Form 6-K Itau Unibanco Holding For: Aug 09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of August, 2022

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça Alfredo Egydio de Souza Aranha, 100-Torre Conceicao

CEP 04344-902 São Paulo, SP, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82–

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 9, 2022.

| Itaú Unibanco Holding S.A. | ||

| By: | /s/ Renato Lulia Jacob | |

| Name: | Renato Lulia Jacob | |

| Title: | Group Head of Investor Relations and Market Intelligence | |

| By: | /s/ Alexsandro Broedel | |

| Name: | Alexsandro Broedel | |

| Title: | Chief Financial Officer | |

1

Exhibit 99.1

2021 Reference Form itau Unibanco Holding S.A.

Itau Unibanco Holding S.A. REFERENCE FORM Base Date: 12.31.2021 (in accordance with Attachment 24 to CVM lnstruction No. 480 of December 7, 2009 “CVM lnstruction No. 480”, as amended) Identification lta? Unibanco Holding S.A., a corporation enrolled under the National Register of Legal Entities/Ministry of Finance (CNPJ/MF) under No. 60.872.504/0001-23, with its Articles of lncorporation registered with the Trade Board of the State of S?o Paulo under NlRE No. 35.3.0001023-0, and registered as a publicly-held company with the Brazilian Securities and Exchange Commission (“CVM”) under No. 19348 (“Bank” or “lssuer”). Head Office The lssuer’s head office is located at Pra?a Alfredo Egydio de SouzaAranha, 100, Torre Olavo Setubal, Parque Jabaquara, in the City and State of S?o Paulo, Brazil, Zip Code 04344-902. Investor Relations Office The lnvestor Relations department is located at Pra?a Alfredo Egydio de Souza Aranha, 100, Piso Metr?, Torre Olavo Setubal, Parque Jabaquara, in the City and State of S?o Paulo, Brazil, Zip Code 04344-902. The Group Head of lnvestor Relations is Mr. Renato Lulia Jacob. The lnvestor Relations Department’s telephone number is (0xx11) 2794-3547, fax number is +55 11 5019-8717, and email is [email protected]. lndependent Auditors Firm PricewaterhouseCoopers Auditores Independentes Ltda. for the years ended 12/31/2021, 12/31/2020 and 12/31/2019. Bookkeeping Agent Ita? Corretora de Valores S.A. Stockholders Service The lssuer’s stockholders’ service is carried out at the branches of lta? Unibanco S.A., the head office of which is located at Pra?a AlfredoEgydio de Souza Aranha, 100, Torre Olavo Setubal, Parque Jabaquara, in the City and State of S?o Paulo, Brazil, Zip Code 04344-902. Newspapers from which the Company discloses O Estado de S?o Paulo newspaper. lnformation Website http://www.itau.com.br/relacoes-com-investidores The information included in theCompany’s website is not an integral part of this Reference Form. Last update of this Reference Form 08/08/2022

Historical resubmission Version Reasons for resubmission Date of update V2 Updated items: 10.3 and 15.7 06/14/2022 Updated items: 10.3, 12.1, 12.2, 12.5/6, 12.7/8, 12.9, V3 07/11/2022 12.12, 13.1, 15.4 and 15.7 V4 Updated item: 7.2 07/20/2022 V5 Updated items: 11.1, 11.2 and 12.5/6 08/08/2022

ITEM 11. PROJECTIONS 11.1. Projections must identify: Information provided in this item on business prospects, projections and operational and financial goals is solely forecasts based on Management’s current expectations in relation to the Bank’s future. These prospects are highly dependent on market conditions and on the general economic performance of Brazil, the sector, and international markets. Therefore, our actual results and performance may differ substantially from those in this forward-looking information. This item contains information that is or could be construed as forward-looking information based largely on our current expectations and projections with respect to future events and financial trends that affect our activities. Due to these risks and uncertainties, the information, circumstances, and prospective facts mentioned in this item may not occur. Our actual results and performance may differ substantially from those in this forward-looking information. Words such as “believe”, “may”, “should”, “estimate”, “continue”, “anticipate”, “intend”, “expect” and others alike are used to identify forward-looking statements but are not the only way to identify such statements. a) subject matter of the projection Projections are disclosed based on the Managerial Result, considering: 1) Accumulated variation in the 12-month period: Total loan portfolio, including financial guarantees provided and corporate securities; Financial margin with clients; Commissions and fees and result from insurance operations; and Non-interest expenses. 2) Accumulated amount in the 12-month period: Financial margin with the market; and Cost of credit, which includes result from loan losses, impairment, and discounts granted. 3) Expected income and social contribution tax rate. 4) Recurring managerial ROE. 5) Expectation of the efficiency ratio in Brazil. 6) Expectation of the Tier I capital ratio. projected period and the period for which the projection is valid Projected period: Fiscal year 2022; Period for which the projection is valid: current year or until Management states otherwise. assumptions considered indicating which ones may be influenced by the issuer´s management and those which are beyond its control c.1) Assumptions under Management control for fiscal year 2022

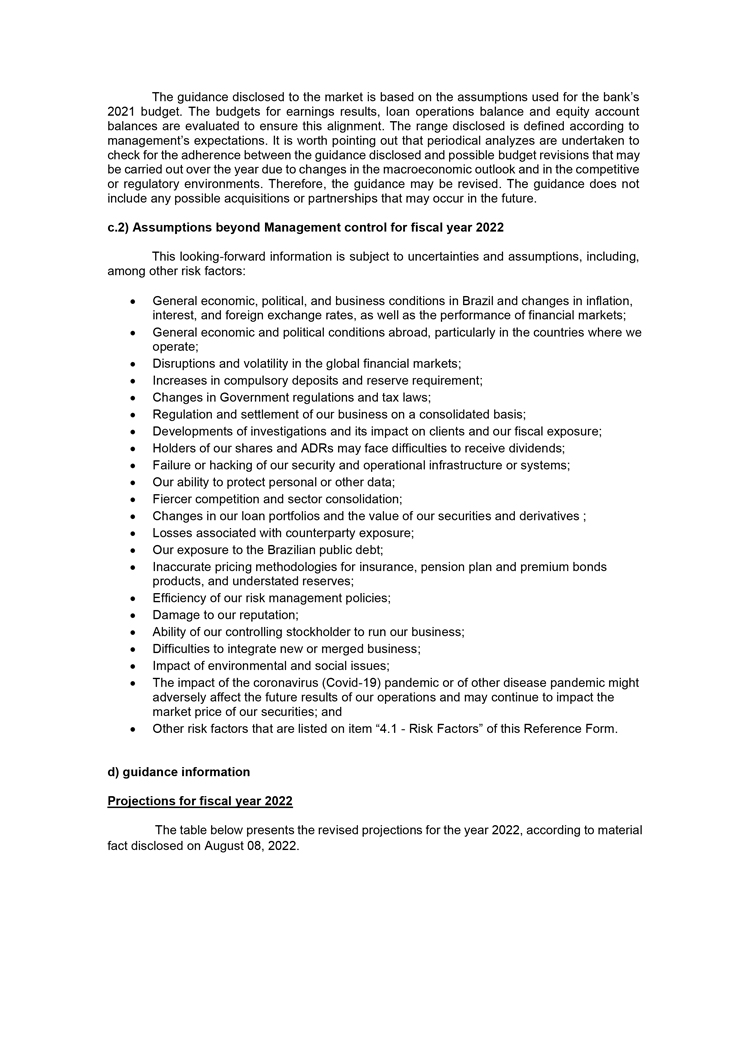

The guidance disclosed to the market is based on the assumptions used for the bank’s 2021 budget. The budgets for earnings results, loan operations balance and equity account balances are evaluated to ensure this alignment. The range disclosed is defined according to management’s expectations. It is worth pointing out that periodical analyzes are undertaken to check for the adherence between the guidance disclosed and possible budget revisions that may be carried out over the year due to changes in the macroeconomic outlook and in the competitive or regulatory environments. Therefore, the guidance may be revised. The guidance does not include any possible acquisitions or partnerships that may occur in the future. c.2) Assumptions beyond Management control for fiscal year 2022 This looking-forward information is subject to uncertainties and assumptions, including, among other risk factors: General economic, political, and business conditions in Brazil and changes in inflation, interest, and foreign exchange rates, as well as the performance of financial markets; General economic and political conditions abroad, particularly in the countries where we operate; Disruptions and volatility in the global financial markets; Increases in compulsory deposits and reserve requirement; Changes in Government regulations and tax laws; Regulation and settlement of our business on a consolidated basis; Developments of investigations and its impact on clients and our fiscal exposure; Holders of our shares and ADRs may face difficulties to receive dividends; Failure or hacking of our security and operational infrastructure or systems; Our ability to protect personal or other data; Fiercer competition and sector consolidation; Changes in our loan portfolios and the value of our securities and derivatives ; Losses associated with counterparty exposure; Our exposure to the Brazilian public debt; Inaccurate pricing methodologies for insurance, pension plan and premium bonds products, and understated reserves; Efficiency of our risk management policies; Damage to our reputation; Ability of our controlling stockholder to run our business; Difficulties to integrate new or merged business; Impact of environmental and social issues; The impact of the coronavirus (Covid-19) pandemic or of other disease pandemic might adversely affect the future results of our operations and may continue to impact the market price of our securities; and Other risk factors that are listed on item “4.1—Risk Factors” of this Reference Form. d) guidance information Projections for fiscal year 2022 The table below presents the revised projections for the year 2022, according to material fact disclosed on August 08, 2022.

[Graphic Appears Here] (1)Includes units abroad ex-Latin America; (2) Includes financial guarantees provided and corporate securities; (3) Composed of result from loan losses, impairment and discounts granted; (4) commissions and fees (+) income from insurance, pension plan and premium bonds operations (-) expenses for claims (-) insurance, pension plan and premium bonds selling expenses. It’s worth mentioning that the company considers, for management purposes, a cost of capital of around 14.5% per year. 11.2. If the issuer has disclosed guidance over the last three fiscal years: a) Inform which ones are being replaced by new projections and which ones are the same The indicators presented and monitored for the 2022 guidance remain unchanged compared to the ones presented in 2021 and 2019. For the 2022 projections, there was the inclusion of the perspectives of recurring managerial ROE, Brazil’s efficiency ratio, and Tier I capital ratio. It’s worth mentioning that, according to Material Fact disclosed on May 4, 2020, 2020 guidance was suspended due to the lack of visibility regarding COVID-19 crises impacts. These indicators: (i) total loan portfolio, (ii) financial margin with clients, (iii) financial margin with the market, (iv) cost of credit, (v) commissions and fees and result from insurance operations, (vi) non-interest expenses, and (vii) effective income and social contribution tax rate. b) with respect to the projections related to periods that have already elapsed, compare the data projected with the effective performance of the indicators, clearly presenting the reason for any differences in projections Projections for fiscal year 2021

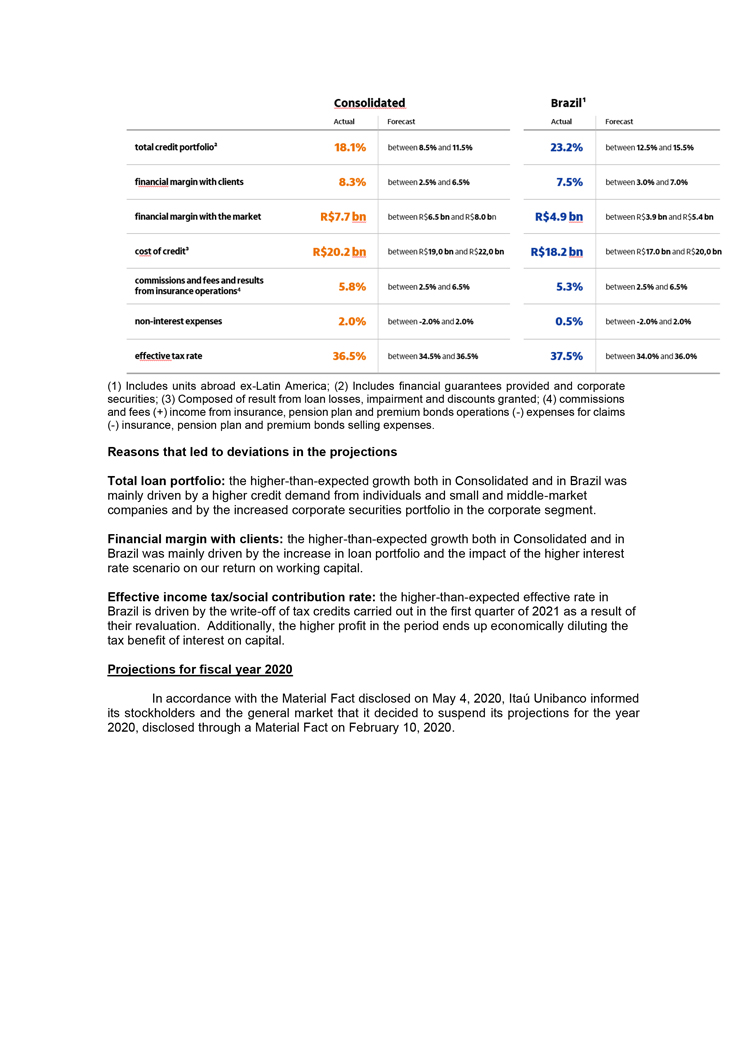

[Graphic Appears Here] (1) Includes units abroad ex-Latin America; (2) Includes financial guarantees provided and corporate securities; (3) Composed of result from loan losses, impairment and discounts granted; (4) commissions and fees (+) income from insurance, pension plan and premium bonds operations (-) expenses for claims (-) insurance, pension plan and premium bonds selling expenses. Reasons that led to deviations in the projections Total loan portfolio: the higher-than-expected growth both in Consolidated and in Brazil was mainly driven by a higher credit demand from individuals and small and middle-market companies and by the increased corporate securities portfolio in the corporate segment. Financial margin with clients: the higher-than-expected growth both in Consolidated and in Brazil was mainly driven by the increase in loan portfolio and the impact of the higher interest rate scenario on our return on working capital. Effective income tax/social contribution rate: the higher-than-expected effective rate in Brazil is driven by the write-off of tax credits carried out in the first quarter of 2021 as a result of their revaluation. Additionally, the higher profit in the period ends up economically diluting the tax benefit of interest on capital. Projections for fiscal year 2020 In accordance with the Material Fact disclosed on May 4, 2020, Itaú Unibanco informed its stockholders and the general market that it decided to suspend its projections for the year 2020, disclosed through a Material Fact on February 10, 2020.

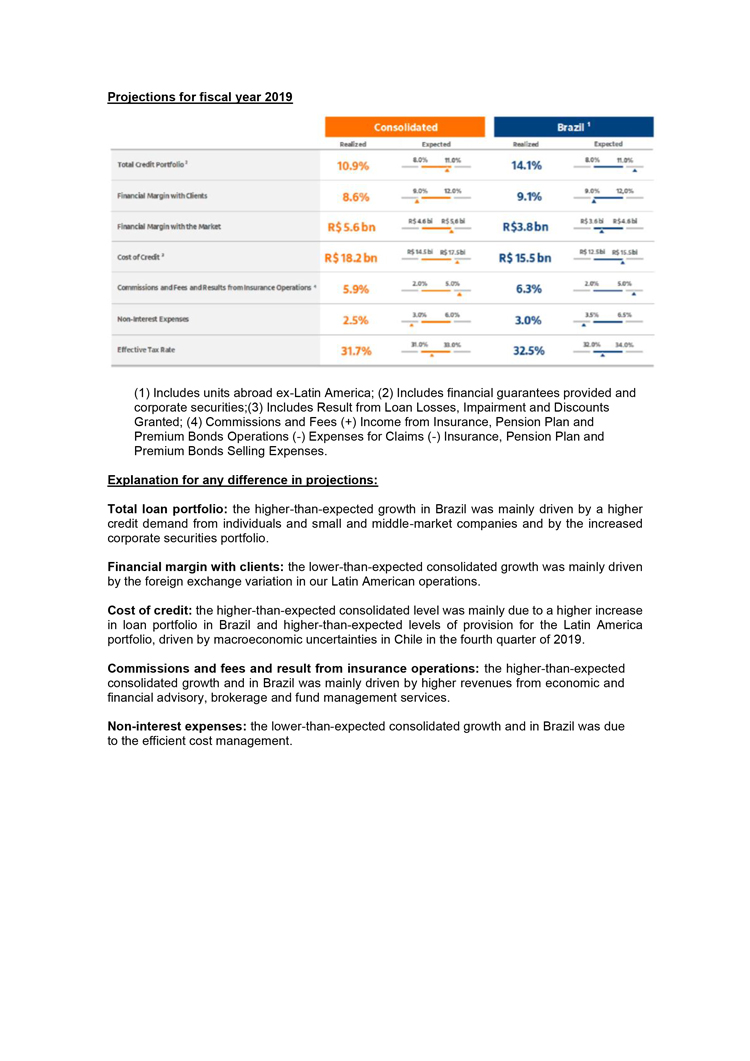

Projections for fiscal year 2019 [Graphic Appears Here] (1) Includes units abroad ex-Latin America; (2) Includes financial guarantees provided and corporate securities;(3) Includes Result from Loan Losses, Impairment and Discounts Granted; (4) Commissions and Fees (+) Income from Insurance, Pension Plan and Premium Bonds Operations (-) Expenses for Claims (-) Insurance, Pension Plan and Premium Bonds Selling Expenses. Explanation for any difference in projections: Total loan portfolio: the higher-than-expected growth in Brazil was mainly driven by a higher credit demand from individuals and small and middle-market companies and by the increased corporate securities portfolio. Financial margin with clients: the lower-than-expected consolidated growth was mainly driven by the foreign exchange variation in our Latin American operations. Cost of credit: the higher-than-expected consolidated level was mainly due to a higher increase in loan portfolio in Brazil and higher-than-expected levels of provision for the Latin America portfolio, driven by macroeconomic uncertainties in Chile in the fourth quarter of 2019. Commissions and fees and result from insurance operations: the higher-than-expected consolidated growth and in Brazil was mainly driven by higher revenues from economic and financial advisory, brokerage and fund management services. Non-interest expenses: the lower-than-expected consolidated growth and in Brazil was due to the efficient cost management.

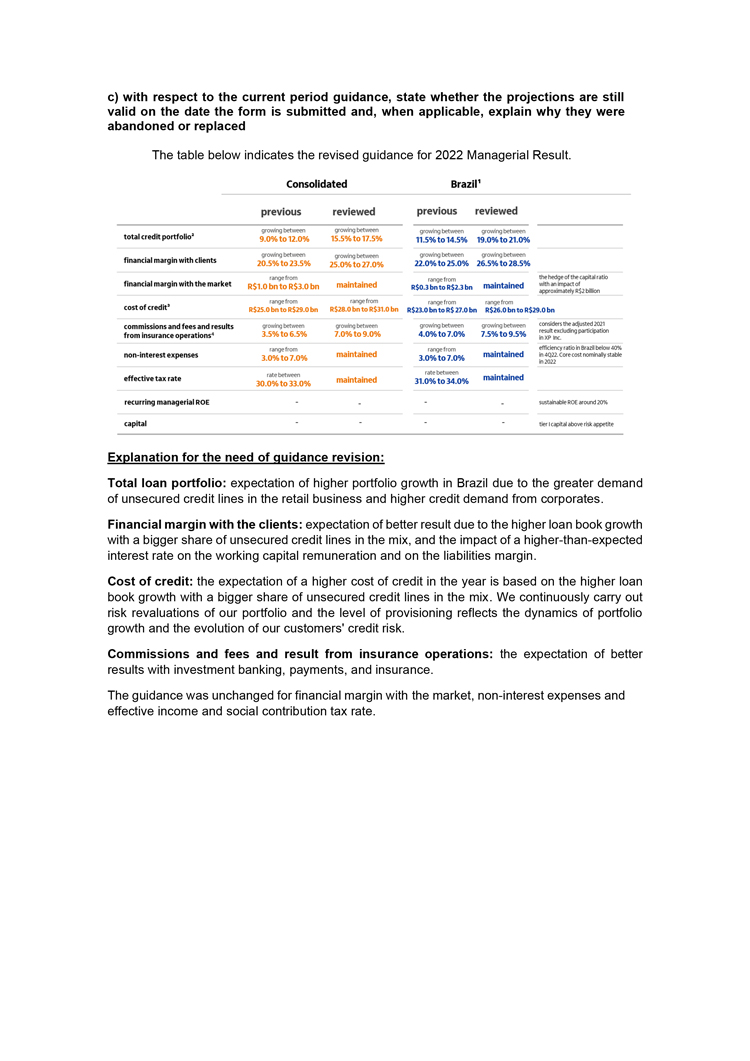

c) with respect to the current period guidance, state whether the projections are still valid on the date the form is submitted and, when applicable, explain why they were abandoned or replaced The table below indicates the revised guidance for 2022 Managerial Result. [Graphic Appears Here] Explanation for the need of guidance revision: Total loan portfolio: expectation of higher portfolio growth in Brazil due to the greater demand of unsecured credit lines in the retail business and higher credit demand from corporates. Financial margin with the clients: expectation of better result due to the higher loan book growth with a bigger share of unsecured credit lines in the mix, and the impact of a higher-than-expected interest rate on the working capital remuneration and on the liabilities margin. Cost of credit: the expectation of a higher cost of credit in the year is based on the higher loan book growth with a bigger share of unsecured credit lines in the mix. We continuously carry out risk revaluations of our portfolio and the level of provisioning reflects the dynamics of portfolio growth and the evolution of our customers’ credit risk. Commissions and fees and result from insurance operations: the expectation of better results with investment banking, payments, and insurance. The guidance was unchanged for financial margin with the market, non-interest expenses and effective income and social contribution tax rate.

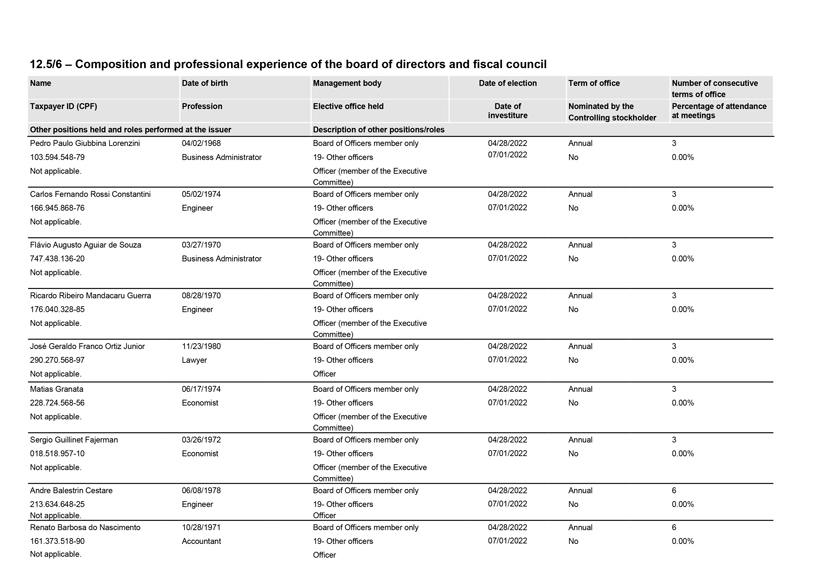

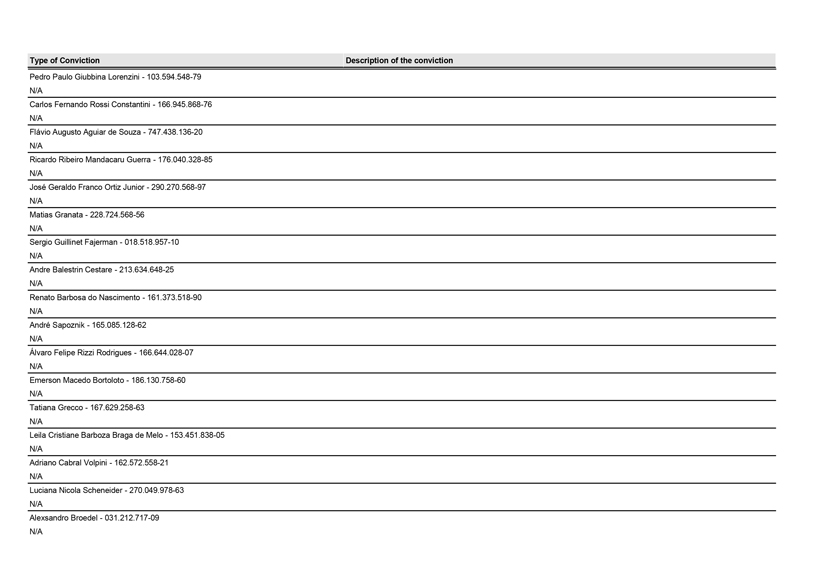

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture Controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles Pedro Paulo Giubbina Lorenzini 04/02/1968 Board of Officers member only 04/28/2022 Annual 3 103.594.548-79 Business Administrator 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Carlos Fernando Rossi Constantini 05/02/1974 Board of Officers member only 04/28/2022 Annual 3 166.945.868-76 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Flávio Augusto Aguiar de Souza 03/27/1970 Board of Officers member only 04/28/2022 Annual 3 747.438.136-20 Business Administrator 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Ricardo Ribeiro Mandacaru Guerra 08/28/1970 Board of Officers member only 04/28/2022 Annual 3 176.040.328-85 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) José Geraldo Franco Ortiz Junior 11/23/1980 Board of Officers member only 04/28/2022 Annual 3 290.270.568-97 Lawyer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Matias Granata 06/17/1974 Board of Officers member only 04/28/2022 Annual 3 228.724.568-56 Economist 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Sergio Guillinet Fajerman 03/26/1972 Board of Officers member only 04/28/2022 Annual 3 018.518.957-10 Economist 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Andre Balestrin Cestare 06/08/1978 Board of Officers member only 04/28/2022 Annual 6 213.634.648-25 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Renato Barbosa do Nascimento 10/28/1971 Board of Officers member only 04/28/2022 Annual 6 161.373.518-90 Accountant 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer

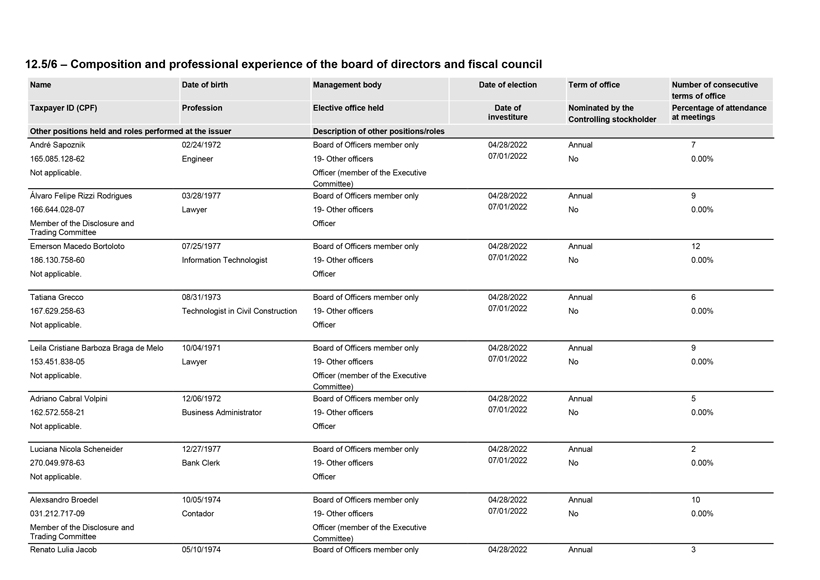

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture Controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles André Sapoznik 02/24/1972 Board of Officers member only 04/28/2022 Annual 7 165.085.128-62 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Álvaro Felipe Rizzi Rodrigues 03/28/1977 Board of Officers member only 04/28/2022 Annual 9 166.644.028-07 Lawyer 19- Other officers 07/01/2022 No 0.00% Member of the Disclosure and Officer Trading Committee Emerson Macedo Bortoloto 07/25/1977 Board of Officers member only 04/28/2022 Annual 12 186.130.758-60 Information Technologist 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Tatiana Grecco 08/31/1973 Board of Officers member only 04/28/2022 Annual 6 167.629.258-63 Technologist in Civil Construction 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Leila Cristiane Barboza Braga de Melo 10/04/1971 Board of Officers member only 04/28/2022 Annual 9 153.451.838-05 Lawyer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Adriano Cabral Volpini 12/06/1972 Board of Officers member only 04/28/2022 Annual 5 162.572.558-21 Business Administrator 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Luciana Nicola Scheneider 12/27/1977 Board of Officers member only 04/28/2022 Annual 2 270.049.978-63 Bank Clerk 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Alexsandro Broedel 10/05/1974 Board of Officers member only 04/28/2022 Annual 10 031.212.717-09 Contador 19- Other officers 07/01/2022 No 0.00% Member of the Disclosure and Officer (member of the Executive Trading Committee Committee) Renato Lulia Jacob 05/10/1974 Board of Officers member only 04/28/2022 Annual 3

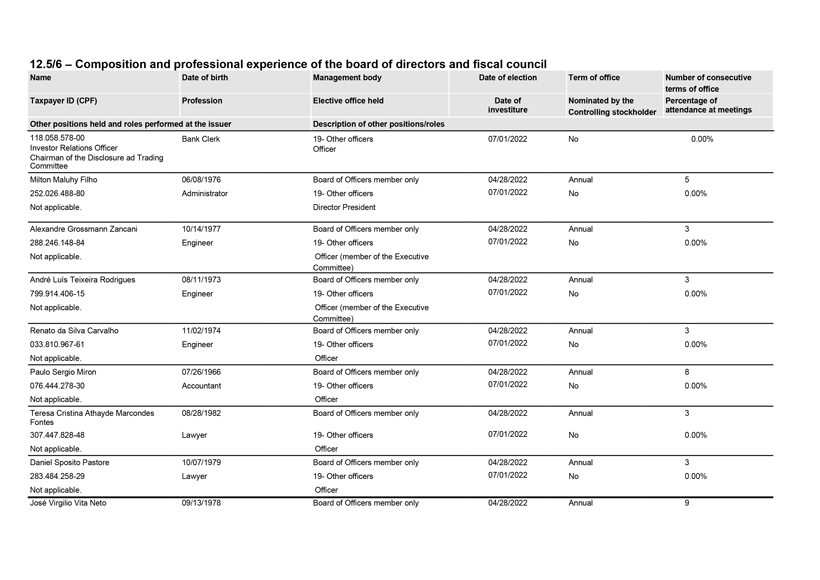

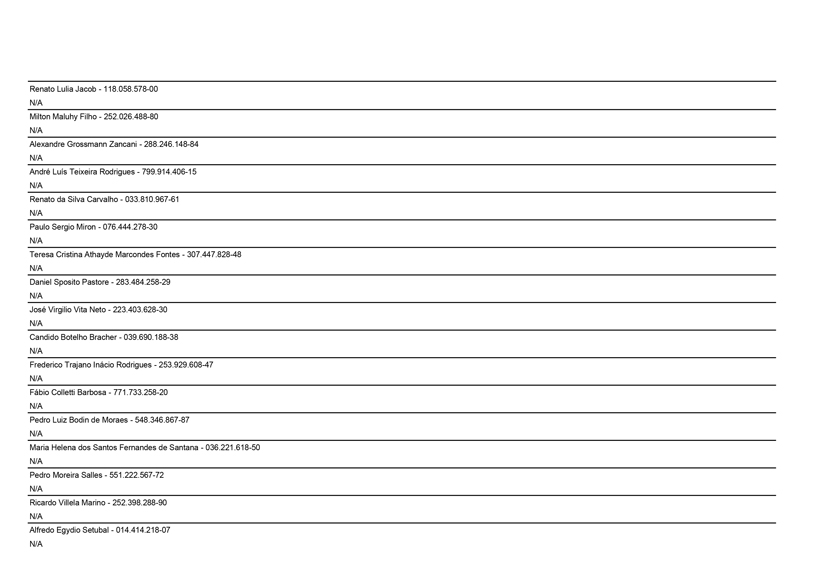

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of investiture Controlling stockholder attendance at meetings Other positions held and roles performed at the issuer Description of other positions/roles 118.058.578-00 Bank Clerk 19- Other officers 07/01/2022 No 0.00% Investor Relations Officer Officer Chairman of the Disclosure ad Trading Committee Milton Maluhy Filho 06/08/1976 Board of Officers member only 04/28/2022 Annual 5 252.026.488-80 Administrator 19- Other officers 07/01/2022 No 0.00% Not applicable. Director President Alexandre Grossmann Zancani 10/14/1977 Board of Officers member only 04/28/2022 Annual 3 288.246.148-84 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) André Luís Teixeira Rodrigues 08/11/1973 Board of Officers member only 04/28/2022 Annual 3 799.914.406-15 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer (member of the Executive Committee) Renato da Silva Carvalho 11/02/1974 Board of Officers member only 04/28/2022 Annual 3 033.810.967-61 Engineer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Paulo Sergio Miron 07/26/1966 Board of Officers member only 04/28/2022 Annual 8 076.444.278-30 Accountant 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Teresa Cristina Athayde Marcondes 08/28/1982 Board of Officers member only 04/28/2022 Annual 3 Fontes 307.447.828-48 Lawyer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer Daniel Sposito Pastore 10/07/1979 Board of Officers member only 04/28/2022 Annual 3 283.484.258-29 Lawyer 19- Other officers 07/01/2022 No 0.00% Not applicable. Officer José Virgilio Vita Neto 09/13/1978 Board of Officers member only 04/28/2022 Annual 9

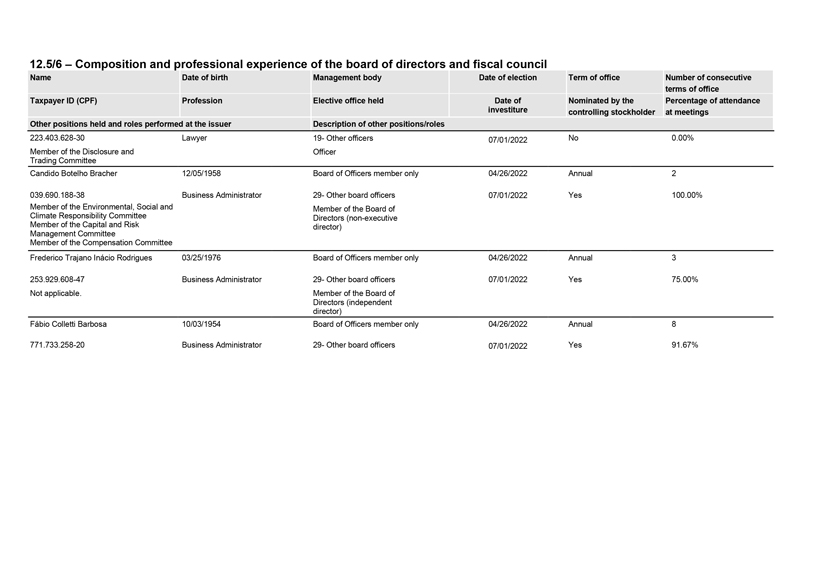

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles 223.403.628-30 Lawyer 19- Other officers 07/01/2022 No 0.00% Member of the Disclosure and Officer Trading Committee Candido Botelho Bracher 12/05/1958 Board of Officers member only 04/26/2022 Annual 2 039.690.188-38 Business Administrator 29- Other board officers 07/01/2022 Yes 100.00% Member of the Environmental, Social and Member of the Board of Climate Responsibility Committee Directors (non-executive Member of the Capital and Risk director) Management Committee Member of the Compensation Committee Frederico Trajano Inácio Rodrigues 03/25/1976 Board of Officers member only 04/26/2022 Annual 3 253.929.608-47 Business Administrator 29- Other board officers 07/01/2022 Yes 75.00% Not applicable. Member of the Board of Directors (independent director) Fábio Colletti Barbosa 10/03/1954 Board of Officers member only 04/26/2022 Annual 8 771.733.258-20 Business Administrator 29- Other board officers 07/01/2022 Yes 91.67%

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles Member of the Personnel Member of the Board of Committee Directors (independent director) Member of the Nomination and Corporate Governance Committee Member of the Strategy Committee Chairman of the Related Parties Committee Member of the Environmental, Social and Climate Responsibility Committee Pedro Luiz Bodin de Moraes 07/13/1956 Board of Directors member only 04/26/2022 Annual 15 548.346.867-87 Economist 29—Other board members 07/01/2022 Yes 100.00% Chairman of the Capital and Risk Member of the Board of Management Committee Directors (independent director) Member of the Related Parties Committee Maria Helena dos Santos Fernandes de 06/23/1959 Board of Directors member only 04/26/2022 Annual 2 Santana 036.221.618-50 Economist 29—Other board members 07/01/2022 Yes 100.00% Member of the Related Member of the Board of Parties Committee Directors (independent director) Pedro Moreira Salles 10/20/1959 Board of Directors member only 04/26/2022 Annual 15 551.222.567-72 Banqueiro 29 – Other board members 07/01/2022 Yes 100.00%

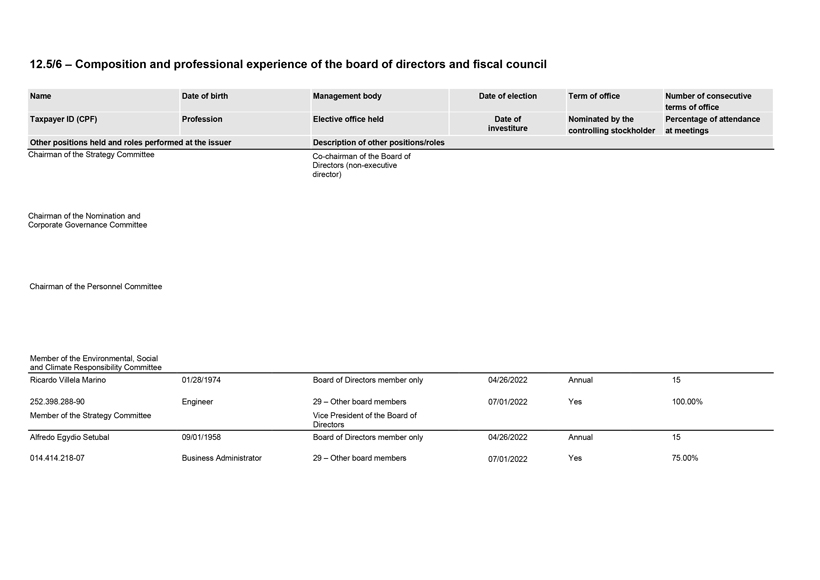

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles Chairman of the Strategy Committee Co-chairman of the Board of Directors (non-executive director) Chairman of the Nomination and Corporate Governance Committee Chairman of the Personnel Committee Member of the Environmental, Social and Climate Responsibility Committee Ricardo Villela Marino 01/28/1974 Board of Directors member only 04/26/2022 Annual 15 252.398.288-90 Engineer 29 – Other board members 07/01/2022 Yes 100.00% Member of the Strategy Committee Vice President of the Board of Directors Alfredo Egydio Setubal 09/01/1958 Board of Directors member only 04/26/2022 Annual 15 014.414.218-07 Business Administrator 29 – Other board members 07/01/2022 Yes 75.00%

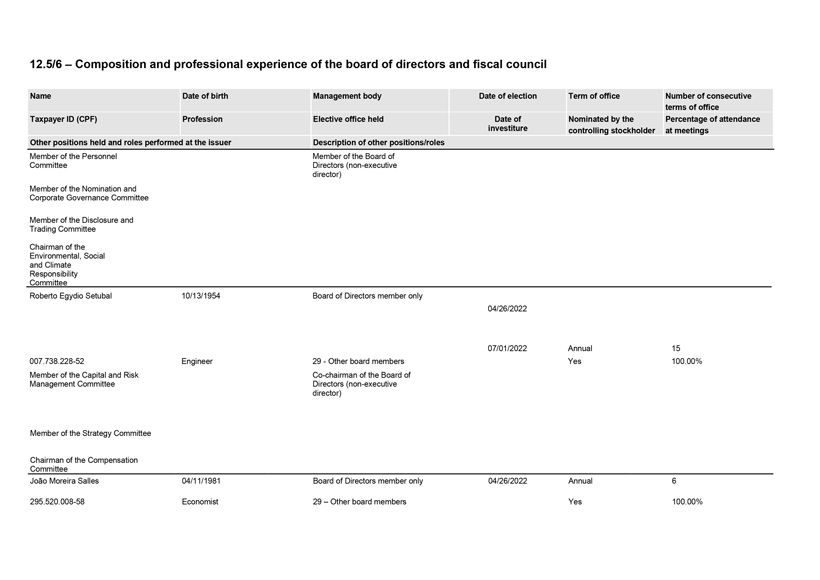

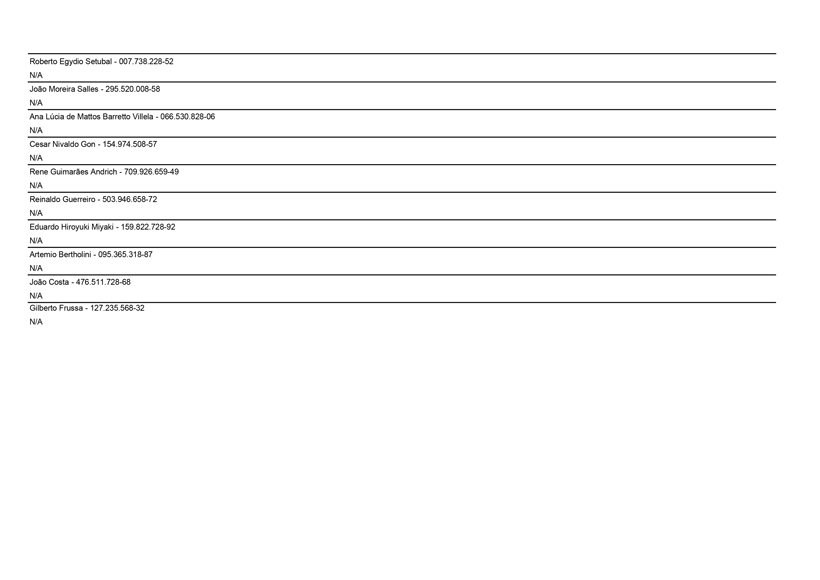

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles Member of the Personnel Member of the Board of Committee Directors (non-executive director) Member of the Nomination and Corporate Governance Committee Member of the Disclosure and Trading Committee Chairman of the Environmental, Social and Climate Responsibility Committee Roberto Egydio Setubal 10/13/1954 Board of Directors member only 04/26/2022 07/01/2022 Annual 15 007.738.228-52 Engineer 29—Other board members Yes 100.00% Member of the Capital and Risk Co-chairman of the Board of Management Committee Directors (non-executive director) Member of the Strategy Committee Chairman of the Compensation Committee João Moreira Salles 04/11/1981 Board of Directors member only 04/26/2022 Annual 6 295.520.008-58 Economist 29 – Other board members Yes 100.00%

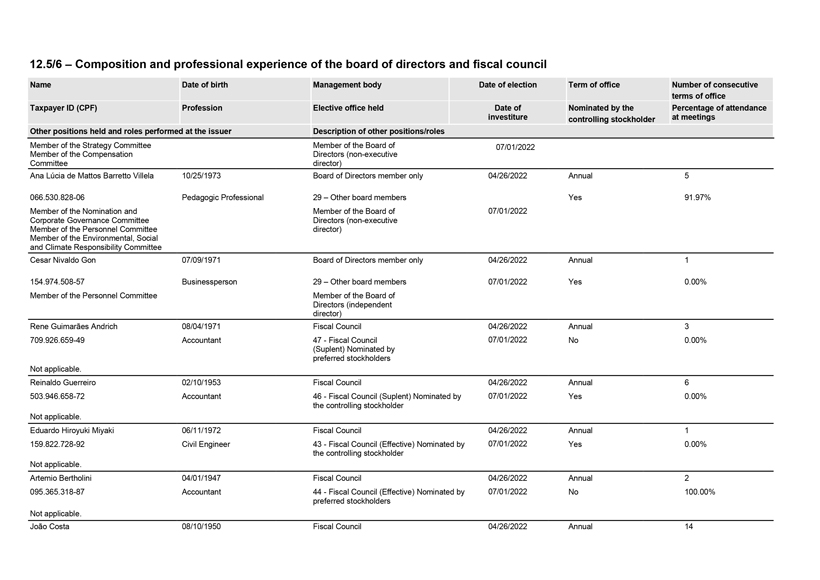

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles Member of the Strategy Committee Member of the Board of 07/01/2022 Member of the Compensation Directors (non-executive Committee director) Ana Lúcia de Mattos Barretto Villela 10/25/1973 Board of Directors member only 04/26/2022 Annual 5 066.530.828-06 Pedagogic Professional 29 – Other board members Yes 91.97% Member of the Nomination and Member of the Board of 07/01/2022 Corporate Governance Committee Directors (non-executive Member of the Personnel Committee director) Member of the Environmental, Social and Climate Responsibility Committee Cesar Nivaldo Gon 07/09/1971 Board of Directors member only 04/26/2022 Annual 1 154.974.508-57 Businessperson 29 – Other board members 07/01/2022 Yes 0.00% Member of the Personnel Committee Member of the Board of Directors (independent director) Rene Guimarães Andrich 08/04/1971 Fiscal Council 04/26/2022 Annual 3 709.926.659-49 Accountant 47—Fiscal Council 07/01/2022 No 0.00% (Suplent) Nominated by preferred stockholders Not applicable. Reinaldo Guerreiro 02/10/1953 Fiscal Council 04/26/2022 Annual 6 503.946.658-72 Accountant 46—Fiscal Council (Suplent) Nominated by 07/01/2022 Yes 0.00% the controlling stockholder Not applicable. Eduardo Hiroyuki Miyaki 06/11/1972 Fiscal Council 04/26/2022 Annual 1 159.822.728-92 Civil Engineer 43—Fiscal Council (Effective) Nominated by 07/01/2022 Yes 0.00% the controlling stockholder Not applicable. Artemio Bertholini 04/01/1947 Fiscal Council 04/26/2022 Annual 2 095.365.318-87 Accountant 44—Fiscal Council (Effective) Nominated by 07/01/2022 No 100.00% preferred stockholders Not applicable. João Costa 08/10/1950 Fiscal Council 04/26/2022 Annual 14 393139-001 08Aug22 19:10 Page 20

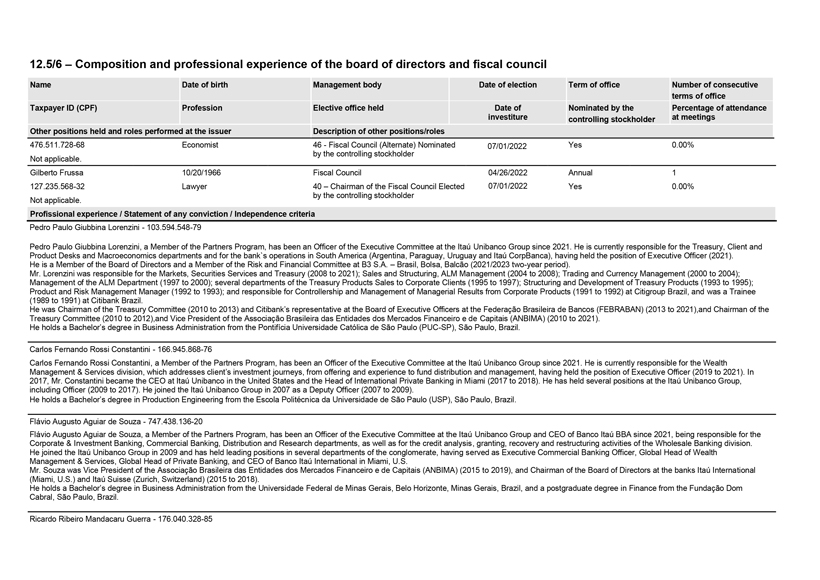

12.5/6 – Composition and professional experience of the board of directors and fiscal council Name Date of birth Management body Date of election Term of office Number of consecutive terms of office Taxpayer ID (CPF) Profession Elective office held Date of Nominated by the Percentage of attendance investiture controlling stockholder at meetings Other positions held and roles performed at the issuer Description of other positions/roles 476.511.728-68 Economist 46—Fiscal Council (Alternate) Nominated 07/01/2022 Yes 0.00% by the controlling stockholder Not applicable. Gilberto Frussa 10/20/1966 Fiscal Council 04/26/2022 Annual 1 127.235.568-32 Lawyer 40 – Chairman of the Fiscal Council Elected 07/01/2022 Yes 0.00% Not applicable. by the controlling stockholder Profissional experience / Statement of any conviction / Independence criteria Pedro Paulo Giubbina Lorenzini—103.594.548-79 Pedro Paulo Giubbina Lorenzini, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group since 2021. He is currently responsible for the Treasury, Client and Product Desks and Macroeconomics departments and for the bank`s operations in South America (Argentina, Paraguay, Uruguay and Itaú CorpBanca), having held the position of Executive Officer (2021). He is a Member of the Board of Directors and a Member of the Risk and Financial Committee at B3 S.A. – Brasil, Bolsa, Balcão (2021/2023 two-year period). Mr. Lorenzini was responsible for the Markets, Securities Services and Treasury (2008 to 2021); Sales and Structuring, ALM Management (2004 to 2008); Trading and Currency Management (2000 to 2004); Management of the ALM Department (1997 to 2000); several departments of the Treasury Products Sales to Corporate Clients (1995 to 1997); Structuring and Development of Treasury Products (1993 to 1995); Product and Risk Management Manager (1992 to 1993); and responsible for Controllership and Management of Managerial Results from Corporate Products (1991 to 1992) at Citigroup Brazil, and was a Trainee (1989 to 1991) at Citibank Brazil. He was Chairman of the Treasury Committee (2010 to 2013) and Citibank’s representative at the Board of Executive Officers at the Federação Brasileira de Bancos (FEBRABAN) (2013 to 2021),and Chairman of the Treasury Committee (2010 to 2012),and Vice President of the Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais (ANBIMA) (2010 to 2021). He holds a Bachelor’s degree in Business Administration from the Pontifícia Universidade Católica de São Paulo (PUC-SP), São Paulo, Brazil. Carlos Fernando Rossi Constantini—166.945.868 -76 Carlos Fernando Rossi Constantini, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group since 2021. He is currently responsible for the Wealth Management & Services division, which addresses client’s investment journeys, from offering and experience to fund distribution and management, having held the position of Executive Officer (2019 to 2021). In 2017, Mr. Constantini became the CEO at Itaú Unibanco in the United States and the Head of International Private Banking in Miami (2017 to 2018). He has held several positions at the Itaú Unibanco Group, including Officer (2009 to 2017). He joined the Itaú Unibanco Group in 2007 as a Deputy Officer (2007 to 2009). He holds a Bachelor’s degree in Production Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil. Flávio Augusto Aguiar de Souza—747.438.136 -20 Flávio Augusto Aguiar de Souza, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group and CEO of Banco Itaú BBA since 2021, being responsible for the Corporate & Investment Banking, Commercial Banking, Distribution and Research departments, as well as for the credit analysis, granting, recovery and restructuring activities of the Wholesale Banking division. He joined the Itaú Unibanco Group in 2009 and has held leading positions in several departments of the conglomerate, having served as Executive Commercial Banking Officer, Global Head of Wealth Management & Services, Global Head of Private Banking, and CEO of Banco Itaú International in Miami, U.S. Mr. Souza was Vice President of the Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais (ANBIMA) (2015 to 2019), and Chairman of the Board of Directors at the banks Itaú International (Miami, U.S.) and Itaú Suisse (Zurich, Switzerland) (2015 to 2018). He holds a Bachelor’s degree in Business Administration from the Universidade Federal de Minas Gerais, Belo Horizonte, Minas Gerais, Brazil, and a postgraduate degree in Finance from the Fundação Dom Cabral, São Paulo, Brazil. Ricardo Ribeiro Mandacaru Guerra—176.040.328 -85

Ricardo Ribeiro Mandacaru Guerra, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group since 2021, responsible for the technology department in the position of CIO since 2015. He has held several positions at the Itaú Unibanco Group, including Executive Officer (2014 to 2021), Channels Officer (2008 to 2014); Financing Products Superintendent—Individuals (2007 to 2008); Credit Policies Superintendent (2006 to 2007); Electronic Channels Management Superintendent (2002 to 2006), and Internet Project Leader (1996 to 2000). He joined the Itaú Unibanco Group in 1993 as a System Analyst. He holds a Bachelor’s degrees in Civil Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil, and in Business Administration from the Faculdade de Economia, Administração, Contabilidade e Atuária da Universidade de São Paulo (FEA-USP), São Paulo, Brazil, and an MBA from the Kellogg School of Management at Northwestern University, Illinois, U.S. José Geraldo Franco Ortiz Junior—290.270.568 -97 José Geraldo Franco Ortiz Junior, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2021. He joined the Itaú Unibanco Group in 2003 as an intern, and has served in a number of positions, such as: Legal Assistant (2003 to 2004); Lawyer (2004 to 2006); Senior Lawyer (2006 to 2008); Legal Manager (2009 to 2013), and Legal Superintendent (2013 to 2020). Mr. Ortiz Junior also worked as Non-US Legal Intern at law firm Jones Day of New York (2009) and as an intern at IBM Brasil (2001 to 2003). He holds a Bachelor’s degree in Law from the Faculdade de Direito da Universidade de São Paulo (USP), São Paulo, Brazil, and a Master’s degree (LL.M) from the Columbia University Law School, New York, U.S. Matias Granata—228.724.568 -56 Matias Granata, a Partner, has been an Officer of the Executive Committee at the Itaú Unibanco Group responsible for the risks department (CRO) since 2021. He has held several positions at the Itaú Unibanco Group, including Officer (2014 to 2021), responsible for AML, Credit Risk, Modeling and Market and Liquidity Risks. He holds a Bachelor’s degree in Economics from the Universidad de Buenos Aires (UBA), Buenos Aires, Argentina, a postgraduate degree in Economics from the Universidad Torcuato Di Tella (UTDT), Buenos Aires, Argentina, and a Master’s degree in International Economic Policy from the University of Warwick, British Chevening Scholarship, United Kingdom. Sergio Guillinet Fajerman—018.518.957 -10 Sergio Guillinet Fajerman, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group since 2021. He is currently responsible for the Personnel department. He has held several positions at the Itaú Unibanco Group, including Executive Officer (2017 to 2021) and Corporate Personnel Management Officer and Personnel Officer at the General Wholesale Banking Office (2010 to 2017). He is a representative of the Itaú Unibanco Group in the Human Resources Committee (CHR) of FEBRABAN. He holds a Bachelor’s degree in Economics from the Universidade Federal do Rio de Janeiro (UFRJ), Rio de Janeiro, Brazil; MBA in Corporate Finance from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Brazil; MBA from INSEAD, Fontainebleau, France and has attended the Advanced HR Executive Program from the University of Michigan, Michigan, U.S. Andre Balestrin Cestare—213.634.648 -25 Andre Balestrin Cestare, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2017. He is currently responsible for the Financial Planning of the Wholesale Banking and Technology and Operations department. He has held several positions at the Itaú Unibanco Group, including Financial Planning Officer—Retail Banking (2017 to 2019) and Finance Superintendent (2010 to 2017). Mr. Cestare was also a Member of the Board of Directors at Financeira Itaú CBD and ConectCar from 2017 to 2019. He holds a Bachelor’s degree in Mechanical Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil; a Postgraduate degree in Business Administration and a Professional Master’s degree in Finance and Economics, both from the Fundação Getulio Vargas (FGV), São Paulo, Brazil. He also attended the Executive Qualification Program from the Fundação Dom Cabral, São Paulo, Brazil. Renato Barbosa do Nascimento—161.373.518 -90 Renato Barbosa do Nascimento, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2017, responsible for the internal audit function of the investment banking, WMS, financial crimes, M&A, Treasury, Risks, Accounting, Fiscal, Finance departments and foreign units. He held several positions within PricewaterhouseCoopers Auditores Independentes (PwC) (São Paulo, Brazil), including Audit Partner from 2009 to 2017. He took part in a three-year professional exchange program at PwC in Mexico City, Mexico, as audit officer leading external audits in subsidiaries of international entities of the financial industry in Mexico (2014 to 2017). His main responsibility as Audit Partner was to lead external audits in entities of the financial industry in São Paulo (2009 to 2014). In that period, Mr. Nascimento was also responsible for monitoring external audits carried out by the PwC teams of the United States, United Kingdom, Switzerland, Portugal, Chile, Argentina, Paraguay and Uruguay in subsidiaries of Brazilian financial institutions in these countries. Also at PwC (São Paulo, Brazil) he was Audit Senior Manager of the financial industry (2008 to 2009), and his main responsibility was to manage teams in charge of carrying out audits of entities of the financial industry, regulated by the Banco Central do Brasil. Between 2006 and 2008, Mr. Nascimento took part in a two-year professional exchange program at PwC in London, United Kingdom, and his main responsibilities were managing external audits of British financial institutions in England, managing external audits of subsidiaries of international banks, as well as the resulting development of knowledge on the application of the International Financial Reporting Standards (IFRS), Sarbanes Oxley (SOx) rules and policies issued by the Public Company Accounting Oversight Board (PCAOB). Additionally, he took part in a two-year professional exchange program at PwC in Montevideo, Uruguay, managing external audits of local banks, international institutions, and offshore entities, among others. He holds a Bachelor’s degrees in Accounting and in Business Administration, both from the Universidade Paulista, São Paulo, Brazil and Master’s degree in Business Administration (MBA) from Fundação Getulio Vargas (FGV), São Paulo, Brazil. In 2021, Mr. Nascimento attended the executive training course Fintech Revolution:Transformative Financial Services and Strategies, organized by the Wharton School of the University ofPennsylvania 393139-00108Aug22 19:10Page 22. André Sapoznik—165.085.128 -62

André Sapoznik, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group since 2016, having held the position of Vice President (2016 to 2021). He joined the Itaú Unibanco Group in 1998 and was elected Officer in 2004. He holds a Bachelor’s degree in Production Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil and MBA from Stanford Graduate School of Business, California, U.S. Álvaro Felipe Rizzi Rodrigues—166.644.028 -07 Álvaro Felipe Rizzi Rodrigues, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2014. He is currently responsible for the Legal Wholesale Banking Department (investment banking, treasury, wealth management services, banking products, allocated funds and onlending, international loans and foreign exchange), the Tax Department, the Proprietary M&A Legal Matters Department and the Anti-Trust, Corporate and International Legal Matters Departments. Mr. Rodrigues had been previously responsible for the Legal Retail Banking Department (responsible for legal issues related to products and services of the retail banking, insurance and pension plan business) and the Institutional Legal Department (Corporate and Corporate Governance, Contracts, Intellectual Property and Corporate Paralegal Matters) . He joined the Itaú Unibanco Group in 2005, serving as Legal Manager and Legal Superintendent (2005 to 2014). He also worked in the Corporate Law and Contract Law departments (1998 to 2005) at Tozzini Freire Advogados. He holds a Bachelor’s degree in Law from the Faculdade de Direito da Universidade de São Paulo (USP), São Paulo, Brazil. He has also attended a specialization course in Corporate Law from the Pontifícia Universidade Católica de São Paulo (PUC-SP), São Paulo, Brazil, and holds a Master of Laws (L.L.M.) from Columbia University Law School, New York, U.S. Emerson Macedo Bortoloto—186.130.758 -60 Emerson Macedo Bortoloto has been an Officer at the Itaú Unibanco Group since 2011. He joined the Itaú Unibanco Group in 2003, taking over a number of positions in the Internal Audit department. He is currently the Internal Audit Officer, responsible for managing the Audit department, whose mission is to plan, carry out and report on audits in Itaú Unibanco Group Retail processes and business, as well as in processes of the Information Technology, Information Security and Cybersecurity area. Mr. Bortoloto was responsible for evaluating processes related to Market, Credit and Operational Risks, in addition to Project Auditing and Continuous Auditing. Also at the Itaú Unibanco Group, he was responsible for auditing in the Information Technology and Retail Credit Analysis and Granting processes. He has been a Member of the Audit Committees of Itaú Unibanco’s controlled companies and affiliates, such as: Banco Itaú Paraguay, Banco Itaú Uruguay, CIP – Câmara Interbancária de Pagamentos and Tecban—Tecnologia Bancária. Mr. Bortoloto worked at Ernst & Young Auditores Independentes (2001 to 2003) and at Banco Bandeirantes (1992 to 2001), being responsible for auditing IT and operational processes. He holds a Bachelor’s degree in Data Processing Technology, a Postgraduate degree in Audit and Consulting in Information Security from the Faculdades Associadas de São Paulo (FASP), São Paulo, Brazil, and an MBA in Internal Auditing from the Fundação Instituto de Pesquisas Contábeis, Atuariais e Financeiras (FIPECAFI), Brazil. He is CISA certified by the Information Systems Audit and Control Association (ISACA). Tatiana Grecco—167.629.258 -63 Tatiana Grecco, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2017. She has worked at the financial and capital markets since 1994, when she joined the Capital Markets Department. She has built a consistent and successful career over the years within the firm, starting as a Back-Office Analyst of institutional and private banking investors’ portfolios. In 1998, she became a Fund Portfolio Manager at Itaú Asset Management. After that, she worked as a Senior Portfolio Manager of fixed income and technical provision portfolios for five years and later became the Superintendent of Technical Provision Portfolio Management. In 2009, Ms. Grecco commenced the indexed fund business at Itaú Asset Management, through mutual funds and ETFs – Exchange Traded Funds. In 2014, she also became the Superintendent of Solutions for Asset Allocation and Quantitative Funds. She has coordinated the ETF Committee and the ESG Workgroup at ANBIMA for several years. She was also Vice President of the Fixed Income and Multimarket Funds Committee at the same Association, contributing to the development of Brazilian Mutual Funds. Since 2017, she has been responsible for the market and liquidity risk control at the Itaú Unibanco, Itaú Asset Management and Itaú Corretora de Valores units. She holds a Bachelor’s degree in Civil Construction with major in Technology from the Universidade Estadual Paulista (UNESP), São Paulo, Brazil, a Postgraduate degree in Finance from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Brazil, a Master’s degree in Business Administration from the Fundação Getulio Vargas (FGV), São Paulo, Brazil, and is certified by the Executive Education Program on Asset Management from the Yale University, Connecticut, U.S. She has also been a Certified Financial Planner (CFP) since 2009 and is Asset Manager certified by ANBIMA (CGA). Leila Cristiane Barboza Braga de Melo—153.451.838 -05 Leila Cristiane Barboza Braga de Melo, has been a Partner of Itaú Unibanco since 2008 and an Officer of the Executive Committee since 2021. She is currently responsible for the entire Legal, External Ombudsman’s Office, Government Relations, Corporate Communication and Sustainability departments. She joined the Itaú Unibanco Group in 1997, working at Unibanco’s Legal Advisory Department, where she carried out legal services at all business and institutional departments. Ms. Melo was elected Deputy Officer in 2008. She has held several positions at the Itaú Unibanco Group, including Officer (2009 to 2015) and Executive Officer (2015 to 2021). She is also an Officer and a Member of the Board of Directors at W.I.L.L. – Women in Leadership in Latin America (a nongovernmental organization with international coverage focused on improving the individual and collective value of women in leadership positions in Latin America). In 2000 and 2001, Ms. Melo worked in the Project Finance and Securities Departments of the Debevoise & Plimpton firm in New York. She holds a Bachelor’s degree in Law from the Universidade de São Paulo (USP), São Paulo, Brazil, and attended a Specialization course on Financial Law and Capital Markets from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Brazil, and on Fundamentals of Business Law from the New York University, New York, U. S., and attended the Fellows Program from the IWF World Leadership Conference and Gala, Atlanta, Georgia, U.S., from the Harvard Business School,Cambridge, Massachusetts, U.S. nd fromthe INSEAD, Fontainebleau, France. Adriano Cabral Volpini—162.572.558 -21

Adriano Cabral Volpini, a Partner of Itaú Unibanco, has been Corporate Security Officer and Chief Security Officer (CSO) at the Itaú Unibanco Group since 2012. He has held several positions at the Itaú Unibanco Group, including Superintendent of Prevention of Unlawful Acts (2005 to 2012); Manager of Prevention of Unlawful Acts (2004 to 2005); Inspection Manager (2003); Inspector (1998 to 2003); Auditor (1996 to 1997) and in the Branch Operation Department (1991 to 1996). He also holds management positions in several companies of the Itaú Unibanco Group. He holds a Bachelor’s degree in Social Communication and a postgraduate degree in Accounting and Financial Administration, both from the Fundação Armando Álvares Penteado (FAAP), São Paulo, Brazil and an MBA in Finance from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Brazil. Luciana Nicola Scheneider—270.049.978 -63 Luciana Nicola Schneider, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2022. She has held several positions at the Itaú Unibanco Group, including Superintendent of Institutional Relations, Sustainability and New Business (2018 to 2021) and Superintendent of Government and Institutional Relations (2009 to 2018). She worked as a Social Responsibility Manager (2004 to 2009) at Instituto Unibanco S.A. and at the Endomarketing department at Unibanco S.A. (1997 to 2004). Ms. Schneider was also a Member of the Steering Committee (2005 to 2007) at Associação Junior Achievement of the São Paulo State. She holds a Bachelor’s degree in Law from the Universidade São Judas Tadeu, São Paulo, Brazil, and postgraduate degrees in Semiotics from the Pontifícia Universidade Católica de São Paulo (PUC-SP), São Paulo, Brazil and in Leadership and Public Management from the Centro de Liderança Pública – CLP and Center on the Legal Profession at Harvard Business School, Cambridge, Massachusetts, USA. Alexsandro Broedel—031.212.717 -09 Alexsandro Broedel, a Member of the Partners Program, has been an Officer of the Executive Committee and CFO since 2021, having held the position of Group Executive Finance Director (2015 to 2020) and Head of Investor Relations (2017 to 2020) at the Itaú Unibanco Group. He joined the Itaú Unibanco Group in 2012 as the Finance and Control Officer. Mr. Broedel has previously served as an Officer at the Comissão de Valores Mobiliários (CVM). He is a Full Professor at FEA-USP and Trustee of the IFRS Foundation. He holds a Bachelor’s degrees in Accounting and Law from the Universidade de São Paulo (USP), São Paulo, Brazil. He holds a Ph.D. in Accounting and Finance from the Manchester Business School, Manchester, United Kingdom, and is a Chartered Management Accountant (FCMA, CGMA), London, United Kingdom. Renato Lulia Jacob—118.058.578 -00 Renato Lulia Jacob has been a Partner and an Officer at the Itaú Unibanco Group, concurrently acting as the Group Head of Investor Relations and Market Intelligence since 2020. He has been a Member of the Disclosure and Trading Committee since 2019, having served as its Chairman since 2020. Mr. Jacob has been at the Itaú Unibanco Group for 19 years, having held several positions, including CEO and Member of the Board of Directors at Itau BBA International plc, in the United Kingdom, and Member of the Boards of Directors at Itau International, in the U.S., and Itau Suisse, in Switzerland (2016 to 2020), a Managing Director of Banco Itau Argentina S.A. (2006 to 2010) and a Managing Director, Head of CIB Europe (2011 to 2015). He has been an Independent Member of the Boards of the Royal Institution of Great Britain, Fight For Peace International, and the Brazilian Chamber of Commerce in Great Britain, in the United Kingdom. He holds a Bachelor’s degree in Civil Engineering from the Universidade de São Paulo (USP), São Paulo, Brazil, and has attended the Advanced Management Program and taken part in the CEO Academy, both from The Wharton School of the University of Pennsylvania, Philadelphia, U.S. Milton Maluhy Filho—252.026.488 -80 Milton Maluhy Filho, a Partner, has been a Chief Executive Officer at the Itaú Unibanco Group since 2021, having served as a CFO and a CRO as well. Mr. Maluhy has held several positions at the Itaú Unibanco Group, including Vice President (2019 to 2020) and CEO of Itaú CorpBanca (Chile) (2016 to 2018), being responsible for the merger of two banks, CorpBanca and Banco Itaú Chile. He joined the Itaú Unibanco Group in 2002 and was elected Officer in 2007. He holds a Bachelor’s degree in Business Administration. Alexandre Grossmann Zancani—288.246.148 -84 Alexandre Grossmann Zancani, a Member of the Partners Program, has been an Officer of the Executive Committee at the Itaú Unibanco Group since 2021, having held the position of Executive Officer at the Itaú Unibanco Group (2019 to 2021). He was a Digital Business, Data, New Undertakings and Innovation Officer (2017 to 2019), a Risk Officer – Individuals and Consumers (2015 to 2017), an Executive Credit Superintendent at Santander – Individuals and Financing Companies (2013 to 2015), an Executive Credit Superintendent at Santander – Individuals (2012 to 2013) at Santander (Brazil), an Executive Credit and Collection Superintendent (2009 to 2012) at Santander Cards and a Member of the Board of Directors (2017 to 2018) at Banco PSA Finance Brasil S.A. He holds a Bachelor’s degree in Computer Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil and an MBA from the INSEAD, Fontainebleau, France. André Luís Teixeira Rodrigues—799.914.406 -15 André Luís Teixeira Rodrigues, has been a Partner since 2010 and a Member of the Executive Committee at the Itaú Unibanco Group since 2021. He is currently responsible for the Retail Banking segment, which includes Itaú Branches, Uniclass, Personnalité, Companies departments, Government and Payroll segments, and is also responsible for the Insurance, Products and Strategic Planning – Individuals and Companies, CRM, Digital Channels and User Experience (UX) departments. He joined the Itaú Unibanco Group in 2000 and has been an Officer since 2005. He was an Executive Officer from 2008 and 2020, having worked at Banco Itaú BBA from its creation in 2003 to 2018 and at the Retail Banking segment as from 2019. He holds a Bachelor’sdegree in MechanicalEngineeringwithmajorinAutomationand Systems (“Mechatronics”) from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil. Renato da Silva Carvalho—033.810.967 -61

Renato da Silva Carvalho, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2020. He is currently responsible for the Wholesale Banking’s Financial Planning department. Mr. Carvalho has held several positions at the Itaú Unibanco Group, including Finance Superintendent, Wholesale Banking (2017 to 2020) and Market and Liquidity Risk Superintendent/Manager (2010 to 2017). He worked as Investment Market Risk Associate Director (2008 to 2010) at Fidelity International LTD (London, United Kingdom), Market Risk Associate Director (2006 to 2008) at Mizuho International LTD (London, United Kingdom), and Market and Liquidity Risk Analyst (1998 to 2006) at Banco Brascan S.A. (Rio de Janeiro, Brazil). He holds a Bachelor’s degree in Production Engineering from the Universidade Federal do Rio de Janeiro (UFRJ), Rio de Janeiro, Brazil; an Executive MBA in Finance from the Instituto Brasileiro de Mercado de Capitais (IBMEC), Brazil; an MBA in System Analysis, Project and Management from the Pontifícia Universidade Católica do Rio de Janeiro (PUC-RJ), Rio de Janeiro, Brazil; and a M.Sc.in Production Engineering from the Universidade Federal do Rio de Janeiro (UFRJ), Rio de Janeiro, Brazil; and he has attended the Executive Program from the Fundação Dom Cabral, Minas Gerais, Brazil. He is a certified Professional Risk Manager (PRM) by the Professional Risk Management International Association (PRMIA) and a Financial Risk Manager (FRM) by the Global Association of Risk Professionals (GARP). Paulo Sergio Miron—076.444.278 -30 Paulo Sergio Miron, a Member of the Partners Program, has been the Officer responsible for internal audit (CAE – statutory audit committee) at the Itaú Unibanco Group since 2015. He has been an Officer at the Instituto Unibanco and the Fundação Itaú para Educação e Cultura, a Member of the Fiscal Council at the Fundação Maria Cecilia Souto Vidigal, of the Fiscal Council at Instituto Lemann and of the Fiscal Council at the Fundação Nova Escola, and a Coordinator of the Audit Committee at Zup Tecnologia. Mr. Miron has served as a financial specialist at the Audit Committee of Porto Seguro and XP. With over 28 years of experience in independent auditing, he was a partner at PricewaterhouseCoopers (PwC)—Brazil (1996 to 2014) responsible for the audit work at large Brazilian financial conglomerates, the Brasília office in Distrito Federal (DF), and both the government services and the banking departments. Mr. Miron also coordinated the PwC Brazil’s department of training at financial institutions for over ten years, and worked as a college professor teaching financial market-related courses. He is a speaker at many seminars on governance, auditing and financial market issues. He holds a Bachelor’s degrees in Economics from the Universidade Presbiteriana Mackenzie, São Paulo, Brazil and in Accounting from the Universidade São Judas Tadeu, São Paulo, Brazil. Teresa Cristina Athayde Marcondes Fontes—307.447.828 -48 Teresa Cristina Athayde Marcondes Fontes, a Member of the Partners Program, joined the Itaú Unibanco Group in 2003. She worked until 2017 at the legal advisory to institutional and business departments and, from 2017 to 2019, she was responsible for the Conglomerate’s Compliance, Retail Banking and Labor segments, including as a liaison with a number of regulatory bodies. She was elected Officer in 2019 and has been responsible for the Civil Litigation Office. She holds a Bachelor’s degree in Law from the Faculdade de Direito da Universidade de São Paulo (USP), São Paulo, Brazil; a post-graduate degree in Commercial Law from the University of Paris, Panthéon Sorbonne, Paris, France; an MBA from the Fundação Dom Cabral, São Paulo, Brazil; a post-MBA from the Kellogg School of Management at Northwestern University, Illinois, U.S., and has attended the Executive Education Program from the Fundação Dom Cabral, São Paulo, Brazil. Daniel Sposito Pastore—283.484.258 -29 Daniel Sposito Pastore, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2020. He has held several positions at the Itaú Unibanco Group, including Legal Superintendent working at the labor, criminal, union relations, higher courts, labor advisory and WMS areas (2012 to 2020); Legal Manager, WMS, working at the International, Asset and Brokerage departments (2008 to 2011), Legal Lawyer, WMS (2004 to 2008); Lawyer, Banking Law (2002 to 2003), and Legal Assistant (M&A Legal) (2000 to 2002). Mr. Pastore served at the Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais (ANBIMA) as an effective Member of the Legal Committee (2012 to 2016), having served as Vice President (2015 to 2016); Coordinator and Liaison on behalf of ANBIMA with the Comissão de Valores Mobiliários (CVM) for issuing and implementing new rules on suitability, asset management and trust management and investment funds (2014 to 2016), and Coordinator of the revision of self-regulation codes for trust management, asset management and investment funds (2015 to 2016). He has been a Member of the legal labor committee (since 2017) and a Member of the union negotiation committee (since 2020) at the Federação Brasileira de Bancos (FEBRABAN). He holds a Bachelor’s degree in Law from the Universidade Presbiteriana Mackenzie, São Paulo, Brazil, and a post-graduate degree in Financial and Capital Markets Law from the Instituto de Ensino e Pesquisa (INSPER), São Paulo, Brazil. José Virgilio Vita Neto – 223.403.628 -30 José Virgilio Vita Neto, a Member of the Partners Program, has been an Officer at the Itaú Unibanco Group since 2011, being currently responsible for Tax Advisory and Litigation, Corporate Legal departments, in addition to the Legal Advisory of all Business departments of the General Retail Banking Office. He joined the Itaú Unibanco Group in 2000, working as a lawyer until 2003, being responsible for the Wholesale Banking Legal Consulting department, particularly structured operations and real estate loans. Mr. Vita Neto worked as Legal Manager (2003 to 2008), being responsible for the Wholesale Banking Legal department, particularly structured operations, real estate loans, foreign exchange, derivatives and project finance, retail legal advisory and administrative and investigative proceedings, including those related to consumer protection bodies. He also acted as Legal Superintendent (2008 to 2011), responsible for retail legal advisory, administrative and investigative proceedings, litigation for major cases and public-interest civil actions. He holds a Bachelor’s degree in Law from the Universidade de São Paulo (USP), São Paulo, Brazil; Master’s degree in Civil Law – Contracts from the Universidad de Salamanca – Spain; Ph.D. in Civil Law – Contracts from the Universidade de São Paulo (USP) São Paulo, Brazil, and has attended the Authentic Leadership Development Program from the Harvard Business School, Boston, U.S. Candido Botelho 393139-00108Aug22 19:10Page 25 Bracher—039.690.188 -38

Candido Botelho Bracher (Non-Executive Member) has been a Member of the Board of Directors at the Itaú Unibanco Group since 2021. He has held several positions at the Itaú Unibanco Group, including CEO (2017 to 2021), Wholesale Banking Senior Vice President (“Diretor Geral”) (2015 to 2017) and Vice President (2004 to 2015). Mr. Bracher has been a Member of the Board of Directors of Mastercard Incorporated since 2021 and was a Member of the Board of Directors (2009 to 2014) of BM&FBOVESPA S.A. – Bolsa de Valores, Mercadorias e Futuros (currently B3 S.A. – Brasil, Bolsa, Balcão), an Alternate Member of the Board of Directors (1999 to 2005), and a Member of the Board of Directors (2005 to 2013) of Pão de Açúcar – Companhia Brasileira de Distribuição. He holds a Bachelor’s degree in Business Administration from the Fundação Getulio Vargas (FGV), São Paulo, Brazil. Frederico Trajano Inácio Rodrigues—253.929.608 -47 Frederico Trajano Inácio Rodrigues (Independent Member) has been a Member of the Board of Directors at the Itaú Unibanco Group since 2020. He has been the Chief Executive Officer (CEO) of Magazine Luiza S.A. since 2016, having been an Executive Sales and Marketing Officer (2010 to 2015), a Commercial Officer, and was also in charge of the Marketing Office (2004 to 2010). He started his career in 2000, being responsible for the E-Commerce department. Mr. Rodrigues has been an Effective Member of the Board of Directors of Luizaseg Seguros S.A. since 2005, and worked in the retail and consumer goods departments at Deutsche Bank Securities (1998 to 1999). He holds a Bachelor’s degree in Business Administration from the Fundação Getulio Vargas (FGV), São Paulo, Brazil, and attended the Program for Executives from the University of California, Stanford, U.S. Fábio Colletti Barbosa—771.733.258 -20 Fábio Colletti Barbosa (Independent Member) has been a Member of the Board of Directors at the Itaú Unibanco Group since 2015. He has been a Member of the Board of Directors of Natura Group since 2017; a Member of the Board of Directors of Companhia Brasileira de Metalurgia e Mineração (CBMM) since 2015; and a Member of the Board of Directors of Ambev since 2021. He was CEO (2011 to 2014) at Abril Comunicações S.A.; Chairman of the Board of Directors (2011) at Banco Santander (Brazil) S.A.; CEO (2008 to 2010) at Banco Santander S.A.; and CEO (1996 to 2008) at Banco ABNAMRO/Real S.A. Mr. Barbosa also served as Chairman of the Board of Directors of Fundação OSESP (2012 to 2019), and is currently a Board Member at UN Foundation (U.S.) since 2011; a Member of the Board of Directors of Instituto Empreender Endeavor since 2008 (Chairman since 2015); and a Member of the Investment Committee of Gávea Investimentos since 2015. He holds a Bachelor’s degree in Business Administration from the Fundação Getulio Vargas (FGV), São Paulo, Brazil and a Master’s degree in Business Administration from the Institute for Management Development (IMD), Lausanne, Switzerland. Pedro Luiz Bodin de Moraes—548.346.867 -87 Pedro Luiz Bodin de Moraes (Independent Member) has been a Member of the Board of Directors at the Itaú Unibanco Group since 2003. He has been a partner at Cambuhy Investimentos Ltda. since 2011 and at Ventor Investimentos Ltda. since 2009. He was an Officer (2002 to 2003) and a Partner (2005 to 2014) at Icatu Holding S.A.; and an Officer and a Partner (1993 to 2002) at Banco Icatu S.A. Mr. Bodin de Moraes also served as a Monetary Policy Officer at the Banco Central do Brasil (1991 to 1992) and as an Officer at Banco Nacional de Desenvolvimento Econômico e Social (BNDES) (1990 to 1991). He holds a Bachelor’s and Master’s degrees in Economics from the Pontifícia Universidade Católica do Rio de Janeiro (PUC-RJ), Rio de Janeiro, Brazil, and a Ph.D. in Economics from the Massachusetts Institute of Technology (MIT), Cambridge, Massachusetts, U.S. Maria Helena dos Santos Fernandes de Santana—036.221.618 -50 Maria Helena dos Santos Fernandes de Santana (Independent Member) has been a Member of the Board of Directors at the Itaú Unibanco Group since 2021. She was a Member of the Audit Committee between 2014 and 2020. She has been a Member of the Board of Directors and Coordinator of the People, Appointment and Governance Committee at Oi S.A. since 2018, a Member of the Board of Directors and Chairwoman of the Audit Committee at CI&T Inc., and a Member of the Board of Directors at Fortbras S.A. She was a Member of the Board of Directors (2018 to 2019) and the Chairwoman of the Audit Committee at XP Inc. between 2019 and 2021, having previously served as the Chairwoman of the Audit Committee at XP Investimentos S.A. (2018 to 2019). Ms. Santana served as a Member of the Board of Directors at Bolsas y Mercados Españoles (BME) (2016 to 2020), a Member of the Board of Trustees at the IFRS Foundation (2014 to 2019), a Member of the Board of Directors and Chairwoman of the Corporate Governance Committee at Companhia Brasileira de Distribuição S.A. (2013 to 2017), a Member of the Board of Directors and Audit Committee Coordinator at Totvs S.A. (2013 to 2017), a Member of the Board of Directors at CPFL Energia S.A. (2013 to 2015), Chairwoman (2007 to 2012) and Officer (2006 to 2007) of the Brazilian Securities and Exchange Commission (CVM).She represented CVM at the Financial Stability Board (FSB) (2009 to 2012). She was Chairwoman of the Executive Committee at the International Organization of Securities Commissions (IOSCO) (2011 to 2012), and also a Member of the International Integrated Reporting Committee (IIRC) in the same period. She worked at the Bolsa de Valores de São Paulo (currently B3 S.A. – Brasil, Bolsa, Balcão) (1994 to 2006), where she was involved in the set-up and was responsible for the implementation of the New Market and other corporate governance segments. Ms. Santana was Vice President of the Instituto Brasileiro de Governança Corporativa (IBGC) (2004 to 2006), having been a Member of its Board of Directors between 2001 and 2006. She has been a Member of the Latin-American Roundtable on Corporate Governance (OECD) (since 2000). She holds Bachelor’sdegree in Economics from theFac ldadede Economia, Administração, Cont bilidade e Atuária of the Universidade de São Paulo (FEA-USP) São Paulo, Brazil. Pedro Moreira Salles—551.222.567 -72

Pedro Moreira Salles (Non-Executive Co-Chairman) has been a Co-Chairman of the Board of Directors at the Itaú Unibanco Group since 2017, and he was also the Chairman of the Board of Directors (2009 to 2017) and Executive Vice President (2008 to 2009). He has held several positions at the Itaú Unibanco Group, including CEO (2004 to 2008). He serves as the Chairman of the Board of Directors at Instituto Unibanco; Board of Directors at the Federação Brasileira de Bancos (FEBRABAN); Board of Directors at Companhia Brasileira de Metalurgia e Mineração (CBMM); and Board of Directors at Alpargatas S.A. He is also a Member of the Decision-Making Council, the INSPER’s Board of Associates, and the Board of Directors at Fundação Osesp. He holds a Bachelor’s degree, magna cum laude, in Economics and History from the University of California, Los Angeles (UCLA), U.S. He holds a Master’s degree in International Relations from the Yale University and he has attended the OPM – Owner/President Management Program at the Harvard University, both in the United States. Ricardo Villela Marino—252.398.288 -90 Ricardo Villela Marino (Non-Executive Vice President) has been a Vice President of the Board of Directors at the Itaú Unibanco Group since 2020. He was also a Member of the Board of Directors (2008 to 2020) and the Chairman of the bank’s Latin America Strategic Council since 2018. He has held several positions at the Itaú Unibanco Group since 2002, including Vice President (2010 to 2018). He has also been an Alternate Member of the Board of Directors of Itaúsa S.A. since 2011; a Member of the Strategy and New Business Committee since 2021; a Member of the Sustainability Council since 2019, and he was a Member of the Investment Policies Committee (2008 to 2011); an Alternate Member of the Board of Directors of Dexco S.A. since 2009; an Alternate Member of the Board of Directors of Itautec S.A. (2009 to 2019) and an Alternate Member of the Board of Directors of Elekeiroz S.A. (2009 to 2018). He holds a Bachelor’s degree in Mechanical Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil and a Master’s degree in Business Administration from the MIT Sloan School of Management, Cambridge, Massachusetts, U.S. Alfredo Egydio Setubal—014.414.218 -07 Alfredo Egydio Setubal (Non-Executive Member) has been a Member of the Board of Directors at the Itaú Unibanco Group since 2007. He has held several positions at the Itaú Unibanco Group, including Vice President (1996 to 2015), Investor Relations Officer (1995 to 2015), Executive Officer (1993 to 1996), and Managing Director (1988 to 1993). He has been a Member of the Nomination and Corporate Governance Committee since 2009, a Member of the Personnel Committee and the Risk and Capital Management Committee since 2015, a Member of the Environmental, Social and Climate Responsibility Committee since 2019 (formerly called Social Responsibility Committee), and he was a Member of the Accounting Policies Committee (2008 to 2009). He has been the CEO and Investor Relations Officer at Itaúsa S.A. since 2015, Vice Chairman of the Board of Directors since 2008, a Member of the Disclosure and Trading Committee since 2009, having been Coordinator to this Committee since 2015, a Member of the Investment Policies Committee (2008 to 2011), Coordinator of the Investment Committee and a Member of the Finance, the Personnel and Ethics, and the Sustainability and Risks committees since 2017. Mr. Setubal has been a Member of the Board of Directors and of the Strategy Committee at Alpargatas S.A. since 2017, a Member of the Board of Directors since 2015, Co-chairman of the Board since 2017 and a Member of the Personnel, Governance and Nomination Committee since 2015 at Duratex S.A. He has been Chairman of the Board of Trustees since 2008 at the Fundação Itaú para Educação, a Member of the Board of Directors of the Museu de Arte Moderna de São Paulo (MAM) since 1992 and of the Instituto de Arte Contemporânea. He has been Vice Chairman of the Board of Directors at the Fundação Bienal de São Paulo since 2017 (and a Member since 2009) and Chairman of the Decision-Making Council at the Museu de Arte de São Paulo (MASP) since 2018. He has a Member of the Superior Guidance, Nomination and Ethics Committee since 2010 at the Instituto Brasileiro de Relações com Investidores – IBRI, having been Chairman of the Board of Directors (1999 to 2009). Mr. Setubal also served as a Member of the Board of Directors at the Associação Brasileira das Companhias Abertas (ABRASCA) (1999 to 2017) and Vice Chairman of the Board of Directors at the Instituto Itaú Cultural (2005 to 2019), having worked as a Board Member (1993 to 2005), Executive Vice President (2005 to 2019) and an Executive Officer (1996 to 2005). He holds Bachelor’s and Postgraduate degrees in Business Administration, both from the Fundação Getulio Vargas (FGV), São Paulo, Brazil, with specialization from INSEAD, Fontainebleau, France. Roberto Egydio Setubal—007.738.228 -52 Roberto Egydio Setubal (Non-Executive Co-Chairman) has been a Co-Chairman of the Board of Directors at the Itaú Unibanco Group since 2017. He was also the Vice Chairman of the Board of Directors (2003 to 2017) and CEO (1994 to 2017). He has held several positions at the Itaú Unibanco Group, including Senior Vice President (“Diretor Geral”) (1990 to 1994). He has served as Vice Chairman of the Board of Directors and a Member of the Strategy and New Business Committee of Itaúsa S.A. since 2021 and was Managing Vice President (1994 to 2021) and Chairman of the Accounting Policies Committee (2008 to 2011). Since 1994 he has been a Member of the Board of the International Monetary Conference. He was President of the Federação Nacional dos Bancos (FENABAN) and of the Federação Brasileira de Bancos (FEBRABAN) (1997 to 2001) and President of the Advisory Board of the Federação Brasileira de Bancos (FEBRABAN) (2008 to 2017). In 2000, Mr. Setubal became a Member of the Trilateral Commission and the International Board of the NYSE and in 2002 he became a Member of the International Advisory Committee of the Federal Reserve Bank of New York. In 2010, he became a Member of the China Development Forum. He holds a Bachelor’s degree in Production Engineering from the Escola Politécnica da Universidade de São Paulo (USP), São Paulo, Brazil and a Master of Science degree in Engineering from the Stanford University, California, U.S. João Moreira Salles—2 -.52 . 08-58