Form 487 m funds Trust

1933 Act File No.: 333-255867

1940 Act File No.: 811-23503

Securities

and Exchange Commission

Washington, D.C. 20549

Amendment No. 1 to

Form S-6

for Registration under the Securities Act of 1933

of Securities of Unit Investment

Trusts Registered on Form N-8B-2

| A. | Exact name of trust: m+ funds Trust |

| B. | Name of depositor: Cowen Prime Services, LLC |

| C. | Complete address of depositor’s principal executive offices: |

Cowen Prime Services, LLC

599 Lexington Avenue

New York, New York 10022

| D. | Name and complete address of agent for service: |

| With a copy to: | |

|

Ian Shainbrown Alaia Capital, LLC 62 West 45th St. 5th Floor New York, NY 10036 |

Anna T. Pinedo Mayer Brown LLP 1221 Avenue of the Americas New York, New York 10020 |

It is proposed that this filing will become effective (check appropriate box)

| o | immediately upon filing pursuant to paragraph (b) |

| o | on (date) pursuant to paragraph (b) |

| o | 60 days after filing pursuant to paragraph (a)(1) |

| o | on (date) pursuant to paragraph (a)(1) of Rule 485. |

If appropriate, check the following box:

| o | this post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

| E. | Title of securities being registered: Units of undivided beneficial interest in the trust |

| F. | Approximate date of proposed public offering: As soon as practicable after the effective date of the Registration Statement |

| x | Check box if it is proposed that this filing will become effective on July 30, 2021 at 9:00 a.m. pursuant to Rule 487. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. No one may sell units of the trust until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell units and is not soliciting an offer to buy units in any state where the offer or sale is not permitted.

Preliminary Prospectus Dated July 30, 2021

Subject to Completion

m+ Buffer 15 Fund

m+ funds Trust, Series 1-21

(A unit investment trust that is a series of m+ funds Trust)

As described more fully in this prospectus with capitalized terms as defined herein:

| · | Designed for investors who intend to purchase units at inception and hold them until the Maturity Date, and who seek a percentage return per unit equal to any percentage increase in the value of the SPDR® S&P 500® ETF Trust (the “Reference Asset”) relative to the Initial Reference Value (the “Equal Upside”), up to a maximum total return of 19.20% (the “Capped Return”) (equivalent to an annualized total return of 8.43% over the approximately 2.17 year life of the trust), while having protection against the first 15.00% decrease (the “Buffer”) in the value of the Reference Asset. |

| · | m+ Buffer 15 Fund seeks to deliver any of the price appreciation of the Reference Asset, up to a cap, or any of the Reference Asset’s price depreciation in excess of the Buffer, up to a maximum loss of 83.00% (the “Maximum Loss”), decreased by the trust’s fees and expenses. |

| · | Portfolio of exchange-traded options and cash, and/or cash equivalents (to pay the creation and development fee, organizational costs and annual operating expenses). |

| · | Investors should be willing to forgo interest and dividend payments and, if the price of the Reference Asset declines by more than the 15.00% Buffer, be willing to lose a significant portion (up to 83.00%) of their investment. Any potential loss would be increased as a result of the trust’s fees and expenses or if the units were purchased at a public offering price above the Inception Value. There is no assurance that the trust will achieve its investment objective. |

| · | Investors who purchase units at a price that is above the Inception Value will be subject to, on the Maturity Date, a maximum total return per unit that will be less than the Capped Return, or a maximum total loss per unit that can be greater than the Maximum Loss. |

| · | The trust may experience substantial losses from the exchange-traded options and option positions may expire worthless. Investors may experience a substantial loss (up to 83.00%) of their investment. Investors who redeem units before the Maturity Date may lose money even if the value of the Reference Asset has increased by then. |

Minimum purchase of 100 units.

The percentage increase or decrease of the Reference Asset relative to the Initial Reference Value described above is the percentage increase or decrease in the Reference Asset from when the Option strike levels are set to the close of the market on the Options Expiration Date.

The trust’s ability to provide the Equal Upside, the Capped Return, limited downside protection via the Buffer and the Maximum Loss, depends on unitholders purchasing units valued at their Inception Value of $10.000 and holding them until the Maturity Date. Because the price at which you may purchase units at inception will also include certain organizational costs, sales charges and the creation and development fee, it may be higher than the Inception Value. As the trust is designed to provide Equal Upside, subject to the Capped Return and limited downside protection via the Buffer and the Maximum Loss, only on the Maturity Date and based on a unit value equal to the Inception Value, investors who purchase units at or above the Inception Value may have a loss on the Maturity Date.

Prospectus

July [●], 2021

As with any investment, the Securities and Exchange Commission has not approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any contrary representation is a criminal offense.

| Overview | 3 |

| Investment Objective | 3 |

| Principal Investment Strategy | 3 |

| Principal Risks | 13 |

| Who Should Invest | 17 |

| Summary Information | 18 |

| Fees and expenses Table | 19 |

| Hypothetical Option Expiration Examples | 23 |

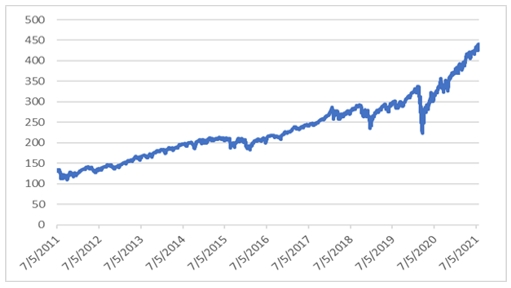

| Reference Asset Past Performance | 27 |

| How To Buy Units | 28 |

| How To Sell Your Units | 30 |

| Distributions | 32 |

| Investment Risks | 32 |

| Trust Administration | 38 |

| Distribution Of Units | 40 |

| Taxes | 41 |

| Legal Matters | 47 |

| Additional Information | 47 |

| Report of Independent Registered Public Accounting Firm | 48 |

m+ Buffer 15 Fund seeks to deliver the price appreciation of a Reference Asset, up to a cap, while having protection against the first 15.00% decrease in the value of the Reference Asset, decreased by the trust’s fees and expenses.

However, there is no assurance that the trust will achieve its investment objective.

m+ is a trade name owned by Alaia Capital, LLC exclusively to market certain unit investment trusts.

We may use this prospectus as a preliminary prospectus for a future trust. In this case you should note that:

The information in this prospectus is not complete with respect to future trusts and may be changed. No one may sell units of a future trust until a registration statement is filed with the Securities and Exchange Commission and is effective. This prospectus is not an offer to sell units and is not soliciting an offer to buy units in any state where the offer or sale is not permitted.

Capitalized terms are defined below in the text and in the “Summary of Defined Terms.”

| - ii - |

Overview

m+ funds Trust (the “trust”) is a unit investment trust that is a Delaware statutory trust organized in series. Cowen Prime Services, LLC (the “sponsor”) serves as the sponsor of the Trust and each trust series. m+ is a trade name owned by Alaia Capital, LLC exclusively to market certain unit investment trusts.

Investment Objective

The trust seeks to provide a percentage return per unit on the Maturity Date equal to any percentage increase in the value of the Reference Asset relative to the Initial Reference Value (the “Equal Upside”), up to a maximum total return of 19.20% (the “Capped Return”) (equivalent to an annualized total return of 8.43% over the approximately 2.17-year life of the trust), while also providing protection against the first 15.00% decrease (the “Buffer”) in the value of the Reference Asset, reduced by the amount of the trust’s fees and expenses. If the value of the Reference Asset decreases from the Initial Reference Value by more than the Buffer, the return on the units will be negative and will equal the percentage decrease in the Reference Asset in excess of the Buffer, up to a maximum loss of 83.00% (the “Maximum Loss”), decreased by the trust’s fees and expenses.

The Reference Asset for this trust is the SPDR® S&P 500® ETF Trust, which is an exchange-traded fund that tracks the performance of a broad-based U.S. equity index. When we use the term “value,” we mean the price of the shares of the Reference Asset. References to the “trust” mean the Series 1-21, a unit investment trust that is a series of m+ funds Trust.

The trust is scheduled to terminate in approximately 2.17-years.

There is no assurance that the trust will achieve its investment objective.

Principal Investment Strategy

The trust seeks to achieve its objective by investing in a portfolio of cash and cash equivalents, and a series of FLexible EXchange® options (“FLEX Options,” or the “Options”) on the Reference Asset at various strike price levels. The FLexible EXchange® options trademark is owned by Chicago Board Options Exchange, Incorporated.

The trust’s portfolio is intended to earn returns based on the performance of the Reference Asset as more fully explained in this prospectus.

Generally, the expiration date for the Options in the trust’s portfolio will be on or shortly before the trust’s mandatory dissolution date on September 29, 2023 (the “Maturity Date”), subject to adjustment as described below. As explained below, the trust’s portfolio includes written and purchased “call options” and “put options” with formulas to calculate the option payments at expiration based on the performance of the Reference Asset. Under normal circumstances, the trust’s assets will consist solely of cash and/or cash equivalents, and the Options.

The Options are all European style options, which means that they will be exercisable at the strike price only on the Options Expiration Date.

The trust is intended to provide a “Capped Return”, with “Equal Upside,” subject to a limited downside protection via the “Buffer” and a “Maximum Loss” and subject to reductions for the amount of trust fees and expenses, as explained below:

| · | Capped Return” denotes that the return per unit may not exceed a maximum return of 19.20%, at which the amount per unit will equal the “Maximum Amount per Unit,” reduced by the amount of the trust’s fees and expenses. |

| · | “Equal Upside” denotes that for any percentage increase in the value of the Reference Asset, the trust seeks to provide unitholders with a return per unit from the Inception Value that equals such percentage increase, reduced by the amount of the trust’s fees and expenses. |

| - 3 - |

| · | “Buffer” denotes that for any percentage decrease in the value of the Reference Asset up to and including 15.00%, the trust seeks to return to unitholders the Inception Value per unit, reduced by the amount of the trust’s fees and expenses. |

| · | “Maximum Loss” denotes that for any percentage decrease in the Reference Asset relative to the Initial Reference Value in excess of the Buffer, unitholders will be subject to a maximum loss of 83.00% from the Inception Value of $10.000, or $8.300 per unit, decreased by the trust’s fees and expenses. |

Hypothetical Performance Return Examples

The following four examples illustrate hypothetical performance returns of the trust. None of the examples below take into account the payment by the trust of its fees and expenses.

In the above hypothetical example, the Final Reference Value of the Reference Asset is above its Initial Reference Value, and above the value that would lead to the Maximum Amount per Unit. If the Reference Asset increases as per above, the trust would seek to provide unitholders with a percentage return that is the “Capped Return,” and the value per unit would be the Maximum Amount per Unit. In this scenario, because the Reference Asset has increased by more than 19.20%, the return of the units would underperform the return of a direct investment in the Reference Asset to the extent that it exceeds the Capped Return.

In the above hypothetical example, the Final Reference Value of the Reference Asset is above its Initial Reference Value but below the value that would lead to the Maximum Amount per Unit. If the Reference Asset increases as per above, the trust would seek to provide unitholders with a percentage return that would equal the percentage increase of the value of the Reference Asset. In this scenario, the return of the units would equal the percentage increase of a direct investment in the Reference Asset, reduced by the amount of the trust’s fees and expenses.

In the above hypothetical example, the Final Reference Value of the Reference Asset is below its Initial Reference Value, but above the Buffer. If the Reference Asset decreases as per above, the trust would seek to return to unitholders the Inception Value per unit. In this scenario, which we refer to as a performance that is “Buffered,” the units would not experience a loss and therefore would outperform a direct investment in the Reference Asset, reduced by the amount of the trust’s fees and expenses.

| - 4 - |

In the above hypothetical example, the Final Reference Value of the Reference Asset is below its Initial Reference Value, and below the Buffer. If the Reference Asset decreases as per above, the trust would seek to provide unitholders with a loss that is less than the decline of the Reference Asset, which we refer to as a performance that is “Buffered.” The loss on units would be subject to the Maximum Loss per Unit of 83.00% from the Inception Value, decreased by the trust’s fees and expenses. In this scenario, the percentage decrease on the value of the units would outperform the percentage decrease on the value of a direct investment in the Reference Asset due to the Buffer.

The trust may experience substantial downside from the Options and option contract positions may expire worthless. Investors may lose a significant portion (up to 83.00%) of their investment, decreased by the trust’s fees and expenses. The trust’s ability to provide Equal Upside, up to the Capped Return, or to limit losses to the Maximum Loss depends on unitholders purchasing units valued at their Inception Value of $10.000 and holding them until the Maturity Date. Because the price at which you may purchase units at inception will also include certain organizational costs, sales charges and the creation and development fee, it may be higher than the Inception Value.

The following four examples illustrate hypothetical total returns for units of the trust purchased at different unit prices. None of the examples below takes into account the payment by the trust of its fees and expenses. The examples below assume a unit Inception Value of $10.000, that units are purchased and held for a period of 2.17-years at which point the trust will terminate, and that at such point, at the Maturity Date, the trust will provide a percentage return equal to any increase in the Reference Asset, or the Equal Upside, up to a Capped Return of 19.20%, subject to limited downside protection via a Buffer of 15.00% (decreased by the trust’s fees and expenses).

Based on the stated assumptions, if the Final Reference Value has increased by 40% from the Initial Reference Value, then, at the Maturity Date the total return per unit will depend on the purchased price of each unit as follows:

| Unit price when purchased |

Unit price on the Maturity Date |

Total return per unit purchased |

Annualized return per unit purchased |

| $11.920 | $11.920 | 0.00% | 0.00% |

| $11.000 | $11.920 | 8.36% | 3.77% |

| $10.000 | $11.920 | 19.20% | 8.43% |

| $9.000 | $11.920 | 32.44% | 13.82% |

| $8.000 | $11.920 | 49.00% | 20.17% |

| - 5 - |

Alternatively, based on the stated assumptions, if the Final Reference Value has increased by 10% from the Initial Reference Value, then, at the Maturity Date the total return per unit will depend on the purchased price of each unit as follows:

| Unit price when purchased |

Unit price on the Maturity Date |

Total return per unit purchased |

Annualized return per unit purchased |

| $11.920 | $11.000 | -7.72% | -3.63% |

| $11.000 | $11.000 | 0.00% | 0.00% |

| $10.000 | $11.000 | 10.00% | 4.49% |

| $9.000 | $11.000 | 22.22% | 9.69% |

| $8.000 | $11.000 | 37.50% | 15.81% |

Alternatively, based on the stated assumptions, if the Final Reference Value has decreased by 8% from the Initial Reference Value, then, at the Maturity Date the total return per unit will depend on the purchased price of each unit as follows:

| Unit price when purchased |

Unit price on the Maturity Date |

Total return per unit purchased |

Annualized return per unit purchased |

| $11.920 | $10.000 | -16.11% | -7.77% |

| $11.000 | $10.000 | -9.09% | -4.30% |

| $10.000 | $10.000 | 0.00% | 0.00% |

| $9.000 | $10.000 | 11.11% | 4.98% |

| $8.000 | $10.000 | 25.00% | 10.83% |

Alternatively, based on the stated assumptions, if the Final Reference Value has decreased by 30% from the Initial Reference Value, then, at the Maturity Date the total return per unit will depend on the purchased price of each unit as follows:

| Unit price when purchased |

Unit price on the Maturity Date |

Total return per unit purchased |

Annualized return per unit purchased |

| $11.920 | $8.500 | -28.69% | -14.43% |

| $11.000 | $8.500 | -22.73% | -11.20% |

| $10.000 | $8.500 | -15.00% | -7.22% |

| $9.000 | $8.500 | -5.56% | -2.60% |

| $8.000 | $8.500 | 6.25% | 2.83% |

The tables above are provided for illustrative purposes only and are hypothetical. the actual Buffer and Capped Return, among others, will likely differ and will be set at the close of regular trading on the New York Stock Exchange on the date prior to the inception date.

Investors will not receive a positive return (i.e., they will lose money) on their investment unless they receive more on their units than they originally invest (which amount is $10.368 per unit for units purchased at the trust’s inception, or $10.161 per unit for units purchased for Fee Accounts, subject to a Wrap Fee).

| - 6 - |

The trust’s investment strategy description, descriptions of the Options, the descriptions and graphs above are hypothetical illustrations of the mathematical principles underlying the payoff of the Options and the operation of the trust’s investment objective. There is no assurance that the trust will achieve its investment objective through the use of this strategy. Illustrations of the possible returns of the trust’s investment objective assuming certain positive and negative returns on the value of the Reference Asset relative to the Initial Reference Value appear under “Hypothetical Option Expiration Examples” in this prospectus. Additional information about the strategy and the Options appears below. These examples, as well as the ones above, do not attempt to present any projection of actual trust performance. These examples are merely intended to illustrate the operation of the Options at the scheduled expiration and the amount per unit that the trust would receive or pay in certain situations at the scheduled expiration of the Options. You may realize a return that is higher or lower than the intended returns as a result of redeeming units prior to the Maturity Date or as a result of purchasing units other than at the Inception Value. You may also realize a return that is higher or lower than the intended returns in the event that the Options are otherwise liquidated by the trust prior to expiration, due to redemptions or otherwise, in the event that the trust is terminated prior to the Maturity Date, if the trust is unable to maintain the proportional relationship of the Options based on the number of Option contracts in the trust’s portfolio, if a Corporate Action (defined below) occurs with respect to the Reference Asset, or as a result of increases in potential tax-related expenses and other expenses of the trust above estimated levels. The trust seeks to achieve its objective by investing in a portfolio consisting of cash and/or cash equivalents, and purchased and written FLEX Options scheduled to expire on the Maturity Date (the “Options Expiration Date”) with payouts at expiration calculated based on the performance of the Reference Asset relative to the value of the Reference Asset on the day prior to the trust’s inception when the Options strike levels are set (the “Initial Reference Value”). The Options may be liquidated as of the close of market on the Options Expiration Date rather than be exercised according to the Options’ terms in order to avoid having the trust receive shares of the Reference Asset or be obligated to deliver shares of the Reference Asset. Each Option entitles the holder thereof (i.e. the purchaser of the Option) the option to purchase (for the call options) or sell (for the put options) 100 shares of the Reference Asset at the strike price.

| - 7 - |

| Summary of Defined Terms | |

| Options Expiration Date: | September 29, 2023 |

| Maturity Date: | September 29, 2023, subject to adjustment, as described below |

| Reference Asset: | The SPDR® S&P 500® ETF Trust, an exchange-traded fund |

| Unit price at inception: | $10.368 per unit, or $10.161 per unit for Fee Accounts, subject to a Wrap Fee |

| Initial Reference Value: | $440.65 |

| Final Reference Value: | The Official Closing Value of the Reference Asset on the Options Expiration Date |

| Official Closing Value: | The closing price of the Reference Asset on any scheduled trading day based upon the value displayed on the relevant Bloomberg Professional® service page with respect to the Reference Asset, “SPY <EQUITY>” or any successor page on the Bloomberg Professional® service or any successor service, as applicable. |

| Buffer: | 15.00% ($1.500 per unit)* |

| Maximum Loss per Unit: | 83.00% per unit ($8.300 per unit)* |

| Equal Upside: | The price return of the Reference Asset from the Initial Reference Value to the Official Closing Value on the Options Expiration Date* |

| Capped Return: | 19.20% (equivalent to an annualized return of 8.43% over the approximately 2.17-year life of the trust)* |

| Maximum Amount per Unit: | $11.920 per unit, resulting from a Capped Return of 19.20%* |

| Inception Value: | $10.000 per unit, the net asset value per unit at the inception date |

* At the Maturity Date the value of the units, and the effect of the Equal Upside, the Capped Return, the Maximum Amount per Unit and the Buffer will be reduced by, and the Maximum Loss per Unit will be increased by, the amount of the fees and expenses incurred by the trust during the life of the trust.

| |

The value of the Options on the Options Expiration Date will allow the trust to provide gains or losses based on the performance of the Reference Asset for units purchased at a price equal to their Inception Value and held until the Maturity Date:

| · | If the value of the Reference Asset appreciates from the Initial Reference Value over the life of the trust, the trust seeks to provide unitholders with a percentage return equal to the percentage increase of the value of the Reference Asset (the “Equal Upside”), up to the Capped Return of 19.20%, resulting in an amount per unit not to exceed the Maximum Amount per Unit, subject to reductions by the amount of the trust fees and expenses. |

| · | If the value of the Reference Asset decreases from the Initial Reference Value over the life of the trust by 15.00% or less (the “Buffer”), the trust seeks to return to unitholders the Inception Value of $10.000, subject to reduction by the amount of the trust fees and expenses. |

| · | If the value of the Reference Asset decreases from the Initial Reference Value over the life of the trust by more than the Buffer, the return on the units will be negative and will equal the percentage decrease in the Reference Asset in excess of the Buffer, up to the Maximum Loss of 83.00%, decreased by the amount of the trust fees and expenses. |

Investors may lose a substantial amount (up to 83.00%) of their investment. The intended Maximum Loss per Unit is $8.300 (83.00%) based on an Inception Value of $10.000. The Maximum Loss per Unit is subject to being increased by the amount of the trust fees and expenses.

| - 8 - |

The “Maturity Date” for the units will be September 29, 2023, as specified above under “Summary of Defined Terms,” unless that day is not a business day, in which case the Maturity Date will be the next following business day. If the trust postpones the Options Expiration Date, because such day is not a trading day or otherwise, then the Maturity Date will be automatically postponed to equal that of the postponed Options Expiration Date. In certain situations the trust may terminate prior to the Maturity Date as existed prior to the postponement(s). See the “Trust Administration—Dissolution of the Trust” section in this prospectus for further information.

A “trading day” with respect to the Options is a business day as determined by the trust, on which trading for listed options is generally conducted on the primary securities exchange(s) or market(s) on which the Options are listed or admitted for trading and on which general banking transactions are conducted.

A “business day” with respect to units, means a day on which the New York Stock Exchange is scheduled to be open for regular trading and on which general banking transactions are conducted.

All determinations by the trust affecting the Options Expiration Date will be made by Alaia Capital, LLC as portfolio consultant to the trust (the “Portfolio Consultant”), and will be based on the determinations and conventions applied by the Options Clearing Corporation (the “OCC”), a market clearinghouse, to the FLEX Options and/or to listed options with as similar terms and underlying assets as possible to those of the FLEX Options and the Reference Asset, respectively.

Subject to determination by the Securities Committee of the OCC, adjustments may be made to the FLEX Options over the Reference Asset for certain events (collectively, “Corporate Actions”) specified in the OCC’s by-laws and rules: certain stock dividends or distributions, stock splits, reverse stock splits, rights offerings, distributions, reorganizations, recapitalizations, or reclassifications with respect to an underlying security, or a merger, consolidation, dissolution or liquidation of the issuer of the underlying security. According to the OCC’s by-laws, the nature and extent of any such adjustment is to be determined by the OCC’s Securities Committee, in light of the circumstances known to it at the time such determination is made, based on its judgment as to what is appropriate for the protection of investors and the public interest, taking into account such factors as fairness to holders and writers (or purchasers and sellers) of the affected options, the maintenance of a fair and orderly market in the affected options, consistency of interpretation and practice, efficiency of exercise settlement procedures, and the coordination with other clearing agencies of the clearance and settlement of transactions in the underlying interest.

The Options. The trust’s initial portfolio may include a portfolio of various kinds of FLEX Options. Below, we describe FLEX Options generally.

FLEX Options. FLEX Options are customized option contracts available through national securities exchanges that are guaranteed for settlement by the OCC. FLEX Options are listed on a U.S. national securities exchange. FLEX Options provide investors with the ability to customize assets and indices referenced by the options, exercise prices, exercise styles (i.e., American-style, exercisable any time prior to the expiration date, or European-style, exercisable only on the option expiration date) and expiration dates, while achieving price discovery in competitive, transparent auctions markets and avoiding the counterparty exposure of over-the-counter options positions. Each option contract entitles the holder thereof to purchase (for the call options) or sell (for the put options) 100 shares of the Reference Asset at the strike price.

The OCC guarantees performance by each of the counterparties to the FLEX Options, becoming the “buyer for every seller and the seller for every buyer,” protecting clearing members and options traders from counterparty risk.

All of the information set forth above relating to the Options and the OCC has been obtained from the OCC. The description and terms of the Options to be entered into with the OCC are set forth in the by-laws and rules of the OCC, available at www.optionsclearing.com. Please see www.optionsclearing.com for more information relating thereto, which websites are not considered part of this prospectus nor are they incorporated by reference herein.

Initial Option Portfolio. The trust will purchase or sell a series of FLEX Options, which are referred to as the Purchased Call Options, Purchased Put Options, Written Put Options and Written Call Options (as further defined below).

| - 9 - |

Description of the Reference Asset

We have derived all information contained in this prospectus regarding the SPDR® S&P 500® ETF Trust (the “SPY”), including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. Such information reflects the policies of, and is subject to change by, State Street Global Advisors Trust Company, as trustee of the SPY, and PDR Services, LLC (wholly owned by NYSE Euronext), as sponsor of the SPY. Information provided to or filed with the Securities and Exchange Commission (the “Commission”) by the SPY pursuant to the Securities Act of 1933 and the Investment Company Act of 1940 can be located by reference to Commission file numbers 033-46080 and 811-06125, respectively, through the Commission’s website at www.sec.gov. Information provided to or filed with the Commission can also be inspected and copied at the public reference facility maintained by the Commission. None of this publicly available information is incorporated by reference into this prospectus. We have not undertaken any independent review or due diligence of such information.

The Reference Asset seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the S&P 500® Index (the “Underlying Index”). To maintain the correspondence between the composition and weightings of stocks held by the Reference Asset and constituent stocks of the Underlying Index, the Reference Asset adjusts its holdings from time to time to conform to periodic changes in the identity and/or relative weightings of the index securities.

The Reference Asset utilizes a “passive” or “indexing” investment approach in attempting to track the performance of the Underlying Index. The Reference Asset seeks to invest in substantially all of the securities that comprise the Underlying Index. The Reference Asset typically earns income from dividends from securities held by the Reference Asset. These amounts, net of expenses and taxes (if applicable), are passed along to the Reference Asset’s shareholders as “ordinary income.” In addition, the Reference Asset realizes capital gains or losses whenever it sells securities. Net long-term capital gains are distributed to shareholders as “capital gain distributions.” However, because the component return of the Reference Asset will be calculated based only on the share price of the Reference Asset, you will not receive any benefit from or be entitled to receive income, dividend, or capital gain distributions from the Reference Asset or any equivalent payments.

The shares of the Reference Asset trade on the NYSE under the symbol “SPY.”

The Underlying Index

All disclosures contained in this document regarding the Underlying Index, including, without limitation, its make-up, method of calculation, and changes in its components, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, S&P Dow Jones Indices LLC (the “Index Sponsor”). The Index Sponsor, which licenses the copyright and all other rights to the Underlying Index, has no obligation to continue to publish, and may discontinue publication of, the Underlying Index. We do not accept any responsibility for the calculation, maintenance or publication of the Underlying Index or any successor index.

The Underlying Index is intended to provide an indication of the pattern of common stock price movement. The calculation of the level of the Underlying Index is based on the relative value of the aggregate market value of the common stocks of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941 through 1943.

The Index Sponsor chooses companies for inclusion in the Underlying Index with the aim of achieving a distribution by broad industry groupings that approximates the distribution of these groupings in the common stock population of its Stock Guide Database of over 10,000 companies, which the Index Sponsor uses as an assumed model for the composition of the total market. Relevant criteria employed by the Index Sponsor include the viability of the particular company, the extent to which that company represents the industry group to which it is assigned, the extent to which the market price of that company’s common stock generally is responsive to changes in the affairs of the respective industry and the market value and trading activity of the common stock of that company. Eleven main groups of companies constitute the Underlying Index, with the approximate percentage of the market capitalization of the Underlying Index included in each group as of June 30, 2021 indicated: Information Technology (27.4%), Health Care (13.0%), Consumer Discretionary (12.13%), Financials (11.3%), Communication Services (11.1%), Industrials (8.5%), Consumer Staples (5.9%), Energy (2.9%), Materials (2.6%), Real Estate (2.6%) and Utilities (2.5%). The Index Sponsor may from time to time, in its sole discretion, add companies to, or delete companies from, the Underlying Index to achieve the objectives stated above.

| - 10 - |

The Index Sponsor calculates the Underlying Index by reference to the prices of the constituent stocks of the Underlying Index without taking account of the value of dividends paid on those stocks. As a result, the return on the units will not reflect the return you would realize if you actually owned the index constituent stocks and received the dividends paid on those stocks.

Computation of the Underlying Index

While the Index Sponsor currently employs the following methodology to calculate the Underlying Index, no assurance can be given that the Index Sponsor will not modify or change this methodology in a manner that may affect the Redemption Amount.

Prior to March 2005, the Market Value of a constituent stock was calculated as the product of the market price per share and the total number of outstanding shares of the constituent stock. In March 2004, the Index Sponsor announced that it would transition the Underlying Index to float adjusted market capitalization weights. The transition began in March 2005 and was completed in September 2005. The Index Sponsor’s criteria for selecting stocks for the Underlying Index was not changed by the shift to float adjustment. However, the adjustment affects each company’s weight in the Underlying Index (i.e., its Market Value). Currently, the Index Sponsor calculates the Underlying Index based on the total float-adjusted market capitalization of each constituent stock, where each stock’s weight in the Underlying Index is proportional to its float-adjusted Market Value.

Under the float adjustment, the share counts used in calculating the Underlying Index reflect only those shares that are available to investors, not all of a company’s outstanding shares. The float adjustment excludes shares that are closely held by control groups, other publicly traded companies or government agencies.

All shareholdings representing more than 5% of a stock’s outstanding shares, other than holdings by “block owners,” are removed from the float for purposes of calculating the Underlying Index. Generally, these “control shareholders” will include officers and directors, private equity, venture capital and special equity firms, other publicly traded companies that hold shares for control, strategic partners, holders of restricted shares, ESOPs, employee and family trusts, foundations associated with the company, holders of unlisted share classes of stock, government entities at all levels (other than government retirement/pension funds) and any individual person who controls a 5% or greater stake in a company as reported in regulatory filings. However, holdings by block owners, such as depositary banks, pension funds, mutual funds and ETF providers, 401(k) plans of the company, government retirement/pension funds, investment funds of insurance companies, asset managers and investment funds, independent foundations and savings and investment plans, will ordinarily be considered part of the float.

Treasury stock, stock options, equity participation units, warrants, preferred stock, convertible stock, and rights are not part of the float. Shares of a U.S. company traded in Canada as “exchangeable shares,” are normally part of the float unless those shares form a control block. All multiple share class companies that have listed share class lines will be adjusted for shares and float such that each share class line will only represent that line’s shares and float. The decision to include each publicly listed line is evaluated individually. All multiple share class companies that have an unlisted class line will also be adjusted. For each stock, an investable weight factor (“IWF”) is calculated by dividing the available float shares, defined as the total shares outstanding less shares held by control holders. The float-adjusted index is then calculated by dividing the sum of the IWF multiplied by both the price and the total shares outstanding for each stock by an index divisor (the “Divisor”). As of July 31, 2017, companies with multiple share class lines are no longer eligible for inclusion in the SPX. Constituents of the Index prior to July 31, 2017 with multiple share classes will be grandfathered in and continue to be included in the SPX. If a constituent company of the Index reorganizes into a multiple share class line structure, that company will remain in the Index at the Discretion of the S&P Index Committee in order to minimize turnover.

The Underlying Index is also calculated using a base-weighted aggregate methodology: the level of the Underlying Index reflects the total Market Value of all the constituent stocks relative to the Underlying Index base period of 1941-43. The daily index value of the Underlying Index is the quotient of the total float-adjusted market capitalization of the index’s constituents and its divisor.

The simplest capitalization weighted index can be thought of as a portfolio consisting of all available shares of the stocks in the index. While this might track this portfolio’s value in dollar terms, it would probably yield an unwieldy number in the trillions. Therefore, the actual number used in the Underlying Index is scaled to a more easily handled number, currently in the thousands, by dividing the portfolio Market Value by the Divisor.

| - 11 - |

Ongoing maintenance of the Underlying Index includes monitoring and completing the adjustments for additions and deletions of the constituent companies, share changes, stock splits, stock dividends and stock price adjustments due to company restructurings or spin-offs. Continuity in the level of the Underlying Index is maintained by adjusting the Divisor for all changes in the Underlying Index constituents’ share capital after the base date. Some corporate actions, such as stock splits and stock dividends do not require Divisor adjustments because following a stock split or stock dividend, both the stock price and number of shares outstanding are adjusted by the Index Sponsor so that there is no change in the Market Value of the constituent stock. Corporate actions (such as stock splits, stock dividends, non-zero price spin-offs and rights offerings) are applied after the close of trading on the day before the ex-date.

To prevent the level of the Underlying Index from changing due to corporate actions, all corporate actions which affect the total Market Value of the Underlying Index also require a Divisor adjustment. By adjusting the Divisor for the change in total Market Value, the level of the Underlying Index remains constant. This helps maintain the level of the Underlying Index as an accurate barometer of stock market performance and ensures that the movement of the Underlying Index does not reflect the corporate actions of individual companies in the Underlying Index. The divisor is adjusted such that the index value at an instant just prior to a change in base capital equals the index value at an instant immediately following that change. As noted in the preceding paragraph, some corporate actions, such as stock splits and stock dividends, require simple changes in the common shares outstanding and the stock prices of the companies in the Underlying Index and do not require Divisor adjustments.

The table below summarizes the types of index maintenance adjustments and indicates whether or not a Divisor adjustment is required.

| Type of Corporate Action | Comments | Divisor Adjustment | ||

| Company added/deleted | Net change in market value determines Divisor adjustment. | Yes | ||

| Change in shares outstanding | Any combination of secondary issuance, share repurchase or buy back—share counts revised to reflect change. | Yes | ||

| Stock split | Share count revised to reflect new count. Divisor adjustment is not required since the share count and price changes are offsetting. | No | ||

| Spin-off | If spun-off company is not being added to the index, the divisor adjustment reflects the decline in Index Market Value (i.e., the value of the spun-off unit). | Yes | ||

| Spin-off | Spun-off company added to the index, no company removed from the index. | No | ||

| Spin-off | Spun-off company added to the index using a non-zero price and applying a price adjustment to the parent. | Yes | ||

| Change in IWF | Increasing (decreasing) the IWF increases (decreases) the total market value of the index. The Divisor change reflects the change in market value caused by the change to an IWF. | Yes | ||

| Special dividend | When a company pays a special dividend the share price is assumed to drop by the amount of the dividend; the divisor adjustment reflects this drop in Index Market Value. | Yes |

| - 12 - |

| Type of Corporate Action | Comments | Divisor Adjustment | ||

| Rights offering | Each shareholder receives the right to buy a proportional number of additional shares at a set (often discounted) price. The calculation assumes that the offering is fully subscribed. Divisor adjustment reflects increase in market cap measured as the shares issued multiplied by the price paid. | Yes |

Each of the corporate events exemplified in the table requiring an adjustment to the Divisor has the effect of altering the Market Value of the constituent stock and consequently of altering the aggregate Market Value of the Underlying Index constituent stocks (the “Post-Event Aggregate Market Value”). In order that the level of the Underlying Index (the “Pre-Event Index Value”) not be affected by the altered Market Value (whether increase or decrease) of the affected constituent stock, a new Divisor (“New Divisor”) is derived as follows:

| Post-Event Aggregate Market Value New Divisor |

= | Pre-Event Index Value |

| New Divisor | = | Post-Event Aggregate Market Value Pre-Event Index Value |

Another large part of the Underlying Index maintenance process involves tracking the changes in the number of shares outstanding of each of the companies whose stocks are included in the Underlying Index. Four times a year, on a Friday close to the end of each calendar quarter, the share totals of companies in the Underlying Index are updated as required by any changes in the number of shares outstanding and then the Divisor is adjusted accordingly. In addition, changes in a company’s shares outstanding of 5% or more due to mergers or acquisitions of publicly held companies that trade on a major exchange are implemented when the transaction occurs, even if both of the companies are in different headline indices, and regardless of the size of the change. Other changes of 5% or more (due to, for example, secondary public offerings (also known as placements), tender offers, Dutch auctions, exchange offers, bought deal equity offerings, prospectus offerings, company stock repurchases, private placements, redemptions, exercise of options, warrants, conversion of derivative securities, at-the-market stock offerings, and acquisitions of private companies or non-index companies that do not trade on a major exchange) are made weekly, and are announced after the market close on Fridays for implementation after the close of trading on the following Friday (one week later). If a 5% or more change causes a company’s IWF to change by 5 percentage points or more (for example from 0.80 to 0.85), the IWF will be updated at the same time as the share change, except IWF changes resulting from partial tender offers will be considered on a case-by-case basis. Changes to an IWF or number of shares outstanding of less than 5 percentage points are accumulated and made quarterly on the third Friday of March, June, September and December. In the case of rights issuances, price adjustments and share changes at the full rights ratio are applied at the opening of the rights ex-date.

Principal Risks

As with all investments, you can lose money by investing in the units of the trust. The trust also might not perform as well as you expect. This can happen for several reasons, including the following:

| · | The trust’s investment objective is designed to be achieved only if you purchase units at the Inception Value and hold them until the Maturity Date. The trust’s investment objective has not been designed to deliver on its objective if the units are bought at prices different than the Inception Value or are redeemed prior to the Maturity Date. Prior to the Maturity Date, the value of the trust’s portfolio could vary because of related factors other than the value of the Reference Asset. Certain related factors include interest rates, implied volatility levels and dividend yields of the Reference Asset, implied dividend levels of the Reference Asset, the Underlying Index and the securities comprising the Underlying Index, and general market conditions. |

| - 13 - |

| · | Security prices will fluctuate. The value of your investment may fall over time. Amounts available to distribute to unitholders upon dissolution of the trust will depend primarily on the performance of the trust’s investment and are not guaranteed. Upon dissolution of the trust and at any other point in time, the units may be worth less than your original investment. The value of the units will decrease over time by the trust annual fees and expenses. |

| · | Return on the units is subject to a capped return and limited downside protection. The maximum gain or loss for units purchased at their Inception Value and held for the life of the trust is based on the value of the Reference Asset and subject to the Maximum Amount per Unit. If the value of the Reference Asset increases more than approximately 19.20% over the Initial Reference Value as of the Options Expiration Date, the amount per unit will be capped at the Maximum Amount per Unit and their performance will be less than any performance of the Reference Asset of greater than 19.20%. Because the Buffer is designed to protect only against Reference Asset declines relative to the Initial Reference Value over the life of the trust of 15.00%, unitholders may experience significant losses on their investment and potentially as much as 83.00% of their investment, if the value of the Reference Asset declines by more than the Buffer. Due to trust fees and expenses, at the Maturity Date the value of the units, and the effect of the Buffer, will be reduced, and the Maximum Loss per Unit will be subject to increase. See “Principal Investment Strategy—Hypothetical Performance Return Examples.” You may realize a gain or loss that is higher or lower than the intended gains or losses as a result of redeeming units prior to the Maturity Date, if Options are otherwise terminated by the trust prior to expiration, due to redemptions or otherwise, if the trust is unable to maintain the proportional relationship of the Options based on the number of Option contracts in the trust’s portfolio, if a Corporate Action occurs with respect to the Reference Asset or because of increases in potential tax-related expenses and other expenses of the trust. |

| · | Investors who purchase units at a price that is above the Inception Value will be subject to, on the Maturity Date, a maximum total loss per unit which can be greater than the Maximum Loss. The trust’s ability to provide the Equal Upside, the Capped Return and limited downside protection via the Buffer is dependent on unitholders purchasing units at a price equal to their Inception Value and holding them until the Maturity Date. The return on units purchased at a price that is higher than the Inception Value will be less than for units purchased at the Inception Value. For example, if units are purchased at a price of $10.50 per unit, and the Reference Asset increases relative to the Initial Reference Value by 30% on the Options Expiration Date, the return on the purchased units on the Maturity Date would equal approximately 13.52%, whereas such return would equal 19.20% if such units would have been bought at the Inception Value. Conversely, if the Reference Asset decreases relative to the Initial Reference Value by 30% on the Options Expiration Date, the return on the purchased units on the Maturity Date would equal approximately -19.05%, whereas such return would equal -15.00% if units would have been bought at the Inception Value. |

| · | Investors will have little or no return if they purchase units at or near the Capped Return. As shown in the table on pages 5 and 6, as the unit price increases, the maximum total return per unit purchased will decrease, and the maximum loss per unit purchased will increase. |

| · | Investors who redeem units before the Maturity Date may lose money even if the value of the Reference Asset has increased by then. |

| · | You may lose a significant portion (up to 83.00%) of your investment. The trust does not provide principal protection and you may not receive the return of the capital you invest. |

| · | The trust might not achieve its objective in certain circumstances. Certain circumstances under which the trust might not achieve its objective are if the trust disposes of Options due to redemptions or otherwise, if the trust is unable to maintain the proportional relationship based on the number of Option contracts of the Options in the trust’s portfolio, or because of trust expenses or due to adverse tax law changes affecting treatment of the Options. |

| · | The value of the Options may change with the implied volatility of the Reference Asset, the Underlying Index and the securities comprising the Underlying Index. No one can predict whether implied volatility will rise or fall in the future. |

| - 14 - |

| · | The values of the Options do not increase or decrease at the same rate as the Reference Asset. The Options are all European style options, which means that they will be exercisable at the strike price only on the Options Expiration Date. Prior to the Options Expiration Date, the value of the Options will be determined based upon market quotations or using other recognized pricing methods. The value of the Options prior to the Options Expiration Date may vary because of related factors other than the value of the Reference Asset. Factors that may influence the value of the Options are interest rate changes, implied volatility levels of the Reference Asset, the Underlying Index and the securities comprising the Underlying Index, and general economic conditions, among others. |

| · | The trust may experience substantial exposure to losses from the Options. |

| · | Credit risk is the risk an issuer, guarantor or counterparty of a security in the trust is unable or unwilling to meet its obligation on the security. The OCC acts as guarantor and central counterparty with respect to the FLEX Options. As a result, the ability of the trust to meet its objective depends on the OCC being able to meet its obligations. |

| · | Unitholders will not have control, voting rights or rights to receive cash dividends or other distributions or other rights that holders of a direct investment in the Reference Asset or its constituents would have. |

| · | Cash balances may be insufficient to meet any or all expenses of the Trust. If the cash balances in the income and capital accounts are insufficient to provide for expenses and other amounts payable by the trust, the trust may sell trust property to make such payments. These sales may result in losses to unitholders and the inability of the trust to meet its investment objective. You could experience a dilution of your investment if we increase the size of the trust as we sell units. There is no assurance that your investment will maintain its size or composition. |

| · | The trust may be forced to liquidate and terminate prior to the Maturity Date to satisfy a redemption request by a large unitholder. See the “Trust Administration—Dissolution of the Trust” section in this prospectus for further information. There can be no assurance that you will be able to invest the proceeds from an early termination in a similar or better investment. |

| · | Liquidity risk is the risk that the value of an Option will fall in value if trading in the Option is limited or absent. No one can guarantee that a liquid secondary trading market will exist for the Options. Trading in the Options may be less deep and liquid than the market for certain other securities. FLEX Options may be less liquid than certain non-customized options. In a less liquid market for the Options, liquidating the Options, including in response to a redemption request, may require the payment of a premium or acceptance of a discounted price and may take longer to complete, in which case unitholders may realize a return that is higher or lower than the intended returns. In a less liquid market for the Options, the liquidation of a large number of options may more significantly impact the price. A less liquid trading market may adversely impact the value of the Options and your units. |

| · | It is not anticipated that there will be an existing market for options with the same customized terms as the Options and an active market may not be established. Prior to the trust’s inception date, there has been no existing trading market for the Options. A unitholder who elects to receive a Distribution In Kind (as defined below) may receive an option. There can be no assurance that a liquid secondary market for the options will exist. |

| · | Under certain circumstances, current market prices may not be available with respect to the Options. Under those circumstances, the value of the Options will require more reliance on the judgment of the evaluator than that required for securities for which there is an active trading market. This creates a risk of mispricing or improper valuation of the Options which could impact the value received or paid for units. |

| · | Creation of additional units subsequent to the initial deposit may alter the proportional relationship based on the number of Option contracts in the portfolio. If the trust is unable to maintain the proportional relationship between the Options in the portfolio, it may be unable to achieve its objective. |

| - 15 - |

| · | On the Maturity Date, a new trust series with similar terms to those in the series may not necessarily be available. Upon the Maturity Date, there is no guarantee that a new series of the trust would be available for reinvestment of the proceeds from the dissolution of the trust, and if such new series from the trust were to be available, the terms of such new series may differ from those of the series and will depend on a number of factors, including market factors, which will be prevalent at such time. |

| · | We do not actively manage the portfolio. Except in limited circumstances, the trust will hold, and continue to buy the same securities even if their market value declines. |

| · | Tax risk. The trust intends to elect and to qualify each year to be treated as a regulated investment company (“RIC”) under Subchapter M of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). As a RIC, the trust will not be subject to U.S. federal income tax on the portion of its net investment income and net capital gain that it distributes to unitholders, provided that it satisfies certain requirements of the Code. If the trust does not qualify as a RIC for any taxable year and certain relief provisions are not available, the trust’s taxable income will be subject to tax at the trust level and to a further tax at the unitholder level when such income is distributed. See “Investment Risks—Tax Risks” and “Taxes” sections in this prospectus for further information. |

| - 16 - |

Who Should Invest

You should consider this investment if you want:

| · | to own securities representing interests in Options in a single investment. |

| · | the potential for capital appreciation on the Reference Asset subject to a cap. |

| · | to forego gains greater than the Capped Return. |

| · | a growth-oriented investment that will receive no periodic distributions. |

| · | to accept the risk of as much as a 83.00% loss of your investment, decreased by the trust’s fees and expenses. |

You should not consider this investment if you:

| · | are uncomfortable with the risks of an unmanaged investment in option contracts. |

| · | are uncomfortable with exposure to the risks associated with the Options. |

| · | are uncomfortable with a return that depends upon the performance of the Reference Asset. |

| · | are uncomfortable foregoing gains greater than the Capped Return. |

| · | are uncomfortable with the risk that you may lose as much as 83.00% of your investment. |

| · | are not willing to be subject to a maximum return that is less than the Capped Return, and potentially much less, or a loss that can be greater than the Maximum Loss, if units are purchased at a price above the Inception Value. |

| · | are uncomfortable with not receiving any income or periodic distributions. |

| · | are uncomfortable with the negative effect of the trust’s fees and expenses. |

| · | cannot hold the units until the Maturity Date. |

| - 17 - |

Summary Information

| Unit price at inception:* | $10.368, or $10.161 for Fee Accounts, subject to a Wrap Fee |

| Inception date: | July 30, 2021 |

| Maturity Date: | September 29, 2023 |

| Estimated net annual distribution per unit: | $0.00 |

| Annual Distribution dates: | 25th day of December |

| Annual Record dates: | 10th day of December |

| Initial distribution date: | December 25, 2021 |

| Initial record date: | December 10, 2021 |

| CUSIP Number | |

| Standard Accounts: | 55247F376 |

| Fee Based Accounts: | 55247F384 |

| Minimum investment: | 100 units |

*As of July 30, 2021, and may vary thereafter.

| - 18 - |

Fees and expenses Table

The amounts below are estimates of the direct and indirect expenses that you may incur based on a $10.368 public offering price for standard accounts. If units of the trust are purchased for a Fee Account subject to a Wrap Fee, then investors are eligible to purchase the units at a public offering price that is not subject to, and will not include, the concession of 2.00% received by authorized brokers and dealers who are participating in the distribution of the units, but will be subject to the maximum distribution fee net of such concession amount, plus the organization costs. Please refer to “Fee Accounts” under “How To Buy Units.” Actual expenses may vary.

| Distribution Fee |

As a % of Public Offering Price |

Amount per Unit ($) | ||

| Initial distribution fee (2) | 0.50% | $0.052 | ||

| Initial sales concession (2) | 2.00% | $0.207 | ||

| Creation and development fee (3) | 0.75% | $0.078 | ||

| Maximum distribution fee (1) | 3.25% | $0.337 | ||

| Organization costs (4) | 0.30% | $0.031 | ||

| Annual Operating Expenses (5) |

As a % of Net Assets |

Amount per Unit ($) | ||

| Trustee fee (6) | 0.12% | $0.012 | ||

| Supervisory, evaluation and administration fees (7) | 0.10% | $0.010 | ||

| Other | 0.06% | $0.006 | ||

| Total | 0.28% | $0.028 |

(1) The maximum distribution fee includes an initial distribution fee, the initial sales concession and the creation and development fee to compensate the sponsor for creating and developing the trust. The maximum distribution fee is equal to 3.25% of the public offering price per unit. Investors are obligated to pay the entire applicable maximum distribution fee, other than for units purchased in Fee Accounts subject to a Wrap Fee.

(2) The price that you pay to purchase units of the trust includes an initial distribution fee and the initial sales concession. The sum of the initial distribution fee and the initial sales concession is equal to the difference between the maximum distribution fee (maximum of 3.25% of the public offering price per unit) and the creation and development fee. Authorized brokers and dealers who are participating in the distribution of the units, other than for units purchased in Fee Accounts subject to a Wrap Fee, will receive a concession of 2.00% of the public offering price per unit at the time such units are purchased. The initial distribution fee for units purchased by accounts without the involvement of certain agents or intermediaries aiding in the distribution of units of the trust may be decreased or eliminated. Consequently, the price that investors pay to purchase units may differ. Because the creation and development fee is a fixed dollar amount regardless of any changes in the public offering price, the percentage and dollar amount of the initial distribution fee and the initial sales concession will vary as the public offering price varies. As such, if the public offering price exceeds $10.368 per unit, the initial distribution fee and the initial sales concession will be greater than the percentage and dollar amount provided above. Despite the variability of the initial distribution fee and the initial sales concession, each investor is obligated to pay the entire applicable maximum distribution fee that is applicable, other than for units purchased in Fee Accounts subject to a Wrap Fee.

(3) The sponsor receives the creation and development fee for creating and developing the trust, including determining the trust’s objectives, policies, composition and size, selecting service providers and information services and for providing other similar administrative and ministerial functions. The creation and development fee is fixed at $0.078 per unit and is paid to the sponsor at the close of the initial offering period, which is expected to be approximately 1 month from the Inception Date. Units purchased after the close of the initial offering period will not be subject to the creation and development fee. Because the creation and development fee is a fixed dollar amount regardless of any changes in the public offering price, the percentage amount of the creation and development fee will vary as the public offering price varies. The percentage amount that constitutes the creation and development fee as set forth above is based on a $10.368 per unit public offering price as of the Inception Date. As such, if the public offering price is less than $10.368 per unit, the creation and development fee will be greater on a percentage basis than the percentage provided above.

| - 19 - |

(4) The organizational cost is fixed at $0.031 per unit. As it is assessed on a fixed dollar amount per unit, it will vary over time as a percentage of the public offering price per unit and is paid by the trust at the close of the initial offering period, which is expected to be approximately 1 month from the Inception Date. To the extent the actual organization costs are greater than the estimated amount of $0.031 per unit of the trust, only the estimated organization costs will be charged to the trust.

(5) Operating expenses do not include brokerage costs and other transactional fees, or other custody charges. The trust is responsible for the annual operating expenses. The estimated operating expenses are based upon an estimated trust size. Because certain of the operating expenses are fixed amounts, if the trust does not reach such estimated size or falls below the estimated size over its life, the actual amount of the operating expenses may exceed the amounts reflected.

(6) Trustee fees are a minimum of $10,000 per annum.

(7) Supervisory, evaluation and administration fees may be adjusted for inflation without unitholders’ approval, but in no case will the annual fees paid for providing these services be more than the actual cost of providing such services in such year.

Example

This example helps you compare the cost of this trust with other unit trusts and mutual funds. In the example we assume that the expenses do not change and that the trust’s annual return is 5.00%. Your actual returns and expenses will vary. Based on these assumptions, you would pay these expenses for every $10,000 you invest in the trust:

| 1 year | $382 |

| 2-years | $409 |

| 2.17-years | $413 |

| - 20 - |

m+ funds Trust, Series 1-21

TRUST PORTFOLIO

As of July 30, 2021

| FLEX Options (2) | Reference Asset |

Options Expiration Date |

Strike Price as a % of Initial Reference Value |

% of Net Assets |

Number of Contracts |

Market Contract |

Cost of Securities to Trust (1) |

| Purchased Call Options (3) | SPY(4) | September 29, 2023 | 2.00% | 95.14% | 4 | $41,924 | $167,696 |

| Purchased Put Options (3) | SPY(4) | September 29, 2023 | 100.00% | 11.63% | 4 | $5,125 | $20,500 |

| Total Purchased Options | 106.77% | $188,196 | |||||

| Written Call Options (3) | SPY(4) | September 29, 2023 | 119.20% | (2.28)% | 4 | $1,004 | $(4,016) |

| Written Put Options (3) | SPY(4) | September 29, 2023 | 85.00% | (6.49)% | 4 | $2,861 | $(11,444) |

| Total Written Options | (8.77)% | $(15,460) | |||||

| Total Options | 98.00% | $172,736 |

| Notes to Portfolio |

|

| Alaia Capital, LLC is the evaluator of the trust. Alaia Capital, LLC determined the initial prices of the securities shown under “Portfolio” in this prospectus as of the close of business on the day before the date of this prospectus. | |

| (1) The value of FLEX Options is based on the last quoted price for the Options where readily available and appropriate. In cases where the Options were not traded on a valuation date or where the evaluator determines that market quotations are unavailable or inappropriate (e.g. due to infrequent transactions, thin trading or otherwise), the value of the Options may be based on the last asked or bid price provided by dealers active in market-making of securities similar to the Options in the over-the-counter market if available and appropriate. During the initial offering period the determination for the Purchased Call and Put Options will generally be on the basis of ask prices and for the Written Call and Put Options will generally be on the basis of bid prices. After the initial offering period ends, such determination for the Purchased Call and Put Options will generally be on the basis of bid prices and for the Written Call and Put Options will generally be on the basis of ask prices. | |

| If market quotes, ask prices and bid prices are unavailable or inappropriate (e.g. due to infrequent transactions, thin trading or otherwise), each Option’s value is based on the evaluator’s good faith determination of the fair value of the Options at its reasonable discretion. To determine the fair value of the Options, where and if available, the evaluator may use values generated using third party valuation services. The evaluator may also generate their own model-based valuations of the Options, including using the Black-Scholes model for option valuation and use current market quotations and ask/bid prices for comparable listed options that are more actively traded. |

| - 21 - |

| Account Standards Codification 820, “Fair Value Measurements” establishes a framework for measuring fair value and expands disclosure about fair value measurements in financial statements for the trust. The framework under the standard is comprised of a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The standard describes three levels of inputs that may be used to measure fair value: | |

| Level 1: Quote prices (unadjusted) for identical assets or liabilities in active markets that the trust has the ability to access as of the measurement date. | |

| Level 2: Significant observable inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, quoted prices in markets that are not active, and other inputs that are observable or can be corroborated by observable market data. | |

| Level 3: Significant unobservable inputs that reflect on a trust’s own assumptions about the assumptions that market participants would use in pricing an asset or liability. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Changes in valuation techniques may result in transfers in or out of an investment’s assigned level as described above. | |

| The following table summarizes the trust’s investment as of the trust’s inception, based on inputs used to value them: |

| Level 1 | Level 2 | Level 3 | |

| Purchased Options | $0 | $188,196 | $0 |

| Written Options | 0 | (15,460) | 0 |

| Total | $0 | $172,736 | $0 |

| The cost of the securities to the sponsor and the sponsor’s profit or (loss) (which is the difference between the cost of the securities to the sponsor and the cost of securities to the trust) are $172,769 and $(33) respectively |

| (2) Each Option contract entitles the holder thereof (i.e. the purchaser of the Option) to purchase (for the Call Options) or sell (for the Put Options) 100 shares of the Reference Asset at the strike price. |

|

(3) This is a non-income producing security. |

| (4) SPY is the ticker symbol for the SPDR® S&P 500® ETF Trust. |

| - 22 - |

Hypothetical Option Expiration Examples

The following table illustrates the expected payments due on the Options on the Options Expiration Date and examples of hypothetical trust gains and losses for units held from the date the Option strikes are set to the scheduled Maturity Date. These amounts are not inclusive of the maximum distribution fee and all other trust fees and expenses. The examples do not take into consideration transaction fees which may be charged by certain broker-dealers for processing transactions. The examples are based on various hypothetical values of “Reference Asset Returns” (Final Reference Value/Initial Reference Value - 100%) over the life of the trust, and the consequent expected values of the Options. Reference Asset Returns represent the percentage price increase or decrease in the Reference Asset from the time when the Option strike prices are set to the close of the market on the Options Expiration Date.

The table below is a hypothetical illustration of the mathematical principles underlying the trust’s investment strategy and the expected value of the Options on the Options Expiration Date. The amounts under “Hypothetical final distribution on Maturity Date per unit” and “Hypothetical return per unit” are net of all estimated fees and expenses. The illustration does not predict or project the performance of units, the trust or the trust’s investment strategy. For an explanation of the Option computations, please refer to the discussion under “Principal Investment Strategy.”

The amount shown in the table below under “Estimated trust expenses per unit (over life of trust)” is only an estimate of the annual operating expenses per unit and based on an assumed trust’s Inception Value on the trust inception date of $10.000. The “Cash value per unit” is the amount of cash and/or cash equivalents per unit on the trust inception date. The “Sub-total per unit” is the sum of the “Net Payments on Options on Options Expiration Date” and the “Cash value per unit.” The amount shown under “Hypothetical final distribution on Maturity Date per unit” is the sum of the “Sub-total per unit” minus “Estimated trust expenses per unit (over life of trust).” The amount shown under “Hypothetical return per unit on initial net asset value” is the “Hypothetical final distribution on Maturity Date per unit” divided by the net asset value per unit at inception. Units will not be purchased at the net asset value but at the public offering price. The amount shown under “Hypothetical return per unit on initial public offering price – Fee Accounts” is the “Hypothetical final distribution on Maturity Date per unit” divided by the initial public offering price per unit for Fee Accounts, subject to a Wrap Fee. The amount shown under “Hypothetical return per unit on initial public offering price” is the “Hypothetical final distribution on Maturity Date per unit” divided by the initial public offering price per unit. Amounts are rounded for ease of understanding. The actual amounts that you receive or actual losses that you experience may vary from these estimates with the actual value of the Options on the Options Expiration Date, changes in expenses, if Options are otherwise terminated by the trust prior to expiration due to redemptions or otherwise, or a change in the proportional relationship of the Options based on the number of Option contracts.

The table below and the written examples that follow all assume a life of trust of 2.17 years, a Buffer of 15.00%, a Capped Return of 19.20%, a Maximum Loss per Unit of $8.300, a public offering price at inception of $10.368 or $10.161 for units purchased in Fee Accounts subject to a Wrap Fee, and an Inception Value per unit of $10.000. The actual Buffer, Maximum Loss per Unit, Capped Return, public offering price, Inception Value, life of trust, estimated trust expenses per unit and other estimates will likely differ and some will be set at the close of regular trading on the New York Stock Exchange on the date prior to the inception date.

| - 23 - |

The returns in the table below under “Hypothetical return per unit on the Inception Value of $10” can only be achieved under the stated assumptions and only if units are purchased at the Inception Value and are held until the Maturity Date.

| Hypothetical Reference Asset Return |

Net payment on Options on Options Expiration Date per unit |

Cash value per unit |

Sub-total per unit |

Estimated trust expenses per unit (over life of trust) |

Hypothetical final distribution on Maturity Date per unit |

Hypothetical return per unit on initial net asset value of $10 |

Hypothetical return per unit on initial public offering price - Fee Accounts |

Hypothetical return per unit on initial public offering price - Standard Accounts | |

| 55% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 50% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 45% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 40% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 35% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 30% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 25% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 20% | 11.72 | 0.20 | 11.92 | 0.06 | 11.86 | 18.60% | 16.72% | 14.39% | |

| 15% | 11.30 | 0.20 | 11.50 | 0.06 | 11.44 | 14.40% | 12.59% | 10.34% | |

| 10% | 10.80 | 0.20 | 11.00 | 0.06 | 10.94 | 9.40% | 7.67% | 5.52% | |

| 5% | 10.30 | 0.20 | 10.50 | 0.06 | 10.44 | 4.40% | 2.75% | 0.69% | |