Form 6-K D-MARKET Electronic Serv For: May 23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

Date of Report: May 23, 2022

Commission File Number: 001-40553

D-MARKET Elektronik Hizmetler ve Ticaret Anonim Şirketi

(Exact Name of registrant as specified in its charter)

D-MARKET Electronic

Services & Trading

(Translation of Registrant’s Name into English)

Kuştepe Mahallesi Mecidiyeköy Yolu

Cadde no: 12 Kule 2 K2

Istanbul, Turkey

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| D-MARKET ELECTRONIC SERVICES & TRADING | ||

| May 23, 2022 | By: | /s/ MEHMET MURAT EMIRDAĞ |

| Name: | Mehmet Murat Emirdağ | |

| Title: | Chief Executive Officer | |

| By: | /s/ HALIL KORHAN ÖZ | |

| Name: | Halil Korhan Öz | |

| Title: | Chief Financial Officer |

EXHIBITS

Exhibit 99.1

Hepsiburada Announces 2021 Annual General Assembly

ISTANBUL, May 23, 2022 - D-MARKET Electronic Services & Trading (d/b/a "Hepsiburada”) (NASDAQ: HEPS), a leading Turkish e-commerce platform, will hold its 2021 Annual General Assembly on Wednesday, June 24, 2022 at 14.00 İstanbul time at the Company’s headquarters at Kuştepe Mahallesi, Mecidiyeköy Yolu Caddesi, No:12 Trump Towers Kule:2 Şişli, İstanbul.

Holders of the Company's American Depositary Shares (the "ADSs") who wish to exercise their voting rights for the underlying shares must act through the depositary of the Company's ADS program, The Bank of New York Mellon.

The agenda of the Annual General Assembly consists of the following items in accordance with the relevant provisions of the Turkish Commercial Code and the Regulation on Principles and Procedures for General Assembly Meetings of Joint Stock Companies and Ministry Representatives in Such Meetings (the “Regulation”) governing agenda of ordinary general assembly meetings:

| 1. | Opening and election of the General Assembly Meeting Chairmanship; |

| 2. | Giving authority to General Assembly Meeting Chairmanship to sign the minutes of the meeting; |

| 3. | Review and discussion of the Board of Director's Annual Report and Independent Auditor's Report for 2021, as required under the Regulation; |

| 4. | Review, discussion and ratification of the 2021 financial statements, as required under the Regulation; |

| 5. | Release of the members of the Board of Directors for their respective activities in the 2021 financial year, as required under the Regulation; |

| 6. | Decision on the appropriation of 2021 net profit, as required under the Regulation; |

| 7. | Deciding about the members of the Board of Directors’ due to their membership of the Board of Directors and Committees remuneration and the rights such as attendance, premium and bonus, as required under the Regulation; |

| 8. | Approval of appointment of Halil Cem Karakaş, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Mehmet Erol Çamur’s resignation as a director, as required under the TCC and the Regulation, |

Approval of appointment of Ahmet Fadıl Ashaboğlu, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Halil Korhan Öz’s resignation as a director, as required under the TCC and the Regulation,

Approval of appointment of Tayfun Bayazıt, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Mustafa Aydemir’s resignation as a director as required under the TCC and the Regulation;

| 9. | Appointment of the Independent Auditor for the year 2022, as required under the Regulation; |

| 10. | As required under the TCC, empowerment of members of the Board of Directors, in connection with carrying out an activity which is a commercial transaction falling under the scope of the Company’s business either on their own or on a third party's account as well as becoming a partner with unlimited liability at a company that is engaged in the same type of commercial transactions, as referred to Article 396 of the TCC; |

| 11. | Approval of indemnification primarily by the Company to the fullest extent permissible by law of all the losses that may arise due to the responsibilities of the Board Members and the Executive Committee Members due to their duties as well as of the signing of the indemnification agreements between the Company and each Board Member and each Executive Committee Member as agreed by the Board of Directors, within the framework of the director liability insurance policy; |

| 12. | To determine the upper limit for the aid and donations to be made until the next Ordinary General Assembly meeting of the Company as 2 per thousands of the total net assets of the Company and approve the authorization of the Board of Directors within this context; |

| 13. | Closing. |

Explanatory notes on the agenda items along with the copies of certain materials related to the Annual General Assembly will be made available on the Company’s investor relations website https://investors.hepsiburada.com/ as of May 23, 2022.

About Hepsiburada

Hepsiburada is a leading e-commerce technology platform in Turkey, combining a globally proven e-commerce business model with a one-stop 'Super App' to cater to our customers' everyday needs and to help make people's daily lives better. Customers can access a broad range of products and services including same-day delivery of groceries and essentials, products from international merchants, airline tickets and payment services through our embedded digital wallet, Hepsipay. As at the end of December 2021, we had seamlessly connected 41.8 million members and 75 thousand Active Merchants.

Founded in Istanbul in 2000, Hepsiburada was built to lead the digitalization of commerce in Turkey. As a female-founded organization, we are committed to meaningful action to empower women. Through our 'Technology Empowerment for Women Entrepreneurs' programme, we have reached around 29 thousand female entrepreneurs across Turkey to date.

Investor Relations Contact

Media Contact

Exhibit 99.2

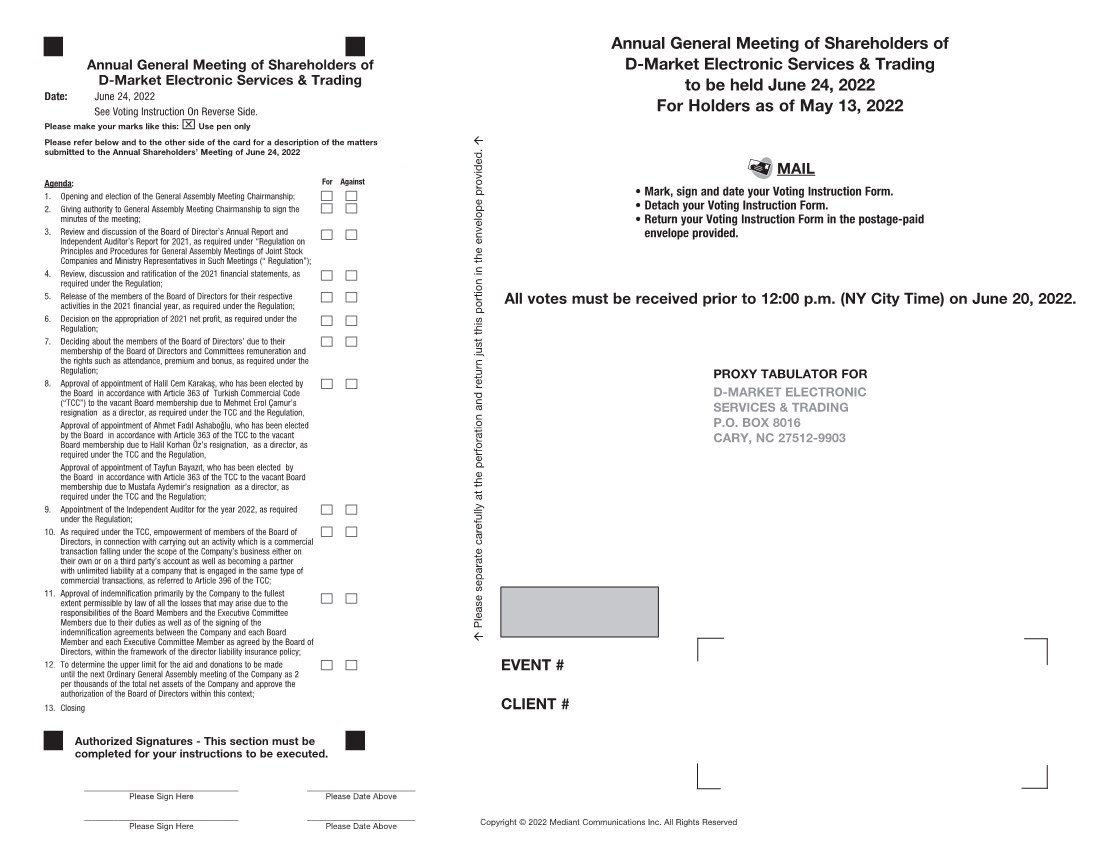

| 20282 D-Market Electronic Services VIF Proof 6 Annual General Meeting of Shareholders of D-Market Electronic Services & Trading Date: June 24, 2022 See Voting Instruction On Reverse Side. Please make your marks like this: x Use pen only Please refer below and to the other side of the card for a description of the matters submitted to the Annual Shareholders’ Meeting of June 24, 2022 Mark, sign and date your Voting Instruction Form. Detach your Voting Instruction Form. Return your Voting Instruction Form in the postage-paid envelope provided. MAIL Annual General Meeting of Shareholders of D-Market Electronic Services & Trading to be held June 24, 2022 For Holders as of May 13, 2022 All votes must be received prior to 12:00 p.m. (NY City Time) on June 20, 2022. Copyright © 2022 Mediant Communications Inc. All Rights Reserved _____________________________________ __________________________ Please Sign Here Please Date Above _____________________________________ __________________________ Please Sign Here Please Date Above Please separate carefully at the perforation and return just this portion in the envelope provided. Authorized Signatures - This section must be completed for your instructions to be executed. EVENT # CLIENT # PROXY TABULATOR FOR D-MARKET ELECTRONIC SERVICES & TRADING P.O. BOX 8016 CARY, NC 27512-9903 Agenda: 1. Opening and election of the General Assembly Meeting Chairmanship; 2. Giving authority to General Assembly Meeting Chairmanship to sign the minutes of the meeting; 3. Review and discussion of the Board of Director’s Annual Report and Independent Auditor’s Report for 2021, as required under “Regulation on Principles and Procedures for General Assembly Meetings of Joint Stock Companies and Ministry Representatives in Such Meetings (“ Regulation”); 4. Review, discussion and ratification of the 2021 financial statements, as required under the Regulation; 5. Release of the members of the Board of Directors for their respective activities in the 2021 financial year, as required under the Regulation; 6. Decision on the appropriation of 2021 net profit, as required under the Regulation; 7. Deciding about the members of the Board of Directors’ due to their membership of the Board of Directors and Committees remuneration and the rights such as attendance, premium and bonus, as required under the Regulation; 8. Approval of appointment of Halil Cem Karakaş, who has been elected by the Board in accordance with Article 363 of Turkish Commercial Code (“TCC”) to the vacant Board membership due to Mehmet Erol Çamur’s resignation as a director, as required under the TCC and the Regulation, Approval of appointment of Ahmet Fadıl Ashaboğlu, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Halil Korhan Öz’s resignation, as a director, as required under the TCC and the Regulation, Approval of appointment of Tayfun Bayazıt, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Mustafa Aydemir’s resignation as a director, as required under the TCC and the Regulation; 9. Appointment of the Independent Auditor for the year 2022, as required under the Regulation; 10. As required under the TCC, empowerment of members of the Board of Directors, in connection with carrying out an activity which is a commercial transaction falling under the scope of the Company’s business either on their own or on a third party’s account as well as becoming a partner with unlimited liability at a company that is engaged in the same type of commercial transactions, as referred to Article 396 of the TCC; 11. Approval of indemnification primarily by the Company to the fullest extent permissible by law of all the losses that may arise due to the responsibilities of the Board Members and the Executive Committee Members due to their duties as well as of the signing of the indemnification agreements between the Company and each Board Member and each Executive Committee Member as agreed by the Board of Directors, within the framework of the director liability insurance policy; 12. To determine the upper limit for the aid and donations to be made until the next Ordinary General Assembly meeting of the Company as 2 per thousands of the total net assets of the Company and approve the authorization of the Board of Directors within this context; 13. Closing Directors Recommend For Against |

| 20282 D-Market Electronic Services VIF Proof 6 D-Market Electronic Services & Trading Instructions to The Bank of New York Mellon, as Depositary (Must be received prior to 12:00 p.m. (NY City Time) on June 20, 2022) The undersigned registered holder of American Depositary Receipts hereby requests and instructs The Bank of New York Mellon, as Depositary, to endeavor, in so far as practicable, to vote or cause to be voted the amount of shares or other Deposited Securities represented by such Receipt of D-Market Electronic Services & Trading registered in the name of the undersigned on the books of the Depositary as of the close of business May 13, 2022 at the Annual General Meeting of D-Market Electronic Services & Trading to be held on June 24, 2022 in Istanbul. NOTES: 1. Please direct the Depositary how it is to vote by placing X in the appropriate box opposite the resolution. PROXY TABULATOR FOR D-MARKET ELECTRONIC SERVICES & TRADING P.O. BOX 8016 CARY, NC 27512-9903 (Continued and to be marked, dated and signed, on the other side) |

Exhibit 99.3

D-MARKET ELEKTRONİK HİZMETLER VE TİCARET A.Ş.

(D-MARKET ELECTRONIC SERVICES AND TRADING)

EXPLANATORY NOTES ON THE AGENDA AND INFORMATION ABOUT THE ANNUAL GENERAL

ASSEMBLY OF THE SHAREHOLDERS OF D-MARKET

TO BE HELD ON JUNE 24, 2022

As per the decision of the Board of Directors of D-Market Elektronik Hizmetler ve Ticaret A.Ş. (“D-Market” or the “Company”) dated May 20, 2022, shareholders in D-Market (“D-Market shareholders”) are invited to attend the Annual General Assembly Meeting of Shareholders (the “General Assembly”) to be held on June 24, 2022, at 14:00 (local time) at Kuştepe Mahallesi Mecidiyeköy Yolu Caddesi No:12 Trump Towers Kule:2 Kat:2 Şişli/İstanbul.

Agenda of the General Assembly and Other Information

| 1. | Opening and election of the General Assembly Meeting Chairmanship |

In accordance with the “Turkish Commercial Code” no. 6102 (“TCC”), the “Regulation on the Principles and Procedures for General Assembly Meetings of Joint Stock Companies and the Representatives of the Ministry Attending Such Meetings” (“Regulation”), D-Market’s Articles of Association and the “Internal Directive on the Working Principles of the General Assembly”, the Chairmanship of the General Assembly shall be elected by shareholders.

| 2. | Giving authority to General Assembly Meeting Chairmanship to sign the minutes of the meeting |

In accordance with the TCC and Regulation the shareholders attending the General Assembly shall vote to authorize the Chairmanship to keep minutes of the General Assembly and sign them.

| 3. | Review and discussion of the Board of Director's Annual Report and Independent Auditor's Report for 2021, as required under the Regulation |

In accordance with the provisions of the TCC, D-Market shareholders may obtain the Company’s Annual Activity Report prepared by the Board of Directors from the Company’s headquarters free of charge or download from https://investors.hepsiburada.com/ website. Additionally, D-Market shareholders may obtain the independent auditors’ report prepared by Güney Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. (Ernst and Young) from the Company headquarters free of charge or from https://investors.hepsiburada.com/ website.

| 4. | Review, discussion and ratification of the 2021 financial statements, as required under the Regulation |

According to Article 28 of D-Market’s Articles of Association, D-Market’s accounting period starts on the first day of January and ends on the last day of December. Within this framework, the financial statements of the Company for the period between January 1,2021 and December 31, 2021 shall be read and submitted for the approval of the shareholders attending the General Assembly. D-Market shareholders may obtain these documents from the Company’s headquarters or from https://investors.hepsiburada.com/ website.

| 5. | Release of the members of the Board of Directors for their respective activities in the 2021 financial year, as required under the Regulation |

As per the provisions of the TCC, release of the members of the Board of Directors from liability for their activities in connection with their service on the Board of Directors for the 2021 financial year shall be submitted for the approval of the shareholders attending the General Assembly.

| 6. | Decision on the appropriation of 2021 net profit, as required under the Regulation |

In view of there not having been any profit for the fiscal year ended December 31, 2021, according to the statement of comprehensive loss of the Company for that period, the Board of Directors proposes to the shareholders attending the General Assembly to approve its determination not to distribute any dividend.

| 7. | Deciding about the members of the Board of Directors’ due to their membership of the Board of Directors and Committees remuneration and the rights such as attendance, premium and bonus, as required under the Regulation |

The Board of Directors proposes that the shareholders attending the General Assembly approve the following remuneration, premium, bonus and other rights of the members of the Board of Directors due to their independent membership of the Board of Directors and Committees:

| ● | 100,000 USD annual gross payment to independent board members |

| ● | 20,000 USD annual gross payment to chairpersons of the committees |

| ● | 10,000 USD annual gross payment to the other independent members of the committees |

Remuneration for the Chairperson and board members due to their membership of the Board of Directors and Committees* will be decided in line with Article 394 of TCC and Article 15 of D-Market’s Articles of Association.

| 8. | Approval of appointment of Halil Cem Karakaş, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Mehmet Erol Çamur’s resignation as a director, as required under the TCC and the Regulation, |

Approval of appointment of Ahmet Fadıl Ashaboğlu, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Halil Korhan Öz’s resignation as a director, as required under the TCC and the Regulation,

Approval of appointment of Tayfun Bayazıt, who has been elected by the Board in accordance with Article 363 of the TCC to the vacant Board membership due to Mustafa Aydemir’s resignation as a director as required under the TCC and the Regulation

The resumes of Mr. Karakaş, Mr. Ashaboğlu and Mr. Bayazıt are as below:

Mr. Cem Karakaş, 47, is an industrial restructuring leader in global snacking industry. He has led large scale restructuring and growth programs in biscuit and chocolate industries building and rationalizing several dozen manufacturing plants around the world as well as leading omni-channel market entry programs. Latest, Dr. Karakaş was the founding CEO of Pladis, the largest European biscuit player and one of the largest snacking companies globally. Prior to that Dr Karakaş held CEO and CFO roles in Yıldız Group and Erdemir Group of Turkey. Dr Karakaş is the executive chairman Aran Ard Teoranta and Rudi’s Organic, the fastest growing European and North American free-from bakery players. Dr Karakaş has a Bachelor’s degree in management from Middle East Technical University, Master’s degree in business administration in finance from Massachusetts Institute of Technology and a Doctorate degree in finance from Istanbul University.

*Committee: Audit Committee, Corporate Governance Committee and Risk Committee

Mr. Ahmet Ashaboğlu, 51, holds a BSc degree from Tufts University and a Master of Science degree from Massachusetts Institute of Technology (MIT), both in Mechanical Engineering. He began his career as a Research Assistant at MIT in 1994, followed by various positions in capital markets within UBS Warburg, New York (1996-1999). After serving as a management consultant at McKinsey & Company, New York (1999-2003), Ahmet Ashaboğlu moved back to Turkey and joined Koç Holding as Finance Group Coordinator in 2003. He was appointed as Group Chief Financial Officer at Koç Holding in 2006 and served in that position until April 2022. Ahmet Ashaboğlu is currently a board member of Mavi, Yapı Kredi Bank, Koç Financial Services, Koç Finansman and Sirena Marine.

Mr. Tayfun Bayazıt, 64, started his banking career at Citibank in 1983 after having received a BS degree in Mechanical Engineering (1980) and an MBA from Columbia University, New York, (Finance and International Business - 1983).He subsequently worked in executive positions within Cukurova Group for 13 consecutive years (Yapı Kredi as Senior EVP and Executive Committee Member, Interbank as CEO, Banque de Commerce et de Placements S.A. Switzerland as President and CEO). In 1999, he was appointed as Vice Chairman of Doğan Holding and an Executive Director of Disbank. In 2001 he assumed the CEO position at Disbank. In 2003, he was also appointed Chairman and was requested to remain as CEO of Fortis Turkey and the region in July 2005 after its acquisition. Subsequently, he was elected as Chairman of Fortis in 2006.Mr. Bayazıt came back to Yapı Kredi in 2007 (at which time Yapı Kredi was owned by a joint venture of the UniCredit and the Koç Group) as CEO and two years later he was elected as Chairman. He served as chairman of all Yapı Kredi subsidiaries including Yapı Kredi Sigorta (property and casualty insurance) and Yapı Kredi Emeklilik (private pension and life) for 4 years. Yapı Kredi was the fourth largest high street bank in Turkey with subsidiaries in Holland, Bahrain and Russia, actively involved in mortgage lending among other individual banking activities with a strong digital focus.Mr. Bayazıt left this post in August 2011 to set up his own firm “Bayazit Consulting Services.” He was then elected as the Country Chairman for MarshMcLennan Group (Marsh, Mercer and Oliver Wyman exist in Turkey) in September 2012 and serves on the board of directors of MLP Care (healthcare) and Coca Cola Icecek (bottling and distribution) as an independent director. He is also a board member at Aydem Enerji and Boyner companies. He is a member of TUSIAD (Turkish Industrialists and Businessmen Association) High Advisory Board and takes an active role in other non-governmental organizations such as the World Resources Institute, Corporate Governance Association of Turkey. He is a member of the board of trustees of Bosphorus University and Turkish Education Volunteers Foundation.

| 9. | Appointment of the Independent Auditor for the year 2022, as required under the Regulation |

The shareholders attending the General Assembly shall vote on the appointment of Güney Bağımsız Denetim ve Serbest Muhasebeci Mali Müşavirlik A.Ş. (Ernst & Young) as auditor of the fiscal year 2022 accounts, as per the proposal of the Board of Directors and Audit Committee.

| 10. | As required under the TCC, empowerment of members of the Board of Directors, in connection with carrying out an activity which is a commercial transaction falling under the scope of the Company’s business either on their own or on a third party's account as well as becoming a partner with unlimited liability at a company that is engaged in the same type of commercial transactions, as referred to Article 396 of the TCC |

In accordance with Article 396 of the Turkish Commercial Code entitled “Prohibition on Competing”, which states empowerment of members of the Board of Directors, in connection with carrying out an activity which is a commercial transaction falling under the scope of the Company’s business either on their own or on a third party's account as well as becoming a partner with unlimited liability at a company that is engaged in the same type of commercial transactions is required and, Board members may engage in transactions described in Article 396 only with the approval of the majority of the shareholders attending the General Assembly. In line with these regulations, such authorizations for the members of Board of Directors shall be submitted to the approval of shareholders attending the General Assembly.

| 11. | Approval of indemnification primarily by the Company to the fullest extent permissible by law of all the losses that may arise due to the responsibilities of the Board Members and the Executive Committee Members due to their duties as well as of the signing of the indemnification agreements between the Company and each Board Member and each Executive Committee Member as agreed by the Board of Directors, within the framework of the director liability insurance policy |

Further details regarding the director liability insurance policy can be found on the page 116, via the below mentioned link.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001850235/000110465922054726/heps-20211231x20f.htm

| 12. | To determine the upper limit for the aid and donations to be made until the next Ordinary General Assembly meeting of the Company as 2 per thousands of the total net assets of the Company and approve the authorization of the Board of Directors within this context |

The upper limit of 0.2 per cent of the total net assets of the Company for the aid and donations to be made until the next ordinary (i.e. annual) General Assembly meeting of shareholders as approved by the Board of Directors shall be submitted to the approval of the shareholders attending the General Assembly.

| 13. | Closing |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Adevinta (ASA) publishes its 2023 Annual Report

- CTT Systems AB (publ.) - Interim Report First Quarter 2024

- Completion of capital reduction in Spar Nord Bank A/S

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share