Form 497K ProFunds

Summary Prospectus Investor and Service Class

November 30, 2022

Falling U.S. Dollar ProFund

|

CLASS

|

TICKER

|

CUSIP

|

|

Investor

|

FDPIX

|

74318A-190

|

|

Service

|

FDPSX

|

74318A-182

|

This Summary Prospectus is designed to provide investors with key fund information in a clear and concise format. Before you invest, you may want to review the Fund’s Full Prospectus, which contains more information about the Fund and its risks. The Fund’s Full Prospectus, dated November 30, 2022, and Statement of Additional Information, dated November 30, 2022, and as each hereafter may be supplemented or amended, are incorporated by reference into this Summary Prospectus. All of this information may be obtained at no cost either: online at ProFunds.com/ProFundsinfo; by calling 888-PRO-3637 (888-776-3637) (financial professionals should call 888-PRO-5717 (888-776-5717)); or by sending an e-mail request to [email protected]. The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

2 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

Investment Objective

Falling U.S. Dollar ProFund (the “Fund”) seeks daily investment results, before fees and expenses, that correspond to the daily performance of the basket of non-U.S. currencies included in the ICE® U.S. Dollar Index® (the “Index”). The Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States, as measured in 1973 (the “Benchmark”). These currencies and their weightings as of December 31, 2021 are: euro 57.6%; Japanese yen 13.6%; British pound 11.9%; Canadian dollar 9.1%; Swedish krona 4.2% and Swiss franc 3.6%. The Fund is designed to benefit from a decline in the value of the U.S. Dollar against the value of the currencies included in the Benchmark. Accordingly, as the value of the U.S. Dollar depreciates (i.e., “falls”) versus the Benchmark, the performance of the Fund generally should be expected to increase. As the value of the U.S. Dollar appreciates versus the Benchmark, the performance of the Fund generally should be expected to decline.

Fees and Expenses of the Fund

The table below describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

Shareholder Fees

(fees paid directly from your investment)

Wire Fee $10

|

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the

value of your investment)

|

||

|

|

Investor

Class

|

Service

Class

|

|

Investment Advisory Fees

|

0.75%

|

0.75%

|

|

Distribution and Service (12b-1) Fees

|

0.00%

|

1.00%

|

|

Other Expenses

|

4.19%

|

4.19%

|

|

Total Annual Fund Operating Expenses

Before Fee Waivers and Expense

Reimbursements

|

4.94%

|

5.94%

|

|

Fee Waivers/Reimbursements1

|

-3.16%

|

-3.16%

|

|

Total Annual Fund Operating Expenses

After Fee Waivers and Expense

Reimbursements

|

1.78%

|

2.78%

|

1

ProFund Advisors LLC (“ProFund Advisors”) has contractually agreed to waive Investment Advisory and Management Services Fees and to reimburse Other Expenses to the extent Total Annual Fund Operating Expenses Before Fee Waivers and Expense Reimbursements, as a percentage of average daily net assets, exceed 1.78% for Investor Class shares and 2.78% for Service Class shares through November 30, 2023. After such date, the expense limitation may be terminated or revised by ProFund Advisors. Amounts waived or reimbursed in a particular contractual period may be recouped by ProFund Advisors within three years of the end of that contractual

period, however, such recoupment will be limited to the lesser of any expense limitation in place at the time of recoupment or the expense limitation in place at the time of waiver or reimbursement.

Example: This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of each period. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same, except that the fee waiver/expense reimbursement is assumed only to pertain to the first year. Although your actual costs may be higher or lower, based on these assumptions your approximate costs would be:

|

|

1 Year

|

3 Years

|

5 Years

|

10 Years

|

|

Investor Class

|

$181

|

$1,201

|

$2,223

|

$4,782

|

|

Service Class

|

$281

|

$1,484

|

$2,665

|

$5,520

|

The Fund pays transaction and financing costs associated with the purchase and sale of securities and derivatives. These costs are not reflected in the table or the example above.

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the Fund’s shares are held in a taxable account. These costs, which are not reflected in the Annual Fund Operating Expenses or in the example above, affect the Fund’s performance. During the most recent fiscal year, the Fund’s annual portfolio turnover rate was 0% of the average value of its entire portfolio. This portfolio turnover rate is calculated without regard to cash instruments or derivatives transactions. If such transactions were included, the Fund’s portfolio turnover rate would be significantly higher.

Principal Investment Strategies

The Fund invests in financial instruments that ProFund Advisors believes, in combination, should track the performance of the Index. The Index is calculated and maintained by ICE Data Indices, LLC. The Index measures the value of the U.S. Dollar against a basket of currencies of the top six trading partners of the United States as measured in 1973. The Index is published under the Bloomberg ticker symbol “DXY.”

The Fund will invest principally in the financial instruments set forth below. The Fund expects that its cash balances maintained in connection with the use of financial instruments will typically be held in money market instruments.

•Derivatives —The Fund invests in derivatives, which are financial instruments whose value is derived from the value of an underlying asset or assets, such as stocks, bonds, funds (including exchange-traded funds (“ETFs”)), currencies, interest rates or indexes. The Fund invests in derivatives to

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 3

gain exposure to the Benchmark. These derivatives principally include:

○Forward Contracts — Two-party contracts where a purchase or sale of a specific quantity of a commodity, security, foreign currency or other financial instrument is entered into with dealers or financial institutions at a set price, with delivery and settlement at a specified future date. Forward contracts may also be structured for cash settlement, rather than physical delivery.

•Money Market Instruments — The Fund invests in short-term cash instruments that have a remaining maturity of 397 days or less and exhibit high quality credit profiles, for example:

○U.S. Treasury Bills — U.S. government securities that have initial maturities of one year or less, and are supported by the full faith and credit of the U.S. government.

○Repurchase Agreements — Contracts in which a seller of securities, usually U.S. government securities or other money market instruments, agrees to buy the securities back at a specified time and price. Repurchase agreements are primarily used by the Fund as a short-term investment vehicle for cash positions.

ProFund Advisors uses a mathematical approach to investing. Using this approach, ProFund Advisors determines the type, quantity and mix of investment positions that it believes, in combination, the Fund should hold to produce returns consistent with the Fund’s investment objective. The Fund may invest in or gain exposure to only a representative sample of the securities in the Index or to securities not contained in the Index or in financial instruments, with the intent of obtaining exposure with aggregate characteristics similar to those of the Index. In managing the assets of the Fund, ProFund Advisors does not invest the assets of the Fund in securities or financial instruments based on ProFund Advisors’ view of the investment merit of a particular security, instrument, or company, nor does it conduct conventional investment research or analysis or forecast market movement or trends. The Fund seeks to remain fully invested at all times in securities and/or financial instruments that, in combination, provide exposure to the returns of the Index without regard to market conditions, trends or direction.

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

Principal Risks

You could lose money by investing in the Fund.

The principal risks described below are intended to provide information about the factors likely to have a significant adverse impact on the Fund’s returns and consequently the value of an investment in the Fund. The risks are presented in an order intended to facilitate readability and their order does not imply that the realization of one risk is more likely to occur than

another risk or likely to have a greater adverse impact than another risk.

•Risks Associated with the Use of Derivatives — Investing in derivatives may be considered aggressive and may expose the Fund to greater risks and may result in larger losses or smaller gains than investing directly in the reference asset(s) underlying those derivatives. These risks include counterparty risk, liquidity risk and increased correlation risk. When the Fund uses derivatives, there may be imperfect correlation between the value of the reference asset(s) underlying the derivative (e.g., the Index) and the derivative, which may prevent the Fund from achieving its investment objective. Because derivatives often require only a limited initial investment, the use of derivatives also may expose the Fund to losses in excess of those amounts initially invested. Any costs associated with using derivatives will also have the effect of lowering the Fund’s return.

•Correlation Risk — A number of factors may affect the Fund’s ability to achieve a high degree of correlation with the Index, and there is no guarantee that the Fund will achieve a high degree of correlation. Failure to achieve a high degree of correlation may prevent the Fund from achieving its investment objective.

Factors that may adversely affect the Fund’s correlation with the Index include fees, expenses, transaction costs, income items, valuation methodology, accounting standards and disruptions or illiquidity in the markets for the financial instruments in which the Fund invests. The Fund may not have investment exposure to all of the securities in the Index, or its weighting of investment exposure to securities may be different from that of the Index. In addition, the Fund may invest in securities not included in the Index. The Fund may take or refrain from taking positions in order to improve tax efficiency, comply with regulatory restrictions, or for other reasons, each of which may negatively affect the Fund’s correlation with the Index. The Fund may also be subject to large movements of assets into and out of the Fund, potentially resulting in the Fund being over- or underexposed to the Index and may be impacted by Index reconstitutions and Index rebalancing events. Additionally, the Fund’s underlying investments may trade on markets that may not be open on the same day as the Fund, which may cause a difference between the performance of the Fund and the performance of the Index on such day. Any of these factors could decrease correlation between the performance of the Fund and the Index and may hinder the Fund’s ability to meet its investment objective.

•Counterparty Risk — Investing in derivatives and repurchase agreements involves entering into contracts with third parties (i.e., counterparties). The use of derivatives and repurchase agreements involves risks that are different from those associated with ordinary portfolio securities transactions. The Fund will be subject to credit risk (i.e., the risk that a counterparty is or is perceived to be unwilling or unable to

4 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

make timely payments or otherwise meet its contractual obligations) with respect to the amount it expects to receive from counterparties to derivatives and repurchase agreements entered into by the Fund. If a counterparty becomes bankrupt or fails to perform its obligations, or if any collateral posted by the counterparty for the benefit of the Fund is insufficient or there are delays in the Fund’s ability to access such collateral, the value of an investment in the Fund may decline.

•Foreign Currency Risk — Investments linked to or denominated in foreign currencies are exposed to additional risk factors versus those investments denominated in U.S. dollars and linked to U.S. investments. The value of an investment linked to or denominated in a foreign currency could change significantly as foreign currencies strengthen or weaken relative to the U.S. dollar. Devaluations of a currency by a government or banking authority may also have significant impact on the value of any investments linked to or denominated in that currency. Risks related to foreign currencies also include those related to economic or political developments, market inefficiencies or a higher risk that essential investment information may be incomplete, unavailable, or inaccurate. Foreign currency losses could offset or exceed any potential gains, or add to losses, in the related investments. Currency markets are also generally not as regulated as securities markets.

•Market Risk — The Fund is subject to market risks that will affect the value of its shares, including adverse issuer, political, regulatory, market or economic developments, as well as developments that impact specific economic sectors, industries or segments of the market.

•Geographic Concentration Risk — Because the Fund focuses its investments in particular foreign countries or geographic regions, an investment in the Fund may be more volatile than a more geographically diversified fund. The performance of the Fund will be affected by the political, social and economic conditions in those foreign countries and geographic regions and subject to the related risks.

•Non-Diversification Risk — The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended (“1940 Act”). This means it has the ability to invest a relatively high percentage of its assets in the securities of a small number of issuers or in financial instruments with a single counterparty or a few counterparties. This may increase the Fund’s volatility and increase the risk that the Fund’s performance will decline based on the performance of a single issuer or the credit of a single counterparty.

•Index Performance Risk — The Index is maintained by a third party provider unaffiliated with the Fund or ProFund Advisors. There can be no guarantee or assurance that the methodology used by the third party provider to create the Index will result in the Fund achieving positive returns. Further, there can be no guarantee that the methodology

underlying the Index or the daily calculation of the Index will be free from error. It is also possible that the value of the Index may be subject to intentional manipulation by third-party market participants. The Index used by the Fund may underperform other asset classes and may underperform other similar indices. Each of these factors could have a negative impact on the performance of the Fund.

•Active Investor Risk —The Fund permits short-term trading of its securities. A significant portion of assets invested in the Fund may come from professional money managers and investors who use the Fund as part of active trading or tactical asset allocation strategies. These strategies often call for frequent trading to take advantage of anticipated changes in market conditions, which could increase portfolio turnover and may result in additional costs for the Fund. In addition, large movements of assets into and out of the Fund may have a negative impact on the Fund’s ability to achieve its investment objective or maintain a consistent level of operating expenses. In certain circumstances, the Fund’s expense ratio may vary from current estimates or the historical ratio disclosed in this Prospectus.

•Early Close/Late Close/Trading Halt Risk — An exchange or market may close early, close late or issue trading halts on specific securities or financial instruments. As a result, the ability to trade certain securities or financial instruments may be restricted, which may result in the Fund being unable to trade those and other related financial instruments at all. In these circumstances, the Fund may be unable to rebalance its portfolio, may be unable to accurately price its investments and/or may incur substantial trading losses.

•Liquidity Risk — In certain circumstances, such as the disruption of the orderly markets for the financial instruments in which the Fund invests, the Fund might not be able to acquire or dispose of certain holdings quickly or at prices that represent true market value in the judgment of ProFund Advisors. Markets for the financial instruments in which the Fund invests may be disrupted by a number of events, including but not limited to economic crises, political crises, health crises, natural disasters, excessive volatility, new legislation, or regulatory changes inside or outside of the U.S. For example, regulation limiting the ability of certain financial institutions to invest in certain financial instruments would likely reduce the liquidity of those instruments. These situations may prevent the Fund from limiting losses, realizing gains or achieving a high correlation with the Index.

•Portfolio Turnover Risk — The Fund may incur high portfolio turnover in connection with managing the Fund’s investment exposure. Additionally, active trading of the Fund’s shares is expected to cause more frequent purchase and sales activities that could, in certain circumstances, increase the number of portfolio transactions. High levels of portfolio transactions increase transaction costs and may result in

FUND NUMBERS :: Investor Class 113 :: Service Class 143 :: Falling U.S. Dollar ProFund :: 5

increased taxable gains. Each of these factors could have a negative impact on the performance of the Fund.

•Tax Risk — In order to qualify for the special tax treatment accorded a regulated investment company (“RIC”) and its shareholders, the Fund must derive at least 90% of its gross income for each taxable year from “qualifying income,” meet certain asset diversification tests at the end of each taxable quarter, and meet annual distribution requirements. The Fund’s pursuit of its investment strategies will potentially be limited by the Fund’s intention to qualify for such treatment and could adversely affect the Fund’s ability to so qualify. The Fund may make certain investments, the treatment of which for these purposes is unclear. If, in any year, the Fund were to fail to qualify for the special tax treatment accorded a RIC and its shareholders, and were ineligible to or were not to cure such failure, the Fund would be taxed in the same manner as an ordinary corporation subject to U.S. federal income tax on all its income at the fund level. The resulting taxes could substantially reduce the Fund’s net assets and the amount of income available for distribution. In addition, in order to requalify for taxation as a RIC, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest, and make certain distributions. Please see the section entitled “Taxation” in the Statement of Additional Information for more information.

•Valuation Risk — In certain circumstances (e.g., if ProFund Advisors believes market quotations are not reliable, or a trading halt closes an exchange or market early), ProFund Advisors may, pursuant to procedures approved by the Board of Trustees of the Fund, choose to determine a fair value price as the basis for determining the value of such investment for such day. The fair value of an investment determined by ProFund Advisors may be different from other value determinations of the same investment. Portfolio investments that are valued using techniques other than market quotations, including “fair valued” investments, may be subject to greater fluctuation in their value from one day to the next than would be the case if market quotations were used. In addition, there is no assurance that the Fund could sell a portfolio investment for the value established for it at any time, and it is possible that the Fund would incur a loss because a portfolio investment is sold at a discount to its established value.

Please see “Investment Objectives, Principal Investment Strategies and Related Risks” in the Fund’s Prospectus for additional details.

Investment Results

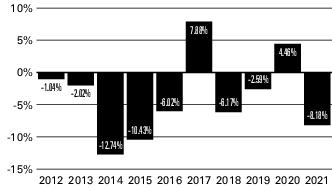

The bar chart below shows how the Fund’s investment results for Investor Class shares have varied from year to year, and the table shows how the Fund’s average annual total returns for various periods compare with different broad measures of market performance. Performance for Service Class shares would differ to the extent their fees and expenses differ. This information provides some indication of the risks of investing in the Fund. In

addition, the Fund’s performance information reflects applicable fee waivers and/or expense limitations, if any, in effect during the periods presented. Absent such fee waivers/expense limitations, if any, performance would have been lower. Past results (before and after taxes) are not predictive of future results. Updated information on the Fund’s results can be obtained by visiting the Fund’s website (www.profunds.com).

Annual Returns as of December 31

|

Best Quarter

|

(ended

|

6/30/2017

|

):

|

4.16%

|

|

Worst Quarter

|

(ended

|

3/31/2015

|

):

|

-8.84%

|

|

Year-to-Date

|

(ended

|

9/30/2022

|

):

|

-15.95%

|

Average Annual Total Returns

As of December 31, 2021

|

|

One

Year

|

Five

Years

|

Ten

Years

|

Inception

Date

|

|

Investor Class Shares

|

|

|

|

2/17/2005

|

|

– Before Taxes

|

-8.18%

|

-1.11%

|

-3.88%

|

|

|

– After Taxes on Distributions

|

-8.18%

|

-1.11%

|

-3.88%

|

|

|

– After Taxes on Distributions

and Sale of Shares

|

-4.84%

|

-0.84%

|

-2.82%

|

|

|

Service Class Shares

|

-9.09%

|

-2.06%

|

-4.82%

|

2/17/2005

|

|

S&P 500®1

|

28.71%

|

18.47%

|

16.55%

|

|

|

ICE® U.S. Dollar Index®2

|

6.37%

|

-1.31%

|

1.78%

|

|

1

Reflects no deduction for fees, expenses or taxes. Adjusted to reflect the reinvestment of dividends paid by issuers in the Index.

2

Reflects no deduction for fees, expenses or taxes.

Average annual total returns are shown on a before- and after-tax basis for Investor Class shares only. After-tax returns for Service Class shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold the Fund’s shares through tax-deferred arrangements, such as a retirement account. After-tax returns may exceed the return before taxes due to a tax benefit from realizing a capital loss on a sale of shares.

6 :: Falling U.S. Dollar ProFund :: TICKERS :: Investor Class FDPIX :: Service Class FDPSX

Annual returns are required to be shown and should not be interpreted as suggesting that the Fund should or should not be held for longer periods of time.

Management

The Fund is advised by ProFund Advisors. Alexander Ilyasov, Senior Portfolio Manager, and James Linneman, Portfolio Manager, have jointly and primarily managed the Fund since April 2019 and March 2022, respectively.

Purchase and Sale of Fund Shares

The minimum initial investment amounts for all classes, which may be waived at the discretion of the Fund, are:

•$5,000 for accounts that list a financial professional.

•$15,000 for self-directed accounts.

You may purchase, redeem or exchange Fund shares on any day which the New York Stock Exchange is open for business. Depending on where your account is held, you may redeem your shares by contacting your financial professional or the Fund by mail, telephone, wire transfer or on-line (www.profunds.com).

Tax Information

The Fund’s distributions generally are taxable, and will be taxed as ordinary income, qualified dividend income or capital gains, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account. You may be taxed later upon withdrawal of monies from such tax-advantaged arrangements. The Fund intends to distribute income, if any, and capital gains, if any, at least annually.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Fund shares through a financial intermediary, such as a broker-dealer or investment adviser, the Fund and its distributor may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other financial intermediary to recommend the Fund over another investment. Ask your financial intermediary or visit your financial intermediary’s website for more information.

P.O. Box 182800

Columbus, OH 43218-2800

Columbus, OH 43218-2800

Receive investor materials electronically:

Shareholders may sign up for electronic delivery of investor materials. By doing so, you will receive the information faster and help us reduce the impact on the environment of providing these materials. To enroll in electronic delivery,

1.

Go to www.icsdelivery.com

2.

Select the first letter of your brokerage firm’s name.

3.

From the list that follows, select your brokerage firm. If your brokerage firm is not listed, electronic delivery may not

be available. Please contact your brokerage firm.

4.

Complete the information requested, including the e-mail address where you would like to receive notifications for electronic documents.

Your information will be kept confidential and will not be used for any purpose other than electronic delivery. If you change your mind, you can cancel electronic delivery at any time and revert to physical delivery of your materials. Just go to www.icsdelivery.com, perform the first three steps above, and follow the instructions for cancelling electronic delivery. If you have any questions, please contact your brokerage firm.

ProFunds®

Post Office Mailing Address for Investments

P.O. Box 182800

Columbus, OH 43218-2800

P.O. Box 182800

Columbus, OH 43218-2800

Phone Numbers

For Financial Professionals: (888) PRO-5717 (888) 776-5717

For All Others: (888) PRO-FNDS (888) 776-3637 Or: (614) 470-8122

Fax Number: (800) 782-4797

For Financial Professionals: (888) PRO-5717 (888) 776-5717

For All Others: (888) PRO-FNDS (888) 776-3637 Or: (614) 470-8122

Fax Number: (800) 782-4797

Website Address: ProFunds.com

Investment Company Act File No. 811-08239

FDP NOV22

FDP NOV22

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Entergy Texas’ First Solar Resource Helps Customers Meet Sustainability Goals

- Åsa Vilsson new CFO at Elanders

- Dimensional Fund Advisors Ltd. : Form 8.3 - DS SMITH PLC - Ordinary Shares

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share