impose liquidity fees and redemption gates. The

Fund’s Board of Directors has determined that the Fund will not be subject to the liquidity fee and redemption gate provisions of Rule 2a-7, although the Board may elect to impose liquidity fees or redemption gates in the future.

The Fund is a money market fund and seeks to maintain a

stable share price of $1.00. In order to do this, the Fund must follow rules of the Securities and Exchange Commission (“SEC”) as to the liquidity, diversification and maturity of its investments.

Investors will be given at least 60 days’ written

notice in advance of any change to the Fund’s 80% investment policy set forth above.

Principal Risks of Investing in the Fund

You could lose money by investing in the Fund. Although the

Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The

Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

The following is a summary of the principal risks of investing

in the Fund.

Credit Risk. The Fund may suffer losses if the issuer of a fixed income security owned by the Fund is unable to make interest or principal payments. Credit risk is expected to be low for the Fund because of its investment in U.S.

Government securities.

Interest Rate Risk. While the Fund will invest primarily in short-term securities, you should be aware that the value of the Fund’s investments may be subject to changes in interest rates. A decline in interest rates will generally

affect the Fund’s yield as these securities mature or are sold and the Fund purchases new short-term securities with lower yields. Generally, an increase in interest rates causes the value of a debt instrument to decrease. The change in value

for shorter-term securities is usually smaller than for securities with longer maturities. Because the Fund invests in securities with short maturities and seeks to maintain a stable net asset value of $1.00 per share, it is possible, though

unlikely, that an increase or

decrease in interest rates would change the value of your investment in

the Fund. In addition, when interest rates are very low, the Fund’s expenses could absorb all or a significant portion of the Fund’s income, and, if the Fund’s expenses exceed the Fund’s income, the Fund may be unable to

maintain its $1.00 share price. The Fund may be subject to a greater risk of rising interest rates due to the current period of historically low rates and the effect of potential government fiscal policy initiatives and resulting market reaction to

these initiatives.

Repurchase Agreements Risk. Repurchase agreements are agreements in which the seller of a security to the Fund agrees to repurchase that security from the Fund at a mutually agreed upon price and date. Repurchase agreements carry the risk that the

counterparty may not fulfill its obligations under the agreement. This could cause the Fund’s income and the value of the Fund to decline.

U.S. Government Obligations Risk. U.S. Treasury obligations are backed by the “full faith and credit” of the U.S. Government and are generally considered to have low credit risk. Unlike U.S. Treasury obligations, securities issued or

guaranteed by federal agencies or authorities and U.S. Government-sponsored instrumentalities or enterprises may or may not be backed by the full faith and credit of the U.S. Government and are therefore subject to greater credit risk than

securities issued or guaranteed by the U.S. Treasury.

Performance Information

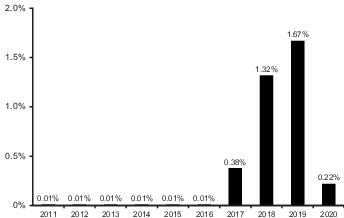

The following Risk/Return Bar Chart and Table illustrate

the risks of investing in the Fund by showing changes in the Fund’s performance from calendar year to calendar year and comparing the Fund’s average annual returns to those of the FTSE Treasury Bill 3 Month Index. Prior to September

28, 2016, the Fund operated as a prime money market fund and invested in certain types of securities that the Fund is no longer permitted to hold as part of its principal investment strategy. Consequently, the performance information below may have

been different if the current investment limitations had been in effect during the period prior to the Fund’s conversion to a government money market fund. Fees and expenses incurred at the contract level are not reflected in the bar chart or

table. If these amounts were reflected, returns would be less than those shown. Of course, past

Tweet

Tweet Share

Share