Form 6-K TASEKO MINES LTD For: Mar 31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

As at May 4, 2021

Commission File Number: 001-31965

Taseko Mines Limited

(Translation of registrant's name into English)

12th Floor - 1040 West Georgia St., Vancouver, BC, V6E 4H1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

SUBMITTED HEREWITH

Exhibits

| Exhibit | Description | |

| 99.1 | Condensed Consolidated Interim Financial Statements for the period ended March 31, 2021 | |

| 99.2 | Management's Discussion and Analysis for the period ended March 31, 2021 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Taseko Mines Limited | ||

| (Registrant) | ||

| Date: May 4, 2021 | By: | /s/ Bryce Hamming |

|

|

||

| Bryce Hamming | ||

| Title: | CFO | |

Condensed Consolidated Interim Financial Statements

March 31, 2021

(Unaudited)

| TASEKO MINES LIMITED | |||||||

| Condensed Consolidated Balance Sheets | |||||||

| (Unaudited) | |||||||

| March 31, | December 31, | ||||||

| Note | 2021 | 2020 | |||||

| ASSETS | |||||||

| Current assets | |||||||

| Cash and equivalents | 197,018 | 85,110 | |||||

| Accounts receivable | 30,846 | 6,689 | |||||

| Inventories | 9 | 50,156 | 58,841 | ||||

| Other financial assets | 8 | 11,806 | 3,583 | ||||

| Prepaids | 3,122 | 2,975 | |||||

| 292,948 | 157,198 | ||||||

| Property, plant and equipment | 10 | 768,258 | 742,619 | ||||

| Other financial assets | 8 | 5,256 | 5,298 | ||||

| Goodwill | 5,185 | 5,250 | |||||

| 1,071,647 | 910,365 | ||||||

| LIABILITIES | |||||||

| Current liabilities | |||||||

| Accounts payable and other liabilities | 48,038 | 51,747 | |||||

| Current portion of long-term debt | 11 | 18,888 | 17,617 | ||||

| Current portion of deferred revenue | 12 | 6,726 | 5,604 | ||||

| Interest payable on senior secured notes | 4,890 | 1,160 | |||||

| Current income tax payable | 687 | 2,356 | |||||

| 79,229 | 78,484 | ||||||

| Long-term debt | 11 | 520,781 | 345,787 | ||||

| Provision for environmental rehabilitation ("PER") | 80,097 | 78,983 | |||||

| Deferred and other tax liabilities | 34,642 | 39,060 | |||||

| Deferred revenue | 12 | 46,413 | 47,154 | ||||

| Other financial liabilities | 13 | 4,991 | 3,525 | ||||

| 766,153 | 592,993 | ||||||

| EQUITY | |||||||

| Share capital | 14 | 473,711 | 472,870 | ||||

| Contributed surplus | 54,540 | 53,433 | |||||

| Accumulated other comprehensive income ("AOCI") | 5,065 | 7,674 | |||||

| Deficit | (227,822 | ) | (216,605 | ) | |||

| 305,494 | 317,372 | ||||||

| 1,071,647 | 910,365 | ||||||

| Commitments and contingencies | 15 |

The accompanying notes are an integral part of these consolidated interim financial statements

| TASEKO MINES LIMITED | |||||||

| Condensed Consolidated Statements of Comprehensive Income (Loss) | |||||||

| (Cdn$ in thousands, except share and per share amounts) | |||||||

| (Unaudited) | |||||||

| Three months ended March 31, | |||||||

| Note | 2021 | 2020 | |||||

| Revenues | 3 | 86,741 | 62,084 | ||||

| Cost of sales | |||||||

| Production costs | 4 | (56,428 | ) | (56,161 | ) | ||

| Depletion and amortization | 4 | (15,838 | ) | (27,148 | ) | ||

| Earnings (loss) from mining operations | 14,475 | (21,225 | ) | ||||

| General and administrative | (5,296 | ) | (3,898 | ) | |||

| Share-based compensation expense | 14b | (2,790 | ) | (184 | ) | ||

| Project evaluation expenditures | (312 | ) | (157 | ) | |||

| Gain (loss) on derivatives | 5 | (1,991 | ) | 5,855 | |||

| Other income | 352 | 395 | |||||

| Income (loss) before financing costs and income taxes | 4,438 | (19,214 | ) | ||||

| Finance expenses, net | 6 | (23,883 | ) | (10,621 | ) | ||

| Foreign exchange gain (loss) | 3,926 | (29,233 | ) | ||||

| Loss before income taxes | (15,519 | ) | (59,068 | ) | |||

| Income tax recovery | 7 | 4,302 | 10,118 | ||||

| Net loss | (11,217 | ) | (48,950 | ) | |||

| Other comprehensive income (loss): | |||||||

| Loss on financial assets | 8 | (211 | ) | (194 | ) | ||

| Foreign currency translation reserve | (2,398 | ) | 16,686 | ||||

| Total other comprehensive income (loss) | (2,609 | ) | 16,492 | ||||

| Total comprehensive loss | (13,826 | ) | (32,458 | ) | |||

| Loss per share | |||||||

| Basic | (0.04 | ) | (0.20 | ) | |||

| Diluted | (0.04 | ) | (0.20 | ) | |||

| Weighted average shares outstanding (thousands) | |||||||

| Basic | 282,854 | 246,194 | |||||

| Diluted | 282,854 | 246,194 | |||||

The accompanying notes are an integral part of these consolidated interim financial statements

| TASEKO MINES LIMITED | |||||||

| Condensed Consolidated Statements of Cash Flows | |||||||

| (Cdn$ in thousands) | |||||||

| (Unaudited) | |||||||

| Three months ended March 31, | |||||||

| Note | 2021 | 2020 | |||||

| Operating activities | |||||||

| Net loss for the period | (11,217 | ) | (48,950 | ) | |||

| Adjustments for: | |||||||

| Depletion and amortization | 15,838 | 27,148 | |||||

| Income tax recovery | 7 | (4,302 | ) | (10,118 | ) | ||

| Share-based compensation expense | 14b | 2,920 | 246 | ||||

| (Gain) loss on derivatives | 5 | 1,991 | (5,855 | ) | |||

| Finance expenses, net | 6 | 23,883 | 10,621 | ||||

| Foreign exchange (gain) loss | (4,202 | ) | 29,747 | ||||

| Amortization of deferred revenue | 12 | (987 | ) | (1,140 | ) | ||

| Other operating activities | - | 2,860 | |||||

| Net change in working capital: | |||||||

| Change in accounts receivable | 16 | (23,844 | ) | 9,314 | |||

| Change in other working capital items | 16 | (3,363 | ) | 3,798 | |||

| Cash provided by (used for) operating activities | (3,283 | ) | 17,671 | ||||

| Investing activities | |||||||

| Gibraltar capitalized stripping costs | 10 | (21,452 | ) | (13,916 | ) | ||

| Gibraltar capital expenditures | 10 | (5,010 | ) | (1,544 | ) | ||

| Florence Copper development costs | 10 | (6,351 | ) | (2,023 | ) | ||

| Other project development costs | 10 | (523 | ) | (761 | ) | ||

| Purchase of copper put and fuel call options | 5 | (11,143 | ) | (988 | ) | ||

| Proceeds from copper put options | - | 2,868 | |||||

| Other investing activities | 478 | 177 | |||||

| Cash used for investing activities | (44,001 | ) | (16,187 | ) | |||

| Financing activities | |||||||

| Net proceeds from issuance of senior secured notes | 11e | 496,098 | - | ||||

| Repayment of senior secured notes | 11e | (317,225 | ) | - | |||

| Redemption cost on settlement of senior secured notes | (8,714 | ) | - | ||||

| Interest paid | (5,183 | ) | (994 | ) | |||

| Repayment of equipment loans and leases | (4,777 | ) | (4,341 | ) | |||

| Proceeds on exercise of options | 494 | - | |||||

| Cash provided by (used for) financing activities | 160,693 | (5,335 | ) | ||||

| Effect of exchange rate changes on cash and equivalents | (1,501 | ) | 822 | ||||

| Increase (decrease) in cash and equivalents | 111,908 | (3,029 | ) | ||||

| Cash and equivalents, beginning of period | 85,110 | 53,198 | |||||

| Cash and equivalents, end of period | 197,018 | 50,169 | |||||

| Supplementary cash flow disclosures | 16 | ||||||

The accompanying notes are an integral part of these consolidated interim financial statements.

| TASEKO MINES LIMITED | |||||||||||||||

| Condensed Consolidated Statements of Changes in Equity | |||||||||||||||

| (Cdn$ in thousands) | |||||||||||||||

| (Unaudited) | |||||||||||||||

| Share | Contributed | ||||||||||||||

| capital | surplus | AOCI | Deficit | Total | |||||||||||

| Balance at January 1, 2020 | 436,318 | 51,622 | 6,827 | (193,081 | ) | 301,686 | |||||||||

| Share-based compensation | - | 617 | - | - | 617 | ||||||||||

| Total comprehensive income (loss) for the period | - | - | 16,492 | (48,950 | ) | (32,458 | ) | ||||||||

| Balance at March 31, 2020 | 436,318 | 52,239 | 23,319 | (242,031 | ) | 269,845 | |||||||||

| Balance at January 1, 2021 | 472,870 | 53,433 | 7,674 | (216,605 | ) | 317,372 | |||||||||

| Share-based compensation | - | 1,454 | - | - | 1,454 | ||||||||||

| Exercise of options | 841 | (347 | ) | - | - | 494 | |||||||||

| Total comprehensive loss for the period | - | - | (2,609 | ) | (11,217 | ) | (13,826 | ) | |||||||

| Balance at March 31, 2021 | 473,711 | 54,540 | 5,065 | (227,822 | ) | 305,494 | |||||||||

The accompanying notes are an integral part of these consolidated interim financial statements.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

1. REPORTING ENTITY

Taseko Mines Limited (the "Company" or "Taseko") is a corporation governed by the British Columbia Business Corporations Act. These unaudited condensed consolidated interim financial statements of the Company as at and for the three month period ended March 31, 2021 comprise the Company, its subsidiaries and its 75% interest in the Gibraltar joint venture. The Company is principally engaged in the production and sale of metals, as well as related activities including mine permitting and development, within the province of British Columbia, Canada and the State of Arizona, USA. Seasonality does not have a significant impact on the Company's operations.

2. SIGNIFICANT ACCOUNTING POLICIES

(a) Statement of compliance

These condensed consolidated interim financial statements have been prepared in accordance with IAS 34, Interim Financial Reporting and follow the same accounting policies and methods of application as the Company's most recent annual financial statements. These condensed consolidated interim financial statements do not include all of the information required for full consolidated annual financial statements and should be read in conjunction with the consolidated financial statements of the Company as at and for the year ended December 31, 2020, prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB).

These condensed consolidated interim financial statements were authorized for issue by the Company's Audit and Risk Committee on May 4, 2021.

(b) Use of judgments and estimates

In preparing these condensed consolidated interim financial statements, management has made judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets and liabilities, income and expense. Actual results may differ from these estimates.

The significant judgments made by management in applying the Company's accounting policies and the key sources of estimation uncertainty were the same as those applied to the consolidated financial statements as at and for the year ended December 31, 2020.

On March 11, 2020, the World Health Organization declared the coronavirus ("COVID-19") outbreak a pandemic creating an unprecedented global health and economic crisis. COVID-19's impact on global markets has been significant. The duration and magnitude of COVID-19's effects on the economy, movement of goods and services across international borders, the copper market, and on the Company's financial and operational performance continues to remain uncertain at this time. As of the date of these statements, there has not been any direct impact on the Company's operations as a result of COVID-19.

The Company will continue to closely monitor the potential impact of COVID-19 on its business. Should the duration, spread or intensity of the COVID-19 pandemic deteriorate in the future, there could be a potentially material and negative impact on the Company's operating plan, its cash flows, and the valuation of its long-lived assets due to decreases in metal prices, potential future decreases in revenue from the sale of its products and the profitability of its ongoing operations. Impacts from COVID-19 could also include a temporary cessation of mining operations at the Gibraltar mine due to a localized outbreak amongst personnel at the mine site or in the Company's supply chain. The Company's access to financing to support the development of its other mineral properties, including the Florence Copper project, could also be negatively impacted or delayed as a result of COVID-19.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

3. REVENUES

| Three months ended | ||||||

| March 31, | ||||||

| 2021 | 2020 | |||||

| Copper contained in concentrate | 78,750 | 75,928 | ||||

| Molybdenum concentrate | 5,686 | 3,842 | ||||

| Silver (Note 12) | 727 | 996 | ||||

| Price adjustments on settlement receivables | 4,941 | (12,960 | ) | |||

| Total gross revenue | 90,104 | 67,806 | ||||

| Less: Treatment and refining costs | (3,363 | ) | (5,722 | ) | ||

| Revenue | 86,741 | 62,084 | ||||

4. COST OF SALES

| Three months ended | ||||||

| March 31, | ||||||

| 2021 | 2020 | |||||

| Site operating costs | 47,156 | 53,547 | ||||

| Transportation costs | 3,305 | 4,519 | ||||

| Changes in inventories of finished goods | (2,259 | ) | (1,302 | ) | ||

| Changes in inventories of ore stockpiles | 8,226 | (603 | ) | |||

| Production costs | 56,428 | 56,161 | ||||

| Depletion and amortization | 15,838 | 27,148 | ||||

| Cost of sales | 72,266 | 83,309 | ||||

Site operating costs include personnel costs, non-capitalized waste stripping costs, repair and maintenance costs, consumables, operating supplies and external services.

5. DERIVATIVE INSTRUMENTS

During the three month period ended March 31, 2021, the Company purchased copper put option contracts for a total of 41 million pounds of copper with maturity dates ranging from July 2021 to December 2021, with a strike price of US$3.75 per pound, at a total cost of $11,143.

The Company recognized a net realized loss of $1,659 on copper put options for 22.5 million pounds with a strike price of $3.20 that expired out-of-the-money during the three month period.

During the three month period ended March 31, 2021, the Company received proceeds of $404 on diesel fuel call options with $313 received after the quarter. There were no fuel call options outstanding at March 31, 2021.

The following table outlines the (gains) losses associated with derivative instruments:

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

| Three months ended | ||||||

| March 31, | ||||||

| 2021 | 2020 | |||||

| Realized (gain) loss on copper put options | 1,659 | (2,507 | ) | |||

| Realized gain on fuel call options | (470 | ) | - | |||

| Unrealized (gain) loss on copper put options | 771 | (3,667 | ) | |||

| Unrealized loss on fuel call options | 31 | 319 | ||||

| 1,991 | (5,855 | ) | ||||

6. FINANCE EXPENSES

| Three months ended | ||||||

| March 31, | ||||||

| 2021 | 2020 | |||||

| Interest expense | 9,746 | 9,360 | ||||

| Finance expense - deferred revenue (Note 12) | 1,368 | 1,056 | ||||

| Accretion on PER | 105 | 355 | ||||

| Finance income | (75 | ) | (150 | ) | ||

| Loss on settlement of long-term debt (Note 11a) | 12,739 | - | ||||

| 23,883 | 10,621 | |||||

As part of the bond refinancing completed on February 10, 2021, the Company redeemed its US$250 million senior secured notes, which resulted in an accounting loss of $12,739, comprised of $6,941 paid on the call premium, a write-off of deferred financing costs of $4,025 and additional interest costs over the call period of $1,773.

7. INCOME TAX

| Three months ended March 31, |

||||||

| 2021 | 2020 | |||||

| Current income tax expense | 131 | - | ||||

| Deferred income tax recovery | (4,433 | ) | (10,118 | ) | ||

| (4,302 | ) | (10,118 | ) | |||

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

8. OTHER FINANCIAL ASSETS

| March 31, 2021 |

December 31, 2020 |

|||||

| Current: | ||||||

| Marketable securities | 1,579 | 1,791 | ||||

| Copper put options (Note 5) | 10,227 | 1,514 | ||||

| Fuel call options (Note 5) | - | 278 | ||||

| 11,806 | 3,583 | |||||

| Long-term: | ||||||

| Investment in subscription receipts | 1,200 | 1,200 | ||||

| Reclamation deposits | 2,798 | 2,825 | ||||

| Restricted cash | 1,258 | 1,273 | ||||

| 5,256 | 5,298 |

The Company holds strategic investments in publicly traded and privately owned mineral exploration and development companies, including marketable securities and subscription receipts. Marketable securities and the investment in subscription receipts are accounted for at fair value through other comprehensive income (FVOCI).

9. INVENTORIES

| March 31, 2021 |

December 31, 2020 |

|||||

| Ore stockpiles | 11,139 | 21,946 | ||||

| Copper contained in concentrate | 10,190 | 7,948 | ||||

| Molybdenum concentrate | 415 | 398 | ||||

| Materials and supplies | 28,412 | 28,549 | ||||

| 50,156 | 58,841 |

During the three months ended March 31, 2021, the Company recorded an impairment reversal of $3,740 to adjust the carrying value of ore stockpiles to net realizable value, of which $1,228 is recorded in depletion and amortization and the balance in production costs.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

10. PROPERTY, PLANT & EQUIPMENT

The following schedule shows the continuity of property, plant and equipment net book value for the three months ended March 31, 2021:

| Three months ended March 31, 2021 |

|||

| Net book value beginning of period | 742,619 | ||

| Additions: | |||

| Gibraltar capitalized stripping costs | 24,556 | ||

| Gibraltar capital expenditures | 6,444 | ||

| Florence Copper development costs | 9,933 | ||

| Yellowhead development costs | 479 | ||

| Aley development costs | 44 | ||

| Other items: | |||

| Right of use assets | 1,929 | ||

| Rehabilitation costs asset | 1,082 | ||

| Disposals | (203 | ) | |

| Foreign exchange translation and other | (2,356 | ) | |

| Depletion and amortization | (16,269 | ) | |

| Net book value at March 31, 2021 | 768,258 |

| Net book value | Gibraltar Mines (75%) |

Florence Copper |

Yellowhead | Aley | Other | Total | ||||||||||||

| At December 31, 2020 | 504,995 | 203,079 | 18,649 | 13,861 | 2,035 | 742,619 | ||||||||||||

| Net additions | 32,765 | 9,894 | 479 | 44 | - | 43,182 | ||||||||||||

| Changes in rehabilitation cost asset | 1,082 | - | - | - | - | 1,082 | ||||||||||||

| Depletion and amortization | (16,195 | ) | 27 | - | - | (101 | ) | (16,269 | ) | |||||||||

| Foreign exchange translation and other | - | (2,356 | ) | - | - | - | (2,356 | ) | ||||||||||

| At March 31, 2021 | 522,647 | 210,644 | 19,128 | 13,905 | 1,934 | 768,258 |

Non-cash additions to property, plant and equipment include $3,104 of depreciation of capitalized stripping.

Since its acquisition of the Florence Copper Project in November 2014, the Company has incurred and capitalized a total of $114.3 million in project development and other costs, including capitalized interest.

Depreciation related to the right of use assets for the three months period ended March 31, 2021 was $941.

10

TASEKO MINES LIMITED

Notes to Condensed Consolidated Interim Financial Statements

(Cdn$ in thousands - Unaudited)

11. DEBT

| March 31, 2021 |

December 31, 2020 |

|||||

| Current: | ||||||

| Lease liabilities (b) | 9,248 | 8,094 | ||||

| Secured equipment loans (c) | 7,616 | 7,536 | ||||

| Lease related obligations (d) | 2,024 | 1,987 | ||||

| 18,888 | 17,617 | |||||

| Long-term: | ||||||

| Senior secured notes (a) | 491,801 | 313,965 | ||||

| Lease liabilities (b) | 11,482 | 11,829 | ||||

| Secured equipment loans (c) | 10,561 | 12,536 | ||||

| Lease related obligations (d) | 6,937 | 7,457 | ||||

| 520,781 | 345,787 | |||||

| Total debt | 539,669 | 363,404 |

(a) Senior secured notes

On February 10, 2021, the Company completed an offering of US$400 million aggregate principal amount of senior secured notes (the "2026 Notes"). The 2026 Notes mature on February 15, 2026 and bear interest at an annual rate of 7.0%, payable semi-annually on February 15 and August 15. A portion of the proceeds were used to redeem the outstanding US$250 million 8.75% Senior Secured Notes (the "2022 Notes") due on June 15, 2022. The remaining proceeds, net of transaction costs, call premium and accrued interest, of approximately $167 million (US$131 million) are available for capital expenditures, including at its Florence Copper project and Gibraltar mine, working capital and for general corporate purposes.

The 2026 Notes are secured by liens on the shares of Taseko's wholly-owned subsidiary, Gibraltar Mines Ltd., and the subsidiary's rights under the joint venture agreement relating to the Gibraltar mine, as well as the shares of Curis Holdings (Canada) Ltd. and Florence Holdings Inc. The 2026 Notes are guaranteed by each of Taseko's existing and future restricted subsidiaries. The 2026 Notes also allow for up to US$145 million of first lien secured debt to be issued and up to US$50 million of debt for equipment financing, all subject to the terms of the note indenture. The Company is also subject to certain restrictions on asset sales, issuance of preferred stock, dividends and other restricted payments. However, there are no maintenance covenants with respect to the Company's financial performance.

The Company may redeem some or all of the 2026 Notes at any time on or after February 15, 2023, at redemption prices ranging from 103.5% to 100%, plus accrued and unpaid interest to the date of redemption. Prior to February 15, 2023, all or part of the notes may be redeemed at 100%, plus a make-whole premium, plus accrued and unpaid interest to the date of redemption. Until February 15, 2023, the Company may redeem up to 10% of the aggregate principal amount of the notes, at a redemption price of 103%, plus accrued and unpaid interest to the date of redemption. In addition, until February 15, 2023, the Company may redeem up to 40% of the aggregate principal amount of the notes, in an amount not greater than the net proceeds of certain equity offerings, at a redemption price of 107%, plus accrued and unpaid interest to the date of redemption. On a change of control, the 2026 Notes are redeemable at the option of the holder at a price of 101%.

The settlement of the 2022 Notes resulted in an accounting loss of $12,739 (Note 6).

(b) Lease liabilities

Lease liabilities includes the Company's outstanding lease liabilities under IFRS 16.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

(c) Secured equipment loans

The equipment loans are secured by existing mining equipment at the Gibraltar mine and commenced between June, 2018 and August of 2019 with monthly repayment terms ranging between 48 and 60 months and with interest rates ranging between 5.2% to 6.4%.

(d) Lease related obligations

Lease related obligations relate to a lease arising under a sale leaseback transaction on certain items of equipment at the Gibraltar mine. The lease commenced in June, 2019 and has a term of 54 months. At the end of the lease term, the Company has an option to renew the term, an option to purchase the equipment at fair market value or option to return the equipment. The lease contains a fixed price early buy-out option exercisable at the end of 48 months.

(e) Debt continuity

The following schedule shows the continuity of total debt for the first three months of 2021:

| Total debt as at December 31, 2020 | 363,404 | ||

| Settlement of 2022 Notes | (317,225 | ) | |

| Foreign exchange gain | (1,075 | ) | |

| Write-off of deferred financing charges | 4,025 | ||

| Issuance of 2026 Notes | 507,560 | ||

| Deferred financing charges | (11,462 | ) | |

| Lease additions | 3,257 | ||

| Lease liabilities and equipment loans repayments | (4,777 | ) | |

| Unrealized foreign exchange gain | (4,628 | ) | |

| Amortization of deferred financing charges | 590 | ||

| Total debt as at March 31, 2021 | 539,669 |

12. DEFERRED REVENUE

On March 3, 2017, the Company entered into a silver stream purchase and sale agreement with Osisko Gold Royalties Ltd. ("Osisko"), whereby the Company received an upfront cash deposit payment of US$33 million for the sale of an equivalent amount of its 75% share of Gibraltar payable silver production until 5.9 million ounces of silver have been delivered to Osisko. After that threshold has been met, 35% of an equivalent amount of Taseko's share of all future payable silver production from Gibraltar will be delivered to Osisko. The Company receives cash payments of US$2.75 per ounce for all silver deliveries made under the agreement.

On April 24, 2020, Taseko entered into an amendment to its silver stream with Osisko and received $8,510 in exchange for reducing the delivery price of silver from US$2.75 per ounce to nil. The amendment is accounted for as a contract modification under IFRS 15 Revenue from Contracts with Customers. The funds received were available for general working capital purposes.

The Company recorded the deposits from Osisko as deferred revenue and recognizes amounts in revenue as silver is delivered. The amortization of deferred revenue is calculated on a per unit basis using the estimated total number of silver ounces expected to be delivered to Osisko over the life of the Gibraltar Mine. The current portion of deferred revenue is an estimate based on deliveries anticipated over the next twelve months.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

The following table summarizes changes in the Osisko deferred revenue:

| Balance at January 1, 2020 | 43,991 | ||||

| Deferred revenue deposit (amendment to silver stream) | 8,510 | ||||

| Finance expense | 5,172 | ||||

| Amortization of deferred revenue | (4,915 | ) | |||

| Balance at December 31, 2020 | 52,758 | ||||

| Finance expense (Note 6) | 1,368 | ||||

| Amortization of deferred revenue | (987 | ) | |||

| Balance at March 31, 2021 | 53,139 | ||||

| March 31, 2021 |

December 31, 2020 |

|||||

| Current portion of deferred revenue | 6,726 | 5,604 | ||||

| Long-term portion of deferred revenue | 46,413 | 47,154 | ||||

| Total deferred revenue | 53,139 | 52,758 |

13. OTHER FINANCIAL LIABILITIES

| |

March 31, 2021 |

December 31, 2020 |

||||

| Long-term: | ||||||

| Deferred share units (Note 14b) | 4,991 | 3,525 |

14. EQUITY

(a) Share capital

The Company's authorized share capital consists of an unlimited number of common shares with no par value.

| Common shares (thousands) |

|||

| Common shares outstanding at January 1, 2021 | 282,115 | ||

| Exercise of share options | 1,002 | ||

| Common shares outstanding at March 31, 2021 | 283,117 |

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

(b) Share-based compensation

| Options (thousands) |

Average price | |||||

| Outstanding at December 31, 2020 | 8,969 | 1.19 | ||||

| Granted | 2,327 | 1.58 | ||||

| Exercised | (1,002 | ) | 0.66 | |||

| Expired | (324 | ) | 2.86 | |||

| Outstanding at March 31, 2021 | 9,970 | 1.28 | ||||

| Exercisable at March 31, 2021 | 7,336 | 1.30 |

During the three month period ended March 31, 2021, the Company granted 2,327,000 (2020 - 1,096,000) share options to directors, executives and employees, exercisable at an average exercise price of $1.58 per common share (2020 - $0.72 per common share) over a five year period. The total fair value of options granted was $2,024 (2020 - $438) based on a weighted average grant-date fair value of $0.87 (2020 - $0.40) per option.

The fair value of options was measured at the grant date using the Black-Scholes formula. Expected volatility is estimated by considering historic average share price volatility. The inputs used in the Black-Scholes formula are as follows:

| Three months ended | |||

| March 31, 2021 | |||

| Expected term (years) | 5 | ||

| Forfeiture rate | 0% | ||

| Volatility | 67% | ||

| Dividend yield | 0% | ||

| Risk-free interest rate | 0.4% | ||

| Weighted-average fair value per option | $ | 0.87 |

The Company has other share-based compensation plans in the form of Deferred Share Units ("DSUs") and Performance Share Units ("PSUs").

| DSUs (thousands) |

PSUs (thousands) |

|||||

| Outstanding at January 1, 2021 | 2,123 | 2,650 | ||||

| Granted | 198 | 530 | ||||

| Settled | - | (400 | ) | |||

| Outstanding at March 31, 2021 | 2,321 | 2,780 |

During the three month period ended March 31, 2021, 198,000 DSUs were issued to directors (2020 - 572,000) and 530,000 PSUs to senior executives (2020 - 825,000). The fair value of DSUs and PSUs granted was $1,235 (2020 - $899), with a weighted average fair value at the grant date of $1.58 per unit for the DSUs (2020 - $0.72 per unit) and $1.74 per unit for the PSUs (2020 - $0.59 per unit).

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

Share-based compensation expense (recovery) is comprised as follows:

| Three months ended March 31, | ||||||

| 2021 | 2020 | |||||

| Share options - amortization | 1,186 | 323 | ||||

| Performance share units - amortization | 268 | 294 | ||||

| Change in fair value of deferred share units | 1,466 | (371 | ) | |||

| 2,920 | 246 | |||||

15. COMMITMENTS AND CONTINGENCIES

(a) Commitments

The Company is a party to certain contracts relating to service and supply agreements. Future minimum payments under these agreements as at March 31, 2021 are presented in the following table:

| Remainder of 2021 | 3,863 | ||

| 2022 | 849 | ||

| 2023 | - | ||

| 2024 | - | ||

| 2025 | - | ||

| 2026 and thereafter | - | ||

| Total commitments | 4,712 |

As at March 31, 2021, the Company had outstanding capital commitments of $1,501 (at December 31, 2020 - $2,733).

(b) Contingencies

The Company has guaranteed 100% of certain capital lease and equipment loans entered into by the Gibraltar joint venture in which it holds a 75% interest. As a result, the Company has guaranteed the joint venture partner's 25% share of this debt which amounted to $13,859 as at March 31, 2021.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

16. SUPPLEMENTARY CASH FLOW INFORMATION

| For the three months ended March 31, | ||||||

| 2021 | 2020 | |||||

| Net change in working capital items: | ||||||

| Accounts receivable | (23,844 | ) | 9,314 | |||

| Change in other working capital items: | ||||||

| Inventories | 6,105 | (2,970 | ) | |||

| Prepaids | (382 | ) | 717 | |||

| Accounts payable and accrued liabilities | (7,275 | ) | (1,378 | ) | ||

| Advance payment on product sales | - | 6,912 | ||||

| Interest payable | (11 | ) | 517 | |||

| Mineral tax payable | (1,800 | ) | - | |||

| (3,363 | ) | 3,798 | ||||

| Non-cash investing and financing activities | ||||||

| Assets acquired under capital lease | 1,328 | 1,211 | ||||

| ROU assets | 1,929 | 1,763 | ||||

17. FAIR VALUE MEASUREMENTS

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy establishes three levels to classify the inputs to valuation techniques used to measure fair value, by reference to the reliability of the inputs used to estimate the fair values.

Level 1 - quoted prices (unadjusted) in active markets for identical assets or liabilities;

Level 2 - inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly (i.e., as prices) or indirectly (i.e., derived from prices); and

Level 3 - inputs for the asset or liability that are not based on observable market data (unobservable inputs).

The fair values of the senior secured notes are $511,712 and the carrying value is $491,801 at March 31, 2021. The fair value of all other financial assets and liabilities approximates their carrying value.

The Company has certain financial assets and liabilities that are measured at fair value on a recurring basis and uses the fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value, with Level 1 inputs having the highest priority.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

| Level 1 | Level 2 | Level 3 | Total | |||||||||

| March 31, 2021 | ||||||||||||

| Financial assets designated as FVPL | ||||||||||||

| Derivative asset copper put options | - | 10,227 | - | 10,227 | ||||||||

| - | 10,227 | - | 10,227 | |||||||||

| Financial assets designated as FVOCI | ||||||||||||

| Marketable securities | 1,579 | - | - | 1,579 | ||||||||

| Investment in subscription receipts | - | - | 1,200 | 1,200 | ||||||||

| Reclamation deposits | 2,798 | - | - | 2,798 | ||||||||

| 4,377 | - | 1,200 | 5,577 | |||||||||

| December 31, 2020 | ||||||||||||

| Financial assets designated as FVPL | ||||||||||||

| Derivative asset copper put options | - | 1,514 | - | 1,514 | ||||||||

| Derivative asset fuel call options | - | 278 | - | 278 | ||||||||

| - | 1,792 | - | 1,792 | |||||||||

| Financial assets designated as FVOCI | ||||||||||||

| Marketable securities | 1,791 | - | - | 1,791 | ||||||||

| Investment in subscription receipts | - | - | 1,200 | 1,200 | ||||||||

| Reclamation deposits | 2,825 | - | - | 2,825 | ||||||||

| 4,616 | - | 1,200 | 5,816 |

There have been no transfers between fair value levels during the reporting period. The carrying value of cash and equivalents, accounts receivable, accounts payable and accrued liabilities approximate their fair value as at March 31, 2021.

The fair value of the senior secured notes, a Level 1 instrument, is determined based upon publicly available information. The fair value of the lease liabilities and secured equipment loans, Level 2 instruments, are determined through discounting future cash flows at an interest rate of 5.5% based on the relevant loans effective interest rate.

The fair values of Level 2 instruments are based on broker quotes. Similar contracts are traded in an active market and the broker quotes reflect the actual transactions in similar instruments.

The Company's metal concentrate sales contracts are subject to provisional pricing with the selling price adjusted at the end of the quotational period. At each reporting date, the Company's settlement receivable on these contracts are marked-to-market based on a quoted forward price for which there exists an active commodity market. At March 31, 2021 the Company had settlement receivables of $6,137 (2020 - settlement payables of $1,812).

The subscription receipts, a Level 3 instrument, are valued based on a management estimate. As the subscription receipts are an investment in a private exploration and development company, there are no observable market data inputs.

Commodity Price Risk

The Company is exposed to the risk of fluctuations in prevailing market commodity prices on the metals it produces. The Company enters into copper put option contracts to reduce the risk of short-term copper price volatility. The amount and duration of the hedge position is based on an assessment of business-specific risk elements combined with the copper pricing outlook. Copper put option contracts are typically extended adding incremental quarters at established put strike prices to provide the necessary price protection.

|

TASEKO MINES LIMITED Notes to Condensed Consolidated Interim Financial Statements (Cdn$ in thousands - Unaudited) |

Provisional pricing mechanisms embedded within the Company's sales arrangements have the character of a commodity derivative and are carried at fair value as part of accounts receivable.

The table below summarizes the impact on revenue and receivables for changes in commodity prices on the provisionally invoiced sales volumes.

| As at March 31, | |||

| 2021 | |||

| Copper increase/decrease by US$0.41/lb.1 | 8,099 |

1The analysis is based on the assumption that the period end copper price increases 10% with all other variables held constant. At March 31, 2021, 15.7 million pounds of copper in concentrate were exposed to copper price movements. The closing exchange rate at March 31, 2021 of CAD/USD 1.2575 was used in the analysis.

The sensitivities in the above table have been determined with foreign currency exchange rates held constant. The relationship between commodity prices and foreign currencies is complex and movements in foreign exchange can impact commodity prices. The sensitivities should therefore be used with care.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

This management discussion and analysis ("MD&A") is intended to help the reader understand Taseko Mines Limited ("Taseko", "we", "our" or the "Company"), our operations, financial performance, and current and future business environment. This MD&A is intended to supplement and complement the consolidated financial statements and notes thereto, prepared in accordance with IAS 34 of International Financial Reporting Standards ("IFRS") for the three months ended March 31, 2021 (the "Financial Statements"). You are encouraged to review the Financial Statements in conjunction with your review of this MD&A and the Company's other public filings, which are available on the Canadian Securities Administrators' website at www.sedar.com and on the EDGAR section of the United States Securities and Exchange Commission's ("SEC") website at www.sec.gov.

This MD&A is prepared as of May 4, 2021. All dollar figures stated herein are expressed in Canadian dollars, unless otherwise specified. Included throughout this MD&A are references to Non-GAAP performance measures which are denoted with an asterisk and further explanation including their calculations are provided on page 22.

Cautionary Statement on Forward-Looking Information

This discussion includes certain statements that may be deemed "forward-looking statements". All statements in this discussion, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities, and events or developments that the Company expects are forward-looking statements. Although we believe the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, global economic events arising from the coronavirus (COVID-19) pandemic outbreak, exploitation and exploration successes, continued availability of capital and financing and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. All of the forward-looking statements made in this MD&A are qualified by these cautionary statements. We disclaim any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by applicable law. Further information concerning risks and uncertainties associated with these forward-looking statements and our business may be found in the Company's other public filings with the SEC and Canadian provincial securities regulatory authorities.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

CONTENTS

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

OVERVIEW

Taseko Mines Limited ("Taseko" or "Company") is a mining company that seeks to create long-term shareholder value by acquiring, developing, and operating large tonnage mineral deposits which are capable of supporting a mine for ten years or longer. The Company's principal operating asset is the 75% owned Gibraltar mine, which is located in central British Columbia and is one of the largest copper mines in North America. Taseko also owns Florence Copper, which is advancing towards construction starting later this year with commercial production expected by 2023, as well as the Yellowhead copper, New Prosperity gold-copper, Aley niobium and Harmony gold projects.

HIGHLIGHTS

| Operating Data (Gibraltar - 100% basis) | Three months ended March 31, | ||||||||

| 2021 | 2020 | Change | |||||||

| Tons mined (millions) | 32.0 | 28.5 | 3.5 | ||||||

| Tons milled (millions) | 7.2 | 7.5 | (0.3 | ) | |||||

| Production (million pounds Cu) | 22.2 | 32.4 | (10.2 | ) | |||||

| Sales (million pounds Cu) | 22.0 | 31.1 | (9.1 | ) | |||||

| Financial Data | Three months ended March 31, | ||||||||

| (Cdn$ in thousands, except for per share amounts) | 2021 | 2020 | Change | ||||||

| Revenues | 86,741 | 62,084 | 24,657 | ||||||

| Earnings from mining operations before depletion and amortization* | 30,313 | 5,923 | 24,390 | ||||||

| Adjusted EBITDA* | 23,722 | 5,346 | 18,376 | ||||||

| Adjusted net loss* | (5,534 | ) | (21,647 | ) | 16,113 | ||||

| Per share - basic ("Adjusted EPS")* | (0.02 | ) | (0.09 | ) | 0.07 | ||||

| Net loss (GAAP) | (11,217 | ) | (48,950 | ) | 37,733 | ||||

| Per share - basic ("EPS") | (0.04 | ) | (0.20 | ) | 0.16 | ||||

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

First Quarter Review

-

First quarter earnings from mining operations before depletion and amortization* was $30.3 million, Adjusted EBITDA* was $23.7 million and Adjusted net loss* was $5.5 million ($0.02 loss per share);

-

Site operating costs, net of by-product credits* were US$1.96 per pound produced, and total operating costs (C1)* were US$2.23 per pound produced;

-

The Gibraltar mine produced 22.2 million pounds of copper in the first quarter. Copper recoveries were 81.5% and copper head grades were 0.19%;

-

Gibraltar sold 22.0 million pounds of copper in the quarter (100% basis) which resulted in $82.3 million of revenue for Taseko. Average LME copper prices were US$3.86 per pound in the quarter and revenue also included positive provisional price adjustments of $3.6 million due to the rising copper price;

-

As mining advances in the Pollyanna pit, management expects improved grades and copper production in the second quarter, and much higher grade and production levels in the second half of the year, which will lead to lower operating costs per pound and improved earnings;

-

On February 10, 2021, Taseko closed an offering of US$400 million 7% Senior Secured Notes due in 2026. A portion of the proceeds were used to redeem all of the outstanding US$250 million 8.75% 2022 Senior Secured Notes on March 3, 2021;

-

The Company’s cash balance at March 31, 2021 was $197.0 million, and was affected by a negative working capital adjustment of $27.2 million in the first quarter related primarily to an increase in accounts receivable due to shipment timing;

-

In March 2021, the Company extended its copper price protection strategy by purchasing put options covering 41 million pounds of copper at a strike price of US$3.75 per pound for the second half of 2021;

-

During the quarter, Gibraltar entered into an off-take contract for 45 thousand tonnes of copper concentrate shipments in the second half of this year which included deeply discounted TCRC's at some of the lowest levels the mine has ever seen since it was re-opened in 2004;

-

On May 4, 2021, the Gibraltar mine was awarded the prestigious 2020 John Ash Safety Award presented by the Ministry of Energy and Mines for having the lowest injury-frequency rate that has worked at least one million hours during the year. This is the 5th time Gibraltar has won this award over the last 7 years; and

-

Final design and engineering of the commercial in-situ production facility as well as procurement of certain critical components is well underway to ensure construction of the commercial facility can commence following receipt of the UIC permit, which is expected in the third quarter of this year.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

REVIEW OF OPERATIONS

Gibraltar mine (75% Owned)

|

Operating data (100% basis) |

Q1 2021 |

Q4 2020 |

Q3 2020 |

Q2 2020 |

Q1 2020 |

|

Tons mined (millions) |

32.0 |

26.4 |

23.3 |

20.5 |

28.5 |

|

Tons milled (millions) |

7.2 |

7.5 |

7.5 |

7.7 |

7.5 |

|

Strip ratio |

6.0 |

1.9 |

1.5 |

1.9 |

2.7 |

|

Site operating cost per ton milled (CAD$)* |

$8.73 |

$11.67 |

$9.57 |

$7.66 |

$9.52 |

|

Copper concentrate |

|

|

|

|

|

|

Head grade (%) |

0.19 |

0.20 |

0.23 |

0.28 |

0.26 |

|

Copper recovery (%) |

81.5 |

83.3 |

85.0 |

85.2 |

83.4 |

|

Production (million pounds Cu) |

22.2 |

25.0 |

28.9 |

36.8 |

32.4 |

|

Sales (million pounds Cu) |

22.0 |

25.0 |

28.6 |

39.3 |

31.1 |

|

Inventory (million pounds Cu) |

3.6 |

3.4 |

3.6 |

3.8 |

6.4 |

|

Molybdenum concentrate |

|

|

|

|

|

|

Production (thousand pounds Mo) |

530 |

549 |

668 |

639 |

412 |

|

Sales (thousand pounds Mo) |

552 |

487 |

693 |

656 |

403 |

|

Per unit data (US$ per pound produced)* |

|

|

|

|

|

|

Site operating costs* |

$2.23 |

$2.67 |

$1.85 |

$1.15 |

$1.64 |

|

By-product credits* |

(0.27) |

(0.14) |

(0.14) |

(0.11) |

(0.11) |

|

Site operating costs, net of by-product credits* |

$1.96 |

$2.53 |

$1.71 |

$1.04 |

$1.53 |

|

Off-property costs |

0.27 |

0.29 |

0.29 |

0.30 |

0.29 |

|

Total operating costs (C1)* |

$2.23 |

$2.82 |

$2.00 |

$1.34 |

$1.82 |

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

OPERATIONS ANALYSIS

First Quarter Review

To-date, there have been no interruptions to the Company's operations, logistics and supply chains as a result of the COVID-19 pandemic. Heightened health and safety protocols continue to be implemented and monitored for effectiveness.

Copper production in the first quarter was 22.2 million pounds and was impacted by lower mined ore grades from the Pollyanna pit. Additionally, ore hardness in the Pollyanna Pit benches and in ore drawn from the stockpiles continued to have some affect on recoveries and mill throughput in the quarter.

A total of 32.0 million tons were mined in the first quarter of 2021, an increase of 5.6 million tons over the prior quarter. The increased waste stripping was attributed to higher productivities and shorter hauling distances in the upper benches of the Pollyanna pit. Site operating costs, net of by-product credits for the first quarter were US$1.96 per pound of copper produced.

The strip ratio for the first quarter was 6.0 to 1 and reflects the increased waste stripping in Pollyanna. In addition, ore stockpiles decreased during the quarter by 2.6 million tons.

Total site spending (including capitalized stripping of $21.5 million spent in the quarter) was generally consistent with the prior quarter. Capital expenditures in the first quarter also included costs associated with the dewatering system for the Gibraltar pit where mining is expected to start in the second quarter.

Molybdenum production was 530 thousand pounds in the first quarter. Molybdenum prices strengthened in the first quarter and averaged US$11.32 per pound, compared to US$9.01 per pound in Q4 2020. By-product credits per pound of copper produced* was US$0.27 in the first quarter, an increase over the prior quarters due to the higher molybdenum price and fewer copper pounds produced in the current period.

Off-property costs per pound produced* were US$0.27 for the first quarter and lower than prior quarters due to the benefit of lower treatment and refining charges in the current year. Gibraltar extended its long-term copper concentrate offtake contract, for roughly 50% of its production, for 2021 which is expected to result in at least a 30% reduction in treatment and refining costs in 2021. The Company also entered into an offtake contract for 45,000 tons of copper concentrate for later in the year at some of the lowest TCRC levels ever seen by the mine.

Total operating costs per pound produced (C1)* were US$2.23 for the quarter. Contributing to the decrease in C1* costs was significantly increased capitalized stripping costs in the first quarter, which was $20.3 million more than the prior quarter. The impact of capitalized stripping costs on lower C1* costs is partially offset by fewer copper pounds being produced in the first quarter and the weakening US dollar.

GIBRALTAR OUTLOOK

Mining will continue to be focused on the Pollyanna pit which will be the main source of ore in 2021. Management expects improved grades and copper production in the second quarter and much higher grade and production levels in the second half of the year as higher-grade areas in Pollyanna are opened-up and available for processing. Ore release from the Gibraltar pit will commence in the second half of the year. Ore from the Gibraltar pit is relatively softer and is expected to require less energy to grind, which will provide opportunities for increased mill throughput in the future. Gibraltar produced 123 million pounds in 2020 and is expected to produce 125 million pounds on a 100% basis in 2021.

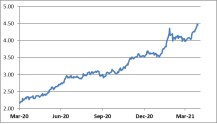

Copper prices are currently around US$4.50 per pound, compared to the average LME copper price of US$3.86 per pound in Q1 and US$2.80 per pound in 2020. Copper prices have recovered swiftly since March 2020 and are testing decade high levels due to recovery in Chinese and the rest of world demand coupled with continued supply and political disruptions, most notably in South America. Many governments are now focusing on increased infrastructure investment to stimulate economic recovery after the pandemic, including green initiatives, which will require new primary supplies of copper. Most industry analysts are projecting ongoing supply constraints and deficits, which should support these higher copper prices in the years to come.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

In March 2021 and in preparation for capital spend at Florence, the Company extended its copper price protection strategy by purchasing put options covering 41 million pounds of copper at a strike price of US$3.75 per pound for the second half of 2021. Protecting a significant operating margin in 2021 allows the Company to focus on and advance near-term capital growth plans related to Florence Copper, and fund the Yellowhead Copper Project's ongoing environmental assessment work. This approach to managing copper price volatility does not cap the Company's cash flow should copper prices continue at these levels or increase further.

All of the above factors are supportive of improved financial performance at the Gibraltar mine for the remainder of 2021.

FLORENCE COPPER

Florence Copper represents a low-cost growth project that will have an annual production capacity of 85 million pounds of copper over a 21-year mine life, and with the expected C1* operating cost of US$0.90 per pound puts Florence Copper in the lowest quartile of the global copper cost curve. The commercial production facility at Florence will also be one of the greenest sources of mined copper, with carbon emissions, water and energy consumption all dramatically lower than a conventional mine. We have successfully operated a Production Test Facility ("PTF") for the last two years at Florence to demonstrate that the in-situ copper recovery ("ISCR") process can produce high quality cathode while operating within permit conditions.

The next phase of Florence Copper will include the construction and operation of the commercial ISCR facility with an estimated capital cost of US$230 million (including reclamation bonding and working capital). At a conservative copper price of US$3.00 per pound, Florence Copper is expected to generate an after-tax internal rate of return of 37%, an after-tax net present value of US$680 million at a 7.5% discount rate, and an after-tax payback period of 2.5 years.

In December 2020, the Company received the Aquifer Protection Permit ("APP") from the Arizona Department of Environmental Quality ("ADEQ"). During the APP process, Florence Copper received strong support from local community members, business owners and elected officials. The other required permit is the Underground Injection Control ("UIC") permit from the U.S. Environmental Protection Agency ("EPA"). The EPA's technical review for the UIC permit has identified no significant issues and the Company expects to receive the draft permit in the coming months followed by the final UIC permit in the third quarter after which construction of the commercial ISCR facility at Florence Copper can commence.

On March 23, 2021, the Company announced a favourable appeals court decision that upholds Florence Copper's right to mine its private property within the Town, and also awarded US$1.7 million in legal fees and costs to Florence Copper.

The Company now has the majority of the required construction funding for Florence Copper in hand, and with stronger expected operating cash flows from Gibraltar due to higher prevailing copper prices, the Company has numerous options available to obtain the remaining funding including retaining 100% ownership of the project.

Final design engineering for the commercial production facility as well as procurement of certain critical components is well underway to ensure a smooth and efficient transition into construction once the final UIC permit is received later this year.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

ANNUAL ESG REPORT

The Company recently published its annual Environmental, Social, and Governance ("ESG") Report, titled 'Sustainability: Our Low Carbon Future' (the "Report"), highlighting Taseko's sustainability performance for 2020.

In this year's Report, Taseko has reported Scope 1 and 2 greenhouse gas emissions for Gibraltar which shows that the mine ranks in the first quartile of all copper mines globally. When commercial operations at Florence Copper commence, the Company's combined greenhouse gas emissions intensity will drop even lower, to an estimated 1.53 tonnes of carbon dioxide equivalent ("CO2e") per tonne of copper equivalent, based on an independent analysis by Skarn Associates.

Sustainability report highlights:

- Rigorous health and safety protocols enabled operations to continue at Gibraltar and at Florence Copper during the COVID-19 pandemic;

- Recognition from the British Columbia Technical and Research Committee on Reclamation with the Jake McDonald Award for outstanding work in mine reclamation and Indigenous collaboration;

- Outstanding safety performance at Gibraltar with zero loss time incidents, zero days lost, zero loss time severity, and zero loss time frequency;

- Continued commitment to a diverse workforce that reflects the communities in which we operate. In 2020 28% of the new hires at Taseko were female and 15% were Indigenous people;

- A priority on securing local goods and services with $116 million and US$2.5 million being distributed to local suppliers from Gibraltar and Florence Copper, respectively; $72 million and US$2.1 million was distributed in wages to local employees from Gibraltar and Florence Copper, respectively;

- Low Scope 1 and 2 greenhouse gas emission of 1.66 tonnes of CO2e per tonnes of copper produced equivalent and 0.09 tonnes of CO2e per tonnes of copper equivalent produced, respectively; and

- Continued discussions with our Indigenous neighbours, that included a Framework Agreement with a local Indigenous Nation to begin discussions on the Yellowhead Copper Project, as well as an extension to the standstill agreement with Tŝilhqot'in Nation as both parties seek a long-term solution to the conflict regarding New Prosperity.

The full Report can be viewed and downloaded at www.tasekomines.com/esg/overview.

On May 4, 2021, the Gibraltar mine was awarded the prestigious 2020 John Ash Safety Award presented by the Ministry of Energy and Mines for having the lowest injury-frequency rate that has worked at least one million hours during the year. This is the 5th time Gibraltar has won this award over the last 7 years.

PERSONNEL UPDATE

Brian Battison, Vice President of Corporate Affairs, who has been with Taseko since 2006, will be retiring at the end of June 2021. He will continue to act as an adviser to the Company to support our government relations work after his retirement over the coming year.

LONG-TERM GROWTH STRATEGY

Taseko's strategy has been to grow the Company by acquiring and developing a pipeline of complementary projects focused on copper in stable mining jurisdictions. We continue to believe this will generate long-term returns for shareholders. Our other development projects are focused primarily on copper and are located in British Columbia.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

Yellowhead Copper Project

Yellowhead Mining Inc. ("Yellowhead") has an 817 million tonnes reserve and a 25-year mine life with a pre-tax net present value of $1.3 billion at an 8% discount rate using a US$3.10 per pound copper price. Capital costs of the project are estimated at $1.3 billion over a 2-year construction period. Over the first 5 years of operation, the copper equivalent grade will average 0.35% producing an average of 200 million pounds of copper per year at an average C1* cost, net of by-product credit, of US$1.67 per pound of copper. The Yellowhead Copper Project contains valuable precious metal by-products with 440,000 ounces of gold and 19 million ounces of silver with a life of mine value of over $1 billion at current prices.

The Company is focusing its current efforts on advancing the environmental assessment and some additional engineering work in conjunction with ongoing engagement with local communities including First Nations. A focus group has been formed between the Company and high-level regulators in the appropriate Provincial ministries in order to expedite the advancement of the environmental assessment and the permitting of the project. Management also commenced joint venture partnering discussions in 2020 with a number of strategic industry groups that are interested in potentially investing in the Yellowhead project in combination with acquiring significant copper offtake rights.

New Prosperity Gold-Copper Project

In late 2019, the Tŝilhqot'in Nation, as represented by Tŝilhqot'in National Government, and Taseko entered into a confidential dialogue, facilitated by the Province of British Columbia, to try to obtain a long-term solution to the conflict regarding Taseko's proposed gold-copper mine currently known as New Prosperity, acknowledging Taseko's commercial interests and the Tŝilhqot'in Nation's opposition to the project. The dialogue was supported by the parties' agreement on December 7, 2019 to a one-year standstill on certain outstanding litigation and regulatory matters that relate to Taseko's tenures and the area in the vicinity of Teẑtan Biny (Fish Lake).

The COVID-19 pandemic delayed the commencement of the dialogue, but the Tŝilhqot'in Nation and Taseko have made progress in establishing a constructive dialogue. In December 2020, the parties agreed to extend the standstill for a further year to continue this dialogue.

Aley Niobium Project

Environmental monitoring and product marketing initiatives on the Aley Niobium project continue. The pilot plant program has successfully completed the niobium flotation process portion of the test, raising confidence in the design and providing feed to the converter portion of the process. Completion of the converter pilot test, which is underway, will provide additional process data to support the design of the commercial process facilities and provide final product samples for marketing purposes.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

MARKET REVIEW

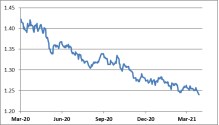

Copper Molybdenum Canadian/US Dollar Exchange

Prices (USD per pound for Commodities)

(Source Data: Bank of Canada, Platts Metals, and London Metals Exchange)

Copper prices are currently around US$4.50 per pound with continued upside amongst a bullish market backdrop and sentiment. After a dramatic but short-lived drop in copper prices with the onset of COVID-19 in March of 2020, copper prices have dramatically recovered and are now testing decade highs and even record levels in Canadian dollar terms. Supply challenges caused by the pandemic and political uncertainty, particularly in Peru and Chile where the largest copper mines in the world are located, saw curtailed operations and project delays which continue to impact supply in 2021. At the same time, Chinese demand recovered swiftly in the second half of 2020 with significant restocking taking place resulting in an estimated 2020 deficit of copper of over 500,000 tonnes, the highest in more than a decade. Focus in 2021 is now turning to the expected demand growth, inflation and the weaker US dollar arising from the expected economic recovery in North America and Europe resulting from unprecedented stimulus measures announced by central governments. The rollout of vaccine programs should improve the 2021 global demand outlook, further pressuring the copper supply deficit. The longer-term outlook for copper is also favourable with the focus on government investment in construction and infrastructure including initiatives focused on green sources of power and the electrification of transportation which are inherently copper intensive. This increased demand for copper after years of under investment by the industry in new mine supply is expected to support strong copper prices in the years ahead.

Molybdenum prices have also experienced volatility in 2020 due to the combination of a COVID-19 induced global economic slowdown and a decrease in molybdenum usage which has a particularly high dependence on demand from the oil and gas and transportation sectors. The average molybdenum price was US$11.32 per pound during the first quarter of 2021, compared to US$9.01 per pound in the fourth quarter of 2020. The Company's sales agreements specify molybdenum pricing based on the published Platts Metals reports.

Approximately 80% of the Gibraltar mine's costs are Canadian dollar denominated and therefore, fluctuations in the Canadian/US dollar exchange rate can have a significant effect on the Company's operating results and unit production costs, which are earned and in some cases reported in US dollars. Overall, the Canadian dollar modestly strengthened by approximately 1.2% during 2021.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

FINANCIAL PERFORMANCE

Earnings

| Three months ended March 31, |

|||||||||

| (Cdn$ in thousands) | 2021 | 2020 | Change | ||||||

| Net loss | (11,217 | ) | (48,950 | ) | 37,733 | ||||

| Net unrealized foreign exchange loss | 8,798 | 29,747 | (20,949 | ) | |||||

| Realized foreign exchange gain on settlement of long-term debt | (13,000 | ) | - | (13,000 | ) | ||||

| Loss on settlement of long-term debt | 12,739 | - | 12,739 | ||||||

| Unrealized (gain) loss on copper put and fuel call options | 802 | (3,348 | ) | 4,150 | |||||

| Estimated tax effect of adjustments | (3,656 | ) | 904 | (4,560 | ) | ||||

| Adjusted net loss * | (5,534 | ) | (21,647 | ) | 16,113 | ||||

The Company's net loss was $11.2 million ($0.04 loss per share) for the three months ended March 31, 2021, compared to a net loss of $49.0 million ($0.20 loss per share) for the same period in 2020. The decreased net loss in the current period was primarily due to the greater earnings from mining operations before depletion and amortization* which was $30.3 million for the current quarter compared to $5.9 million for the same period in 2020. During the first quarter of 2021, earnings from mining operations was positively impacted by the higher average copper price, an increase in waste stripping costs being capitalized, lower depletion and amortization expense partially offset by lower sales volumes of copper concentrate due to the lower grade ore being processed from the Pollyanna pit.

The net foreign exchange gain or loss is substantially driven by the translation of the Company’s US dollar denominated senior secured notes. The first quarter of 2020 was negatively impacted by the sharp fall in the Canadian dollar following the onset of COVID-19 which resulted in an unrealized foreign exchange loss of $29.7 million in the prior year quarter, compared to a weakening US dollar trend in the current quarter which resulted in a $4.2 million net foreign exchange gain. The $4.2 million in net foreign exchange gain was comprised of a realized foreign exchange gain of $13.0 million recorded on settlement of the US$250 million 8.75% Senior Secured Notes (“2022 Notes”) of which only $1.1 million related to foreign exchange rate movements in the current quarter with the balance recognized as unrealized in previous fiscal years. The $8.8 million net unrealized foreign exchange loss includes the $11.9 million reversal of these unrealized foreign exchange gains on the 2022 Notes for prior periods offset by $3.1 million in unrealized foreign exchange gains on the new 2026 Notes in the current quarter due to the weakening US dollar trend. The $12.7 million settlement loss recorded upon repayment of the 2022 Notes from the bond refinancing in February of 2021 also increased the GAAP net loss in the current quarter.

Included in net income (loss) are a number of items that management believes require adjustment in order to better measure the underlying operating performance of the mining business. Unrealized gains or losses or items that are not recurring have been adjusted in determining adjusted net income (loss) as well as their estimated tax effect. No adjustments are made to adjusted net income (loss) for positive or negative provisional price adjustments in the quarter as these adjustments normalize or reverse throughout the year.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

Revenues

| Three months ended March 31, |

|||||||||

| (Cdn$ in thousands) | 2021 | 2020 | Change | ||||||

| Copper contained in concentrate | 78,750 | 75,928 | 2,822 | ||||||

| Molybdenum concentrate | 5,686 | 3,842 | 1,844 | ||||||

| Silver | 727 | 996 | (269 | ) | |||||

| Price adjustments on settlement receivables | 4,941 | (12,960 | ) | 17,901 | |||||

| Total gross revenue | 90,104 | 67,806 | 22,298 | ||||||

| Less: treatment and refining costs | (3,363 | ) | (5,722 | ) | 2,359 | ||||

| Revenue | 86,741 | 62,084 | 24,657 | ||||||

| (thousands of pounds, unless otherwise noted) | |||||||||

| Sales of copper in concentrate** | 15,919 | 22,478 | (6,559 | ) | |||||

| Average realized copper price (US$ per pound) | 4.09 | 2.06 | 2.03 | ||||||

| Average LME copper price (US$ per pound) | 3.86 | 2.56 | 1.30 | ||||||

| Average exchange rate (US$/CAD) | 1.27 | 1.34 | (0.07 | ) | |||||

** This amount includes a net smelter payable deduction of approximately 3.5% to derive net payable pounds of copper sold.

Copper revenues for the three months ended March 31, 2021 increased by $2.8 million compared to the same period in 2020, primarily due to higher prevailing LME copper prices by US$1.30 per pound in the current quarter, partially offset by decreases in the volume of payable copper sold by 6.6 million pounds (75% basis). The Company also recognized positive net price adjustments of $3.6 million, for provisionally priced copper concentrate due to increasing copper price trends following shipment, compared to negative price adjustments of $13.6 million in the prior year quarter which reflected the sharp drop in the copper price seen last March with the onset of COVID-19. These revenue adjustments resulted in a US$0.18 per pound increase to the average realized copper price for the quarter, compared to a US$0.44 per pound decrease in the first quarter in 2020. Partially offsetting the higher copper price this quarter was the weakening US dollar.

Molybdenum revenues for the three months ended March 31, 2021 increased by $1.8 million compared to the same period in 2020, primarily due to higher molybdenum sales volumes by 112 thousand pounds (75% basis) and higher average molybdenum prices of US$11.32 per pound, compared to US$9.63 per pound for the same prior period. During the three months ended March 31, 2021, positive net price adjustments of $1.3 million were recorded for provisionally priced molybdenum concentrate.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

Cost of sales

| Three months ended March 31, |

|||||||||

| (Cdn$ in thousands) | 2021 | 2020 | Change | ||||||

| Site operating costs | 47,156 | 53,547 | (6,391 | ) | |||||

| Transportation costs | 3,305 | 4,519 | (1,214 | ) | |||||

| Changes in inventories of finished goods | (2,259 | ) | (1,302 | ) | (957 | ) | |||

| Changes in inventories of ore stockpiles | 8,226 | (603 | ) | 8,829 | |||||

| Production costs | 56,428 | 56,161 | 267 | ||||||

| Depletion and amortization | 15,838 | 27,148 | (11,310 | ) | |||||

| Cost of sales | 72,266 | 83,309 | (11,043 | ) | |||||

| Site operating costs per ton milled* | $ | 8.73 | $ | 9.52 | $ | (0.79 | ) | ||

Site operating costs for the three months ended March 31, 2021 decreased by $6.4 million, compared to the same prior period primarily due to greater stripping costs being capitalized in 2021 compared to 2020. For the three months ended March 31, 2021, capitalized waste stripping costs for the Pollyanna pit were $21.5 million, compared to $13.9 million for the same period in 2020.

Cost of sales is also impacted by changes in copper concentrate inventories and ore stockpiles. Although finished copper inventory increased only modestly by 0.2 million pounds over the quarter, the finished goods inventory had a higher average production cost per pound than the fourth quarter of 2020. There was also a decrease of 2.6 million tons in the ore stockpiles during the quarter, which resulted in an increase in production costs of $8.2 million.

Depletion and amortization for the three months ended March 31, 2021 decreased by $11.3 million over the same period in 2020. Ore tons that were mined from the Granite pit in the first quarter of 2020 had a higher depreciation cost per ton compared to the current ore being mined from the Pollyanna pit.

Other operating (income) expenses

| Three months ended March 31, |

|||||||||

| (Cdn$ in thousands) | 2021 | 2020 | Change | ||||||

| General and administrative | 5,296 | 3,898 | 1,398 | ||||||

| Share-based compensation expense | 2,790 | 184 | 2,606 | ||||||

| Project evaluation expenditures | 312 | 157 | 155 | ||||||

| Realized (gain) loss on derivative instruments | 1,189 | (2,507 | ) | 3,696 | |||||

| Unrealized (gain) loss on derivative instruments | 802 | (3,348 | ) | 4,150 | |||||

| Other income, net | (352 | ) | (395 | ) | 43 | ||||

| 10,037 | (2,011 | ) | 12,048 | ||||||

General and administrative expenses have increased in the three months ended March 31, 2021, compared to the same prior period primarily due to timing of accruals for certain employment and consulting services.

Share-based compensation expense is comprised of amortization of share options and performance share units and the expense on deferred share units. Share-based compensation expense increased for the three months ended March 31, 2021, compared to the same period in 2020, primarily due to the revaluation of the liability for deferred share units resulting from an increase in the Company's share price during the period. More information is set out in Note 14 of the March 31, 2021 unaudited condensed consolidated interim financial statements.

|

TASEKO MINES LIMITED Management's Discussion and Analysis |

During the three months ended March 31, 2021, the Company realized a loss of $1.2 million for premiums paid for copper put options covering first quarter production at a strike price of US$3.20 per pound that settled out-of-the-money during the period. The realized gain of $2.5 million in the first quarter of 2020 relates to copper put options with a strike price of $2.60 per pound that settled in the money during that period when copper prices dropped in March following the onset of COVID-19. For the three months ended March 31, 2021, the net unrealized loss of $0.8 million relates to the fair value adjustments on outstanding copper put and fuel call options. The net unrealized gain of $3.3 million in the first quarter of 2020 relates substantially to the fair value adjustment for 7.5 million outstanding copper put options that expired in-the-money for the month of April 2020.

Project evaluation expenditures represent costs associated with the New Prosperity project.

Finance expenses and income

| Three months ended March 31, |

|||||||||

| (Cdn$ in thousands) | 2021 | 2020 | Change | ||||||

| Interest expense | 9,746 | 9,360 | 386 | ||||||

| Loss on settlement of long-term debt | 12,739 | - | 12,739 | ||||||

| Finance expense - deferred revenue | 1,368 | 1,056 | 312 | ||||||

| Accretion of PER | 105 | 355 | (250 | ) | |||||

| Finance income | (75 | ) | (150 | ) | 75 | ||||

| 23,883 | 10,621 | 13,262 | |||||||

As part of the bond refinancing completed on February 10, 2021, the Company redeemed its US$250 million senior secured notes which resulted in a loss on settlement of $12.7 million, comprised of $6.9 million paid in call premium, interest costs over the redemption call period of $1.8 million and a write-off of deferred financing costs of $4.0 million.

Finance expense on deferred revenue adjustments represents the implicit financing component of the upfront deposit from the silver sales streaming arrangement with Osisko Gold Royalties Ltd. ("Osisko").

Income tax

| Three months ended March 31, |

|||||||||

| (Cdn$ in thousands) | 2021 | 2020 | Change | ||||||

| Current income tax expense | 131 | - | 131 | ||||||

| Deferred income tax recovery | (4,433 | ) | (10,118 | ) | 5,685 | ||||

| Income tax recovery | (4,302 | ) | (10,118 | ) | 5,816 | ||||

| Effective tax rate | 27.7% | 17.1% | 10.6% | ||||||

| Canadian statutory rate | 27.0% | 27.0% | - | ||||||

| B.C. Mineral tax rate | 9.5% | 9.5% | - | ||||||

|

TASEKO MINES LIMITED Management's Discussion and Analysis |