Form 497K BLACKROCK FUNDS

|

|

NOVEMBER 28, 2022 |

Summary Prospectus

BlackRock FundsSM | Great Pacific Shares

| • | BlackRock Liquid Environmentally Aware Fund |

Great Pacific Shares: GPEXX

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus (including amendments and supplements), reports to shareholders and other information about the Fund, including the Fund’s statement of additional information, online at http://www.blackrock.com/prospectus. You can also get this information at no cost by calling (800) 441-7450 or by sending an e-mail request to [email protected], or from your financial professional. The Fund’s prospectus and statement of additional information, both dated November 28, 2022, as amended and supplemented from time to time, are incorporated by reference into (legally made a part of) this Summary Prospectus.

This Summary Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this Summary Prospectus. Any representation to the contrary is a criminal offense.

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

Summary Prospectus

Investment Objective

The investment objective of BlackRock Liquid Environmentally Aware Fund (the “Fund”), a series of BlackRock FundsSM (the “Trust”), is to seek as high a level of current income as is consistent with liquidity and preservation of capital while giving consideration to select environmental criteria.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell Great Pacific Shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to your financial professional or your selected securities dealer, broker, investment adviser, service provider or industry professional (including BlackRock Advisors, LLC (“BlackRock”) and its affiliates) (each, a “Financial Intermediary”), which are not reflected in the table and example below. More information about these fees and expenses is available from your Financial Intermediary and in the “Details About the Share Class” section on page 17 of the Fund’s prospectus and in the “Purchase of Shares” section on page II-29 of Part II of the Fund’s Statement of Additional Information.

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) |

Great Pacific Shares | ||||

| Management Fee |

0.10% | ||||

| Distribution and/or Service (12b-1) Fees |

None | ||||

| Other Expenses1,2 |

0.16% | ||||

| Administration Fee |

0.10% | ||||

| Miscellaneous Other Expenses1,2 |

0.06% | ||||

| Total Annual Fund Operating Expenses2 |

0.26% | ||||

| Fee Waivers and/or Expense Reimbursements3 |

(0.06)% | ||||

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements3 |

0.20% | ||||

| 1 | Miscellaneous Other Expenses have been restated to reflect current fees. |

| 2 | Total Annual Fund Operating Expenses do not correlate to the ratio of expenses to average net assets given in the Fund’s most recent annual report, which does not include the restatement of Miscellaneous Other Expenses to reflect current fees. |

| 3 | As described in the “Management of the Fund” section of the Fund’s prospectus beginning on page 24, BlackRock has contractually agreed to waive and/or reimburse fees or expenses in order to limit Miscellaneous Other Expenses (excluding Dividend Expense, Interest Expense, Acquired Fund Fees and Expenses and certain other Fund expenses) to 0.00% of average daily net assets through June 30, 2033. This agreement may be terminated upon 90 days’ notice by a majority of the non-interested trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund. |

Example:

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Great Pacific Shares |

$ | 20 | $ | 64 | $ | 113 | $ | 255 | ||||||||

Principal Investment Strategies of the Fund

The Fund seeks to achieve its investment objective by investing in a broad range of U.S. dollar-denominated money market instruments, including government, U.S. and foreign bank, and commercial obligations and repurchase agreements. Under normal conditions, the Fund will invest at least 80% of the value of its net assets, plus the amount of any borrowings for investment purposes, in securities whose issuer or guarantor, in the opinion of BlackRock, the Fund’s investment manager, at the time of purchase, meets the Fund’s environmental criteria. This policy is a non-fundamental policy of the Fund. However, the Fund will provide shareholders with at least 60 days’ prior written notice of any changes to the policy.

BlackRock will consider the following as part of the Fund’s environmental criteria:

| ∎ | The Fund will invest in securities whose issuer (or guarantor, if applicable) at the time of the Fund’s investment have better than average performance in environmental practices. In evaluating performance in environmental practices, |

2

| BlackRock will use data or other environmental, social, or governance risk metrics including ratings provided by independent research vendor(s) in determining whether to invest (or continue to invest) in securities issued or guaranteed by a particular entity. These independent research vendor(s) may consider one or more of the following factors: Issuer or industry exposure to environmentally intensive activities, disclosures by an issuer around climate-related issues and environmental matters or specific targets or plans by an issuer to manage environmental exposures. These independent vendor(s) may also consider environmental issues relative to a specific sector. BlackRock may change an independent research vendor at any time in its discretion. BlackRock will consider factors such as emissions, energy and water intensity, waste generation, green revenues and environmental disclosure levels in evaluating the environmental performance of an issuer or guarantor. |

| ∎ | U.S. Government securities will be considered to have met the Fund’s environmental criteria |

| ∎ | The Fund will not invest in securities issued or guaranteed by entities: |

| — | that derive more than 5% of their revenue from fossil fuels mining, exploration or refinement; or |

| — | that derive more than 5% of their revenue from thermal coal or nuclear energy based power generation. |

In determining the efficacy of an issuer’s or guarantor’s environmental practices, BlackRock may also employ a proprietary model it has developed to consider the impact of various actions of an issuer or guarantor. The model uses third party data as well as information obtained by BlackRock to assess whether particular environmental factors may be material to an issuer or guarantor and capture any momentum around these factors. The model also seeks to consider more current headline news around an issuer or guarantor. The model may employ different inputs and weigh the significance of those inputs differently than the third party data sources that are used. BlackRock will conduct, as appropriate, its environmental evaluation of issuers and guarantors relative to a specific sector or across multiple sectors.

In addition, the Fund may invest in mortgage- and asset-backed securities, short-term obligations issued by or on behalf of states, territories and possessions of the United States, the District of Columbia, and their respective authorities, agencies, instrumentalities and political subdivisions and derivative securities such as tender option bonds, beneficial interests in municipal trust certificates and partnership trusts. The Fund may invest in “green” bonds where, in the opinion of BlackRock, the use of proceeds from the sale of these securities will be used to finance projects intended to generate an environmental benefit. The Fund may also invest in variable and floating rate instruments, and transact in securities on a when-issued, delayed delivery or forward commitment basis.

The Fund may invest up to 20% of the value of its net assets, plus the amount of any borrowings for investment purposes, in securities whose issuer (and, if applicable, guarantor) have below average performance in environmental practices or whose issuer (and, if applicable, guarantor) are not evaluated by any independent research vendor(s) currently used by the Fund, and whose issuer (and, if applicable, guarantor) do not otherwise meet the Fund’s environmental criteria.

The securities purchased by the Fund are subject to the quality, diversification and other requirements of Rule 2a-7 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and other rules of the Securities and Exchange Commission. The Fund will only purchase securities that present minimal credit risk as determined by BlackRock pursuant to guidelines approved by the Trust’s Board of Trustees (the “Board”).

Principal Risks of Investing in the Fund

Risk is inherent in all investing. You could lose money by investing in the Fund. Because the share price of the Fund will fluctuate, when you sell your shares, they may be worth more or less than what you originally paid for them. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

The following is a summary description of principal risks of investing in the Fund. The relative significance of each risk factor below may change over time and you should review each risk factor carefully.

| ∎ | Credit Risk — Credit risk refers to the possibility that the issuer of a debt security (i.e., the borrower) will not be able to make payments of interest and principal when due. Changes in an issuer’s credit rating or the market’s perception of an issuer’s creditworthiness may also affect the value of the Fund’s investment in that issuer. |

| ∎ | Environmental Criteria Risk — The risk that because the Fund’s environmental criteria exclude securities of certain issuers for nonfinancial reasons, the Fund may forgo some market opportunities available to funds that do not use these criteria. Consequently, the Fund may underperform funds that do not utilize an environmental strategy. BlackRock’s assessment of an issuer’s environmental criteria may change over time, which could cause the Fund to hold securities that may no longer meet BlackRock’s current environmental criteria. |

3

In evaluating the environmental criteria for an issuer or guarantor, BlackRock is dependent upon information and data that may be incomplete, inaccurate or unavailable. Currently, environmental data often lacks standardization, consistency and in some cases transparency. There may be different methodologies used by different data sources who compile environmental ratings of issuers or guarantors. This could adversely affect the analysis of the environmental criteria relevant to a particular issuer or guarantor. If BlackRock were to solely rely on this data, the Fund may invest in issuers or guarantors who may not meet the environmental criteria for investment. Investing on the basis of environmental criteria is qualitative and subjective by nature and there can be no assurance that the process utilized by any vendors of BlackRock or any judgment exercised by BlackRock will reflect the beliefs or values of any particular investor.

| ∎ | Liquidity Fee and Redemption Gate Risk — The Board has discretion to impose a liquidity fee of up to 2% upon sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. Accordingly, you may not be able to sell your shares or your redemptions may be subject to a liquidity fee when you sell your shares at certain times. |

| ∎ | Extension Risk — When interest rates rise, certain obligations will be paid off by the obligor more slowly than anticipated, causing the value of these securities to fall. |

| ∎ | Foreign Exposure Risk — Securities issued or supported by foreign entities, including foreign banks and corporations, may involve additional risks and considerations. Extensive public information about the foreign issuer may not be available, and unfavorable political, economic or governmental developments in the foreign country involved could affect the payment of principal and interest. |

| ∎ | Income Risk — Income risk is the risk that the Fund’s yield will vary as short-term securities in its portfolio mature and the proceeds are reinvested in securities with different interest rates. |

| ∎ | Interest Rate Risk — Interest rate risk is the risk that the value of a debt security may fall when interest rates rise. In general, the market price of debt securities with longer maturities will go up or down more in response to changes in interest rates than the market price of shorter-term securities. Due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. Very low or negative interest rates may magnify interest rate risk. During periods of very low or negative interest rates, the Fund may be unable to maintain positive returns or pay dividends to Fund shareholders. The Fund may be subject to a greater risk of rising interest rates due to the recent period of historically low interest rates. The Federal Reserve has recently begun to raise the federal funds rate as part of its efforts to address rising inflation. There is a risk that interest rates will continue to rise, which will likely drive down the prices of bonds and other fixed-income securities. Changing interest rates may have unpredictable effects on markets, may result in heightened market volatility and may detract from the Fund’s ability to achieve its investment objective. |

| ∎ | Market Risk and Selection Risk — Market risk is the risk that one or more markets in which the Fund invests will go down in value, including the possibility that the markets will go down sharply and unpredictably. The value of a security or other asset may decline due to changes in general market conditions, economic trends or events that are not specifically related to the issuer of the security or other asset, or factors that affect a particular issuer or issuers, exchange, country, group of countries, region, market, industry, group of industries, sector or asset class. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issues like pandemics or epidemics, recessions, or other events could have a significant impact on the Fund and its investments. Selection risk is the risk that the securities selected by Fund management will underperform the markets, the relevant indices or the securities selected by other funds with similar investment objectives and investment strategies. This means you may lose money. |

An outbreak of an infectious coronavirus (COVID-19) that was first detected in December 2019 developed into a global pandemic that has resulted in numerous disruptions in the market and has had significant economic impact leaving general concern and uncertainty. Although vaccines have been developed and approved for use by various governments, the duration of the pandemic and its effects cannot be predicted with certainty. Because the Fund invests in short-term instruments these events have caused some instruments to have declining yields, which may impair the results of the Fund if these conditions persisted. The impact of this coronavirus, and other epidemics and pandemics that may arise in the future, could affect the economies of many nations, individual companies and the market in general ways that cannot necessarily be foreseen at the present time.

| ∎ | Mortgage- and Asset-Backed Securities Risks — Mortgage- and asset-backed securities represent interests in “pools” of mortgages or other assets, including consumer loans or receivables held in trust. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risks. These securities also are subject to risk of default on the underlying mortgage or asset, particularly during periods of economic downturn. Small movements in interest rates (both increases and decreases) may quickly and significantly reduce the value of certain mortgage-backed securities. |

| ∎ | Prepayment Risk — When interest rates fall, certain obligations will be paid off by the obligor more quickly than originally anticipated, and the Fund may have to invest the proceeds in securities with lower yields. |

4

| ∎ | Repurchase Agreements and Purchase and Sale Contracts Risk — If the other party to a repurchase agreement or purchase and sale contract defaults on its obligation under the agreement, the Fund may suffer delays and incur costs or lose money in exercising its rights under the agreement. If the seller fails to repurchase the security in either situation and the market value of the security declines, the Fund may lose money. |

| ∎ | Treasury Obligations Risk — Direct obligations of the U.S. Treasury have historically involved little risk of loss of principal if held to maturity. However, due to fluctuations in interest rates, the market value of such securities may vary during the period shareholders own shares of the Fund. |

| ∎ | U.S. Government Obligations Risk — Certain securities in which the Fund may invest, including securities issued by certain U.S. Government agencies and U.S. Government sponsored enterprises, are not guaranteed by the U.S. Government or supported by the full faith and credit of the United States. |

| ∎ | Variable and Floating Rate Instrument Risk — Variable and floating rate securities provide for periodic adjustment in the interest rate paid on the securities. These securities may be subject to greater illiquidity risk than other fixed income securities, meaning the absence of an active market for these securities could make it difficult for the Fund to dispose of them at any given time. |

| ∎ | When-Issued and Delayed Delivery Securities and Forward Commitments Risk — When-issued and delayed delivery securities and forward commitments involve the risk that the security the Fund buys will lose value prior to its delivery. There also is the risk that the security will not be issued or that the other party to the transaction will not meet its obligation. If this occurs, the Fund may lose both the investment opportunity for the assets it set aside to pay for the security and any gain in the security’s price. |

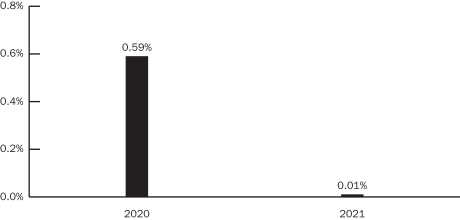

Great Pacific Shares do not have a full calendar year of performance history as of the date of this prospectus. As a result, the chart and table shown below give you a picture of the long-term performance for Institutional Shares of the Fund, which are not offered in this prospectus. The performance of the Fund’s Great Pacific Shares would be substantially similar to Institutional Shares because Great Pacific Shares and Institutional Shares are invested in the same portfolio of securities and performance would only differ to the extent that Great Pacific Shares and Institutional Shares have different expenses. The actual returns of Great Pacific Shares would have been approximately the same as those of Institutional Shares because Great Pacific Shares have the same expenses as Institutional Shares.

The information shows you how the Fund’s performance has varied year by year and provides some indication of the risks of investing in the Fund. To the extent that dividends and distributions have been paid by the Fund, the performance information for the Fund in the chart and table assumes reinvestment of the dividends and distributions. As with all such investments, past performance is not an indication of future results. The table includes all applicable fees. If BlackRock and its affiliates had not waived or reimbursed certain Fund expenses during these periods, the Fund’s returns would have been lower. The Fund is a money market fund managed pursuant to the requirements of Rule 2a-7 under the Investment Company Act. Updated information on the Fund’s performance can be obtained by visiting http://www.blackrock.com/cash or can be obtained by phone at (800) 441-7450.

Institutional Shares

ANNUAL TOTAL RETURNS

BlackRock Liquid Environmentally Aware Fund

As of 12/31

During the periods shown in the bar chart, the highest return for a quarter was 0.30% (quarter ended March 31, 2020) and the lowest return for a quarter was -0.01% (quarter ended December 31, 2021). The year-to-date return as of September 30, 2022 was 0.69%.

5

| For the periods ended 12/31/21 Average Annual Total Returns |

1 Year | Since Inception (April 8, 2019) |

||||||

| BlackRock Liquid Environmentally Aware Fund — Institutional Shares |

||||||||

| Return Before Taxes |

0.01 | % | 0.78 | % | ||||

To obtain the Fund’s current 7-day yield, call (800) 441-7450 or visit the Fund’s website at www.blackrock.com/cash.

The Fund’s investment manager is BlackRock Advisors, LLC (previously defined as “BlackRock”). The Fund’s sub-adviser is BlackRock International Limited (the “Sub-Adviser”). Where applicable, “BlackRock” refers also to the Sub-Adviser.

Purchase and Sale of Fund Shares

You may generally purchase or redeem shares of the Fund each day on which both the New York Stock Exchange and the Federal Reserve Bank of Philadelphia are open.

Shares are only available for purchase by clients of Great Pacific Securities and its affiliates.

To open an account with the Fund, contact Great Pacific Securities by telephone at 714-619-3015 or by e-mail at [email protected].

To purchase or sell shares of the Fund you should contact your Financial Intermediary, contact the Fund by phone at (800) 441-7450, use the Fund’s internet-based order entry program, or use such other electronic means as the Fund agrees to in its sole discretion with your Financial Intermediary. You have until the close of the federal funds wire (normally 6:45 p.m. Eastern time) to get your purchase money in to the Fund on the day of your purchase or your purchase order will be cancelled.

The Fund’s initial and subsequent investment minimums generally are as follows, although the Fund may reduce or waive the minimums in some cases.

| Great Pacific Shares | ||

| Minimum Initial Investment | $2 million for individuals and institutional investors | |

| Minimum Additional Investment | No subsequent minimum. |

The Fund’s dividends and distributions may be subject to U.S. federal income taxes and may be taxed as ordinary income or capital gains, unless you are a tax-exempt investor or are investing through a qualified tax-exempt plan described in section 401(a) of the Internal Revenue Code of 1986, as amended, in which case you may be subject to U.S. federal income tax when distributions are received from such tax-deferred arrangements.

Payments to Broker/Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a Financial Intermediary such as Great Pacific Securities, the Fund and BlackRock Investments, LLC, the Fund’s distributor, or its affiliates may pay the Financial Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Financial Intermediary and your individual financial professional to recommend the Fund over another investment.

Ask your individual financial professional or visit your Financial Intermediary’s website for more information.

6

[This page intentionally left blank]

INVESTMENT COMPANY ACT FILE # 811-05742

SPRO-LEAF-GP-1122

|

|

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Caris Life Sciences to Showcase Extensive Research Highlighting the Clinical Value of Comprehensive Molecular Profiling at ASCO 2024

- Trane Technologies Accelerates Growth through Leading Sustainability Performance

- Qomolangma Acquisition Corp. Announces Receipt of Notice from Nasdaq Regarding Filing of Annual Report on Form 10-K

Create E-mail Alert Related Categories

SEC FilingsSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share