Form 497K GABELLI EQUITY SERIES

The Gabelli Small Cap Growth Fund

A series of Gabelli Equity Series Funds, Inc.

SUMMARY PROSPECTUS January 27, 2023

Class AAA (GABSX), A (GCASX), C (GCCSX), I (GACIX)

Before you invest, you may want to review the Fund’s Prospectus and Statement of Additional Information (“SAI”), which contain more information about the Fund and its risks. You can find the Fund’s Prospectus and SAI and other information about the Fund online at www.gabelli.com. You can also get this information at no cost by calling 800-422-3554 or by sending an email request to [email protected]. The Fund’s Prospectus and SAI, both dated January 27, 2023 are incorporated by reference into this Summary Prospectus.

Investment Objective

The Small Cap Growth Fund seeks to provide a high level of capital appreciation.

Fees and Expenses of the Small Cap Growth Fund:

This table describes the fees and expenses that you may pay if you buy and hold the following classes of shares of the Small Cap Growth Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts on Class A shares if you and your family invest, or agree to invest in the future, at least $50,000 in Class A shares of the Gabelli family of mutual funds. More information about these and other discounts is available from your financial professional and in the section entitled, “Classes of Shares” on page 45 of the prospectus and in Appendix A, “Sales Charge Reductions and Waivers Available through Certain Intermediaries,” attached to the Fund’s prospectus.

| Class AAA Shares |

Class A Shares |

Class C Shares |

Class I Shares | |||||||||||||||||

| Shareholder Fees |

||||||||||||||||||||

| (fees paid directly from your investment): |

||||||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Purchases |

None | 5.75% | None | None | ||||||||||||||||

| Maximum Deferred Sales Charge (Load) (as a percentage of |

None | None | 1.00% | None | ||||||||||||||||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None | None | None | None | ||||||||||||||||

| Redemption Fees (as a percentage of amount redeemed for shares |

2.00% | 2.00% | 2.00% | 2.00% | ||||||||||||||||

| Exchange Fee |

None | None | None | None | ||||||||||||||||

| Annual Fund Operating Expenses |

||||||||||||||||||||

| (expenses that you pay each year as a percentage of the value of |

||||||||||||||||||||

| Management Fees |

1.00% | 1.00% | 1.00% | 1.00% | ||||||||||||||||

| Distribution and Service (Rule 12b-1) Fees |

0.25% | 0.25% | 1.00% | None | ||||||||||||||||

| Other Expenses |

0.14% | 0.14% | 0.14% | 0.14% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Annual Fund Operating Expenses |

1.39% | 1.39% | 2.14% | 1.14% | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Expense Example

This example is intended to help you compare the cost of investing in the Small Cap Growth Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000 in the Small Cap Growth Fund for the time periods shown and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Small Cap Growth Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class AAA Shares |

$ | 142 | $ | 440 | $ | 761 | $ | 1,669 | ||||||||||||

| Class A Shares |

$ | 708 | $ | 990 | $ | 1,292 | $ | 2,148 | ||||||||||||

| Class C Shares |

$ | 317 | $ | 670 | $ | 1,149 | $ | 2,472 | ||||||||||||

| Class I Shares |

$ | 116 | $ | 362 | $ | 628 | $ | 1,386 | ||||||||||||

You would pay the following expenses if you did not redeem your shares of the Small Cap Growth Fund:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||||||

| Class AAA Shares |

$ | 142 | $ | 440 | $ | 761 | $ | 1,669 | ||||||||||||

| Class A Shares |

$ | 708 | $ | 990 | $ | 1,292 | $ | 2,148 | ||||||||||||

| Class C Shares |

$ | 217 | $ | 670 | $ | 1,149 | $ | 2,472 | ||||||||||||

| Class I Shares |

$ | 116 | $ | 362 | $ | 628 | $ | 1,386 | ||||||||||||

Portfolio Turnover

The Small Cap Growth Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when the Small Cap Growth Fund’s shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect the Small Cap Growth Fund’s performance. During the most recent fiscal year, the Small Cap Growth Fund’s portfolio turnover rate was 1% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Small Cap Growth Fund invests at least 80% of its net assets in equity securities of companies that are considered to be small companies at the time the Small Cap Growth Fund makes its investment. The Small Cap Growth Fund invests primarily in the common stocks of companies which Gabelli Funds, LLC, the Small Cap Growth Fund’s adviser (the “Adviser”), believes are likely to have rapid growth in revenues and above average rates of earnings growth. The Adviser currently characterizes small capitalization companies for the Small Cap Growth Fund as those with total common stock market values of $3 billion or less at the time of investment.

In selecting investments for the Small Cap Growth Fund, the Adviser seeks issuers with a dominant market share or niche franchise in growing and/or consolidating industries. The Adviser considers for purchase the stocks of small capitalization (capitalization is the price per share multiplied by the number of shares outstanding) companies with experienced management, strong balance sheets, and rising free cash flow and earnings. The Adviser’s goal is to invest long term in the stocks of companies trading at reasonable market valuations relative to perceived economic worth.

Frequently, smaller companies exhibit one or more of the following traits:

| • | New products or technologies |

| • | New distribution methods |

| • | Rapid changes in industry conditions due to regulatory or other developments |

| • | Changes in management or similar characteristics that may result not only in expected growth in revenues but in an accelerated or above average rate of earnings growth, which would usually be reflected in capital appreciation. |

2

In addition, because smaller companies are less actively followed by stock analysts and less information is available on which to base stock price evaluations, the market may overlook favorable trends in particular smaller growth companies and then adjust its valuation more quickly once investor interest is gained.

Principal Risks

You may want to invest in the Small Cap Growth Fund if:

| • | you are a long term investor |

| • | you seek capital appreciation |

| • | you believe that the market will favor small capitalization stocks over the long term |

The Small Cap Growth Fund’s share price will fluctuate with changes in the market value of the Small Cap Growth Fund’s portfolio securities. An investment in the Small Cap Growth Fund is not a deposit of a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. When you sell Small Cap Growth Fund shares, they may be worth more or less than what you paid for them; you may lose money by investing in the Small Cap Growth Fund.

Investing in the Small Cap Growth Fund involves the following risks:

| • | Market Disruption, Inflation and Interest Rate Risk. General economic and market conditions, such as interest rates, availability of credit, inflation rates, economic uncertainty, supply chain disruptions, labor shortages, energy and other resource shortages, changes in laws, trade barriers, currency exchange controls and national and international political circumstances (including governmental responses to public health crises or the spread of infectious diseases), may have long-term negative effects on the U.S. and worldwide financial markets and economy, and thus the Fund. Inflation risk is the risk that the value of assets or income from investments will be worth less in the future as inflation decreases the value of money. Recently, inflation has increased to its highest level in decades, and the Federal Reserve has been raising the federal funds rate in response. General interest rate fluctuations may have a substantial negative impact on the Fund’s investments, the value of the Fund and the Fund’s rate of return. Recently, central banks such as the Federal Reserve Bank have been increasing interest rates in an effort to slow the rate of inflation. There is a risk that increased interest rates may cause the economy to enter a recession. Any such recession would negatively impact the Fund and the investments held by the Fund. |

| • | Equity Risk. Equity risk is the risk that the prices of the securities held by the Small Cap Growth Fund will change due to general market and economic conditions, perceptions regarding the industries in which the companies issuing the securities participate, and the issuer company’s particular circumstances. |

| • | Foreign Securities Risk. Investments in foreign securities involve risks relating to political, social, and economic developments abroad, as well as risks resulting from the differences between the regulations to which U.S. and foreign issuers and markets are subject. These risks include expropriation, differing accounting and disclosure standards, currency exchange risks, settlement difficulties, market illiquidity, difficulties enforcing legal rights, and greater transaction costs. These risks are more pronounced in the securities of companies located in emerging markets. |

| • | Management Risk. If the portfolio manager is incorrect in his assessment of the growth prospects of the securities the Small Cap Growth Fund holds, then the value of the Small Cap Growth Fund’s shares may decline. |

| • | Small Capitalization Company Risk. Investing in securities of small capitalization companies may involve greater risks than investing in larger, more established issuers. Smaller capitalization companies typically have relatively lower revenues, limited product lines and lack of management depth, and may have a smaller share of the market for their products or services, than larger capitalization companies. The stocks of smaller capitalization companies tend to have less trading volume than stocks of larger capitalization companies. Less trading volume may make it more difficult for the portfolio manager to sell securities of smaller capitalization companies at quoted market prices. Finally, there are periods when investing in smaller capitalization stocks fall out of favor with investors and the stocks of smaller capitalization companies underperform. |

| • | Value Investing Risk. The Small Cap Growth Fund invests in “value” stocks. The portfolio manager may be wrong in the assessment of a company’s value and the stocks the Small Cap Growth Fund holds may not reach what the portfolio manager believes are their full values. From time to time “value” investing falls out of favor with investors. During those periods, the Small Cap Growth Fund’s relative performance may suffer. |

3

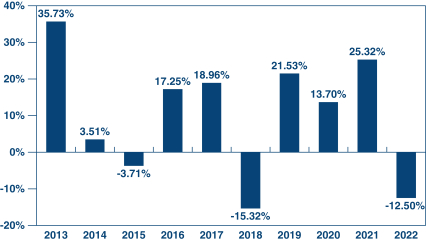

Performance

The bar chart and table that follow provide an indication of the risks of investing in the Small Cap Growth Fund by showing changes in the Small Cap Growth Fund’s performance from year to year and by showing how the Small Cap Growth Fund’s average annual returns for one year, five years, and ten years compared with those of a broad based securities market index. As with all mutual funds, the Small Cap Growth Fund’s past performance (before and after taxes) does not predict how the Small Cap Growth Fund will perform in the future. Updated information on the Small Cap Growth Fund’s results can be obtained by visiting www.gabelli.com.

SMALL CAP GROWTH FUND

(Total Returns for Class AAA Shares for the Years Ended December 31)

During the calendar years shown in the bar chart, the highest return for a quarter was 23.36% (quarter ended December 31, 2020), and the lowest return for a quarter was (29.29)% (quarter ended March 31, 2020).

| Average Annual Total Returns (for the years ended December 31, 2022) |

Past One Year |

Past Five Years |

Past Ten Years | ||||||||||||

| The Gabelli Small Cap Growth Fund Class AAA Shares |

|||||||||||||||

| Return Before Taxes |

(12.50) | % | 5.11 | % | 9.24 | % | |||||||||

| Return After Taxes on Distributions |

(14.29) | % | 1.98 | % | 7.16 | % | |||||||||

| Return After Taxes on Distributions and Sale of Fund Shares |

(6.09) | % | 3.72 | % | 7.33 | % | |||||||||

| Class A Shares (first issued on 12/31/03) |

|||||||||||||||

| Return Before Taxes |

(17.52) | % | 3.88 | % | 8.60 | % | |||||||||

| Class C Shares (first issued on 12/31/03) |

|||||||||||||||

| Return Before Taxes |

(14.01) | % | 4.33 | % | 8.43 | % | |||||||||

| Class I Shares (first issued on 1/11/08) |

|||||||||||||||

| Return Before Taxes |

(12.28) | % | 5.37 | % | 9.51 | % | |||||||||

| S&P SmallCap 600 Index (reflects no deduction for fees, |

(16.10) | % | 5.88 | % | 10.82 | % | |||||||||

| Lipper Small-Cap Core Funds Average |

(15.22) | % | 5.48 | % | 9.48 | % | |||||||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. After-tax returns are shown for only Class AAA shares, and after-tax returns for other classes will vary. In some instances, the “Return After Taxes on Distributions and Sale of Fund Shares” may be greater than the “Return After Taxes on Distributions” because the investor is assumed to be able to use the capital loss from the sale of Fund shares to offset other taxable gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Small Cap Growth Fund shares through tax-deferred arrangements, such as 401(k) plans or Individual Retirement Accounts, including Roth IRAs and SEP IRAs (collectively, “IRAs”).

4

Management

The Adviser. Gabelli Funds, LLC

The Portfolio Manager. Mr. Mario J. Gabelli, CFA, Chief Investment Officer — Value Portfolios of the Adviser, has served as portfolio manager of the Small Cap Growth Fund since its inception on October 22, 1991.

Purchase and Sale of Fund Shares

The minimum initial investment for Class AAA, Class A, and Class C shares is $1,000 ($250 for “IRAs” or Coverdell Education Savings Plans). There is no minimum initial investment for Class AAA, Class A, and Class C shares in an automatic monthly investment plan. Class I shares are available to investors with a minimum investment of $10,000 when purchasing the shares directly through G.distributors, LLC, the Small Cap Growth Fund’s distributor (“G.distributors” or the “Distributor”), or investors purchasing Class I shares through brokers or financial intermediaries that have entered into selling agreements with the Distributor specifically with respect to Class I shares, and which have different minimum investment amounts. If you transact in Class I Shares through a broker or financial intermediary, you may be required to pay a commission and/or other forms of compensation to the broker or financial intermediary. The Distributor reserves the right to waive or change minimum investment amounts. There is no minimum for subsequent investments.

Since the minimum initial investment amount for Class I shares of Small Cap Growth Fund purchased through the Distributor has been reduced to $10,000, shareholders eligible to purchase other share classes of Small Cap Growth Fund and making an initial investment of $10,000 should instead consider purchasing Class I shares of Small Cap Growth Fund since Class I shares carry no sales load and no ongoing distribution fees. Investors and shareholders who wish to purchase shares of Small Cap Growth Fund through a broker or financial intermediary should consult their broker or financial intermediary with respect to the purchase of shares of Small Cap Growth Fund. Please refer to Small Cap Growth Fund’s statutory prospectus for additional information about share class conversions and exchanges among funds managed by the Adviser or its affiliates.

You can purchase or redeem shares of the Small Cap Growth Fund on any day the New York Stock Exchange (“NYSE”) is open for trading (a “Business Day”). You may purchase or redeem shares of the Small Cap Growth Fund by written request via mail (The Gabelli Funds, P.O. Box 219204, Kansas City, MO 64121-9204), personal or overnight delivery (The Gabelli Funds, c/o SS&C Global Investor & Distribution Solutions, Inc., 430 W 7th Street STE 219204, Kansas City, MO 64105-1407), Internet, bank wire, or Automated Clearing House (“ACH”) system. You may also purchase shares of the Small Cap Growth Fund by telephone, if you have an existing account with banking instructions on file, or redeem at 800-GABELLI (800-422-3554).

Shares of the Small Cap Growth Fund can also be purchased or sold through registered broker-dealers or other financial intermediaries that have entered into appropriate selling agreements with the Distributor. The broker-dealer or other financial intermediary will transmit these transaction orders to the Small Cap Growth Fund on your behalf and send you confirmation of your transactions and periodic account statements showing your investments in the Small Cap Growth Fund.

Tax Information

The Small Cap Growth Fund expects that distributions will generally be taxable as ordinary income or long term capital gains, unless you are investing through a tax deferred arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Small Cap Growth Fund through a broker-dealer or other financial intermediary (such as a bank), the Small Cap Growth Fund and its related companies may pay the intermediary for the sale of Small Cap Growth Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Small Cap Growth Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

5

This Page Was Intentionally Left Blank.

This Page Was Intentionally Left Blank.

443 multi 2023

8

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- INVESTIGATION ALERT: The Schall Law Firm Announces it is Investigating Claims Against FiscalNote Holdings, Inc. and Encourages Investors to Contact the Firm

- Bionxt Solutions Announces Odf Cladribine Update and Financing

- ROSEN, A LEADING AND TOP RANKED LAW FIRM, Encourages Lifecore Biomedical Inc. f/k/a Landec Corporation Investors to Inquire About Securities Class Action Investigation – LFCR, LNDC

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share