Form 497K RIVERPARK FUNDS TRUST

Summary Prospectus |

January 26, 2023 |

RiverPark Long/Short Opportunity Fund

Retail Class Shares (Ticker Symbol: RLSFX)

* Class C Shares are not currently being offered for sale to investors. |

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus and other information about the Fund online at http://www.riverparkfunds.com/how-to-invest. You may also obtain this information at no cost by calling 1-888-564-4517 or by sending an e-mail request to [email protected]. The Fund’s statutory prospectus (“Prospectus”) and statement of additional information (“SAI”), both dated January 26, 2023, are incorporated by reference into this Summary Prospectus. |

|

Investment Objective

The RiverPark Long/Short Opportunity Fund (“RiverPark Long/Short” or the “Fund”) seeks long-term capital appreciation while managing downside volatility.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. The Fund does not charge any fees paid directly from your investment (including those commonly described as Load or Sales Charges). You may, however, be required to pay commissions and/or other forms of compensation to a broker for transactions in Institutional Class Shares or Retail Class Shares, which are not reflected in the tables or the examples below. Shares of the Fund are available in other share classes that have different fees and expenses.

Shareholder Fees (fees paid directly from your investment) |

Retail |

Institutional |

Class C |

Maximum Sales Charge (Load) Imposed on Purchases |

None |

None |

None |

Maximum Deferred Sales Charge (Load) |

None |

None |

None |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None |

None |

None |

Redemption Fee |

None |

None |

None |

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Retail |

Institutional |

Class C |

Management Fees |

1.50% |

1.50% |

1.50% |

Distribution and Service (12b-1) Fees |

None |

None |

1.00% |

Shareholder Servicing Fees1 |

0.25% |

None |

None |

Administrative Fees1 |

0.14% |

0.09% |

0.09% |

Other Expenses2 |

0.15% |

0.16% |

0.16% |

Total Annual Fund Operating Expenses |

2.04% |

1.75% |

2.75% |

Fee Waiver and/or Expense Reimbursement3 |

-0.04% |

— |

— |

Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement |

2.00% |

1.75% |

2.75% |

|

1 |

Estimate based on current asset levels for the Retail Class Shares and Institutional Class Shares. |

|

2 |

Other Expenses, which include administration, transfer agency and custodian fees, is an estimate based on current asset levels for the Retail Class Shares and Institutional Class Shares. Other Expenses for the Class C Shares are based on the estimated Other Expenses of the Institutional Class Shares. |

1

|

3 |

The Adviser has agreed contractually to waive its fees and to reimburse expenses of the Fund, including expenses associated with the Fund’s shareholder services plan and administrative services plan, to the extent necessary to ensure that operating expenses (excluding acquired fund fees and expenses and extraordinary expenses) do not exceed, on an annual basis, 2.00% for the Retail Class Shares, 1.85% for the Institutional Class Shares and 2.85% for the Class C Shares of the Fund’s average net assets. This agreement is in effect until at least January 31, 2024, and, subject to annual approval by the Board of Trustees of RiverPark Funds Trust, this arrangement will remain in effect unless and until the Board of Trustees approves its modification or termination or the Adviser notifies the Fund at least 30 days prior to the annual approval of its determination not to continue the agreement. This agreement may be terminated with 90 days’ notice by a majority of the independent members of the Board or a majority of the Fund’s outstanding shares. |

Example

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

|

1 Year |

3 Years |

5 Years |

10 Years |

Retail |

$ 203 |

$ 636 |

$ 1,095 |

$ 2,366 |

Institutional |

$ 178 |

$ 551 |

$ 949 |

$ 2,062 |

Class C |

$ 278 |

$ 853 |

$ 1,454 |

$ 3,080 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the example, affect the Fund’s performance. During the fiscal year ended September 30, 2022, the Fund’s portfolio turnover rate was 51% of the average value of its portfolio.

Principal Investment Strategies

RiverPark Long/Short Opportunity Fund seeks long-term capital appreciation while managing downside volatility by investing long in equity securities that RiverPark believes have above-average growth prospects and selling short equity securities the Adviser believes are competitively disadvantaged over the long term. The Fund invests primarily in the securities of U.S. companies, but it may also invest outside the U.S. The Fund limits its investments in the securities of foreign issuers to no more than 15% of its assets. The equity securities in which the Fund invests are primarily common stocks. The Fund may invest in the equity securities of issuers with small, medium or large market capitalizations.

The Fund is an opportunistic long/short investment fund. The Fund’s investment goal is to achieve above average rates of return with less volatility and less downside risk as compared to U.S. equity markets. The Fund seeks to accomplish its objective through in depth, long-term, fundamental research. The Fund focuses its research on what the Adviser believes to be the dominant secular, economic and demographic changes in society. The Adviser seeks to identify the industries and companies most affected, positively or negatively, by these changes. On the long side, the Adviser seeks to identify those companies that the Adviser believes have strong growth prospects, best in class management teams, strong pricing power, large market opportunities and high returns on capital. The Adviser uses a fundamental research driven approach to identify those industries and companies with the strongest growth prospects for revenue, earnings and/or cash flow over the medium and long term and seeks to buy stock in companies at attractive valuations. In addition, on the short side, the Adviser seeks to identify those companies that the Adviser believes have low quality management teams, a history of poor capital allocation, are losing competitive and pricing advantage and may have contracting earnings for the foreseeable future. The Adviser then employs a value discipline in constructing the Fund’s portfolio and seeks to purchase and/or sell short securities if and only if the Adviser believes that the current price does not properly reflect the company’s long-term prospects and risks.

Individual company derivatives may be used to enhance the risk return profile of specific investment opportunities, and market index derivatives may be employed to manage market and industry exposure. The types of derivatives in which the Fund may invest include call options, put options and swap contracts. The Fund will primarily use options, calls and puts, to make investments that have less downside risk as compared to investment directly in the equities underlying the option. The Fund does not intend to use options for the purpose of gaining leverage to any material degree. Examples of strategies that the Fund may pursue using options include: (i) selling calls on existing positions, (ii) selling puts in cases where a decline in the value of a stock would trigger the Adviser’s decision to purchase the stock pursuant to the Fund’s strategy, (iii) purchasing calls where the Adviser perceives there to be significant downside risk associated with the underlying stock, and (iv) purchasing puts to hedge existing long positions. The Fund may also use swaps when the Adviser determines such contracts to be a cost effective and more efficient manner to gain exposure to securities as compared to direct investment in the underlying security.

2

The Fund may sell securities short so long as, as a result of that sale, the current value of securities sold short by the Fund does not exceed 50% of the value of its gross assets (including the amounts borrowed) and 100% of the value of its net assets. The amount of shorts in the portfolio at any given time will be dependent on finding attractively priced short ideas and the desire to manage the overall net market exposure of the Fund. Additionally, the Fund’s principal investment strategy may include borrowing so long as the Fund limits its borrowing to no more than 30% of its total assets (including the amounts borrowed). Selling securities short and borrowing are considered forms of leverage.

Principal Risks

The Fund is subject to a number of risks that may affect the value of its shares and cause you to lose money, including the risks listed below. Each risk summarized below is a principal risk of investing in the Fund, and different risks may be more significant at different times depending upon market conditions or other factors.

Geopolitical and Health Crisis Risks. Geopolitical events and health crises, including pandemics, war, terrorism, trade disputes, government shutdowns, market closures, natural and environmental disasters, and other public health crises and related events and governments’ reactions to such events have led, and in the future may lead, to economic uncertainty, decreased economic activity, increased market volatility and other disruptive effects on U.S. and global economies and markets. The increasing interconnectedness of markets around the world may result in many markets being affected by such events even if they occur in a single country or region. Such events may have significant adverse direct or indirect effects on the Fund and its investments. A health crisis may also exacerbate other pre-existing risks. The COVID-19 global pandemic and related shutdowns have caused, and could cause in the future, substantial market volatility and exchange trading suspensions and closures, affecting both the liquidity and the volatility of the Fund’s investments.

Equity Securities Risks. The Fund invests primarily in equity securities. Although investments in equity securities, such as stocks, historically have been a leading choice for long-term investors, the values of stocks rise and fall depending on many factors. The stock or other security of a company may not perform as well as expected, and may decrease in value, because of factors related to the company (such as poorer than expected earnings or certain management decisions) or to the industry in which the company is engaged (such as a reduction in the demand for products or services in a particular industry). Market and economic factors may adversely affect securities markets generally, which could in turn adversely affect the value of the Fund’s investments, regardless of the performance or expected performance of companies in which the Fund invests.

Market Risk. Because the Fund invests a substantial portion of its assets in common stocks, it is subject to stock market risk. Market risk involves the possibility that the value of the Fund’s investments in stocks will decline due to drops in the stock market. In general, the value of the Fund will move in the same direction as the overall stock market in which the Fund invests, which will vary from day to day in response to the activities of individual companies, as well as general market, regulatory, political and economic conditions.

Risks of Using Leverage and Short Sales. The Fund may use leverage. Leverage is the practice of borrowing money to purchase securities. These investment practices involve special risks. Leverage can increase the investment returns of the Fund if the securities purchased increase in value in an amount exceeding the cost of the borrowing. However, if the securities decrease in value, the Fund will suffer a greater loss than would have resulted without the use of leverage. A short sale is the sale by the Fund of a security which it does not own in anticipation of purchasing the same security in the future at a lower price to close the short position. A short sale will be successful if the price of the shorted security decreases. However, if the underlying security goes up in price during the period in which the short position is outstanding, the Fund will realize a loss. The risk on a short sale is unlimited because the Fund must buy the shorted security at the higher price to complete the transaction. Therefore, short sales may be subject to greater risks than investments in long positions. With a long position, the maximum sustainable loss is limited to the amount paid for the security plus the transaction costs, whereas there is no maximum attainable price of the shorted security. The Fund would also incur increased transaction costs associated with selling securities short. In addition, if the Fund sells securities short, it must maintain a segregated account with its custodian containing cash or high-grade securities equal to (i) the greater of the current market value of the securities sold short or the market value of such securities at the time they were sold short, less (ii) any collateral deposited with the Fund’s broker (not including the proceeds from the short sales). The Fund may be required to add to the segregated account as the market price of a shorted security increases. As a result of maintaining and adding to its segregated account, the Fund may maintain higher levels of cash or liquid assets (for example, U.S. Treasury bills, repurchase agreements, high quality commercial paper and long equity positions) for collateral needs thus reducing its overall managed assets available for trading purposes.

Growth Stock Risk. The Fund invests in growth stocks. Growth stocks are subject to the risk that their growth prospects and/or expectations will not be fulfilled, which could result in a substantial decline in their value and adversely impact the Fund’s performance. When growth investing is out of favor, the Fund’s share price may decline even though the companies the Fund holds have sound fundamentals. Growth stocks may also experience higher than average volatility.

3

Small and Medium Capitalization Company Risk. The Fund may invest in the securities of smaller capitalization companies which may be newly formed or have limited product lines, distribution channels and financial and managerial resources. The risks associated with these investments are generally greater than those associated with investments in the securities of larger, more well-established companies. This may cause the Fund’s share price to be more volatile when compared to investment companies that focus only on large capitalization companies. Securities of small or medium capitalization companies are more likely to experience sharper swings in market values, less liquid markets, in which it may be more difficult for the Adviser to sell at times and at prices that the Adviser believes appropriate and generally are more volatile than those of larger companies. Compared to large companies, smaller companies are more likely to have (i) less information publicly available, (ii) more limited product lines or markets and less mature businesses, (iii) fewer capital resources, (iv) more limited management depth and (v) shorter operating histories. Further, the equity securities of smaller companies are often traded over the counter and generally experience a lower trading volume than is typical for securities that are traded on a national securities exchange. Consequently, the Funds may be required to dispose of these securities over a longer period of time (and potentially at less favorable prices) than would be the case for securities of larger companies, offering greater potential for gains and losses and associated tax consequences.

Information Technology Risk. The Information Technology sector is an important sector for growth-oriented strategies and thus may represent a large percentage of the investments of the Fund. The sector includes a number of important industries such as software & services, hardware & equipment, and semiconductors. Investments in Information Technology are potentially riskier than investments in more mature industries because the nature of technology is that it is rapidly changing. Therefore, products or services that may initially look promising may subsequently fail or become obsolete and barriers to entry are difficult to determine. Additionally, valuations are often higher, and price movements may be more volatile.

Concentration Risk. The Fund’s investments may at times be highly concentrated in the securities of a particular issuer, sponsor, industry, sector, asset class or geographic region. In the event of adverse occurrences affecting such issuer, sponsor, industry, sector, asset class or geographic region more than the market as a whole, the Fund may be susceptible to an increased risk of loss.

Foreign Securities Risk. The Fund may invest in foreign securities, including direct investments in securities of foreign issuers and investments in depositary receipts (such as ADRs) that represent indirect interests in securities of foreign issuers. These investments involve certain risks not generally associated with investments in securities of U.S. issuers. Public information available concerning foreign issuers may be more limited than would be with respect to domestic issuers. Different accounting standards may be used by foreign issuers, and foreign trading markets may not be as liquid as U.S. markets. Foreign securities also involve such risks as currency fluctuation risk, delays in transaction settlements, possible imposition of withholding or confiscatory taxes, possible currency transfer restrictions, and the difficulty of enforcing obligations in other countries. With any investment in foreign securities, there exist certain economic, political and social risks, including the risk of adverse political developments, nationalization, confiscation without fair compensation and war.

Management Risk. Management risk means that the Adviser’s security selections and other investment decisions might produce losses or cause the Fund to underperform when compared to other funds with similar investment goals.

Options Risk. The Fund will expose investors to the risks inherent in trading options. These risks include, but are not limited to, volatile movements in the price of the underlying instrument and misjudgments as to the future prices of the options and/or the underlying instrument. Increased option volatility can increase both the profit potential and the risk associated with the Fund’s trading. While volatility can be monitored and reacted to, there is no cost-effective means of hedging against market volatility. Selling options creates additional risks. The seller of a “naked” call option (or the seller of a put option who has a short position in the underlying instrument) is subject to the risk of a rise in the price in the underlying instrument above the strike price, which risk is reduced only by the premium received for selling the option. In exchange for the proceeds received from selling the call option (in lieu of an outright short position), the option seller gives up (or will not participate in) all of the potential gain resulting from a decrease in the price of the underlying instrument below the strike price prior to expiration of the option. The seller of a “naked” put option (or the seller of a call option who has a long position in the underlying instrument) is subject to the risk of a decline in price of the underlying instrument below the strike price, which risk is reduced only by the proceeds received from selling the option. In exchange for the premium received for selling the put option (in lieu of an outright long position), the option seller gives up (or will not participate in) all of the potential gain resulting from an increase in the price of the underlying instrument above the strike price prior to the expiration of the option. Due to the inherent leveraged nature of options, a relatively small adverse move in the price of the underlying instrument may result in immediate and substantial losses to the Fund.

Swaps Risk. The use of swaps is a highly specialized activity that involves investment techniques, risk analyses and tax planning different from those associated with ordinary portfolio securities transactions. These transactions can result in sizeable realized and unrealized capital gains and losses relative to the gains and losses from the Fund’s direct investments in the reference assets and short sales. Transactions in swaps can involve greater risks than if the Fund had invested directly in the reference asset because, in addition to general market risks, swaps are also subject to illiquidity risk, counterparty risk,

4

credit risk and valuation risk. Because they are two-party contracts and because they may have terms of greater than seven days, swap transactions may be considered to be illiquid. Moreover, the Fund bears the risk of loss of the amount expected to be received under a swap in the event of the default or bankruptcy of a swap counterparty. Some swaps may be complex and valued subjectively. Swaps may also be subject to pricing or “basis” risk, which exists when a particular swap becomes extraordinarily expensive relative to historical prices or the price of corresponding cash market instruments. Under certain market conditions it may not be economically feasible to initiate a transaction or liquidate a position in time to avoid a loss or take advantage of an opportunity. The prices of swaps can be very volatile, and a variance in the degree of volatility or in the direction of the price of the reference asset from the expectations may produce significant losses in the Fund’s investments in swaps. In addition, a perfect correlation between a swap and an investment position may be impossible to achieve. As a result, the Fund’s use of swaps may not be effective in fulfilling the Fund’s investment strategies and may contribute to losses that would not have been incurred otherwise.

Portfolio Turnover Risk. The Fund may engage in short-term trading strategies and securities may be sold without regard to the length of time held when, in the opinion of the Adviser, investment considerations warrant such action. These policies, together with the ability of the Fund to effect short sales of securities and to engage in transactions in options, may have the effect of increasing the annual rate of portfolio turnover of the Funds. A high portfolio turnover rate will result in greater brokerage commissions and transaction costs. It may also result in greater realization of gains, which may include short-term gains taxable at ordinary income tax rates.

See “Description of Principal Risks” beginning on page 47 of the Prospectus for a discussion of each of these risks.

Performance

The following bar chart and table provide some indication of the risks of investing in the Fund by showing changes in performance from year to year. The performance information for periods prior to March 30, 2012 shown below is for the Fund’s predecessor partnership (RiverPark Opportunity Fund, LLC). The predecessor partnership was merged into and reorganized as the Fund, a series of RiverPark Funds Trust, as of March 30, 2012. The merger and reorganization of the predecessor partnership into the Fund was for purposes entirely unrelated to the establishment of a performance record. The Fund is managed by the same portfolio manager and in a manner that is in all material respects equivalent to the management of the predecessor partnership since its inception on September 30, 2009. During its operating history, the predecessor partnership’s investment policies, objectives, guidelines and restrictions were in all material respects equivalent to the Fund’s. The information for periods prior to March 30, 2012 shows how the predecessor partnership’s performance varied from year to year and reflects the actual fees and expenses that were charged when the Fund was a partnership. When the Fund was a partnership, it charged certain investors a 20% performance fee and capped its non-performance related expenses at 2% at annual rates. The Fund does not charge a performance fee. If the annual returns for the predecessor partnership were charged the same fees and expenses as the Fund, the annual returns for the predecessor partnership would have been higher. From its inception on September 30, 2009 through March 30, 2012, the predecessor partnership was not subject to certain investment restrictions, diversification requirements and other restrictions of the Investment Company Act of 1940, as amended (the “1940 Act”) or the Code, which if they had been applicable, might have adversely affected its performance. The information below provides some indications of the risks of investing in the Fund. Comparison of performance to an appropriate index indicates how the Fund’s and the predecessor partnership’s average annual returns compare with those of a broad measure of market performance. The Fund’s and the predecessor partnership’s past performance is not necessarily an indication of how the Fund will perform in the future. Past performance (before and after taxes) is no guarantee of future results.

5

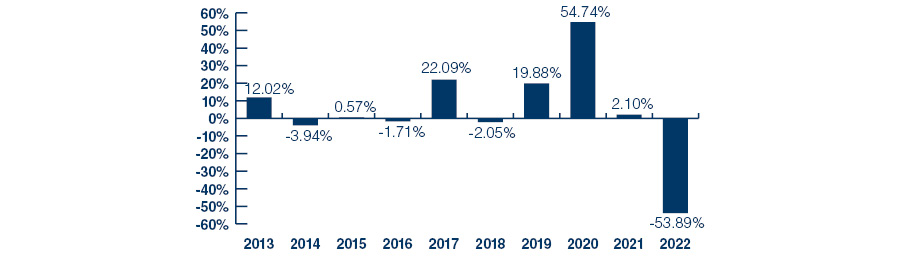

Calendar Year Total Returns

(as of December 31)

Institutional Class (RLSIX)1

During the period of time shown in the bar chart, the highest quarterly return was 18.17% for the quarter ended June 30, 2020, and the lowest quarterly return was -35.18% for the quarter ended June 30, 2022.

The performance table below shows how the Fund’s average annual return for the calendar year, the five years ended December 31, 2022, the ten years ended December 31, 2022 and since inception of the Fund’s predecessor partnership (September 30, 2009), compared to that of the Fund’s benchmarks (S&P 500 Total Return Index and Morningstar Long/Short Equity Category (sourced from Morningstar Principia)):

Average Annual Total Returns |

1 Year |

5 Years |

10 Years |

Since |

Institutional Class Shares (RLSIX) |

|

|

|

|

Return Before Taxes |

-53.89% |

-3.08% |

1.06% |

3.23% |

Return After-Tax on Distributions* |

-53.89% |

-4.11% |

0.47% |

—** |

Return After-Tax on Distributions and Sale of Fund Shares* |

-31.90% |

-2.17% |

0.88% |

—** |

Retail Class Shares (RLSFX) |

|

|

|

|

Return Before Taxes |

-53.98% |

-3.29% |

0.86% |

3.06% |

S&P 500 Total Return Index (reflects no deduction for fees, expenses or taxes) |

-18.11% |

9.42% |

12.56% |

12.41% |

Morningstar Long/Short Equity Category (reflects no deduction for fees, expenses or taxes) |

-8.35% |

2.60% |

4.00% |

3.47% |

|

* |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns are for Institutional Class Shares only. The after-tax returns for Retail Class Shares will vary. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. |

|

** |

Prior to March 30, 2012, the Fund was an unregistered partnership, did not qualify as a regulated investment company (“RIC”) for federal income tax purposes and did not pay dividends and distributions. As a result of the different tax treatment, the Fund is unable to show the after-tax returns for the predecessor partnership for periods prior to March 30, 2012. |

Updated performance information is available by calling the Fund, toll free, at 888-564-4517, or by visiting the Fund’s website at www.riverparkfunds.com.

6

Management

Investment Adviser

RiverPark Advisors, LLC serves as the Fund’s investment adviser.

Portfolio Manager

Conrad van Tienhoven is the portfolio manager primarily responsible for the investment decisions of the Fund. Mr. van Tienhoven has been associated with the Adviser since 2009.

Purchase and Sale of Fund Shares

You may purchase, redeem or exchange Fund shares on any business day by written request by mail (RiverPark Funds, P.O. Box 219008, Kansas City, MO 64121-9008), by wire transfer, by telephone at 888-564-4517, or through a financial intermediary. The minimum initial investment in the Retail Class Shares is $1,000. The minimum initial investment in the Institutional Class Shares is $50,000. Class C Shares, when offered for sale to investors, will have a minimum initial investment of $1,000. There is no minimum for subsequent investments. Transactions received, in good order, before the close of trading on the NYSE (usually 4:00 p.m. Eastern Time) will receive the net asset value on that day. Requests received after the close of trading will be processed on the next business day and will receive the next day’s calculated net asset value.

Tax Information

The Fund’s distributions will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Please see also, “ADDITIONAL TAX INFORMATION” in the SAI, for additional information regarding the taxation of the Fund.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create conflicts of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your financial planner or visit your financial intermediary’s website for more information.

7

RPF-SM-006-1200

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- LINCOLN ALERT: Bragar Eagel & Squire, P.C. Announces that a Class Action Lawsuit Has Been Filed Against Lincoln National Corporation and Encourages Investors to Contact the Firm

- Australian Oilseeds, Largest APAC Producer of Non-Chemical, Non-GMO “Cold-Processing” Vegetable Oil, Enters into Contract with Woolworths and Costco Australia.

- Akanda Appoints Cooper to the Board of Directors

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share