Form 497K RENAISSANCE CAPITAL GREE

RENAISSANCE IPO ETF

A SERIES OF RENAISSANCE CAPITAL GREENWICH FUNDS

Summary Prospectus

Symbol: IPO

Principal U.S. Listing Exchange: NYSE Arca, Inc.

January 31, 2023

Before you invest in the Renaissance IPO ETF (the “Fund”), you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information, reports to shareholders, and other information about the Fund online at www.renaissancecapital.com/IPO-Investing/US-IPO-ETF-Documents. You can also get this information at no cost by calling 1-866-486-6645 or by sending an email request to [email protected]. The Fund’s prospectus and Statement of Additional Information, both dated January 31, 2023 are incorporated by referenced into this Summary Prospectus.

INVESTMENT OBJECTIVE

The Renaissance IPO ETF (the “Fund”), a series of Renaissance Capital Greenwich Funds (the “Trust”), seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Renaissance IPO Index (the “Index”).

FUND FEES AND EXPENSES

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund (“Shares”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or the example below.

| Shareholder Fees (fees paid directly from your investment) | None |

|

Annual Fund Operating Expenses |

|

| (expenses that you pay each year as a percentage of the value of your investment) | |

| Management Fee | 0.60% |

| Distribution and Service (12b-1) Fees* | None |

| Other Expenses | 0.00% |

| Total Annual Fund Operating Expenses | 0.60% |

_____________

*The Board has adopted a 12b-1 Plan but no 12b-1 fees are being charged.

EXAMPLE

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds. This example does not take into account brokerage commissions or other fees to financial intermediaries that you may pay when purchasing or selling Shares of the Fund. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your Shares at the end of those periods. The example also assumes that your investment has a 5% annual return and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| YEAR | EXPENSES |

| 1 | $61 |

| 3 | $192 |

| 5 | $335 |

| 10 | $750 |

PORTFOLIO TURNOVER

The Fund will pay transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional transaction costs and may result in higher taxes when the Fund Shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, may affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 57% of the average value of its portfolio.

| 2 |

PRINCIPAL INVESTMENT STRATEGIES

The Fund seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Index. The Index, designed by IPO research firm Renaissance Capital LLC (the “Index Provider”), is a portfolio of companies that have recently completed an initial public offering (“IPO”) and are listed on a U.S. exchange. IPOs are a category of unseasoned equities under-represented in core equity indices. The Index is designed to capture approximately 80% of the total market capitalization of newly public companies, which are those companies that have gone public within the last three years and meet the Index Provider’s size, liquidity and free float criteria. At each quarterly rebalance, new IPOs that meet the Index Provider’s eligibility criteria are included and constituent companies that have been public for three years are removed. Constituents are weighted by free float-adjusted market capitalization with individual weights capped at 10%. The Index has been constructed using a transparent and rules-based methodology.

The Fund normally invests at least 80% of its total assets in securities that comprise the Index. Depositary receipts representing securities that comprise the Index may count towards compliance with the Fund’s 80% policy. The Fund may also invest up to 20% of its assets in certain futures, options, and swap contracts, cash and cash equivalents, as well as in common stocks not included in the Index but which will help the Fund track the Index. Convertible securities and depositary receipts not included in the Index may be used by the Fund in seeking performance that corresponds to its Index and in managing cash flows.

The Index is comprised of common stocks, depositary receipts, real estate investment trusts (“REITs”) and partnership units. These securities may include IPOs of foreign companies that are listed on a U.S. exchange, as well as IPOs of companies which are located in countries categorized as emerging markets.

The Fund’s 80% investment policy is non-fundamental and requires 60 days’ prior written notice to shareholders before it can be changed.

The Fund, using a “passive” or indexing investment approach, attempts to approximate the investment performance of the Index by investing in a portfolio of securities that generally replicates the Index. Renaissance Capital LLC (the “Adviser”) expects that, over time, the correlation between the Fund’s performance before fees and expenses and that of the Index will be 95% or better. A figure of 100% would indicate perfect correlation.

The Fund may concentrate its investments in a particular industry or group of industries to the extent that the Index concentrates in an industry or group of industries. Information technology frequently represents a major sector in the Index, and within this sector, Software frequently represents the largest industry group. As of September 30, 2022, the Index also had significant exposure (i.e., 25% or more) to the consumer discretionary sector.

The Fund may lend securities to broker-dealers, banks and other institutions. When the Fund loans its portfolio securities, it will receive, at the inception of each loan, liquid collateral equal to at least 102% (for U.S.-listed securities) or 105% (for non-U.S.-listed securities) of the value of the portfolio securities being loaned.

PRINCIPAL RISKS OF INVESTING IN THE FUND

Investors in the Fund should be willing to accept a high degree of volatility in the price of the Fund’s Shares and the possibility of significant losses. An investment in the Fund involves a substantial degree of risk. The Fund is subject to the principal investment risks noted below, any of which may adversely affect the Fund’s net asset value (“NAV”), trading price, yield, total return and ability to meet its investment objective. An investment in the Fund is not a deposit with a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Therefore, you should consider carefully the following risks before investing in the Fund.

Risk of Investing in IPOs. The Fund invests in companies that have recently completed an initial public offering. The stocks of such companies are unseasoned equities lacking a trading history, a track record of reporting to investors and widely available research coverage. IPOs are thus often subject to extreme price volatility and speculative trading. These stocks may have above-average price appreciation in connection with the initial public offering prior to inclusion in the Index. The price of stocks included in the Index may not continue to appreciate and

| 3 |

the performance of these stocks may not replicate the performance exhibited in the past. In addition, IPOs share similar illiquidity risks of private equity and venture capital. The free float shares held by the public in an IPO are typically a small percentage of the market capitalization. The ownership of many IPOs often includes large holdings by venture capital and private equity investors who seek to sell their shares in the public market in the months following an IPO when shares restricted by lock-up are released, causing greater volatility and possible downward pressure during the time that locked-up shares are released.

Information Technology Risk. Information technology frequently represents a major sector in the Index, and within this sector, Software frequently represents the largest industry group. Information technology companies are generally subject to the risks of rapidly changing technologies; short product life cycles; fierce competition; aggressive pricing and reduced profit margins; the loss of patent, copyright and trademark protections; cyclical market patterns; evolving industry standards; and frequent new product introductions. Information technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology company stocks, especially those which are internet-related, have experienced extreme price and volume fluctuations that are often unrelated to their operating performance.

Software Industry Risk. Technological developments, fixed-rate pricing and the ability to attract and retain skilled employees can significantly affect companies operating in the software industry. Changing domestic and international demand, research and development costs and product obsolescence can affect the profitability of software companies. Software company stocks may experience substantial fluctuations in market price. Companies in the software industry may be adversely affected by, among other things, the decline or fluctuation of subscription renewal rates for their products and services and actual or perceived vulnerabilities in their products or services.

Consumer Discretionary Risk. Companies engaged in the consumer discretionary sector are affected by fluctuations in supply and demand and changes in consumer preferences, social trends and marketing campaigns. Changes in consumer spending as a result of world events, political and economic conditions, commodity price volatility, changes in exchange rates, imposition of import controls, increased competition, depletion of resources and labor relations also may adversely affect these companies.

Small and Mid-Capitalization Company Risk. The Fund invests in small and mid-capitalization companies. Such companies may be more vulnerable to adverse general market or economic developments, and their securities may be less liquid and may experience greater price volatility than larger, more established companies as a result of several factors, including limited trading volumes, products or financial resources, management inexperience and less publicly available information. Accordingly, such companies are generally subject to greater market risk than larger, more established companies.

Depositary Receipt Risk. The Fund may hold the securities of non-U.S. companies in the form of American Depositary Receipts (“ADRs”). ADRs are negotiable certificates issued by a U.S. financial institution that represent a specified number of shares in a foreign stock and trade on a U.S. national securities exchange, such as the New York Stock Exchange. Sponsored ADRs are issued with the support of the issuer of the foreign stock underlying the ADRs and carry all of the rights of common shares, including voting rights. The underlying securities of the ADRs in the Fund’s portfolio are usually denominated or quoted in currencies other than the U.S. Dollar. As a result, changes in foreign currency exchange rates may affect the value of the Fund’s portfolio. In addition, because the underlying securities of ADRs trade on foreign exchanges at times when the U.S. markets are not open for trading, the value of the securities underlying the ADRs may change materially at times when the U.S. markets are not open for trading, regardless of whether there is an active U.S. market for shares of the Fund.

REIT Risk. Investments in securities of real estate companies involve risks. These risks include, among others, adverse changes in national, state or local real estate conditions; obsolescence of properties; changes in the availability, cost and terms of mortgage funds; and the impact of changes in environmental laws. In addition, a REIT that fails to comply with federal tax requirements affecting REITs may be subject to federal income taxation, or the federal tax requirement that a REIT distribute substantially all of its net income to its shareholders may result in a REIT having insufficient capital for future expenditures. The value of a REIT can depend on the structure of and cash flow generated by the REIT. In addition, like mutual funds, REITs have expenses, including advisory and administration

| 4 |

fees that are paid by their shareholders. As a result, you will absorb duplicate levels of fees when the Fund invests in REITs. In addition, REITs are subject to certain provisions under federal tax law. The failure of a company to qualify as a REIT could have adverse consequences for the Fund, including significantly reducing return to the Fund on its investment in such company.

Partnership Unit Risk. Investments in partnership units such as master limited partnerships and trusts, involve risks that differ from an investment in common stock. Holders of partnership units have more limited control and limited rights to vote on matters affecting the partnership. There are also certain tax risks associated with an investment in partnership units. In addition, conflicts of interest may exist between common unit holders, subordinated unit holders and the general partner of a partnership, including a conflict arising as a result of incentive distribution payments.

Non-U.S. Issuer Risk. Certain companies in which the Fund may invest may be non-U.S. issuers whose securities are listed on U.S. exchanges. These securities involve risks beyond those associated with investments in U.S. securities, including greater market volatility, higher transactional costs, the possibility that the liquidity of such securities could be impaired because of future political and/or economic developments, such as the imposition of trading restrictions with or economic sanctions on foreign countries, taxation by foreign governments, political instability, and the possibility that foreign governmental restrictions may be adopted which might adversely affect such securities. The selection of securities of non-U.S. issuers may be more difficult because there may be less publicly available information concerning such non-U.S. issuers or the accounting, auditing and financial reporting standards, practices and requirements applicable to non-U.S. issuers may differ from those applicable to U.S. issuers.

Emerging Markets Risk. The Fund may invest a portion of its portfolio in securities of issuers located in emerging markets. Emerging market companies involve certain risks not associated with investing in developed market countries because emerging market countries are often in the initial stages of their industrialization cycles and have low per capita income. These increased risks include the possibility of investment and trading limitations, unexpected market closures, greater liquidity concerns, higher price volatility, greater delays and possibility of disruptions in settlement transactions, greater political uncertainties and greater dependence on international trade or development assistance. In addition, emerging market countries may be subject to overburdened infrastructures and environmental problems. Companies in emerging market countries generally may be subject to less stringent regulatory, financial reporting, recordkeeping, accounting and auditing standards than companies in more developed countries, and information about such companies may be less available and reliable. Securities law and the enforcement of systems of taxation in many emerging market countries may change quickly and unpredictably, and the ability to bring and enforce actions may be limited. The Fund is not actively managed and does not select investments based on investor protection considerations.

Equity Securities Risk. The value of the equity securities held by the Fund may fall due to general market and economic conditions, perceptions regarding the markets in which the issuers of securities held by the Fund participate, or factors relating to specific issuers in which the Fund invests. Equity securities are subordinated to preferred securities and debt in a company’s capital structure with respect to priority in right to a share of corporate income, and therefore will be subject to greater dividend risk than preferred securities or debt instruments. In addition, while broad market measures of equity securities have historically generated higher average returns than fixed income securities, equity securities have also experienced significantly more volatility in those returns.

Market Risk. The prices of the securities in the Fund are subject to the risk associated with investing in the securities market, including general economic conditions and sudden and unpredictable drops in value. An investment in the Fund may lose money.

COVID-19 Risk. The global outbreak of the novel strain of coronavirus, COVID-19, has resulted in instances of market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. Efforts to contain the spread of COVID-19 have resulted in travel restrictions, closed international borders, disruptions of healthcare systems, business operations and supply chains, layoffs, lower consumer demand, defaults and other significant economic impacts, all of which have disrupted global economic activity across many industries and may exacerbate other pre-existing political, social and economic risks, locally or globally. The ongoing effects of COVID-19 are unpredictable and may result in significant and prolonged effects on the Fund’s performance.

Index Tracking Risk. The Fund’s return may not match the return of the Index for a number of reasons. For example, the Fund incurs a number of operating expenses not applicable to the Index and incurs costs associated with buying

| 5 |

and selling securities, especially when rebalancing the Fund’s securities holdings to reflect changes in the composition of the Index. Because the Fund bears the costs and risks associated with buying and selling securities while such costs and risks are not factored into the return of the Index, the Fund’s return may deviate significantly from the return of the Index. In addition, the Fund may not be able to invest in certain securities included in the Index, or invest in them in the exact proportions in which they are represented in the Index, due to legal restrictions or other limitations. To the extent the Fund calculates its NAV based on fair value prices and the value of the Index is based on securities’ closing prices, the Fund’s ability to track the Index may be adversely affected.

Replication Management Risk. An investment in the Fund involves risks similar to those of investing in any fund of equity securities traded on an exchange, such as market fluctuations caused by such factors as economic and political developments, changes in interest rates and perceived trends in security prices. However, because the Fund is not “actively” managed, unless a specific security is removed from the Index, the Fund generally would not sell a security because the security’s issuer was in financial trouble. Therefore, the Fund’s performance could be lower than funds that may actively shift their portfolio assets to take advantage of market opportunities or to lessen the impact of a market decline or a decline in the value of one or more issuers.

Market Trading Risk. The Fund faces numerous market trading risks, including the potential lack of an active market for the Shares, losses from trading in secondary markets, and disruption in the creation/redemption process of the Fund. In stressed market conditions, the market for Shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s portfolio holdings, which may cause a variance in the market price of Shares and their underlying NAV and wider bid-ask spreads. In addition, an exchange or market may issue trading halts on specific securities or financial instruments. As a result, the ability to trade certain securities or financial instruments may be restricted, which may disrupt the Fund’s creation/redemption process, potentially affect the price at which Shares trade in the secondary market, and/or result in the Fund being unable to trade certain securities or financial instruments at all. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and/or may incur substantial trading losses. Any of these factors may lead to the Shares trading at a premium or discount to the Fund’s NAV and wider bid-ask spreads.

Premium/Discount Risk. Shares trade on a stock exchange at prices at, above or below the Fund’s most recent NAV. The Fund’s NAV is calculated at the end of each business day and fluctuates with changes in the market value of the Fund’s holdings. The trading price of the Shares fluctuates continuously throughout trading hours on the exchange, based on both the relative market supply of, and demand for, the Shares and the underlying value of the Fund’s portfolio holdings. As a result, the trading prices of the Shares may deviate from the Fund’s NAV. In addition, disruptions to creations and redemptions, the existence of extreme market volatility or potential lack of an active trading market for Shares may result in Shares trading at a significant premium or discount to NAV. Any of these factors discussed herein, among others, may lead to the Shares trading at a premium or discount to NAV. If a shareholder purchases Shares at a time when the market price is at a premium to the NAV or sells Shares at a time when the market price is at a discount to the NAV, the shareholder may sustain losses.

Non-Diversified Risk. The Fund is classified as a “non-diversified” investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). Therefore, the Fund may invest a relatively high percentage of its assets in a smaller number of issuers or may invest a larger proportion of its assets in a single company. As a result, the gains and losses on a single investment may have a greater impact on the Fund’s NAV and may make the Fund more volatile than more diversified funds. The Fund may be particularly vulnerable to this risk because it seeks to replicate an index that is comprised of a limited number of securities.

Concentration Risk. The Fund’s assets may be concentrated in a particular sector or sectors or industry or group of industries to the extent the Index concentrates in a particular sector or sectors or industry or group of industries. The Fund may be subject to the risk that economic, political or other conditions that have a negative effect on that sector or industry will negatively impact the Fund to a greater extent than if the Fund’s assets were invested in a wider variety of sectors or industries.

Portfolio Turnover Risk. The Fund may engage in frequent trading of its portfolio securities in connection with the rebalancing or adjustment of the Index. A portfolio turnover rate of 200%, for example, is equivalent to the Fund buying and selling all of its securities two times during the course of a year. A high portfolio turnover rate (such as 100% or more) could result in high brokerage costs for the Fund. While a high portfolio turnover rate can result in an

| 6 |

increase in taxable capital gain distributions to the Fund’s shareholders, the Fund will seek to utilize the in-kind creation and redemption mechanism (described below) to minimize realization of capital gains to the extent possible.

Securities Lending Risk. The Fund may engage in securities lending. Securities lending involves the risk that the Fund may lose money because the borrower of the Fund’s loaned securities fails to return the securities in a timely manner or at all. The Fund could also lose money in the event of a decline in the value of the collateral provided for the loaned securities or a decline in the value of any investments made with cash collateral. These events could also trigger adverse tax consequences for the Fund.

Authorized Participant Concentration Risk. Only an authorized participant may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that act as authorized participants. To the extent that these institutions exit the business or are unable to proceed with creation and/or redemption orders with respect to the Fund and no other authorized participant is able to step forward to create or redeem Creation Units (as defined below), this may result in a significantly diminished trading market for Shares, and Shares may trade at a discount to NAV and possibly face trading halts and/or delisting. This risk may be more pronounced in volatile markets, potentially where there are significant redemptions in ETFs generally. Investments in non-U.S. securities, which may have lower trading volumes or could experience extended market closures or trading halts, may increase the risk that authorized participants may not be able to effectively create or redeem Creation Units or the risk that the Shares may be halted and/or delisted.

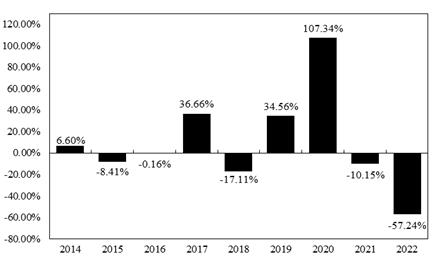

PERFORMANCE

The bar chart that follows shows how the Fund’s performance has varied from year to year. The table below the bar chart shows the Fund’s average annual returns (before and after taxes) and provides some indication of the risks of investing in the Fund by comparing the performance of the Fund over time to the performance of the Index, and a broad-based market index (S&P 500 Index). The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

The Fund’s highest quarterly return was in the second quarter of 2020 with a return of 52.77%. The Fund’s lowest quarterly return was in the second quarter of 2022 with a return of -31.64%.

| 7 |

Renaissance IPO ETF Average Annual Total Returns

for periods ended December 31, 2022:

|

One Year |

Five Year |

Since Inception (10/14/13) | |

| Return Before Taxes | -57.24% | -2.34% | 2.85% |

| Return After Taxes on Distributions* | -57.24% | -2.40% | 2.67% |

| Return After Taxes on Distributions and Sale of Fund Shares* | -33.89% | -1.77% | 2.16% |

| Renaissance IPO Index (reflects no deduction for fees, expenses or taxes) | -56.95% | -1.83% | 3.45% |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | -18.11% | 9.42% | 11.33% |

* After-tax returns were calculated using the historically highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold Shares of the Fund through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts.

PORTFOLIO MANAGEMENT

Investment Adviser. Renaissance Capital LLC.

Portfolio Manager. The following individual is primarily responsible for the day-to-day management of the Fund’s portfolio:

| Name | Title with Adviser | Date Began Managing the Fund |

| Tiffany Ng | Portfolio Manager | January 2021 |

SUMMARY INFORMATION ABOUT PURCHASES AND SALES OF FUND SHARES AND TAXES

PURCHASE AND SALE OF FUND SHARES

The Fund issues and redeems Shares at NAV only in a large specified number of Shares each called a “Creation Unit,” or multiples thereof. A Creation Unit consists of 50,000 Shares. Creation Units are sold only to and from institutional brokers through participation agreements.

Individual Shares of the Fund may only be purchased and sold in secondary market transactions through a broker or dealer at a market price. Shares of the Fund are listed on NYSE Arca, Inc. (the “Exchange”) and because Shares trade at market prices rather than NAV, Shares of the Fund may trade at a price greater than NAV (premium) or less than NAV (discount). When buying or selling Fund Shares in the secondary market, you may incur costs attributable to the difference between the highest price a buyer is willing to pay to purchase Fund Shares (bid) and the lowest price a seller is willing to accept for Fund Shares (ask) (the “bid-ask spread”). Recent information regarding the Fund’s NAV, market price, premiums and discounts, and bid-ask spreads is available at www.renaissancecapital.com.

TAX INFORMATION

The Fund’s distributions are taxable and will generally be taxed as ordinary income or capital gains, unless you are investing through a tax-advantaged account such as an IRA or 401(k), in which case distributions from such account may be taxed as ordinary income when withdrawn from the tax-advantaged account.

| 8 |

PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES

If you purchase Shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Adviser and its related companies may pay the intermediary for the sale of Fund Shares and related services. These payments may create a conflict of interest by influencing the broker-dealer, salesperson or other intermediary or its employees or associated persons to recommend the Fund over another investment. Ask your financial adviser or visit your financial intermediary’s website for more information.

| 9 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Konsolidator maintains its financial expectations for 2024

- Information relating to the total number of voting rights and shares making up the share capital on 25th of April 2024

- Block listing Interim Review

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share