Form 497K NEEDHAM FUNDS INC

SUMMARY PROSPECTUS

May 1, 2021

| Needham Aggressive Growth Fund | Retail Class Ticker Symbol: NEAGX Institutional Class Ticker Symbol: NEAIX | ||||

Before you invest, you may want to review the Needham Aggressive Growth Fund’s (the Aggressive Growth Fund) prospectus, which contains more information about the Aggressive Growth Fund and its risks. You can find the Aggressive Growth Fund’s prospectus, reports to shareholders, and other information about the Aggressive Growth Fund online at https://www.needhamfunds.com/mutual-funds/aggressive-growth-fund/. You can also get this information at no cost by calling 1-800-625-7071 or by sending an e-mail request to webmail@needhamco.com. The Aggressive Growth Fund’s Prospectus and Statement of Additional Information, each dated May 1, 2021 (as revised or supplemented), are incorporated by reference into this Summary Prospectus.

Investment Objective

The Needham Aggressive Growth Fund (the “Aggressive Growth Fund”) seeks long-term, tax-efficient capital appreciation.

Fees and Expenses of the Aggressive Growth Fund

This table describes the fees and expenses you may pay if you buy, hold and sell shares of the Aggressive Growth Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| Retail Class | Institutional Class | ||||||||||

| Annual Fund Operating Expenses | |||||||||||

(expenses that you pay each year as a percentage of the value of your investment) | |||||||||||

| Management Fees | 1.25 | % | 1.25 | % | |||||||

| Distribution and/or Service (12b-1) Fees | 0.25 | % | None | ||||||||

| Other Expenses | |||||||||||

Dividends on Short Positions and Interest Expense(a) | 0.00 | % | 0.00 | % | |||||||

| All Remaining Other Expenses | 0.46 | % | 0.46 | % | |||||||

| Total Other Expenses | 0.46 | % | 0.46 | % | |||||||

| Total Annual Fund Operating Expenses | 1.96 | % | 1.71 | % | |||||||

Fee Waiver/Expense Reimbursement(b) | -0.11 | % | -0.53 | % | |||||||

Total Annual Fund Operating Expenses after Fee Waiver/ Expense Reimbursement (or Recoupment) | 1.85 | % | 1.18 | % | |||||||

(a)Amounts to less than 0.01%.

(b)Reflects a contractual agreement by Needham Investment Management LLC (the “Adviser”) to waive its fee and, if necessary, reimburse the Aggressive Growth Fund until April 30, 2022 to the extent Total Annual Fund Operating Expenses exceed 1.85% and 1.18% of the average daily net assets of Retail Class shares and Institutional Class shares, respectively, of the Aggressive Growth Fund (the “Expense Cap”). This agreement can only be amended or terminated by agreement of the Company, upon approval of the Company’s Board of Directors, and the Adviser and will terminate automatically in the event of termination of the Investment Advisory Agreement between the Adviser and the Company, on behalf of the Aggressive Growth Fund. For a period of up to 36 months from the time of any waiver or reimbursement pursuant to this agreement, the Adviser may recoup from the Aggressive Growth Fund fees waived and expenses reimbursed to the extent that such recovery would not cause the Total Annual Fund Operating Expenses of the Aggressive Growth Fund to exceed the lesser of the Expense Cap in effect (i) at the time of the waiver or reimbursement, or (ii) at the time of recoupment. Any such recovery will not include interest. The Expense Cap limitation on Total Annual Fund Operating Expenses excludes taxes, interest, brokerage, dividends on short positions, fees and expenses of “acquired funds” and extraordinary items but includes the management fee.

Example

This example is intended to help you compare the cost of investing in the Aggressive Growth Fund with the cost of investing in other mutual funds.

1 | ||

The example assumes that you invest $10,000 in the Aggressive Growth Fund for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, that all dividends and distributions have been reinvested, and that the Aggressive Growth Fund’s operating expenses remain the same (after giving effect to the fee waiver and expense reimbursement arrangement in year one only). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||

| Retail Class | $188 | $605 | $1,047 | $2,276 | ||||||||||

| Institutional Class | $120 | $487 | $878 | $1,975 | ||||||||||

Portfolio Turnover

The Aggressive Growth Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Aggressive Growth Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Aggressive Growth Fund’s performance. During the most recent fiscal year, the Aggressive Growth Fund’s portfolio turnover rate was 13% of the average value of its portfolio.

Principal Investment Strategies

Under normal conditions, the Aggressive Growth Fund invests at least 65% of its total assets in the equity securities (principally, common stock) of domestic issuers listed on a nationally recognized securities exchange. The Aggressive Growth Fund invests principally in markets and industries with strong growth potential, focusing primarily on the market leaders in these areas as these companies often garner a disproportionate share of the positive financial returns. Although the Aggressive Growth Fund may invest in companies of any size, the Aggressive Growth Fund’s investment strategy may result in a focus on smaller companies. The Aggressive Growth Fund may, but is not required to, invest in stocks from a variety of industries included in the technology, healthcare, energy and industrials, specialty retailing, media/leisure/cable/entertainment and business and consumer services sectors. Although the Aggressive Growth Fund’s investments have typically been most heavily weighted in the information technology and healthcare sectors, the allocation of the Aggressive Growth Fund’s assets among the various sectors may change at any time. The Aggressive Growth Fund may engage in short sales. The Aggressive Growth Fund may make a profit or loss depending upon whether the market price of the security sold short decreases or increases between the date of the short sale and the date on which the Aggressive Growth Fund replaces the borrowed security.

Principal Investment Risks

Stock Investing and Market Risks. The Aggressive Growth Fund invests primarily in equity securities that fluctuate in value. Fund losses may be incurred due to declines in one or more markets in which Fund investments are made. These declines may be the result of, among other things, political, regulatory, market, economic or social developments affecting the relevant market(s). In addition, turbulence and reduced liquidity in financial markets may negatively affect many issuers, which could have an adverse effect on your Fund investment. Global economies and financial markets are increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers worldwide. As a result, local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions or other events could have a significant negative impact on global economic and market conditions. The coronavirus disease 2019 (COVID-19) global pandemic and the aggressive responses taken by many governments or voluntarily imposed by private parties, including closing borders, restricting travel and imposing prolonged quarantines or similar restrictions, as well as the closure of, or operational changes to, many retail and other businesses, have had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may impact your Fund investment.

Growth Investing Risks. The Aggressive Growth Fund invests in stocks believed by the Adviser to have the potential for growth, but that may not realize such perceived potential for extended periods of time or may never realize such perceived growth potential. Such stocks may be more volatile than other stocks because they can be more sensitive to investor perceptions of the issuing company’s growth potential.

Small Company Investment Risks. The Aggressive Growth Fund often invests in smaller companies that may have limited product lines, markets or financial resources. These smaller companies may trade at a lower volume than more widely held securities and may fluctuate in value more sharply than those of other securities.

2 | ||

Focus Risks. Although the Aggressive Growth Fund is classified as “diversified” under the 1940 Act, the Aggressive Growth Fund may invest its assets in a smaller number of issuers than other, more diversified, funds. The Aggressive Growth Fund’s NAV may be more vulnerable to changes in the market value of a single issuer or group of issuers and may be relatively more susceptible to adverse effects from any single corporate, industry, economic, market, political or regulatory occurrence than if the Aggressive Growth Fund’s investments consisted of securities issued by a larger number of issuers.

Market Capitalization Risks. To the extent the Aggressive Growth Fund emphasizes stocks of small, mid or large cap companies, it will assume the associated risks. At any given time, any of these market capitalizations may be out of favor with investors. Larger companies may be less responsive to changes and opportunities affecting their business than are small and mid cap companies, though small and mid cap companies tend to have less established operating histories, less predictable earnings and revenues (some companies may be experiencing significant losses), and more volatile share prices than those of larger companies.

Sector Risks. To the extent that the Aggressive Growth Fund focuses its investments in securities of issuers in a particular market sector, such as technology companies or healthcare companies, the Aggressive Growth Fund will be significantly affected by developments in that sector.

Technology companies generally operate in intensely competitive markets. This level of competition can put pressure on the prices of their products and services which could adversely affect their profitability. Also, because technology development in many areas increases at a rapid rate, these companies often produce products with very short life cycles and face the risk of product obsolescence. Other risks include worldwide competition, changes in consumer preferences, problems with product compatibility, the effects of economic slowdowns, and changes in government regulation.

The value of equity securities of healthcare companies may fluctuate because of changes in the regulatory and competitive environment in which they operate. Many healthcare companies offer products and services that are subject to governmental regulation and may be adversely affected by changes in governmental policies or laws. Failure to obtain regulatory approvals or changes in governmental policies regarding funding or subsidies may also adversely affect the value of the equity securities of healthcare companies. Healthcare companies may also be strongly affected by scientific or technological developments and their products may quickly become obsolete. Furthermore, these companies may be adversely affected by product liability-related lawsuits. The securities of companies in these sectors may experience more price volatility than securities of companies in other sectors.

Short Sales Risks. Short sales present the risk that the price of the security sold short will increase in value between the time of the short sale and the time the Aggressive Growth Fund must purchase the security to return it to the lender. The Aggressive Growth Fund may not be able to close a short position at a favorable price or time and the loss of value on a short sale is potentially unlimited.

Loss of money is a risk of investing in the Aggressive Growth Fund.

Bar Chart and Performance Table

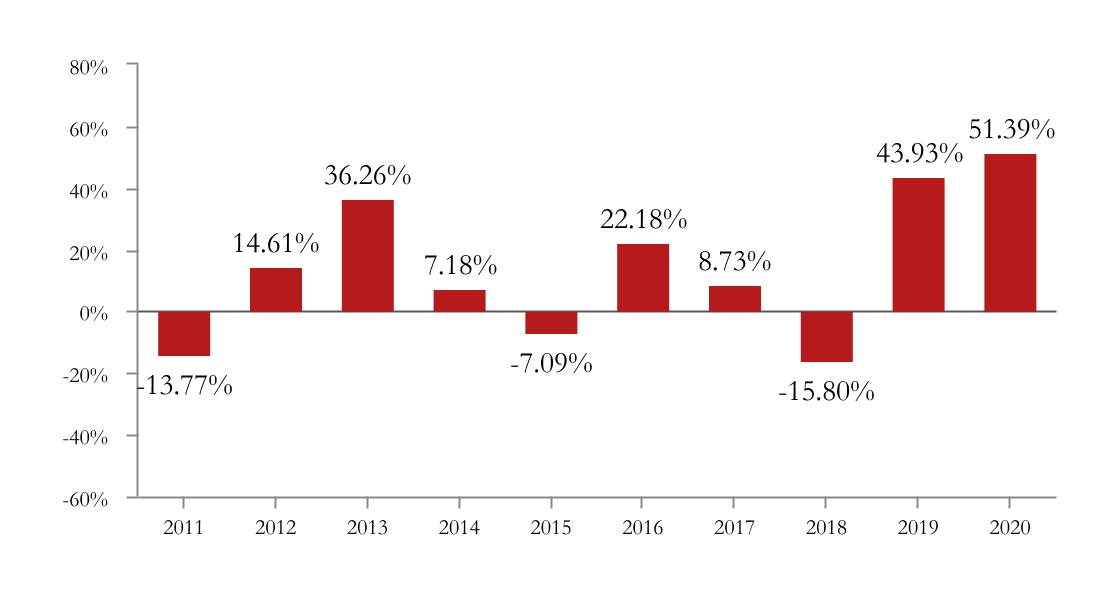

The information in the bar chart and table that follows provides some indication of the risks of investing in the Aggressive Growth Fund by showing changes in the performance of the Aggressive Growth Fund’s Retail Class shares from year to year and by showing how the Aggressive Growth Fund’s average annual returns for 1, 5 and 10 years and for the life of the Aggressive Growth Fund compare to those of broad measures of market performance.

The Aggressive Growth Fund’s past performance (before and after taxes) is not necessarily an indication of how the Aggressive Growth Fund will perform in the future. Updated performance information is available on the Aggressive Growth Fund’s website at www.needhamfunds.com.

3 | ||

Calendar Year Total Returns as of December 31 – Retail Class

During the ten-year period shown in the above chart, the highest quarterly return was 34.85% (for the quarter ended 6/30/2020) and the lowest quarterly return was -26.93% (for the quarter ended 9/30/2011).

Average annual total returns for the periods ended December 31, 2020

The following table shows the average annual returns of the Aggressive Growth Fund’s shares and the change in value of certain broad-based market indices over various periods ended December 31, 2020. The index information is intended to permit you to compare the Aggressive Growth Fund’s performance to several broad measures of market performance.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not include the impact of state and local taxes.

Your actual after-tax returns depend on your tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their shares in a tax-deferred account (including a 401(k) or IRA), or to investors who are tax-exempt. After-tax returns are shown only for Retail Class shares. After-tax returns for Institutional Class shares may vary.

Average annual total returns for the periods ended December 31, 2020

Class (Inception Date) | 1 Year | 5 Years | 10 Years | Since Inception (9/4/01) | Since Inception (12/30/16) | ||||||||||||

| Retail Class (9/4/01) | |||||||||||||||||

Return Before Taxes | 51.39% | 19.50% | 12.57% | 11.43% | N/A | ||||||||||||

Return After Taxes on Distributions | 49.88% | 17.27% | 11.12% | 10.33% | N/A | ||||||||||||

Return After Taxes on Distributions and Redemption | 31.29% | 15.12% | 9.95% | 9.53% | N/A | ||||||||||||

Institutional Class (12/30/16) | |||||||||||||||||

Return Before Taxes | 52.36% | N/A | N/A | N/A | 19.53% | ||||||||||||

S&P 500® Index* | 18.40% | 15.22% | 13.88% | 8.55% | 16.03% | ||||||||||||

Russell 2000® Index* | 19.96% | 13.26% | 11.20% | 9.20% | 11.32% | ||||||||||||

*Comparative indices reflect no deductions for fees, expenses, or taxes.

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2021. All rights in the Russell 2000 Index (the “Index”) vest in the relevant LSE Group company which owns the Index. The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. Neither the LSE Group nor its licensors accept any liability for any errors or omissions in the Index; no party may rely on the Index returns shown; and the LSE Group makes no claim, prediction, warranty or representation about the Needham Aggressive Growth Fund or the suitability of the Index with respect to the Needham Aggressive Growth Fund. No further distribution of data from the LSE Group is permitted without the

4 | ||

relevant LSE Group company's express written consent. The LSE Group is not connected to the Needham Aggressive Growth Fund and does not promote, sponsor or endorse the Needham Aggressive Growth Fund or the content of this prospectus.

Investment Adviser

Needham Investment Management LLC is the investment adviser of the Aggressive Growth Fund.

Portfolio Manager

The portfolio manager of the Aggressive Growth Fund is John O. Barr. Mr. Barr is Executive Vice President and has been Portfolio Manager of the Aggressive Growth Fund since 2010.

Purchase, Exchange, and Redemption of Fund Shares

You may purchase, exchange, or redeem shares of the Aggressive Growth Fund at any time by sending a written request to The Needham Funds, c/o U.S. Bancorp Fund Services, LLC, P.O. Box 701, Milwaukee, WI 53201-0701, by calling 1-800-625-7071, or by wire transfer.

The minimum initial and subsequent investment amounts are shown below.

| Type of Account | To Open Your Account | To Add to Your Account | ||||||

| Retail Class | ||||||||

Individuals, Corporations, Partnerships, Trusts | $2,000 | $100 | ||||||

IRAs | $1,000 | None | ||||||

| Institutional Class | ||||||||

All Accounts | $100,000 | None | ||||||

Tax Information

The Aggressive Growth Fund intends to make distributions each year. The Aggressive Growth Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an IRA. Such tax-deferred arrangements may be taxed later upon withdrawal of monies from those arrangements.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Aggressive Growth Fund through a broker-dealer or other financial intermediary (such as a bank), the Aggressive Growth Fund and its related companies may pay the intermediary for the sale of Aggressive Growth Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Aggressive Growth Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5 | ||

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Accolade Inc. (ACCD) PT Lowered to $13 at Needham

- Needham Upgrades Silicon Labs (SLAB) to Buy

- Day One Biopharmaceuticals (DAWN) PT Raised to $33 at Needham

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Needham & CompanySign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share