Form 425 Khosla Ventures Acquisit Filed by: Khosla Ventures Acquisition Co.

Filed by Khosla Ventures Acquisition Co.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Khosla Ventures Acquisition Co.

Commission File No. 001-40131

Valo’s Next Chapter Lunch and Learn June 21, 2021 Proprietary and Confidential

Disclaimer Proprietary and Confidential Additional Information and Where to Find It This document relates to a proposed transaction between Valo Health, LLC (“Valo”) and Khosla Ventures Acquisition Co. (“KVAC”). This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. KVAC intends to file a registration statement on Form S-4 with the SEC, which will include a document that serves as a prospectus and proxy statement of KVAC, referred to as a proxy statement/prospectus. A final proxy statement/prospectus will be sent to all KVAC shareholders. KVAC also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of KVAC are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction. Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by KVAC through the website maintained by the SEC at www.sec.gov. The documents filed by KVAC with the SEC also may be obtained free of charge at KVAC's website at https://khoslaventuresacquisitionco.com/kvsa or upon written request to Secretary at Khosla Ventures Acquisition Co., 2128 Sand Hill Road, Menlo Park, California 94025. Participants in Solicitation KVAC and Valo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from KVAC's shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction will be contained in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph. Forward-Looking Statements This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Valo and KVAC. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of KVAC’s securities, (ii) the risk that the transaction may not be completed by the business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by either party, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval of the adoption of the Agreement and Plan of Merger, dated as of June 9, 2021 (the “Merger Agreement”), by and among KVAC, Valo, Valo Health, Inc., a Delaware corporation and a direct wholly owned subsidiary of Valo and Killington Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of KVAC, by the shareholders of KVAC, the satisfaction of the minimum trust account amount following any redemptions by KVAC’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the inability to complete the PIPE transaction, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (vii) the effect of the announcement or pendency of the transaction on Valo's business relationships, operating results, and business generally, (viii) risks that the proposed transaction disrupts current plans and operations of Valo, (ix) the outcome of any legal proceedings that may be instituted against Valo or against KVAC related to the merger agreement or the proposed transaction, (x) the ability to maintain the listing of KVAC’s securities on a national securities exchange, (xi) changes in the competitive and regulated industries in which Valo operates, variations in operating performance across competitors, changes in laws and regulations affecting Valo's business and changes in the combined capital structure, (xii) the ability to implement business plans and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xiii) the risk of downturns and a changing regulatory landscape in the highly competitive drug discovery and development industry, and (ix) costs related to the transaction and the failure to realize anticipated benefits of the transaction or to realize estimated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-4 discussed above and other documents filed by KVAC from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Valo and KVAC assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Valo nor KVAC gives any assurance that either Valo or KVAC, or the combined company, will achieve its expectations.

Valo is planning to go public! The Big News Proprietary and Confidential

Agenda Proprietary and Confidential What is a SPAC? Why We’re Going Public Why KVAC? What This Means for You Timeline Important Things to Remember Communications Guidelines 1 2 3 4 5 6 7

What is a SPAC? Proprietary and Confidential A “SPAC” is a Special Purpose Acquisition Company A publicly-traded investment company, formed for the sole purpose of combining with private companies A SPAC completes an initial public offering (IPO) selling shares to investors with the purpose of identifying and combining with a successful private company The sponsor of the SPAC has 18-24 months to identify an appropriate private company, conduct diligence and negotiate deal terms for a business combination After the business combination, the operating business gains access to funds invested in the SPAC and additional money raised from PIPE (Private Investment in Public Equity) investors The SPAC model can enable emerging growth companies to build a high-quality institutional investor base that is focused on long-term value creation

Why We’re Going Public Proprietary and Confidential We believe the potential of going public with Khosla Ventures Acquisition Co. (KVAC) brings access to significant new resources to invest in our business, the opportunity to partner with the team at Khosla Ventures (KV), and their extraordinary ecosystem of technology leaders We expect to raise approximately $450-500M at a $2.8 billion pro forma market valuation for the combined company Net proceeds from this transaction after transaction expenses will be used to advance Valo’s two current clinical and multiple preclinical assets, develop its software platform, support new and existing growth initiatives and working capital, and other general purposes

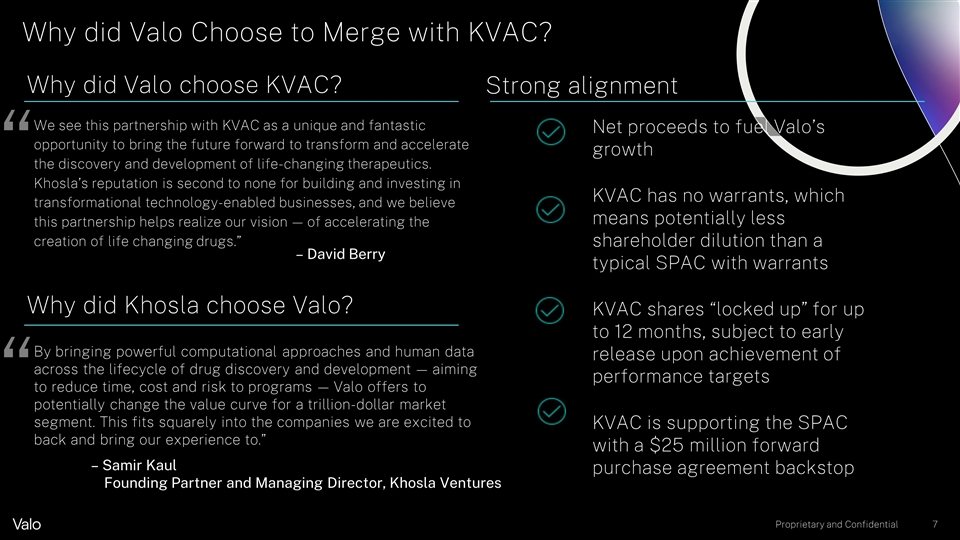

Why did Valo Choose to Merge with KVAC? Proprietary and Confidential Why did Valo choose KVAC? Why did Khosla choose Valo? Strong alignment We see this partnership with KVAC as a unique and fantastic opportunity to bring the future forward to transform and accelerate the discovery and development of life-changing therapeutics. Khosla’s reputation is second to none for building and investing in transformational technology-enabled businesses, and we believe this partnership helps realize our vision — of accelerating the creation of life changing drugs.” By bringing powerful computational approaches and human data across the lifecycle of drug discovery and development — aiming to reduce time, cost and risk to programs — Valo offers to potentially change the value curve for a trillion-dollar market segment. This fits squarely into the companies we are excited to back and bring our experience to.” “ “ – David Berry – Samir Kaul Founding Partner and Managing Director, Khosla Ventures Net proceeds to fuel Valo’s growth KVAC has no warrants, which means potentially less shareholder dilution than a typical SPAC with warrants KVAC shares “locked up” for up to 12 months, subject to early release upon achievement of performance targets KVAC is supporting the SPAC with a $25 million forward purchase agreement backstop

What This Means for You Our goals, deliverables, and strategy remain unchanged; careful budget and people planning are still priorities Valo’s operations and leadership will not change – this transaction will not result in potential job impacts as the SPAC does not have any employees Public company compliance requirements More details to come as we go forward, on topics such as incentive units/options Proprietary and Confidential

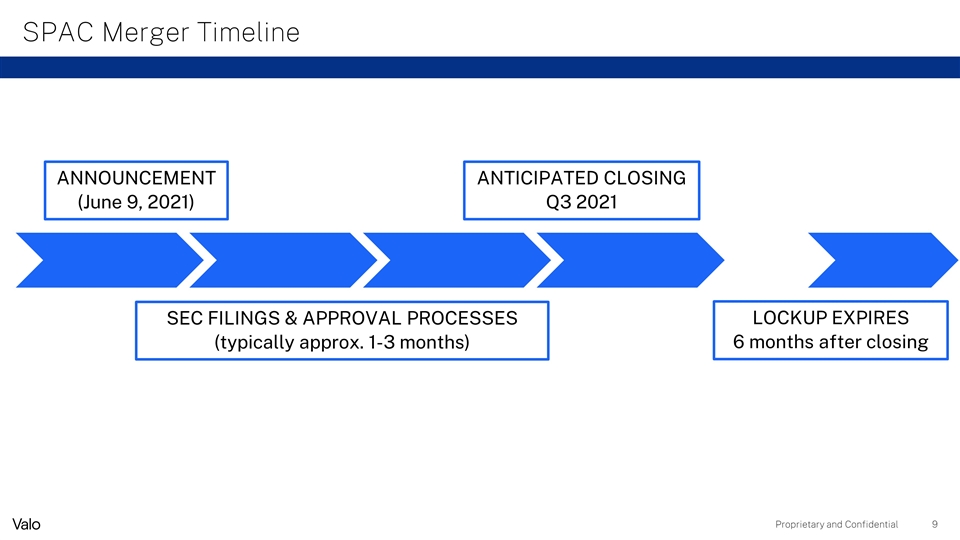

SPAC Merger Timeline Proprietary and Confidential ANNOUNCEMENT (June 9, 2021) SEC FILINGS & APPROVAL PROCESSES (typically approx. 1-3 months) Anticipated Closing Q3 2021 Lockup Expires 6 months after closing

Important Things to Remember Proprietary and Confidential This is exciting news, but we haven't closed yet! We anticipate that the transaction will close in Q3 2021 and we would become a public company soon thereafter Execution! Execution! Execution! While a small team focuses on closing the transaction, Valo has not changed, and everyone should continue to focus on execution and excellence As Valo transitions into life as a public company, we become subject to new rules and regulations which will impact our internal and external communications It’s important that you do not share non-public information about the transaction in any form of communication, whether oral or written, with anyone outside of Valo; see the material provided in the Valo Now shared drive As promised, we will share additional information with you as we work toward closing

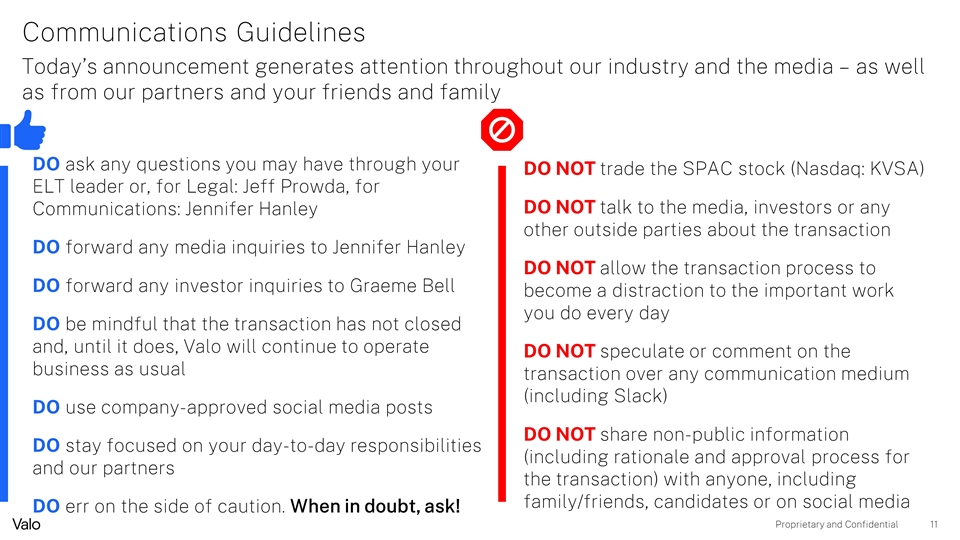

Communications Guidelines Proprietary and Confidential DO ask any questions you may have through your ELT leader or, for Legal: Jeff Prowda, for Communications: Jennifer Hanley DO forward any media inquiries to Jennifer Hanley DO forward any investor inquiries to Graeme Bell DO be mindful that the transaction has not closed and, until it does, Valo will continue to operate business as usual DO use company-approved social media posts DO stay focused on your day-to-day responsibilities and our partners DO err on the side of caution. When in doubt, ask! DO NOT trade the SPAC stock (Nasdaq: KVSA) DO NOT talk to the media, investors or any other outside parties about the transaction DO NOT allow the transaction process to become a distraction to the important work you do every day DO NOT speculate or comment on the transaction over any communication medium (including Slack) DO NOT share non-public information (including rationale and approval process for the transaction) with anyone, including family/friends, candidates or on social media Today’s announcement generates attention throughout our industry and the media – as well as from our partners and your friends and family

What Can You Do Focus on executing your day-to-day responsibilities As Valorians, and members of our championship team, exemplify the well-known leadership principle of Bill Belichick, head coach of the New England Patriots: “Do your job!” Go team! Proprietary and Confidential

Questions? [email protected] Proprietary and Confidential

Additional Information and Where to Find It

This document relates to a proposed transaction between Valo Health, LLC (“Valo”) and Khosla Ventures Acquisition Co. (“KVAC”). This document does not constitute an offer to sell or exchange, or the solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. KVAC intends to file a registration statement on Form S-4 with the SEC, which will include a document that serves as a prospectus and proxy statement of KVAC, referred to as a proxy statement/prospectus. A final proxy statement/prospectus will be sent to all KVAC shareholders. KVAC also will file other documents regarding the proposed transaction with the SEC. Before making any voting decision, investors and security holders of KVAC are urged to read the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed transaction as they become available because they will contain important information about the proposed transaction.

Investors and security holders will be able to obtain free copies of the registration statement, the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by KVAC through the website maintained by the SEC at www.sec.gov.

The documents filed by KVAC with the SEC also may be obtained free of charge at KVAC’s website at https://khoslaventuresacquisitionco.com/kvsa or upon written request to Secretary at Khosla Ventures Acquisition Co., 2128 Sand Hill Road, Menlo Park, California 94025.

Participants in Solicitation

KVAC and Valo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from KVAC’s shareholders in connection with the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the business combination will be contained in the proxy statement/prospectus when available. You may obtain free copies of these documents as described in the preceding paragraph.

Forward-Looking Statements

This document contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Valo and KVAC. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and

assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect the price of KVAC’s securities, (ii) the risk that the transaction may not be completed by the business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by either party, (iii) the failure to satisfy the conditions to the consummation of the transaction, including the approval of the adoption of the Agreement and Plan of Merger, dated as of June 9, 2021 (the “Merger Agreement”), by and among KVAC, Valo, Valo Health, Inc., a Delaware corporation and a direct wholly owned subsidiary of Valo and Killington Merger Sub Inc., a Delaware corporation and a direct wholly owned subsidiary of KVAC, by the shareholders of KVAC, the satisfaction of the minimum trust account amount following any redemptions by KVAC’s public shareholders and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the inability to complete the PIPE transaction, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (vii) the effect of the announcement or pendency of the transaction on Valo’s business relationships, operating results, and business generally, (viii) risks that the proposed transaction disrupts current plans and operations of Valo, (ix) the outcome of any legal proceedings that may be instituted against Valo or against KVAC related to the merger agreement or the proposed transaction, (x) the ability to maintain the listing of KVAC’s securities on a national securities exchange, (xi) changes in the competitive and regulated industries in which Valo operates, variations in operating performance across competitors, changes in laws and regulations affecting Valo’s business and changes in the combined capital structure, (xii) the ability to implement business plans and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xiii) the risk of downturns and a changing regulatory landscape in the highly competitive drug discovery and development industry, and (ix) costs related to the transaction and the failure to realize anticipated benefits of the transaction or to realize estimated pro forma results and underlying assumptions, including with respect to estimated shareholder redemptions. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the registration statement on Form S-4 discussed above and other documents filed by KVAC from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Valo and KVAC assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Valo nor KVAC gives any assurance that either Valo or KVAC, or the combined company, will achieve its expectations.

Serious News for Serious Traders! Try StreetInsider.com Premium Free!

You May Also Be Interested In

- Paramount Global (PARA) and Skydance are closer to a merger - CNBC

- T-Mobile (TMUS) and EQT Announce JV to Acquire Lumos

- KKR & Co. (KKR) to Acquire $1.64B Student Housing Portfolio from BREIT (BX)

Create E-mail Alert Related Categories

SEC FilingsRelated Entities

Definitive AgreementSign up for StreetInsider Free!

Receive full access to all new and archived articles, unlimited portfolio tracking, e-mail alerts, custom newswires and RSS feeds - and more!

Tweet

Tweet Share

Share