Form 6-K Adecoagro S.A. For: Apr 20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April 2022

Commission File Number: 001-35052

Adecoagro S.A.

(Translation of registrant’s name into English)

Vertigo Naos Building 6,

Rue Eugene Ruppert,

L-2453, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes No

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes No

Indicate by check mark whether by furnishing the information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

#95656109v2

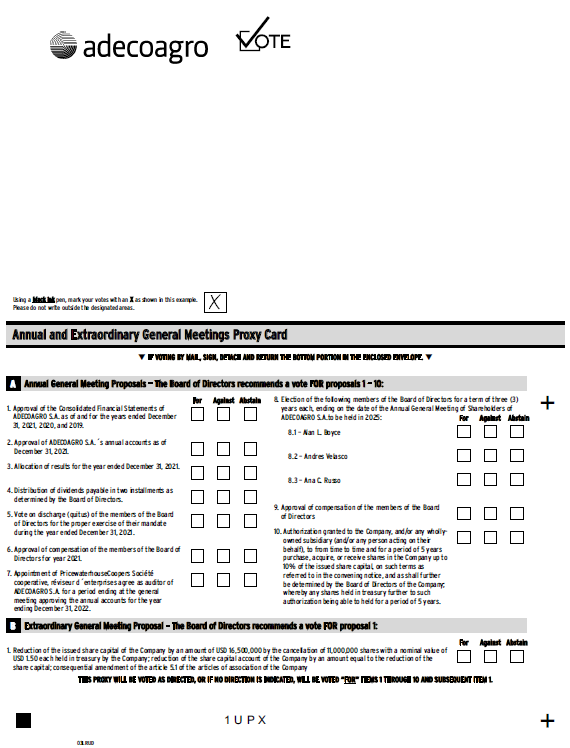

ANNUAL GENERAL MEETING OF SHAREHOLDERS

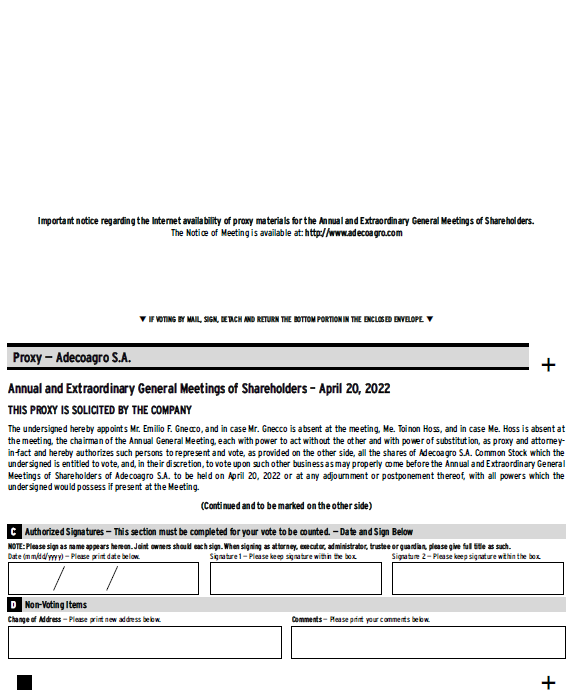

This Report of Foreign Private Issuer on Form 6-K (this “Form 6-K”) is being furnished by Adecoagro S.A. (“Adecoagro” or the “Company”) with the Securities and Exchange Commission (the “SEC”) to provide shareholders with important information concerning the Annual General Meeting of Shareholders (the “AGM”) to be held on April 20, 2022 at 10:00 am (CET) and the Extraordinary General Meeting of Shareholders (the “EGM”) to be held on April 20, 2022, immediately after the AGM, at Vertigo Naos Building, 6 Rue Eugène Ruppert, L - 2453 Luxembourg.

The Company is attaching to this Form 6-K: (i) the convening notice and agenda for the AGM and EGM, together with the voting instructions, and (ii) a copy of the proxy card to vote any shares by proxy.

Shareholders of record on March 7, 2022 may vote their shares and submit a proxy card by following the instructions provided with the proxy materials mailed to them on or about March 17, 2022.

Shareholders may submit questions in advance by contacting our investor relations department at (5411) 4836-8651 or ir@adecoagro.com.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Adecoagro S.A. | ||||||||||||||||||||

| Date: April 12, 2022 | By: | /s/ Emilio Gnecco | ||||||||||||||||||

| Name: | Emilio Gnecco | |||||||||||||||||||

| Title: | Chief Legal Officer | |||||||||||||||||||

#95656109v2

Exhibit 99.1

Adecoagro S.A.

Société Anonyme

Vertigo Naos Building

6, Rue Eugène Ruppert

L - 2453 Luxembourg

R.C.S. Luxembourg: B 153.681

(the “Company”)

Convening Notice to the

Annual General Meeting of Shareholders (the “AGM”)

to be held on April 20, 2022, at 10:00 a.m. (CET) and

Extraordinary General Meeting of Shareholders (the “EGM”)

to be held on April 20, 2022, right thereafter the AGM

at Vertigo Naos Building, 6 Rue Eugène Ruppert, L - 2453 Luxembourg

Dear Shareholders,

The Board of Directors of Adecoagro S.A. (the “Board”) is pleased to invite you to attend the Annual General Meeting of Shareholders of Adecoagro S.A. to be held on April 20, 2022 at 10:00 a.m. (CET) at the registered office of the Company in Luxembourg and the Extraordinary General Meeting of Shareholders of Adecoagro S.A. to be held on April 20, 2022 immediately after the AGM at the registered office of the Company in Luxembourg, with the following agendas:

A.Agenda for the Annual General Meeting of Shareholders

1.Approval of the Consolidated Financial Statements as of and for the years ended December 31, 2021, 2020, and 2019.

The Board of Directors of the Company recommends a vote FOR approval of the Company’s consolidated financial statements as of December 31, 2021, 2020 and 2019, after due consideration of the reports from each of the Board and the independent auditor on such consolidated financial statements. The consolidated balance sheets of the Company and its subsidiaries and the related consolidated income statements, consolidated statements of changes in shareholders’ equity, consolidated cash flow statements and the notes to such consolidated financial statements, the report from the independent auditor on such consolidated financial statements and management’s discussion and analysis on the Company’s results of operations and financial condition are included in the Company’s 2021 annual report, a copy of which is available on Company’s website at www.adecoagro.com. Copies of the Company’s 2021 annual report are also available free of charge at the Company’s registered office in Luxembourg, between 10:00 a.m. and 5:00 p.m., Luxembourg time.

2.Approval of the Company’s annual accounts as of December 31, 2021.

The Board recommends a vote FOR approval of the Company’s annual accounts as of December 31, 2021, after due consideration of the Board’s management report and the report from the independent auditor on such annual accounts. These documents are included in the Company’s 2021 annual report, a copy of which is available on

1

#95656111v2

our website at www.adecoagro.com. Copies of the Company’s 2021 annual report are also available free of charge at the Company’s registered office in Luxembourg, between 10:00 a.m. and 5:00 p.m., Luxembourg time.

3.Allocation of results for the year ended December 31, 2021.

The Consolidated Financial Statements show a gain of USD 130,714,132 and the statutory solus account of the Company under Luxembourg GAAP show a loss of USD 3,902,971 on a standalone basis. The Board recommends a vote FOR the carry forward of such loss.

4.Distribution of dividends payable in two installments as determined by the Board of Directors.

The Board noted that on November 9, 2021, the Board approved the implementation of a distribution policy as of 2022 (the “Distribution Policy”) to distribute annually a minimum of 40% of the Adjusted Free Cash from Operations generated during the previous year, subject to the conditions set forth by Luxembourg law. The Distribution Policy consists of a cash dividend distribution and share repurchases under the existing program from time to time as deemed appropriate.

Considering the Company has sufficient distributable reserves and subject to the conditions set forth by Luxembourg law, the Board recommends a vote FOR the declaration of a dividend of an amount of USD 35,000,000 to be paid to the outstanding shares in two installments of USD 17,500,000 each (in May 2022 and November 2022), and to delegate power to the Board of Directors to determine the record dates and the payment dates therefor.

5.Vote on discharge (quitus) of the members of the Board of Directors for the proper exercise of their mandate during the year ended December 31, 2021.

In accordance with applicable Luxembourg law and regulations, it is proposed that, upon approval of the Company’s annual accounts as of December 31, 2021, all who were members of the Board during the year 2021, be discharged from any liability in connection with the management of the Company’s affairs during such year.

The Board recommends a vote FOR the discharge (quitus) of the members of the Board of Directors for the proper exercise of their mandate during the year ended December 31, 2021.

6. Approval of compensation of members of the Board of Directors for year 2021.

The compensation of the Company’s directors is approved annually at the ordinary general shareholders’ meeting.

The Board informs that the compensation to our directors approved at the Annual General Meeting held on April 21, 2021 (the “AGM 2021”) was allocated as follows:

| Name | Cash USD | Restricted Shares | ||||||

| Plínio Musetti | 70,000 | 7,861 | ||||||

| Alan Leland Boyce | 50,000 | 7,861 | ||||||

| Andrés Velasco | 70,000 | 7,861 | ||||||

| Mark Schachter | 70,000 | 7,861 | ||||||

| Guillaume van der Linden | 50,000 | 7,861 | ||||||

| Mariano Bosch (*) | - | - | ||||||

| Daniel González | 70,000 | 7,861 | ||||||

| Ivo Andrés Sarjanovic | 70,000 | 7,861 | ||||||

| Alejandra Smith | 50,000 | 7,861 | ||||||

| Total approved AGM 2021 | 500,000 | 62,888 | ||||||

| Total actually allocated | 500,000 | 62,888 | ||||||

(*) Mr. Mariano Bosch declined and therefore did not receive his fees neither in cash nor in restricted shares.

The Board recommends a vote FOR the allocation of compensation of directors for year 2021.

2

#95656111v2

7.Appointment of PricewaterhouseCoopers Société Coopérative, réviseur d’entreprises agréé as auditor of the Company for a period ending at the general meeting approving the annual accounts for the year ending December 31, 2022.

The Board recommends a vote FOR the re-appointment of PricewaterhouseCoopers Société Coopérative, réviseur d’entreprises agréé as auditor of the Company for a term ending for a period ending at the general meeting approving the annual accounts for the year ending December 31, 2022.

8.Election of the following members of the Board of Directors: (i) Mr. Alan L. Boyce, Mr. Andrés Velasco and Mrs. Ana Cristina Russo, for a term of three (3) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2025.

The Directors are appointed by the General Meeting of Shareholders for a period of up to three (3) years; provided however the Directors shall be elected on a staggered basis, with one third (1/3) of the Directors being elected each year and provided further that such three year term may be exceeded by a period up to the annual general meeting held following the third anniversary of the appointment. The Directors shall be eligible for re-election indefinitely.

The Board recommends a vote FOR the re-election of Mr. Alan L. Boyce and Mr. Andres Velasco, and the election of Mrs. Ana Cristina Russo, each as member of the Board, for a term of three (3) years each, ending the date of the Annual General Meeting of Shareholders of the Company to be held in year 2025.

The Board affirmatively determined that Mr. Alan L. Boyce, Andrés Velasco and Mrs. Ana Cristina Russo qualify as independent directors in accordance with NYSE standards.

Set forth below is a summary biographical information of each of the candidates:

Alan L. Boyce. Mr. Boyce is a co-founder of Adecoagro and has been a member of the Company’s board of directors since 2002 and has been Chairman of the Risk and Commercial Committee since 2011. Mr. Boyce is co-founder and Chairman of Materra LLC, a California based owner and operator of 15,000 acres of farmland where it grows pistachios, dates, citrus and organic vegetables. Since 1985, Mr. Boyce has served as the Chief Financial Officer of Boyce Land Co. Inc., a farmland management company that runs 10 farmland limited partnerships in the United States. Mr. Boyce is co-founder and CEO of Westlands Solar Farms, the only farmer-owned utility scale solar PV developer in California and recently co-founded Prairie Harvest, which is developing hemp-processing technologies to efficiently separate CBD in the field. Mr. Boyce formerly served as the director of special situations at Soros Fund Management from 1999 to 2007, where he managed an asset portfolio of the Quantum Fund and had principal operational responsibilities for the fund’s investments in South America. Mr. Boyce also served as managing director at the Community Reinvestment Act at Bankers Trust from 1986 to 1999 where he was in charge of fixed-income arbitrage proprietary trading, the bank’s mortgage portfolio and compliance. In addition, Mr. Boyce was senior managing director for investment strategy at Countrywide Financial from 2007 to 2008 and worked at the U.S. Federal Reserve Board from 1982 to 1984. He graduated with a degree in Economics from Pomona College, and has a Masters in Business Administration from Stanford University. Mr. Boyce is an American citizen.

Andres Velasco. Mr. Velasco has been a member of the Company’s board of directors since 2011. Mr. Velasco was the Minister of Finance of Chile between March 2006 and March 2010 and was also the president of the Latin American and Caribbean Economic Association from 2005 to 2007. Prior to entering the government sector, Mr. Velasco was Sumitomo-FASID Professor of Development and International Finance at Harvard University’s John F. Kennedy School of Government, an appointment he had held since 2000. From 1993 to 2000, he was Assistant and then Associate Professor of Economics and the director of the Center for Latin American and Caribbean Studies at New York University. During 1988 to 1989, he was Assistant Professor at Columbia University. Currently Mr. Velasco serves as Adjunct Professor of Public Policy at Harvard University, and a Tinker Visiting Professor at Columbia University. He also performs consulting services on various economic matters rendering economic advice to an array of clients, including certain of our shareholders. Mr. Velasco has been appointed Dean of New School of Public Policy at London School of Economics. Mr. Velasco holds a Ph.D. in economics from Columbia University and was a postdoctoral fellow in political economy at Harvard University and the Massachusetts Institute of Technology. He received a B.A. in economics and philosophy and an M.A. in international relations from Yale University. Mr. Velasco is a Chilean citizen.

Ana Cristina Russo. Mrs. Russo graduated in business administration from Fundação Getúlio Vargas, São Paulo, Brazil. She joined Unilever as a Trainee in 1989 and worked directly with the brand and category managers supporting them on strategic planning, marketing & sales programs definitions. While doing well at Unilever, she left the company five years later to join Remy Cointreau, where she was CFO Brazil very early in her career and with responsibility for finance, HR, IT, Legal, and Export/Import. In 1996, a former Unilever colleague recommended her to Kraft (at the time, part of PMI). Mrs. Russo joined as FP&A for one of Kraft’s BUs. Since then and over twenty years, she has built a highly successful career with Philip Morris. Mrs. Russo

3

#95656111v2

had several enriching experiences within the finance functions, i.e. Treasurer, Controller, Finance Director Brazil, Director Financial Planning Easter Europe, Middle East & Africa, VP Finance LA&C and VP Corporate Audit. She is currently serving as Managing Director for Central America, Dominican Republic and Caribe, responsible for full P&L of this new cluster, with direct presence in nine countries and indirect in the remaining twenty-four. Mrs. Russo is Brazilian and Italian citizen.

9.Approval of compensation of members of the Board of Directors for year 2022.

The compensation of the Company’s directors is approved annually at the ordinary general shareholders’ meeting.

The proposed aggregate compensation to our directors for year 2022 amounts to up to USD 500,000 and a grant of restricted shares (out of the treasury shares) of up to an aggregate amount of 75,904 shares under the Adecoagro’s Amended and Restated Restricted Share and Restricted Stock Unit Plan, as amended, allocated as follows:

| Name | Cash USD | Restricted Shares | ||||||

| Plínio Musetti | 70,000 | 9,488 | ||||||

| Alan Leland Boyce | 50,000 | 9,488 | ||||||

| Andrés Velasco | 70,000 | 9,488 | ||||||

| Mark Schachter | 70,000 | 9,488 | ||||||

| Guillaume van der Linden | 50,000 | 9,488 | ||||||

| Mariano Bosch (*) | - | - | ||||||

| Daniel González | 70,000 | 9,488 | ||||||

| Ana Cristina Russo | 50,000 | 9,488 | ||||||

| Ivo Andrés Sarjanovic | 70,000 | 9,488 | ||||||

(*) Mr. Mariano Bosch declined and therefore will not receive his fees neither in cash nor in restricted shares.

The Board recommends a vote FOR the proposed compensation of directors for year 2022.

10.Authorization under article 430-15 of the Luxembourg law of August 10, 1915, granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to from time to time and for a period of five (5) years purchase, acquire, or receive shares in the Company up to ten per cent (10%) of the issued share capital, on such terms as referred to below, and as shall further be determined by the Board of Directors of the Company; whereby any shares held in treasury further to such authorization being able to held for a period of five (5) years.

The Board noted that in relation with the implementation of the Company’s buyback program, the annual general meeting of the shareholders of the Company held on April 21, 2021, resolved to renew the authorization to the Board to hold and buy back shares of the Company within the limit of ten per cent (10%) of the issued share capital of the Company.

The Board noted that the Company is about to reach the 10% threshold of shares bought under the buyback program which are in turn held in treasury. The Board therefore resolved to propose to the shareholders of the Company (i) to cancel all or a portion of the shares held in treasury (and reduce the share capital), cancellation which will be addressed and resolved upon by the EGM convened right thereafter this AGM; and (ii) to provide a new authorization to purchase, acquire, or receive shares in the Company up to ten per cent (10%) of the issued share capital of the Company for a period of five (5) years; whereby any shares held in treasury further to such authorization being able to held for a period of five (5) years.

In furtherance thereof, the Board of Directors of the Company recommends a vote FOR the approval of a new authorization under article 430-15 of the Luxembourg law of August 10, 1915, granted to the Company, and/or any wholly-owned subsidiary (and/or any person acting on their behalf), to from time to time and for a period of five (5) years purchase, acquire, or receive shares in the Company up to ten per cent (10%) of the issued share capital, on such terms as referred to below, and as shall further be determined by the Board of Directors of the Company; whereby any shares held in treasury further to such authorization being able to held for a period of five (5) years.

Acquisitions may be made in any manner including without limitation, by tender or other offer(s), buyback program(s), over the stock exchange or in privately negotiated transactions or in any other manner as determined by the Board of Directors (including derivative transactions or transactions having the same or similar economic effect than an acquisition).

In the case of acquisitions for value:

4

#95656111v2

(i)in the case of acquisitions other than in the circumstances set forth under (ii), for a net purchase price being (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the closing price, as reported by the New York City edition of the Wall Street Journal, or, if not reported therein, any other authoritative source to be selected by the Board of Directors of the Company (the “Closing Price”), over the ten (10) trading days preceding the date of the purchase (or as the case may be the date of the commitment to the transaction);

(ii)in case of a tender offer (or if deemed appropriate by the Board of Directors, a buyback program),

a.in case of a formal offer being published, for a set net purchase price or a purchase price range, each time within the following parameters: (x) no less than fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over the ten (10) trading days preceding the publication date, provided however that if the stock exchange price during the offer period fluctuates by more than 10 %, the Board of Directors may adjust the offer price or range to such fluctuations;

b.in case a public request for sell offers is made, a price range may be set (and revised by the Board of Directors as deemed appropriate) provided that acquisitions may be made at a price which is no less than (x) fifty per cent of the lowest stock price and (y) no more than fifty per cent above the highest stock price, in each case being the Closing Price over a period determined by the Board of Directors provided that such period may not start more than five (5) trading days before the sell offer start date of the relevant offer and may not end after the last day of the relevant sell offer period.

B.Agenda for the Extraordinary General Meeting of Shareholders

1. Reduction of the issued share capital of the Company by an amount of sixteen million five hundred thousand United States Dollars (USD 16,500,000) by the cancellation of 11,000,000 (eleven million) shares with a nominal value of one United States Dollar and fifty cents (USD 1.50) each held in treasury by the Company; reduction of the share capital account of the Company by an amount equal to the reduction of the share capital; consequential amendment of the article 5.1 of the articles of association of the Company.

The Board recommends a vote FOR the approval of: (i) the reduction of the issued share capital of the Company by an amount of sixteen million five hundred thousand United States Dollars (USD 16,500,000) by the cancellation of 11,000,000 (eleven million) shares with a nominal value of one United States Dollar and fifty cents (USD 1.50) each held in treasury by the Company; (ii) the reduction of the share capital account of the Company by an amount equal to the reduction of the share capital; and (iii) the consequential amendment of the article 5.1 of the articles of association of the Company, so as to now read as follows:

“5.1. The Company has an issued share capital of one hundred and sixty-seven million seventy-two thousand seven hundred and twenty-two US Dollars and fifty cents (USD 167,072,722.50) represented by a total of one hundred and eleven million three hundred and eighty-one thousand eight hundred and fifteen (111,381,815) fully paid Shares, each with a nominal value of one US Dollar and fifty cents (USD 1.50), with such rights and obligations as set forth in the present Articles.”

***************

Each of the items to be voted on the AGM will be passed by a simple majority of the votes validly cast, irrespective of the number of Shares represented.

Quorum for EGM shall be at least one-half of the issued share capital of the Company. If said quorum is not present, a second meeting may be convened at which there shall be no quorum requirement. Each of the items to be voted on the EGM will be passed by a two thirds (2/3) majority of the votes validly cast.

Any shareholder who holds one or more shares(s) of the Company on March 7, 2022 (the “Record Date”) shall be admitted to the meetings and may attend the meetings in person or vote by proxy. Shareholders who have sold their Shares between the Record Date and the date of the meetings cannot attend the meetings or vote by proxy. In case of breach of such prohibition, criminal sanctions may apply.

Holders who have withdrawn their shares from DTC between April 15, 2022, and the date of the meetings should contact the Company in advance of the date of the meetings at 6, Rue Eugène Ruppert, L-2453 Luxembourg, or at Av. Fondo de la Legua 936, B1640EDO |

5

#95656111v2

Martínez, Pcia de Buenos Aires, Argentina, to make separate arrangements to be able to attend the meetings or vote by proxy.

Attached to this notice is a proxy card, which you will need to complete in order to vote your Shares by proxy. Proxy cards must be received by the tabulation agent no later than 3:00 p.m. New York City Time on April 19, 2022, in order for such votes to count.

Please consult the Company’s website as to the procedures for attending the meetings or to be represented by way of proxy. A copy of this notice is also available on the Company’s website.

Copies of the Consolidated Financial Statements as of and for the years ended December 31, 2021, 2020, and 2019 of the Company and the Company’s annual accounts as of December 31, 2021 together with the Company´s 2021 annual report, relevant management and audit reports are available on the Company’s website www.adecoagro.com and may also be obtained free of charge at the Company’s registered office in Luxembourg.

Yours faithfully

The Board of Directors

6

#95656111v2

Procedures for Attending the meetings and Voting by Proxy

Any shareholder who holds one or more shares(s) of the Company on March 7, 2022 (the “Record Date”) shall be admitted to the meetings and may attend the meetings in person, through their duly appointed attorneys or vote by proxy. Attorneys must properly evidence their powers to represent a shareholder by a valid power-of-attorney, which should be filed no later than April 19, 2022, at the address indicated below.

In the case of Shares owned by a corporation or any other legal entity, individuals representing such entity who wish to attend the meetings in person and vote at the meetings on behalf of such entity, must present evidence of their authority to attend and vote at the meetings, by means of a proper document (such as a general or special power-of-attorney) issued by the respective entity. A copy of such power of attorney or other proper document should be filed not later than April 19, 2022, at any of the addresses indicated below.

Address for filing powers-of-attorney:

Adecoagro S.A.

Vertigo Naos Building,

6 Rue Eugène Ruppert,

L – 2453, Luxembourg

Attention: Emilio Gnecco

To vote by proxy, holders of Shares will need to complete proxy cards. Proxy cards must be received by the tabulation agent at the return address indicated on the proxy cards, Computershare Shareowner Services LLC, P.O. Box 43101, Providence, RI 02940, no later than 3:00 p.m. New York City Time on April 19, 2022, in order for such votes to count.

If you hold your shares through a brokerage account, please contact your broker to receive information regarding how you may vote your shares.

7

#95656111v2

Exhibit 99.2

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Nel ASA: Hy Stor Energy places gigawatt capacity reservation for Mississippi Clean Hydrogen Hub

- Dimensional Fund Advisors Ltd. : Form 8.3 - DS SMITH PLC - Ordinary Shares

- Form 8.5 (EPT/RI) - Mattioli Woods

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share