Form 497K BlackRock Funds V

|

JANUARY 27, 2023 |

Summary Prospectus

BlackRock Funds V | Class K Shares

| • | BlackRock Sustainable Low Duration Bond Fund |

Class K: BSLKX

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and supplements), reports to shareholders and other information about the Fund, including the Fund’s statement of additional information, online at http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 537-4942 or by sending an e-mail request to [email protected], or from your financial professional. The Fund’s prospectus and statement of additional information, both dated January 27, 2023, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary Prospectus.

This Summary Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Key Facts About BlackRock Sustainable Low Duration Bond Fund

The investment objective of the BlackRock Sustainable Low Duration Bond Fund (the “Fund”) is to seek total return in excess of the reference benchmark in a manner that is consistent with preservation of capital while seeking to maintain certain environmental, social and governance (“ESG”) characteristics, climate risk exposure and climate opportunities relative to the Fund’s benchmark.

This table describes the fees and expenses that you may pay if you buy, hold and sell Class K Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or selected securities dealer, broker, investment adviser, service provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each a “Financial Intermediary”), which are not reflected in the table and example below.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Class K Shares | |||||||||

| Management Fee1 |

0.31 | % | ||||||||

| Distribution and/or Service (12b-1) Fees |

None | |||||||||

| Other Expenses2 |

0.41 | % | ||||||||

| Total Annual Fund Operating Expenses3 |

0.72 | % | ||||||||

| Fee Waivers and/or Expense Reimbursements1,4 |

(0.37 | )% | ||||||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1,4 |

0.35 | % | ||||||||

| 1 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 31, BlackRock has contractually agreed to waive the management fee with respect to any portion of the Fund’s assets estimated to be attributable to investments in other equity and fixed-income mutual funds and exchange-traded funds managed by BlackRock or its affiliates that have a contractual management fee, through June 30, 2024. In addition, BlackRock has contractually agreed to waive its management fees by the amount of investment advisory fees the Fund pays to BlackRock indirectly through its investment in money market funds managed by BlackRock or its affiliates, through June 30, 2024. The contractual agreements may be terminated upon 90 days’ notice by a majority of the non-interested trustees of BlackRock Funds V (the “Trust”) or by a vote of a majority of the outstanding voting securities of the Fund. |

| 2 | Other Expenses have been restated to reflect current fees. |

| 3 | The Total Annual Fund Operating Expenses do not correlate to the ratios of expenses to average net assets given in the Fund’s most recent annual report, which do not include the restatement of Other Expenses to reflect current fees. |

| 4 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 31, BlackRock has contractually agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) to 0.35% of average daily net assets through June 30, 2024. The Fund may have to repay some of these waivers and/or reimbursements to BlackRock in the two years following such waivers and/or reimbursements. Any such repayment obligation will terminate on October 19, 2028. The contractual agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Class K Shares |

$ | 36 | $ | 193 | $ | 364 | $ | 860 | ||||||||

Portfolio Turnover:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the fiscal period from October 18, 2021 to September 30, 2022, the Fund’s portfolio turnover rate was 178% (not annualized) of the average value of its portfolio.

2

Principal Investment Strategies of the Fund

The Fund normally invests at least 80% of its assets in bonds. The Fund may invest up to 20% of its assets in non-investment grade bonds (commonly called “high yield” or “junk bonds”). The Fund may also invest up to 35% of its assets in assets of foreign issuers, of which 10% (as a percentage of the Fund’s assets) may be invested in emerging markets issuers. Up to 10% of the Fund’s assets may be exposed to non-US currency risk. A bond of a foreign issuer, including an emerging market issuer, will not count toward the 10% limit on non-US currency exposure if the bond is either (i) US dollar-denominated or (ii) non-US dollar-denominated, but hedged back to US dollars. The Fund may also invest up to 5% of its assets in convertible securities with a minimum rating of B. Split rated bonds will be considered to have the higher credit rating. Split rated bonds are bonds that receive different ratings from two or more rating agencies.

To determine the Fund’s investable universe, Fund management will first seek to screen out certain issuers based on ESG criteria determined by BlackRock, subject to the considerations noted below. Such screening criteria principally includes: (i) issuers that derive more than zero percent of revenue from the production of controversial weapons; (ii) issuers that derive more than zero percent of revenue from the production of civilian firearms; (iii) issuers that derive more than zero percent of revenue from the production of tobacco-related products; (iv) issuers that derive more than five percent of revenue from thermal coal generation, unless such issuers either (a) have made certain commitments to reduce climate impact or (b) derive at least fifty percent of revenue from alternative energy sources; (v) issuers that derive more than five percent of revenue from thermal coal mining; (vi) issuers that derive more than five percent of revenue from oil sands extraction; (vii) issuers ranked in the bottom half of the applicable fossil issuers peer group by recognized third-party rating agencies; (viii) issuers identified as violators of the United Nations Global Compact, which are globally accepted principles covering corporate behavior in the areas of human rights, labor, environment, and anti-corruption; and (ix) issuers receiving an ESG rating of CCC (or equivalent) by recognized third-party rating agencies. Notwithstanding the foregoing, the Fund may invest in green bonds of issuers that exceed the thresholds stated in (iv), (v), (vi) and (vii) above. The Fund relies on one or more third-party ratings agencies to identify issuers for purposes of the above screening criteria. Third-party rating agencies may base the above screening criteria on an estimate when revenue for a covered business activity is not disclosed by the issuer or publicly available.

The Fund’s screening criteria is measured at the time of investment and is dependent upon information and data that may be incomplete, inaccurate, unavailable or estimated. Where the Fund’s screening criteria looks solely to third-party ratings or data, issuers are only screened to the extent such ratings or data have been assigned or made available by the third parties. This screening criteria is subject to change over time at BlackRock’s discretion.

BlackRock utilizes a proprietary sustainability scoring system, fundamental sector research and third-party ESG data in constructing the Fund’s portfolio. Fund management also selects and weights securities based on an issuer’s ability to manage the ESG risks to which its business is exposed, as determined by BlackRock. Fund management makes such determinations based on BlackRock’s ESG research, which includes due diligence of the ESG risks and opportunities facing an issuer, as well as third-party ESG ratings. BlackRock researches and develops investment insights related to economic transition, which include target carbon transition readiness and climate opportunities.

While Fund management considers ESG characteristics as well as climate risk exposure and climate opportunities, only one or two of these categories may be considered with respect to a particular investment or sector, and categories may be weighted differently according to the type of investment being considered. In addition, the Fund may gain indirect exposure (through, including but not limited to, derivatives and investments in other investment companies) to issuers with exposures that are inconsistent with the ESG-related criteria used by Fund management.

The Fund seeks to maintain certain ESG characteristics, climate risk exposure and climate opportunities relative to the ICE BofA 1-3 Year US Corporate & Government Index (the “Benchmark”). Specifically, with respect to the Fund’s investments in certain sectors of fixed income instruments, the Fund generally seeks to invest in a portfolio that, in BlackRock’s view, (i) has an aggregate ESG assessment that is better than that of the Benchmark, (ii) has an aggregate carbon emissions assessment that is lower than that of the Benchmark, and (iii) in the aggregate, includes issuers that BlackRock believes are better positioned to capture climate opportunities relative to the issuers in the Benchmark. Fund management makes such assessments based on BlackRock’s ESG research, which includes due diligence of ESG risks and opportunities facing an issuer, as well as third-party ESG ratings. The Fund may invest in other sectors that are not included in such assessments.

The Fund invests primarily in investment grade bonds and maintains an average portfolio duration that is between 0 and 3 years. Investment grade bonds are bonds rated in the four highest categories by at least one of the major rating agencies or determined by the management team to be of similar quality. Generally, the higher the rating of a bond, the higher the likelihood that interest and principal payments will be made on time.

The management team evaluates sectors of the bond market and individual securities within these sectors. The management team selects bonds from several sectors including: U.S. Treasuries and agency securities, commercial and residential mortgage-backed securities, collateralized mortgage obligations (“CMOs”), asset-backed securities and corporate bonds. Mortgage-backed securities are asset-backed securities based on a particular type of asset, a mortgage. There is a wide variety of mortgage-backed securities involving commercial or residential, fixed rate or adjustable rate mortgages and mortgages issued by banks or government agencies. CMOs are bonds that are backed by cash flows from pools of

3

mortgages. CMOs may have multiple classes with different payment rights and protections. Asset-backed securities are bonds that are backed by a pool of assets, usually loans such as installment sale contracts or credit card receivables.

The Fund may buy or sell options or futures on a security or an index of securities, or enter into credit default swaps and interest rate or foreign currency transactions, including swaps (collectively, commonly known as derivatives). The Fund may use derivative instruments to hedge its investments or to seek to enhance returns. The Fund may seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as reverse repurchase agreements and mortgage dollar rolls).

The Fund may engage in active and frequent trading of portfolio securities to achieve its principal investment strategies.

Principal Risks of Investing in the Fund

Risk is inherent in all investing. The value of your investment in the Fund, as well as the amount of return you receive on your investment, may fluctuate significantly from day to day and over time. You may lose part or all of your investment in the Fund or your investment may not perform as well as other similar investments. The following is a summary description of principal risks of investing in the Fund. The relative significance of each risk factor below may change over time and you should review each risk factor carefully.

| ∎ | Debt Securities Risk — Debt securities, such as bonds, involve interest rate risk, credit risk, extension risk, and prepayment risk, among other things. |

Interest Rate Risk — The market value of bonds and other fixed-income securities changes in response to interest rate changes and other factors. Interest rate risk is the risk that prices of bonds and other fixed-income securities will increase as interest rates fall and decrease as interest rates rise.

The Fund may be subject to a greater risk of rising interest rates due to the recent period of historically low interest rates. For example, if interest rates increase by 1%, assuming a current portfolio duration of ten years, and all other factors being equal, the value of the Fund’s investments would be expected to decrease by 10%. (Duration is a measure of the price sensitivity of a debt security or portfolio of debt securities to relative changes in interest rates.) The magnitude of these fluctuations in the market price of bonds and other fixed-income securities is generally greater for those securities with longer maturities. Fluctuations in the market price of the Fund’s investments will not affect interest income derived from instruments already owned by the Fund, but will be reflected in the Fund’s net asset value. The Fund may lose money if short-term or long-term interest rates rise sharply in a manner not anticipated by Fund management.

To the extent the Fund invests in debt securities that may be prepaid at the option of the obligor (such as mortgage-backed securities), the sensitivity of such securities to changes in interest rates may increase (to the detriment of the Fund) when interest rates rise. Moreover, because rates on certain floating rate debt securities typically reset only periodically, changes in prevailing interest rates (and particularly sudden and significant changes) can be expected to cause some fluctuations in the net asset value of the Fund to the extent that it invests in floating rate debt securities.

These basic principles of bond prices also apply to U.S. Government securities. A security backed by the “full faith and credit” of the U.S. Government is guaranteed only as to its stated interest rate and face value at maturity, not its current market price. Just like other fixed-income securities, government-guaranteed securities will fluctuate in value when interest rates change.

A general rise in interest rates has the potential to cause investors to move out of fixed-income securities on a large scale, which may increase redemptions from funds that hold large amounts of fixed-income securities. Heavy redemptions could cause the Fund to sell assets at inopportune times or at a loss or depressed value and could hurt the Fund’s performance.

Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. The degree of credit risk depends on both the financial condition of the issuer and the terms of the obligation.

Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these obligations to fall.

Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields.

| ∎ | ESG Investing Risk — The Fund intends to screen out particular issuers pursuant to certain criteria established by BlackRock, and to measure ESG characteristics, including characteristics related to climate, with respect to certain investments pursuant to a methodology determined by BlackRock. This may affect the Fund’s exposure to certain issuers and the Fund may forego certain investment opportunities. The Fund’s results may be lower than other funds that do not seek to invest in issuers based on ESG criteria, or that use a different methodology to screen out issuers or evaluate ESG criteria. The Fund seeks to identify issuers that it believes are better positioned to manage |

4

| ESG risks and opportunities related to their businesses and to avoid certain companies and industries with ESG related risks, but investors may differ in their views of what constitutes positive or negative ESG criteria. As a result, the Fund may invest in issuers that do not reflect the beliefs and values of any particular investor. In evaluating a security or issuer based on ESG criteria, BlackRock is dependent upon certain information and data from third party providers of ESG research, which may be incomplete, inaccurate or unavailable. As a result, there is a risk that BlackRock may incorrectly assess a security or issuer. There is also a risk that BlackRock may not apply the relevant ESG criteria correctly or that the Fund could have indirect exposure to issuers who do not meet the relevant ESG criteria used by the Fund. Neither the Fund nor BlackRock make any representation or warranty, express or implied, with respect to the fairness, correctness, accuracy, reasonableness or completeness of such ESG assessment. There may be limitations with respect to availability of ESG data in certain sectors, as well as limited availability of investments with positive ESG assessments in certain sectors. BlackRock’s evaluation of ESG criteria is subjective and may change over time. |

The Fund may not include all instruments in its ESG-related assessments, and may place weight on other factors when selecting investments. In addition, the Fund may not be successful in its objectives related to ESG characteristics, climate risk and climate opportunities. There is no guarantee that these objectives will be achieved, and such assessments are at BlackRock’s discretion.

| ∎ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

An outbreak of an infectious coronavirus (COVID-19) that was first detected in December 2019 developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Although vaccines have been developed and approved for use by various governments, the duration of the pandemic and its effects cannot be predicted with certainty. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

| ∎ | Mortgage- and Asset-Backed Securities Risks — Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. |

| ∎ | U.S. Government Issuer Risk — Treasury obligations may differ in their interest rates, maturities, times of issuance and other characteristics. Obligations of U.S. Government agencies and authorities are supported by varying degrees of credit but generally are not backed by the full faith and credit of the U.S. Government. No assurance can be given that the U.S. Government will provide financial support to its agencies and authorities if it is not obligated by law to do so. |

| ∎ | Borrowing Risk — Borrowing may exaggerate changes in the net asset value of Fund shares and in the return on the Fund’s portfolio. Borrowing will cost the Fund interest expense and other fees. The costs of borrowing may reduce the Fund’s return. Borrowing may cause the Fund to liquidate positions when it may not be advantageous to do so to satisfy its obligations. |

| ∎ | Derivatives Risk — The Fund’s use of derivatives may increase its costs, reduce the Fund’s returns and/or increase volatility. Derivatives involve significant risks, including: |

Leverage Risk — The Fund’s use of derivatives can magnify the Fund’s gains and losses. Relatively small market movements may result in large changes in the value of a derivatives position and can result in losses that greatly exceed the amount originally invested.

Market Risk — Some derivatives are more sensitive to interest rate changes and market price fluctuations than other securities. The Fund could also suffer losses related to its derivatives positions as a result of unanticipated market movements, which losses are potentially unlimited. Finally, BlackRock may not be able to predict correctly the direction of securities prices, interest rates and other economic factors, which could cause the Fund’s derivatives positions to lose value.

5

Counterparty Risk — Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will be unable or unwilling to fulfill its contractual obligation, and the related risks of having concentrated exposure to such a counterparty.

Illiquidity Risk — The possible lack of a liquid secondary market for derivatives and the resulting inability of the Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for the Fund to value accurately.

Operational Risk — The use of derivatives includes the risk of potential operational issues, including documentation issues, settlement issues, systems failures, inadequate controls and human error.

Legal Risk — The risk of insufficient documentation, insufficient capacity or authority of counterparty, or legality or enforceability of a contract.

Volatility and Correlation Risk — Volatility is defined as the characteristic of a security, an index or a market to fluctuate significantly in price within a short time period. A risk of the Fund’s use of derivatives is that the fluctuations in their values may not correlate with the overall securities markets.

Valuation Risk — Valuation for derivatives may not be readily available in the market. Valuation may be more difficult in times of market turmoil since many investors and market makers may be reluctant to purchase complex instruments or quote prices for them.

Hedging Risk — Hedges are sometimes subject to imperfect matching between the derivative and the underlying security, and there can be no assurance that the Fund’s hedging transactions will be effective. The use of hedging may result in certain adverse tax consequences.

Tax Risk — Certain aspects of the tax treatment of derivative instruments, including swap agreements and commodity-linked derivative instruments, are currently unclear and may be affected by changes in legislation, regulations or other legally binding authority. Such treatment may be less favorable than that given to a direct investment in an underlying asset and may adversely affect the timing, character and amount of income the Fund realizes from its investments.

Regulatory Risk — Derivative contracts are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) in the United States and under comparable regimes in Europe, Asia and other non-U.S. jurisdictions. Under the Dodd-Frank Act, with respect to uncleared swaps, swap dealers are required to collect variation margin from the Fund and may be required by applicable regulations to collect initial margin from the Fund. Both initial and variation margin may be comprised of cash and/or securities, subject to applicable regulatory haircuts. Shares of investment companies (other than certain money market funds) may not be posted as collateral under applicable regulations. In addition, regulations adopted by global prudential regulators that are now in effect require certain bank-regulated counterparties and certain of their affiliates to include in certain financial contracts, including many derivatives contracts, terms that delay or restrict the rights of counterparties, such as the Fund, to terminate such contracts, foreclose upon collateral, exercise other default rights or restrict transfers of credit support in the event that the counterparty and/or its affiliates are subject to certain types of resolution or insolvency proceedings. The implementation of these requirements with respect to derivatives, as well as regulations under the Dodd-Frank Act regarding clearing, mandatory trading and margining of other derivatives may increase the costs and risks to the Fund of trading in these instruments and, as a result, may affect returns to investors in the Fund.

| ∎ | Dollar Rolls Risk — Dollar rolls involve the risk that the market value of the securities that the Fund is committed to buy may decline below the price of the securities the Fund has sold. These transactions may involve leverage. |

| ∎ | Emerging Markets Risk — Emerging markets are riskier than more developed markets because they tend to develop unevenly and may never fully develop. Investments in emerging markets may be considered speculative. Emerging markets are more likely to experience hyperinflation and currency devaluations, which adversely affect returns to U.S. investors. In addition, many emerging securities markets have far lower trading volumes and less liquidity than developed markets. |

| ∎ | Foreign Securities Risk — Foreign investments often involve special risks not present in U.S. investments that can increase the chances that the Fund will lose money. These risks include: |

| ∎ | The Fund generally holds its foreign securities and cash in foreign banks and securities depositories, which may be recently organized or new to the foreign custody business and may be subject to only limited or no regulatory oversight. |

| ∎ | Changes in foreign currency exchange rates can affect the value of the Fund’s portfolio. |

| ∎ | The economies of certain foreign markets may not compare favorably with the economy of the United States with respect to such issues as growth of gross national product, reinvestment of capital, resources and balance of payments position. |

6

| ∎ | The governments of certain countries, or the U.S. Government with respect to certain countries, may prohibit or impose substantial restrictions through capital controls and/or sanctions on foreign investments in the capital markets or certain industries in those countries, which may prohibit or restrict the ability to own or transfer currency, securities, derivatives or other assets. |

| ∎ | Many foreign governments do not supervise and regulate stock exchanges, brokers and the sale of securities to the same extent as does the United States and may not have laws to protect investors that are comparable to U.S. securities laws. |

| ∎ | Settlement and clearance procedures in certain foreign markets may result in delays in payment for or delivery of securities not typically associated with settlement and clearance of U.S. investments. |

| ∎ | The Fund’s claims to recover foreign withholding taxes may not be successful, and if the likelihood of recovery of foreign withholding taxes materially decreases, due to, for example, a change in tax regulation or approach in the foreign country, accruals in the Fund’s net asset value for such refunds may be written down partially or in full, which will adversely affect the Fund’s net asset value. |

| ∎ | High Portfolio Turnover Risk — The Fund may engage in active and frequent trading of its portfolio securities. High portfolio turnover (more than 100%) may result in increased transaction costs to the Fund, including brokerage commissions, dealer mark-ups and other transaction costs on the sale of the securities and on reinvestment in other securities. The sale of Fund portfolio securities may result in the realization and/or distribution to shareholders of higher capital gains or losses as compared to a fund with less active trading policies. These effects of higher than normal portfolio turnover may adversely affect Fund performance. In addition, investment in mortgage dollar rolls and participation in to be announced (“TBA”) transactions may significantly increase the Fund’s portfolio turnover rate. A TBA transaction is a method of trading mortgage-backed securities where the buyer and seller agree upon general trade parameters such as agency, settlement date, par amount, and price at the time the contract is entered into but the mortgage-backed securities are delivered in the future, generally 30 days later. |

| ∎ | Illiquid Investments Risk — The Fund may not acquire any illiquid investment if, immediately after the acquisition, the Fund would have invested more than 15% of its net assets in illiquid investments. An illiquid investment is any investment that the Fund reasonably expects cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. Liquid investments may become illiquid after purchase by the Fund, particularly during periods of market turmoil. There can be no assurance that a security or instrument that is deemed to be liquid when purchased will continue to be liquid for as long as it is held by the Fund, and any security or instrument held by the Fund may be deemed an illiquid investment pursuant to the Fund’s liquidity risk management program. The Fund’s illiquid investments may reduce the returns of the Fund because it may be difficult to sell the illiquid investments at an advantageous time or price. In addition, if the Fund is limited in its ability to sell illiquid investments during periods when shareholders are redeeming their shares, the Fund will need to sell liquid securities to meet redemption requests and illiquid securities will become a larger portion of the Fund’s holdings. An investment may be illiquid due to, among other things, the reduced number and capacity of traditional market participants to make a market in fixed-income securities or the lack of an active trading market. To the extent that the Fund’s principal investment strategies involve derivatives or securities with substantial market and/or credit risk, the Fund will tend to have the greatest exposure to the risks associated with illiquid investments. Illiquid investments may be harder to value, especially in changing markets, and if the Fund is forced to sell these investments to meet redemption requests or for other cash needs, the Fund may suffer a loss. This may be magnified in a rising interest rate environment or other circumstances where investor redemptions from fixed-income mutual funds may be higher than normal. In addition, when there is illiquidity in the market for certain securities, the Fund, due to limitations on illiquid investments, may be subject to purchase and sale restrictions. |

| ∎ | Junk Bonds Risk — Although junk bonds generally pay higher rates of interest than investment grade bonds, junk bonds are high risk investments that are considered speculative and may cause income and principal losses for the Fund. |

| ∎ | Leverage Risk — Some transactions may give rise to a form of economic leverage. These transactions may include, among others, derivatives, and may expose the Fund to greater risk and increase its costs. The use of leverage may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet the applicable requirements of the Investment Company Act of 1940, as amended (the “Investment Company Act”), and the rules thereunder. Increases and decreases in the value of the Fund’s portfolio will be magnified when the Fund uses leverage. |

| ∎ | Mezzanine Securities Risk — Mezzanine securities carry the risk that the issuer will not be able to meet its obligations and that the equity securities purchased with the mezzanine investments may lose value. |

| ∎ | Repurchase Agreements and Purchase and Sale Contracts Risk — If the other party to a repurchase agreement or purchase and sale contract defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security in either situation and the market value of the security declines, the Fund may lose money. |

7

| ∎ | Reverse Repurchase Agreements Risk — Reverse repurchase agreements involve the sale of securities held by the Fund with an agreement to repurchase the securities at an agreed-upon price, date and interest payment. Reverse repurchase agreements involve the risk that the other party may fail to return the securities in a timely manner or at all. The Fund could lose money if it is unable to recover the securities and the value of the collateral held by the Fund, including the value of the investments made with cash collateral, is less than the value of the securities. These events could also trigger adverse tax consequences for the Fund. In addition, reverse repurchase agreements involve the risk that the interest income earned in the investment of the proceeds will be less than the interest expense. |

| ∎ | Risk of Investing in the United States — Certain changes in the U.S. economy, such as when the U.S. economy weakens or when its financial markets decline, may have an adverse effect on the securities to which the Fund has exposure. |

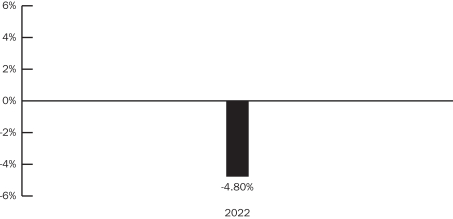

The information shows you how the Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund. The table compares the Fund’s performance to that of the ICE BofA 1-3 Year US Corporate & Government Index. To the extent that dividends and distributions have been paid by the Fund, the performance information for the Fund in the chart and table assumes reinvestment of the dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. The table includes all applicable fees. If the Fund’s investment manager and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. Updated information on the Fund’s performance, including its current net asset value, can be obtained by visiting http://www.blackrock.com or can be obtained by phone at 800-882-0052.

Class K Shares

ANNUAL TOTAL RETURNS

BLACKROCK SUSTAINABLE LOW DURATION BOND FUND

As of 12/31

During the period shown in the bar chart, the highest return for a quarter was 1.30% (quarter ended December 31, 2022) and the lowest return for a quarter was –2.88% (quarter ended March 31, 2022).

| For the periods ended 12/31/22 Average Annual Total Returns |

1 Year | Since Inception (October 18, 2021) |

||||||

| BlackRock Sustainable Low Duration Bond Fund — Class K Shares |

||||||||

| Return Before Taxes |

(4.80 | )% | (4.16 | )% | ||||

| Return After Taxes on Distributions |

(6.17 | )% | (5.37 | )% | ||||

| Return After Taxes on Distributions and Sale of Fund Shares |

(2.84 | )% | (3.66 | )% | ||||

| ICE BofA 1-3 Year US Corporate & Government Index (Reflects no deduction for fees, expenses or taxes) |

(3.76 | )% | (3.39 | )% | ||||

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

The Fund’s investment manager is BlackRock Advisors, LLC (previously defined as “BlackRock”). The Fund’s sub-advisers are BlackRock International Limited and BlackRock (Singapore) Limited. Where applicable, the use of the term BlackRock also refers to the Fund’s sub-advisers.

8

| Name |

Portfolio Manager of the Fund Since | Title | ||

| Akiva Dickstein |

2021 | Managing Director of BlackRock, Inc. | ||

| Bob Miller1 |

2021 | Managing Director of BlackRock, Inc. | ||

| Scott MacLellan, CFA, CMT |

2021 | Managing Director of BlackRock, Inc. | ||

| Ashley Schulten |

2021 | Managing Director of BlackRock, Inc. | ||

| Adam Carlin, CFA |

2022 | Director of BlackRock, Inc. | ||

| Amanda Liu, CFA |

2022 | Director of BlackRock, Inc. | ||

| Sam Summers |

2022 | Director of BlackRock, Inc. | ||

| 1 | On or about March 31, 2023, Bob Miller will retire from BlackRock, Inc., and will no longer serve as a portfolio manager of the Fund. |

Purchase and Sale of Fund Shares

Class K Shares of the Fund are available only to (i) certain employee benefit plans, such as health savings accounts, and certain employer-sponsored retirement plans (not including SEP IRAs, SIMPLE IRAs and SARSEPs) (collectively, “Employer-Sponsored Retirement Plans”), (ii) collective trust funds, investment companies and other pooled investment vehicles, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares, (iii) “Institutional Investors,” which include, but are not limited to, endowments, foundations, family offices, banks and bank trusts, local, city, and state governmental institutions, corporations and insurance company separate accounts, each of which may purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to purchase such shares, (iv) clients of private banks that purchase shares of the Fund through a Financial Intermediary that has entered into an agreement with the Fund’s distributor to sell such shares, (v) fee-based advisory platforms of a Financial Intermediary that (a) has specifically acknowledged in a written agreement with the Fund’s distributor and/or its affiliate(s) that the Financial Intermediary shall offer such shares to fee-based advisory clients through an omnibus account held at the Fund or (b) transacts in the Fund’s shares through another intermediary that has executed such an agreement and (vi) any other investors who met the eligibility criteria for BlackRock Shares or Class K Shares prior to August 15, 2016 and have continually held Class K Shares of the Fund in the same account since August 15, 2016.

You may purchase or redeem shares of the Fund each day the New York Stock Exchange is open. Purchase orders may also be placed by calling (800) 537-4942, by mail (c/o BlackRock, P.O. Box 9819, Providence, Rhode Island 02940-8019), or online at www.blackrock.com. Institutional Investors are subject to a $5 million minimum initial investment requirement. Other investors, including Employer-Sponsored Retirement Plans, have no minimum initial investment requirement. There is no minimum investment amount for additional purchases.

Different income tax rules apply depending on whether you are invested through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code of 1986, as amended. If you are invested through such a plan (and Fund shares are not “debt-financed property” to the plan), then the dividends paid by the Fund and the gain realized from a redemption or exchange of Fund shares will generally not be subject to U.S. federal income taxes until you withdraw or receive distributions from the plan. If you are not invested through such a plan, then the Fund’s dividends and gain from a redemption or exchange may be subject to U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor.

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a financial professional or selected securities dealer, broker, investment adviser, service provider or industry professional (including BlackRock and its affiliates) (each a “Financial Intermediary”), the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Class K Shares are only available through a Financial Intermediary if the Financial Intermediary will not receive from Fund assets, or the Fund’s distributor’s or an affiliate’s resources, any commission payments, shareholder servicing fees (including sub-transfer agent and networking fees), or distribution fees (including Rule 12b-1 fees) with respect to assets invested in Class K Shares.

Ask your individual financial professional or visit your Financial Intermediary’s website for more information.

9

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

[This page intentionally left blank]

INVESTMENT COMPANY ACT FILE # 811-23339

SPRO-SLDB-K-0123

|

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Form 8.5 (EPT/RI) - musicMagpie Plc

- Orange: Combined Ordinary and Extraordinary Shareholders’ Meeting of 22 May 2024 Availability of documents

- Notice of AGM

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share