Form 497K Franklin Custodian Funds

SUMMARY PROSPECTUS | |||||||

FRANKLIN GROWTH FUND | |||||||

Franklin Custodian Funds | |||||||

February 1, 2023 | |||||||

| |||||||

Class A | Class C | Class R | Class R6 | Advisor Class |

FKGRX | FRGSX | FGSRX | FIFRX | FCGAX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information, reports to shareholders and other information about the Fund online at www.franklintempleton.com/prospectus. You can also get this information at no cost by calling (800) DIAL BEN/342-5236 or by sending an e-mail request to [email protected]. The Fund’s prospectus and statement of additional information, both dated February 1, 2023, as may be supplemented, are all incorporated by reference into this Summary Prospectus.

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

Investment Goal

Capital appreciation.

Fees and Expenses of the Fund

These tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may qualify for sales charge discounts in Class A if you and your family invest, or agree to invest in the future, at least $25,000 in Franklin Templeton funds and certain other funds distributed through Franklin Distributors, LLC, the Fund’s distributor. More information about these and other discounts is available from your financial professional and under “Your Account” on page 166 in the Fund’s Prospectus and under “Buying and Selling Shares” on page 88 of the Fund’s Statement of Additional Information. In addition, more information about sales charge discounts and waivers for purchases of shares through specific financial intermediaries is set forth in Appendix A – “Intermediary Sales Charge Discounts and Waivers” to the Fund’s prospectus.

Please note that the tables and examples below do not reflect any transaction fees that may be charged by financial intermediaries, or commissions that a shareholder may be required to pay directly to its financial intermediary when buying or selling Class R6 or Advisor Class shares.

Shareholder Fees

(fees paid directly from your investment)

| Class A |

| Class C |

| Class R |

| Class R6 |

| Advisor

| |

Maximum Sales Charge

(Load) | 5.50% |

| None |

| None |

| None |

| None | |

Maximum Deferred Sales Charge | None | 1 | 1.00% |

| None |

| None |

| None | |

1. | There is a 1% contingent deferred sales charge that applies to investments of $1 Million or more (see "Investment of $1 Million or More" under "Choosing a Share Class") and purchases by certain retirement plans without an initial sales charge on shares sold within 18 months of purchase. | |||||||||

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A |

| Class C |

| Class R |

| Class R6 |

| Advisor

|

Management fees | 0.43% |

| 0.43% |

| 0.43% |

| 0.43% |

| 0.43% |

Distribution and service (12b-1) fees | 0.25% |

| 1.00% |

| 0.50% |

| None |

| None |

Other expenses | 0.12% |

| 0.12% |

| 0.12% |

| 0.03% |

| 0.12% |

Total annual Fund operating expenses | 0.80% |

| 1.55% |

| 1.05% |

| 0.46% |

| 0.55% |

2 | Summary Prospectus | franklintempleton.com |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The Example reflects adjustments made to the Fund's operating expenses due to the fee waivers and/or expense reimbursements by management for the 1 Year numbers only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| 1 Year |

| 3 Years |

| 5 Years |

| 10 Years |

Class A |

| $627 |

| $791 |

| $969 |

| $1,485 | |

Class C |

| $258 |

| $490 |

| $846 |

| $1,645 | |

Class R |

| $107 |

| $334 |

| $579 |

| $1,282 | |

Class R6 |

| $47 |

| $147 |

| $257 |

| $578 | |

Advisor Class |

| $56 |

| $176 |

| $307 |

| $689 | |

If you do not sell your shares: |

|

|

|

|

|

|

| ||

Class C |

| $158 |

| $490 |

| $846 |

| $1,645 | |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 4.95% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund invests substantially in the equity securities of companies that are leaders in their industries. In selecting securities, the investment manager considers many factors, including historical and potential growth in revenues and earnings, assessment of strength and quality of management, and determination of a company's strategic positioning in its industry.

Although the Fund normally invests substantially in the equity securities (principally common stocks) of U.S.-based large and medium market capitalization companies, it may invest in companies in new and emerging industries where growth is expected to be above average and may invest up to 25% of its assets in smaller companies.

franklintempleton.com | Summary Prospectus | 3 |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

The Fund's investment manager is a research driven, fundamental investor, generally pursuing a "buy-and-hold" growth strategy. As a "bottom-up" investor focusing primarily on individual securities, the investment manager chooses companies that it believes are positioned for growth in revenues, earnings or assets. Such advantages as a particular marketing niche, proven technology, sound financial records, strong management, and industry leadership are all factors the investment manager believes point to strong growth potential. Although the investment manager searches for investments across a large number of sectors, from time to time, based on economic conditions, the Fund may have significant positions in particular sectors including technology, health care and industrials.

Principal Risks

You could lose money by investing in the Fund. Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency of the U.S. government.

Market The market values of securities or other investments owned by the Fund will go up or down, sometimes rapidly or unpredictably. The market value of a security or other investment may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all investments. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise.

The global outbreak of the novel strain of coronavirus, COVID-19, has resulted in market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. Efforts to contain the spread of COVID-19 have resulted in global travel restrictions and disruptions of healthcare systems, business operations and supply chains, layoffs, volatility in consumer demand for certain products, defaults and credit ratings downgrades, and other significant economic impacts. The effects of COVID-19 have impacted global economic activity across many industries and may heighten other pre-existing political, social and economic risks, locally or globally. The full impact of the COVID-19 pandemic is unpredictable and may adversely affect the Fund’s performance.

Stock prices tend to go up and down more dramatically than those of debt securities. A slower-growth or recessionary economic environment could have an adverse effect on the prices of the various stocks held by the Fund.

Focus To the extent that the Fund focuses on particular countries, regions, industries, sectors or types of investment from time to time, the Fund may be subject to greater risks of adverse developments in such areas of focus than a fund

4 | Summary Prospectus | franklintempleton.com |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

that invests in a wider variety of countries, regions, industries, sectors or investments.

For example, the technology sector historically has been volatile due to the rapid pace of product change and development. Companies in the technology sector may be affected by worldwide technological developments, the success of their products and services (which may be outdated quickly), anticipated products or services that are delayed or cancelled, and investor perception of the company and/or its products or services. The activities of health care companies may be funded or subsidized by federal and state governments and changes in funding may adversely affect the profitability of these companies. Companies in the industrials sector are at risk for environmental damage and product liability claims and may be adversely affected by commodity price volatility, changes in exchange rates, imposition of export or import controls, increased competition, depletion of resources, technological developments and labor relations. In addition, companies in all of these sectors may be adversely affected by changes in government regulation, world events and economic conditions.

Growth Style Investing Growth stock prices reflect projections of future earnings or revenues, and can, therefore, fall dramatically if the company fails to meet those projections. Prices of these companies’ securities may be more volatile than other securities, particularly over the short term. In addition, investment styles can go in and out of favor, which could cause additional volatility in the prices of the Fund’s portfolio holdings.

Small and Mid Capitalization Companies Securities issued by smaller and midsize capitalization companies may be more volatile in price than those of larger companies and may involve substantial risks. Such risks may include greater sensitivity to economic conditions, less certain growth prospects, lack of depth of management and funds for growth and development, and limited or less developed product lines and markets. In addition, smaller and midsize capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying any loans.

Management The Fund is subject to management risk because it is an actively managed investment portfolio. The Fund's investment manager applies investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results.

Cybersecurity Cybersecurity incidents, both intentional and unintentional, may allow an unauthorized party to gain access to Fund assets, Fund or customer data (including private shareholder information), or proprietary information, cause the Fund, the investment manager and/or their service providers (including, but not

franklintempleton.com | Summary Prospectus | 5 |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality or prevent Fund investors from purchasing, redeeming or exchanging shares or receiving distributions. The investment manager has limited ability to prevent or mitigate cybersecurity incidents affecting third party service providers, and such third party service providers may have limited indemnification obligations to the Fund or investment manager. Cybersecurity incidents may result in financial losses to the Fund and its shareholders, and substantial costs may be incurred in an effort to prevent or mitigate future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers experience cybersecurity incidents.

Because technology is frequently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the Fund's ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the Fund, the investment manager and their service providers are subject to the risk of cyber incidents occurring from time to time.

Performance

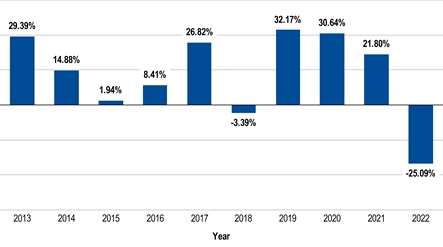

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You can obtain updated performance information at franklintempleton.com or by calling (800) DIAL BEN/342-5236.

The secondary index in the table below shows how the Fund`s performance compares to a group of securities that reflect the Fund's growth style bias.

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

6 | Summary Prospectus | franklintempleton.com |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

Class A Annual Total Returns

Best Quarter: | 2020, Q2 | 23.86% |

Worst Quarter: | 2022, Q2 | -18.47% |

Average Annual Total Returns

(figures reflect sales charges)

For periods ended December 31, 2022

|

| 1 Year |

| 5 Years |

| 10 Years |

| Since Inception |

| |

Franklin Growth Fund - Class A |

|

|

|

|

|

|

|

|

| |

| Return before taxes |

| -29.21% |

| 7.54% |

| 11.60% |

| — |

|

| Return after taxes on distributions |

| -30.78% |

| 5.86% |

| 10.44% |

| — |

|

| Return after taxes on distributions and sale of Fund shares |

| -16.13% |

| 6.00% |

| 9.60% |

| — |

|

Franklin Growth Fund - Class C |

| -26.31% |

| 7.95% |

| 11.40% |

| — |

| |

Franklin Growth Fund - Class R |

| -25.26% |

| 8.50% |

| 11.96% |

| — |

| |

Franklin Growth Fund - Class R6 |

| -24.82% |

| 9.14% |

| — |

| 12.25% | 1 | |

Franklin Growth Fund - Advisor Class |

| -24.89% |

| 9.04% |

| 12.51% |

| — |

| |

S&P 500 Index (index reflects no deduction for fees, expenses or taxes) |

| -18.11% |

| 9.43% |

| 12.56% |

| — |

| |

Russell 1000 Growth Index (index reflects no deduction for fees, expenses or taxes) |

| -29.14% |

| 10.96% |

| 14.10% |

| — |

| |

1. | Since inception May 1, 2013. | |||||||||

No one index is representative of the Fund's portfolio.

The figures in the average annual total returns table above reflect the Class A shares maximum front-end sales charge of 5.50%. Prior to September 10, 2018,

franklintempleton.com | Summary Prospectus | 7 |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

Class A shares were subject to a maximum front-end sales charge of 5.75%. If the prior maximum front-end sales charge of 5.75% was reflected, performance for Class A shares in the average annual total returns table would be lower.

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A and after-tax returns for other classes will vary.

Investment Manager

Franklin Advisers, Inc. (Advisers)

Portfolio Managers

Serena

Perin Vinton, CFA

Senior Vice President of Advisers and portfolio manager of

the Fund since 2008.

Robert Rendler, CFA

Portfolio Manager and Research Analyst

of Advisers and portfolio manager of the Fund since 2016.

Joyce Lin, CFA

Portfolio Manager and

Research Analyst of Advisers and portfolio manager of the Fund since 2021.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund on any business day online through our website at franklintempleton.com, by mail (Franklin Templeton Investor Services, P.O. Box 997151, Sacramento, CA 95899-7151), or by telephone at (800) 632-2301. For Class A, C and R, the minimum initial purchase for most accounts is $1,000 (or $25 under an automatic investment plan). Class R6 and Advisor Class are only available to certain qualified investors and the minimum initial investment will vary depending on the type of qualified investor, as described under "Your Account — Choosing a Share Class — Qualified Investors — Class R6" and "— Advisor Class" in the Fund's prospectus. There is no minimum investment for subsequent purchases.

Taxes

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-

8 | Summary Prospectus | franklintempleton.com |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions would generally be taxed when withdrawn from the tax-advantaged account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's website for more information.

franklintempleton.com | Summary Prospectus | 9 |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

This page intentionally left blank

10 | Summary Prospectus | franklintempleton.com |

FRANKLIN

GROWTH FUND

SUMMARY PROSPECTUS

This page intentionally left blank

franklintempleton.com | Summary Prospectus | 11 |

| |

Franklin Distributors, LLC One Franklin Parkway San Mateo, CA 94403-1906 franklintempleton.com Franklin Growth Fund | |

Investment Company Act file #811-00537 © 2023 Franklin Templeton. All rights reserved.

| 106 PSUM 02/23 |

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Composition of the Nomination Committee of Orion Corporation

- RROCKET Burns 50% of Its Supply to Fuel Growth and Investor Confidence

- REBELXL - A Revolutionary Reformer Pilates Franchise Announce the Grand Opening of Its First Studio in Wyckoff, New Jersey

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share

10% Total Recycled Fiber 00070359

10% Total Recycled Fiber 00070359