | 167,018 | ||||||||

Commitments (notes 11(a), 14) Subsequent events (notes 11(a), 15)

Approved on behalf of the Board of Directors:

| “Forrester A. Clark” |

| “Steve Cook” |

|

| Chief Executive Officer |

| Director |

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited | 1 |

| Fury Gold Mines Limited | ||||

| Condensed Interim Consolidated Statements of (Earnings) Loss and Comprehensive (Income) Loss | ||||

| (Expressed in thousands of Canadian dollars, except per share amounts – Unaudited) |

| Three months ended March 31 |

| |||||||||||

|

|

| Note |

|

| 2022 |

|

| 2021 |

| |||

| Operating expenses: |

|

|

|

|

|

|

|

|

| |||

| Exploration and evaluation |

|

| 8 |

|

| $ | 1,272 |

|

| $ | 3,688 |

|

| Fees, salaries, and other employee benefits |

|

| 10 |

|

|

| 758 |

|

|

| 1,261 |

|

| Insurance |

|

|

|

|

|

| 193 |

|

|

| 133 |

|

| Legal and professional |

|

|

|

|

|

| 236 |

|

|

| 917 |

|

| Marketing and investor relations |

|

|

|

|

|

| 218 |

|

|

| 592 |

|

| Office and administration |

|

|

|

|

|

| 136 |

|

|

| 200 |

|

| Regulatory and compliance |

|

|

|

|

|

| 69 |

|

|

| 117 |

|

|

|

|

|

|

|

|

| 2,882 |

|

|

| 6,908 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net gain on disposition of mineral interests |

|

| 3 |

|

|

| (48,390 | ) |

|

| - |

|

| Unrealized net (gain) loss on marketable securities |

|

| 4 |

|

|

| (45 | ) |

|

| 932 |

|

| Net loss from associate |

|

| 6 |

|

|

| 449 |

|

|

| - |

|

| Amortization of flow-through share premium |

|

| 7 |

|

|

| (403 | ) |

|

| (1,223 | ) |

| Accretion of provision for site reclamation and closure |

|

|

|

|

|

| 17 |

|

|

| 13 |

|

| Interest expense on lease liability |

|

|

|

|

|

| 21 |

|

|

| 26 |

|

| Interest income |

|

|

|

|

|

| (4 | ) |

|

| (20 | ) |

| Foreign exchange loss |

|

|

|

|

|

| 2 |

|

|

| 6 |

|

|

|

|

|

|

|

|

| (48,353 | ) |

|

| (266 | ) |

| (Earnings) loss before taxes |

|

|

|

|

|

| (45,471 | ) |

|

| 6,642 |

|

| Income tax refunded |

|

| 12 |

|

|

| (165 | ) |

|

| (1,717 | ) |

| Net (earnings) loss |

|

|

|

|

| $ | (45,636 | ) |

| $ | 4,925 |

|

| Total comprehensive (income) loss |

|

|

|

|

| $ | (45,636 | ) |

| $ | 4,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Earnings) loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted (earnings) loss per share |

|

| 13 |

|

| $ | (0.37 | ) |

| $ | 0.04 |

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited | 2 |

| Fury Gold Mines Limited | ||||||

| Condensed Interim Consolidated Statements of Equity | ||||||

| (Expressed in thousands of Canadian dollars, except share amounts – Unaudited) |

|

|

| Number of common shares |

|

| Share capital |

|

| Share option and warrant reserve |

|

| Deficit |

|

| Total |

| |||||

| Balance at December 31, 2020 |

|

| 117,823,857 |

|

| $ | 294,710 |

|

| $ | 11,521 |

|

| $ | (139,959 | ) |

| $ | 166,272 |

|

| Total comprehensive loss |

|

| - |

|

|

| - |

|

|

| - |

|

|

| (4,925 | ) |

|

| (4,925 | ) |

| Warrants exercised |

|

| 10,793 |

|

|

| 17 |

|

|

| (1 | ) |

|

| - |

|

|

| 16 |

|

| Share-based compensation |

|

| - |

|

|

| - |

|

|

| 913 |

|

|

| - |

|

|

| 913 |

|

| Balance at March 31, 2021 |

|

| 117,834,650 |

|

| $ | 294,727 |

|

| $ | 12,433 |

|

| $ | (144,884 | ) |

| $ | 162,276 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

|

| 125,720,950 |

|

| $ | 295,464 |

|

| $ | 18,640 |

|

| $ | (156,749 | ) |

| $ | 157,355 |

|

| Total comprehensive income |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 45,636 |

|

|

| 45,636 |

|

| Share-based compensation (note 10(a)) |

|

| - |

|

|

| - |

|

|

| 499 |

|

|

| - |

|

|

| 499 |

|

| Balance at March 31, 2022 |

|

| 125,720,950 |

|

| $ | 295,464 |

|

| $ | 19,139 |

|

| $ | (111,113 | ) |

| $ | 203,490 |

|

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited | 3 |

| Fury Gold Mines Limited |

|

|

|

|

|

| ||||||

| Condensed Interim Consolidated Statements of Cash Flows | ||||||||||||

| (Expressed in thousands of Canadian dollars – Unaudited) | ||||||||||||

| Three months ended March 31 |

| |||||||||||

|

|

| Note |

|

| 2022 |

|

| 2021 |

| |||

| Operating activities: |

|

|

|

|

|

|

|

|

| |||

| Net earnings (loss) |

|

|

|

| $ | 45,636 |

|

| $ | (4,925 | ) | |

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

| |

| Interest income |

|

|

|

|

| (4 | ) |

|

| (20 | ) | |

| Items not involving cash: |

|

|

|

|

|

|

|

|

|

|

| |

| Net gain on disposition of mineral interests |

|

| 3 |

|

|

| (48,390 | ) |

|

| - |

|

| Unrealized net (gain) loss on marketable securities |

|

| 4 |

|

|

| (45 | ) |

|

| 932 |

|

| Depreciation |

|

|

|

|

|

| 86 |

|

|

| 90 |

|

| Net loss from associate |

|

| 6 |

|

|

| 449 |

|

|

| - |

|

| Amortization of flow-through share premium |

|

| 7 |

|

|

| (403 | ) |

|

| (1,223 | ) |

| Accretion expense |

|

|

|

|

|

| 17 |

|

|

| 13 |

|

| Share-based compensation |

|

| 11 |

|

|

| 499 |

|

|

| 913 |

|

| Interest expense on lease liability |

|

|

|

|

|

| 21 |

|

|

| 26 |

|

| Changes in non-cash working capital |

|

| 13 |

|

|

| (564 | ) |

|

| 334 |

|

| Cash used in operating activities |

|

|

|

|

|

| (2,698 | ) |

|

| (3,860 | ) |

| Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest received |

|

|

|

|

|

| 4 |

|

|

| 20 |

|

| Acquisition of Eastmain, net of cash acquired |

|

|

|

|

|

| - |

|

|

| (1,209 | ) |

| Proceeds from disposition of mineral interests, net of transaction costs |

|

| 3 |

|

|

| 4,479 |

|

|

| - |

|

| Property and equipment additions |

|

|

|

|

|

| - |

|

|

| (69 | ) |

| Cash provided by (used in) investing activities |

|

|

|

|

|

| 4,483 |

|

|

| (1,258 | ) |

| Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Lease payments |

|

|

|

|

|

| (46 | ) |

|

| (44 | ) |

| Proceeds from share option and warrant exercises |

|

|

|

|

|

| - |

|

|

| 16 |

|

| Cash used in financing activities |

|

|

|

|

|

| (46 | ) |

|

| (28 | ) |

| Increase (decrease) in cash |

|

|

|

|

|

| 1,739 |

|

|

| (5,146 | ) |

| Cash, beginning of the period |

|

|

|

|

|

| 3,259 |

|

|

| 15,361 |

|

| Cash, end of the period |

|

|

|

|

| $ | 4,998 |

|

| $ | 10,215 |

|

Supplemental cash flow information (note 12)

The accompanying notes form an integral part of these condensed interim consolidated financial statements.

| Fury Gold Mines Limited | 4 |

| Note 1: Nature of operations |

Fury Gold Mines Limited (the “Company” or “Fury Gold”) was incorporated on June 9, 2008, under the Business Corporations Act (British Columbia) and is listed on the Toronto Stock Exchange and the NYSE-American, with its common shares trading under the symbol FURY. The Company’s registered and records office is at 1500-1055 West Georgia Street Vancouver, BC, V6E 4N7 and the mailing address is 1630-1177 West Hastings Street, Vancouver, BC, V6E 2K3.

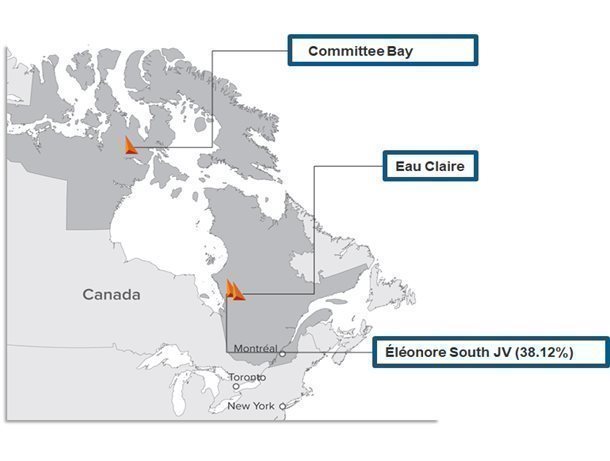

The Company’s principal business activity is the acquisition and exploration of resource projects in Canada. At March 31, 2022, the Company had two principal projects: Eau Claire in Quebec, and Committee Bay in Nunavut.

Sale of Homestake Resources Corporation

On December 6, 2021, the Company entered into a definitive agreement (the "Purchase Agreement") with Dolly Varden Silver Corporation (“Dolly Varden”) pursuant to which the Company agreed to sell to Dolly Varden a 100% interest in Fury Gold's wholly owned subsidiary, Homestake Resources Corporation (“Homestake Resources”) in exchange for $5,000 in cash and 76,504,590 common shares in Dolly Varden. Homestake Resources is the owner of a 100% interest in the Homestake Ridge gold-silver project which is located adjacent to the Dolly Varden Project owned by Dolly Varden in the Golden Triangle, British Columbia (“the Dolly Varden Transaction”). The Dolly Varden Transaction completed on February 25, 2022. As a result, Fury acquired 76,504,590 common shares of Dolly Varden on February 25, 2022, representing approximately 35.3% of the Dolly Varden Shares currently outstanding and 32.9% of Dolly Varden on a fully diluted basis.

In connection with the Dolly Varden Transaction and as contemplated in the Purchase Agreement, Dolly Varden and Fury Gold have also entered into an investor rights agreement dated February 25, 2022 (the "Investor Rights Agreement"). Pursuant to its obligations under the Investor Rights Agreement, Dolly Varden has appointed Forrester “Tim” Clark, the Chief Executive Officer (“CEO”) of Fury Gold, and Michael Henrichsen, the Chief Geological Officer of Fury Gold, to the board of directors of Dolly Varden.

Response to COVID-19

The situation in Canada regarding COVID-19 remains fluid and permitted activities continue to be subject to change. At the Company’s Eau Claire project in Quebec, all on-site employees have participated in the vaccination program and have received both doses and the booster dose. On-site measures are in place to mitigate the potential spread of the COVID-19 virus. These measures include a pre-travel COVID-19 screening questionnaire; a pre-travel COVID-19 PCR testing; and on-site Rapid Testing for COVID-19.

| Note 2: Basis of presentation |

Statement of compliance

These unaudited condensed interim consolidated financial statements (the “interim financial statements”) have been prepared in accordance with International Accounting Standard 34 – Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”). Certain disclosures included in the Company’s annual consolidated financial statements (the “consolidated financial statements”) prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the IASB and interpretations issued by the IFRS Interpretations Committee (“IFRICs”) have been condensed or omitted herein. Accordingly, these interim financial statements should be read in conjunction with the Company’s consolidated financial statements for the year ended December 31, 2021.

These interim financial statements were approved and authorized for issuance by the Board of Directors of the Company on May 12, 2022.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 5 |

Basis of preparation and consolidation

These interim financial statements incorporate the financial statements of the Company and entities controlled by the Company (its subsidiaries). Control exists when the Company has power over an investee, exposure or rights to variable returns from its involvement with the investee, and the ability to use its power over the investee to affect the amount of the Company’s returns. The Company’s interim results are not necessarily indicative of its results for a full year.

The subsidiaries (with a beneficial interest of 100%) of the Company at March 31, 2022 were as follows:

| Subsidiary | Place of incorporation | Functional currency |

| North Country Gold Corp. (“North Country”) | BC, Canada | CAD |

| Eastmain Resources Inc. (“Eastmain”) | ON, Canada | CAD |

| Eastmain Mines Inc. (“Eastmain Mines”) (a) | Canada | CAD |

| Fury Gold USA Limited (“Fury Gold USA”) (b) | Delaware, U.S.A. | USD |

(a) Company incorporated federally in Canada.

(b) Fury Gold USA was incorporated on November 21, 2021 and will provide certain administrative services with respect to short-term employee benefits for US resident personnel.

These interim financial statements also include a 35.3% investment in Dolly Varden (note 6) that is accounted for using the equity method. Dolly Varden owns the Kitsault project which includes the Dolly Varden Project and the Homestake Ridge gold-silver project in British Columbia, Canada.

These interim financial statements have been prepared on a historical cost basis except for certain financial instruments that have been measured at fair value (note 14). All amounts are expressed in thousands of Canadian dollars unless otherwise noted. Reference to US$ are to United States dollars. All intercompany balances and transactions have been eliminated.

Segmented information

The Company’s operating segments are reviewed by the key decision maker to make decisions about resources to be allocated to the segments and to assess their performance. The Company operates in one reportable operating segment, being the acquisition, exploration, and development of mineral resource properties, and in one geographical location, Canada.

Critical accounting estimates, judgements, and policies

The preparation of financial statements in accordance with IFRS requires management to select accounting policies and make estimates and judgments that may have a significant impact on consolidated financial statements. Estimates are continuously evaluated and are based on management’s experience and expectations of future events that are believed to be reasonable under the circumstances. Actual outcomes may differ from these estimates.

In preparing the Company’s interim financial statements for the three months ended March 31, 2022, the Company applied the significant accounting policies and critical accounting estimates and judgements disclosed in notes 3 and 5, respectively, of its consolidated financial statements for the year ended December 31, 2021, except as noted below:

Investment in associate

The Company conducts a portion of its business through an equity interest in an associate. An associate is an entity over which the Company has significant influence and is neither a subsidiary nor a joint venture. The Company has significant influence when it has the power to participate in the financial and operating policy decisions of the associate but does not have control or joint control over those policy decisions.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 6 |

The Company accounts for its investment in associate using the equity method. Under the equity method, the Company’s investment in an associate is initially recognized at cost and subsequently increased or decreased to recognize the Company's share of earnings and losses of the associate, after any adjustments necessary to give effect to uniform accounting policies, and for impairment losses after the initial recognition date. The Company’s share of an associate’s losses that are in excess of its investment in the associate are recognized only to the extent that the Company has incurred legal or constructive obligations or made payments on behalf of the associate. The Company's share of earnings and losses of its associate are recognized in net (earnings)/loss during the period.

New and amended standards not yet effective

Certain pronouncements have been issued by the IASB that are mandatory for accounting periods beginning after December 31, 2022. The Company has not early adopted any of these pronouncements, and they are not expected to have a significant impact in the foreseeable future on the Company's consolidated financial statements once adopted.

| Note 3: Sale of Homestake Resources |

On February 25, 2022, the Company completed the sale of Homestake Resources to Dolly Varden for cash proceeds of $5,000 and 76,504,590 common shares of Dolly Varden (note 6). The Company’s resulting interest in Dolly Varden represented approximately 35.3% of the issued and outstanding common shares of Dolly Varden on February 25, 2022, which has been accounted for using the equity method (note 6). The Company recognized a gain of $48,390, net of transaction costs of $589, on the date of disposition, calculated as follows:

| Net assets derecognized: |

| Total |

| |

| Mineral interests |

| $ | 16,460 |

|

| Reclamation bond |

|

| 68 |

|

|

|

| $ | 16,528 |

|

| Net proceeds: |

|

|

| |

| Cash |

| $ | 5,000 |

|

| Working capital adjustment |

|

| 68 |

|

| 76,504,590 common shares of Dolly Varden |

|

| 60,439 |

|

| Transaction costs |

|

| (589 | ) |

|

|

| $ | 64,918 |

|

| Net gain on disposition |

| $ | 48,390 |

|

The fair value of the common shares of Dolly Varden received on date of disposition is based on the market price of the shares at the date of disposition of C$0.79.

The Company has sufficient non-capital losses as at March 31, 2022 to offset the capital gain arising on disposition of Homestake Resources. As such, there is nil tax payable on the sale of Homestake Resources.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 7 |

| Note 4: Marketable securities |

The marketable securities held by the Company were as follows:

|

|

| Total |

| |

| Balance at December 31, 2020 |

| $ | 2,675 |

|

| Additions |

|

| 110 |

|

| Sale of marketable securities |

|

| (1,000 | ) |

| Realized loss on disposition |

|

| (311 | ) |

| Unrealized net loss |

|

| (869 | ) |

| Balance at December 31, 2021 |

| $ | 605 |

|

| Unrealized net gain |

|

| 45 |

|

| Balance at March 31, 2022 |

| $ | 650 |

|

During the year ended December 31, 2021, the Company sold 1,581,177 common shares of Benz Mining Corp (“Benz Mining”) for total proceeds of $1,000. Upon disposition, the Company realized a loss of $311, representing the decline in market value from the deemed date of acquisition of the shares on October 9, 2020, as part of the acquisition of Eastmain to date of disposition. As at March 31, 2022, the Company held 174,658 common shares of Benz Mining, received in respect of an option payment on certain mineral properties (note 10). The Company also holds 500,000 warrants which may be exchanged for 500,000 common shares of Benz Mining, with an exercise price of $0.12 and an expiry date of April 27, 2023.

Subsequent to three months ended March 31, 2022, the Company exercised 500,000 warrants of Benz Mining with an exercise price of $0.12.

Purchases and sales of marketable securities are accounted for as of the trade date.

| Note 5: Mineral interests |

The Company’s principal resource properties are located in Canada.

Quebec

The Company maintains interests in 12 properties within the James Bay region of Quebec. The principal projects are:

Eau Claire

The Company owns a 100% interest in the Eau Claire project located immediately north of the Eastmain reservoir, approximately 10 kilometres (“km”) northeast of Hydro Quebec’s EM-1 hydroelectric power facility, 80 km north of the town of Nemaska, 320 km northeast of the town of Matagami, and 800 km north of Montreal, Quebec. The property consists of map-designated claims totaling approximately 23,000 hectares.

Eastmain Mine

The Eastmain Mine project hosts the Eastmain Mine gold deposit. The past-producing Eastmain Mine project comprises 152 mineral claims and an industrial lease. Located on the eastern most part of the Upper Eastmain River Greenstone Belt of the James Bay District of northern Quebec, the property covers approximately 80 km2 of highly prospective terrain.

In 2019, Benz Mining entered into an option agreement with Eastmain to allow Benz Mining the option to earn a 75% interest in the Eastmain Mine property in return for making option payments of $2,320 between October 2019 and October 2023, and incurring exploration expenditures of $3,500 on the property. The option payments may be settled in both cash and shares. Upon completion of the first option to earn 75%, Benz Mining may acquire the remaining 25% interest upon payment of $1,000 upon closing of project financing, and $1,500 upon commencement of commercial production. This option agreement was subsequently amended in April 2020 to grant Benz Mining the option to earn up to 100% of the Ruby Hill properties located to the west of the Eastmain Mine project. The Company would retain 1-2% net smelter return (“NSR”) royalties pursuant to the amended agreement are due annually in October.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 8 |

Éléonore South Joint Venture

The Éléonore South Joint Venture project consists of two separate blocks of map-designated claims, comprising a total of 282 claims covering approximately 147 km2 of the Opinaca area of James Bay, Quebec. The Éléonore West block consists of 34 mineral claims covering approximately 18 km2, while the Éléonore South block contains 248 claims extending over an area of approximately 130 km2. The project is a three-way joint venture agreement between Eastmain, Azimut Exploration Inc. (“Azimut”), and Goldcorp Canada Ltd. (“Goldcorp Canada”), a wholly owned subsidiary of Newmont Corporation. Project ownership is based on participation in the funding of annual exploration programs. As such, the project is held by the joint operation partners approximately as follows: Fury Gold 38.12%, Goldcorp Canada 38.11%, and Azimut 23.77%. The Company is currently designated as operator.

Nunavut

Committee Bay

The Company, through its wholly owned subsidiary North Country, owns a 100% interest in the Committee Bay project located in Nunavut, Canada. The Committee Bay project includes approximately 280,000 hectares situated along the Committee Bay Greenstone Belt located within the Western Churchill province of Nunavut. The Committee Bay project is subject to a 1% NSR royalty on gold production, with certain portions subject to an additional 1.5% NSR royalty. The 1.5% NSR royalty is payable on only 7,596 hectares and can be purchased by the Company within two years of commencement of commercial production for $2,000 for each one-third (0.5%) of the 1.5% NSR royalty.

Gibson MacQuoid

In 2017, the Company acquired a number of prospecting permits and mineral claims along the Gibson MacQuoid Greenstone Belt in Nunavut, Canada. In 2019, the Company staked additional claims, which overlapped the Company’s prospecting claims that expired in February 2020, to maintain a contiguous land package over the Company’s current areas of interest. The Company’s claims, which are located between the Meliadine deposit and Meadowbank mine, cover approximately 120 km of strike length of the prospective greenstone belt and total 51,622 hectares collectively.

|

|

| Quebec |

|

| Nunavut |

|

| British Columbia |

|

| Total |

| ||||

| Balance at December 31, 2020 |

| $ | 125,354 |

|

| $ | 19,358 |

|

| $ | 16,060 |

|

| $ | 160,772 |

|

| Option payment received |

|

| (260 | ) |

|

| - |

|

|

| - |

|

|

| (260 | ) |

| Purchase of Homestake Ridge royalty |

|

| - |

|

|

| - |

|

|

| 400 |

|

|

| 400 |

|

| Disposition of mineral interests |

|

| (50 | ) |

|

| - |

|

|

| - |

|

|

| (50 | ) |

| Change in estimate of provision for site reclamation and closure |

|

| 50 |

|

|

| (219 | ) |

|

| - |

|

|

| (169 | ) |

| Balance at December 31, 2021 |

| $ | 125,094 |

|

| $ | 19,139 |

|

| $ | 16,460 |

|

| $ | 160,693 |

|

| Sale of Homestake Resources (note 3) |

|

| - |

|

|

| - |

|

|

| (16,460 | ) |

|

| (16,460 | ) |

| Change in estimate of provision for site reclamation and closure |

|

| (195 | ) |

|

| (166 | ) |

|

| - |

|

|

| (361 | ) |

| Balance at March 31, 2022 |

| $ | 124,899 |

|

| $ | 18,973 |

|

| $ | - |

|

| $ | 143,872 |

|

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 9 |

| Note 6: Investment in Associate |

The Dolly Varden Transaction completed on February 25, 2022. As a result, Fury acquired 76,504,590 Dolly Varden Shares on February 25, 2022, representing approximately 35.3% of the Dolly Varden Shares outstanding. On March 31, 2022, Dolly Varden completed a private placement which included the issuance of 11.3 million common shares, resulting in the Company’s equity interest being diluted to 33.2% as of March 31, 2022. Dolly Varden holds a 100% interest in the gold-silver Kitsault Valley project including the Dolly Varden Project and the Homestake Ridge gold-silver project, located in the southern tip of the Golden Triangle of British Columbia.

The carrying amounts of the Company’s investment in Dolly Varden at March 31, 2022 was:

| Carrying amount at December 31, 2021 |

| $ | - |

|

| Acquisition of equity investment (note 3) |

|

| 60,439 |

|

| Company’s share of net loss of associate |

|

| (449 | ) |

| Carrying amount at March 31, 2022 |

| $ | 59,990 |

|

The fair market value of the Company’s investment in Dolly Varden as at March 31, 2022 was $62,734 based upon a closing share price of $0.82.

Summarized financial information of Dolly Varden on a 100% basis is as follows:

|

|

| Three months ended March 31 2022 |

| |

| Exploration and evaluation |

| $ | 124 |

|

| Marketing |

|

| 212 |

|

| Stock-based compensation |

|

| 822 |

|

| Other |

|

| 113 |

|

| Net loss of associate |

|

| 1,271 |

|

| Company’s equity share of net loss |

| $ | 449 |

|

|

|

| At March 31 |

| |

|

|

| 2022 |

| |

| Current assets |

| $ | 26,240 |

|

| Non-current assets |

|

| 157,478 |

|

| Current liabilities |

|

| (3,025 | ) |

| Net assets |

|

| 180,693 |

|

| Company’s equity share of net assets of associate |

| $ | 59,990 |

|

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 10 |

| Note 7: Flow-through share premium liability |

Flow-through shares are issued at a premium, calculated as the difference between the price of a flow-through share and the price of a common share at that date. Tax deductions generated by eligible expenditures are passed through to the shareholders of the flow-through shares once the eligible expenditures are incurred and renounced. In July 2020, in response to the economic impact of COVID-19, the Government of Canada extended the timelines for eligible expenditures from 24 to 36 months.

The flow-through share funding and expenditures, along with the corresponding impact on the flow-through share premium liability, were as follows:

| Quebec |

| Flow-through funding and expenditures |

|

| Flow-through Premium liability |

| ||

| Balance at December 31, 2020 |

| $ | 18,079 |

|

| $ | 7,644 |

|

| Flow-through eligible expenditures |

|

| (10,789 | ) |

|

| (4,520 | ) |

| Balance at December 31, 2021 |

| $ | 7,290 |

|

| $ | 3,124 |

|

| Flow-through eligible expenditures |

|

| (939 | ) |

|

| (403 | ) |

| Balance at March 31, 2022 |

| $ | 6,351 |

|

| $ | 2,721 |

|

In September 2020, the Company completed an equity financing by raising $23,000 through the issuance of 7,750,000 subscription receipts. Out of the subscription receipts sold, 5,000,000 were flow-through receipts for gross proceeds of $17,500 and were exchanged for Fury Gold common shares designated as flow-through shares, while 2,750,000 subscription receipts were sold as non-flow-through for gross proceeds of $5,500 and exchanged for Fury Gold common shares. The flow-through proceeds are being used for mineral exploration in Quebec. The Company is committed to incur the remaining exploration expenditures of $6,351 (December 31, 2021 – $7,290) before December 31, 2022, which was renounced to investors in December 2020.

| Note 8: Exploration and evaluation costs |

For the three months ended March 31, 2022 and 2021, the Company’s exploration and evaluation costs were as follows:

|

|

| Quebec |

|

| Nunavut |

|

| British Columbia |

|

| Total |

| ||||

| Assaying |

| $ | 162 |

|

| $ | 18 |

|

| $ | 2 |

|

| $ | 182 |

|

| Exploration drilling |

|

| 14 |

|

|

| - |

|

|

| - |

|

|

| 14 |

|

| Camp cost, equipment, and field supplies |

|

| 131 |

|

|

| 58 |

|

|

| 10 |

|

|

| 199 |

|

| Geological consulting services |

|

| (24 | ) |

|

| 2 |

|

|

| - |

|

|

| (22 | ) |

| Geophysical analysis |

|

| 120 |

|

|

| - |

|

|

| - |

|

|

| 120 |

|

| Permitting, environmental and community costs |

|

| 29 |

|

|

| 59 |

|

|

| - |

|

|

| 88 |

|

| Expediting and mobilization |

|

| 2 |

|

|

| - |

|

|

| - |

|

|

| 2 |

|

| Salaries and wages |

|

| 443 |

|

|

| 14 |

|

|

| 1 |

|

|

| 458 |

|

| Fuel and consumables |

|

| 80 |

|

|

| - |

|

|

| - |

|

|

| 80 |

|

| Aircraft and travel |

|

| 19 |

|

|

| - |

|

|

| - |

|

|

| 19 |

|

| Share-based compensation |

|

| 130 |

|

|

| 1 |

|

|

| 1 |

|

|

| 132 |

|

| Three months ended March 31, 2022 |

| $ | 1,106 |

|

| $ | 152 |

|

| $ | 14 |

|

| $ | 1,272 |

|

|

|

| Quebec |

|

| Nunavut |

|

| British Columbia |

|

| Total |

| ||||

| Assaying |

| $ | 378 |

|

| $ | 30 |

|

| $ | 14 |

|

| $ | 422 |

|

| Exploration drilling |

|

| 1,272 |

|

|

| - |

|

|

| - |

|

|

| 1,272 |

|

| Camp cost, equipment, and field supplies |

|

| 375 |

|

|

| 59 |

|

|

| 3 |

|

|

| 437 |

|

| Geological consulting services |

|

| 176 |

|

|

| 34 |

|

|

| 2 |

|

|

| 212 |

|

| Geophysical analysis |

|

| 149 |

|

|

| - |

|

|

| - |

|

|

| 149 |

|

| Permitting, environmental and community costs |

|

| 95 |

|

|

| 34 |

|

|

| 13 |

|

|

| 142 |

|

| Expediting and mobilization |

|

| 7 |

|

|

| - |

|

|

| - |

|

|

| 7 |

|

| Salaries and wages |

|

| 504 |

|

|

| 45 |

|

|

| 20 |

|

|

| 569 |

|

| Fuel and consumables |

|

| 174 |

|

|

| 35 |

|

|

| - |

|

|

| 209 |

|

| Aircraft and travel |

|

| 61 |

|

|

| - |

|

|

| 1 |

|

|

| 62 |

|

| Share-based compensation |

|

| 160 |

|

|

| 34 |

|

|

| 13 |

|

|

| 207 |

|

| Three months ended March 31, 2021 |

| $ | 3,351 |

|

| $ | 271 |

|

| $ | 66 |

|

| $ | 3,688 |

|

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 11 |

| Note 9: Share capital |

Authorized

Unlimited common shares without par value.

Unlimited preferred shares – nil issued and outstanding.

Share issuances

Three months ended March 31, 2022:

|

| i. | The Company did not have any new share issuances during the three months ended March 31, 2022. |

Three months ended March 31, 2021:

|

| i. | 10,793 shares were issued as a result of share warrants being exercised with a weighted average exercise price of $1.46 for gross proceeds of $16. An amount of $1 attributed to the fair value of these share warrants was transferred from the equity reserves and recorded against share capital. |

| Note 10: Share option and warrant reserves |

(a) Share-based compensation expense

The Company uses the fair value method of accounting for all share-based payments to directors, officers, employees, and other service providers. During the three months ended March 31, 2022 and 2021, the share-based compensation expense was as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2022 |

|

| 2021 |

| ||

| Recognized in net (earnings) loss and included in: |

|

|

|

|

|

| ||

| Exploration and evaluation costs |

| $ | 132 |

|

| $ | 207 |

|

| Fees, salaries and other employee benefits |

|

| 367 |

|

|

| 706 |

|

| Total share-based compensation expense |

| $ | 499 |

|

| $ | 913 |

|

During the three months ended March 31, 2022, the Company granted 1,745,000 (March 31, 2021 – nil) share options to directors, officers, employees, and certain consultants who provide certain on-going services to the Company, representative of employee services. The weighted average fair value per option of these share options was calculated as $0.43 using the Black-Scholes option valuation model at the grant date. There were no share options granted during the three months ended March 31, 2021.

The fair value of the share-based options granted during the three months ended March 31, 2022 was based on the following weighted average assumptions:

|

|

| Three months ended March 31 |

| |

|

|

| 2022 |

| |

| Risk-free interest rate |

|

| 1.63% | |

| Expected dividend yield |

| Nil |

| |

| Share price volatility |

|

| 66% | |

| Expected forfeiture rate |

|

| 3% | |

| Expected life in years |

|

| 5.00 |

|

The risk-free interest rate assumption is based on the Government of Canada benchmark bond yields and treasury bills with a remaining term that approximates the expected life of the share-based options. The expected volatility assumption is based on the historical and implied volatility of the Company’s common shares. The expected forfeiture rate and the expected life in years are based on historical trends.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 12 |

(b) Share option plan

The Company maintains a rolling share option plan providing for the issuance of share options up to 10% of the Company’s issued and outstanding common shares at the time of the grant. The Company may grant share options from time to time to its directors, officers, employees, and other service providers. The share options typically vest as to 25% on the date of the grant and 12.5% every three months thereafter for a total vesting period of 18 months.

The number of share options issued and outstanding and the weighted average exercise price were as follows:

|

|

| Number of share options |

|

| Weighted average exercise price ($/option) |

| ||

| Outstanding, December 31, 2020 |

|

| 8,141,004 |

|

| $ | 2.67 |

|

| Granted |

|

| 1,405,000 |

|

|

| 1.03 |

|

| Exercised |

|

| (5,834 | ) |

|

| 0.86 |

|

| Expired |

|

| (1,685,048 | ) |

|

| 3.62 |

|

| Forfeited |

|

| (1,103,125 | ) |

|

| 2.04 |

|

| Outstanding, December 31, 2021 |

|

| 6,751,997 |

|

| $ | 2.00 |

|

| Granted |

|

| 1,745,000 |

|

|

| 1.00 |

|

| Expired |

|

| (383,620 | ) |

|

| 3.94 |

|

| Forfeited |

|

| (197,903 | ) |

|

| 1.80 |

|

| Outstanding, March 31, 2022 |

|

| 7,915,474 |

|

| $ | 1.69 |

|

As at March 31, 2022, the number of share options outstanding was as follows:

|

|

| Options outstanding |

|

| Options exercisable |

| ||||||||||||||||||

| Exercise price ($/option) |

| Number of shares |

|

| Weighted average exercise price ($/option) |

|

| Weighted average remaining life (years) |

|

| Number of shares |

|

| Weighted average exercise price ($/option) |

|

| Weighted average remaining life (years) |

| ||||||

| $0.56 – $1.95 |

|

| 4,604,003 |

|

|

| 1.17 |

|

|

| 2.62 |

|

|

| 2,422,128 |

|

|

| 1.33 |

|

|

| 2.44 |

|

| $2.05 – $5.31 |

|

| 3,180,203 |

|

|

| 2.17 |

|

|

| 3.34 |

|

|

| 2,865,828 |

|

|

| 2.19 |

|

|

| 3.31 |

|

| $7.54 – $9.86 |

|

| 131,268 |

|

|

| 7.88 |

|

|

| 0.17 |

|

|

| 131,268 |

|

|

| 7.88 |

|

|

| 0.17 |

|

|

|

|

| 7,915,474 |

|

|

| 1.69 |

|

|

| 2.86 |

|

|

| 5,419,224 |

|

|

| 1.94 |

|

|

| 2.84 |

|

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 13 |

(c) Share purchase warrants

The number of share purchase warrants outstanding at March 31, 2022 was as follows:

|

|

| Warrants outstanding |

|

| Weighted average exercise price ($/share) |

| ||

| Outstanding at December 31, 2020 |

|

| 1,626,740 |

|

| $ | 1.66 |

|

| Issued |

|

| 7,461,450 |

|

|

| 1.20 |

|

| Exercised |

|

| (101,042 | ) |

|

| 1.46 |

|

| Expired |

|

| (775,695 | ) |

|

| 1.42 |

|

| Outstanding at December 31, 2021 |

|

| 8,211,453 |

|

| $ | 1.27 |

|

| Expired |

|

| (412,190 | ) |

|

| 1.11 |

|

| Outstanding at March 31, 2022 |

|

| 7,799,263 |

|

| $ | 1.28 |

|

The following table reflects the warrants issued and outstanding as of March 31, 2022:

| Expiry date |

| Warrants outstanding |

|

| Exercise price ($/share) |

| ||

| September 12, 2022 |

|

| 337,813 |

|

|

| 2.96 |

|

| October 6, 2024 |

|

| 5,085,670 |

|

|

| 1.20 |

|

| October 12, 2024 |

|

| 2,375,780 |

|

|

| 1.20 |

|

| Total |

|

| 7,799,263 |

|

|

| 1.28 |

|

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 14 |

| Note 11: Related party transactions and balances |

All transactions with related parties have occurred in the normal course of operations. All amounts are unsecured, non-interest bearing, and have no specific terms of settlement, unless otherwise noted.

(a) Related parties

Universal Mineral Services Ltd. (“UMS”) provides geological, financial, and transactional advisory services as well as administrative services to the Company on an ongoing, cost recovery basis. Having these services available through UMS, on an as needed basis, allows the Company to maintain a more efficient and cost-effective corporate overhead structure by hiring fewer full-time employees and engaging outside professional advisory firms less frequently. The agreement has an indefinite term and can be terminated by either party upon providing due notice. Prior to December 31, 2021, UMS was a private company with one director in common, Mr. Ivan Bebek. On December 31, 2021, Mr. Bebek resigned as a director of UMS, with Mr. Steven Cook assuming sole directorship of UMS. Subsequently, on April 1, 2022, the Company purchased a 25% share interest in UMS for nominal consideration. The remaining 75% of UMS is owned equally by three other junior resource issuers, who share a head office location.

|

|

| Three months ended March 31 |

| |||||

|

|

| 2022 |

|

| 2021 |

| ||

| Universal Mineral Services Ltd. |

|

|

|

|

|

| ||

| Exploration and evaluation costs: |

|

|

|

|

|

| ||

| Quebec |

| $ | 46 |

|

| $ | 38 |

|

| Nunavut |

|

| 4 |

|

|

| 5 |

|

| British Columbia |

|

| 1 |

|

|

| 7 |

|

| Fees, salaries and other employee benefits |

|

| 46 |

|

|

| 10 |

|

| Legal and professional fees |

|

| 20 |

|

|

| 2 |

|

| Marketing and investor relations |

|

| 10 |

|

|

| 23 |

|

| Office and administration |

|

| 42 |

|

|

| 46 |

|

| Total transactions for the period |

| $ | 169 |

|

| $ | 131 |

|

The outstanding balance owing at March 31, 2022, was $73 (March 31, 2021 – $24) which is included in accounts payable. In addition, the Company had $150 on deposit with UMS as at March 31, 2022 (March 31, 2021 – $150) and $23 in current prepaids (March 31, 2021 – $nil) representing certain geological software licenses purchased on behalf of the Company by UMS, and which are amortized over twelve months.

On July 1, 2021, UMS commenced an office lease with a term of ten years, for which certain rent expenses will be payable by the Company. As at March 31, 2022, the Company expects to incur approximately $659 in respect of its share of future rental expense.

(b) Key management personnel

Key management personnel include Fury Gold’s board of directors and certain executive officers of the Company, including the Chief Executive Officer and Chief Financial Officer.

The remuneration of the Company’s key management personnel was as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2022 |

|

| 2021 (b) |

| ||

| Short-term benefits provided to executives (a) |

| $ | 232 |

|

| $ | 317 |

|

| Directors’ fees paid to non-executive directors |

|

| 47 |

|

|

| 52 |

|

| Share-based payments |

|

| 313 |

|

|

| 663 |

|

| Total |

| $ | 592 |

|

| $ | 1,032 |

|

(a) Short-term employee benefits include salaries, bonuses payable within twelve months of the date of the condensed interim consolidated statements of financial position, and other annual employee benefits.

(b) As a result of the acquisition of Eastmain and the formation of a new board of directors and management team, certain former key management personnel of the Company were provided with transition contracts to support the formation of Fury Gold until April 2021. For the three months ended March 31, 2021, $87 of short-term benefits and $54 of share-based payment expense were recognized in the condensed interim consolidated statements of (earnings) loss and comprehensive (income) loss in respect of these transition arrangements.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 15 |

| Note 12: Supplemental cash flow information |

The impact of changes in non-cash working capital was as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2022 |

|

| 2021 |

| ||

| Accounts receivable |

| $ | 107 |

|

| $ | 255 |

|

| Prepaid expenses and deposits |

|

| (48 | ) |

|

| (204 | ) |

| Accounts payable and accrued liabilities |

|

| (623 | ) |

|

| 283 |

|

| Change in non-cash working capital |

| $ | (564 | ) |

| $ | 334 |

|

Operating activities include the following cash received:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2022 |

|

| 2021 |

| ||

| Income taxes refunded |

| $ | 165 |

|

| $ | 1,717 |

|

| Note 13: (Earnings) loss per share |

For the three months ended March 31, 2022, and 2021, the weighted average number of shares outstanding and (earnings) loss per share were as follows:

|

|

| Three months ended March 31 |

| |||||

|

|

| 2022 |

|

| 2021 |

| ||

| Net (earnings) Loss |

| $ | (45,636 | ) |

| $ | 4,925 |

|

| Weighted average basic number of shares outstanding |

|

| 125,720,950 |

|

|

| 117,829,973 |

|

| Basic (earnings) loss per share |

| $ | (0.36 | ) |

| $ | 0.04 |

|

| Weighted average diluted number of shares outstanding |

|

| 125,752,129 |

|

|

| 117,829,973 |

|

| Diluted (earnings) loss per share |

| $ | (0.36 | ) |

| $ | 0.04 |

|

All of the outstanding share options and share purchase warrants at March 31, 2021 were anti-dilutive for the periods then ended as the Company was in a loss position.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 16 |

| Note 14: Financial instruments |

The Company’s financial instruments as at March 31, 2022 consisted of cash, accounts receivable, deposits, and accounts payable and accrued liabilities. The fair values of these financial instruments approximate their carrying values, unless otherwise noted.

(a) Financial assets and liabilities by categories

|

|

| At March 31, 2022 |

|

| At December 31, 2021 |

| ||||||||||||||||||

|

|

| Amortized Cost |

|

| FVTPL |

|

| Total |

|

| Amortized Cost |

|

| FVTPL |

|

| Total |

| ||||||

| Cash |

| $ | 4,998 |

|

| $ | - |

|

| $ | 4,998 |

|

| $ | 3,259 |

|

| $ | - |

|

| $ | 3,259 |

|

| Marketable securities |

|

| - |

|

|

| 650 |

|

|

| 650 |

|

|

| - |

|

|

| 605 |

|

|

| 605 |

|

| Deposits |

|

| 175 |

|

|

| - |

|

|

| 175 |

|

|

| 243 |

|

|

| - |

|

|

| 243 |

|

| Accounts receivable |

|

| 265 |

|

|

| - |

|

|

| 265 |

|

|

| 372 |

|

|

| - |

|

|

| 372 |

|

| Total financial assets |

|

| 5,438 |

|

|

| 650 |

|

|

| 6,088 |

|

|

| 3,874 |

|

|

| 605 |

|

|

| 4,479 |

|

| Accounts payable and accrued liabilities |

|

| 1,266 |

|

|

| - |

|

|

| 1,266 |

|

|

| 1,888 |

|

|

| - |

|

|

| 1,888 |

|

| Total financial liabilities |

| $ | 1,266 |

|

| $ | - |

|

| $ | 1,266 |

|

| $ | 1,888 |

|

| $ | - |

|

| $ | 1,888 |

|

(b) Financial assets and liabilities measured at fair value

The categories of the fair value hierarchy that reflect the significance of inputs used in making fair value measurements are as follows:

Level 1 – fair values based on unadjusted quoted prices in active markets for identical assets or liabilities;

Level 2 – fair values based on inputs that are observable for the asset or liability, either directly or indirectly; and

Level 3 – fair values based on inputs for the asset or liability that are not based on observable market data.

The Company’s policy to determine when a transfer occurs between levels is to assess the impact at the date of the event or the change in circumstances that could result in a transfer. No transfers occurred between the levels during the period.

The Company’s financial instruments measured at fair value on a recurring basis were as follows:

|

|

| At March 31, 2022 |

|

| At December 31, 2021 |

| ||||||||||

|

|

| Level 1 |

|

| Level 2(1) |

|

| Level 1 |

|

| Level 2(1) |

| ||||

| Marketable securities |

|

| 300 |

|

|

| 350 |

|

|

| 282 |

|

|

| 323 |

|

(1) Marketable securities included in level 2 include warrants that are valued using an option pricing model which utilizes a combination of quoted prices and market-derived inputs, including volatility estimates.

During the three months ended March 31, 2022, there were no financial assets or financial liabilities measured and recognized in the condensed interim consolidated statements of financial position at fair value that would be categorized as level 3 in the fair value hierarchy.

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 17 |

(c) Financial instruments and related risks

The Company’s financial instruments are exposed to liquidity risk, and market risks, which include currency risk and price risk. As at March 31, 2022, the primary risks were as follows:

Liquidity risk

Liquidity risk is the risk that the Company will encounter difficulty in meeting obligations associated with financial liabilities. The Company proactively manages its capital resources and has in place a budgeting and cash management process to help determine the funds required to ensure the Company has the appropriate liquidity to meet its current exploration plans and achieve its growth objectives. The Company ensures that there is sufficient liquidity available to meet its short-term business requirements, taking into account its anticipated cash outflows from exploration activities, and its holdings of cash and marketable securities. The Company monitors and adjusts, when required, these exploration programs as well as corporate administrative costs to ensure that adequate levels of working capital are maintained.

As at March 31, 2022, the Company had unrestricted cash of $4,998 (December 31, 2021 – $3,259), working capital surplus of $2,366 (December 31, 2021 – working capital deficit of $428), which the Company defines as current assets less current liabilities, and an accumulated deficit of $111,113 (December 31, 2021 – $156,749). The Company notes that the flow-through share premium liability, which reduced the Company’s working capital by $2,721 (December 31, 2021 – $3,124), is not settled through cash payment. Instead, the flow-through share premium liability will be drawn down as the Company incurs exploration expenditures for the Eau Claire project. During the three months ended March 31, 2022, Fury Gold recognized net earnings of $45,636 (three months ended March 31, 2021 – loss of $4,925) primarily arising from the sale of Homestake Resources (note 3). The Company expects to incur future operating losses in relation to exploration activities. With no source of operating cash flow, there is no assurance that sufficient funding will be available to conduct further exploration and development of its mineral properties.

Subsequent to three months ended March 31, 2022, the Company completed a non-brokered private placement for gross proceeds of $11,000 (note 15).

The Company’s contractual obligations are as follows:

|

|

| Within 1 year |

|

| 2 to 3 years |

|

| Over 3 years |

|

| At March 31 2022 |

|

| At December 31 2021 |

| |||||

| Accounts payable and accrued liabilities |

| $ | 1,266 |

|

| $ | - |

|

| $ | - |

|

| $ | 1,266 |

|

| $ | 1,888 |

|

| Quebec flow-through expenditure requirements |

|

| 6,351 |

|

|

| - |

|

|

| - |

|

|

| 6,351 |

|

|

| 7,290 |

|

| Undiscounted lease payments |

|

| 184 |

|

|

| 377 |

|

|

| 16 |

|

|

| 577 |

|

|

| 622 |

|

| Total |

| $ | 7,801 |

|

| $ | 377 |

|

| $ | 16 |

|

| $ | 8,194 |

|

| $ | 9,800 |

|

The Company entered into a drilling contract in November 2020, for which the Company has committed to drill a total of 50,000 metres. As at March 31, 2022, the company remains obligated to drill a further 15,000 meters in Quebec. The expenditures for the remaining drilling meters will be applied against the flow-through expenditure requirements included in the table above.

The Company also makes certain payments arising on mineral claims and leases on an annual or bi-annual basis to ensure all the Company’s properties remain in good standing. Cash payments of $22 were made during the three months ended March 31, 2022, in respect of these mineral claims, with $122 recognized in prepaid expenses as at March 31, 2022 (March 31, 2021 – $242).

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 18 |

Market risk

This is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market prices. Significant market risks to which the Company is exposed are as follows:

| i. | Currency risk |

The Company is exposed to currency risk by having balances and transactions in currencies that are different from its functional currency (the Canadian dollar). The Company’s foreign currency exposure related to its financial assets and liabilities held in US dollars was as follows:

|

|

| At March 31 2022 |

|

| At December 31 2021 |

| ||

| Financial assets |

|

|

|

|

|

| ||

| US$ bank accounts |

| $ | 121 |

|

| $ | 569 |

|

| Financial liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

| (73 | ) |

|

| (160 | ) |

|

|

| $ | 48 |

|

| $ | 409 |

|

A 10% increase or decrease in the US dollar to Canadian dollar exchange rate would not have a material impact on the Company’s net loss.

| ii. | Price risk |

The Company holds certain investments in marketable securities (note 4) which are measured at fair value, being the closing share price of each equity security at the date of the condensed interim consolidated statements of financial position. The Company is exposed to changes in share prices which would result in gains and losses being recognized in the earnings for the period. A 10% increase or decrease in the Company’s marketable securities’ share prices would not have a material impact on the Company’s net income.

| Note 15: Subsequent events |

| i) | On April 14, 2022, the Company completed a non-brokered private placement with two placees who include a Canadian corporate investor and a US institutional investor, for a private placement sale of 13.75 million common shares of the Company at a price of $0.80 for proceeds of $11,000 (the “Private Placement”). Proceeds from the Private Placement will be used to fund continued exploration at the Company’s Eau Claire project in Quebec and for general working capital. |

|

|

|

| ii) | On April 22, 2022, the Company issued 1.7m share options to directors, officers and employees of the Company, with an exercise price of $1.00 and a term of five years. |

| Fury Gold Mines Limited Notes to Q1 2022 Condensed Interim Consolidated Financial Statements (Expressed in thousands of Canadian dollars, except where noted – Unaudited) | 19 |

EXHIBIT 99.2

(An exploration company)

MANAGEMENT’S DISCUSSION AND ANALYSIS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2022

This Management’s Discussion and Analysis (the “MD&A”) for Fury Gold Mines Limited (“Fury Gold” or the “Company”) should be read in conjunction with the condensed interim consolidated financial statements of the Company and related notes thereto for the three months ended March 31, 2022. The condensed interim consolidated financial statements have been prepared in accordance with International Accounting Standard 34 – Interim Financial Reporting (“IAS 34”) of the International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). All dollar amounts presented are expressed in thousands of Canadian dollars unless otherwise stated. Certain amounts presented in this MD&A have been rounded. The effective date of this MD&A is May 12, 2022.

| 2 | |

| 5 | |

| 6 | |

| 7 | |

| 13 | |

| SECTION 6: FINANCIAL POSITION, LIQUIDITY, AND CAPITAL RESOURCES | 15 |

| 18 | |

| 18 | |

| 19 | |

| 20 |

| Fury Gold Mines Limited Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Three Months Ended March 31, 2022 (Amounts expressed in thousands of Canadian dollars, unless otherwise noted) | 1 |

1.1 Forward-looking statements

Certain statements made in this MD&A contain forward-looking information within the meaning of applicable Canadian and United States securities laws (“forward-looking statements”). These forward-looking statements are presented for the purpose of assisting the Company’s securityholders and prospective investors in understanding management’s views regarding those future outcomes and may not be appropriate for other purposes. When used in this MD&A, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. Specific forward-looking statements in this MD&A include, but are not limited to: issues relating to the COVID-19 pandemic, including its potential impacts on the Company’s business and operations; future capital expenditures and requirements, and sources and timing of additional financing; the Company’s exploration activities, including the success of such exploration activities; the Company’s mineral reserves and mineral resources; estimates of mineral reserves and mineral resources; the realization of mineral resource and mineral reserve estimates; any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements; the timing and amount of estimated future production, production guidance and net revenue expectations, anticipated cash flows, costs of production, capital expenditures; realization of unused tax benefits; statements relating to the financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of the Company; and other events or conditions that may occur in the future.

The forward-looking statements contained in this MD&A represent the Company’s views only as of the date such statements were made. Forward-looking statements contained in this MD&A are based on management’s plans, estimates, projections, beliefs and opinions as at the time such statements were made, and the assumptions related to these plans, estimates, projections, beliefs and opinions may change. Such assumptions, which may prove to be incorrect, include: the Company’s budget, including expected costs and the assumptions regarding market conditions and other factors upon which the Company has based its expenditure expectations; the Company’s ability to raise additional capital to proceed with its exploration plans; the Company’s ability to obtain or renew the licences and permits necessary for the operation and expansion of its existing operations and for the development, construction and commencement of new operations; that financial markets will not in the long term be adversely impacted by the COVID-19 pandemic; production and cost estimates; the Company’s ability to obtain all necessary regulatory approvals, permits and licences for its planned activities under governmental and other applicable regulatory regimes; the Company’s ability to complete and successfully integrate acquisitions; the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues; the Company’s expectations regarding the demand for, and supply and price of, precious metals; the Company’s ability to recruit and retain qualified personnel; the Company’s mineral reserve and resource estimates, and the assumptions upon which they are based; the Company’s ability to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain required regulatory approvals.

Inherent in the forward-looking statements are known and unknown risks, uncertainties and other factors beyond the Company’s ability to control or predict, that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in its industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Some of the risks and other factors (some of which are beyond the Company’s control) which could cause results to differ materially from those expressed in the forward-looking statements and information contained in this MD&A include, but are not limited to, risks related to: COVID-19 and other pandemics; fluctuations in spot and forward markets for silver, gold, base metals and certain other commodities (such as natural gas, fuel oil and electricity); risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins and flooding); the speculative nature of mineral exploration and development; the estimation of mineral reserves and mineral resources, including the realization of mineral reserve estimates; the Company’s ability to obtain addition funding; global financial conditions, including the market reaction to COVID-19; competitive conditions in the exploration and mining industry; environmental risks and remediation measures, including evolving environmental regulations and legislation; the Company’s mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues; health and safety regulations and legislation; changes in laws and regulations; changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in jurisdictions in which the Company operates; volatility in the price of the Common Shares, and uncertainty and volatility related to stock market prices and conditions; future dilution and fluctuation in the price of the Common Shares; acquisitions, partnerships and joint ventures; disputes as to the validity of mining or exploration titles or claims or rights, which constitute most of our property holdings; the Company’s limited business history and history of losses, which may continue in the future; general business, economic, competitive, political and social uncertainties; and public health crises such as the COVID-19 pandemic and other uninsurable risks. This is not an exhaustive list of the risks and other factors that may affect any of the Company’s forward-looking statements. Readers should refer to the risks discussed herein and in the Company’s Annual Information Form (the “Annual Information Form”) for the year ended December 31, 2021, subsequent disclosure filings with the Canadian Securities Administrators, the Company’s registration statement on Form 40-F for the year ended December 31, 2021, and subsequent disclosure filings with the United States Securities and Exchange Commission (the “SEC”), available on SEDAR at www.sedar.com and with the SEC at www.sec.gov, as applicable.

| Fury Gold Mines Limited Management’s Discussion and Analysis of Financial Condition and Results of Operations for the Three Months Ended March 31, 2022 (Amounts expressed in thousands of Canadian dollars, unless otherwise noted) | 2 |

Although the Company believes that the assumptions and expectations reflected in those forward-looking statements were reasonable at the time such statements were made, there can be no assurance that such assumptions and expectations will prove to be correct. The Company cannot guarantee future results, levels of activity, performance or achievements and actual results or developments may differ materially from those contemplated by the forward-looking statements. The Company does not undertake to update any forward-looking statements, except to the extent required by applicable securities laws.