Form 425 Prime Impact Acquisition Filed by: Prime Impact Acquisition I

Filed by Cheche Group Inc. and Cheche Technology Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended, and deemed filed

pursuant to Rule 14a-12 under the Securities Exchange Act of 1934, as amended

Subject Company: Prime Impact Acquisition I

Commission File No.: 001-39501

Date: January 30, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 30, 2023 (January 29, 2023)

PRIME IMPACT ACQUISITION I

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-39501 | 98-1554335 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

123 E San Carlos Street, Suite 12

San Jose, California 95112

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (650) 825-6965

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange | ||

| Units, each consisting of one Class A Ordinary Share and one-third of one Warrant to acquire one Class A Ordinary Share | PIAI.U | The New York Stock Exchange | ||

| Class A Ordinary Shares, par value $0.0001 per share | PIAI | The New York Stock Exchange | ||

| Warrants, each whole Warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 | PIAI.W | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry into a Material Definitive Agreement |

Business Combination Agreement

On January 29, 2023, Prime Impact Acquisition I, a Cayman Islands exempted company (“SPAC”), Cheche Group Holdings Inc., a Cayman Islands exempted company (“Holdings”), Cheche Merger Sub Inc., a Cayman Islands exempted company and wholly owned direct subsidiary of Holdings (“Merger Sub”), and Cheche Technology, Inc., a Cayman Islands exempted company (the “Company”), entered into a business combination agreement (the “Business Combination Agreement”), pursuant to which, among other things, (a) on the Closing Date, SPAC will merge with and into Holdings (the “Initial Merger”), with Holdings surviving the Initial Merger (Holdings, in its capacity as the surviving corporation of the Initial Merger, is sometimes referred to herein as the “Surviving Corporation”) and (b) on the Closing Date, following the Initial Merger, Merger Sub will merge with and into the Company (the “Acquisition Merger”, and together with the Initial Merger, the “Mergers”), with the Company surviving the Acquisition Merger as a wholly owned subsidiary of the Surviving Corporation (the Company, in its capacity as the surviving corporation of the Acquisition Merger, is sometimes referred to herein as the “Surviving Subsidiary Company”). The Mergers, together with the other transactions related thereto, are referred to herein as the “Transactions.” References herein to “SPAC” shall refer to Prime Impact Acquisition I for all periods prior to completion of the Initial Merger and to the Surviving Corporation for all periods after completion of the Initial Merger.

Conversion of Securities

At the effective time of the Initial Merger (the “Initial Merger Effective Time”), by virtue of the Initial Merger and without any action on the part of SPAC, Merger Sub, the Company, Holdings or the holders of any of the following securities:

| (i) | each then issued and outstanding SPAC Class A ordinary share, par value $0.0001 per share (“SPAC Class A Ordinary Share”) and SPAC Class B ordinary share, par value $0.0001 per share (“SPAC Founder Shares”), will convert automatically, on a one-for-one basis, into one Surviving Company Class A ordinary share, par value $0.00001 per share (“Surviving Company Class A Ordinary Share”); |

| (ii) | each then issued and outstanding Holdings ordinary share, par value $0.00001 per share, will be redeemed for par value; |

| (iii) | each then issued and outstanding whole warrant exercisable for one SPAC Class A Ordinary Share (each, a “SPAC Warrant”) will be assumed by the Surviving Company and will convert automatically, on a one-for-one basis, into one whole warrant exercisable for one Surviving Company Class A Ordinary Share (each resulting warrant, an “Assumed SPAC Warrant”); and |

| (iv) | each SPAC Class A Ordinary Share and SPAC Founder Share that is issued and outstanding immediately prior to the Initial Effective Time and held by shareholders of the SPAC who have demanded properly in writing dissenters’ rights for such shares shall be cancelled and cease to exist in consideration for the right to receive payment of such SPAC Class A Ordinary Shares or SPAC Founders Share as provided in Section 3.06(a) of the Business Combination Agreement. |

On the Closing Date and immediately prior to the effective time of the Acquisition Merger (the “Acquisition Merger Effective Time”), each preferred share of the Company that is issued and outstanding immediately prior to the Acquisition Merger Effective Time will convert automatically into a number of ordinary shares, par value $0.00001 per share, of the Company (“Company Ordinary Shares”) at the then-effective conversion rate in accordance with the Company’s sixth amended and restated articles of association (the “Conversion”).

At the Acquisition Merger Effective Time, by virtue of the Acquisition Merger and without any action on the part of the Surviving Corporation, Merger Sub, the Company or the holders of any of the following securities:

| (i) | Each then issued and outstanding Company Ordinary Share (including the outstanding Company Ordinary Shares held in the Company’s treasury and other than any Excluded Shares and Company Founder Shares (each as defined below)), will be canceled and converted into the right to receive a number of Surviving Company Class A Ordinary Shares based on the Per Share Merger Consideration; |

| (ii) | Each then issued and outstanding Company Ordinary Share held by the Company’s Chief Executive Officer and an affiliated entity (the “Company Founder Shares”) as of immediately prior to the Acquisition Merger Effective Time will be canceled and converted into the right to receive a number of Surviving Company Class B Ordinary Shares based on the Per Share Merger Consideration; |

| (iii) | Each Company Ordinary Share owned by Holdings and Merger Sub immediately prior to the Acquisition Merger Effective Time (each an “Excluded Share”) will be canceled without any conversion thereof and no payment or distribution will be made with respect thereto; |

| (iv) | If the Company Warrant (as defined in the Business Combination Agreement) is outstanding and unexercised as of immediately prior to the Acquisition Merger Effective Time, the Company Warrant will be automatically assumed and converted into a warrant to purchase Surviving Company Class A Ordinary Shares subject to the same terms and conditions (including exercisability terms) as were applicable to such Company Warrant immediately prior to the Acquisition Merger Effective Time, taking into account any changes thereto by reason of the Transactions; |

| (v) | Each Company Option (as defined in the Business Combination Agreement) that is outstanding and unexercised as of immediately prior to the Acquisition Merger Effective Time, whether or not vested, will be assumed and converted into an option to purchase such number of Surviving Company Class A Ordinary Shares and for a per share exercise price, in each case, based on the applicable Per Share Merger Consideration (each, an “Exchanged Option”). Except as specifically provided in the Business Combination Agreement, each Exchanged Option shall be subject to the same terms and conditions (including applicable vesting, acceleration, expiration and forfeiture provisions) that applied to the corresponding Company Option immediately prior to the Acquisition Merger Effective Time; |

| (vi) | Each Company Restricted Share (as defined in the Business Combination Agreement) that is outstanding immediately prior to the Acquisition Merger Effective Time will be assumed and converted into such number of Surviving Company Class A Ordinary Shares (“Exchanged Restricted Shares”) based on the Per Share Merger Consideration. Except as specifically provided in the Business Combination Agreement, the Exchanged Restricted Shares shall be subject to the same terms and conditions (including applicable vesting, acceleration, expiration and forfeiture provisions) that applied to the corresponding Company Restricted Shares immediately prior to the Acquisition Merger Effective Time; |

| (vii) | Each Company Capital Share (as defined in the Business Combination Agreement) that is issued and outstanding immediately prior to the Initial Effective Time and held by Company shareholders who have demanded properly in writing dissenters’ rights for such shares shall be cancelled and cease to exist in consideration for the right to receive payment of such Company Capital Shares as provided in Section 3.06(b) of the Business Combination Agreement; |

| (viii) | Each ordinary share of Merger Sub that is issued and outstanding immediately prior to the Acquisition Merger Effective Time shall be converted into and become one validly issued, fully paid and non-assessable ordinary share of the Surviving Subsidiary Company. Such ordinary shares of the Surviving Subsidiary Company shall have the same rights, powers and privileges as the ordinary shares of Merger Sub so converted and shall constitute the only issued and outstanding share capital of the Surviving Subsidiary Company. |

For purposes of this Form 8-K:

| • | “Aggregate Fully Diluted Company Shares” means, without duplication, (a) the aggregate number of Company Ordinary Shares that are (i) (x) issued and outstanding and (y) held in the Company’s treasury immediately prior to the Acquisition Merger Effective Time, (ii) issuable directly or indirectly upon, or subject to, the conversion, exercise or settlement of any Company Equity Interests issued and outstanding immediately prior to the Acquisition Merger Effective Time, including Company Preferred Shares, Company Options, Company Restricted Shares and the Company Warrant, in each case, that are issued and outstanding immediately prior to the Acquisition Merger Effective Time, or (iii) issuable pursuant to any Permitted Equity Financing; |

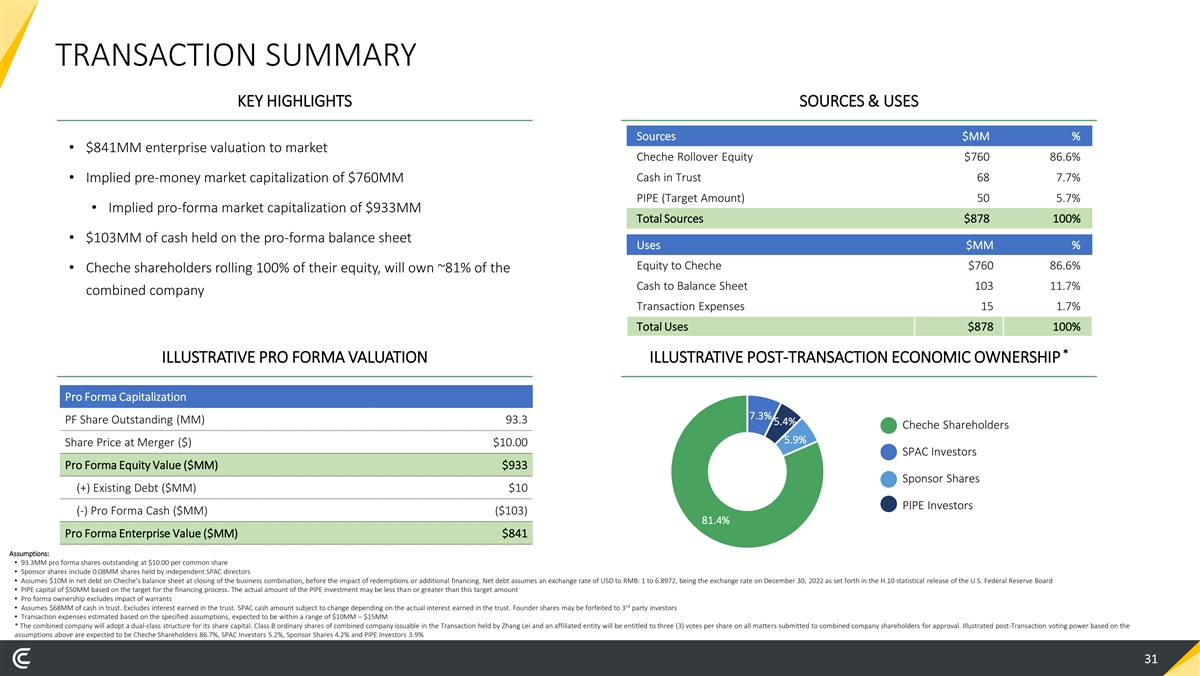

| • | “Aggregate Merger Consideration” means a number of Surviving Company Class A Ordinary Shares and Surviving Company Class B Ordinary Shares equal to the quotient obtained by dividing (i) $760,000,000, by (ii) $10.00; and |

| • | “Per Share Merger Consideration” means a number of Surviving Company Class A Ordinary Shares or Surviving Company Class B Ordinary Shares, as applicable, equal to (i) the Aggregate Merger Consideration divided by (ii) the Aggregate Fully Diluted Company Shares. |

Dual-Class Structure

Following the completion of the Transactions, the issued and outstanding share capital of Holdings will consist of Surviving Company Class A Ordinary Shares and Surviving Company Class B Ordinary Shares. The Company’s Chief Executive Officer and an affiliated entity will beneficially own all of the issued Surviving Company Class B Ordinary Shares. Holders of Surviving Company Class A Ordinary Shares and Surviving Company Class B Ordinary Shares have the same rights except for voting and conversion rights. Each Surviving Company Class A Ordinary Share is entitled to one (1) vote, and each Surviving Company Class B Ordinary Share is entitled to three (3) votes. At the option of the holder of Surviving Company Class B Ordinary Shares, each Surviving Company Class B Ordinary Share is convertible into one Surviving Company Class A Ordinary Share at any time. Surviving Company Class A Ordinary Shares are not convertible into Surviving Company Class B Ordinary Shares under any circumstances.

Representations, Warranties and Covenants

The parties to the Business Combination Agreement have agreed to customary representations and warranties for transactions of this type. In addition, the parties to the Business Combination Agreement agreed to be bound by certain customary covenants for transactions of this type, including, among others, covenants with respect to the conduct of the Company and its subsidiaries during the period between execution of the Business Combination Agreement and the Acquisition Merger Effective Time. Each of the parties to the Business Combination Agreement has agreed to use its reasonable best efforts to take, or cause to be taken, appropriate action, and to do, or cause to be done, such things as are necessary, proper or advisable under applicable laws or otherwise, and each shall cooperate with the other, to consummate and make effective the Transactions.

Conditions to Each Party’s Obligation to Consummate the Transactions

Under the Business Combination Agreement, the obligations of the parties to consummate the Initial Merger are subject to the satisfaction or waiver by each of SPAC and the Company (where permissible) of certain customary closing conditions of the respective parties, including, without limitation:

| (i) | The written consent of the requisite shareholders of the Company in favor of the approval and adoption of the Business Combination Agreement and the Transactions, including the Mergers (the “Written Consent”) having been delivered to SPAC; |

| (ii) | The Required SPAC Proposals (as defined in the Business Combination Agreement) having each been approved and adopted by the requisite affirmative vote of the SPAC shareholders at a duly called meeting of the SPAC’s shareholders (the “SPAC Shareholders’ Meeting”); |

| (iii) | No governmental authority shall have enacted, issued or enforced any governmental order which is then pending or in effect and has or would have the effect of making the Transactions, including the Mergers, illegal or otherwise prohibiting consummation of the Transactions, including the Mergers; |

| (iv) | The registration statement and proxy to be filed by Holdings in connection with the Transactions (the “Registration Statement”) having been declared effective under the Securities Act of 1933, as amended (the “Securities Act”) and no stop order suspending the effectiveness of the Registration Statement being in effect, and no proceedings for purposes of suspending the effectiveness of the Registration Statement having been initiated or threatened by the SEC; |

| (v) | The Surviving Company Ordinary Shares to be issued pursuant to the Business Combination Agreement, and the Assumed SPAC Warrants (and the Surviving Company Class A Ordinary Shares issuable upon exercise thereof) having been approved for listing on the NASDAQ, or another national securities exchange mutually agreed to by the parties to the Business Combination Agreement, as of the Closing Date, subject only to official notice of listing thereof; and |

| (vi) | Either (x) SPAC having at least $5,000,001 of net tangible assets after giving effect to the redemption of public shares by SPAC’s public shareholders, in accordance with SPAC’s organizational documents and after giving effect to the potential PIPE Investment (as defined below), or (y) the Surviving Company Ordinary Shares to be issued pursuant to the Business Combination Agreement shall not constitute “penny stock” as such term is defined in Rule 3a51-1 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

Under the Business Combination Agreement, the obligations of the parties to consummate the Acquisition Merger are subject to the satisfaction or waiver by each of SPAC and the Company (where permissible) of certain customary closing conditions of the respective parties, including, without limitation:

| (i) | The Initial Closing having been completed. |

Conditions to the Obligation of SPAC, Holdings and Merger Sub to Consummate the Transactions

The obligations of SPAC, Holdings and Merger Sub to consummate the Transactions are subject to the satisfaction or waiver by SPAC (where permissible) at or prior to the Acquisition Merger Effective Time of the following additional conditions:

| (i) | The accuracy of the representations and warranties of the Company as determined in accordance with the Business Combination Agreement; |

| (ii) | The Company having performed or complied in all material respects with all agreements and covenants required by the Business Combination Agreement to be performed or complied with by them on or prior to the Acquisition Merger Effective Time; provided, that, the Company shall only be deemed to have not performed or complied in all material respects with all agreements and covenants required by the Business Combination Agreement to be performed or complied with by it on or prior to the Acquisition Merger Effective Time if the Company has materially breached such a covenant or agreement and failed to cure such breach within five (5) days after written notice of such breach has been delivered by the SPAC to the Company (or if earlier, the Outside Date); |

| (iii) | Since the date of the Business Combination Agreement, no Company material adverse effect, as determined in accordance with the Business Combination Agreement, has occurred; and |

| (iv) | The Company having delivered to SPAC a customary officer’s certificate, dated as of the Closing Date, signed by an officer of the Company, certifying as to the satisfaction of certain conditions specified in the Business Combination Agreement. |

Conditions to the Obligation of the Company Consummate the Transactions

The obligations of the Company to consummate the Transactions are subject to the satisfaction or waiver by the Company (where permissible) at or prior to Acquisition Merger Effective Time of the following additional conditions:

| (i) | the accuracy of the representations and warranties of SPAC, Holdings and Merger Sub as determined in accordance with the Business Combination Agreement; |

| (ii) | each of SPAC, Holdings and Merger Sub having performed or complied in all material respects with all agreements and covenants required by the Business Combination Agreement to be performed or |

| complied with by it on or prior to the Acquisition Merger Effective Time; provided, that, SPAC, Holdings or Merger Sub shall only be deemed to have not performed or complied in all material respects with all agreements and covenants required by the Business Combination Agreement to be performed or complied with by it on or prior to the Acquisition Merger Effective Time if the SPAC, Holdings or Merger Sub has materially breached such a covenant or agreement and failed to cure such breach within five (5) days after written notice of such breach has been delivered by the Company to the SPAC (or if earlier, the Outside Date); |

| (iii) | Certain deferred underwriting commission wavier letters delivered to SPAC shall remain enforceable in accordance with their terms and shall have not been withdrawn or become invalid; and |

| (iv) | SPAC having delivered to the Company a certificate, dated the date of the Closing Date, signed by the Chief Executive Officer of SPAC, certifying as to the satisfaction of certain conditions specified in the Business Combination Agreement. |

Termination

The Business Combination Agreement may be terminated under certain customary and limited circumstances prior to the closing of the Merger, including:

| (i) | by mutual written consent of the Company and SPAC; |

| (ii) | by either party if the Acquisition Merger Effective Time has not occurred prior to September 13, 2023 (the “Outside Date”) subject to specified exceptions; |

| (iii) | by either party (i) upon rejection by China Cybersecurity Review Technology and Certificate Center of the Transactions under the New Measures for Cybersecurity Review, or (ii) if the Administrative Measures for the Filing of Overseas Securities Offering and Listing by Domestic Companies (Draft for Comment) shall have been formally enacted and become effective, and the Transactions are rejected by the China Securities Regulatory Commission; |

| (iv) | by either party if any governmental order has become final and nonappealable and has the effect of making consummation of the Transactions, including the Mergers, illegal or otherwise preventing or prohibiting consummation of the Transactions or the Mergers; |

| (v) | by the Company if any of the Required SPAC Proposals shall fail to receive the requisite vote for approval at the SPAC Shareholders’ Meeting (subject to any adjournment, postponement or recess of such meeting); |

| (vi) | by the Company as a result of any breach by SPAC, Holdings or Merger Sub of any representation, warranty, covenant or agreement on the part of SPAC, Holdings or Merger Sub set forth in the Business Combination Agreement that gives rise to a failure of a condition precedent set forth in Section 8.03(a) or Section 8.03(b) of the Business Combination Agreement, in each case, subject to specified exceptions; |

| (vii) | by the SPAC as a result of any breach by the Company of any representation, warranty, covenant or agreement on the part of the Company set forth in the Business Combination Agreement that gives rise to a failure of a condition precedent set forth in Section 8.02(a) or Section 8.02(b) of the Business Combination Agreement, in each case, subject to specified exceptions; |

| (viii) | by SPAC at any time before the Company delivers to SPAC the requisite approval of the shareholders of the Company, in the event that the Company fails to deliver Written Consent constituting the requisite approval of the shareholders of the Company to SPAC within five (5) business days of the Registration Statement becoming effective; and |

| (ix) | by SPAC at any time before the Company delivers to SPAC the PCAOB financial statements that are required to be included in the initial Registration Statement, in the event the Company fails to deliver such financial statements within 75 days of the date of the Business Combination Agreement. |

If the Business Combination Agreement is validly terminated in accordance with its terms, none of the parties will have any liability or any further obligation under the Business Combination Agreement with certain limited exceptions, including liability arising out of any fraud or willful and material breach.

Expenses

Except as set forth in the Business Combination Agreement, all expenses incurred in connection with the Business Combination Agreement and the Transactions shall be paid by the party incurring such expenses, whether or not the Mergers or any other Transaction is consummated; provided that SPAC and the Company shall each pay one half of the filing fee for the Notification and Report Forms filed under the HSR Act, if any, and one half of any filing fee payable in connection with the Registration Statement; provided, further, that if the Acquisition Closing is consummated, the Surviving Company shall be responsible for paying the SPAC’s transaction expenses and the Company’s transaction expenses as set forth in the Business Combination Agreement. Notwithstanding the immediately preceding sentence or anything to the contrary in the Business Combination Agreement or any other related document, to the extent that: (a) the aggregate SPAC’s transaction expenses; exceed (b) the combined proceeds from (x) the funds held in the SPAC’s trust account at Closing (after deducting all the amounts to be paid pursuant to the exercise of the redemption rights, but prior to payment of any SPAC transaction expenses or other liabilities of the SPAC, the Company or any of their respective affiliates or representatives), plus (y) the gross proceeds raised from the portion of the potential PIPE Investment, if any, that was procured through the efforts led by the SPAC, its affiliates and/or representatives (such sum the “Aggregate Capital Raised” and such excess, the “Overage Amount”), Prime Impact Cayman, LLC (“Sponsor”) shall (or shall cause an affiliate of Sponsor to) purchase, pursuant to a PIPE Subscription Agreement (as defined in the Business Combination Agreement), a number of Surviving Company Class A Ordinary Shares or other equity securities of the Surviving Company having an aggregate value equal to the Overage Amount, either (A) on the best terms, including purchase price, pursuant to which Surviving Company Class A Ordinary Shares or other equity securities of the Surviving Company shall have been sold to any third party, other than the Sponsor, pursuant to the PIPE Investment or, (B) if no Surviving Company Class A Ordinary Shares or other equity securities of the Surviving Company shall have been sold to any third party, other than the Sponsor, pursuant to the PIPE Investment, on terms mutually agreed by the Sponsor and the Company, which shall in no event be worse in any material respect to the Sponsor than the best terms, including price, that the SPAC and the Company mutually agree prior to the Closing Date to offer to any third party, other than Sponsor, to purchase Surviving Company Class A Ordinary Shares or other equity securities of the Surviving Company in connection with a potential PIPE Investment. For the avoid of doubt and notwithstanding anything to the contrary in the Business Combination Agreement, prior to the Outside Date, other than as set forth in this Section 7.11, Section 7.19 and Section 9.03 of the Business Combination Agreement, the Company shall not be required to advance or pay for any costs or expenses incurred in connection with the Business Combination Agreement and the Transactions.

Potential PIPE Investment

Prior to the Initial Closing, Holdings may enter into one or more subscription agreements (each, a “PIPE Subscription Agreement”) with third-party investors named therein (such investors, collectively, with any permitted assignees or transferees, the “PIPE Investors”), in each case, on terms mutually acceptable to the SPAC and the Company, pursuant to which, on the terms and subject to the conditions set forth therein, immediately following the Initial Merger Effective Time and prior to the Acquisition Merger Effective Time, such PIPE Investors will purchase from the Surviving Company newly issued Surviving Company Class A Ordinary Shares or other Equity Securities of the Surviving Company (the “PIPE Investment”).

A copy of the Business Combination Agreement is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference. The foregoing description of the Business Combination Agreement and the Transactions does not purport to be complete and is qualified in its entirety by reference to the full text of the Business Combination Agreement filed with this Current Report on Form 8-K. The Business Combination Agreement is included to provide security holders with information regarding its terms. It is not intended to provide any other factual information about the Company, Holdings, SPAC or Merger Sub. In particular, the assertions embodied in representations and warranties by the Company, Holdings, SPAC and Merger Sub contained in the Business Combination Agreement are subject to important qualifications and limitations agreed to by the parties in connection with negotiating such agreement, including being qualified by confidential information in the disclosure schedules provided by the parties in connection with the execution of the Business Combination Agreement, and are

subject to standards of materiality applicable to the contracting parties that may differ from those applicable to security holders. The confidential disclosures contain information that modifies, qualifies and creates exceptions to the representations and warranties set forth in the Business Combination Agreement. Moreover, certain representations and warranties in the Business Combination Agreement were used for the purpose of allocating risk between the parties, rather than establishing matters as facts. Accordingly, security holders should not rely on the representations and warranties in the Business Combination Agreement as characterizations of the actual state of facts about the Company, Holdings, SPAC or Merger Sub. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Business Combination Agreement, which subsequent information may or may not be fully reflected in SPAC’s public disclosures.

Sponsor Support Agreement

Concurrent with the execution and delivery of the Business Combination Agreement, the Sponsor, entered into an agreement (the “Sponsor Support Agreement”) with the SPAC, the Company and Holdings pursuant to which, among other things, the Sponsor agreed to (a) effective upon the Acquisition Closing, waive the anti-dilution rights set forth in SPAC’s organizational documents to have the SPAC Founder Shares convert into Surviving Company Class A Ordinary Shares in connection with the Transactions at a ratio of greater than one-for-one; (b) vote all SPAC Founder Shares held by them in favor of the adoption and approval of the Business Combination Agreement and the Transactions; (c) forfeit and surrender, for no consideration, effective as of immediately prior to the Initial Merger Effective Time, 2,557,736 of its SPAC Founder Shares and 2,860,561 SPAC Warrants; (d) if the Aggregate Capital Raised is less than $50 million, forfeit and surrender, for no consideration, effective as of immediately prior to the Initial Merger Effective Time, an additional 1,203,315 SPAC Founder Shares; and (e) be bound by certain transfer restrictions with respect to the Surviving Company Class A Ordinary Shares issuable to the Sponsor in the Initial Merger in respect of the SPAC Founder Shares held by Sponsor immediately prior to the Initial Merger Effective Time, on the terms and subject to the conditions set forth in the Sponsor Support Agreement.

A copy of the Sponsor Support Agreement is attached as Exhibit 10.1 hereto and is incorporated herein by reference. The foregoing description of the Sponsor Support Agreement is not complete and is subject to, and qualified in its entirety by, reference to the actual agreement.

Shareholder Support Agreement

Concurrent with the execution and delivery of the Business Combination Agreement, the Company delivered to SPAC shareholder support agreements (the “Shareholder Support Agreements”) duly executed by certain shareholders of the Company (the “Key Shareholders”) who own shares of Company share capital sufficient to approve the Transactions in accordance with the Company’s organizational documents and applicable law. Pursuant to the Shareholder Support Agreements, among other things, the Key Shareholders agreed to: (a) within forty eight (48) hours after the Registration Statement is declared effective by the SEC to execute and deliver a Written Consent approving the Business Combination Agreement and the Transactions; and (b) be bound by certain transfer restrictions with respect to the Surviving Company Class A Ordinary Shares and Surviving Company Class B Ordinary Shares issuable to such Key Shareholders in the Acquisition Merger in respect of the Company Ordinary Shares (after giving effect to the Conversion) and Company Founder Shares held by such Key Shareholders immediately prior to the Acquisition Merger Effective Time, on the terms and subject to the conditions set forth in the Shareholder Support Agreements.

A copy of the form of Shareholder Support Agreements is attached as Exhibit 10.2 hereto and is incorporated herein by reference. The foregoing description of the Shareholder Support Agreements is not complete and is subject to, and qualified in its entirety by, reference to the actual agreements.

Amended and Restated Registration Rights Agreement

The Business Combination Agreement contemplates that, at the Acquisition Closing, the Sponsor, certain former directors of the SPAC, and certain Company shareholders will enter into an Amended and Restated Registration and Shareholder Rights Agreement (the “Registration Rights Agreement”), pursuant to which the Surviving Company will agree to register for resale, pursuant to applicable securities laws and regulations, certain Surviving Company Ordinary Shares and other equity securities of the Surviving Company that are held by such parties thereto from time to time.

The foregoing description of the Amended and Restated Registration Rights Agreement is not complete and is subject to, and qualified in its entirety by, reference to the actual agreement.

| Item 7.01. | Regulation FD Disclosure. |

On January 30, 2023, SPAC and the Company issued a joint press release announcing the execution of the Business Combination Agreement and announcing that SPAC and the Company have recorded a joint investor conference call (the “Conference Call”) that is available at https://ir.primeimpactcapital.com.

A copy of the press release, which includes information regarding the Conference Call, is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The script that SPAC and the Company used for the Conference Call is attached hereto as Exhibit 99.2 and incorporated herein by reference.

Attached as Exhibit 99.3 to this Current Report on Form 8-K and incorporated herein by reference is an investor presentation relating to the Transactions.

Attached as Exhibit 99.4 to the Current Report on Form 8-K and incorporated herein by reference is the transcript to an investor video presentation relating to the Transactions.

Such exhibits and the information set forth therein will not be deemed to be filed for purposes of Section 18 of the Exchange Act, or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act.

Important Information for Shareholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or constitute a solicitation of any vote or approval.

In connection with the Transactions, Holdings will file the Registration Statement with the SEC, which will include a proxy statement of SPAC and a prospectus of Holdings. SPAC and Holdings also plan to file other documents with the SEC regarding the Transactions. After the Registration Statement has been cleared by the SEC, a definitive proxy statement/prospectus will be mailed to the shareholders of SPAC. SHAREHOLDERS OF SPAC AND THE COMPANY ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE TRANSACTIONS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS. Shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about SPAC, the Company and Holdings once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov.

Participants in the Solicitation

SPAC and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of SPAC in connection with the Transactions. The Company, Holdings and their respective officers and directors may also be deemed participants in such solicitation. Information about the directors and executive officers of SPAC, as well as other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

No Offer or Solicitation

This Current Report is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Transactions, and does not constitute an offer to sell or the solicitation of an offer to buy any securities of SPAC, Holdings or the Company, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act.

Forward Looking Statements

The information included herein and in any oral statements made in connection herewith include “forward-looking statements.”. All statements other than statements of historical facts contained herein are forward-looking statements. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “project,” “forecast,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics, projections of market opportunity and market share. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of the Company and SPAC’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of, fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of the Company and SPAC. These forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; risks relating to the uncertainty of the projected financial information with respect to the Company; the inability of the parties to successfully or timely consummate the Transactions, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Transactions or that the approval of the shareholders of SPAC or the shareholders of the Company is not obtained; the failure to realize the anticipated benefits of the Transactions; risks related to the rollout of the Company’s business and the timing of expected business milestones; the effects of competition on the Company’s future business; the amount of redemption requests made by SPAC’s public shareholders; the ability of SPAC or the combined company to issue equity or equity-linked securities or obtain debt financing in connection with the Transactions or in the future and those factors discussed in SPAC’s final prospectus dated September 9, 2020, and any subsequently filed periodic or current reports, in each case, under the heading “Risk Factors,” and other documents of SPAC filed, or to be filed, with the SEC or to be filed by Holdings with the SEC. If any of these risks materialize or SPAC’s or the Company’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither SPAC nor the Company presently know or that SPAC and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect SPAC’s and the Company’s expectations, plans or forecasts of future events and views as of the date hereof. SPAC and the Company anticipate that subsequent events and developments will cause SPAC’s and the Company’s assessments to change. However, while SPAC, the Company and Holdings may elect to update these forward-looking statements at some point in the future, SPAC, the Company and Holdings specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing SPAC’s, the Company’s and Holdings’ assessments as of any date subsequent to the date hereof. Accordingly, undue reliance should not be placed upon the forward-looking statements. Additional information concerning these and other factors that may impact SPAC’s, the Company’s or Holdings’ expectations and projections can be found in SPAC’s periodic filings with the SEC, and Holdings’ filings with the SEC. SPAC’s and Holdings’ SEC filings are available publicly on the SEC’s website at www.sec.gov.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. |

Exhibit | |

| 2.1* | Business Combination Agreement, dated as of January 29, 2023, by and among SPAC, Merger Sub, the Company and Holdings. | |

| 10.1 | Sponsor Support Agreement, dated as of January 29, 2023 by and among SPAC, Sponsor. | |

| 10.2* | Form of Shareholder Support Agreement by and among SPAC, the Company and the shareholders party thereto. | |

| 99.1 | Press Release, dated January 30, 2023. | |

| 99.2 | Conference Call Script. | |

| 99.3 | Investor Presentation. | |

| 99.4 | Transcript to Investor Video. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

| * | All schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| PRIME IMPACT ACQUISITION I | ||||||

| Date: January 30, 2023 | By: | /s/ Mark Long | ||||

| Name: | Mark Long | |||||

| Title: | Co-Chief Executive Officer | |||||

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

by and among

PRIME IMPACT ACQUISITION I,

CHECHE MERGER SUB INC.,

CHECHE GROUP INC.,

and

CHECHE TECHNOLOGY INC.

Dated as of January 29, 2023

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I DEFINITIONS |

3 | |||||

| 1.01 |

Certain Definitions | 3 | ||||

| 1.02 |

Further Definitions | 15 | ||||

| 1.03 |

Construction | 17 | ||||

| ARTICLE II AGREEMENT AND PLAN OF MERGER |

18 | |||||

| 2.01 |

The Mergers | 18 | ||||

| 2.02 |

Effective Times; Closing | 18 | ||||

| 2.03 |

Effect of the Mergers | 19 | ||||

| 2.04 |

Constitutional Documents of the Surviving Company | 19 | ||||

| 2.05 |

Directors and Officers of Surviving Company; Directors of Surviving Subsidiary Company | 20 | ||||

| ARTICLE III EFFECTS OF THE MERGER |

20 | |||||

| 3.01 |

Conversion of Securities | 20 | ||||

| 3.02 |

Exchange Procedures. | 23 | ||||

| 3.03 |

[Reserved] | 25 | ||||

| 3.04 |

Register of Members | 25 | ||||

| 3.05 |

Dissenters’ Rights | 25 | ||||

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

26 | |||||

| 4.01 |

Organization and Qualification; Subsidiaries | 27 | ||||

| 4.02 |

Constitutional Documents | 28 | ||||

| 4.03 |

Capitalization | 28 | ||||

| 4.04 |

Authority Relative to this Agreement | 29 | ||||

| 4.05 |

No Conflict; Required Filings and Consents | 30 | ||||

| 4.06 |

Permits; Compliance | 31 | ||||

| 4.07 |

Financial Statements | 32 | ||||

| 4.08 |

Business Activities; Absence of Certain Changes or Events | 33 | ||||

| 4.09 |

Absence of Litigation | 33 | ||||

| 4.10 |

Reserved | 33 | ||||

| 4.11 |

Labor and Employment Matters | 33 | ||||

| 4.12 |

Real Property; Title to Tangible Assets | 35 | ||||

| 4.13 |

Intellectual Property; Data Security | 35 | ||||

| 4.14 |

Taxes | 40 | ||||

| 4.15 |

Environmental Matters | 42 | ||||

| 4.16 |

Material Contracts | 43 | ||||

| 4.17 |

Customers and Suppliers | 44 | ||||

| 4.18 |

Insurance | 45 | ||||

| 4.19 |

Board Approval; Vote Required | 45 | ||||

| 4.20 |

Certain Business Practices | 45 | ||||

| 4.21 |

Interested Party Transactions | 46 | ||||

| 4.22 |

Exchange Act | 46 | ||||

i

| 4.23 |

Brokers | 47 | ||||

| 4.24 |

Control Documents. | 47 | ||||

| 4.25 |

Exclusivity of Representations and Warranties | 47 | ||||

| 4.26 |

Company’s Investigation and Reliance | 48 | ||||

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF SPAC, HOLDINGS AND MERGER SUB |

48 | |||||

| 5.01 |

Corporate Organization | 48 | ||||

| 5.02 |

Constitutional Documents | 49 | ||||

| 5.03 |

Capitalization | 49 | ||||

| 5.04 |

Authority Relative to This Agreement | 50 | ||||

| 5.05 |

No Conflict; Required Filings and Consents | 51 | ||||

| 5.06 |

Compliance | 51 | ||||

| 5.07 |

SEC Filings; Financial Statements; Sarbanes-Oxley | 52 | ||||

| 5.08 |

Business Activities; Absence of Certain Changes or Events | 53 | ||||

| 5.09 |

Absence of Litigation | 54 | ||||

| 5.10 |

Board Approval; Vote Required | 54 | ||||

| 5.11 |

No Prior Operations of Holdings and Merger Sub | 55 | ||||

| 5.12 |

Brokers | 55 | ||||

| 5.13 |

SPAC Trust Fund | 55 | ||||

| 5.14 |

Taxes | 56 | ||||

| 5.15 |

Registration and Listing | 58 | ||||

| 5.16 |

Insurance | 58 | ||||

| 5.17 |

Agreements; Contracts and Commitments | 58 | ||||

| 5.18 |

Title to Property | 59 | ||||

| 5.19 |

Employees | 59 | ||||

| 5.20 |

Intellectual Property | 59 | ||||

| 5.21 |

Investment Company Act | 59 | ||||

| 5.22 |

SPAC’s, Holdings’ and Merger Sub’s Investigation and Reliance | 59 | ||||

| 5.23 |

Exclusivity of Representations and Warranties | 60 | ||||

| ARTICLE VI CONDUCT OF BUSINESS PENDING THE MERGERS |

60 | |||||

| 6.01 |

Conduct of Business by the Company Pending the Mergers | 60 | ||||

| 6.02 |

Conduct of Business by SPAC, Holdings and Merger Sub Pending the Mergers | 64 | ||||

| 6.03 |

Claims Against Trust Account | 66 | ||||

| ARTICLE VII ADDITIONAL AGREEMENTS |

67 | |||||

| 7.01 |

No Solicitation | 67 | ||||

| 7.02 |

Registration Statement; Proxy Statement | 69 | ||||

| 7.03 |

Company Shareholder Approval | 72 | ||||

| 7.04 |

SPAC Shareholders’ Meeting, Holdings’ Shareholder’s Approval and Merger Sub Shareholder’s Approval | 72 | ||||

| 7.05 |

Access to Information; Confidentiality | 73 | ||||

| 7.06 |

Incentive Equity Plan | 74 | ||||

| 7.07 |

Directors’ and Officers’ Indemnification | 74 | ||||

| 7.08 |

Notification of Certain Matters | 77 | ||||

ii

| 7.09 |

Further Action; Reasonable Best Efforts; PIPE Investment | 77 | ||||

| 7.10 |

Public Announcements | 78 | ||||

| 7.11 |

Stock Exchange Listing | 78 | ||||

| 7.12 |

Antitrust | 79 | ||||

| 7.13 |

Trust Account; SPAC Operating Account | 80 | ||||

| 7.14 |

Tax Matters | 80 | ||||

| 7.15 |

Directors | 81 | ||||

| 7.16 |

SPAC Public Filings | 81 | ||||

| 7.17 |

Litigation | 81 | ||||

| 7.18 |

PCAOB Financial Statements | 82 | ||||

| 7.19 |

Overseas Securities Offering and Listing Filings | 82 | ||||

| ARTICLE VIII CONDITIONS TO THE MERGERS |

83 | |||||

| 8.01 |

Conditions to the Obligations of Each Party | 83 | ||||

| 8.02 |

Conditions to the Obligations of SPAC, Holdings and Merger Sub | 84 | ||||

| 8.03 |

Conditions to the Obligations of the Company | 85 | ||||

| ARTICLE IX TERMINATION, AMENDMENT AND WAIVER |

86 | |||||

| 9.01 |

Termination | 86 | ||||

| 9.02 |

Effect of Termination | 87 | ||||

| 9.03 |

Expenses | 87 | ||||

| 9.04 |

Amendment | 88 | ||||

| 9.05 |

Waiver | 88 | ||||

| ARTICLE X GENERAL PROVISIONS |

88 | |||||

| 10.01 |

Notices | 88 | ||||

| 10.02 |

Nonsurvival of Representations, Warranties and Covenants | 89 | ||||

| 10.03 |

Severability | 89 | ||||

| 10.04 |

Entire Agreement; Assignment | 90 | ||||

| 10.05 |

Parties in Interest | 90 | ||||

| 10.06 |

Governing Law | 90 | ||||

| 10.07 |

Waiver of Jury Trial | 90 | ||||

| 10.08 |

Headings | 91 | ||||

| 10.09 |

Counterparts | 91 | ||||

| 10.10 |

Specific Performance | 91 | ||||

| 10.11 |

No Recourse | 91 | ||||

| 10.12 |

Conflicts and Privilege | 92 | ||||

| Exhibit A | Form of Amended and Restated Registration Rights Agreement | |

| Exhibit B | Form of Constitutional Documents of the Surviving Company | |

| Exhibit C | Form of Omnibus Incentive Plan | |

| Schedule A | Company Knowledge Parties | |

| Schedule B | Key Company Shareholders | |

| Schedule C | Holdings Director Nominees | |

| Schedule I | Certain Directors and Advisors of SPAC | |

| Schedule II | Company Material Adverse Effect Knowledge Parties | |

iii

BUSINESS COMBINATION AGREEMENT

This Business Combination Agreement, dated as of January 29, 2023 (this “Agreement”), is entered into by and among Prime Impact Acquisition I, a Cayman Islands exempted company (together with its successor, “SPAC”), Cheche Group Inc., a Cayman Islands exempted company (“Holdings”), Cheche Merger Sub Inc., a Cayman Islands exempted company and wholly owned direct Subsidiary of Holdings (“Merger Sub”), and Cheche Technology Inc., a Cayman Islands exempted company (the “Company”). SPAC, Holdings, Merger Sub and the Company are collectively referred to herein as the “Parties” and individually as a “Party”.

WHEREAS, Holdings is a wholly owned direct Subsidiary of Prime Impact Cayman, LLC (the “Sponsor”), a Cayman Islands limited liability company;

WHEREAS, upon the terms and subject to the conditions of this Agreement and in accordance with the Cayman Islands Companies Act (As Revised) (the “Companies Act”), the Parties will enter into a business combination transaction pursuant to which (a) on the Closing Date, SPAC will merge with and into Holdings (the “Initial Merger”), with Holdings surviving the Initial Merger (Holdings, in its capacity as the surviving company of the Initial Merger, is sometimes referred to herein as the “Surviving Company”), and (b) on the Closing Date but after the Initial Merger Effective Time, Merger Sub will merge with and into the Company (the “Acquisition Merger” and, together with the Initial Merger, the “Mergers”), with the Company surviving the Acquisition Merger as a wholly owned Subsidiary of the Surviving Company (the Company, in its capacity as the surviving company of the Acquisition Merger, is sometimes referred to herein as the “Surviving Subsidiary Company”);

WHEREAS, each of the parties agrees that for U.S. federal income tax purposes, (a) it is intended that (i) the Initial Merger qualify as a “reorganization” described in Section 368(a)(1)(F) of the Code to which SPAC and Holdings are parties within the meaning of Section 368(b) of the Code and (ii) the Acquisition Merger qualify as a “reorganization” within the meaning of Section 368(a) of the Code to which Holdings, Merger Sub and the Company are parties within the meaning of Section 368(b) of the Code; and (b) this Agreement is intended to constitute, and is hereby adopted as, a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a) with respect to each of (i) the Initial Merger and (ii) the Acquisition Merger;

WHEREAS, the board of directors of the Company (the “Company Board”) has unanimously (a) determined that this Agreement and the Transactions are in the best interests of the Company, (b) approved and adopted this Agreement and the Transactions and declared their advisability, and (c) recommended that the shareholders of the Company approve and adopt this Agreement and approve the Transactions and directed that this Agreement and the Transactions be submitted for consideration by the Company’s shareholders (the “Company Recommendation”);

WHEREAS, the board of directors of SPAC (the “SPAC Board”) has unanimously (a) determined that this Agreement and the Transactions are in the best interests of SPAC, (b) approved and adopted this Agreement and the Transactions and declared their advisability, and (c) recommended that the shareholders of SPAC approve and adopt this Agreement and approve the Transactions, and directed that this Agreement and the Transactions be submitted for consideration by the shareholders of SPAC at the SPAC Shareholders’ Meeting;

1

WHEREAS, the board of directors of Merger Sub (the “Merger Sub Board”) has unanimously (a) determined that this Agreement and the Acquisition Merger are in the best interests of Merger Sub, (b) approved and adopted this Agreement and the Acquisition Merger and declared their advisability, and (c) recommended that the sole shareholder of Merger Sub approve and adopt this Agreement and approve the Acquisition Merger and directed that this Agreement and the Acquisition Merger be submitted for consideration by the sole shareholder of Merger Sub;

WHEREAS, the board of directors of Holdings (the “Holdings Board”) has unanimously (a) determined that this Agreement and the Transactions are in the best interests of Holdings, (b) approved and adopted this Agreement and the Transactions and declared their advisability, and (c) recommended that the sole shareholder of Holdings approve and adopt this Agreement and approve the Transactions and directed that this Agreement and the Transactions be submitted for consideration by the sole shareholder of Holdings;

WHEREAS, concurrently with the execution and delivery of this Agreement, SPAC, the Company and the Key Company Shareholders, as shareholders holding Company Capital Shares sufficient to constitute the Requisite Company Shareholder Approval, are entering into a Shareholder Support Agreement, dated as of the date hereof (the “Company Shareholder Support Agreement”), providing that, among other things, the Key Company Shareholders will vote their Company Capital Shares in favor of this Agreement and the Transactions (including the Mergers);

WHEREAS, in connection with the Acquisition Closing, Holdings, the Sponsor and certain other shareholders of SPAC and certain shareholders of the Company shall enter into an Amended and Restated Registration Rights Agreement (the “Registration Rights Agreement”) substantially in the form attached hereto as Exhibit A (with such changes as may be agreed in writing by SPAC and the Company); and

WHEREAS, concurrently with the execution and delivery of this Agreement, the Sponsor and each of the individuals set forth on Schedule I has executed and delivered to the Company the Sponsor Support Agreement, dated as of the date hereof (the “Sponsor Support Agreement”) pursuant to which the Sponsor has agreed to, among other things, vote to adopt and approve this Agreement and the other Transaction Documents and the Transactions.

WHEREAS, prior to the Initial Closing (as defined below), Holdings may enter into one or more subscription agreements (each, a “PIPE Subscription Agreement”) with third party investors named therein (such investors, collectively, with any permitted assignees or transferees, the “PIPE Investors”), in each case, on terms mutually acceptable to the SPAC and the Company, pursuant to which, on the terms and subject to the conditions set forth therein, immediately following the Initial Merger Effective Time and prior to the Acquisition Merger Effective Time, such PIPE Investors will purchase from the Surviving Company newly issued Surviving Company Class A Ordinary Shares or other Equity Securities of the Surviving Company (the “PIPE Investment”).

2

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

ARTICLE I

DEFINITIONS

1.01 Certain Definitions. For purposes of this Agreement:

“2019 Equity Incentive Plan” means the Company’s 2019 Equity Incentive Plan as such may have been amended, supplemented or modified from time to time.

“Affiliate” of a specified person means a person who, directly or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, such specified person.

“Aggregate Fully Diluted Company Shares” means, without duplication, (a) the aggregate number of Company Ordinary Shares that are (i) (x) issued and outstanding and (y) held in the Company’s treasury immediately prior to the Acquisition Merger Effective Time, (ii) issuable directly or indirectly upon, or subject to, the conversion, exercise or settlement of any Company Equity Interests issued and outstanding immediately prior to the Acquisition Merger Effective Time, including Company Preferred Shares, Company Options, Company Restricted Shares and the Company Warrant, in each case, that are issued and outstanding immediately prior to the Acquisition Merger Effective Time, or (iii) issuable pursuant to any Permitted Equity Financing.

“Aggregate Merger Consideration” means a number of Surviving Company Ordinary Shares equal to the quotient obtained by dividing (i) the Company Valuation, by (ii) $10.00.

“Ancillary Agreements” means the Registration Rights Agreement, the Sponsor Support Agreement, the Company Shareholder Support Agreement and all other agreements, certificates and instruments executed and delivered by SPAC, Merger Sub, the Company or Holdings in connection with the Transactions and specifically contemplated by this Agreement.

“Anti-Corruption Laws” means (i) the U.S. Foreign Corrupt Practices Act of 1977, as amended, (ii) the UK Bribery Act 2010, (iii) anti-bribery legislation promulgated by the European Union and implemented by its member states, (iv) legislation adopted in furtherance of the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions, and (v) similar legislation applicable to the Company or any Company Subsidiary from time to time.

“Business Combination” has the meaning ascribed to such term in the SPAC Articles of Association.

“Business Data” means all business information and data that is accessed, collected, used, stored, shared, distributed, transferred, disclosed, destroyed, disposed of or otherwise processed by any of the Business Systems or otherwise in the course of the conduct of the business of the Company or any Company Subsidiaries.

3

“Business Day” means any day on which the principal offices of the SEC in Washington, D.C. are open to accept filings, or, in the case of determining a date when any payment is due, any day on which banks are not required or authorized to close in New York, NY, the PRC, the Cayman Islands or Hong Kong; provided, that banks shall not be deemed to be authorized or obligated to be closed due to a “shelter in place,” “non-essential employee” or similar closure of physical branch locations at the direction of any Governmental Authority if such banks’ electronic funds transfer systems (including for wire transfers) are open for use by customers on such day.

“Business Systems” means all Software, computer hardware (whether general or special purpose), communications and telecommunications networks, servers, peripherals and computer systems, including any outsourced systems and processes, and any Software and systems provided via the cloud or “as a service” or installed on premises, that are owned or used in the conduct of the business of the Company or any Company Subsidiaries.

“CAC” means the Cyberspace Administration of the PRC.

“CARES Act” means the Coronavirus Aid, Relief and Economic Security Act of 2020, as in effect from time to time, together with all amendments thereto and all regulations and guidance issued by any Governmental Authority with respect thereto, any executive order or executive memo (including the Memorandum on Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster, dated August 8, 2020) intended to address the consequences of COVID-19, and any analogous or similar provisions under applicable Law.

“Company Capital Shares” means the Company Ordinary Shares and the Company Preferred Shares.

“Company Constitutional Documents” means (i) the sixth amended and restated articles of associations of the Company, and (ii) the fifth amended and restated shareholders agreement dated November 3, 2022, by and among the Company and certain of its shareholders, in each case as amended, modified or supplemented from time to time.

“Company Equity Interests” means Company Capital Shares, Company Options, Company Restricted Shares and the Company Warrant.

“Company Transaction Expenses” means any out-of-pocket fees and expenses payable by the Company or any of its Subsidiaries (whether or not billed or accrued for) as a result of or in connection with the negotiation, documentation and consummation of the Transactions, including (a) all fees, costs, expenses, brokerage fees, commissions, finders’ fees and disbursements of financial advisors, investment banks, data room administrators, attorneys, accountants and other advisors and service providers, including consultants and public relations firms, as appointed by the Company, and (b) subject to Section 9.03, any and all filing fees payable by the Company or any of its Subsidiaries or their respective Affiliates to the Governmental Authorities in connection with the Transactions.

“Company IP” means, collectively, all Company-Owned IP and Company-Licensed IP.

4

“Company-Licensed IP” means all Intellectual Property rights owned or purported to be owned by a third party and licensed to the Company or any Company Subsidiary or used or held for use in the conduct of the business of the Company and its Company Subsidiaries.

“Company Material Adverse Effect” means any Effect that, individually or in the aggregate with all other events, circumstances, changes and effects, (i) would, or would reasonably be expected to, have a material adverse effect on the business, financial condition, assets, liabilities, operations, or results of operations of the Company and the Company Subsidiaries taken as a whole or (ii) would, or would reasonably be expected to, prevent, materially delay or materially impede the performance by the Company of its obligations under this Agreement or the consummation of the Mergers or any of the other Transactions; provided, however, that none of the following shall be deemed to constitute, alone or in combination, or be taken into account in the determination of whether, there has been or will be a Company Material Adverse Effect: (a) any change or proposed change in or change in the interpretation of any Law or GAAP; (b) events or conditions generally affecting the industries or geographic areas in which the Company and the Company Subsidiaries operate; (c) any downturn in general economic conditions, including changes in the credit, debt, securities, financial or capital markets (including changes in interest or exchange rates, prices of any security or market index or commodity or any disruption of such markets); (d) any geopolitical conditions, outbreak of hostilities, acts of war, sabotage, cyberterrorism, terrorism or military actions (including any escalation or general worsening thereof), or any earthquakes, volcanic activity, hurricanes, tsunamis, tornadoes, floods, mudslides, wild fires or other natural disasters, weather conditions, or other force majeure events, or any epidemic, disease, outbreak or pandemic (including COVID-19 or any COVID-19 Measures or any change in such COVID-19 Measures or interpretations following the date of this Agreement, and including any impact of such pandemics on the health of any officer, employee or consultant of the Company or the Company Subsidiaries); (e) any actions taken or not taken by the Company or the Company Subsidiaries as required by this Agreement or at the written request of, or with the written consent of, SPAC; (f) any Effect attributable to the announcement or execution, pendency, negotiation or consummation of the Mergers or any of the other Transactions (including the impact thereof on relationships with customers, suppliers, employees or Governmental Authorities) (provided that this clause (f) shall not apply to any representation or warranty to the extent the purpose of such representation or warranty is to address the consequences resulting from this Agreement or the consummation of the Transactions); (g) any matter specifically set forth on the Company Disclosure Schedule; (h) any Effect to the extent actually known by those individuals set forth on Schedule II on or prior to the date hereof; or (i) any failure to meet any projections, forecasts, guidance, estimates, milestones, budgets or financial or operating predictions of revenue, earnings, cash flow or cash position, provided that this clause (i) shall not prevent a determination that any Effect underlying such failure has resulted in a Company Material Adverse Effect (to the extent such Effect is not otherwise excluded from this definition of Company Material Adverse Effect), except in the cases of clauses (a) through (d), to the extent that the Company and the Company Subsidiaries, taken as a whole, are disproportionately affected thereby as compared with other similarly situated participants in the industries in which the Company and the Company Subsidiaries operate.

“Company Options” means all outstanding options to purchase 108,206,300 Company Ordinary Shares, whether or not exercisable and whether or not vested, granted under the 2019 Equity Incentive Plan or otherwise. For the avoidance of doubt, “Company Options” shall not include the “Company Warrant.”

5

“Company Ordinary Shares” means the Company’s Ordinary Shares, par value $0.00001 per share.

“Company-Owned IP” means all Intellectual Property rights owned or purported to be owned by the Company or any of the Company Subsidiaries.

“Company Preferred Shares” means (1) Series Seed Preferred Shares of the Company, par value US$0.00001 per share, (2) Series Pre-A Preferred Shares of the Company, par value US$0.00001 per share, (3) Series A Preferred Shares of the Company, par value US$0.00001 per share, (4) Series B Preferred Shares of the Company, par value US$0.00001 per share, (5) Series C Preferred Shares of the Company, par value US$0.00001 per share, (6) Series D1 Preferred Shares of the Company, par value US$0.00001 per share, (7) Series D2 Preferred Shares of the Company, par value US$0.00001 per share, and (8) Series D3 Preferred Shares of the Company, par value US$0.00001 per share.

“Company Restricted Shares Awards” means all outstanding restricted shares award covering 23,171,603 Company Ordinary Shares, whether or not vested, granted under the 2019 Equity Incentive Plan or otherwise.

“Company Subsidiary” means each Subsidiary of the Company, including each of the WFOEs, the VIE Entity and their Subsidiaries.

“Company Valuation” means $760,000,000.

“Company Warrant” means a warrant to purchase an aggregate of 865,228 shares of Company Capital Shares issued to Innoven Capital China Pte. Ltd.

“Confidential Information” means any information, knowledge or data concerning the businesses or affairs of (i) the Company or the Company Subsidiaries that is not already generally available to the public, or (ii) any Suppliers or customers of the Company or any Company Subsidiaries, in each case that either (x) the Company or the Company Subsidiaries are bound to keep confidential or (y) with respect to clause (i), the Company or the applicable Company Subsidiary purport to maintain as a trade secret under applicable Laws.

“Contract” means any legally binding written or oral agreement, contract, lease, sublease, loan agreement, security agreement, license, sublicense, indenture, deed, mortgage, commitment, promise, undertaking, or other similar instrument or obligation, to which the party in question is a party, or to which any property, business operation, or right of the party in question is subject or bound.

“control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, or as trustee or executor, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of Equity Securities, as trustee or executor, by contract or otherwise.

6

“Control Documents” means, collectively, exclusive option agreement(s), power(s) of attorney, equity interest pledge agreement(s), exclusive business cooperation agreement(s) and any other documents (as applicable) entered into by the relevant Company Subsidiaries and the shareholders of the VIE Entity.

“COVID-19” means SARS-CoV-2 or COVID-19, and any evolutions or mutations thereof.

“COVID-19 Measures” means any quarantine, “shelter in place,” “work from home,” workforce reduction, social distancing, shut down, closure, sequester, safety or any other Law, Governmental Order, Action, directive, guidelines or recommendations by any Governmental Authority in relation to COVID-19.

“CSRC” means the China Securities Regulatory Commission.

“Environmental Laws” means any Laws relating to: (i) releases or threatened releases of, or exposure of any person to, Hazardous Substances or materials containing Hazardous Substances; (ii) the manufacture, handling, transport, use, treatment, storage or disposal of Hazardous Substances or materials containing Hazardous Substances; (iii) pollution or protection of the environment, natural resources or human health and safety; (iv) land use; or (v) the characterization of products or services as renewable, green, sustainable, or similar such claims.

“Equity Securities” means any share, share capital, capital stock, partnership, membership, any other ownership interest or similar interest in any Person (including any share appreciation, phantom stock, profit participation or similar rights), and any direct or indirect option, warrant, right, security (including debt securities) convertible, exchangeable or exercisable, directly or indirectly, therefor.

“Ex-Im Laws” means all applicable Laws relating to export, re-export, transfer, and import controls, including the U.S. Export Administration Regulations, the customs and import Laws administered by U.S. Customs and Border Protection, and the EU Dual Use Regulation.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Founder Shares” means the Company Ordinary Shares directly or indirectly held by Zhang Lei and Mutong Holdings Limited.

“Governmental Order” means any ruling, order, judgment, injunction, edict, decree, writ, stipulation, determination or award, in each case, entered by or with any Governmental Authority.

“Hazardous Substance(s)” means material, substance or waste that is listed, regulated, or otherwise defined as “hazardous,” “toxic,” or “radioactive,” or as a “pollutant” or “contaminant” (or words of similar intent or meaning) under Environmental Laws, including petroleum, petroleum by-products, asbestos or asbestos-containing material, polychlorinated biphenyls, per and polyfluoroalkyl substances, flammable or explosive substances, or pesticides.

“Holdings Constitutional Documents” means the memorandum and articles of association of Holdings, as amended, modified or supplemented from time to time.

7

“HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

“Intellectual Property” means (i) patents, patent applications and patent disclosures, together with all reissues, continuations, continuations-in-part, divisionals, revisions, extensions or reexaminations thereof, (ii) trademarks and service marks, trade dress, logos, trade names, corporate names, brands, slogans, and other source identifiers together with all translations, adaptations, derivations, combinations and other variants of the foregoing, and all applications, registrations, and renewals in connection therewith, together with all of the goodwill associated with the foregoing, (iii) copyrights, and other works of authorship (whether or not copyrightable), and moral rights, and registrations and applications for registration, renewals and extensions thereof, (iv) trade secrets, proprietary or confidential information, know-how (including ideas, formulas, compositions and inventions (whether or not patentable or reduced to practice)), and database rights, (v) Internet domain names and social media accounts, (vi) all other intellectual property or proprietary rights of any kind or description in any jurisdiction throughout the world, and (vii) copies and tangible embodiments of any of the foregoing, in whatever form or medium.

“Key Company Shareholders” means the persons and entities listed on Schedule B.

“knowledge” or “to the knowledge” of a person means in the case of the Company, the actual knowledge of each persons listed on Schedule A after reasonable inquiry of the individuals with operational responsibility in the functional area of such person, and in the case of SPAC, the actual knowledge of the individuals listed on Schedule II, after reasonable inquiry.

“Law” means any federal, national, state, county, municipal, provincial, local, foreign or multinational, statute, constitution, common law, ordinance, code, decree, order, judgment, rule, regulation, ruling or requirement issued, enacted, adopted, promulgated, implemented or otherwise put into effect by or under the authority of any Governmental Authority.

“Leased Real Property” means the real property leased by the Company or Company Subsidiaries as tenant, together with, to the extent leased by the Company or Company Subsidiaries, all buildings and other structures, facilities or improvements located thereon and all easements, licenses, rights and appurtenances of the Company or Company Subsidiaries relating to the foregoing.

“Lien” means any lien, security interest, mortgage, pledge, adverse claim or other encumbrance of any kind that secures the payment or performance of an obligation (other than those created under applicable securities laws).

“Listing Exchange” mean the Nasdaq Capital Market, the New York Stock Exchange, or another national securities exchange mutually agreed to by the parties as of the Closing Date, subject only to official notice of issuance thereof.

“Merger Sub Constitutional Documents” means the memorandum and articles of association of Merger Sub, as amended, modified or supplemented from time to time.

8

“Open Source Software” means any Software that is licensed pursuant to (i) any license that is a license approved by the open source initiative and listed at http://www.opensource.org/licenses, which licenses include all versions of the GNU General Public License (GPL), the GNU Lesser General Public License (LGPL), the GNU Affero GPL, the MIT license, the Eclipse Public License, the Common Public License, the CDDL, the Mozilla Public License (MPL), the Artistic License, the Netscape Public License, the Sun Community Source License (SCSL), and the Sun Industry Standards License (SISL), (ii) any license to Software that is considered “free” or “open source software” by the Open Source Initiative or the Free Software Foundation, or (iii) any Reciprocal License, in each case whether or not source code is available or included in such license.

“Per Share Merger Consideration” means a number of Surviving Company Ordinary Shares equal to (i) Aggregate Merger Consideration divided by (ii) the Aggregate Fully Diluted Company Shares.