Form 497K LAZARD FUNDS INC

Lazard Funds April 30, 2021

Summary Prospectus

Before you invest, you may want to review the Portfolio’s Prospectus, which contains more information about the Portfolio and its risks. The Portfolio’s Prospectus and Statement of Additional Information (“SAI”), both dated April 30, 2021 (as revised or supplemented), are incorporated by reference into this Summary Prospectus. You can find the Portfolio’s Prospectus, SAI and other information about the Portfolio online at https://www.lazardassetmanagement.com/us/en_us/funds/list/mutual-funds/42. You can also get this information at no cost by calling (800) 823-6300 or by sending an e-mail request to [email protected].

Lazard Emerging Markets Equity Advantage Portfolio | Institutional Shares | Open Shares | R6 Shares | ||

LEAIX | LEAOX | READX |

Investment Objective

The Portfolio seeks long-term capital appreciation.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the Portfolio, a series of The Lazard Funds, Inc. (the “Fund”). You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and the Example below.

|

| Institutional Shares |

| Open Shares |

| R6 Shares |

|

Annual Portfolio Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

|

|

| ||||

Management Fees1 |

| .75% |

| .75% |

| .75% |

|

Distribution and Service (12b-1) Fees |

| None |

| .25% |

| None |

|

Other Expenses |

| 1.12% |

| 1.58% |

| 1.12% | 2 |

Total Annual Portfolio Operating Expenses |

| 1.87% |

| 2.58% |

| 1.87% |

|

Fee Waiver and/or Expense Reimbursement3 |

| .97% |

| 1.43% |

| 1.02% |

|

Total Annual Portfolio Operating Expenses After Fee Waiver and/or Expense Reimbursement |

| .90% |

| 1.15% |

| .85% |

|

1 Restated to reflect current management fee.

2 Based on estimated amounts for the current fiscal year, using amounts for Institutional Shares from the last fiscal year.

2 Reflects a contractual agreement by Lazard Asset Management LLC (the “Investment Manager”) to waive its fee and, if necessary, reimburse the Portfolio until April 30, 2022, to the extent Total Annual Portfolio Operating Expenses exceed .90%, 1.15% and .85% of the average daily net assets of the Portfolio’s Institutional Shares, Open Shares and R6 Shares, respectively, exclusive of taxes, brokerage, interest on borrowings, fees and expenses of “Acquired Funds,” fees and expenses related to filing foreign tax reclaims and extraordinary expenses. This expense limitation agreement can only be amended by agreement of the Fund, upon approval by the Fund’s Board of Directors, and the Investment Manager to lower the net amount shown and will terminate automatically in the event of termination of the Management Agreement between the Investment Manager and the Fund, on behalf of the Portfolio.

Example

This Example is intended to help you compare the cost of investing in the Portfolio with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in the Portfolio for the time periods indicated and then hold or redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Portfolio’s operating expenses remain the same, giving effect to the expense limitation agreement in year one only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

| 1 year | 3 years | 5 years | 10 years |

Institutional Shares | $ 92 | $ 493 | $ 921 | $ 2,111 | |||

Open Shares | $ 117 | $ 666 | $ 1,242 | $ 2,808 | |||

R6 Shares | $ 87 | $ 489 | $ 916 | $ 2,107 | |||

Portfolio Turnover

The Portfolio pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Portfolio shares are held in a taxable account. These costs, which are not reflected in annual portfolio operating expenses or in the Example, affect the Portfolio’s performance. During the most recent fiscal year, the Portfolio’s portfolio turnover rate was 91% of the average value of its portfolio.

Principal Investment Strategies

The Portfolio invests primarily in equity securities, principally common stocks, of emerging markets companies. In managing the Portfolio, the Investment Manager utilizes a quantitatively driven, bottom up stock selection process. The Portfolio management team selects investments for the Portfolio from a broad investment universe of emerging market stocks and depositary receipts, including American Depositary Receipts (“ADRs”), Global Depositary Receipts and European Depositary Receipts, real estate investment trusts (“REITs”), warrants and rights. The active, quantitative approach utilized by the Portfolio management team involves initial screening, risk assessment and evaluation of each company relative to its global peers. The Investment Manager uses an objective, systematic investment process that blends both risk and stock ranking assessments designed to capture attractive risk-to-return characteristics. In addition to a multidimensional assessment of risk, each company is evaluated daily according to four independent measures: growth, value, sentiment and quality. The Portfolio may invest across the capitalization spectrum.

Under normal circumstances, the Portfolio invests at least 80% of its assets in equity securities of companies that are economically tied to emerging market countries. The allocation of the Portfolio’s assets among countries and regions will vary from time to time based on the Investment Manager’s judgment and its analysis of market conditions. Implementation of the Portfolio’s investment strategy may, during certain periods, result in the investment of a significant portion of the Portfolio’s assets in a particular country.

The Portfolio considers a company to be “economically tied to emerging markets countries” if: (i) the company is organized under the laws of or domiciled in an emerging markets country or maintains its principal place of business in an emerging markets country; (ii) the securities of such company are traded principally in emerging markets countries; or (iii) during the most recent fiscal year of the company, the company derived at least 50% of its revenues or profits from goods produced or sold, investments made, or services performed in emerging markets countries or that has at least 50% of its assets in emerging markets countries. The Portfolio considers emerging markets countries to be all countries: (i) included in the MSCI Emerging Markets Index; or (ii) not included in the MSCI World Index.

The Portfolio may invest in exchange-traded open-end management investment companies (“ETFs”), generally those that pursue a passive index-based strategy.

Principal Investment Risks

The value of your investment in the Portfolio will fluctuate, which means you could lose money.

Market Risk. The Portfolio may incur losses due to declines in one or more markets in which it invests. These declines may be the result of, among other things, political, regulatory, market, economic or social developments affecting the relevant market(s). To the extent that such developments impact specific industries, market sectors,

Summary Prospectus

2

countries or geographic regions, the Portfolio’s investments in such industries, market sectors, countries and/or geographic regions can be expected to be particularly affected, especially if such investments are a significant portion of its investment portfolio. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed income markets may negatively affect many issuers, which could adversely affect the Portfolio. Global economies and financial markets are increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers worldwide. As a result, local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues, recessions or other events could have a significant negative impact on global economic and market conditions. The coronavirus disease 2019 (COVID-19) global pandemic and the aggressive responses taken by many governments or voluntarily imposed by private parties, including closing borders, restricting travel and imposing prolonged quarantines or similar restrictions, as well as the closure of, or operational changes to, many retail and other businesses, has had negative impacts, and in many cases severe negative impacts, on markets worldwide. It is not known how long such impacts, or any future impacts of other significant events described above, will or would last, but there could be a prolonged period of global economic slowdown, which may be expected to impact the Portfolio and its investments.

Issuer Risk. The value of a security may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced demand for the issuer’s goods or services, as well as the historical and prospective earnings of the issuer and the value of its assets or factors unrelated to the issuer’s value, such as investor perception.

Non-US Securities Risk. The Portfolio’s performance will be influenced by political, social and economic factors affecting the non-US countries and companies in which the Portfolio invests. Non-US securities carry special risks, such as less developed or less efficient trading markets, political instability, a lack of company information, differing auditing and legal standards, and, potentially, less liquidity.

Emerging Market Risk. Emerging market countries generally have economic structures that are less diverse and mature, and political systems that are less stable, than those of developed countries. The economies of countries with emerging markets may be based predominantly on only a few industries, may be highly vulnerable to changes in local or global trade conditions, and may suffer from extreme debt burdens or volatile inflation rates. The securities markets of emerging market countries have historically been extremely volatile and less liquid than more developed markets. These market conditions may continue or worsen. Investments in these countries may be subject to political, economic, legal, market and currency risks. Significant devaluation of emerging market currencies against the US dollar may occur subsequent to acquisition of investments denominated in emerging market currencies.

Foreign Currency Risk. Investments denominated in currencies other than US dollars may experience a decline in value, in US dollar terms, due solely to fluctuations in currency exchange rates. The Portfolio’s investments denominated in such currencies (particularly currencies of emerging markets countries), as well as any investments in currencies themselves, could be adversely affected by delays in, or a refusal to grant, repatriation of funds or conversion of currencies. Irrespective of any foreign currency exposure hedging, the Portfolio may experience a decline in the value of its portfolio securities, in US dollar terms, due solely to fluctuations in currency exchange rates. The Investment Manager does not intend to actively hedge the Portfolio’s foreign currency exposure.

Depositary Receipts Risk. ADRs and similar depositary receipts typically will be subject to certain of the risks associated with direct investments in the securities of non-US companies, because their values depend on the performance of the underlying non-US securities. However, currency fluctuations will impact investments in depositary receipts differently than direct investments in non-US dollar-denominated non-US securities, because a depositary receipt will not appreciate in value solely as a result of appreciation in the currency in which the underlying non-US dollar security is denominated.

Summary Prospectus

3

Quantitative Model Risk. The success of the Portfolio’s investment strategy depends largely upon the effectiveness of the Investment Manager’s quantitative model. A quantitative model, such as the risk and other models used by the Investment Manager requires adherence to a systematic, disciplined process. The Investment Manager’s ability to monitor and, if necessary, adjust its quantitative model could be adversely affected by various factors including incorrect or outdated market and other data inputs. Factors that affect a security’s value can change over time, and these changes may not be reflected in the quantitative model. In addition, factors used in quantitative analysis and the weight placed on those factors may not be predictive of a security’s value.

Small and Mid Cap Companies Risk. Small and mid cap companies carry additional risks because their earnings tend to be less predictable, their share prices more volatile and their securities less liquid than larger, more established companies. The shares of small and mid cap companies tend to trade less frequently than those of larger companies, which can have an adverse effect on the pricing of these securities and on the ability to sell these securities when the Investment Manager deems it appropriate.

Large Cap Companies Risk. Investments in large cap companies may underperform other segments of the market when such other segments are in favor or because such companies may be less responsive to competitive challenges and opportunities and may be unable to attain high growth rates during periods of economic expansion.

REIT Risk. REITs are subject to similar risks as an investment in a realty-related company. Consequently, investments in REITs could lead to investment results that may be significantly different from investments in the broader securities markets. The risks related to investments in realty-related companies include, but are not limited to: adverse changes in general economic and local market conditions; adverse developments in employment; changes in supply or demand for similar or competing properties; unfavorable changes in applicable taxes, governmental regulations and interest rates; operating or development expenses; and lack of available financing. Due to certain special considerations that apply to REITs, investments in REITs may carry additional risks not necessarily present in investments in other securities. REIT securities (including those trading on national exchanges) typically have trading volumes that are less than those of securities of other types of companies, which may affect the Portfolio’s ability to trade or liquidate those securities. An investment in a REIT may be adversely affected if the REIT fails to comply with applicable laws and regulations, including failing to quality as a REIT under the Internal Revenue Code of 1986, as amended. Failure to qualify with any of these requirements could jeopardize a company’s status as a REIT. The Portfolio generally will have no control over the operations and policies of a REIT, including qualification as a REIT.

ETF Risk. Shares of ETFs may trade at prices that vary from their net asset values, sometimes significantly. The shares of ETFs may trade at prices at, below or above their net asset value. In addition, the performance of an ETF pursuing a passive index-based strategy may diverge from the performance of the index. The Portfolio’s investments in ETFs are subject to the risks of the ETFs’ investments, as well as to the general risks of investing in ETFs. The Portfolio will bear not only the Portfolio’s management fees and operating expenses, but also the Portfolio’s proportional share of the management fees and operating expenses of the ETFs in which the Portfolio invests. The Portfolio may be limited by Section 12 of the Investment Company Act of 1940, as amended (the “1940 Act”), in the amount of its assets that may be invested in one or more ETFs unless the relevant ETF(s) have received an exemptive order from the Securities and Exchange Commission (the “SEC”) on which the Portfolio may rely or an exemption is available. New Rule 12d1-4 under the 1940 Act will allow the Portfolio to acquire the securities of another investment company, including ETFs, in excess of the limitations imposed by Section 12 of the 1940 Act without obtaining an exemptive order from the SEC, subject to certain limitations and conditions. The aforementioned exemptive orders will be rescinded effective January 19, 2022, and by such date the Portfolio will have to comply with the requirements of Rule 12d1-4 in order to rely on its exemptions from the requirements of Section 12.

Summary Prospectus

4

Other Equity Securities Risk. Investments in rights and warrants involve certain risks, including the possible lack of a liquid market for resale, price fluctuations and the failure of the price of the underlying security to reach a level at which the right or warrant can be prudently exercised, in which case the right or warrant may expire without being exercised and result in a loss of the Portfolio’s entire investment.

Country Risk. Implementation of the Portfolio’s investment strategy may, during certain periods, result in the investment of a significant portion of the Portfolio’s assets in a particular country, such as China, and the Portfolio would be expected to be affected by political, regulatory, market, economic and social developments affecting that country. Specific risks associated with investments in China include exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization, exchange control regulations (including currency blockage), trading halts, imposition of tariffs, limitations on repatriation and differing legal standards.

The Portfolio may invest in eligible renminbi-denominated class A shares of equity securities that are listed and traded on certain Chinese stock exchanges (“China A-Shares”) through Hong Kong Stock Connect Program (“Stock Connect”). While Stock Connect is not subject to individual investment quotas, daily and aggregate investment quotas apply to all Stock Connect participants, which may restrict or preclude the Portfolio’s ability to invest in China A-Shares (although the Portfolio would be permitted to sell China A-Shares regardless of the quota balance). Stock Connect is also subject to trading, clearance, settlement and operational risks.

Securities Selection Risk. Securities and other investments selected by the Investment Manager for the Portfolio may not perform to expectations. This could result in the Portfolio’s underperformance compared to other funds with similar investment objectives or strategies.

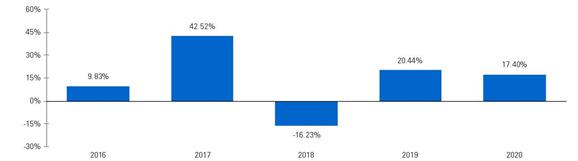

Performance Bar Chart and Table

Year-by-Year

Total Returns for Institutional Shares

As

of 12/31

The accompanying bar chart and table provide some indication of the risks of investing in Lazard Emerging Markets Equity Advantage Portfolio by showing the Portfolio’s year-by-year performance and its average annual performance compared to that of a broad measure of market performance. The bar chart shows how the performance of the Portfolio’s Institutional Shares has varied from year to year. Updated performance information is available at www.lazardassetmanagement.com or by calling (800) 823-6300. The Portfolio’s past performance (before and after taxes) is not necessarily an indication of how the Portfolio will perform in the future.

Calendar Years ended December 31

Best Quarter: | |

Q4 2020 | 17.93% |

|

|

Worst Quarter: | |

Q1 2020 | -23.63% |

Average Annual Total Returns

(for the periods ended

December 31, 2020)

After-tax returns are shown only for Institutional Shares. After-tax returns of the Portfolio’s other share classes will vary. After-tax returns are calculated using the historical highest individual marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their shares

Summary Prospectus

5

through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Returns shown below for the Portfolio’s R6 Shares (which were not operational as of December 31, 2020) reflect the performance of the Portfolio’s Institutional Shares. R6 Shares would have had substantially similar returns as Institutional Shares because the share classes are invested in the same portfolio of securities, and the returns would differ only to the extent that the classes do not have the same expenses.

| Inception

| 1 Year | 5 Years | Life of |

Institutional Shares: | 5/29/2015 |

|

|

|

Returns Before Taxes |

| 17.40% | 13.14% | 7.78% |

Returns After Taxes on Distributions |

| 17.31% | 12.99% | 7.58% |

Returns After Taxes on Distributions and Sale of Portfolio Shares |

| 10.62% | 10.73% | 6.29% |

Open Shares (Returns Before Taxes) | 5/29/2015 | 17.10% | 12.82% | 7.47% |

R6 Shares (Returns Before Taxes) |

| 17.40% | 13.14% | 7.78% |

MSCI Emerging Markets Index |

| 18.31% | 12.81% | 7.15% |

(reflects no deduction for fees, expenses or taxes) |

|

|

|

|

Management

Investment Manager

Lazard Asset Management LLC

Portfolio Managers/Analysts

Paul Moghtader, portfolio manager/analyst on various of the Investment Manager’s Global Advantage portfolio management teams, has been with the Portfolio since May 2015.

Taras Ivanenko, portfolio manager/analyst on various of the Investment Manager’s Global Advantage portfolio management teams, has been with the Portfolio since May 2015.

Ciprian Marin, portfolio manager/analyst on various of the Investment Manager’s Global Advantage portfolio management teams, has been with the Portfolio since May 2015.

Craig Scholl, portfolio manager/analyst on various of the Investment Manager’s Global Advantage portfolio management teams, has been with the Portfolio since May 2015.

Susanne Willumsen, portfolio manager/analyst on various of the Investment Manager’s Global Advantage portfolio management teams, has been with the Portfolio since May 2015.

Alex Lai, portfolio manager/analyst on various of the Investment Manager’s Global Advantage portfolio management teams, has been with the Portfolio since May 2019.

Summary Prospectus

6

Purchase and Sale of Portfolio Shares

The initial investment minimums are:

Institutional Shares*† | $ | 10,000 |

Open Shares* | $ | 2,500 |

R6 Shares† | $ | 1,000,000 |

* Unless the investor is a client of a securities dealer or other institution which has made an aggregate minimum initial purchase for its clients of at least $10,000 for Institutional Shares or $2,500 for Open Shares.

† There is no minimum investment amount for Board members and other individuals considered to be affiliates of the Fund or the Investment Manager and their family members, discretionary accounts with the Investment Manager, affiliated and non-affiliated registered investment companies and, for R6 Shares only, certain types of employee benefit plans.

The subsequent investment minimum is $50 for Institutional Shares and Open Shares. There is no subsequent investment minimum for R6 Shares.

Open Shares investors investing directly with a Portfolio who meet the Institutional Shares minimum may request that their Open Shares be converted to Institutional Shares. Investors investing through a securities dealer or other institution should consult that firm regarding share class availability and applicable minimums.

Portfolio shares are redeemable through the Fund’s transfer agent, DST Asset Manager Solutions, Inc., on any business day by telephone, mail or overnight delivery. Clients of financial intermediaries may be subject to the intermediaries’ procedures.

Tax Information

All dividends and short-term capital gains distributions are generally taxable to you as ordinary income, and long-term capital gains are generally taxable as such, whether you receive the distribution in cash or reinvest it in additional shares.

Financial Intermediary Compensation (Open and Institutional Shares only)

Payments to Broker-Dealers and Other

Financial Intermediaries

If you purchase shares of a Portfolio through a broker-dealer or other financial intermediary (such as a bank), the Portfolio and/or the Investment Manager and its affiliates may pay the intermediary for the sale of Portfolio shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Portfolio over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

000841120 | |

Lazard Asset Management LLC • 30 Rockefeller Plaza • New York, NY 10112 • www.lazardassetmanagement.com |

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Great Lakes Dredge & Dock (GLDD) Announces $150M Second-Lien Financing Agreement

- CEL-SCI Corp (CVM) Appoints Mario Gobbo to Its Board

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

LazardSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share